| | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811- 05635) | |

| | |

| Exact name of registrant as specified in charter: | Putnam Diversified Income Trust |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | | |

| Name and address of agent for service: | | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: September 30, 2009 | | |

| |

| Date of reporting period: October 1, 2008 — March 31, 2009 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Since 1937, when George Putnam created a prudent mix of stocks and bonds in a single, professionally managed portfolio, we have championed the wisdom of the balanced approach. Today, we offer a world of equity, fixed-income, multi-asset, and absolute-return portfolios so investors can pursue a range of financial goals. Our seasoned portfolio managers seek superior results over time, backed by original, fundamental research on a global scale. We believe in service excellence, in the value of experienced financial advice, and in putting clients first in everything we do.

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

Putnam

Diversified

Income Trust

3| 31|09

Semiannual Report

| | |

| Message from the Trustees | 2 | |

| About the fund | 4 | |

| Performance snapshot | 6 | |

| Interview with your fund’s Portfolio Manager | 7 | |

| Performance in depth. | 12 | |

| Expenses | 14 | |

| Portfolio turnover | 15 | |

| Your fund’s management. | 16 | |

| Terms and definitions | 18 | |

| Trustee approval of management contract | 19 | |

| Other information for shareholders. | 24 | |

| Financial statements | 25 | |

Message from the Trustees

Dear Fellow Shareholder:

After 18 months of deep and painful losses, the stock market showed a glimmer of promise late in the first quarter. For the first 10 weeks of 2009, the S&P 500 Index fell by approximately 25%, before abruptly reversing course with just three weeks left in the quarter. Recent technical and valuation improvements also may augur well for the fixed-income market.

While the bottom of a bear market can only be identified in retrospect, we are encouraged by the upswing because it corresponds closely to historic turning points in the stock market. Notably, the upswing followed more aggressive government stimulus efforts and Federal Reserve action, as well as the kind of widespread sell-offs by investors that are often associated with market bottoms.

Under President and CEO Robert L. Reynolds, Putnam Investments has instituted several changes in order to position Putnam mutual funds for a market recovery. In April, Walter C. Donovan, a 25-year investment-industry veteran, joined Putnam as Chief Investment Officer. Mr. Donovan will lead a reinvigorated investment organization strengthened by the arrival during the past few months of several well-regarded senior portfolio managers, research analysts, and equity traders.

We also are pleased to announce that Ravi Akhoury has been elected to the Board of Trustees of the Putnam Funds. From 1992 to 2007, Mr. Akhoury was Chairman and CEO of MacKay Shields,

2

a multi-product investment management firm with over $40 billion in assets under management. He serves as advisor to New York Life Insurance Company, and previously was a member of its Executive Management Committee.

We would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Seeking broad diversification across global bond markets

When Putnam Diversified Income Trust was launched in 1988, its three-pronged focus on U.S. investment-grade bonds, high-yield corporate bonds, and non-U.S. bonds was considered innovative. Lower-rated, higher-yielding corporate bonds were relatively new, having just been established in the late 1970s. And, at the time of the fund’s launch, few investors were venturing outside the United States for fixed-income opportunities.

The bond investment landscape has undergone a transformation in the two decades since. New sectors like mortgage- and asset-backed securities now make up a sizable portion of the U.S. investment-grade market. The high-yield corporate bond sector has also grown significantly. Outside of the United States, the popularity of the euro has resulted in a large market of European government bonds. There are also growing opportunities to invest in the government and corporate debt of emerging-market countries.

The fund’s investment perspective has been broadened to keep pace with the market expansion over time. To respond to the market’s increasing complexity, Putnam’s fixed-income group aligns teams of specialists with varied investment opportunities. Each team identifies compelling strategies within its area of expertise. The fund’s managers select from among these strategies, striving to systematically build a diversified portfolio that carefully balances risk and return.

The fund’s multi-strategy approach is designed to target the expanding opportunities of today’s global bond marketplace. As different factors drive the performance of various fixed-income sectors, the fund seeks to take advantage of changing market leadership in pursuit of high current income consistent with capital preservation.

International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Unlike bonds, bond funds have ongoing fees and expenses. The use of derivatives involves special risks and may result in losses.

