UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-05594 |

| |

| Exact name of registrant as specified in charter: | | Prudential Short-Term Corporate Bond Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French 655 Broad Street, 6th Floor Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 12/31/2023 |

| |

| Date of reporting period: | | 12/31/2023 |

Item 1 – Reports to Stockholders

PGIM SHORT-TERM CORPORATE BOND FUND

ANNUAL REPORT

DECEMBER 31, 2023

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2024 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Short-Term Corporate Bond Fund informative and useful. The report covers performance for the 12-month period that ended December 31, 2023. Despite elevated inflation, recession fears, and a banking industry crisis, financial markets rallied and the global economy remained resilient throughout the period. Employers continued hiring, consumers continued spending, and home prices rose as inflation eventually cooled and the economic outlook improved. Stocks rose for much of the period and then surged late in the period when the Federal Reserve (the Fed) signaled several potential interest-rate cuts in 2024. For the entire period, equities in both US and international markets posted gains. |

After falling much of the period, bond markets rebounded when the Fed began moderating its rate-hiking cycle. Higher interest rates also offered investors an additional cushion from fixed income volatility. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted gains during the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 14th-largest investment manager with more than $1.3 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President and Principal Executive Officer

PGIM Short-Term Corporate Bond Fund

February 15, 2024

PGIM Short-Term Corporate Bond Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 12/31/23 |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| | | | |

Class A | | | | | | | | |

| | | | |

(with sales charges) | | 4.20 | | 1.59 | | 1.49 | | — |

| | | | |

(without sales charges) | | 6.60 | | 2.05 | | 1.72 | | — |

| | | | |

Class C | | | | | | | | |

| | | | |

(with sales charges) | | 4.79 | | 1.29 | | 0.98 | | — |

| | | | |

(without sales charges) | | 5.79 | | 1.29 | | 0.98 | | — |

| | | | |

Class R | | | | | | | | |

| | | | |

(without sales charges) | | 6.25 | | 1.71 | | 1.43 | | — |

| | | | |

Class Z | | | | | | | | |

| | | | |

(without sales charges) | | 6.85 | | 2.30 | | 1.98 | | — |

| | | | |

Class R2 | | | | | | | | |

| | | | |

(without sales charges) | | 6.41 | | 1.90 | | N/A | | 1.62

(12/27/2017) |

| | | | |

Class R4 | | | | | | | | |

| | | | |

(without sales charges) | | 6.68 | | 2.14 | | N/A | | 1.88

(12/27/2017) |

| | | | |

Class R6 | | | | | | | | |

| | | | |

(without sales charges) | | 6.95 | | 2.39 | | 2.09 | | — |

| | | | |

Bloomberg 1–5 Year US Credit Index | | | | | | | | |

| | | | |

| | | 5.94 | | 2.21 | | 2.01 | | — |

| | | | |

| | | | | | | | |

|

| Average Annual Total Returns as of 12/31/23 Since Inception (%) |

| | | | |

| | | | | | | | | Class R2, Class R4 (12/27/2017) |

| | | | |

Bloomberg 1–5 Year US Credit Index | | | | | | | | 2.02 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’s inception date.

4 Visit our website at pgim.com/investments

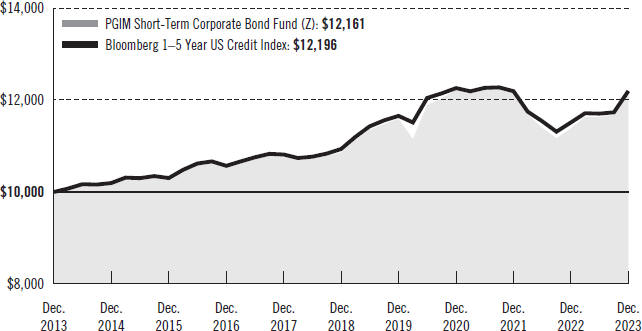

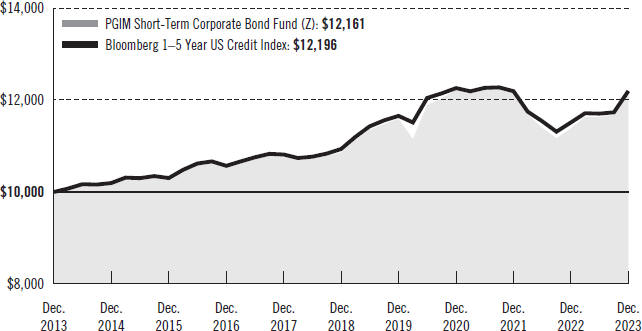

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Bloomberg 1–5 Year US Credit Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (December 31, 2013) and the account values at the end of the current fiscal year (December 31, 2023) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary, due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns in the table and the graph do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Short-Term Corporate Bond Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Class A | | Class C | | Class R | | Class Z | | Class R2 | | Class R4 | | Class R6 |

| | | | | | | | |

Maximum initial sales charge | | 2.25% of the public offering price | | None | | None | | None | | None | | None | | None |

| | | | | | | | |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | For purchases prior to May 1, 2023: 1.00% on sales of $500,000 or more made within 12 months of purchase For purchases on or after May 1, 2023: 1.00% on sales of $250,000 or more made within 18 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None | | None | | None |

| | | | | | | | |

Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.25% | | 1.00% | | 0.75% (0.50% currently) | | None | | 0.25% | | None | | None |

| | | | | | | | |

Shareholder service fees | | None | | None | | None | | None | | 0.10%* | | 0.10%* | | None |

*Shareholder service fee reflects maximum allowable fees under a shareholder services plan.

Benchmark Definition

Bloomberg 1–5 Year US Credit Index—The Bloomberg 1–5 Year US Credit Index is an unmanaged index of publicly issued US corporate and specified foreign debentures and secured notes that meet specific maturity (between one and five years), liquidity, and quality requirements. It gives an indication of how short- and intermediate-term bonds have performed.

6 Visit our website at pgim.com/investments

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | | | |

| |

| Credit Quality expressed as a percentage of total investments as of 12/31/23 (%) | | | |

| |

AAA | | | 15.8 | |

| |

AA | | | 9.2 | |

| |

A | | | 26.0 | |

| |

BBB | | | 46.3 | |

| |

BB | | | 2.0 | |

| |

Not Rated | | | 0.3 | |

| |

Cash/Cash Equivalents | | | 0.4 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | |

| | | |

| Distributions and Yields as of 12/31/23 | | | | | | |

| | | |

| | | Total Distributions

Paid for One Year ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| | | |

Class A | | 0.34 | | 4.58 | | 4.57 |

| | | |

Class C | | 0.26 | | 3.99 | | 3.97 |

| | | |

Class R | | 0.30 | | 4.35 | | 4.09 |

| | | |

Class Z | | 0.36 | | 4.91 | | 4.91 |

| | | |

Class R2 | | 0.32 | | 4.50 | | 5.45 |

| | | |

Class R4 | | 0.35 | | 4.75 | | 4.23 |

| | | |

Class R6 | | 0.37 | | 5.00 | | 5.01 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

PGIM Short-Term Corporate Bond Fund 7

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Short-Term Corporate Bond Fund’s Class Z shares returned 6.85% in the 12-month reporting period that ended December 31, 2023, outperforming the 5.94% return of the Bloomberg 1–5 Year US Credit Index (the Index).

