UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-05549

Reynolds Funds, Inc.

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Frederick L. Reynolds

Reynolds Capital Management

2580 Kekaa Drive #115

Lahaina, Hawaii 96761

(Name and address of agent for service)

(800) 773-9665

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: March 31, 2007

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2007

REYNOLDS FUNDS

No-Load Mutual Funds

Reynolds

Blue Chip Growth Fund

Seeking Long-Term Capital Appreciation

Reynolds

Opportunity Fund

Seeking Long-Term Capital Appreciation

Reynolds

Fund

Seeking Long-Term Capital Appreciation

1-800-773-9665

www.reynoldsfunds.com

REYNOLDS FUNDS

May 22, 2007

Dear Fellow Shareholders:

The past year can be characterized as a period of many crosscurrents in the U.S. economy including: (1) a weakening housing market, auto market and capital spending; (2) interest rates rising early in the period and then flattening; (3) productivity growth positive although growing at a lower rate than previously; (4) low unemployment accompanied by slowing job growth; (5) a recent slowing of consumer spending, although consumer confidence is still positive; and (6) a weakening U.S. dollar. Gross Domestic Product (GDP) is still showing good growth, but is growing at a slower rate in 2007 than the last few years. GDP is estimated to increase 2.3% in calendar 2007 after increasing 3.3% in calendar 2006 and 3.2% in 2005. The weaker U.S. economy is causing lower inflation. Inflation, as measured by the Consumer Price Index, is estimated to increase 2.2% in calendar 2007 after increasing 2.6% in 2006 and 3.4% in 2005. Although inflation is moderating, it is still above the range of 1-2% that the Federal Reserve (the Fed) is comfortable with. As a result, the Fed is still worried about inflation and will likely continue to hold interest rates steady this year unless the economy slows from here.

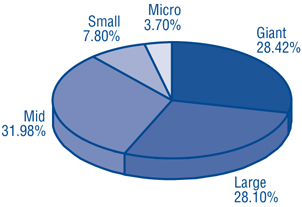

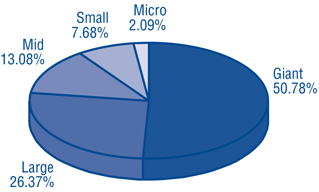

Opportunistic Investing in Companies of Various Sizes

The Reynolds Funds invest in companies of various sizes as classified by their market capitalizations. A company’s market capitalization is calculated by taking the number of shares the company has outstanding multiplied by its current market price. This is one way that the Reynolds Funds differentiate their investment styles. Other considerations in selecting companies for the portfolios include revenue growth rates, product innovations, financial strength, management’s knowledge and experience plus the overall economic and geopolitical environments and interest rates.

Reynolds Blue Chip Growth Fund | Reynolds Opportunity Fund | Reynolds Fund |

Portfolio as of March 31, 2007 | Portfolio as of March 31, 2007 | Portfolio as of March 31, 2007 |

|  |  |

| Source: Morningstar web site and Morningstar Market Cap Breakpoints |

| Morningstar separates stock portfolio holdings into five market-capitalization groups: Giant, Large, Mid, Small and Micro. Of the 5,000 largest domestic stocks in the equities database, the top 1% are categorized as Giant, the next 4% are Large, the next 15% are Mid, the next 30% are Small, and the remaining 50% are Micro. Stocks outside of the largest 5,000 are also classified as Micro. |

- 1 -

Market caps are the minimum in each cap group; therefore, the minimum large market cap is the large-mid breakpoint and mid is the mid-small breakpoint, etc. As of March 31, 2007 the minimums in each cap group are as follows:

| (in millions) | |

| Giant | $45,668.40 |

| Large | $11,511.49 |

| Mid | $2,063.70 |

| Small | $574.10 |

| Micro | <$574.10 |

Low Long-Term Interest Rates by Historical Standards Are a Significant Positive for Stock Valuations

Long-term interest rates remain near historically low levels. Low long-term interest rates usually result in higher stock valuations for many reasons including:

| (1) | Long-term borrowing costs of corporations are lower resulting in higher business confidence and profits. |

| (2) | Long-term borrowing costs of individuals are lower which increases consumer confidence and spending. |

| (3) | A company’s stock is usually valued by placing a present value on that company’s future stream of earnings and dividends. The present value should be higher when interest and inflation rates are low. |

The Reynolds Blue Chip Growth Fund

The long-term strategy of the Reynolds Blue Chip Growth Fund is to emphasize investment in “blue chip” growth companies. In the long-term these companies build value as their earnings grow. This growth in value should ultimately be recognized in higher stock prices for these companies. The Blue Chip Growth Fund’s total return was 4.07% for the six months ending March 31, 2007 and -0.56% for the three months ending March 31, 2007.

Performance highlights (as of March 31, 2007)

Cumulative Total Return | Average Annual Total Return | |||

| One Year | -6.31% | -6.31% | ||

| Three years | -4.65% | -1.57% | ||

| Five Years | -6.01% | -1.23% | ||

| Ten Years | 24.64% | 2.23% | ||

| Since inception (August 12, 1988) | 242.12% | 6.82% | ||

The Reynolds Opportunity Fund

The Reynolds Opportunity Fund emphasizes investments in “blue chip” growth companies in addition to emerging growth companies. The Opportunity Fund’s total return was 5.16% for the six months ending March 31,2007 and 0.23% for the three months ending March 31, 2007.

Performance highlights (as of March 31, 2007)

Cumulative Total Return | Average Annual Total Return | |||

| One Year | -14.87% | -14.87% | ||

| Three years | -16.47% | -5.82% | ||

| Five Years | 2.85% | 0.56% | ||

| Ten Years | 32.94% | 2.89% | ||

| Since inception (January 30, 1992) | 97.96% | 4.61% | ||

The Reynolds Fund

The Reynolds Fund is a general stock fund that owns companies of all types and sizes. The Reynolds Fund’s total return was 2.61% for the six months ending March 31, 2007 and flat for the three months ending March 31, 2007.

- 2 -

Performance highlights (as of March 31, 2007)

Cumulative Total Return | Average Annual Total Return | |||

| One Year | -15.50% | -15.50% | ||

| Three years | -23.31% | -8.47% | ||

| Five Years | 25.59% | 4.66% | ||

| Since inception (October 1, 1999) | -41.10% | -6.82% | ||

Economic Discussion

The World Economy

Foreign economic growth remains generally strong in 2007 as macroeconomic policy generally remains supportive of good growth. Globalization is helping to raise real income in many foreign companies and monetary policy is not overly restrictive. U.S. export growth should remain a positive as there is strong growth in the rest of the world. However, it also means that central banks in major foreign economies will likely tighten further. The Blue Chip, Opportunity, and Reynolds Funds are positioned to participate in the long-term worldwide growth trends through their investments in U.S. headquartered and foreign headquartered companies whose stocks or American Depositary Receipts (ADRs) trade in the United States. We have some investments in foreign headquartered companies in the Reynolds Funds at the present time. We are planning on increasing our investments in foreign headquartered companies in the future where we believe that the long-term fundamentals are positive and their stock prices are attractive.

The U.S. Economy

The U.S. economy grew at a 1.3% rate in the first quarter of 2007. This was the lowest rate of growth in the last four years. However, a number of companies reported strong quarterly earnings, particularly ones with higher foreign components to their business. Some economic positives are that during the first half of 2007: (1) a scenario for a soft economic landing seems to be unfolding; (2) the worst of the economic slowdown may have passed; (3) capacity utilization and capital costs remain favorable; and (4) the efficiencies of the economy resulting from such things as technology enhancements and productivity increases are quite positive. Some economic negatives are that: (1) housing should remain a significant drag on the U.S. economy for awhile; (2) spending for autos and other big-ticket items is expected to moderate over the course of 2007; and (3) business capital spending and software spending has weakened recently.

Consumer spending represents approximately 65% of GDP. Consumer spending has been weakening; however, it remains a continued positive. Continued real income gains and an improvement in consumer psychology due to a tight labor market should continue to benefit growth in consumer spending. GDP increased 3.3% in 2006 after increasing 3.2% in 2005, 3.9% in 2004, 2.7% in 2003, 1.9% in 2002, 0.8% in 2001 and 3.7% in 2000. GDP is estimated to increase 2.3% in 2007.

U.S. inflation is low relative to the last thirty-five years due to such factors as: (1) a slowing U.S. economy; (2) global competition; (3) advances in technology resulting in increasing productivity; and (4) technology innovations that are helping to lower production and distribution costs. U.S. inflation, as measured by the Consumer Price Index, increased 2.6% in 2006, after increasing 3.4% in 2005, 2.7% in 2004, 2.3% in 2003, 1.6% in 2002, 2.8% in 2001 and 3.4% in 2000. U.S. inflation is estimated to increase 2.2% in 2007. This is a moderating rate versus the year before. However, inflation is still above the range of 1-2% growth that the Fed is comfortable with and is the Fed’s primary policy concern. Members of the Fed have stated in recent weeks that their main worry was not that the economy might slow more than desired but that inflation might not come down as much as needed to keep it under control. As a result, the Fed is likely to hold interest rates flattish throughout the rest of the year unless the economy weakens further. In a recent poll conducted by the Wall Street Journal, 75% of the economists surveyed currently believe that the Fed is doing the right thing regarding interest rates.

