UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05518

The RBB Fund, Inc.

(Exact name of registrant as specified in charter)

Bellevue Park Corporate Center

103 Bellevue Parkway

Wilmington, DE 19809

(Address of principal executive offices) (Zip code)

Salvatore Faia

BNY Mellon Investment Servicing (US) Inc.

103 Bellevue Parkway

Wilmington, DE 19809

(Name and address of agent for service)

Registrant’s telephone number, including area code: 302-791-1851

Date of fiscal year end: August 31

Date of reporting period: February 28, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

THE RBB FUND, INC.

Money Market Portfolio

Fund Expense Examples

(Unaudited)

As a shareholder of the Money Market Portfolio (the “Portfolio”), you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution fees, and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the six-month period from September 1, 2012 through February 28, 2013 and held for the entire period.

Actual Expenses

The first line of the accompanying tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the accompanying tables provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees that may be incurred by shareholders of other funds. Therefore, the second line of the accompanying tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | |

| | | Money Market Portfolio – Bedford Class | |

| | | Beginning

Account Value

September 1, 2012 | | | Ending

Account Value

February 28, 2013 | | | Expenses Paid

During

Period* | |

Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | $ | 1.29 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.51 | | | | 1.30 | |

| |

| | | Money Market Portfolio – Sansom Street Class | |

| | | Beginning

Account Value

September 1, 2012 | | | Ending

Account Value

February 28, 2013 | | | Expenses Paid

During

Period* | |

Actual | | $ | 1,000.00 | | | $ | 1,000.20 | | | $ | 1.19 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.60 | | | | 1.20 | |

| * | Expenses are equal to the Portfolio’s annualized six month expense ratio of 0.26% for the Bedford Class shares and 0.24% for the Sansom Street Class shares, which includes waived fees or reimbursed expenses, multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. The Portfolio’s ending account value on the first line in each table is based on the actual six-month total return of 0.01% for the Bedford Class shares and 0.02% for the Sansom Street Class shares. |

1

THE RBB FUND, INC.

Money Market Portfolio

Portfolio Holdings Summary Table

February 28, 2013

(Unaudited)

| | | | | | | | |

Security

Type | | % of Net

Assets | | | Value | |

| | |

Short Term Investments: | | | | | | | | |

Commercial Paper | | | 35.4 | % | | $ | 238,861,825 | |

Certificates of Deposit | | | 31.8 | | | | 214,803,000 | |

U.S. Treasury Obligations | | | 10.7 | | | | 72,035,866 | |

Municipal Bonds | | | 8.5 | | | | 57,635,000 | |

Repurchase Agreements | | | 8.1 | | | | 54,764,000 | |

Agency Obligations | | | 5.7 | | | | 38,183,026 | |

Variable Rate Obligations | | | 1.3 | | | | 8,600,000 | |

Liabilities in Excess of Other Assets | | | (1.5 | ) | | | (9,834,821 | ) |

| | | | | | | | |

NET ASSETS | | | 100.0 | % | | $ | 675,047,896 | |

| | | | | | | | |

Portfolio holdings are subject to change at any time.

2

THE RBB FUND, INC.

Money Market Portfolio

Schedule of Investments

February 28, 2013

(Unaudited)

| | | | | | | | |

| | | Par

(000) | | | Value | |

CERTIFICATES OF DEPOSIT—31.8% | |

Euro Dollar Certificates Of Deposit(a)—2.4% | |

National Australia Bank Ltd.,London | | | | | | | | |

0.429%, 04/10/13 | | $ | 10,000 | | | $ | 10,000,000 | |

0.302%, 10/21/13 | | | 6,000 | | | | 6,000,000 | |

| | | | | | | | |

| | | | | | | 16,000,000 | |

| | | | | | | | |

Yankee Dollar Certificates Of Deposit(b)—29.4% | |

Australia & New Zealand Banking Group Ltd., New York(a) | | | | | | | | |

0.284%, 04/30/13 | | | 5,000 | | | | 5,000,674 | |

Bank of Montreal,

Chicago(a) | | | | | | | | |

0.200%, 05/17/13 | | | 5,000 | | | | 5,000,000 | |

0.422%, 07/17/13 | | | 5,000 | | | | 5,000,000 | |

0.365%, 01/10/14 | | | 4,000 | | | | 4,000,000 | |

Bank of Nova Scotia, Houston(a) | | | | | | | | |

0.263%, 11/26/13 | | | 5,000 | | | | 5,000,000 | |

0.358%, 01/02/14 | | | 5,000 | | | | 5,000,000 | |

Bank of Tokyo Mitsubishi UFJ, Ltd., New York | | | | | | | | |

0.260%, 04/08/13 | | | 5,000 | | | | 4,999,947 | |

0.340%, 04/22/13 | | | 6,000 | | | | 6,000,000 | |

0.250%, 05/30/13 | | | 10,000 | | | | 10,000,000 | |

Canadian Imperial Bank of Commerce, New

York(a) | | | | | | | | |

0.330%, 02/04/14 | | | 5,000 | | | | 5,000,000 | |

0.330%, 03/03/14 | | | 10,000 | | | | 10,000,000 | |

Credit Suisse, New York | | | | | | | | |

0.280%, 06/06/13 | | | 7,000 | | | | 7,000,000 | |

Deutsche Bank AG, New York | | | | | | | | |

0.410%, 08/08/13 | | | 5,000 | | | | 5,000,000 | |

DNB Bank ASA, New York | | | | | | | | |

0.280%, 07/19/13 | | | 2,000 | | | | 2,000,000 | |

Mitsubishi UFJ Trust and Banking Corp., New York(a) | | | | | | | | |

0.322%, 05/15/13 | | | 7,000 | | | | 7,000,000 | |

Mizuho Corporate Bank, New York | | | | | | | | |

0.270%, 04/03/13 | | | 15,000 | | | | 15,000,000 | |

Nordea Bank Finland PLC, New York | | | | | | | | |

0.260%, 06/03/13 | | | 4,000 | | | | 4,000,052 | |

0.275%, 07/17/13 | | | 1,945 | | | | 1,944,963 | |

Rabobank Nederland NV, New York | | | | | | | | |

0.482%, 04/24/13 | | | 6,300 | | | | 6,300,000 | |

0.420%, 10/29/13(a) | | | 12,000 | | | | 12,000,000 | |

0.405%, 01/08/14 | | | 6,000 | | | | 6,000,000 | |

| | | | | | | | |

| | | Par

(000) | | | Value | |

CERTIFICATES OF DEPOSIT—(Continued) | |

Yankee Dollar Certificates Of Deposit—(Continued) | |

Royal Bank of Canada, New

York(a) | | | | | | | | |

0.442%, 05/16/13 | | $ | 6,500 | | | $ | 6,500,000 | |

Skandinaviska Enskilda Banken, New York | | | | | | | | |

0.310%, 03/28/13 | | | 7,000 | | | | 7,000,000 | |

0.300%, 04/08/13 | | | 2,040 | | | | 2,040,000 | |

Sumitomo Mitsui Banking Corp., New York | | | | | | | | |

0.230%, 05/02/13 | | | 10,000 | | | | 10,000,000 | |

Sumitomo Mitsui Trust Bank Ltd., New York | | | | | | | | |

0.230%, 05/13/13 | | | 7,500 | | | | 7,500,000 | |

0.270%, 05/22/13 | | | 7,000 | | | | 7,000,000 | |

Svenska Handelsbanken, New York | | | | | | | | |

0.230%, 06/05/13 | | | 6,000 | | | | 5,999,840 | |

0.260%, 06/10/13 | | | 4,000 | | | | 4,000,112 | |

Toronto Dominion Bank, New York | | | | | | | | |

0.320%, 03/18/13 | | | 7,000 | | | | 7,000,000 | |

0.300%, 07/22/13 | | | 3,000 | | | | 3,000,000 | |

Westpac Banking Corp., New York(a) | | | | | | | | |

0.338%, 11/01/13 | | | 7,520 | | | | 7,517,412 | |

| | | | | | | | |

| | | | | | | 198,803,000 | |

| | | | | | | | |

TOTAL CERTIFICATES OF DEPOSIT | | | | | |

(Cost $214,803,000) | | | | | | | 214,803,000 | |

| | | | | | | | |

COMMERCIAL PAPER—35.4% | | | | | |

Asset Backed—15.7% | | | | | | | | |

Aspen Funding

Corp.(c) | | | | | | | | |

0.300%, 03/04/13 | | | 10,000 | | | | 9,999,750 | |

Atlantis One Funding

Corp.(c) | | | | | | | | |

0.471%, 03/07/13 | | | 10,000 | | | | 9,999,217 | |

Cancara Asset Securitization LLC(c) | | | | | | | | |

0.240%, 05/03/13 | | | 4,000 | | | | 3,998,320 | |

0.230%, 05/23/13 | | | 3,000 | | | | 2,998,409 | |

Chariot Funding LLC(c) | | | | | | | | |

0.190%, 04/29/13 | | | 7,000 | | | | 6,997,820 | |

Gotham Funding Corp.(c) | | | | | | | | |

0.180%, 03/11/13 | | | 4,000 | | | | 3,999,800 | |

Jupiter Securitization Company LLC(c) | | | | | | | | |

0.210%, 03/04/13 | | | 5,000 | | | | 4,999,913 | |

Liberty Street Funding

LLC(c) | | | | | | | | |

0.160%, 03/08/13 | | | 7,050 | | | | 7,049,781 | |

The accompanying notes are an integral part of these financial statements.

