UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811- 05635)

Exact name of registrant as specified in charter: Putnam Diversified Income Trust

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| | | |

| Name and address of agent for service: | | Beth S. Mazor, Vice President | |

| | | One Post Office Square | |

| | | Boston, Massachusetts 02109 | |

| | |

| Copy to: | | John W. Gerstmayr, Esq. | |

| | | Ropes & Gray LLP | |

| | | One International Place | |

| | | Boston, Massachusetts 02110 | |

Registrant’s telephone number, including area code: (617) 292-1000

Date of fiscal year end: September 30, 2008

Date of reporting period: October 1, 2007 — March 31, 2008

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

With a focus on investment performance, below-average expenses, and in-depth information about our funds, we put the interests of investors first and seek to set the standard for integrity and service.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam

Diversified

Income Trust

3 | 31 | 08

Semiannual Report

| |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Performance snapshot | 6 |

| Interview with your fund’s Portfolio Leader | 7 |

| Performance in depth | 13 |

| Expenses | 16 |

| Portfolio turnover | 18 |

| Risk | 19 |

| Your fund’s management | 20 |

| Terms and definitions | 22 |

| Trustee approval of management contract | 24 |

| Other information for shareholders | 29 |

| Financial statements | 30 |

Cover photograph: © Richard H. Johnson

Message from the Trustees

Dear Fellow Shareholder:

Challenges continued to mount for investors in the first quarter of 2008. The markets struggled as economic news — from falling housing prices to rising inflation — painted a gloomy backdrop to an already-difficult situation. Many economists now believe that the United States is in or near recession. Fortunately, the Federal Reserve Board (the Fed) and federal lawmakers have reacted quickly, employing creative and, in some instances, unprecedented moves to ameliorate the situation. As of this writing, the Fed has cut rates a total of 3.25 percentage points since last September and added nearly $400 billion in liquidity to the credit markets. In a historic move, the Fed also provided financing to facilitate JPMorgan Chase’s buyout of investment bank Bear Stearns, which was on the brink of failure. In February, lawmakers, working with the president, approved an economic stimulus package that will put $168 billion into the hands of millions of U.S. taxpayers startin g this month.

As investors it is important to keep a long-term perspective and remember the counsel of your financial representative during times like these. Markets can recover quickly, and investors who sit on the sidelines run the risk of missing the rebound. The normal condition of the economy and corporate earnings is one of growth, albeit with occasional interruptions. What’s more, recessions in the United States are usually short-lived compared with economic expansions. Since 1960, the economy has experienced 7 recessions lasting an average of 11 months, versus 64 months for the average expansion. Perhaps most important is the value that a properly diversified portfolio can offer by balancing areas of weakness with areas of strength.

2

Starting this month, we have changed the portfolio manager’s commentary in this report to a question-and-answer format. We feel this new approach makes the information more readable and accessible, and we hope you think so as well.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam Investments.

Putnam Diversified Income Trust: Seeking broad

diversification across global bond markets

When Putnam Diversified Income Trust was launched in 1988, its three-pronged focus on U.S. investment-grade bonds, high-yield corporate bonds, and non-U.S. bonds was considered innovative. Lower-rated, higher-yielding corporate bonds were relatively new, having just been established in the late 1970s. And, at the time of the fund’s launch, few investors were venturing outside the United States for fixed-income opportunities.

The bond investment landscape has undergone a transformation in the nearly two decades since. New sectors like mortgage-and asset-backed securities now make up over one third of the U.S. investment-grade market. The high-yield corporate bond sector has also grown significantly. Outside the United States, the popularity of the euro has resulted in a large market of European government bonds. There are also growing opportunities to invest in the government and corporate debt of emerging-market countries.

The fund’s investment perspective has been broadened to keep pace with the market expansion over time. To process the market’s increasing complexity, Putnam’s nearly 100-member fixed-income group aligns teams of specialists with varied investment opportunities. Each team identifies compelling strategies within its area of expertise. Your fund’s management team selects from among these strategies, striving to systematically build a diversified portfolio that carefully balances risk and return.

We believe the fund’s multi-strategy approach is well suited to the expanding opportunities of today’s global bond marketplace. As different factors drive the performance of the various fixed-income sectors, the fund’s diversified strategy seeks to take advantage of changing market leadership in pursuit of high current income consistent with capital preservation.

International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Unlike bonds, bond funds have ongoing fees and expenses. The use of derivatives involves special risks and may result in losses.

Key drivers of fixed-income returns

Government

Interest-rate levels are a primary driver of performance. Generally, bond prices decline when interest rates rise, and rise when interest rates fall. Interest rates — and bond yields — rise and fall according to investor expectations about the health of the economy. Differences in countries’ economic cycles and currency values create opportunities for global investors.

Credit

Corporate bond performance tends to track the health of the overall economy more closely than other bonds. These bonds are less sensitive to interest-rate movements and tend to perform well when the economy strengthens.

Securitized

Interest-rate cycles also affect mortgage- and asset-backed securities (MBSs/ABSs). Because MBSs are the securitized cash flows of mortgages, prepayment rates are another consideration. For ABSs, managers monitor the credit quality of the underlying assets, which comprise the securitized cash flow of anything from credit card debt to manufactured housing debt.

Optimizing the risk/return trade-off across multiple sectors

Putnam believes that building a diversified portfolio with multiple income-generating strategies is the best way to pursue your fund’s objectives. The fund’s portfolio is composed of a broad spectrum of government, credit, and securitized debt instruments.

Performance snapshot

Putnam Diversified

Income Trust

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 7 and 13–15 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit www.putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

6

The period in review

Bill, thank you for taking the time today to talk about Diversified Income Trust’s most recent semiannual period. How did the fund perform?

