UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05549

Reynolds Funds, Inc.

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Frederick L. Reynolds

Reynolds Capital Management

2580 Kekaa Drive #115

Lahaina, Hawaii 96761

(Name and address of agent for service)

414-765-4124

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: March 31, 2010

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2010

| REYNOLDS |

| BLUE CHIP |

| GROWTH FUND |

| Seeking Long-Term Capital Appreciation |

A No-Load Mutual Fund

1-800-773-9665

www.reynoldsfunds.com

REYNOLDS BLUE CHIP GROWTH FUND

May 14, 2010

Dear Fellow Shareholders:

Performance highlights (March 31, 2010)

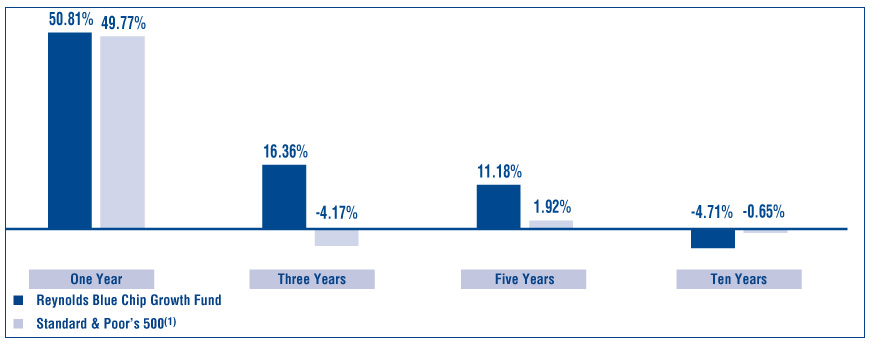

The performance of the Reynolds Blue Chip Growth Fund in the six months ended March 31, 2010 was +12.78%. The performance of the Standard & Poor’s 500(1) Index during that same period was +11.75%. The average total returns of the Reynolds Blue Chip Growth Fund for the one year and annualized 3-year, 5-year and 10-year periods through March 31, 2010 were 50.81%, 16.36%, 11.18% and -4.71%, respectively. The average total returns for the Fund’s benchmark, the Standard & Poor’s 500, for the one year and annualized 3-year, 5-year and 10-year periods through March 31, 2010 were 49.77%, -4.17%, 1.92% and -0.65%, respectively.

| (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e. its market price per share times the number of shares outstanding.) Stocks may be added or deleted from the Index from time to time. |

The performance of the Reynolds Blue Chip Growth Fund during the three months ended March 31, 2010 was +7.44%. The performance of the Standard & Poor’s 500 Index during that same period was +5.39%.

Portfolio Strategy

Ideally I would always invest in stocks for the long-term and have low turnover. However, it is very important to closely analyze intermediate-term potential economic cycles and resulting stock market problems or positives. Two and one half years ago in October 2007, I became increasingly concerned regarding several potential economic problems. I believed that one of these potential problems was high housing prices, and the increasingly speculative financial instruments that had evolved in this segment of the economy. As a result, I began implementing a strong “defensive investment strategy” for the Reynolds Blue Chip Growth Fund by selling equities held in the Fund and raising the cash position. The beginning of the implementation of this defensive investment strategy coincided within a few days of the intermediate top of the stock market in October 2007. I began purchasing equities for the Blue Chip Fund in March 2009, as I believed that the prices of many high quality equities had declined to attractive long-term buying ranges and the massive amount of stimulus that was being implemented worldwide would be a positive. The beginning of the implementation of this more “normal investment strategy” also coincided within a few days of the intermediate bottom of the stock market.

- 1 -

The U.S. Economy

The U.S. economic recovery that started in mid-2009 has continued so far in 2010. U.S. Gross Domestic Product (GDP), helped by various stimulus measures, expanded at a 3.2% annual rate in the quarter ended March 31, 2010. U.S. GDP increased at a 5.6% rate in the quarter ended December 31, 2009 and increased at a 2.2% rate in the quarter ended September 30, 2009 after decreasing in each of the previous four quarters.

There are some current and potential economic and investment negatives at the present time including: (1) more than 8.4 million jobs have been lost since the recession started in December 2007 and unemployment is above 9%; (2) construction will continue to lag, as past overbuilding negatively affects rents and valuations, making it difficult for buyers and investors to obtain financing; (3) mortgage rates are low, but mortgage credit is still somewhat tight; (4) risk aversion among lenders continues at high levels; (5) interest rates may be increasing in the future; (6) the oil spill in the Gulf of Mexico; (7) economic problems with some individual Euro-zone countries such as Greece, Spain, Portugal and Ireland which may spread to other countries; and (8) debt problems in Europe may negatively affect U.S. economic growth. I n addition, now that global government stimulus programs of more than $2 trillion have occurred, eventually central banks will need to withdraw some of the stimulus and guard against inflation. However, compared with pouring money into the economy, draining money from the economy is a much tougher job for central banks. The near term policy focus is to balance the need to maintain stable and relatively fast growth, the need to adjust the economic structure and the need to manage inflationary expectations.

There are many current and potential economic and investment positives: (1) payrolls increased 230,000 in March and 290,000 in April, and manufacturing employment increased for the fourth straight month, further indicating that a recovery has taken hold; (2) the housing market has shown some signs of bottoming and stabilizing; (3) manufacturing is playing a larger role in the economy, as firms begin to rebuild inventories after a long two year reduction; (4) growth in the service sector is gaining momentum and broadening, although it is not as strong as the manufacturing sector; (5) apparent stability in home prices have given a boost to consumer spending in 2010; (6) businesses have been able to use the credit markets to strengthen their balance sheets; (7) business equipment investment has continued to pick up; (8) inflat ion remains at moderate levels; (9) interest rates remain low; (10) many companies recently reported better than expected quarterly earnings; (11) many companies reported revenue growth, not just earnings growth from cutting expenses in the most recent quarters; and (12) recent productivity gains have been quite strong.

The U.S. economic recovery is being affected by a number of secular factors that are altering the pace and composition of growth. The economy in 2010 is being affected by greater prudence and less speculation in lending, the importance of exports and jobs and less leverage for consumer spending. GDP decreased 2.4% in calendar 2009, after increasing 0.4% in calendar 2008, 2.1% in 2007, 2.8% in 2006, 3.1% in 2005, 3.9% in 2004, 2.7% in 2003, 1.9% in 2002, 0.8% in 2001 and 3.7% in 2000. GDP is forecast to increase 3.0% in 2010.

U.S. inflation numbers have been helped in the last few years by such factors as: (1) global competition; (2) advances in technology resulting in increasing productivity; and (3) technology innovations that are helping to lower production and distribution costs. Inflation, as measured by the Consumer Price Index, decreased 0.3% in 2009, after increasing 3.8% in 2008, 2.9% in 2007, 3.2% in 2006, 3.4% in 2005, 2.7% in 2004, 2.3% in 2003, 1.6% in 2002, 2.8% in 2001 and 3.4% in 2000. U.S. inflation is forecast to increase 2.0% in 2010.

The World Economy

The global economic recovery that started in mid-2009 has continued so far in 2010. Recovery is strongest in Asia with China having the strongest growth. Other Asian countries are having strong growth rates as well. Recovery is also occurring in Latin America and Brazil. Economic growth has also returned to Western Europe, although at a slower pace than other regions. The biggest risk to Euro-zone economic growth is related to the government debt crisis that has appeared recently, particularly in Greece. Europe will need significant fiscal retrenchment in the next few years which will slow their economic growth. Some developing countries in the world have been growing faster than the U.S. in the last few years. Their economies continued to grow faster than the U.S. during the most recent worldwide econ omic slowdown and their economies are forecast to grow faster than the U.S. in 2010.

The World Economy decreased 0.8% in 2009 and is forecast to increase 4.2% in 2010. Among “advanced economies”: (1) Japan decreased 5.2% in 2009 and is forecast to increase 2.5% in 2010; (2) the Euro-zone decreased 4.0% in 2009 and is forecast to increase 1.1% in 2010; (3) the United Kingdom decreased 4.9% in 2009 and is forecast to increase 1.1% in 2010; (4) Canada decreased 2.6% in 2009 and is forecast to increase 3.2% in 2010; and (5) Korea increased 0.2% in 2009 and is forecast to increase 5.3% in 2010.

The biggest developing economies are many times referred to as the “BRIC” economies, which is short for Brazil, Russia, India, and China. China’s population is approximately 20% of the world’s total population of approximately 6.8 billion. It is the third largest economy in the world after the U.S. and Japan and it is the world’s fastest-growing major economy. Many economists believe that China has a

- 2 -

particularly good long-term outlook. It should soon overtake Japan and become the world’s second largest economy. China was one of the first countries to show a pickup in growth last year and it helped to lead the world out of recession. The acceleration in China’s growth is resulting in policy makers beginning to withdraw record fiscal and monetary stimulus. For example, bank lending has recently been tightened. GDP increased 8.5% in 2009 and is forecast to increase 10.0% in 2010.

Brazil is Latin America’s biggest economy. Brazil emerged from its first recession since 2003 in the second quarter of 2009. GDP decreased 0.2% in 2009 and is forecast to increase 4.9% in 2010.

India’s population is approximately 17% of the world’s population. It is the world’s second fastest growing economy. India’s economy increased 6.8% in 2009 and is forecast to increase 8.0% in 2010. Russia’s economy decreased 7.9% in 2009 and is forecast to increase 3.6% in 2010.

Many worldwide larger multinational companies should be well positioned to benefit long-term from worldwide growth. To the extent that some of these companies’ U.S. earnings are growing slower, this could be somewhat offset by their possible stronger foreign earnings. The long-term strategy of the Reynolds Blue Chip Growth Fund is to be structured to benefit from this worldwide growth by investing in many of these leading multinational growth companies.

The Blue Chip Fund is positioned to participate in long-term worldwide growth trends through investments in multinational U.S. headquartered companies. In addition, the Fund has investments in leading foreign headquartered companies, whose stocks or American Depositary Receipts (ADRs) trade in the United States. These ADR’s are denominated in dollars and they must use GAAP (Generally Accepted Accounting Principles) accounting to qualify as an ADR. The Blue Chip Fund may hold up to 35% of its assets in ADR’s.

Opportunistic Investing in Companies of Various Sizes

The Reynolds Blue Chip Growth Fund usually invests in companies of various sizes as classified by their market capitalizations. A company’s market capitalization is calculated by taking the number of shares the company has outstanding multiplied by its current market price. Other considerations in selecting companies for the Fund include revenue growth rates, product innovations, financial strength, management’s knowledge and experience plus the overall economic and geopolitical environments and interest rates.