How did the short-term US investment-grade corporate bond sector perform?

| · | | The short-term investment-grade corporate bond sector, as measured by the Index, underperformed the broader credit market in 2023, posting total returns and excess returns over US Treasuries of 5.94% and 1.59%, respectively. US corporate bonds of all durations, as measured by the Bloomberg Credit Index, returned 8.18% for the period, with an excess return over US Treasuries of 4.20%. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

| · | | In the first quarter of 2023, financials were the main driver of US investment-grade corporate spread widening, as stresses emerged in the global banking sector in mid-March. Volatility increased, spreads widened, and credit curves flattened. Markets began to recover in the final weeks of March, as fears of widespread contagion eased and the focus shifted to the longer-term implications of tighter lending conditions. The primary market slowed in March amid a challenging backdrop. However, healthy supply in January and February made up for much of the slowdown. Gross issuance totaled $396 billion, split 65/35 between non-financials and financials. By quality, BBB-rated bonds outperformed A-rated bonds over the quarter, and industrials outperformed financials. |

| · | | US investment-grade corporate spreads tightened in the second quarter of 2023. Financials were the main driver of spread tightening, retracing from the peaks hit during the regional bank crisis in March to slightly tighter than where spreads began the year, though this was bifurcated between money center and regional banks. The primary market picked up in May and June following muted issuance in March and April. Gross issuance totaled $712 billion through the first half of 2023, split 65/35 between non-financials and financials. By quality, BBB-rated bonds slightly outperformed A-rated bonds over the quarter, and financials outperformed non-financials. |

| · | | US investment-grade corporate spreads tightened marginally in the third quarter of 2023, as economic data remained resilient, Consumer Price Index (CPI) data continued to trend in the right direction, and macroeconomic risks to the US economy generally appeared to be fading. By quality, BBB-rated bonds outperformed A-rated bonds over the quarter, and non-financials outperformed financials. The primary market (i.e., new issuance) picked up in September, pushing gross issuance to $286 billion in the quarter. |

| · | | In the fourth quarter of 2023, US investment-grade corporate spreads tightened, as expectations for an economic soft landing and a dovish US Federal Reserve pivot gathered steam. (When central banks raise interest rates just enough to slow the economy and lower inflation without causing a recession, it is known as a soft landing. |

8 Visit our website at pgim.com/investments

| | When they raise rates enough to cause a significant economic slowdown or a recession, it is known as a hard landing.) (A dovish view indicates a looser monetary policy supported by holding interest rates steady or lowering them.) Economic data remained resilient, with the CPI continuing to trend lower and macroeconomic risks to the US economy generally appearing to fade. US Treasury yields declined, especially longer-maturity tenors. BBB-rated bonds outperformed A-rated bonds over the fourth quarter and full-year 2023. Non-financials outperformed financials. Total gross issuance of $1.2 trillion in 2023 was comparable to 2022, with Yankee banks, US banks, and healthcare leading supply. (Yankee banks have a large US presence but are based outside the US.) Net issuance totaled $511 billion in 2023, slightly higher than the $503 billion in 2022. |

What worked?

| · | | The Fund’s positioning and selection in investment-grade corporate bonds were the largest contributors to returns during the reporting period. Allocations to AAA-rated collateralized loan obligations and high-quality short-duration high yield bonds were also significant contributors. |

| · | | Within credit, security selection in banking, electric utilities, and technology added to performance. Positioning in KeyCorp (banking), Dominion Energy Inc. (electric utilities), and Citigroup Inc. (banking) were among the top single-name contributors to performance. |

What didn’t work?

| · | | The Fund’s security selection in US Treasuries was the largest detractor from returns during the period. |

| · | | Within credit, positioning in finance companies detracted from performance. Positioning in UBS Group AG (banking), HSBC Holdings Plc (banking), and Bank of Nova Scotia (banking) limited results. |

Did the Fund use derivatives?

| · | | The Fund utilized US Treasury futures during the reporting period to hedge interest rate risk relative to the Index to help immunize any impact from fluctuations in interest rates, which is more efficient than managing interest rate risk through the purchases and sales of cash corporate bonds. Overall, relative to the Index, the use of Treasury futures detracted from performance for the reporting period. |

| · | | Interest rate swaps were also used to help manage duration and yield curve exposure. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) In aggregate, the use of these swaps had a negative impact on the Fund’s performance during the reporting period. The Fund also used credit derivatives in the form of credit default swaps, as well as options on this product, and the Credit Default Swap Index (CDX) to manage credit risk. Overall, their use had a positive impact on performance during the period. |

PGIM Short-Term Corporate Bond Fund 9

Strategy and Performance Overview* (continued)

Current Outlook

| · | | PGIM Fixed Income expects US investment-grade corporate spreads to remain rangebound between 95 and 125 basis points in 2024. (One basis point equals 0.01%.) Performance will likely be driven by carry more than spread tightening. In this environment, credit selection takes on additional importance (i.e., alpha is likely to come from names not owned versus those that are). (Alpha is a measure of an investment’s active return compared to a market or index.) |

| · | | PGIM Fixed Income believes attractive yields, as well as strong fundamentals and technicals, will support the US investment-grade bond sector going forward. Yields in the sector recently reached the highest levels since the Global Financial Crisis in 2007-08. As a result, PGIM Fixed Income believes investment-grade bonds should remain attractive to institutional investors and asset allocators. |

| · | | PGIM Fixed Income expects market technicals to remain well-balanced this year. Year-over-year gross supply in 2024 is expected to be flat, but net supply could be slightly lower due to increased maturities. Therefore, if rates stay elevated and credit quality persists, strong demand should continue in 2024, in PGIM Fixed Income’s view. |

| · | | In terms of positioning, PGIM Fixed Income continues to view bank bonds as attractive investments, led by the “big six” US money-center banks, which may benefit from depositors moving funds from smaller institutions and retain much more diversity in loan exposure and lines of revenue. Next in order of preference are super-regional banks, which have returned to the primary market, and large Yankee bank bonds. |

| · | | PGIM Fixed Income continues to favor financials and more defensive electric utilities over richer-trading industrials. It also continues to overweight energy, believing the sector should continue to benefit focusing in on names with higher quality geographic exposures or advantageous positions along the midstream chain as our outlook for commodity prices has softened somewhat. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

10 Visit our website at pgim.com/investments

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended December 31, 2023. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

PGIM Short-Term Corporate Bond Fund 11

Fees and Expenses (continued)

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | | |

PGIM Short-Term Corporate Bond Fund | | Beginning

Account Value

July 1, 2023 | | Ending

Account Value

December 31, 2023 | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid

During the Six-Month Period* |

| | | | | |

Class A | | Actual | | $1,000.00 | | $1,045.60 | | 0.71% | | $3.66 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,021.63 | | 0.71% | | $3.62 |

| | | | | |

Class C | | Actual | | $1,000.00 | | $1,041.70 | | 1.47% | | $7.56 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,017.80 | | 1.47% | | $7.48 |

| | | | | |

Class R | | Actual | | $1,000.00 | | $1,043.90 | | 1.04% | | $5.36 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,019.96 | | 1.04% | | $5.30 |

| | | | | |

Class Z | | Actual | | $1,000.00 | | $1,045.80 | | 0.47% | | $2.42 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,022.84 | | 0.47% | | $2.40 |

| | | | | |

Class R2 | | Actual | | $1,000.00 | | $1,044.60 | | 0.88% | | $4.54 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,020.77 | | 0.88% | | $4.48 |

| | | | | |

Class R4 | | Actual | | $1,000.00 | | $1,045.90 | | 0.63% | | $3.25 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,022.03 | | 0.63% | | $3.21 |

| | | | | |

Class R6 | | Actual | | $1,000.00 | | $1,047.30 | | 0.38% | | $1.96 |

| | | | | |

| | | Hypothetical | | $1,000.00 | | $1,023.29 | | 0.38% | | $1.94 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended December 31, 2023, and divided by the 365 days in the Fund’s fiscal year ended December 31, 2023 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

12 Visit our website at pgim.com/investments

Schedule of Investments

as of December 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 98.2% | | | | | | | | | | | | | | |

| | | | |

ASSET-BACKED SECURITIES 13.4% | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations | | | | | | | | | | | | | | |

| | | | |

Allegro CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2018-02A, Class A, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | | 6.755%(c) | | | 07/15/31 | | | 4,759 | | | $ | 4,752,482 | |

Anchorage Capital CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2013-01A, Class A1R, 144A, 3 Month SOFR + 1.512% (Cap N/A, Floor 0.000%) | | | 6.905(c) | | | 10/13/30 | | | 3,259 | | | | 3,259,522 | |

Atlas Senior Loan Fund Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2016-07A, Class A1R2, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | | 6.741(c) | | | 11/27/31 | | | 63,852 | | | | 63,784,963 | |

