UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05547

Laudus Trust

(Exact name of registrant as specified in charter)

| | |

| 211 Main Street, San Francisco, California | | 94105 |

| (Address of principal executive offices) | | (Zip code) |

Marie Chandoha

Laudus Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

Item 1: Report(s) to Shareholders.

Annual Report

March 31, 2015

Laudus Mondrian Funds™

Laudus Mondrian International Equity Fund

Laudus Mondrian Emerging Markets Fund

Laudus Mondrian International Government Fixed Income Fund

Laudus Mondrian Global Government Fixed Income Fund

Adviser

Charles Schwab Investment Management, Inc.

Subadviser

Mondrian Investment Partners Limited

This page is intentionally left blank.

| 2 |

| 3 |

| 4 |

| 4 |

| 7 |

| 10 |

| 13 |

| 16 |

| 17 |

| 17 |

| 25 |

| 33 |

| 40 |

| 48 |

| 62 |

| 63 |

| 64 |

| 67 |

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM).

Distributor: ALPS Distributors, Inc.

The industry/sector classification of certain funds’ portfolio holdings uses the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI and Standard & Poor’s. GICS is a service mark of MSCI and S&P and has been licensed for use by CSIM and certain affiliates. Charles Schwab & Co, Inc. and ALPS Distributors, Inc. are unaffiliated entities.

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

| Total Return for the Twelve Months Ended March 31, 2015 |

| Laudus Mondrian International Equity Fund1 | |

| Investor Shares (Ticker Symbol: LIEQX) | -0.02% |

| Select Shares (Ticker Symbol: LIEFX) | 0.04% |

| Institutional Shares (Ticker Symbol: LIEIX) | 0.11% |

| MSCI EAFE Index® (Net) | -0.92% |

| MSCI EAFE® Value Index (Net) | -2.90% |

| Performance Details | pages 4-6 |

| |

| Laudus Mondrian Emerging Markets Fund1 | |

| Investor Shares (Ticker Symbol: LEMIX) | -3.46% |

| Select Shares (Ticker Symbol: LEMSX) | -3.26% |

| Institutional Shares (Ticker Symbol: LEMNX) | -3.03% |

| MSCI Emerging Markets Index (Net) | 0.44% |

| Performance Details | pages 7-9 |

| |

| Laudus Mondrian International Government Fixed Income Fund (Ticker Symbol: LIFNX) | -9.37% |

| Citigroup non-U.S. Dollar World Government Bond Index | -9.82% |

| Performance Details | pages 10-12 |

| |

| Laudus Mondrian Global Government Fixed Income Fund (Ticker Symbol: LMGDX) | -6.34% |

| Custom Composite Index2 | -5.63% |

| Citigroup World Government Bond Index | -5.50% |

| Performance Details | pages 13-15 |

All fund and index figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Performance data quoted does not reflect the non-recurring redemption fee of 2% that may be charged if shares are sold or exchanged within 30 days of the purchase date. If these fees were reflected, the performance data quoted would be lower.

For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by CSIM. Without these reductions, the funds’ returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

There are risks associated with investing in securities of foreign issuers, such as erratic market conditions, economic and political instability, fluctuations in currency and exchange rates, and an increased risk of price volatility associated with less uniformity in accounting and reporting requirements. Investing in emerging markets accentuates these risks. Investments in emerging markets may be more likely to experience political turmoil or rapid changes in market or economic conditions than more developed countries.

Bond funds are subject to increased risk of loss of principal during periods of volatile interest rates. When interest rates rise, bond prices fall which may impact the value of a bond fund's shares.

Please see prospectus for further detail and investor eligibility requirements.

| 1 | The fund's performance relative to the indices may be affected by fair-value pricing, see financial note 2 for more information. |

| 2 | The Custom Composite Index is composed of the Citigroup World Government Bond Index from the Fund’s inception until the close of business on 3/31/13, and a blend of 80% Citigroup World Government Bond Index/20% Citigroup Custom Emerging Markets Government Bond Index from 4/1/2013 forward. |

Marie Chandoha is President and CEO of Charles Schwab Investment Management, Inc. and the funds covered in this report.

Dear Shareholder,

At Charles Schwab Investment Management, we provide funds that are designed to be part of the foundation of a diversified portfolio. We formed the Laudus Fund family to provide shareholders with access to third-party managers with strong investment processes. Mondrian Investment Partners Limited, subadviser for the Laudus Mondrian funds, specializes in a value-oriented approach to international, emerging markets, and fixed income investing. Mondrian utilizes bottom-up security analysis, rigorous valuation, and top-down country and currency analysis, while applying risk management techniques to help guide security selection and portfolio allocation decisions.

For the 12-month reporting period ended March 31, 2015, the Laudus Mondrian International Equity Fund and the Laudus Mondrian International Government Fixed Income Fund both outperformed their respective indices, while the Laudus Mondrian Global Government Fixed Income Fund and the Laudus Mondrian Emerging Markets Fund underperformed their respective indices. The appreciation of the U.S. dollar versus many international currencies negatively affected both international equity and fixed income markets alike, generally reducing returns on overseas investments in U.S. dollar terms. Among fixed income securities, international government bond yields generally fell, with several dipping into negative territory during the reporting period. U.S. bond yields also fell overall due to concerns of slowing economic momentum, but in general were higher than those of other countries. Reflecting these conditions, the Citigroup Non-U.S. Dollar World Government Bond Index returned approximately -9.8%.

Among stocks, emerging markets slightly outperformed developed international markets overall, though both markets generated negative returns in U.S. dollar terms. Uncertain global economic growth weighed on international returns, as did falling oil prices and sustained geopolitical tensions in Russia and the Middle East. Many central banks, including the European Central Bank and the Bank of Japan, stepped up economic measures toward the end of the reporting period to stimulate growth and combat threats of deflation, reflecting signs of divergence between central bank policies in the U.S. and those of other countries. In this environment, the MSCI EAFE Index— representing the performance of large-cap international stocks—returned approximately -0.9% and the MSCI Emerging Markets Index returned approximately 0.4%.1

For more information about the Laudus Mondrian Funds, please continue reading this report. Please also note that on February 6, 2015, the Laudus Mondrian Institutional Emerging Markets Fund was merged into the Institutional Shares class of the Laudus Mondrian Emerging Markets Fund, and the Laudus Mondrian Institutional International Equity Fund was merged into the Institutional Shares class of the Laudus Mondrian International Equity Fund. You can find further details about these mergers, as well as additional information on the Laudus Mondrian Funds, by visiting our new website at csimfunds.com, which provides improved functionality, enhanced design, and access to industry insights. We are also happy to hear from you at 1 800-447-3332.

Sincerely,

For the 12-month reporting period ended March 31, 2015, the Laudus Mondrian International Equity Fund and the Laudus Mondrian International Government Fixed Income Fund both outperformed their respective indices, while the Laudus Mondrian Global Government Fixed Income Fund and the Laudus Mondrian Emerging Markets Fund underperformed their respective indices.

Indices are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. Index figures assume dividends and distributions were reinvested.

| 1 | The total returns cited are calculated net of foreign withholding taxes. For definitions of the referenced indices, please see the Glossary. |

Laudus Mondrian International Equity Fund

The Laudus Mondrian International Equity Fund (the fund) seeks long-term capital appreciation. Under normal circumstances, the fund invests primarily in common stocks of non-U.S. large-capitalization issuers, including the securities of emerging market companies, that, in the subadviser’s opinion, are undervalued at the time of purchase based on fundamental value analysis. For more information concerning the fund’s investment objective, strategies, and risks, please see the prospectus.

Market Highlights. International stocks from developed markets generated negative returns, in part due to extreme currency movements throughout the reporting period. Diverging central bank policies across the world weakened most international currencies versus the U.S. dollar, reducing returns on overseas investments in U.S. dollar terms. Geopolitical tensions in Ukraine and the Middle East also weighed on international returns and contributed to increased market volatility, as did economic uncertainty over Greece and the eurozone. Toward the end of the reporting period, better economic data in Europe helped international equity markets to rebound, while central bank decisions continued to affect many international currencies. For example, in early 2015, the Swiss National Bank removed the Swiss franc’s peg to the euro, the European Central Bank launched quantitative easing, and the Reserve Bank of Australia and the Bank of Canada both announced cuts to official interest rates.

From a sector standpoint, the Health Care sector was one of the better performers for the 12-month reporting period, helped by generally resilient earnings, U.S. dollar strength, and merger and acquisition activity. The Energy sector, however, underperformed by comparison as oil prices dropped to historically low levels, despite slightly rebounding toward the end of the reporting period.