Key drivers of

fixed-income returns

Government Interest-rate levels are primary drivers of performance. Generally, bond prices decline when interest rates rise, and rise when interest rates fall. Interest rates — and bond yields — rise and fall according to investor expectations about the health of the economy. Differences in countries’ economic cycles and currency values may create opportunities for global investors.

Credit Corporate bond performance tends to track the health of the overall economy more closely than other bonds. These bonds are less sensitive to interest-rate movements and tend to perform well when the economy strengthens.

Securitized Interest-rate cycles also affect mortgage- and asset-backed securities (MBSs/ABSs). Because MBSs are the securitized cash flows of mortgages, prepayment rates are another consideration. For ABSs, managers monitor the credit quality of the underlying assets, which comprise the securitized cash flow of anything from credit card debt to manufactured housing debt.

Optimizing the risk/return trade-off across multiple sectors

Putnam believes that building a diversified portfolio with multiple income-generating strategies is the best way to pursue your fund’s objectives. The fund’s portfolio is composed of a broad spectrum of government, credit, and securitized debt instruments.

Weightings are shown as a percentage of the fund’s total investment portfolio value. Allocations and holdings in each sector will vary over time. For more information on current fund holdings, see pages 26–73.

Performance snapshot

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 7 and 12–13 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. Due to market volatility, current performance may be higher or lower than performance shown. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

† Inception date of the JPMorgan Developed High Yield Index was 12/31/94, after the fund’s inception.

6

Interview with your

fund’s Portfolio Manager

D. William Kohli

Bill, thank you for taking the time today to talk about Putnam Diversified Income Trust’s most recent semiannual period. How did the fund perform?

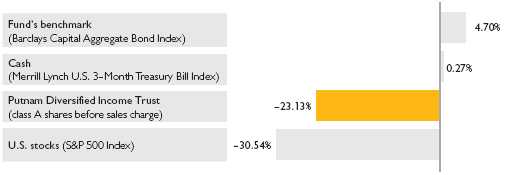

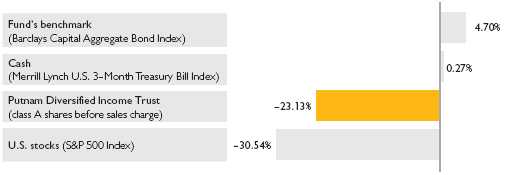

The past semiannual period was a tale of two very contrasting quarters. In terms of performance results, this period can be summarized as a very difficult one for the credit markets and the fund. At the peak of the financial crisis last October and November, even issues with very secure cash flows found few buyers. Interest-rate spreads, or differences in yield between credit instruments and Treasuries, widened dramatically as prices of many credit instruments plummeted. In an almost desperate flight to perceived quality during the height of the credit crisis, investors fled credit instruments for the perceived safe haven of Treasuries. And in the unwinding of risk that followed, some of the highest-quality non-Treasury securities experienced the biggest price declines as investors sold at any cost. Specifically, the fund declined 23.13% at net asset value, versus a return of 4.70% for the Barclays Capital Aggregate Bond Index and a –7 .63% return for the fund’s Lipper peer group.

Broad market index and fund performance

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 3/31/09. See page 6 and pages 12–13 for additional fund performance information. Index descriptions can be found on page 18.

7

You talked about contrasting quarters. How did the period begin in terms of major events affecting the credit markets and how did it evolve?

Over the past 18 months, we have witnessed the dramatic unfolding of a significant deleveraging process in the United States — as well as worldwide — on a scale that is unprecedented. Following Lehman Brothers’ bankruptcy declaration, breakup, and liquidation last September, credit market prices declined sharply in October and November 2008. Leading up to that point, we had seen a surge in home foreclosures, severe problems for the securitized loan markets, the collapse of Bear Stearns, and instances where the money markets virtually froze and short-term Treasury yields turned negative because of unprecedented Treasury security demand. In October and November 2008, another significant drop in commercial and residential property values was reported, and panic selling of credit instruments by individuals and institutions, including large hedge funds, ensued. Non-Treasury instruments — regardless of quality —simply had too many sellers and very few buyers. And yields of credit instruments compared with Treasuries spiked to spread levels that had never been seen before.