Series 2018-11A, Class A1L, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 0.000%) | | | 6.741(c) | | | 07/26/31 | | | 9,225 | | | | 9,216,890 | |

Bain Capital Credit CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-02A, Class AR, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | | 6.764(c) | | | 10/17/32 | | | 50,000 | | | | 49,995,540 | |

Battalion CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2018-12A, Class A1, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.070%) | | | 6.701(c) | | | 05/17/31 | | | 13,458 | | | | 13,448,488 | |

Canyon Capital CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-01A, Class A1R, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | | 6.755(c) | | | 04/15/32 | | | 45,000 | | | | 44,918,046 | |

Carlyle Global Market Strategies CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2015-04A, Class A1R, 144A, 3 Month SOFR + 1.602% (Cap N/A, Floor 0.000%) | | | 7.017(c) | | | 07/20/32 | | | 7,500 | | | | 7,510,251 | |

CBAM Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2020-12A, Class AR, 144A, 3 Month SOFR + 1.442% (Cap N/A, Floor 1.442%) | | | 6.857(c) | | | 07/20/34 | | | 19,500 | | | | 19,393,772 | |

CIFC Funding Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2013-03RA, Class A1, 144A, 3 Month SOFR + 1.242% (Cap N/A, Floor 0.980%) | | | 6.640(c) | | | 04/24/31 | | | 17,936 | | | | 17,930,600 | |

Series 2017-02A, Class AR, 144A, 3 Month SOFR + 1.212% (Cap N/A, Floor 0.950%) | | | 6.627(c) | | | 04/20/30 | | | 66,332 | | | | 66,251,088 | |

Crown City CLO (Cayman Islands), | | | | | | | | | | | | | | |

Series 2020-01A, Class A1AR, 144A, 3 Month SOFR + 1.452% (Cap N/A, Floor 1.190%) | | | 6.867(c) | | | 07/20/34 | | | 60,000 | | | | 59,812,008 | |

Elevation CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2014-02A, Class A1R, 144A, 3 Month SOFR + 1.492% (Cap N/A, Floor 0.000%) | | | 6.885(c) | | | 10/15/29 | | | 3,226 | | | | 3,227,081 | |

Series 2017-06A, Class A1, 144A, 3 Month SOFR + 1.542% (Cap N/A, Floor 1.542%) | | | 6.935(c) | | | 07/15/29 | | | 6,781 | | | | 6,783,720 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 13

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Elmwood CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-01A, Class AR, 144A, 3 Month SOFR + 1.712% (Cap N/A, Floor 1.450%) | | | 7.127%(c) | | | 10/20/33 | | | 17,500 | | | $ | 17,532,365 | |

HPS Loan Management Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2016-10A, Class A1RR, 144A, 3 Month SOFR + 1.402% (Cap N/A, Floor 1.140%) | | | 6.817(c) | | | 04/20/34 | | | 49,000 | | | | 48,909,958 | |

Jamestown CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-14A, Class A1AR, 144A, 3 Month SOFR + 1.462% (Cap N/A, Floor 1.200%) | | | 6.877(c) | | | 10/20/34 | | | 50,000 | | | | 49,973,815 | |

Madison Park Funding Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2018-30A, Class A, 144A, 3 Month SOFR + 1.012% (Cap N/A, Floor 1.012%) | | | 6.405(c) | | | 04/15/29 | | | 9,582 | | | | 9,573,403 | |

MidOcean Credit CLO (Cayman Islands), | | | | | | | | | | | | | | |

Series 2014-03A, Class A1R, 144A, 3 Month SOFR + 1.382% (Cap N/A, Floor 1.120%) | | | 6.794(c) | | | 04/21/31 | | | 23,628 | | | | 23,635,591 | |

Northwoods Capital Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2017-15A, Class A1R, 144A, 3 Month SOFR + 1.472% (Cap N/A, Floor 1.472%) | | | 6.842(c) | | | 06/20/34 | | | 40,000 | | | | 39,842,080 | |

Oaktree CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-01A, Class A1R, 144A, 3 Month SOFR + 1.372% (Cap N/A, Floor 1.110%) | | | 6.784(c) | | | 04/22/30 | | | 35,000 | | | | 34,973,169 | |

Ocean Trails CLO (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-07A, Class AR, 144A, 3 Month SOFR + 1.272% (Cap N/A, Floor 1.010%) | | | 6.674(c) | | | 04/17/30 | | | 23,290 | | | | 23,254,277 | |

Octagon Investment Partners 31 Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2017-01A, Class AR, 144A, 3 Month SOFR + 1.312% (Cap N/A, Floor 1.050%) | | | 6.727(c) | | | 07/20/30 | | | 13,511 | | | | 13,494,931 | |

OZLM Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2014-09A, Class A1A3, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | | 6.777(c) | | | 10/20/31 | | | 75,000 | | | | 74,940,450 | |

Series 2015-11A, Class A1R, 144A, 3 Month SOFR + 1.512% (Cap N/A, Floor 0.000%) | | | 6.902(c) | | | 10/30/30 | | | 20,453 | | | | 20,462,936 | |

Romark CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2018-02A, Class A1, 144A, 3 Month SOFR + 1.437% (Cap N/A, Floor 1.175%) | | | 6.815(c) | | | 07/25/31 | | | 20,219 | | | | 20,219,676 | |

Signal Peak CLO Ltd., | | | | | | | | | | | | | | |

Series 2018-05A, Class A, 144A, 3 Month SOFR + 1.372% (Cap N/A, Floor 1.110%) | | | 6.750(c) | | | 04/25/31 | | | 8,510 | | | | 8,510,663 | |

Silver Creek CLO Ltd., | | | | | | | | | | | | | | |

Series 2014-01A, Class AR, 144A, 3 Month SOFR + 1.502% (Cap N/A, Floor 0.000%) | | | 6.917(c) | | | 07/20/30 | | | 7,917 | | | | 7,918,616 | |

See Notes to Financial Statements.

14

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Sound Point CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2013-01A, Class A1R, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.332%) | | | 6.711%(c) | | | 01/26/31 | | | 8,731 | | | $ | 8,722,068 | |

Series 2013-03RA, Class A, 144A, 3 Month SOFR + 1.412% (Cap N/A, Floor 1.150%) | | | 6.807(c) | | | 04/18/31 | | | 21,243 | | | | 21,223,641 | |

Series 2014-03RA, Class A1R, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.070%) | | | 6.744(c) | | | 10/23/31 | | | 40,000 | | | | 39,951,936 | |

Series 2017-03A, Class A1R, 144A, 3 Month SOFR + 1.242% (Cap N/A, Floor 0.980%) | | | 6.657(c) | | | 10/20/30 | | | 19,584 | | | | 19,558,143 | |

Series 2019-01A, Class AR, 144A, 3 Month SOFR + 1.342% (Cap N/A, Floor 1.080%) | | | 6.757(c) | | | 01/20/32 | | | 60,000 | | | | 59,881,260 | |

Symphony CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2016-18A, Class A1RR, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | | 6.774(c) | | | 07/23/33 | | | 45,000 | | | | 45,020,790 | |

TCW CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2017-01A, Class A1RR, 144A, 3 Month SOFR + 1.442% (Cap N/A, Floor 1.180%) | | | 6.832(c) | | | 10/29/34 | | | 25,000 | | | | 24,972,472 | |

THL Credit Wind River CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-01A, Class AR, 144A, 3 Month SOFR + 1.422% (Cap N/A, Floor 1.160%) | | | 6.837(c) | | | 07/20/34 | | | 39,500 | | | | 39,202,008 | |

Tralee CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2021-07A, Class A1, 144A, 3 Month SOFR + 1.582% (Cap N/A, Floor 1.320%) | | | 6.960(c) | | | 04/25/34 | | | 32,000 | | | | 32,044,854 | |

Trimaran Cavu Ltd., | | | | | | | | | | | | | | |

Series 2019-01A, Class A1, 144A, 3 Month SOFR + 1.722% (Cap N/A, Floor 1.460%) | | | 7.137(c) | | | 07/20/32 | | | 20,000 | | | | 20,007,864 | |