- 3 -

Investment Outlook

There are many investment positives. Among them are: (1) the economy is growing although at a slower rate; (2) corporate profits are still good, particularly for companies with higher overseas exposure; (3) interest rate increases by the Fed have stopped near term; (4) U.S. industry is more competitive than at any time in the past quarter century and U.S. companies are the leaders in the majority of industries worldwide; (5) although consumer spending and confidence have weakened they remain positive; (6) U. S. productivity continues to increase although at a slower rate; (7) unit labor costs have recently slowed; (8) the Internet is beginning to produce efficiencies; (9) corporate cost cutting has been very successful; (10) price-earnings ratios are in line with historical averages; and (11) Ben Bernanke, the new head of the Federal Reserve Board, appears to be quite capable.

Some possible investment negatives, which we are watching are: (1) the possibility of higher inflation resulting in such things as higher interest rates; (2) high energy prices; (3) large federal spending and federal deficits; (4) the housing slowdown including sub prime mortgage delinquencies; (5) possible weakening consumer confidence; (6) the possibility that the economy slows further from here and we do not have a soft landing; (7) the possibility that the weak dollar could eventually push long term interest rates higher; (8) efforts to slow China’s economic boom; (9) the war in Iraq; and (10) terrorism around the world. The Reynolds Funds have temporarily adopted a more defensive position by temporarily raising the levels of cash in the Funds.

Linked Money Market Fund

The First American Treasury Obligations Fund is a money market fund offered by U.S. Bancorp Fund Services, LLC, an affiliate of our Transfer Agent. This Fund is offered as a money market alternative to our shareholders. The First American Treasury Obligations Fund offers many free shareholder conveniences including automatic investment and withdrawal plans and check writing access to your funds and is linked to any holdings you have in the Reynolds Funds. This Fund is also included on your quarterly statements.

Information about the Reynolds Funds

Reynoldsfunds.com web site: You can now access current information about your investment holdings via our web site, reynoldsfunds.com. You must first request a personal identification number (PIN) by calling our shareholder service representatives at (800) 773-9665. You will be able to view your account list, account detail (including balances), transaction history, distributions, and current Fund prices. Additional information available (PIN number not needed) includes quarterly updates of the returns of the Reynolds Funds, top ten holdings of each portfolio and industry percentages. Also, detailed statistics and graphs of past performances from a link to MSN Money for the three Reynolds Funds.

For automatic current daily net asset values: Call 1-800-773-9665 (1-800-7REYNOLDS) twenty-four hours-a-day, seven days a week and press “any key” then “1”. The updated current net asset values for all of the Reynolds Funds are usually available each business day after 5 P.M. (PST).

For First American Treasury Obligations Fund current one and seven day yields: Call 1-800-773-9665 and press “any key” then “1”.

For shareholders to automatically access their current account information: Call 1-800-773-9665 (twenty-four hours-a-day, seven days a week), press “any key” then “2” and enter your 16 digit account number which appears at the top right of your statement.

To speak to a Fund representative regarding current daily net asset values, current account information and any other questions: Call 1-800-773-9665 and press “0” from 6 A.M. to 5 P.M. (PST).

Shareholder statement frequency: Consolidated statements summarizing all Reynolds Funds and First American Treasury Obligations Fund accounts held by a shareholder are sent quarterly. In addition, individual Fund statements are sent when a shareholder purchases or redeems shares. Blue Chip, Opportunity and Reynolds Fund statements are sent twice a year if, and when, any ordinary income or capital gains are distributed.

- 4 -

Tax reporting: Individual 1099 forms, which summarize any dividend income and any long- or short-term capital gains, are sent annually to shareholders each January. The percentage of income earned from various government securities, if any, for the Reynolds Funds and the First American Treasury Obligations Fund are also reported in January.

Minimum investment: $1,000 for regular and retirement accounts ($100 for additional investments for all accounts - except for the Automatic Investment Plan, which is $50 for regular and retirement plan accounts).

Prototype plans for retirement plans: All types are offered including the Roth IRA, Coverdell Education Savings Account, SIMPLE IRA Plan, 401(k), SEP IRA, 403b and Fund Sponsored Qualified Retirement Plans.

Automatic Investment Plan: There is no charge to automatically debit your checking account to invest in any of the Reynolds Funds or the First American Treasury Obligations Fund ($50 minimum for any of these Funds) at periodic intervals to make automatic purchases in any of these Funds. This is useful for dollar cost averaging.

Systematic Withdrawal Plan: For shareholders with a $10,000 minimum starting balance, there is no charge to automatically redeem shares ($100 minimum) in any of the Reynolds Funds or the First American Treasury Obligations Fund as often as monthly and send a check to you or transfer funds to your bank account.

Free Check Writing: Free check writing ($100 minimum) is offered for accounts invested in the First American Treasury Obligations Fund.

Exchanges or regular redemptions between the Reynolds Funds and/or the First American Treasury Obligations Fund: As often as desired - no charge.

NASDAQ symbols: Reynolds Blue Chip Growth Fund - RBCGX, Reynolds Opportunity Fund - ROPPX, Reynolds

Fund - REYFX, and First American Treasury Obligations Fund - FATXX.

Portfolio Manager: Frederick Reynolds is the portfolio manager of each of the Reynolds Funds.

The Reynolds Funds are No-Load: No front-end sales commissions or deferred sales charges (“loads”) are charged. Over 40% of all mutual funds impose these marketing charges that are ultimately paid by the shareholder. These marketing charges are either: (1) a front-end fee or “load” in which up to 5% of a shareholder’s assets are deducted from the original investment (some funds even charge a fee when a shareholder reinvests capital gains or dividends); or (2) a back-end penalty fee or “load” which is typically deducted from a shareholder’s account if a shareholder redeems within five years of the original investment. These fees reduce a shareholder’s return. The Reynolds Funds are No-Load as they do not have these extra charges.

We appreciate your continued confidence in the Reynolds Funds and would like to welcome our new shareholders. We look forward to strong results in the future.

Sincerely,

Frederick L. Reynolds

President

This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Reynolds Funds unless accompanied or preceded by the Funds’ current prospectus. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.reynoldsfunds.com.

- 5 -

Reynolds Funds, Inc.

COST DISCUSSION

As a shareholder of the Reynolds Funds, you do not incur (except as described below) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees, but do incur ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Reynolds Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2006 through March 31, 2007.

Actual Expenses

The first line of each Fund in the table below provides information about actual account values and actual expenses for that particular Reynolds Fund. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

In addition to the costs highlighted and described below, the only Reynolds Funds transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with a Reynolds Fund. To determine your total costs of investing in a Reynolds Fund, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example below.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a particular Reynolds Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Reynolds Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account | Ending Account | Expenses Paid During | |

Value 10/1/06 | Value 3/31/07 | Period* 10/1/06-3/31/07 | |

| Reynolds Blue Chip Growth Fund Actual | $1,000.00 | $1,040.70 | $10.28 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.90 | $10.15 |

| Reynolds Opportunity Fund Actual | $1,000.00 | $1,051.60 | $10.28 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.90 | $10.10 |

| Reynolds Fund Actual | $1,000.00 | $1,026.10 | $11.16 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.90 | $11.09 |

| * | Expenses are equal to the Funds’ annualized expense ratio of 2.02%, 2.01% and 2.21%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period between October 1, 2006 and March 31, 2007). |

- 6 -

Reynolds Blue Chip Growth Fund

STATEMENT OF NET ASSETS

March 31, 2007 (Unaudited)

