UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05476

LORD ABBETT GLOBAL FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Brooke A. Fapohunda, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2014

| Item 1: | | Report(s) to Shareholders. |

2014 LORD ABBETT

ANNUAL REPORT

Lord Abbett

Emerging Markets Corporate Debt Fund

Emerging Markets Currency Fund

Emerging Markets Local Bond Fund

Multi-Asset Global Opportunity Fund

For the fiscal year ended December 31, 2014

Table of Contents

Lord Abbett Emerging Markets Corporate Debt Fund,

Lord Abbett Emerging Markets Currency Fund,

Lord Abbett Emerging Markets Local Bond Fund, and

Lord Abbett Multi-Asset Global Opportunity Fund

Annual Report

For the fiscal year ended December 31, 2014

Daria L. Foster, Director, President and Chief Executive Officer of the Lord Abbett Funds, and E. Thayer Bigelow, Independent Chairman of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended December 31, 2014. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and more timely information about the Funds, please visit our website at www.lordabbett.com, where you also can access the quarterly commentaries that provide updates on the Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Daria L. Foster

Director, President and Chief Executive Officer

Emerging Markets Corporate Debt Fund

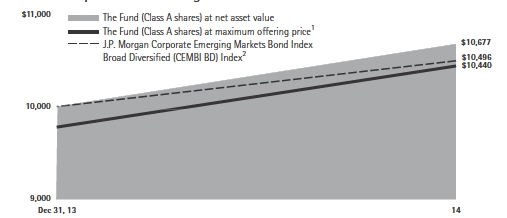

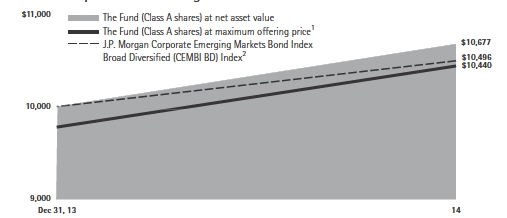

For the fiscal year ended December 31, 2014, the Fund returned 6.76%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified,1 which returned 4.96% during the same period.

During the 12-month period, emerging market corporate debt (as represented by the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified1) outperformed emerging market currencies (as represented by Barclays Global Emerging Markets Strategy Index2) and outperformed emerging market local bonds (as represented by the JP Morgan GBI-EM Global Diversified Index3). Emerging markets corporate debt also

1

underperformed domestic equity markets (as represented by the S&P 500® Index4) and underperformed fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index5).

The Fund’s overweight to high-yield emerging markets corporate debt during the middle of the 12-month period was likely a contributor to performance relative to the benchmark. Emerging markets high yield outperformed in this period due to an increased demand for higher-yielding emerging-market assets, driven by low interest rates in the U.S. and European developed markets. The Fund’s underweight to Russian debt for most of the fourth quarter likely helped performance, as Russian debt deteriorated in the latter half of the period. Russian debt markets were hurt significantly by falling oil prices and the continued strain of international sanctions; this led to a severe lack of liquidity in the market. The Fund’s overweight exposure to the telecommunication services sector likely benefited performance, as this sector rallied during the period.

The Fund’s overweight position to Brazilian bonds in the fourth quarter was a likely detractor to relative performance. Brazilian bonds came under pressure in the second half of the period, as issuance stalled and Brazil struggled to emerge from a recession that has led to the downgrade of its debt from ratings agencies. The Fund’s underweight to utilities, particularly in the third quarter, likely hurt the overall

performance of the Fund. The utility sector benefited from declining energy prices, which helped reduce costs and improve profit margins. The Fund maintained an underweight position to Philippine bonds throughout most of the period, which likely detracted from overall performance. The Philippines, and its corporate bond market, benefited from higher growth prospects and the nation’s status as a net importer of oil.

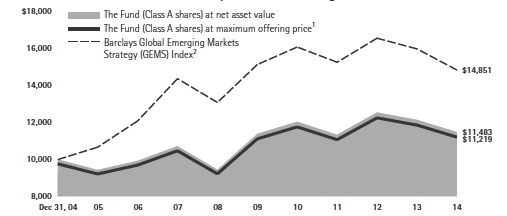

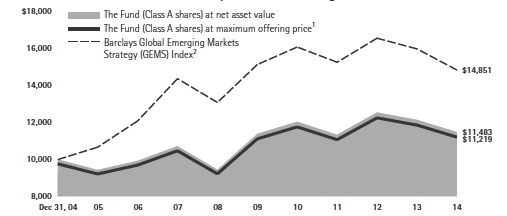

Emerging Markets Currency Fund

For the fiscal year ended December 31, 2014, the Fund returned -5.49%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Barclays Global Emerging Markets Strategy (GEMS) Index,2 which returned -7.16% during the same period.

During the 12-month period, emerging market currencies (as represented by Barclays Global Emerging Markets Strategy Index2) underperformed emerging market corporate debt (as represented by the J.P. Morgan CEMBI Broad Diversified Index1) and emerging market local bonds (as represented by the J.P. Morgan GBI-EM Global Diversified Index3). Emerging market currencies also underperformed domestic equity markets (as represented by the S&P 500® Index4) and underperformed fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index5).

The Fund’s overweight position in the Colombian peso in the first half of the

2

12-month period, followed by an underweight in the latter half, was a positive contributor to performance relative to the benchmark. The currency rallied early in the period due to a rebalance of the JP Morgan GBI-EM Global Diversified and GBI-EM Global indexes, and the fall in the second half of the period was the result of the slide in oil prices. The Fund benefited from an overweight position in the Malaysian ringgit to start the period, and continued to benefit as the exposure was switched to an underweight in the latter half. The ringgit performed well in the first half of the period, as the Malaysian central bank signaled it may increase its benchmark interest rate, but fell in the latter half as oil prices plummeted. The Fund’s short position in the euro throughout the period benefited, despite hurting the Fund in the early portion of the period, as the euro rallied. Later in the period, the euro fell to two-year lows against the U.S. dollar on fears of European recession, Greek election turmoil, and renewed stimulus measures by the European Central Bank. The Fund maintained a neutral or underweight position to the Polish zloty throughout most of the period, which benefited as the zloty depreciated on fears of deflation, as consumer prices continued to fall through the latter half of the period.

Detracting from relative performance was an underweight to the Indonesian rupiah in the first half of the period. Although the underweight helped in January, the currency rallied on optimism

in regard to the election of the former governor of Jakarta, Joko Widodo, and renewed intervention by the Indonesian central bank, and, ultimately, the short position detracted. The Fund’s overweight to the Mexican peso detracted from performance, as the currency depreciated throughout the period. Despite a positive reform story, the peso suffered due to falling oil prices and weak growth. The Fund’s overweight to the Brazilian real detracted from performance in the second half of the period. The real suffered due to uncertainty in regard to the presidential election as incumbent Dilma Rousseff continued to rally support.

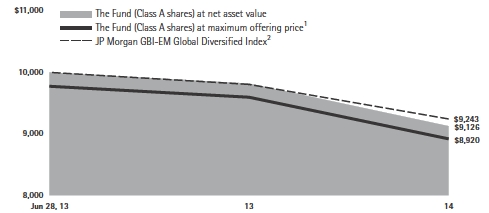

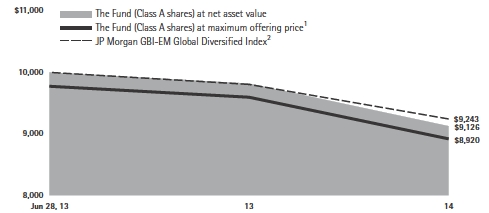

Emerging Markets Local Bond Fund

For the fiscal year ended December 31, 2014, the Fund returned -7.05%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the JP Morgan GBI-EM Global Diversified Index,3 which returned -5.72% during the same period.

During the 12-month period, emerging market local debt (as represented by the J.P. Morgan GBI-EM Global Diversified Index3) underperformed emerging market corporate debt (as represented by the J.P. Morgan CEMBI Broad Diversified Index1) and outperformed emerging market currencies (as represented by Barclays Global Emerging Markets Strategy Index2). Emerging market local bonds also underperformed domestic equity markets

3

(as represented by the S&P 500® Index4) and underperformed fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index5).

