FCX has organized its operations into five primary divisions – North America copper mines, South America mining, Indonesia mining, Africa mining and Molybdenum operations. Notwithstanding this structure, FCX internally reports information on a mine-by-mine basis. Therefore, FCX concluded that its operating segments include individual mines. Operating segments that meet certain thresholds are reportable segments. Further discussion of the reportable segments included in FCX’s primary operating divisions, as well as FCX’s other reportable segments – Rod & Refining and Atlantic Copper Smelting & Refining – follows.

PT Freeport Indonesia, including 9.36 percent owned through PT Indocopper Investama. FCX has established certain unincorporated joint ventures with Rio Tinto, under which Rio Tinto has a 40 percent interest in certain assets and future production exceeding specified annual amounts of copper, gold and silver.

The Molybdenum segment also includes FCX’s wholly owned Climax molybdenum mine in Colorado, which has been on care-and-maintenance status since 1995. FCX is advancing construction activities at the Climax molybdenum mine and is monitoring market conditions to determine the timing for startup of mining and milling activities.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO THE BOARD OF DIRECTORS AND STOCKHOLDERS OF

FREEPORT-McMoRan COPPER & GOLD INC.

We have reviewed the condensed consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. as of September 30, 2010, and the related consolidated statements of income for the three- and nine-month periods ended September 30, 2010 and 2009, the consolidated statements of cash flows for the nine-month periods ended September 30, 2010 and 2009, and the consolidated statement of equity for the nine-month period ended September 30, 2010. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Freeport-McMoRan Copper & Gold Inc. as of December 31, 2009, and the related consolidated statements of operations, cash flows, and equity for the year then ended (not presented herein), and in our report dated February 26, 2010, we expressed an unqualified opinion on those consolidated financial statements and which report included an explanatory paragraph for the Company’s adoption of guidance originally issued in FASB Statement No. 160, Noncontrolling Interests in Consolidated Financial Statements (codified in FASB ASC Topic 810, Consolidation) effective J anuary 1, 2009. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2009, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ ERNST & YOUNG LLP

Phoenix, Arizona

November 5, 2010

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

OVERVIEW

In Management’s Discussion and Analysis of Financial Condition and Results of Operations, “we,” “us” and “our” refer to Freeport-McMoRan Copper & Gold Inc. (FCX) and its consolidated subsidiaries. You should read this discussion in conjunction with our financial statements, the related Management’s Discussion and Analysis of Financial Condition and Results of Operations and the discussion of our Business and Properties in our Form 10-K for the year ended December 31, 2009, filed with the United States (U.S.) Securities and Exchange Commission (SEC). The results of operations reported and summarized below are not necessarily indicative of future operating results. References to “Notes” are Notes included in our Notes to Consolidated Financial Statements. Th roughout Management's Discussion and Analysis of Financial Condition and Results of Operations all references to earnings or losses per share are on a diluted basis, unless otherwise noted.

We are one of the world’s largest copper, gold and molybdenum mining companies in terms of reserves and production. Our portfolio of assets includes the Grasberg minerals district in Indonesia, significant mining operations in North and South America, and the Tenke Fungurume (Tenke) minerals district in the Democratic Republic of Congo (DRC). The Grasberg minerals district contains the largest single recoverable copper reserve and the largest single gold reserve of any mine in the world based on the latest available reserve data provided by third-party industry consultants. We also operate Atlantic Copper, our wholly owned copper smelting and refining unit in Spain.

We have significant reserves and future development opportunities within our portfolio of assets. At December 31, 2009, we had estimated consolidated recoverable proven and probable reserves of 104.2 billion pounds of copper (determined using a long-term average copper price of $1.60 per pound), with potential for greater reserves at higher prices.

We are increasing near-term production at several of our copper mines and are undertaking major projects, including the development of the El Abra sulfide reserves and the massive underground ore bodies at Grasberg. We are also advancing development activities at the Climax molybdenum mine. In addition, studies are under way to evaluate a large-scale concentrator expansion at Cerro Verde, a major mill project at El Abra, various mill projects to process significant sulfide ore in North America and staged expansion options at Tenke. The advancement of these studies is designed to position us to invest in production growth within our existing portfolio of assets. Refer to “Operations” for further discussion of our current operating and development activities.

Our results for the third quarter and first nine months of 2010, compared with the 2009 periods, primarily reflected higher realized copper prices (refer to “Consolidated Results” for further discussion of our consolidated financial results for the quarter and nine-month periods ended September 30, 2010 and 2009).

At September 30, 2010, we had $3.7 billion in consolidated cash and $4.7 billion in long-term debt. During October 2010, we made open-market purchases of $18 million of our 9½% Senior Notes for $26 million, and our Board of Directors authorized an increase in FCX’s common stock dividend. Refer to “Capital Resources and Liquidity” for further discussion.

In October 2010, we resolved the ongoing contract review with the DRC government. The conclusion of the review process confirmed that Tenke Fungurume Mining’s (TFM) mining contracts are in good standing and acknowledged the rights and benefits granted under the existing contracts. In connection with the review, TFM has made several commitments, which it expects to be reflected in amendments to its mining contracts. Refer to Note 10 and “Operations – Africa Mining” for further discussion.

OUTLOOK

Our financial results can vary significantly as a result of fluctuations in the market prices of copper and, to a lesser extent, gold and molybdenum. World market prices for these commodities have fluctuated historically and are affected by numerous factors beyond our control. Because we cannot control the price of our products, the key measures which management focuses on in operating our business are sales volumes, unit net cash costs and operating cash flow. Discussion of the outlook for each of these measures follows.

Sales Volumes. Consolidated sales from mines for the year 2010 are expected to approximate 3.85 billion pounds of copper, 1.9 million ounces of gold and 65 million pounds of molybdenum, including 895 million pounds of copper, 585 thousand ounces of gold and 15 million pounds of molybdenum for fourth-quarter 2010. These sales volume estimates are dependent on the achievement of targeted mining rates, the successful operation of production facilities, the impact of weather conditions and other factors.

Unit Net Cash Costs. Assuming average prices of $1,300 per ounce of gold and $15 per pound of molybdenum for fourth-quarter 2010 and achievement of current 2010 sales volume and cost estimates, we estimate our consolidated unit net cash costs (net of by-product credits) for our copper mining operations - including Africa mining - would average approximately $0.83 per pound of copper for the year 2010. The impact of price changes on consolidated unit net cash costs in 2010 would approximate $0.008 per pound for each $50 per ounce change in the average price of gold for fourth-quarter 2010 and $0.003 per pound for each $2 per pound change in the average price of molybdenum for fourth-quarter 2010. Estimated consolidated unit net cash costs in 2010 are higher, compared with consolidate d unit net cash costs of $0.55 per pound of copper in 2009, primarily because of lower projected copper and gold sales volumes from Grasberg, combined with increases in input costs. Refer to “Consolidated Results – Production and Delivery Costs” for further discussion of consolidated production and delivery costs.

Operating Cash Flows. Our operating cash flows vary with prices realized from copper, gold and molybdenum sales, our sales volumes, production costs, income taxes and other working capital changes and other factors. Based on the above projected consolidated sales volumes and unit net cash costs for 2010, and assuming average prices of $3.75 per pound of copper, $1,300 per ounce of gold and $15 per pound of molybdenum for fourth-quarter 2010, we estimate consolidated operating cash flows would approximate $6.0 billion for the year 2010, net of an estimated $0.5 billion for working capital requirements. In addition to projected working capital requirements, our estimate of operating cash flow for the year 2010 is also net of estimated taxes of $2.8 billion (refer to “Consolidate d Results – (Provision for) Benefit from Income Taxes” for further discussion of our projected annual consolidated effective income tax rate for the year 2010). The impact of price changes on operating cash flows in 2010 would approximate $60 million for each $0.10 per pound change in the average price of copper for fourth-quarter 2010, $10 million for each $50 per ounce change in the average price of gold for fourth-quarter 2010 and $8 million for each $2 per pound change in the average price of molybdenum for fourth-quarter 2010.