The dramatic reduction of access to credit for individuals and businesses drove the United States and all major European countries into the worst economic downturn since the Great Depression. The U.S. Federal Reserve [the Fed] and several other central banks responded with a series of

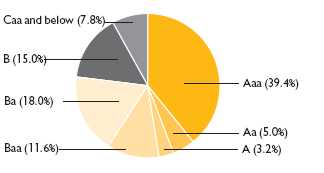

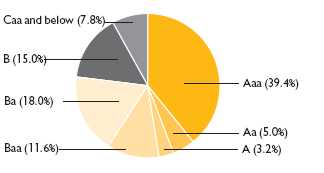

Credit quality overview

Credit qualities shown as a percentage of portfolio value as of 3/31/09. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody’s but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

8

short-term interest-rate cuts designed to stimulate economic activity, and the Fed and U.S. Treasury introduced a number of new lending facilities designed to spur renewed credit flows and lending among — and by — large financial institutions. After the Fed reduced short-term interest to near zero, it shifted its strategy to “quantitative easing,” buying up bank securities to inject more money into the financial system with the goal of spurring additional lending by banks. In early February 2009, Congress approved an $800 billion stimulus package designed to buoy the economy with new spending, and in March, Treasury Secretary Geithner announced a public/private partnership to buy up so-called “toxic” mortgage assets from banks as another way to restore credit flows. The result of this series of government efforts was a gradual shift — at least temporarily — to a stabilization of the credit markets. Th ese markets, which had started to bounce back in December, performed strongly during the first quarter of 2009. However, for the fund’s semiannual period, this strength was insufficient to overcome the steep price declines that we saw last October and November.

Bill, what was the portfolio managers’ strategy during this volatile period?

First, we continued our strategy of focusing on high-quality credit instruments that we believe carry minimal fundamental credit risk. Though the performance of most credit instruments was highly correlated at the low point for the bond market last fall (as many investors fled to Treasuries), we believe

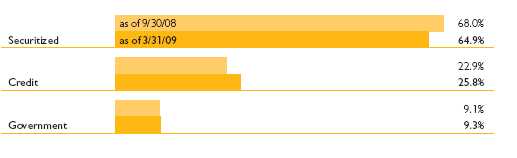

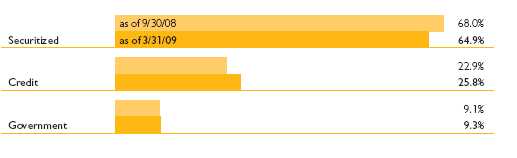

Comparison of sector weightings

This chart shows how the fund’s weightings have changed over the past six months. Weightings are shown as a percentage of total investment portfolio value. Holdings will vary over time.

9

that our focus on high credit quality will reward investors over time. Beginning in late 2007, we began to find compelling opportunities among what we perceived to be severely undervalued securities in the commercial mortgage-backed securities [CMBS], CMBS interest-only securities [CMBS IOs], collateralized mortgage obligations [CMOs], and inverse floating-rate notes markets, and we purchased large amounts of these securities at various points over the past 15 months.

Two factors helped the fund bounce back somewhat from the tremendous market downdraft of October and November. First, the fund’s investments in CMBS IOs and inverse floating-rate securities benefited from the slow rate of prepayments that the mortgage market was experiencing. Both types of securities were producing substantial cash flows even in the difficult economic environment, and these two types of holdings strongly benefited performance from December through February when the credit markets stabilized. Second, during the latter part of the period, the fund profited from our prior decision to position the portfolio for yield-curve steepening during the atypical market environment in which yields on short-term credit instruments were higher than on long-term issues. This strategy was based on our view that the yield curve would continue to normalize, with longer-term yields rising, as the government significantly ramped up spending to deal with the economic crisis and concern grew over budget deficits and longer-term inflation.

IN THE NEWS

On April 16, 2009, the U.S. Treasury Department launched a $9.9 billion mortgage modification program aimed at stemming the tide of rising, record foreclosures in the United States, which included a 24% year-over-year increase in foreclosure filings in first quarter 2009. Under the plan, which could help an estimated three to four million homeowners, theTreasury will pay six of the nation’s largest mortgage service companies a $1,000 one-time fee each time they reduce a homeowner’s mortgage payments to 38% of his or her income for five years.TheTreasury would then subsidize further homeowner payments down to 31% of income. Further, these mortgage servicers will receive as much as $1,000 per year for as many as three years, if a borrower stays current in the program. Homeowners who maintain their standing in the program are also eligible to receive up to $1,000 a year for five years to be used to reduce loan principals.

