UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5511

Variable Insurance Products Fund II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2018 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products: Index 500 Portfolio

Semi-Annual Report June 30, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Ten Stocks as of June 30, 2018

| | % of fund's net assets |

| Apple, Inc. | 3.9 |

| Microsoft Corp. | 3.3 |

| Amazon.com, Inc. | 3.0 |

| Facebook, Inc. Class A | 2.0 |

| Berkshire Hathaway, Inc. Class B | 1.6 |

| JPMorgan Chase & Co. | 1.5 |

| Exxon Mobil Corp. | 1.5 |

| Alphabet, Inc. Class C | 1.5 |

| Alphabet, Inc. Class A | 1.5 |

| Johnson & Johnson | 1.4 |

| | 21.2 |

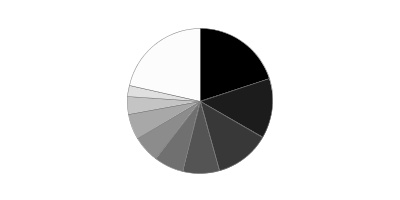

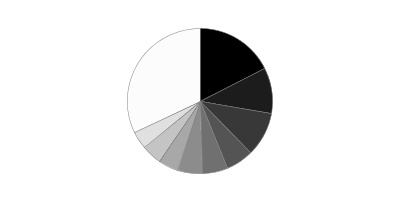

Top Market Sectors as of June 30, 2018

| | % of fund's net assets |

| Information Technology | 25.9 |

| Health Care | 14.0 |

| Financials | 13.8 |

| Consumer Discretionary | 12.9 |

| Industrials | 9.5 |

| Consumer Staples | 6.8 |

| Energy | 6.3 |

| Utilities | 2.9 |

| Real Estate | 2.9 |

| Materials | 2.6 |

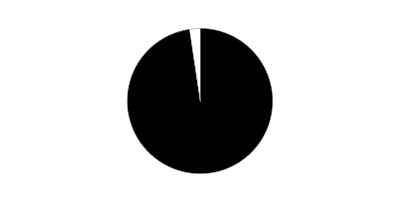

Asset Allocation (% of fund's net assets)

| As of June 30, 2018* |

| | Stocks and Equity Futures | 100.0% |

* Foreign investments – 3.7%

Schedule of Investments June 30, 2018 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.6% | | | |