Shares | Value | |||

COMMON STOCKS — 50.3% (a) | ||||

Aerospace — 1.6% | ||||

| 3,000 | Boeing Co. | $ | 266,730 | |

| 1,000 | Raytheon Co. | 52,460 | ||

| 2,000 | United Technologies Corp. | 130,000 | ||

| 449,190 | ||||

Airlines — 0.9% | ||||

| 3,000 | AMR Corp.* | 91,350 | ||

| 1,500 | General Dynamics Corp. | 114,600 | ||

| 1,000 | US Airways Group, Inc.* | 45,480 | ||

| 251,430 | ||||

Apparel — 0.6% | ||||

| 2,000 | Polo Ralph Lauren Corp. | 176,300 | ||

Application Software — 0.5% | ||||

| 5,000 | Microsoft Corp. | 139,350 | ||

Automotive — 0.3% | ||||

| 3,000 | CarMax, Inc.* | 73,620 | ||

Banks — 0.2% | ||||

| 1,000 | JPMorgan Chase & Co. | 48,380 | ||

Building — 0.5% | ||||

| 1,500 | Home Depot, Inc. | 55,110 | ||

| 3,000 | Lowe’s Companies, Inc. | 94,470 | ||

| 149,580 | ||||

Cable TV/Broadcasting — 1.2% | ||||

| 2,500 | Comcast Corp.* | 64,875 | ||

| 3,500 | Grupo Televisa S.A. SP-ADR | 104,300 | ||

| 7,500 | News Corp. | 173,400 | ||

| 342,575 | ||||

Communication Equipment — 1.9% | ||||

| 3,000 | C-COR Inc.* | 41,580 | ||

| 8,000 | Cisco Systems Inc.* | 204,240 | ||

| 6,500 | L.M. Ericsson Telephone | |||

| Co. SP-ADR | 241,085 | |||

| 1,500 | QUALCOMM Inc. | 63,990 | ||

| 550,895 | ||||

Computer & Peripherals — 1.5% | ||||

| 1,500 | Hewlett-Packard Co. | 60,210 | ||

| 4,000 | International Business | |||

| Machines Corp. | 377,040 | |||

| 437,250 | ||||

Drugs — 0.3% | ||||

| 1,000 | Novo Nordisk A/S - SP-ADR | 90,530 | ||

Electronics — 0.7% | ||||

| 15,000 | GigaMedia Ltd.* | 207,300 | ||

Energy-Services — 1.9% | ||||

| 1,000 | Cameron International Corp.* | 62,790 | ||

| 2,500 | Diamond Offshore | |||

| Drilling, Inc. | 202,375 | |||

| 2,500 | Schlumberger Ltd. | 172,750 | ||

| 1,500 | Transocean Inc.* | 122,550 | ||

| 560,465 | ||||

Engineering/Construction — 0.3% | ||||

| 1,000 | Fluor Corp. | 89,720 | ||

Entertainment/Media — 3.7% | ||||

| 8,000 | Apple, Inc.* | 743,280 | ||

| 9,500 | The Walt Disney Co. | 327,085 | ||

| 1,070,365 | ||||

Financial Services — 6.4% | ||||

| 500 | Bear Stearns Companies Inc. | 75,175 | ||

| 2,500 | Goldman Sachs Group, Inc. | 516,575 | ||

| 4,000 | Lehman Brothers Holdings Inc. | 280,280 | ||

| 7,500 | Merrill Lynch & Co., Inc. | 612,525 | ||

| 3,500 | Morgan Stanley | 275,660 | ||

| 5,500 | Charles Schwab Corp. | 100,595 | ||

| 1,860,810 | ||||

Grocery Stores — 0.8% | ||||

| 5,000 | Whole Foods Market, Inc. | 224,250 | ||

Hotel — 1.5% | ||||

| 3,000 | Hilton Hotels Corp. | 107,880 | ||

| 2,500 | Marriott International, Inc. | 122,400 | ||

- 7 -

Reynolds Blue Chip Growth Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2007 (Unaudited)

Shares | Value | |||

COMMON STOCKS — 50.3% (a) (Continued) | ||||

Hotel — 1.5% (Continued) | ||||

| 3,000 | Starwood Hotels & Resorts | |||

| Worldwide, Inc | $ | 194,550 | ||

| 424,830 | ||||

Industrial Metals & Minerals — 0.1% | ||||

| 1,000 | Peabody Energy Corp. | 40,240 | ||

Insurance — 0.4% | ||||

| 2,666 | China Life Insurance | |||

| Co., Ltd. ADR | 114,345 | |||

Integrated Oil & Gas — 0.4% | ||||

| 2,000 | Noble Energy, Inc. | 119,300 | ||

Internet Information Providers — 3.2% | ||||

| 1,950 | Google Inc.* | 893,412 | ||

| 500 | Yahoo! Inc.* | 15,645 | ||

| 909,057 | ||||

Internet Software & Services — 0.4% | ||||

| 3,000 | IAC/InterActiveCorp* | 113,130 | ||

Machinery — 0.5% | ||||

| 1,500 | Joy Global Inc. | 64,350 | ||

| 1,000 | Terex Corp.* | 71,760 | ||

| 136,110 | ||||

Medical Services — 0.3% | ||||

| 1,500 | Humana Inc.* | 87,030 | ||

Oil & Gas Refining & Marketing — 0.4% | ||||

| 1,000 | Tesoro Corp. | 100,430 | ||

Recreation — 1.8% | ||||

| 1,500 | Las Vegas Sands Corp.* | 129,915 | ||

| 6,000 | Mattel, Inc. | 165,420 | ||

| 2,000 | MGM MIRAGE* | 139,040 | ||

| 1,000 | Wynn Resorts, Ltd. | 94,860 | ||

| 529,235 | ||||

Restaurants — 1.1% | ||||

| 4,500 | McDonald’s Corp. | 202,725 | ||

| 1,000 | Panera Bread Co.* | 59,060 | ||

| 2,000 | Papa John’s International, Inc.* | 58,800 | ||

| 320,585 | ||||

Retail-Specialty — 4.3% | ||||

| 1,000 | AutoZone, Inc.* | 128,140 | ||

| 1,500 | Bed Bath & Beyond Inc.* | 60,255 | ||

| 2,000 | Best Buy Co., Inc. | 97,440 | ||

| 5,500 | Coach, Inc.* | 275,275 | ||

| 3,500 | eBay Inc.* | 116,025 | ||

| 2,000 | Office Depot, Inc.* | 70,280 | ||

| 1,000 | OfficeMax Inc. | 52,740 | ||

| 1,500 | Ross Stores, Inc. | 51,600 | ||

| 7,000 | Starbucks Corp.* | 219,520 | ||

| 4,000 | Tiffany & Co. | 181,920 | ||

| 1,253,195 | ||||

Retail Stores — 5.1% | ||||

| 5,000 | Costco Wholesale Corp. | 269,200 | ||

| 6,000 | J.C. Penney Company, Inc. | 492,960 | ||

| 1,000 | Kohl’s Corp.* | 76,610 | ||

| 10,000 | Nordstrom, Inc. | 529,400 | ||

| 2,000 | Target Corp. | 118,520 | ||

| 1,486,690 | ||||

Semiconductor Capital Spending — 0.1% | ||||

| 500 | KLA-Tencor Corp. | 26,660 | ||

Semiconductors — 0.4% | ||||

| 3,500 | NVIDIA Corp.* | 100,730 | ||

Services — 2.3% | ||||

| 500 | Dun & Bradstreet Corp. | 45,600 | ||

| 3,000 | FedEx Corp. | 322,290 | ||

| 1,500 | Priceline.com Inc.* | 79,890 | ||

| 3,000 | United Parcel Service, Inc. Cl B | 210,300 | ||

| 658,080 | ||||

System Software — 0.4% | ||||

| 2,500 | Infosys Technologies | |||

| Ltd. SP-ADR | 125,625 | |||

- 8 -

Reynolds Blue Chip Growth Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2007 (Unaudited)

Shares | Value | |||

COMMON STOCKS — 50.3% (a) (Continued) | ||||

Telecommunications — 0.1% | ||||

| 1,000 | AT&T Inc. | $ | 39,430 | |

Telephone Services — 0.6% | ||||

| 2,000 | Telefonos de Mexico | |||

| SA de CV- SP-ADR | 66,800 | |||

| 5,500 | Time Warner Telecom Inc.* | 114,235 | ||

| 181,035 | ||||

Transportation — 0.6% | ||||

| 2,500 | PACCAR Inc. | 183,500 | ||

Utilities — 0.7% | ||||

| 2,000 | Constellation Energy Group | 173,900 | ||

| 4,000 | Dynegy Inc.* | 37,040 | ||

| 210,940 | ||||

Wireless Communication — 2.3% | ||||

| 4,500 | China Mobile Ltd. SP-ADR | 201,825 | ||

| 2,600 | Research In Motion Ltd.* | 354,874 | ||

| 3,500 | Vodafone Group PLC - SP-ADR | 94,010 | ||

| 650,709 | ||||

| Total common stocks | ||||

| (cost $12,502,005) | 14,532,896 | |||

Principal Amount | ||||

SHORT-TERM INVESTMENTS — 47.3% (a) | ||||

U.S. Treasury Securities — 34.5% | ||||

| $10,000,000 | U.S. Treasury Bills, | |||

| 4.97%, due 04/26/07 | 9,965,486 | |||

| Total U.S. treasury securities | ||||

| (cost $9,965,486) | 9,965,486 | |||

Variable Rate Demand Notes — 12.8% | ||||

| 1,109,413 | American Family | |||

| Financial Services, 4.96% | 1,109,413 | |||

| 1,300,000 | U.S. Bank, N.A., 5.07% | 1,300,000 | ||

| 1,300,000 | Wisconsin Corporate Central | |||

| Credit Union, 4.99% | 1,300,000 | |||

| Total variable rate | ||||

| demand notes | ||||

| (cost $3,709,413) | 3,709,413 | |||

| Total short-term investments | ||||

| (cost $13,674,899) | 13,674,899 | |||

| Total investments | ||||

| (cost $26,176,904) | 28,207,795 | |||

| Cash and receivables, | ||||

less liabilities — 2.4% (a) | 688,076 | |||

Net Assets | $ | 28,895,871 | ||

| Net Asset Value Per Share | ||||

| ($0.01 par value, 40,000,000 | ||||

| shares authorized), offering | ||||

| and redemption price | ||||

| ($28,895,871 ÷ 958,099 | ||||

| shares outstanding) | $ | 30.16 | ||

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

ADR - American Depositary Receipts

The accompanying notes to financial statements are an integral part of this statement.