10

Did you incorporate any additional changes in strategy during the period?

Yes, with the intent of decreasing the fund’s price volatility, we have been reducing the overall level of commercial mortgage assets in the fund, and shifting to short-duration commercial mortgages and residential mortgages. Within the residential mortgage area, we have recently emphasized hybrid ARMs [combining features of both fixed-rate and adjustable-rate mortgages] and Alt-A mortgages [considered more risky than prime mortgages but higher quality than subprime] at what we feel are very depressed prices. We believe both types of residential mortgages were unfairly punished by the market during the most intense periods of market illiquidity over the past 18 months. And it’s very important to note that we are making these investments on the basis of our calculation that even if the current bad economic situation worsens considerably, we will still receive the proper cash flows from these securities.

Bill, what is your outlook for the economy, the credit markets, and the fund over the next several months?

Obviously, the seismic changes in today’s financial landscape make it difficult to formulate a strong call concerning the magnitude of the economic impact. Further deterioration in growth is a distinct possibility. However, we believe that some potential bad economic news is already “priced into” the financial markets, and that markets are often ahead of the fundamental economic story in anticipating the future direction of the economy, positive or negative.

Because it is impossible to predict even the short-term economic future, we are focusing on cash flows. That is, we are looking to invest in bonds that will produce steady returns even if a bad U.S. economy gets significantly worse. We are also emphasizing shorter duration and high quality. At the same time, though we expect market volatility to persist, we think that the level of value in the bond market is so high it is off the charts. For the first time in more than 15 years, double-digit yields are available from fixed-income instruments during a period when inflation is still very low. To us, the potential returns from a select mix of credit instruments are extremely attractive.

Thanks again, Bill, for sharing your insights with us.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

11

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended March 31, 2009, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section of putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only avail able to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

| | | | | | | | | | |

| Fund performance Total return for periods ended 3/31/09 | | | | |

|

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (10/3/88) | (3/1/93) | (2/1/99) | (12/1/94) | (12/1/03) | (7/1/96) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 4.82% | 4.61% | 4.02% | 4.02% | 4.01% | 4.01% | 4.53% | 4.36% | 4.54% | 4.96% |

|

| 10 years | 10.80 | 6.40 | 2.83 | 2.83 | 2.33 | 2.33 | 8.00 | 4.49 | 7.57 | 13.05 |

| Annual average | 1.03 | 0.62 | 0.28 | 0.28 | 0.23 | 0.23 | 0.77 | 0.44 | 0.73 | 1.23 |

|

| 5 years | –19.23 | –22.45 | –22.04 | –23.20 | –22.42 | –22.42 | –20.13 | –22.74 | –20.60 | –18.50 |

| Annual average | –4.18 | –4.96 | –4.86 | –5.14 | –4.95 | –4.95 | –4.40 | –5.03 | –4.51 | –4.01 |

|

| 3 years | –26.59 | –29.53 | –28.09 | –29.89 | –28.36 | –28.36 | –27.05 | –29.44 | –27.43 | –26.27 |

| Annual average | –9.79 | –11.01 | –10.41 | –11.16 | –10.52 | –10.52 | –9.98 | –10.97 | –10.14 | –9.66 |

|

| 1 year | –30.08 | –32.90 | –30.46 | –33.65 | –30.72 | –31.35 | –30.12 | –32.41 | –30.44 | –30.11 |

|

| 6 months | –23.13 | –26.23 | –23.36 | –27.00 | –23.48 | –24.20 | –23.18 | –25.68 | –23.32 | –23.08 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund limited expenses, without which returns would have been lower.