Venture CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2016-24A, Class ARR, 144A, 3 Month SOFR + 1.162% (Cap N/A, Floor 0.900%) | | | 6.577(c) | | | 10/20/28 | | | 11,778 | | | | 11,762,008 | |

Voya CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-03A, Class AR, 144A, 3 Month SOFR + 1.342% (Cap N/A, Floor 1.080%) | | | 6.744(c) | | | 10/17/32 | | | 25,000 | | | | 24,996,882 | |

Series 2020-02A, Class A1R, 144A, 3 Month SOFR + 1.422% (Cap N/A, Floor 1.160%) | | | 6.818(c) | | | 07/19/34 | | | 30,000 | | | | 30,035,310 | |

Wellfleet CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2018-03A, Class A1A, 144A, 3 Month SOFR + 1.512% (Cap N/A, Floor 1.250%) | | | 6.927(c) | | | 01/20/32 | | | 9,000 | | | | 9,002,117 | |

Whitebox CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2019-01A, Class ANAR, 144A, 3 Month SOFR + 1.392% (Cap N/A, Floor 1.130%) | | | 6.790(c) | | | 07/24/32 | | | 30,500 | | | | 30,441,910 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 15

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Wind River CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2016-01KRA, Class A1R2, 144A, 3 Month SOFR + 1.472% (Cap N/A, Floor 1.210%) | | | 6.865%(c) | | | 10/15/34 | | | 25,000 | | | $ | 24,902,088 | |

Zais CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | |

Series 2017-02A, Class A, 144A, 3 Month SOFR + 1.552% (Cap N/A, Floor 0.000%) | | | 6.945(c) | | | 04/15/30 | | | 13,075 | | | | 13,078,664 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $1,219,296,678) | | | | | | | | | | | | | 1,218,330,396 | |

| | | | | | | | | | | | | | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 1.7% | | | | | | | | | | | | | | |

Benchmark Mortgage Trust, | | | | | | | | | | | | | | |

Series 2020-IG03, Class A2, 144A | | | 2.475 | | | 09/15/48 | | | 66,200 | | | | 63,243,726 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2016-C02, Class A3 | | | 2.575 | | | 08/10/49 | | | 12,367 | | | | 11,672,642 | |

Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2015-CR22, Class A3 | | | 3.207 | | | 03/10/48 | | | 11,373 | | | | 11,040,360 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2016-C01, Class A4 | | | 3.311 | | | 03/17/49 | | | 35,685 | | | | 34,227,568 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | |

Series 2016-C032, Class ASB | | | 3.514 | | | 12/15/49 | | | 4,400 | | | | 4,261,673 | |

Series 2016-C29, Class A3 | | | 3.058 | | | 05/15/49 | | | 9,885 | | | | 9,454,211 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | |

Series 2015-MS01, Class A3 | | | 3.510 | | | 05/15/48 | | | 6,928 | | | | 6,698,465 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2015-NXS01, Class A3 | | | 3.058 | | | 05/15/48 | | | 3,095 | | | | 3,095,392 | |

Series 2016-BNK01, Class A2 | | | 2.399 | | | 08/15/49 | | | 10,436 | | | | 9,734,260 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $165,894,563) | | | | | | | | | | | | | 153,428,297 | |

| | | | | | | | | | | | | | |

| | | | |

CORPORATE BONDS 82.6% | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 1.4% | | | | | | | | | | | | | | |

| | | | |

BAE Systems Finance, Inc. (United Kingdom), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 7.500 | | | 07/01/27 | | | 3,034 | | | | 3,276,419 | |

Boeing Co. (The), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.196 | | | 02/04/26 | | | 22,000 | | | | 20,789,634 | |

Sr. Unsec’d. Notes | | | 2.700 | | | 02/01/27 | | | 49,380 | | | | 46,585,125 | |

Sr. Unsec’d. Notes | | | 7.950 | | | 08/15/24 | | | 1,874 | | | | 1,896,613 | |

L3Harris Technologies, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.400 | | | 01/15/27 | | | 18,300 | | | | 18,685,102 | |

See Notes to Financial Statements.

16

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

RTX Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.000% | | | | 03/15/31 | | | | 20,000 | | | $ | 21,286,101 | |

Spirit AeroSystems, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes(a) | | | 3.850 | | | | 06/15/26 | | | | 17,975 | | | | 17,320,079 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 129,839,073 | |

| | | | |

Agriculture 1.9% | | | | | | | | | | | | | | | | |

| | | | |

Altria Group, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 2.350 | | | | 05/06/25 | | | | 10,505 | | | | 10,132,626 | |

BAT Capital Corp. (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 3.557 | | | | 08/15/27 | | | | 4,524 | | | | 4,315,013 | |

Gtd. Notes | | | 4.700 | | | | 04/02/27 | | | | 28,229 | | | | 27,941,192 | |

BAT International Finance PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 1.668 | | | | 03/25/26 | | | | 26,865 | | | | 24,914,179 | |

Gtd. Notes | | | 5.931 | | | | 02/02/29 | | | | 10,911 | | | | 11,312,774 | |

Imperial Brands Finance PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.125 | | | | 07/27/27 | | | | 12,610 | | | | 12,914,044 | |

Philip Morris International, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 4.875 | | | | 02/13/26 | | | | 14,835 | | | | 14,877,102 | |

Sr. Unsec’d. Notes | | | 4.875 | | | | 02/15/28 | | | | 20,529 | | | | 20,765,079 | |

Sr. Unsec’d. Notes | | | 5.250 | | | | 09/07/28 | | | | 8,521 | | | | 8,771,869 | |

Reynolds American, Inc. (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.450 | | | | 06/12/25 | | | | 212 | | | | 209,561 | |

Viterra Finance BV (Netherlands), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 2.000 | | | | 04/21/26 | | | | 35,200 | | | | 32,643,283 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 168,796,722 | |

| | | | |

Airlines 0.8% | | | | | | | | | | | | | | | | |

| | | | |

American Airlines 2013-1 Class A Pass-Through Trust, | | | | | | | | | | | | | | | | |

Pass-Through Certificates | | | 4.000 | | | | 01/15/27 | | | | 1,074 | | | | 1,028,817 | |

Delta Air Lines, Inc./SkyMiles IP Ltd., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.500 | | | | 10/20/25 | | | | 16,892 | | | | 16,641,769 | |

Sr. Sec’d. Notes, 144A | | | 4.750 | | | | 10/20/28 | | | | 29,560 | | | | 28,967,913 | |

Southwest Airlines Co., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.125 | | | | 06/15/27 | | | | 7,215 | | | | 7,248,198 | |

United Airlines 2014-1 Class A Pass-Through Trust, | | | | | | | | | | | | | | | | |

Pass-Through Certificates | | | 4.000 | | | | 10/11/27 | | | | 3,210 | | | | 3,066,076 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 17

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Airlines (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

United Airlines, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.375% | | | | 04/15/26 | | | | 12,515 | | | $ | 12,206,131 | |

Sr. Sec’d. Notes, 144A | | | 4.625 | | | | 04/15/29 | | | | 4,540 | | | | 4,230,850 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 73,389,754 | |

| | | | |

Apparel 0.2% | | | | | | | | | | | | | | | | |

| | | | |

VF Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.400 | | | | 04/23/25 | | | | 20,475 | | | | 19,558,461 | |

| | | | |

Auto Manufacturers 3.2% | | | | | | | | | | | | | | | | |

| | | | |

Ford Motor Credit Co. LLC, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.700 | | | | 08/10/26 | | | | 57,895 | | | | 53,634,077 | |

Sr. Unsec’d. Notes | | | 4.000 | | | | 11/13/30 | | | | 2,865 | | | | 2,567,980 | |

Sr. Unsec’d. Notes | | | 4.950 | | | | 05/28/27 | | | | 1,075 | | | | 1,049,545 | |

Sr. Unsec’d. Notes | | | 6.798 | | | | 11/07/28 | | | | 2,955 | | | | 3,092,092 | |

Sr. Unsec’d. Notes | | | 6.950 | | | | 03/06/26 | | | | 10,200 | | | | 10,450,908 | |

General Motors Financial Co., Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.250 | | | | 01/08/26 | | | | 39,885 | | | | 36,909,809 | |

