UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-5531

| Barings Participation Investors | |

| (Exact name of registrant as specified in charter) | |

| | |

| | | |

| 300 South Tryon Street, Suite 2500, Charlotte, NC 28202 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| | | |

| Janice M. Bishop, Vice President, Secretary and Chief Legal Officer Independence Wharf, 470 Atlantic Ave., Boston, MA 02210 | |

| (Name and address of agent for service) | |

Registrant's telephone number, including area code: 413-226-1000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/19

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 110 F Street NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Attached hereto is the semi-annual shareholder report transmitted to shareholders pursuant to Rule 30e-1 of the Investment Company Act of 1940, as amended.

Barings

Participation Investors

Report for the Six Months Ended June 30, 2019 |

| |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website http://www.barings.com/MPV, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank). You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account. | |

| | |

Adviser

Barings LLC

300 S Tryon St., Suite 2500

Charlotte, NC 28202

Independent Registered Public Accounting Firm

KPMG LLP

Boston, Massachusetts 02110

Counsel to the Trust

Ropes & Gray LLP

Boston, Massachusetts 02111

Custodian

State Street Bank and Trust Company

Boston, Massachusetts 02110

Transfer Agent & Registrar

DST Systems, Inc.

P.O. Box 219086

Kansas City, Missouri 64121-9086

1-800-647-7374

Internet Website

www.barings.com/mpv

| Barings Participation Investors c/o Barings LLC 300 S Tryon St., Suite 2500 Charlotte, NC 28202 (413) 226-1516 |

Investment Objective and Policy

Barings Participation Investors (the "Trust") is a closed-end management investment company, first offered to the public in 1988, whose shares are traded on the New York Stock Exchange under the trading symbol "MPV". The Trust's share price can be found in the financial section of most newspapers under either the New York Stock Exchange listings or Closed-End Fund Listings.

The Trust's investment objective is to maintain a portfolio of securities providing a current yield and, when available, an opportunity for capital gains. The Trust's principal investments are privately placed, below investment grade, long-term debt obligations including bank loans and mezzanine debt instruments. Such direct placement securities may, in some cases, be accompanied by equity features such as common stock, preferred stock, warrants, conversion rights, or other equity features. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically made to small or middle market companies. In addition, the Trust may invest, subject to certain limitations, in marketable debt securities (including high yield and/or investment grade securities) and marketable common stock. Below investment grade or high yield securities have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay capital.

The Trust distributes substantially all of its net income to shareholders each year. Accordingly, the Trust pays dividends to shareholders in January, May, August, and November. All registered shareholders are automatically enrolled in the Dividend Reinvestment and Cash Purchase Plan unless cash distributions are requested.

Form N-PORT

The Trust files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Part F of Form N-PORT. This information is available (i) on the SEC's website at http://www.sec.gov; and (ii) at the SEC's Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available upon request by calling, toll-free, 866-399-1516.

Proxy Voting Policies & Procedures; Proxy Voting Record

The Trustees of the Trust have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Barings LLC ("Barings"). A description of Barings' proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 866-399-1516; (2) on the Trust's website at www.barings.com/mpv; and (3) on the SEC's website at http://www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) on the Trust's website at www.barings.com/mpv; and (2) on the SEC's website at http://www.sec.gov.

Legal Matters

The Trust has entered into contractual arrangements with an investment adviser, transfer agent and custodian (collectively "service providers") who each provide services to the Trust. Shareholders are not parties to, or intended beneficiaries of, these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the Trust.

Under the Trust's Bylaws, any claims asserted against or on behalf of the Trust, including claims against Trustees and officers must be brought in courts located within the Commonwealth of Massachusetts.

The Trust's registration statement and this shareholder report are not contracts between the Trust and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Barings Participation Investors

TO OUR SHAREHOLDERS

July 31, 2019

We are pleased to present the June 30, 2019 Quarterly Report of Barings Participation Investors (the "Trust").

The Board of Trustees declared a quarterly dividend of $0.27 per share, payable on August 16, 2019 to shareholders of record on August 5, 2019. The Trust paid a $0.27 per share dividend for the preceding quarter. The Trust earned $0.26 per share of net investment income for the second quarter of 2019, compared to $0.28 per share in the previous quarter.

During the second quarter, the net assets of the Trust increased to $146,435,341 or $13.87 per share compared to $143,396,463 or $13.60 per share on March 31, 2019. This translates to a 4.0% total return for the quarter, based on the change in the Trust's net assets assuming the reinvestment of all dividends. Longer term, the Trust returned 9.4%, 9.3%, 8.8%, 11.4%, and 12.2% for the 1, 3, 5, 10, and 25-year periods, respectively, based on the change in the Trust's net assets assuming the reinvestment of all dividends.

The Trust's share price increased during the quarter, from $15.36 per share as of March 31, 2019 to $16.31 per share as of June 30, 2019, which resulted in a total return for the quarter of 8.1%. The Trust's market price of $16.31 per share equates to a 17.6% premium over the June 30, 2019 net asset value per share of $13.87. The Trust's average quarter-end premium for the 3, 5 and 10-year periods was 7.2%, 3.9% and 8.7%, respectively. U.S. equity markets, as approximated by the Russell 2000 Index, increased 2.1% for the quarter. U.S. fixed income markets, as approximated by the Bloomberg Barclays U.S. Corporate High Yield Index and the Credit Suisse Leverage Loan Index, increased 2.5% and 1.6% for the quarter, respectively.

The Trust closed three new private placement investments and five add-on investments to existing portfolio companies during the first quarter. The total amount invested by the Trust in these transactions was $3,251,610. Of note, all of the new platform investments were floating rate senior secured term loans. Over the past couple of years, the Trust has increasingly invested in term loans with floating interest rates. As interest rates fluctuate, we expect interest income to fluctuate due to the base interest rates on the floating rate loans resetting quarterly. Please note that the Trust's own senior term loan is fixed rate and therefore, fluctuations in base interest rates will not impact the Trust's cost of borrowing.

Middle market merger and acquisition activity continues to remain below 2018 levels. The lower M&A activity coupled with continued hyper-competitive market conditions led to aggressive credit terms including increased leverage and lower pricing. As a result of these factors, the Trust's new investment activity was lower than recent quarters. It continues to be difficult to source traditional higher yielding junior debt opportunities as the all-senior structures continue to be more prevalent in the middle market. As always, we continue to be selective in our investment choices and maintain underwriting discipline.

The Trust's current portfolio continues to exhibit sound credit quality. Realization activity continued through the second quarter with five private investment exits during the quarter, all of which resulted in favorable results. In addition, two companies fully prepaid their debt held by the Trust. The Trust was also the beneficiary of one of its equity investments paying a dividend during the quarter. We remain cautiously optimistic about realization activity over the next few quarters as there are several companies in which the Trust has outstanding investments that are in the process of being sold.

The Trust was able to maintain its $0.27 per share quarterly dividend in the second quarter. While the Trust's expansion of its target investment criteria in 2017 has allowed for increased private debt investment opportunities, and as a result, more stable recurring investment income, recurring investment income fell slightly short of fully funding this quarter's dividend. As has occurred from time to time in the past, the slight shortfall was covered with earnings carry forwards and other non-recurring income. Due to the continued market decline in higher yielding junior debt investment opportunities, over time it may become difficult to maintain the dividend at $0.27 per share. We and the Board of Trustees will continue to evaluate the current and future earnings capacity of the Trust and formulate a dividend strategy that is consistent with the Trust's recurring earnings.

Thank you for your continued interest in and support of Barings Participation Investors.

(Continued)