The Fund’s underweight to Turkish bonds likely detracted from performance relative to the benchmark, as Turkey, in particular, maintained an exceptionally high yield in an environment of declining global yields. The Fund’s underweight to South African bonds also likely detracted from performance relative to the benchmark, as issuance fell and bond yields remained high. Poland likely detracted from relative performance, as the Fund remained underweight in the second half of the period, anticipating an end to its rate-hiking cycle. In contrast, Poland extended its rate-hiking schedule through much of the period, and the Fund’s underweight exposure was likely a detriment. The Fund’s exposure to corporate bonds, particularly in Russia, likely detracted from relative performance, as credit spreads relative to sovereign yields widened.

The Fund’s relative performance likely benefited from an overweight position to Romanian bonds. Romania’s performance was driven by the broad fall in European yields, as the European Central Bank was proactive in promoting stimulus measures to spur a faltering European economy, and the Romanian central bank cut its main rate to a record 3%. The Fund’s overweight to Mexico in the latter half of the period likely contributed to relative performance

during the period. Yields in Mexico fell throughout the period, as oil continued its drastic slide and the peso hit a two-year low against the dollar. An overweight position to Colombian bonds throughout most of the period was a likely contributor to relative performance, as demand for the bonds increased. Demand was likely driven, in part, by a rebalance of the J.P. Morgan GBI-EM Global Diversified and GBI-EM Global indexes. The change increased the weighting of Colombia, from 3.2% to 8.0%, and from 1.8% to 5.6% in the GBI-EM Global Diversified Index and GBI-EM Global Index, respectively.

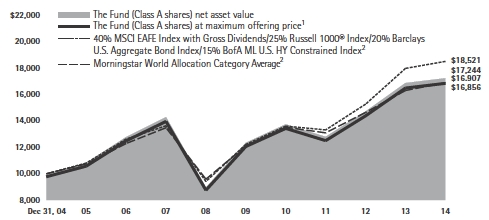

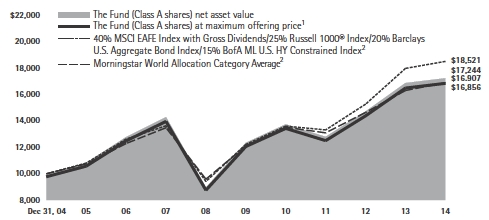

Multi-Asset Global Opportunity Fund

For the fiscal year ended December 31, 2014, the Fund returned 2.15%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the 40% MSCI EAFE Index with Gross Dividends6/25% Russell 1000® Index7/20% Barclays U.S. Aggregate Bond Index5/15% BofA Merrill Lynch U.S. High Yield Constrained Index8, which returned 2.96% over the same period.

During the 12-month period, domestic equity markets (as represented by the S&P 500® Index4) outperformed fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index5). Domestic equity markets also outperformed foreign equity markets (as represented by the MSCI EAFE Index with Gross Dividends6) and emerging market currencies (as

4

represented by Barclays Global Emerging Markets Strategy Index2).

Detracting from relative performance was the Fund’s allocation to emerging market currencies. Although the Fund reduced its holdings in this asset class by the end of the period, a strengthening U.S. dollar caused emerging market currencies to underperform the blended benchmark. In addition, the Fund’s exposure to short-duration corporate credit detracted from performance, as this segment of the fixed-income market underperformed the broad fixed-income market (as represented by the Barclay’s U.S. Aggregate Bond Index3).

The Fund’s position in equities contributed to relative performance, as stocks outpaced bonds during the period. In addition, the Fund’s overweight position to mid-cap stocks likely contributed to performance, as this segment of the equity market outperformed the blended benchmark during the period.

Each Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI BD) is a market capitalization-weighted index that tracks total returns of U.S. dollar-denominated debt instruments issued by corporate entities in emerging markets countries. The index limits the current face amount allocations of the bonds in the CEMBI Broad by constraining the total face amount outstanding for countries with larger debt stocks.

2 The Barclays Global Emerging Markets Strategy (GEMS) Index is based on investing in one-month synthetic money market deposits across 15 diversified Emerging Market currencies.

3 The JP Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified Index is a comprehensive global emerging markets index that consists of regularly traded, liquid fixed-rate and domestic currency government bonds.

4 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

5 The Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Total return comprises price appreciation/

depreciation and income as a percentage of the original investment.

6 The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The MSCI EAFE Index with Gross Dividends approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits.

7 The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index.

8 The BofA Merrill Lynch U.S. High Yield Constrained Index is a capitalization-weighted index of all U.S. dollar-denominated below investment-grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have a below investment-grade rating (based on an average of Moody’s, Standard & Poor’s, and Fitch), at least 18 months to final maturity at the time of issuance, at

5

least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule, and a minimum amount outstanding of $100 million. The index caps individual issuer at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. The face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. In the event there are fewer than 50 issuers in the Index, each is equally weighted and the face values of their respective bonds are increased or decreased on a pro-rata basis.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in a Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place. Without such waivers and expense reimbursements, the Funds’ returns would have been lower.

The annual commentary above discusses the views of the Funds’ management and various portfolio holdings of the Funds as of December 31, 2014. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Funds’ portfolios are actively managed and may change significantly, the Funds may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Funds’ portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see each Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

6

Emerging Markets Corporate Debt Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI BD) Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Period Ended December 31, 2014

| | 1 Year |

| Class A3 | 4.39% |

| Class C4 | 4.91% |

| Class F5 | 6.86% |

| Class I5 | 6.97% |

| Class R25 | 6.97% |

| Class R35 | 6.97% |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Class A shares commenced operations on December 6, 2013 and performance for the Class began on December 31, 2013. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all

dividends and distributions reinvested for the period shown ended December 31, 2014, is calculated using the SEC-required uniform method to compare such return.

4 Class C shares commenced operations on December 6, 2013 and performance for the Class began on December 31, 2013. The 1% CDSC for Class C normally applies before the first anniversary of the purchase date.

5 Commenced operations on December 6, 2013 and performance for the Class began on December 31, 2013. Performance is at net asset value.

7

Emerging Markets Currency Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Barclays Global Emerging Markets Strategy (GEMS) Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2014

| | 1 Year | 5 Years | 10 Years | Life of Class |

| Class A3 | -7.56% | -0.27% | 1.16% | – |

| Class B4 | -10.81% | -0.93% | 0.84% | – |

| Class C5 | -7.11% | -0.49% | 0.75% | – |

| Class F6 | -5.40% | 0.33% | – | 1.60% |

| Class I7 | -5.32% | 0.40% | 1.70% | – |

| Class P7 | -5.68% | 0.01% | 1.32% | – |

| Class R26 | -5.85% | -0.19% | – | 1.16% |

| Class R36 | -5.77% | -0.11% | – | 1.23% |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ending December 31, 2014, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years and 0% for 10 years. Class B shares

automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Performance is at net asset value.

8

Emerging Markets Local Bond Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the JP Morgan GBI-EM Global Diversified Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2014

| | 1 Year | Life of Class |

| Class A3 | -9.13% | -7.29% |

| Class C4 | -8.59% | -6.62% |

| Class F5 | -6.88% | -5.78% |

| Class I5 | -6.79% | -5.69% |

| Class R25 | -6.79% | -5.88% |

| Class R35 | - 6.79% | -5.85% |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Class A shares commenced operations on June 21, 2013 and performance for the Class began on June 28, 2013. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for the period shown ended

December 31, 2014, is calculated using the SEC-required uniform method to compare such return.

4 Class C shares commenced operations on June 21, 2013 and performance for the Class began on June 28, 2013. The 1% CDSC for Class C normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Commenced operations on June 21, 2013 and performance for the Class began on June 28, 2013. Performance is at net asset value.

9

Multi-Asset Global Opportunity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the 40% MSCI EAFE Index with Gross Dividends/25% Russell 1000® Index/20% Barclays U.S. Aggregate Bond Index/15% BofA Merrill Lynch U.S. High Yield Constrained Index and Morningstar World Allocation Category Average, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett and reimbursed by the Underlying Funds; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2014

| | 1 Year | 5 Years | 10 Years | Life of Class |

| Class A3 | -0.16% | 6.43% | 5.36% | – |

| Class B4 | -3.31% | 5.83% | 5.04% | – |

| Class C5 | 0.51% | 6.16% | 4.90% | – |

| Class F6 | 2.39% | 7.10% | – | 2.60% |

| Class I7 | 2.47% | 7.20% | 5.94% | – |

| Class R28 | 1.86% | 6.78% | – | 4.79% |

| Class R38 | 2.01% | 6.70% | – | 4.73% |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all distributions reinvested for the periods shown ending December 31, 2014, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years and 0% for 10 years. Class B shares

automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Performance is at net asset value.