Sr. Unsec’d. Notes | | | 1.500 | | | | 06/10/26 | | | | 9,390 | | | | 8,609,157 | |

Sr. Unsec’d. Notes | | | 2.350 | | | | 02/26/27 | | | | 5,090 | | | | 4,688,679 | |

Sr. Unsec’d. Notes | | | 2.400 | | | | 04/10/28 | | | | 11,815 | | | | 10,611,620 | |

Sr. Unsec’d. Notes(a) | | | 2.400 | | | | 10/15/28 | | | | 23,040 | | | | 20,470,602 | |

Sr. Unsec’d. Notes | | | 2.750 | | | | 06/20/25 | | | | 13,900 | | | | 13,377,649 | |

Sr. Unsec’d. Notes | | | 2.900 | | | | 02/26/25 | | | | 4,580 | | | | 4,445,842 | |

Sr. Unsec’d. Notes | | | 5.800 | | | | 01/07/29 | | | | 7,285 | | | | 7,463,105 | |

Hyundai Capital America, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 6.100 | | | | 09/21/28 | | | | 20,000 | | | | 20,778,003 | |

Mercedes-Benz Finance North America LLC (Germany), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.800 | | | | 03/30/28 | | | | 10,000 | | | | 10,099,514 | |

Nissan Motor Acceptance Co. LLC, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN | | | 1.125 | | | | 09/16/24 | | | | 14,285 | | | | 13,789,064 | |

Sr. Unsec’d. Notes, 144A, MTN | | | 1.850 | | | | 09/16/26 | | | | 15,000 | | | | 13,492,752 | |

Nissan Motor Co. Ltd. (Japan), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 3.522 | | | | 09/17/25 | | | | 4,000 | | | | 3,852,539 | |

Toyota Motor Credit Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | | 3.800(cc) | | | | 10/24/25 | | | | 10,000 | | | | 9,795,734 | |

Sr. Unsec’d. Notes, MTN | | | 5.250 | | | | 09/11/28 | | | | 19,250 | | | | 19,956,319 | |

Volkswagen Group of America Finance LLC (Germany), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.000 | | | | 11/16/26 | | | | 19,775 | | | | 20,238,342 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 289,373,332 | |

See Notes to Financial Statements.

18

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Banks 22.8% | | | | | | | | | | | | | | | | |

| | | | |

Banco Santander SA (Spain), | | | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes | | | 1.849% | | | | 03/25/26 | | | | 30,400 | | | $ | 28,136,161 | |

Bank of America Corp., | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series JJ | | | 5.125(ff) | | | | 06/20/24 | (oo) | | | 3,685 | | | | 3,640,825 | |

Sr. Unsec’d. Notes | | | 1.734(ff) | | | | 07/22/27 | | | | 93,500 | | | | 85,643,361 | |

Sr. Unsec’d. Notes | | | 5.202(ff) | | | | 04/25/29 | | | | 36,480 | | | | 36,702,653 | |

Sr. Unsec’d. Notes | | | 5.819(ff) | | | | 09/15/29 | | | | 43,750 | | | | 45,161,378 | |

Sr. Unsec’d. Notes, MTN | | | 1.197(ff) | | | | 10/24/26 | | | | 36,790 | | | | 34,171,081 | |

Sr. Unsec’d. Notes, MTN | | | 1.319(ff) | | | | 06/19/26 | | | | 10,040 | | | | 9,450,256 | |

Sr. Unsec’d. Notes, MTN(a) | | | 2.015(ff) | | | | 02/13/26 | | | | 52,845 | | | | 50,770,887 | |

Sr. Unsec’d. Notes, MTN(a) | | | 2.087(ff) | | | | 06/14/29 | | | | 32,800 | | | | 28,926,008 | |

Sr. Unsec’d. Notes, MTN | | | 2.456(ff) | | | | 10/22/25 | | | | 12,420 | | | | 12,102,744 | |

Sr. Unsec’d. Notes, Series N | | | 1.658(ff) | | | | 03/11/27 | | | | 65,520 | | | | 60,612,622 | |

Sub. Notes, Series L, MTN | | | 3.950 | | | | 04/21/25 | | | | 11,000 | | | | 10,815,921 | |

Bank of Nova Scotia (The) (Canada), | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series 2(a) | | | 3.625(ff) | | | | 10/27/81 | | | | 50,000 | | | | 37,562,500 | |

Barclays PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.304(ff) | | | | 08/09/26 | | | | 38,900 | | | | 38,694,530 | |

Sr. Unsec’d. Notes | | | 5.501(ff) | | | | 08/09/28 | | | | 4,295 | | | | 4,311,106 | |

Sr. Unsec’d. Notes | | | 5.829(ff) | | | | 05/09/27 | | | | 15,060 | | | | 15,173,515 | |

Sr. Unsec’d. Notes | | | 6.496(ff) | | | | 09/13/27 | | | | 32,530 | | | | 33,446,799 | |

BNP Paribas SA (France), | | | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | | 1.323(ff) | | | | 01/13/27 | | | | 9,560 | | | | 8,819,191 | |

Sr. Non-Preferred Notes, 144A | | | 2.159(ff) | | | | 09/15/29 | | | | 6,595 | | | | 5,728,608 | |

Sr. Non-Preferred Notes, 144A | | | 2.219(ff) | | | | 06/09/26 | | | | 4,465 | | | | 4,262,685 | |

Sr. Preferred Notes, 144A | | | 5.335(ff) | | | | 06/12/29 | | | | 1,550 | | | | 1,569,972 | |

BPCE SA (France), | | | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | | 2.375 | | | | 01/14/25 | | | | 15,075 | | | | 14,561,662 | |

Sub. Notes, 144A, MTN | | | 4.500 | | | | 03/15/25 | | | | 3,640 | | | | 3,569,595 | |

CaixaBank SA (Spain), | | | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | | 6.684(ff) | | | | 09/13/27 | | | | 15,790 | | | | 16,179,598 | |

Citibank NA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.803 | | | | 09/29/28 | | | | 23,000 | | | | 24,015,114 | |

Citigroup, Inc., | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series V | | | 4.700(ff) | | | | 01/30/25 | (oo) | | | 26,675 | | | | 24,856,235 | |

Sr. Unsec’d. Notes(a) | | | 1.122(ff) | | | | 01/28/27 | | | | 47,480 | | | | 43,641,202 | |

Sr. Unsec’d. Notes(a) | | | 1.462(ff) | | | | 06/09/27 | | | | 81,450 | | | | 74,542,306 | |

Sr. Unsec’d. Notes | | | 3.106(ff) | | | | 04/08/26 | | | | 15,355 | | | | 14,930,101 | |

Sub. Notes | | | 4.450 | | | | 09/29/27 | | | | 8,160 | | | | 7,971,419 | |

Credit Suisse AG (Switzerland), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.950 | | | | 04/09/25 | | | | 18,380 | | | | 17,782,718 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 19

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Danske Bank A/S (Denmark), | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | | 3.244%(ff) | | | 12/20/25 | | | 2,500 | | | $ | 2,438,558 | |

Deutsche Bank AG (Germany), | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes | | | 2.129(ff) | | | 11/24/26 | | | 1,935 | | | | 1,810,020 | |

Sr. Non-Preferred Notes | | | 2.311(ff) | | | 11/16/27 | | | 3,525 | | | | 3,218,043 | |

Sr. Non-Preferred Notes | | | 2.552(ff) | | | 01/07/28 | | | 4,522 | | | | 4,139,185 | |

Sr. Non-Preferred Notes, SOFR + 1.219% | | | 6.620(c) | | | 11/16/27 | | | 4,625 | | | | 4,480,020 | |

Sr. Non-Preferred Notes | | | 6.720(ff) | | | 01/18/29 | | | 11,915 | | | | 12,467,000 | |

Sr. Non-Preferred Notes(a) | | | 6.819(ff) | | | 11/20/29 | | | 20,510 | | | | 21,565,816 | |

Sr. Non-Preferred Notes | | | 7.146(ff) | | | 07/13/27 | | | 13,200 | | | | 13,738,047 | |