Sincerely,

Robert M. Shettle

President

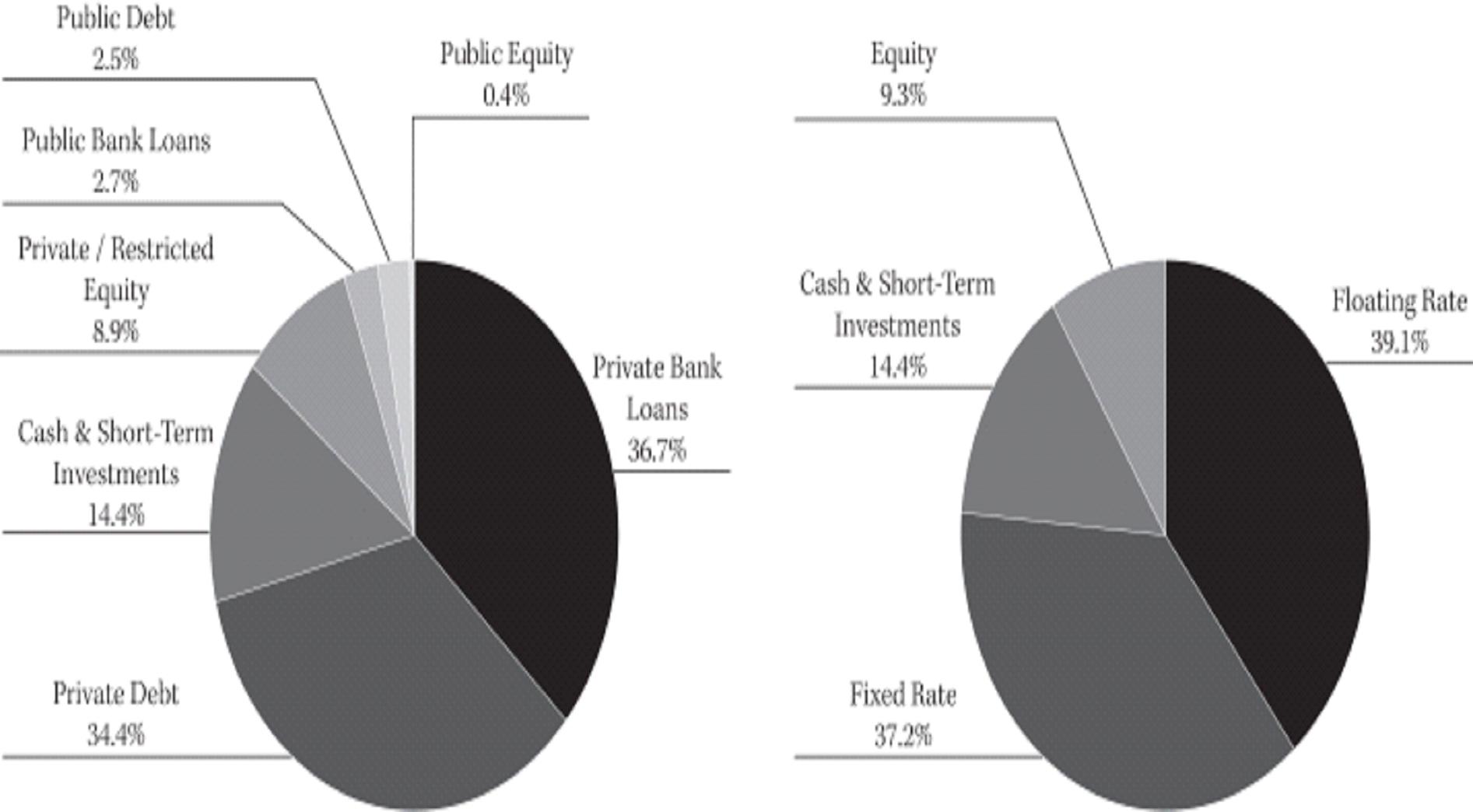

Portfolio Composition as of 6/30/19*

* Based on market value of total investments

Cautionary Notice: Certain statements contained in this report may be "forward looking" statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of the Trust's trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Trust's current or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information, future events, or otherwise.

Barings Participation Investors

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

June 30, 2019

(Unaudited)

| Assets: | | | |

| | | | |

Investments

(See Consolidated Schedule of Investments) | | | |

Corporate restricted securities at fair value

(Cost - $123,831,423 ) | | $ | 121,099,996 | |

Corporate restricted securities at market value

(Cost - $7,796,797 ) | | | 7,293,365 | |

Corporate public securities at market value

(Cost - $9,297,595 ) | | | 8,988,176 | |

| Short-term securities at amortized cost | | | 9,478,396 | |

| | | | | |

| Total investments (Cost - $150,404,211 ) | | | 146,859,933 | |

| | | | | |

| Cash | | | 13,639,157 | |

| Interest receivable | | | 1,064,018 | |

| Receivable for investments sold | | | 386,841 | |

| Other assets | | | 14,104 | |

| | | | | |

| Total assets | | | 161,964,053 | |

| | | | | |

| | | | | |

| Liabilities: | | | | |

| Note payable | | | 15,000,000 | |

| Investment advisory fee payable | | | 329,480 | |

| Interest payable | | | 27,267 | |

| Accrued expenses | | | 171,965 | |

| | | | | |

| Total liabilities | | | 15,528,712 | |

| | | | | |

| Commitments and Contingencies (See Note 8) | | | | |

| | | | | |

| Total net assets | | $ | 146,435,341 | |

| | | | | |

| | | | | |

| Net Assets: | | | | |

| Common shares, par value $.01 per share | | $ | 105,583 | |

| Additional paid-in capital | | | 141,926,663 | |

| Total distributable earnings | | | 4,403,095 | |

| | | | | |

| Total net assets | | $ | 146,435,341 | |

| | | | | |

| Common shares issued and outstanding (14,787,750 authorized) | | | 10,558,290 | |

| | | | | |

| Net asset value per share | | $ | 13.87 | |

| | | | | |

See Notes to Consolidated Financial Statements

CONSOLIDATED STATEMENT OF OPERATIONS

For the six months ended June 30, 2019

(Unaudited)

| Investment Income: | | | |

| Interest | | $ | 6,827,955 | |

| Dividends | | | 89,520 | |

| Other | | | 66,534 | |

| | | | | |

| Total investment income | | | 6,984,009 | |

| | | | | |

| | | | | |

| Expenses: | | | | |

| Investment advisory fees | | | 652,122 | |

| Interest | | | 306,750 | |

| Professional fees | | | 160,130 | |

| Trustees' fees and expenses | | | 120,000 | |

| Reports to shareholders | | | 72,000 | |

| Custodian fees | | | 12,000 | |

| Other | | | 57,597 | |

| | | | | |

| Total expenses | | | 1,380,599 | |

| | | | | |

| Investment income - net | | | 5,603,410 | |

| | | | | |

| Net realized and unrealized gain on investments: | | | | |

| Net realized gain on investments before taxes | | | 1,801,122 | |

| Income tax expense | | | (85,278 | ) |

| | | | | |

| Net realized gain on investments after taxes | | | 1,715,844 | |

| | | | | |

| Net increase (decrease) in unrealized appreciation (depreciation) of investments before taxes | | | 2,744,652 | |

| | | | | |

| Net increase (decrease) in unrealized appreciation (depreciation) of investments after taxes | | | 2,744,652 | |

| | | | | |

| Net gain on investments | | | 4,460,496 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 10,063,906 | |

| | | | | |

See Notes to Consolidated Financial Statements

Barings Participation Investors

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended June 30, 2019

(Unaudited)

| Net decrease in cash: | | | |

| Cash flows from operating activities: | | | |

| Purchases/Proceeds/Maturities from short-term portfolio securities, net | | $ | (9,458,031 | ) |

| Purchases of portfolio securities | | | (9,501,337 | ) |

| Proceeds from disposition of portfolio securities | | | 17,607,436 | |

| Interest, dividends and other income received | | | 5,985,680 | |

| Interest expense paid | | | (306,750 | ) |

| Operating expenses paid | | | (972,399 | ) |

| Income taxes paid | | | (932,484 | ) |

| Net cash provided by operating activities | | | 2,422,115 | |

Cash flows from financing activities: | | | | |

| Cash dividends paid from net investment income | | | (5,688,875 | ) |

| Receipts for shares issued on reinvestment of dividends | | | 468,946 | |

| Net cash used for financing activities | | | (5,219,929 | ) |

| Net decrease in cash | | | (2,797,814 | ) |

| Cash - beginning of period | | | 16,436,971 | |

| Cash - end of period | | $ | 13,639,157 | |

| | | | | |

| | | | | |

Reconciliation of net decrease in net assets to

net cash provided by operating activities: | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 10,063,906 | |

| Increase in investments | | | (5,679,493 | ) |

| Decrease in interest receivable | | | 120,630 | |

| Increase in receivable for investments sold | | | (386,841 | ) |

| Increase in other assets | | | (11,861 | ) |

| Decrease in tax payable | | | (847,206 | ) |

| Increase in investment advisory fee payable | | | 17,295 | |

| Increase in accrued expenses | | | 84,155 | |

| Decrease in payable for investments purchased | | | (938,470 | ) |

| Total adjustments to net assets from operations | | | (7,641,791 | ) |

| Net cash provided by operating activities | | $ | 2,422,115 | |

| | | | | |

See Notes to Consolidated Financial Statements

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

| | | For the six

months ended

6/30/2019

(Unaudited) | | | For the

year ended

12/31/2018 | |

| Increase / (decrease) in net assets: | | | | | | |

| Operations: | | | | | | |

| Investment income - net | | $ | 5,603,410 | | | $ | 10,797,239 | |

| Net realized gain on investments after taxes | | | 1,715,844 | | | | 2,674,681 | |

| Net change in unrealized appreciation (depreciation) of investments after taxes | | | 2,744,652 | | | | (9,832,362 | ) |

| Net increase in net assets resulting from operations | | | 10,063,906 | | | | 3,639,558 | |

| | | | | | | | | |

| Increase from common shares issued on reinvestment of dividends | | | | | | | | |

| Common shares issued (2019 - 31,391; 2018 - 68,737) | | | 468,946 | | | | 971,512 | |

| | | | | | | | | |

| Dividends to shareholders from: | | | | | | | | |

| Distributable earnings to Common Stock Shareholders (2019 - $0.27 per share; 2018 - $1.08 per share) | | | (2,846,612 | ) | | | (11,342,034 | ) |

| Total increase / (decrease) in net assets | | | 7,686,240 | | | | (6,730,964 | ) |

| | | | | | | | | |

| Net assets, beginning of period/year | | | 138,749,101 | | | | 145,480,065 | |

| | | | | | | | | |

| | | | | | | | | |

| Net assets, end of period/year | | $ | 146,435,341 | | | $ | 138,749,101 | |

| | | | | | | | | |

See Notes to Consolidated Financial Statements

Barings Participation Investors

CONSOLIDATED SELECTED FINANCIAL HIGHLIGHTS

Selected data for each share of beneficial interest outstanding:

| | | For the six

months ended

6/30/2019

(Unaudited) | | | For the years ended December 31, | |

| | | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Net asset value: | | | | | | | | | | | | | | | |

| Beginning of period/year | | $ | 13.18 | | | $ | 13.91 | | | $ | 13.15 | | | $ | 13.10 | | | $ | 13.35 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.53 | | | | 1.03 | | | | 1.09 | | | | 1.00 | | | | 0.95 | |

| Net realized and unrealized gain (loss) on investments | | | 0.42 | | | | (0.68) | | | | 0.75 | | | | 0.13 | | | | (0.12) | |

| | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | 0.95 | | | | 0.35 | | | | 1.84 | | | | 1.13 | | | | 0.83 | |

| | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income to common shareholders | | | (0.27) | | | | (1.08) | | | | (1.08) | | | | (1.08) | | | | (1.08) | |

| Dividends from realized gain on investments to common shareholders | | | — | | | | — | | | | — | | | | — | | | | — | |

| Increase from dividends reinvested | | | 0.01 (b) | | | | (0.00) (b) | | | | (0.00) | | | | (0.00) | | | | (0.00) | |

| | | | | | | | | | | | | | | | | | | | | |

| Total dividends | | | (0.26) | | | | (1.08) | | | | (1.08) | | | | (1.08) | | | | (1.08) | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value: End of period/year | | $ | 13.87 | | | $ | 13.18 | | | $ | 13.91 | | | $ | 13.15 | | | $ | 13.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| Per share market value: | | | | | | | | | | | | | | | | | | | | |

| End of period/year | | $ | 16.31 | | | $ | 15.05 | | | $ | 14.10 | | | $ | 14.20 | | | $ | 13.75 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total investment return | | | | | | | | | | | | | | | | | | | | |

| Net asset value (c) | | | 7.34% | | | | 2.53% | | | | 14.29% | | | | 8.75% | | | | 6.23% | |

| Market value (c) | | | 10.30% | | | | 15.02% | | | | 7.21% | | | | 11.45% | | | | 12.66% | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets (in millions): | | | | | | | | | | | | | | | | | | | | |

| End of period/year | | $ | 146.44 | | | $ | 138.75 | | | $ | 145.48 | | | $ | 136.61 | | | $ | 135.35 | |

| Ratio of total expenses to average net assets (d) | | | 2.06% (e) | | | | 2.76% | | | | 3.23% | | | | 2.26% | | | | 2.17% | |

| Ratio of operating expenses to average net assets | | | 1.51% (e) | | | | 1.56% | | | | 1.49% | | | | 1.35% | | | | 1.49% | |

| Ratio of interest expense to average net assets | | | 0.43% (e) | | | | 0.42% | | | | 0.43% | | | | 0.44% | | | | 0.44% | |

| Ratio of income tax expense to average net assets | | | 0.12% (e) | | | | 0.78% | | | | 1.31% | | | | 0.47% | | | | 0.24% | |

| Ratio of net investment income to average net assets | | | 7.88% (e) | | | | 7.47% | | | | 7.92% | | | | 7.45% | | | | 6.95% | |

| Portfolio turnover | | | 6% | | | | 48% | | | | 24% | | | | 31% | | | | 30% | |

| (a) | Calculated using average shares. |

| (b) | Rounds to less than $0.01 per share. |

| (c) | Net asset value return represents portfolio returns based on change in the Trust's net asset value assuming the reinvestment of all dividends and distributions which differs from the total investment return based on the Trust's market value due to the difference between the Trust's net asset value and the market value of its shares outstanding; past performance is no guarantee of future results. |

| (d) | Total expenses include income tax expense. |

| Senior borrowings: | | | | | | | | | | | | | | | |

| Total principal amount (in millions) | | $ | 15 | | | $ | 15 | | | $ | 15 | | | $ | 15 | | | $ | 15 | |

| | | | | | | | | | | | | | | | | | | | | |

| Asset coverage per $1,000 of indebtedness | | $ | 10,762 | | | $ | 10,250 | | | $ | 10,699 | | | $ | 10,107 | | | $ | 10,023 | |

See Notes to Consolidated Financial Statements

CONSOLIDATED SCHEDULE OF INVESTMENTS

June 30, 2019

(Unaudited)

| Corporate Restricted Securities - 87.68%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| Private Placement Investments - 82.70%: (C) | | | | | | | | | | | | |

| | |

| 1A Smart Start, Inc. | |

| A designer, distributor and lessor of ignition interlock devices ("IIDs"). IIDs are sophisticated breathalyzers wired to a vehicles ignition system. | |

10.65% Second Lien Term Loan due 12/22/2022 (LIBOR + 8.250%) | | $ | 1,725,000 | | | 12/21/17 | | | $ | 1,701,764 | | | $ | 1,688,653 | |

| | |

| ABC Industries, Inc. | |

| A manufacturer of mine and tunneling ventilation products in the U.S. | |

| 13% Senior Subordinated Note due 07/31/2019 | | $ | 109,335 | | | 08/01/12 | | | | 109,124 | | | | 109,335 | |

| Preferred Stock Series A (B) | | 125,000 shs. | | | 08/01/12 | | | | 125,000 | | | | 287,548 | |

Warrant, exercisable until 2022, to purchase common stock at $.02 per share (B) | | 22,414 shs. | | | 08/01/12 | | | | 42,446 | | | | 48,699 | |

| | | | | | | | | | | 276,570 | | | | 445,582 | |

| | | | | | | | | | | | | | | | |

| Accelerate Learning | |

| A provider of standards-based, digital science education content of K-12 schools. | |

6.83% Term Loan due 12/31/2024 (LIBOR + 4.500%) | | $ | 1,083,664 | | | 12/19/18 | | | | 1,063,891 | | | | 1,059,175 | |

| | |

| Advanced Manufacturing Enterprises LLC | |

| A designer and manufacturer of large, custom gearing products for a number of critical customer applications. | |

| Limited Liability Company Unit (B) | | 1,945 uts. | | | | * | | | | 207,911 | | | | 31,487 | |

| * 12/07/12, 07/11/13 and 06/30/15. | | | | | | | | | | | | | | | | |

| | |

| AFC - Dell Holding Corporation | |

| A distributor and provider of inventory management services for "C-Parts" used by OEMs in their manufacturing and production facilities. | |

13% (1% PIK) Senior Subordinated Note due 02/28/2022 | | $ | 1,555,029 | | | | * | | | | 1,543,945 | | | | 1,555,030 | |

| Preferred Stock (B) | | 1,174 shs. | | | | ** | | | | 117,405 | | | | 151,785 | |

| Common Stock (B) | | 363 shs. | | | | ** | | | | 363 | | | | — | |

| * 03/27/15 and 11/16/18. | | | | | | | | | | | 1,661,713 | | | | 1,706,815 | |

| ** 03/27/15 and 11/15/18. | | | | | | | | | | | | | | | | |

| | |

| Aftermath, Inc. | |

| A provider of crime scene cleanup and biohazard remediation services. | |

8.33% Term Loan due 04/10/2025 (LIBOR + 5.750%) | | $ | 1,259,442 | | | 04/09/19 | | | | 1,232,165 | | | | 1,234,221 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | |

| AM Conservation Holding Corp. | |

| A supplier of energy efficiency ("EE") products, including lighting, shower heads and aerators, and weatherization products such as door seals and weather stripping. | |

11.5% (1.5% PIK) Senior Subordinated Note due 04/30/2023 | | $ | 1,568,182 | | | | 10/31/16 | | | $ | 1,552,626 | | | $ | 1,591,705 | |

11.5% (1.25% PIK) Senior Subordinated Note due 04/30/2023 | | $ | 206,039 | | | | 10/06/17 | | | | 202,935 | | | | 210,159 | |

| Common Stock (B) | | 156,818 shs. | | | | 10/31/16 | | | | 156,818 | | | | 229,941 | |

| | | | | | | | | | | | 1,912,379 | | | | 2,031,805 | |

| | |

| AMS Holding LLC | |

| A leading multi-channel direct marketer of high-value collectible coins and proprietary-branded jewelry and watches. | |

Limited Liability Company Unit Class A Preferred (B)(F) | | 114 uts. | | | | 10/04/12 | | | | 113,636 | | | | 161,570 | |

| | | | | | | | | | | | | | | | | |

| ASC Holdings, Inc. | |

| A manufacturer of capital equipment used by corrugated box manufacturers. | |

13% (1% PIK) Senior Subordinated Note due 05/18/2021 | | $ | 767,613 | | | | 11/19/15 | | | | 761,309 | | | | 614,090 | |

| Limited Liability Company Unit (B) | | 111,100 uts. | | | | 11/18/15 | | | | 111,100 | | | | — | |

| | | | | | | | | | | | 872,409 | | | | 614,090 | |

| | |

| Audio Precision | |

| A provider of high-end audio test and measurement sensing instrumentation software and accessories. | |

7.83% Term Loan due 07/27/2024 (LIBOR + 5.500%) | | $ | 1,795,500 | | | | 10/30/18 | | | | 1,763,753 | | | | 1,721,255 | |

| | |

| Aurora Parts & Accessories LLC | |

| A distributor of aftermarket over-the-road semi-trailer parts and accessories sold to customers across North America. | |

| 14% Junior Subordinated Note due 08/17/2022 | | $ | 11,623 | | | | 08/30/18 | | | | 11,623 | | | | 11,711 | |

| 11% Senior Subordinated Note due 02/17/2022 | | $ | 1,515,400 | | | | 08/17/15 | | | | 1,500,440 | | | | 1,515,400 | |

| Preferred Stock (B) | | 210 shs. | | | | 08/17/15 | | | | 209,390 | | | | 189,916 | |

| Common Stock (B) | | 210 shs. | | | | 08/17/15 | | | | 210 | | | | — | |

| | | | | | | | | | | | 1,721,663 | | | | 1,717,027 | |

| | |

| Avantech Testing Services LLC | |

| A manufacturer of custom Non-Destructive Testing ("NDT") systems and provider of NDT and inspections services primarily to the oil country tubular goods market. | |

15% (3.75% PIK) Senior Subordinated Note due 03/31/2021 (D) | | $ | 6,777 | | | | 07/31/14 | | | | 6,650 | | | | — | |

| Limited Liability Company Unit (B)(F) | | 45,504 uts. | | | | * | | | | — | | | | — | |