Performance. The fund’s Investor Shares returned -0.02% for the 12-month reporting period ended March 31, 2015. For performance comparisons, the fund uses the MSCI EAFE Index (Net) (the index), which returned -0.92%.

Positioning and Strategies. Stock selection in markets and sectors contributed to relative investment returns for the fund over the 12-month reporting period. These strategies resulted in country weightings and stock selections that generally enhanced the fund’s overall performance, as did the fund’s currency allocations. However, the results of the fund’s sector allocations generated comparatively mixed results, and currency movements during the reporting period generally held back returns for countries in which the fund invests.

Among stocks, the fund’s holdings of Kao Corp., a company that develops and sells consumer products worldwide, contributed the most to the fund’s total return over the reporting period. Strong operational results and announcements of increased dividends and buybacks helped Kao Corp. rebound, and the fund’s holdings of this stock returned approximately 43% for the 12-month reporting period. From a country perspective, the fund’s Japanese holdings contributed the most to the fund’s total return. Although the fund was slightly underweight to Japan relative to the index, effective stock selection within this country made up for this relative weighting.

The fund’s holdings of Eni S.p.A., a company engaged in the oil and gas, electricity generation and sale, petrochemicals, oilfield services construction, and engineering industries, detracted the most from the fund’s total return. Eni S.p.A. returned approximately -28%, in part due to falling oil prices, which reflected a subdued outlook for oil demand and supply. From a country perspective, stocks from the United Kingdom detracted the most from the fund’s total return. The fund’s United Kingdom holdings returned approximately -9%, and though the fund was underweight to this country, stock selection detracted from performance relative to the index.

Among sectors, an overweight in Telecommunication Services stocks and an underweight in the Financials sector enhanced the fund’s performance. However, an overweight position in the Energy sector and an underweight in the Industrials sector somewhat offset these results. Stock selection among equity markets in Switzerland and Spain was strong on a relative basis, while stock selection in Italy reduced the fund’s relative results.

As of 03/31/15:

| Fund Characteristics |

| Number of Companies1 | 40 |

| Weighted Average Market Cap (millions) | $79,834 |

| Price/Earnings Ratio (P/E) | 19.67 |

| Price/Book Ratio (P/B) | 1.85 |

Portfolio Turnover

(One year trailing)2 | 36% |

| Fund Overview | | | |

| | Investor Shares | Select Shares | Institutional Shares |

| Minimum Initial Investment | $100 | $50,000 | $500,000 |

| Inception Date | 6/16/2008 | 6/16/2008 | 6/16/2008 |

| Ticker Symbol | LIEQX | LIEFX | LIEIX |

| Cusip | 51855Q614 | 51855Q564 | 51855Q580 |

| NAV | $6.45 | $6.48 | $6.50 |

Management views and portfolio holdings may have changed since the report date.

| 1 | Short-term investments are not included. |

| 2 | Portfolio turnover excludes the impact of investment activity from a merger with another fund. |

Laudus Mondrian International Equity Fund

Performance and Fund Facts as of 03/31/15

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The performance information does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.csimfunds.com.

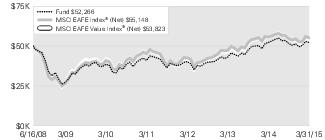

June 16, 2008 – March 31, 2015

Performance of Hypothetical

$10,000 Investment in Investor Shares1

June 16, 2008 – March 31, 2015

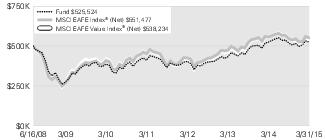

Performance of Hypothetical

$50,000 Investment in Select Shares1

June 16, 2008 – March 31, 2015

Performance of Hypothetical

$500,000 Investment in Institutional Shares1

Average Annual Total Returns1

| Class and Inception Date | 1 Year | 5 Years | Since Inception |

| Investor Shares (6/16/08) | -0.02% | 6.02% | 0.43% |

| Select Shares (6/16/08) | 0.04% | 6.26% | 0.65% |

| Institutional Shares (6/16/08) | 0.11% | 6.34% | 0.74% |

| MSCI EAFE Index® (Net) | -0.92% | 6.16% | 1.45% |

| MSCI EAFE® Value Index (Net) | -2.90% | 5.27% | 1.09% |

Fund Expense Ratios2: Investor Shares: 1.19% / Select Shares: 0.98% / Institutional Shares: Net 0.90%; Gross 0.97%

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Performance data quoted does not reflect the non-recurring redemption fee of 2% that may be charged if shares are sold or exchanged within 30 days of the purchase date. If these fees were reflected, the performance data quoted would be lower.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | As stated in the prospectus. Net Expenses: The adviser has agreed to limit the total annual fund operating expenses (excluding interest, taxes and certain non-routine expenses) of the fund to 0.90%, 1.05%, and 1.30% for the Institutional, Select, and Investor classes, respectively, until at least 7/30/2016. Gross Expenses: Reflects the total annual fund operating expenses without the effect of contractual fee waivers. For actual rates during the period, refer to the Financial Highlights section of the Financial Statements. |

Laudus Mondrian International Equity Fund

Performance and Fund Facts as of 03/31/15 continued

Country Weightings % of Investments

| United Kingdom | 18.5% |

| Japan | 17.5% |

| Switzerland | 15.6% |

| Germany | 9.8% |

| France | 8.8% |

| Spain | 7.7% |

| Singapore | 4.3% |

| Netherlands | 3.5% |

| Israel | 3.0% |

| Other Countries | 11.3% |

| Total | 100.0% |

Sector Weightings % of Equities

| Health Care | 16.5% |

| Consumer Staples | 16.3% |

| Telecommunication Services | 15.9% |

| Financials | 11.6% |

| Energy | 9.8% |

| Information Technology | 8.5% |

| Utilities | 7.9% |

| Industrials | 6.1% |

| Consumer Discretionary | 4.9% |

| Materials | 2.5% |

| Total | 100.0% |

Top Equity Holdings % of Net Assets1

| ABB Ltd. – Reg'd | 3.5% |

| Sanofi | 3.4% |

| Takeda Pharmaceutical Co., Ltd. | 3.4% |

| Koninklijke Ahold N.V. | 3.3% |

| GlaxoSmithKline plc | 3.3% |

| Zurich Insurance Group AG | 3.3% |

| Iberdrola S.A. | 3.2% |

| Deutsche Telekom AG – Reg'd | 3.2% |

| Unilever plc | 3.2% |

| Canon, Inc. | 3.2% |

| Total | 33.0% |

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability, fluctuations in currency and exchange rates, and an increased risk of price volatility associated with less uniformity in accounting and reporting requirements.

Management views and portfolio holdings may have changed since the report date.

| 1 | This list is not a recommendation of any security by the investment adviser or subadviser. |

Laudus Mondrian Emerging Markets Fund

The Laudus Mondrian Emerging Markets Fund (the fund) seeks long-term capital appreciation. Under normal circumstances, the fund invests primarily in common stocks of large-capitalization emerging market companies that, in the subadviser’s opinion, are undervalued at the time of purchase based on fundamental analysis. For more information concerning the fund’s investment objective, strategies, and risks, please see the prospectus.

Market Highlights. Emerging market stocks generated modest overall returns in U.S. dollar terms, though the period was marked by significant volatility in equity, currency, and commodity markets globally. Many emerging market central banks, including those in China and Indonesia, cut interest rates to help spur growth, while others, such as in Brazil, raised interest rates to combat inflation. In the U.S., the Federal Reserve ended its asset-purchase program in October, but decided to maintain historically low short-term interest rates for the time being. Speculation surrounding the timing of a rise in short-term U.S. interest rates, combined with declining commodity prices, contributed to a tough market for emerging market exporters, particularly those with current account deficits.

Asian markets performed well overall, with Indian and Indonesian markets reacting positively to recent election outcomes. Taiwan was strong as the Information Technology sector rallied, though Korean stocks fell on weakness in the Industrials sector. Within Europe, the Middle East, and Africa, Turkey’s strong local market return was offset by the weak lira, and equity markets in Greece fell on speculation surrounding a possible exit from the eurozone. Currency weakness weighed on many eastern European markets, though South Africa outperformed despite a weak rand.

Reflecting these conditions, most emerging market currencies depreciated versus the U.S. dollar, reducing returns on emerging market investments in U.S. dollar terms. China’s renminbi and the Philippine’s peso were two of the few currencies that appreciated versus the U.S. dollar. Currencies that sharply underperformed included Brazil’s real, Russia’s ruble, and Colombia’s peso, all of which depreciated by more than 20% versus the U.S. dollar, significantly reducing returns from these markets.