3

THE RBB FUND, INC.

Money Market Portfolio

Schedule of Investments (Continued)

February 28, 2013

(Unaudited)

| | | | | | | | |

| | | Par

(000) | | | Value | |

COMMERCIAL PAPER—(Continued) | | | | | | | | |

Asset Backed—(Continued) | | | | | | | | |

Manhattan Asset Funding Co. LLC(c) | | | | | | | | |

0.200%, 03/12/13 | | $ | 7,000 | | | $ | 6,999,572 | |

Metlife Short Term Funding LLC(c) | | | | | | | | |

0.250%, 07/22/13 | | | 5,000 | | | | 4,995,034 | |

Mont Blanc Capital Corp.(c) | | | | | | | | |

0.350%, 03/04/13 | | | 5,000 | | | | 4,999,854 | |

0.190%, 03/20/13 | | | 3,000 | | | | 2,999,699 | |

Nieuw Amsterdam Receivables Corp.(c) | | | | | | | | |

0.170%, 03/07/13 | | | 6,000 | | | | 5,999,830 | |

0.190%, 04/18/13 | | | 15,000 | | | | 14,996,200 | |

Surrey Funding Corp.(c) | | | | | | | | |

0.230%, 04/03/13 | | | 14,995 | | | | 14,991,839 | |

| | | | | | | | |

| | | | | | | 106,025,038 | |

| | | | | | | | |

Banks—19.7% | | | | | | | | |

Australia & New Zealand Banking Ltd. | | | | | | | | |

0.373%, 01/17/14 | | | 4,000 | | | | 4,000,000 | |

Collateralized Commercial Paper Co. LLC(c) | | | | | | | | |

0.310%, 05/15/13 | | | 7,000 | | | | 6,995,479 | |

Commonwealth Bank of Australia(a) | | | | | | | | |

0.340%, 11/14/13 | | | 4,500 | | | | 4,499,678 | |

DNB Bank ASA(c) | | | | | | | | |

0.270%, 07/30/13 | | | 7,500 | | | | 7,491,506 | |

0.270%, 08/05/13 | | | 7,000 | | | | 6,991,757 | |

General Electric Capital Corp.(c) | | | | | | | | |

0.240%, 08/12/13 | | | 1,000 | | | | 998,907 | |

0.240%, 08/26/13 | | | 5,000 | | | | 4,994,067 | |

ING US Funding LLC(c) | | | | | | | | |

0.220%, 05/09/13 | | | 15,000 | | | | 14,993,675 | |

0.230%, 05/09/13 | | | 6,500 | | | | 6,497,135 | |

La Caisse Centrale Desjardins Du Quebec(c) | | | | | | | | |

0.250%, 03/04/13 | | | 10,000 | | | | 9,999,792 | |

Lloyds TSB Bank PLC(c) | | | | | | | | |

0.240%, 04/23/13 | | | 5,000 | | | | 4,998,233 | |

0.235%, 04/24/13 | | | 5,000 | | | | 4,998,237 | |

Nordea North America, Inc., Delaware(c) | | | | | | | | |

0.300%, 05/16/13 | | | 6,000 | | | | 5,996,200 | |

0.280%, 07/15/13(c) | | | 1,945 | | | | 1,942,943 | |

0.280%, 07/16/13(c) | | | 1,945 | | | | 1,942,927 | |

| | | | | | | | |

| | | Par

(000) | | | Value | |

COMMERCIAL PAPER—(Continued) | | | | | | | | |

Banks—(Continued) | | | | | | | | |

NRW.Bank(c) | | | | | | | | |

0.175%, 03/05/13 | | $ | 10,000 | | | $ | 9,999,806 | |

UBS Finance LLC, Delaware(c) | | | | | | | | |

0.200%, 03/11/13 | | | 20,000 | | | | 19,998,889 | |

Westpac Banking Corp. | | | | | | | | |

0.500%, 04/02/13(c) | | | 5,500 | | | | 5,497,556 | |

0.289%, 10/08/13(a) | | | 10,000 | | | | 10,000,000 | |

| | | | | | | | |

| | | | | | | 132,836,787 | |

| | | | | | | | |

TOTAL COMMERCIAL PAPER (Cost $238,861,825) | | | | | | | 238,861,825 | |

| | | | | | | | |

MUNICIPAL BONDS—8.5% | | | | | | | | |

California—1.0% | | | | | | | | |

California Housing Finance Agency Revenue, Series A, RB (LOC: Fannie Mae, Freddie Mac)(a)(d) | | | | | | | | |

0.110%, 03/07/13 | | | 3,000 | | | | 3,000,000 | |

San Francisco, City & County Redevelopment Agency, Multifamily Revenue, Series A, RB (LOC: Fannie Mae)(a)(d) | | | | | | | | |

0.090%, 03/07/13 | | | 3,900 | | | | 3,900,000 | |

| | | | | | | | |

| | | | | | | 6,900,000 | |

| | | | | | | | |

Connecticut—0.8% | | | | | | | | |

Connecticut State, Health & Educational Facilities Authority Revenue, New Haven Hospital, Series K-2, RB (LOC: JPMorgan Chase Bank)(a)(d) | | | | | | | | |

0.100%, 03/07/13 | | | 5,400 | | | | 5,400,000 | |

| | | | | | | | |

Michigan—1.1% | | | | | | | | |

Michigan State Housing Development Authority, Series D, RB (LOC: Fannie Mae)(a)(d) | | | | | | | | |

0.110%, 03/07/13 | | | 7,900 | | | | 7,900,000 | |

| | | | | | | | |

New York—3.8% | | | | | | | | |

New York City, Housing Development Corp., Multifamily Rent Housing Revenue, Series A, RB (LOC: Fannie Mae)(a)(d) | | | | | | | | |

0.100%, 03/07/13 | | | 6,000 | | | | 6,000,000 | |

The accompanying notes are an integral part of these financial statements.

4

THE RBB FUND, INC.

Money Market Portfolio

Schedule of Investments (Continued)

February 28, 2013

(Unaudited)

| | | | | | | | |

| | | Par

(000) | | | Value | |

MUNICIPAL BONDS—(Continued) | | | | | | | | |

New York—(Continued) | | | | | | | | |

New York City, Industrial Development Agency Civic Facility Revenue, New York Law School Project, Series A, RB (LOC: JPMorgan Chase Bank)(a)(d) | | | | | | | | |

0.110%, 03/07/13 | | $ | 4,335 | | | $ | 4,335,000 | |

New York State Dormitory Authority, City University, Series D, RB (LOC: TD Bank NA)(a)(d) | | | | | | | | |

0.100%, 03/07/13 | | | 5,000 | | | | 5,000,000 | |

New York State, Housing Finance Agency Revenue, RB (LOC: Freddie Mac)(a)(d) | | | | | | | | |

0.080%, 03/07/13 | | | 5,200 | | | | 5,200,000 | |

Westchester County, Health Care Revenue, RB (LOC: TD Bank NA)(a)(d) | | | | | | | | |

0.150%, 03/07/13 | | | 5,000 | | | | 5,000,000 | |

| | | | | | | | |

| | | | | | | 25,535,000 | |

| | | | | | | | |

Tennessee—1.2% | | | | | | | | |

Eclipse Funding Trust, Various 2007-0005-Solar Eclipse-Blount, RB (LOC: U.S. Bank NA)(a)(d) | | | | | | | | |