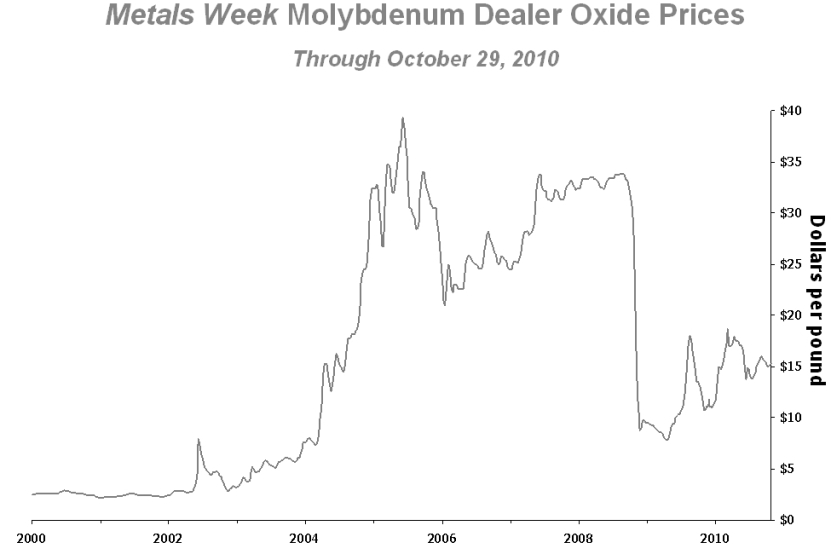

COPPER, GOLD AND MOLYBDENUM MARKETS

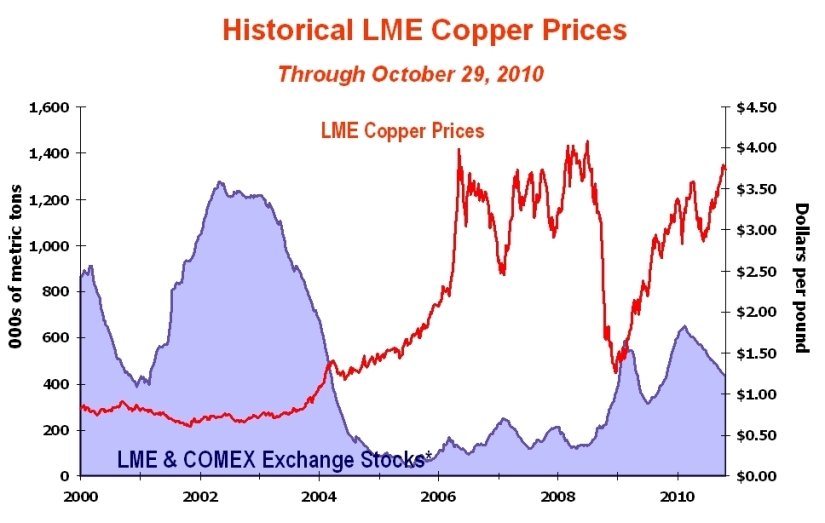

World prices for copper, gold and molybdenum have fluctuated significantly since January 2000. The London Metal Exchange (LME) spot copper price varied from a low of $0.60 per pound in 2001 to a high of $4.08 per pound in 2008, the London gold price fluctuated from a low of approximately $256 per ounce in 2001 to a new record high of $1,373 per ounce in October 2010, and the Metals Week Molybdenum Dealer Oxide weekly average price ranged from $2.19 per pound in 2000 to a high of $39.25 per pound in 2005. Copper, gold and molybdenum prices are affected by numerous factors beyond our control as described further in our “Risk Factors” contained in Part I, Item 1A of our Form 10-K for the year ended December 31, 2009.

* Excludes Shanghai stocks, producer, consumer and merchant stocks.

This graph presents LME spot copper prices and reported stocks of copper at the LME and the New York Mercantile Exchange (COMEX) from January 2000 through October 2010. From 2006 through most of 2008, disruptions associated with strikes and other operational issues, combined with growing demand from China and other emerging economies, resulted in low levels of inventory. Beginning in late 2008, slowing consumption led to increases in inventory levels; however, China’s increased buying activity contributed to a decline in exchange inventories. After reaching a low in July 2009, inventories grew during the second half of 2009 with combined LME and COMEX stocks ending the year at approximately 592 thousand metric tons. Inventories have since decreased and at September 30, 2010, combined LME and COMEX stocks totaled approximately 451 th ousand metric tons, which represents approximately 9 days of global consumption.

Turmoil in the U.S. financial markets and concerns about the global economy negatively impacted copper prices in late 2008, which declined to a four-year low of $1.26 per pound in December 2008; however, copper prices have since improved significantly, we believe primarily because of a combination of strong demand from China, recovering demand in the western world and limitations of available supply. During third-quarter 2010, LME spot copper prices ranged from $2.88 per pound to $3.65 per pound and averaged $3.29 per pound. We believe the underlying fundamentals of the copper business remain positive, supported by limited supplies from existing mines and the absence of significant new development projects. Future copper prices are expected to be volatile and are likely to be influenced by demand from China, economic activity in the U.S. and other industrialized countries, the timing of the development of new supplies of copper and production levels of mines and copper smelters. The LME spot copper price closed at $3.73 per pound on October 29, 2010.

This graph presents London gold prices from January 2000 through October 2010. Gold prices reached a new record high of $1,373 in October 2010, supported by investment demand and weakness in the U.S. dollar. During third-quarter 2010, gold prices ranged from approximately $1,157 per ounce to $1,308 per ounce and averaged $1,227 per ounce. London gold prices closed at approximately $1,347 per ounce on October 29, 2010.

This graph presents the Metals Week Molybdenum Dealer Oxide weekly average price from January 2000 through October 2010. In late 2008, molybdenum prices declined significantly as a result of the financial market turmoil and a decline in demand; however, molybdenum prices have since improved and, we believe are supported by improved demand in metallurgical and chemicals sectors. During third-quarter 2010, the weekly average price of molybdenum ranged from $13.88 per pound to $16.03 per pound and averaged $14.98 per pound. The weekly average Metals Week Molybdenum Dealer Oxide price was $15.30 per pound on October 29, 2010.

CONSOLIDATED RESULTS

| | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | 2010 | | 2009 | | 2010 | | 2009 | |

Financial Data (in millions, except per share amounts) | | | | | | | | | | | | |

Revenuesa | $ | 5,152 | b | $ | 4,144 | b | $ | 13,379 | b | $ | 10,430 | b |

| Operating income | $ | 2,499 | b | $ | 2,084 | b | $ | 5,971 | b | $ | 4,264 | b |

| Net income | $ | 1,533 | | $ | 1,203 | | $ | 3,580 | | $ | 2,222 | |

| Net income attributable to noncontrolling interests | $ | 355 | | $ | 224 | | $ | 793 | | $ | 492 | |

Net income attributable to FCX common stockholdersc | $ | 1,178 | | $ | 925 | d | $ | 2,724 | d | $ | 1,556 | d |

| Diluted net income per share attributable to FCX common stockholders | $ | 2.49 | | $ | 2.07 | d | $ | 5.88 | d | $ | 3.70 | d |

| Diluted weighted-average common shares outstanding | | 474 | | | 472 | | | 474 | | | 428 | |

| | | | | | | | | | | | | |

| FCX Mining Operating Data | | | | | | | | | | | | |

Copper (recoverable) | | | | | | | | | | | | |

| Production (millions of pounds) | | 1,042 | | | 1,015 | | | 2,901 | | | 3,125 | |

| Sales, excluding purchases (millions of pounds) | | 1,081 | | | 1,000 | | | 2,955 | | | 3,122 | |

| Average realized price per pound | $ | 3.50 | | $ | 2.75 | | $ | 3.33 | | $ | 2.35 | |

Site production and delivery costs per pounde | $ | 1.38 | | $ | 1.15 | | $ | 1.38 | | $ | 1.08 | |

Unit net cash costs per pounde | $ | 0.82 | | $ | 0.50 | | $ | 0.87 | | $ | 0.53 | |

Gold (recoverable) | | | | | | | | | | | | |

| Production (thousands of ounces) | | 492 | | | 708 | | | 1,257 | | | 2,105 | |

| Sales, excluding purchases (thousands of ounces) | | 497 | | | 706 | | | 1,273 | | | 2,088 | |

| Average realized price per ounce | $ | 1,266 | | $ | 987 | | $ | 1,204 | | $ | 944 | |

Molybdenum (recoverable) | | | | | | | | | | | | |

| Production (millions of pounds) | | 19 | | | 15 | | | 53 | | | 42 | |

| Sales, excluding purchases (millions of pounds) | | 17 | | | 16 | | | 50 | | | 42 | |

| Average realized price per pound | $ | 16.06 | | $ | 13.95 | | $ | 16.43 | | $ | 11.93 | |

| a. | Includes the impact of adjustments to provisionally priced concentrate and cathode sales recognized in prior periods. Refer to “Revenues” for further discussion. |

| b. | Following is a summary of revenues and operating income (loss) by operating division (in millions): |

| | Three Months Ended September 30, 2010 | | Three Months Ended September 30, 2009 | |

| | | | | | Operating | | | | | | Operating | |

| | | | | | Income | | | | | | Income | |

| | | Revenues | | | (Loss) | | | Revenues | | | (Loss) | |

| North America copper mines | $ | 990 | | $ | 395 | | $ | 920 | | $ | 399 | |

| South America mining | | 1,465 | | | 937 | | | 1,018 | | | 572 | |

| Indonesia mining | | 1,874 | | | 1,249 | | | 1,656 | | | 1,199 | |

| Africa mining | | 307 | | | 132 | | | 113 | | | 4 | |

| Molybdenum | | 293 | | | 78 | | | 258 | | | 65 | |

| Rod & Refining | | 1,181 | | | 6 | | | 963 | | | 4 | |

| Atlantic Copper Smelting & Refining | | 595 | | | (8 | ) | | 495 | | | (11 | ) |

| Corporate, other & eliminations | | (1,553 | ) | | (290 | ) | | (1,279 | ) | | (148 | ) |