8 Commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Performance is at net asset value.

10

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2014 through December 31, 2014).

Actual Expenses

For each class of each Fund, the first line of the table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period 7/1/14 – 12/31/14” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

11

Emerging Markets Corporate Debt Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | | Ending | | | Expenses | |

| | Account | | | Account | | | Paid During | |

| | Value | | | Value | | | Period† | |

| | | | | | | | 7/1/14 - | |

| | 7/1/14 | | | 12/31/14 | | | 12/31/14 | |

| Class A | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 991.80 | | | $5.27 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,019.91 | | | $5.35 | |

| Class C | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 987.70 | | | $9.27 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,015.88 | | | $9.40 | |

| Class F | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 992.20 | | | $4.77 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.42 | | | $4.84 | |

| Class I | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 992.80 | | | $4.27 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.92 | | | $4.33 | |

| Class R2 | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 992.80 | | | $4.27 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.92 | | | $4.33 | |

| Class R3 | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 992.80 | | | $4.27 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.92 | | | $4.33 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.05% for Class A, 1.85% for Class C, 0.95% for Class F, 0.85% for Classes I, R2 and R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

December 31, 2014

| Sector* | %** |

| Auto | | 1.61 | % |

| Basic Industry | | 1.17 | % |

| Consumer Cyclicals | | 3.88 | % |

| Consumer Discretionary | | 1.71 | % |

| Consumer Non-Cyclical | | 0.21 | % |

| Consumer Services | | 3.68 | % |

| Consumer Staples | | 5.15 | % |

| Energy | | 11.76 | % |

| Financial Services | | 27.43 | % |

| Foreign Government | | 2.05 | % |

| Sector* | %** |

| Health Care | | 0.82 | % |

| Integrated Oils | | 1.27 | % |

| Materials and Processing | | 8.20 | % |

| Producer Durables | | 3.07 | % |

| Technology | | 2.88 | % |

| Telecommunications | | 9.51 | % |

| Transportation | | 5.07 | % |

| U.S. Government | | 0.96 | % |

| Utilities | | 6.45 | % |

| Repurchase Agreement | | 3.12 | % |

| Total | | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

12

Emerging Markets Currency Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | | Ending | | | Expenses | |

| | | Account | | | Account | | | Paid During | |

| | | Value | | | Value | | | Period† | |

| | | | | | | | | 7/1/14 - | |

| | | 7/1/14 | | | 12/31/14 | | | 12/31/14 | |

| Class A | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 913.80 | | | $4.78 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.21 | | | $5.04 | |

| Class B | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 910.60 | | | $8.62 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.18 | | | $9.10 | |

| Class C | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 910.00 | | | $7.80 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.04 | | | $8.24 | |

| Class F | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 915.70 | | | $4.30 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.72 | | | $4.53 | |

| Class I | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 914.60 | | | $3.81 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.22 | | | $4.02 | |

| Class P | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 914.40 | | | $5.65 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.31 | | | $5.96 | |

| Class R2 | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 912.10 | | | $6.70 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.20 | | | $7.07 | |

| Class R3 | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 913.70 | | | $6.17 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.75 | | | $6.51 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.99% for Class A, 1.79% for Class B, 1.62% for Class C, 0.89% for Class F, 0.79% for Class I, 1.17% for Class P, 1.39% for Class R2 and 1.28% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

December 31, 2014

| Sector* | %** |

| Asset-Backed | | 20.69 | % |

| Automotive | | 1.47 | % |

| Banking | | 6.83 | % |

| Basic Industry | | 3.13 | % |

| Capital Goods | | 1.17 | % |

| Consumer Goods | | 0.61 | % |

| Energy | | 8.34 | % |

| Financial Services | | 3.33 | % |

| Foreign Government | | 0.06 | % |

| Health Care | | 4.50 | % |

| Insurance | | 1.17 | % |

| Sector* | %** |

| Leisure | | 3.11 | % |

| Media | | 2.49 | % |

| Mortgage-Backed | | 29.03 | % |

| Municipal | | 0.21 | % |

| Real Estate | | 3.41 | % |

| Retail | | 2.84 | % |

| Services | | 1.27 | % |

| Technology & Electronics | | 2.04 | % |

| Telecommunications | | 0.94 | % |

| Transportation | | 1.07 | % |

| Utility | | 2.29 | % |

| Total | | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

13

Emerging Markets Local Bond Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | | Ending | | | Expenses | |

| | Account | | | Account | | | Paid During | |

| | Value | | | Value | | | Period† | |

| | | | | | | | 7/1/14 - | |

| | 7/1/14 | | | 12/31/14 | | | 12/31/14 | |

| Class A | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 880.30 | | | $4.98 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,019.91 | | | $5.35 | |

| Class C | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 877.40 | | | $8.57 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,016.08 | | | $9.20 | |

| Class F | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 881.40 | | | $4.51 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.42 | | | $4.84 | |

| Class I | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 881.80 | | | $4.03 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.92 | | | $4.33 | |

| Class R2 | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 881.80 | | | $4.03 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.92 | | | $4.33 | |

| Class R3 | | | | | | | | | | |

| Actual | $ | 1,000.00 | | | $ | 881.80 | | | $4.03 | |

| Hypothetical (5% Return Before Expenses) | $ | 1,000.00 | | | $ | 1,020.92 | | | $4.33 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.05% for Class A, 1.81% for Class C, 0.95% for Class F, 0.85% for Classes I, R2, and R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

December 31, 2014

| Sector* | %** |

| Consumer Services | | 0.93 | % |

| Financial Services | | 6.66 | % |

| Foreign Government | | 86.24 | % |

| Integrated Oils | | 1.95 | % |

| Telecommunications | | 0.90 | % |

| Transportation | | 0.79 | % |

| Utilities | | 2.53 | % |

| Total | | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

14

Multi-Asset Global Opportunity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | | Ending | | | Expenses | |

| | | Account | | | Account | | | Paid During | |

| | | Value | | | Value | | | Period†# | |

| | | | | | | | | 7/1/14 - | |

| | | 7/1/14 | | | 12/31/14 | | | 12/31/14 | |

| Class A | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 953.70 | | | $1.72 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | $1.79 | |

| Class B | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 950.70 | | | $5.36 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.71 | | | $5.55 | |

| Class C | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 951.00 | | | $5.36 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.71 | | | $5.55 | |

| Class F | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 955.20 | | | $0.99 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.20 | | | $1.02 | |

| Class I | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 955.20 | | | $0.49 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.70 | | | $0.51 | |

| Class R2 | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 952.10 | | | $3.40 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.73 | | | $3.52 | |

| Class R3 | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 952.90 | | | $2.81 | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.33 | | | $2.91 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.35% for Class A, 1.09% for Classes B and C, 0.20% for Class F, 0.10% for Class I, 0.69% for Class R2 and 0.57% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

| # | Does not include expenses of Underlying Funds in which Multi-Asset Global Opportunity Fund invests. |

Portfolio Holdings Presented by Portfolio Allocation

December 31, 2014

| Underlying Fund Name | %* |

| Lord Abbett Affiliated Fund, Inc.-Class I | | 1.18 | % |

| Lord Abbett Equity Trust-Calibrated Large Cap Value Fund-Class I | | 0.00% | ** |

| Lord Abbett Equity Trust-Calibrated Mid Cap Value Fund-Class I | | 12.57 | % |

| Lord Abbett Global Fund, Inc.-Emerging Markets Currency Fund-Class I | | 15.58 | % |

| Lord Abbett Research Fund, Inc.-Growth Opportunities Fund-Class I | | 1.95 | % |

| Lord Abbett Investment Trust-High Yield Fund-Class I | | 18.92 | % |

| Lord Abbett Securities Trust-International Dividend Income Fund-Class I | | 37.27 | % |

| Lord Abbett Mid Cap Stock Fund, Inc.-Class I | | 12.53 | % |

| | | 100.00 | % |

| * | Represents percent of total investments. |

| ** | Amount is less than .01%. |

15

Schedule of Investments

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

| | | | | | | Shares | | | Fair | |

| Investments | | | | | | (000) | | | Value | |

| LONG-TERM INVESTMENTS 94.78% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| COMMON STOCK 0.05% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Oil | | | | | | | | | | | | |