Performance. The fund’s Investor Shares returned -3.46% for the 12-month reporting period ended March 31, 2015. For performance comparisons, the fund uses the MSCI Emerging Markets Index (Net) (the index), which returned 0.44%.

Positioning and Strategies. Stock selection in markets and sectors contributed to weak relative investment returns for the fund over the 12-month reporting period. Although the fund’s country allocations helped offset these results somewhat, currency movements during the reporting period generally held back returns for countries in which the fund invests.

Stock selection in China and Brazil were two of the top detractors from relative performance. For example, the fund’s holdings of preferred stock of Brazil-based Vale S.A. returned approximately -59% and were among the largest detractors from the total return of the fund. Vale S.A., a metals and mining company, suffered from the decline in iron ore prices which resulted in missed estimates and weaker earnings reports during the reporting period. In China, the fund’s lack of investment in the strongly performing Financials sector and certain rapidly appreciating Information Technology stocks were also a meaningful drag on relative returns.

Turkiye Petrol Rafinerileri A.S., a company primarily engaged in the refining of crude oil and petroleum products in Turkey, benefitted from rising demand for fuel and oil derivatives, as well as growth within the petrochemicals industry. The fund’s holdings of Turkiye Petrol Rafinerileri A.S. returned approximately 16% for the 12-month reporting period and an overweight of this stock contributed to relative performance.

From a sector perspective, an underweight exposure to Financials, which was driven up predominantly by strength in Chinese banks and insurers, negatively affected the fund’s total return and return relative to the index. However, several country allocations had a positive impact. Underweight positions in Korea and Colombia helped, where weak local markets compounded depreciating non-U.S. currencies, as did the absence from weak European markets, such as Poland and Greece.

As of 03/31/15:

| Fund Characteristics |

| Number of Companies1 | 48 |

| Weighted Average Market Cap (millions) | $37,249 |

| Price/Earnings Ratio (P/E) | 13.23 |

| Price/Book Ratio (P/B) | 1.84 |

Portfolio Turnover

(One year trailing)2 | 30% |

| Fund Overview | | | |

| | Investor Shares | Select Shares | Institutional Shares |

| Minimum Initial Investment | $100 | $50,000 | $500,000 |

| Inception Date | 11/2/2007 | 11/2/2007 | 11/2/2007 |

| Ticker Symbol | LEMIX | LEMSX | LEMNX |

| Cusip | 51855Q648 | 51855Q630 | 51855Q622 |

| NAV | $8.18 | $8.18 | $8.18 |

Management views and portfolio holdings may have changed since the report date.

| 1 | Short-term investments are not included. |

| 2 | Portfolio turnover excludes the impact of investment activity from a merger with another fund. |

Laudus Mondrian Emerging Markets Fund

Performance and Fund Facts as of 03/31/15

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The performance information does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.csimfunds.com.

November 2, 2007 – March 31, 2015

Performance of Hypothetical

$10,000 Investment in Investor Shares1

November 2, 2007 – March 31, 2015

Performance of Hypothetical

$50,000 Investment in Select Shares1

November 2, 2007 – March 31, 2015

Performance of Hypothetical

$500,000 Investment in Institutional Shares1

Average Annual Total Returns1

| Class and Inception Date | 1 Year | 5 Years | Since Inception |

| Investor Shares (11/2/07) | -3.46% | 0.33% | -1.20% |

| Select Shares (11/2/07) | -3.26% | 0.62% | -0.92% |

| Institutional Shares (11/2/07) | -3.03% | 0.71% | -0.85% |

| MSCI Emerging Markets Index (Net) | 0.44% | 1.75% | -1.63% |

Fund Expense Ratios2: Investor Shares: 1.57% / Select Shares: 1.32% / Institutional Shares: 1.17%

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Performance data quoted does not reflect the non-recurring redemption fee of 2% that may be charged if shares are sold or exchanged within 30 days of the purchase date. If these fees were reflected, the performance data quoted would be lower.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | As stated in the prospectus. Please see the prospectus for more information. For actual rates during the period, refer to the Financial Highlights section of the Financial Statements. |

Laudus Mondrian Emerging Markets Fund

Performance and Fund Facts as of 03/31/15 continued

Country Weightings % of Investments

| China | 17.1% |

| Taiwan | 11.2% |

| India | 10.6% |

| Brazil | 7.6% |

| Malaysia | 7.1% |

| Republic of Korea | 5.6% |

| Mexico | 5.5% |

| United States | 4.8% |

| Indonesia | 4.3% |

| South Africa | 4.2% |

| Turkey | 3.5% |

| United Kingdom | 3.2% |

| Philippines | 2.8% |

| Other Countries | 12.5% |

| Total | 100.0% |

Sector Weightings % of Equities

| Financials | 20.6% |

| Information Technology | 15.5% |

| Consumer Discretionary | 14.5% |

| Utilities | 10.9% |

| Telecommunication Services | 10.1% |

| Energy | 9.4% |

| Industrials | 8.1% |

| Consumer Staples | 7.2% |

| Health Care | 2.4% |

| Materials | 1.3% |

| Total | 100.0% |

Top Equity Holdings % of Net Assets1

| Taiwan Semiconductor Manufacturing Co., Ltd. | 4.1% |

| Fibra Uno Administracion S.A. de C.V. | 3.6% |

| China Resources Power Holdings Co., Ltd. | 3.4% |

| Unilever plc | 3.2% |

| Hyundai Mobis Co., Ltd. | 3.0% |

| China Mobile Ltd. | 3.0% |

| Yum! Brands, Inc. | 2.9% |

| Tenaga Nasional Berhad | 2.8% |

| Philippine Long Distance Telephone Co. ADR | 2.8% |

| Belle International Holdings Ltd. | 2.7% |

| Total | 31.5% |

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability, fluctuations in currency and exchange rates, and an increased risk of price volatility associated with less uniformity in accounting and reporting requirements. Investing in emerging markets accentuates these risks. Investments in emerging markets may be more likely to experience political turmoil or rapid changes in market or economic conditions than more developed countries.

Management views and portfolio holdings may have changed since the report date.

| 1 | This list is not a recommendation of any security by the investment adviser or subadviser. |

Laudus Mondrian International Government Fixed Income Fund

The Laudus Mondrian International Government Fixed Income Fund (the fund) seeks long-term total return consistent with its value-oriented investment approach. The fund invests primarily in fixed income securities that may also provide the potential for capital appreciation, and in issuers that are organized, have a majority of their assets, or derive most of their operating income outside of the U.S. As such, the fund may invest in securities issued in any currency and may hold foreign currency. For more information concerning the fund’s investment objective, strategies, and risks, please see the prospectus.

Market Highlights. International bond indices generated negative overall returns for the 12-month reporting period. Inflationary pressures continued to be subdued globally, reinforced by the recent fall in global commodities prices. However, as the U.S. dollar appreciated versus many international currencies, returns on overseas fixed income securities were diminished in U.S. dollar terms. The Swedish krona and the Norwegian krone delivered two of the weakest currency performances, both returning around -25% versus the U.S. dollar, while the Singaporean dollar outperformed by comparison, returning approximately -8.0%.

Reflecting these conditions, the strongest performer and the only market with positive returns was the United Kingdom, notably helped by softening inflation over the reporting period. Norway was one of the weakest performing markets, as falling oil prices dampened the value of Norwegian exports and helped to push to the krone lower.

Performance. The fund returned -9.37% for the 12-month reporting period ended March 31, 2015. For performance comparisons, the fund uses the Citigroup non-U.S. Dollar World Government Bond Index, which returned -9.82%.

Positioning and Strategies. The fund’s outperformance for the 12-month reporting period was primarily driven by an underweight in bonds from the eurozone and from Japan. These fixed income markets were particularly affected by the appreciation of the U.S. dollar, which meant that the fund’s smaller position in these securities enhanced relative performance. Also contributing to the fund’s relative performance was an overweight to the U.S. dollar, as many international currencies depreciated versus the U.S. dollar over the reporting period.

In contrast, an overweight to Sweden detracted from the fund’s performance. Though fixed income securities from Sweden generated positive returns in local-currency terms for the 12-month reporting period, the depreciation of the Swedish krona compared with the U.S. dollar caused returns from Sweden to be weaker than many other markets in U.S. dollar terms. As a result, the fund’s overweight in these securities reduced its relative return. The relatively low duration positioning of the fund also detracted from performance in a time of generally falling international bond yields.

