UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-05594 |

| |

| Exact name of registrant as specified in charter: | | Prudential Short-Term Corporate Bond Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | 12/31/2024 |

| |

| Date of reporting period: | | 12/31/2024 |

Item 1 – Reports to Stockholders

| | (a) | Report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class A shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class A | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the period, the Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to help

manage

duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

on performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call

(800) 225-1852 or (973) 367-3529

from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 12/31/2024 |

| | | |

Class A with sales charges | | | |

Class A without sales charges | | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund has added this broad-based index in response to

new

regulatory requirements.

WHAT ARE SOME KEY FUND STATISTICS AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT

ARE

SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Short-Term Corporate Bond Fund

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class C shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class C | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the

period

,

the

Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to help manage duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

on performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 12/31/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund has added this broad-based index in

response

to new regulatory requirements.

WHAT ARE SOME KEY FUND

STATISTICS

AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT

ARE

SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Short-Term Corporate Bond Fund

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class R shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class R | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the period, the Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to

help

manage duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

on performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 12/31/2024 |

| | | |

| | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund has added this broad-based index in response to new regulatory

requirements

.

WHAT

ARE

SOME KEY FUND STATISTICS AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT

ARE

SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Short-Term Corporate Bond Fund

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class Z shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class Z | | |

WHAT

AFFECTED

THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the period, the Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to help manage duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

on performance.

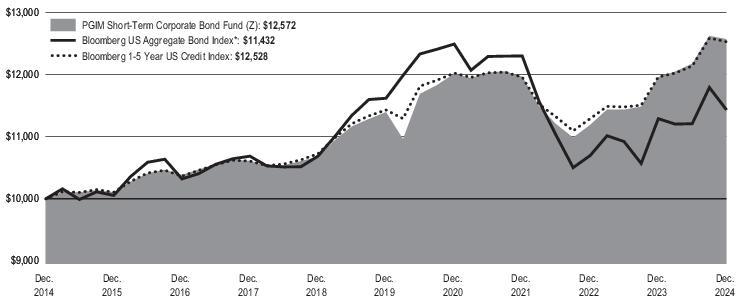

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class Z shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 12/31/2024 |

| | | |

| | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund has added this broad-based index in response to new regulatory requirements.

WHAT ARE SOME KEY FUND STATISTICS AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Short-Term Corporate Bond Fund

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class R2 shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class R2 | | |

WHAT

AFFECTED

THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the period, the Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to help manage duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

on performance.

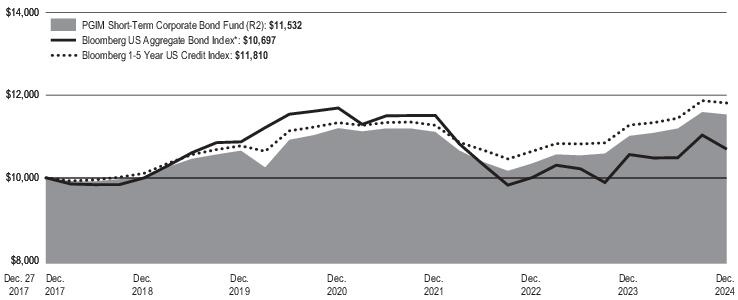

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R2 shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 27, 2017 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 12/31/2024 |

| | | |

| | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund has added this broad-based index in response to new regulatory r

equir

ements.

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the month-end

closest to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM

Short

-Term Corporate Bond Fund

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class R4 shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class R4 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During

the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the period, the Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to help manage duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

on performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R4 shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 27, 2017 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 12/31/2024 |

| | | |

| | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund h

a

s added this broad-based index in response to new regulatory requirements.

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the month-end

closest to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT

ARE

SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Short-Term Corporate Bond Fund

PGIM Short-Term Corporate Bond Fund

ANNUAL SHAREHOLDER REPORT – December 31, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Short-Term Corporate Bond Fund (the “Fund”)

for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT

WERE

THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Short-Term Corporate Bond Fund—Class R6 | | |

WHAT

AFFECTED

THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and

employment data showed some signs of softening. The US Federal Reserve's easing cycle—which began in September of 2024 with a

50-basis-point (bp) rate cut followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater

market volatility due to election and fiscal uncertainty. (One basis point equals 0.01%.) As demand for yield remained robust, credit spreads

largely tightened, and performance across fixed income sectors was positive.

■

The following contributed most to the Fund’s performance relative to the Bloomberg 1-5 Year US Credit Index (the Index) during the period:

security selection in US investment-grade corporates and US high yield corporates; positioning in AAA collateralized loan obligations (CLOs)

and non-agency AAA commercial mortgage-backed securities (CMBS); underweights to the sovereign credit and emerging-markets

investment-grade sectors; credit positioning in banking, electric utilities, healthcare & pharmaceuticals, midstream energy, and technology; and

having more risk over the period, on average, than the Index (from a market perspective).

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: security selection in US Treasuries,

largely driven by the use of futures.

