UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05577

The Glenmede Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

100 Summer Street, Floor 7

SUM0703

Boston, MA 02111

(Address of Principal Executive Offices)(Zip Code)

Michael P. Malloy, Esq.

Secretary

Drinker Biddle & Reath LLP

One Logan Square

Suite 2000

Philadelphia, PA 19103-6996

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 1-800-442-8299

Date of Fiscal Year End: October 31, 2017

Date of Reporting Period: October 31, 2017

Item 1. Reports to Stockholders.

The Glenmede Fund, Inc.

The Glenmede Portfolios

Annual Report

October 31, 2017

The performance for the portfolios shown on pages 2 to 4 and 6 to 24 represents past performance and is not a guarantee of future results. A portfolio’s share price and investment return will vary with market conditions, and the principal value of shares, when redeemed, may be more or less than their original cost.

An investment in a portfolio is neither insured nor guaranteed by the U.S. Government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency or bank.

Unlike actual fund performance, performance of an index does not reflect any expenses or transaction costs. A direct investment in an unmanaged index is not possible.

The reports concerning the portfolios included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the portfolios in the future. These statements are based on the adviser’s predictions and expectations concerning certain future events and their expected impact on the portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events and other factors that may influence the future performance of the portfolios. The adviser believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

TABLE OF CONTENTS

THE GLENMEDE FUND, INC. AND THE GLENMEDE PORTFOLIOS

PRESIDENT’S LETTER

Dear Shareholder:

We are pleased to present the annual report of the Glenmede family of funds for the fiscal year ended October 31, 2017. Domestic equity markets were very strong during the fiscal year ended October 31, 2017, surging to new highs. This was fueled by President Trump’s election which resulted in anticipation of business friendly regulatory, tax and fiscal policies. Global equity returns were also robust as the global expansion continued in developed and emerging market countries. The U.S. Government yield curve flattened significantly as a result of three increases in the Fed Funds target. Money market fund yields also rose because of the increase in the Fed Funds target.

At the fiscal year end on October 31, 2017, The Glenmede Fund, Inc. and The Glenmede Portfolios (collectively, the “Glenmede Funds”) consisted of nineteen portfolios with total assets of $13.1 billion. During the fiscal year, one new portfolio was launched: The Glenmede Equity Income Portfolio.

This fiscal year ended October 31, 2017 showed very positive returns across domestic equity asset classes in response to improving growth in the U.S. economy and the “Trump effect.” The S&P 500 Index1 gained 23.63%. Small cap stocks did even better than large cap stocks with the Russell 2000® Index1 returning 27.85% versus a return of 23.67% on the Russell 1000® Index1 for the fiscal year ended October 31, 2017. The MSCI EAFE Index1 performed as well as domestic stocks for the fiscal year, gaining 23.44%. Short term interest rates increased more than longer rates flattening the curve as the Fed Funds Target range rose to 1.00% - 1.25%. One year maturity treasuries rose 78 basis points3 and 30 year treasury yields rose only 30 basis points3. The Bloomberg Barclays Capital U.S. Aggregate Bond Index1 gained 0.90% and the Bloomberg Barclays Capital Municipal 1-10 Year Blend Index1 gained 1.67% for the fiscal year ended October 31, 2017.

The Glenmede Large Cap Core Portfolio (Advisor Class and Institutional Class) achieved a five star («««««) Overall Morningstar RatingTM2 among 1,214 Large Blend Equity Funds for the period ended October 31, 2017 (based on risk adjusted returns). The Glenmede Secured Options Portfolio (Advisor Class and Institutional Class) achieved a five star («««««) Overall Morningstar RatingTM2 among 77 Option Writing Funds for the period ended October 31, 2017 (based on risk adjusted returns). The Glenmede Large Cap Growth Portfolio (Advisor Class) achieved a four star (««««) Overall Morningstar RatingTM2 among 1,233 Large Growth Equity Funds for the period ended October 31, 2017 (based on risk adjusted returns). The Glenmede Large Cap Value Portfolio achieved a four star (««««) Overall Morningstar RatingTM2 among 1,102 Large Value Equity Funds for the period ended October 31, 2017 (based on risk adjusted returns). The Glenmede Small Cap Equity Portfolio (Advisor Class and Institutional Class) achieved a four star (««««) Overall Morningstar RatingTM2 among 655 U.S. Domiciled Small Blend Equity Funds for the period ended October 31, 2017 (based on risk adjusted returns). The Glenmede Strategic Equity Portfolio achieved a four star (««««) Overall Morningstar RatingTM2 among 1,214 U.S. Domiciled Large Blend Equity Funds for the period ended October 31, 2017 (based on risk adjusted returns). The Glenmede Total Market Portfolio achieved a four star (««««) Overall Morningstar RatingTM2 among 373 U.S. Domiciled Mid Cap Value Equity Funds for the period ended October 31, 2017 (based on risk adjusted returns).

The Glenmede Muni Intermediate Portfolio and Core Fixed Income Portfolio have a high quality bias. The Muni Intermediate Portfolio achieved a four star (««««) Overall Morningstar RatingTM2 among 171 Muni National Short Funds for the period ended October 31, 2017 (based on risk-adjusted returns). The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metric.

We have featured the new Equity Income Portfolio and the Large Cap Value Portfolio and included Portfolio Highlights for each individual fund in this report. We welcome any questions about the Glenmede Funds and thank our shareholders for their continued support.

Sincerely,

Mary Ann B. Wirts

President

December 7, 2017

Past performance is no guarantee of future results.

Mutual fund investing involves risks. Principal loss is possible. The Portfolios may invest in foreign securities which, especially in emerging markets, will involve greater volatility and political, economic and currency risks and differences in accounting methods. The Small Cap Equity Portfolio, U.S. Emerging Growth Portfolio and Mid Cap Equity Portfolio invest in smaller companies, which will involve additional risks such as limited liquidity and greater volatility than larger companies. Short sales by the Long/Short Portfolio and Total Market Portfolio involve leverage risk, credit exposure to brokers that execute the short sales and have potentially unlimited losses. Use of derivatives by the Secured Options Portfolio and the Global Secured Options Portfolio may involve greater liquidity, counterparty, credit and pricing risks. The Muni Intermediate Portfolio, High Yield Municipal Portfolio and Short Term Tax Aware Fixed Income Portfolio invest in debt instruments of municipal issuers whose ability to meet their obligations may be affected by political and economic factors in the Issuer’s region. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Income from tax-exempt funds may be subject to state and local taxes and a portion of income may be subject to the federal alternative minimum tax for certain investors. Federal income tax rules will apply to any capital gains distributions. Investments in asset backed and mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The High Yield Municipal Portfolio invests in “Junk Bonds” which are securities rated below investment grade and are high risk investments that have greater credit risk, are less liquid and have more volatile prices than investment grade bonds. The Secured Options Portfolio and the Global Secured Options Portfolio invest in options which have risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates and currency exchange rates. Covered call writing may limit the upside of an underlying security. This investment may not be suitable for all investors. The application of the social, governance and/or environmental standards of the Responsible ESG U.S. Equity Portfolio and the women in leadership criteria of the Women in Leadership U.S. Equity Portfolio will affect each Portfolio’s exposure to certain Issuers, industries, sectors, regions and countries and may impact the relative performance of these Portfolios, either positively or negatively, depending on whether such investments are in or out of favor. The Equity Income Portfolio invests in dividend paying stocks. Issuers that have paid regular dividends or distributions to shareholders may not continue to do so at the same level or at all in the future. Dividend paying securities can fall out of favor with the market, causing the Portfolio during such periods to underperform funds that do not focus on dividends.

Diversification does not assure a profit or protect against a loss in a declining market.