Other strategies used by the subadviser included buying fully covered, defensive forward currency contracts. Such contracts are used to hedge what the subadviser believes to be overvalued currencies, based on proprietary currency models. The notional value of these currency contracts ranged from approximately 7% to 14% of the fund’s net assets, and had a positive overall effect on performance.

As of 03/31/15:

| Fund Characteristics |

| Number of Issues1 | 39 |

| Weighted Average Maturity2 | 9.3 Yrs |

| Weighted Average Duration2 | 7.5 Yrs |

Portfolio Turnover

(One year trailing) | 50% |

| Fund Overview | |

| | Fund |

| Minimum Initial Investment | $100 |

| Inception Date | 11/2/2007 |

| Ticker Symbol | LIFNX |

| Cusip | 51855Q655 |

| NAV | $9.45 |

Management views and portfolio holdings may have changed since the report date.

| 1 | Short-term investments are not included. |

| 2 | See Glossary for definitions of maturity and duration. |

Laudus Mondrian International Government Fixed Income Fund

Performance and Fund Facts as of 03/31/15

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The performance information does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.csimfunds.com.

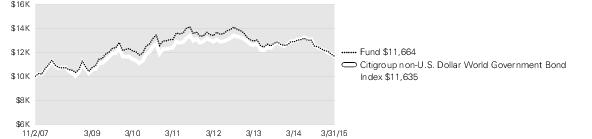

November 2, 2007 – March 31, 2015

Performance of Hypothetical

$10,000 Investment1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Laudus Mondrian International Government Fixed Income Fund (11/2/07) | -9.37% | -0.75% | 2.09% |

| Citigroup non-U.S. Dollar World Government Bond Index | -9.82% | 0.38% | 2.06% |

Fund Expense Ratio3: 0.69%

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Performance data quoted does not reflect the non-recurring redemption fee of 2% that may be charged if shares are sold or exchanged within 30 days of the purchase date. If these fees were reflected, the performance data quoted would be lower.

| 1 | Fund expenses may have been partially absorbed by CSIM. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 27, 2009, the Investor Share class, Select Share class and Institutional Share class of the fund were combined into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | As stated in the prospectus. Please see the prospectus for more information. For actual rates during the period, refer to the Financial Highlights section of the Financial Statements. |

Laudus Mondrian International Government Fixed Income Fund

Performance and Fund Facts as of 03/31/15 continued

Country Weightings % of Investments1

| Japan | 17.7% |

| United Kingdom | 13.0% |

| Sweden | 9.9% |

| Germany | 5.7% |

| Mexico | 4.8% |

| France | 4.7% |

| Austria | 4.5% |

| Netherlands | 4.4% |

| New Zealand | 4.4% |

| Finland | 4.4% |

| Canada | 4.0% |

| Other Countries | 5.8% |

| Supranational* | 16.7% |

| Total | 100.0% |

Currency Weightings % of Investments2

| Euro Currency | 31.8% |

| Japanese Yen | 34.3% |

| Great British Pound | 13.0% |

| Swedish Krona | 9.8% |

| Mexican Peso | 4.8% |

| U.S. Dollar | 2.3% |

| Polish Zloty | 2.1% |

| Malaysian Ringgit | 1.9% |

| New Zealand Dollar | 0.0% 3 |

| Total | 100.0% |

Sector Weightings % of Investments

| Government Bonds | 81.5% |

| Supranational* | 16.7% |

| Other Investment Companies | 1.8% |

| Total | 100.0% |

Top Holdings % of Net Assets4

| Sweden Government Bond, 3.50%, 06/01/22 | 5.7% |

| Japan Government Thirty Year Bond, 2.40%, 12/20/34 | 5.4% |

| France Government Bond OAT, 5.75%, 10/25/32 | 4.6% |

| Mexico Government Bond, 6.50%, 06/10/21 | 4.5% |

| Austria Government Bond, 6.25%, 07/15/27 | 4.5% |

| Netherlands Government Bond, 5.50%, 01/15/28 | 4.4% |

| Finland Government Bond, 3.50%, 04/15/21 | 4.4% |

| Japan Government Thirty Year Bond, 1.70%, 03/20/44 | 4.3% |

| European Investment Bank, 1.40%, 06/20/17 | 4.3% |

| Nordic Investment Bank, 1.70%, 04/27/17 | 4.1% |

| Total | 46.2% |

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability, fluctuations in currency and exchange rates, and an increased risk of price volatility associated with less uniformity in accounting and reporting requirements.

Management views and portfolio holdings may have changed since the report date.

| * | Supranational bonds represent the debt of international organizations or institutions such as the World Bank, the International Monetary Fund, regional multilateral development banks and others. Bonds are issued and held in Japanese yen and euro. |

| 1 | Country weights may include issues via Samurai bonds issued in Japanese yen by non-Japanese entities and/or Yankee bonds issued in U.S. dollars by non-U.S. entities. |

| 2 | Includes forward foreign currency exchange contracts exposure, which may results in negative exposure to a particular currency. |

| 3 | Amount is less than 0.05% |

| 4 | This list is not a recommendation of any security by the investment adviser or subadviser. |

Laudus Mondrian Global Government Fixed Income Fund

The Laudus Mondrian Global Government Fixed Income Fund (the fund) seeks long-term total return consistent with its value-oriented investment approach. The fund invests primarily in fixed income securities that may also provide the potential for capital appreciation, while investing in issuers located throughout the world, including emerging markets. As such, the fund may invest in securities issued in any currency and may hold foreign currency. For more information concerning the fund’s investment objective, strategies, and risks, please see the prospectus.

Market Highlights. International bond indices generated negative overall returns for the 12-month reporting period. Among developed markets, the U.S. performed well, in part due to the strong U.S. dollar. Inflationary pressures continued to be subdued globally, reinforced by the recent fall in global commodities prices. However, as the U.S. dollar appreciated versus many international currencies, returns on overseas fixed income securities were diminished in U.S. dollar terms. The Brazilian real and the Norwegian krone delivered two of the weakest currency performances versus the U.S. dollar, both returning around -25%, while the British pound outperformed by comparison, returning approximately -10.9%.

Reflecting these conditions, the strongest performers and the only two markets with positive returns were the U.S. and the United Kingdom. By comparison, Norway was one of the weakest performing markets, as falling oil prices dampened the value of Norwegian exports and helped to push to the krone lower.

Performance. For the 12-month reporting period ended March 31, 2015, the fund returned -6.34%. By comparison, the Custom Composite Index (the index) returned -5.63%.1

Positioning and Strategies. The fund’s underperformance relative to the index during the reporting period was primarily driven by an overweight to Russian bonds. Russia was one of the weakest performing markets, as both the local market and currency fell in response to the decline in global oil prices. These factors, combined with the ongoing geopolitical tensions with Ukraine, meant that the fund’s larger position in these bonds reduced relative performance. Also detracting from the performance of the fund was an overweight to Sweden. Though fixed income securities from Sweden generated positive returns in local-currency terms for the 12-month reporting period, the depreciation of the Swedish krona compared with the U.S. dollar caused returns from Sweden to be weaker than many other markets in U.S. dollar terms.

By comparison, the fund’s underweight to bonds from the eurozone and from Japan contributed to fund performance. These fixed income markets were particularly affected by the appreciation of the U.S. dollar, which meant that the fund’s smaller position in these securities enhanced relative performance. A smaller exposure to bonds from Hungary, which performed poorly, also enhanced the fund’s performance relative to the index.

Other strategies used by the subadviser included buying fully covered, defensive forward currency contracts. Such contracts are used to hedge what the subadviser believes to be overvalued currencies, based on proprietary currency models. The notional value of these currency contracts ranged from approximately 7% to 15% of the fund’s net assets, and had a positive overall effect on performance.

As of 03/31/15:

| Fund Characteristics |

| Number of Issues2 | 63 |

| Weighted Average Maturity3 | 8.5 Yrs |

| Weighted Average Duration3 | 6.7 Yrs |

Portfolio Turnover

(One year trailing) | 62% |

| Fund Overview | |

| | Fund |

| Minimum Initial Investment | $100 |

| Inception Date | 7/10/2012 |

| Ticker Symbol | LMGDX |

| Cusip | 51855Q119 |

| NAV | $8.71 |

Management views and portfolio holdings may have changed since the report date.

| 1 | The Custom Composite Index is composed of a blend of 80% Citigroup World Government Bond Index/20% Citigroup Custom Emerging Markets Government Bond Index. |

| 2 | Short-term investments are not included. |

| 3 | See Glossary for definitions of maturity and duration. |

Laudus Mondrian Global Government Fixed Income Fund

Performance and Fund Facts as of 03/31/15

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The performance information does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.csimfunds.com.