■

During the period, the Fund utilized derivatives in the form of credit default swaps to manage credit risk, as well as financial futures, options,

and forwards to help manage duration positioning and yield curve exposure. Overall, the use of these derivatives had a negative impact

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 31, 2014 to December 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 12/31/2024 |

| | | |

| | | |

Bloomberg US Aggregate Bond Index* | | | |

Bloomberg 1-5 Year US Credit Index | | | |

*The Fund has added this

broad

-based index in response to new regulatory requirements.

WHAT ARE

SOME

KEY FUND STATISTICS AS OF 12/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 12/31/2024?

Credit Quality expressed as a percentage of total investments as of 12/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Short-Term Corporate Bond Fund

| | (b) | Copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule – Not applicable. |

Item 2 – Code of Ethics – See Exhibit (a)(1) of Item 19

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 800-225-1852, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

Item 3 – Audit Committee Financial Expert –

The registrant’s Board has determined that Ms. Grace C. Torres, member of the Board’s Audit Committee is an “audit committee financial expert,” and that she is “independent,” for purposes of this item.

Item 4 – Principal Accountant Fees and Services –

For the fiscal years ended December 31, 2024, and December 31, 2023, PricewaterhouseCoopers LLP (“PwC”), the Registrant’s principal accountant, billed the Registrant $43,044 and $40,280, respectively, for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

For the fiscal years ended December 31, 2024, and December 31, 2023: none.

For the fiscal years ended December 31, 2024, and December 31, 2023: none.

For the fiscal years ended December 31, 2024, and December 31, 2023: none.

(e) (1) Audit Committee Pre-Approval Policies and Procedures

THE PGIM MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent

Accountants

The Audit Committee of each PGIM Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve the independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | | a review of the nature of the professional services expected to be provided, |

| | • | | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds

On an annual basis, the scope of audits for each Fund, audit fees and expenses, and audit-related and non-audit services (and fees proposed in respect thereof) proposed to be performed by the Fund’s independent accountants will be presented by the Treasurer and the independent accountants to the Audit Committee for review and, as appropriate, approval prior to the initiation of such services.

Such presentation shall be accompanied by confirmation by both the Treasurer and the independent accountants that the proposed non-audit services will not adversely affect the independence of the independent accountants. Such proposed non-audit services shall be described in sufficient detail to enable the Audit Committee to assess the appropriateness of such services and fees, and the compatibility of the provision of such services with the auditor’s independence. The Committee shall receive periodic reports on the progress of the audit and other services which are approved by the Committee or by the Committee Chair pursuant to authority delegated in this Policy.

The categories of services enumerated under “Audit Services”, “Audit-related Services”, and “Tax Services” are intended to provide guidance to the Treasurer and the independent accountants as to those categories of services which the Committee believes are generally consistent with the independence of the independent accountants and which the Committee (or the Committee Chair) would expect upon the presentation of specific proposals to pre-approve. The enumerated categories are not intended as an exclusive list of audit, audit-related or tax services, which the Committee (or the Committee Chair) would consider for pre-approval.

Audit Services

The following categories of audit services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Annual Fund financial statement audits |

| | • | | Seed audits (related to new product filings, as required) |

| | • | | SEC and regulatory filings and consents |

Audit-related Services

The following categories of audit-related services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Accounting consultations |

| | • | | Fund merger support services |

| | • | | Agreed Upon Procedure Reports |

| | • | | Other Internal Control Reports |

Individual audit-related services that fall within one of these categories (except for fund merger support services) and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated). Fees related to fund merger support services are subject to a separate authorized pre-approval by the Audit Committee with fees determined on a per occurrence and merger complexity basis.

Tax Services

The following categories of tax services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Tax compliance services related to the filing or amendment of the following: |

| | • | | Federal, state and local income tax compliance; and, |

| | • | | Sales and use tax compliance |

| | • | | Timely RIC qualification reviews |

| | • | | Tax distribution analysis and planning |

| | • | | Tax authority examination services |

| | • | | Tax appeals support services |

| | • | | Accounting methods studies |

| | • | | Fund merger support services |

| | • | | Tax consulting services and related project |

Individual tax services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated).

Other Non-Audit Services

Certain non-audit services that the independent accountants are legally permitted to render will be subject to pre-approval by the Committee or by one or more Committee members to whom the Committee has delegated this authority and who will report to the full Committee any pre-approval decisions made pursuant to this Policy. Non-audit services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Proscribed Services

The Fund’s independent accountants will not render services in the following categories of non-audit services:

| | • | | Bookkeeping or other services related to the accounting records or financial statements of the Fund |

| | • | | Financial information systems design and implementation |

| | • | | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| | • | | Internal audit outsourcing services |

| | • | | Management functions or human resources |

| | • | | Broker or dealer, investment adviser, or investment banking services |

| | • | | Legal services and expert services unrelated to the audit |

| | • | | Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

Pre-approval of Non-Audit Services Provided to Other Entities Within the PGIM Fund Complex

Certain non-audit services provided to PGIM Investments LLC or any of its affiliates that also provide ongoing services to the PGIM Mutual Funds will be subject to pre-approval by the Audit Committee. The only non-audit services provided to these entities that will require pre-approval are those related directly to the operations and financial reporting of the Funds. Individual projects that are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $30,000. Services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Although the Audit Committee will not pre-approve all services provided to PGIM Investments LLC and its affiliates, the Committee will receive an annual report from the Fund’s independent accounting firm showing the aggregate fees for all services provided to PGIM Investments and its affiliates.

