UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05476

LORD ABBETT GLOBAL FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Brooke A. Fapohunda, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2015

| Item 1: | Report(s) to Shareholders. |

2015 LORD ABBETT

ANNUAL REPORT

Lord Abbett

Emerging Markets Corporate Debt Fund

Emerging Markets Currency Fund

Emerging Markets Local Bond Fund

Multi-Asset Global Opportunity Fund

For the fiscal year ended December 31, 2015

Table of Contents

Lord Abbett Emerging Markets Corporate Debt Fund,

Lord Abbett Emerging Markets Currency Fund,

Lord Abbett Emerging Markets Local Bond Fund, and

Lord Abbett Multi-Asset Global Opportunity Fund

Annual Report

For the fiscal year ended December 31, 2015

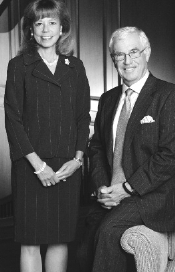

Daria L. Foster, Director, President and Chief Executive Officer of the Lord Abbett Funds, and E. Thayer Bigelow, Independent Chairman of the Lord Abbett Funds. | | Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended December 31, 2015. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and more timely information about the Funds, please visit our website at www.lordabbett.com, where you also can access the quarterly commentaries that provide updates on the Fund’s performance and other portfolio related updates. Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come. Best regards,

Daria L. Foster Director, President and Chief Executive Officer |

Emerging Markets Corporate Debt Fund

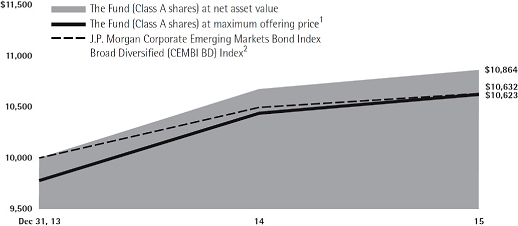

For the fiscal year ended December 31, 2015, the Fund returned 1.77%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified1, which returned 1.30% during the same period.

During the 12-month period, the U.S. dollar denominated emerging market corporate debt (as represented by the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified1) generally outperformed emerging market currencies (as represented by the Barclays Global Emerging Markets Strategy Index2) and emerging market local bonds (as represented by the JP Morgan GBI-EM Global Diversified Index3). The asset class

1

benefited from lack of local currency exposure since the majority of emerging market currencies declined relative to the U.S. dollar in 2015. Emerging markets corporate debt also generally outperformed U.S. fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index4).

In terms of regional allocations, the Fund’s overweight to Russian debt in the first half of 2015 contributed to performance relative to the benchmark. Russian bonds rallied, as tensions in the Ukrainian conflict subsided to a degree. The Fund’s overweight to Brazilian debt in the first four months of 2015 also contributed to relative performance. During the last eight months of 2015, the Fund reduced its exposure to Brazilian bonds, which pared earlier gains following news of a massive corruption scandal at Brazil’s national oil company, Petrobras, and finished the year underperforming the Fund’s benchmark. In addition, the Fund’s underweight exposure to the oil and gas sector in the second half of the year benefited performance, as commodity prices suffered significant declines during that period.

The Fund’s overweight exposure to the industrial sector detracted from relative performance in the second quarter of 2015, as industrials underperformed. In terms of regional allocations, the Fund’s overweight to Mexican debt in the fourth quarter of 2015 hurt performance, as Mexican bonds underperformed during the period. Finally, the Fund’s exposure to U.S high-yield bonds at the end of 2015

detracted from performance, as investor concerns over liquidity and defaults in commodity-related sectors intensified.

Emerging Markets Currency Fund

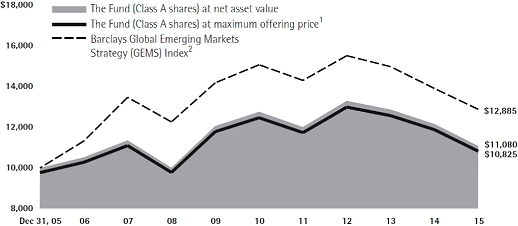

For the fiscal year ended December 31, 2015, the Fund returned -8.95%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Barclays Global Emerging Markets Strategy (GEMS) Index2, which returned -7.37% during the same period.

During 2015, emerging market currencies (as represented by Barclays Global Emerging Markets Strategy Index2) broadly underperformed emerging market corporate debt (as represented by the J.P. Morgan CEMBI Broad Diversified Index1) and outperformed emerging market local bonds (as represented by the J.P. Morgan GBI-EM Global Diversified Index3). Emerging market currencies also broadly underperformed domestic equity markets (as represented by the S&P 500® Index5) and underperformed U.S. fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index4).

Detracting from relative performance was the Fund’s overweight positioning to Latin American currencies in the first half of 2015. Idiosyncratic risks remained high in the region, and, subsequently, the currencies underperformed. In addition, the Fund’s overweight to currencies that are often driven by commodity prices, such as the Russian ruble, in the second part of

2

the year hurt performance due to the underlying weakness in commodities during the period.

In the beginning of the year, the Fund’s underweight position in the euro was a positive contributor to performance, relative to the benchmark, as the European Central Bank announced a quantitative easing program and the euro depreciated against the U.S. dollar. In the second part of the year, the Fund benefited from an underweight exposure to Asian currencies. The region’s currencies were adversely affected by the People’s Bank of China’s surprising decision to devalue the yuan in August 2015, and remained under pressure for the rest of the year.

Emerging Markets Local Bond Fund

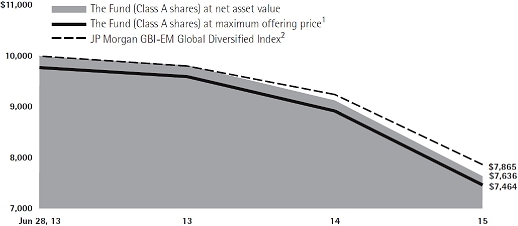

For the fiscal year ended December 31, 2015, the Fund returned -16.32%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the JP Morgan GBI-EM Global Diversified Index3, which returned -14.92% during the same period.

During the 12-month period, emerging market local debt (as represented by the J.P. Morgan GBI-EM Global Diversified Index3) generally underperformed emerging market corporate debt (as represented by the J.P. Morgan CEMBI Broad Diversified Index1) and emerging market currencies (as represented by Barclays Global Emerging Markets Strategy Index2). Emerging market local bonds also

generally underperformed domestic equity markets (as represented by the S&P 500® Index5) and U.S. fixed-income markets (as represented by the Barclays U.S. Aggregate Bond Index4).

The Fund’s overweight positioning to Latin American currencies was the largest detractor to overall performance of the Fund in the first half of 2015. Idiosyncratic risks remained high in the region, and, subsequently, the currencies underperformed. In addition, the Fund’s overweight to Indonesian bonds in the third quarter of 2015 hurt performance, as the bonds were adversely affected by the People’s Bank of China’s surprising decision to devalue the yuan.

In the beginning of the year, the Fund’s exposure to the European currencies, such as Polish zloty and Romanian leu, was a positive contributor to performance, as the European Central Bank announced a quantitative easing program and both currencies depreciated against the U.S. dollar. The Fund’s exposure to Latin America was significantly reduced in the second part of the year, and an underweight to Brazilian bonds, in particular, helped performance, as political instability and economic woes continued to plague the country and the region.

Multi-Asset Global Opportunity Fund

For the fiscal year ended December 31, 2015, the Fund returned -7.43%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions

3

reinvested, compared to its benchmark, 40% MSCI EAFE® Index with Gross Dividends6/25% Russell 1000® Index7/20% Barclays U.S. Aggregate Bond Index4/15% BofA Merrill Lynch U.S. High Yield Constrained Index8, which returned -0.32% over the same period.

During the 12-month period, domestic equity markets (as represented by the S&P 500® Index5) outperformed fixed income markets (as represented by the Barclays U.S. Aggregate Bond Index4). Domestic equity markets also outperformed foreign equity markets (as represented by the MSCI EAFE® Index with Gross Dividends6) and emerging market currencies (as represented by Barclays Global Emerging Markets Strategy Index2).

Detracting from relative performance was the Fund’s overweight exposure to international equities as U.S. stocks outpaced international equities during the period. Also detracting from the Fund’s relative performance was exposure to

emerging markets currencies. A strengthening U.S. dollar and declining commodity prices caused emerging market currencies to underperform the blended benchmark.