0.110%, 03/07/13 | | | 8,000 | | | | 8,000,000 | |

| | | | | | | | |

Texas—0.6% | | | | | | | | |

Texas State, Veterans Housing Assessment Project, Series A-2, GO (Liquidity Facility: JPMorgan Chase & Co.)(a)(d) | | | | | | | | |

0.160%, 03/07/13 | | | 3,900 | | | | 3,900,000 | |

| | | | | | | | |

TOTAL MUNICIPAL BONDS | | | | | | | | |

(Cost $57,635,000) | | | | | | | 57,635,000 | |

| | | | | | | | |

VARIABLE RATE OBLIGATIONS—1.3% | | | | | |

Banks—1.3% | | | | | | | | |

JPMorgan Chase Bank NA(a) | | | | | | | | |

0.373%, 05/17/13 | | | 8,600 | | | | 8,600,000 | |

| | | | | | | | |

TOTAL VARIABLE RATE OBLIGATIONS | | | | | |

(Cost $8,600,000) | | | | | | | 8,600,000 | |

| | | | | | | | |

AGENCY OBLIGATIONS—5.7% | | | | | | | | |

Fannie Mae | | | | | | | | |

0.173%, 02/27/15(a) | | | 6,000 | | | | 5,996,991 | |

| | | | | | | | |

| | | Par

(000) | | | Value | |

AGENCY OBLIGATIONS—(Continued) | | | | | | | | |

Freddie Mac | | | | | | | | |

0.390%, 09/03/13(a) | | $ | 5,000 | | | $ | 4,999,486 | |

0.142%, 09/13/13(a) | | | 22,200 | | | | 22,192,774 | |

0.180%, 11/05/13(c) | | | 5,000 | | | | 4,993,775 | |

| | | | | | | | |

TOTAL AGENCY OBLIGATIONS | | | | | | | | |

(Cost $38,183,026) | | | | | | | 38,183,026 | |

| | | | | | | | |

U.S. TREASURY OBLIGATIONS—10.7% | | | | | |

U.S. Treasury Notes | | | | | | | | |

0.625%, 04/30/13 | | | 17,000 | | | | 17,011,744 | |

0.500%, 05/31/13 | | | 10,000 | | | | 10,008,051 | |

3.500%, 05/31/13 | | | 6,000 | | | | 6,049,818 | |

0.375%, 06/30/13 | | | 7,500 | | | | 7,503,386 | |

3.375%, 06/30/13 | | | 7,000 | | | | 7,074,415 | |

0.125%, 08/31/13 | | | 4,000 | | | | 3,998,505 | |

0.750%, 09/15/13 | | | 7,785 | | | | 7,809,972 | |

0.125%, 09/30/13 | | | 6,500 | | | | 6,498,435 | |

2.000%, 11/30/13 | | | 6,000 | | | | 6,081,540 | |

| | | | | | | | |

TOTAL U.S. TREASURY OBLIGATIONS | | | | | |

(Cost $72,035,866) | | | | | | | 72,035,866 | |

| | | | | | | | |

REPURCHASE AGREEMENTS—8.1% | | | | | | | | |

Deutsche Bank Securities, Inc. (Tri-Party Agreement dated 02/28/13 to be repurchased at $34,764,183, collateralized by $35,191,000 par value, Federal National Mortgage Backed Securities, 0.000%-1.2500%, due 07/01/2013 to 02/27/2014, Fair Value of the collateral is $35,459,538) | | | | | | | | |

0.190%, 03/01/13 | | | 34,764 | | | | 34,764,000 | |

Morgan Stanley & Co. LLC (Tri-Party Agreement dated 02/28/13 to be repurchased at $20,000,111, collateralized by $20,034,480, par value, Federal National Mortgage Backed Security, 2.500%, due 12/01/2027, Fair Value of the collateral is $20,600,000) | | | | | | | | |

0.200%, 03/01/13 | | | 20,000 | | | | 20,000,000 | |

| | | | | | | | |

TOTAL REPURCHASE AGREEMENTS | | | | | |

(Cost $54,764,000) | | | | | | | 54,764,000 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

5

THE RBB FUND, INC.

Money Market Portfolio

Schedule of Investments (Concluded)

February 28, 2013

(Unaudited)

| | | | | | |

| | | | | Value | |

TOTAL INVESTMENTS AT VALUE—101.5% | |

(Cost $684,882,717)* | | | | $ | 684,882,717 | |

| | | | | | |

LIABILITIES IN EXCESS OF

OTHER ASSETS—(1.5)% | | | (9,834,821 | ) |

| | | | | | |

NET ASSETS (APPLICABLE TO 674,380,542 BEDFORD SHARES AND 661,999 SANSOM STREET SHARES)—100.0% | | | | $ | 675,047,896 | |

| | | | | | |

| * | Aggregate cost is the same for financial reporting and Federal tax purposes. |

| (a) | Variable Rate Security. Rate shown is as of report date. |

| (b) | Issuer is a US branch of a foreign domiciled bank. |

| (c) | Rate disclosed represents the discount rate at the time of purchase. |

| (d) | Rate shown is as of report date and the date shown is date on which principal and accrued interest may be recovered through demand. |

| LLC | Limited Liability Company |

| PLC | Public Liability Company |

The accompanying notes are an integral part of these financial statements.

6

THE RBB FUND, INC.

Money Market Portfolio

Statement of Assets and Liabilities

February 28, 2013

(Unaudited)

| | | | |

ASSETS | | | | |

Investments, at value (Cost $630,118,717) | | $ | 630,118,717 | |

Repurchase agreements, at value (Cost $54,764,000) | | | 54,764,000 | |

Cash | | | 4,565 | |

Receivables | | | | |

Interest receivable | | | 308,804 | |

Prepaid expenses and other assets | | | 91,361 | |

| | | | |

Total assets | | | 685,287,447 | |

| | | | |

| |

LIABILITIES | | | | |

Payables | | | | |

Investments purchased | | | 10,000,000 | |

Distribution to shareholders | | | 110 | |

Investment advisory and administration fees | | | 99,515 | |

Printing fees | | | 56,414 | |

Professional fees | | | 30,712 | |

Transfer agent fees | | | 14,593 | |

Distribution fees (Bedford Class) | | | 10,151 | |

Regulatory administration fees | | | 8,130 | |

Directors’ and officers’ fees | | | 6,101 | |

Custodian fees | | | 1,561 | |

Other accrued expenses and liabilities | | | 12,264 | |

| | | | |

Total liabilities | | | 10,239,551 | |

| | | | |

Net Assets | | $ | 675,047,896 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Par Value | | $ | 675,043 | |

Paid-in Capital | | | 674,367,474 | |

Accumulated net investment loss | | | (16,215 | ) |

Accumulated net realized gain from investments | | | 21,594 | |

| | | | |

Net Assets | | $ | 675,047,896 | |

| | | | |

| |

BEDFORD CLASS | | | | |

Net assets | | $ | 674,385,918 | |

| | | | |

Shares outstanding ($0.001 par value, 1,500,000,000 shares authorized) | | | 674,380,542 | |

| | | | |

Net asset value, offering and redemption price per share | | $ | 1.00 | |

| | | | |

| |

SANSOM STREET CLASS | | | | |

Net assets | | $ | 661,978 | |

| | | | |

Shares outstanding ($0.001 par value, 1,500,000,000 shares authorized) | | | 661,999 | |

| | | | |

Net asset value, offering and redemption price per share | | $ | 1.00 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

7

THE RBB FUND, INC.

Money Market Portfolio

Statement of Operations

For the Six Months Ended February 28, 2013

(Unaudited)

| | | | | | |

Investment Income | | | | | | |

Interest | | | | $ | 882,147 | |

| | | | | | |

Total investment income | | | | | 882,147 | |

| | | | | | |

| | |

Expenses | | | | | | |

Distribution fees (Bedford Class)(1) | | | | | 2,062,087 | |

Investment advisory and administration fees | | | | | 1,297,178 | |

Printing and shareholder reporting fees | | | | | 135,467 | |

Custodian fees | | | | | 75,226 | |

Professional fees | | | | | 46,263 | |

Directors’ and officers’ fees | | | | | 26,811 | |

Regulatory administration fees | | | | | 24,299 | |

Transfer agent fees | | | | | 22,797 | |

Insurance fees | | | | | 17,048 | |

Registration and filing fees | | | | | 15,438 | |

Other expenses | | | | | 9,202 | |

| | | | | | |

Total expenses before waivers | | | | | 3,731,816 | |

Less: Advisory and administration waivers | | | (898,136 | ) |

Less: Distribution fee waivers (Bedford Class)(1) | | | (1,985,850 | ) |

| | | | | | |

Net expenses after waivers | | | | | 847,830 | |

| | | | | | |

Net investment income | | | | | 34,317 | |

| | | | | | |

Net realized gain from investments | | | | | 11,082 | |

| | | | | | |

Net increase in net assets resulting from operations | | | | $ | 45,399 | |

| | | | | | |

| (1) | See Note 2 in Notes to Financial Statements |

The accompanying notes are an integral part of the financial statements.