Limited Liability Company Unit Class C Preferred (B)(F) | | 78,358 uts. | | | | 09/29/17 | | | | 484,578 | | | | — | |

| * 07/31/14 and 10/14/15. | | | | | | | | | | | 491,228 | | | | — | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | |

| BBB Industries LLC | |

| A supplier of re-manufactured parts to the North American automotive aftermarket. | |

10.83% Second Lien Term Loan due 06/26/2026 (LIBOR + 8.500%) | | $ | 1,725,000 | | | 08/02/18 | | | $ | 1,679,128 | | | $ | 1,664,711 | |

| | | | | | | | | | | | | | | | |

| BCC Software, Inc. | | | | | | | | | | | | | | | |

| A provider of software and data solutions which enhance mail processing to help direct mail marketers realize discounts from the U.S. Postal Service, avoid penalties associated with mailing errors, and improve the accuracy and efficiency of marketing campaigns. | |

12% (1% PIK) Senior Subordinated Note due 04/11/2023 | | $ | 1,910,735 | | | | * | | | | 1,881,092 | | | | 1,921,677 | |

| Preferred Stock Series A (B) | | 27 shs. | | | | * | | | | 272,163 | | | | 272,200 | |

| Common Stock Class A (B) | | 783 shs. | | | | * | | | | 861 | | | | 297,981 | |

| * 10/11/17 and 01/28/19. | | | | | | | | | | | 2,154,116 | | | | 2,491,858 | |

| | | | | | | | | | | | | | | | | |

| BDP International, Inc. | | | | | | | | | | | | | | | | |

| A provider of transportation and related services to the chemical and life sciences industries. | |

7.58% Term Loan due 12/14/2024 (LIBOR + 5.250%) | | $ | 2,458,838 | | | 12/18/18 | | | | 2,414,023 | | | | 2,403,256 | |

| | | | | | | | | | | | | | | | | |

| BEI Precision Systems & Space Company, Inc. | | | | | | | | | | | | | | | | |

| A provider of advanced design, manufacturing, and testing for custom optical encoder-based positioning systems, precision accelerometers, and micro scanners. | |

12% (1% PIK) Senior Subordinated Note due 04/28/2024 | | $ | 1,480,774 | | | 04/28/17 | | | | 1,458,318 | | | | 1,459,227 | |

| Limited Liability Company Unit (B)(F) | | 2,893 uts. | | | | * | | | | 289,269 | | | | 244,629 | |

| * 04/28/17 and 02/07/19. | | | | | | | | | | | 1,747,587 | | | | 1,703,856 | |

| | | | | | | | | | | | | | | | | |

| Blue Wave Products, Inc. | | | | | | | | | | | | | | | | |

| A distributor of pool supplies. | | | | | | | | | | | | | | | | |

13% (1% PIK) Senior Subordinated Note due 09/30/2019 | | $ | 168,943 | | | 10/12/12 | | | | 168,286 | | | | 168,849 | |

| Common Stock (B) | | 51,064 shs. | | | 10/12/12 | | | | 51,064 | | | | 45,635 | |

Warrant, exercisable until 2022, to purchase common stock at $.01 per share (B) | | 20,216 shs. | | | 10/12/12 | | | | 20,216 | | | | 18,067 | |

| | | | | | | | | | | | 239,566 | | | | 232,551 | |

| | | | | | | | | | | | | | | | | |

| BlueSpire Holding, Inc. | | | | | | | | | | | | | | | | |

| A marketing services firm that integrates strategy, technology, and content to deliver customized marketing solutions for clients in the senior living, financial services and healthcare end markets. | |

| Common Stock (B) | | 2,956 shs. | | | 06/30/15 | | | | 937,438 | | | | — | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| Brown Machine LLC | | | | | | | | | | | | |

| A designer and manufacturer of thermoforming equipment used in the production of plastic packaging containers within the food and beverage industry. | |

7.83% Term Loan due 10/04/2024 (LIBOR + 5.250%) | | $ | 715,482 | | | 10/03/18 | | | $ | 707,641 | | | $ | 702,588 | |

| | | | | | | | | | | | | | | | |

| Cadence, Inc. | | | | | | | | | | | | | | | |

| A full-service contract manufacturer ("CMO") and supplier of advanced products, technologies, and services to medical device, life science, and industrial companies. | |

6.9% Lien Term Loan due 04/30/2025 (LIBOR + 4.500%) | | $ | 904,409 | | | | * | | | | 889,134 | | | | 886,435 | |

| * 05/14/18 and 05/31/19. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Cadent, LLC | | | | | | | | | | | | | | | | |

| A provider of advertising solutions driven by data and technology. | |

7.63% Term Loan due 09/07/2023 (LIBOR + 5.250%) | | $ | 1,020,908 | | | 09/04/18 | | | | 1,012,312 | | | | 1,015,803 | |

| | | | | | | | | | | | | | | | | |

| CHG Alternative Education Holding Company | | | | | | | | | | | | | | | | |

| A leading provider of publicly-funded, for profit pre-K-12 education services targeting special needs children at therapeutic day schools and "at risk" youth through alternative education programs. | |

13.5% (1.5% PIK) Senior Subordinated Note due 06/19/2020 | | $ | 810,002 | | | 01/19/11 | | | | 807,449 | | | | 810,002 | |

14% (2% PIK) Senior Subordinated Note due 06/19/2020 | | $ | 215,625 | | | 08/03/12 | | | | 215,015 | | | | 214,570 | |

| Common Stock (B) | | 375 shs. | | | 01/19/11 | | | | 37,500 | | | | 28,888 | |

Warrant, exercisable until 2021, to purchase common stock at $.01 per share (B) | | 295 shs. | | | 01/19/11 | | | | 29,250 | | | | 22,708 | |

| | | | | | | | | | | | 1,089,214 | | | | 1,076,168 | |

| | | | | | | | | | | | | | | | | |

| Clarion Brands Holding Corp. | | | | | | | | | | | | | | | | |

| A portfolio of six over-the-counter (OTC) pharmaceutical brands whose products are used to treat tinnitus or ringing of the ear, excessive sweating, urinary tract infections, muscle pain, and skin conditions. | |

| Limited Liability Company Unit (B) | | 1,853 uts. | | | 07/18/16 | | | | 189,267 | | | | 328,349 | |

| | | | | | | | | | | | | | | | | |

| Claritas Holdings, Inc. | | | | | | | | | | | | | | | | |

| A market research company that provides market segmentation insights to customers engaged in direct-to-consumer and business-to-business marketing activities. | |

| 8.33% Term Loan due 12/31/2023 (LIBOR +6.000%) | | $ | 1,636,924 | | | 12/20/18 | | | | 1,600,304 | | | | 1,632,913 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| Clubessential LLC | | | | | | | | | | | | |

| A leading SaaS platform for private clubs and resorts. | |

12.09% Senior Subordinated Note due 01/12/2024 (LIBOR +9.500%) | | $ | 1,787,305 | | | 01/16/18 | | | $ | 1,758,737 | | | $ | 1,746,303 | |

| | | | | | | | | | | | | | | | |

| CORA Health Services, Inc. | | | | | | | | | | | | | | | |

| A provider of outpatient rehabilitation therapy services. | |

| 11% (1% PIK) Term Loan due 05/05/2025 | | $ | 1,679,878 | | | | * | | | | 1,181,182 | | | | 1,181,182 | |

| Preferred Stock Series A (B) | | 758 shs. | | | 06/30/16 | | | | 2,647 | | | | 100,000 | |

| Common Stock Class A (B) | | 3,791 shs. | | | 06/30/16 | | | | 3,791 | | | | 124,886 | |

| * 05/01/18 and 06/28/19. | | | | | | | | | | | 1,187,620 | | | | 1,406,068 | |

| | | | | | | | | | | | | | | | | |

| Dart Buyer, Inc. | | | | | | | | | | | | | | | | |

| A manufacturer of helicopter aftermarket equipment and OEM Replacement parts for rotorcraft operators, providers and OEMs. | |

7.84% Term Loan due 04/01/2025 (LIBOR + 5.250%) | | $ | 1,725,000 | | | 04/01/19 | | | | 828,716 | | | | 832,344 | |

| | | | | | | | | | | | | | | | | |

| Del Real LLC | | | | | | | | | | | | | | | | |

| A manufacturer and distributor of fully-prepared fresh refrigerated Hispanic entrees as well as side dishes that are typically sold on a heat-and-serve basis at retail grocers. | |

| 11% Senior Subordinated Note due 04/06/2023 | | $ | 1,420,588 | | | 10/07/16 | | | | 1,401,681 | | | | 1,286,164 | |

| Limited Liability Company Unit (B)(F) | | 368,799 uts. | | | | * | | | | 368,928 | | | | 196,914 | |

| * 10/07/16, 07/25/18, 03/13/19 and 06/17/19. | | | | | | | | | | | 1,770,609 | | | | 1,483,078 | |

| | | | | | | | | | | | | | | | | |

| Discovery Education, Inc. | | | | | | | | | | | | | | | | |

| A provider of standards-based, digital education content for K-12 schools. | |

6.65% Term Loan due 04/30/2024 (LIBOR + 4.750%) | | $ | 1,921,590 | | | 04/20/18 | | | | 1,890,645 | | | | 1,915,722 | |

| | | | | | | | | | | | | | | | | |

| DPL Holding Corporation | | | | | | | | | | | | | | | | |

| A distributor and manufacturer of aftermarket undercarriage parts for medium and heavy duty trucks and trailers. | |

| Preferred Stock (B) | | 25 shs. | | | 05/04/12 | | | | 252,434 | | | | 281,815 | |

| Common Stock (B) | | 25 shs. | | | 05/04/12 | | | | 28,048 | | | | — | |

| | | | | | | | | | | | 280,482 | | | | 281,815 | |

| | | | | | | | | | | | | | | | | |

| DuBois Chemicals, Inc. | | | | | | | | | | | | | | | | |

| A provider of consumable, value-added specialty cleaning chemical solutions to the industrial, transportation paper and water markets. | |