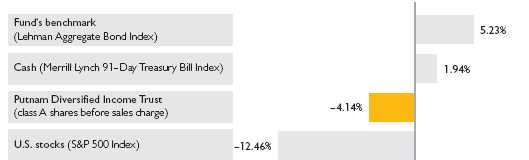

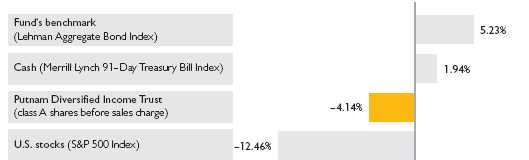

The past six months represented the most volatile period for fixed-income credit markets that I’ve experienced during my 20 years as a money manager. Because of the multiple problems affecting the credit markets over the past six months, the “flight-to-quality” trade into Treasury securities dominated the marketplace. Many investors fled even the highest-quality credit instruments, especially mortgages. Significantly, for the fund the sell-off of mortgage securities during the period was both broad and largely indiscriminate. That is why, despite our continued cautious stance on duration (a measure of portfolio risk) and credit risk, the fund had a loss of 4.14%. It significantly underperformed its benchmark, approximately 22.5% of which is made up of government securities, which returned 5.23%. The fund also underperformed its peer

Broad market index and fund performance

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 3/31/08. See page 6 and pages 13–15 for additional fund performance information. Index descriptions can be found on page 23.

7

group, Lipper Multi-Sector Income Funds, which edged down 0.02%.

Could you discuss the major events that took place during the period within the fixed-income marketplace?

November, December, January, and March were difficult. In November, we experienced an additional wave of weak housing statistics and more problems in the bank loan market. At the end of 2007, fixed-income markets endured additional selling pressure as corporations and financial institutions attempted to clean up their balance sheets by divesting themselves of what they perceived to be weaker credits.

In January, the markets faced the additional challenge of a decline in consumer spending, with unemployment at the highest level we have seen for many years. Investors were concerned that U.S. growth might be in decline, and that global growth might also be significantly affected. In the first quarter of 2008, as news headlines highlighted a series of significant “write-downs” of structured securities and depressed earnings for prominent financial firms, global credit markets became increasingly illiquid.

What response did the liquidity squeeze and economic slowdown prompt from the government?

Credit quality overview

Credit qualities shown as a percentage of portfolio value as of 3/31/08. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody’s but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

8

Initially, the Federal Reserve Board (the Fed) took a cautious approach, but the extreme pressure on global liquidity forced the Fed to act decisively, cutting the federal funds rate by two and a half percentage points over five FOMC meetings from October to March. The Fed also employed a number of creative measures in an attempt to restore liquidity to the markets, extending substantial credit to commercial and investment banks. Congress and the White House agreed on a large fiscal stimulus package to try to bolster consumer spending, and, as we speak, Congress is attempting to fashion a plan to relieve pressure on residential mortgageholders and reduce the steady stream of foreclosures.

Of the large number of strategies the fund uses to generate returns, which ones helped performance during the period?

The strategy that helped the most, preventing even greater underperformance, was the fund’s “steepener” strategy, where we overweight shorter-term securities and underweight longer-term issues. This strategy is based on our view that the yield curve will steepen as global central banks continue to cut short-term rates and longer-term rates trend higher on the liquidity squeeze and inflation concerns. Also, the fund’s non-U.S.-dollar positions in Europe, Japan, Canada, and Australia contributed

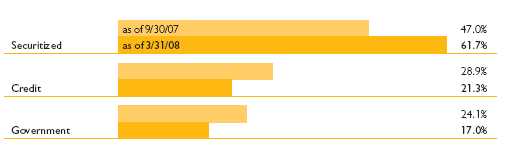

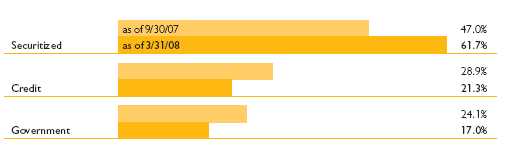

Comparison of sector weightings

This chart shows how the fund’s sector weightings have changed over the past six months. Weightings are shown as a percentage of portfolio value. Holdings will vary over time.

9

significantly, based in part on the weaker dollar.

Bill, you mentioned that the sell-off of mortgage securities during the period was broad and largely indiscriminate. Please discuss its effect on the fund's strategy and performance.

We believe that one of the main strengths of Diversified Income Trust is the broad diversification of our strategies. However, as a result of the rapid panic selling and flight to quality that we have recently observed, the nine strategies that we employ in the structured securities area (out of a total of 70 to 90 strategies used at any given time within the portfolio as a whole) have become unusually correlated. These nine strategies involving structured securities —three examples are investments in Aaa-rated commercial-backed securities (CMBSs), Aaa-rated home equity loans, and collaterized mortgage obligations (CMOs) — have recently been behaving as if they were only one strategy. In the short term, the fund has not received the diversification benefits that this variety of strategies has historically provided and that we believe it will provide again in the future. In our opinion, this is the main reason for the fund’s recent underperformance.

How have you reacted to these circumstances?

Aside from the difficulties in trying to mitigate short-term volatility, the market currently offers some of the best opportunities for future returns that many of us have seen in two decades. At several points during recent periods of volatility, when we saw an opportunity, we have increased our positions within very high-quality mortgage and mortgage-backed securities with two- to five-year time horizons. We believe we have done so without significantly increasing the portfolio’s credit risk. While we want to limit short-term volatility as much as possible, we do not want to give up the potential for strong gains. At some point, the market is going to stabilize and prices should rise quickly, preventing investors who have waited on the sidelines from being able to purchase highly rated structured securities at the levels we are currently seeing. The opportunity cost of not participating is, in our opinion, much greater than the cost of short-term pricing volatility. As we believe the majority of our shareholders have long-term investment horizons, we are making a conscious trade-off between short-term volatility and the potential for future gains, as we seek outperformance over the next three to five years.