- 9 -

Reynolds Blue Chip Growth Fund

STATEMENT OF OPERATIONS

For the Six Months Ending March 31, 2007 (Unaudited)

INCOME: | ||||

| Dividends | $ | 130,082 | ||

| Interest | 225,281 | |||

| Total income | 355,363 | |||

EXPENSES: | ||||

| Management fees | 172,326 | |||

| Transfer agent fees | 52,434 | |||

| Administrative services | 35,920 | |||

| Insurance expense | 31,134 | |||

| Professional fees | 23,822 | |||

| Printing and postage expense | 23,767 | |||

| Custodian fees | 17,994 | |||

| Registration fees | 15,828 | |||

| Distribution fees | 13,960 | |||

| Board of Directors fees | 5,000 | |||

| Other expenses | 3,606 | |||

| Total expenses before reimbursement | 395,791 | |||

| Less expenses reimbursed by adviser | (48,145 | ) | ||

| Net expenses | 347,646 | |||

NET INVESTMENT INCOME | 7,717 | |||

NET REALIZED GAIN ON INVESTMENTS | 490,835 | |||

NET CHANGE IN UNREALIZED APPRECIATION ON INVESTMENTS | 1,102,577 | |||

NET GAIN ON INVESTMENTS | 1,593,412 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,601,129 | ||

The accompanying notes to financial statements are an integral part of this statement.

- 10 -

Reynolds Blue Chip Growth Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the Six Months Ending March 31, 2007 (Unaudited) and For the Year Ended September 30, 2006

2007 | 2006 | ||||||

OPERATIONS: | |||||||

| Net investment income (loss) | $ | 7,717 | $ | (256,831 | ) | ||

| Net realized gain on investments | 490,835 | 9,832,798 | |||||

| Net increase (decrease) in unrealized appreciation on investments | 1,102,577 | (9,881,632 | ) | ||||

| Net increase (decrease) in net assets resulting from operations | 1,601,129 | (305,665 | ) | ||||

FUND SHARE ACTIVITIES: | |||||||

| Proceeds from shares issued (11,274 and 93,795 shares, respectively) | 336,704 | 2,815,296 | |||||

| Cost of shares redeemed (374,371 and 619,340 shares, respectively) | (11,329,479 | ) | (18,663,544 | ) | |||

| Net decrease in net assets derived from Fund share activities | (10,992,775 | ) | (15,848,248 | ) | |||

| TOTAL DECREASE | (9,391,646 | ) | (16,153,913 | ) | |||

| NET ASSETS AT THE BEGINNING OF THE PERIOD | 38,287,517 | 54,441,430 | |||||

| NET ASSETS AT THE END OF THE PERIOD (Includes accumulated | |||||||

| net investment income (loss) of $7,717 and $(256,831), respectively) | $ | 28,895,871 | $ | 38,287,517 | |||

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each period)

(Unaudited) | |||||||||||||||||||

For the Six | |||||||||||||||||||

Months Ending | Years Ended September 30, | ||||||||||||||||||

March 31, 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||

PER SHARE OPERATING PERFORMANCE: | |||||||||||||||||||

| Net asset value, beginning of period | $ | 28.98 | $ | 29.48 | $ | 26.98 | $ | 27.93 | $ | 19.61 | $ | 29.73 | |||||||

| Income from investment operations: | |||||||||||||||||||

| Net investment income (loss)* | 0.01 | (0.17 | ) | (0.34 | ) | (0.40 | ) | (0.22 | ) | (0.25 | ) | ||||||||

| Net realized and unrealized gains (losses) on investments | 1.17 | (0.33 | ) | 2.84 | (0.55 | )** | 8.54 | (9.87 | ) | ||||||||||

| Total from investment operations | 1.18 | (0.50 | ) | 2.50 | (0.95 | ) | 8.32 | (10.12 | ) | ||||||||||

| Less distributions: | |||||||||||||||||||

| Dividend from net investment income | — | — | — | — | — | — | |||||||||||||

| Distribution from net realized gains | — | — | — | — | — | — | |||||||||||||

| Total from distributions | — | — | — | — | — | — | |||||||||||||

| Net asset value, end of period | $ | 30.16 | $ | 28.98 | $ | 29.48 | $ | 26.98 | $ | 27.93 | $ | 19.61 | |||||||

TOTAL RETURN | 4.07% | (1) | (1.70% | ) | 9.27% | (3.44% | ) | 42.43% | (34.04% | ) | |||||||||

RATIOS/SUPPLEMENTAL DATA: | |||||||||||||||||||

| Net assets, end of period (in 000’s $) | 28,896 | 38,288 | 54,441 | 84,210 | 138,903 | 80,033 | |||||||||||||

Ratio of expenses (after reimbursement) to average net assets*** | 2.02% | (2) | 2.01% | 1.80% | 1.63% | 1.74% | 1.51% | ||||||||||||

Ratio of net investment income (loss) to average net assets**** | 0.04% | (2) | (0.55% | ) | (1.18% | ) | (1.33% | ) | (0.88% | ) | (0.82% | ) | |||||||

| Portfolio turnover rate | 140.0% | 280.9% | 167.6% | 94.0% | 83.7% | 67.0% | |||||||||||||

| (1) | Not Annualized. |

| (2) | Annualized. |

| * | Net Investment income (loss) per share is calculated using average shares outstanding. |

| ** | The amount shown may not correlate with the aggregate gains and losses of portfolio securities due to the timing of subscriptions and redemptions of Fund shares. |

| *** | Computed after giving effect to adviser’s expense limitation undertaking. If the Fund had paid all of its expenses for the six months ending March 31, 2007, the ratio would have been 2.30%(2). |

| **** | If the Fund had paid all of its expenses for the six months ending March 31,2007, the ratio would have been (0.24%)(2). |

The accompanying notes to financial statements are an integral part of these statements.

- 11 -

Reynolds Opportunity Fund

STATEMENT OF NET ASSETS

March 31, 2007 (Unaudited)

Shares | Value | |||

COMMON STOCKS — 59.2% (a) | ||||

Airlines — 0.9% | ||||

| 2,000 | AMR Corp.* | $ | 60,900 | |

Apparel — 3.0% | ||||

| 1,500 | Crocs, Inc.* | 70,875 | ||

| 1,000 | Deckers Outdoor Corp.* | 71,020 | ||

| 1,000 | Phillips-Van Heusen Corp. | 58,800 | ||

| 200,695 | ||||

Application Software — 0.7% | ||||

| 1,500 | BMC Software, Inc.* | 46,185 | ||

Automotive — 0.7% | ||||

| 2,000 | CarMax, Inc.* | 49,080 | ||

Business Software & Services — 1.9% | ||||

| 2,500 | Akamai Technologies, Inc.* | 124,800 | ||

Cable TV/Broadcasting — 0.9% | ||||

| 2,000 | Grupo Televisa S.A. SP-ADR | 59,600 | ||

Communication Equipment — 5.7% | ||||

| 2,600 | Cisco Systems Inc.* | 66,378 | ||

| 3,500 | Corning Inc.* | 79,590 | ||

| 2,500 | L.M. Ericsson Telephone | |||

| Co. SP-ADR | 92,725 | |||

| 4,000 | Harmonic Inc.* | 39,280 | ||

| 4,000 | Network Equipment | |||

| Technologies, Inc.* | 38,800 | |||

| 6,500 | Tellabs, Inc.* | 64,350 | ||

| 381,123 | ||||

Communication Services — 2.6% | ||||

| 3,000 | WebEx Communications, Inc.* | 170,580 | ||

Computer & Peripherals — 2.4% | ||||

| 2,500 | Network Appliance, Inc.* | 91,300 | ||

| 5,500 | STEC Inc.* | 38,720 | ||

| 5,000 | Sun Microsystems, Inc.* | 30,050 | ||

| 160,070 | ||||

Electronics — 3.9% | ||||

| 19,000 | GigaMedia Ltd.* | 262,580 | ||

Financial Services — 4.5% | ||||

| 2,500 | E*TRADE Financial Corp.* | 53,050 | ||

| 300 | Goldman Sachs Group, Inc. | 61,989 | ||

| 1,000 | Merrill Lynch & Co., Inc. | 81,670 | ||

| 1,000 | Morgan Stanley | 78,760 | ||

| 1,500 | TD Ameritrade Holding Corp.* | 22,320 | ||

| 297,789 | ||||

Insurance — 1.7% | ||||

| 2,666 | China Life Insurance | |||

| Co., Ltd. ADR | 114,345 | |||

Internet Information Providers — 3.2% | ||||

| 3,500 | CDC Corp.* | 31,640 | ||

| 400 | Google Inc.* | 183,264 | ||

| 214,904 | ||||

Internet Software & Services — 3.6% | ||||

| 3,000 | Internet Capital Group, Inc.* | 32,100 | ||

| 9,000 | Red Hat, Inc.* | 206,370 | ||

| 238,470 | ||||

Recreation — 1.6% | ||||

| 1,500 | MGM MIRAGE* | 104,280 | ||

Retail-Specialty — 2.2% | ||||

| 2,000 | Best Buy Co., Inc. | 97,440 | ||

| 1,500 | Starbucks Corp.* | 47,040 | ||

| 144,480 | ||||

Retail Stores — 4.5% | ||||

| 1,000 | J.C. Penney Company, Inc. | 82,160 | ||

| 1,500 | Kohl’s Corp.* | 114,915 | ||

| 2,000 | Nordstrom, Inc. | 105,880 | ||

| 302,955 | ||||

Semiconductors — 5.2% | ||||

| 1,500 | Broadcom Corp.* | 48,105 | ||

| 2,000 | Lam Research Corp.* | 94,680 | ||

| 3,000 | NVIDIA Corp.* | 86,340 | ||

- 12 -

Reynolds Opportunity Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2007 (Unaudited)