10.4% Second Lien Term Loan due 08/31/2025 (LIBOR + 8.000%) | | $ | 1,725,000 | | | 09/19/18 | | | | 1,709,722 | | | | 1,677,562 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | | |

| Dunn Paper | | | | | | | | | | | | | |

| A provider of specialty paper for niche product applications. | |

11.15% Second Lien Term Loan due 08/26/2023 (LIBOR + 8.750%) | | $ | 1,725,000 | | | | 09/28/16 | | | $ | 1,704,124 | | | $ | 1,705,594 | |

| | | | | | | | | | | | | | | | | |

| ECG Consulting Group | | | | | | | | | | | | | | | | |

| A healthcare management consulting company who provides strategic, financial, operational, and technology related consulting services to healthcare providers. | |

11.5% (0.5% PIK) Senior Subordinated Note due 06/20/2025 | | $ | 571,969 | | | | 06/20/18 | | | | 561,728 | | | | 583,408 | |

11.5% (0.5% PIK) Senior Subordinated Note due 06/20/2025 | | $ | 1,333,569 | | | | 11/21/14 | | | | 1,320,569 | | | | 1,333,569 | |

| Limited Liability Company Unit (F) | | 230 uts. | | | | 11/19/14 | | | | 36,199 | | | | 175,064 | |

| | | | | | | | | | | | 1,918,496 | | | | 2,092,041 | |

| | | | | | | | | | | | | | | | | |

| Electronic Power Systems | | | | | | | | | | | | | | | | |

| A provider of electrical testing services for apparatus equipment and protection & controls infrastructure. | |

7.33% Term Loan due 12/21/2024 (LIBOR + 5.000%) | | $ | 1,761,536 | | | | 12/21/18 | | | | 1,737,350 | | | | 1,730,143 | |

| Common Stock (B) | | 52 shs. | | | | 12/28/18 | | | | 52,176 | | | | 55,944 | |

| | | | | | | | | | | | 1,789,526 | | | | 1,786,087 | |

| | | | | | | | | | | | | | | | | |

| Elite Sportwear Holding, LLC | | | | | | | | | | | | | | | | |

| A designer and manufacturer of gymnastics, competitive cheerleading and swimwear apparel in the U.S. and internationally. | |

11.5% (1% PIK) Senior Subordinated Note due 09/20/2022 (D) | | $ | 1,588,640 | | | | 10/14/16 | | | | 1,568,694 | | | | 1,509,208 | |

| Limited Liability Company Unit (B)(F) | | 101 uts. | | | | 10/14/16 | | | | 159,722 | | | | 23,179 | |

| | | | | | | | | | | | 1,728,416 | | | | 1,532,387 | |

| | | | | | | | | | | | | | | | | |

| English Color & Supply LLC | | | | | | | | | | | | | | | | |

| A distributor of aftermarket automotive paint and related products to collision repair shops, auto dealerships and fleet customers through a network of stores in the Southern U.S. | |

11.5% (0.5% PIK) Senior Subordinated Note due 12/31/2023 | | $ | 1,340,636 | | | | 06/30/17 | | | | 1,320,303 | | | | 1,340,636 | |

| Limited Liability Company Unit (B)(F) | | 397,695 uts. | | | | 06/30/17 | | | | 397,695 | | | | 455,075 | |

| | | | | | | | | | | | 1,717,998 | | | | 1,795,711 | |

| | | | | | | | | | | | | | | | | |

| E.S.P. Associates, P.A. | | | | | | | | | | | | | | | | |

| A professional services firm providing engineering, surveying and planning services to infrastructure projects. | |

| Limited Liability Company Unit (B) | | 229 uts. | | | | 04/04/18 | | | | 228,955 | | | | 328,300 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| F G I Equity LLC | | | | | | | | | | | | |

| A manufacturer of a broad range of filters and related products that are used in commercial, light industrial, healthcare, gas turbine, nuclear, laboratory, clean room, hotel, educational system, and food processing settings. | |

| Limited Liability Company Unit Class B-1 (B) | | 65,789 uts. | | | 12/15/10 | | | $ | 56,457 | | | $ | 626,055 | |

| Limited Liability Company Unit Class B-2 (B) | | 8,248 uts. | | | 12/15/10 | | | | 7,078 | | | | 78,489 | |

| Limited Liability Company Unit Class B-3 (B) | | 6,522 uts. | | | 08/30/12 | | | | 13,844 | | | | 63,757 | |

| Limited Liability Company Unit Class C (B) | | 1,575 uts. | | | 12/20/10 | | | | 8,832 | | | | 87,493 | |

| | | | | | | | | | 86,211 | | | | 855,794 | |

| | | | | | | | | | | | | | | |

| GD Dental Services LLC | | | | | | | | | | | | | | |

| A provider of convenient "onestop" general, specialty, and cosmetic dental services with 21 offices located throughout South and Central Florida. | |

| Limited Liability Company Unit Preferred (B) | | 76 uts. | | | 10/05/12 | | | | 75,920 | | | | 34,029 | |

| Limited Liability Company Unit Common (B) | | 767 uts. | | | 10/05/12 | | | | 767 | | | | — | |

| | | | | | | | | | 76,687 | | | | 34,029 | |

| | | | | | | | | | | | | | | |

| gloProfessional Holdings, Inc. | | | | | | | | | | | | | | |

| A marketer and distributor of premium mineral-based cosmetics, cosmeceuticals and professional hair care products to the professional spa and physician's office channels. | |

14% (2% PIK) Senior Subordinated Note due 11/30/2021 (D) | | $ | 1,339,546 | | | 03/27/13 | | | | 948,916 | | | | 1,272,569 | |

| Preferred Stock (B) | | 295 shs. | | | 03/29/19 | | | | 295,276 | | | | 295,276 | |

| Common Stock (B) | | 1,181 shs. | | | 03/27/13 | | | | 118,110 | | | | 17,816 | |

| | | | | | | | | | | 1,362,302 | | | | 1,585,661 | |

| | | | | | | | | | | | | | | | |

| GraphPad Software, Inc. | | | | | | | | | | | | | | | |

| A provider of data analysis, statistics and graphing software solution for scientific research applications, with a focus on the life sciences and academic end-markets. | |

8.33% Term Loan due 12/21/2022 (LIBOR + 6.000%) | | $ | 2,458,838 | | | | * | | | | 2,422,211 | | | | 2,422,274 | |

| * 12/19/17 and 04/16/19. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| GTI Holding Company | | | | | | | | | | | | | | | | |

| A designer, developer, and marketer of precision specialty hand tools and handheld test instruments. | |

| Common Stock (B) | | 1,046 shs. | | | | * | | | | 104,636 | | | | 134,803 | |

Warrant, exercisable until 2027, to purchase common stock at $.01 per share (B) | | 397 shs. | | | 02/05/14 | | | | 36,816 | | | | 51,164 | |

| * 02/05/14 and 11/22/17. | | | | | | | | | | | 141,452 | | | | 185,967 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | |

| Handi Quilter Holding Company (Premier Needle Arts) | |

| A designer and manufacturer of long-arm quilting machines and related components for the consumer quilting market. | |

| Limited Liability Company Unit Preferred (B) | | 372 uts. | | | | * | | | $ | 371,644 | | | $ | 497,021 | |

Limited Liability Company Unit Common Class A (B) | | 3,594 uts. | | | 12/19/14 | | | | — | | | | — | |

| * 12/19/14 and 04/29/16. | | | | | | | | | | 371,644 | | | | 497,021 | |

| | | | | | | | | | | | | | | | |

| Happy Floors Acquisition, Inc. | | | | | | | | | | | | | | | |

| A wholesale importer and value-added distributor of premium European flooring tile to residential and commercial end markets. | |

11.5% (1% PIK) Senior Subordinated Note due 01/01/2023 | | $ | 1,001,369 | | | 07/01/16 | | | | 989,704 | | | | 1,011,383 | |

| Common Stock (B) | | 150 shs. | | | 07/01/16 | | | | 149,500 | | | | 192,907 | |

| | | | | | | | | | | | 1,139,204 | | | | 1,204,290 | |

| | | | | | | | | | | | | | | | | |

| Hartland Controls Holding Corporation | | | | | | | | | | | | | | | | |

| A manufacturer and distributor of electronic and electromechanical components. | |

14% (2% PIK) Senior Subordinated Note due 08/14/2020 | | $ | 1,162,959 | | | 02/14/14 | | | | 1,158,371 | | | | 1,162,959 | |

| 12% Senior Subordinated Note due 08/14/2020 | | $ | 431,250 | | | 06/22/15 | | | | 430,195 | | | | 431,250 | |

| Common Stock (B) | | 821 shs. | | | 02/14/14 | | | | 822 | | | | 290,381 | |

| | | | | | | | | | | | 1,589,388 | | | | 1,884,590 | |

| | | | | | | | | | | | | | | | | |

| Healthline Media, Inc. | | | | | | | | | | | | | | | | |

| A consumer health platform that offers a variety of health-based articles and information for consumers. | |