Geopark Ltd. (Chile)*(a)

(cost $12,008) | | | | | | | 1 | | | $ | 6,413 | |

| | | | | | | | | | | | | |

| | | | | | | Principal | | | | | |

| | | Interest | | Maturity | | Amount | | | | | |

| | | Rate | | Date | | (000) | | | | | |

| | | | | | | | | | | | | |

| CONVERTIBLE BOND 0.09% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Technology | | | | | | | | | | | | �� |

Vipshop Holdings Ltd. (China)(a)

(cost $11,163) | | 1.50% | | 3/15/2019 | | $ | 10 | | | | 11,950 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS 90.68% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Air Transportation 3.26% | | | | | | | | | | | | |

| Air Canada (Canada)†(a) | | 7.75% | | 4/15/2021 | | | 200 | | | | 208,750 | |

| Avianca Holdings SA/Avianca Leasing LLC/Grupo Taca Holdings Ltd. (Panama)†(a) | | 8.375% | | 5/10/2020 | | | 200 | | | | 207,000 | |

| Total | | | | | | | | | | | 415,750 | |

| | | | | | | | | | | | | |

| Auto Parts: Original Equipment 1.58% | | | | | | | | | | | | |

| Nexteer Automotive Group Ltd.† | | 5.875% | | 11/15/2021 | | | 200 | | | | 201,000 | |

| | | | | | | | | | | | | |

| Banks: Money Center 3.23% | | | | | | | | | | | | |

| Banco de Bogota SA (Colombia)†(a) | | 5.00% | | 1/15/2017 | | | 200 | | | | 208,500 | |

| BBVA Banco Continental SA (Peru)†(a) | | 5.25% | | 9/22/2029 | | | 200 | | | | 203,400 | |

| Total | | | | | | | | | | | 411,900 | |

| | | | | | | | | | | | | |

| Banks: Regional 13.02% | | | | | | | | | | | | |

| Banco de Galicia y Buenos Aires SA (Argentina)†(a) | | 8.75% | | 5/4/2018 | | | 150 | | | | 150,375 | |

| Banco Mercantil del Norte SA (Mexico)(a) | | 4.375% | | 7/19/2015 | | | 48 | | | | 48,720 | |

| Bangkok Bank PCL (Hong Kong)†(a) | | 5.00% | | 10/3/2023 | | | 200 | | | | 223,159 | |

| Bank of China Ltd. (China)†(a) | | 5.00% | | 11/13/2024 | | | 200 | | | | 206,312 | |

| Corpbanca SA (Chile)(a) | | 3.125% | | 1/15/2018 | | | 200 | | | | 199,177 | |

| ICICI Bank Ltd. (Hong Kong)†(a) | | 5.75% | | 11/16/2020 | | | 200 | | | | 222,503 | |

| Itau Unibanco Holding SA† | | 5.50% | | 8/6/2022 | | | 200 | | | | 202,000 | |

| Korea Development Bank (The) (South Korea)(a) | | 3.00% | | 3/17/2019 | | | 200 | | | | 206,503 | |

| QNB Finance Ltd. | | 2.875% | | 4/29/2020 | | | 200 | | | | 199,000 | |

| Total | | | | | | | | | | | 1,657,749 | |

| | | |

| 16 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Beverages 1.45% | | | | | | | | | | | | |

| Anadolu Efes Biracilik ve Malt Sanayii AS (Turkey)†(a) | | 3.375% | | 11/1/2022 | | $ | 200 | | | $ | 184,500 | |

| | | | | | | | | | | | | |

| Broadcasting 0.36% | | | | | | | | | | | | |

| iHeartCommunications, Inc. | | 6.875% | | 6/15/2018 | | | 50 | | | | 45,688 | |

| | | | | | | | | | | | | |

| Business Services 1.78% | | | | | | | | | | | | |

| DP World Ltd. (United Arab Emirates)†(a) | | 6.85% | | 7/2/2037 | | | 200 | | | | 226,556 | |

| | | | | | | | | | | | | |

| Chemicals 5.00% | | | | | | | | | | | | |

| Braskem America Finance Co.† | | 7.125% | | 7/22/2041 | | | 200 | | | | 199,000 | |

| Hexion U.S. Finance Corp./Hexion Nova | | | | | | | | | | | | |

| Scotia Finance ULC | | 9.00% | | 11/15/2020 | | | 20 | | | | 14,500 | |

| Mexichem SAB de CV (Mexico)†(a) | | 4.875% | | 9/19/2022 | | | 200 | | | | 207,000 | |

| OCP SA (Morocco)†(a) | | 6.875% | | 4/25/2044 | | | 200 | | | | 216,020 | |

| Total | | | | | | | | | | | 636,520 | |

| | | | | | | | | | | | | |

| Computer Software 0.14% | | | | �� | | | | | | | | |

| First Data Corp. | | 11.75% | | 8/15/2021 | | | 16 | | | | 18,440 | |

| | | | | | | | | | | | | |

| Containers 0.95% | | | | | | | | | | | | |

| PaperWorks Industries, Inc.† | | 9.50% | | 8/15/2019 | | | 120 | | | | 120,450 | |

| | | | | | | | | | | | | |

| Diversified 3.08% | | | | | | | | | | | | |

| San Miguel Corp. (Philippines)(a) | | 4.875% | | 4/26/2023 | | | 200 | | | | 186,750 | |

| TML Holdings Pte Ltd. (Singapore)(a) | | 5.75% | | 5/7/2021 | | | 200 | | | | 206,021 | |

| Total | | | | | | | | | | | 392,771 | |

| | | | | | | | | | | | | |

| Drugs 0.81% | | | | | | | | | | | | |

| Teva Pharmaceutical Finance Co. BV (Curacao)(a) | | 3.65% | | 11/10/2021 | | | 100 | | | | 102,627 | |

| | | | | | | | | | | | | |

| Electric: Power 6.31% | | | | | | | | | | | | |

| AES El Salvador Trust II (Panama)†(a) | | 6.75% | | 3/28/2023 | | | 200 | | | | 189,200 | |

| E.CL SA (Chile)†(a) | | 4.50% | | 1/29/2025 | | | 200 | | | | 201,183 | |

| Korea Western Power Co., Ltd. (South Korea)†(a) | | 2.875% | | 10/10/2018 | | | 200 | | | | 204,281 | |

| Perusahaan Listrik Negara PT (Indonesia)†(a) | | 5.50% | | 11/22/2021 | | | 200 | | | | 209,500 | |

| Total | | | | | | | | | | | 804,164 | |

| | | | | | | | | | | | | |

| Engineering & Contracting Services 1.57% | | | | | | | | | | | | |

| China Railway Resources Huitung Ltd. (Hong Kong)(a) | | 3.85% | | 2/5/2023 | | | 200 | | | | 199,655 | |

| | | |

| | See Notes to Financial Statements. | 17 |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Entertainment 0.18% | | | | | | | | | | | | |

| Shingle Springs Tribal Gaming Authority† | | 9.75% | | 9/1/2021 | | $ | 20 | | | $ | 22,500 | |

| | | | | | | | | | | | | |

| Financial Services 0.79% | | | | | | | | | | | | |

| SUAM Finance BV (Curacao)†(a) | | 4.875% | | 4/17/2024 | | | 100 | | | | 100,250 | |

| | | | | | | | | | | | | |

| Financial: Miscellaneous 0.09% | | | | | | | | | | | | |

| First Cash Financial Services, Inc. | | 6.75% | | 4/1/2021 | | | 11 | | | | 11,495 | |

| | | | | | | | | | | | | |

| Food 3.79% | | | | | | | | | | | | |

| Diamond Foods, Inc.† | | 7.00% | | 3/15/2019 | | | 25 | | | | 25,687 | |

| FAGE Dairy Industry SA/FAGE USA Dairy Industry, Inc. (Greece)†(a) | | 9.875% | | 2/1/2020 | | | 20 | | | | 21,000 | |

| Gruma SAB de CV (Mexico)†(a) | | 4.875% | | 12/1/2024 | | | 200 | | | | 207,500 | |