An investment in a Portfolio is neither insured nor guaranteed by the Federal Deposit Insurance Corporation, any other government agency or bank.

| 1 | The indices are defined on pages 25 to 26. |

| 2 | ©2017 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. |

For each fund with at least a three-year history, Morningstar calculates a Overall Morningstar Rating™1, (based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance, (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages). The Large Cap Core Portfolio (Advisor Class and Institutional Class) was rated against the following numbers of U.S.-domiciled Large Blend Equity funds over the following time periods: 1,214 funds overall, 1,214 funds in the last three years, 1,078 funds in the last five years, and 794 funds in the last ten years. With respect to these Large Blend Equity funds, the Large Cap Core Portfolio (Advisor Class and Institutional Class) received an Overall Morningstar Rating™ of ««««« stars and a Morningstar Rating™ of «« «« « stars, ««««« stars, and «« ««« stars for the three-, five- and ten-year periods, respectively. The Large Cap Growth Portfolio (Advisor Class) was rated against the following numbers of U.S.-domiciled Large Growth Equity funds over the following time periods: 1,233 funds overall, 1,233 funds in the last three years, 1,107 funds in the last five years and 782 funds in the last ten years. With respect to these Large Growth Equity funds, the Large Cap Growth Portfolio (Advisor Class) received an Overall Morning-star Rating™ of «««« stars and a Morningstar Rating™ of «««« stars, «« «« « stars, and «««« stars for the three-, five and ten-year periods, respectively. The Secured Options Portfolio (Advisor Class and Institutional Class) was rated against the following numbers of Option Writing funds over the following time periods: 77 funds overall, 77 funds in the last three years, and 35 funds in the last five years. With respect to these Option Writing funds, the Secured Options Portfolio (Advisor Class and Institutional Class) received an Overall Morningstar Rating™ of «« «« « stars and a Morningstar Rating™ of «««« stars and «« ««« stars for the three- and five year periods, respectively. The Muni Intermediate Portfolio was rated against the following numbers of U.S.- domiciled Muni National Short funds over the following time periods: 171 funds overall, 171 funds in the last three years, 149 funds in the last five years, and 93 funds in the last ten years. With respect to these Muni National Short funds, the Muni Intermediate Portfolio received an Overall Morningstar Rating™ of «««« stars and a Morningstar Rating™ of «««« stars, «« «« stars, and «««« stars for the three-, five- and ten-year

periods, respectively. The Large Cap Value Portfolio was rated against the following numbers of Large Value funds over the following time periods: 1,102 funds overall, 1,102 funds in the last three years, 956 funds in the last five years, and 682 funds in the last ten years. With respect to these Large Value funds, the Large Cap Value Portfolio received an Overall Morningstar Rating™ of «« «« stars and a Morningstar Rating™ of «« «« stars, «««« stars, and «« «« stars for the three-, five- and ten-year periods, respectively. The Small Cap Equity Portfolio (Advisor Class and Institutional Class) was rated against the following numbers of U.S.- Domiciled Small Blend Equity funds over the following time periods; 655 funds overall, 655 funds in the last three years, 559 funds in the last five years and 394 funds in the last ten years. With respect to these Small Blend Equity funds, the Small Cap Equity Portfolio (Advisor Class and Institutional Class) received an Overall Morningstar Rating™ of «««« stars and a Morningstar Rating™ of ««« stars, ««« « stars and «« «« stars for the three-, five- and ten- year periods, respectively. The Strategic Equity Portfolio was rated against the following numbers of U.S.- domiciled Large Blend Equity funds over the following time periods: 1,214 funds overall, 1,214 funds in the last three years, 1,078 funds in the last five years and 794 funds in the last ten years. With respect to these Large Blend Equity funds, the Strategic Equity Portfolio received an Overall Morningstar Rating™ of «« «« stars and a Morningstar Rating™ of «« «« « stars, «««« stars and «« « stars for the three-, five- and ten year periods, respectively. The Total Market Portfolio was rated against the following numbers of U.S.- domiciled Mid-Cap Value funds over the following time periods: 373 funds overall, 373 funds in the last three years, 319 funds in the last five years and 227 funds in the last ten years. With respect to these Mid-Cap Value funds, the Total Market Portfolio received an Overall Morningstar Rating™ of «««« stars and a Morningstar Rating™ of «««« stars, «« «« « stars and «««« stars for the three-, five- and ten-year periods, respectively. Past performance is no guarantee of future results.

| 3 | A basis point equals .01%. |

This material must be preceded or accompanied by a current prospectus.

The Glenmede Fund, Inc. and The Glenmede Portfolios are distributed by Quasar Distributors, LLC. 12/17.

THE GLENMEDE FUND, INC.

Equity Income Portfolio

Launched in December 2016, this year marks the first year of activity for the Glenmede Equity Income Portfolio. The fund, managed by Wade Wescott, focuses not only on dividend yield, but also on dividend growth. The aim of the fund is to achieve a high level of current income and long-term growth of capital consistent with reasonable risk to principal.

The fund attempts to identify stocks of companies that have a dividend yield above the S&P 500 Index at the time of purchase and are expected to be dividend growers in the future. Historically, many companies that have accomplished this have had high profitability, lower payout ratios, and lower financial leverage than average. This forms the basis for the fund’s approach to stock selection.

For an investor in common stocks, the dividend is the only tangible item the shareholder receives on an ongoing basis from the underlying companies. Our approach to dividends and dividend growth can be summarized in the following manner: we believe that a growing dividend can have an upward pull on share prices, and while in down markets, an attractive yield can provide downside support.

Large Cap Value Portfolio

In addition to managing the Equity Income Portfolio, Mr. Wescott also manages the Glenmede Large Cap Value Portfolio. This fund is benchmarked against the Russell 1000® Value Index. This fund attempts to generate long term total return by purchasing stocks that have lower valuations than the overall market. With valuation as the starting point, the stock selection process focuses on companies experiencing better fundamentals than their respective sectors, or the overall market. This fund’s strategy is based on our belief that while valuations can provide good purchase prices, in the longer term, it is fundamentals that drive share prices.

Mr. Wescott has been in the investment management business for almost 30 years, in various roles as an analyst and portfolio manager. Over that time he has continued to refine his approach to both dividend and value stocks. He has been with Glenmede Investment Management for 12 years and has been the portfolio manager of the Equity Income Portfolio since its inception in December 2016 and the Large Cap Value Portfolio since 2008.

THE GLENMEDE FUND, INC.

Core Fixed Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Core Fixed Income Portfolio | | | | | Bloomberg

Barclays Capital

U.S. Aggregate

Bond Index | | | Morningstar

Intermediate-Term

Bond Average | |

Year ended 10/31/17 | | | 0.75% | | | | 0.90% | | | | 1.52% | |

Five Years ended 10/31/17 | | | 1.38% | | | | 2.04% | | | | 2.08% | |

Ten Years ended 10/31/2017 | | | 3.81% | | | | 4.19% | | | | 3.89% | |

Inception (11/17/88) through 10/31/171 | | | 5.87% | | | | 6.32% | | | | 5.69% | |

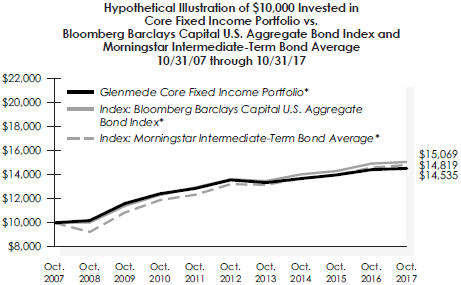

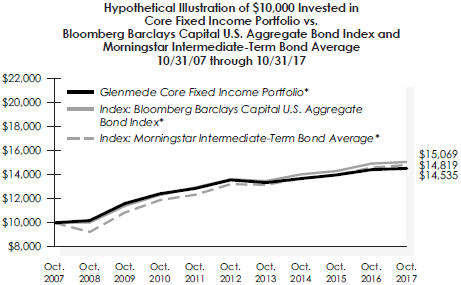

The Core Fixed Income Portfolio seeks to add value by monitoring yield curve exposure while utilizing sector and security selection. Diversification, liquidity, and low risk themes dominate the Portfolio’s investment discipline. The Portfolio returned 0.75% for the fiscal year ended October 31, 2017. The Portfolio’s benchmark, the Bloomberg Barclays Capital U. S. Aggregate Bond Index, returned 0.90% for the fiscal year and the Portfolio’s peer group, the Morningstar Intermediate - Term Bond Average, returned 1.52% for the fiscal year. The Portfolio’s underperformance versus the Bloomberg Barclays Capital U.S. Aggregate Bond Index can be attributed to the lower overall duration relative to the Index, and the Portfolio’s bias towards higher credit quality. The lower tier credits, namely the triple B component of the Index, rallied throughout the fiscal year returning 4.38% versus the double A component returning 1.66%. Our higher quality bias contributed negatively to the Portfolio’s performance. The Portfolio’s underperformance versus its peer group can also be attributed to the Portfolio’s high credit quality bias and low risk themes. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.54%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| 1 | Benchmark returns are for the periods beginning November 30, 1988 for Bloomberg Barclays Capital U.S. Aggregate Bond Index and December 1, 1988 for Morningstar Intermediate-Term Bond Average. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Strategic Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| | | | | | Return After Taxes on | | | | | | | |

| Strategic Equity Portfolio | | Return

Before

Taxes | | | Distributions | | | Distributions

and Sales of

Fund Shares | | | S&P 500

Index | | | Morningstar

Large

Blend Average | |

Year ended 10/31/17 | | | 27.83% | | | | 25.56% | | | | 16.92% | | | | 23.63% | | | | 22.34% | |