7.13% Term Loan due 11/20/2023 (LIBOR + 4.750%) | | $ | 1,645,637 | | | 11/20/18 | | | | 1,616,073 | | | | 1,638,334 | |

| | | | | | | | | | | | | | | | | |

| HHI Group, LLC | | | | | | | | | | | | | | | | |

| A developer, marketer, and distributor of hobby-grade radio control products. | |

14% (2% PIK) Senior Subordinated Note due 11/26/2020 | | $ | 1,701,039 | | | 01/17/14 | | | | 1,693,617 | | | | 1,701,039 | |

| Limited Liability Company Unit (B)(F) | | 102 uts. | | | 01/17/14 | | | | 101,563 | | | | 113,061 | |

| | | | | | | | | | | | 1,795,180 | | | | 1,814,100 | |

| | | | | | | | | | | | | | | | | |

| Hollandia Produce LLC | | | | | | | | | | | | | | | | |

| A hydroponic greenhouse producer of branded root vegetables. | |

11% (3.25% PIK) Senior Subordinated Note due 03/31/2021 | | $ | 1,470,027 | | | | * | | | | 1,460,166 | | | | 1,470,027 | |

10.44% Term Loan due 12/12/2020 (LIBOR + 8.000%) | | $ | 109,916 | | | 04/06/18 | | | | 109,916 | | | | 109,722 | |

10.44% Term Loan due 12/11/2020 (LIBOR + 8.000%) | | $ | 146,780 | | | 04/06/18 | | | | 146,780 | | | | 146,522 | |

| * 12/30/15 and 12/23/16. | | | | | | | | | | | 1,716,862 | | | | 1,726,271 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | | |

| Holley Performance Products | | | | | | | | | | | | | |

| A provider of automotive aftermarket performance products. | |

7.58% Term Loan due 10/17/2024 (LIBOR + 5.000%) | | $ | 2,452,675 | | | | 10/24/18 | | | $ | 2,419,312 | | | $ | 2,379,095 | |

| | | | | | | | | | | | | | | | | |

| HOP Entertainment LLC | | | | | | | | | | | | | | | | |

| A provider of post production equipment and services to producers of television shows and motion pictures. | |

| Limited Liability Company Unit Class F (B)(F) | | 47 uts. | | | | 10/14/11 | | | | — | | | | — | |

| Limited Liability Company Unit Class G (B)(F) | | 114 uts. | | | | 10/14/11 | | | | — | | | | — | |

| Limited Liability Company Unit Class H (B)(F) | | 47 uts. | | | | 10/14/11 | | | | — | | | | — | |

| Limited Liability Company Unit Class I (B)(F) | | 47 uts. | | | | 10/14/11 | | | | — | | | | — | |

| | | | | | | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

| Impact Confections | | | | | | | | | | | | | | | | |

An independent manufacturer and marketer of confectionery products including Warheads® brand sour candies, Melster® brand classic candies, and co-manufactured/private label classic candies. | |

15%(15% PIK) Senior Subordinated Note due 11/10/2020 (D) | | $ | 1,092,190 | | | | 11/10/14 | | | | 1,084,388 | | | | — | |

| Common Stock (B) | | 2,300 shs. | | | | 11/10/14 | | | | 230,000 | | | | — | |

| | | | | | | | | | | | 1,314,388 | | | | — | |

| | | | | | | | | | | | | | | | | |

| JMH Investors LLC | | | | | | | | | | | | | | | | |

| A developer and manufacturer of custom formulations for a wide variety of foods. | |

| Limited Liability Company Unit (B)(F) | | 1,038,805 uts. | | | | 12/05/12 | | | | 232,207 | | | | — | |

| Limited Liability Company Unit Class A-1 (B)(F) | | 159,048 uts. | | | | 10/31/16 | | | | 159,048 | | | | 426,535 | |

| Limited Liability Company Unit Class A-2 (B)(F) | | 1,032,609 uts. | | | | 10/31/16 | | | | — | | | | 336,579 | |

| | | | | | | | | | | | 391,255 | | | | 763,114 | |

| | | | | | | | | | | | | | | | | |

| K P I Holdings, Inc. | | | | | | | | | | | | | | | | |

| The largest player in the U.S. non-automotive, non-ferrous die casting segment. | |

| Limited Liability Company Unit Class C Preferred (B) | | 40 uts. | | | | 06/30/15 | | | | — | | | | 94,881 | |

| Common Stock (B) | | 353 shs. | | | | 07/15/08 | | | | 285,619 | | | | 59,318 | |

| | | | | | | | | | | | 285,619 | | | | 154,199 | |

| | | | | | | | | | | | | | | | | |

| LAC Acquisition LLC | | | | | | | | | | | | | | | | |

| A provider of center-based applied behavior analysis treatment centers for children diagnosed with autism spectrum disorder. | |

8.08% Term Loan due 10/01/2024 (LIBOR + 5.750%) | | $ | 1,773,334 | | | | 10/01/18 | | | | 1,107,023 | | | | 1,095,237 | |

| Limited Liability Company Unit Class A (F) | | 22,222 uts. | | | | 10/01/18 | | | | 22,222 | | | | 18,667 | |

| | | | | | | | | | | | 1,129,245 | | | | 1,113,904 | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| Manhattan Beachwear Holding Company | | | | | | | | | | | | |

| A designer and distributor of women's swimwear. | |

12.5% Senior Subordinated Note due 05/30/2022 (D) | | $ | 419,971 | | | 01/15/10 | | | $ | 404,121 | | | $ | 398,972 | |

15% (2.5% PIK) Senior Subordinated Note due 05/30/2022 (D) | | $ | 115,253 | | | 10/05/10 | | | | 114,604 | | | | 109,490 | |

| Common Stock (B) | | 35 shs. | | | 10/05/10 | | | | 35,400 | | | | 15,726 | |

| Common Stock Class B (B) | | 118 shs. | | | 01/15/10 | | | | 117,647 | | | | 52,263 | |

Warrant, exercisable until 2023, to purchase common stock at $.01 per share (B) | | 104 shs. | | | 10/05/10 | | | | 94,579 | | | | 46,252 | |

| | | | | | | | | | | 766,351 | | | | 622,703 | |

| | | | | | | | | | | | | | | | |

| Master Cutlery LLC | | | | | | | | | | | | | | | |

| A designer and marketer of a wide assortment of knives and swords. | |

| 13% Senior Subordinated Note due 04/17/2020 | | $ | 896,315 | | | 04/17/15 | | | | 894,576 | | | | 26,889 | |

| Limited Liability Company Unit | | 5 uts. | | | 04/17/15 | | | | 678,329 | | | | — | |

| | | | | | | | | | | 1,572,905 | | | | 26,889 | |

| | | | | | | | | | | | | | | | |

| Merex Holding Corporation | | | | | | | | | | | | | | | |

| A provider of after-market spare parts and components, as well as maintenance, repair and overhaul services for "out of production" or "legacy" aerospace and defense systems that are no longer effectively supported by the original equipment manufacturers. | |

| 16% Senior Subordinated Note due 03/03/2022 (D) | | $ | 454,295 | | | 09/22/11 | | | | 449,013 | | | | 431,580 | |

15% PIK Senior Subordinated Note due 04/30/2022 (D) | | $ | 23,839 | | | 08/18/15 | | | | 23,839 | | | | 20,263 | |

15% PIK Senior Subordinated Note due 03/03/2022 (D) | | $ | 41,306 | | | 01/03/19 | | | | 41,306 | | | | 41,306 | |

| 14% PIK Senior Subordinated Note due 03/03/2022 | | $ | 76,188 | | | | * | | | | 76,188 | | | | 76,105 | |

| Common Stock Class A (B) | | 83,080 shs. | | | | ** | | | | 170,705 | | | | 208,729 | |

| * 10/21/16, 01/27/17 and 10/13/17. | | | | | | | | | | | 761,051 | | | | 777,983 | |

| ** 08/18/15, 10/20/16 and 01/27/17. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| MES Partners, Inc. | | | | | | | | | | | | | | | | |

| An industrial service business offering an array of cleaning and environmental services to the Gulf Coast region of the U.S. | |

12% (1% PIK) Senior Subordinated Note due 09/30/2021 | | $ | 1,134,615 | | | 09/30/14 | | | | 1,125,579 | | | | 1,134,615 | |

12% (1% PIK) Senior Subordinated Note due 09/30/2021 | | $ | 304,812 | | | 02/28/18 | | | | 300,749 | | | | 306,180 | |

| Common Stock Class B (B) | | 259,252 shs. | | | | * | | | | 244,163 | | | | 12,461 | |

| * 09/30/14 and 02/28/18. | | | | | | | | | | | 1,670,491 | | | | 1,453,256 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| MeTEOR Education LLC | | | | | | | | | | | | |

| A leading provider of classroom and common area design services, furnishings, equipment and instructional support to K-12 schools. | |

| 12% Senior Subordinated Note due 06/20/2023 | | $ | 915,819 | | | 03/09/18 | | | $ | 901,262 | | | $ | 908,564 | |

| Limited Liability Company Unit (B)(F) | | 182 uts. | | | 03/09/18 | | | | 183,164 | | | | 98,572 | |

| | | | | | | | | | | 1,084,426 | | | | 1,007,136 | |

| | | | | | | | | | | | | | | | |

| Midwest Industrial Rubber, Inc. | | | | | | | | | | | | | | | |

| A supplier of industrial maintenance, repair, and operations ("MRO") products, specializing in the fabrication and distribution of lightweight conveyor belting and related conveyor components and accessories. | |