| Tingyi Cayman Islands Holding Corp. (China)(a) | | 3.875% | | 6/20/2017 | | | 200 | | | | 207,658 | |

| WhiteWave Foods Co. (The) | | 5.375% | | 10/1/2022 | | | 20 | | | | 20,650 | |

| Total | | | | | | | | | | | 482,495 | |

| | | | | | | | | | | | | |

| Gaming 0.16% | | | | | | | | | | | | |

| Mohegan Tribal Gaming Authority | | 9.75% | | 9/1/2021 | | | 20 | | | | 20,500 | |

| | | | | | | | | | | | | |

| Industrial Products 1.52% | | | | | | | | | | | | |

| KOC Holding AS (Turkey)†(a) | | 3.50% | | 4/24/2020 | | | 200 | | | | 194,300 | |

| | | | | | | | | | | | | |

| Jewelry, Watches & Gemstones 1.49% | | | | | | | | | | | | |

| ALROSA Finance SA (Luxembourg)†(a) | | 7.75% | | 11/3/2020 | | | 200 | | | | 190,000 | |

| | | | | | | | | | | | | |

| Machinery: Agricultural 1.48% | | | | | | | | | | | | |

| Comfeed Finance BV (Netherlands)†(a) | | 6.00% | | 5/2/2018 | | | 200 | | | | 188,000 | |

| | | | | | | | | | | | | |

| Media 3.24% | | | | | | | | | | | | |

| Columbus International, Inc. (Barbados)†(a) | | 7.375% | | 3/30/2021 | | | 200 | | | | 208,750 | |

| VTR Finance BV (Netherlands)†(a) | | 6.875% | | 1/15/2024 | | | 200 | | | | 204,500 | |

| Total | | | | | | | | | | | 413,250 | |

| | | | | | | | | | | | | |

| Metals & Minerals: Miscellaneous 1.46% | | | | | | | | | | | | |

| MMC Norilsk Nickel OJSC via MMC Finance Ltd. (Ireland)(a) | | 4.375% | | 4/30/2018 | | | 200 | | | | 186,000 | |

| | | | | | | | | | | | | |

| Natural Gas 3.13% | | | | | | | | | | | | |

| Fermaca Enterprises S de RL de CV (Mexico)†(a) | | 6.375% | | 3/30/2038 | | | 200 | | | | 204,500 | |

| Transportadora de Gas del Peru SA (Peru)†(a) | | 4.25% | | 4/30/2028 | | | 200 | | | | 194,000 | |

| Total | | | | | | | | | | | 398,500 | |

| | | |

| 18 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Oil 6.86% | | | | | | | | | | | | |

| Dolphin Energy Ltd. (United Arab Emirates)†(a) | | 5.50% | | 12/15/2021 | | $ | 200 | | | $ | 225,600 | |

| Genel Energy Finance plc (United Kingdom)(a) | | 7.50% | | 5/14/2019 | | | 200 | | | | 171,000 | |

| GeoPark Latin America Ltd. Agencia en Chile (Chile)†(a) | | 7.50% | | 2/11/2020 | | | 200 | | | | 177,000 | |

| Kosmos Energy Ltd.† | | 7.875% | | 8/1/2021 | | | 200 | | | | 171,000 | |

| Petroleos de Venezuela SA (Venezuela)†(a) | | 6.00% | | 11/15/2026 | | | 50 | | | | 18,500 | |

| Petronas Capital Ltd. (Malaysia)†(a) | | 5.25% | | 8/12/2019 | | | 100 | | | | 110,999 | |

| Total | | | | | | | | | | | 874,099 | |

| | | | | | | | | | | | | |

| Oil: Integrated International 1.24% | | | | | | | | | | | | |

| Petrobras Global Finance BV (Netherlands)(a) | | 4.375% | | 5/20/2023 | | | 65 | | | | 56,068 | |

| Petroleos Mexicanos (Mexico)(a) | | 5.50% | | 6/27/2044 | | | 100 | | | | 102,500 | |

| Total | | | | | | | | | | | 158,568 | |

| | | | | | | | | | | | | |

| Paper & Forest Products 0.20% | | | | | | | | | | | | |

| Mercer International, Inc. (Canada)†(a) | | 7.75% | | 12/1/2022 | | | 25 | | | | 25,375 | |

| | | | | | | | | | | | | |

| Real Estate Investment Trusts 6.31% | | | | | | | | | | | | |

| China Overseas Finance Cayman V Ltd. | | 3.95% | | 11/15/2022 | | | 200 | | | | 194,399 | |

| China South City Holdings Ltd. (Hong Kong)(a) | | 8.25% | | 1/29/2019 | | | 200 | | | | 199,505 | |

| Fibra Uno Trust (Mexico)†(a) | | 5.25% | | 12/15/2024 | | | 200 | | | | 206,520 | |

| Shimao Property Holdings Ltd. (Hong Kong)(a) | | 8.125% | | 1/22/2021 | | | 200 | | | | 202,812 | |

| Total | | | | | | | | | | | 803,236 | |

| | | | | | | | | | | | | |

| Retail 3.64% | | | | | | | | | | | | |

| Hot Topic, Inc.† | | 9.25% | | 6/15/2021 | | | 20 | | | | 21,500 | |

| Lotte Shopping Co., Ltd. (South Korea)†(a) | | 3.375% | | 5/9/2017 | | | 200 | | | | 206,012 | |

| Pacific Emerald Pte Ltd. (Singapore)(a) | | 9.75% | | 7/25/2018 | | | 200 | | | | 210,500 | |

| PF Chang’s China Bistro, Inc.† | | 10.25% | | 6/30/2020 | | | 25 | | | | 25,062 | |

| Total | | | | | | | | | | | 463,074 | |

| | | | | | | | | | | | | |

| Technology 1.56% | | | | | | | | | | | | |

| Alibaba Group Holding Ltd. (China)†(a) | | 3.60% | | 11/28/2024 | | | 200 | | | | 198,779 | |

| | | | | | | | | | | | | |

| Telecommunications 9.31% | | | | | | | | | | | | |

| Altice SA (Luxembourg)†(a) | | 7.75% | | 5/15/2022 | | | 200 | | | | 200,875 | |

| Bharti Airtel International Netherlands BV (Netherlands)†(a) | | 5.125% | | 3/11/2023 | | | 200 | | | | 214,456 | |

| Digicel Group Ltd. (Jamaica)†(a) | | 7.125% | | 4/1/2022 | | | 200 | | | | 186,500 | |

| Ooredoo International Finance Ltd.† | | 3.25% | | 2/21/2023 | | | 200 | | | | 193,250 | |

| SingTel Group Treasury Pte Ltd. (Singapore)(a) | | 4.50% | | 9/8/2021 | | | 200 | | | | 221,889 | |

| | | |

| | See Notes to Financial Statements. | 19 |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Telecommunications (continued) | | | | | | | | | | | | |

| Vimpel Communications via VIP Finance Ireland Ltd. OJSC (Ireland)†(a) | | 7.748% | | 2/2/2021 | | $ | 200 | | | $ | 168,200 | |

| Total | | | | | | | | | | | 1,185,170 | |

| | | | | | | | | | | | | |

| Transportation: Miscellaneous 1.69% | | | | | | | | | | | | |

| Mersin Uluslararasi Liman Isletmeciligi AS (Turkey)†(a) | | 5.875% | | 8/12/2020 | | | 200 | | | | 215,300 | |

| Total Corporate Bonds (cost $11,561,550) | | | | | | | | | | | 11,548,661 | |

| | | | | | | | | | | | | |

| FOREIGN BOND(b) 1.02% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Netherlands | | | | | | | | | | | | |

United Group BV†

(cost $142,230) | | 7.875% | | 11/15/2020 | | EUR | 100 | | | | 129,354 | |

| | | | | | | | | | | | | |

| FOREIGN GOVERNMENT OBLIGATION 2.00% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Philippines | | | | | | | | | | | | |

Republic of Philippines(a)

(cost $253,833) | | 8.375% | | 6/17/2019 | | $ | 200 | | | | 255,100 | |

| | | | | | | | | | | | | |

| U.S. TREASURY OBLIGATION 0.94% | | | | | | | | | | | | |

U.S. Treasury Note

(cost $119,653) | | 1.625% | | 12/31/2019 | | | 120 | | | | 119,831 | |

| Total Long-Term Investments (cost $12,100,437) | | | | | | | | | | | 12,071,309 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENT 3.06% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| REPURCHASE AGREEMENT | | | | | | | | | | | | |