Portfolio as of March 31, 2010

Source: Morningstar web site and Morningstar Market Cap Breakpoints

Morningstar separates stock portfolio holdings into five market-capitalization groups: Giant, Large, Mid, Small and Micro. Of the 5,000 largest domestic stocks in the equities database, the top 1% are categorized as Giant, the next 4% are Large, the next 15% are Mid, the next 30% are Small, and the remaining 50% are Micro. Stocks outside of the largest 5,000 are also classified as Micro.

Market caps are the minimum in each cap group; therefore, the minimum large market cap is the large-mid breakpoint and mid is the mid-small breakpoint, etc. As of March 31, 2010 the minimums in each cap group are as follows:

| (in millions) | |||||

| Giant | $ | 42,515.80 | |||

| Large | $ | 9,587.26 | |||

| Mid | $ | 2,072.66 | |||

| Small | $ | 579.29 | |||

| Micro | < | $ | 579.29 | ||

- 3 -

The long-term strategy of the Reynolds Blue Chip Growth Fund is to emphasize investment in “blue chip” growth companies. In the long-term these companies build value as their earnings grow. This growth in value should ultimately be recognized in higher stock prices for these companies.

Low Long-Term Interest Rates by Historical Standards are a Significant Positive for Stock Valuations

Long-term interest rates remain near historically low levels. Low long-term interest rates usually result in higher stock valuations for many reasons including:

| (1) | Long-term borrowing costs of corporations are lower resulting in higher business confidence and profits. |

| (2) | Long-term borrowing costs of individuals are lower which increases consumer confidence and spending. |

| (3) | A company’s stock is usually valued by placing a present value on that company’s future stream of earnings and dividends. The present value is higher when interest and inflation rates are low. |

Linked Money Market Fund

The First American Treasury Obligations Fund is a money market fund offered by an affiliate of our transfer agent, U.S. Bancorp Fund Services, LLC. This Fund is offered as a money market alternative to our shareholders. The First American Treasury Obligations Fund offers many free shareholder conveniences including automatic investment and withdrawal plans and check writing access to your funds and is linked to your holdings in the Reynolds Blue Chip Growth Fund. This Fund is also included on your quarterly statements.

Information about the Reynolds Blue Chip Growth Fund and the First American Treasury Obligations Fund

Reynoldsfunds.com website: You can access current information about your investment holdings via our website, reynoldsfunds.com. You must first request a personal identification number (PIN) by calling our shareholder service representatives at (800) 773-9665. You will be able to view your account list, account detail (including balances), transaction history, distributions, and the current Reynolds Blue Chip Growth Fund net asset value. Additional information available (PIN number not needed) includes quarterly updates of the returns of the Blue Chip Fund, top ten holdings and industry percentages. Also, detailed statistics and graphs of past performances from a link to Morningstar for the Blue Chip Fund.

For automatic current daily net asset values: Call 1-800-773-9665 (1-800-7REYNOLDS) twenty-four hours a day, seven days a week and press “any key” then “1”. The updated current net asset value for the Blue Chip Fund is usually available each business day after 5 P.M. (PST).

For the Reynolds Blue Chip Growth Fund shareholders to automatically access their current account information: Call 1-800-773-9665 (twenty-four hours a day, seven days a week), press “any key” then “2” and enter your 16 digit account number which appears at the top right of your statement.

To speak to a Fund representative regarding the current daily net asset value, current account information and any other questions: Call 1-800-773-9665 and press “0” from 6 A.M. to 5 P.M. (PST).

Shareholder statement frequency: Consolidated statements summarizing the Blue Chip Fund and First American Treasury Obligations Fund accounts held by a shareholder are sent quarterly. In addition, individual Blue Chip Fund statements are sent whenever a transaction occurs. These transactions are: (1) statements are sent for the Blue Chip Fund or First American Treasury Obligations Fund when a shareholder purchases or redeems shares; (2) Blue Chip Fund statements are sent twice a year if, and when, any ordinary income or capital gains are distributed.

Tax reporting: Individual 1099 forms, which summarize any dividend income and any long- or short-term capital gains, are sent annually to shareholders each January. The percentage of income earned from various government securities, if any, for the Blue Chip Fund and the First American Treasury Obligations Fund are also reported in January.

Minimum investment: $1,000 for regular and retirement accounts ($100 for additional investments for all accounts – except for the Automatic Investment Plan, which is $50 for regular and retirement plan accounts).

- 4 -

Retirement plans: All types are offered including Traditional IRA, Roth IRA, Coverdell Education Savings Account, SIMPLE IRA Plan, and SEP IRA.

Automatic Investment Plan: There is no charge to automatically debit your checking account to invest in the Blue Chip Fund or the First American Treasury Obligations Fund ($50 minimum for either of these Funds) at periodic intervals to make automatic purchases in either of these Funds. This is useful for dollar cost averaging for the Blue Chip Fund.

Systematic Withdrawal Plan: For shareholders with a $10,000 minimum starting balance, there is no charge to automatically redeem shares ($100 minimum) in the Blue Chip Fund or the First American Treasury Obligations Fund as often as monthly and send a check to you or transfer funds to your bank account.

Free Check Writing: Free check writing ($100 minimum) is offered for accounts invested in the First American Treasury Obligations Fund.

Exchanges or regular redemptions between the Blue Chip Fund and the First American Treasury Obligations Fund: As often as desired – no charge.

NASDAQ symbols: Reynolds Blue Chip Growth Fund – RBCGX and First American Treasury Obligations Fund – FATXX.

Portfolio Manager: Frederick Reynolds is the portfolio manager of the Reynolds Blue Chip Growth Fund.

The Reynolds Blue Chip Growth Fund and the First American Treasury Obligations Fund are No-Load: No front-end sales commissions or deferred sales charges (“loads”) are charged. Over 40% of all mutual funds impose these marketing charges that are ultimately paid by the shareholder. These marketing charges are either: (1) a front-end fee or “load” in which up to 5% of a shareholder’s assets are deducted from the original investment (some funds even charge a fee when a shareholder reinvests capital gains or dividends); or (2) a back-end penalty fee or “load” which is typically deducted from a shareholder’s account if a shareholder redeems within five years of the original investment. These fees reduce a shareholder’s return. The Blue Chip Fund and First American Treasury Obligations Fund are No-Load as they do not have these extra charges.

We appreciate your continued confidence in the Reynolds Blue Chip Growth Fund and would like to welcome our new shareholders. We look forward to strong results in the future.

Sincerely,

Frederick L. Reynolds

President

This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Reynolds Blue Chip Growth Fund unless accompanied or preceded by the Fund’s current prospectus. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.reynoldsfunds.com.

- 5 -

Reynolds Blue Chip Growth Fund

COST DISCUSSION (Unaudited)

As a shareholder of the Reynolds Blue Chip Growth Fund, you do not incur (except as described below) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees, but do incur ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2009 through March 31, 2010.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

In addition to the costs highlighted and described below, the only Fund transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with the Fund. To determine your total costs of investing in the Fund, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example below.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account | Ending Account | Expenses Paid During | |

| Value 10/01/09 | Value 3/31/10 | Period* 10/01/09-3/31/10 | |

| Reynolds Blue Chip Growth Fund Actual | $1,000.00 | $1,127.50 | $10.56 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.00 | $10.00 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.99% multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period between October 1, 2009 and March 31, 2010). |

- 6 -

Reynolds Blue Chip Growth Fund

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2010 (Unaudited)

| ASSETS: | ||||

| Investments in securities, at value (cost $66,147,990) | $ | 79,280,918 | ||

| Receivable from investments sold | 1,733,667 | |||

| Cash | 547,498 | |||

| Receivable from shareholders for purchases | 539,411 | |||

| Net dividends receivable | 65,680 | |||

| Total assets | $ | 82,167,174 | ||

| LIABILITIES: | ||||

| Payable to brokers for investments purchased | $ | 2,233,720 | ||

| Payable to shareholders for redemptions | 1,043 | |||

| Payable to adviser for management fees | 63,920 | |||

| Other liabilities | 48,310 | |||

| Total liabilities | 2,346,993 | |||

| NET ASSETS: | ||||

| Capital Stock, $0.01 par value; 40,000,000 shares authorized; 1,690,665 shares outstanding | 152,312,350 | |||

| Net unrealized appreciation on investments | 13,132,928 | |||

| Accumulated net realized loss on investments | (85,625,097 | ) | ||

| Net assets | 79,820,181 | |||

| Total liabilities and net assets | $ | 82,167,174 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE: | ||||

| Net asset value, offering and redemption price per share ($79,820,181 ÷ 1,690,665 shares outstanding) | $ | 47.21 | ||

The accompanying notes to financial statements are an integral part of this statement.

SCHEDULE OF INVESTMENTS

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) | |||||||

| COMMON STOCKS — 99.3% (a) | |||||||

| Aerospace & Defense — 2.1% | |||||||

| 5,400 | BE Aerospace, Inc.* | $ | 164,430 | ||||

| 3,100 | The Boeing Co. | 225,091 | |||||

| 2,100 | General Dynamics Corp. | 162,120 | |||||

| 2,800 | Goodrich Corp. | 197,456 | |||||

| 1,700 | Hexcel Corp.* | 24,548 | |||||

| 2,700 | Honeywell International Inc. | 122,229 | |||||

| 1,000 | L-3 Communications Holdings, Inc. | 91,630 | |||||

| 1,300 | Lockheed Martin Corp. | 108,186 | |||||

| 2,600 | Northrop Grumman Corp. | 170,482 | |||||

| 2,300 | Raytheon Co. | 131,376 | |||||

| 1,800 | Rockwell Collins, Inc. | 112,662 | |||||

| 2,000 | United Technologies Corp. | 147,220 | |||||

| 1,657,430 | |||||||

| Air Freight & Logistics — 0.4% | |||||||

| 800 | Expeditors International | ||||||

| of Washington, Inc. | 29,536 | ||||||

| 1,000 | FedEx Corp. | 93,400 | |||||

| 2,500 | United Parcel Service, Inc. Cl B | 161,025 | |||||

| 283,961 | |||||||

| Airlines — 2.2% | |||||||

| 1,200 | Alaska Air Group, Inc.* | 49,476 | |||||

| 2,600 | Allegiant Travel Co.* | 150,436 | |||||

| 18,000 | AMR Corp.* | 163,980 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 7 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Airlines — 2.2% (Continued) | |||||||