Given all the uncertainty that you’ve outlined, what is your outlook for the economy and the fund?

Many market watchers are predicting a sharp economic downturn, followed at some point by a relatively swift “bounceback” for the economy. However, based on mixed economic data and the fact that the housing market will

10

most likely impede growth for some time to come, we think we will see a period of near-zero to very slow growth over the next two to three quarters. One positive for the economy is that growth outside the United States continues to be strong, which should spur demand for U.S. products and services.

In terms of the fund, we have already seen one benefit from our decision to seek opportunities during periods when the market has been struggling —significantly greater interest income accumulated from higher-yielding securities. Overall, we plan to continue to diversify the portfolio across a broad range of fixed-income sectors and securities.

Thanks again, Bill, for sharing your insights with us.

I N T H E N E W S

For the first time since the Great Depression, the Federal Reserve has extended financing to non-banks — specifically, primary dealers such as securities broker-dealers — as part of its ongoing attempt to inject liquidity into the struggling credit markets. The so-called Primary Dealer Credit Facility (PDCF), established in March, allows the Federal Reserve Bank of New York to provide overnight cash reserves to primary dealers in exchange for a broad range of collateral. The new credit facility aims to help primary dealers in providing financing to participants in capital markets and to promote an overall orderly functioning of the markets. The PDCF will remain in effect for six months and may be extended if the Fed deems it necessary.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. The use of derivatives involves special risks and may result in losses.

11

Of special interest

We are pleased to report that effective April 2008, your fund’s dividend was increased from $0.042 to $0.057 per share. This dividend increase was possible due to an increase in interest income from more high-yield and emerging-market bonds and the widening of spreads in the mortgage market.

12

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended March 31, 2008, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section of www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally o nly available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance

Total return for periods ended 3/31/08

| | | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | (10/3/88) | | (3/1/93) | | (2/1/99) | | (12/1/94) | | (12/1/03) | (7/1/96) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.02% | 6.79% | 6.19% | 6.19% | 6.20% | 6.20% | 6.71% | 6.53% | 6.74% | 7.17% |

|

| 10 years | 52.81 | 46.68 | 41.61 | 41.61 | 41.47 | 41.47 | 48.66 | 43.89 | 48.83 | 56.50 |

| Annual average | 4.33 | 3.91 | 3.54 | 3.54 | 3.53 | 3.53 | 4.04 | 3.71 | 4.06 | 4.58 |

|

| 5 years | 35.69 | 30.25 | 30.58 | 28.61 | 30.49 | 30.49 | 33.81 | 29.48 | 33.90 | 37.33 |

| Annual average | 6.29 | 5.43 | 5.48 | 5.16 | 5.47 | 5.47 | 6.00 | 5.30 | 6.01 | 6.55 |

|

| 3 years | 9.37 | 5.02 | 6.94 | 4.21 | 6.83 | 6.83 | 8.43 | 4.89 | 8.35 | 10.16 |

| Annual average | 3.03 | 1.65 | 2.26 | 1.38 | 2.23 | 2.23 | 2.73 | 1.60 | 2.71 | 3.28 |

|

| 1 year | –2.68 | –6.59 | –3.46 | –8.07 | –3.54 | –4.46 | –2.95 | –6.07 | –3.05 | –2.54 |

|

| 6 months | –4.14 | –7.95 | –4.56 | –9.22 | –4.53 | –5.47 | –4.31 | –7.42 | –4.40 | –4.12 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After sales charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively, as of 1/2/08. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund may have limited expenses, without which returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

13

Comparative index returns

For periods ended 3/31/08

| | | | | | | | |

| | | | |

| | | | | | Lipper |

| | | Lehman | | Citigroup | | JPMorgan | | Multi-Sector |

| | | Aggregate | | Non-U.S. | | Global | | Income Funds |

| | | Bond | | World Govt. | | High Yield | | category |

| | | Index | | Bond Index | | Bond Index | | average† |

|

| Annual average | | | | |

| (life of fund) | 7.51% | 7.87% | — * | 7.63% |

|

| 10 years | 79.71 | 103.57 | 67.21% | 64.50 |

| Annual average | 6.04 | 7.37 | 5.28 | 5.02 |

|

| 5 years | 25.12 | 53.81 | 53.09 | 40.71 |

| Annual average | 4.58 | 8.99 | 8.89 | 7.02 |

|

| 3 years | 17.35 | 23.89 | 16.07 | 15.37 |

| Annual average | 5.48 | 7.40 | 5.09 | 4.86 |

|

| 1 year | 7.67 | 22.31 | –3.06 | 1.81 |

|

| 6 months | 5.23 | 15.27 | –3.76 | –0.02 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Inception date of index was 12/31/93, after the fund’s inception.

† Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 3/31/08, there were 146, 133, 117, 87, 62, and 5 funds, respectively, in this Lipper category.