Five Years ended 10/31/17 | | | 15.04% | | | | 12.69% | | | | 11.50% | | | | 15.18% | | | | 13.16% | |

Ten Years ended 10/31/17 | | | 7.26% | | | | 6.10% | | | | 5.59% | | | | 7.51% | | | | 5.96% | |

Inception ( 07/20/89) through 10/31/171 | | | 8.94% | | | | 7.54% | | | | 7.20% | | | | 9.81% | | | | 8.27% | |

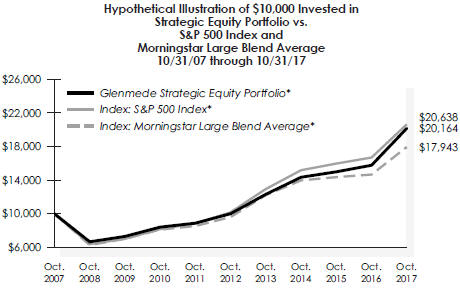

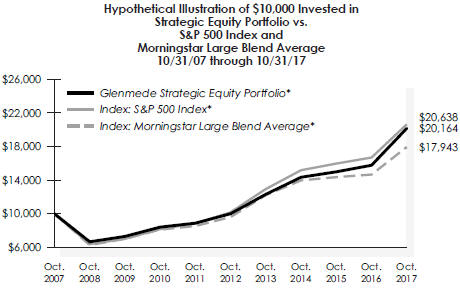

For the fiscal year ended October 31, 2017, the Strategic Equity Portfolio returned 27.83%. The S&P 500 Index returned 23.63% for the same period. Relative performance versus the Index was positive across most sectors. Stock selection was a notable benefit to the Portfolio within the Industrial, Consumer Discretionary and Consumer Staple sectors. The Portfolio’s relative sector allocations were helpful in the Financial, Technology, Real Estate, Telecommunication and Utility sectors. Its focus on owning companies that demonstrate consistently strong profitability also aided relative performance during this period. Relatively weaker stock selection within the Financial, Technology and Energy sectors were partial offsets to the factors previously mentioned, as was the Portfolio’s underweighting of the Materials sector versus the Index. The Portfolio seeks to generate outperformance over time by investing in those companies with strong profitability whose shares are trading at attractive valuations. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.84%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| 1 | Benchmark returns are for the period beginning July 31, 1989. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Small Cap Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | | | | | |

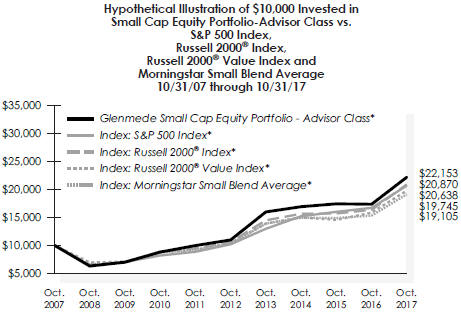

| Average Annual Total Return | |

| Small Cap Equity Portfolio - Advisor Class | | | | | Russell 2000®

Index | | | Russell 2000®

Value Index | | | S&P 500

Index | | | Morningstar

Small

Blend Average | |

Year ended 10/31/17 | | | 27.84% | | | | 27.85% | | | | 24.81% | | | | 23.63% | | | | 24.89% | |

Five Years ended 10/31/17 | | | 15.11% | | | | 14.49% | | | | 13.58% | | | | 15.18% | | | | 13.26% | |

Ten Years ended 10/31/2017 | | | 8.28% | | | | 7.63% | | | | 7.04% | | | | 7.51% | | | | 6.70% | |

Inception (03/01/91) through 10/31/171 | | | 10.95% | | | | 10.28% | | | | 11.69% | | | | 9.82% | | | | 10.51% | |

| | | | | | |

| Small Cap Equity Portfolio - Institutional Class | | | | | | | | | | | | | | | |

Year ended 10/31/17 | | | 28.10% | | | | 27.85% | | | | 24.81% | | | | 23.63% | | | | 24.89% | |

Five Years ended 10/31/17 | | | 15.34% | | | | 14.49% | | | | 13.58% | | | | 15.18% | | | | 13.26% | |

Ten Years ended10/31/17 | | | 8.50% | | | | 7.63% | | | | 7.04% | | | | 7.51% | | | | 6.70% | |

Inception (01/02/98) through 10/31/171,2 | | | 11.13% | | | | 10.28% | | | | 11.69% | | | | 9.82% | | | | 10.51% | |

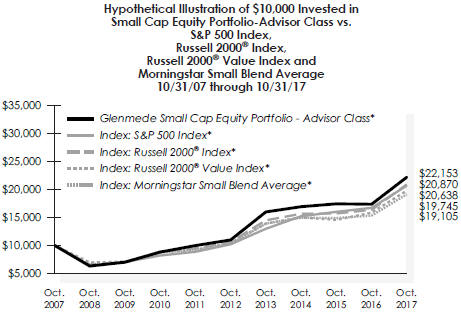

For the fiscal year ended October 31, 2017, the Small Cap Equity Portfolio Advisor Class returned 27.84% and the Small Cap Equity Portfolio Institutional Class returned 28.10%, compared to the Russell 2000® Index return of 27.85% and the Morningstar Small Blend Average return of 24.89%. The consumer sector accounted for the majority of the outper-formance, followed by the basic industry and real estate sectors. The energy sector was the worst performing sector on a relative basis. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.91% and 0.71% for the Advisor and Institutional Class shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

| 1 | Benchmark returns are for the inception period beginning February 28, 1991 for both Russell 2000® Indices and the S&P 500 Index and April 1, 1991 for the Morningstar Small Blend Average. |

| 2 | Average annual total return for the Institutional Class includes the period from 03/01/91 through 10/31/17. Prior to the inception of the Institutional Class on 01/02/98, performance for the Institutional Class is based on the average annual total return of the Advisor Class. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Mid Cap Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

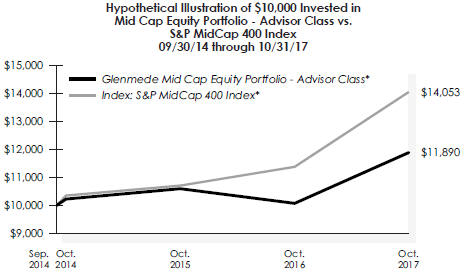

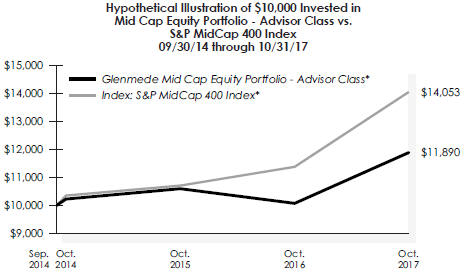

| | | | | | | | |

| Average Annual Total Return | |

| Mid Cap Equity Portfolio - Advisor Class1 | | | | | S&P MidCap

400 Index | |

Year ended 10/31/17 | | | 18.00% | | | | 23.48% | |

Inception (09/30/14) through 10/31/17 | | | 5.77% | | | | 11.66% | |

For the fiscal year ended October 31, 2017, the Mid Cap Equity Portfolio Advisor Class returned 18.00% compared to the S&P MidCap 400 Index return of 23.48%. The consumer sector accounted for the majority of the underperformance, followed by the healthcare and technology sectors. The financial services sector was the best performing sector on a relative basis. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 1.15% for the Advisor Class shares. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| 1 | The Mid Cap Equity Portfolio Institutional Class has not commenced operations. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Large Cap Value Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