| 3,000 | China Southern Airlines Company | ||||||

| Ltd. - SP-ADR* | $ | 67,050 | |||||

| 7,500 | Continental Airlines, Inc. Cl B* | 164,775 | |||||

| 12,800 | Delta Air Lines, Inc.* | 186,752 | |||||

| 7,800 | GOL Intelligent Airlines Inc. - SP-ADR | 96,642 | |||||

| 8,000 | Hawaiian Holdings, Inc.* | 58,960 | |||||

| 6,000 | JetBlue Airways Corp.* | 33,480 | |||||

| 1,700 | Ryanair Holdings PLC - SP-ADR* | 46,189 | |||||

| 27,200 | Southwest Airlines Co. | 359,584 | |||||

| 2,900 | Tam SA - SP-ADR | 49,184 | |||||

| 9,000 | UAL Corp.* | 175,950 | |||||

| 16,900 | US Airways Group, Inc.* | 124,215 | |||||

| 1,726,673 | |||||||

| Auto Components — 0.4% | |||||||

| 7,200 | China Automotive Systems, Inc.* | 166,392 | |||||

| 3,000 | The Goodyear Tire & Rubber Co.* | 37,920 | |||||

| 3,500 | Johnson Controls, Inc. | 115,465 | |||||

| 319,777 | |||||||

| Automobiles — 0.9% | |||||||

| 27,700 | Ford Motor Co.* | 348,189 | |||||

| 2,000 | Harley-Davidson, Inc. | 56,140 | |||||

| 2,000 | Honda Motor Co., Ltd. - SP-ADR | 70,580 | |||||

| 13,500 | Tata Motors Ltd. - SP-ADR | 249,210 | |||||

| 400 | Toyota Motor Corp. - SP-ADR | 32,168 | |||||

| 756,287 | |||||||

| Beverages — 1.6% | |||||||

| 400 | Anheuser-Busch InBev N.V. - SP-ADR | 20,180 | |||||

| 1,300 | The Boston Beer Company, Inc.* | 67,938 | |||||

| 3,800 | The Coca-Cola Co. | 209,000 | |||||

| 1,100 | Coca-Cola Femsa, S.A.B. | ||||||

| de C.V. - SP-ADR | 73,095 | ||||||

| 26,000 | Cott Corp.* | 201,500 | |||||

| 1,700 | Diageo PLC - SP-ADR | 114,665 | |||||

| 2,900 | Dr Pepper Snapple Group, Inc. | 101,993 | |||||

| 1,000 | Fomento Económico Mexicano, | ||||||

| S.A.B. de C.V. - SP-ADR | 47,530 | ||||||

| 2,500 | Hansen Natural Corp.* | 108,450 | |||||

| 4,600 | PepsiCo, Inc. | 304,336 | |||||

| 1,248,687 | |||||||

| Biotechnology — 1.4% | |||||||

| 2,600 | Alkermes, Inc.* | 33,722 | |||||

| 1,000 | Amgen Inc.* | 59,760 | |||||

| 4,600 | Amylin Pharmaceuticals, Inc.* | 103,454 | |||||

| 1,500 | Biogen Idec Inc.* | 86,040 | |||||

| 1,000 | BioMarin Pharmaceutical Inc.* | 23,370 | |||||

| 3,500 | Celera Corp.* | 24,850 | |||||

| 800 | Celgene Corp.* | 49,568 | |||||

| 24,000 | Cell Therapeutics, Inc.* | 12,977 | |||||

| 700 | Cephalon, Inc.* | 47,446 | |||||

| 4,500 | Dendreon Corp.* | 164,115 | |||||

| 5 | Genta, Inc.* | 0 | |||||

| 700 | Genzyme Corp.* | 36,281 | |||||

| 1,400 | Gilead Sciences, Inc.* | 63,672 | |||||

| 4,400 | Human Genome Sciences, Inc.* | 132,880 | |||||

| 15,200 | Incyte Corp.* | 212,192 | |||||

| 4,000 | SciClone Pharmaceuticals, Inc.* | 14,120 | |||||

| 500 | Vertex Pharmaceuticals Inc.* | 20,435 | |||||

| 4,000 | Vical Inc.* | 13,440 | |||||

| 1,098,322 | |||||||

| Building Products — 0.2% | |||||||

| 11,000 | Masco Corp. | 170,720 | |||||

| Capital Markets — 1.4% | |||||||

| 600 | Affiliated Managers Group, Inc.* | 47,400 | |||||

| 1,400 | Bank Of New York Mellon Corp. | 43,232 | |||||

| 300 | BlackRock, Inc. | 65,328 | |||||

| 44,300 | E*TRADE Financial Corp.* | 73,095 | |||||

| 2,700 | The Goldman Sachs Group, Inc. | 460,701 | |||||

| 1,200 | Jefferies Group, Inc. | 28,404 | |||||

| 1,200 | Legg Mason, Inc. | 34,404 | |||||

| 1,000 | Morgan Stanley | 29,290 | |||||

| 1,200 | Piper Jaffray Companies, Inc.* | 48,360 | |||||

| 1,000 | T. Rowe Price Group Inc. | 54,930 | |||||

| 1,400 | Raymond James Financial, Inc. | 37,436 | |||||

| 3,000 | Charles Schwab Corp. | 56,070 | |||||

| 1,500 | State Street Corp. | 67,710 | |||||

| 1,500 | TD Ameritrade Holding Corp.* | 28,590 | |||||

| 1,074,950 | |||||||

The accompanying notes to financial statements are an integral part of this schedule.

- 8 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Chemicals — 1.8% | |||||||

| 2,700 | Agrium Inc. | $ | 190,701 | ||||

| 600 | Air Products and Chemicals, Inc. | 44,370 | |||||

| 1,500 | Cytec Industries Inc. | 70,110 | |||||

| 4,000 | The Dow Chemical Co. | 118,280 | |||||

| 4,000 | E.I. du Pont de Nemours and Co. | 148,960 | |||||

| 700 | Eastman Chemical Co. | 44,576 | |||||

| 3,700 | W.R. Grace & Co.* | 102,712 | |||||

| 2,800 | International Flavors | ||||||

| & Fragrances Inc. | 133,476 | ||||||

| 600 | The Lubrizol Corp. | 55,032 | |||||

| 2,800 | Monsanto Co. | 199,976 | |||||

| 1,400 | The Mosaic Co. | 85,078 | |||||

| 1,000 | Nalco Holding Co. | 24,330 | |||||

| 4,700 | Olin Corp. | 92,214 | |||||

| 800 | Potash Corporation of | ||||||

| Saskatchewan Inc. | 95,480 | ||||||

| 900 | Sigma-Aldrich Corp. | 48,294 | |||||

| 1,453,589 | |||||||

| Commercial Banks — 1.3% | |||||||

| 1,000 | BB&T Corp. | 32,390 | |||||

| 10,600 | Fifth Third Bancorp | 144,054 | |||||

| 1,500 | Hudson City Bancorp, Inc. | 21,240 | |||||

| 17,000 | Huntington Bancshares Inc. | 91,290 | |||||

| 12,200 | KeyCorp | 94,550 | |||||

| 1,400 | PNC Financial Services Group, Inc. | 83,580 | |||||

| 9,000 | Regions Financial Corp. | 70,650 | |||||

| 5,600 | SunTrust Banks, Inc. | 150,024 | |||||

| 9,000 | Synovus Financial Corp. | 29,610 | |||||

| 1,500 | The Toronto-Dominion Bank | 111,870 | |||||

| 1,700 | U.S. Bancorp | 43,996 | |||||

| 2,000 | Wells Fargo & Co. | 62,240 | |||||

| 4,500 | Zions Bancorporation | 98,190 | |||||

| 1,033,684 | |||||||

| Commercial Services & Supplies — 0.6% | |||||||

| 2,500 | Avery Dennison Corp. | 91,025 | |||||

| 1,000 | Consolidated Graphics, Inc.* | 41,410 | |||||

| 600 | Corrections Corporation of America* | 11,916 | |||||

| 1,200 | Herman Miller, Inc. | 21,672 | |||||

| 2,200 | RINO International Corp.* | 52,206 | |||||

| 2,500 | Rollins, Inc. | 54,200 | |||||

| 25,600 | The Standard Register Co. | 136,960 | |||||

| 1,000 | Sykes Enterprises, Inc.* | 22,840 | |||||

| 1,000 | Waste Management, Inc. | 34,430 | |||||

| 466,659 | |||||||

| Communications Equipment — 3.6% | |||||||

| 7,000 | Brocade Communications | ||||||

| Systems, Inc.* | 39,970 | ||||||

| 13,400 | Ciena Corp.* | 204,216 | |||||

| 13,900 | Cisco Systems, Inc.* | 361,817 | |||||

| 1,100 | F5 Networks, Inc.* | 67,661 | |||||

| 30,875 | Finisar Corp.* | 485,046 | |||||

| 1,000 | Harris Corp. | 47,490 | |||||

| 7,500 | Ituran Location and Control Ltd. | 119,400 | |||||

| 31,000 | JDS Uniphase Corp.* | 388,430 | |||||

| 6,000 | Juniper Networks, Inc.* | 184,080 | |||||

| 8,500 | Motorola, Inc.* | 59,670 | |||||

| 2,500 | NETGEAR, Inc.* | 65,250 | |||||

| 7,400 | Nokia Corp. - SP-ADR | 114,996 | |||||

| 1,200 | Plantronics, Inc. | 37,536 | |||||

| 1,000 | QUALCOMM Inc. | 41,990 | |||||

| 5,300 | Research In Motion Ltd.* | 391,935 | |||||

| 19,500 | Sierra Wireless Inc.* | 164,385 | |||||

| 15,500 | Tellabs, Inc. | 117,335 | |||||

| 2,891,207 | |||||||

| Communications Equipment | |||||||

| Manufacturing — 0.0% | |||||||

| 3,000 | Ericsson L M Tel Co. SP-ADR | 31,320 | |||||

| Computers & Peripherals — 5.0% | |||||||

| 10,150 | Apple Inc.* | 2,384,539 | |||||

| 8,000 | Dell Inc.* | 120,080 | |||||

| 7,000 | EMC Corp.* | 126,280 | |||||

| 2,900 | Hewlett-Packard Co. | 154,135 | |||||

| 4,000 | Hutchinson Technology Inc.* | 24,960 | |||||

| 2,800 | International Business | ||||||

| Machines Corp. | 359,100 | ||||||

| 3,000 | Lexmark International, Inc.* | 108,240 | |||||

| 4,500 | NetApp, Inc.* | 146,520 | |||||

| 2,300 | QLogic Corp.* | 46,690 | |||||

| 4,700 | SanDisk Corp.* | 162,761 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 9 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Computers & Peripherals — 5.0% (Continued) | |||||||