| Total | $ | 5,152 | | $ | 2,499 | | $ | 4,144 | | $ | 2,084 | |

| | Nine Months Ended September 30, 2010 | | Nine Months Ended September 30, 2009 | |

| | | | | | Operating | | | | | | Operating | |

| | | | | | Income | | | | | | Income | |

| | | Revenues | | | (Loss) | | | Revenues | | | (Loss) | |

| North America copper mines | $ | 3,088 | | $ | 1,339 | | $ | 2,241 | | $ | 543 | |

| South America mining | | 3,383 | | | 1,970 | | | 2,604 | | | 1,291 | |

| Indonesia mining | | 4,260 | | | 2,561 | | | 4,388 | | | 2,983 | |

| Africa mining | | 763 | | | 322 | | | 170 | | | (64 | ) |

| Molybdenum | | 893 | | | 271 | | | 590 | | | 69 | |

| Rod & Refining | | 3,383 | | | 16 | | | 2,329 | | | 11 | |

| Atlantic Copper Smelting & Refining | | 1,844 | | | (21 | ) | | 1,202 | | | (40 | ) |

| Corporate, other & eliminations | | (4,235 | ) | | (487 | ) | | (3,094 | ) | | (529 | ) |

| Total | $ | 13,379 | | $ | 5,971 | | $ | 10,430 | | $ | 4,264 | |

| c. | After net income attributable to noncontrolling interests in subsidiaries and preferred dividends. During second-quarter 2010, our 6¾% Mandatory Convertible Preferred Stock converted into 39 million shares of our common stock and the final preferred dividend payment was made. |

| d. | Includes net losses on early extinguishment of debt totaling $67 million ($0.14 per share) for the first nine months of 2010, and $28 million for the third quarter and first nine months of 2009 ($0.06 per share for third-quarter 2009 and $0.07 per share for the first nine months of 2009). Refer to Note 6 for further discussion of these transactions. |

| e. | Reflects per pound weighted-average production and delivery costs and unit net cash costs (net of by-product credits) for all copper mines. The 2009 periods exclude the results of Africa mining as start-up activities were still under way. For reconciliations of the per pound costs by operating division to production and delivery costs applicable to sales reported in our consolidated financial statements, refer to “Operations – Unit Net Cash Costs” and to “Product Revenues and Production Costs.” |

Revenues

Consolidated revenues include the sale of copper concentrates, copper cathodes, copper rod, gold, molybdenum and other metals by our North and South America copper mines, the sale of copper concentrates (which also contain significant quantities of gold and silver) by our Indonesia mining operation, the sale of copper cathodes and cobalt hydroxide by our Africa mining operation, the sale of molybdenum in various forms by our Molybdenum operations, and the sale of copper cathodes, copper anodes, and gold in anodes and slimes by Atlantic Copper. Following is a summary of changes in our consolidated revenues between periods (in millions):

| | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| Consolidated revenues – 2009 periods | $ | 4,144 | | $ | 10,430 | |

| Higher sales price realizations from mining operations: | | | | | | |

| Copper | | 811 | | | 2,807 | |

| Gold | | 138 | | | 332 | |

| Molybdenum | | 35 | | | 223 | |

| (Lower) higher sales volumes from mining operations: | | | | | | |

| Copper | | 221 | | | (399 | ) |

| Gold | | (206 | ) | | (769 | ) |

| Molybdenum | | 4 | | | 95 | |

| Cobalt | | 66 | | | 150 | |

| Higher purchased copper | | 115 | | | 145 | |

| Lower net adjustments for prior period/year provisionally priced sales, | | | | | | |

| including PT Freeport Indonesia’s 2009 forward copper sales contracts | | (35 | ) | | (54 | ) |

| Higher Atlantic Copper revenues | | 100 | | | 642 | |

| Other, including intercompany eliminations | | (241 | ) | | (223 | ) |

| Consolidated revenues – 2010 periods | $ | 5,152 | | $ | 13,379 | |

Higher consolidated revenues of $5.2 billion in third-quarter 2010 and $13.4 billion for the first nine months of 2010, compared with $4.1 billion in third-quarter 2009 and $10.4 billion for the first nine months of 2009 were primarily because of higher metal price realizations. Realized copper prices increased to an average of $3.50 per pound in third-quarter 2010 (compared with $2.75 per pound in third-quarter 2009) and $3.33 per pound for the first nine months of 2010 (compared with $2.35 per pound for the first nine months of 2009). Realized gold prices increased to an average of $1,266 per ounce in third-quarter 2010 (compared with $987 per ounce in third-quarter 2009) and $1,204 per ounce for the first nine months of 2010 (compared with $944 per ounce for the first nine months of 2009). Realized molybdenum prices increased to an ave rage of $16.06 per pound in third-quarter 2010 (compared with $13.95 per pound in third-quarter 2009) and $16.43 per pound for the first nine months of 2010 (compared with $11.93 per pound for the first nine months of 2009).

Consolidated copper sales volumes totaled 1.1 billion pounds in third-quarter 2010 and 3.0 billion pounds for the first nine months of 2010, compared with 1.0 billion pounds in third-quarter 2009 and 3.1 billion pounds for the first nine months of 2009. Higher copper sales volumes for third-quarter 2010 primarily reflected higher copper ore grades and mill throughput at our South America mining operations, higher share of Grasberg volumes in accordance with joint venture arrangements and additional volumes provided by our Tenke mine in Africa, partly offset by lower ore grades at our North America copper mines. Lower copper sales volumes for the first nine months of 2010 primarily reflected lower ore grades at Grasberg during the first half of 2010 and lower volumes at our North and South America copper mines, partly offset by additional volumes provided by our Tenke mine in

Africa. Consolidated gold sales volumes decreased to 497 thousand ounces in third-quarter 2010 and 1.3 million ounces for the first nine months of 2010, compared with 706 thousand ounces in third-quarter 2009 and 2.1 million ounces for the first nine months of 2009, as a result of mining in a lower ore-grade section at Grasberg resulting from planned mine sequencing. Consolidated molybdenum sales volumes increased to 17 million pounds for third-quarter 2010 and 50 million pounds for the first nine months of 2010, compared with 16 million pounds for third-quarter 2009 and 42 million pounds for the first nine months of 2009, reflecting improved demand in the chemicals sector. Refer to “Operations” for further discussion.

During the first nine months of 2010, approximately 51 percent of our mined copper was sold in concentrate, approximately 26 percent as cathodes and approximately 23 percent as rod from our North America operations. Substantially all concentrate and cathode sales contracts at our copper mining operations provide final copper pricing in a specified future period (generally one to four months from the shipment date) based primarily on quoted LME prices. We receive market prices based on prices in the specified future period, which results in price fluctuations recorded through revenues until the date of settlement. We record revenues and invoice customers at the time of shipment based on then-current LME prices, which results in an embedded derivative on our provisional priced concentrate and cathode sales that is adjusted to fair value thr ough earnings each period, using the period-end forward prices, until the date of final pricing. To the extent final prices are higher or lower than what was recorded on a provisional basis, an increase or decrease to revenues is recorded each reporting period until the date of final pricing. Accordingly, in times of rising copper prices, our revenues benefit from higher prices received for contracts priced at current market rates and also from an increase related to the final pricing of provisionally priced sales pursuant to contracts entered into in prior periods; in times of falling copper prices, the opposite occurs.

At June 30, 2010, we had provisionally priced copper sales at our copper mining operations totaling 364 million pounds of copper (net of intercompany sales and noncontrolling interests) recorded at an average of $2.95 per pound. Higher prices during third-quarter 2010 resulted in favorable adjustments to these prior period provisionally priced copper sales and increased consolidated revenues by $191 million ($85 million to net income attributable to FCX common stockholders or $0.18 per share), compared with a net increase of $237 million ($116 million to net income attributable to FCX common stockholders or $0.25 per share) in third-quarter 2009. Additionally, adjustments to prior year provisionally priced copper sales at our copper mining operations resulted in a net decrease to consolidated revenues of $23 million ($9 million to net inc ome attributable to FCX common stockholders or $0.02 per share) for the first nine months of 2010, compared with a net increase of $132 million ($61 million to net income attributable to FCX common stockholders or $0.14 per share) for the first nine months of 2009.

LME spot copper prices averaged $3.29 per pound in third-quarter 2010, compared with our average realized price of $3.50 per pound. At September 30, 2010, we had provisionally priced copper sales at our copper mining operations totaling 390 million pounds of copper (net of intercompany sales and noncontrolling interests) recorded at an average of $3.63 per pound, subject to final pricing over the next several months. We estimate that each $0.05 change from the September 30, 2010, average price for provisionally priced copper sales would have a net impact on our 2010 consolidated revenues of approximately $26 million ($13 million to net income attributable to FCX common stockholders). The LME spot copper price closed at $3.73 per pound on October 29, 2010.

In April 2009, we entered into forward sales contracts on certain of PT Freeport Indonesia’s provisionally priced copper sales at March 31, 2009, which final priced from April 2009 through July 2009 (refer to Note 7 for further discussion).