The Fund’s underweight exposure to developed markets currencies contributed to relative performance as the divergence between the monetary policies of the U.S. Federal Reserve and other central banks across most of the developed world led to U.S. dollar appreciation for the period. In addition, within fixed income, the Fund’s exposure to short duration bonds contributed to relative performance as this segment of the market outperformed the blended benchmark.

Each Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

4

1 The J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI BD) is a market capitalization-weighted index that tracks total returns of U.S. dollar-denominated debt instruments issued by corporate entities in emerging markets countries. The index limits the current face amount allocations of the bonds in the CEMBI Broad by constraining the total face amount outstanding for countries with larger debt stocks.

2 The Barclays Global Emerging Markets Strategy (GEMS) Index is based on investing in one-month synthetic money market deposits across 15 diversified Emerging Market currencies.

3 The JP Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified Index is a comprehensive global emerging markets index that consists of regularly traded, liquid fixed-rate and domestic currency government bonds.

4 The Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Total return comprises price appreciation/ depreciation and income as a percentage of the original investment.

5 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

6 The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE® Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The MSCI EAFE® Index with Gross Dividends approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits.

7 The Russell 1000 Index® measures the performance of the 1,000 largest companies in the Russell 3000 Index and represents approximately 92% of the total market capitalization of the Russell 3000 Index.

8 The BofA Merrill Lynch U.S. High Yield Constrained

Index is a capitalization-weighted index of all US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. The index caps individual issuer at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. The face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. In the event there are fewer than 50 issuers in the Index, each is equally weighted and the face values of their respective bonds are increased or decreased on a pro-rata basis.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other

Information Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place. Without such waivers and expense reimbursements, the Funds’ returns would have been lower.

The annual commentary above discusses the views of the Funds’ management and various portfolio

5

holdings of the Funds as of December 31, 2015. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Funds’ portfolio is actively managed and may change significantly, the Funds may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Funds’

portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see each Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

6

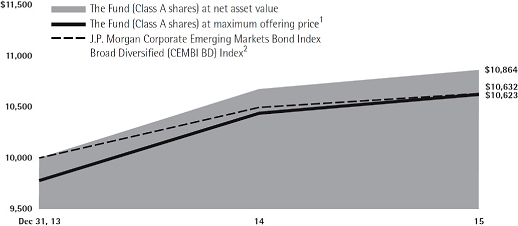

Emerging Markets Corporate Debt Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI BD) Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2015

| | 1 Year | Life of Class | |

| Class A3 | -0.51% | 3.08% | |

| Class C4 | 0.07% | 3.45% | |

| Class F5 | 1.83% | 4.32% | |

| Class I5 | 1.98% | 4.45% | |

| Class R25 | 1.98% | 4.45% | |

| Class R35 | 1.98% | 4.45% | |

| Class R46 | – | -1.33% | * |

| Class R56 | – | -1.21% | * |

| Class R66 | – | -1.18% | * |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Class A shares commenced operations on December 6, 2013 and performance for the Class began on December 31, 2013. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for the period shown ended December 31, 2015, is calculated using the SEC-required uniform method to compare such return.

4 Class C shares commenced operations on December 6, 2013 and performance for the Class began on December 31, 2013. The 1% CDSC for Class C normally applies before the first anniversary of the purchase date.

5 Commenced operations on December 6, 2013 and performance for the Class began on December 31, 2013. Performance is at net asset value.

6 Commenced operations and performance for the Class began on June 30, 2015. Performance is at net asset value.

* Since share Class has existed for less than one year, average annual returns are not provided.

7

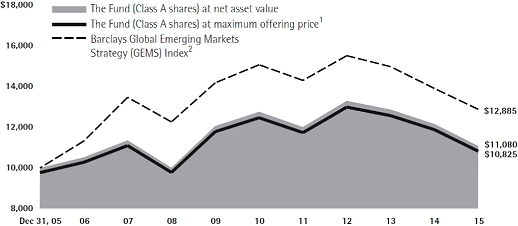

Emerging Markets Currency Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Barclays Global Emerging Markets Strategy (GEMS) Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2015

| | 1 Year | 5 Years | 10 Years | Life of Class | |

| Class A3 | -10.96% | -3.25% | 0.80% | – | |

| Class B4 | -14.22% | -3.92% | 0.49% | – | |

| Class C5 | -10.33% | -3.42% | 0.40% | – | |

| Class F6 | -8.86% | -2.70% | – | 0.27% | |

| Class I7 | -8.79% | -2.61% | 1.32% | – | |

| Class R26 | -9.30% | -3.17% | – | -0.16% | |

| Class R36 | -9.24% | -3.08% | – | -0.10% | |

| Class R48 | – | – | – | -6.44% | * |

| Class R58 | – | – | – | -6.34% | * |

| Class R68 | – | – | – | -6.29% | * |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ending December 31, 2015, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years and 0% for 10 years. Class B shares automatically

convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Performance is at net asset value.

8 Commenced operations and performance for the Class began on June 30, 2015. Performance is at net asset value.

* Since share Class has existed for less than one year, average annual returns are not provided.

8

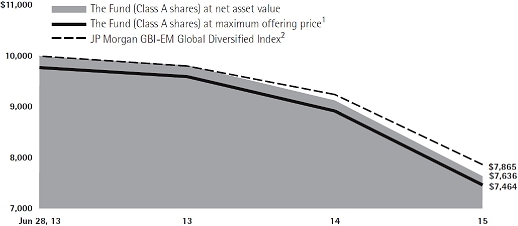

Emerging Markets Local Bond Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the JP Morgan GBI-EM Global Diversified Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2015

| | 1 Year | Life of Class | |

| Class A3 | -18.20% | -11.00% | |

| Class C4 | -17.71% | -10.87% | |

| Class F5 | -16.23% | -10.09% | |

| Class I5 | -16.15% | -10.01% | |

| Class R25 | -16.15% | -10.11% | |

| Class R35 | -16.15% | -10.09% | |

| Class R46 | – | -11.24% | * |

| Class R56 | – | -11.13% | * |

| Class R66 | – | -11.11% | * |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Class A shares commenced operations on June 21, 2013 and performance for the Class began on June 28, 2013. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for the period shown ended December 31, 2015, is calculated using the SEC-required uniform method to compare such return.

4 Class C shares commenced operations on June 21, 2013 and performance for the Class began on June 28, 2013. The 1% CDSC for Class C normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Commenced operations on June 21, 2013 and performance for the Class began on June 28, 2013. Performance is at net asset value.

6 Commenced operations and performance for the Class began on June 30, 2015. Performance is at net asset value.

* Since share Class has existed for less than one year, average annual returns are not provided.

9

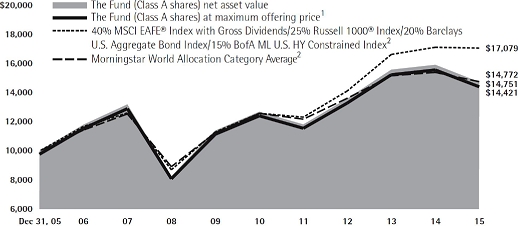

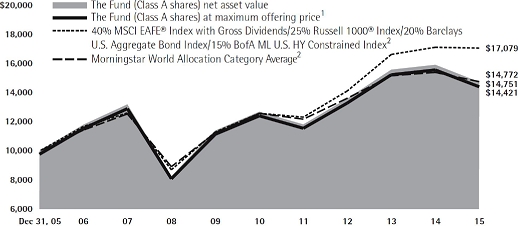

Multi-Asset Global Opportunity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the 40% MSCI EAFE® Index with Gross Dividends/25% Russell 1000® Index/20% Barclays U.S. Aggregate Bond Index/15% BofA Merrill Lynch U.S. High Yield Constrained Index and Morningstar World Allocation Category Average, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett and reimbursed by the Underlying Funds; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower.

Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2015

| | 1 Year | 5 Years | 10 Years | Life of Class | |

| Class A3 | -9.53% | 2.57% | 3.73% | – | |

| Class B4 | -12.37% | 1.96% | 3.40% | – | |

| Class C5 | -9.02% | 2.29% | 3.25% | – | |

| Class F6 | -7.28% | 3.21% | – | 1.35% | |

| Class I7 | -7.23% | 3.29% | 4.28% | – | |

| Class R28 | -7.75% | 2.78% | – | 3.03% | |

| Class R38 | -7.69% | 2.81% | – | 2.98% | |

| Class R49 | – | – | – | -8.18% | * |

| Class R59 | – | – | – | -8.10% | * |

| Class R69 | – | – | – | -8.09% | * |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all distributions reinvested for the periods shown ending December 31, 2015, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years and 0% for 10 years. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Performance is at net asset value.

8 Commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Performance is at net asset value.

9 Commenced operations and performance for the Class began on June 30, 2015. Performance is at net asset value.

* Since share Class has existed for less than one year, average annual returns are not provided.

10

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2015 through December 31, 2015).

Actual Expenses

For each class of each Fund, the first line of the table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period 7/1/15 – 12/31/15” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

11

Emerging Markets Corporate Debt Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses | |

| | | Account | | Account | | Paid During | |

| | | Value | | Value | | Period† | |

| | | | | | | 7/1/15 - | |

| | | 7/1/15 | | 12/31/15 | | 12/31/15 | |

| Class A | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 986.80 | | | | $5.26 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,019.91 | | | | $5.35 | | |

| Class C | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 983.40 | | | | $8.85 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,016.28 | | | | $9.00 | | |

| Class F | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 987.10 | | | | $4.76 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.42 | | | | $4.84 | | |

| Class I | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 987.90 | | | | $4.26 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R2 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 987.90 | | | | $4.26 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R3 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 987.90 | | | | $4.26 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R4 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 986.70 | | | | $5.51 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,019.66 | | | | $5.60 | | |

| Class R5 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 987.90 | | | | $4.26 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R6 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 988.20 | | | | $3.96 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,021.22 | | | | $4.02 | | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.05% for Class A, 1.77% for Class C, 0.95% for Class F, 0.85% for Classes I, R2 and R3, 1.10% for Class R4, 0.85% for Class R5 and 0.79% for Class R6) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

12

Portfolio Holdings Presented by Sector

December 31, 2015

| Sector* | %** |

| Auto | 1.07 | % |

| Basic Industry | 1.30 | % |

| Consumer Cyclicals | 3.70 | % |

| Consumer Discretionary | 2.15 | % |

| Consumer Services | 1.99 | % |

| Consumer Staples | 3.99 | % |

| Energy | 16.95 | % |

| Financial Services | 34.80 | % |

| Foreign Government | 3.84 | % |

| Health Care | 0.44 | % |

| Materials and Processing | 8.72 | % |

| Technology | 2.41 | % |

| Telecommunications | 7.31 | % |

| Transportation | 2.64 | % |

| Utilities | 5.59 | % |

| Repurchase Agreement | 3.10 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

13

Emerging Markets Currency Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses | |

| | | Account | | Account | | Paid During | |

| | | Value | | Value | | Period† | |

| | | | | | | 7/1/15 - | |

| | | 7/1/15 | | 12/31/15 | | 12/31/15 | |

| Class A | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 935.60 | | | | $4.93 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.11 | | | | $5.14 | | |

| Class B | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 930.40 | | | | $8.81 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,016.08 | | | | $9.20 | | |

| Class C | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 933.20 | | | | $7.89 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,017.04 | | | | $8.24 | | |

| Class F | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 936.10 | | | | $4.39 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.67 | | | | $4.58 | | |

| Class I | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 936.40 | | | | $3.95 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,021.12 | | | | $4.13 | | |

| Class R2 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 933.90 | | | | $6.82 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,018.15 | | | | $7.12 | | |

| Class R3 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 934.10 | | | | $6.34 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,018.65 | | | | $6.61 | | |

| Class R4 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 935.60 | | | | $4.88 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.16 | | | | $5.09 | | |

| Class R5 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 936.60 | | | | $3.76 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,021.32 | | | | $3.92 | | |

| Class R6 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 937.10 | | | | $3.27 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,021.83 | | | | $3.41 | | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.01% for Class A, 1.81% for Class B, 1.62% for Class C, 0.90% for Class F, 0.81% for Class I, 1.40% for Class R2, 1.30% for Class R3, 1.01% for Class R4, 0.76% for Class R5 and 0.67% for Class R6) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

14

Portfolio Holdings Presented by Sector

December 31, 2015

| Sector* | %** |

| Asset Backed | 14.68% |

| Automotive | 1.29% |

| Banking | 3.97% |

| Basic Industry | 2.66% |

| Capital Goods | 1.63% |

| Consumer Goods | 1.71% |

| Energy | 9.44% |

| Financial Services | 2.95% |

| Foreign Government | 0.03% |

| Healthcare | 4.81% |

| Insurance | 1.10% |

| Leisure | 2.57% |

| Media | 3.47% |

| Mortgage Backed | 32.82% |

| Municipal | 0.49% |

| Real Estate | 3.50% |

| Retail | 0.12% |

| Services | 0.56% |

| Technology & Electronics | 3.23% |

| Telecommunications | 1.19% |

| Transportation | 2.08% |

| U.S. Government | 3.10% |

| Utility | 2.60% |

| Total | 100.00% |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

15

Emerging Markets Local Bond Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses | |

| | | Account | | Account | | Paid During | |

| | | Value | | Value | | Period† | |

| | | | | | | 7/1/15 - | |

| | | 7/1/15 | | 12/31/15 | | 12/31/15 | |

| Class A | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 887.50 | | | | $5.00 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,019.91 | | | | $5.35 | | |

| Class C | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 884.30 | | | | $8.36 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,016.33 | | | | $8.94 | | |

| Class F | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 887.90 | | | | $4.52 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.42 | | | | $4.84 | | |

| Class I | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 888.40 | | | | $4.05 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R2 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 888.40 | | | | $4.05 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R3 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 888.40 | | | | $4.05 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R4 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 887.60 | | | | $5.23 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,019.66 | | | | $5.60 | | |

| Class R5 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 888.70 | | | | $4.05 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,020.92 | | | | $4.33 | | |

| Class R6 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 888.90 | | | | $3.81 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,021.17 | | | | $4.08 | | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.05% for Class A, 1.76% for Class C, 0.95% for Class F, 0.85% for Classes I, R2 and R3, 1.10% for Class R4, 0.85% for Class R5 and 0.80% for Class R6) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

16

Portfolio Holdings Presented by Sector

December 31, 2015

| Sector* | %** |

| Consumer Services | 1.15% |

| Energy | 2.25% |

| Financial Services | 3.48% |

| Foreign Government | 88.71% |

| Telecommunications | 1.08% |

| Transportation | 0.77% |

| Utilities | 2.56% |

| Total | 100.00% |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

17

Multi-Asset Global Opportunity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses | |

| | | Account | | Account | | Paid During | |

| | | Value | | Value | | Period†# | |

| | | | | | | 7/1/15 - | |

| | | 7/1/15 | | 12/31/15 | | 12/31/15 | |

| Class A | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 918.10 | | | | $1.69 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,023.44 | | | | $1.79 | | |

| Class B | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 914.70 | | | | $5.31 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,019.66 | | | | $5.60 | | |

| Class C | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 914.10 | | | | $5.31 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,019.66 | | | | $5.60 | | |

| Class F | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 919.70 | | | | $0.97 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,024.20 | | | | $1.02 | | |

| Class I | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 919.00 | | | | $0.48 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,024.70 | | | | $0.51 | | |

| Class R2 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 916.50 | | | | $3.38 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,021.68 | | | | $3.57 | | |

| Class R3 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 916.60 | | | | $2.85 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,022.23 | | | | $3.01 | | |

| Class R4 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 918.20 | | | | $1.50 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,023.64 | | | | $1.58 | | |

| Class R5 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 919.00 | | | | $0.34 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,024.85 | | | | $0.36 | | |

| Class R6 | | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | $ | 919.10 | | | | $0.44 | | |

| Hypothetical (5% Return Before Expenses) | | | $1,000.00 | | | $ | 1,024.75 | | | | $0.46 | | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.35% for Class A, 1.10% for Classes B and C, 0.20% for Class F, 0.10% for Class I, 0.70% for Class R2, 0.59% for Class R3, 0.31% for Class R4, 0.07% for Class R5 and 0.09% for Class R6) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

| # | Does not include expenses of Underlying Funds in which Multi-Asset Global Opportunity Fund invests. |