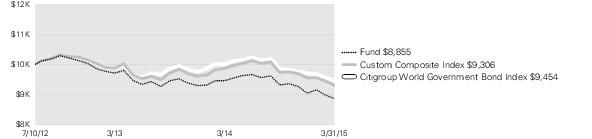

July 10, 2012 – March 31, 2015

Performance of Hypothetical

$10,000 Investment1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | Since Inception |

| Laudus Mondrian Global Government Fixed Income Fund (7/10/12) | -6.34% | -4.37% |

| Custom Composite Index2 | -5.63% | -2.61% |

| Citigroup World Government Bond Index | -5.50% | -2.04% |

Fund Expense Ratios3: Net 0.85%; Gross 1.74%

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Performance data quoted does not reflect the non-recurring redemption fee of 2% that may be charged if shares are sold or exchanged within 30 days of the purchase date. If these fees were reflected, the performance data quoted would be lower.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | The Custom Composite Index is composed of the Citigroup World Government Bond Index from the Fund’s inception until the close of business on 3/31/13, and a blend of 80% Citigroup World Government Bond Index/20% Citigroup Custom Emerging Markets Government Bond Index from 4/1/2013 forward. |

| 3 | As stated in the prospectus. Net Expenses: Reflects expenses expected to be charged to shareholders through at least 7/30/16. The adviser expects to hold expenses at this level by waiving its management fees and/or bearing other expenses. Gross Expenses: Reflects the total annual fund operating expenses without the effect of contractual fee waivers. Please see the prospectus for more information. For actual rates during the period, refer to the Financial Highlights section of the Financial Statements. |

Laudus Mondrian Global Government Fixed Income Fund

Performance and Fund Facts as of 03/31/15 continued

Country Weightings % of Investments1

| United States | 36.5% |

| Japan | 13.4% |

| Germany | 10.3% |

| United Kingdom | 8.0% |

| Mexico | 7.2% |

| Brazil | 4.4% |

| Poland | 3.4% |

| New Zealand | 3.3% |

| Malaysia | 3.0% |

| Other Countries | 10.5% |

| Total | 100.0% |

Currency Weightings % of Investments2

| Japanese Yen | 20.8% |

| U.S. Dollar | 19.9% |

| Euro Currency | 14.4% |

| Great British Pound | 8.0% |

| Swedish Krona | 8.0% |

| Mexican Peso | 7.2% |

| Brazilian Real | 4.5% |

| Polish Zloty | 3.4% |

| Malaysian Ringgit | 3.0% |

| Russian Ruble | 1.9% |

| South African Rand | 1.8% |

| Australian Dollar | 1.6% |

| Chinese Yuan Renminbi | 1.4% |

| Colombian Peso | 1.3% |

| Indonesian Rupiah | 1.2% |

| Turkish Lira | 1.0% |

| Peruvian Nuevo Sol | 0.6% |

| New Zealand Dollar | 0.0% 3 |

| Total | 100.0% |

Sector Weightings % of Investments

| Government Bonds | 63.5% |

| U.S. Government Securities | 33.8% |

| Short-Term Investments | 1.4% |

| Other Investment Companies | 1.3% |

| Total | 100.0% |

Top Holdings % of Net Assets4

| U.S. Treasury Notes, 3.63%, 02/15/21 | 7.6% |

| U.S. Treasury Notes, 2.13%, 08/15/21 | 5.8% |

| U.S. Treasury Notes, 3.63%, 08/15/19 | 5.5% |

| U.S. Treasury Notes, 1.25%, 04/30/19 | 5.1% |

| Bundesobligation, 0.50%, 02/23/18 | 4.8% |

| U.S. Treasury Notes, 2.13%, 08/31/20 | 4.2% |

| Japan Government Ten Year Bond, 0.80%, 09/20/20 | 3.9% |

| Japan Government Ten Year Bond, 1.40%, 03/20/18 | 3.7% |

| United Kingdom Gilt, 2.75%, 09/07/24 | 3.4% |

| Japan Government Thirty Year Bond, 1.70%, 03/20/44 | 3.4% |

| Total | 47.4% |

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability, fluctuations in currency and exchange rates, and an increased risk of price volatility associated with less uniformity in accounting and reporting requirements.

Management views and portfolio holdings may have changed since the report date.

| 1 | Country weights may include issues via Samurai bonds issued in Japanese yen by non-Japanese entities and/or Yankee bonds issued in U.S. dollars by non-U.S. entities. |

| 2 | Includes forward foreign currency exchange contracts exposure, which may results in negative exposure to a particular currency. |

| 3 | Amount is less than 0.05% |

| 4 | This list is not a recommendation of any security by the investment adviser or subadviser. |

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees; and (2) ongoing costs, including management fees, transfer agent and shareholder services fees, and other fund expenses.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for the period beginning October 1, 2014 and held through March 31, 2015.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund or share class under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s or share class’ actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in a fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs, such as redemption fees. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Expense Ratio1

(Annualized) | Beginning

Account Value

at 10/1/14 | Ending

Account Value

(Net of Expenses)

at 3/31/15 | Expenses Paid

During Period2

10/1/14-3/31/15 |

| Laudus Mondrian International Equity Fund | | | | |

| Investor Shares | | | | |

| Actual Return | 1.16% | $1,000.00 | $ 1,013.70 | $5.82 |

| Hypothetical 5% Return | 1.16% | $1,000.00 | $ 1,019.12 | $5.84 |

| Select Shares | | | | |

| Actual Return | 1.05% | $1,000.00 | $1,014.30 | $5.27 |

| Hypothetical 5% Return | 1.05% | $1,000.00 | $1,019.66 | $5.29 |

| Institutional Shares | | | | |

| Actual Return | 0.90% | $1,000.00 | $1,014.90 | $4.52 |

| Hypothetical 5% Return | 0.90% | $1,000.00 | $ 1,020.41 | $4.53 |

| Laudus Mondrian Emerging Markets Fund | | | | |

| Investor Shares | | | | |

| Actual Return | 1.60% | $1,000.00 | $ 945.80 | $ 7.76 |

| Hypothetical 5% Return | 1.60% | $1,000.00 | $ 1,016.92 | $8.05 |

| Select Shares | | | | |

| Actual Return | 1.35% | $1,000.00 | $ 946.70 | $6.55 |

| Hypothetical 5% Return | 1.35% | $1,000.00 | $ 1,018.17 | $ 6.79 |

| Institutional Shares | | | | |

| Actual Return | 1.20% | $1,000.00 | $ 947.90 | $5.83 |

| Hypothetical 5% Return | 1.20% | $1,000.00 | $ 1,018.92 | $6.04 |

| Laudus Mondrian International Government Fixed Income Fund | | | | |

| Actual Return | 0.75% | $1,000.00 | $ 932.00 | $3.61 |

| Hypothetical 5% Return | 0.75% | $1,000.00 | $ 1,021.16 | $ 3.78 |

| Laudus Mondrian Global Government Fixed Income Fund | | | | |

| Actual Return | 0.85% | $1,000.00 | $ 950.90 | $4.13 |

| Hypothetical 5% Return | 0.85% | $1,000.00 | $1,020.66 | $4.28 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights which covers a 12-month period. |

| 2 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 182 days of the period, and divided by 365 days of the fiscal year. |