Production and Delivery Costs

Consolidated production and delivery costs increased to $2.3 billion in third-quarter 2010 and $6.2 billion for the first nine months of 2010, compared with $1.7 billion in third-quarter 2009 and $5.1 billion for the first nine months of 2009, primarily reflecting higher input costs at our mining operations and higher costs of concentrate purchases at Atlantic Copper associated with higher copper prices.

Consolidated site production and delivery costs for our copper mining operations averaged $1.38 per pound of copper for both the third quarter and first nine months of 2010, compared with $1.15 per pound of copper in third-quarter 2009 and $1.08 per pound of copper for the first nine months of 2009. Higher site production and delivery costs in the 2010 periods primarily reflected increased input costs (including materials, labor and energy). The first nine months of 2010 were also impacted by lower copper sales volumes at Grasberg. Refer to “Operations – Unit Net Cash Costs” for further discussion of unit net cash costs associated with our operating divisions, and to

“Product Revenues and Production Costs” for reconciliations of per pound costs by operating division to production and delivery costs applicable to sales reported in our consolidated financial statements.

Our copper mining operations require a significant amount of energy, principally electricity, diesel, coal and natural gas. For the year 2010, we expect energy costs (including Africa mining) to approximate 20 percent of our consolidated copper production costs, which reflects purchases of approximately 220 million gallons of diesel fuel; 6,150 gigawatt hours of electricity at our North America, South America and Africa copper mining operations (we generate all of our power at our Indonesia mining operation); 800 thousand metric tons of coal for our coal power plant in Indonesia; and 1 million MMBTU (million british thermal units) of natural gas at certain of our North America mines. Energy costs for 2009, which excluded Africa mining, approximated 20 percent of our consolidated copper production costs.

Depreciation, Depletion and Amortization

Consolidated depreciation, depletion and amortization expense increased to $268 million in third-quarter 2010 and $788 million for the first nine months of 2010, compared with $252 million in third-quarter 2009 and $740 million for the first nine months of 2009. Higher depreciation, depletion and amortization in third-quarter 2010 primarily reflected additional expense at our Tenke Fungurume mine and higher expense under the unit-of-production method at our Grasberg mine. Higher depreciation, depletion and amortization for the first nine months of 2010 also reflected additional expense at our Tenke Fungurume mine as well as higher straight-line depreciation expense at our North America copper mines, partly offset by lower expense under the unit-of-production method at our South America and Grasberg mines.

Lower of Cost or Market (LCM) Inventory Adjustments

Inventories are required to be recorded at the lower of cost or market. In first-quarter 2009, we recognized charges totaling $19 million ($15 million to net income attributable to FCX common stockholders or $0.04 per share) for LCM molybdenum inventory adjustments.

Selling, General and Administrative Expenses

Consolidated selling, general and administrative expenses increased to $81 million in third-quarter 2010 and $277 million for the first nine months of 2010, compared with $74 million in third-quarter 2009 and $225 million for the first nine months of 2009, primarily reflecting higher stock-based compensation and other incentive compensation costs. The first nine months of 2010 also included charges associated with relocating our corporate offices.

Exploration and Research Expenses

Consolidated exploration and research expenses increased to $35 million in third-quarter 2010 and $104 million for the first nine months of 2010, compared with $19 million in third-quarter 2009 and $73 million for the first nine months of 2009. Exploration activities are being conducted near our existing mines with a focus on opportunities to expand reserves that will support the development of additional future production capacity in the large mineral districts where we currently operate. Significantly expanded drilling activities in recent years have been successful in generating reserve additions and in identifying potential additional mineral resources adjacent to existing ore bodies. Results indicate opportunities for future potential reserve additions at Morenci, Sierrita and Bagdad in North America, at Cerro Verde and El Abra in So uth America and in the Tenke Fungurume district.

For the year 2010, exploration spending is expected to approximate $120 million. Exploration activities will continue to focus primarily on the potential for future reserve additions at our existing mineral districts.

Restructuring and Other Charges

For the first nine months of 2009, we recognized net charges of $23 million ($18 million to net income attributable to FCX common stockholders or $0.04 per share) associated with revised operating plans, including contract termination costs, other project cancellation costs and charges for employee severance and benefits, partially offset by pension and postretirement gains for special retirement benefits and curtailments.

Interest Expense, Net

Consolidated interest expense (before capitalization) decreased to $126 million in third-quarter 2010 and $409 million for the first nine months of 2010, compared with $172 million in third-quarter 2009 and $520 million for the first nine months of 2009, primarily reflecting the impact of debt repayments during 2009 and the first half of 2010.

Capitalized interest totaled $23 million in third-quarter 2010, $39 million for the first nine months of 2010, $10 million in third-quarter 2009 and $69 million for the first nine months of 2009 associated with our development activities.

Losses on Early Extinguishment of Debt

For the first nine months of 2010, we recorded losses on early extinguishment of debt totaling $77 million ($67 million to net income attributable to FCX common stockholders or $0.14 per share) associated with the redemption of our Senior Floating Rate Notes and open-market purchases of our 8.25% and 8.375% Senior Notes during the first half of 2010.

In third-quarter 2009, we recorded losses on early extinguishment of debt totaling $31 million ($28 million to net income attributable to FCX common stockholders or $0.06 per share for third-quarter 2009 and $0.07 per share for the first nine months of 2009) associated with the redemption of our 6⅞% Senior Notes and open-market purchases of our 8.25% and 8.375% Senior Notes.

Refer to Note 6 for further discussion of these transactions.

Provision for Income Taxes

Our income tax provision for the 2010 periods resulted from taxes on international operations ($772 million for the third quarter and $1.8 billion for the first nine months) and U.S. operations ($73 million for the third quarter and $205 million for the first nine months). As presented in the table below, our consolidated effective income tax rate was 35 percent for the first nine months of 2010.

Our income tax provision for the 2009 periods resulted from taxes on international operations ($660 million for the third quarter and $1.5 billion for the first nine months) and U.S. operations ($24 million for the third quarter and $29 million for the first nine months). During the first nine months of 2009, we did not record a benefit for losses generated in the U.S., and those losses could not be used to offset income generated from international operations. These factors combined with the high proportion of income earned in Indonesia, which was taxed at an effective tax rate of 43 percent, caused our consolidated effective income tax rate of 41 percent for the first nine months of 2009 to be higher than the U.S. federal statutory rate of 35 percent.

A summary of the approximate amounts in the calculation of our consolidated provision for income taxes for the first nine months of 2010 and 2009 follows (in millions, except percentages):

| | | Nine Months Ended | | Nine Months Ended | |

| | | September 30, 2010 | | September 30, 2009 | |

| | | | | | | | Income Tax | | | | | | | Income Tax | |

| | | Income | | | Effective | | (Provision) | | Income | | | Effective | | (Provision) | |

| | | (Loss)a | | | Tax Rate | | Benefit | | (Loss)a | | | Tax Rate | | Benefit | |

| U.S. | | $ | 905 | | | 23% | | $ | (205 | ) | $ | (135 | ) | | (21)% | | $ | (29 | ) |

| South America | | | 1,926 | | | 33% | | | (629 | ) | | 1,269 | | | 33% | | | (418 | ) |

| Indonesia | | | 2,569 | | | 42% | | | (1,069 | ) | | 2,952 | | | 43% | | | (1,257 | ) |

| Africa | | | 251 | | | 30% | | | (75 | ) | | (111 | ) | | 26% | | | 29 | |

| Eliminations and other | | | (125 | ) | | N/A | | | 43 | | | (217 | ) | | N/A | | | 74 | |

Annualized rate adjustment b | | | N/A | | | N/A | | | (21 | ) | | N/A | | | N/A | | | 44 | |

| Consolidated FCX | | $ | 5,526 | | | 35%c | | $ | (1,956 | ) | $ | 3,758 | | | 41% | | $ | (1,557 | ) |

| a. | Represents income (loss) by geographic location before income taxes and equity in affiliated companies’ net earnings. |

| b. | In accordance with applicable accounting rules, we adjust our interim provision for income taxes to equal our estimated annualized tax rate. |

| c. | Our estimated consolidated effective tax rate for the year 2010 will vary with commodity price changes and the mix of income from international and U.S. operations. Assuming average prices of $3.75 per pound of copper, $1,300 per ounce of gold and $15 per pound of molybdenum for fourth-quarter 2010 and current 2010 sales volume and cost estimates, we estimate our annual consolidated effective tax rate will approximate 35 to 36 percent. |

OPERATIONS

North America Copper Mines

We have seven copper mines in North America – Morenci, Sierrita, Bagdad, Safford and Miami in Arizona, and Tyrone and Chino in New Mexico. All of these mining operations are wholly owned, except for Morenci, an unincorporated joint venture, in which we own an 85 percent undivided interest.

The North America copper mines include open-pit mining, sulfide ore concentrating, leaching and solution extraction/electrowinning (SX/EW) operations. In addition to copper, the Sierrita and Bagdad mines produce molybdenum as a by-product. A majority of the copper produced at our North America copper mines is cast into copper rod by our Rod & Refining operations. The remainder of our North America copper sales is primarily in the form of copper cathode or copper concentrate. Refer to Note 11 for further discussion of our reportable segment in the North America copper mines division.