| 9,500 | Seagate Technology* | $ | 173,470 | ||||

| 5,100 | Western Digital Corp.* | 198,849 | |||||

| 4,005,624 | |||||||

| Construction & Engineering — 0.4% | |||||||

| 3,700 | Fluor Corp. | 172,087 | |||||

| 2,500 | Foster Wheeler AG* | 67,850 | |||||

| 1,200 | Jacobs Engineering Group Inc.* | 54,228 | |||||

| 294,165 | |||||||

| Consumer Electronics — 0.1% | |||||||

| 2,300 | Garmin Ltd. | 88,504 | |||||

| Consumer Finance — 0.3% | |||||||

| 4,000 | American Express Co. | 165,040 | |||||

| 800 | Capital One Financial Corp. | 33,128 | |||||

| 5,000 | Discover Financial Services | 74,500 | |||||

| 272,668 | |||||||

| Consumer Services-Diversified — 0.1% | |||||||

| 800 | Grand Canyon Education, Inc.* | 20,912 | |||||

| 500 | New Oriental Education & | ||||||

| Technology Group, Inc. - SP-ADR* | 42,755 | ||||||

| 63,667 | |||||||

| Containers & Packaging — 0.3% | |||||||

| 700 | Ball Corp. | 37,366 | |||||

| 15,500 | Boise, Inc.* | 95,015 | |||||

| 2,500 | Owens-Illinois, Inc.* | 88,850 | |||||

| 1,800 | Sealed Air Corp. | 37,944 | |||||

| 259,175 | |||||||

| Distributors — 0.1% | |||||||

| 1,200 | Genuine Parts Co. | 50,688 | |||||

| Electrical Equipment — 0.6% | |||||||

| 1,800 | Baldor Electric Co. | 67,320 | |||||

| 18,000 | Capstone Turbine Corp.* | 22,860 | |||||

| 3,300 | Emerson Electric Co. | 166,122 | |||||

| 1,700 | Rockwell Automation, Inc. | 95,812 | |||||

| 1,000 | A.O. Smith Corp. | 52,570 | |||||

| 1,900 | Thomas & Betts Corp.* | 74,556 | |||||

| 479,240 | |||||||

| Electronic Equipment, Instruments | |||||||

| & Components — 1.4% | |||||||

| 1,500 | Agilent Technologies, Inc.* | 51,585 | |||||

| 4,500 | Brightpoint, Inc.* | 33,885 | |||||

| 800 | Coherent, Inc.* | 25,568 | |||||

| 6,200 | Corning Inc. | 125,302 | |||||

| 1,000 | Dolby Laboratories Inc.* | 58,670 | |||||

| 18,500 | Flextronics International Ltd.* | 145,040 | |||||

| 600 | Itron, Inc.* | 43,542 | |||||

| 3,800 | Jabil Circuit, Inc. | 61,522 | |||||

| 2,000 | Molex Inc. | 41,720 | |||||

| 15,600 | Sanmina-SCI Corp.* | 257,400 | |||||

| 1,200 | Tech Data Corp.* | 50,280 | |||||

| 1,200 | Trimble Navigation Ltd.* | 34,464 | |||||

| 15,100 | Vishay Intertechnology, Inc.* | 154,473 | |||||

| 1,083,451 | |||||||

| Energy Equipment & Services — 3.0% | |||||||

| 1,200 | Atwood Oceanics, Inc.* | 41,556 | |||||

| 2,500 | Baker Hughes Inc. | 117,100 | |||||

| 5,500 | Cameron International Corp.* | 235,730 | |||||

| 11,100 | CGG-Veritas - SP-ADR* | 314,352 | |||||

| 2,300 | Diamond Offshore Drilling, Inc. | 204,263 | |||||

| 3,000 | Halliburton Co. | 90,390 | |||||

| 1,600 | Helmerich & Payne, Inc. | 60,928 | |||||

| 800 | Nabors Industries Ltd.* | 15,704 | |||||

| 800 | National-Oilwell Varco Inc. | 32,464 | |||||

| 1,600 | Noble Corp. | 66,912 | |||||

| 6,800 | Parker Drilling Co.* | 33,524 | |||||

| 9,000 | Rowan Companies, Inc.* | 261,990 | |||||

| 5,000 | Schlumberger Ltd. | 317,300 | |||||

| 3,000 | Smith International, Inc. | 128,460 | |||||

| 1,000 | Tenaris S.A. - SP-ADR | 42,940 | |||||

| 4,200 | Transocean Ltd.* | 362,796 | |||||

| 2,200 | Weatherford | ||||||

| International Ltd.* | 34,892 | ||||||

| 2,361,301 | |||||||

| Financial Services-Diversified — 0.6% | |||||||

| 4,100 | Bank of America Corp. | 73,185 | |||||

| 34,700 | Citigroup Inc.* | 140,535 | |||||

| 2,900 | JPMorgan Chase & Co. | 129,775 | |||||

| 1,500 | The NASDAQ OMX Group, Inc.* | 31,680 | |||||

| 11,500 | NewStar Financial, Inc.* | 73,370 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 10 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Financial Services-Diversified — 0.6% (Continued) | |||||||

| 1,600 | NYSE Euronext | $ | 47,376 | ||||

| 495,921 | |||||||

| Food & Staples Retailing — 1.7% | |||||||

| 1,000 | BJ’s Wholesale Club, Inc.* | 36,990 | |||||

| 1,500 | Casey’s General Stores, Inc. | 47,100 | |||||

| 5,700 | Costco Wholesale Corp. | 340,347 | |||||

| 4,000 | CVS Caremark Corp. | 146,240 | |||||

| 12,200 | The Great Atlantic & Pacific | ||||||

| Tea Company, Inc.* | 93,574 | ||||||

| 5,500 | Rite Aid Corp.* | 8,250 | |||||

| 1,600 | Safeway Inc. | 39,776 | |||||

| 1,500 | SUPERVALU Inc. | 25,020 | |||||

| 1,500 | Sysco Corp. | 44,250 | |||||

| 3,900 | Wal-Mart Stores, Inc. | 216,840 | |||||

| 2,200 | Walgreen Co. | 81,598 | |||||

| 5,500 | Whole Foods Market, Inc.* | 198,825 | |||||

| 5,500 | Winn-Dixie Stores, Inc.* | 68,695 | |||||

| 1,347,505 | |||||||

| Food Products — 1.0% | |||||||

| 900 | Campbell Soup Co. | 31,815 | |||||

| 2,400 | ConAgra Foods, Inc. | 60,168 | |||||

| 2,500 | General Mills, Inc. | 176,975 | |||||

| 2,300 | H.J. Heinz Co. | 104,903 | |||||

| 3,000 | The Hershey Co. | 128,430 | |||||

| 700 | Kellogg Co. | 37,401 | |||||

| 1,000 | Kraft Foods Inc. | 30,240 | |||||

| 1,200 | Ralcorp Holdings, Inc.* | 81,336 | |||||

| 8,800 | Sara Lee Corp. | 122,584 | |||||

| 700 | The J.M. Smucker Co. | 42,182 | |||||

| 816,034 | |||||||

| Health Care Equipment & Supplies — 1.3% | |||||||

| 700 | C.R. Bard, Inc. | 60,634 | |||||

| 1,200 | Baxter International Inc. | 69,840 | |||||

| 1,000 | Becton, Dickinson & Co. | 78,730 | |||||

| 1,000 | Edwards Lifesciences Corp.* | 98,880 | |||||

| 2,300 | Hospira, Inc.* | 130,295 | |||||

| 700 | IDEXX Laboratories, Inc.* | 40,285 | |||||

| 1,800 | Kinetic Concepts, Inc.* | 86,058 | |||||

| 1,200 | Medtronic, Inc. | 54,036 | |||||

| 1,300 | ResMed Inc.* | 82,745 | |||||

| 800 | Sirona Dental Systems, Inc.* | 30,424 | |||||

| 500 | St. Jude Medical, Inc.* | 20,525 | |||||

| 2,100 | Stryker Corp. | 120,162 | |||||

| 3,500 | Varian Medical Systems, Inc.* | 193,655 | |||||

| 1,066,269 | |||||||

| Health Care Providers & Services — 2.1% | |||||||

| 1,500 | Aetna Inc. | 52,665 | |||||

| 4,800 | AmerisourceBergen Corp. | 138,816 | |||||

| 1,200 | Brookdale Senior Living Inc.* | 24,996 | |||||

| 3,500 | Cardinal Health, Inc. | 126,105 | |||||

| 1,200 | CIGNA Corp. | 43,896 | |||||

| 2,100 | Community Health Systems Inc.* | 77,553 | |||||

| 1,200 | Coventry Health Care, Inc.* | 29,664 | |||||

| 1,100 | Express Scripts, Inc.* | 111,936 | |||||

| 13,000 | Health Management Associates, Inc.* | 111,800 | |||||

| 1,500 | HEALTHSOUTH Corp.* | 28,050 | |||||

| 1,500 | Humana Inc.* | 70,155 | |||||

| 1,600 | Lincare Holdings Inc.* | 71,808 | |||||

| 800 | Magellan Health Services, Inc.* | 34,784 | |||||

| 1,000 | McKesson Corp. | 65,720 | |||||

| 1,800 | Medco Health Solutions, Inc.* | 116,208 | |||||

| 1,000 | Patterson Companies Inc. | 31,050 | |||||

| 1,200 | PSS World Medical, Inc.* | 28,212 | |||||

| 700 | Quest Diagnostics Inc. | 40,803 | |||||

| 24,500 | Tenet Healthcare Corp.* | 140,140 | |||||

| 2,500 | UnitedHealth Group Inc. | 81,675 | |||||

| 800 | Universal Health Services, Inc. | 28,072 | |||||

| 2,400 | WellCare Health Plans Inc.* | 71,520 | |||||

| 1,800 | WellPoint Inc.* | 115,884 | |||||

| 1,641,512 | |||||||

| Health Care Technology — 0.2% | |||||||

| 1,200 | Cerner Corp.* | 102,072 | |||||

| 800 | Computer Programs & Systems, Inc. | 31,264 | |||||

| 2,100 | Omnicell, Inc.* | 29,463 | |||||

| 162,799 | |||||||

| Home Building — 1.0% | |||||||

| 2,000 | Beazer Homes USA, Inc.* | 9,080 | |||||

| 8,700 | D.R. Horton, Inc. | 109,620 | |||||

| 2,400 | Gafisa S.A. - SP-ADR | 32,976 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 11 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Home Building — 1.0% (Continued) | |||||||