Fund’s annual operating expenses For the fiscal year ended 9/30/07

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual fund | | | | | | |

| operating expenses | 0.98% | 1.73% | 1.73% | 1.23% | 1.23% | 0.73% |

|

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

14

Fund price and distribution information

For the six-month period ended 3/31/08

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.255 | $0.217 | $0.219 | $0.243 | $0.240 | $0.267 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.255 | $0.217 | $0.219 | $0.243 | $0.240 | $0.267 |

|

| Share value: | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 9/30/07 | $9.91 | $10.32* | $9.83 | $9.84 | $9.81 | $10.14 | $9.89 | $9.92 |

|

| 3/31/08 | 9.25 | 9.64 | 9.17 | 9.18 | 9.15 | 9.46 | 9.22 | 9.25 |

|

| Current yield | | | | | | | | |

| (end of period) | | | | | | | | |

|

| Current | | | | | | | | |

| dividend rate 1 | 5.45% | 5.23% | 4.71% | 4.71% | 5.25% | 5.07% | 5.21% | 5.71% |

|

| Current 30-day | | | | | | | | |

| SEC yield 2 | N/A | 6.71 | 6.25 | 6.25 | N/A | 6.53 | 6.76 | 7.25 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

* Reflects an increase in sales charges that took effect on 1/2/08.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

15

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam Diversified IncomeTrust from October 1, 2007, to March 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 5.04 | $ 8.70 | $ 8.70 | $ 6.26 | $ 6.26 | $ 3.82 |

|

| Ending value (after expenses) | | $958.60 | $954.40 | $954.70 | $956.90 | $956.00 | $958.80 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/08. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended March 31, 2008, use the calculation method below. To find the value of your investment on October 1, 2007, call Putnam at 1-800-225-1581.

16

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 5.20 | $ 8.97 | $ 8.97 | $ 6.46 | $ 6.46 | $ 3.94 |

|

| Ending value (after expenses) | | $1,019.85 | $1,016.10 | $1,016.10 | $1,018.60 | $1,018.60 | $1,021.10 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/08. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund’s annualized | | | | | | | |

| expense ratio | | 1.03% | 1.78% | 1.78% | 1.28% | 1.28% | 0.78% |

|

| Average annualized expense | | | | | | | |

| ratio for Lipper peer group* | | 1.07% | 1.82% | 1.82% | 1.32% | 1.32% | 0.82% |

|

* Putnam is committed to keeping fund expenses below the Lipper peer group average expense ratio and will limit fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times and for different periods. The fund’s expense ratio shown here is annualized data for the most rec ent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 3/31/08.

17

Your fund’s portfolio turnover

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s assets within a one-year period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the table below to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons

Percentage of holdings that change every year

| | | | | | |

| | | 2007 | 2006 | 2005 | 2004 | 2003 |

|

| Putnam Diversified Income Trust | | 74%* | 71%* | 126%* | 99% | 146%† |

|

| Lipper Multi-Sector Income Funds | | | | | | |

| category average | | 119% | 124% | 127% | 104% | 145% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on September 30. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2007 is based on information available as of 12/31/07.

* Excludes dollar roll transactions.

† Excludes certain Treasury note transactions executed in connection with a short-term trading strategy.

18

Your fund’s risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Morningstar Risk.

Your fund’s Morningstar ® Risk

Your fund’s Morningstar Risk is shown alongside that of the average fund in its Morningstar category. The risk bar broadens the comparison by translating the fund’s Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of March 31, 2008. A higher Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over a 3-year period, if available. Those measures are weighted and averaged to produce the fund’s Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2008 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

19

Your fund’s management

Your fund is managed by the members of the Putnam Core Fixed-Income and Fixed-Income High-Yield teams. D. William Kohli is the Portfolio Leader. Michael Atkin, Rob Bloemker, Kevin Murphy, and Paul Scanlon are Portfolio Members of the fund. The Portfolio Leader and Portfolio Members coordinate the teams’ management of the fund.

For a complete listing of the members of the Putnam Core Fixed-Income and Fixed-Income High-Yield teams, including those who are not Portfolio Leaders or Portfolio Members of your fund, please visit the Individual Investors section of www.putnam.com.

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of March 31, 2008, and March 31, 2007.

N/A indicates the individual was not a Portfolio Leader or Portfolio Member as of 3/31/07.

Trustee and Putnam employee fund ownership

As of March 31, 2008, all of the Trustees of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | | |

| | | Total assets in | |

| | Assets in the fund | all Putnam funds | |

| |

| Trustees | $ 776,000 | $ 88,000,000 | |

| |

| Putnam employees | $14,091,000 | $630,000,000 | |

| |

20

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

D. William Kohli is also a Portfolio Leader of Putnam Global Income Trust, Putnam Premier Income Trust, and Putnam Master Intermediate Income Trust.

Michael Atkin is also a Portfolio Member of Putnam Global Income Trust, Putnam Premier Income Trust, and Putnam Master Intermediate Income Trust.

Rob Bloemker is also a Portfolio Leader of Putnam U.S. Government Income Trust, Putnam American Government Income Fund, and Putnam Income Fund. He is also a Portfolio Member of Putnam Global Income Trust, Putnam Premier Income Trust, and Putnam Master Intermediate Income Trust.

Kevin Murphy is also a Portfolio Member of Putnam Income Fund, Putnam Premier Income Trust, Putnam Master Intermediate Income Trust, and Putnam Utilities Growth & Income Fund.

Paul Scanlon is also a Portfolio Leader of Putnam High Yield Trust, Putnam High Yield Advantage Fund, and Putnam Floating Rate Income Fund. He is also a Portfolio Member of Putnam Premier Income Trust and Putnam Master Intermediate Income Trust.

D. William Kohli, Michael Atkin, Rob Bloemker, Kevin Murphy, and Paul Scanlon may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

During the reporting period ended March 31, 2008, Michael Atkin joined your fund’s management team, following the departure of Portfolio Member Jeffrey Kaufman.

21

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

22

Comparative indexes

Citigroup Non-U.S. World Government Bond Index is an unmanaged index generally considered to be representative of the world bond market.