Repurchase Agreement dated 12/31/2014, Zero Coupon due 1/2/2015 with Fixed Income Clearing Corp. collateralized by $405,000 of U.S. Treasury Note at 0.75% due 3/31/2018; value: $399,345; proceeds: $389,116

(cost $389,116) | | | | | | | 389 | | | | 389,116 | |

| Total Investments in Securities 97.84% (cost $12,489,553) | | | | | | | | | | | 12,460,425 | |

| Cash and Other Assets in Excess Liabilities(c) 2.16% | | | | | | | | | | | 274,688 | |

| Net Assets 100.00% | | | | | | | | | | $ | 12,735,113 | |

| | | |

| 20 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

| EUR | | euro. |

| * | | Non-income producing security. |

| † | | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, unless registered under such Act or exempted from registration, may only be resold to qualified institutional buyers. |

| (a) | | Foreign security traded in U.S. dollars. |

| (b) | | Investment in non-U.S. dollar denominated securities. |

| (c) | | Cash and Other Assets in Excess Liabilities include net unrealized appreciation/depreciation on forward foreign currency exchange contracts and futures contracts as follows: |

Open Forward Foreign Currency Exchange Contracts at December 31, 2014:

Forward

Foreign

Currency

Exchange

Contracts | | Transaction

Type | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $

Cost on

Origination

Date | | | U.S. $

Current

Value | | | Unrealized

Appreciation | |

| Colombian peso | | Buy | | Morgan Stanley | | 3/4/2015 | | 300,500,000 | | $ | 123,303 | | | $ | 126,098 | | | $ | 2,795 | |

| Brazilian real | | Sell | | Goldman Sachs | | 1/9/2015 | | 280,000 | | | 111,129 | | | | 105,220 | | | | 5,909 | |

| Brazilian real | | Sell | | Goldman Sachs | | 1/9/2015 | | 516,200 | | | 199,496 | | | | 193,982 | | | | 5,514 | |

| Colombian peso | | Sell | | Goldman Sachs | | 3/4/2015 | | 300,500,000 | | | 130,228 | | | | 126,099 | | | | 4,129 | |

| euro | | Sell | | Morgan Stanley | | 2/13/2015 | | 211,300 | | | 262,911 | | | | 255,784 | | | | 7,127 | |

| Unrealized Appreciation on Forward Foreign Currency Exchange Contracts | | | | | | | | | | $ | 25,474 | |

| Forward | | | | | | | | | | | | | | | | | |

| Foreign | | | | | | | | | | U.S. $ | | | | | | | |

| Currency | | | | | | | | | | Cost on | | | U.S. $ | | | | |

| Exchange | | Transaction | | | | Expiration | | Foreign | | Origination | | | Current | | | Unrealized | |

| Contracts | | Type | | Counterparty | | Date | | Currency | | Date | | | Value | | | Depreciation | |

| Brazilian real | | Buy | | Goldman Sachs | | 1/9/2015 | | 516,200 | | $ | 201,008 | | | $ | 193,981 | | | $ | (7,027 | ) |

| Brazilian real | | Buy | | Morgan Stanley | | 1/9/2015 | | 280,000 | | | 111,429 | | | | 105,220 | | | | (6,209 | ) |

| euro | | Buy | | Goldman Sachs | | 2/13/2015 | | 106,800 | | | 132,696 | | | | 129,284 | | | | (3,412 | ) |

| Unrealized Depreciation on Forward Foreign Currency Exchange Contracts | | | | | | | | | | | $ | (16,648 | ) |

Open Futures Contracts at December 31, 2014:

| | | | | | | | | | | | Unrealized | |

| Type | | Expiration | | Contracts | | Position | | Fair Value | | | Depreciation | |

| U.S. 10-Year Treasury Note | | March 2015 | | 5 | | Short | | | $(633,984 | ) | | | $(3,680 | ) |

| | | |

| | See Notes to Financial Statements. | 21 |

Schedule of Investments (concluded)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2014

The following is a summary of the inputs used as of December 31, 2014 in valuing the Fund’s investments carried at fair value(1):

| Investment Type(2)(3) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 6,413 | | | $ | – | | | $ | – | | | $ | 6,413 | |

| Convertible Bond | | | – | | | | 11,950 | | | | – | | | | 11,950 | |

| Corporate Bonds | | | – | | | | 11,548,661 | | | | – | | | | 11,548,661 | |

| Foreign Bond | | | – | | | | 129,354 | | | | – | | | | 129,354 | |

| Foreign Government Obligation | | | – | | | | 255,100 | | | | – | | | | 255,100 | |

| U.S. Treasury Obligation | | | – | | | | 119,831 | | | | – | | | | 119,831 | |

| Repurchase Agreement | | | – | | | | 389,116 | | | | – | | | | 389,116 | |

| Total | | $ | 6,413 | | | $ | 12,454,012 | | | $ | – | | | $ | 12,460,425 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | | | | | | | | | | | | | | | | |

| Assets | | $ | – | | | $ | 25,474 | | | $ | – | | | $ | 25,474 | |

| Liabilities | | | – | | | | (16,648 | ) | | | – | | | | (16,648 | ) |

| Futures Contracts | | | | | | | | | | | | | | | | |

| Assets | | | – | | | | – | | | | – | | | | – | |

| Liabilities | | | (3,680 | ) | | | – | | | | – | | | | (3,680 | ) |

| Total | | $ | (3,680 | ) | | $ | 8,826 | | | $ | – | | | $ | 5,146 | |

| | |

| (1) | Refer to Note 2(p) for a description of fair value measurements and the three-tier hierarchy of inputs. |

| (2) | See Schedule of Investments for fair values in each industry and identification of foreign issuers and/or geography. |

| (3) | There were no level transfers during the fiscal year ended December 31, 2014. |

| | | |

| 22 | See Notes to Financial Statements. | |

Schedule of Investments

EMERGING MARKETS CURRENCY FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| LONG-TERM INVESTMENTS 89.79% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| ASSET-BACKED SECURITIES 20.86% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Automobiles 9.24% | | | | | | | | | | | | |

| Ally Auto Receivables Trust 2014-2 A3 | | 1.25% | | 4/15/2019 | | $ | 1,550 | | | $ | 1,548,369 | |

| AmeriCredit Automobile Receivables Trust 2012-4 A3 | | 0.67% | | 6/8/2017 | | | 350 | | | | 350,415 | |

| AmeriCredit Automobile Receivables Trust 2012-5 A3 | | 0.62% | | 6/8/2017 | | | 1,180 | | | | 1,180,081 | |

| AmeriCredit Automobile Receivables Trust 2013-1 A3 | | 0.61% | | 10/10/2017 | | | 230 | | | | 230,256 | |

| AmeriCredit Automobile Receivables Trust 2013-1 B | | 1.07% | | 3/8/2018 | | | 257 | | | | 257,386 | |

| AmeriCredit Automobile Receivables Trust 2013-3 B | | 1.58% | | 9/10/2018 | | | 250 | | | | 251,128 | |

| AmeriCredit Automobile Receivables Trust 2013-4 A2 | | 0.74% | | 11/8/2016 | | | 419 | | | | 418,725 | |

| AmeriCredit Automobile Receivables Trust 2013-5 A2A | | 0.65% | | 3/8/2017 | | | 203 | | | | 202,780 | |

| AmeriCredit Automobile Receivables Trust 2013-5 A3 | | 0.90% | | 9/10/2018 | | | 586 | | | | 585,856 | |

| BMW Vehicle Lease Trust 2013-1 A4 | | 0.66% | | 6/20/2016 | | | 500 | | | | 500,281 | |

| BMW Vehicle Lease Trust 2014-1 A3 | | 0.73% | | 2/21/2017 | | | 1,870 | | | | 1,868,781 | |

| California Republic Auto Receivables Trust 2013-1 A2† | | 1.41% | | 9/17/2018 | | | 951 | | | | 956,013 | |

| California Republic Auto Receivables Trust 2013-2 A2 | | 1.23% | | 3/15/2019 | | | 541 | | | | 543,238 | |

| California Republic Auto Receivables Trust 2014-1 A3 | | 0.85% | | 5/15/2018 | | | 170 | | | | 169,897 | |