8

THE RBB FUND, INC.

Money Market Portfolio

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Six Months Ended

February 28,2013

(Unaudited) | | | For the

Year Ended

August 31, 2012 | |

Increase in net assets: | | | | | |

From operations: | | | | | |

Net investment income | | $ | 34,317 | | | $ | 164,652 | |

Net realized gain from investments | | | 11,082 | | | | 10,512 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 45,399 | | | | 175,164 | |

| | | | | | | | |

Dividends to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Bedford Class | | | (50,434 | ) | | | (181,565 | ) |

Sansom Street Class | | | (98 | ) | | | (1,323 | ) |

| | | | | | | | |

Net decrease in net assets from dividends to shareholders | | | (50,532 | ) | | | (182,888 | ) |

| | | | | | | | |

Capital transactions (at $1.00 per share): | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Bedford Class | | | 248,287,092 | | | | 717,471,265 | |

Sansom Street Class | | | 778,420 | | | | 4,334,284 | |

Shares issued on reinvestment of distributions: | | | | | | | | |

Bedford Class | | | 49,464 | | | | 178,351 | |

Sansom Street Class | | | 79 | | | | 138 | |

Shares repurchased: | | | | | | | | |

Bedford Class | | | (215,656,688 | ) | | | (797,075,673 | ) |

Sansom Street Class | | | (356,547 | ) | | | (23,614,456 | ) |

| | | | | | | | |

Increase/(decrease) in net assets derived from capital transactions | | | 33,101,820 | | | | (98,706,091 | ) |

| | | | | | | | |

Total increase/(decrease) in net assets | | | 33,096,687 | | | | (98,713,815 | ) |

Net assets: | | | | | | | | |

Beginning of period | | | 641,951,209 | | | | 740,665,024 | |

| | | | | | | | |

End of period | | $ | 675,047,896 | | | $ | 641,951,209 | |

| | | | | | | | |

Accumulated net investment loss, end of period | | $ | (16,215 | ) | | $ | — | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Shares sold | | | | | | | | |

Bedford Class | | | 248,287,092 | | | | 717,471,265 | |

Sansom Street Class | | | 778,420 | | | | 4,334,284 | |

Shares reinvested | | | | | | | | |

Bedford Class | | | 49,464 | | | | 178,351 | |

Sansom Street Class | | | 79 | | | | 138 | |

Shares repurchased | | | | | | | | |

Bedford Class | | | (215,656,688 | ) | | | (797,075,673 | ) |

Sansom Street Class | | | (356,547 | ) | | | (23,614,456 | ) |

| | | | | | | | |

Total Share Activity | | | 33,101,820 | | | | (98,706,091 | ) |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

9

THE RBB FUND, INC.

Money Market Portfolio

Financial Highlights

(For a Share Outstanding Throughout each Year)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | The Bedford Class | |

| | | | | | |

| | | For the

Six Months

Ended

February 28, 2013

(Unaudited) | | | For the

Year

Ended

August 31, 2012 | | | For the

Year

Ended

August 31, 2011 | | | For the

Year

Ended

August 31, 2010 | | | For the

Year

Ended

August 31, 2009 | | | For the

Year

Ended

August 31, 2008 | |

| | | | | | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.0001 | | | | 0.0003 | | | | 0.0002 | | | | 0.0003 | | | | 0.0074 | | | | 0.0307 | |

Net gains (losses) on securities | | | —(a | ) | | | —(a | ) | | | —(a | ) | | | —(a | ) | | | —(a | ) | | | —(a | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net income from investment operations | | | 0.0001 | | | | 0.0003 | | | | 0.0002 | | | | 0.0003 | | | | 0.0074 | | | | 0.0307 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment

income) | | | (0.0001 | ) | | | (0.0003 | ) | | | (0.0002 | ) | | | (0.0003 | ) | | | (0.0074 | ) | | | (0.0307 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 0.01%(b | ) | | | 0.03% | | | | 0.02% | | | | 0.03% | | | | 0.74% | | | | 3.12% | |

| | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period

(000’s omitted) | | $ | 674,386 | | | $ | 641,711 | | | $ | 721,145 | | | $ | 593,570 | | | $ | 545,194 | | | $ | 319,387 | |

Ratios of expenses to average

net assets(c) | | | 0.26%(d | ) | | | 0.25% | | | | 0.27% | | | | 0.31% | | | | 0.69% | | | | 0.90% | |

Ratios of net investment income

to average net assets | | | 0.01%(d | ) | | | 0.02% | | | | 0.02% | | | | 0.02% | | | | 0.65% | | | | 2.94% | |

| (a) | Amount is less than $0.00005 per share. |

| (c) | Without the waiver of advisory fees, distribution fees, and/or reimbursement of certain operating expenses, the ratios of expenses to average net assets for the Bedford Class of the Money Market Portfolio would have been 1.18% (annualized) for the six months ended February 28, 2013 and 1.15%, 1.12%, 1.18%, 1.24% and 1.23% for the years ended August 31, 2012, 2011, 2010, 2009 and 2008, respectively. |

The accompanying notes are an integral part of the financial statements.

10

THE RBB FUND, INC.

Money Market Portfolio

Financial Highlights (Concluded)

(For a Share Outstanding Throughout each Year)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | The Sansom Street Class | |

| | | | | | |

| | | For the

Six Months

Ended

February 28, 2013

(Unaudited) | | | For the

Year

Ended

August 31, 2012 | | | For the

Year

Ended

August 31, 2011 | | | For the

Year

Ended

August 31, 2010 | | | For the

Year

Ended

August 31, 2009 | | | For the

Year

Ended

August 31, 2008 | |

| | | | | | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.0002 | | | | 0.0004 | | | | 0.0006 | | | | 0.0010 | | | | 0.0121 | | | | 0.0365 | |

Net gains (losses) on securities | | | —(a | ) | | | —(a | ) | | | —(a | ) | | | —(a | ) | | | —(a | ) | | | —(a | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net income from investment operations | | | 0.0002 | | | | 0.0004 | | | | 0.0006 | | | | 0.0010 | | | | 0.0121 | | | | 0.0365 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment

income) | | | (0.0002 | ) | | | (0.0004 | ) | | | (0.0006 | ) | | | (0.0010 | ) | | | (0.0121 | ) | | | (0.0365 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 0.02%(b | ) | | | 0.05% | | | | 0.06% | | | | 0.10% | | | | 1.21% | | | | 3.71% | |

| | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period

(000’s omitted) | | $ | 662 | | | $ | 240 | | | $ | 19,520 | | | $ | 37,708 | | | $ | 32,496 | | | $ | 28,749 | |

Ratios of expenses to average

net assets(c) | | | 0.24%(d | ) | | | 0.23% | | | | 0.23% | | | | 0.24% | | | | 0.25% | | | | 0.31% | |

Ratios of net investment income

to average net assets | | | 0.03%(d | ) | | | 0.04% | | | | 0.06% | | | | 0.09% | | | | 0.93% | | | | 3.64% | |

| (a) | Amount is less than $0.00005 per share. |

| (c) | Without the waiver of advisory fees and reimbursement of certain operating expenses, the ratios of expenses to average net assets for the Sansom Street Class of the Money Market Portfolio would have been 0.53% (annualized) for the six months ended February 28, 2013 and 0.50%, 0.47%, 0.54%, 0.60% and 0.60% for the years ended August 31, 2012, 2011, 2010, 2009 and 2008, respectively. |

The accompanying notes are an integral part of the financial statements.

11

THE RBB FUND, INC.

Money Market Portfolio

Notes to Financial Statements

February 28, 2013

(Unaudited)

1. Summary of Significant Accounting Policies

The RBB Fund, Inc. (“RBB” or the “Company”) was incorporated under the laws of the State of Maryland on February 29, 1988, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. RBB is a “series fund,” which is a mutual fund divided into separate portfolios. Each portfolio is treated as a separate entity for certain matters under the 1940 Act, and for other purposes, and a shareholder of one portfolio is not deemed to be a shareholder of any other portfolio. Currently, RBB has seventeen active investment portfolios, including the Money Market Portfolio (“Portfolio”).