(e) (2) Percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X –

| | | | | | | | |

| | | | Fiscal Year Ended December 31, 2024 | | Fiscal Year Ended December 31, 2023 | | |

| | 4(b) | | Not applicable. | | Not applicable. | | |

| | 4(c) | | Not applicable. | | Not applicable. | | |

| | 4(d) | | Not applicable. | | Not applicable. | | |

(f) Percentage of hours expended attributable to work performed by other than full time employees of principal accountant if greater than 50%.

The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

(g) Non-Audit Fees

The aggregate non-audit fees billed by the Registrant’s principal accountant for services rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant for the fiscal years ended December 31, 2024, and December 31, 2023 was $0 and $0, respectively.

(h) Principal Accountant’s Independence

Not applicable as the Registrant’s principal accountant has not provided non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X.

(i) Not applicable.

(j) Not applicable.

Item 5 – Audit Committee of Listed Registrants – Not applicable.

Item 6 – Investments – The registrant’s Schedule of Investments is included in the financial statements filed under Item 7

of this Form.

Items 7 – 11 (Refer to Report below)

PRUDENTIAL SHORT-TERM CORPORATE BOND FUND, INC.

PGIM Short-Term Corporate Bond Fund

FINANCIAL STATEMENTS AND OTHER INFORMATION

DECEMBER 31, 2024

| | | | |

| Table of Contents | | Financial Statements and Other Information | | December 31, 2024 |

| | | |

| | | | | |

Form N-CSR Item 7 - Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Schedule of Investments

as of December 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 97.5% | | | | | | | | | | | | |

| | | | |

ASSET-BACKED SECURITIES 12.0% | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations | | | | | | | | | | | | |

| | | | |

AGL CLO Ltd. (United Kingdom), | | | | | | | | | | | | |

Series 2022-22A, Class A1R, 144A, 3 Month SOFR + 1.190% (Cap N/A, Floor 1.190%) | | 5.750%(c) | | 01/20/37 | | | 25,300 | | | $ | 25,337,644 | |

Anchorage Capital CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2024-30A, Class A1, 144A, 3 Month SOFR + 1.300% (Cap N/A, Floor 1.300%) | | 5.615(c) | | 01/20/37 | | | 31,100 | | | | 31,105,256 | |

Atlas Senior Loan Fund Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2016-07A, Class A1R2, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 1.100%) | | 5.883(c) | | 11/27/31 | | | 39,235 | | | | 39,276,514 | |

Series 2018-11A, Class A1L, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 0.000%) | | 5.979(c) | | 07/26/31 | | | 5,126 | | | | 5,129,933 | |

Battalion CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2018-12A, Class A1, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.070%) | | 5.817(c) | | 05/17/31 | | | 9,763 | | | | 9,772,074 | |

Carlyle Global Market Strategies CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2012-04A, Class A1R4, 144A, 3 Month SOFR + 1.120% (Cap N/A, Floor 1.120%) | | 5.752(c) | | 04/22/32 | | | 8,923 | | | | 8,927,850 | |

CarVal CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-01A, Class AR2, 144A, 3 Month SOFR + 1.020% (Cap N/A, Floor 1.020%) | | 5.376(c) | | 04/20/32 | | | 39,500 | | | | 39,576,140 | |

CBAM Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2020-12A, Class AR, 144A, 3 Month SOFR + 1.442% (Cap N/A, Floor 1.442%) | | 6.059(c) | | 07/20/34 | | | 19,500 | | | | 19,535,660 | |

CIFC Funding Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2013-03RA, Class A1, 144A, 3 Month SOFR + 1.242% (Cap N/A, Floor 0.980%) | | 5.876(c) | | 04/24/31 | | | 11,780 | | | | 11,780,517 | |

Series 2017-02A, Class AR, 144A, 3 Month SOFR + 1.212% (Cap N/A, Floor 0.950%) | | 5.829(c) | | 04/20/30 | | | 43,323 | | | | 43,377,900 | |

Crown City CLO (Cayman Islands), | | | | | | | | | | | | |

Series 2020-01A, Class A1AR, 144A, 3 Month SOFR + 1.452% (Cap N/A, Floor 1.190%) | | 6.069(c) | | 07/20/34 | | | 60,000 | | | | 60,116,928 | |

HPS Loan Management Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 10A-16, Class A1R3, 144A, 3 Month SOFR + 1.120% (Cap N/A, Floor 1.120%) | | 5.737(c) | | 04/20/34 | | | 50,000 | | | | 50,029,165 | |