| | | Shares | Value |

| CONSUMER DISCRETIONARY - 12.9% | | | |

| Auto Components - 0.2% | | | |

| Aptiv PLC | | 89,988 | $8,245,600 |

| BorgWarner, Inc. | | 67,124 | 2,897,072 |

| The Goodyear Tire & Rubber Co. | | 81,511 | 1,898,391 |

| | | | 13,041,063 |

| Automobiles - 0.4% | | | |

| Ford Motor Co. | | 1,330,299 | 14,726,410 |

| General Motors Co. | | 431,129 | 16,986,483 |

| Harley-Davidson, Inc. (a) | | 56,567 | 2,380,339 |

| | | | 34,093,232 |

| Distributors - 0.1% | | | |

| Genuine Parts Co. | | 49,872 | 4,577,751 |

| LKQ Corp. (b) | | 105,263 | 3,357,890 |

| | | | 7,935,641 |

| Diversified Consumer Services - 0.0% | | | |

| H&R Block, Inc. | | 71,102 | 1,619,704 |

| Hotels, Restaurants & Leisure - 1.6% | | | |

| Carnival Corp. | | 137,979 | 7,907,576 |

| Chipotle Mexican Grill, Inc. (b) | | 8,313 | 3,585,979 |

| Darden Restaurants, Inc. | | 42,073 | 4,504,335 |

| Hilton Worldwide Holdings, Inc. | | 94,956 | 7,516,717 |

| Marriott International, Inc. Class A | | 100,881 | 12,771,535 |

| McDonald's Corp. | | 266,861 | 41,814,450 |

| MGM Mirage, Inc. | | 170,313 | 4,944,186 |

| Norwegian Cruise Line Holdings Ltd. (b) | | 70,257 | 3,319,643 |

| Royal Caribbean Cruises Ltd. | | 57,574 | 5,964,666 |

| Starbucks Corp. | | 469,025 | 22,911,871 |

| Wynn Resorts Ltd. | | 28,787 | 4,817,217 |

| Yum! Brands, Inc. | | 109,853 | 8,592,702 |

| | | | 128,650,877 |

| Household Durables - 0.4% | | | |

| D.R. Horton, Inc. | | 116,729 | 4,785,889 |

| Garmin Ltd. (a) | | 37,803 | 2,305,983 |

| Leggett & Platt, Inc. (a) | | 44,615 | 1,991,614 |

| Lennar Corp. Class A | | 92,991 | 4,882,028 |

| Mohawk Industries, Inc. (b) | | 21,551 | 4,617,733 |

| Newell Brands, Inc. | | 165,076 | 4,257,310 |

| PulteGroup, Inc. | | 89,279 | 2,566,771 |

| Whirlpool Corp. (a) | | 21,930 | 3,206,824 |

| | | | 28,614,152 |

| Internet & Direct Marketing Retail - 4.2% | | | |

| Amazon.com, Inc. (b) | | 136,880 | 232,668,624 |

| Expedia, Inc. | | 41,079 | 4,937,285 |

| Netflix, Inc. (b) | | 147,741 | 57,830,260 |

| The Booking Holdings, Inc. (b) | | 16,373 | 33,189,545 |

| TripAdvisor, Inc. (a)(b) | | 36,421 | 2,029,014 |

| | | | 330,654,728 |

| Leisure Products - 0.1% | | | |

| Hasbro, Inc. | | 38,641 | 3,566,951 |

| Mattel, Inc. (a) | | 116,922 | 1,919,859 |

| | | | 5,486,810 |

| Media - 2.3% | | | |

| CBS Corp. Class B | | 116,060 | 6,524,893 |

| Charter Communications, Inc. Class A (b) | | 62,952 | 18,458,156 |

| Comcast Corp. Class A | | 1,560,765 | 51,208,700 |

| Discovery Communications, Inc.: | | | |

| Class A (a)(b) | | 53,039 | 1,458,573 |

| Class C (non-vtg.) (b) | | 116,099 | 2,960,525 |

| DISH Network Corp. Class A (b) | | 77,812 | 2,615,261 |

| Interpublic Group of Companies, Inc. | | 131,028 | 3,071,296 |

| News Corp.: | | | |

| Class A | | 130,263 | 2,019,077 |

| Class B | | 41,388 | 656,000 |

| Omnicom Group, Inc. (a) | | 77,250 | 5,891,858 |

| The Walt Disney Co. | | 505,307 | 52,961,227 |

| Twenty-First Century Fox, Inc.: | | | |

| Class A | | 358,238 | 17,800,846 |

| Class B | | 149,268 | 7,354,434 |

| Viacom, Inc. Class B (non-vtg.) | | 119,966 | 3,618,175 |

| | | | 176,599,021 |

| Multiline Retail - 0.5% | | | |

| Dollar General Corp. | | 86,389 | 8,517,955 |

| Dollar Tree, Inc. (b) | | 80,814 | 6,869,190 |

| Kohl's Corp. | | 57,179 | 4,168,349 |

| Macy's, Inc. | | 104,127 | 3,897,474 |

| Nordstrom, Inc. (a) | | 39,922 | 2,067,161 |

| Target Corp. | | 181,198 | 13,792,792 |

| | | | 39,312,921 |

| Specialty Retail - 2.3% | | | |

| Advance Auto Parts, Inc. | | 25,161 | 3,414,348 |

| AutoZone, Inc. (b) | | 9,062 | 6,079,968 |

| Best Buy Co., Inc. | | 83,356 | 6,216,690 |

| CarMax, Inc. (a)(b) | | 60,521 | 4,410,165 |

| Foot Locker, Inc. | | 40,144 | 2,113,582 |

| Gap, Inc. | | 73,747 | 2,388,665 |

| Home Depot, Inc. | | 392,059 | 76,490,711 |

| L Brands, Inc. (a) | | 82,439 | 3,040,350 |

| Lowe's Companies, Inc. | | 279,376 | 26,699,964 |

| O'Reilly Automotive, Inc. (b) | | 27,840 | 7,616,189 |

| Ross Stores, Inc. | | 128,687 | 10,906,223 |

| Tiffany & Co., Inc. | | 34,625 | 4,556,650 |

| TJX Companies, Inc. | | 213,125 | 20,285,238 |

| Tractor Supply Co. | | 41,482 | 3,172,958 |

| Ulta Beauty, Inc. (b) | | 19,431 | 4,536,361 |

| | | | 181,928,062 |

| Textiles, Apparel & Luxury Goods - 0.8% | | | |

| Hanesbrands, Inc. (a) | | 122,480 | 2,697,010 |

| Michael Kors Holdings Ltd. (b) | | 50,944 | 3,392,870 |

| NIKE, Inc. Class B | | 435,954 | 34,736,815 |

| PVH Corp. | | 26,190 | 3,921,167 |

| Ralph Lauren Corp. | | 18,922 | 2,378,874 |

| Tapestry, Inc. | | 97,822 | 4,569,266 |

| Under Armour, Inc.: | | | |

| Class A (sub. vtg.) (a)(b) | | 63,209 | 1,420,938 |

| Class C (non-vtg.) (a)(b) | | 64,015 | 1,349,436 |

| VF Corp. | | 111,275 | 9,071,138 |

| | | | 63,537,514 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 1,011,473,725 |