Laudus Mondrian International Equity Fund

Financial Statements

Financial Highlights

| Investor Shares | 4/1/14–

3/31/15 | 4/1/13–

3/31/14 | 4/1/12–

3/31/13 | 4/1/11–

3/31/12 | 4/1/10–

3/31/11 | |

| Per-Share Data ($) |

| Net asset value at beginning of period | 8.76 | 7.43 | 7.19 | 7.73 | 7.52 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.16 | 0.29 | 0.21 | 0.26 | 0.16 | |

| Net realized and unrealized gains (losses) | (0.31) | 1.25 | 0.26 | (0.45) | 0.28 | |

| Total from investment operations | (0.15) | 1.54 | 0.47 | (0.19) | 0.44 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.88) | (0.21) | (0.22) | (0.30) | (0.23) | |

| Distributions from net realized gains | (1.28) | — | (0.01) | (0.05) | — | |

| Total distributions | (2.16) | (0.21) | (0.23) | (0.35) | (0.23) | |

| Net asset value at end of period | 6.45 | 8.76 | 7.43 | 7.19 | 7.73 | |

| Total return (%) | (0.02) | 20.86 | 6.79 | (2.02) | 5.94 | |

| Ratios/Supplemental Data (%) |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 1.17 | 1.27 | 1.40 | 1.40 | 1.40 | |

| Gross operating expenses | 1.33 | 1.29 | 1.51 | 1.63 | 1.63 | |

| Net investment income (loss) | 2.08 | 3.56 | 3.03 | 3.49 | 2.19 | |

| Portfolio turnover rate | 36 2 | 25 | 29 | 35 | 33 | |

| Net assets, end of period ($ x 1,000) | 3,486 | 1,185 | 926 | 1,048 | 1,009 | |

| |

| Select Shares | 4/1/14–

3/31/15 | 4/1/13–

3/31/14 | 4/1/12–

3/31/13 | 4/1/11–

3/31/12 | 4/1/10–

3/31/11 | |

| Per-Share Data ($) |

| Net asset value at beginning of period | 8.79 | 7.45 | 7.20 | 7.75 | 7.53 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.20 | 0.37 | 0.24 | 0.26 | 0.21 | |

| Net realized and unrealized gains (losses) | (0.35) | 1.19 | 0.26 | (0.44) | 0.25 | |

| Total from investment operations | (0.15) | 1.56 | 0.50 | (0.18) | 0.46 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.88) | (0.22) | (0.24) | (0.32) | (0.24) | |

| Distributions from net realized gains | (1.28) | — | (0.01) | (0.05) | — | |

| Total distributions | (2.16) | (0.22) | (0.25) | (0.37) | (0.24) | |

| Net asset value at end of period | 6.48 | 8.79 | 7.45 | 7.20 | 7.75 | |

| Total return (%) | 0.04 | 21.17 | 7.18 | (1.82) | 6.20 | |

| Ratios/Supplemental Data (%) |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 1.08 3 | 1.07 | 1.12 | 1.12 | 1.12 | |

| Gross operating expenses | 1.23 | 1.08 | 1.26 | 1.40 | 1.36 | |

| Net investment income (loss) | 2.56 | 4.53 | 3.37 | 3.51 | 2.86 | |

| Portfolio turnover rate | 36 2 | 25 | 29 | 35 | 33 | |

| Net assets, end of period ($ x 1,000) | 2,981 | 2,238 | 768 | 938 | 542 | |

1

Calculated based on the average shares outstanding during the period.

2

Portfolio turnover excludes the impact of investment activity from a merger with another fund. See financial note 13 for additional information.

3

Effective October 1, 2014, the annual operating expense was reduced. The ratio presented for period ended 3/31/15 is a blended ratio. (See financial note 4)

Laudus Mondrian International Equity Fund

Financial Highlights continued

| Institutional Shares | 4/1/14–

3/31/15 | 4/1/13–

3/31/14 | 4/1/12–

3/31/13 | 4/1/11–

3/31/12 | 4/1/10–

3/31/11 | |

| Per-Share Data ($) |

| Net asset value at beginning of period | 8.81 | 7.46 | 7.22 | 7.76 | 7.54 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.27 | 0.35 | 0.23 | 0.29 | 0.23 | |

| Net realized and unrealized gains (losses) | (0.41) | 1.22 | 0.27 | (0.46) | 0.24 | |

| Total from investment operations | (0.14) | 1.57 | 0.50 | (0.17) | 0.47 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.89) | (0.22) | (0.25) | (0.32) | (0.25) | |

| Distributions from net realized gains | (1.28) | — | (0.01) | (0.05) | — | |

| Total distributions | (2.17) | (0.22) | (0.26) | (0.37) | (0.25) | |

| Net asset value at end of period | 6.50 | 8.81 | 7.46 | 7.22 | 7.76 | |

| Total return (%) | 0.11 | 21.31 | 7.10 | (1.63) | 6.28 | |

| Ratios/Supplemental Data (%) |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 1.01 2 | 1.05 | 1.05 | 1.05 | 1.05 | |

| Gross operating expenses | 1.07 | 1.07 | 1.11 | 1.23 | 1.21 | |

| Net investment income (loss) | 3.28 | 4.24 | 3.22 | 3.92 | 3.08 | |

| Portfolio turnover rate | 36 3 | 25 | 29 | 35 | 33 | |

| Net assets, end of period ($ x 1,000) | 91,981 | 162,366 | 127,709 | 119,049 | 126,758 | |

| |

1

Calculated based on the average shares outstanding during the period.

2

Effective October 1, 2014, the annual operating expense was reduced. The ratio presented for period ended 3/31/15 is a blended ratio. (See financial note 4)

3

Portfolio turnover excludes the impact of investment activity from a merger with another fund. See financial note 13 for additional information.

Laudus Mondrian International Equity Fund

Portfolio Holdings as of March 31, 2015

This section shows all the securities in the fund's portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund's Form N-Q is available on the SEC's website at http://www.sec.gov and may be viewed and copied at the SEC's Public Reference Room in Washington, D.C. Call 1-800-SEC-0330 for information on the operation of the Public Reference Room. The fund also makes available its complete schedule of portfolio holdings 15-20 days after calendar quarters on the fund's website at www.csimfunds.com/laudusfunds_prospectus.