RBB has authorized capital of one hundred billion shares of common stock of which 80.573 billion shares are currently classified into one hundred and forty-two classes of common stock. Each class represents an interest in an active or inactive RBB investment portfolio. The Portfolio has issued shares with a par value of $0.001.

SECURITY VALUATION — Securities held in the Portfolio are valued under the amortized cost method, which approximates fair value. Under this method, securities are valued at cost when purchased and thereafter a constant accretion of discount or amortization of premium is recorded until maturity of the security. Regular review and monitoring of the valuation is performed to ensure that cost continues to approximate fair value and to avoid dilution or other unfair results to shareholders. The Portfolio seeks to maintain net asset value (“NAV”) per share at $1.00.

Fair Value Measurements — The inputs and valuations techniques used to measure fair value of the Portfolio’s investments are summarized into three levels as described in the hierarchy below:

| | • | | Level 1 — quoted prices in active markets for identical securities; |

| | • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| | • | | Level 3 — significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of net assets). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used, as of February 28, 2013, in valuing the Portfolio’s net assets carried at fair value:

| | | | | | | | | | | | | | | | |

| | | Total

Value at

February 28, 2013 | | | Level 1

Quoted

Price | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | |

Investments in Securities* | | $ | 684,882,717 | | | $ | — | | | $ | 684,882,717 | | | $ | — | |

| | | | | | | | | | | | | | | | |

| * | Please refer to the Schedule of Investments for industry and security type breakouts. |

Securities held in the Portfolio are valued at amortized cost, in accordance with rules under the 1940 Act. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

12

THE RBB FUND, INC.

Money Market Portfolio

Notes to Financial Statements (Continued)

February 28, 2013

(Unaudited)

At the end of each fiscal quarter, management evaluates the classification of Levels 1, 2 and 3 assets and liabilities. Various factors are considered, such as changes in liquidity from the prior reporting period; whether or not a broker is willing to execute at the quoted price; the depth and consistency of prices from third party pricing services; and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the classification of Level 1 and Level 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Portfolio’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Portfolio may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

For fair valuations using significant unobservable inputs, U.S. generally accepted accounting principles (“U.S. GAAP”) require the Fund to present a reconciliation of the beginning to ending balances for reported market values that presents changes attributable to total realized and unrealized gains or losses, purchase and sales, and transfers in and out of Level 3 during the period. Transfers in and out between Levels are based on values at the end of the period. U.S. GAAP also requires the Fund to disclose amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. A reconciliation of Level 3 investments is presented only when the Fund had an amount of Level 3 investments at the end of the reporting period that was meaningful in relation to its net assets. The amounts and reasons for all transfers in and out of each Level within the three-tier hierarchy are disclosed when the Fund had an amount of total transfers during the reporting period that was meaningful in relation to its net assets as of the end of the reporting period.

For the six months ended February 28, 2013, there were no transfers between Levels 1, 2 and 3 for the Portfolio.

SECURITY TRANSACTIONS, INVESTMENT INCOME, AND EXPENSES — The Fund records security transactions based on the trade date for financial reporting purposes. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes. Interest income is accrued when earned. Certain expenses, such as distribution fee and service organization fees, are class specific expenses and vary by class. Expenses not directly attributable to a specific portfolio or class are allocated based on relative net assets of each portfolio and class. Expenses incurred on behalf of a specific class, fund or fund family of the Company are charged directly to the class, fund or fund family (in proportion to net assets). Expenses incurred for all portfolios within the Company (such as director or professional fees) are charged to all portfolios in proportion to their average net assets of RBB, or in such other manner as the Company’s Board of Directors deems fair or equitable. Expenses and fees, including investment advisory and administration fees, are accrued daily and taken into account for the purpose of determining the NAV of the Portfolio.

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — Dividends from net investment income are declared daily, recorded on the ex-dividend date and paid monthly. All dividends from net investment income are taxed as ordinary income. Any net realized capital gains are distributed at least annually. Income subject to dividends and capital gain subject to distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP.

FEDERAL INCOME TAXES — No provision is made for federal income taxes. It is the Company’s intention to have the Portfolio continue to qualify for and elect the tax treatment applicable to regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended and make the requisite distributions to its shareholders which will be sufficient to relieve it from federal income and excise taxes.

13

THE RBB FUND, INC.

Money Market Portfolio

Notes to Financial Statements (Continued)

February 28, 2013

(Unaudited)

REPURCHASE AGREEMENTS — Money market instruments may be purchased from financial institutions, such as banks and non-bank dealers, subject to the seller’s agreement to repurchase them at an agreed upon date and price. Collateral for repurchase agreements may have longer maturities than the maximum permissible remaining maturity of portfolio investments, provided the repurchase agreements themselves mature in 13 months or less. The seller is required on a daily basis to maintain the value of the securities subject to the agreement at no less than the repurchase price. The agreements are conditioned upon the collateral being deposited under the Federal Reserve book entry system or held in a separate account by the Portfolio’s custodian or an authorized securities depository. In the event the counterparty defaults and the fair value of the collateral declines, the Portfolio could experience losses, delays and costs in liquidating the collateral.

USE OF ESTIMATES — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and those differences could be significant.

CASH AND CASH EQUIVALENTS — The Funds consider liquid assets deposited with a bank demand deposit account to be cash equivalents. These investments represent amounts held with financial institutions that are readily accessible to pay Fund expenses or purchase investments. Cash and cash equivalents are valued at cost plus accrued interest, which approximates market value.

OTHER — In the normal course of business, the Portfolio may enter into contracts that provide general indemnifications. The Portfolio’s maximum exposure under these arrangements is dependent on claims that may be made against the Portfolio in the future and therefore, cannot be estimated; however, based on experience, the risk of material loss for such claims is considered remote.

2. Investment Adviser and Other Services

Pursuant to an Investment Advisory and Administration Agreement, BlackRock Advisors LLC (the “Adviser” or “BALLC”), an indirect wholly owned subsidiary of BlackRock, Inc., serves as investment adviser and administrator for the Portfolio.

BALLC (assignee of BlackRock Institutional Management Corporation) and BNY Mellon Investment Servicing (US) Inc, (“BNY Mellon”), have entered into a delegation agreement on behalf of the Portfolio, wherein BNY Mellon has agreed to perform administration and accounting services for an annual fee of 0.10% of the average net assets of the Portfolio, paid out of the fee paid to BALLC.

For its advisory services, BALLC is entitled to receive the following fees, computed daily and payable monthly, and based on the Portfolio’s average daily net assets:

|

Annual Rate |

0.45% of first $250 million of net assets; |

0.40% of next $250 million of net assets; and |

0.35% of net assets in excess of $500 million. |

The Adviser has contractually agreed to waive fees and/or reimburse expenses for the Portfolio such that total annual Portfolio operating expenses after fee waivers and/or expense reimbursements (excluding certain Portfolio expenses) do not exceed 0.25%. The following expenses are excluded from the contractual limitation: (i) interest, taxes, dividends tied to short sales, brokerage commissions, and other expenditures which are capitalized in accordance with U.S. GAAP; (ii) expenses

14

THE RBB FUND, INC.

Money Market Portfolio

Notes to Financial Statements (Continued)

February 28, 2013

(Unaudited)

incurred directly or indirectly by the Portfolio as a result of investments in other investment companies and pooled investment vehicles; (iii) other expenses attributable to, and incurred as a result of, the Portfolio’s investments; (iv) distribution and servicing (12b-1) fees; and (v) other extraordinary expenses (including litigation expenses) not incurred in the ordinary course of the Portfolio’s business, if any, of the Bedford Shares and the Sansom Street Shares of the Portfolio. This contractual limitation is in effect through December 31, 2013 and may not be terminated without the approval of the Company’s Board of Directors. The Adviser may terminate this arrangement at any time after December 31, 2013. Prior to December 20, 2011, the Adviser voluntarily waived a portion of its management fees and/or reimbursed expenses for the Portfolio.

For each class of shares within the Portfolio, the net advisory fee charged to each class is the same on a relative basis. For the six months ended February 28, 2013, advisory fees and waivers were as follows:

| | | | | | | | | | |

Gross Advisory

and

Administration

Fee | | | Waiver | | | Net Advisory

and

Administration

Fee | |

| | $1,297,178 | | | $ | (898,136 | ) | | $ | 399,042 | |

As of February 28, 2013, the Portfolio owed BALLC $99,515 in advisory and administration fees.

