- SNBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Sleep Number (SNBR) 8-KResults of Operations and Financial Condition

Filed: 24 Apr 08, 12:00am

Select Comfort

First Quarter 2008 Investor Call

April 23, 2008

Statements used in this press release that relate to future plans, events, financial results or performance are forward-looking statements that are subject to certain risks and uncertainties including, among others, such factors as general and industry economic trends; uncertainties arising

from global events; consumer confidence; effectiveness of our advertising and promotional efforts;

our ability to secure suitable retail locations; our ability to attract and retain qualified sales

professionals and other key employees; consumer acceptance of our products, product quality,

innovation and brand image; our ability to continue to expand and improve our product line; industry

competition; warranty expenses; risks of potential litigation; our dependence on significant suppliers,

and the vulnerability of any suppliers to commodity shortages, inflationary pressures, labor

negotiations, liquidity concerns or other factors; our ability to fund our operations, through cash flow

from operations, or availability under our bank line of credit or other sources, and the cost of credit or

other capital resources necessary to finance operations; rising commodity costs; the capability of our

information systems to meet our business requirements and our ability to upgrade our systems on a

cost-effective basis without disruptions to our business; and increasing government regulations,

including new flammability standards for the bedding industry which bring product cost pressures

and have required implementation of systems and manufacturing process changes to ensure

compliance. Additional information concerning these and other risks and uncertainties is contained in

our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K,

and other periodic reports filed with the SEC. The company has no obligation to publicly update or

revise any of the forward-looking statements that may be in this news release.

Forward Looking Statements

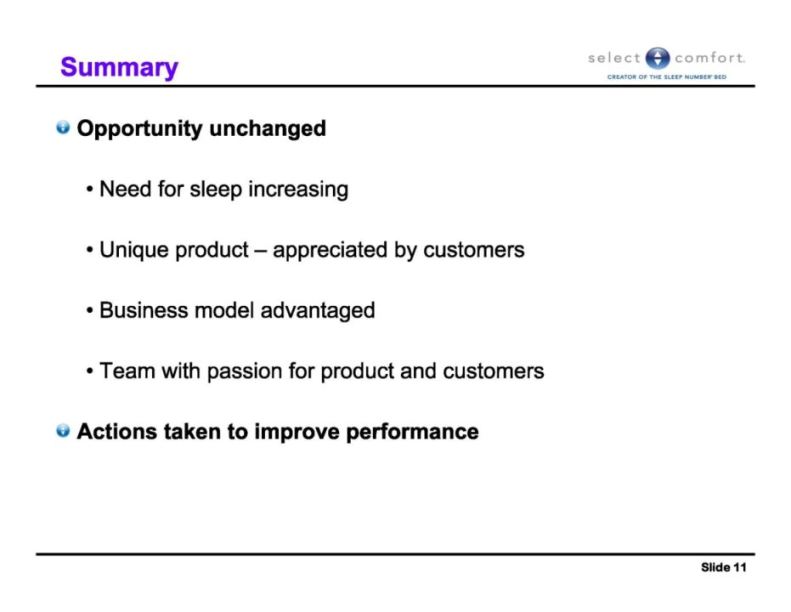

FY08 First Quarter Results Summary

Q1

Q1

2008

2007

Change

Net Sales

168.2

$

216.5

$

(48.3)

$

Gross Profit

96.9

$

134.2

$

(37.3)

$

Operating (loss) income

(11.0)

$

16.8

$

(27.8)

$

Net (loss) income per share

(0.16)

$

0.21

$

(0.37)

$

Diluted Shares (millions)

44.1

51.8

(7.7)

($ in millions, except EPS)

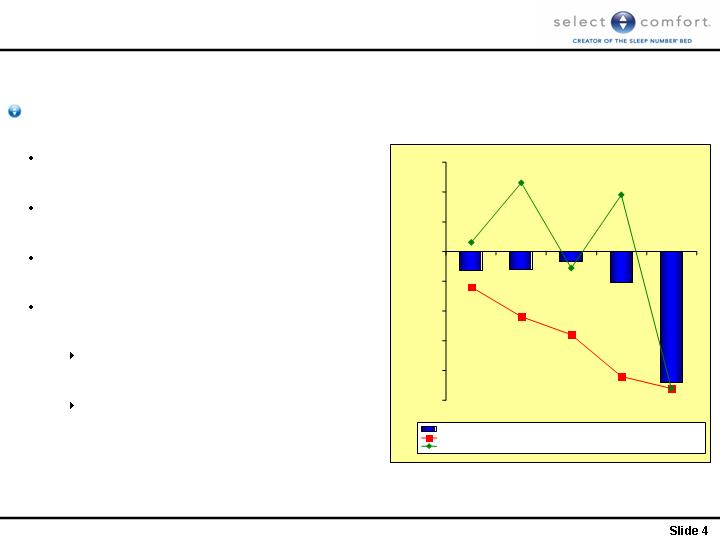

Combination of External and Company-Specific Q1 Events

Macro - existing home sales down 23%

Media investment reduced 23% vs. PY

Product mix lowered sales by $6M

Wholesale timing lowered sales by $7M

QVC

Retail Partners

Factors Affecting First Quarter Revenue

(3%)