Operating and Development Activities. We have restarted the Morenci mill and have commenced a staged ramp up of Morenci’s mining rates. We have also resumed certain project development activities, including initiating restarts of mining at the Miami and Chino mines and construction of a new sulphur burner at Safford.

Morenci Mill Restart and Mine Ramp-up. In March 2010, we restarted the Morenci mill to process available sulfide material currently being mined. Mill throughput averaged 31,000 metric tons of ore per day during third-quarter 2010 and is expected to increase to approximately 50,000 metric tons per day by 2011. We have also commenced a staged ramp up at the Morenci mine from the 2009 rate of 450,000 metric tons per day to 635,000 metric tons per day. The mining rate averaged over 480,000 metric tons per day in third-quarter 2010. These activities will enable Morenci’s annual copper production to increase by approximately 125 million pounds beginning in 2011. Further increases to Morenci’s mining rate are being evaluated.

Miami Restart. In first-quarter 2010, we initiated limited mining activities at the Miami mine to improve efficiencies of ongoing reclamation projects associated with historical mining operations at the site. During an approximate five-year mine life, we expect to ramp up production at Miami to approximately 100 million pounds of copper per year by late 2011. We are investing approximately $40 million for this project, which is benefiting from the use of existing mining equipment.

Chino Restart. In October 2010, we announced that we are initiating a restart of mining and milling activities at the Chino mine, which were suspended in late 2008. The ramp up of mining and milling activities will significantly increase copper production at Chino, which is currently producing small amounts of copper from existing leach stockpiles. Planned mining and milling rates are expected to be achieved by the end of 2013. Annual incremental copper production of 100 million pounds is expected in 2012 and 2013 and 200 million pounds in 2014. Capital costs for the project are expected to approximate $150 million, associated with equipment and mill refurbishment.

Safford Sulphur Burner. We are constructing a sulphur burner at the Safford mine, which will provide a more cost effective source of sulphuric acid used in SX/EW operations and lower transportation costs. This project is expected to be completed in the first half of 2011 at a capital investment of approximately $150 million. Project costs of $57 million have been incurred as of September 30, 2010, of which $29 million was incurred during the first nine months of 2010.

Twin Buttes Acquisition. In December 2009, we purchased the Twin Buttes copper mine, which ceased operations in 1994, and is adjacent to our Sierrita mine. The purchase provides significant synergies in the Sierrita minerals district, including the potential for expanded mining activities and access to material that can be used for Sierrita tailings and stockpile reclamation purposes. Studies have commenced to incorporate the Twin Buttes resources in our development plans.

Operating Data. Following is summary operating data for the North America copper mines for the third quarters and first nine months of 2010 and 2009:

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2010 | | 2009 | | 2010 | | 2009 | |

| Operating Data, Net of Joint Venture Interest | | | | | | | | | | | | | |

Copper (millions of recoverable pounds) | | | | | | | | | | | | | |

| Production | | | 259 | | | 290 | | | 786 | | | 851 | |

| Sales, excluding purchases | | | 267 | | | 303 | | | 847 | | | 885 | |

| Average realized price per pound | | $ | 3.32 | | $ | 2.69 | | $ | 3.28 | | $ | 2.15 | |

| | | | | | | | | | | | | | |

Molybdenum (millions of recoverable pounds) | | | | | | | | | | | | | |

Productiona | | | 7 | | | 7 | | | 18 | | | 20 | |

| | | | | | | | | | | | | | |

| 100% Operating Data | | | | | | | | | | | | | |

| SX/EW operations | | | | | | | | | | | | | |

| Leach ore placed in stockpiles (metric tons per day) | | | 653,400 | | | 519,200 | | | 634,000 | | | 580,200 | |

| Average copper ore grade (percent) | | | 0.22 | | | 0.30 | | | 0.24 | | | 0.30 | |

| Copper production (millions of recoverable pounds) | | | 179 | | | 216 | | | 563 | | | 639 | |

| | | | | | | | | | | | | | |

| Mill operations | | | | | | | | | | | | | |

| Ore milled (metric tons per day) | | | 190,500 | | | 166,300 | | | 183,000 | | | 172,500 | |

| Average ore grade (percent): | | | | | | | | | | | | | |

| Copper | | | 0.32 | | | 0.32 | | | 0.31 | | | 0.33 | |

| Molybdenum | | | 0.03 | | | 0.03 | | | 0.02 | | | 0.03 | |

| Copper recovery rate (percent) | | | 82.6 | | | 86.8 | | | 83.0 | | | 85.7 | |

| Production (millions of recoverable pounds): | | | | | | | | | | | | | |

| Copper | | | 100 | | | 93 | | | 280 | | | 270 | |

| Molybdenum | | | 7 | | | 7 | | | 18 | | | 20 | |

| a. | Reflects by-product molybdenum production from the North America copper mines. Sales of by-product molybdenum are reflected in the Molybdenum division. |

Copper sales volumes from our North America copper mines decreased to 267 million pounds in third-quarter 2010 and 847 million pounds for the first nine months of 2010, compared with copper sales volumes of 303 million pounds in third-quarter 2009 and 885 million pounds for the first nine months of 2009, primarily because of anticipated lower ore grades at Safford and lower mill throughput because of unscheduled crusher maintenance at Bagdad. The first nine months of 2010 were also impacted by lower ore grades and mill maintenance at Sierrita.

Consolidated copper sales volumes from our North America copper mines are expected to approximate 1.1 billion pounds for the year 2010, compared with 1.2 billion pounds in 2009. As discussed above in “Operating and Development Activities,” we are increasing mining and milling rates at the Morenci mine and restarting the Miami and Chino mines, which are expected to result in higher production in future periods.

Unit Net Cash Costs. Unit net cash costs per pound of copper is a measure intended to provide investors with information about the cash-generating capacity of our mining operations expressed on a basis relating to the primary metal product for our respective operations. We use this measure for the same purpose and for monitoring operating performance by our mining operations. This information differs from measures of performance determined in accordance with generally accepted accounting principles (GAAP) in the U.S. and should not be considered in isolation or as a substitute for measures of performance determined in accordance with U.S. GAAP. This measure is presented by other mining companies, although our measure may not be comparable to similarly titled measures repor ted by other companies.

Gross Profit per Pound of Copper and Molybdenum

The following tables summarize unit net cash costs and gross profit per pound of copper and molybdenum at the North America copper mines for the third quarters and first nine months of 2010 and 2009. Refer to “Product Revenues and Production Costs” for an explanation of the “by-product” and “co-product” methods and a reconciliation of unit net cash costs to production and delivery costs applicable to sales reported in our consolidated financial statements.

| | Three Months Ended September 30, 2010 | | Three Months Ended September 30, 2009 | |

| | By- | | Co-Product Method | | By- | | Co-Product Method | |

| | Product | | | | Molyb- | | Product | | | | | Molyb- | |

| | Method | | Copper | | denuma | | Method | | Copper | | denuma | |

| Revenues, excluding adjustments | $ | 3.32 | | $ | 3.32 | | $ | 15.10 | | $ | 2.69 | | $ | 2.69 | | $ | 13.58 | |

| | | | | | | | | | | | | | | | | | | |

| Site production and delivery, before net noncash | | | | | | | | | | | | | | | | | | |

| and other costs shown below | | 1.62 | | | 1.45 | | | 8.18 | | | 1.22 | | | 1.10 | | | 6.71 | |

By-product creditsa | | (0.36 | ) | | – | | | – | | | (0.29 | ) | | – | | | – | |

| Treatment charges | | 0.10 | | | 0.10 | | | – | | | 0.08 | | | 0.08 | | | – | |

| Unit net cash costs | | 1.36 | | | 1.55 | | | 8.18 | | | 1.01 | | | 1.18 | | | 6.71 | |

| Depreciation, depletion and amortization | | 0.24 | | | 0.22 | | | 0.51 | | | 0.22 | | | 0.20 | | | 0.53 | |

| Noncash and other costs, net | | 0.11 | | | 0.11 | | | (0.12 | ) | | 0.07 | | | 0.07 | | | 0.05 | |

| Total unit costs | | 1.71 | | | 1.88 | | | 8.57 | | | 1.30 | | | 1.45 | | | 7.29 | |

| Revenue adjustments, primarily for hedging | | – | | | – | | | – | | | 0.02 | | | 0.02 | | | – | |

| Idle facility and other non-inventoriable costs | | (0.10 | ) | | (0.10 | ) | | (0.04 | ) | | (0.07 | ) | | (0.07 | ) | | – | |

| Gross profit per pound | $ | 1.51 | | $ | 1.34 | | $ | 6.49 | | $ | 1.34 | | $ | 1.19 | | $ | 6.29 | |

| | | | | | | | | | | | | | | | | | | |

| Copper sales (millions of recoverable pounds) | | 266 | | | 266 | | | | | | 302 | | | 302 | | | | |