Fifth Third Bancorp, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.339(ff) | | | 07/27/29 | | | 33,640 | | | | 34,998,125 | |

Goldman Sachs Group, Inc. (The), | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series U | | | 3.650(ff) | | | 08/10/26(oo) | | | 16,130 | | | | 14,479,548 | |

Sr. Unsec’d. Notes | | | 1.431(ff) | | | 03/09/27 | | | 56,555 | | | | 52,134,920 | |

Sr. Unsec’d. Notes | | | 1.542(ff) | | | 09/10/27 | | | 72,845 | | | | 66,073,439 | |

Sr. Unsec’d. Notes | | | 4.482(ff) | | | 08/23/28 | | | 22,925 | | | | 22,505,414 | |

Sr. Unsec’d. Notes, EMTN | | | 4.650 | | | 05/31/24 | | | 5,000 | | | | 4,966,897 | |

Sr. Unsec’d. Notes, Series FRN, SOFR + 0.790% (Cap | | | | | | | | | | | | | | |

N/A, Floor 0.000%) | | | 6.208(c) | | | 12/09/26 | | | 28,200 | | | | 27,901,850 | |

Sr. Unsec’d. Notes, Series VAR | | | 1.093(ff) | | | 12/09/26 | | | 23,255 | | | | 21,424,420 | |

HSBC Holdings PLC (United Kingdom), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.013(ff) | | | 09/22/28 | | | 5,750 | | | | 5,109,599 | |

Sr. Unsec’d. Notes | | | 5.210(ff) | | | 08/11/28 | | | 900 | | | | 898,868 | |

Huntington Bancshares, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.208(ff) | | | 08/21/29 | | | 36,040 | | | | 37,154,835 | |

JPMorgan Chase & Co., | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series CC, 3 Month SOFR + 2.842% | | | 8.219(c) | | | 02/01/24(oo) | | | 11,600 | | | | 11,563,896 | |

Jr. Sub. Notes, Series HH | | | 4.600(ff) | | | 02/01/25(oo) | | | 15,824 | | | | 15,242,888 | |

Jr. Sub. Notes, Series II | | | 4.000(ff) | | | 04/01/25(oo) | | | 5,225 | | | | 4,925,793 | |

Sr. Unsec’d. Notes | | | 1.040(ff) | | | 02/04/27 | | | 20,000 | | | | 18,373,080 | |

Sr. Unsec’d. Notes | | | 1.045(ff) | | | 11/19/26 | | | 59,970 | | | | 55,531,058 | |

Sr. Unsec’d. Notes(a) | | | 1.470(ff) | | | 09/22/27 | | | 39,288 | | | | 35,591,491 | |

Sr. Unsec’d. Notes | | | 1.578(ff) | | | 04/22/27 | | | 64,714 | | | | 59,719,716 | |

Sr. Unsec’d. Notes | | | 2.083(ff) | | | 04/22/26 | | | 24,675 | | | | 23,646,923 | |

Sr. Unsec’d. Notes | | | 5.299(ff) | | | 07/24/29 | | | 25,000 | | | | 25,367,732 | |

KeyBank NA, | | | | | | | | | | | | | | |

Sub. Notes | | | 6.950 | | | 02/01/28 | | | 8,600 | | | | 8,746,188 | |

KeyCorp, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN(a) | | | 2.550 | | | 10/01/29 | | | 5,570 | | | | 4,728,934 | |

Sr. Unsec’d. Notes, MTN | | | 4.100 | | | 04/30/28 | | | 9,513 | | | | 8,950,760 | |

See Notes to Financial Statements.

20

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Lloyds Banking Group PLC (United Kingdom), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.438%(ff) | | | 02/05/26 | | | 12,615 | | | $ | 12,179,095 | |

Sr. Unsec’d. Notes | | | 5.985(ff) | | | 08/07/27 | | | 9,050 | | | | 9,204,687 | |

Mitsubishi UFJ Financial Group, Inc. (Japan), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.538(ff) | | | 07/20/27 | | | 45,830 | | | | 41,862,680 | |

Sr. Unsec’d. Notes(a) | | | 5.242(ff) | | | 04/19/29 | | | 11,435 | | | | 11,585,292 | |

Mizuho Financial Group, Inc. (Japan), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.554(ff) | | | 07/09/27 | | | 24,455 | | | | 22,333,252 | |

Morgan Stanley, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 0.985(ff) | | | 12/10/26 | | | 50,880 | | | | 46,826,905 | |

Sr. Unsec’d. Notes | | | 1.593(ff) | | | 05/04/27 | | | 33,720 | | | | 31,060,989 | |

Sr. Unsec’d. Notes | | | 5.449(ff) | | | 07/20/29 | | | 17,800 | | | | 18,136,847 | |

Sr. Unsec’d. Notes | | | 6.296(ff) | | | 10/18/28 | | | 14,900 | | | | 15,621,962 | |

Sr. Unsec’d. Notes, GMTN | | | 1.512(ff) | | | 07/20/27 | | | 32,690 | | | | 29,870,397 | |

Sr. Unsec’d. Notes, MTN(a) | | | 2.475(ff) | | | 01/21/28 | | | 29,305 | | | | 27,198,031 | |

Sr. Unsec’d. Notes, MTN | | | 5.164(ff) | | | 04/20/29 | | | 24,090 | | | | 24,202,453 | |

PNC Financial Services Group, Inc. (The), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.582(ff) | | | 06/12/29 | | | 13,335 | | | | 13,602,163 | |

Sr. Unsec’d. Notes | | | 6.615(ff) | | | 10/20/27 | | | 27,685 | | | | 28,730,917 | |

Popular, Inc. (Puerto Rico), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 7.250 | | | 03/13/28 | | | 15,795 | | | | 16,249,106 | |

Regions Financial Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.800 | | | 08/12/28 | | | 1,114 | | | | 954,332 | |

Societe Generale SA (France), | | | | | | | | | | | | | | |

Gtd. Notes, 144A, SOFR + 1.050% | | | 6.425(c) | | | 01/21/26 | | | 20,190 | | | | 20,056,478 | |

Sr. Non-Preferred Notes, 144A, MTN | | | 6.446(ff) | | | 01/10/29 | | | 6,000 | | | | 6,200,588 | |

Sumitomo Mitsui Financial Group, Inc. (Japan), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.902 | | | 09/17/28 | | | 18,905 | | | | 16,533,873 | |

Sr. Unsec’d. Notes | | | 2.174 | | | 01/14/27 | | | 9,285 | | | | 8,576,390 | |

Truist Financial Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN(a) | | | 4.873(ff) | | | 01/26/29 | | | 48,415 | | | | 47,798,949 | |

Sr. Unsec’d. Notes, MTN(a) | | | 6.047(ff) | | | 06/08/27 | | | 33,630 | | | | 34,233,332 | |

Sr. Unsec’d. Notes, MTN | | | 7.161(ff) | | | 10/30/29 | | | 2,030 | | | | 2,190,574 | |

U.S. Bancorp, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | | 5.775(ff) | | | 06/12/29 | | | 28,455 | | | | 29,226,684 | |

UBS Group AG (Switzerland), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 1.305(ff) | | | 02/02/27 | | | 12,675 | | | | 11,597,625 | |

Sr. Unsec’d. Notes, 144A(a) | | | 1.494(ff) | | | 08/10/27 | | | 16,550 | | | | 14,966,239 | |

Sr. Unsec’d. Notes, 144A | | | 2.193(ff) | | | 06/05/26 | | | 3,250 | | | | 3,087,500 | |

Sr. Unsec’d. Notes, 144A | | | 6.246(ff) | | | 09/22/29 | | | 20,000 | | | | 20,823,770 | |

UniCredit SpA (Italy), | | | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | | 2.569(ff) | | | 09/22/26 | | | 6,745 | | | | 6,345,774 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 21

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | | | |

| | | | |

UniCredit SpA (Italy), (cont’d.) | | | | | | | | | | | | | | |

Sr. Preferred Notes, 144A | | | 1.982%(ff) | | | 06/03/27 | | | 17,600 | | | $ | 16,104,132 | |