12% (1% PIK) Senior Subordinated Note due 12/02/2022 | | $ | 1,594,206 | | | 12/02/16 | | | | 1,573,754 | | | | 1,610,148 | |

| Preferred Stock (B) | | 1,711 shs. | | | 12/02/16 | | | | 171,116 | | | | 213,130 | |

| Common Stock (B) | | 242 shs. | | | 12/02/16 | | | | 242 | | | | 28,298 | |

| | | | | | | | | | | 1,745,112 | | | | 1,851,576 | |

| | | | | | | | | | | | | | | | |

| Motion Controls Holdings | | | | | | | | | | | | | | | |

| A manufacturer of high performance mechanical motion control and linkage products. | |

14.25% (1.75% PIK) Senior Subordinated Note due 08/15/2020 | | $ | 291,812 | | | 11/30/10 | | | | 291,054 | | | | 291,812 | |

| Limited Liability Company Unit Class B-1 (B)(F) | | 75,000 uts. | | | 11/30/10 | | | | — | | | | 59,825 | |

| Limited Liability Company Unit Class B-2 (B)(F) | | 6,801 uts. | | | 11/30/10 | | | | — | | | | 5,425 | |

| | | | | | | | | | | 291,054 | | | | 357,062 | |

| | | | | | | | | | | | | | | | |

| New Mountain Learning, LLC | | | | | | | | | | | | | | | |

| A leading provider of blended learning solutions to the K-12 and post-secondary school market. | |

8.33% Term Loan due 03/16/2024 (LIBOR + 6.000%) | | $ | 1,693,422 | | | 03/15/18 | | | | 1,665,644 | | | | 1,515,641 | |

| | | | | | | | | | | | | | | | |

| NSi Industries Holdings, Inc. | | | | | | | | | | | | | | | |

| A manufacturer and distributer of electrical components and accessories to small to mid-sized electrical wholesalers. | |

12.75% (1.75% PIK) Senior Subordinated Note due 05/17/2023 | | $ | 1,959,064 | | | | * | | | | 1,930,573 | | | | 1,959,064 | |

| Common Stock (B) | | 207 shs. | | | 05/17/16 | | | | 207,000 | | | | 361,419 | |

| * 06/30/16 and 03/11/19. | | | | | | | | | | | 2,137,573 | | | | 2,320,483 | |

| | | | | | | | | | | | | | | | | |

| PANOS Brands LLC | | | | | | | | | | | | | | | | |

| A marketer and distributor of branded consumer foods in the specialty, natural, better-for-you,"free from" healthy and gluten-free categories. | |

12% (1% PIK) Senior Subordinated Note due 08/17/2022 | | $ | 1,775,705 | | | 02/17/17 | | | | 1,755,959 | | | | 1,784,584 | |

| Common Stock Class B (B) | | 380,545 shs. | | | | * | | | | 380,545 | | | | 461,408 | |

| * 01/29/16 and 02/17/17. | | | | | | | | | | | 2,136,504 | | | | 2,245,992 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| PB Holdings LLC | | | | | | | | | | | | |

| A designer, manufacturer and installer of maintenance and repair parts and equipment for industrial customers. | |

7.33% Term Loan due 02/28/2024 (LIBOR + 5.000%) | | $ | 947,136 | | | 03/06/19 | | | $ | 799,499 | | | $ | 805,669 | |

| | | | | | | | | | | | | | | | |

| Pegasus Transtech Corporation | | | | | | | | | | | | | | | |

| A provider of end-to-end document, driver and logistics management solutions, which enable its customers (carriers, brokers, and drivers) to operate more efficiently, reduce manual overhead, enhance compliance, and shorten cash conversion cycles. | |

| 11.25% Term Loan due 11/16/2022 | | $ | 172,413 | | | 11/14/17 | | | | 169,412 | | | | 167,215 | |

8.65% Term Loan due 11/17/2024 (LIBOR + 6.250%) | | $ | 1,947,417 | | | 11/14/17 | | | | 1,909,980 | | | | 1,898,413 | |

| | | | | | | | | | | 2,079,392 | | | | 2,065,628 | |

| | | | | | | | | | | | | | | | |

| Petroplex Inv Holdings LLC | | | | | | | | | | | | | | | |

| A leading provider of acidizing services to E&P customers in the Permian Basin. | |

| Limited Liability Company Unit | | 0.40% int. | | | | * | | | | 175,339 | | | | 19,442 | |

| * 11/29/12 and 12/20/16. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Polytex Holdings LLC | | | | | | | | | | | | | | | | |

| A manufacturer of water based inks and related products serving primarily the wall covering market. | |

13.9% (1% PIK) Senior Subordinated Note due 12/31/2020 | | $ | 1,069,985 | | | 07/31/14 | | | | 1,064,183 | | | | 534,992 | |

| Limited Liability Company Unit | | 148,096 uts. | | | 07/31/14 | | | | 148,096 | | | | — | |

| Limited Liability Company Unit Class F | | 36,976 uts. | | | | * | | | | 24,802 | | | | — | |

| * 09/28/17 and 02/15/18. | | | | | | | | | | | 1,237,081 | | | | 534,992 | |

| | | | | | | | | | | | | | | | | |

| PPC Event Services | | | | | | | | | | | | | | | | |

| A special event equipment rental business. | | | | | | | | | | | | | | | | |

14% (2% PIK) Senior Subordinated Note due 05/28/2023 | | $ | 1,226,568 | | | 11/20/14 | | | | 1,220,469 | | | | 1,226,568 | |

| Limited Liability Company Unit (B) | | 3,450 uts. | | | 11/20/14 | | | | 172,500 | | | | 415,195 | |

| Limited Liability Company Unit Series A-1 (B) | | 339 uts. | | | 03/16/16 | | | | 42,419 | | | | 36,396 | |

| | | | | | | | | | | | 1,435,388 | | | | 1,678,159 | |

| | | | | | | | | | | | | | | | | |

| ReelCraft Industries, Inc. | | | | | | | | | | | | | | | | |

| A designer and manufacturer of heavy-duty reels for diversified industrial, mobile equipment OEM, auto aftermarket, government/military and other end markets. | |

10.5% (0.5% PIK) Senior Subordinated Note due 02/28/2023 | | $ | 1,443,252 | | | 11/13/17 | | | | 1,443,253 | | | | 1,472,117 | |

| Limited Liability Company Unit Class B | | 293,617 uts. | | | 11/13/17 | | | | 184,688 | | | | 415,640 | |

| | | | | | | | | | | | 1,627,941 | | | | 1,887,757 | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | | |

| REVSpring, Inc. | | | | | | | | | | | | | |

| A provider of accounts receivable management and revenue cycle management services to customers in the healthcare, financial and utility industries. | |

10.58% Second Lien Term Loan due 10/11/2026 (LIBOR + 8.250%) | | $ | 1,725,000 | | | | 10/11/18 | | | $ | 1,677,908 | | | $ | 1,664,481 | |

| | | | | | | | | | | | | | | | | |

| Rock-it Cargo | | | | | | | | | | | | | | | | |

| A provider of specialized international logistics solutions to the music touring, performing arts, live events, fine art and specialty industries. | |

6.7% Term Loan due 06/22/2024 (LIBOR + 4.500%) | | $ | 2,446,513 | | | | 07/30/18 | | | | 2,394,697 | | | | 2,420,714 | |

| | | | | | | | | | | | | | | | | |

| ROI Solutions | | | | | | | | | | | | | | | | |

| Call center outsourcing and end user engagement services provider. | |

7.59% Term Loan due 07/31/2024 (LIBOR + 5.000%) | | $ | 1,629,605 | | | | 07/31/18 | | | | 637,488 | | | | 626,672 | |

| | | | | | | | | | | | | | | | | |

| Ruffalo Noel Levitz | | | | | | | | | | | | | | | | |

| A provider of enrollment management, student retention and career services, and fundraising management for colleges and universities. | |

8.69% Term Loan due 05/29/2022 (LIBOR + 6.000%) | | $ | 1,260,698 | | | | 01/08/19 | | | | 1,244,447 | | | | 1,249,058 | |

| | | | | | | | | | | | | | | | | |

| Sandvine Corporation | | | | | | | | | | | | | | | | |

| A provider of active network intelligence solutions. | | | | | | | | | | | | | | | | |

10.4% Second Lien Term Loan due 11/02/2026 (LIBOR + 8.000%) | | $ | 1,725,000 | | | | 11/01/18 | | | | 1,685,432 | | | | 1,673,907 | |

| | | | | | | | | | | | | | | | | |

| Sara Lee Frozen Foods | | | | | | | | | | | | | | | | |

| A provider of frozen bakery products, desserts and sweet baked goods. | |

6.9% Lien Term Loan due 07/31/2024 (LIBOR + 4.500%) | | $ | 1,525,622 | | | | 07/27/18 | | | | 1,496,554 | | | | 1,482,044 | |

| | | | | | | | | | | | | | | | | |

| Scaled Agile, Inc. | | | | | | | | | | | | | | | | |

| A provider of training and certifications for IT professionals focused on software development. | |

7.65% Term Loan due 06/28/2025 (LIBOR + 5.250%) | | $ | 754,000 | | | | 06/27/19 | | | | 746,470 | | | | 746,460 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| SMB Machinery Holdings, Inc. | | | | | | | | | | | | |

| A reseller of used, rebuilt and refurbished packaging and processing equipment, primarily serving the bottling and food manufacturing industries. | |

14% (2% PIK) Senior Subordinated Note due 10/30/2020 (D) | | $ | 738,694 | | | 10/18/13 | | | $ | 726,147 | | | $ | — | |

| Common Stock (B) | | 841 shs. | | | 10/18/13 | | | | 84,100 | | | | — | |

| | | | | | | | | | | 810,247 | | | | — | |

| | | | | | | | | | | | | | | | |

| Specified Air Solutions | | | | | | | | | | | | | | | |

| A manufacturer and distributor of heating, dehumidification and other air quality solutions. | |