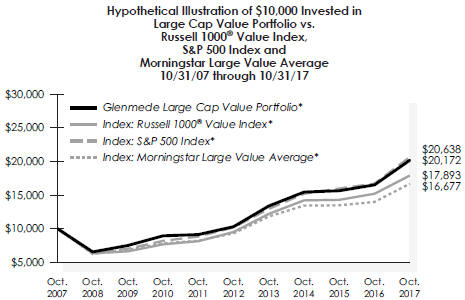

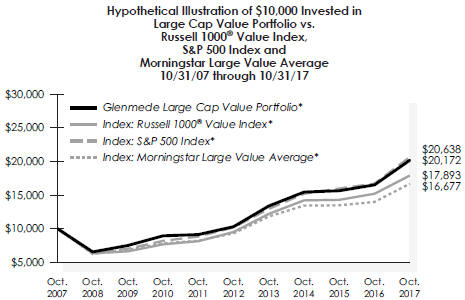

| | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| Large Cap Value Portfolio | | | | | Russell 1000®

Value Index | | | S&P 500

Index | | | Morningstar

Large

Value Average | |

Year ended 10/31/17 | | | 22.17% | | | | 17.78% | | | | 23.63% | | | | 19.35% | |

Five Years ended 10/31/17 | | | 14.40% | | | | 13.48% | | | | 15.18% | | | | 12.32% | |

Ten Years ended 10/31/2017 | | | 7.27% | | | | 5.99% | | | | 7.51% | | | | 5.23% | |

Inception (01/04/93) through 10/31/171 | | | 9.45% | | | | 9.93% | | | | 9.58% | | | | 8.32% | |

For the fiscal year ended October 31, 2017, the Large Cap Value Portfolio returned 22.17% versus 17.78% for its benchmark, the Russell 1000® Value Index. Performance was driven both by stock selection and sector allocation, with stock selection being the primary driver. Looking across sectors, Technology, Industrials, and Energy contributed to much of our relative outperformance. Consumer Staples was the only sector with a negative relative contribution, while Telecom and Consumer Discretionary were virtual ties. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.91%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| 1 | Benchmark returns are for the period beginning December 31, 1992. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

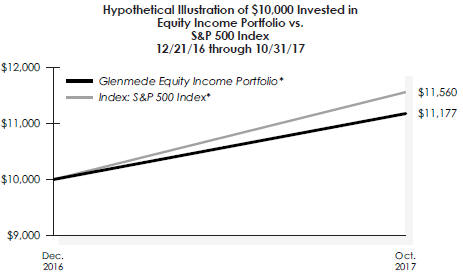

Equity Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

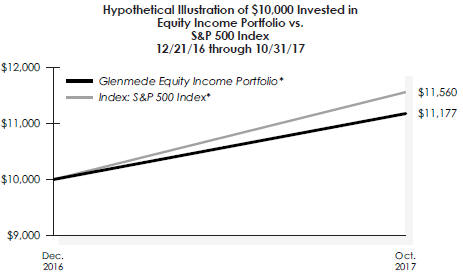

| | | | | | | | |

| Average Annual Total Return | |

| Equity Income Portfolio | | | | | S&P 500

Index | |

Since Inception (12/21/16) through 10/31/17 | | | 11.77% | | | | 15.60% | |

For the period ended October 31, 2017, the Equity Income Portfolio returned 11.77% versus 15.60% for its benchmark, the S&P 500 Index. Most of this performance gap can be attributed to the underperformance of the Portfolio’s dividend yield stocks, which we define as stocks with a dividend yield greater than that of the S&P 500 Index. Looking at relative performance across sectors, Technology, Consumer Discretionary, and Consumer Staples were the most significant detractors. Positive relative performance came from the Industrials, Energy, and Utilities sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 2.63%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

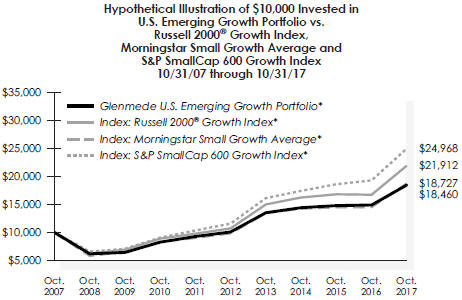

U.S. Emerging Growth Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| | | Return After Taxes on | | | S&P Small Cap

600

Growth Index | | | Russell 2000®

Growth Index | | | Morningstar

Small

Growth Average | |

| U.S. Emerging Growth Portfolio | | Return

Before

Taxes | | | Distributions | | | Distributions

and Sale of

Fund Shares | | | | |

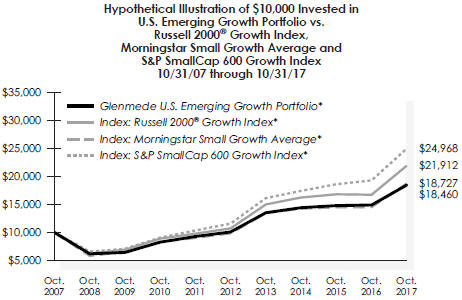

Year ended 10/31/17 | | | 23.91% | | | | 23.80% | | | | 13.58% | | | | 29.44% | | | | 31.00% | | | | 28.98% | |

Five Years ended 10/31/17 | | | 12.84% | | | | 12.14% | | | | 10.16% | | | | 16.61% | | | | 15.36% | | | | 13.70% | |

Ten Years ended 10/31/17 | | | 6.32% | | | | 5.99% | | | | 5.04% | | | | 9.58% | | | | 8.16% | | | | 6.46% | |

Inception (12/29/99) through 10/31/171 | | | 2.09% | | | | 1.86% | | | | 1.62% | | | | 10.00% | | | | 5.41% | | | | 5.51% | |

For the fiscal year ended October 31, 2017, the Portfolio underperformed the S&P SmallCap 600 Growth Index by 5.53%, the Russell 2000® Growth Index by 7.09% and the Morningstar Small Growth Average by 5.07%, respectively. In the past fiscal year, the Portfolio’s performance had mixed effects from multifactor ranking models which biased the Portfolio towards stocks with lower valuations, favorable fundamentals, positive earnings/revenue estimate trends and technicals. Leading industry group indicators were positive to performance, including relative overweighting of health care and underweighting of energy stocks. The Portfolio had positive relative stock performance in six of eleven sectors versus the S&P SmallCap 600 Growth Index. The most favorable contributions from stock selection came in real estate and consumer staples sectors. The most negative relative contributions from stock selection were in information technology and industrials sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.94%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report. The Portfolio was liquidated on November 15, 2017.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Portfolio was liquidated on November 15, 2017 and therefore there are no more recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| 1 | Benchmark returns are for the period beginning December 31, 1999. |

The indices and certain terms are defined on pages 25 to 25.

THE GLENMEDE FUND, INC.

Large Cap Core Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| | | | Return After Taxes on | | | Russell 1000®

Index | | | Morningstar

Large Blend

Average | |

| Large Cap Core Portfolio - Advisor Class | | Return

Before

Taxes | | | Distributions | | | Distributions

and Sales of

Fund Shares | | | |

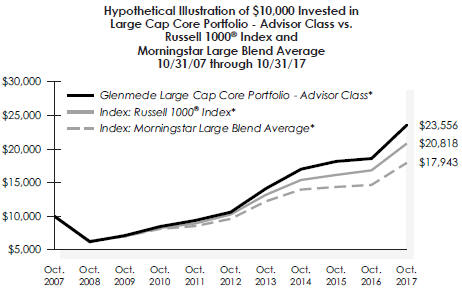

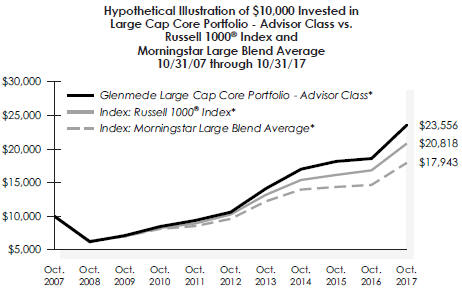

Year ended 10/31/17 | | | 26.74% | | | | 26.30% | | | | 15.17% | | | | 23.67% | | | | 22.34% | |

Five Years ended 10/31/17 | | | 17.29% | | | | 16.67% | | | | 13.88% | | | | 15.18% | | | | 13.16% | |

Ten Years ended 10/31/17 | | | 8.95% | | | | 8.57% | | | | 7.24% | | | | 7.61% | | | | 5.96% | |