Shares | Value | |||

COMMON STOCKS — 59.2% (a) (Continued) | ||||

Semiconductors — 5.2% (Continued) | ||||

| 4,000 | Texas Instruments Inc. | $ | 120,400 | |

| 349,525 | ||||

Services — 1.4% | ||||

| 2,000 | Monster Worldwide Inc.* | 94,740 | ||

Telephone Services — 1.6% | ||||

| 5,000 | Time Warner Telecom Inc.* | 103,850 | ||

Wireless Communication — 7.0% | ||||

| 10,500 | Brightpoint, Inc.* | 120,120 | ||

| 1,000 | China Mobile Ltd. SP-ADR | 44,850 | ||

| 1,500 | Research In Motion Ltd.* | 204,735 | ||

| 1,000 | Vimpel-Communications | |||

| SP-ADR* | 94,840 | |||

| 464,545 | ||||

| Total common stocks | ||||

| (cost $2,126,643) | 3,945,496 | |||

Principal Amount | ||||

SHORT-TERM INVESTMENTS — 36.8% (a) | ||||

U.S. Treasury Securities — 22.4% | ||||

| $1,500,000 | U.S. Treasury Bills, | |||

| 4.97%, due 04/26/07 | 1,494,823 | |||

| Total U.S. treasury securities | ||||

| (cost $1,494,823) | 1,494,823 | |||

Variable Rate Demand Notes — 14.4% | ||||

| 318,467 | American Family Financial | |||

| Services, 4.96% | 318,467 | |||

| 320,000 | U.S. Bank, N.A., 5.07% | 320,000 | ||

| 320,000 | Wisconsin Corporate Central | |||

| Credit Union, 4.99% | 320,000 | |||

| Total variable rate | ||||

| demand notes | ||||

| (cost $958,467) | 958,467 | |||

| Total short-term investments | ||||

| (cost $2,453,290) | 2,453,290 | |||

| Total investments | ||||

| (cost $4,579,933) | 6,398,786 | |||

| Cash and receivables, | ||||

less liabilities — 4.0% (a) | 266,882 | |||

Net Assets | $ | 6,665,668 | ||

| Net Asset Value Per Share | ||||

| ($0.01 par value, 40,000,000 | ||||

| shares authorized), offering | ||||

| and redemption price | ||||

| ($6,665,668 ÷ 503,997 | ||||

| shares outstanding) | $ | 13.23 | ||

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

ADR - American Depositary Receipts

The accompanying notes to financial statements are an integral part of this statement.

- 13 -

Reynolds Opportunity Fund

STATEMENT OF OPERATIONS

For the Six Months Ending March 31, 2007 (Unaudited)

INCOME: | ||||

| Dividends | $ | 19,710 | ||

| Interest | 44,698 | |||

| Total income | 64,408 | |||

EXPENSES: | ||||

| Management fees | 43,894 | |||

| Professional fees | 20,864 | |||

| Administrative services | 12,342 | |||

| Transfer agent fees | 12,206 | |||

| Registration fees | 12,063 | |||

| Insurance expense | 7,475 | |||

| Printing and postage expense | 6,401 | |||

| Custodian fees | 6,200 | |||

| Distribution fees | 5,020 | |||

| Board of Directors fees | 2,500 | |||

| Other expenses | 9,908 | |||

| Total expenses before reimbursement | 138,873 | |||

| Less expenses reimbursed by adviser | (50,629 | ) | ||

| Net expenses | 88,244 | |||

NET INVESTMENT LOSS | (23,836 | ) | ||

NET REALIZED GAIN ON INVESTMENTS | 299,268 | |||

NET CHANGE IN UNREALIZED APPRECIATION ON INVESTMENTS | 227,484 | |||

NET GAIN ON INVESTMENTS | 526,752 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 502,916 | ||

The accompanying notes to financial statements are an integral part of this statement.

- 14 -

Reynolds Opportunity Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the Six Months Ending March 31, 2007 (Unaudited) and For the Year Ended September 30, 2006

2007 | 2006 | ||||||

OPERATIONS: | |||||||

| Net investment loss | $ | (23,836 | ) | $ | (96,822 | ) | |

| Net realized gain on investments | 299,268 | 2,589,083 | |||||

| Net increase (decrease) in unrealized appreciation on investments | 227,484 | (3,146,390 | ) | ||||

| Net increase (decrease) in net assets resulting from operations | 502,916 | (654,129 | ) | ||||

DISTRIBUTIONS TO SHAREHOLDERS: | |||||||

| Distributions from net realized gains ($3.5969 and $0.0300 per share, respectively) | (2,483,597 | )* | (22,906 | )* | |||

FUND SHARE ACTIVITIES: | |||||||

| Proceeds from shares issued (15,869 and 200,434 shares, respectively) | 250,677 | 3,511,709 | |||||

| Net asset value of shares issued in distributions reinvested | |||||||

| (188,151 and 1,395 shares, respectively) | 2,440,316 | 21,855 | |||||

| Cost of shares redeemed (393,152 and 278,863 shares, respectively) | (5,184,574 | ) | (4,834,401 | ) | |||

| Net decrease in net assets derived from Fund share activities | (2,493,581 | ) | (1,300,837 | ) | |||

| TOTAL DECREASE | (4,474,262 | ) | (1,977,872 | ) | |||

| NET ASSETS AT THE BEGINNING OF THE PERIOD | 11,139,930 | 13,117,802 | |||||

| NET ASSETS AT THE END OF THE PERIOD (Includes accumulated | |||||||

| net investment loss of $23,836 and $96,822, respectively) | $ | 6,665,668 | $ | 11,139,930 | |||

* See Note 8

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each period)

(Unaudited) | |||||||||||||||||||

For the Six | |||||||||||||||||||

Months Ending | Years Ended September 30, | ||||||||||||||||||

March 31, 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||

PER SHARE OPERATING PERFORMANCE: | |||||||||||||||||||

| Net asset value, beginning of period | $ | 16.07 | $ | 17.03 | $ | 16.89 | $ | 18.28 | $ | 11.24 | $ | 16.82 | |||||||

| Income from investment operations: | |||||||||||||||||||

| Net investment loss* | (0.03 | ) | (0.14 | ) | (0.29 | ) | (0.38 | ) | (0.23 | ) | (0.23 | ) | |||||||

| Net realized and unrealized gains (losses) on investments | 0.79 | (0.79 | ) | 1.73 | (0.27 | ) | 7.27 | (5.31 | ) | ||||||||||

| Total from investment operations | 0.76 | (0.93 | ) | 1.44 | (0.65 | ) | 7.04 | (5.54 | ) | ||||||||||

| Less distributions: | |||||||||||||||||||

| Dividend from net investment income | — | — | — | — | — | — | |||||||||||||

| Distributions from net realized gains | (3.60 | ) | (0.03 | ) | (1.30 | ) | (0.74 | ) | — | (0.04 | ) | ||||||||

| Total from distributions | (3.60 | ) | (0.03 | ) | (1.30 | ) | (0.74 | ) | — | (0.04 | ) | ||||||||

| Net asset value, end of period | $ | 13.23 | $ | 16.07 | $ | 17.03 | $ | 16.89 | $ | 18.28 | $ | 11.24 | |||||||

TOTAL RETURN | 5.16% | (1) | (5.46% | ) | 8.68% | (4.29% | ) | 62.63% | (33.02% | ) | |||||||||

RATIOS/SUPPLEMENTAL DATA: | |||||||||||||||||||

| Net assets, end of period (in 000’s $) | 6,666 | 11,140 | 13,118 | 18,855 | 26,446 | 14,065 | |||||||||||||

Ratio of expenses (after reimbursement) to average net assets** | 2.01% | (2) | 1.99% | 2.07% | 1.96% | 2.02% | 1.87% | ||||||||||||

Ratio of net investment loss to average net assets*** | (0.54%) | (2) | (0.80% | ) | (1.74% | ) | (1.87% | ) | (1.56% | ) | (1.33% | ) | |||||||

| Portfolio turnover rate | 85.6% | 185.6% | 97.5% | 65.7% | 88.4% | 195.0% | |||||||||||||

| (1) | Not Annualized. (2) Annualized. |

| * | Net Investment loss per share is calculated using average shares outstanding. |

| ** | Computed after giving effect to adviser’s expense limitation undertaking. If the Fund had paid all of its expenses for the six months ending March 31, 2007 and for the years ended September 30, 2006 and 2005, the ratios would have been 3.17%(2), 2.44% and 2.22%, respectively. |

| *** | If the Fund had paid all of its expenses for the six months ending March 31,2007 and for the years ended September 30, 2006 and 2005, the ratios would have been (1.70%)(2), (1.25%) and (1.89%), respectively. |

The accompanying notes to financial statements are an integral part of these statements.