JPMorgan Global High Yield Bond Index is a dollar-denominated index consisting of non-investment-grade corporate bonds, which are issued by both U.S. and non-U.S. companies.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Merrill Lynch 91-Day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

23

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract between Putnam Management’s affiliate, Putnam Investments Limited (“PIL”), and Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not“interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2007, the Contract Committee met several times to consider the information provided by Putnam Management and other information develop ed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract and sub-management contract, effective July 1, 2007. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

In addition, in anticipation of the sale of Putnam Investments to Great-West Lifeco, at a series of meetings ending in March 2007, the Trustees reviewed and approved new management and distribution arrangements to take effect upon the change of control. Shareholders of all funds approved the management contracts in May 2007, and the change of control transaction was completed on August 3, 2007. Upon the change of control, the management contracts that were approved by the Trustees in June 2007 automatically terminated and were replaced by new contracts that had been approved by shareholders. In connection with their review for the June 2007 continuance of the Putnam funds’ management contracts, the Trustees did not identify any facts or circumstances that would alter the substance of the conclusions and recommendations they made in their review of the contracts to take effect upon the change of control.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in

24

the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 37th percentile in management fees and in the 11th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2006 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, h ad been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management had committed to maintain at least through 2007. In anticipation of the change of control of Putnam Investments, the Trustees requested, and received a commitment from Putnam Management and Great-West Lifeco, to extend this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any

25

applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2007, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2006. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to con tinue to work with Putnam Management to plan for an eventual resumption in the growth of assets, and to consider the potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds.This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance during the review period

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the

26

experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period.The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Multi-Sector Income Funds) for the one-, three- and five-year periods ended March 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | Three-year period | Five-year period |

|

| 57th | 48th | 38th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2007, there were 118, 104 and 86 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.)

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Multi-Sector Income Funds category for the one-, five-, and ten-year periods ended March 31, 2008, were 89%, 65%, and 67%, respectively. Over the one-, five-, and ten-year periods ended March 31, 2008, the fund ranked 119th out of 133, 57th out of 87, and 42nd out of 62, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

27

the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking“best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the custodian agreement, the Trustees considered that, effective January 1, 2007, the Putnam funds had engaged State Street Bank and Trust Company as custodian and began to transition the responsibility for providing custody services away from PFTC.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional cli ents, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

28

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available in the Individual Investors section of www.putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

29

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

30

The fund’s portfolio 3/31/08 (Unaudited)

U.S. GOVERNMENT AND AGENCY MORTGAGE OBLIGATIONS (56.0%)*

| | | | |

| | | Principal amount | | Value |

|

| U.S. Government Guaranteed Mortgage Obligations (0.2%) | | | | |

| Government National Mortgage Association | | | | |

| Pass-Through Certificates | | | | |

| 6 1/2s, with due dates from August 20, 2037 | | | | |

| to November 20, 2037 | $ | 4,605,992 | $ | 4,800,127 |

|

| |

| U.S. Government Agency Mortgage Obligations (55.8%) | | | | |

| Federal Home Loan Mortgage Corporation | | | | |

| Pass-Through Certificates | | | | |

| 6s, September 1, 2021 | | 74,696 | | 76,983 |

| 5 1/2s, May 1, 2020 | | 344,063 | | 352,624 |

| Federal National Mortgage Association Pass-Through Certificates | | | | |

| 6 1/2s, with due dates from October 1, 2036 to August 1, 2037 | | 4,534,747 | | 4,702,497 |

| 6s, April 1, 2021 | | 3,718,537 | | 3,835,322 |

| 6s, TBA, April 1, 2038 | | 30,000,000 | | 30,724,218 |

| 5 1/2s, with due dates from March 1, 2037 to January 1, 2038 | | 12,041,361 | | 12,166,479 |

| 5 1/2s, with due dates from January 1, 2009 to February 1, 2021 | | 4,235,130 | | 4,345,977 |

| 5 1/2s, TBA, May 1, 2038 | | 275,000,000 | | 276,976,563 |

| 5 1/2s, TBA, April 1, 2038 | | 473,000,000 | | 477,397,434 |

| 5s, TBA, April 1, 2038 | | 476,000,000 | | 471,016,851 |

| 4 1/2s, with due dates from August 1, 2033 to October 1, 2035 | | 12,550,182 | | 12,137,531 |

| 4s, with due dates from May 1, 2019 to September 1, 2020 | | 775,723 | | 756,955 |

| | | | | 1,294,489,434 |

|

| |

| Total U.S. government and agency mortgage obligations (cost $1,288,736,453) | $ | 1,299,289,561 |

U.S. TREASURY OBLIGATIONS (2.9%)*

| | | | |

| | | Principal amount | | Value |

|

| U.S. Treasury Bonds 6 1/4s, May 15, 2030 | $ | 17,182,000 | $ | 21,987,591 |

| U.S. Treasury Strip zero %, November 15, 2024 | | 98,235,000 | | 46,283,184 |

|

| Total U.S. treasury obligations (cost $58,719,475) | | | $ | 68,270,775 |

COLLATERALIZED MORTGAGE OBLIGATIONS (32.3%)*

| | | | |

| | | Principal amount | | Value |

|

| Asset Backed Funding Certificates 144A FRB | | | | |

| Ser. 06-OPT3, Class B, 5.099s, 2036 | $ | 129,000 | $ | 7,494 |

| Banc of America Commercial Mortgage, Inc. | | | | |

| FRB Ser. 07-3, Class A3, 5.659s, 2049 | | 765,000 | | 759,316 |

| Ser. 07-2, Class A2, 5.634s, 2049 | | 2,590,000 | | 2,544,301 |

| Ser. 05-6, Class A2, 5.165s, 2047 | | 4,776,000 | | 4,770,357 |

| Ser. 07-5, Class XW, Interest only (IO), 0.608s, 2051 | | 233,800,680 | | 6,045,127 |