For providing regulatory administration services to RBB, BNY Mellon is entitled to receive compensation as agreed to by the Company and BNY Mellon. This fee is allocated to each portfolio of the Company in proportion to its net assets of the Company.

In addition, BNY Mellon serves as the Portfolio’s transfer and dividend disbursing agent. For providing transfer agent services, BNY Mellon is entitled to receive a monthly fee equal to an annual percentage rate of the Portfolio’s average daily net assets, subject to certain minimum monthly fees.

The Bank of New York Mellon provides certain custodian services to the Portfolio and is entitled to receive out of pocket expenses.

BNY Mellon may also voluntarily waive a portion of their fees and/or reimburse expenses.

The Portfolio, on behalf of the Bedford Class of shares of the Portfolio, has adopted a Distribution Plan pursuant to Rule 12b-1 under the 1940 Act (the “Plan”). The Portfolio has entered into a Distribution Agreement with Foreside Funds Distributors LLC (“Foreside Distributors”).

The Plan provides for the Bedford Class to make monthly payments, based on average net assets, to Foreside Distributors of up to 0.65% on an annualized basis. Foreside Distributors may voluntarily waive these fees at its discretion. For the six months ended February 28, 2013, distribution fees paid to Foreside Distributors for the Bedford Class were as follows:

| | | | | | | | | | | | |

| | | Gross

Distribution

Fee | | | Waiver | | | Net

Distribution

Fee | |

Bedford Class | | $ | 2,062,087 | | | $ | (1,985,850 | ) | | $ | 76,237 | |

The Portfolio will not pay BALLC, BNY Mellon or Foreside Distributors at a later time for any amounts waived or assumed.

15

THE RBB FUND, INC.

Money Market Portfolio

Notes to Financial Statements (Continued)

February 28, 2013

(Unaudited)

The Portfolio has entered into service agreements with BNY Mellon which render support services to customers who are the beneficial owners of the Sansom Street Class in consideration of the payment of 0.10% of the daily net asset value of such shares.

3. Director Compensation

The Directors of the Company receive an annual retainer and meeting fees for meetings attended. The remuneration paid to the Directors by the Portfolio during the six months ended February 28, 2013 was $26,352. Certain employees of BNY Mellon serve as an Officer or Director of the Company. They are not compensated by the Portfolio or the Company.

4. Federal Income Tax Information

The Portfolio intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Therefore, no federal tax provision is required.

The Portfolio has followed the authoritative guidance on accounting for and disclosure of uncertainty in tax positions, which requires the Portfolio to determine whether a tax position is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The Portfolio has determined that there was no effect on the financial statements from following this authoritative guidance. In the normal course of business, the Portfolio is subject to examination by federal, state and local jurisdictions, where applicable, for tax years for which applicable statutes of limitations have not expired.

Distributions to shareholders from net investment income and realized gains are determined in accordance with federal income tax regulations, which may differ from net investment income and realized gains recognized for financial reporting purposes. Accordingly, the character of distributions and composition of net assets for tax purposes may differ from those reflected in the accompanying financial statements. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on the tax treatment; temporary differences do not require such reclassification.

As of August 31, 2012, the Portfolio had $10,676 of undistributed ordinary income for federal tax purposes.

The difference between the book and tax basis components of distributable earnings relate principally to the timing of recognition of income and gains for Federal income tax purposes. Short-term capital gains are reported as ordinary income dividends for Federal income tax purposes.

The tax character of dividends and distributions paid during the last fiscal year was as follows:

| | | | |

| | | Ordinary

Income | |

2012 | | $ | 182,888 | |

Dividends paid from net investment income and short-term capital gains are treated as ordinary income distributions for federal income tax purposes.

Accumulated capital losses represent net capital loss carry forwards as of August 31, 2012 that may be available to offset future realized capital gains and thereby reduce future capital gains distributions. Under the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”), the Portfolio is permitted to carry forward capital losses

16

THE RBB FUND, INC.

Money Market Portfolio

Notes to Financial Statements (Concluded)

February 28, 2013

(Unaudited)

incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those future taxable years will be required to be utilized prior to any losses incurred in pre-enactment taxable years. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under the previous law. The Portfolio’s first fiscal year end subject to the Modernization Act was August 31, 2012. During the fiscal year ended August 31, 2012, the Fund did not utilize any prior year capital loss carry forwards. As of August 31, 2012, the Portfolio had no pre- or post-enactment capital loss carry forwards.

5. Subsequent Event

Management has evaluated the impact of all subsequent events on the Portfolio through the date the financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

17

THE RBB FUND, INC.

Money Market Portfolio

Additional Information

(Unaudited)

Proxy Voting

Policies and procedures that the Portfolio uses to determine how to vote proxies relating to portfolio securities as well as information regarding how the Portfolio voted proxies relating to portfolio securities for the most recent 12-month period ended June 30 are available without charge, upon request, by calling the number shown below and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

| | |

Bedford | | (800) 888-9723 |

Sansom Street | | (800) 430-9618 |

Quarterly Portfolio Schedules

The Company files its complete schedule of portfolio holdings with the SEC for the first and third fiscal quarter of each fiscal year (quarters ended November 30 and May 31) on Form N-Q. The Company’s Form N-Q is available on the SEC website at http://www.sec.gov and may be reviewed and copied at the SEC Public Reference Room in Washington, D.C. Information on the operation of the SEC Public Reference Room may be obtained by calling (202) 551-8090.

18

[THIS PAGE INTENTIONALLY LEFT BLANK.]

Investment Adviser

BlackRock Advisors LLC

100 Bellevue Parkway

Wilmington, DE 19809

Transfer Agent

BNY Mellon Investment Servicing (US) Inc.

4400 Computer Drive

Westborough, MA 01581

Principal Underwriter

Foreside Funds Distributors LLC

400 Berwyn Park

899 Cassatt Road

Berwyn, PA 19312

Custodian

The Bank of New York Mellon

One Wall Street

New York, NY 10286

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

Two Commerce Square, Suite 1700

2001 Market Street

Philadelphia, PA 19103-7042

Counsel

Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

The Bedford Class

of

The RBB Fund, Inc.

Money Market

Portfolio

Semi-Annual Report

February 28, 2013

(Unaudited)

An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it’s possible to lose money by investing in the Portfolio.

This report is submitted for the general information of the shareholders of the Portfolio. It is not authorized for distribution unless preceded or accompanied by a current prospectus for the Portfolio.

BOGLE INVESTMENT MANAGEMENT

SMALL CAP GROWTH FUND

SEMI-ANNUAL REPORTFORTHE SIX-MONTH PERIOD ENDED FEBRUARY 28, 2013

(UNAUDITED)

Fellow Shareholder:

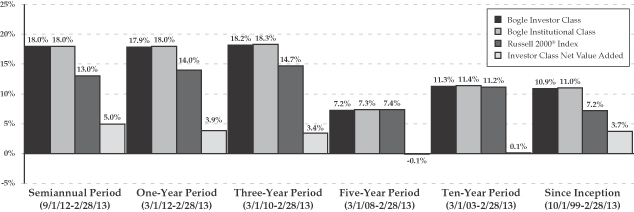

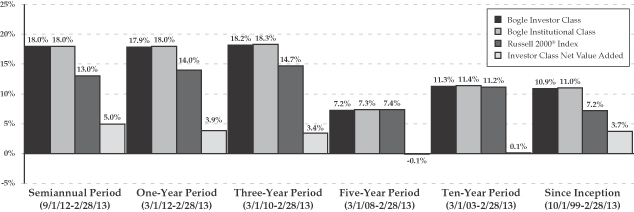

During the most recent semiannual reporting period ended February 28, 2013, the Bogle Small Cap Growth Fund (the “Fund”) outperformed its benchmark by +4.95%, returning +17.97% for both the Investor and Institutional shares net of fees, while the unmanaged Russell 2000® index of smaller companies gained +13.02%. Equity markets posted robust gains over the last six months, advancing steadily from the middle of November through the middle of February. Concerns about European sovereign debt issues, which affected global markets in 2011 and early 2012, seemed to fade, while U.S. economic indicators continued to strengthen. U.S. investors appeared optimistic about corporate earnings growth, employment and the housing market. Limits on government spending increases due to budget triggers seemed to be perceived positively by investors as a means to rein in spendthrift politicians, as opposed to a significant threat to economic growth. The Federal Reserve remained highly accommodative, providing additional support to U.S. equity markets. As investors became less concerned about the general risks of equity investing, the extremely high correlations of stock price movements of the previous two years dropped significantly. A more moderate correlation environment tends to provide a more favorable backdrop for our investment strategy, confirmed by the Fund’s nearly five percentage point advantage over its benchmark for the period. The market environment is discussed further in the next section of this letter, followed by more detailed semiannual performance evaluation, including investment model performance and performance attribution. We then present the fundamental characteristics of the Fund and its benchmark, highlighting the Fund’s above-benchmark median expected growth rate and below-benchmark price-based ratios (as has been the case for almost four years). Finally, we close with an update on developments at Bogle Investment Management, L.P.