(3%)

(5%)

(22%)

(2%)

(25%)

(20%)

(15%)

(10%)

(5%)

0%

5%

10%

15%

Q1-07

Q2-07

Q3-07

Q4-07

Q1-08

Company-Owned Channels Unit Order % Change vs. Prior Year

Existing Home Sales

Total Media Spending Change vs. Prior Year

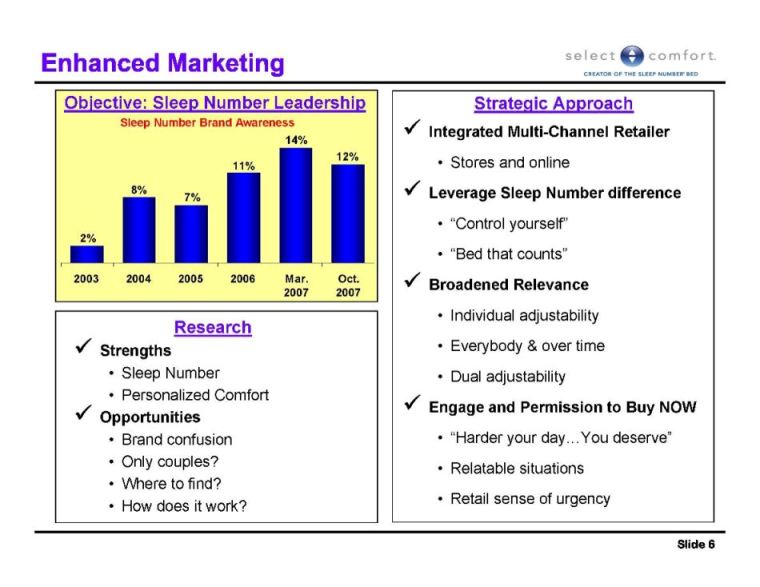

Actions in Face of Difficult Environment

2008 Impact

Cost and Margin

$30M

Staffing: Corporate, sales & operations

Lowered promotions, price increase

Cash, Inventory and Payables Management

$8M - $15M

Deferral of programs: International, SAP & Stores

Stabilize / Restore Sales

Restore media investment

Equal to 2007 for Q2 to Q4

New product introduction (6000 model)

Improving Mix

New media campaign

March Launch

Channel Performance and Store Summary

Q1 Channel Sales

Store Summary

Stores with New Fitch Design by Quarter

2 8 9 14 24 41 53 58

Total Store Count

471

485

483

478

481

478

447

460

Q1-07

Q2-07

Q3-07

Q4-07

Q1-08

Q2-08(E)

Q3-08(E)

Q4-08(E)

Q1 Net Operating Results Roadmap

($ in millions)

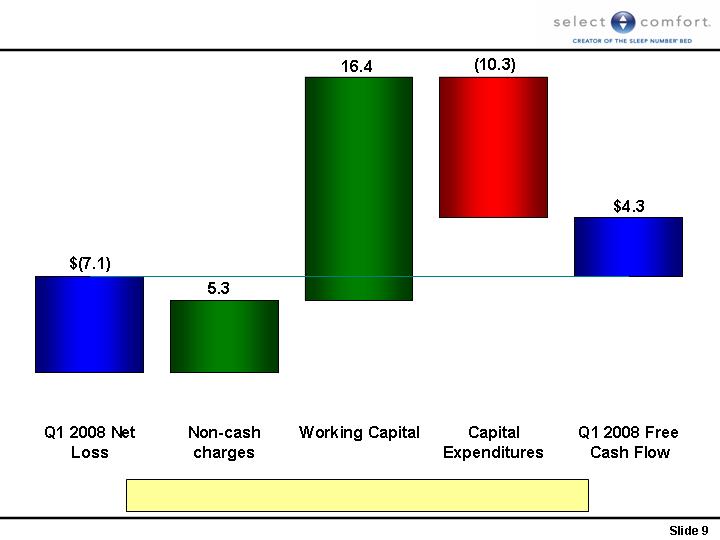

Cash Generation Remains Strong

($ in millions)

Operating Cash Flow of $14.6M

Targeting Return to Profitability in Q3

Operating Profit Benefit of $10M+

Q1 and Q3 historically similar: Planned Q3 Improvements

Cost Reductions

$4M -$5M

Corporate, selling, staffing reductions

Flat store count

Lower consumer financing costs (lower interest rates)

Q1 severance

Gross Margin Enhancements

+2 ppts

Plant staffing reductions

Product mix improvement

Pricing / promotion

Sales Opportunities

+$10M - $15M

Media investment

New campaign

Wholesale normalized