|

| CONSUMER STAPLES - 6.8% | | | |

| Beverages - 1.7% | | | |

| Brown-Forman Corp. Class B (non-vtg.) | | 89,025 | 4,363,115 |

| Constellation Brands, Inc. Class A (sub. vtg.) | | 57,103 | 12,498,134 |

| Molson Coors Brewing Co. Class B | | 62,891 | 4,279,104 |

| Monster Beverage Corp. (b) | | 139,606 | 7,999,424 |

| PepsiCo, Inc. | | 481,889 | 52,463,255 |

| The Coca-Cola Co. | | 1,301,625 | 57,089,273 |

| | | | 138,692,305 |

| Food & Staples Retailing - 1.4% | | | |

| Costco Wholesale Corp. | | 149,069 | 31,152,440 |

| Kroger Co. | | 276,263 | 7,859,682 |

| Sysco Corp. | | 162,904 | 11,124,714 |

| Walgreens Boots Alliance, Inc. | | 289,855 | 17,395,648 |

| Walmart, Inc. | | 491,700 | 42,114,105 |

| | | | 109,646,589 |

| Food Products - 1.1% | | | |

| Archer Daniels Midland Co. | | 190,052 | 8,710,083 |

| Campbell Soup Co. (a) | | 65,394 | 2,651,073 |

| ConAgra Foods, Inc. | | 133,747 | 4,778,780 |

| General Mills, Inc. | | 201,508 | 8,918,744 |

| Hormel Foods Corp. (a) | | 91,787 | 3,415,394 |

| Kellogg Co. (a) | | 84,877 | 5,930,356 |

| McCormick & Co., Inc. (non-vtg.) (a) | | 41,222 | 4,785,462 |

| Mondelez International, Inc. | | 501,336 | 20,554,776 |

| The Hershey Co. | | 47,490 | 4,419,419 |

| The J.M. Smucker Co. (a) | | 38,609 | 4,149,695 |

| The Kraft Heinz Co. | | 203,038 | 12,754,847 |

| Tyson Foods, Inc. Class A | | 101,146 | 6,963,902 |

| | | | 88,032,531 |

| Household Products - 1.4% | | | |

| Church & Dwight Co., Inc. | | 83,168 | 4,421,211 |

| Clorox Co. | | 44,016 | 5,953,164 |

| Colgate-Palmolive Co. | | 296,479 | 19,214,804 |

| Kimberly-Clark Corp. | | 118,728 | 12,506,808 |

| Procter & Gamble Co. | | 854,645 | 66,713,589 |

| | | | 108,809,576 |

| Personal Products - 0.2% | | | |

| Coty, Inc. Class A (a) | | 160,705 | 2,265,941 |

| Estee Lauder Companies, Inc. Class A | | 76,127 | 10,862,562 |

| | | | 13,128,503 |

| Tobacco - 1.0% | | | |

| Altria Group, Inc. | | 643,261 | 36,530,792 |

| Philip Morris International, Inc. | | 528,324 | 42,656,880 |

| | | | 79,187,672 |

|

| TOTAL CONSUMER STAPLES | | | 537,497,176 |

|

| ENERGY - 6.3% | | | |

| Energy Equipment & Services - 0.8% | | | |

| Baker Hughes, a GE Co. Class A | | 141,527 | 4,674,637 |

| Halliburton Co. | | 297,721 | 13,415,308 |

| Helmerich & Payne, Inc. (a) | | 37,006 | 2,359,503 |

| National Oilwell Varco, Inc. (a) | | 129,839 | 5,635,013 |

| Schlumberger Ltd. | | 470,770 | 31,555,713 |

| TechnipFMC PLC | | 147,511 | 4,681,999 |

| | | | 62,322,173 |

| Oil, Gas & Consumable Fuels - 5.5% | | | |

| Anadarko Petroleum Corp. | | 175,065 | 12,823,511 |

| Andeavor | | 47,253 | 6,198,649 |

| Apache Corp. (a) | | 129,884 | 6,072,077 |

| Cabot Oil & Gas Corp. | | 153,449 | 3,652,086 |

| Chevron Corp. | | 649,483 | 82,114,136 |

| Cimarex Energy Co. | | 32,434 | 3,299,835 |

| Concho Resources, Inc. (a)(b) | | 50,666 | 7,009,641 |

| ConocoPhillips Co. | | 397,674 | 27,686,064 |

| Devon Energy Corp. | | 177,890 | 7,820,044 |

| EOG Resources, Inc. | | 196,739 | 24,480,234 |

| EQT Corp. | | 85,722 | 4,730,140 |

| Exxon Mobil Corp. | | 1,438,967 | 119,045,740 |

| Hess Corp. | | 88,995 | 5,952,876 |

| HollyFrontier Corp. | | 60,002 | 4,105,937 |

| Kinder Morgan, Inc. | | 644,815 | 11,393,881 |

| Marathon Oil Corp. | | 289,978 | 6,048,941 |

| Marathon Petroleum Corp. | | 156,980 | 11,013,717 |

| Newfield Exploration Co. (b) | | 67,882 | 2,053,431 |

| Noble Energy, Inc. | | 164,649 | 5,808,817 |

| Occidental Petroleum Corp. | | 260,265 | 21,778,975 |

| ONEOK, Inc. | | 139,714 | 9,756,229 |

| Phillips 66 Co. | | 142,642 | 16,020,123 |

| Pioneer Natural Resources Co. | | 57,924 | 10,961,538 |

| The Williams Companies, Inc. | | 281,308 | 7,626,260 |

| Valero Energy Corp. | | 146,459 | 16,232,051 |

| | | | 433,684,933 |

|

| TOTAL ENERGY | | | 496,007,106 |

|

| FINANCIALS - 13.8% | | | |

| Banks - 6.1% | | | |

| Bank of America Corp. | | 3,204,868 | 90,345,229 |

| BB&T Corp. | | 265,017 | 13,367,457 |

| Citigroup, Inc. | | 866,654 | 57,996,486 |

| Citizens Financial Group, Inc. | | 164,746 | 6,408,619 |

| Comerica, Inc. | | 58,435 | 5,312,910 |

| Fifth Third Bancorp | | 232,982 | 6,686,583 |

| Huntington Bancshares, Inc. | | 375,556 | 5,543,207 |

| JPMorgan Chase & Co. | | 1,157,193 | 120,579,511 |

| KeyCorp | | 360,831 | 7,050,638 |

| M&T Bank Corp. | | 49,362 | 8,398,944 |

| Peoples United Financial, Inc. (a) | | 118,234 | 2,138,853 |

| PNC Financial Services Group, Inc. | | 159,570 | 21,557,907 |

| Regions Financial Corp. | | 381,728 | 6,787,124 |

| SunTrust Banks, Inc. | | 157,982 | 10,429,972 |

| SVB Financial Group (b) | | 18,004 | 5,198,835 |

| U.S. Bancorp | | 530,317 | 26,526,456 |

| Wells Fargo & Co. | | 1,490,544 | 82,635,759 |

| Zions Bancorporation | | 66,994 | 3,529,914 |

| | | | 480,494,404 |

| Capital Markets - 3.0% | | | |

| Affiliated Managers Group, Inc. | | 18,460 | 2,744,448 |

| Ameriprise Financial, Inc. | | 49,150 | 6,875,102 |

| Bank of New York Mellon Corp. | | 343,502 | 18,525,063 |

| BlackRock, Inc. Class A | | 41,917 | 20,918,260 |

| Brighthouse Financial, Inc. (a) | | 40,708 | 1,631,170 |

| Cboe Global Markets, Inc. | | 38,232 | 3,978,804 |

| Charles Schwab Corp. | | 408,111 | 20,854,472 |

| CME Group, Inc. | | 115,730 | 18,970,462 |

| E*TRADE Financial Corp. (b) | | 89,696 | 5,485,807 |

| Franklin Resources, Inc. | | 108,325 | 3,471,816 |

| Goldman Sachs Group, Inc. | | 119,390 | 26,333,852 |

| IntercontinentalExchange, Inc. | | 196,864 | 14,479,347 |

| Invesco Ltd. | | 139,607 | 3,707,962 |

| Moody's Corp. | | 56,743 | 9,678,086 |

| Morgan Stanley | | 463,281 | 21,959,519 |

| MSCI, Inc. | | 30,257 | 5,005,416 |

| Northern Trust Corp. | | 71,880 | 7,395,733 |

| Raymond James Financial, Inc. | | 44,121 | 3,942,211 |

| S&P Global, Inc. | | 85,410 | 17,414,245 |

| State Street Corp. | | 124,192 | 11,561,033 |

| T. Rowe Price Group, Inc. | | 82,296 | 9,553,743 |

| The NASDAQ OMX Group, Inc. | | 39,723 | 3,625,518 |

| | | | 238,112,069 |

| Consumer Finance - 0.7% | | | |

| American Express Co. | | 242,704 | 23,784,992 |

| Capital One Financial Corp. | | 165,326 | 15,193,459 |

| Discover Financial Services | | 118,608 | 8,351,189 |

| Synchrony Financial | | 241,130 | 8,048,919 |

| | | | 55,378,559 |

| Diversified Financial Services - 1.6% | | | |

| Berkshire Hathaway, Inc. Class B (b) | | 654,162 | 122,099,337 |

| Jefferies Financial Group, Inc. | | 103,048 | 2,343,312 |

| | | | 124,442,649 |

| Insurance - 2.4% | | | |

| AFLAC, Inc. | | 263,119 | 11,319,379 |

| Allstate Corp. | | 119,462 | 10,903,297 |

| American International Group, Inc. | | 305,099 | 16,176,349 |