| 18,500 | Hovnanian Enterprises, Inc.* | $ | 80,475 | ||||

| 4,900 | KB Home | 82,075 | |||||

| 7,400 | Lennar Corp. | 127,354 | |||||

| 1,800 | Meritage Homes Corp.* | 37,800 | |||||

| 8,875 | Pulte Group Inc.* | 99,844 | |||||

| 3,700 | The Ryland Group, Inc. | 83,028 | |||||

| 7,000 | Standard Pacific Corp.* | 31,640 | |||||

| 3,200 | Toll Brothers, Inc.* | 66,560 | |||||

| 760,452 | |||||||

| Hotels, Restaurants & Leisure — 5.9% | |||||||

| 3,000 | Brinker International, Inc. | 57,840 | |||||

| 500 | Buffalo Wild Wings Inc.* | 24,055 | |||||

| 1,500 | Burger King Holdings Inc. | 31,890 | |||||

| 4,500 | California Pizza Kitchen, Inc.* | 75,555 | |||||

| 5,000 | Caribou Coffee Company, Inc.* | 33,100 | |||||

| 1,200 | Carnival Corp. | 46,656 | |||||

| 2,400 | The Cheesecake Factory Inc.* | 64,944 | |||||

| 1,100 | Chipotle Mexican Grill, Inc.* | 123,937 | |||||

| 2,100 | Choice Hotels International, Inc. | 73,101 | |||||

| 2,100 | Cracker Barrel Old Country Store, Inc. | 97,398 | |||||

| 5,400 | Ctrip.com | ||||||

| International, Ltd. - SP-ADR* | 211,680 | ||||||

| 3,100 | Darden Restaurants, Inc. | 138,074 | |||||

| 8,200 | Denny’s Corp.* | 31,488 | |||||

| 700 | DineEquity, Inc.* | 27,671 | |||||

| 8,700 | Domino’s Pizza, Inc.* | 118,668 | |||||

| 1,100 | Home Inns & Hotels | ||||||

| Management, Inc. - SP-ADR* | 36,014 | ||||||

| 2,500 | Hyatt Hotels Corp.* | 97,400 | |||||

| 6,200 | International Game Technology | 114,390 | |||||

| 49,000 | Jamba, Inc.* | 133,280 | |||||

| 23,700 | Las Vegas Sands Corp.* | 501,255 | |||||

| 3,821 | Marriott International, Inc. | 120,438 | |||||

| 6,800 | McDonald’s Corp. | 453,696 | |||||

| 17,500 | MGM MIRAGE* | 210,000 | |||||

| 4,700 | P.F. Chang’s China Bistro, Inc.* | 207,411 | |||||

| 2,300 | Panera Bread Co.* | 175,927 | |||||

| 1,500 | Papa John’s International, Inc.* | 38,565 | |||||

| 1,100 | Peet’s Coffee & Tea Inc.* | 43,615 | |||||

| 4,600 | Royal Caribbean Cruises Ltd.* | 151,754 | |||||

| 26,490 | Ruth’s Hospitality Group Inc.* | 140,397 | |||||

| 16,800 | Starbucks Corp. | 407,736 | |||||

| 4,700 | Starwood Hotels & Resorts | ||||||

| Worldwide, Inc. | 219,208 | ||||||

| 5,500 | Wyndham Worldwide Corp. | 141,515 | |||||

| 3,450 | Wynn Resorts Ltd. | 261,614 | |||||

| 3,000 | Yum! Brands, Inc. | 114,990 | |||||

| 4,725,262 | |||||||

| Household Durables — 1.2% | |||||||

| 1,200 | Helen of Troy Ltd.* | 31,272 | |||||

| 19,400 | La-Z-Boy Inc.* | 243,276 | |||||

| 600 | Mohawk Industries, Inc.* | 32,628 | |||||

| 4,000 | Newell Rubbermaid Inc. | 60,800 | |||||

| 2,200 | Sony Corp. - SP-ADR | 84,304 | |||||

| 2,830 | Stanley Black & Decker Inc. | 162,470 | |||||

| 3,000 | Tempur-Pedic International Inc.* | 90,480 | |||||

| 2,700 | Tupperware Brands Corp. | 130,194 | |||||

| 1,400 | Whirlpool Corp. | 122,150 | |||||

| 957,574 | |||||||

| Household Products — 0.6% | |||||||

| 1,600 | The Clorox Co. | 102,624 | |||||

| 1,900 | Colgate-Palmolive Co. | 161,994 | |||||

| 2,700 | Kimberly-Clark Corp. | 169,776 | |||||

| 1,300 | The Procter & Gamble Co. | 82,251 | |||||

| 516,645 | |||||||

| Industrial Conglomerates — 0.7% | |||||||

| 1,700 | 3M Co. | 142,069 | |||||

| 11,200 | General Electric Co. | 203,840 | |||||

| 4,700 | McDermott International, Inc.* | 126,524 | |||||

| 4,600 | Textron Inc. | 97,658 | |||||

| 570,091 | |||||||

| Insurance — 1.1% | |||||||

| 1,000 | Aflac, Inc. | 54,290 | |||||

| 300 | American International Group, Inc.* | 10,242 | |||||

| 500 | Berkshire Hathaway Inc. Cl B* | 40,635 | |||||

| 1,400 | China Life Insurance | ||||||

| Company, Ltd. - SP-ADR | 100,856 | ||||||

| 10,900 | Genworth Financial Inc.* | 199,906 | |||||

| 1,500 | Hartford Financial Services | ||||||

| Group, Inc. | 42,630 | ||||||

The accompanying notes to financial statements are an integral part of this schedule.

- 12 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Insurance — 1.1% (Continued) | |||||||

| 1,400 | Lincoln National Corp. | $ | 42,980 | ||||

| 2,500 | MetLife, Inc. | 108,350 | |||||

| 1,200 | Prudential Financial, Inc. | 72,600 | |||||

| 1,000 | Torchmark Corp. | 53,510 | |||||

| 2,300 | The Travelers Companies, Inc. | 124,062 | |||||

| 850,061 | |||||||

| Internet & Catalog Retail — 2.2% | |||||||

| 4,700 | Amazon.com, Inc.* | 637,931 | |||||

| 9,400 | Expedia, Inc. | 234,624 | |||||

| 1,400 | Netflix Inc.* | 103,236 | |||||

| 2,500 | Overstock.com, Inc.* | 40,625 | |||||

| 1,200 | PetMed Express, Inc. | 26,604 | |||||

| 2,800 | Priceline.com Inc.* | 714,000 | |||||

| 1,757,020 | |||||||

| Internet Software & Services — 3.7% | |||||||

| 9,700 | Akamai Technologies, Inc.* | 304,677 | |||||

| 12,500 | Art Technology Group, Inc.* | 55,125 | |||||

| 1,350 | Baidu, Inc. - SP-ADR* | 805,950 | |||||

| 12,700 | eBay Inc.* | 342,265 | |||||

| 1,350 | Google Inc.* | 765,464 | |||||

| 3,800 | IAC/InterActiveCorp* | 86,412 | |||||

| 2,500 | NetEase.com Inc. - SP-ADR* | 88,675 | |||||

| 4,500 | SAVVIS, Inc.* | 74,250 | |||||

| 2,200 | SINA Corp.* | 82,918 | |||||

| 2,500 | Sohu.com Inc.* | 136,500 | |||||

| 4,200 | ValueClick, Inc.* | 42,588 | |||||

| 2,600 | VeriSign, Inc.* | 67,626 | |||||

| 1,000 | WebMD Health Corp.* | 46,380 | |||||

| 4,500 | Yahoo! Inc.* | 74,385 | |||||

| 2,973,215 | |||||||

| IT Services — 2.1% | |||||||

| 4,100 | Acxiom Corp.* | 73,554 | |||||

| 800 | Automatic Data Processing, Inc. | 35,576 | |||||

| 4,700 | Cognizant Technology | ||||||

| Solutions Corp.* | 239,606 | ||||||

| 1,200 | Computer Sciences Corp.* | 65,388 | |||||

| 1,500 | Fiserv, Inc.* | 76,140 | |||||

| 5,300 | Infosys Technologies Ltd. - SP-ADR | 311,905 | |||||

| 400 | Mastercard, Inc. | 101,600 | |||||

| 2,200 | Paychex, Inc. | 67,540 | |||||

| 9,800 | Satyam Computer Services | ||||||

| Ltd. - SP-ADR* | 51,156 | ||||||

| 1,400 | TeleTech Holdings, Inc.* | 23,912 | |||||

| 1,200 | Unisys Corp.* | 41,868 | |||||

| 14,900 | VeriFone Holdings, Inc.* | 301,129 | |||||

| 2,900 | Visa Inc. | 263,987 | |||||

| 1,653,361 | |||||||

| Leisure Equipment & Products — 0.1% | |||||||

| 10,500 | Eastman Kodak Co.* | 60,795 | |||||

| 1,200 | Mattel, Inc. | 27,288 | |||||

| 88,083 | |||||||

| Life Sciences Tools & Services — 0.4% | |||||||

| 5,100 | Affymetrix, Inc.* | 37,434 | |||||

| 300 | Dionex Corp.* | 22,434 | |||||

| 1,200 | PerkinElmer, Inc. | 28,680 | |||||

| 5,900 | Sequenom Inc.* | 37,229 | |||||

| 700 | Thermo Fisher Scientific, Inc.* | 36,008 | |||||

| 1,800 | Waters Corp.* | 121,572 | |||||

| 283,357 | |||||||

| Machinery — 3.1% | |||||||

| 2,900 | Bucyrus International, Inc. | 191,371 | |||||

| 7,000 | Caterpillar Inc. | 439,950 | |||||

| 1,200 | Cummins Inc. | 74,340 | |||||

| 600 | Danaher Corp. | 47,946 | |||||

| 6,500 | Deere & Co. | 386,490 | |||||

| 2,300 | Eaton Corp. | 174,271 | |||||

| 2,800 | Gardner Denver Inc. | 123,312 | |||||

| 2,500 | Illinois Tool Works Inc. | 118,400 | |||||

| 2,500 | Ingersoll-Rand PLC | 87,175 | |||||

| 7,200 | Joy Global Inc. | 407,520 | |||||

| 600 | Oshkosh Corp.* | 24,204 | |||||

| 800 | PACCAR Inc. | 34,672 | |||||

| 2,700 | Pall Corp. | 109,323 | |||||

| 2,500 | Parker Hannifin Corp. | 161,850 | |||||

| 5,700 | Terex Corp.* | 129,447 | |||||

| 2,510,271 | |||||||

| Media — 3.4% | |||||||

| 13,900 | Belo Corp. | 94,798 | |||||

| 11,900 | CBS Corp. Cl B Non-Voting | 165,886 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 13 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Media — 3.4% (Continued) | |||||||