Portfolio Holdings Presented by Asset Allocation

December 31, 2015

| Asset Allocation | %* |

| Mutual Funds | 98.76% |

| Exchange Traded Fund | 0.94% |

| Municipal Bonds | 0.30% |

| Total | 100.00% |

| * | Represents percent of total investments. |

18

Schedule of Investments

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| LONG-TERM INVESTMENTS 96.06% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CORPORATE BONDS 91.95% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Air Transportation 1.03% | | | | | | | | | | | | |

| Air Canada (Canada)†(a) | | 7.75% | | 4/15/2021 | | $ | 200 | | | $ | 208,500 | |

| Emirates Airline (United Arab Emirates)†(a) | | 4.50% | | 2/6/2025 | | | 181 | | | | 183,170 | |

| Total | | | | | | | | | | | 391,670 | |

| | | | | | | | | | | | | |

| Auto Parts: Original Equipment 0.54% | | | | | | | | | | | | |

| Nexteer Automotive Group Ltd.† | | 5.875% | | 11/15/2021 | | | 200 | | | | 205,000 | |

| | | | | | | | | | | | | |

| Automotive 0.52% | | | | | | | | | | | | |

| Hyundai Capital America† | | 2.60% | | 3/19/2020 | | | 200 | | | | 196,673 | |

| | | | | | | | | | | | | |

| Banks: Money Center 0.56% | | | | | | | | | | | | |

| Export-Import Bank of Korea (South Korea)(a) | | 4.00% | | 1/29/2021 | | | 200 | | | | 213,498 | |

| | | | | | | | | | | | | |

| Banks: Regional 20.09% | | | | | | | | | | | | |

| ADCB Finance Cayman Ltd. | | 2.75% | | 9/16/2019 | | | 200 | | | | 198,467 | |

| Agricola Senior Trust† | | 6.75% | | 6/18/2020 | | | 220 | | | | 219,771 | |

| Akbank TAS (Turkey)†(a) | | 4.00% | | 1/24/2020 | | | 200 | | | | 193,499 | |

| Alfa Bank OJSC Via Alfa Bond Issuance plc (Ireland)†(a) | | 7.75% | | 4/28/2021 | | | 200 | | | | 209,500 | |

| Axis Bank Ltd. (United Arab Emirates)†(a) | | 3.25% | | 5/21/2020 | | | 200 | | | | 200,997 | |

| Banco de Bogota SA (Colombia)†(a) | | 5.00% | | 1/15/2017 | | | 200 | | | | 203,200 | |

| Banco de Credito del Peru (Peru)†(a) | | 4.25% | | 4/1/2023 | | | 150 | | | | 150,562 | |

| Banco Internacional del Peru (Panama)†(a) | | 5.75% | | 10/7/2020 | | | 200 | | | | 214,500 | |

| Banco Santander Chile (Chile)†(a) | | 3.875% | | 9/20/2022 | | | 150 | | | | 149,734 | |

| BanColombia SA (Colombia)(a) | | 6.125% | | 7/26/2020 | | | 200 | | | | 206,500 | |

| Bangkok Bank PCL (Hong Kong)†(a) | | 4.80% | | 10/18/2020 | | | 100 | | | | 107,860 | |

| Bangkok Bank PCL (Hong Kong)†(a) | | 5.00% | | 10/3/2023 | | | 200 | | | | 218,546 | |

| Bank of China Ltd. (China)†(a) | | 5.00% | | 11/13/2024 | | | 200 | | | | 206,661 | |

| Bank of India (Jersey)(a) | | 3.125% | | 5/6/2020 | | | 200 | | | | 196,118 | |

| BBVA Banco Continental SA (Peru)†(a) | | 5.00% | | 8/26/2022 | | | 200 | | | | 205,000 | |

| BBVA Bancomer SA† | | 6.008% | | 5/17/2022 | | | 200 | | | | 199,250 | |

| BBVA Bancomer SA† | | 6.75% | | 9/30/2022 | | | 150 | | | | 165,375 | |

| CBQ Finance Ltd. | | 2.875% | | 6/24/2019 | | | 200 | | | | 200,534 | |

| CBQ Finance Ltd.† | | 7.50% | | 11/18/2019 | | | 100 | | | | 114,625 | |

| Corpbanca SA (Chile)(a) | | 3.125% | | 1/15/2018 | | | 200 | | | | 195,174 | |

| DBS Bank Ltd. (Singapore)†(a) | | 2.35% | | 2/28/2017 | | | 200 | | | | 201,805 | |

| DBS Bank Ltd. (Singapore)†(a) | | 3.625% | | 9/21/2022 | | | 200 | | | | 203,647 | |

| | See Notes to Financial Statements. | 19 |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Banks: Regional (continued) | | | | | | | | | | | | |

| ICICI Bank Ltd. (Hong Kong)†(a) | | 5.75% | | 11/16/2020 | | $ | 200 | | | $ | 222,007 | |

| Industrial & Commercial Bank of China Ltd. | | | | | | | | | | | | |

| (United Arab Emirates)(a) | | 2.625% | | 5/26/2020 | | | 200 | | | | 197,620 | |

| Industrial Bank of Korea (South Korea)†(a) | | 2.00% | | 4/23/2020 | | | 200 | | | | 196,351 | |

| KEB Hana Bank (South Korea)†(a) | | 2.50% | | 6/12/2019 | | | 400 | | | | 400,752 | |

| Korea Development Bank (The) (South Korea)(a) | | 3.00% | | 3/17/2019 | | | 200 | | | | 204,665 | |

| National Savings Bank (Sri Lanka)†(a) | | 5.15% | | 9/10/2019 | | | 200 | | | | 187,000 | |

| Oversea-Chinese Banking Corp., Ltd. (Singapore)†(a) | | 3.15% | | 3/11/2023 | | | 200 | | | | 201,133 | |

| Popular, Inc. | | 7.00% | | 7/1/2019 | | | 30 | | | | 28,163 | |

| QNB Finance Ltd. | | 2.125% | | 2/14/2018 | | | 200 | | | | 199,228 | |

| QNB Finance Ltd. | | 2.875% | | 4/29/2020 | | | 200 | | | | 201,529 | |

| Sberbank of Russia via SB Capital SA (Luxembourg)†(a) | | 6.125% | | 2/7/2022 | | | 200 | | | | 201,380 | |

| Siam Commercial Bank Ltd. (Hong Kong)†(a) | | 3.375% | | 9/19/2017 | | | 200 | | | | 203,541 | |

| State Bank of India (United Kingdom)†(a) | | 3.25% | | 4/18/2018 | | | 200 | | | | 202,978 | |

| Turkiye Garanti Bankasi AS (Turkey)†(a) | | 6.25% | | 4/20/2021 | | | 200 | | | | 208,546 | |

| Turkiye Halk Bankasi AS (Turkey)†(a) | | 4.75% | | 2/11/2021 | | | 200 | | | | 190,993 | |

| Vnesheconombank Via VEB Finance plc (Ireland)†(a) | | 6.902% | | 7/9/2020 | | | 200 | | | | 202,999 | |

| Woori Bank (South Korea)†(a) | | 4.75% | | 4/30/2024 | | | 200 | | | | 205,048 | |

| Total | | | | | | | | | | | 7,615,258 | |

| | | | | | | | | | | | | |

| Beverages 1.98% | | | | | | | | | | | | |

| Anadolu Efes Biracilik Ve Malt Sanayii AS (Turkey)†(a) | | 3.375% | | 11/1/2022 | | | 200 | | | | 168,581 | |

| Central American Bottling Corp. (Guatemala)†(a) | | 6.75% | | 2/9/2022 | | | 200 | | | | 203,500 | |

| Fomento Economico Mexicano SAB de CV (Mexico)(a) | | 2.875% | | 5/10/2023 | | | 200 | | | | 187,211 | |

| JB y Cia SA de CV (Mexico)†(a) | | 3.75% | | 5/13/2025 | | | 200 | | | | 191,510 | |

| Total | | | | | | | | | | | 750,802 | |

| | | | | | | | | | | | | |

| Building Materials 0.51% | | | | | | | | | | | | |

| Cemex SAB de CV (Mexico)†(a) | | 7.25% | | 1/15/2021 | | | 200 | | | | 193,000 | |