Due to market volatility, current performance may be higher or lower than performance shown. A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

12

| | | | |

| Comparative index returns For periods ended 3/31/09 | | |

|

| | Barclays Capital | Citigroup Non-U.S. | JPMorgan | Lipper Multi-Sector |

| | Aggregate | World Govt. | Developed High | Income Funds |

| | Bond Index | Bond Index | Yield Index | category average** |

|

| Annual average (life of fund) | 7.29% | 7.12% | —* | 6.41% |

|

| 10 years | 74.04 | 70.62 | 31.09% | 41.79 |

| Annual average | 5.70 | 5.49 | 2.74 | 3.46 |

|

| 5 years | 22.41 | 24.01 | –1.17 | 5.51 |

| Annual average | 4.13 | 4.40 | –0.23 | 0.99 |

|

| 3 years | 18.35 | 23.95 | –13.71 | –4.72 |

| Annual average | 5.78 | 7.42 | –4.80 | –1.71 |

|

| 1 year | 3.13 | –6.43 | –20.14 | –13.21 |

|

| 6 months | 4.70 | 2.56 | –14.79 | –7.63 |

|

Index and Lipper results should be compared to fund performance at net asset value.

*Inception date of index was 12/31/94, after the fund’s inception.

**Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 3/31/09, there were 161, 151, 112, 98, 70, and 5 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 3/31/09

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.342 | $0.317 | $0.320 | $0.336 | $0.336 | $0.350 |

|

| Capital gains | | — | — | — | | — | — | — |

|

| Total | $0.342 | $0.317 | $0.320 | $0.336 | $0.336 | $0.350 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 9/30/08 | $8.10 | $8.44 | $8.04 | $8.03 | $8.02 | $8.29 | $8.06 | $8.08 |

|

| 3/31/09 | 5.89 | 6.14 | 5.85 | 5.83 | 5.83 | 6.03 | 5.85 | 5.87 |

|

| Current yield (end of period) | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| Current dividend rate 1 | 11.61% | 11.14% | 10.87% | 11.11% | 11.53% | 11.14% | 11.49% | 11.86% |

|

| Current 30-day SEC yield 2,3 | | | | | | | | |

| (with expense limitation) | N/A | 11.61 | 11.35 | 11.35 | N/A | 11.45 | 11.85 | 12.35 |

|

| Current 30-day SEC yield 3 | | | | | | | | |

| (without expense limitation) | N/A | 11.59 | 11.32 | 11.32 | N/A | 11.42 | 11.82 | 12.32 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 For a portion of the period, this fund may have limited expenses, without which yields would have been lower.

3 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund’s annual operating expenses For the fiscal year ended 9/30/08

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual fund operating expenses | 1.04% | 1.79% | 1.79% | 1.29% | 1.29% | 0.79% |

|

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

13

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The following table shows the expenses you would have paid on a $1,000 investment in Putnam Diversified Income Trust from October 1, 2008, to March 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | $4.85 | $8.15 | $8.14 | $5.95 | $5.95 | $3.75 |

|

| Ending value (after expenses) | $768.70 | $766.40 | $765.20 | $768.20 | $766.80 | $769.20 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/09. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

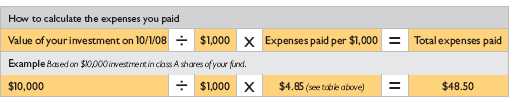

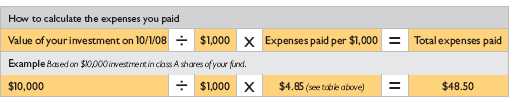

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended March 31, 2009, use the following calculation method. To find the value of your investment on October 1, 2008, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

14

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | $5.54 | $9.30 | $9.30 | $6.79 | $6.79 | $4.28 |

|

| Ending value (after expenses) | $1,019.45 | $1,015.71 | $1,015.71 | $1,018.20 | $1,018.20 | $1,020.69 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/09. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund’s annualized | | | | | | |

| expense ratio | 1.10% | 1.85% | 1.85% | 1.35% | 1.35% | 0.85% |

|

| Average annualized expense | | | | | | |

| ratio for Lipper peer group* | 1.12% | 1.87% | 1.87% | 1.37% | 1.37% | 0.87% |

|

* Putnam keeps fund expenses below the Lipper peer group average expense ratio by limiting our fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage/service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times; the fund’s expense ratio shown here is annualized data for the most recent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 3/31/09.

Your fund’s portfolio turnover

Putnam funds are actively managed by experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s assets within a one-year period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

15

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the following table to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons Percentage of holdings that change every year

| | | | | |

| | 2008 | 2007 | 2006 | 2005 | 2004 |

|

| Putnam Diversified Income Trust | 157% | 74% | 71% | 126% | 99% |

|

| Lipper Multi-Sector Income Funds | | | | | |

| category average | 148% | 119% | 124% | 127% | 104% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on September 30. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2008 is based on information available as of 12/31/08.