| Holdings by Category | Cost

($) | Value

($) |

| 98.4% | Common Stock | 80,619,036 | 96,872,347 |

| 0.0% | Rights | — | 31,084 |

| 1.7% | Other Investment Company | 1,648,604 | 1,648,604 |

| 100.1% | Total Investments | 82,267,640 | 98,552,035 |

| (0.1)% | Other Assets and Liabilities, Net | | (103,445) |

| 100.0% | Net Assets | | 98,448,590 |

| Security | Number

of Shares | Value

($) |

| Common Stock 98.4% of net assets |

| Australia 1.7% |

| Insurance 1.7% |

| QBE Insurance Group Ltd. | 164,092 | 1,622,018 |

| China 1.8% |

| Telecommunication Services 1.8% |

| China Mobile Ltd. | 138,000 | 1,798,470 |

| France 8.8% |

| Capital Goods 2.5% |

| Compagnie de Saint-Gobain | 55,838 | 2,451,695 |

| Energy 2.3% |

| Total S.A. | 45,157 | 2,244,619 |

| Pharmaceuticals, Biotechnology & Life Sciences 3.4% |

| Sanofi | 33,693 | 3,327,487 |

| Telecommunication Services 0.6% |

| Orange S.A. | 40,577 | 651,649 |

| | | 8,675,450 |

| Germany 9.8% |

| Automobiles & Components 1.7% |

| Daimler AG - Reg'd | 16,961 | 1,628,845 |

| Software & Services 3.2% |

| SAP SE | 43,368 | 3,134,524 |

| Telecommunication Services 3.2% |

| Deutsche Telekom AG - Reg'd | 172,604 | 3,156,998 |

| Security | Number

of Shares | Value

($) |

| Utilities 1.7% |

| RWE AG | 67,642 | 1,722,161 |

| | | 9,642,528 |

| Israel 3.0% |

| Pharmaceuticals, Biotechnology & Life Sciences 3.0% |

| Teva Pharmaceutical Industries Ltd. ADR | 47,700 | 2,971,710 |

| Italy 2.1% |

| Energy 2.1% |

| Eni S.p.A. | 118,145 | 2,044,871 |

| Japan 17.6% |

| Automobiles & Components 3.1% |

| Honda Motor Co., Ltd. | 93,200 | 3,042,321 |

| Food & Staples Retailing 1.9% |

| Seven & i Holdings Co., Ltd. | 43,600 | 1,832,214 |

| Household & Personal Products 1.8% |

| Kao Corp. | 35,000 | 1,747,690 |

| Insurance 2.8% |

| Tokio Marine Holdings, Inc. | 74,300 | 2,804,588 |

| Pharmaceuticals, Biotechnology & Life Sciences 3.4% |

| Takeda Pharmaceutical Co., Ltd. | 66,100 | 3,299,571 |

| Technology Hardware & Equipment 3.2% |

| Canon, Inc. | 88,700 | 3,138,320 |

| Telecommunication Services 1.4% |

| NTT DOCOMO, Inc. | 80,500 | 1,406,819 |

| | | 17,271,523 |

| Netherlands 3.4% |

| Food & Staples Retailing 3.3% |

| Koninklijke Ahold N.V. | 168,872 | 3,327,768 |

| Media 0.1% |

| Reed Elsevier N.V. | 2,464 | 61,397 |

| | | 3,389,165 |

| Singapore 4.3% |

| Banks 1.9% |

| United Overseas Bank Ltd. | 112,320 | 1,882,725 |

| Telecommunication Services 2.4% |

| Singapore Telecommunications Ltd. | 740,800 | 2,363,920 |

| | | 4,246,645 |

| Spain 7.7% |

| Banks 1.7% |

| Banco Santander S.A. | 223,640 | 1,676,489 |

| Telecommunication Services 2.8% |

| Telefonica S.A. | 192,723 | 2,742,352 |

| Utilities 3.2% |

| Iberdrola S.A. | 490,733 | 3,164,518 |

| | | 7,583,359 |

Laudus Mondrian International Equity Fund

Portfolio Holdings continued

| Security | Number

of Shares | Value

($) |

| Sweden 2.1% |

| Telecommunication Services 2.1% |

| TeliaSonera AB | 328,296 | 2,086,218 |

| Switzerland 15.6% |

| Capital Goods 3.5% |

| ABB Ltd. - Reg'd * | 161,752 | 3,431,407 |

| Food, Beverage & Tobacco 3.1% |

| Nestle S.A. - Reg'd | 41,097 | 3,094,701 |

| Insurance 3.3% |

| Zurich Insurance Group AG * | 9,606 | 3,246,849 |

| Materials 2.5% |

| Syngenta AG - Reg'd | 7,251 | 2,463,370 |

| Pharmaceuticals, Biotechnology & Life Sciences 3.2% |

| Novartis AG - Reg'd | 31,431 | 3,102,255 |

| | | 15,338,582 |

| Taiwan 2.0% |

| Semiconductors & Semiconductor Equipment 2.0% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 420,154 | 1,952,691 |

| United Kingdom 18.5% |

| Energy 5.3% |

| BP plc | 400,721 | 2,597,538 |

| Royal Dutch Shell plc, Class A | 88,561 | 2,642,542 |

| | | 5,240,080 |

| Food & Staples Retailing 2.7% |

| Tesco plc | 730,746 | 2,608,437 |

| Food, Beverage & Tobacco 3.2% |

| Unilever plc | 75,421 | 3,146,822 |

| Pharmaceuticals, Biotechnology & Life Sciences 3.3% |

| GlaxoSmithKline plc | 142,932 | 3,290,286 |

| Telecommunication Services 1.2% |

| Vodafone Group plc | 357,407 | 1,169,551 |

| Utilities 2.8% |

| National Grid plc | 217,325 | 2,793,941 |

| | | 18,249,117 |

| Total Common Stock |

| (Cost $80,619,036) | | 96,872,347 |

| Security | Number

of Shares | Value

($) |

| Rights 0.0% of net assets |

| Spain 0.0% |

| Telecommunication Services 0.0% |

| Telefonica S.A. * | 192,723 | 31,084 |

| Total Rights |

| (Cost $—) | | 31,084 |

|

| Other Investment Company 1.7% of net assets |

| United States 1.7% |

| State Street Institutional U.S. Government Money Market Fund, Premier Class 0.00% (a) | 1,648,604 | 1,648,604 |

| Total Other Investment Company |

| (Cost $1,648,604) | | 1,648,604 |

End of Investments.

At 03/31/15, the tax basis cost of the fund's investments was $84,125,109 and the unrealized appreciation and depreciation were $16,750,087 and ($2,323,161), respectively, with a net unrealized appreciation of $14,426,926.

At 03/31/15, the values of certain foreign securities held by the fund aggregating $93,900,637 were adjusted from their closing market values in accordance with international fair valuation procedures approved by the fund's Board of Trustees. (See financial note 2(a) for additional information).

| * | Non-income producing security. |

| (a) | The rate shown is the 7-day yield. |

| | |

| ADR – | American Depositary Receipt |

| Reg'd – | Registered |

Laudus Mondrian International Equity Fund

Portfolio Holdings continued

The following is a summary of the inputs used to value the fund's investments as of March 31, 2015 (see financial note 2(a) for additional information):

| Description | | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | | Other Significant

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total | |

| Common Stock1 | | $— | | $93,900,637 | | $— | | $93,900,637 | |

| Israel 1 | | 2,971,710 | | — | | — | | 2,971,710 | |

| Rights 1 | | 31,084 | | — | | — | | 31,084 | |

| Other Investment Company1 | | 1,648,604 | | — | | — | | 1,648,604 | |

| Total | | $4,651,398 | | $93,900,637 | | $— | | $98,552,035 | |

| 1 | As categorized in Portfolio Holdings. |

The fund's policy is to recognize transfers between Level 1, Level 2 and Level 3 as of the beginning of the fiscal year. There were security transfers in the amount of $5,387,361 from Level 1 to Level 2 for the period ended March 31, 2015. The transfers between Level 1 and Level 2 were primarily due to the use of international fair valuation by the fund. There were no transfers in or out of Level 3 securities during the period.

Laudus Mondrian International Equity Fund

Statement of

Assets and Liabilities

As of March 31, 2015

| Assets |

| Investments, at value (cost $82,267,640) | | $98,552,035 |

| Foreign currency, at value (cost $116,983) | | 116,696 |

| Receivables: | | |

| Investments sold | | 181,523 |

| Fund shares sold | | 424,602 |

| Dividends | | 181,068 |

| Foreign tax reclaims | | 151,118 |

| Prepaid expenses | + | 588 |

| Total assets | | 99,607,630 |

| Liabilities |

| Payables: | | |

| Investments bought | | 1,037,569 |

| Investment adviser fees | | 10,575 |

| Independent trustees' fees | | 5,550 |

| Distribution and shareholder services fees | | 673 |

| Fund shares redeemed | | 630 |

| Accrued expenses | + | 104,043 |

| Total liabilities | | 1,159,040 |

| Net Assets |

| Total assets | | 99,607,630 |

| Total liabilities | – | 1,159,040 |

| Net assets | | $98,448,590 |

| Net Assets by Source | | |

| Capital received from investors | | 81,196,903 |

| Net investment income not yet distributed | | 238,502 |

| Net realized capital gains | | 748,513 |

| Net unrealized capital appreciation | | 16,264,672 |

| Net Asset Value (NAV) by Shares Class | |

| Share Class | Net Assets | ÷ | Shares

Outstanding | = | NAV |

| Investor Shares | $3,486,138 | | 540,472 | | $6.45 |

| Select Shares | $2,980,998 | | 460,008 | | $6.48 |

| Institutional Shares | $91,981,454 | | 14,147,640 | | $6.50 |

| | | | | | |

Laudus Mondrian International Equity Fund

Statement of

Operations

For the period April 1, 2014 through March 31, 2015

| Investment Income |

| Dividends (net of foreign withholding taxes of $435,751) | | $5,007,035 |

| Expenses |

| Investment adviser fees | | 964,775 |

| Professional fees | | 75,741 |

| Transfer agent fees | | 68,756 |

| Custodian fees | | 51,802 |

| Registration fees | | 50,430 |

| Accounting and administration fees | | 30,658 |

| Independent trustees' fees | | 10,497 |

| Distribution and shareholder services fees (Investor Shares) | | 2,685 |

| Interest expense | | 490 |

| Sub-accounting and sub-transfer agent fees: | | |

| Investor Shares | | 1,280 |

| Select Shares | | 3,038 |

| Other expenses | + | 12,284 |

| Total expenses | | 1,272,436 |

| Expense reduction by adviser | – | 82,813 |

| Net expenses | – | 1,189,623 |

| Net investment income | | 3,817,412 |

| Realized and Unrealized Gains (Losses) |

| Net realized gains on investments | | 15,903,598 |

| Net realized losses on foreign currency transactions | + | (64,495) |

| Net realized gains | | 15,839,103 |

| Net change in unrealized appreciation (depreciation) on investments | | (19,582,584) |

| Net change in unrealized appreciation (depreciation) on foreign currency translations | + | 199,752 |

| Net change in unrealized appreciation (depreciation) | + | (19,382,832) |

| Net realized and unrealized losses | | (3,543,729) |

| Increase in net assets resulting from operations | | $273,683 |

Laudus Mondrian International Equity Fund

Statement of

Changes in Net Assets

For the current and prior report periods

| Operations | |

| | 4/1/14-3/31/15 | 4/1/13-3/31/14 |

| Net investment income | | $3,817,412 | $6,442,067 |

| Net realized gains | | 15,839,103 | 4,311,620 |

| Net change in unrealized appreciation (depreciation) | + | (19,382,832) | 18,713,546 |