| | | | | | | | | | | | | |

| Business Services 1.62% | | | | | | | | | | | | |

| DP World Ltd. (United Arab Emirates)†(a) | | 6.85% | | 7/2/2037 | | | 200 | | | | 197,500 | |

| HPHT Finance 15 Ltd.† | | 2.875% | | 3/17/2020 | | | 210 | | | | 209,116 | |

| Mersin Uluslararasi Liman Isletmeciligi AS (Turkey)†(a) | | 5.875% | | 8/12/2020 | | | 200 | | | | 205,616 | |

| Total | | | | | | | | | | | 612,232 | |

| 20 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Chemicals 3.10% | | | | | | | | | | | | |

| Braskem Finance Ltd. | | 6.45% | | 2/3/2024 | | $ | 200 | | | $ | 173,000 | |

| Israel Chemicals Ltd. (Israel)†(a) | | 4.50% | | 12/2/2024 | | | 200 | | | | 200,920 | |

| Mexichem SAB de CV (Mexico)†(a) | | 4.875% | | 9/19/2022 | | | 200 | | | | 199,500 | |

| OCP SA (Morocco)†(a) | | 6.875% | | 4/25/2044 | | | 200 | | | | 197,066 | |

| PhosAgro OAO via PhosAgro Bond Funding Ltd. (Ireland)†(a) | | 4.204% | | 2/13/2018 | | | 200 | | | | 198,375 | |

| PTT Global Chemical PCL (Thailand)†(a) | | 4.25% | | 9/19/2022 | | | 200 | | | | 205,094 | |

| Total | | | | | | | | | | | 1,173,955 | |

| | | | | | | | | | | | | |

| Containers 0.29% | | | | | | | | | | | | |

| PaperWorks Industries, Inc.† | | 9.50% | | 8/15/2019 | | | 120 | | | | 110,400 | |

| | | | | | | | | | | | | |

| Diversified 1.39% | | | | | | | | | | | | |

| Hutchison Whampoa International 03/33 Ltd. | | 7.45% | | 11/24/2033 | | | 100 | | | | 136,389 | |

| Hutchison Whampoa International 14 Ltd. (Hong Kong)†(a) | | 3.625% | | 10/31/2024 | | | 200 | | | | 198,816 | |

| KOC Holding AS (Turkey)†(a) | | 3.50% | | 4/24/2020 | | | 200 | | | | 192,024 | |

| Total | | | | | | | | | | | 527,229 | |

| | | | | | | | | | | | | |

| Drugs 0.43% | | | | | | | | | | | | |

| Teva Pharmaceutical Finance Co. LLC | | 6.15% | | 2/1/2036 | | | 150 | | | | 164,481 | |

| | | | | | | | | | | | | |

| Electric: Power 5.54% | | | | | | | | | | | | |

| AES El Salvador Trust II† | | 6.75% | | 3/28/2023 | | | 200 | | | | 179,500 | |

| AES Gener SA (Chile)†(a) | | 5.00% | | 7/14/2025 | | | 200 | | | | 191,792 | |

| Dubai Electricity & Water Authority (United Arab Emirates)†(a) | | 7.375% | | 10/21/2020 | | | 100 | | | | 118,729 | |

| E.CL SA (Chile)†(a) | | 4.50% | | 1/29/2025 | | | 200 | | | | 197,553 | |

| Eskom Holdings SOC Ltd. (South Africa)†(a) | | 6.75% | | 8/6/2023 | | | 200 | | | | 174,500 | |

| Israel Electric Corp. Ltd. (Israel)†(a) | | 7.25% | | 1/15/2019 | | | 200 | | | | 222,412 | |

| Korea East-West Power Co. Ltd. (South Korea)†(a) | | 2.50% | | 6/2/2020 | | | 200 | | | | 199,307 | |

| Korea Hydro & Nuclear Power Co., Ltd. (South Korea)†(a) | | 3.25% | | 6/15/2025 | | | 200 | | | | 199,894 | |

| Korea Western Power Co. Ltd. (South Korea)†(a) | | 2.875% | | 10/10/2018 | | | 200 | | | | 203,118 | |

| Majapahit Holding BV (Netherlands)†(a) | | 8.00% | | 8/7/2019 | | | 200 | | | | 224,500 | |

| Star Energy Geothermal Wayang Windu Ltd. (Indonesia)†(a) | | 6.125% | | 3/27/2020 | | | 200 | | | | 190,200 | |

| Total | | | | | | | | | | | 2,101,505 | |

| | | | | | | | | | | | | |

| Energy Equipment & Services 0.56% | | | | | | | | | | | | |

| Greenko Dutch BV (Netherlands)†(a) | | 8.00% | | 8/1/2019 | | | 200 | | | | 210,450 | |

| | See Notes to Financial Statements. | 21 |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Engineering & Contracting Services 1.08% | | | | | | | | | | | | |

| Aeropuertos Dominicanos Siglo XXI SA (Dominican Republic)†(a) | | 9.75% | | 11/13/2019 | | $ | 200 | | | $ | 209,000 | |

| China Railway Resources Huitung Ltd. (Hong Kong)(a) | | 3.85% | | 2/5/2023 | | | 200 | | | | 198,695 | |

| Total | | | | | | | | | | | 407,695 | |

| | | | | | | | | | | | | |

| Entertainment 0.26% | | | | | | | | | | | | |

| Eldorado Resorts, Inc.† | | 7.00% | | 8/1/2023 | | | 70 | | | | 68,950 | |

| Mohegan Tribal Gaming Authority | | 9.75% | | 9/1/2021 | | | 30 | | | | 30,075 | |

| Total | | | | | | | | | | | 99,025 | |

| | | | | | | | | | | | | |

| Financial Services 1.86% | | | | | | | | | | | | |

| Guanay Finance Ltd.† | | 6.00% | | 12/15/2020 | | | 200 | | | | 198,500 | |

| Indian Railway Finance Corp., Ltd. (India)(a) | | 3.917% | | 2/26/2019 | | | 200 | | | | 205,548 | |

| Link Finance Cayman 2009 Ltd. (The) | | 3.60% | | 9/3/2024 | | | 200 | | | | 200,450 | |

| SUAM Finance BV (Curacao)†(a) | | 4.875% | | 4/17/2024 | | | 100 | | | | 101,750 | |

| Total | | | | | | | | | | | 706,248 | |

| | | | | | | | | | | | | |

| Food 1.98% | | | | | | | | | | | | |

| Cencosud SA (Chile)†(a) | | 4.875% | | 1/20/2023 | | | 200 | | | | 189,556 | |

| Cosan Luxembourg SA (Luxembourg)†(a) | | 5.00% | | 3/14/2023 | | | 200 | | | | 165,250 | |

| Gruma SAB de CV (Mexico)†(a) | | 4.875% | | 12/1/2024 | | | 200 | | | | 205,000 | |

| Minerva Luxembourg SA (Luxembourg)†(a) | | 7.75% | | 1/31/2023 | | | 200 | | | | 189,000 | |

| Total | | | | | | | | | | | 748,806 | |

| | | | | | | | | | | | | |

| Government 1.65% | | | | | | | | | | | | |

| EXIM Sukuk Malaysia Berhad (Malaysia)(a) | | 2.874% | | 2/19/2019 | | | 200 | | | | 199,885 | |

| IPIC GMTN Ltd.† | | 5.50% | | 3/1/2022 | | | 200 | | | | 224,960 | |

| MDC-GMTN B.V. (Netherlands)†(a) | | 3.25% | | 4/28/2022 | | | 200 | | | | 200,500 | |

| Total | | | | | | | | | | | 625,345 | |

| | | | | | | | | | | | | |

| Household Equipment/Products 0.51% | | | | | | | | | | | | |

| Turkiye Sise ve Cam Fabrikalari AS (Turkey)†(a) | | 4.25% | | 5/9/2020 | | | 200 | | | | 192,500 | |

| | | | | | | | | | | | | |

| Household Furnishings 0.48% | | | | | | | | | | | | |

| Arcelik AS (Turkey)†(a) | | 5.00% | | 4/3/2023 | | | 200 | | | | 182,967 | |

| | | | | | | | | | | | | |

| Insurance 0.53% | | | | | | | | | | | | |

| AIA Group Ltd. (Hong Kong)†(a) | | 2.25% | | 3/11/2019 | | | 200 | | | | 199,194 | |