| Banc of America Commercial Mortgage, Inc. 144A | | | | |

| Ser. 01-1, Class J, 6 1/8s, 2036 | | 1,170,000 | | 1,020,259 |

| Ser. 01-1, Class K, 6 1/8s, 2036 | | 2,633,000 | | 1,943,328 |

31

COLLATERALIZED MORTGAGE OBLIGATIONS (32.3%)* continued

| | | | | |

| | | | Principal amount | | Value |

|

| Banc of America Funding Corp. Ser. 07-4, Class 4A2, | | | | | |

| IO, 5 1/2s, 2034 | | $ | 13,316,938 | $ | 2,425,920 |

| Bayview Commercial Asset Trust 144A | | | | | |

| Ser. 07-5A, IO, 1.55s, 2037 | | | 6,305,745 | | 887,849 |

| Ser. 07-1, Class S, IO, 1.211s, 2037 | | | 14,126,730 | | 1,534,163 |

| Bear Stearns Commercial Mortgage Securities, Inc. | | | | | |

| FRB Ser. 00-WF2, Class F, 8.189s, 2032 | | | 1,174,000 | | 1,135,520 |

| Ser. 07-PW17, Class A3, 5.736s, 2050 | | | 9,430,000 | | 8,823,840 |

| Bear Stearns Commercial Mortgage Securities, Inc. | | | | | |

| 144A Ser. 07-PW18, Class X1, IO, 0.06s, 2050 | | | 274,919,005 | | 2,352,070 |

| Broadgate Financing PLC sec. FRB Ser. D, 6.626s, | | | | | |

| 2023 (United Kingdom) | GBP | | 2,707,450 | | 4,073,285 |

| Citigroup Mortgage Loan Trust, Inc. IFB Ser. 07-6, | | | | | |

| Class 2A5, IO, 4.051s, 2037 | | $ | 7,485,574 | | 597,616 |

| Citigroup/Deutsche Bank Commercial Mortgage Trust | | | | | |

| Ser. 06-CD3, Class A4, 5.658s, 2048 | | | 483,000 | | 476,381 |

| Citigroup/Deutsche Bank Commercial Mortgage Trust | | | | | |

| 144A Ser. 07-CD5, Class XS, IO, 0.062s, 2044 | | | 163,077,376 | | 1,444,306 |

| Commercial Mortgage Acceptance Corp. Ser. 97-ML1, | | | | | |

| IO, 0.571s, 2017 | | | 24,533,046 | | 964,072 |

| Countrywide Alternative Loan Trust IFB Ser. 04-2CB, | | | | | |

| Class 1A5, IO, 5.001s, 2034 | | | 9,515,333 | | 535,981 |

| Countrywide Home Loans Ser. 05-2, Class 2X, IO, 1.16s, 2035 | | 21,424,811 | | 476,079 |