Jamestown CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-14A, Class A1AR, 144A, 3 Month SOFR + 1.462% (Cap N/A, Floor 1.200%) | | 6.079(c) | | 10/20/34 | | | 50,000 | | | | 50,074,805 | |

LCM Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 39A, Class A1R, 144A, 3 Month SOFR + 1.340% (Cap N/A, Floor 1.340%) | | 5.996(c) | | 10/15/34 | | | 48,400 | | | | 48,537,388 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 1

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | |

| | | | |

MidOcean Credit CLO (Cayman Islands), | | | | | | | | | | | | |

Series 2014-03A, Class A1R, 144A, 3 Month SOFR + 1.382% (Cap N/A, Floor 1.120%) | | 5.999%(c) | | 04/21/31 | | | 7,592 | | | $ | 7,596,434 | |

Northwoods Capital Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-15A, Class A1R, 144A, 3 Month SOFR + 1.472% (Cap N/A, Floor 1.472%) | | 5.826(c) | | 06/20/34 | | | 40,000 | | | | 40,062,480 | |

OCP CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2020-08RA, Class AR, 144A, 3 Month SOFR + 1.250% (Cap N/A, Floor 1.250%) | | 5.773(c) | | 10/17/36 | | | 18,000 | | | | 18,041,288 | |

Palmer Square CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2015-01A, Class A1A5, 144A, 3 Month SOFR + 1.050% (Cap N/A, Floor 1.050%) | | 0.000(c) | | 05/21/34 | | | 40,000 | | | | 40,000,000 | |

Shackleton CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2015-07RA, Class ARR, 144A, 3 Month SOFR + 1.100% (Cap N/A, Floor 1.100%) | | 5.756(c) | | 07/15/31 | | | 12,800 | | | | 12,824,530 | |

Sixth Street CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-08A, Class A1R2, 144A, 3 Month SOFR + 1.150% (Cap N/A, Floor 1.150%) | | 5.594(c) | | 10/20/34 | | | 45,000 | | | | 45,031,703 | |

Sound Point CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2013-01A, Class A1R, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.332%) | | 5.949(c) | | 01/26/31 | | | 4,745 | | | | 4,749,491 | |

Series 2013-03RA, Class A, 144A, 3 Month SOFR + 1.412% (Cap N/A, Floor 1.150%) | | 6.044(c) | | 04/18/31 | | | 15,104 | | | | 15,132,648 | |

Series 2014-03RA, Class A1R, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.070%) | | 5.958(c) | | 10/23/31 | | | 29,721 | | | | 29,756,262 | |

Series 2017-03A, Class A1R, 144A, 3 Month SOFR + 1.242% (Cap N/A, Floor 0.980%) | | 5.859(c) | | 10/20/30 | | | 8,436 | | | | 8,436,391 | |

TCW CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-01A, Class A1RR, 144A, 3 Month SOFR + 1.442% (Cap N/A, Floor 1.180%) | | 6.046(c) | | 10/29/34 | | | 25,000 | | | | 25,006,035 | |

Series 2020-01A, Class A1R3, 144A, 3 Month SOFR + 1.050% (Cap N/A, Floor 0.000%) | | 0.000(c) | | 04/20/34 | | | 40,000 | | | | 40,000,000 | |

THL Credit Wind River CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-01A, Class AR, 144A, 3 Month SOFR + 1.422% (Cap N/A, Floor 1.160%) | | 6.039(c) | | 07/20/34 | | | 39,500 | | | | 39,575,338 | |

Tralee CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2021-07A, Class A1, 144A, 3 Month SOFR + 1.582% (Cap N/A, Floor 1.320%) | | 6.207(c) | | 04/25/34 | | | 32,000 | | | | 32,019,270 | |

Trimaran Cavu Ltd., | | | | | | | | | | | | |

Series 2019-01A, Class A1R, 144A, 3 Month SOFR + 1.190% (Cap N/A, Floor 1.190%) | | 5.505(c) | | 01/20/37 | | | 44,851 | | | | 44,851,000 | |

See Notes to Financial Statements.

2

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | |

| | | | |

Trinitas CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-11A, Class A1RR, 144A, 3 Month SOFR + 1.190% (Cap N/A, Floor 1.190%) | | 5.757%(c) | | 07/15/34 | | | 40,000 | | | $ | 40,004,240 | |

Voya CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-03A, Class AR, 144A, 3 Month SOFR + 1.342% (Cap N/A, Floor 1.080%) | | 5.989(c) | | 10/17/32 | | | 25,000 | | | | 25,000,355 | |

Series 2020-02A, Class A1R, 144A, 3 Month SOFR + 1.422% (Cap N/A, Floor 1.160%) | | 6.039(c) | | 07/19/34 | | | 30,000 | | | | 30,000,000 | |

Wellfleet CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-XA, Class A1R2, 144A, 3 Month SOFR + 1.120% (Cap N/A, Floor 1.120%) | | 5.413(c) | | 07/20/32 | | | 26,650 | | | | 26,680,906 | |