Molybdenum sales (millions of recoverable pounds)b | | | | | | | | 7 | | | | | | | | | 7 | |

| | Nine Months Ended September 30, 2010 | | Nine Months Ended September 30, 2009 | |

| | By- | | Co-Product Method | | By- | | Co-Product Method | |

| | Product | | | | Molyb- | | Product | | | | | Molyb- | |

| | Method | | Copper | | denuma | | Method | | Copper | | denuma | |

| Revenues, excluding adjustments | $ | 3.28 | | $ | 3.28 | | $ | 15.49 | | $ | 2.15 | | $ | 2.15 | | $ | 10.52 | |

| | | | | | | | | | | | | | | | | | | |

| Site production and delivery, before net noncash | | | | | | | | | | | | | | | | | | |

| and other costs shown below | | 1.46 | | | 1.31 | | | 8.06 | | | 1.26 | | | 1.16 | | | 5.46 | |

By-product creditsa | | (0.33 | ) | | – | | | – | | | (0.23 | ) | | – | | | – | |

| Treatment charges | | 0.09 | | | 0.09 | | | – | | | 0.09 | | | 0.09 | | | – | |

| Unit net cash costs | | 1.22 | | | 1.40 | | | 8.06 | | | 1.12 | | | 1.25 | | | 5.46 | |

| Depreciation, depletion and amortization | | 0.24 | | | 0.23 | | | 0.59 | | | 0.22 | | | 0.21 | | | 0.37 | |

| Noncash and other costs, net | | 0.13 | | | 0.12 | | | (0.01 | ) | | 0.12 | | | 0.12 | | | 0.08 | |

| Total unit costs | | 1.59 | | | 1.75 | | | 8.64 | | | 1.46 | | | 1.58 | | | 5.91 | |

| Revenue adjustments, primarily for hedging | | – | | | – | | | – | | | 0.11 | | | 0.11 | | | – | |

| Idle facility and other non-inventoriable costs | | (0.08 | ) | | (0.08 | ) | | (0.02 | ) | | (0.09 | ) | | (0.09 | ) | | – | |

| Gross profit per pound | $ | 1.61 | | $ | 1.45 | | $ | 6.83 | | $ | 0.71 | | $ | 0.59 | | $ | 4.61 | |

| | | | | | | | | | | | | | | | | | | |

| Copper sales (millions of recoverable pounds) | | 845 | | | 845 | | | | | | 885 | | | 885 | | | | |

Molybdenum sales (millions of recoverable pounds)b | | | | | | | | 18 | | | | | | | | | 20 | |

| a. | Molybdenum by-product credits and revenues reflect volumes produced at market-based pricing and also include tolling revenues at Sierrita. |

| b. | Reflects molybdenum produced by the North America copper mines. |

Higher unit net cash costs (net of by-product credits) for our North America copper mines of $1.36 per pound of copper in third-quarter 2010 and $1.22 per pound of copper for the first nine months of 2010, compared with $1.01 per pound of copper in third-quarter 2009 and $1.12 per pound of copper for the first nine months of 2009, primarily reflected higher site production and delivery costs ($0.40 per pound for the quarter and $0.20 per pound for the nine month period) mostly associated with higher input costs and increased mining and milling activities at certain mines. Partly offsetting these higher costs were higher molybdenum credits ($0.07 per pound for the quarter and $0.10 per pound for the nine month period) resulting from higher molybdenum prices.

Some of our U.S. copper rod customers request a fixed market price instead of the COMEX average price in the month of shipment. We hedge this price exposure in a manner that allows us to receive market prices in the month of shipment while the customer pays the fixed price they requested. Because these contracts previously did not meet the criteria to qualify for hedge accounting, revenue adjustments in the third quarter and first nine months of 2009 primarily reflect unrealized gains on these copper derivative contracts.

Our operating North America copper mines have varying cost structures because of differences in ore grades and ore characteristics, processing costs, by-products and other factors. Based on current operating plans and assuming achievement of current 2010 sales volume and cost estimates and an average price of $15 per pound of molybdenum for fourth-quarter 2010, we estimate that average unit net cash costs (net of by-product credits) for our North America copper mines would approximate $1.25 per pound of copper for the year 2010, compared with $1.11 per pound in 2009. Each $2 per pound change in the average price of molybdenum during fourth-quarter 2010 would have an approximate $0.01 per pound impact on the North America copper mines’ 2010 unit net cash costs.

South America Mining

We have four copper mines in South America – Cerro Verde in Peru, and Candelaria, Ojos del Salado and El Abra in Chile. We own a 53.56 percent interest in Cerro Verde, an 80 percent interest in both Candelaria and Ojos del Salado and a 51 percent interest in El Abra.

South America mining includes open-pit and underground mines, sulfide ore concentrating, leaching and SX/EW operations. In addition to copper, the Cerro Verde mine produces molybdenum concentrates as a by-product, and the Candelaria and Ojos del Salado mines produce gold and silver as by-products. Production from our South America mines is sold as copper concentrate or copper cathode under long-term contracts. Our South America mines sell a portion of their copper concentrate and cathode inventories to Atlantic Copper, an affiliated smelter. Refer to Note 11 for further discussion of our reportable segment in the South America mining division.

Operating and Development Activities. The molybdenum circuit at Cerro Verde, which had been temporarily curtailed, resumed operations in September 2009. We have also resumed certain project development activities, including the El Abra sulfide project and the Cerro Verde mill optimization project.

El Abra Sulfide. We are engaged in construction activities associated with the development of a large sulfide deposit at El Abra to extend its mine life by over 10 years. Construction activities for the initial phase of the project are approximately 55 percent complete, and are expected to be complete in 2011. Production from the sulfide ore, which is projected to ramp up to approximately 300 million pounds of copper per year, is expected to replace the currently depleting oxide copper production beginning in 2011. The aggregate capital investment for this project is expected to total $725 million through 2015, of which approximately $565 million is for the initial phase of the project. Aggregate project costs of $269 million have been incurred as of September 30, 2010, of which $19 4 million was incurred during the first nine months of 2010.

We are also engaged in studies for a potential milling operation at El Abra to process additional sulfide material and to achieve higher recoveries.

Cerro Verde Expansion. We are completing a project to increase throughput at the existing Cerro Verde concentrator. This project, which is expected to be completed by the end of 2010, is designed to add 30 million pounds of additional copper production per year by increasing mill throughput from 108,000 metric tons of ore per day to 120,000 metric tons of ore per day. The aggregate capital investment for this project is expected to total approximately $50 million.

In addition, we are evaluating the potential for a large-scale concentrator expansion at Cerro Verde. Reserve additions in recent years have provided opportunities to significantly expand the existing facility’s capacity. A range of expansion options are being considered and the related feasibility study is expected to be completed in the first half of 2011.

Other Matters. As reported in Note 14 of our report on Form 10-K for the year ended December 31, 2009, Cerro Verde was notified by SUNAT, the Peruvian national tax authority, of its intent to assess mining royalties related to the minerals processed by the Cerro Verde concentrator, which was added to Cerro Verde’s processing facilities in late 2006. In August 2009, Cerro Verde received a formal assessment approximating $50 million in connection with its alleged obligations for mining royalties and fines for the period from October 2006 through December

2007. In April 2010, SUNAT issued a ruling denying Cerro Verde’s protest of the assessment, and in May 2010 Cerro Verde appealed this decision to the Tax Court. Cerro Verde has also received a formal assessment approximating $40 million in royalties for the year 2008, and a request for information for mining royalties covering the year 2009. SUNAT may continue to assess mining royalties annually until this matter is resolved by the Tax Court.

Cerro Verde is challenging these royalties because its stability agreement with the Peruvian government exempts from royalties all minerals extracted from its mining concession, irrespective of the method used for processing those minerals. No amounts have been accrued for this contingency. If Cerro Verde is ultimately found responsible for those royalties, it will also be liable for interest, which accrues at rates that range from 6 to 18 percent based on the year accrued and the currency in which the amounts would be payable.

During 2006, the Peruvian government announced that all mining companies operating in Peru would make annual contributions to local development funds for a five-year period (covering the years 2006 through 2010) when copper prices exceed certain levels. Cerro Verde's contribution is equal to 3.75 percent of after-tax profits totaling $26 million for the first nine months of 2010 and $28 million for the year 2009. It is not certain whether the contribution will be extended, abandoned, or replaced by a tax or different mechanism. We will continue to monitor the activity associated with this matter.

In July 2010, the Chilean legislature approved and enacted a temporary increase to the provisional corporate income tax rate for 2011 and 2012. Taxes paid as a result of the increase will be available as a credit against withholding taxes applicable on distributions to non-resident shareholders. As a result, the increase in the corporate income tax rate did not have an impact on our financial results for the first nine months of 2010, and we do not expect the change in rates to have a significant impact on our financial results in 2011 and 2012.

In October 2010, the Chilean legislature approved an increase in mining royalty taxes to help fund earthquake reconstruction activities, education and health programs. Mining royalty taxes at our Chilean operations are currently stabilized through 2017 at a rate of 4 percent, and totaled $26 million in 2009. However, under the new legislation we have the option to transfer from our stabilized rate to a sliding scale of 5 to 9 percent for the years 2010 through 2012, and would return to the 4 percent rate for the years 2013 through 2017. Beginning in 2018 through 2023, rates would move to a sliding scale of 5 to 14 percent. We are currently evaluating implementation of the proposal, and estimate that, if we elect to participate, th e additional royalty from the increased rates would approximate $15 million for the first nine months of 2010.