| Countrywide Home Loans 144A Ser. 03-R4, Class 1A, | | | | | |

| Principal only (PO), zero %, 2034 | | | 39,403 | | 33,016 |

| Credit Suisse Mortgage Capital Certificates | | | | | |

| FRB Ser. 07-C4, Class A2, 5.811s, 2039 | | | 3,679,000 | | 3,694,886 |

| Ser. 07-C5, Class A3, 5.694s, 2040 | | | 50,230,000 | | 48,884,790 |

| CRESI Finance Limited Partnership 144A | | | | | |

| FRB Ser. 06-A, Class D, 3.399s, 2017 | | | 369,000 | | 335,790 |

| FRB Ser. 06-A, Class C, 3.199s, 2017 | | | 1,093,000 | | 1,000,095 |

| Criimi Mae Commercial Mortgage Trust 144A | | | | | |

| Ser. 98-C1, Class B, 7s, 2033 | | | 12,244,905 | | 12,265,721 |

| CS First Boston Mortgage Securities Corp. 144A | | | | | |

| FRB Ser. 05-TFLA, Class L, 4.668s, 2020 | | | 4,911,000 | | 4,174,350 |

| FRB Ser. 05-TFLA, Class K, 4.118s, 2020 | | | 2,413,000 | | 2,147,570 |

| Ser. 98-C2, Class F, 6 3/4s, 2030 | | | 8,998,000 | | 9,223,648 |

| Ser. 98-C1, Class F, 6s, 2040 | | | 7,396,000 | | 5,177,200 |

| Ser. 02-CP5, Class M, 5 1/4s, 2035 | | | 2,599,000 | | 779,700 |

| Deutsche Mortgage & Asset Receiving Corp. | | | | | |

| Ser. 98-C1, Class X, IO, 0.251s, 2031 | | | 39,083,329 | | 1,276,315 |

| DLJ Commercial Mortgage Corp. Ser. 98-CF2, Class B4, | | | | | |

| 6.04s, 2031 | | | 2,235,111 | | 1,940,099 |

| DLJ Commercial Mortgage Corp. 144A Ser. 98-CF2, | | | | | |

| Class B5, 5.95s, 2031 | | | 7,128,872 | | 5,666,099 |

| European Loan Conduit 144A FRB Ser. 22A, Class D, | | | | | |

| 6.428s, 2014 (Ireland) | GBP | | 2,461,000 | | 3,830,836 |

| European Prime Real Estate PLC 144A FRB Ser. 1-A, | | | | | |

| Class D, 6.434s, 2014 (United Kingdom) | GBP | | 1,731,702 | | 2,564,441 |

32

COLLATERALIZED MORTGAGE OBLIGATIONS (32.3%)* continued

| | | | |

| | | Principal amount | | Value |

|

| Fannie Mae | | | | |

| FRB Ser. 03-W17, Class 12, IO, 1.15s, 2033 | $ | 18,370,390 | $ | 649,128 |

| FRB Ser. 06-54, Class CF, zero %, 2035 | | 450,281 | | 430,300 |

| IFB Ser. 06-70, Class SM, 32.736s, 2036 | | $775,622 | | 1,037,819 |

| IFB Ser. 06-76, Class QB, 24.008s, 2036 | | 4,907,941 | | 6,822,324 |

| IFB Ser. 06-63, Class SP, 23.708s, 2036 | | 5,362,959 | | 7,352,091 |

| IFB Ser. 07-W7, Class 1A4, 23.588s, 2037 | | 2,266,865 | | 3,059,237 |

| IFB Ser. 06-104, Class GS, 21.145s, 2036 | | 1,740,759 | | 2,306,581 |

| IFB Ser. 06-60, Class TK, 18.205s, 2036 | | 1,717,549 | | 2,144,375 |

| IFB Ser. 05-25, Class PS, 16.726s, 2035 | | 3,110,838 | | 3,868,244 |

| IFB Ser. 05-74, Class CP, 15.221s, 2035 | | 2,732,407 | | 3,331,441 |

| IFB Ser. 05-115, Class NQ, 15.192s, 2036 | | 1,403,023 | | 1,644,380 |

| IFB Ser. 06-27, Class SP, 15.038s, 2036 | | 3,685,000 | | 4,465,942 |

| IFB Ser. 06-8, Class HP, 15.038s, 2036 | | 3,926,873 | | 4,773,884 |

| IFB Ser. 06-8, Class WK, 15.038s, 2036 | | 6,202,936 | | 7,476,764 |

| IFB Ser. 05-106, Class US, 15.038s, 2035 | | 6,355,144 | | 7,750,338 |

| IFB Ser. 05-99, Class SA, 15.038s, 2035 | | 3,227,816 | | 3,823,102 |

| IFB Ser. 06-60, Class CS, 14.561s, 2036 | | 2,464,692 | | 2,818,423 |

| IFB Ser. 05-74, Class CS, 12.873s, 2035 | | 3,115,570 | | 3,610,298 |

| IFB Ser. 04-79, Class S, 12.653s, 2032 | | 3,859,006 | | 4,339,703 |

| IFB Ser. 05-114, Class SP, 12.433s, 2036 | | 1,757,802 | | 1,936,210 |

| IFB Ser. 05-95, Class OP, 12.328s, 2035 | | 1,938,806 | | 2,172,162 |

| IFB Ser. 05-95, Class CP, 12.152s, 2035 | | 444,600 | | 510,329 |

| IFB Ser. 06-62, Class NS, 12.092s, 2036 | | 1,174,013 | | 1,213,642 |

| IFB Ser. 05-83, Class QP, 10.637s, 2034 | | 1,100,503 | | 1,187,031 |

| IFB Ser. 07-W6, Class 6A2, IO, 5.201s, 2037 | | 4,765,301 | | 625,405 |

| IFB Ser. 06-90, Class SE, IO, 5.201s, 2036 | | 9,254,705 | | 1,337,484 |

| IFB Ser. 04-51, Class XP, IO, 5.101s, 2034 | | 9,266,323 | | 1,029,069 |

| IFB Ser. 03-66, Class SA, IO, 5.051s, 2033 | | 5,697,881 | | 710,661 |

| IFB Ser. 08-7, Class SA, IO, 4.951s, 2038 | | 22,209,602 | | 2,866,438 |

| IFB Ser. 07-W6, Class 5A2, IO, 4.691s, 2037 | | 5,759,913 | | 735,967 |

| IFB Ser. 07-W2, Class 3A2, IO, 4.681s, 2037 | | 6,292,024 | | 772,732 |

| IFB Ser. 06-115, Class BI, IO, 4.661s, 2036 | | 6,347,423 | | 583,787 |

| IFB Ser. 05-113, Class AI, IO, 4.631s, 2036 | | 2,984,135 | | 363,485 |

| IFB Ser. 05-113, Class DI, IO, 4.631s, 2036 | | 172,887 | | 17,876 |

| IFB Ser. 07-60, Class AX, IO, 4.551s, 2037 | | 23,271,611 | | 2,646,880 |

| IFB Ser. 06-60, Class SI, IO, 4.551s, 2036 | | 6,250,631 | | 760,308 |