| Aon PLC | | 83,103 | 11,399,239 |

| Arthur J. Gallagher & Co. | | 61,950 | 4,044,096 |

| Assurant, Inc. | | 18,011 | 1,863,958 |

| Chubb Ltd. | | 158,314 | 20,109,044 |

| Cincinnati Financial Corp. | | 50,768 | 3,394,348 |

| Everest Re Group Ltd. | | 13,928 | 3,210,125 |

| Hartford Financial Services Group, Inc. | | 121,722 | 6,223,646 |

| Lincoln National Corp. | | 74,333 | 4,627,229 |

| Loews Corp. | | 88,994 | 4,296,630 |

| Marsh & McLennan Companies, Inc. | | 172,446 | 14,135,399 |

| MetLife, Inc. | | 345,492 | 15,063,451 |

| Principal Financial Group, Inc. | | 90,522 | 4,793,140 |

| Progressive Corp. | | 197,934 | 11,707,796 |

| Prudential Financial, Inc. | | 142,747 | 13,348,272 |

| The Travelers Companies, Inc. | | 91,855 | 11,237,541 |

| Torchmark Corp. | | 35,893 | 2,922,049 |

| Unum Group | | 75,178 | 2,780,834 |

| Willis Group Holdings PLC | | 44,809 | 6,793,044 |

| XL Group Ltd. | | 87,785 | 4,911,571 |

| | | | 185,260,437 |

|

| TOTAL FINANCIALS | | | 1,083,688,118 |

|

| HEALTH CARE - 14.0% | | | |

| Biotechnology - 2.5% | | | |

| AbbVie, Inc. | | 515,071 | 47,721,328 |

| Alexion Pharmaceuticals, Inc. (b) | | 75,622 | 9,388,471 |

| Amgen, Inc. | | 226,356 | 41,783,054 |

| Biogen, Inc. (b) | | 71,716 | 20,814,852 |

| Celgene Corp. (b) | | 240,236 | 19,079,543 |

| Gilead Sciences, Inc. | | 441,924 | 31,305,896 |

| Incyte Corp. (b) | | 59,795 | 4,006,265 |

| Regeneron Pharmaceuticals, Inc. (b) | | 26,287 | 9,068,752 |

| Vertex Pharmaceuticals, Inc. (b) | | 86,610 | 14,720,236 |

| | | | 197,888,397 |

| Health Care Equipment & Supplies - 3.1% | | | |

| Abbott Laboratories | | 595,862 | 36,341,623 |

| Abiomed, Inc. (b) | | 14,361 | 5,874,367 |

| Align Technology, Inc. (b) | | 24,517 | 8,388,246 |

| Baxter International, Inc. | | 167,438 | 12,363,622 |

| Becton, Dickinson & Co. | | 90,815 | 21,755,641 |

| Boston Scientific Corp. (b) | | 468,961 | 15,335,025 |

| Danaher Corp. | | 208,935 | 20,617,706 |

| Dentsply Sirona, Inc. | | 77,300 | 3,383,421 |

| Edwards Lifesciences Corp. (b) | | 71,638 | 10,428,344 |

| Hologic, Inc. (b) | | 92,789 | 3,688,363 |

| IDEXX Laboratories, Inc. (b) | | 29,522 | 6,434,025 |

| Intuitive Surgical, Inc. (b) | | 38,506 | 18,424,351 |

| Medtronic PLC | | 460,263 | 39,403,115 |

| ResMed, Inc. | | 48,513 | 5,024,977 |

| Stryker Corp. | | 109,232 | 18,444,916 |

| The Cooper Companies, Inc. | | 16,661 | 3,922,832 |

| Varian Medical Systems, Inc. (b) | | 31,100 | 3,536,692 |

| Zimmer Biomet Holdings, Inc. | | 69,086 | 7,698,944 |

| | | | 241,066,210 |

| Health Care Providers & Services - 3.1% | | | |

| Aetna, Inc. | | 111,173 | 20,400,246 |

| AmerisourceBergen Corp. | | 55,282 | 4,713,896 |

| Anthem, Inc. | | 86,735 | 20,645,532 |

| Cardinal Health, Inc. | | 105,594 | 5,156,155 |

| Centene Corp. (b) | | 69,735 | 8,592,049 |

| Cigna Corp. | | 82,680 | 14,051,466 |

| CVS Health Corp. | | 345,531 | 22,234,920 |

| DaVita HealthCare Partners, Inc. (b) | | 47,446 | 3,294,650 |

| Envision Healthcare Corp. (a)(b) | | 41,168 | 1,811,804 |

| Express Scripts Holding Co. (b) | | 190,914 | 14,740,470 |

| HCA Holdings, Inc. | | 94,974 | 9,744,332 |

| Henry Schein, Inc. (a)(b) | | 52,349 | 3,802,631 |

| Humana, Inc. | | 46,794 | 13,927,298 |

| Laboratory Corp. of America Holdings (b) | | 34,769 | 6,242,079 |

| McKesson Corp. | | 68,672 | 9,160,845 |

| Quest Diagnostics, Inc. | | 46,161 | 5,074,940 |

| UnitedHealth Group, Inc. | | 326,612 | 80,130,988 |

| Universal Health Services, Inc. Class B | | 29,620 | 3,300,853 |

| | | | 247,025,154 |

| Health Care Technology - 0.1% | | | |

| Cerner Corp. (b) | | 107,136 | 6,405,661 |

| Life Sciences Tools & Services - 0.9% | | | |

| Agilent Technologies, Inc. | | 108,743 | 6,724,667 |

| Illumina, Inc. (b) | | 49,961 | 13,953,608 |

| Mettler-Toledo International, Inc. (b) | | 8,630 | 4,993,577 |

| PerkinElmer, Inc. | | 37,602 | 2,753,594 |

| Quintiles Transnational Holdings, Inc. (b) | | 55,009 | 5,490,998 |

| Thermo Fisher Scientific, Inc. | | 136,739 | 28,324,116 |

| Waters Corp. (b) | | 26,627 | 5,154,721 |

| | | | 67,395,281 |

| Pharmaceuticals - 4.3% | | | |

| Allergan PLC | | 115,239 | 19,212,646 |

| Bristol-Myers Squibb Co. | | 555,536 | 30,743,362 |

| Eli Lilly & Co. | | 324,640 | 27,701,531 |

| Johnson & Johnson | | 911,591 | 110,612,452 |

| Merck & Co., Inc. | | 914,363 | 55,501,834 |

| Mylan NV (b) | | 175,195 | 6,331,547 |

| Nektar Therapeutics (a)(b) | | 54,760 | 2,673,931 |

| Perrigo Co. PLC | | 43,765 | 3,190,906 |

| Pfizer, Inc. | | 1,988,113 | 72,128,740 |

| Zoetis, Inc. Class A | | 164,453 | 14,009,751 |

| | | | 342,106,700 |

|

| TOTAL HEALTH CARE | | | 1,101,887,403 |

|

| INDUSTRIALS - 9.5% | | | |

| Aerospace & Defense - 2.6% | | | |

| Arconic, Inc. | | 144,410 | 2,456,414 |

| General Dynamics Corp. | | 93,887 | 17,501,476 |

| Harris Corp. | | 40,353 | 5,832,623 |

| Huntington Ingalls Industries, Inc. | | 15,124 | 3,278,732 |

| L3 Technologies, Inc. | | 26,673 | 5,129,751 |

| Lockheed Martin Corp. | | 84,428 | 24,942,564 |

| Northrop Grumman Corp. | | 59,268 | 18,236,764 |

| Raytheon Co. | | 97,629 | 18,859,970 |

| Rockwell Collins, Inc. | | 55,818 | 7,517,568 |

| Textron, Inc. | | 87,020 | 5,735,488 |

| The Boeing Co. | | 186,124 | 62,446,463 |

| TransDigm Group, Inc. (a) | | 16,572 | 5,719,660 |

| United Technologies Corp. | | 252,884 | 31,618,087 |

| | | | 209,275,560 |

| Air Freight & Logistics - 0.7% | | | |

| C.H. Robinson Worldwide, Inc. (a) | | 47,324 | 3,959,126 |

| Expeditors International of Washington, Inc. | | 59,369 | 4,339,874 |

| FedEx Corp. | | 83,554 | 18,971,771 |

| United Parcel Service, Inc. Class B | | 234,363 | 24,896,381 |

| | | | 52,167,152 |

| Airlines - 0.4% | | | |

| Alaska Air Group, Inc. | | 41,892 | 2,529,858 |

| American Airlines Group, Inc. | | 141,610 | 5,375,516 |

| Delta Air Lines, Inc. | | 219,340 | 10,866,104 |

| Southwest Airlines Co. | | 181,295 | 9,224,290 |

| United Continental Holdings, Inc. (b) | | 80,100 | 5,585,373 |

| | | | 33,581,141 |

| Building Products - 0.3% | | | |

| A.O. Smith Corp. | | 49,308 | 2,916,568 |

| Allegion PLC | | 32,274 | 2,496,717 |

| Fortune Brands Home & Security, Inc. | | 49,595 | 2,662,756 |

| Johnson Controls International PLC | | 314,792 | 10,529,792 |

| Masco Corp. | | 105,528 | 3,948,858 |

| | | | 22,554,691 |

| Commercial Services & Supplies - 0.3% | | | |

| Cintas Corp. | | 29,380 | 5,437,357 |

| Copart, Inc. (b) | | 68,682 | 3,884,654 |

| Republic Services, Inc. | | 75,789 | 5,180,936 |

| Stericycle, Inc. (b) | | 29,085 | 1,898,960 |