Operating Data. Following is summary operating data for our South America mining operations for the third quarters and first nine months of 2010 and 2009:

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2010 | | 2009 | | 2010 | | 2009 | |

Copper (millions of recoverable pounds) | | | | | | | | | | | | | |

| Production | | | 356 | | | 340 | | | 1,007 | | | 1,046 | |

| Sales | | | 377 | | | 327 | | | 995 | | | 1,040 | |

| Average realized price per pound | | $ | 3.55 | | $ | 2.79 | | $ | 3.36 | | $ | 2.43 | |

| | | | | | | | | | | | | | |

Gold (thousands of recoverable ounces) | | | | | | | | | | | | | |

| Production | | | 29 | | | 22 | | | 68 | | | 69 | |

| Sales | | | 30 | | | 20 | | | 69 | | | 68 | |

| Average realized price per ounce | | $ | 1,265 | | $ | 976 | | $ | 1,211 | | $ | 935 | |

| | | | | | | | | | | | | | |

Molybdenum (millions of recoverable pounds) | | | | | | | | | | | | | |

Productiona | | | 2 | | | – | | | 5 | | | 1 | |

| | | | | | | | | | | | | | |

| SX/EW operations | | | | | | | | | | | | | |

| Leach ore placed in stockpiles (metric tons per day) | | | 281,000 | | | 251,500 | | | 261,500 | | | 254,100 | |

| Average copper ore grade (percent) | | | 0.39 | | | 0.46 | | | 0.42 | | | 0.45 | |

| Copper production (millions of recoverable pounds) | | | 122 | | | 142 | | | 385 | | | 420 | |

| | | | | | | | | | | | | | |

| Mill operations | | | | | | | | | | | | | |

| Ore milled (metric tons per day) | | | 193,800 | | | 174,200 | | | 187,100 | | | 181,000 | |

Average ore grade (percent):b | | | | | | | | | | | | | |

| Copper | | | 0.69 | | | 0.66 | | | 0.64 | | | 0.67 | |

| Molybdenum | | | 0.02 | | | 0.02 | | | 0.02 | | | 0.02 | |

| Copper recovery rate (percent) | | | 90.7 | | | 89.0 | | | 90.0 | | | 89.4 | |

| Production (recoverable): | | | | | | | | | | | | | |

| Copper (millions of pounds) | | | 234 | | | 198 | | | 622 | | | 626 | |

| Gold (thousands of ounces) | | | 29 | | | 22 | | | 68 | | | 69 | |

| Molybdenum (millions of pounds) | | | 2 | | | – | | | 5 | | | 1 | |

| a. | Reflects by-product molybdenum production from our Cerro Verde copper mine. Sales of by-product molybdenum are reflected in the Molybdenum division. |

| b. | Average ore grades of gold produced at our South America mining operations rounds to less than 0.001 grams per metric ton. |

Copper sales volumes from our South America mining operations increased to 377 million pounds in third-quarter 2010, compared with 327 million pounds in third-quarter 2009, primarily reflecting higher ore grades and mill throughput at Candelaria and timing of shipments at Cerro Verde, partly offset by anticipated lower ore grades at El Abra. For the first nine months of 2010, copper sales volumes decreased to 995 million pounds, compared with 1.0 billion pounds for the first nine months of 2009, primarily reflecting anticipated lower ore grades at El Abra and timing of shipments at Cerro Verde.

Consolidated sales volumes from South America mining are expected to approximate 1.3 billion pounds of copper and 100 thousand ounces of gold for the year 2010, compared with 1.4 billion pounds of copper and 90 thousand ounces of gold in 2009. Projected copper sales volumes for 2010 are lower than 2009 primarily reflecting anticipated lower ore grades, principally at El Abra in connection with the depletion of the oxide ore resource and the transition to the sulfide deposit.

Unit Net Cash Costs. Unit net cash costs per pound of copper is a measure intended to provide investors with information about the cash-generating capacity of our mining operations expressed on a basis relating to the primary metal product for our respective operations. We use this measure for the same purpose and for monitoring operating performance by our mining operations. This information differs from measures of performance determined in accordance with U.S. GAAP and should not be considered in isolation or as a substitute for measures of performance determined in accordance with U.S. GAAP. This measure is presented by other mining companies, although our measure may not be comparable to similarly titled measures reported by other companies.

Gross Profit per Pound of Copper

The following tables summarize unit net cash costs and gross profit per pound of copper at the South America mining operations for the third quarters and first nine months of 2010 and 2009. Unit net cash costs per pound of copper are reflected under the by-product and co-product methods as the South America mining operations also had small amounts of molybdenum, gold and silver sales. Refer to “Product Revenues and Production Costs” for an explanation of the “by-product” and “co-product” methods and a reconciliation of unit net cash costs to production and delivery costs applicable to sales reported in our consolidated financial statements.

| | Three Months Ended September 30, 2010 | | Three Months Ended September 30, 2009 | |

| | By-Product | | Co-Product | | By-Product | | Co-Product | |

| | Method | | Method | | Method | | Method | |

| Revenues, excluding adjustments | $ | 3.55 | | $ | 3.55 | | $ | 2.79 | | $ | 2.79 | |

| | | | | | | | | | | | | |

| Site production and delivery, before net noncash | | | | | | | | | | | | |

| and other costs shown below | | 1.16 | | | 1.09 | | | 1.14 | | | 1.09 | |

| By-product credits | | (0.21 | ) | | – | | | (0.10 | ) | | – | |

| Treatment charges | | 0.18 | | | 0.18 | | | 0.15 | | | 0.15 | |

| Unit net cash costs | | 1.13 | | | 1.27 | | | 1.19 | | | 1.24 | |

| Depreciation, depletion and amortization | | 0.17 | | | 0.17 | | | 0.20 | | | 0.20 | |

| Noncash and other costs, net | | 0.02 | | | 0.02 | | | 0.01 | | | 0.02 | |

| Total unit costs | | 1.32 | | | 1.46 | | | 1.40 | | | 1.46 | |

| Revenue adjustments, primarily for pricing on | | | | | | | | | | | | |

| prior period open sales | | 0.28 | | | 0.28 | | | 0.37 | | | 0.37 | |

| Other non-inventoriable costs | | (0.04 | ) | | (0.03 | ) | | (0.03 | ) | | (0.02 | ) |

| Gross profit per pound | $ | 2.47 | | $ | 2.34 | | $ | 1.73 | | $ | 1.68 | |

| | | | | | | | | | | | | |

| Copper sales (millions of recoverable pounds) | | 377 | | | 377 | | | 327 | | | 327 | |

| | Nine Months Ended September 30, 2010 | | Nine Months Ended September 30, 2009 | |

| | By-Product | | Co-Product | | By-Product | | Co-Product | |

| | Method | | Method | | Method | | Method | |

| Revenues, excluding adjustments | $ | 3.36 | | $ | 3.36 | | $ | 2.43 | | $ | 2.43 | |

| | | | | | | | | | | | | |

| Site production and delivery, before net noncash | | | | | | | | | | | | |

| and other costs shown below | | 1.19 | | | 1.12 | | | 1.05 | | | 0.99 | |

| By-product credits | | (0.19 | ) | | – | | | (0.11 | ) | | – | |

| Treatment charges | | 0.15 | | | 0.15 | | | 0.15 | | | 0.14 | |

| Unit net cash costs | | 1.15 | | | 1.27 | | | 1.09 | | | 1.13 | |

| Depreciation, depletion and amortization | | 0.19 | | | 0.18 | | | 0.19 | | | 0.19 | |

| Noncash and other costs, net | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | |

| Total unit costs | | 1.35 | | | 1.46 | | | 1.29 | | | 1.33 | |

| Revenue adjustments, primarily for pricing on | | | | | | | | | | | | |

| prior period open sales | | (0.01 | ) | | (0.01 | ) | | 0.11 | | | 0.11 | |

| Other non-inventoriable costs | | (0.03 | ) | | (0.03 | ) | | (0.02 | ) | | (0.02 | ) |

| Gross profit per pound | $ | 1.97 | | $ | 1.86 | | $ | 1.23 | | $ | 1.19 | |

| | | | | | | | | | | | | |

| Copper sales (millions of recoverable pounds) | | 995 | | | 995 | | | 1,040 | | | 1,040 | |

Lower unit net cash costs (net of by-product credits) for our South America mining operations of $1.13 per pound of copper in third-quarter 2010, compared with $1.19 per pound in third-quarter 2009, primarily reflected higher by-product credits ($0.11 per pound) associated with higher gold and molybdenum volumes and prices, partly offset by higher treatment charges ($0.03 per pound) and higher site production and delivery costs ($0.02 per pound). Higher site production and delivery costs in third-quarter 2010 were primarily related to higher input costs and the impact of higher copper prices on profit sharing programs, partly offset by higher sales volumes.