| 3,800 | DIRECTV* | $ | 128,478 | ||||

| 13,600 | The Walt Disney Co. | 474,776 | |||||

| 800 | DreamWorks Animation SKG, Inc.* | 31,512 | |||||

| 14,600 | Entercom Communications Corp.* | 173,594 | |||||

| 28,000 | Gannett Co., Inc. | 462,560 | |||||

| 1,500 | Grupo Televisa S.A. - SP-ADR | 31,530 | |||||

| 9,400 | IMAX Corp.* | 169,106 | |||||

| 3,500 | Lee Enterprises, Inc.* | 11,865 | |||||

| 2,000 | Live Nation Entertainment, Inc.* | 29,000 | |||||

| 4,000 | Martha Stewart Living | ||||||

| Omnimedia, Inc.* | 22,320 | ||||||

| 12,000 | The McClatchy Co.* | 58,920 | |||||

| 9,900 | The New York Times Co.* | 110,187 | |||||

| 8,000 | News Corp. Cl B | 136,080 | |||||

| 103,000 | Sirius XM Radio Inc.* | 89,661 | |||||

| 3,000 | Time Warner Cable Inc. | 159,930 | |||||

| 1,500 | Time Warner Inc. | 46,905 | |||||

| 7,500 | Viacom, Inc. Cl B* | 257,850 | |||||

| 3,900 | Virgin Media Inc. | 67,314 | |||||

| 2,722,272 | |||||||

| Metals & Mining — 5.9% | |||||||

| 600 | Agnico-Eagle Mines Ltd. | 33,402 | |||||

| 3,600 | AK Steel Holding Corp. | 82,296 | |||||

| 4,300 | Alcoa Inc. | 61,232 | |||||

| 2,500 | Allegheny Technologies, Inc. | 134,975 | |||||

| 3,700 | Aluminum Corporation | ||||||

| of China Ltd. - SP-ADR | 95,238 | ||||||

| 800 | AngloGold Ashanti Ltd. - SP-ADR | 30,360 | |||||

| 2,500 | ArcelorMittal NYS | 109,775 | |||||

| 2,000 | Barrick Gold Corp. | 76,680 | |||||

| 1,800 | BHP Billiton Ltd. - SP-ADR | 144,576 | |||||

| 18,000 | China Precision Steel, Inc.* | 37,800 | |||||

| 3,000 | Cliffs Natural Resources Inc. | 212,850 | |||||

| 5,000 | Coeur d’ Alene Mines Corp.* | 74,900 | |||||

| 10,000 | Commercial Metals Co. | 150,600 | |||||

| 1,200 | Companhia Siderurgica | ||||||

| Nacional S.A. - SP-ADR | 47,916 | ||||||

| 3,500 | Eldorado Gold Corp.* | 42,280 | |||||

| 3,700 | Freeport-McMoRan | ||||||

| Copper & Gold Inc. | 309,098 | ||||||

| 5,700 | Gerdau S.A. - SP-ADR | 92,910 | |||||

| 6,500 | Gold Fields Ltd. - SP-ADR | 82,030 | |||||

| 1,500 | Goldcorp, Inc. | 55,830 | |||||

| 14,000 | Golden Star Resources Ltd.* | 54,180 | |||||

| 6,000 | Harmony Gold Mining | ||||||

| Company Ltd. - SP-ADR | 56,880 | ||||||

| 12,000 | Hecla Mining Co.* | 65,640 | |||||

| 3,500 | IAMGOLD Corp. | 46,270 | |||||

| 2,200 | Ivanhoe Mines Ltd.* | 38,302 | |||||

| 5,600 | Kinross Gold Corp. | 95,704 | |||||

| 3,100 | Mechel - SP-ADR | 88,102 | |||||

| 2,000 | Newmont Mining Corp. | 101,860 | |||||

| 42,000 | Northgate Minerals Corp.* | 126,000 | |||||

| 3,000 | Nucor Corp. | 136,140 | |||||

| 2,500 | Pan American Silver Corp. | 57,875 | |||||

| 700 | Randgold Resources Ltd. | 53,781 | |||||

| 400 | Rio Tinto PLC - SP-ADR | 94,692 | |||||

| 5,500 | RTI International Metals, Inc.* | 166,815 | |||||

| 3,000 | Silver Standard Resources Inc.* | 53,370 | |||||

| 9,000 | Silver Wheaton Corp.* | 141,120 | |||||

| 6,500 | Southern Copper Corp. | 205,855 | |||||

| 1,600 | Steel Dynamics, Inc. | 27,952 | |||||

| 17,000 | Taseko Mines Ltd.* | 88,060 | |||||

| 2,400 | Teck Resources Ltd. Cl B* | 104,544 | |||||

| 2,300 | Ternium S.A. - SP-ADR* | 94,369 | |||||

| 15,600 | Titanium Metals Corp.* | 258,804 | |||||

| 4,200 | United States Steel Corp. | 266,784 | |||||

| 9,600 | Vale S.A. - SP-ADR | 309,024 | |||||

| 7,000 | Yamana Gold Inc. | 68,950 | |||||

| 4,675,821 | |||||||

| Multiline Retail — 2.1% | |||||||

| 4,300 | 99 Cents Only Stores* | 70,090 | |||||

| 1,600 | Big Lots, Inc.* | 58,272 | |||||

| 8,600 | Dillard’s, Inc. | 202,960 | |||||

| 1,300 | Dollar Tree, Inc.* | 76,986 | |||||

| 1,000 | Family Dollar Stores, Inc. | 36,610 | |||||

| 2,000 | Kohl’s Corp.* | 109,560 | |||||

| 8,000 | Macy’s, Inc. | 174,160 | |||||

| 9,400 | Nordstrom, Inc. | 383,990 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 14 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Multiline Retail — 2.1% (Continued) | |||||||

| 5,700 | J.C. Penney Company, Inc. | $ | 183,369 | ||||

| 18,900 | Saks, Inc.* | 162,540 | |||||

| 3,900 | Target Corp. | 205,140 | |||||

| 1,663,677 | |||||||

| Office Electronics — 0.2% | |||||||

| 16,467 | Xerox Corp. | 160,553 | |||||

| Oil, Gas & Consumable Fuels — 5.1% | |||||||

| 1,400 | Anadarko Petroleum Corp. | 101,962 | |||||

| 1,600 | Apache Corp. | 162,400 | |||||

| 1,200 | Arch Coal, Inc. | 27,420 | |||||

| 1,500 | BP- PLC - SP-ADR | 85,605 | |||||

| 28,300 | Brigham Exploration Co.* | 451,385 | |||||

| 5,000 | Cabot Oil & Gas Corp. | 184,000 | |||||

| 2,700 | Cenovus Energy Inc. | 70,767 | |||||

| 3,250 | Chesapeake Energy Corp. | 76,830 | |||||

| 300 | Chevron Corp. | 22,749 | |||||

| 1,000 | Concho Resources Inc.* | 50,360 | |||||

| 1,300 | ConocoPhillips | 66,521 | |||||

| 3,000 | Devon Energy Corp. | 193,290 | |||||

| 9,000 | El Paso Corp. | 97,560 | |||||

| 1,000 | Enbridge Inc. | 47,750 | |||||

| 4,500 | EnCana Corp. | 139,635 | |||||

| 1,500 | EOG Resources, Inc. | 139,410 | |||||

| 300 | Exxon Mobil Corp. | 20,094 | |||||

| 800 | Hess Corp. | 50,040 | |||||

| 1,000 | Holly Corp. | 27,910 | |||||

| 25,500 | Ivanhoe Energy, Inc.* | 84,915 | |||||

| 8,000 | Massey Energy Co. | 418,320 | |||||

| 1,000 | Murphy Oil Corp. | 56,190 | |||||

| 1,600 | Newfield Exploration Co.* | 83,280 | |||||

| 2,300 | Noble Energy, Inc. | 167,900 | |||||

| 1,000 | Occidental Petroleum Corp. | 84,540 | |||||

| 5,500 | Peabody Energy Corp. | 251,350 | |||||

| 3,500 | Petroleo Brasileiro S.A. - SP-ADR | 155,715 | |||||

| 800 | Range Resources Corp. | 37,496 | |||||

| 1,500 | Southwestern Energy Co.* | 61,080 | |||||

| 2,500 | Suncor Energy, Inc. | 81,350 | |||||

| 2,000 | Tesoro Corp. | 27,800 | |||||

| 800 | Valero Energy Corp. | 15,760 | |||||

| 4,500 | Whiting Petroleum Corp.* | 363,780 | |||||

| 3,500 | The Williams Companies, Inc. | 80,850 | |||||

| 1,500 | Clayton Williams Energy, Inc.* | 52,470 | |||||

| 600 | XTO Energy, Inc. | 28,308 | |||||

| 4,066,792 | |||||||

| Paper & Forest Products — 0.3% | |||||||

| 5,500 | International Paper Co. | 135,355 | |||||

| 3,100 | Weyerhaeuser Co. | 140,337 | |||||

| 275,692 | |||||||

| Personal Products — 0.6% | |||||||

| 700 | Avon Products, Inc. | 23,709 | |||||

| 1,500 | China Sky One Medical, Inc.* | 23,565 | |||||

| 3,800 | Elizabeth Arden, Inc.* | 68,400 | |||||

| 1,600 | Herbalife Ltd. | 73,792 | |||||

| 2,500 | Estee Lauder Companies, Inc. | 162,175 | |||||

| 3,800 | Medifast, Inc.* | 95,494 | |||||

| 800 | Nutri System, Inc. | 14,248 | |||||

| 500 | Weight Watchers International, Inc. | 12,765 | |||||

| 474,148 | |||||||

| Pharmaceuticals — 2.9% | |||||||

| 1,400 | Abbott Laboratories | 73,752 | |||||

| 900 | Allergan, Inc. | 58,788 | |||||

| 3,200 | Bristol-Myers Squibb Co. | 85,440 | |||||

| 4,800 | Dr. Reddy’s Laboratories | ||||||

| Ltd. - SP-ADR | 135,504 | ||||||

| 3,000 | Elan Corp. PLC - SP-ADR* | 22,740 | |||||

| 1,200 | Forest Laboratories, Inc.* | 37,632 | |||||

| 31,000 | Generex Biotechnology Corp.* | 16,700 | |||||

| 10,900 | Jazz Pharmaceuticals, Inc.* | 118,810 | |||||

| 6,900 | Johnson & Johnson | 449,880 | |||||

| 2,600 | Eli Lilly and Co. | 94,172 | |||||

| 2,400 | Medicis Pharmaceutical Corp. | 60,384 | |||||

| 3,000 | Merck & Co., Inc. | 112,050 | |||||

| 6,900 | Mylan, Inc.* | 156,699 | |||||

| 1,100 | Novo Nordisk A/S - SP-ADR | 84,832 | |||||

| 6,800 | Perrigo Co. | 399,296 | |||||

| 4,000 | Pfizer Inc. | 68,600 | |||||

| 2,700 | Questcor Pharmaceuticals, Inc.* | 22,221 | |||||

| 1,600 | Salix Pharmaceuticals, Ltd.* | 59,600 | |||||

| 1,800 | Teva Pharmaceutical Industries Ltd. | 113,544 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 15 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Pharmaceuticals — 2.9% (Continued) | |||||||