- 15 -

Reynolds Fund

STATEMENT OF NET ASSETS

March 31, 2007 (Unaudited)

Shares | Value | |||

COMMON STOCKS — 48.8% (a) | ||||

Aerospace — 0.9% | ||||

| 1,000 | United Technologies Corp. | $ | 65,000 | |

Application Software — 0.8% | ||||

| 2,000 | Microsoft Corp. | 55,740 | ||

Biotechnology — 0.6% | ||||

| 500 | Gilead Sciences, Inc.* | 38,250 | ||

Building — 0.7% | ||||

| 1,500 | Lowe’s Companies, Inc. | 47,235 | ||

Communication Equipment — 2.3% | ||||

| 5,000 | C-COR Inc.* | 69,300 | ||

| 1,500 | L.M. Ericsson Telephone Co. SP-ADR | 55,635 | ||

| 10,000 | Finisar Corp.* | 35,000 | ||

| 159,935 | ||||

Computer & Peripherals — 1.7% | ||||

| 1,000 | International Business | |||

| Machines Corp. | 94,260 | |||

| 4,000 | Sun Microsystems, Inc.* | 24,040 | ||

| 118,300 | ||||

Electronics — 2.1% | ||||

| 10,500 | GigaMedia Ltd.* | 145,110 | ||

Energy-Services — 2.2% | ||||

| 1,000 | Schlumberger Ltd. | 69,100 | ||

| 1,000 | Transocean Inc.* | 81,700 | ||

| 150,800 | ||||

Entertainment/Media — 3.4% | ||||

| 2,500 | Apple, Inc.* | 232,275 | ||

Financial Services — 8.6% | ||||

| 600 | Goldman Sachs Group, Inc. | 123,978 | ||

| 1,000 | Lehman Brothers Holdings Inc. | 70,070 | ||

| 2,000 | Merrill Lynch & Co., Inc. | 163,340 | ||

| 3,000 | Morgan Stanley | 236,280 | ||

| 593,668 | ||||

Gold & Silver — 1.1% | ||||

| 1,000 | Silver Standard Resources Inc.* | 34,860 | ||

| 3,000 | Yamana Gold Inc. | 43,080 | ||

| 77,940 | ||||

Grocery Stores — 1.3% | ||||

| 2,000 | Whole Foods Market, Inc. | 89,700 | ||

Insurance — 1.3% | ||||

| 499 | China Life Insurance | |||

| Co., Ltd. ADR | 21,402 | |||

| 2,000 | Tower Group, Inc. | 64,440 | ||

| 85,842 | ||||

Internet Information Providers — 3.5% | ||||

| 6,500 | CDC Corp.* | 58,760 | ||

| 400 | Google Inc.* | 183,264 | ||

| 242,024 | ||||

Medical Services — 1.1% | ||||

| 5,000 | Emdeon Corp.* | 75,650 | ||

Restaurants — 0.3% | ||||

| 500 | P.F. Chang’s China Bistro, Inc.* | 20,940 | ||

Retail-Specialty — 4.4% | ||||

| 1,000 | Best Buy Co., Inc. | 48,720 | ||

| 2,000 | Coach, Inc.* | 100,100 | ||

| 1,000 | eBay Inc.* | 33,150 | ||

| 2,000 | PC Connection, Inc.* | 28,600 | ||

| 3,000 | Starbucks Corp.* | 94,080 | ||

| 304,650 | ||||

Retail Stores — 4.6% | ||||

| 500 | J.C. Penney Company, Inc. | 41,080 | ||

| 3,500 | Nordstrom, Inc. | 185,290 | ||

| 1,500 | Target Corp. | 88,890 | ||

| 315,260 | ||||

Semiconductor Capital Spending — 0.4% | ||||

| 500 | KLA-Tencor Corp. | 26,660 | ||

Semiconductors — 0.6% | ||||

| 2,000 | Rambus Inc.* | 42,500 | ||

System Software — 0.7% | ||||

| 1,000 | Infosys Technologies Ltd. SP-ADR | 50,250 | ||

Utilities — 0.5% | ||||

| 4,000 | Dynegy Inc.* | 37,040 | ||

Wireless Communication — 5.7% | ||||

| 1,000 | China Mobile Ltd. SP-ADR | 44,850 | ||

| 1,500 | Research In Motion Ltd.* | 204,735 | ||

| 1,500 | Vimpel-Communications SP-ADR* | 142,260 | ||

| 391,845 | ||||

| Total common stocks | ||||

| (cost $3,038,872) | 3,366,614 | |||

Principal Amount | ||||

SHORT-TERM INVESTMENTS — 48.8% (a) | ||||

U.S. Treasury Securities — 36.1% | ||||

| $2,500,000 | U.S. Treasury Bills, | |||

| 4.97%, due 04/26/07 | 2,491,372 | |||

| Total U.S. treasury securities | ||||

| (cost $2,491,372) | 2,491,372 | |||

- 16 -

Reynolds Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2007 (Unaudited)

Principal Amount | Value | |||

SHORT-TERM INVESTMENTS — 48.8% (a) (Continued) | ||||

Variable Rate Demand Notes — 12.7% | ||||

| $ 275,000 | American Family Financial | |||

| Services, 4.96% | $ | 275,000 | ||

| 326,678 | U.S. Bank, N.A., 5.07% | 326,678 | ||

| 275,000 | Wisconsin Corporate Central | |||

| Credit Union, 4.99% | 275,000 | |||

| Total variable rate demand | ||||

| notes (cost $876,678) | 876,678 | |||

| Total short-term investments | ||||

| (cost $3,368,050) | 3,368,050 | |||

| Total investments | ||||

| (cost $6,406,922) | 6,734,664 | |||

| Cash and receivables, | ||||

less liabilities — 2.4% (a) | 168,753 | |||

Net Assets | $ | 6,903,417 | ||

| Net Asset Value Per Share | ||||

| ($0.01 par value, 40,000,000 | ||||

| shares authorized), offering | ||||

| and redemption price | ||||

| ($6,903,417 ÷ 1,172,767 | ||||

| shares outstanding) | $ | 5.89 | ||

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

ADR - American Depositary Receipt

STATEMENT OF OPERATIONS

For the Six Months Ending March 31, 2007 (Unaudited)

INCOME: | ||||

| Dividends | $ | 26,764 | ||

| Interest | 57,649 | |||

| Total income | 84,413 | |||

EXPENSES: | ||||

| Management fees | 50,815 | |||

| Professional fees | 20,199 | |||

| Interest expense | 13,188 | |||

| Administrative services | 12,926 | |||

| Transfer agent fees | 12,562 | |||

| Registration fees | 10,847 | |||

| Custodian fees | 10,520 | |||

| Printing and postage expense | 7,785 | |||

| Insurance expense | 7,677 | |||

| Distribution fees | 3,780 | |||

| Board of Directors fees | 2,500 | |||

| Other expenses | 9,826 | |||

| Total expenses before reimbursement | 162,625 | |||

| Less expenses reimbursed by adviser | (50,436 | ) | ||

| Net expenses | 112,189 | |||

NET INVESTMENT LOSS | (27,776 | ) | ||

NET REALIZED GAIN ON INVESTMENTS | 407,109 | |||

NET CHANGE IN UNREALIZED APPRECIATION ON INVESTMENTS | (30,108 | ) | ||

NET GAIN ON INVESTMENTS | 377,001 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 349,225 | ||

The accompanying notes to financial statements are an integral part of these statements.