Inception (02/27/04) through 10/31/171 | | | 9.73% | | | | 9.36% | | | | 8.12% | | | | 8.53% | | | | 7.12% | |

Large Cap Core Portfolio - Institutional Class | | | | | | | | | | | | | | | |

Year ended 10/31/17 | | | 26.96% | | | | 26.43% | | | | 15.30% | | | | 23.67% | | | | 22.34% | |

Inception (12/30/15) through 10/31/171,2 | | | 9.93% | | | | 9.55% | | | | 8.29% | | | | 8.53% | | | | 7.12% | |

For the fiscal year ended October 31, 2017, the Portfolio outperformed the Russell 1000® Index by 3.07% and outper-formed the Morningstar Large Blend Average by 4.40%. In the past fiscal year, the Portfolio’s performance was positively impacted from multifactor ranking models with biases towards stocks with lower valuations, favorable fundamentals and positive earnings/revenue estimate trends. In addition, avoiding stocks based on downside risk screens (including sell rankings, earnings surprise indicators and earnings quality measures) had a favorable effect. Leading industry group indicators were positive to performance, including relative overweightings of health care/financials/technology and underweightings of telecom/energy/consumer discretionary stocks. The Portfolio had positive relative stock performance in six of eleven sectors. The most favorable contributions from stock selection came in health care and industrials sectors. The most negative contributions from stock selection were in consumer discretionary and telecommunication services sectors. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2017 Prospectuses, are 0.88% (Advisor Class) and 0.68% (Institutional Class), respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights sections of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| 1 | Benchmark returns are for the period beginning February 28, 2004. |

| 2 | Average annual total return for the Institutional Class includes the period from 02/27/04 through 10/31/17. Prior to the inception of the Institutional Class on 12/30/15, performance for the Institutional Class is based on the average annual total return of the Advisor Class. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Large Cap Growth Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| | | | | | Return After Taxes on | | | | | | | |

| Large Cap Growth Portfolio - Advisor Class | | Return

Before

Taxes | | | Distributions | | | Distributions

and Sales of

Fund Shares | | | Russell 1000®

Growth Index | | | Morningstar

Large Growth

Average | |

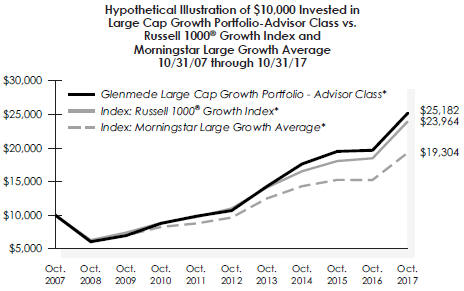

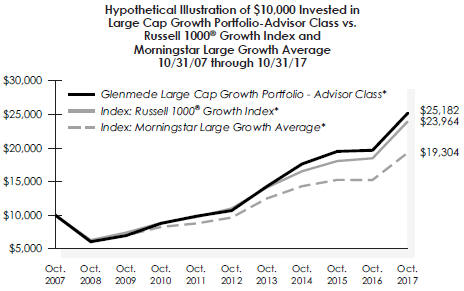

Year ended 10/31/17 | | | 28.05% | | | | 27.80% | | | | 15.89% | | | | 29.71% | | | | 26.56% | |

Five Years ended 10/31/17 | | | 18.68% | | | | 18.11% | | | | 15.06% | | | | 16.83% | | | | 14.86% | |

Ten Years ended 10/31/17 | | | 9.68% | | | | 9.37% | | | | 7.89% | | | | 9.13% | | | | 6.80% | |

Inception (02/27/04) through 10/31/171 | | | 10.18% | | | | 9.89% | | | | 8.55% | | | | 9.15% | | | | 7.66% | |

| | | | | | |

| Large Cap Growth Portfolio - Institutional Class | | | | | | | | | | | | | | | |

Year ended 10/31/17 | | | 28.28% | | | | 27.94% | | | | 16.03% | | | | 29.71% | | | | 26.56% | |

Inception (11/05/15) through 10/31/171,2 | | | 10.39% | | | | 10.09% | | | | 8.73% | | | | 9.15% | | | | 7.66% | |

For the fiscal year ended October 31, 2017, the Portfolio underperformed the Russell 1000® Growth Index by 1.66% and outperformed the Morningstar Large Growth Average by 1.49%, respectively. In the past fiscal year, the Portfolio’s performance had mixed effects from multifactor ranking models, including biases towards stocks with lower valuations, favorable fundamentals, positive earnings/revenue estimate trends and technicals. The Portfolio benefitted from avoiding stocks based on downside risk screens (including sell rankings, earnings surprise indicators and earnings quality measures). Leading industry group indicators were positive to performance, including relative overweightings of health care/financials/technology and underweightings of telecom/energy/consumer discretionary stocks. The Portfolio had positive relative stock performance in six of ten sectors. The most favorable contributions from stock selection came in real estate and materials sectors. The most negative contributions from stock selection were in consumer discretionary and industrial sectors. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2017 Prospectuses, are 0.88% (Advisor Class) and 0.68% (Institutional Class), respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights sections of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| 1 | Benchmark returns are for the period beginning February 28, 2004. |

| 2 | Average annual total return for the Institutional Class includes the period from 02/27/04 through 10/31/17. Prior to the inception of the Institutional Class on 11/05/15, performance for the Institutional Class is based on the average annual total return of the Advisor Class. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Long/Short Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| Long/Short Portfolio | | | | | Bloomberg

Barclays Capital

U.S. Treasury

Bellwether

3-Month Index | | | Russell 3000®

Index | | | Morningstar

Long/Short

Average | |

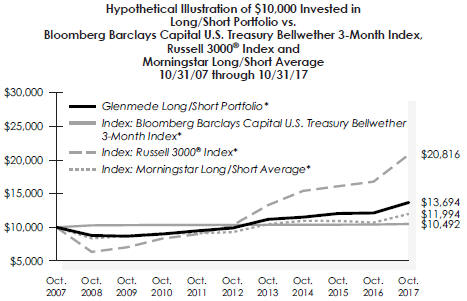

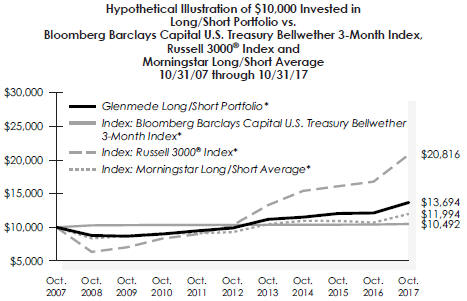

Year ended 10/31/17 | | | 12.91% | | | | 0.73% | | | | 23.98% | | | | 12.09% | |

Five Years ended 10/31/17 | | | 6.72% | | | | 0.25% | | | | 15.12% | | | | 5.02% | |

Ten Years ended 10/31/2017 | | | 3.19% | | | | 0.48% | | | | 7.61% | | | | 1.72% | |

Inception (09/29/06) through 10/31/171 | | | 2.69% | | | | 0.93% | | | | 8.46% | | | | 2.24% | |

For the fiscal year ended October 31, 2017, the Portfolio outperformed the Bloomberg Barclays Capital U.S. Treasury Bellwether 3-Month Index by 12.18% and outperformed Morningstar Long/Short Average by 0.82%, respectively. Over the past fiscal year, average net equity exposure for the Portfolio was about 30%. The Portfolio’s performance had positive contributions from multifactor ranking models with biases towards stocks with lower valuations, favorable fundamentals, positive earnings/revenue estimate trends and technicals. The Portfolio’s long stock positions (+27.9%) outperformed short positions (+17.6%) by about 10.3%. Overall, the Portfolio had positive relative stock performance in six of eleven sectors. The most favorable contributions from stock selection came in health care and consumer discretionary sectors. The most negative contributions from stock selection were in real estate and consumer staples sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 2.72%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| 1 | Benchmark returns are for the periods beginning September 30, 2006 for the Russell 3000® Index and October 1, 2006 for Morningstar Long/Short Average. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Total Market Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

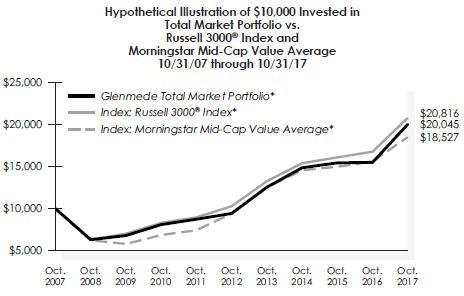

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Total Market Portfolio | | | | | Russell 3000®