| 7,900 | ViroPharma Inc.* | $ | 107,677 | ||||

| 1,200 | VIVUS Inc.* | 10,464 | |||||

| 1,500 | Watson Pharmaceuticals, Inc.* | 62,655 | |||||

| 2,351,440 | |||||||

| Professional Services — 0.2% | |||||||

| 1,600 | Manpower Inc. | 91,392 | |||||

| 13,500 | On Assignment, Inc.* | 96,255 | |||||

| 187,647 | |||||||

| Road & Rail — 0.9% | |||||||

| 3,100 | CSX Corp. | 157,790 | |||||

| 2,500 | Dollar Thrifty Automotive | ||||||

| Group, Inc.* | 80,325 | ||||||

| 8,000 | Hertz Global Holdings, Inc.* | 79,920 | |||||

| 3,100 | Norfolk Southern Corp. | 173,259 | |||||

| 1,500 | Ryder Systems, Inc. | 58,140 | |||||

| 2,400 | Union Pacific Corp. | 175,920 | |||||

| 20,000 | YRC Worldwide, Inc.* | 10,876 | |||||

| 736,230 | |||||||

| Sawmills and Wood Preservation — 0.1% | |||||||

| 3,500 | Louisiana-Pacific Corp.* | 31,675 | |||||

| Semiconductors & Semiconductor | |||||||

| Equipment — 4.9% | |||||||

| 17,700 | Advanced Micro Devices, Inc.* | 164,079 | |||||

| 5,400 | Altera Corp. | 131,274 | |||||

| 2,500 | Analog Devices, Inc. | 72,050 | |||||

| 10,800 | Applied Materials, Inc. | 145,584 | |||||

| 5,100 | ASML Holding N.V. NYS | 180,540 | |||||

| 4,000 | Atmel Corp.* | 20,120 | |||||

| 4,800 | Broadcom Corp. | 159,264 | |||||

| 21,900 | Conexant Systems, Inc.* | 74,460 | |||||

| 2,000 | Cree, Inc.* | 140,440 | |||||

| 4,800 | Cypress Semiconductor Corp.* | 55,200 | |||||

| 3,500 | Entegris Inc.* | 17,640 | |||||

| 6,000 | Integrated Device Technology, Inc.* | 36,780 | |||||

| 11,400 | Intel Corp. | 253,764 | |||||

| 4,000 | KLA-Tencor Corp. | 123,680 | |||||

| 12,100 | Kulicke and Soffa Industries, Inc.* | 87,725 | |||||

| 2,500 | Lam Research Corp.* | 93,300 | |||||

| 9,900 | Lattice Semiconductor Corp.* | 36,333 | |||||

| 10,500 | LSI Corp.* | 64,260 | |||||

| 13,500 | LTX-Credence Corp.* | 40,905 | |||||

| 3,500 | Marvell Technology Group Ltd.* | 71,330 | |||||

| 9,000 | Mattson Technology, Inc.* | 41,580 | |||||

| 3,000 | MEMC Electronic Materials, Inc.* | 45,990 | |||||

| 2,700 | Microchip Technology Inc. | 76,032 | |||||

| 14,000 | Micron Technology, Inc.* | 145,460 | |||||

| 12,400 | Mindspeed Technologies Inc.* | 99,324 | |||||

| 3,700 | Novellus Systems, Inc.* | 92,500 | |||||

| 7,200 | NVIDIA Corp.* | 125,136 | |||||

| 16,500 | ON Semiconductor Corp.* | 132,000 | |||||

| 8,500 | PMC-Sierra, Inc.* | 75,820 | |||||

| 900 | Rambus Inc.* | 19,665 | |||||

| 9,000 | RF Micro Devices, Inc.* | 44,820 | |||||

| 9,100 | Skyworks Solutions, Inc.* | 141,960 | |||||

| 2,500 | Standard Microsystems Corp.* | 58,200 | |||||

| 16,000 | Teradyne, Inc.* | 178,720 | |||||

| 7,000 | Texas Instruments Inc. | 171,290 | |||||

| 19,600 | TriQuint Semiconductor, Inc.* | 137,200 | |||||

| 5,300 | Veeco Instruments Inc.* | 230,550 | |||||

| 5,400 | Xilinx, Inc. | 137,700 | |||||

| 3,922,675 | |||||||

| Software — 3.7% | |||||||

| 2,100 | Adobe Systems Inc.* | 74,277 | |||||

| 1,000 | Advent Software, Inc.* | 44,750 | |||||

| 7,400 | Ariba Inc.* | 95,090 | |||||

| 2,700 | AsiaInfo Holdings, Inc.* | 71,496 | |||||

| 2,700 | Autodesk, Inc.* | 79,434 | |||||

| 1,800 | BMC Software, Inc.* | 68,400 | |||||

| 1,700 | Check Point Software | ||||||

| Technologies Ltd.* | 59,602 | ||||||

| 4,900 | Citrix Systems, Inc.* | 232,603 | |||||

| 3,500 | Compuware Corp.* | 29,400 | |||||

| 1,200 | Fair Isaac Corp. | 30,408 | |||||

| 2,500 | Informatica Corp.* | 67,150 | |||||

| 2,000 | Intuit Inc.* | 68,680 | |||||

| 2,584 | JDA Software Group, Inc.* | 71,887 | |||||

| 2,000 | McAfee Inc.* | 80,260 | |||||

| 7,600 | Microsoft Corp. | 222,452 | |||||

The accompanying notes to financial statements are an integral part of this schedule.

- 16 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Software — 3.7% (Continued) | |||||||