- 17 -

Reynolds Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the Six Months Ending March 31, 2007 (Unaudited) and For the Year Ended September 30, 2006

2007 | 2006 | ||||||

OPERATIONS: | |||||||

| Net investment loss | $ | (27,776 | ) | $ | (319,793 | ) | |

| Net realized gain on investments | 407,109 | 3,067,926 | |||||

| Net decrease in unrealized appreciation on investments | (30,108 | ) | (4,124,068 | ) | |||

| Net increase (decrease) in net assets resulting from operations | 349,225 | (1,375,935 | ) | ||||

FUND SHARE ACTIVITIES: | |||||||

| Proceeds from shares issued (149,266 and 2,192,161 shares, respectively) | 886,333 | 14,777,919 | |||||

| Cost of shares redeemed (1,378,145 and 3,133,450 shares, respectively) | (8,125,568 | ) | (18,873,229 | ) | |||

| Net decrease in net assets derived from Fund share activities | (7,239,235 | ) | (4,095,310 | ) | |||

| TOTAL DECREASE | (6,890,010 | ) | (5,471,245 | ) | |||

| NET ASSETS AT THE BEGINNING OF THE PERIOD | 13,793,427 | 19,264,672 | |||||

| NET ASSETS AT THE END OF THE PERIOD (Includes accumulated | |||||||

| net investment loss of $27,776 and $319,793, respectively) | $ | 6,903,417 | $ | 13,793,427 | |||

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each period)

(Unaudited) | |||||||||||||||||||

For the Six | |||||||||||||||||||

Months Ending | Years Ended September 30, | ||||||||||||||||||

March 31, 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||

PER SHARE OPERATING PERFORMANCE: | |||||||||||||||||||

| Net asset value, beginning of period | $ | 5.74 | $ | 5.76 | $ | 5.39 | $ | 6.01 | $ | 3.01 | $ | 4.35 | |||||||

| Income from investment operations: | |||||||||||||||||||

| Net investment loss* | (0.01 | ) | (0.10 | ) | (0.17 | ) | (0.16 | ) | (0.11 | ) | (0.06 | ) | |||||||

| Net realized and unrealized gains (losses) on investments | 0.16 | 0.08 | ** | 0.54 | (0.46 | ) | 3.11 | (1.28 | ) | ||||||||||

| Total from investment operations | 0.15 | (0.02 | ) | 0.37 | (0.62 | ) | 3.00 | (1.34 | ) | ||||||||||

| Less distributions: | |||||||||||||||||||

| Dividend from net investment income | — | — | — | — | — | — | |||||||||||||

| Distribution from net realized gains | — | — | — | — | — | — | |||||||||||||

| Total from distributions | — | — | — | — | — | — | |||||||||||||

| Net asset value, end of period | $ | 5.89 | $ | 5.74 | $ | 5.76 | $ | 5.39 | $ | 6.01 | $ | 3.01 | |||||||

TOTAL RETURN | 2.61% | (1) | (0.35% | ) | 6.86% | (10.17% | ) | 99.67% | (30.80% | ) | |||||||||

RATIOS/SUPPLEMENTAL DATA: | |||||||||||||||||||

| Net assets, end of period (in 000’s $) | 6,903 | 13,793 | 19,265 | 33,794 | 32,728 | 10,481 | |||||||||||||

Ratio of expenses (after reimbursement) to average net assets*** | 2.21% | (2) | 2.79% | 3.29% | 2.29% | 2.82% | 2.07% | ||||||||||||

Ratio of net investment loss to average net assets**** | (0.55% | )(2) | (1.61% | ) | (3.02% | ) | (2.24% | ) | (2.41% | ) | (1.41% | ) | |||||||

| Portfolio turnover rate | 208.0% | 322.4% | 142.9% | 79.5% | 119.9% | 408.5% | |||||||||||||

| (1) | Not Annualized. (2) Annualized. |

| * | Net Investment loss per share is calculated using average shares outstanding. |

| ** | The amount shown may not correlate with the aggregate gains and losses of portfolio securities due to the timing of subscriptions and redemptions of Fund shares. |

| *** | Computed after giving effect to adviser’s expense limitation undertaking. If the Fund had paid all of its expenses for the six months ending March 31, 2007 and for the years ended September 30, 2006 and 2003, the ratios would have been 3.21%(2), 2.98% and 2.88%, respectively. |

| **** | If the Fund had paid all of its expenses for the six months ending March 31,2007 and for the years ended September 30, 2006 and 2003, the ratios would have been (1.55%)(2), (1.80%) and (2.47%), respectively. |

The accompanying notes to financial statements are an integral part of these statements.

- 18 -

Reynolds Funds, Inc.

NOTES TO FINANCIAL STATEMENTS

March 31, 2007 (Unaudited)

| (1) | Summary of Significant Accounting Policies — |

The following is a summary of significant accounting policies of the Reynolds Funds, Inc. (the “Company”), which is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. This Company consists of a series of three funds: the Reynolds Blue Chip Growth Fund (“Blue Chip Fund”), the Reynolds Opportunity Fund (“Opportunity Fund”) and the Reynolds Fund (“Reynolds Fund”) (collectively the “Funds”). The assets and liabilities of each Fund are segregated and a shareholder’s interest is limited to the Fund in which the shareholder owns shares. The Company was incorporated under the laws of Maryland on April 28,1988.

The investment objective of the Blue Chip Fund is to produce long-term growth of capital by investing in a diversified portfolio of common stocks issued by well-established growth companies commonly referred to as “blue chip” companies; the investment objective of the Opportunity Fund is to produce long-term growth of capital by investing in a diversified portfolio of common stocks having above average growth characteristics; and the investment objective of the Reynolds Fund is to produce long-term growth of capital.

(a) Each security for the Funds, excluding short-term investments, is valued at the last sale price reported by the principal security exchange on which the issue is traded, or if no sale is reported, the latest bid price. Securities which are traded on the Nasdaq National Markets (Nasdaq Global Select Market, Nasdaq Global Market and Nasdaq Capital Market formerly known as the Nasdaq National Market or the Nasdaq Small Cap Market) are valued at the Nasdaq Official Closing Price, or if no sale is reported, the latest bid price. Short-term investments with maturities of 60 days or less, are valued at amortized cost which approximates value. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser under the supervision of the Board of Directors. The fair value of a security is the amount which the Fund might receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the New York Stock Exchange. For financial reporting purposes, investment transactions are recorded on the trade date.

In September 2006, the Financial Accounting Standards Board issued its new Standard No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 is designed to unify guidance for the measurement of fair value of all types of assets, including financial instruments, and certain liabilities. FAS 157 also establishes a hierarchy for measuring fair value in generally accepted accounting principles and expands financial statement disclosures about fair value measurements that are relevant to mutual funds. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and earlier adoption is permitted. At this time, management believes the adoption of FAS 157 will have no material impact on the financial statements of the Funds.

(b) Net realized gains and losses on sales of securities are computed on the identified cost basis.

(c) The Funds record dividend income on the ex-dividend date and interest income on an accrual basis.

(d) The Funds have investments in short-term variable rate demand notes, which are unsecured instruments. The Funds may be susceptible to credit risk with respect to these notes to the extent the issuer defaults on its payment obligation. The Funds’ policy is to monitor the creditworthiness of the issuer and nonperformance by these issuers is not anticipated.

(e) Accounting principles generally accepted in the United States of America (“GAAP”) require that permanent differences between income for financial reporting and tax purposes be reclassified in the capital accounts.

(f) The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

(g) No provision has been made for Federal income taxes since the Funds have elected to be taxed as “regulated investment companies” and intend to distribute substantially all net investment company taxable income and net capital gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies.

- 19 -

Reynolds Funds, Inc.

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2007 (Unaudited)

| (1) | Summary of Significant Accounting Policies — (Continued) |

On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Funds’ tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not meeting the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. At this time, management is evaluating the implications of FIN 48 and its impact on the financial statements but does not anticipate that FIN 48 will have a material impact on the Funds’ financial statements.

| (2) | Investment Adviser and Management Agreement and Transactions With Related Parties — |

The Funds have management agreements with Reynolds Capital Management (“RCM”), with whom an officer and a director of the Funds is affiliated, to serve as investment adviser and manager. Under the terms of the agreements, each Fund will pay RCM a monthly management fee at the annual rate of 1% of such Funds’ daily net assets.

For the six months ending March 31, 2007, RCM reimbursed the Blue Chip Fund, Opportunity Fund and the Reynolds Fund for expenses over 2.00%, 2.00% and 1.95%, respectively, of such Fund’s daily net assets totaling $48,145, $50,629 and $50,436, respectively. Reimbursements exclude interest expense on borrowings from the credit facility.

The Funds have adopted a Service and Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Plan provides that each Fund adopting it may incur certain costs which may not exceed a maximum amount equal to 0.25% per annum of such Fund’s average daily net assets. Payments made pursuant to the Plan may only be used to pay distribution expenses incurred in the current year.

In the normal course of business the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

As of March 31, 2007, one of the Funds’ Directors owned approximately 9.8% and 6.1%, respectively, of the outstanding shares of the Opportunity Fund and Reynolds Fund.

| (3) | Credit Facility — |

U.S. Bank, N.A. has made available to each Fund a credit facility pursuant to the respective Credit Agreements dated August 7, 2000 for the purpose of having cash available to satisfy redemption requests. The Reynolds Fund can also use the credit facility to purchase securities. The Credit Agreements expire July 31, 2007. The terms of the respective agreements are as follows:

Blue Chip | Opportunity | Reynolds | |

Fund | Fund | Fund | |

| Payment Terms | Due in 45 days | Due in 45 days | Due in 90 days |

| Interest | Prime Rate - 1% | Prime Rate - 1% | Prime Rate - 1% |

| Unused Line Fees | 0.10% | 0.10% | 0.10% |

| Credit Limit | $5,000,000 | $975,000 | $10,000,000 |

Variable Limit | |||

| Average Daily Balance Outstanding | $17,302 | $16 | $224,989 |

| Maximum Amount Outstanding | $1,407,000 | $3,000 | $5,841,000 |

| Interest Expense | $3,153 | $494 | $13,188 |

- 20 -

Reynolds Funds, Inc.