Index | | | Morningstar

Mid-Cap Value

Average | |

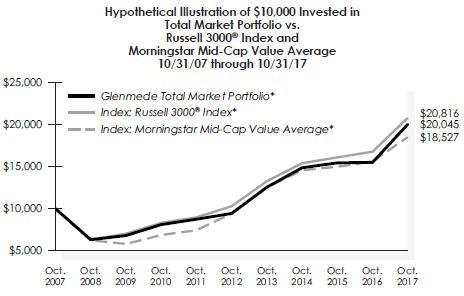

Year ended 10/31/17 | | | 29.18% | | | | 23.98% | | | | 18.48% | |

Five Years ended 10/31/17 | | | 16.25% | | | | 15.12% | | | | 13.08% | |

Ten Years ended 10/31/2017 | | | 7.20% | | | | 7.61% | | | | 6.85% | |

Inception (12/21/06) through 10/31/171 | | | 7.03% | | | | 7.97% | | | | 7.00% | |

The goal of the Total Market Portfolio is to provide additional return relative to a long only equity strategy by investing in incremental long positions of attractive stocks (approximately 100% to 150% of net portfolio value) and shorting unattractive stocks (about 0% to 50% of net portfolio value). For the fiscal year ended October 31, 2017, the Portfolio outperformed the Russell 3000® Index by 5.20% and the Morningstar Mid-Cap Value Average by 10.70%, respectively. The Portfolio’s performance had positive effects from multifactor ranking models with biases towards stocks with lower valuations, favorable fundamentals, positive earnings/revenue estimate trends and technicals. The Portfolio’s long stock positions (+28.2%) outperformed the short positions (+17.2%) by about 11%. Overall, the Portfolio had positive relative stock performance in six of eleven sectors relative to the Russell 3000® Index. The most favorable contributions from stock selection came in health care and energy sectors. The most negative contributions from stock selection were in utilities and information technology sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 2.38%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| 1 | Benchmark returns are for the periods beginning December 31, 2006 for the Russell 3000® Index and January 1, 2007 for Morningstar Mid-Cap Value Average. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

High Yield Municipal Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| High Yield Municipal Portfolio | | | | | Bloomberg Barclays

Municipal Bond

Index | | | Bloomberg

Barclays

Muni BBB

Index | | | Bloomberg

Barclays

Muni High Yield 5%

Tobacco Cap 2%

Issuer Cap Index | | | Morningstar

High Yield

Muni

Average | |

Year ended 10/31/17 | | | 2.89% | | | | 2.19% | | | | 4.17% | | | | 2.91% | | | | 1.98% | |

Inception (12/22/15) through 10/31/171 | | | 4.53% | | | | 2.81% | | | | 4.31% | | | | 5.26% | | | | 3.82% | |

The High Yield Municipal Portfolio trailed the Bloomberg Barclays Municipal High Yield 5% Tobacco Cap 2% Issuer Cap Index, for the trailing 12 months through October 31, 2017. The Portfolio returned 2.89% while the Index returned 2.91%. The Portfolio had an excess return of 0.91% relative to the Morningstar High Yield Municipal fund peer group, which returned 1.98% over the same time period. The Portfolio’s duration and underweight tobacco were detractors, while allocations to General Obligation, utilities and underweight to Sales Tax revenue were additive. The Portfolio continued to maintain exposure to higher credit quality, so as to be consistent with the Portfolio’s goal of a high level of current income exempt from regular federal income tax. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 1.09%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect during certain periods and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| 1 | Benchmark return is for the period beginning January 1, 2016 for the Morningstar High Yield Muni Average. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

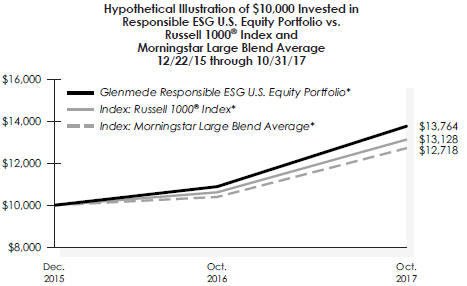

Responsible ESG U.S. Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Responsible ESG U.S. Equity Portfolio | | | | | Russell 1000®

Index | | | Morningstar

Large Blend

Average | |

Year ended 10/31/17 | | | 26.42% | | | | 23.67% | | | | 22.34% | |

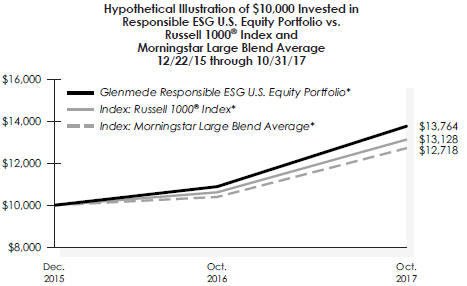

Inception (12/22/15) through 10/31/171 | | | 18.70% | | | | 15.77% | | | | 13.96% | |

For the fiscal year ended October 31, 2017, the Portfolio outperformed the Russell 1000® Index by 2.75% and Morningstar Large Blend Average by 4.08%, respectively. The Portfolio selects stocks based on combination of multi-factor models and ESG ratings (environmental, socially responsible and governance). In the past fiscal year, the Portfolio benefitted from having holdings with better ESG ratings. The Portfolio’s performance was positively impacted from multifactor ranking models with biases towards stocks with lower valuations, favorable fundamentals and positive earnings/ revenue estimate trends. In addition, avoiding stocks based on downside risk screens (including sell rankings, earnings surprise indicators and earnings quality measures) had a favorable effect. Leading industry group indicators were positive to performance, including relative overweightings of health care/financials/technology and underweightings of telecom/energy stocks. The Portfolio had positive relative stock performance in seven of eleven sectors. The most favorable contributions from stock selection came in industrials and energy sectors. The most negative contributions from stock selection were in consumer discretionary and real estate sectors. The Portfolio’s gross annual operating expense ratio, as stated in February 28, 2017 Prospectus, is 2.22%. This ratio can fluctuate and may differ from expense ratio disclosed in Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| 1 | Benchmark returns are for the periods beginning December 22, 2015 for the Russell 1000® Index and January 1, 2016 for Morningstar Large Blend Average. |

The indices and certain terms are defined on pages 25 to 26.

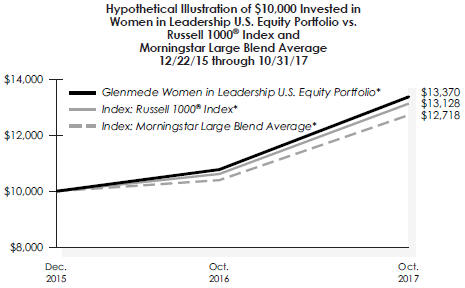

THE GLENMEDE FUND, INC.

Women in Leadership U.S. Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Women in Leadership U.S. Equity Portfolio | | | | | Russell 1000®

Index | | | Morningstar

Large Blend

Average | |

Year ended 10/31/17 | | | 24.11% | | | | 23.67% | | | | 22.34% | |

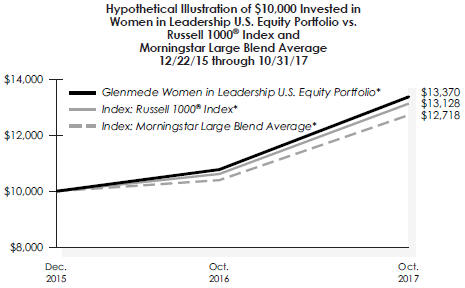

Inception (12/22/15) through 10/31/171 | | | 16.87% | | | | 15.77% | | | | 13.96% | |

For the fiscal year ended October 31, 2017, the Portfolio outperformed the Russell 1000® Index by 0.44% and Morningstar Large Blend Average by 1.77%, respectively. The Portfolio selects stocks based on companies that meet specific women in leadership criteria (including, but not limited to, a chairwoman, female board members, a female chief executive officer or women in management positions). The Portfolio’s performance was positively impacted from multifactor ranking models with biases towards stocks with lower valuations, favorable fundamentals and positive earnings/ revenue estimate trends. In addition, avoiding stocks based on downside risk screens (including sell rankings, earnings surprise indicators and earnings quality measures) had a favorable effect. Leading industry group indicators were positive to performance, including relative overweightings of health care/financials/technology and underweightings of telecom/energy stocks. The Portfolio had positive relative stock performance in six of eleven sectors. The most favorable contributions from stock selection came in energy and health care sectors. The most negative contributions from stock selection were in consumer discretionary and information technology sectors. The Portfolio’s gross annual operating expense ratio, as stated in February 28, 2017 Prospectus, is 2.23%. This ratio can fluctuate and may differ from expense ratio disclosed in Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| 1 | Benchmark returns are for the periods beginning December 22, 2015 for the Russell 1000® Index and January 1, 2016 for Morningstar Large Blend Average. |

The indices and certain terms are defined on pages 25 to 26.