| 13,400 | Oracle Corp. | $ | 344,246 | ||||

| 6,000 | Parametric Technology Corp.* | 108,300 | |||||

| 3,000 | Quest Software, Inc.* | 53,370 | |||||

| 3,000 | Red Hat, Inc.* | 87,810 | |||||

| 1,000 | Rosetta Stone, Inc.* | 23,780 | |||||

| 3,000 | Salesforce.com, Inc.* | 223,350 | |||||

| 1,700 | SAP AG - SP-ADR | 81,889 | |||||

| 1,300 | Solarwinds, Inc.* | 28,158 | |||||

| 2,000 | SonicWALL, Inc.* | 17,380 | |||||

| 2,400 | Sybase, Inc.* | 111,888 | |||||

| 1,800 | Symantec Corp.* | 30,456 | |||||

| 7,000 | TIBCO Software Inc.* | 75,530 | |||||

| 5,700 | VMware Inc.* | 303,810 | |||||

| 18,500 | Wave Systems Corp.* | 74,000 | |||||

| 4,200 | Websense, Inc.* | 95,634 | |||||

| 2,955,490 | |||||||

| Solar — 0.5% | |||||||

| 9,000 | Evergreen Solar, Inc.* | 10,170 | |||||

| 600 | First Solar, Inc.* | 73,590 | |||||

| 11,500 | JA Solar Holdings Co., | ||||||

| Ltd. - SP-ADR* | 64,515 | ||||||

| 3,500 | LDK Solar Co. Ltd. - SP-ADR* | 22,960 | |||||

| 5,000 | Suntech Power Holdings | ||||||

| Co., Ltd. - SP-ADR* | 70,100 | ||||||

| 3,400 | Trina Solar Ltd.* | 82,994 | |||||

| 7,500 | Yingli Green Energy Holding | ||||||

| Company Ltd. - SP-ADR* | 95,550 | ||||||

| 419,879 | |||||||

| Specialty Retail — 6.9% | |||||||

| 2,000 | Abercrombie & Fitch Co. | 91,280 | |||||

| 7,100 | Aeropostale, Inc.* | 204,693 | |||||

| 3,200 | American Eagle Outfitters, Inc. | 59,264 | |||||

| 10,000 | AnnTaylor Stores Corp.* | 207,000 | |||||

| 500 | AutoNation, Inc.* | 9,040 | |||||

| 200 | AutoZone, Inc.* | 34,618 | |||||

| 4,300 | Bed Bath & Beyond Inc.* | 188,168 | |||||

| 9,400 | Best Buy Co., Inc. | 399,876 | |||||

| 24,000 | Blockbuster Inc.* | 6,060 | |||||

| 29,000 | Borders Group, Inc.* | 49,880 | |||||

| 2,000 | The Buckle, Inc. | 73,520 | |||||

| 5,200 | CarMax, Inc.* | 130,624 | |||||

| 7,000 | Chico’s FAS, Inc. | 100,940 | |||||

| 1,500 | The Children’s Place Retail | ||||||

| Stores, Inc.* | 66,825 | ||||||

| 4,000 | Coldwater Creek Inc.* | 27,760 | |||||

| 4,000 | Dick’s Sporting Goods, Inc.* | 104,440 | |||||

| 1,500 | The Dress Barn, Inc.* | 39,240 | |||||

| 2,000 | GameStop Corp.* | 43,820 | |||||

| 2,000 | The Gap, Inc. | 46,220 | |||||

| 1,500 | Guess?, Inc. | 70,470 | |||||

| 800 | The Gymboree Corp.* | 41,304 | |||||

| 12,600 | The Home Depot, Inc. | 407,610 | |||||

| 3,000 | J. Crew Group, Inc.* | 137,700 | |||||

| 800 | Jo-Ann Stores, Inc.* | 33,584 | |||||

| 14,500 | Limited Brands, Inc. | 356,990 | |||||

| 8,700 | Lowe’s Companies, Inc. | 210,888 | |||||

| 44,000 | Office Depot, Inc.* | 351,120 | |||||

| 36,400 | OfficeMax Inc.* | 597,688 | |||||

| 1,000 | O’Reilly Automotive, Inc.* | 41,710 | |||||

| 4,000 | Pacific Sunwear of California, Inc.* | 21,240 | |||||

| 2,500 | PetSmart, Inc. | 79,900 | |||||

| 40,500 | Pier 1 Imports, Inc.* | 257,985 | |||||

| 1,200 | RadioShack Corp. | 27,156 | |||||

| 1,100 | REX Stores Corp.* | 17,820 | |||||

| 3,400 | Ross Stores, Inc. | 181,798 | |||||

| 1,200 | The Sherwin-Williams Co. | 81,216 | |||||

| 2,500 | Staples, Inc. | 58,475 | |||||

| 4,500 | Stein Mart, Inc.* | 40,635 | |||||

| 4,500 | Talbots, Inc.* | 58,320 | |||||

| 1,700 | Tiffany & Co. | 80,733 | |||||

| 2,600 | The TJX Companies, Inc. | 110,552 | |||||

| 7,200 | Ulta Salon, Cosmetics & | ||||||

| Fragrance, Inc.* | 162,864 | ||||||

| 4,100 | Urban Outfitters, Inc.* | 155,923 | |||||

| 2,300 | Williams-Sonoma, Inc. | 60,467 | |||||

| 5,527,416 | |||||||

| Telecommunication Services-Diversified — 0.9% | |||||||

| 1,000 | BT Group PLC - SP-ADR | 18,710 | |||||

| 3,000 | China Unicom (Hong Kong) | ||||||

| Ltd. - SP-ADR | 33,450 | ||||||

The accompanying notes to financial statements are an integral part of this schedule.

- 17 -

Reynolds Blue Chip Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2010 (Unaudited)

| Shares | Value | ||||||

| LONG-TERM INVESTMENTS — 99.3% (a) (Continued) | |||||||

| COMMON STOCKS — 99.3% (a) (Continued) | |||||||

| Telecommunication Services- | |||||||

| Diversified — 0.9% (Continued) | |||||||

| 4,400 | City Telecom (H. K.) Ltd. - SP-ADR | $ | 70,708 | ||||

| 16,500 | Qwest Communications | ||||||

| International Inc. | 86,130 | ||||||

| 9,300 | tw telecom inc.* | 168,795 | |||||

| 2,700 | Verizon Communications Inc. | 83,754 | |||||

| 14,200 | Vimpel-Communications - SP-ADR | 261,422 | |||||

| 722,969 | |||||||

| Telecommunication Services-Wireless — 0.7% | |||||||

| 700 | American Tower Corp.* | 29,827 | |||||

| 1,200 | China Mobile Ltd. - SP-ADR | 57,744 | |||||

| 1,000 | Crown Castle International Corp.* | 38,230 | |||||

| 1,500 | Leap Wireless International, Inc.* | 24,540 | |||||

| 500 | Millicom International Cellular S.A. | 44,575 | |||||

| 5,000 | Mobile TeleSystems - SP-ADR | 277,500 | |||||

| 18,100 | Sprint Nextel Corp.* | 68,780 | |||||

| 1,500 | Turkcell Iletisim Hizmetleri | ||||||

| AS - SP-ADR | 22,590 | ||||||

| 1,000 | Vivo Participacoes S.A. - SP-ADR | 27,110 | |||||

| 590,896 | |||||||

| Textiles, Apparel & Luxury Goods — 1.6% | |||||||

| 2,200 | Coach, Inc. | 86,944 | |||||

| 600 | Kenneth Cole Productions, Inc.* | 7,686 | |||||

| 27,000 | Crocs, Inc.* | 236,790 | |||||

| 900 | Deckers Outdoor Corp.* | 124,200 | |||||

| 1,500 | Gildan Activewear Inc.* | 39,435 | |||||

| 600 | Hanesbrands, Inc.* | 16,692 | |||||

| 17,500 | Joe’s Jeans, Inc.* | 46,025 | |||||

| 12,700 | Liz Claiborne, Inc.* | 94,361 | |||||

| 2,200 | Lululemon Athletica Inc.* | 91,300 | |||||

| 1,500 | NIKE, Inc. Cl B | 110,250 | |||||

| 1,600 | Phillips-Van Heusen Corp. | 91,776 | |||||

| 2,000 | Polo Ralph Lauren Corp. | 170,080 | |||||

| 800 | Skechers U.S.A., Inc.* | 29,056 | |||||

| 1,500 | True Religion Apparel, Inc.* | 45,540 | |||||

| 1,500 | Under Armour, Inc.* | 44,115 | |||||

| 700 | VF Corp. | 56,105 | |||||

| 1,290,355 | |||||||

| Trading Companies & Distributors — 0.2% | |||||||

| 1,500 | Fastenal Co. | 71,985 | |||||

| 700 | W.W. Grainger, Inc. | 75,684 | |||||

| 147,669 | |||||||

| Water Utilities — 0.0% | |||||||

| 1,000 | Southwest Water Co. | 10,440 | |||||

| Total common stocks | |||||||

| (cost $66,147,990) | 79,280,917 | ||||||

| WARRANTS — 0.0% (a) | |||||||

| 70 | Krispy Kreme Doughnuts, Inc.,* | ||||||

| Expiration Date — 03/02/12, | |||||||

| Exercise Price — $12.21 | 1 | ||||||

Total investments — 99.3% | |||||||

| (cost $66,147,990) | 79,280,918 | ||||||

| Cash and receivables, | |||||||

less liabilities — 0.7% (a) | 539,263 | ||||||

| TOTAL NET | |||||||

| ASSETS — 100.0% | $ | 79,820,181 | |||||

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

N.V. – Netherlands Antilles Limited Liability Corp.

NYS – New York Registered Shares

SP-ADR – Sponsored American Depositary Receipts

The accompanying notes to financial statements are an integral part of this schedule.

- 18 -

Reynolds Blue Chip Growth Fund

STATEMENT OF OPERATIONS

For the Six Months Ending March 31, 2010 (Unaudited)

| INCOME: | ||||

| Dividends (net of foreign withholding tax of $6,651) | $ | 314,390 | ||

| Total income | 314,390 | |||

| EXPENSES: | ||||

| Management fees | 305,229 | |||

| Transfer agent fees | 56,000 | |||

| Administrative and accounting services | 47,477 | |||

| Insurance expense | 34,390 | |||

| Professional fees | 33,330 | |||

| Custodian fees | 28,690 | |||

| Registration fees | 26,160 | |||

| Printing and postage expense | 24,110 | |||

| Distribution fees | 22,772 | |||

| Board of Directors fees | 10,000 | |||

| Chief Compliance Officers fees | 10,000 | |||

| Other expenses | 10,418 | |||

| Net expenses | 608,576 | |||

| NET INVESTMENT LOSS | (294,186 | ) | ||

| NET REALIZED GAIN ON INVESTMENTS | 3,561,662 | |||

| NET INCREASE IN UNREALIZED APPRECIATION ON INVESTMENTS | 4,531,760 | |||

| NET GAIN ON INVESTMENTS | 8,093,422 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 7,799,236 | ||

STATEMENTS OF CHANGES IN NET ASSETS

For the Six Months Ending March 31, 2010 (Unaudited) and For the Year Ended September 30, 2009

| 2010 | 2009 | |||||||

| OPERATIONS: | ||||||||

| Net investment loss | $ | (294,186 | ) | $ | (352,303 | ) | ||

| Net realized gain on investments | 3,561,662 | 1,479,604 | ||||||

| Net increase in unrealized appreciation on investments | 4,531,760 | 8,520,213 | ||||||

| Net increase in net assets resulting from operations | 7,799,236 | 9,647,514 | ||||||

| FUND SHARE ACTIVITIES: | ||||||||

| Proceeds from shares issued (755,989 and 626,906 shares, respectively) | 33,181,691 | 22,414,869 | ||||||

| Cost of shares redeemed (225,035 and 162,666 shares, respectively) | (9,713,778 | ) | (5,660,176 | ) | ||||

| Net increase in net assets derived from Fund share activities | 23,467,913 | 16,754,693 | ||||||

| TOTAL INCREASE | 31,267,149 | 26,402,207 | ||||||

| NET ASSETS AT THE BEGINNING OF THE PERIOD | 48,553,032 | 22,150,825 | ||||||

| NET ASSETS AT THE END OF THE PERIOD (Includes undistributed | ||||||||

| net investment income of $0 and $0, respectively) | $ | 79,820,181 | $ | 48,553,032 | ||||

The accompanying notes to financial statements are an integral part of these statements.

- 19 -

Reynolds Blue Chip Growth Fund

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each period)

| (Unaudited) | ||||||||||||||||||||||||

| For the Six | ||||||||||||||||||||||||

| Months Ending | Years Ended September 30, | |||||||||||||||||||||||

| March 31, 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||||||

| PER SHARE OPERATING PERFORMANCE: | ||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 41.87 | $ | 31.85 | $ | 32.05 | $ | 28.98 | $ | 29.48 | $ | 26.98 | ||||||||||||

| Income from investment operations: | ||||||||||||||||||||||||

| Net investment (loss) income (a) | (0.21 | ) | (0.42 | ) | (0.01 | ) | 0.17 | (0.17 | ) | (0.34 | ) | |||||||||||||

| Net realized and unrealized gains (losses) | ||||||||||||||||||||||||

| on investments | 5.55 | 10.44 | 0.02 | 2.90 | (0.33 | ) | 2.84 | |||||||||||||||||

| Total from investment operations | 5.34 | 10.02 | 0.01 | 3.07 | (0.50 | ) | 2.50 | |||||||||||||||||

| Less distributions: | ||||||||||||||||||||||||

| Distributions from net investment income | — | — | (0.21 | ) | — | — | — | |||||||||||||||||

| Distributions from net realized gains | — | — | — | — | — | — | ||||||||||||||||||

| Total from distributions | — | — | (0.21 | ) | — | — | — | |||||||||||||||||

| Net asset value, end of period | $ | 47.21 | $ | 41.87 | $ | 31.85 | $ | 32.05 | $ | 28.98 | $ | 29.48 | ||||||||||||

| TOTAL RETURN | 12.75 | %(1) | 31.46 | % | (0.00 | %) | 10.59 | % | (1.70 | %) | 9.27 | % | ||||||||||||

| RATIOS/SUPPLEMENTAL DATA: | ||||||||||||||||||||||||