INVESTMENT PERFORMANCE — PERIODS ENDING FEBRUARY 28, 2013

BOGLE FUNDVS. RUSSELL 2000® BENCHMARK

All Fund returns are presented net of fees and include the reinvestment of all dividends and other earnings. Multi-year period returns are annualized. Returns shown represent past performance and do not guarantee future results. Current performance may be lower or higher than the returns shown above. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns current to the most recent month-end may be obtained at 1-877-264-5346. The figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The performance quoted reflects fee waivers in effect and would have been less in their absence. The Fund’s annual operating expenses, as stated in the current prospectus, are 1.51% for the Institutional Class and 1.60% for the Investor Class, prior to fee waivers.

1

Market Environment. As mentioned in our introduction, U.S. equity market performance was generally positive in the semiannual reporting period. According to Russell benchmarks, small cap stocks outperformed large cap stocks, with most of the advantage occurring in December and January, and cumulating to more than three percentage points for the period overall (Russell 2000® up +13.02%, Russell 1000® up +9.72%). The Russell 2000® Value Index started to outperform the Russell 2000® Growth Index on September 13th, which was also the date that the Federal Reserve announced round three of its bond purchase program, known as quantitative easing, or QE3. Small cap value stocks held onto their performance advantage for the balance of the semiannual period, and the Value Index gained +14.56%, while the Growth Index returned +11.44%. Among small cap stocks (categorized using our eight proprietary sectors), the industrial sector was the strongest performer, while energy and consumer growth were the weakest. Market volatility was low throughout the semiannual period, with the CBOE Volatility Index® (VIX®) level of implied, expected volatility averaging 15.5. Two small spikes in volatility occurred, one in late-December and another in late-February, but these increases proved to be temporary.

Investment Philosophy and Process. While our investment process has evolved over time as new insights have been added, our core investment principles have not changed since we began managing the Fund more than thirteen years ago. Our philosophy continues to rest on the belief that, in the long run, companies that offer the most attractive combination of good earnings prospects, reasonable share price, and conservative financial reporting will be rewarded by investors; however, over the short-term, valuations can become distorted due to fads or fears that allow stocks to become disconnected from fundamental values. In general, predictable behavioral biases, whether by Wall Street analysts, corporate managers, and/or traders in the marketplace, can create opportunities to earn excess returns. We believe that because these opportunities are behavioral and thus very slow to change, they can be exploited with carefully designed quantitative tools. We also recognize that there are limits to the amount of capital that can be employed to harvest these opportunities and the frequency with which we discover them, so we attempt to preserve our ability to add value for our clients by strictly controlling the asset base we are willing to manage (a marked contrast, we believe, to the asset gatherers that dominate this industry, who seem to want to take your money, with little regard for the impact on their ability to effectively manage it). Finally, we believe that process evolution through continuous research is the only way to maintain a competitive advantage and add value through time. To that end, while our investment process today is conceptually the same as it was thirteen years ago, much of the underlying data have changed over time as we’ve learned new things about how investor behaviors influence security valuations. Our objective, as always, is an investment process that can add value over time, and in a variety of market environments.

Performance Attribution. In the latest semiannual period, the Fund outperformed its benchmark as our composite investment model produced positive stock picking performance. Attribution analysis shows that our modest factor and sector exposures (relative to the benchmark) had no meaningful impact on performance. On a standalone basis, within our small cap investable universe, all the sub-models that combine to form our composite investment model added value during the semiannual period. Our shorter-term, non-fundamental sub-models produced the most consistently positive performance, while relative valuation sub-model returns turned positive in October. Earnings expectations and financial quality model performance was mixed, with recent positive contributions boosting value added for the semiannual period. Stock selection was positive in all sectors except consumer cyclical and technology stocks, with selection in consumer growth stocks contributing the most to relative performance. The dichotomy between the good performance of our composite model and the mixed performance of the sub-models that combine to form it is not unusual, and is also an affirmation of our conviction that the contextual nature of each sub-model’s information is much more important than the standalone information it provides. We continue to maintain a

2

diversified portfolio of 150 to 200 stocks; this diversification helps us to minimize the impact any single stock can have on total Fund performance. At the end of the semiannual period, the Fund held 161 stocks and the largest holding represented 1.4% of portfolio assets. Approximately 80% of the Fund was invested in about 80 positions.

Investment Positioning. As of the end of February 2013, the Fund’s median market capitalization was below that of the benchmark, as we have continued to take advantage of our small size in pursuit of these smaller, generally more rewarding opportunities. The Fund continues to have a higher median analysts’ expected long-term earnings growth rate than the benchmark, due to our tendency to avoid stocks that are expected to have very slow long-term earnings growth. We find that we do not get rewarded as much with successful investments in low growth companies, so we explicitly leave many of them out of the investment process. The Fund also has maintained its attractive valuation exposure, with price-to-earnings and price-to-sales ratios below the benchmark. Note that small deviations from the benchmark reflected in the fundamental characteristics (and sector exposures) of the Fund arise from the bottom up stock selection process and do not reflect attempts to actively time styles or sectors.

Selected risk statistics for the Fund and benchmark are presented in the second half of the table to the right. Total Fund volatility, as measured by the annualized standard deviation of daily returns, was below long-term levels in the semiannual period, averaging 14.4% versus 25.8% since the Fund’s inception. Fund volatility was in line with that of the benchmark. Active volatility, or the variability of the difference between the Fund and benchmark daily returns, was also below long-term levels, at 4.1% versus 6.6% since Fund inception.

| | | | | | | | |

FUNDAMENTAL CHARACTERISTICS

FEBRUARY 28, 2013 | |

Median | | BOGLX* | | | Russell

2000® | |

Market Cap. ($mil.) | | | $969 | | | | $1,300 | |

Estimated Long-Term Earnings Growth Rate** | | | 14.7% | | | | 13.4% | |

Price/Historical Earnings | | | 18.2x | | | | 18.9x | |

Price/Forward Earnings | | | 14.6x | | | | 16.0x | |

Price/Sales | | | 0.9x | | | | 1.9x | |

* The Bogle Small Cap Growth Fund Investor Shares. Median characteristics refer to the Fund’s holdings, not the Fund itself. ** The Estimated Long-Term Earnings Growth Rate is calculated for the Fund’s portfolio of companies and the benchmark companies from First Call analysts’ median estimated earnings growth rate over the next 3 to 5 years. This figure is not indicative of future performance of the Fund; the portfolio and benchmark companies’ actual earnings growth rate will vary from this figure. | |

| | | | | | | | |

RISK STATISTICS*

SEMI ANNUAL PERIOD | |

Measurement | | BOGLX | | | Russell

2000® | |

Standard Deviation | | | 14.4% | | | | 14.0% | |

Active Volatility | | | 4.1% | | | | | |

Beta with Russell 2000® | | | 0.98 | | | | | |

Average Cash | | | 1.1% | | | | | |

* Risk statistics apply to the Fund and benchmark. Standard deviation is a statistical measure of the range of performance. Active volatility is the standard deviation of the difference between the Fund and benchmark performance. Beta is a measure of a portfolio’s sensitivity to market movement. | |

Progress at Bogle Investment Management, L.P. At the end of February 2013, assets in the Fund were $137 million, up $32 million from a year ago, representing $20 million in appreciation and $12 million in net investor inflows. The Fund is open to new shareholders and we continue to have capacity for some additional asset growth. We remain committed to monitoring Fund growth, growth in overall firm assets, and

3

market liquidity conditions to determine when it is appropriate to reclose our investment strategies. We anticipate that if and when we reclose the Fund we will be able to remain open for existing shareholders and financial advisers, as we did when we closed in 2002. Finally, there have been no changes to the investment team, and the team members have now been together for eight years or more.

As a reminder, information about the Fund, including historical NAVs, sector allocation, fundamental characteristics, and top ten holdings, can be viewed on our website, www.boglefunds.com. The NAVs are updated daily while the other Fund information is updated quarterly.