| Waste Management, Inc. | | 135,197 | 10,996,924 |

| | | | 27,398,831 |

| Construction & Engineering - 0.1% | | | |

| Fluor Corp. | | 47,782 | 2,330,806 |

| Jacobs Engineering Group, Inc. | | 40,963 | 2,600,741 |

| Quanta Services, Inc. (b) | | 50,848 | 1,698,323 |

| | | | 6,629,870 |

| Electrical Equipment - 0.6% | | | |

| AMETEK, Inc. | | 78,708 | 5,679,569 |

| Eaton Corp. PLC | | 148,627 | 11,108,382 |

| Emerson Electric Co. | | 214,151 | 14,806,400 |

| Fortive Corp. | | 104,251 | 8,038,795 |

| Rockwell Automation, Inc. | | 42,681 | 7,094,863 |

| | | | 46,728,009 |

| Industrial Conglomerates - 1.6% | | | |

| 3M Co. | | 201,780 | 39,694,162 |

| General Electric Co. | | 2,951,915 | 40,175,563 |

| Honeywell International, Inc. | | 253,862 | 36,568,821 |

| Roper Technologies, Inc. | | 35,061 | 9,673,681 |

| | | | 126,112,227 |

| Machinery - 1.4% | | | |

| Caterpillar, Inc. | | 203,212 | 27,569,772 |

| Cummins, Inc. | | 52,642 | 7,001,386 |

| Deere & Co. | | 110,216 | 15,408,197 |

| Dover Corp. | | 52,571 | 3,848,197 |

| Flowserve Corp. (a) | | 44,467 | 1,796,467 |

| Illinois Tool Works, Inc. | | 103,623 | 14,355,930 |

| Ingersoll-Rand PLC | | 84,277 | 7,562,175 |

| PACCAR, Inc. | | 119,572 | 7,408,681 |

| Parker Hannifin Corp. | | 45,189 | 7,042,706 |

| Pentair PLC | | 55,172 | 2,321,638 |

| Snap-On, Inc. (a) | | 19,235 | 3,091,449 |

| Stanley Black & Decker, Inc. | | 52,446 | 6,965,353 |

| Xylem, Inc. | | 61,150 | 4,120,287 |

| | | | 108,492,238 |

| Professional Services - 0.3% | | | |

| Equifax, Inc. | | 40,881 | 5,114,622 |

| IHS Markit Ltd. (b) | | 121,031 | 6,243,989 |

| Nielsen Holdings PLC | | 113,807 | 3,520,051 |

| Robert Half International, Inc. | | 41,996 | 2,733,940 |

| Verisk Analytics, Inc. (b) | | 52,797 | 5,683,069 |

| | | | 23,295,671 |

| Road & Rail - 1.0% | | | |

| CSX Corp. | | 297,509 | 18,975,124 |

| J.B. Hunt Transport Services, Inc. | | 29,096 | 3,536,619 |

| Kansas City Southern | | 34,871 | 3,694,931 |

| Norfolk Southern Corp. | | 96,028 | 14,487,744 |

| Union Pacific Corp. | | 263,599 | 37,346,706 |

| | | | 78,041,124 |

| Trading Companies & Distributors - 0.2% | | | |

| Fastenal Co.(a) | | 97,764 | 4,705,381 |

| United Rentals, Inc. (b) | | 28,412 | 4,194,179 |

| W.W. Grainger, Inc. (a) | | 17,325 | 5,343,030 |

| | | | 14,242,590 |

|

| TOTAL INDUSTRIALS | | | 748,519,104 |

|

| INFORMATION TECHNOLOGY - 25.9% | | | |

| Communications Equipment - 1.1% | | | |

| Cisco Systems, Inc. | | 1,598,384 | 68,778,464 |

| F5 Networks, Inc. (b) | | 20,771 | 3,581,959 |

| Juniper Networks, Inc. | | 118,667 | 3,253,849 |

| Motorola Solutions, Inc. | | 55,105 | 6,412,569 |

| | | | 82,026,841 |

| Electronic Equipment & Components - 0.4% | | | |

| Amphenol Corp. Class A | | 102,450 | 8,928,518 |

| Corning, Inc. | | 282,213 | 7,763,680 |

| FLIR Systems, Inc. | | 46,635 | 2,423,621 |

| IPG Photonics Corp. (b) | | 12,774 | 2,818,328 |

| TE Connectivity Ltd. | | 119,003 | 10,717,410 |

| | | | 32,651,557 |

| Internet Software & Services - 5.3% | | | |

| Akamai Technologies, Inc. (b) | | 57,993 | 4,246,827 |

| Alphabet, Inc.: | | | |

| Class A (b) | | 101,505 | 114,618,431 |

| Class C (b) | | 103,182 | 115,114,998 |

| eBay, Inc. (b) | | 314,179 | 11,392,131 |

| Facebook, Inc. Class A (b) | | 815,222 | 158,413,939 |

| Twitter, Inc. (b) | | 222,556 | 9,719,021 |

| VeriSign, Inc. (b) | | 32,630 | 4,484,015 |

| | | | 417,989,362 |

| IT Services - 4.5% | | | |

| Accenture PLC Class A | | 218,568 | 35,755,539 |

| Alliance Data Systems Corp. | | 16,381 | 3,820,049 |

| Automatic Data Processing, Inc. | | 149,722 | 20,083,709 |

| Broadridge Financial Solutions, Inc. | | 40,078 | 4,612,978 |

| Cognizant Technology Solutions Corp. Class A | | 199,131 | 15,729,358 |

| DXC Technology Co. | | 96,793 | 7,802,484 |

| Fidelity National Information Services, Inc. | | 112,503 | 11,928,693 |

| Fiserv, Inc. (b) | | 139,157 | 10,310,142 |

| FleetCor Technologies, Inc. (b) | | 30,465 | 6,417,452 |

| Gartner, Inc. (a)(b) | | 31,010 | 4,121,229 |

| Global Payments, Inc. | | 54,225 | 6,045,545 |

| IBM Corp. | | 290,153 | 40,534,374 |

| MasterCard, Inc. Class A | | 311,621 | 61,239,759 |

| Paychex, Inc. | | 108,676 | 7,428,005 |

| PayPal Holdings, Inc. (b) | | 379,348 | 31,588,308 |

| The Western Union Co. | | 156,589 | 3,183,454 |

| Total System Services, Inc. | | 56,384 | 4,765,576 |

| Visa, Inc. Class A | | 607,070 | 80,406,422 |

| | | | 355,773,076 |

| Semiconductors & Semiconductor Equipment - 4.0% | | | |

| Advanced Micro Devices, Inc. (a)(b) | | 280,036 | 4,197,740 |

| Analog Devices, Inc. | | 126,058 | 12,091,483 |

| Applied Materials, Inc. | | 342,609 | 15,825,110 |

| Broadcom, Inc. | | 136,446 | 33,107,257 |

| Intel Corp. | | 1,583,810 | 78,731,195 |

| KLA-Tencor Corp. | | 52,977 | 5,431,732 |

| Lam Research Corp. | | 55,755 | 9,637,252 |

| Microchip Technology, Inc. (a) | | 79,883 | 7,265,359 |

| Micron Technology, Inc. (b) | | 394,173 | 20,670,432 |

| NVIDIA Corp. | | 206,303 | 48,873,181 |

| Qorvo, Inc. (b) | | 42,991 | 3,446,588 |

| Qualcomm, Inc. | | 503,904 | 28,279,092 |

| Skyworks Solutions, Inc. | | 61,882 | 5,980,895 |

| Texas Instruments, Inc. | | 332,708 | 36,681,057 |

| Xilinx, Inc. | | 86,125 | 5,620,518 |

| | | | 315,838,891 |

| Software - 6.1% | | | |

| Activision Blizzard, Inc. | | 258,713 | 19,744,976 |

| Adobe Systems, Inc. (b) | | 167,377 | 40,808,186 |

| ANSYS, Inc. (b) | | 28,555 | 4,973,710 |

| Autodesk, Inc. (b) | | 74,469 | 9,762,141 |

| CA Technologies, Inc. | | 106,198 | 3,785,959 |

| Cadence Design Systems, Inc. (b) | | 95,812 | 4,149,618 |

| Citrix Systems, Inc. (b) | | 43,758 | 4,587,589 |

| Electronic Arts, Inc. (b) | | 104,284 | 14,706,130 |

| Intuit, Inc. | | 82,847 | 16,926,056 |

| Microsoft Corp. | | 2,611,314 | 257,501,674 |

| Oracle Corp. | | 1,012,853 | 44,626,303 |

| Red Hat, Inc. (b) | | 60,386 | 8,114,067 |

| Salesforce.com, Inc. (b) | | 239,724 | 32,698,354 |

| Symantec Corp. | | 211,245 | 4,362,209 |

| Synopsys, Inc. (b) | | 50,645 | 4,333,693 |

| Take-Two Interactive Software, Inc. (b) | | 38,875 | 4,601,245 |

| | | | 475,681,910 |

| Technology Hardware, Storage & Peripherals - 4.5% | | | |

| Apple, Inc. | | 1,670,524 | 309,230,692 |

| Hewlett Packard Enterprise Co. | | 518,987 | 7,582,400 |

| HP, Inc. | | 557,859 | 12,657,821 |

| NetApp, Inc. | | 91,060 | 7,150,942 |

| Seagate Technology LLC | | 97,565 | 5,509,496 |

| Western Digital Corp. | | 101,704 | 7,872,907 |

| Xerox Corp. | | 72,709 | 1,745,016 |

| | | | 351,749,274 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 2,031,710,911 |