10.5% (0.5% PIK) Senior Subordinated Note due 06/19/2024 | | $ | 1,227,995 | | | 12/19/18 | | | | 1,216,491 | | | | 1,252,555 | |

| Limited Liability Company Unit | | 831,904 uts. | | | 02/20/19 | | | | 536,793 | | | | 912,606 | |

| | | | | | | | | | | 1,753,284 | | | | 2,165,161 | |

| | | | | | | | | | | | | | | | |

| SR Smith LLC | | | | | | | | | | | | | | | |

| A manufacturer of mine and tunneling ventilation products in the United States. | |

| 11% Senior Subordinated Note due 03/27/2022 | | $ | 1,084,565 | | | | * | | | | 1,077,889 | | | | 1,084,565 | |

| Limited Liability Company Unit Series A | | 1,072 uts. | | | | * | | | | 1,060,968 | | | | 1,686,004 | |

| * 03/27/17 and 08/07/18. | | | | | | | | | | | 2,138,857 | | | | 2,770,569 | |

| | | | | | | | | | | | | | | | | |

| Strahman Holdings Inc. | | | | | | | | | | | | | | | | |

| A manufacturer of industrial valves and wash down equipment for a variety of industries, including chemical, petrochemical, polymer, pharmaceutical, food processing, beverage and mining. | |

| Preferred Stock Series A (B) | | 158,967 shs. | | | 12/13/13 | | | | 158,967 | | | | 304,677 | |

| Preferred Stock Series A-2 (B) | | 26,543 shs. | | | 09/10/15 | | | | 29,994 | | | | 50,872 | |

| | | | | | | | | | | | 188,961 | | | | 355,549 | |

| | | | | | | | | | | | | | | | | |

| Sunrise Windows Holding Company | | | | | | | | | | | | | | | | |

| A manufacturer and marketer of premium vinyl windows exclusively selling to the residential remodeling and replacement market. | |

| 16% Senior Subordinated Note due 05/28/2020 (D) | | $ | 1,812,109 | | | | * | | | | 1,358,229 | | | | 1,359,082 | |

| Common Stock (B) | | 38 shs. | | | 12/14/10 | | | | 38,168 | | | | — | |

Warrant, exercisable until 2020, to purchase common stock at $.01 per share (B) | | 37 shs. | | | 12/14/10 | | | | 37,249 | | | | — | |

| * 12/14/10, 08/17/12 and 03/31/16. | | | | | | | | | | | 1,433,646 | | | | 1,359,082 | |

| | | | | | | | | | | | | | | | | |

| Sunvair Aerospace Group Inc. | | | | | | | | | | | | | | | | |

| An aerospace maintenance, repair, and overhaul provider servicing landing gears on narrow body aircraft. | |

12% (1% PIK) Senior Subordinated Note due 07/31/2021 (D) | | $ | 1,408,931 | | | 07/31/15 | | | | 1,399,012 | | | | 1,338,484 | |

| Common Stock (B) | | 68 shs. | | | | * | | | | 104,986 | | | | 42,959 | |

| * 07/31/15 and 11/08/17. | | | | | | | | | | | 1,503,998 | | | | 1,381,443 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| Team Drive-Away Holdings LLC | | | | | | | | | | | | |

| An asset-light provider of over the road driveaway services for class 8 trucks and specialized equipment. | |

| Limited Liability Company Unit | | 95,800 uts. | | | 10/15/15 | | | $ | 67,186 | | | $ | 353,598 | |

| | | | | | | | | | | | | | | |

| Therma-Stor Holdings LLC | | | | | | | | | | | | | | |

| A designer and manufacturer of dehumidifiers and water damage restoration equipment for residential and commercial applications. | |

10.5% (0.5% PIK) Senior Subordinated Note due 11/30/2023 | | $ | 1,376,605 | | | 11/30/17 | | | | 1,376,605 | | | | 1,397,024 | |

| Limited Liability Company Unit (B) | | 19,696 uts. | | | 11/30/17 | | | | 3,172 | | | | 7,153 | |

| | | | | | | | | | | 1,379,777 | | | | 1,404,177 | |

| | | | | | | | | | | | | | | | |

| Torrent Group Holdings, Inc. | | | | | | | | | | | | | | | |

| A contractor specializing in the sales and installation of engineered drywells for the retention and filtration of stormwater and nuisance water flow. | |

15% (7.5% PIK) Senior Subordinated Note due 12/05/2020 | | $ | 49,953 | | | 12/05/13 | | | | 101,414 | | | | 49,953 | |

Warrant, exercisable until 2023, to purchase common stock at $.01 per share (B) | | 813 shs. | | | | * | | | | — | | | | 26,950 | |

| * 12/05/13 and 04/11/19. | | | | | | | | | | | 101,414 | | | | 76,903 | |

| | | | | | | | | | | | | | | | | |

| Trident Maritime Systems | | | | | | | | | | | | | | | | |

| A leading provider of turnkey marine vessel systems and solutions for government and commercial new ship construction as well as repair, refurbishment, and retrofit markets worldwide. | |

7.83% Term Loan due 04/30/2024 (LIBOR + 5.500%) | | $ | 2,345,858 | | | 05/14/18 | | | | 2,302,669 | | | | 2,285,512 | |

| | | | | | | | | | | | | | | | | |

| Tristar Global Energy Solutions, Inc. | | | | | | | | | | | | | | | | |

| A hydrocarbon and decontamination services provider serving refineries worldwide. | |

12.5% (1.5% PIK) Senior Subordinated Note due 07/31/2020 | | $ | 1,186,999 | | | 01/23/15 | | | | 1,181,023 | | | | 1,144,022 | |

| | | | | | | | | | | | | | | | | |

| Trystar, Inc. | | | | | | | | | | | | | | | | |

| A niche manufacturer of temporary power distribution products for the power rental, industrial, commercial utility and back-up emergency markets. | |

6.95% Term Loan due 10/01/2023 (LIBOR + 5.000%) | | $ | 2,153,836 | | | 09/28/18 | | | | 2,121,832 | | | | 2,148,474 | |

| Limited Liability Company Unit (B)(F) | | 47 uts. | | | 09/28/18 | | | | 46,562 | | | | 58,475 | |

| | | | | | | | | | | | 2,168,394 | | | | 2,206,949 | |

| | | | | | | | | | | | | | | | | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | |

| U.S. Legal Support, Inc. | | | | | | | | | | | | |

| A provider of court reporting, record retrieval and other legal supplemental services. | |

8.08% Term Loan due 11/12/2024 (LIBOR + 5.750%) | | $ | 2,142,391 | | | | * | | | $ | 1,847,657 | | | $ | 1,833,913 | |

| * 11/29/18 and 03/25/19. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| U.S. Oral Surgery Management | | | | | | | | | | | | | | | | |

| An operator of oral surgery practices providing medically necessary treatments. | |

| 7.4% Term Loan due 12/31/2023 (LIBOR + 5.000%) | | $ | 2,462,305 | | | 01/04/19 | | | | 1,028,566 | | | | 1,040,565 | |

| | | | | | | | | | | | | | | | | |

| U.S. Retirement and Benefit Partners, Inc. | | | | | | | | | | | | | | | | |

| A leading independent provider of outsourced benefit design and administration and retirement services, primarily to K-12 school districts, employee unions, and governmental agencies. | |

11.08% Second Lien Term Loan due 02/14/2023 (LIBOR + 8.750%) | | $ | 1,725,000 | | | 03/05/18 | | | | 1,580,305 | | | | 1,568,114 | |

| | | | | | | | | | | | | | | | | |

| UBEO, LLC | | | | | | | | | | | | | | | | |

| A dealer and servicer of printers and copiers to medium sized businesses. | |

| 11% Term Loan due 10/03/2024 | | $ | 1,725,000 | | | 11/05/18 | | | | 1,340,661 | | | | 1,330,078 | |

| | | | | | | | | | | | | | | | | |

| Velocity Technology Solutions, Inc. | | | | | | | | | | | | | | | | |

| A provider of outsourced hosting services for enterprise resource planning software applications and information technology infrastructure to mid and large-sized enterprises. | |

8.33% Lien Term Loan due 12/07/2023 (LIBOR + 6.000%) | | $ | 2,068,500 | | | 12/07/17 | | | | 2,053,178 | | | | 2,045,521 | |

| | | | | | | | | | | | | | | | | |

| VP Holding Company | | | | | | | | | | | | | | | | |

| A provider of school transportation services for special-needs and homeless children in Massachusetts and Connecticut. | |

7.83% Lien Term Loan due 05/22/2024 (LIBOR + 5.500%) | | $ | 2,448,166 | | | 05/17/18 | | | | 1,711,937 | | | | 1,617,673 | |

| | | | | | | | | | | | | | | | | |

| Westminster Acquisition LLC | | | | | | | | | | | | | | | | |

| A manufacturer of premium, all-natural oyster cracker products sold under the Westminster and Olde Cape Cod brands. | |

12% (1% PIK) Senior Subordinated Note due 08/03/2021 | | $ | 384,979 | | | 08/03/15 | | | | 382,449 | | | | 335,595 | |

| Limited Liability Company Unit (B)(F) | | 370,241 uts. | | | 08/03/15 | | | | 370,241 | | | | — | |

| | | | | | | | | | | | 752,690 | | | | 335,595 | |

| | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2019

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | | Principal Amount,

Shares, Units or

Ownership Percentage | | | Acquisition

Date | | | Cost | | | Fair Value | |

| | | | | | | | | | | | | | |