Wind River CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2016-01KRA, Class A1R2, 144A, 3 Month SOFR + 1.472% (Cap N/A, Floor 1.210%) | | 6.128(c) | | 10/15/34 | | | 25,000 | | | | 25,023,143 | |

Zais CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-02A, Class A, 144A, 3 Month SOFR + 1.552% (Cap N/A, Floor 0.000%) | | 6.208(c) | | 04/15/30 | | | 2,715 | | | | 2,715,914 | |

| | | | | | | | | | | | |

| | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $993,867,104) | | | | | | | | | | | 995,085,202 | |

| | | | | | | | | | | | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 1.6% | | | | | | | | | | | | |

Benchmark Mortgage Trust, | | | | | | | | | | | | |

Series 2020-IG03, Class A2, 144A | | 2.475 | | 09/15/48 | | | 60,891 | | | | 60,621,638 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2016-C02, Class A3 | | 2.575 | | 08/10/49 | | | 12,367 | | | | 12,033,725 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | |

Series 2016-C01, Class A4 | | 3.311 | | 03/17/49 | | | 34,783 | | | | 34,271,024 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | |

Series 2016-C29, Class A3 | | 3.058 | | 05/15/49 | | | 9,854 | | | | 9,684,416 | |

Series 2016-C32, Class ASB | | 3.514 | | 12/15/49 | | | 3,070 | | | | 3,030,715 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | |

Series 2015-MS01, Class A3 | | 3.510 | | 05/15/48 | | | 6,766 | | | | 6,727,498 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2016-BNK01, Class A2 | | 2.399 | | 08/15/49 | | | 10,436 | | | | 10,072,166 | |

| | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $142,826,534) | | | | | | | | | | | 136,441,182 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 3

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

CORPORATE BONDS 82.9% | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 1.5% | | | | | | | | | | | | |

| | | | |

BAE Systems Finance, Inc. (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.500% | | 07/01/27 | | | 5,463 | | | $ | 5,788,713 | |

BAE Systems PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.125 | | 03/26/29 | | | 7,755 | | | | 7,769,861 | |

Boeing Co. (The), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.196 | | 02/04/26 | | | 8,700 | | | | 8,435,731 | |

Sr. Unsec’d. Notes | | 2.700 | | 02/01/27 | | | 37,574 | | | | 35,822,556 | |

Sr. Unsec’d. Notes | | 3.250 | | 02/01/28 | | | 27,812 | | | | 26,187,620 | |

Sr. Unsec’d. Notes | | 3.625 | | 02/01/31 | | | 4,745 | | | | 4,307,707 | |

Sr. Unsec’d. Notes | | 5.150 | | 05/01/30 | | | 15,603 | | | | 15,398,598 | |

Sr. Unsec’d. Notes | | 6.298 | | 05/01/29 | | | 5,210 | | | | 5,402,142 | |

L3Harris Technologies, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.400 | | 06/15/28 | | | 4,720 | | | | 4,639,101 | |

Spirit AeroSystems, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 3.850 | | 06/15/26 | | | 12,300 | | | | 12,016,425 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 125,768,454 | |

| | | | |

Agriculture 2.7% | | | | | | | | | | | | |

| | | | |

Archer-Daniels-Midland Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.250 | | 03/27/30 | | | 33,645 | | | | 31,057,985 | |

BAT Capital Corp. (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes | | 2.259 | | 03/25/28 | | | 5,000 | | | | 4,593,941 | |

Gtd. Notes | | 3.557 | | 08/15/27 | | | 4,524 | | | | 4,376,905 | |

Gtd. Notes | | 4.700 | | 04/02/27 | | | 8,054 | | | | 8,017,298 | |

Gtd. Notes | | 5.834 | | 02/20/31 | | | 8,995 | | | | 9,195,442 | |

BAT International Finance PLC (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes | | 1.668 | | 03/25/26 | | | 26,865 | | | | 25,832,785 | |

Bunge Ltd. Finance Corp., | | | | | | | | | | | | |

Gtd. Notes(a) | | 2.750 | | 05/14/31 | | | 11,705 | | | | 10,114,657 | |

Imperial Brands Finance PLC (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 6.125 | | 07/27/27 | | | 12,610 | | | | 12,942,860 | |

Gtd. Notes, 144A, MTN | | 5.500 | | 02/01/30 | | | 13,600 | | | | 13,752,119 | |

Philip Morris International, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.375 | | 11/01/27 | | | 28,750 | | | | 28,510,669 | |

Sr. Unsec’d. Notes(a) | | 4.875 | | 02/15/28 | | | 20,529 | | | | 20,574,123 | |

Sr. Unsec’d. Notes | | 5.125 | | 02/13/31 | | | 11,550 | | | | 11,558,276 | |

Sr. Unsec’d. Notes | | 5.250 | | 09/07/28 | | | 8,521 | | | | 8,644,656 | |

See Notes to Financial Statements.