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2007 (Unaudited)

| (4) | Distributions to Shareholders — |

Net investment income and net realized gains, if any, for the Funds are distributed to shareholders at least annually.

| (5) | Investment Transactions — |

For the six months ending March 31, 2007, purchases and proceeds of sales of investment securities (excluding short-term securities) were as follows:

Purchases | Sales | |

| Blue Chip Fund | $34,234,423 | $47,541,169 |

| Opportunity Fund | 5,906,920 | 11,485,840 |

| Reynolds Fund | 16,414,595 | 24,862,670 |

| (6) | Accounts Payable and Accrued Liabilities — |

As of March 31, 2007, liabilities of the Funds included the following:

Blue Chip | Opportunity | Reynolds | ||||||||

Fund | Fund | Fund | ||||||||

| Payable to brokers for securities purchased | $ | 85,140 | $ | — | $ | — | ||||

| Payable to RCM for management fees | 25,236 | 5,896 | 5,999 | |||||||

| Payable to shareholders for redemptions | 3,626 | — | — | |||||||

| Due to custodian | 97,086 | — | 69,646 | |||||||

| Interest payable | 514 | 84 | 861 | |||||||

| Other liabilities | 53,324 | 41,423 | 15,799 | |||||||

| Loan payable | — | — | — | |||||||

| (7) | Sources of Net Assets — |

As of March 31, 2007, the sources of net assets were as follows:

Blue Chip | Opportunity | Reynolds | ||||||||

Fund | Fund | Fund | ||||||||

| Fund shares issued and outstanding | $ | 120,948,527 | $ | 4,585,480 | $ | 55,909,342 | ||||

| Net unrealized appreciation on investments | 2,030,891 | 1,818,853 | 327,742 | |||||||

| Accumulated net realized (loss) gain on investments | (94,091,264 | ) | 261,335 | (49,333,667 | ) | |||||

| Undistributed net investment income | 7,717 | — | — | |||||||

| $ | 28,895,871 | $ | 6,665,668 | $ | 6,903,417 | |||||

| (8) | Income Tax Information — |

The following information for the Funds is presented on an income tax basis as of March 31, 2007:

Gross | Gross | Net Unrealized | |||||||||||

Cost of | Unrealized | Unrealized | Appreciation | ||||||||||

Investments | Appreciation | Depreciation | on Investments | ||||||||||

| Blue Chip Fund | $ | 26,198,761 | $ | 2,272,577 | $ | 263,543 | $ | 2,009,034 | |||||

| Opportunity Fund | 4,594,023 | 1,841,637 | 36,874 | 1,804,763 | |||||||||

| Reynolds Fund | 6,412,263 | 434,402 | 112,001 | 322,401 | |||||||||

- 21 -

Reynolds Funds, Inc.

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2007 (Unaudited)

| (8) | Income Tax Information — (Continued) |

The following information for the Funds is presented on an income tax basis as of September 30, 2006:

Gross | Gross | Net Unrealized | Distributable | Distributable | |||||||||||||||

Cost of | Unrealized | Unrealized | Appreciation | Ordinary | Long-Term | ||||||||||||||

Investments | Appreciation | Depreciation | on Investments | Income | Capital Gains | ||||||||||||||

| Blue Chip Fund | $ | 38,260,332 | $ | 1,161,308 | $ | 232,994 | $ | 928,314 | $ | — | $ | — | |||||||

| Opportunity Fund | 10,123,372 | 1,676,768 | 99,489 | 1,577,279 | — | 2,483,590 | |||||||||||||

| Reynolds Fund | 13,720,783 | 528,664 | 180,129 | 348,535 | — | — | |||||||||||||

The difference, if any, between the cost amount for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

The tax components of dividends paid during the year ended September 30, 2006, capital loss carryovers, which may be used to offset future capital gains, subject to Internal Revenue Code limitations (expiring in varying amounts through 2014), as of September 30, 2006, and tax basis post-October losses as of September 30, 2006, which are not recognized for tax purposes until the first day of the following fiscal year are:

September 30, 2006 | September 30, 2005 | ||||||||||||||||||

Ordinary | Long-Term | Net Capital | Ordinary | Long-Term | |||||||||||||||

Income | Capital Gains | Loss | Post-October | Income | Capital Gains | ||||||||||||||

Distributions | Distributions | Carryovers | Losses | Distributions | Distributions | ||||||||||||||

| Blue Chip Fund | $ | — | $ | — | $ | 94,582,099 | $ | — | $ | — | $ | — | |||||||

| Opportunity Fund | — | 22,906 | — | — | — | 1,432,499 | |||||||||||||

| Reynolds Fund | — | — | 49,731,467 | — | — | — | |||||||||||||

The Reynolds Fund has utilized $9,052,923 of its post-October losses from the prior year to increase current year net capital losses. The Blue Chip Fund has utilized $9,623,899 of its capital loss carryovers during the year ended September 30, 2006.

Since there were no ordinary distributions paid for the year ended September 30, 2006 for the Funds, there are no distributions designated as qualifying for the dividends received deduction for corporate shareholders nor as qualified dividend income under the Jobs and Growth Tax Relief Act of 2003 (unaudited).

- 22 -

Reynolds Funds, Inc.

ADVISORY AGREEMENTS

On December 21, 2006, the Board of Directors of Reynolds Funds, Inc. approved the continuation of the investment advisory agreements for the Reynolds Blue Chip Growth Fund, Reynolds Opportunity Fund and Reynolds Fund with Reynolds Capital Management. Prior to approving the continuation of the advisory agreements, the Directors considered:

| • | the nature, extent and quality of the services provided by Reynolds Capital Management |

| • | the investment performance of the Funds |

| • | the costs of the services to be provided and profits to be realized by Reynolds Capital Management from its relationship with the Funds |

| • | the extent to which economies of scale would be realized as the Funds grow and whether fee levels reflect those economies of scale |

| • | the expense ratios of the Funds |

In considering the nature, extent and quality of the services provided by Reynolds Capital Management, the Directors reviewed a report describing the portfolio management, shareholder communication and servicing services provided by Reynolds Capital Management to the Funds. The Directors concluded that Reynolds Capital Management was providing essential services to the Funds as well as services that were in addition to services typically provided non-mutual fund clients.

The Directors compared the performance of the Funds to benchmark indices over various periods of time and concluded that while the performance of the Funds recently was poor, in the past the Funds had performed well and the overall performance warranted the continuation of the advisory agreements. The Directors noted that in addition to the absolute performance of the Funds, they also considered the fact that the Funds adhered to the investment style expected by their shareholders and that investors invested in the Reynolds Funds with the understanding that Reynolds Capital Management would be the investment adviser.

In concluding that the advisory fees payable by the Funds were reasonable, the Directors reviewed reports of the costs of services provided, and the profits realized, by Reynolds Capital Management, from its relationship with the Funds and concluded that such profits were reasonable and not excessive. The Directors also reviewed reports comparing the expense ratios of, and the advisory fees paid by, the Funds, to those of, and paid by, other comparable mutual funds and concluded that the advisory fees paid by the Funds and the expense ratios of the Funds were comparable to those of comparable mutual funds.

The Directors also considered whether the fee schedules of the investment advisory agreements should be adjusted for an increase in assets under management. The Directors concluded that “break points” were not warranted at this time given the anticipated growth of the Funds in the next year and other factors considered.

For additional information about the Directors and Officers or for a description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, please call (800) 773-9665 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission (the “Commission”) at http://www.sec.gov. Information on how the Funds voted proxies relating to portfolio securities is available on the Funds’ website at http://www.reynoldsfunds.com or the website of the Commission no later than August 31 for the prior 12 months ending June 30. The Funds’ file their complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the Commission’s website. The Funds’ Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and that information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

- 23 -

REYNOLDS FUNDS

c/o U.S. BANCORP FUND SERVICES, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

www.reynoldsfunds.com

Board of Directors

DENNIS N. MOSER

FREDERICK L. REYNOLDS

ROBERT E. STAUDER

Investment Adviser

REYNOLDS CAPITAL MANAGEMENT

2580 Kekaa Drive, #115

Lahaina, Hawaii 96761

Administrator

FIDUCIARY MANAGEMENT, INC.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

Transfer Agent and

Dividend Disbursing Agent

U.S. BANCORP FUND SERVICES, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-800-773-9665

or 1-800-7REYNOLDS

1-414-765-4124

Custodian

U.S. Bank, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, Wisconsin 53212

Independent Registered Public Accounting Firm

PRICEWATERHOUSECOOPERS LLP

100 East Wisconsin Avenue

Suite 1800

Milwaukee, Wisconsin 53202

Legal Counsel

FOLEY & LARDNER LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities By Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

None.

Item 11. Controls and Procedures.

| (a) | The disclosure controls and procedures of the Reynolds Funds, Inc. are periodically evaluated. As of March 23, 2007, the date of the last evaluation, we concluded that our disclosure controls and procedures are adequate. |

| (b) | The internal controls of the Reynolds Funds, Inc. are periodically evaluated. There were no changes to Reynolds Funds’ internal control over financial reporting that occurred during the first fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, such controls. |

Item 12. Exhibits.

| (a) | Any code of ethics or amendment thereto. Not applicable. |

| (b) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

| (c) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

SIGNATURES