|

| MATERIALS - 2.6% | | | |

| Chemicals - 1.9% | | | |

| Air Products & Chemicals, Inc. | | 74,498 | 11,601,574 |

| Albemarle Corp. U.S. (a) | | 37,645 | 3,551,053 |

| CF Industries Holdings, Inc. | | 79,313 | 3,521,497 |

| DowDuPont, Inc. | | 788,774 | 51,995,982 |

| Eastman Chemical Co. | | 48,520 | 4,850,059 |

| Ecolab, Inc. | | 88,254 | 12,384,684 |

| FMC Corp. | | 45,718 | 4,078,503 |

| International Flavors & Fragrances, Inc. | | 26,828 | 3,325,599 |

| LyondellBasell Industries NV Class A | | 109,268 | 12,003,090 |

| PPG Industries, Inc. | | 84,738 | 8,789,873 |

| Praxair, Inc. | | 97,669 | 15,446,352 |

| Sherwin-Williams Co. | | 27,979 | 11,403,401 |

| The Mosaic Co. | | 119,204 | 3,343,672 |

| | | | 146,295,339 |

| Construction Materials - 0.1% | | | |

| Martin Marietta Materials, Inc. | | 21,395 | 4,778,145 |

| Vulcan Materials Co. | | 44,926 | 5,798,150 |

| | | | 10,576,295 |

| Containers & Packaging - 0.3% | | | |

| Avery Dennison Corp. | | 29,919 | 3,054,730 |

| Ball Corp. | | 118,697 | 4,219,678 |

| International Paper Co. | | 140,738 | 7,329,635 |

| Packaging Corp. of America | | 32,066 | 3,584,658 |

| Sealed Air Corp. | | 54,774 | 2,325,156 |

| WestRock Co. | | 87,161 | 4,969,920 |

| | | | 25,483,777 |

| Metals & Mining - 0.3% | | | |

| Freeport-McMoRan, Inc. | | 457,938 | 7,904,010 |

| Newmont Mining Corp. | | 181,318 | 6,837,502 |

| Nucor Corp. | | 108,113 | 6,757,063 |

| | | | 21,498,575 |

|

| TOTAL MATERIALS | | | 203,853,986 |

|

| REAL ESTATE - 2.9% | | | |

| Equity Real Estate Investment Trusts (REITs) - 2.8% | | | |

| Alexandria Real Estate Equities, Inc. (a) | | 35,001 | 4,416,076 |

| American Tower Corp. | | 150,108 | 21,641,070 |

| Apartment Investment & Management Co. Class A | | 53,479 | 2,262,162 |

| AvalonBay Communities, Inc. | | 46,974 | 8,074,361 |

| Boston Properties, Inc. | | 52,464 | 6,580,035 |

| Crown Castle International Corp. | | 140,987 | 15,201,218 |

| Digital Realty Trust, Inc. | | 69,998 | 7,810,377 |

| Duke Realty Corp. | | 121,345 | 3,522,645 |

| Equinix, Inc. | | 27,006 | 11,609,609 |

| Equity Residential (SBI) | | 125,146 | 7,970,549 |

| Essex Property Trust, Inc. | | 22,447 | 5,366,404 |

| Extra Space Storage, Inc. | | 42,861 | 4,277,956 |

| Federal Realty Investment Trust (SBI) | | 24,886 | 3,149,323 |

| General Growth Properties, Inc. | | 214,983 | 4,392,103 |

| HCP, Inc. | | 159,671 | 4,122,705 |

| Host Hotels & Resorts, Inc. | | 251,961 | 5,308,818 |

| Iron Mountain, Inc. | | 95,653 | 3,348,812 |

| Kimco Realty Corp. | | 144,411 | 2,453,543 |

| Mid-America Apartment Communities, Inc. | | 38,675 | 3,893,412 |

| Prologis, Inc. | | 181,233 | 11,905,196 |

| Public Storage | | 50,926 | 11,553,072 |

| Realty Income Corp. | | 96,656 | 5,199,126 |

| Regency Centers Corp. | | 50,093 | 3,109,773 |

| SBA Communications Corp. Class A (b) | | 39,149 | 6,464,283 |

| Simon Property Group, Inc. | | 105,255 | 17,913,348 |

| SL Green Realty Corp. | | 30,053 | 3,021,228 |

| The Macerich Co. (a) | | 36,898 | 2,096,913 |

| UDR, Inc. | | 90,950 | 3,414,263 |

| Ventas, Inc. | | 121,101 | 6,896,702 |

| Vornado Realty Trust | | 58,816 | 4,347,679 |

| Welltower, Inc. | | 126,427 | 7,925,709 |

| Weyerhaeuser Co. | | 257,289 | 9,380,757 |

| | | | 218,629,227 |

| Real Estate Management & Development - 0.1% | | | |

| CBRE Group, Inc. (b) | | 102,767 | 4,906,097 |

|

| TOTAL REAL ESTATE | | | 223,535,324 |

|

| TELECOMMUNICATION SERVICES - 2.0% | | | |

| Diversified Telecommunication Services - 2.0% | | | |

| AT&T, Inc. | | 2,468,025 | 79,248,283 |

| CenturyLink, Inc. (a) | | 333,671 | 6,219,627 |

| Verizon Communications, Inc. | | 1,404,322 | 70,651,440 |

| | | | 156,119,350 |

| UTILITIES - 2.9% | | | |

| Electric Utilities - 1.8% | | | |

| Alliant Energy Corp. | | 78,675 | 3,329,526 |

| American Electric Power Co., Inc. | | 167,395 | 11,592,104 |

| Duke Energy Corp. | | 238,254 | 18,841,126 |

| Edison International | | 110,734 | 7,006,140 |

| Entergy Corp. (a) | | 61,457 | 4,965,111 |

| Evergy, Inc. | | 92,179 | 5,175,851 |

| Eversource Energy | | 107,701 | 6,312,356 |

| Exelon Corp. | | 328,108 | 13,977,401 |

| FirstEnergy Corp. (a) | | 152,363 | 5,471,355 |

| NextEra Energy, Inc. | | 160,229 | 26,763,050 |

| PG&E Corp. | | 175,520 | 7,470,131 |

| Pinnacle West Capital Corp. | | 38,043 | 3,064,744 |

| PPL Corp. | | 237,591 | 6,783,223 |

| Southern Co. | | 343,824 | 15,922,489 |

| Xcel Energy, Inc. | | 172,947 | 7,900,219 |

| | | | 144,574,826 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| NRG Energy, Inc. | | 101,670 | 3,121,269 |

| The AES Corp. | | 224,792 | 3,014,461 |

| | | | 6,135,730 |

| Multi-Utilities - 0.9% | | | |

| Ameren Corp. | | 82,812 | 5,039,110 |

| CenterPoint Energy, Inc. | | 146,646 | 4,063,561 |

| CMS Energy Corp. | | 96,023 | 4,539,967 |

| Consolidated Edison, Inc. | | 105,609 | 8,235,390 |

| Dominion Resources, Inc. | | 221,785 | 15,121,301 |

| DTE Energy Co. | | 61,681 | 6,392,002 |

| NiSource, Inc. | | 114,662 | 3,013,317 |

| Public Service Enterprise Group, Inc. | | 171,710 | 9,296,379 |

| SCANA Corp. | | 48,475 | 1,867,257 |

| Sempra Energy | | 89,773 | 10,423,543 |

| WEC Energy Group, Inc. | | 107,243 | 6,933,260 |

| | | | 74,925,087 |

| Water Utilities - 0.1% | | | |

| American Water Works Co., Inc. | | 60,514 | 5,166,685 |

|

| TOTAL UTILITIES | | | 230,802,328 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $3,820,609,819) | | | 7,825,094,531 |