| | | | | | | | | | | | | |

| Lodging 0.48% | | | | | | | | | | | | |

| MCE Finance Ltd. (Hong Kong)†(a) | | 5.00% | | 2/15/2021 | | | 200 | | | | 183,000 | |

| 22 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Machinery: Oil Well Equipment & Services 0.50% | | | | | | | | | | |

| Ferreycorp SAA (Peru)†(a) | | 4.875% | | 4/26/2020 | | $ | 200 | | | $ | 190,000 | |

| | | | | | | | | | | | | |

| Media 1.98% | | | | | | | | | | | | |

| Altice Luxembourg SA (Luxembourg)†(a) | | 7.625% | | 2/15/2025 | | | 200 | | | | 173,000 | |

| Columbus International, Inc. (Barbados)†(a) | | 7.375% | | 3/30/2021 | | | 200 | | | | 198,750 | |

| Myriad International Holdings BV (Netherlands)†(a) | | 5.50% | | 7/21/2025 | | | 200 | | | | 193,240 | |

| VTR Finance BV (Netherlands)†(a) | | 6.875% | | 1/15/2024 | | | 200 | | | | 184,500 | |

| Total | | | | | | | | | | | 749,490 | |

| | | | | | | | | | | | | |

| Metal Fabricating 0.49% | | | | | | | | | | | | |

| Elementia SAB de CV (Mexico)†(a) | | 5.50% | | 1/15/2025 | | | 200 | | | | 184,000 | |

| | | | | | | | | | | | | |

| Metals & Minerals: Miscellaneous 2.98% | | | | | | | | | | | | |

| ALROSA Finance SA (Luxembourg)†(a) | | 7.75% | | 11/3/2020 | | | 200 | | | | 211,175 | |

| Cia Minera Milpo SAA (Peru)†(a) | | 4.625% | | 3/28/2023 | | | 200 | | | | 177,750 | |

| Fresnillo plc (Mexico)†(a) | | 5.50% | | 11/13/2023 | | | 200 | | | | 202,000 | |

| Glencore Funding LLC† | | 4.625% | | 4/29/2024 | | | 3 | | | | 2,194 | |

| MMC Norilsk Nickel OJSC via MMC Finance Ltd. (Ireland)†(a) | | 6.625% | | 10/14/2022 | | | 200 | | | | 204,128 | |

| Southern Copper Corp. (Peru)(a) | | 3.50% | | 11/8/2022 | | | 220 | | | | 203,785 | |

| Volcan Cia Minera SAA (Peru)†(a) | | 5.375% | | 2/2/2022 | | | 200 | | | | 128,000 | |

| Total | | | | | | | | | | | 1,129,032 | |

| | | | | | | | | | | | | |

| Natural Gas 2.55% | | | | | | | | | | | | |

| Fermaca Enterprises S de RL de CV (Mexico)†(a) | | 6.375% | | 3/30/2038 | | | 196 | | | | 184,090 | |

| Gas Natural de Lima y Callao SA (Peru)†(a) | | 4.375% | | 4/1/2023 | | | 200 | | | | 196,500 | |

| Korea Gas Corp. (South Korea)†(a) | | 3.50% | | 7/21/2025 | | | 200 | | | | 204,812 | |

| Nakilat, Inc. (Qatar)†(a) | | 6.267% | | 12/31/2033 | | | 175 | | | | 194,130 | |

| Transportadora de Gas del Peru SA (Peru)†(a) | | 4.25% | | 4/30/2028 | | | 200 | | | | 188,000 | |

| Total | | | | | | | | | | | 967,532 | |

| | | | | | | | | | | | | |

| Oil 12.68% | | | | | | | | | | | | |

| Bill Barrett Corp. | | 7.00% | | 10/15/2022 | | | 5 | | | | 3,375 | |

| CNOOC Finance 2015 USA LLC | | 3.50% | | 5/5/2025 | | | 200 | | | | 190,739 | |

| CrownRock LP/CrownRock Finance, Inc.† | | 7.75% | | 2/15/2023 | | | 48 | | | | 45,360 | |

| Delek & Avner Tamar Bond Ltd. (Israel)†(a) | | 5.412% | | 12/30/2025 | | | 200 | | | | 201,750 | |

| Dolphin Energy Ltd. (United Arab Emirates)†(a) | | 5.50% | | 12/15/2021 | | | 200 | | | | 220,452 | |

| Ecopetrol SA (Colombia)(a) | | 5.875% | | 5/28/2045 | | | 210 | | | | 150,150 | |

| Gazprom Neft OAO via GPN Capital SA (Luxembourg)†(a) | | 4.375% | | 9/19/2022 | | | 200 | | | | 177,630 | |

| Gazprom OAO via Gaz Capital SA (Luxembourg)†(a) | | 4.95% | | 2/6/2028 | | | 200 | | | | 169,498 | |

| | See Notes to Financial Statements. | 23 |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Oil (continued) | | | | | | | | | | | | |

| Gazprom OAO Via Gaz Capital SA (Luxembourg)†(a) | | 6.51% | | 3/7/2022 | | $ | 125 | | | $ | 126,156 | |

| Genel Energy Finance plc (United Kingdom)†(a) | | 7.50% | | 5/14/2019 | | | 200 | | | | 142,316 | |

| Hilcorp Energy I LP/Hilcorp Finance Co.† | | 5.00% | | 12/1/2024 | | | 60 | | | | 50,100 | |

| Kosmos Energy Ltd.† | | 7.875% | | 8/1/2021 | | | 200 | | | | 162,000 | |

| Kunlun Energy Co., Ltd. (Hong Kong)†(a) | | 2.875% | | 5/13/2020 | | | 200 | | | | 197,504 | |

| Lukoil International Finance BV (Netherlands)†(a) | | 7.25% | | 11/5/2019 | | | 200 | | | | 216,000 | |

| MEG Energy Corp. (Canada)†(a) | | 6.375% | | 1/30/2023 | | | 35 | | | | 24,150 | |

| Pan American Energy LLC (Argentina)†(a) | | 7.875% | | 5/7/2021 | | | 175 | | | | 171,500 | |

| Petrobras Global Finance BV (Netherlands)(a) | | 3.00% | | 1/15/2019 | | | 180 | | | | 137,250 | |

| Petrobras Global Finance BV (Netherlands)(a) | | 4.375% | | 5/20/2023 | | | 165 | | | | 109,313 | |

| Petrobras Global Finance BV (Netherlands)(a) | | 5.625% | | 5/20/2043 | | | 52 | | | | 31,850 | |

| Petrobras Global Finance BV (Netherlands)(a) | | 6.25% | | 3/17/2024 | | | 120 | | | | 86,400 | |

| Petronas Capital Ltd. (Malaysia)†(a) | | 5.25% | | 8/12/2019 | | | 100 | | | | 107,929 | |

| PTT PCL (Thailand)†(a) | | 4.50% | | 10/25/2042 | | | 200 | | | | 181,888 | |

| Ras Laffan Liquefied Natural Gas Co., Ltd. II (Qatar)†(a) | | 5.298% | | 9/30/2020 | | | 131 | | | | 140,190 | |

| Reliance Industries Ltd. (India)†(a) | | 4.125% | | 1/28/2025 | | | 250 | | | | 245,531 | |

| Rosneft Oil Co. via Rosneft International Finance Ltd. (Ireland)†(a) | | 4.199% | | 3/6/2022 | | | 200 | | | | 177,456 | |

| RSP Permian, Inc. | | 6.625% | | 10/1/2022 | | | 60 | | | | 55,500 | |

| Sasol Financing International plc (Isle of Man)(a) | | 4.50% | | 11/14/2022 | | | 200 | | | | 183,908 | |

| Seven Generations Energy Ltd. (Canada)†(a) | | 8.25% | | 5/15/2020 | | | 30 | | | | 27,150 | |

| Sibur Securities Ltd. (Ireland)†(a) | | 3.914% | | 1/31/2018 | | | 400 | | | | 389,516 | |

| Sinopec Group Overseas Development 2015 Ltd.† | | 2.50% | | 4/28/2020 | | | 200 | | | | 197,150 | |