| California Republic Auto Receivables Trust 2014-3 A3 | | 1.09% | | 11/15/2018 | | | 550 | | | | 549,451 | |

| Capital Auto Receivables Asset Trust 2013-1 A2 | | 0.62% | | 7/20/2016 | | | 321 | | | | 321,069 | |

| Capital Auto Receivables Asset Trust 2013-2 A2 | | 0.92% | | 9/20/2016 | | | 1,182 | | | | 1,183,208 | |

| Capital Auto Receivables Asset Trust 2014-1 A2 | | 0.96% | | 4/20/2017 | | | 1,905 | | | | 1,907,600 | |

| CarFinance Capital Auto Trust 2014-1A A† | | 1.46% | | 12/17/2018 | | | 165 | | | | 165,226 | |

| CarMax Auto Owner Trust 2013-3 A3 | | 0.97% | | 4/16/2018 | | | 1,027 | | | | 1,029,414 | |

| CarMax Auto Owner Trust 2013-4 A3 | | 0.80% | | 7/16/2018 | | | 790 | | | | 789,318 | |

| CarMax Auto Owner Trust 2014-2 A3 | | 0.98% | | 1/15/2019 | | | 1,240 | | | | 1,236,733 | |

| Chrysler Capital Auto Receivables Trust 2013-AA A3† | | 0.91% | | 4/16/2018 | | | 1,255 | | | | 1,257,837 | |

| Fifth Third Auto Trust 2014-2 A3 | | 0.89% | | 11/15/2018 | | | 1,010 | | | | 1,008,011 | |

| | See Notes to Financial Statements. | 23 |

Schedule of Investments (continued)

EMERGING MARKETS CURRENCY FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Automobiles (continued) | | | | | | | | | | | | |

| Fifth Third Auto Trust 2014-3 A3 | | 0.96% | | 3/15/2019 | | $ | 835 | | | $ | 831,956 | |

| Ford Credit Auto Owner Trust 2014-B A3 | | 0.90% | | 10/15/2018 | | | 715 | | | | 714,705 | |

| GM Financial Automobile Leasing Trust 2014-2A A3† | | 1.22% | | 1/22/2018 | | | 800 | | | | 800,474 | |

| Honda Auto Receivables Owner Trust 2013-4 A3 | | 0.69% | | 9/18/2017 | | | 1,100 | | | | 1,099,432 | |

| Hyundai Auto Receivables Trust 2014-B A3 | | 0.90% | | 12/17/2018 | | | 1,060 | | | | 1,057,556 | |

| Mercedes-Benz Auto Lease Trust 2013-A A3 | | 0.59% | | 2/15/2016 | | | 805 | | | | 804,497 | |

| Mercedes-Benz Auto Lease Trust 2014-A A3 | | 0.68% | | 12/15/2016 | | | 685 | | | | 685,108 | |

| Mercedes-Benz Auto Receivables Trust 2014-1 A3 | | 0.87% | | 10/15/2018 | | | 625 | | | | 623,593 | |

| Nissan Auto Lease Trust 2013-A A3 | | 0.61% | | 4/15/2016 | | | 1,558 | | | | 1,557,536 | |

| Nissan Auto Lease Trust 2014-A A3 | | 0.80% | | 2/15/2017 | | | 590 | | | | 589,778 | |

| Porsche Innovative Lease Owner Trust 2013-1 A3† | | 0.70% | | 8/22/2016 | | | 571 | | | | 571,581 | |

| Porsche Innovative Lease Owner Trust 2014-1 A3† | | 1.03% | | 11/20/2017 | | | 1,945 | | | | 1,942,962 | |

| Santander Drive Auto Receivables Trust 2013-1 A3 | | 0.62% | | 6/15/2017 | | | 621 | | | | 620,525 | |

| Santander Drive Auto Receivables Trust 2013-3 B | | 1.19% | | 5/15/2018 | | | 420 | | | | 420,289 | |

| Santander Drive Auto Receivables Trust 2013-4 A3 | | 1.11% | | 12/15/2017 | | | 1,956 | | | | 1,959,503 | |

| Volkswagen Auto Loan Enhanced Trust 2013-2 A3 | | 0.70% | | 4/20/2018 | | | 1,865 | | | | 1,859,982 | |

| World Omni Automobile Lease Securitization Trust 2014-A A3 | | 1.16% | | 9/15/2017 | | | 475 | | | | 476,211 | |

| Total | | | | | | | | | | | 35,126,761 | |

| | | | | | | | | | | | | |

| Credit Cards 3.65% | | | | | | | | | | | | |

| American Express Credit Account Master Trust 2014-3 A | | 1.49% | | 4/15/2020 | | | 800 | | | | 801,201 | |

| Capital One Multi-Asset Execution Trust 2014-A2 | | 1.26% | | 1/15/2020 | | | 880 | | | | 879,357 | |

| Chase Issuance Trust 2012-A3 | | 0.79% | | 6/15/2017 | | | 2,000 | | | | 2,002,837 | |

| Chase Issuance Trust 2012-A8 | | 0.54% | | 10/16/2017 | | | 2,475 | | | | 2,474,183 | |

| Chase Issuance Trust 2013-A8 | | 1.01% | | 10/15/2018 | | | 540 | | | | 540,201 | |

| Citibank Credit Card Issuance Trust 2012-A1 | | 0.55% | | 10/10/2017 | | | 1,459 | | | | 1,458,816 | |

| Citibank Credit Card Issuance Trust 2013-A6 | | 1.32% | | 9/7/2018 | | | 850 | | | | 855,026 | |

| Discover Card Execution Note Trust 2011-A4 | | 0.511% | # | 5/15/2019 | | | 550 | | | | 552,066 | |

| Discover Card Execution Note Trust 2012-B3 | | 0.611% | # | 5/15/2018 | | | 1,285 | | | | 1,283,952 | |

| World Financial Network Credit Card Master Trust 2013-B A | | 0.91% | | 3/16/2020 | | | 1,050 | | | | 1,048,812 | |

| World Financial Network Credit Card Master Trust 2014-A | | 0.541% | # | 12/15/2019 | | | 2,000 | | | | 2,001,297 | |

| Total | | | | | | | | | | | 13,897,748 | |

| 24 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CURRENCY FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Other 7.97% | | | | | | | | | | | | |

| AMAC CDO Funding I 2006-1A A1† | | 0.439% | # | 11/23/2050 | | $ | 301 | | | $ | 297,836 | |

| Avenue CLO VI Ltd. 2007-6A A2† | | 0.578% | # | 7/17/2019 | | | 500 | | | | 495,720 | |

| Avery Point IV CLO Ltd. 2014-1A A† | | 1.754% | # | 4/25/2026 | | | 1,000 | | | | 1,001,765 | |

| BlueMountain CLO Ltd. 2014-3A A1† | | 1.48% | # | 10/15/2026 | | | 500 | | | | 497,073 | |

| CIFC Funding II Ltd. 2014-2A A1L† | | 1.713% | # | 5/24/2026 | | | 500 | | | | 499,998 | |

| Divcore CLO 2013 | | 4.051% | | 11/27/2032 | | | 1,000 | | | | 966,461 | |

| Dryden XXIII Senior Loan Fund 2012-23RA A1R† | | 1.481% | # | 7/17/2023 | | | 2,000 | | | | 1,984,449 | |

| Fairway Loan Funding Co. 2006-1A A3L† | | 0.888% | # | 10/17/2018 | | | 600 | | | | 596,942 | |

| Fortress Credit BSL II Ltd. 2013-2A A1F† | | 1.731% | # | 10/19/2025 | | | 525 | | | | 523,163 | |

| Fortress Credit BSL Ltd. 2013-1A A† | | 1.411% | # | 1/19/2025 | | | 1,000 | | | | 986,914 | |

| Fraser Sullivan CLO II Ltd. 2006-2A A2† | | 0.547% | # | 12/20/2020 | | | 500 | | | | 497,621 | |

| Galaxy XVIII CLO Ltd. 2014-18A A† | | 1.704% | # | 10/15/2026 | | | 500 | | | | 496,876 | |

| Gleneagles CLO Ltd. 2005-1A B† | | 0.782% | # | 11/1/2017 | | | 500 | | | | 494,150 | |