4

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | |

CORPORATE BONDS (Continued) | | | | | | | | | | |

| | | | |

Agriculture (cont’d.) | | | | | | | | | | | | |

| | | | |

Reynolds American, Inc. (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes | | 4.450% | | 06/12/25 | | | 212 | | | $ | 211,458 | |

Viterra Finance BV (Netherlands), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 2.000 | | 04/21/26 | | | 35,200 | | | | 33,822,328 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 223,205,502 | |

| | | | |

Airlines 0.8% | | | | | | | | | | | | |

| | | | |

American Airlines 2013-1 Class A Pass-Through Trust, | | | | | | | | | | | | |

Pass-Through Certificates | | 4.000 | | 01/15/27 | | | 954 | | | | 943,512 | |

Delta Air Lines, Inc./SkyMiles IP Ltd., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 4.500 | | 10/20/25 | | | 8,446 | | | | 8,404,673 | |

Sr. Sec’d. Notes, 144A | | 4.750 | | 10/20/28 | | | 29,560 | | | | 29,136,405 | |

Southwest Airlines Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 5.125 | | 06/15/27 | | | 7,215 | | | | 7,252,653 | |

United Airlines 2014-1 Class A Pass-Through Trust, | | | | | | | | | | | | |

Pass-Through Certificates | | 4.000 | | 10/11/27 | | | 2,891 | | | | 2,856,833 | |

United Airlines, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 4.375 | | 04/15/26 | | | 12,515 | | | | 12,300,722 | |

Sr. Sec’d. Notes, 144A | | 4.625 | | 04/15/29 | | | 4,540 | | | | 4,315,548 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 65,210,346 | |

| | | | |

Apparel 0.3% | | | | | | | | | | | | |

| | | | |

VF Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | 2.400 | | 04/23/25 | | | 20,475 | | | | 20,285,300 | |

| | | | |

Auto Manufacturers 3.2% | | | | | | | | | | | | |

| | | | |

Ford Motor Credit Co. LLC, | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.700 | | 08/10/26 | | | 50,965 | | | | 48,948,753 | |

Sr. Unsec’d. Notes | | 4.000 | | 11/13/30 | | | 2,865 | | | | 2,579,222 | |

Sr. Unsec’d. Notes | | 4.271 | | 01/09/27 | | | 9,430 | | | | 9,237,065 | |

Sr. Unsec’d. Notes | | 5.800 | | 03/08/29 | | | 8,000 | | | | 8,000,595 | |

Sr. Unsec’d. Notes | | 5.850 | | 05/17/27 | | | 13,740 | | | | 13,882,529 | |

Sr. Unsec’d. Notes | | 6.950 | | 03/06/26 | | | 2,200 | | | | 2,238,818 | |

General Motors Financial Co., Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.250 | | 01/08/26 | | | 39,885 | | | | 38,427,508 | |

Sr. Unsec’d. Notes | | 1.500 | | 06/10/26 | | | 9,390 | | | | 8,949,308 | |

Sr. Unsec’d. Notes | | 2.350 | | 02/26/27 | | | 2,590 | | | | 2,454,286 | |

Sr. Unsec’d. Notes | | 2.400 | | 04/10/28 | | | 11,815 | | | | 10,855,300 | |

Sr. Unsec’d. Notes | | 2.400 | | 10/15/28 | | | 23,040 | | | | 20,888,903 | |

Sr. Unsec’d. Notes | | 5.400 | | 05/08/27 | | | 2,675 | | | | 2,703,146 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 5

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Auto Manufacturers (cont’d.) | | | | | | | | | | | | |

| | | | |

Hyundai Capital America, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.275% | | 06/24/27 | | | 16,850 | | | $ | 16,971,000 | |

Sr. Unsec’d. Notes, 144A | | 6.100 | | 09/21/28 | | | 20,000 | | | | 20,572,403 | |

Nissan Motor Acceptance Co. LLC, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN | | 1.850 | | 09/16/26 | | | 15,000 | | | | 14,076,310 | |

Sr. Unsec’d. Notes, 144A, MTN | | 5.300 | | 09/13/27 | | | 6,590 | | | | 6,523,543 | |

Nissan Motor Co. Ltd. (Japan), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 3.522 | | 09/17/25 | | | 4,000 | | | | 3,935,454 | |

Toyota Motor Credit Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | 4.050 | | 10/24/25 | | | 10,000 | | | | 9,907,949 | |

Volkswagen Group of America Finance LLC (Germany), | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 4.950 | | 08/15/29 | | | 9,600 | | | | 9,359,131 | |

Gtd. Notes, 144A | | 5.300 | | 03/22/27 | | | 14,260 | | | | 14,266,756 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 264,777,979 | |

| | | | |

Auto Parts & Equipment 0.2% | | | | | | | | | | | | |

| | | | |

Aptiv Swiss Holdings Ltd., | | | | | | | | | | | | |

Gtd. Notes | | 4.650 | | 09/13/29 | | | 1,665 | | | | 1,611,528 | |

Gtd. Notes(a) | | 6.875(ff) | | 12/15/54 | | | 13,340 | | | | 13,010,618 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 14,622,146 | |

| | | | |

Banks 22.7% | | | | | | | | | | | | |

| | | | |

Banco Santander SA (Spain), | | | | | | | | | | | | |

Sr. Non-Preferred Notes | | 1.849 | | 03/25/26 | | | 13,400 | | | | 12,902,364 | |