| YPF SA (Argentina)†(a) | | 8.50% | | 7/28/2025 | | | 510 | | | | 488,325 | |

| Total | | | | | | | | | | | 4,808,036 | |

| | | | | | | | | | | | | |

| Paper & Forest Products 0.99% | | | | | | | | | | | | |

| Celulosa Arauco y Constitucion SA (Chile)(a) | | 5.00% | | 1/21/2021 | | | 150 | | | | 156,699 | |

| Mercer International, Inc. (Canada)(a) | | 7.75% | | 12/1/2022 | | | 25 | | | | 25,375 | |

| Suzano Trading Ltd.† | | 5.875% | | 1/23/2021 | | | 200 | | | | 194,500 | |

| Total | | | | | | | | | | | 376,574 | |

| | | | | | | | | | | | | |

| Real Estate Investment Trusts 8.20% | | | | | | | | | | | | |

| China Overseas Finance Cayman V Ltd. | | 3.95% | | 11/15/2022 | | | 200 | | | | 198,852 | |

| Country Garden Holdings Co., Ltd. (China)†(a) | | 7.50% | | 1/10/2023 | | | 400 | | | | 415,012 | |

| Greenland Global Investment Ltd. (China)(a) | | 4.375% | | 7/3/2019 | | | 200 | | | | 201,294 | |

| Jababeka International BV (Netherlands)†(a) | | 7.50% | | 9/24/2019 | | | 200 | | | | 189,941 | |

| JAFZ Sukuk 2019 Ltd. (United Arab Emirates)(a) | | 7.00% | | 6/19/2019 | | | 200 | | | | 223,840 | |

| 24 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Real Estate Investment Trusts (continued) | | | | | | | | | | | | |

| KWG Property Holding Ltd. (China)(a) | | 8.625% | | 2/5/2020 | | $ | 200 | | | $ | 209,000 | |

| MAF Global Securities Ltd. | | 5.25% | | 7/5/2019 | | | 200 | | | | 213,750 | |

| PLA Administradora Industrial S de RL de CV (Mexico)†(a) | | 5.25% | | 11/10/2022 | | | 200 | | | | 194,750 | |

| Poly Real Estate Finance Ltd. | | 5.25% | | 4/25/2019 | | | 200 | | | | 210,317 | |

| Qatari Diar Finance Co. (Qatar)†(a) | | 5.00% | | 7/21/2020 | | | 200 | | | | 221,143 | |

| Shimao Property Holdings Ltd. (Hong Kong)(a) | | 8.375% | | 2/10/2022 | | | 200 | | | | 215,163 | |

| Sukuk Funding No 3 Ltd. (United Arab Emirates)(a) | | 4.348% | | 12/3/2018 | | | 200 | | | | 206,968 | |

| Swire Properties MTN Financing Ltd. (Hong Kong)(a) | | 2.75% | | 3/7/2020 | | | 200 | | | | 200,342 | |

| Yuzhou Properties Co., Ltd. (China)(a) | | 8.625% | | 1/24/2019 | | | 200 | | | | 206,690 | |

| Total | | | | | | | | | | | 3,107,062 | |

| | | | | | | | | | | | | |

| Retail 3.18% | | | | | | | | | | | | |

| El Puerto de Liverpool SAB de CV (Mexico)†(a) | | 3.95% | | 10/2/2024 | | | 200 | | | | 194,750 | |

| Hot Topic, Inc.† | | 9.25% | | 6/15/2021 | | | 20 | | | | 17,800 | |

| InRetail Consumer (Peru)†(a) | | 5.25% | | 10/10/2021 | | | 200 | | | | 202,000 | |

| Lotte Shopping Co., Ltd. (South Korea)†(a) | | 3.375% | | 5/9/2017 | | | 200 | | | | 203,069 | |

| Office Depot de Mexico SA de CV (Mexico)†(a) | | 6.875% | | 9/20/2020 | | | 200 | | | | 202,500 | |

| Pacific Emerald Pte Ltd. (Singapore)(a) | | 9.75% | | 7/25/2018 | | | 200 | | | | 192,000 | |

| SACI Falabella (Chile)†(a) | | 3.75% | | 4/30/2023 | | | 200 | | | | 195,087 | |

| Total | | | | | | | | | | | 1,207,206 | |

| | | | | | | | | | | | | |

| Steel 0.50% | | | | | | | | | | | | |

| Evraz Group SA (Russia)†(a) | | 6.50% | | 4/22/2020 | | | 200 | | | | 188,000 | |

| | | | | | | | | | | | | |

| Technology 2.08% | | | | | | | | | | | | |

| Alibaba Group Holding Ltd. (China)(a) | | 2.50% | | 11/28/2019 | | | 200 | | | | 195,642 | |

| Alibaba Group Holding Ltd. (China)(a) | | 3.60% | | 11/28/2024 | | | 200 | | | | 191,768 | |

| Baidu, Inc. (China)(a) | | 4.125% | | 6/30/2025 | | | 200 | | | | 199,203 | |

| Tencent Holdings Ltd. (China)†(a) | | 3.375% | | 5/2/2019 | | | 200 | | | | 203,528 | |

| Total | | | | | | | | | | | 790,141 | |

| | | | | | | | | | | | | |

| Telecommunications 7.25% | | | | | | | | | | | | |

| America Movil SAB de CV (Mexico)(a) | | 3.125% | | 7/16/2022 | | | 200 | | | | 197,100 | |

| Bharti Airtel International Netherlands BV (Netherlands)†(a) | | 5.125% | | 3/11/2023 | | | 200 | | | | 207,498 | |

| Digicel Ltd. (Jamaica)†(a) | | 6.75% | | 3/1/2023 | | | 200 | | | | 168,000 | |

| Digicel Ltd. (Jamaica)†(a) | | 7.00% | | 2/15/2020 | | | 175 | | | | 160,125 | |

| Emirates Telecommunications Group Co. PJSC (United Arab Emirates)(a) | | 3.50% | | 6/18/2024 | | | 200 | | | | 203,378 | |

| GCX Ltd. (India)†(a) | | 7.00% | | 8/1/2019 | | | 200 | | | | 187,942 | |

| | See Notes to Financial Statements. | 25 |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Telecommunications (continued) | | | | | | | | | | | | |

| HKT Capital No 2 Ltd. | | 3.625% | | 4/2/2025 | | $ | 200 | | | $ | 195,661 | |

| Mobile Telesystems OJSC via MTS International Funding Ltd. (Ireland)†(a) | | 8.625% | | 6/22/2020 | | | 100 | | | | 110,784 | |

| Ooredoo International Finance Ltd.† | | 5.00% | | 10/19/2025 | | | 200 | | | | 216,500 | |

| Sable International Finance Ltd.† | | 6.875% | | 8/1/2022 | | | 200 | | | | 194,000 | |

| SingTel Group Treasury Pte Ltd. (Singapore)(a) | | 4.50% | | 9/8/2021 | | | 400 | | | | 435,384 | |

| Sixsigma Networks Mexico SA de CV (Mexico)†(a) | | 8.25% | | 11/7/2021 | | | 200 | | | | 192,000 | |

| SK Telecom Co., Ltd. (South Korea)†(a) | | 2.125% | | 5/1/2018 | | | 200 | | | | 199,417 | |

| T-Mobile USA, Inc. | | 6.50% | | 1/15/2026 | | | 80 | | | | 80,959 | |

| Total | | | | | | | | | | | 2,748,748 | |

| | | | | | | | | | | | | |

| Transportation: Miscellaneous 1.58% | | | | | | | | | | | | |

| Autoridad del Canal de Panama (Panama)†(a) | | 4.95% | | 7/29/2035 | | | 200 | | | | 207,000 | |

| Kazakhstan Temir Zholy Finance BV (Netherlands)†(a) | | 6.375% | | 10/6/2020 | | | 200 | | | | 197,640 | |

| Lima Metro Line 2 Finance Ltd.† | | 5.875% | | 7/5/2034 | | | 200 | | | | 195,000 | |

| Total | | | | | | | | | | | 599,640 | |

| Total Corporate Bonds (cost $35,545,752) | | | | | | | | | | | 34,856,394 | |

| | | | | | | | | | | | | |

| FOREIGN BOND(b) 0.30% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Netherlands | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Technology | | | | | | | | | | | | |

| United Group BV† | | | | | | | | | | | | |

| (cost $140,212) | | 7.875% | | 11/15/2020 | | EUR | 100 | | | | 114,945 | |

| | | | | | | | | | | | | |

| FOREIGN GOVERNMENT OBLIGATIONS 3.81% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Argentina 2.43% | | | | | | | | | | | | |