Sr. Preferred Notes, 144A, MTN(a) | | | 4.625 | | | 04/12/27 | | | 2,250 | | | | 2,187,162 | |

Wells Fargo & Co., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.303(ff) | | | 10/23/29 | | | 15,865 | | | | 16,736,084 | |

Sr. Unsec’d. Notes, MTN | | | 3.196(ff) | | | 06/17/27 | | | 12,330 | | | | 11,788,931 | |

Sr. Unsec’d. Notes, MTN | | | 5.574(ff) | | | 07/25/29 | | | 25,945 | | | | 26,487,612 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 2,066,206,621 | |

| | | | |

Beverages 0.6% | | | | | | | | | | | | | | |

| | | | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev | | | | | | | | | | | | | | |

Worldwide, Inc. (Belgium), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 3.650 | | | 02/01/26 | | | 4,322 | | | | 4,242,140 | |

Bacardi Ltd. (Bermuda), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 2.750 | | | 07/15/26 | | | 25,340 | | | | 23,821,392 | |

Gtd. Notes, 144A | | | 4.450 | | | 05/15/25 | | | 18,070 | | | | 17,801,456 | |

JDE Peet’s NV (Netherlands), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 1.375 | | | 01/15/27 | | | 4,894 | | | | 4,368,905 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 50,233,893 | |

| | | | |

Biotechnology 0.1% | | | | | | | | | | | | | | |

| | | | |

Amgen, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.150 | | | 03/02/28 | | | 6,515 | | | | 6,661,398 | |

Illumina, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.800 | | | 12/12/25 | | | 5,250 | | | | 5,286,824 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 11,948,222 | |

| | | | |

Building Materials 0.4% | | | | | | | | | | | | | | |

| | | | |

Lennox International, Inc., | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.500 | | | 09/15/28 | | | 14,760 | | | | 15,172,470 | |

Macmillan Bloedel Pembroke LP (Canada), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 7.700 | | | 02/15/26 | | | 3,000 | | | | 3,118,438 | |

Owens Corning, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 3.400 | | | 08/15/26 | | | 18,329 | | | | 17,671,233 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 35,962,141 | |

| | | | |

Chemicals 1.6% | | | | | | | | | | | | | | |

| | | | |

CF Industries, Inc., | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.500 | | | 12/01/26 | | | 32,200 | | | | 31,654,414 | |

See Notes to Financial Statements.

22

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Chemicals (cont’d.) | | | | | | | | | | | | |

| | | | |

Chevron Phillips Chemical Co. LLC/Chevron Phillips | | | | | | | | | | | | |

Chemical Co. LP, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 3.400% | | 12/01/26 | | | 19,417 | | | $ | 18,646,597 | |

Eastman Chemical Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 7.250 | | 01/15/24 | | | 7,000 | | | | 7,002,351 | |

EIDP, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.500 | | 05/15/26 | | | 14,490 | | | | 14,448,027 | |

FMC Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | 3.200 | | 10/01/26 | | | 14,160 | | | | 13,403,447 | |

Sr. Unsec’d. Notes(a) | | 5.150 | | 05/18/26 | | | 17,430 | | | | 17,411,772 | |

LYB Finance Co. BV (Netherlands), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 8.100 | | 03/15/27 | | | 1,008 | | | | 1,085,131 | |

LYB International Finance III LLC, | | | | | | | | | | | | |

Gtd. Notes | | 1.250 | | 10/01/25 | | | 10,904 | | | | 10,188,179 | |

Nutrien Ltd. (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | 4.900 | | 03/27/28 | | | 15,675 | | | | 15,804,888 | |

Sasol Financing USA LLC (South Africa), | | | | | | | | | | | | |

Gtd. Notes | | 5.875 | | 03/27/24 | | | 14,245 | | | | 14,133,889 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 143,778,695 | |

| | | | |

Commercial Services 1.4% | | | | | | | | | | | | |

| | | | |

Ashtead Capital, Inc. (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 1.500 | | 08/12/26 | | | 20,725 | | | | 18,795,252 | |

Gtd. Notes, 144A | | 4.375 | | 08/15/27 | | | 11,380 | | | | 10,933,837 | |

Equifax, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.600 | | 12/15/25 | | | 10,900 | | | | 10,398,714 | |

ERAC USA Finance LLC, | | | | | | | | | | | | |

Gtd. Notes, 144A | | 3.300 | | 12/01/26 | | | 9,230 | | | | 8,851,418 | |

Gtd. Notes, 144A | | 3.800 | | 11/01/25 | | | 19,523 | | | | 19,052,438 | |

Gtd. Notes, 144A | | 4.600 | | 05/01/28 | | | 29,140 | | | | 29,003,960 | |

Global Payments, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.650 | | 02/15/25 | | | 16,290 | | | | 15,788,184 | |

Verisk Analytics, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.000 | | 06/15/25 | | | 16,325 | | | | 16,110,696 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 128,934,499 | |

| | | | |

Computers 1.0% | | | | | | | | | | | | |

| | | | |

Genpact Luxembourg Sarl, | | | | | | | | | | | | |

Gtd. Notes | | 3.375 | | 12/01/24 | | | 23,654 | | | | 23,019,340 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 23

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Computers (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Genpact Luxembourg Sarl/Genpact USA, Inc., | | | | | | | | | | | | | | |

Gtd. Notes | | | 1.750% | | | 04/10/26 | | | 18,395 | | | $ | 17,067,567 | |

International Business Machines Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.700 | | | 05/15/27 | | | 7,500 | | | | 6,845,265 | |

Leidos, Inc., | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 3.625 | | | 05/15/25 | | | 30,205 | | | | 29,461,706 | |

NetApp, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.875 | | | 06/22/25 | | | 10,742 | | | | 10,218,976 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 86,612,854 | |

| | | | |

Distribution/Wholesale 0.2% | | | | | | | | | | | | | | |

| | | | |

Ferguson Finance PLC, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 4.250 | | | 04/20/27 | | | 12,105 | | | | 11,854,026 | |

LKQ Corp., | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 5.750 | | | 06/15/28 | | | 4,050 | | | | 4,159,646 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 16,013,672 | |

| | | | |

Diversified Financial Services 2.6% | | | | | | | | | | | | | | |

| | | | |

American Express Co., | | | | | | | | | | | | | | |

Jr. Sub. Notes | | | 3.550(ff) | | | 09/15/26(oo) | | | 16,080 | | | | 13,782,223 | |

Ameriprise Financial, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | | 5.700 | | | 12/15/28 | | | 19,400 | | | | 20,337,365 | |

Cantor Fitzgerald LP, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 4.500 | | | 04/14/27 | | | 30,625 | | | | 29,377,459 | |

Sr. Unsec’d. Notes, 144A | | | 4.875 | | | 05/01/24 | | | 21,945 | | | | 21,689,117 | |

Capital One Financial Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 6.312(ff) | | | 06/08/29 | | | 19,800 | | | | 20,312,106 | |

Sr. Unsec’d. Notes | | | 7.624(ff) | | | 10/30/31 | | | 7,105 | | | | 7,795,164 | |

Citigroup Global Markets Holdings, Inc., | | | | | | | | | | | | | | |

Gtd. Notes, GMTN | | | 4.650 | | | 06/12/24 | | | 3,870 | | | | 3,855,882 | |

Jefferies Financial Group, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.875 | | | 07/21/28 | | | 16,570 | | | | 16,993,125 | |

LPL Holdings, Inc., | �� | | | | | | | | | | | | | |

Gtd. Notes | | | 6.750 | | | 11/17/28 | | | 15,910 | | | | 16,942,929 | |

Nomura Holdings, Inc. (Japan), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.653 | | | 07/14/26 | | | 16,975 | | | | 15,515,423 | |

Sr. Unsec’d. Notes(a) | | | 2.172 | | | 07/14/28 | | | 6,100 | | | | 5,334,857 | |

Sr. Unsec’d. Notes | | | 2.329 | | | 01/22/27 | | | 39,725 | | | | 36,444,756 | |

See Notes to Financial Statements.