| HLSS Servicer Advance Receivables Backed Notes 2013-T2 A2† | | 1.147% | | 5/16/2044 | | | 500 | | | | 499,514 | |

| HLSS Servicer Advance Receivables Backed Notes 2013-T3 A3† | | 1.793% | | 5/15/2046 | | | 500 | | | | 493,988 | |

| HLSS Servicer Advance Receivables Backed Notes 2013-T3 B3† | | 2.14% | | 5/15/2046 | | | 750 | | | | 741,732 | |

| HLSS Servicer Advance Receivables Backed Notes 2013-T7 AT7† | | 1.981% | | 11/15/2046 | | | 1,650 | | | | 1,634,059 | |

| HLSS Servicer Advance Receivables Trust 2012-T2 A2† | | 1.99% | | 10/15/2045 | | | 750 | | | | 753,060 | |

| HLSS Servicer Advance Receivables Trust 2013-T1 A2† | | 1.495% | | 1/16/2046 | | | 1,660 | | | | 1,659,049 | |

| HLSS Servicer Advance Receivables Trust 2014-T1 AT1† | | 1.244% | | 1/17/2045 | | | 490 | | | | 490,002 | |

| JFIN CLO Ltd. 2007-1A A2† | | 0.471% | # | 7/20/2021 | | | 374 | | | | 370,683 | |

| JFIN Revolver CLO Ltd. 2013-1A A† | | 1.481% | # | 1/20/2021 | | | 750 | | | | 748,646 | |

| KKR Financial CLO Ltd. 2006-1A C† | | 1.183% | # | 8/25/2018 | | | 750 | | | | 736,137 | |

| KKR Financial CLO Ltd. 2007-1A B† | | 0.982% | # | 5/15/2021 | | | 750 | | | | 730,165 | |

| New Residential Advance Receivables Trust | | | | | | | | | | | | |

| Advance Receivables Backed 2014-T2 AT2† | | 2.377% | | 3/15/2047 | | | 400 | | | | 400,543 | |

| Oaktree CLO Ltd. 2014-2A A1A† | | 1.762% | # | 10/20/2026 | | | 525 | | | | 525,000 | |

| Octagon Investment Partners XIX Ltd. 2014-1A A† | | 1.751% | # | 4/15/2026 | | | 500 | | | | 500,887 | |

| OZLM VII Ltd. 2014-7A A1B† | | 1.745% | # | 7/17/2026 | | | 750 | | | | 750,378 | |

| Red River CLO Ltd. 1A A† | | 0.502% | # | 7/27/2018 | | | 275 | | | | 274,021 | |

| SLM Private Education Loan Trust 2010-A 2A† | | 3.411% | # | 5/16/2044 | | | 1,502 | | | | 1,589,836 | |

| SLM Private Education Loan Trust 2011-B A1† | | 1.011% | # | 12/16/2024 | | | 1,433 | | | | 1,437,783 | |

| | See Notes to Financial Statements. | 25 |

Schedule of Investments (continued)

EMERGING MARKETS CURRENCY FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Other (continued) | | | | | | | | | | | | |

| SLM Private Education Loan Trust 2012-A A1† | | 1.561% | # | 8/15/2025 | | $ | 483 | | | $ | 488,599 | |

| SLM Private Education Loan Trust 2012-C A1† | | 1.261% | # | 8/15/2023 | | | 540 | | | | 542,780 | |

| SLM Private Education Loan Trust 2012-E A1† | | 0.911% | # | 10/16/2023 | | | 231 | | | | 232,036 | |

| SLM Private Education Loan Trust 2013-B A1† | | 0.811% | # | 7/15/2022 | | | 590 | | | | 591,479 | |

| SLM Student Loan Trust 2011-1 A1 | | 0.69% | # | 3/25/2026 | | | 792 | | | | 794,880 | |

| Stone Tower CLO V Ltd. 2006-5A A2B† | | 0.559% | # | 7/16/2020 | | | 1,500 | | | | 1,473,869 | |

| Stone Tower CLO VI Ltd. 2007-6A A2B† | | 0.548% | # | 4/17/2021 | | | 600 | | | | 583,911 | |

| Venture XVII CLO Ltd. 2014-17A A† | | 1.711% | # | 7/15/2026 | | | 850 | | | | 845,307 | |

| Venture XVIII CLO Ltd. 2014-18A A† | | 1.737% | # | 10/15/2026 | | | 500 | | | | 496,373 | |

| Westchester CLO Ltd. 2007-1A A1A† | | 0.457% | # | 8/1/2022 | | | 579 | | | | 574,625 | |

| Total | | | | | | | | | | | 30,298,310 | |

| Total Asset-Backed Securities (cost $79,320,848) | | | | | | | | | | | 79,322,819 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS 30.95% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Aerospace/Defense 0.54% | | | | | | | | | | | | |

| Exelis, Inc. | | 4.25% | | 10/1/2016 | | | 2,000 | | | | 2,069,286 | |

| | | | | | | | | | | | | |

| Auto Loans 0.21% | | | | | | | | | | | | |

| Ford Motor Credit Co. LLC | | 4.25% | | 2/3/2017 | | | 500 | | | | 525,296 | |

| Ford Motor Credit Co. LLC | | 6.625% | | 8/15/2017 | | | 250 | | | | 278,858 | |

| Total | | | | | | | | | | | 804,154 | |

| | | | | | | | | | | | | |

| Auto Parts & Equipment 1.12% | | | | | | | | | | | | |

| Continental Rubber of America Corp.† | | 4.50% | | 9/15/2019 | | | 2,500 | | | | 2,602,310 | |

| Delphi Corp. | | 6.125% | | 5/15/2021 | | | 1,500 | | | | 1,638,750 | |

| Total | | | | | | | | | | | 4,241,060 | |

| | | | | | | | | | | | | |

| Banking 4.96% | | | | | | | | | | | | |

| Bank of America Corp. | | 5.25% | | 12/1/2015 | | | 250 | | | | 259,043 | |

| Bank of America Corp. | | 5.70% | | 5/2/2017 | | | 808 | | | | 873,931 | |

| Bank of America Corp. | | 6.05% | | 5/16/2016 | | | 250 | | | | 264,819 | |

| Bank of America Corp. | | 7.80% | | 9/15/2016 | | | 123 | | | | 135,488 | |

| Bank of America Corp. | | 10.20% | | 7/15/2015 | | | 3,000 | | | | 3,148,944 | |

| Citigroup, Inc. | | 5.50% | | 2/15/2017 | | | 500 | | | | 537,761 | |

| Goldman Sachs Group, Inc. (The) | | 2.233% | # | 8/24/2016 | | | 250 | | | | 254,326 | |

| Goldman Sachs Group, Inc. (The) | | 5.625% | | 1/15/2017 | | | 2,000 | | | | 2,145,814 | |

| Korea Development Bank (The) (South Korea)(a) | | 0.857% | # | 1/22/2017 | | | 1,000 | | | | 1,002,634 | |

| Lloyds Bank plc (United Kingdom)(a) | | 9.875% | | 12/16/2021 | | | 1,000 | | | | 1,150,000 | |

| Morgan Stanley | | 5.95% | | 12/28/2017 | | | 3,000 | | | | 3,335,751 | |

| PNC Funding Corp. | | 5.625% | | 2/1/2017 | | | 695 | | | | 750,439 | |

| 26 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CURRENCY FUND December 31, 2014

| | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Banking (continued) | | | | | | | | | | | | |

| Regions Bank | | 7.50% | | 5/15/2018 | | $ | 750 | | | $ | 871,988 | |

| Royal Bank of Scotland plc (The) (United Kingdom)(a) | | 4.375% | | 3/16/2016 | | | 500 | | | | 517,082 | |

| Santander Holdings USA, Inc. | | 3.00% | | 9/24/2015 | | | 1,800 | | | | 1,821,897 | |

| Shinhan Bank (South Korea)†(a) | | 0.883% | # | 4/8/2017 | | | 1,800 | | | | 1,805,431 | |

| Total | | | | | | | | | | | 18,875,348 | |

| | | | | | | | | | | | | |

| Brokerage 0.27% | | | | | | | | | | | | |

| Jefferies Group LLC | | 3.875% | | 11/9/2015 | | | 500 | | | | 510,672 | |

| Jefferies Group LLC | | 5.50% | | 3/15/2016 | | | 500 | | | | 519,281 | |