| Provincia de Buenos Aires†(a) | | 9.95% | | 6/9/2021 | | $ | 350 | | | | 361,375 | |

| Republic of Argentina(a)(c) | | 8.28% | | 12/31/2033 | | | 210 | | | | 242,903 | |

| Republic of Argentina(a) | | 8.75% | | 5/7/2024 | | | 300 | | | | 316,840 | |

| Total | | | | | | | | | | | 921,118 | |

| | | | | | | | | | | | | |

| Cyprus 0.91% | | | | | | | | | | | | |

| Republic of Cyprus(b) | | 3.875% | | 5/6/2022 | | EUR | 241 | | | | 273,039 | |

| Republic of Cyprus(b) | | 4.75% | | 6/25/2019 | | EUR | 60 | | | | 70,324 | |

| Total | | | | | | | | | | | 343,363 | |

| 26 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| Ethiopia 0.47% | | | | | | | | | | |

| Republic of Ethiopia†(a) | | 6.625% | | 12/11/2024 | | $ | 200 | | | $ | 178,080 | |

| Total Foreign Government Obligations (cost $1,430,641) | | | | | | | | | | | 1,442,561 | |

| Total Long-Term Investments (cost $37,116,605) | | | | | | | | | | | 36,413,900 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENT 3.07% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Repurchase Agreement | | | | | | | | | | | | |

| Repurchase Agreement dated 12/31/2015, 0.03% due 1/4/2016 with Fixed Income Clearing Corp. collateralized by $1,190,000 of U.S. Treasury Note at 1.625% due 7/31/2020; value: $1,191,488; proceeds: $1,165,778 (cost $1,165,774) | | | | | | | 1,166 | | | | 1,165,774 | |

| Total Investments in Securities 99.13% (cost $38,282,379) | | | | | | | | | | | 37,579,674 | |

| Cash and Other Assets in Excess of Liabilities(d) 0.87% | | | | | | | | | | | 329,932 | |

| Net Assets 100.00% | | | | | | | | | | $ | 37,909,606 | |

| EUR | | euro. |

| † | | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, unless registered under such Act or exempted from registration, may only be resold to qualified institutional buyers. |

| (a) | | Foreign security traded in U.S. dollars. |

| (b) | | Investment in non-U.S. dollar denominated securities. |

| (c) | | Defaulted (non-income producing security). |

| (d) | | Cash and Other Assets in Excess of Liabilities include net unrealized appreciation/depreciation on forward foreign currency exchange contracts and future contracts as follows: |

Open Forward Foreign Currency Exchange Contracts at December 31, 2015:

Forward

Foreign

Currency

Exchange

Contracts | | Transaction

Type | | Counterparty | | Expiration

Date | | Foreign

Currency | | | U.S. $

Cost on

Origination

Date | | | U.S. $

Current

Value | | Unrealized

Appreciation | |

| euro | | Buy | | State Street Bank and Trust | | 2/16/2016 | | | 4,000 | | | $ | 4,273 | | | $ | 4,351 | | | $ | 78 | |

| euro | | Sell | | Morgan Stanley | | 2/16/2016 | | | 260,000 | | | | 288,402 | | | | 282,848 | | | | 5,554 | |

| Mexican peso | | Sell | | Goldman Sachs | | 1/20/2016 | | | 5,360,000 | | | | 320,093 | | | | 310,665 | | | | 9,428 | |

| Unrealized Appreciation on Forward Foreign Currency Exchange Contracts | | | | | | | | | | $ | 15,060 | |

Forward

Foreign

Currency

Exchange

Contracts | | Transaction

Type | | Counterparty | | Expiration

Date | | | Foreign

Currency | | | | U.S. $

Cost on

Origination

Date | | | | U.S. $

Current

Value | | Unrealized

Depreciation | |

| Mexican peso | | Buy | | Citibank | | 1/20/2016 | | | 5,360,000 | | | $ | 325,190 | | | $ | 310,665 | | | $ | (14,525 | ) |

| euro | | Sell | | Goldman Sachs | | 2/16/2016 | | | 170,000 | | | | 183,022 | | | | 184,939 | | | | (1,917 | ) |

| Unrealized Depreciation on Forward Foreign Currency Exchange Contracts | | | | | | | | | | $ | (16,442 | ) |

| | See Notes to Financial Statements. | 27 |

Schedule of Investments (concluded)

EMERGING MARKETS CORPORATE DEBT FUND December 31, 2015

| Open Futures Contracts at December 31, 2015: | | | | | |

| Type | | Expiration | | Contracts | | Position | | | Fair Value | | | Unrealized

Appreciation | |

| U.S. 10-Year Treasury Note | | March 2016 | | 2 | | Short | | $ | (251,813 | ) | | | $ | 1,340 | |

| | | | | | | | | | | | | | | | |

The following is a summary of the inputs used as of December 31, 2015 in valuing the Fund’s investments carried at fair value(1):

| Investment Type(2)(3) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | – | | | $ | 34,856,394 | | | $ | – | | | $ | 34,856,394 | |

| Foreign Bond | | | – | | | | 114,945 | | | | – | | | | 114,945 | |

| Foreign Government Obligations | | | – | | | | 1,442,561 | | | | – | | | | 1,442,561 | |

| Repurchase Agreement | | | – | | | | 1,165,774 | | | | – | | | | 1,165,774 | |

| Total | | $ | – | | | $ | 37,579,674 | | | $ | – | | | $ | 37,579,674 | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | | | | | | | | | | | | | | | | |

| Assets | | $ | – | | | $ | 15,060 | | | $ | – | | | $ | 15,060 | |

| Liabilities | | | – | | | | (16,442 | ) | | | – | | | | (16,442 | ) |

| Futures Contracts | | | | | | | | | | | | | | | | |

| Assets | | | 1,340 | | | | – | | | | – | | | | 1,340 | |

| Liabilities | | | – | | | | – | | | | – | | | | – | |

| Total | | $ | 1,340 | | | $ | (1,382 | ) | | $ | – | | | $ | (42 | ) |

| (1) | Refer to Note 2(p) for a description of fair value measurements and the three-tier hierarchy of inputs. |

| (2) | See Schedule of Investments for fair values in each industry and identification of foreign issuers and/or geography. |

| (3) | There were no Level 1/Level 2 transfers during the fiscal year ended December 31, 2015. |

| 28 | See Notes to Financial Statements. | |

Schedule of Investments

EMERGING MARKETS CURRENCY FUND December 31, 2015

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| LONG-TERM INVESTMENTS 89.17% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| ASSET-BACKED SECURITIES 14.95% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Automobiles 6.06% | | | | | | | | | | | | |

| AmeriCredit Automobile Receivables Trust 2013-1 B | | 1.07% | | 3/8/2018 | | $ | 221 | | | $ | 221,043 | |

| AmeriCredit Automobile Receivables Trust 2013-3 B | | 1.58% | | 9/10/2018 | | | 250 | | | | 250,053 | |

| AmeriCredit Automobile Receivables Trust 2013-5 A3 | | 0.90% | | 9/10/2018 | | | 359 | | | | 358,706 | |

| Avis Budget Rental Car Funding AESOP LLC 2011-3A A† | | 3.41% | | 11/20/2017 | | | 462 | | | | 467,194 | |

| Avis Budget Rental Car Funding AESOP LLC 2011-5A A† | | 3.27% | | 2/20/2018 | | | 463 | | | | 469,893 | |

| Avis Budget Rental Car Funding AESOP LLC 2012-2A A† | | 2.802% | | 5/20/2018 | | | 1,390 | | | | 1,406,401 | |

| Avis Budget Rental Car Funding AESOP LLC 2014-1A A† | | 2.46% | | 7/20/2020 | | | 459 | | | | 460,850 | |

| Avis Budget Rental Car Funding AESOP LLC 2014-2A A† | | 2.50% | | 2/20/2021 | | | 328 | | | | 327,627 | |

| Avis Budget Rental Car Funding AESOP LLC 2015-2A A† | | 2.63% | | 12/20/2021 | | | 583 | | | | 576,379 | |

| BMW Vehicle Lease Trust 2015-1 A3 | | 1.24% | | 12/20/2017 | | | 1,650 | | | | 1,647,907 | |