| IFB Ser. 06-60, Class UI, IO, 4.551s, 2036 | | 2,653,076 | | 338,226 |

| IFB Ser. 07-W7, Class 3A2, IO, 4.531s, 2037 | | 8,540,501 | | 988,843 |

| IFB Ser. 06-60, Class DI, IO, 4.471s, 2035 | | 6,804,607 | | 659,947 |

| IFB Ser. 07-23, Class SI, IO, 4.171s, 2037 | | 1,780,730 | | 171,734 |

| IFB Ser. 07-54, Class CI, IO, 4.161s, 2037 | | 6,095,027 | | 653,236 |

| IFB Ser. 07-39, Class JI, IO, 4.161s, 2037 | | 6,209,901 | | 552,064 |

| IFB Ser. 07-39, Class PI, IO, 4.161s, 2037 | | 3,988,975 | | 396,136 |

| IFB Ser. 07-30, Class WI, IO, 4.161s, 2037 | | 21,841,851 | | 2,093,657 |

| IFB Ser. 07-28, Class SE, IO, 4.151s, 2037 | | 1,063,553 | | 110,929 |

| IFB Ser. 07-22, Class S, IO, 4.151s, 2037 | | 17,799,191 | | 1,900,279 |

| IFB Ser. 06-128, Class SH, IO, 4.151s, 2037 | | 4,436,390 | | 401,205 |

| IFB Ser. 06-56, Class SM, IO, 4.151s, 2036 | | 4,911,812 | | 514,804 |

| IFB Ser. 06-12, Class SD, IO, 4.151s, 2035 | | 20,472,155 | | 2,530,025 |

33

COLLATERALIZED MORTGAGE OBLIGATIONS (32.3%)* continued

| | | | |

| | | Principal amount | | Value |

|

| Fannie Mae | | | | |

| IFB Ser. 05-90, Class SP, IO, 4.151s, 2035 | $ | 2,942,008 | $ | 314,677 |

| IFB Ser. 05-12, Class SC, IO, 4.151s, 2035 | | 3,699,190 | | 350,453 |

| IFB Ser. 07-W5, Class 2A2, IO, 4.141s, 2037 | | 1,872,943 | | 190,156 |

| IFB Ser. 07-30, Class IE, IO, 4.141s, 2037 | | 11,578,211 | | 1,489,108 |

| IFB Ser. 06-123, Class CI, IO, 4.141s, 2037 | | 11,129,374 | | 1,140,770 |

| IFB Ser. 06-123, Class UI, IO, 4.141s, 2037 | | 4,260,261 | | 435,741 |

| IFB Ser. 07-15, Class BI, IO, 4.101s, 2037 | | 7,571,350 | | 777,094 |

| IFB Ser. 06-126, Class CS, IO, 4.101s, 2037 | | 9,494,535 | | 877,829 |

| IFB Ser. 06-16, Class SM, IO, 4.101s, 2036 | | 11,326,524 | | 1,307,655 |

| IFB Ser. 05-95, Class CI, IO, 4.101s, 2035 | | 7,105,611 | | 819,446 |

| IFB Ser. 05-84, Class SG, IO, 4.101s, 2035 | | 11,218,676 | | 1,226,270 |

| IFB Ser. 05-57, Class NI, IO, 4.101s, 2035 | | 2,335,019 | | 252,712 |

| IFB Ser. 05-104, Class NI, IO, 4.101s, 2035 | | 7,797,906 | | 861,425 |

| IFB Ser. 05-83, Class QI, IO, 4.091s, 2035 | | 1,892,343 | | 236,228 |

| IFB Ser. 06-128, Class GS, IO, 4.081s, 2037 | | 6,871,042 | | 718,535 |

| IFB Ser. 05-83, Class SL, IO, 4.071s, 2035 | | 21,445,951 | | 2,101,787 |

| IFB Ser. 06-114, Class IS, IO, 4.051s, 2036 | | 4,881,797 | | 457,522 |

| IFB Ser. 06-115, Class IE, IO, 4.041s, 2036 | | 3,768,685 | | 420,888 |

| IFB Ser. 06-117, Class SA, IO, 4.041s, 2036 | | 5,627,416 | | 523,656 |

| IFB Ser. 06-121, Class SD, IO, 4.041s, 2036 | | 678,253 | | 64,068 |

| IFB Ser. 06-109, Class SG, IO, 4.031s, 2036 | | 1,590,799 | | 150,979 |

| IFB Ser. 06-104, Class SY, IO, 4.021s, 2036 | | 1,420,616 | | 129,122 |

| IFB Ser. 06-109, Class SH, IO, 4.021s, 2036 | | 5,119,342 | | 595,068 |

| IFB Ser. 06-111, Class SA, IO, 4.021s, 2036 | | 33,058,709 | | 3,470,304 |

| IFB Ser. 07-W6, Class 4A2, IO, 4.001s, 2037 | | 25,530,416 | | 2,684,512 |

| IFB Ser. 06-128, Class SC, IO, 4.001s, 2037 | | 5,968,468 | | 579,949 |

| IFB Ser. 06-43, Class SI, IO, 4.001s, 2036 | | 12,980,395 | | 1,198,049 |

| IFB Ser. 06-8, Class JH, IO, 4.001s, 2036 | | 18,294,651 | | 1,985,129 |

| IFB Ser. 05-122, Class SG, IO, 4.001s, 2035 | | 5,647,302 | | 622,399 |

| IFB Ser. 05-95, Class OI, IO, 3.991s, 2035 | | 1,067,201 | | 137,728 |

| IFB Ser. 06-92, Class LI, IO, 3.981s, 2036 | | 5,523,092 | | 539,481 |

| IFB Ser. 06-99, Class AS, IO, 3.981s, 2036 | | 1,670,423 | | 169,240 |

| IFB Ser. 06-98, Class SQ, IO, 3.971s, 2036 | | 12,755,654 | | 1,209,620 |

| IFB Ser. 06-85, Class TS, IO, 3.961s, 2036 | | 13,226,071 | | 1,184,832 |

| IFB Ser. 07-75, Class PI, IO, 3.941s, 2037 | | 7,060,871 | | 659,792 |

| IFB Ser. 07-88, Class MI, IO, 3.921s, 2037 | | 2,911,201 | | 262,809 |

| IFB Ser. 07-103, Class AI, IO, 3.901s, 2037 | | 25,689,076 | | 2,607,330 |

| IFB Ser. 07-15, Class NI, IO, 3.901s, 2022 | | 11,685,080 | | 990,892 |

| IFB Ser. 07-106, Class SM, IO, 3.861s, 2037 | | 16,183,298 | | 1,441,333 |

| IFB Ser. 08-3, Class SC, IO, 3.851s, 2038 | | 41,046,840 | | 4,223,335 |

| IFB Ser. 07-109, Class XI, IO, 3.851s, 2037 | | 4,230,539 | | 431,415 |

| IFB Ser. 07-109, Class YI, IO, 3.851s, 2037 | | 5,735,952 | | 514,471 |

| IFB Ser. 07-W8, Class 2A2, IO, 3.851s, 2037 | | 10,930,836 | | 1,130,908 |

| IFB Ser. 06-79, Class SH, IO, 3.851s, 2036 | | 9,386,951 | | 1,020,831 |

| IFB Ser. 07-54, Class KI, IO, 3.841s, 2037 | | 3,034,663 | | 276,046 |