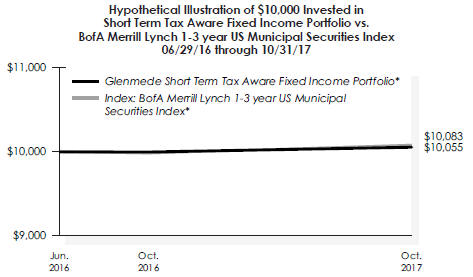

THE GLENMEDE FUND, INC.

Short Term Tax Aware Fixed Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | | | | | |

| Average Annual Total Return | |

| | | | | | Return After Taxes on | | | | |

| Short Term Tax Aware Fixed Income Portfolio | | Return

Before

Taxes | | | Distributions | | | Distributions

and Sales of

Fund Shares | | | BofA

Merrill Lynch

1-3 year

US Municipal

Securities Index | |

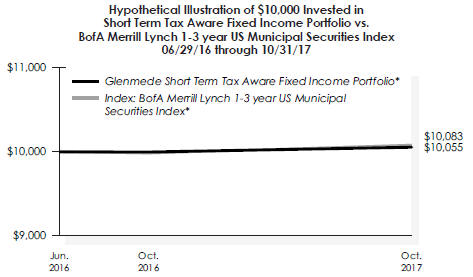

Year ended 10/31/17 | | | 0.57% | | | | 0.31% | | | | 0.35% | | | | 1.00% | |

Inception (06/29/16) through 10/31/171 | | | 0.41% | | | | 0.20% | | | | 0.24% | | | | 0.62% | |

For the fiscal year ended October 31, 2017, the Short Term Tax Aware Fixed Income Portfolio underperformed its primary benchmark, the BofA Merrill Lynch 1-3 Year US Municipal Securities Index. The Portfolio’s duration was kept in-line with the benchmark duration consistently over the period. The Portfolio experienced a drag on its performance from its tactical exposure to taxable securities which underperformed tax-exempt municipal securities. This tactical exposure to taxable securities was reduced throughout the fiscal year so as to be consistent with the Portfolio’s goals of generating after-tax total return consistent with reasonable preservation of capital. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.91%. This rate can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights in this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| 1 | Benchmark returns are for the periods beginning June 29, 2016 for the BofA Merrill Lynch 1-3 Year US Municipal Securities Index. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Secured Options Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Secured Options Portfolio - Advisor Class | | | | | S&P 500

Index | | | CBOE S&P 500

Buy-Write

Index | |

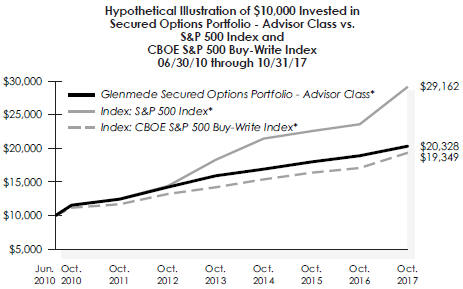

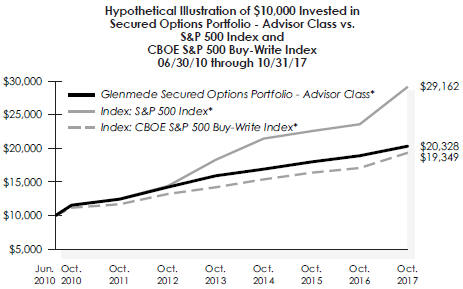

Year ended 10/31/17 | | | 7.53% | | | | 23.63% | | | | 13.26% | |

Five Years ended 10/31/17 | | | 7.39% | | | | 15.18% | | | | 7.92% | |

Inception (06/30/10) through 10/31/17 | | | 10.15% | | | | 15.71% | | | | 9.41% | |

| | | | |

| Secured Options Portfolio - Institutional Class | | | | | | | | | |

Inception (11/09/16) through 10/31/171 | | | 10.41% | | | | 15.71% | | | | 9.41% | |

For the fiscal year ended October 31, 2017, the Secured Options Portfolio purchased and wrote put and call options in an effort to reduce share price volatility, obtain option premiums and provide more stable returns. For this period, the Portfolio achieved a total return of 7.53% while its benchmark, the CBOE S&P 500 Buy-Write Index, returned 13.26% and the S&P 500 Index returned 23.63%. The Portfolio’s underperformance relative to the CBOE S&P 500 Buy-Write Index was caused primarily by the Portfolio’s more defensive positioning throughout the fiscal year. For the period, the written put options with lower strike prices than the CBOE S&P 500 Buy-Write Index provided a larger downside cushion and offered better risk-adjusted returns, while the written call options and generally helped to reduce share price volatility by approximately two-thirds as compared to the S&P 500 Index. Generally speaking, equity securities or cash positions are pledged to secure the written option positions. The Portfolio’s upside underperformance relative to the S&P 500 Index was better than expected given the risk reduction. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2017 Prospectuses, are 0.85% (Advisor Class) and 0.65% (Institutional Class), respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights sections of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

| 1 | Average annual total return for the Institutional Class includes the period from 06/30/10 through 10/31/17. Prior to the inception of the Institutional Class on 11/09/16, performance for the Institutional Class is based on the average annual total return of the Advisor Class. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

Global Secured Options Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

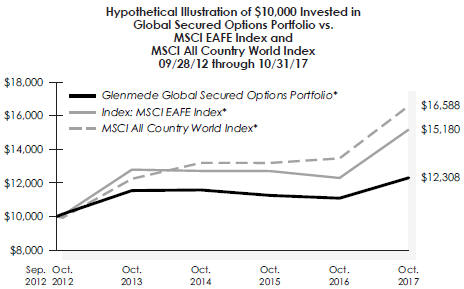

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Global Secured Options Portfolio1 | | | | | MSCI All

Country World

Index2 | | | MSCI

EAFE

Index | |

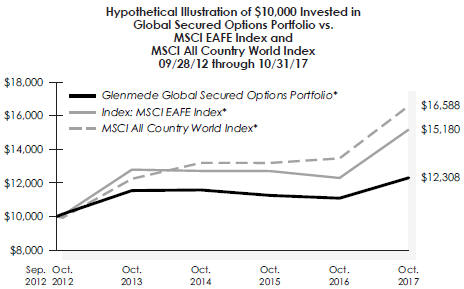

Year ended 10/31/17 | | | 10.94% | | | | 23.20% | | | | 23.44% | |

Five Years ended 10/31/17 | | | 3.93% | | | | 10.80% | | | | 8.53% | |

Inception (09/28/12) through 10/31/17 | | | 4.16% | | | | 10.33% | | | | 8.32% | |

For the fiscal year ended October 31, 2017, the Global Secured Options Portfolio wrote put and call options in an effort to reduce share price volatility, obtain option premiums and provide more stable returns. Risk reduction reduced our price swings relative to the benchmark. For this period, the Portfolio had a total return of 10.94% while its benchmark, the MSCI All Country World (ACWI) Index, returned 23.20%. Covered call and cash-secured put strategies utilized by the Portfolio are expected to underperform the underlying index in strong up markets. For the period, the put options helped to increase the Portfolio’s performance, while the call options generally helped to reduce share price volatility by approximately one-half as compared to the MSCI ACWI Index. Generally speaking, equity securities or cash positions are pledged to secure the written option positions. The Portfolio’s gross annual operating expense ratio, as stated in the May 5, 2017 Prospectus, is 0.99%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| 1 | Formerly known as International Secured Options Portfolio. |

| 2 | Effective May 1, 2017, the Portfolio’s benchmark changed from the MSCI EAFE Index to the MSCI All Country World Index as a result of the change in the Portfolio’s principal investment strategies to permit increased exposure to U.S. investments in addition to foreign investments. |