Your fund’s management

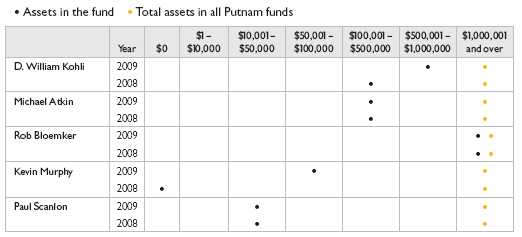

In addition to D. William Kohli, your fund’s Portfolio Managers are Michael Atkin, Rob Bloemker, Kevin Murphy, and Paul Scanlon.

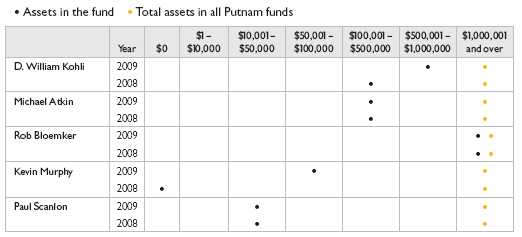

Portfolio management fund ownership

The following table shows how much the fund’s current Portfolio Managers have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of March 31, 2009, and March 31, 2008.

16

Trustee and Putnam employee fund ownership

As of March 31, 2009, all of the Trustees of the Putnam funds owned fund shares. The following table shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | |

| | Assets in the fund | Total assets in all Putnam funds |

| Trustees | $502,000 | $30,000,000 |

|

| Putnam employees | $11,656,000 | $319,000,000 |

|

Other Putnam funds managed by the Portfolio Managers

D. William Kohli is also a Portfolio Manager of Putnam Absolute Return 100 Fund, Putnam Absolute Return 300 Fund, Putnam Global Income Trust, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Michael Atkin is also a Portfolio Manager of Putnam Global Income Trust, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Rob Bloemker is also a Portfolio Manager of Putnam Absolute Return 100 Fund, Putnam Absolute Return 300 Fund, Putnam American Government Income Fund, Putnam Global Income Trust, Putnam Income Fund, Putnam Master Intermediate Income Trust, Putnam Premier Income Trust, and Putnam U.S. Government Income Trust.

Kevin Murphy is also a Portfolio Manager of Putnam Absolute Return 100 Fund, Putnam Absolute Return 300 Fund, Putnam Income Fund, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Paul Scanlon is also a Portfolio Manager of Putnam Absolute Return 100 Fund, Putnam Absolute Return 300 Fund, Putnam Floating Rate Income Fund, Putnam High Yield Advantage Fund, Putnam High Yield Trust, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

D. William Kohli, Michael Atkin, Rob Bloemker, Kevin Murphy, and Paul Scanlon may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

17

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Citigroup Non-U.S. World Government Bond Index is an unmanaged index generally considered to be representative of the world bond market excluding the United States.

JPMorgan Developed High Yield Index is an unmanaged index of high-yield fixed-income securities issued in developed countries.

Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

18

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract, in respect of your fund, between Putnam Management’s affiliate, Putnam Investments Limited (“PIL”), and Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2008, the Contract Committee met several times to consider the information provided by Putnam Management and oth er information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contract, effective July 1, 2008. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees, were subject to the continued application of certain expense reductions and waivers and other considerations noted below, and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prio r years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and

19

the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. In this regard, the Trustees also noted that shareholders of your fund voted in 2007 to approve new management contracts containing an identical fee structure. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 43rd percentile in management fees and in the 19th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2007 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, had been increas ing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations initially implemented in January 2004. The Trustees have received a commitment from Putnam Management and its parent company to continue this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2008, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2007. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

In addition, the Trustees devoted particular attention to analyzing the Putnam funds’ fees and expenses relative to those of competitors in fund complexes of comparable size and with a comparable mix of asset categories. The Trustees concluded that this analysis did not reveal any matters requiring further attention at the current time.