Sr. Non-Preferred Notes | | 5.538(ff) | | 03/14/30 | | | 7,200 | | | | 7,230,355 | |

Sr. Preferred Notes(a) | | 5.439 | | 07/15/31 | | | 16,600 | | | | 16,545,521 | |

Bank of America Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.734(ff) | | 07/22/27 | | | 93,500 | | | | 89,140,307 | |

Sr. Unsec’d. Notes, MTN | | 2.087(ff) | | 06/14/29 | | | 32,800 | | | | 29,734,311 | |

Sr. Unsec’d. Notes, Series N | | 1.658(ff) | | 03/11/27 | | | 65,520 | | | | 63,119,136 | |

Bank of Nova Scotia (The) (Canada), | | | | | | | | | | | | |

Jr. Sub. Notes, Series 2 | | 3.625(ff) | | 10/27/81 | | | 50,000 | | | | 46,000,000 | |

Barclays PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.942(ff) | | 09/10/30 | | | 9,620 | | | | 9,430,312 | |

Sr. Unsec’d. Notes | | 5.304(ff) | | 08/09/26 | | | 18,900 | | | | 18,933,572 | |

Sr. Unsec’d. Notes | | 5.501(ff) | | 08/09/28 | | | 4,295 | | | | 4,337,950 | |

Sr. Unsec’d. Notes | | 5.829(ff) | | 05/09/27 | | | 2,960 | | | | 2,990,646 | |

Sr. Unsec’d. Notes | | 6.496(ff) | | 09/13/27 | | | 32,530 | | | | 33,285,961 | |

BNP Paribas SA (France), | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | 2.159(ff) | | 09/15/29 | | | 6,595 | | | | 5,899,966 | |

See Notes to Financial Statements.

6

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | |

| | | | |

BPCE SA (France), | | | | | | | | | | | | |

Sub. Notes, 144A, MTN | | 4.500% | | 03/15/25 | | | 3,640 | | | $ | 3,631,242 | |

CaixaBank SA (Spain), | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | 6.684(ff) | | 09/13/27 | | | 15,790 | | | | 16,189,650 | |

Canadian Imperial Bank of Commerce (Canada), | | | | | | | | | | | | |

Jr. Sub. Notes(a) | | 6.950(ff) | | 01/28/85 | | | 25,145 | | | | 25,019,275 | |

Citigroup, Inc., | | | | | | | | | | | | |

Jr. Sub. Notes, Series CC | | 7.125(ff) | | 08/15/29(oo) | | | 24,710 | | | | 25,154,434 | |

Jr. Sub. Notes, Series EE | | 6.750(ff) | | 02/15/30(oo) | | | 12,600 | | | | 12,538,422 | |

Jr. Sub. Notes, Series V | | 4.700(ff) | | 01/30/25(oo) | | | 26,675 | | | | 26,553,996 | |

Sr. Unsec’d. Notes | | 1.462(ff) | | 06/09/27 | | | 81,450 | | | | 77,554,097 | |

Sr. Unsec’d. Notes | | 3.057(ff) | | 01/25/33 | | | 18,715 | | | | 16,071,933 | |

Sub. Notes | | 4.450 | | 09/29/27 | | | 8,160 | | | | 8,046,869 | |

Comerica, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 5.982(ff) | | 01/30/30 | | | 44,920 | | | | 45,410,384 | |

Credit Agricole SA (France), | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A, MTN | | 4.631(ff) | | 09/11/28 | | | 8,535 | | | | 8,419,548 | |

Danske Bank A/S (Denmark), | | | | | | | | | | | | |

Sr. Non-Preferred Notes, 144A | | 4.613(ff) | | 10/02/30 | | | 7,280 | | | | 7,059,369 | |

Deutsche Bank AG (Germany), | | | | | | | | | | | | |

Sr. Non-Preferred Notes | | 2.311(ff) | | 11/16/27 | | | 16,725 | | | | 15,895,489 | |

Sr. Non-Preferred Notes | | 2.552(ff) | | 01/07/28 | | | 4,522 | | | | 4,296,290 | |

Sr. Non-Preferred Notes | | 4.999(ff) | | 09/11/30 | | | 6,370 | | | | 6,214,431 | |

Sr. Non-Preferred Notes, SOFR + 1.219% | | 5.701(c) | | 11/16/27 | | | 4,625 | | | | 4,607,577 | |

Sr. Non-Preferred Notes | | 6.720(ff) | | 01/18/29 | | | 1,915 | | | | 1,986,002 | |

Sr. Non-Preferred Notes | | 6.819(ff) | | 11/20/29 | | | 20,510 | | | | 21,455,870 | |

Fifth Third Bancorp, | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 6.339(ff) | | 07/27/29 | | | 33,640 | | | | 34,887,116 | |