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

International Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

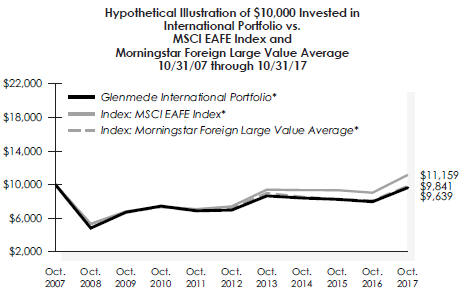

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return | | | | |

| | | | | | Return After Taxes on | | | | | | | |

| International Portfolio | | Return

Before

Taxes | | | Distributions | | | Distributions

and Sales of

Fund Shares | | | MSCI EAFE

Index | | | Morningstar

Foreign Large

Value Average | |

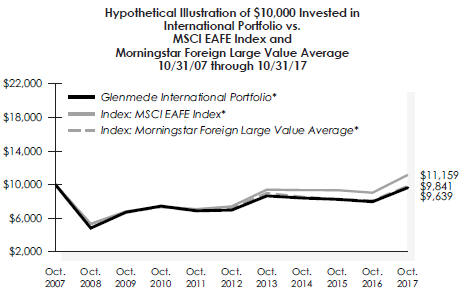

Year ended 10/31/17 | | | 20.96% | | | | 20.07% | | | | 11.87% | | | | 23.44% | | | | 21.31% | |

Five Years ended 10/31/17 | | | 6.69% | | | | 6.30% | | | | 5.21% | | | | 8.53% | | | | 7.43% | |

Ten Years ended 10/31/17 | | | -0.37% | | | | -0.70% | | | | -0.19% | | | | 1.10% | | | | 0.30% | |

Inception (11/17/88) through 10/31/171 | | | 6.95% | | | | 5.66% | | | | 5.59% | | | | 4.81% | | | | 6.69% | |

For the fiscal year ended October 31, 2017, the Portfolio underperformed the MSCI EAFE Index by 2.48% and Morningstar Foreign Large Value Average by 0.35%, respectively. The Portfolio’s performance had mixed effects from multifactor ranking models that biased the Portfolio towards stocks with lower valuations, favorable fundamentals, positive earnings/revenue estimate trends and technicals. The performance was negatively impacted by leading country/ region indicators with relative overweightings in Pacific Rim stocks and underweightings of Italian/Spanish stocks, respectively. The Portfolio had positive relative stock performance in four of eleven sectors. The most favorable contributions from stock selection came in the industrials and real estate sectors. The most negative contributions from stock selection were in consumer staples and materials sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 1.11%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted above reflects fee waivers in effect during certain periods and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns other than after tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| 1 | Benchmark returns are for the period beginning November 30, 1988. |

The indices and certain terms are defined on pages 25 to 26.

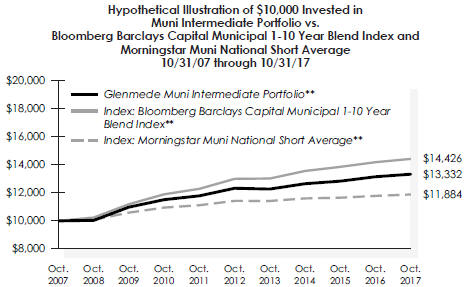

THE GLENMEDE PORTFOLIOS

Muni Intermediate Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2017

| | | | | | | | | | | | |

| Average Annual Total Return | |

| Muni Intermediate Portfolio | | | | | Bloomberg

Barclays Capital

Municipal

1-10 Year Blend

Index | | | Morningstar

Muni National

Short Average | |

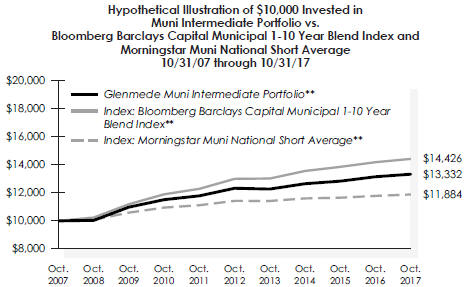

Year ended 10/31/17 | | | 1.38% | | | | 1.67% | | | | 0.86% | |

Five Years ended 10/31/17 | | | 1.58% | | | | 2.10% | | | | 0.78% | |

Ten Years ended 10/31/2017 | | | 2.92% | | | | 3.73% | | | | 1.74% | |

Inception (06/05/92) through 10/31/17 | | | 4.03% | | | | N/A | * | | | 2.97% | |

For the fiscal year ended October 31, 2017, the Muni Intermediate Portfolio underperformed its primary benchmark, the Bloomberg Barclays Capital Municipal 1-10 Year Blend Index. The Portfolio’s duration was kept marginally below the benchmark duration consistently throughout the year in anticipation of the Federal Reserve continuing to hike short-term rates. While the market saw interest rates rise in November and December following the Presidential election, rates moved steadily lower throughout the remainder of the fiscal year despite the Federal Reserve raising interest rates three times during that time period, which contributed to the Portfolio’s underperformance. A lack of supply of new issuance debt, in conjunction with continued strong demand for the asset class from investors, caused lower credit quality to outperform. This also contributed to the Portfolio’s underperformance as the Portfolio continued to maintain exposure to higher credit quality, so as to be consistent with the Portfolio’s goals of principal preservation and high current tax exempt interest income generation. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2017 Prospectus, is 0.25%. This rate can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights in this report.

| * | Index commenced 6/30/93. Thus Portfolio inception comparisons are not provided. |

| ** | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

The indices and certain terms are defined on pages 25 to 26.

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

Glossary of Indices & Terms

Indices — It is not possible to invest directly in an index.

The Bloomberg Barclays Capital Municipal 1-10 Year Blend Index is a composite index made up of several different broad sub-indices: the Barclays Capital Municipal 1-Year Index; Barclays Capital Municipal 3-Year Index; Barclays Capital Municipal 5-Year Index; Barclays Capital Municipal 7-Year Index and the Barclays Capital Municipal 10-Year Index. The total of all these indices represents all maturities between 1-10 Years.

The Bloomberg Barclays Capital U.S. Treasury Bellwether 3-Month Index is a market value-weighted index of investment-grade fixed-rate public obligations of the U.S. Treasury with maturities of 3 months, excluding zero coupon strips.

The Bloomberg Barclays Capital U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Indexes are rebalanced by market capitalization each month.

The Bloomberg Barclays Muni BBB Index is a sub-index of the Bloomberg Barclays U.S. Municipal Index that includes only bonds rated BBB on the day the Index resets. The rating is established using the middle rating of Moody’s Investor Services, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc.

The Bloomberg Barclays Muni High Yield 5% Tobacco 2% Issuer Cap Index is an issuer constrained sub-index of the Bloomberg Barclays US Municipal High Yield Index that caps issuer exposure to 2% and tobacco stocks to 5%.

The Bloomberg Barclays Municipal Bond Index is an unmanaged index of municipal bonds with maturities greater than two years.

The BofA Merrill Lynch 1-3 Year US Municipal Securities Index is a subset of The BofA Merrill Lynch US Municipal Securities Index including all securities with a remaining term to final maturity less than 3 years.

The CBOE S&P 500 Buy-Write Index is an index designed to track the performance of a hypothetical covered call strategy on the S&P 500 Index.

The MSCI ACWI Index is an unmanaged market capitalization weighted index consisting of equity total returns throughout the world.

The MSCI EAFE Index is an unmanaged capitalization weighted composite portfolio consisting of equity total returns of countries in Australia, New Zealand, Europe and the Far East.

The Russell 1000® Index is an unmanaged market capitalization weighted total return index which is comprised of the 1,000 largest companies in the Russell 3000® Index.

The Russell 1000® Growth Index is an unmanaged capitalization weighted total return index which is comprised of securities in the Russell 1000® Index with greater than average growth orientation.

The Russell 1000® Value Index is an unmanaged capitalization weighted total return index which is comprised of those securities in the Russell 1000® Index with a less than average growth orientation.

The Russell 2000® Growth Index is an unmanaged capitalization weighted total return index which is comprised of those securities in the Russell 2000® Index with greater than average growth orientation.

The Russell 2000® Index is an unmanaged market capitalization weighted total return index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index.