| | | Principal Amount | Value |

|

| U.S. Treasury Obligations - 0.0% | | | |

| U.S. Treasury Bills, yield at date of purchase 1.9% to 2.02% 9/27/18 to 11/8/18 (c) | | | |

| (Cost $2,346,910) | | 2,360,000 | 2,347,025 |

| | | Shares | Value |

|

| Money Market Funds - 2.0% | | | |

| Fidelity Cash Central Fund, 1.93% (d) | | 22,237,735 | $22,242,183 |

| Fidelity Securities Lending Cash Central Fund 1.92% (d)(e) | | 132,675,233 | 132,701,768 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $154,923,682) | | | 154,943,951 |

| TOTAL INVESTMENT IN SECURITIES - 101.6% | | | |

| (Cost $3,977,880,411) | | | 7,982,385,507 |

| NET OTHER ASSETS (LIABILITIES) - (1.6)% | | | (124,956,099) |

| NET ASSETS - 100% | | | $7,857,429,408 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P 500 Index Contracts (United States) | 254 | Sept. 2018 | $34,564,320 | $(453,198) | $(453,198) |

The notional amount of futures purchased as a percentage of Net Assets is 0.4%

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $1,640,305.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(e) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $271,950 |

| Fidelity Securities Lending Cash Central Fund | 91,783 |

| Total | $363,733 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $1,011,473,725 | $1,011,473,725 | $-- | $-- |

| Consumer Staples | 537,497,176 | 537,497,176 | -- | -- |

| Energy | 496,007,106 | 496,007,106 | -- | -- |

| Financials | 1,083,688,118 | 1,083,688,118 | -- | -- |

| Health Care | 1,101,887,403 | 1,101,887,403 | -- | -- |

| Industrials | 748,519,104 | 748,519,104 | -- | -- |

| Information Technology | 2,031,710,911 | 2,031,710,911 | -- | -- |

| Materials | 203,853,986 | 203,853,986 | -- | -- |

| Real Estate | 223,535,324 | 223,535,324 | -- | -- |

| Telecommunication Services | 156,119,350 | 156,119,350 | -- | -- |

| Utilities | 230,802,328 | 230,802,328 | -- | -- |

| U.S. Government and Government Agency Obligations | 2,347,025 | -- | 2,347,025 | -- |

| Money Market Funds | 154,943,951 | 154,943,951 | -- | -- |

| Total Investments in Securities: | $7,982,385,507 | $7,980,038,482 | $2,347,025 | $-- |

| Derivative Instruments: | | | | |

| Liabilities | | | | |

| Futures Contracts | $(453,198) | $(453,198) | $-- | $-- |

| Total Liabilities | $(453,198) | $(453,198) | $-- | $-- |

| Total Derivative Instruments: | $(453,198) | $(453,198) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of June 30, 2018. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Equity Risk | | |

| Futures Contracts(a) | $0 | $(453,198) |

| Total Equity Risk | 0 | (453,198) |

| Total Value of Derivatives | $0 | $(453,198) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Consolidated Schedule of Investments. In the Consolidated Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in net unrealized appreciation (depreciation).

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2018 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $129,677,697) — See accompanying schedule:

Unaffiliated issuers (cost $3,822,956,729) | $7,827,441,556 | |

| Fidelity Central Funds (cost $154,923,682) | 154,943,951 | |

| Total Investment in Securities (cost $3,977,880,411) | | $7,982,385,507 |

| Receivable for investments sold | | 8,241,220 |

| Receivable for fund shares sold | | 941,788 |

| Dividends receivable | | 6,468,524 |

| Distributions receivable from Fidelity Central Funds | | 56,605 |

| Receivable for daily variation margin for on futures contracts | | 80,166 |

| Other receivables | | 47,834 |

| Total assets | | 7,998,221,644 |

| Liabilities | | |

| Payable for investments purchased | $3,895,107 | |

| Payable for fund shares redeemed | 3,186,060 | |

| Accrued management fee | 299,378 | |

| Distribution and service plan fees payable | 330,798 | |

| Other affiliated payables | 365,907 | |

| Other payables and accrued expenses | 44,242 | |

| Collateral on securities loaned | 132,670,744 | |

| Total liabilities | | 140,792,236 |

| Net Assets | | $7,857,429,408 |

| Net Assets consist of: | | |

| Paid in capital | | $3,757,276,168 |

| Undistributed net investment income | | 68,360,758 |

| Accumulated undistributed net realized gain (loss) on investments | | 28,985,368 |

| Net unrealized appreciation (depreciation) on investments | | 4,002,807,114 |

| Net Assets | | $7,857,429,408 |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($6,234,610,227 ÷ 22,571,689 shares) | | $276.21 |

| Service Class: | | |

| Net Asset Value, offering price and redemption price per share ($95,668,337 ÷ 347,701 shares) | | $275.15 |

| Service Class 2: | | |

| Net Asset Value, offering price and redemption price per share ($1,527,150,844 ÷ 5,604,371 shares) | | $272.49 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2018 (Unaudited) |

| Investment Income | | |

| Dividends | | $73,944,931 |

| Interest | | 14,791 |

| Income from Fidelity Central Funds | | 363,733 |

| Total income | | 74,323,455 |

| Expenses | | |

| Management fee | $1,766,233 | |

| Transfer agent fees | 2,158,729 | |

| Distribution and service plan fees | 1,956,002 | |

| Independent trustees' fees and expenses | 17,214 | |

| Legal | 1,616 | |

| Miscellaneous | 10,922 | |

| Total expenses before reductions | 5,910,716 | |

| Expense reductions | (446) | |

| Total expenses after reductions | | 5,910,270 |

| Net investment income (loss) | | 68,413,185 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 31,411,114 | |

| Fidelity Central Funds | 569 | |

| Futures contracts | 2,515,419 | |

| Total net realized gain (loss) | | 33,927,102 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 97,990,214 | |

| Fidelity Central Funds | (9,352) | |

| Futures contracts | (905,227) | |

| Total change in net unrealized appreciation (depreciation) | | 97,075,635 |

| Net gain (loss) | | 131,002,737 |

| Net increase (decrease) in net assets resulting from operations | | $199,415,922 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended June 30, 2018 (Unaudited) | Year ended December 31, 2017 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $68,413,185 | $129,706,155 |

| Net realized gain (loss) | 33,927,102 | 37,087,430 |

| Change in net unrealized appreciation (depreciation) | 97,075,635 | 1,213,530,003 |

| Net increase (decrease) in net assets resulting from operations | 199,415,922 | 1,380,323,588 |

| Distributions to shareholders from net investment income | (25,380,058) | (125,118,539) |

| Distributions to shareholders from net realized gain | (27,784,425) | (21,811,874) |

| Total distributions | (53,164,483) | (146,930,413) |

| Share transactions - net increase (decrease) | (24,287,826) | 207,772,017 |

| Total increase (decrease) in net assets | 121,963,613 | 1,441,165,192 |

| Net Assets | | |

| Beginning of period | 7,735,465,795 | 6,294,300,603 |

| End of period | $7,857,429,408 | $7,735,465,795 |

| Other Information | | |

| Undistributed net investment income end of period | $68,360,758 | $25,327,631 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