As always, please let us know if there is any way we can improve your investment experience with us.

Respectfully,

Bogle Investment Management, L.P.

Management Office: 781-283-5000

Shareholder Services Toll Free: 1-877-BOGLEIM (264-5346)

The Fund’s investment adviser, Bogle Investment Management, L.P., has contractually agreed to waive management fees and reimburse expenses through December 31, 2013 to the extent that total annual Fund operating expenses exceed 1.25% and 1.35% for the Institutional Class and Investor Class, respectively. The Adviser, in its discretion, has the right to extend this waiver.

The Russell 2000® is an index of stocks 1001 through 3000 in the Russell 3000® Index as ranked by total market capitalization. A direct investment in the index is not possible. The Russell ® Indexes are a trademark of the Frank Russell Company (“FRC”). FRC is the owner of the copyrights relating to the Russell Indexes and is the source of the Performance Values for the Russell Indexes.

Investing in small companies can involve more volatility, less liquidity and less available information than investing in large companies.

Portfolio composition is subject to change. The current and future portfolio holdings of the Fund are subject to investment risk.

4

BOGLE INVESTMENT MANAGEMENT

SMALL CAP GROWTH FUND

FUND EXPENSE EXAMPLES

(UNAUDITED)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, shareholder servicing fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the six-month period from September 1, 2012 through February 28, 2013, and held for the entire period.

ACTUAL EXPENSES

The first line of the accompanying tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLEFOR COMPARISON PURPOSES

The second line of the accompanying tables provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the accompanying tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | INSTITUTIONAL CLASS | |

| | | BEGINNING ACCOUNT VALUE

SEPTEMBER 1, 2012 | | | ENDING ACCOUNT VALUE

FEBRUARY 28, 2013 | | | EXPENSES PAID DURING

PERIOD* | |

Actual | | $ | 1,000.00 | | | $ | 1,179.70 | | | $ | 6.76 | |

Hypothetical

(5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

5

BOGLE INVESTMENT MANAGEMENT

SMALL CAP GROWTH FUND

FUND EXPENSE EXAMPLES (CONCLUDED)

(UNAUDITED)

| | | | | | | | | | | | |

| | | INVESTOR CLASS | |

| | | BEGINNING ACCOUNT VALUE

SEPTEMBER 1, 2012 | | | ENDING ACCOUNT VALUE

FEBRUARY 28, 2013 | | | EXPENSES PAID DURING

PERIOD* | |

Actual | | $ | 1,000.00 | | | $ | 1,179.70 | | | $ | 7.30 | |

Hypothetical

(5% return before expenses) | | | 1,000.00 | | | | 1,018.10 | | | | 6.76 | |

| *Expenses | are equal to the Fund’s annualized six-month expense ratio of 1.25% for the Institutional Class and 1.35% for the Investor Class, which includes waived fees or reimbursed expenses, multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. The Fund’s ending account values on the first line in each table are based on the actual six-month total investment return for each class of 17.97% for the Institutional Class and 17.97% for the Investor Class. |

6

BOGLE INVESTMENT MANAGEMENT

SMALL CAP GROWTH FUND

PORTFOLIO HOLDINGS SUMMARY TABLE

FEBRUARY 28, 2013

(UNAUDITED)

The following table presents a summary by security type of the portfolio holdings of the Fund:

| | | | | | | | |

| SECURITY TYPE & SECTOR CLASSIFICATION | | % OF NET

ASSETS | | | VALUE | |

| | |

COMMON STOCKS: | | | | | | | | |

Consumer Growth | | | 22.6% | | | $ | 30,916,977 | |

Industrial | | | 18.6 | | | | 25,550,731 | |

Financial | | | 17.8 | | | | 24,366,034 | |

Consumer Cyclical | | | 16.0 | | | | 21,965,760 | |

Technology | | | 14.2 | | | | 19,411,987 | |

Energy | | | 5.6 | | | | 7,630,721 | |

Basic Industry | | | 3.3 | | | | 4,478,714 | |

Utility | | | 0.4 | | | | 566,520 | |

SHORT-TERM INVESTMENTS | | | 1.6 | | | | 2,191,722 | |

LIABILITIESIN EXCESSOF OTHER ASSETS | | | (0.1) | | | | (136,682) | |

| | | | | | | | |

NET ASSETS | | | 100.0% | | | $ | 136,942,484 | |

| | | | | | | | |

Portfolio holdings are subject to change at any time.

The accompanying notes are an integral part of the financial statements.

7

BOGLE INVESTMENT MANAGEMENT

SMALL CAP GROWTH FUND

PORTFOLIOOF INVESTMENTS

FEBRUARY 28, 2013 (UNAUDITED)

| | | | | | | | |

| | | NUMBER

OF SHARES | | | VALUE | |

| | | | | | | | |

COMMON STOCKS—98.5% | |

BASIC INDUSTRY—3.3% | |

Eagle Materials, Inc. | | | 17,731 | | | $ | 1,140,280 | |

Gibraltar Industries, Inc. * | | | 13,028 | | | | 223,430 | |

Headwaters, Inc. * | | | 142,217 | | | | 1,338,261 | |

Huntsman Corp. | | | 81,705 | | | | 1,407,777 | |

Methanex Corp. | | | 500 | | | | 18,290 | |

Steel Dynamics, Inc. | | | 22,965 | | | | 350,676 | |

| | | | | | | | |

| | | | 4,478,714 | |

| | | | | | | | |

CONSUMER CYCLICAL—16.0% | |

ANN, Inc. * | | | 40,314 | | | | 1,140,482 | |

Ascent Capital Group, Inc., Class A * | | | 14,608 | | | | 1,001,962 | |

Big 5 Sporting Goods Corp. | | | 20,998 | | | | 327,359 | |

Brown Shoe Co., Inc. | | | 68,562 | | | | 1,124,417 | |

Central Garden and Pet Co.,Class A * | | | 1,100 | | | | 9,603 | |

Core-Mark Holding Co., Inc. | | | 20,726 | | | | 993,190 | |

Einstein Noah Restaurant Group, Inc. | | | 23,287 | | | | 312,977 | |

Goodyear Tire & Rubber Co., (The) * | | | 92,429 | | | | 1,199,728 | |

Harry Winston Diamond Corp. (CA) * | | | 86,700 | | | | 1,353,387 | |

Haverty Furniture Co., Inc. | | | 18,798 | | | | 344,943 | |

Hot Topic, Inc. | | | 116,533 | | | | 1,258,556 | |

Journal Communications, Inc., Class A * | | | 1,300 | | | | 7,111 | |

Kimball International, Inc., Class B | | | 60,217 | | | | 554,599 | |

Krispy Kreme Doughnuts, Inc. * | | | 114,620 | | | | 1,512,984 | |

MarineMax, Inc. * | | | 3,794 | | | | 49,132 | |

Multimedia Games Holding Co., Inc. * | | | 95,502 | | | | 1,785,887 | |

Nautilus, Inc. * | | | 215,437 | | | | 1,232,300 | |

Nexstar Broadcasting Group, Inc., Class A | | | 101,561 | | | | 1,509,196 | |

Perry Ellis International, Inc. | | | 1,899 | | | | 30,802 | |

Pool Corp. | | | 26,215 | | | | 1,198,550 | |

PulteGroup, Inc. * | | | 54,194 | | | | 1,039,441 | |

| | | | | | | | |

| | | NUMBER

OF SHARES | | | VALUE | |

| | | | | | | | |

CONSUMER CYCLICAL—(CONTINUED) | |

Republic Airways Holdings, Inc. * | | | 141,481 | | | $ | 1,331,336 | |

Stage Stores, Inc. | | | 50,525 | | | | 1,247,462 | |

Town Sports International Holdings, Inc. | | | 15,612 | | | | 144,723 | |

United Stationers, Inc. * | | | 34,686 | | | | 1,255,633 | |

| | | | | | | | |

| | | | 21,965,760 | |

| | | | | | | | |

CONSUMER GROWTH—22.6% | |

Accuray, Inc. * | | | 90,955 | | | | 388,379 | |

Albany Molecular Research, Inc. * | | | 154,670 | | | | 1,249,733 | |

Allscripts Healthcare Solutions, Inc. * | | | 119,623 | | | | 1,521,605 | |

AMAG Pharmaceuticals, Inc. * | | | 19,233 | | | | 318,306 | |

AMN Healthcare Services, Inc. * | | | 119,696 | | | | 1,687,714 | |