| Increase in net assets from operations | | 273,683 | 29,467,233 |

| Distributions to Shareholders | |

| Distributions from net investment income | | | |

| Investor Shares | | (228,950) | (43,562) |

| Select Shares | | (237,028) | (39,623) |

| Institutional Shares | + | (6,208,099) | (4,101,346) |

| Total distributions from net investment income | | (6,674,077) | (4,184,531) |

| Distributions from net realized gains | | | |

| Investor Shares | | (332,869) | — |

| Select Shares | | (343,793) | — |

| Institutional Shares | + | (8,947,584) | — |

| Total distributions from net realized gains | | (9,624,246) | — |

| Total distributions | | ($16,298,323) | $— |

| Transactions in Fund Shares | | | |

| | | 4/1/14-3/31/15 | 4/1/13-3/31/14 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares Sold | | | | | |

| Investor Shares | | 415,068 | $3,051,107 | 124,025 | $1,020,656 |

| Select Shares | | 331,340 | 2,479,377 | 187,963 | 1,551,950 |

| Institutional Shares | + | 4,084,739 | 31,936,081 | 5,128,087 | 41,545,896 |

| Total shares sold | | 4,831,147 | $37,466,565 | 5,440,075 | $44,118,502 |

| Issued in connection with merger | | | | | |

| Institutional Shares | | 4,414,647 | 28,253,737 | — | — |

| Total shares issued in connection with merger | | 4,414,647 | $28,253,737 | — | $— |

| Shares Reinvested | | | | | |

| Investor Shares | | 86,483 | $521,494 | 4,585 | $37,461 |

| Select Shares | | 77,093 | 466,412 | 3,974 | 32,588 |

| Institutional Shares | + | 1,338,949 | 8,127,419 | 118,669 | 975,458 |

| Total shares reinvested | | 1,502,525 | $9,115,325 | 127,228 | $1,045,507 |

| Shares Redeemed | | | | | |

| Investor Shares | | (96,337) | ($716,832) | (117,964) | ($961,598) |

| Select Shares | | (202,963) | (1,634,227) | (40,460) | (338,030) |

| Institutional Shares | + | (14,126,383) | (123,799,839) | (3,918,997) | (32,761,514) |

| Total shares redeemed | | (14,425,683) | ($126,150,898) | (4,077,421) | ($34,061,142) |

| Net transactions in fund shares | | (3,677,364) | ($51,315,271) | 1,489,882 | $11,102,867 |

| Shares Outstanding and Net Assets | | | |

| | | 4/1/14-3/31/15 | 4/1/13-3/31/14 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 18,825,484 | $165,788,501 | 17,335,602 | $129,402,932 |

| Total increase or decrease | + | (3,677,364) | (67,339,911) | 1,489,882 | 36,385,569 |

| End of period | | 15,148,120 | $98,448,590 | 18,825,484 | $165,788,501 |

| Net investment income not yet distributed | | | $238,502 | | $3,160,403 |

Laudus Mondrian Emerging Markets Fund

Financial Statements

Financial Highlights

| Investor Shares | 4/1/14–

3/31/15 | 4/1/13–

3/31/14 | 4/1/12–

3/31/13 | 4/1/11–

3/31/12 | 4/1/10–

3/31/11 | |

| Per-Share Data ($) |

| Net asset value at beginning of period | 8.69 | 9.84 | 9.48 | 9.67 | 8.79 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.14 | 0.11 | 0.12 | 0.16 | 0.14 | |

| Net realized and unrealized gains (losses) | (0.45) | (1.18) | 0.42 | (0.20) | 0.90 | |

| Total from investment operations | (0.31) | (1.07) | 0.54 | (0.04) | 1.04 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.20) | (0.08) | (0.18) | (0.08) | (0.16) | |

| Distributions from net realized gains | — | (0.00) 2 | — | (0.07) | — | |

| Total distributions | (0.20) | (0.08) | (0.18) | (0.15) | (0.16) | |

| Net asset value at end of period | 8.18 | 8.69 | 9.84 | 9.48 | 9.67 | |

| Total return (%) | (3.46) | (10.89) | 5.79 | (0.19) | 11.89 | |

| Ratios/Supplemental Data (%) |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 1.71 3 | 1.80 | 1.80 | 1.80 | 1.80 | |

| Gross operating expenses | 1.77 | 1.86 | 1.89 | 1.90 | 1.91 | |

| Net investment income (loss) | 1.56 | 1.25 | 1.33 | 1.74 | 1.56 | |

| Portfolio turnover rate | 30 4 | 69 | 59 | 43 | 33 | |

| Net assets, end of period ($ x 1,000) | 5,426 | 7,499 | 11,716 | 9,639 | 10,862 | |

| |

| Select Shares | 4/1/14–

3/31/15 | 4/1/13–

3/31/14 | 4/1/12–

3/31/13 | 4/1/11–

3/31/12 | 4/1/10–

3/31/11 | |

| Per-Share Data ($) |

| Net asset value at beginning of period | 8.70 | 9.85 | 9.49 | 9.68 | 8.80 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.17 | 0.13 | 0.12 | 0.18 | 0.17 | |

| Net realized and unrealized gains (losses) | (0.46) | (1.17) | 0.45 | (0.19) | 0.90 | |

| Total from investment operations | (0.29) | (1.04) | 0.57 | (0.01) | 1.07 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.23) | (0.11) | (0.21) | (0.11) | (0.19) | |

| Distributions from net realized gains | — | (0.00) 2 | — | (0.07) | — | |

| Total distributions | (0.23) | (0.11) | (0.21) | (0.18) | (0.19) | |

| Net asset value at end of period | 8.18 | 8.70 | 9.85 | 9.49 | 9.68 | |

| Total return (%) | (3.26) | (10.57) | 6.15 | 0.15 | 12.18 | |

| Ratios/Supplemental Data (%) |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 1.45 3 | 1.52 | 1.52 | 1.52 | 1.52 | |

| Gross operating expenses | 1.51 | 1.59 | 1.66 | 1.66 | 1.66 | |

| Net investment income (loss) | 1.92 | 1.47 | 1.24 | 1.94 | 1.83 | |

| Portfolio turnover rate | 30 4 | 69 | 59 | 43 | 33 | |

| Net assets, end of period ($ x 1,000) | 10,446 | 15,849 | 18,340 | 5,993 | 5,554 | |

1

Calculated based on the average shares outstanding during the period.

2

Per-share amount was less than $0.01.

3

Effective October 1, 2014, the annual operating expense was reduced. The ratio presented for period ended 3/31/15 is a blended ratio. (See financial note 4)

4

Portfolio turnover excludes the impact of investment activity from a merger with another fund. See financial note 13 for additional information.

Laudus Mondrian Emerging Markets Fund

Financial Highlights continued

| Institutional Shares | 4/1/14–

3/31/15 | 4/1/13–

3/31/14 | 4/1/12–

3/31/13 | 4/1/11–

3/31/12 | 4/1/10–

3/31/11 | |

| Per-Share Data ($) |

| Net asset value at beginning of period | 8.69 | 9.85 | 9.49 | 9.68 | 8.80 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.12 | 0.14 | 0.16 | 0.19 | 0.15 | |

| Net realized and unrealized gains (losses) | (0.39) | (1.19) | 0.42 | (0.19) | 0.92 | |

| Total from investment operations | (0.27) | (1.05) | 0.58 | — | 1.07 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.24) | (0.11) | (0.22) | (0.12) | (0.19) | |

| Distributions from net realized gains | — | (0.00) 2 | — | (0.07) | — | |

| Total distributions | (0.24) | (0.11) | (0.22) | (0.19) | (0.19) | |

| Net asset value at end of period | 8.18 | 8.69 | 9.85 | 9.49 | 9.68 | |

| Total return (%) | (3.03) | (10.62) | 6.21 | 0.23 | 12.25 | |

| Ratios/Supplemental Data (%) |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 1.29 3 | 1.45 | 1.45 | 1.45 | 1.45 | |

| Gross operating expenses | 1.31 | 1.52 | 1.49 | 1.50 | 1.51 | |

| Net investment income (loss) | 1.42 | 1.55 | 1.70 | 2.07 | 1.69 | |

| Portfolio turnover rate | 30 4 | 69 | 59 | 43 | 33 | |

| Net assets, end of period ($ x 1,000) | 559,347 | 121,795 | 141,536 | 148,187 | 171,432 | |

| |

1

Calculated based on the average shares outstanding during the period.

2

Per-share amount was less than $0.01.

3

Effective October 1, 2014, the annual operating expense was reduced. The ratio presented for period ended 3/31/15 is a blended ratio. (See financial note 4)

4

Portfolio turnover excludes the impact of investment activity from a merger with another fund. See financial note 13 for additional information.

Laudus Mondrian Emerging Markets Fund

Portfolio Holdings as of March 31, 2015