Goldman Sachs Bank USA, | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 5.414(ff) | | 05/21/27 | | | 19,650 | | | | 19,799,857 | |

Goldman Sachs Group, Inc. (The), | | | | | | | | | | | | |

Jr. Sub. Notes, Series U | | 3.650(ff) | | 08/10/26(oo) | | | 16,130 | | | | 15,404,257 | |

Jr. Sub. Notes, Series X | | 7.500(ff) | | 05/10/29(oo) | | | 15,620 | | | | 16,330,186 | |

Sr. Unsec’d. Notes | | 1.431(ff) | | 03/09/27 | | | 56,555 | | | | 54,273,705 | |

Sr. Unsec’d. Notes | | 1.542(ff) | | 09/10/27 | | | 72,845 | | | | 68,886,144 | |

Sr. Unsec’d. Notes | | 2.615(ff) | | 04/22/32 | | | 5,120 | | | | 4,364,092 | |

Sr. Unsec’d. Notes | | 3.615(ff) | | 03/15/28 | | | 6,630 | | | | 6,444,526 | |

Sr. Unsec’d. Notes | | 3.814(ff) | | 04/23/29 | | | 6,155 | | | | 5,918,594 | |

HSBC Holdings PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.013(ff) | | 09/22/28 | | | 5,750 | | | | 5,299,983 | |

Sr. Unsec’d. Notes | | 2.804(ff) | | 05/24/32 | | | 28,670 | | | | 24,355,859 | |

Sr. Unsec’d. Notes | | 2.871(ff) | | 11/22/32 | | | 5,000 | | | | 4,213,630 | |

See Notes to Financial Statements.

PGIM Short-Term Corporate Bond Fund 7

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | |

| | | | |

HSBC Holdings PLC (United Kingdom), (cont’d.) | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | 5.210%(ff) | | 08/11/28 | | | 900 | | | $ | 902,709 | |

Huntington Bancshares, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 6.208(ff) | | 08/21/29 | | | 36,040 | | | | 37,191,240 | |

JPMorgan Chase & Co., | | | | | | | | | | | | |

Jr. Sub. Notes, Series CC, 3 Month SOFR + 2.842% | | 7.413(c) | | 02/01/25(oo) | | | 11,600 | | | | 11,661,669 | |

Jr. Sub. Notes, Series HH | | 4.600(ff) | | 02/01/25(oo) | | | 15,824 | | | | 15,760,739 | |

Jr. Sub. Notes, Series II | | 4.000(ff) | | 04/01/25(oo) | | | 5,225 | | | | 5,182,588 | |

Sr. Unsec’d. Notes | | 1.040(ff) | | 02/04/27 | | | 20,000 | | | | 19,205,292 | |

Sr. Unsec’d. Notes(a) | | 1.470(ff) | | 09/22/27 | | | 39,288 | | | | 37,153,947 | |

Sr. Unsec’d. Notes | | 1.578(ff) | | 04/22/27 | | | 64,714 | | | | 62,142,319 | |

Sr. Unsec’d. Notes | | 2.083(ff) | | 04/22/26 | | | 24,675 | | | | 24,464,258 | |

Sr. Unsec’d. Notes | | 4.995(ff) | | 07/22/30 | | | 32,810 | | | | 32,684,336 | |

Sr. Unsec’d. Notes | | 5.299(ff) | | 07/24/29 | | | 25,000 | | | | 25,231,066 | |

Sr. Unsec’d. Notes | | 5.581(ff) | | 04/22/30 | | | 25,605 | | | | 26,087,804 | |

KBC Group NV (Belgium), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 4.932(ff) | | 10/16/30 | | | 6,305 | | | | 6,193,925 | |

KeyBank NA, | | | | | | | | | | | | |

Sub. Notes | | 6.950 | | 02/01/28 | | | 8,600 | | | | 8,952,718 | |

KeyCorp, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 2.550 | | 10/01/29 | | | 5,570 | | | | 4,946,486 | |

Sr. Unsec’d. Notes, MTN | | 4.100 | | 04/30/28 | | | 9,513 | | | | 9,201,688 | |

Lloyds Banking Group PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 5.985(ff) | | 08/07/27 | | | 9,050 | | | | 9,185,812 | |

Mitsubishi UFJ Financial Group, Inc. (Japan), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.538(ff) | | 07/20/27 | | | 25,830 | | | | 24,562,153 | |

Mizuho Financial Group, Inc. (Japan), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.869(ff) | | 09/13/30 | | | 24,524 | | | | 22,138,094 | |

Morgan Stanley, | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.985(ff) | | 12/10/26 | | | 50,880 | | | | 49,069,460 | |

Sr. Unsec’d. Notes(a) | | 1.593(ff) | | 05/04/27 | | | 33,720 | | | | 32,325,949 | |

Sr. Unsec’d. Notes | | 4.654(ff) | | 10/18/30 | | | 3,420 | | | | 3,347,355 | |

Sr. Unsec’d. Notes | | 5.449(ff) | | 07/20/29 | | | 17,800 | | | | 17,998,685 | |