Higher unit net cash costs (net of by-product credits) for our South America mining operations of $1.15 per pound of copper for the first nine months of 2010, compared with $1.09 per pound for the first nine months of 2009, primarily reflected higher site production and delivery costs ($0.14 per pound) associated with higher sales volumes and the impact of higher copper prices on profit sharing programs. Partly offsetting higher site production and delivery costs were higher by-product credits ($0.08 per pound) associated with higher molybdenum volumes and prices and higher gold prices.

Our South America mines have varying cost structures because of differences in ore grades and ore characteristics, processing costs, by-products and other factors. Assuming achievement of current 2010 sales volume and cost estimates, we estimate that average unit net cash costs (net of by-product credits) for our South America mining operations would approximate $1.16 per pound of copper in 2010, compared with $1.12 per pound in 2009.

Indonesia Mining

Indonesia mining includes PT Freeport Indonesia’s Grasberg minerals district. We own 90.64 percent of PT Freeport Indonesia, including 9.36 percent owned through our wholly owned subsidiary, PT Indocopper Investama.

PT Freeport Indonesia produces copper concentrates, which contain significant quantities of gold and silver. Substantially all of PT Freeport Indonesia’s copper concentrates are sold under long-term contracts, of which approximately one-half is sold to affiliated smelters, Atlantic Copper and PT Smelting (PT Freeport Indonesia’s 25-percent owned copper smelter and refinery in Indonesia) and the remainder to other customers.

We have established certain unincorporated joint ventures with Rio Tinto plc (Rio Tinto), under which Rio Tinto has a 40 percent interest in certain assets and future production exceeding specified annual amounts of copper, gold and silver.

Development Activities. We have several projects in progress in the Grasberg minerals district, including development of the large-scale, high-grade underground ore bodies located beneath and adjacent to the Grasberg open pit. Aggregate capital spending on these projects is expected to approximate $350 million for the year 2010 ($275 million net to PT Freeport Indonesia). Over the next several years, aggregate capital spending on these projects is expected to average $500 million per year ($400 million net to PT Freeport Indonesia). Considering the long-term nature and large size of these projects, actual costs could differ materially from these estimates.

The following provides additional information on these projects, including the continued development of the Common Infrastructure project, the Grasberg Block Cave and Big Gossan underground mines, a further expansion of the Deep Ore Zone (DOZ) underground mine and development of the Deep Mill Level Zone (DMLZ) ore body.

Common Infrastructure and Grasberg Block Cave. In 2004, PT Freeport Indonesia commenced its Common Infrastructure project to provide access to its large undeveloped underground ore bodies located in the Grasberg minerals district through a tunnel system located approximately 400 meters deeper than its existing underground tunnel system. In addition to providing access to our underground ore bodies, the tunnel system will enable PT Freeport Indonesia to conduct future exploration in prospective areas associated with currently identified ore bodies. The tunnel system has reached the Big Gossan terminal and development of the lower Big Gossan infrastructure is ongoing. We have also advanced development of the Grasberg spur and have completed the tunneling required to reach the Gra sberg underground ore body. Development continues on the Grasberg Block Cave terminal infrastructure and mine access.

In 2008, we completed the feasibility study for the development of the Grasberg Block Cave underground mine, which accounts for over one-third of our reserves in Indonesia. Production at the Grasberg Block Cave mine is currently scheduled to commence at the end of mining the Grasberg open pit, which is expected to continue until mid-2016. The timing of the transition to underground Grasberg Block Cave mine development will continue to be assessed.

Based on the 2008 feasibility study, aggregate mine development capital for the Grasberg Block Cave mine and associated Common Infrastructure is expected to approximate $3.6 billion, which are expected to be incurred between 2008 and 2021, with PT Freeport Indonesia’s share totaling approximately $3.4 billion. Aggregate project costs totaling $213 million have been incurred through September 30, 2010, of which $96 million was incurred during the first nine months of 2010. Targeted production rates once the Grasberg Block Cave mining operation reaches full capacity are expected to approximate 160,000 metric tons of ore per day.

Big Gossan. The Big Gossan underground mine is a high-grade deposit located near PT Freeport Indonesia’s existing milling complex. The Big Gossan mine is being developed as an open-stope mine with backfill consisting of mill tailings and cement, an established mining methodology expected to be higher cost than the block-cave method used at the DOZ mine. Production is ongoing and designed to ramp up to 7,000 metric tons of ore per day

by late 2012 (equal to average annual aggregate incremental production of 125 million pounds of copper and 65,000 ounces of gold, with PT Freeport Indonesia receiving 60 percent of these amounts). The aggregate capital investment for this project is currently estimated at approximately $535 million, with PT Freeport Indonesia’s share totaling approximately $500 million. Aggregate project costs of $430 million have been incurred through September 30, 2010, of which $53 million was incurred during the first nine months of 2010.

DOZ Expansion. PT Freeport Indonesia’s further expansion of the DOZ mine to 80,000 metric tons of ore per day was completed in first-quarter 2010. The capital cost for this expansion approximated $100 million, with PT Freeport Indonesia’s share totaling approximately $60 million. The success of the development of the DOZ mine, one of the world’s largest underground mines, provides confidence in the future development of PT Freeport Indonesia’s large-scale undeveloped underground ore bodies.

DMLZ. The DMLZ ore body lies below the DOZ mine at the 2,590-meter elevation and represents the downward continuation of mineralization in the Ertsberg East Skarn system and neighboring Ertsberg porphyry. The DMLZ feasibility study was completed in fourth-quarter 2009. We plan to mine the ore body using a block-cave method with production beginning in 2015, near completion of mining at the DOZ. Drilling efforts continue to determine the extent of this ore body. We continue to develop the Common Infrastructure project and tunnels from mill level. In 2009, we completed a portion of the spur to the DMLZ mine and reached the edge of the DMLZ terminal, and development continues on terminal infrastructure and mine access. Aggregate mine development capital costs for the DMLZ are expected to approximate $2.1 billion with PT Freeport Indonesia’s share totaling approximately $1.2 billion, which are expected to be incurred from 2009 to 2020. Aggregate project costs totaling $82 million have been incurred through September 30, 2010, including $57 million during the first nine months of 2010. Targeted production rates once the DMLZ mining operation reaches full capacity are expected to approximate 80,000 metric tons of ore per day.

Other Matters. In October 2010, PT Freeport Indonesia received an assessment for additional tax payments from the Indonesian tax authorities related to various audit exceptions for the year 2005. PT Freeport Indonesia is reviewing the assessment and will work with the Indonesian tax authorities to resolve disputed audit exceptions.

From July 2009 through January 2010, there were a series of shooting incidents along the road leading to our mining and milling operations at the Grasberg minerals district. In connection with these incidents there were three fatalities in July 2009, and there have been a number of injuries. The Indonesian government has responded with additional security forces and expressed a strong commitment to protect the safety of the community and our operations. The investigation of these matters is continuing, and we have taken precautionary measures, including limiting use of the road to secured convoys. Our mining and milling activities have continued uninterrupted; however, prolonged limitations on access to the road could adversely affect operations at the mine. See “Risk Factors” contained in Part I, Item 1A of our Form 10-K for the year ended December 31, 2009, for further discussion of these matters.

Operating Data. Following is summary operating data for our Indonesia mining operations for the third quarters and first nine months of 2010 and 2009:

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2010 | | 2009 | | 2010 | | 2009 | |

| Consolidated Operating Data, Net of Joint Venture Interest | | | | | | | | | | | | | |

Copper (millions of recoverable pounds) | | | | | | | | | | | | | |

| Production | | | 358 | | | 331 | | | 913 | | | 1,138 | |

| Sales | | | 364 | | | 330 | | | 919 | | | 1,131 | |

| Average realized price per pound | | $ | 3.60 | | $ | 2.77 | | $ | 3.36 | | $ | 2.41 | |

| | | | | | | | | | | | | | |

Gold (thousands of recoverable ounces) | | | | | | | | | | | | | |

| Production | | | 462 | | | 685 | | | 1,185 | | | 2,033 | |

| Sales | | | 466 | | | 683 | | | 1,200 | | | 2,015 | |

| Average realized price per ounce | | $ | 1,266 | | $ | 988 | | $ | 1,204 | | $ | 944 | |

| | | | | | | | | | | | | | |

| 100% Operating Data | | | | | | | | | | | | | |

| Ore milled (metric tons per day): | | | | | | | | | | | | | |

Grasberg open pita | | | 150,400 | | | 172,100 | | | 150,300 | | | 167,500 | |

DOZ underground minea | | | 78,500 | | | 69,100 | | | 78,500 | | | 71,300 | |

| Total | | | 228,900 | | | 241,200 | | | 228,800 | | | 238,800 | |

| Average ore grade: | | | | | | | | | | | | | |

| Copper (percent) | | | 0.92 | | | 0.90 | | | 0.84 | | | 1.04 | |

| Gold (grams per metric ton) | | | 0.92 | | | 1.33 | | | 0.81 | | | 1.32 | |

| Recovery rates (percent): | | | | | | | | | | | | | |

| Copper | | | 89.1 | | | 90.7 | | | 88.8 | | | 90.7 | |

| Gold | | | 83.6 | | | 84.7 | | | 80.6 | | | 83.5 | |