24

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Diversified Financial Services (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Western Union Co. (The), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.350% | | | 03/15/26 | | | 25,065 | | | $ | 23,071,062 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 231,451,468 | |

| | | | |

Electric 8.8% | | | | | | | | | | | | | | |

| | | | |

Alliant Energy Finance LLC, | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 1.400 | | | 03/15/26 | | | 18,650 | | | | 16,993,002 | |

Ameren Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.750 | | | 03/15/28 | | | 18,710 | | | | 16,551,728 | |

American Electric Power Co., Inc., | | | | | | | | | | | | | | |

Jr. Sub. Notes | | | 2.031 | | | 03/15/24 | | | 10,625 | | | | 10,530,703 | |

Jr. Sub. Notes | | | 5.699 | | | 08/15/25 | | | 14,580 | | | | 14,688,730 | |

Arizona Public Service Co., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 3.350 | | | 06/15/24 | | | 11,000 | | | | 10,855,791 | |

Avangrid, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 3.150 | | | 12/01/24 | | | 6,018 | | | | 5,881,068 | |

Sr. Unsec’d. Notes | | | 3.200 | | | 04/15/25 | | | 14,245 | | | | 13,851,098 | |

Calpine Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 5.125 | | | 03/15/28 | | | 8,000 | | | | 7,666,272 | |

CenterPoint Energy Houston Electric LLC, | | | | | | | | | | | | | | |

General Ref. Mortgage | | | 5.200 | | | 10/01/28 | | | 13,640 | | | | 14,068,985 | |

CenterPoint Energy, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.450 | | | 06/01/26 | | | 24,160 | | | | 22,250,179 | |

Sr. Unsec’d. Notes | | | 2.500 | | | 09/01/24 | | | 11,620 | | | | 11,367,139 | |

Cleveland Electric Illuminating Co. (The), | | | | | | | | | | | | | | |

First Mortgage | | | 5.500 | | | 08/15/24 | | | 5,925 | | | | 5,913,318 | |

CMS Energy Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.950 | | | 02/15/27 | | | 2,445 | | | | 2,292,259 | |

Constellation Energy Generation LLC, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.600 | | | 03/01/28 | | | 7,798 | | | | 8,031,550 | |

Dominion Energy, Inc., | | | | | | | | | | | | | | |

Jr. Sub. Notes | | | 3.071 | | | 08/15/24 | | | 13,520 | | | | 13,288,233 | |

Jr. Sub. Notes, Series B | | | 4.650(ff) | | | 12/15/24(oo) | | | 35,129 | | | | 33,501,531 | |

DTE Energy Co., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, Series C | | | 2.529 | | | 10/01/24 | | | 8,222 | | | | 8,032,485 | |

Sr. Unsec’d. Notes, Series F | | | 1.050 | | | 06/01/25 | | | 31,902 | | | | 30,067,056 | |

Duke Energy Corp., | | | | | | | | | | | | | | |

Jr. Sub. Notes | | | 3.250(ff) | | | 01/15/82 | | | 23,430 | | | | 18,340,224 | |

Sr. Unsec’d. Notes | | | 3.100 | | | 06/15/28 | | | EUR 13,425 | | | | 14,592,589 | |

Edison International, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 4.700 | | | 08/15/25 | | | 15,000 | | | | 14,820,693 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 25

Schedule of Investments (continued)

as of December 31, 2023

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Electric (cont’d.) | | | | | | | | | | | | |

| | | | |

Edison International, (cont’d.) | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.950% | | 04/15/25 | | | 23,050 | | | $ | 22,892,938 | |

Sr. Unsec’d. Notes | | 5.250 | | 11/15/28 | | | 9,355 | | | | 9,418,855 | |

Enel Finance International NV (Italy), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 1.375 | | 07/12/26 | | | 11,300 | | | | 10,304,670 | |

Gtd. Notes, 144A | | 1.875 | | 07/12/28 | | | 20,000 | | | | 17,395,354 | |

Sr. Unsec’d. Notes, 144A | | 4.250 | | 06/15/25 | | | 4,700 | | | | 4,622,483 | |

Entergy Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.900 | | 09/15/25 | | | 32,125 | | | | 29,911,786 | |

Evergy Metro, Inc., | | | | | | | | | | | | |

Mortgage | | 3.650 | | 08/15/25 | | | 15,750 | | | | 15,392,369 | |

Evergy Missouri West, Inc., | | | | | | | | | | | | |

First Mortgage, 144A | | 5.150 | | 12/15/27 | | | 12,220 | | | | 12,302,998 | |

FirstEnergy Transmission LLC, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 2.866 | | 09/15/28 | | | 7,375 | | | | 6,690,703 | |

Fortis, Inc. (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.055 | | 10/04/26 | | | 38,000 | | | | 36,007,941 | |

IPALCO Enterprises, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 3.700 | | 09/01/24 | | | 8,035 | | | | 7,901,168 | |

Metropolitan Edison Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.200 | | 04/01/28 | | | 22,500 | | | | 22,666,586 | |

MidAmerican Energy Co., | | | | | | | | | | | | |

First Mortgage | | 3.100 | | 05/01/27 | | | 2,000 | | | | 1,913,809 | |

Monongahela Power Co., | | | | | | | | | | | | |

First Mortgage, 144A | | 4.100 | | 04/15/24 | | | 4,236 | | | | 4,208,979 | |

NextEra Energy Capital Holdings, Inc., | | | | | | | | | | | | |

Gtd. Notes | | 4.900 | | 02/28/28 | | | 24,775 | | | | 24,995,959 | |

Gtd. Notes | | 5.749 | | 09/01/25 | | | 51,755 | | | | 52,297,901 | |

NRG Energy, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 3.750 | | 06/15/24 | | | 9,285 | | | | 9,168,091 | |

Pacific Gas & Electric Co., | | | | | | | | | | | | |

First Mortgage(a) | | 3.000 | | 06/15/28 | | | 12,000 | | | | 10,937,348 | |

First Mortgage | | 3.750 | | 02/15/24 | | | 25,634 | | | | 25,543,781 | |

Pennsylvania Electric Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.150 | | 03/30/26 | | | 7,026 | | | | 7,012,633 | |

Pinnacle West Capital Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.300 | | 06/15/25 | | | 27,312 | | | | 25,724,473 | |

Public Service Enterprise Group, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.800 | | 08/15/25 | | | 26,665 | | | | 24,919,661 | |

Sempra, | | | | | | | | | | | | |

Jr. Sub. Notes | | 4.125(ff) | | 04/01/52 | | | 20,635 | | | | 17,775,155 | |

Sr. Unsec’d. Notes | | 5.400 | | 08/01/26 | | | 14,285 | | | | 14,476,678 | |

See Notes to Financial Statements.

26

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Electric (cont’d.) | | | | | | | | | | | | |

| | | | |

Southern California Edison Co., | | | | | | | | | | | | |

First Mortgage | | 5.300% | | 03/01/28 | | | 11,535 | | | $ | 11,850,071 | |

Southern Co. (The), | | | | | | | | | | | | |

Jr. Sub. Notes | | 4.475 | | 08/01/24 | | | 8,770 | | | | 8,692,678 | |

Sr. Unsec’d. Notes, Series 21-B | | 1.750 | | 03/15/28 | | | 18,625 | | | | 16,561,055 | |

System Energy Resources, Inc., | | | | | | | | | | | | |

First Mortgage | | 6.000 | | 04/15/28 | | | 8,465 | | | | 8,645,937 | |

Tucson Electric Power Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.050 | | 03/15/25 | | | 5,897 | | | | 5,751,748 | |

Vistra Operations Co. LLC, | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 3.550 | | 07/15/24 | | | 20,525 | | | | 20,214,663 | |

Sr. Sec’d. Notes, 144A | | 3.700 | | 01/30/27 | | | 10,000 | | | | 9,482,881 | |

Xcel Energy, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.750 | | 03/15/27 | | | 11,540 | | | | 10,526,907 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 799,792,892 | |

| | | | |

Electronics 0.6% | | | | | | | | | | | | |

| | | | |

TD SYNNEX Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.250 | | 08/09/24 | | | 60,230 | | | | 58,651,889 | |

| | | | |