VIP Index 500 Portfolio Initial Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $271.18 | $227.46 | $206.43 | $208.12 | $186.29 | $144.91 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | 2.47 | 4.71 | 4.42 | 4.15 | 3.75 | 3.31 |

| Net realized and unrealized gain (loss) | 4.46 | 44.36 | 20.06 | (1.44) | 21.58 | 42.98 |

| Total from investment operations | 6.93 | 49.07 | 24.48 | 2.71 | 25.33 | 46.29 |

| Distributions from net investment income | (.92) | (4.57) | (3.23) | (4.26) | (3.31) | (3.27) |

| Distributions from net realized gain | (.98) | (.78) | (.22) | (.13) | (.18) | (1.64) |

| Total distributions | (1.90) | (5.35) | (3.45) | (4.40)B | (3.50)C | (4.91) |

| Net asset value, end of period | $276.21 | $271.18 | $227.46 | $206.43 | $208.12 | $186.29 |

| Total ReturnD,E,F | 2.59% | 21.71% | 11.86% | 1.33% | 13.57% | 32.25% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .10%I | .10% | .10% | .10% | .10% | .10% |

| Expenses net of fee waivers, if any | .10%I | .10% | .10% | .10% | .10% | .10% |

| Expenses net of all reductions | .10%I | .10% | .10% | .10% | .10% | .10% |

| Net investment income (loss) | 1.79%I | 1.89% | 2.07% | 1.98% | 1.91% | 1.98% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $6,234,610 | $6,139,813 | $5,001,375 | $4,103,865 | $3,823,973 | $3,163,673 |

| Portfolio turnover rateJ | 3%I | 5% | 6% | 9% | 3% | 5% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $4.40 per share is comprised of distributions from net investment income of $4.262 and distributions from net realized gain of $.133 per share.

C Total distributions of $3.50 per share is comprised of distributions from net investment income of $3.314 and distributions from net realized gain of $.184 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP Index 500 Portfolio Service Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $270.23 | $226.70 | $205.82 | $207.49 | $185.77 | $144.53 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | 2.32 | 4.44 | 4.19 | 3.93 | 3.54 | 3.13 |

| Net realized and unrealized gain (loss) | 4.45 | 44.21 | 19.97 | (1.43) | 21.50 | 42.85 |

| Total from investment operations | 6.77 | 48.65 | 24.16 | 2.50 | 25.04 | 45.98 |

| Distributions from net investment income | (.87) | (4.34) | (3.07) | (4.03) | (3.14) | (3.10) |

| Distributions from net realized gain | (.98) | (.78) | (.22) | (.13) | (.18) | (1.64) |

| Total distributions | (1.85) | (5.12) | (3.28)B | (4.17)C | (3.32) | (4.74) |

| Net asset value, end of period | $275.15 | $270.23 | $226.70 | $205.82 | $207.49 | $185.77 |

| Total ReturnD,E,F | 2.54% | 21.59% | 11.75% | 1.24% | 13.46% | 32.12% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .20%I | .20% | .20% | .20% | .20% | .20% |

| Expenses net of fee waivers, if any | .20%I | .20% | .20% | .20% | .20% | .20% |

| Expenses net of all reductions | .20%I | .20% | .20% | .20% | .20% | .20% |

| Net investment income (loss) | 1.69%I | 1.79% | 1.97% | 1.88% | 1.81% | 1.88% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $95,668 | $92,965 | $77,697 | $64,618 | $64,442 | $55,066 |

| Portfolio turnover rateJ | 3%I | 5% | 6% | 9% | 3% | 5% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $3.28 per share is comprised of distributions from net investment income of $3.068 and distributions from net realized gain of $.216 per share.

C Total distributions of $4.17 per share is comprised of distributions from net investment income of $4.033 and distributions from net realized gain of $.133 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP Index 500 Portfolio Service Class 2

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $267.78 | $224.72 | $204.25 | $206.02 | $184.56 | $143.64 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | 2.10 | 4.04 | 3.88 | 3.59 | 3.23 | 2.86 |

| Net realized and unrealized gain (loss) | 4.40 | 43.79 | 19.76 | (1.42) | 21.34 | 42.56 |

| Total from investment operations | 6.50 | 47.83 | 23.64 | 2.17 | 24.57 | 45.42 |

| Distributions from net investment income | (.81) | (3.99) | (2.95) | (3.80) | (2.92) | (2.86) |

| Distributions from net realized gain | (.98) | (.78) | (.22) | (.13) | (.18) | (1.64) |

| Total distributions | (1.79) | (4.77) | (3.17) | (3.94)B | (3.11)C | (4.50) |

| Net asset value, end of period | $272.49 | $267.78 | $224.72 | $204.25 | $206.02 | $184.56 |

| Total ReturnD,E,F | 2.46% | 21.41% | 11.58% | 1.08% | 13.29% | 31.92% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .35%I | .35% | .35% | .35% | .35% | .35% |

| Expenses net of fee waivers, if any | .35%I | .35% | .35% | .35% | .35% | .35% |

| Expenses net of all reductions | .35%I | .35% | .35% | .35% | .35% | .35% |

| Net investment income (loss) | 1.54%I | 1.64% | 1.82% | 1.73% | 1.66% | 1.73% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $1,527,151 | $1,502,688 | $1,215,228 | $575,158 | $466,026 | $367,122 |

| Portfolio turnover rateJ | 3%I | 5% | 6% | 9% | 3% | 5% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $3.94 per share is comprised of distributions from net investment income of $3.804 and distributions from net realized gain of $.133 per share.

C Total distributions of $3.11 per share is comprised of distributions from net investment income of $2.923 and distributions from net realized gain of $.184 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2018

1. Organization.

VIP Index 500 Portfolio (the Fund) is a fund of Variable Insurance Products Fund II (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares and Service Class 2 shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2018 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees of $44,238 are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, respectively.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, market discount, deferred trustees compensation and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $4,162,102,464 |

| Gross unrealized depreciation | (165,886,943) |

| Net unrealized appreciation (depreciation) | $3,996,215,521 |

| Tax cost | $3,985,716,788 |

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

|

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end and is representative of volume of activity during the period. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $173,290,410 and $119,381,231, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is based on an annual rate of .045% of the Fund's average net assets. Under the management contract, the investment adviser pays all other fund-level expenses, except the compensation of the independent Trustees and certain other expenses such as interest expense, including commitment fees. In addition, under an expense contract, the investment adviser pays class-level expenses as necessary so that total expenses do not exceed an annual rate of .10% of each class' average net assets, excluding the distribution and service fee for each applicable class, with certain exceptions.

Sub-Adviser. Geode Capital Management, LLC (Geode), serves as sub-adviser for the Fund. Geode provides discretionary investment advisory services to the Fund and is paid by the investment adviser for providing these services.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate 12b-1 Plans for each Service Class of shares. Each Service Class pays Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, a service fee. For the period, the service fee is based on an annual rate of .10% of Service Class' average net assets and .25% of Service Class 2's average net assets.

For the period, total fees, all of which were re-allowed to insurance companies for the distribution of shares and providing shareholder support services, were as follows:

| Service Class | $47,622 |

| Service Class 2 | 1,908,380 |

| | $1,956,002 |

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing, and shareholder servicing agent for each class. FIIOC receives asset-based fees of .07% of each class's average net assets for transfer agent services, typesetting, and printing and mailing of shareholder reports, excluding mailing of proxy statements. Under the expense contract, each class pays a portion of the transfer agent fees equal to an annual rate of .055% of class-level average net assets. For the period, transfer agent fees for each class were as follows:

| Initial Class | $1,712,693 |

| Service Class | 26,192 |

| Service Class 2 | 419,844 |

| | $2,158,729 |

Interfund Trades. The Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $10,922 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.