20

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of the fund (as a percentage of fund assets) declines as the fund grows in size and crosses specified asset thresholds. Conversely, if the fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale at current asset levels.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel —but also recognized that t his does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

While the Trustees noted the satisfactory investment performance of certain Putnam funds, they considered the disappointing investment performance of many funds in recent periods, particularly over periods in 2007 and 2008. They discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has taken steps to strengthen its investment personnel and processes to address areas of underperformance, including recent efforts to further centralize Putnam Management’s equity research function. In this regard, the Trustees took into consideration efforts by Putnam Management to improve its ability to assess and mitigate investment risk in individual funds, across asset classes, and across the complex as a whole. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate

21

whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Multi-Sector Income Funds) for the one-year, three-year and five-year periods ended December 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | 76th | |

| |

| Three-year period | 58th | |

| |

| Five-year period | 45th | |

| |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report.) Over the one-year, three-year, and five-year periods ended December 31, 2007, there were 124, 111, and 87 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.

The Trustees noted the disappointing performance for your fund for the one-year period ended December 31, 2007. In this regard, the Trustees considered that Putnam Management continues to have confidence in the investment process for your fund given its stronger longer-term record, recognizing the tendency for short-term variability over a market cycle.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations;

other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered changes made in 2008, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policy, which expanded the permitted categories of brokerage and research services payable with soft dollars and increased the permitted soft dollar allocation to third-party services over what had been

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Multi-Sector Income Funds category for the one-year, five-year, and ten-year periods ended March 31, 2009, were 95%, 93%, and 91%, respectively. Over the one-year, five-year, and ten-year periods ended March 31, 2009, your fund ranked 144th out of 151, 92nd out of 98, and 64th out of 70 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

22

authorized in previous years. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage and trends in industry practice to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract arrangements also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the investor servicing agreement, the Trustees considered that certain shareholder servicing functions were shifted to a third-party service provider by PFTC in 2007.

Comparison of retail and institutional

fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparisons of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset classes are typically higher o n average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

23

Other information for shareholders

Important notice regarding delivery

of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2008, are available in the Individual Investors section of putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

24

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings —from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

25

| | | |

| The fund’s portfolio 3/31/09 (Unaudited) | | | |

| |

| |

| U.S. GOVERNMENT AND AGENCY | | | |

| MORTGAGE OBLIGATIONS (49.3%)* | Principal amount | Value |

|

| U.S. Government Guaranteed Mortgage Obligations (0.2%) | | | |

| Government National Mortgage Association Pass-Through | | | |

| Certificates 6 1/2s, TBA, April 1, 2039 | | $3,000,000 | $3,141,328 |

|

| | | | 3,141,328 |

| U.S. Government Agency Mortgage Obligations (49.1%) | | | |

| Federal National Mortgage Association Pass-Through Certificates | | | |

| 6 1/2s, TBA, April 1, 2039 | | 4,000,000 | 4,212,188 |

| 6s, TBA, April 1, 2024 | | 3,000,000 | 3,139,922 |

| 5 1/2s, January 1, 2038 | | 144,497 | 150,198 |

| 5 1/2s, TBA, April 1, 2039 | | 4,000,000 | 4,151,250 |

| 5 1/2s, TBA, April 1, 2024 | | 4,000,000 | 4,168,750 |

| 5s, TBA, May 1, 2039 | | 23,000,000 | 23,657,657 |

| 5s, TBA, April 1, 2039 | | 29,000,000 | 29,915,313 |

| 4 1/2s, TBA, May 1, 2039 | | 170,000,000 | 173,101,174 |

| 4 1/2s, TBA, April 1, 2039 | | 400,000,000 | 408,500,000 |

| 4s, TBA, April 1, 2024 | | 1,000,000 | 1,016,484 |

|

| | | | 652,012,936 |

| Total U.S. government and agency mortgage obligations (cost $651,481,379) | $655,154,264 |

|

| |

| MORTGAGE-BACKED SECURITIES (40.5%)* | Principal amount | Value |

|

| Banc of America Alternative Loan Trust Ser. 06-7, Class A2, | | | |

| 5.707s, 2036 | | $19,993,000 | $8,127,155 |

|

| Banc of America Commercial Mortgage, Inc. | | | |

| FRB Ser. 07-3, Class A2, 5.658s, 2049 | | 7,830,000 | 6,488,042 |

| FRB Ser. 07-3, Class A3, 5.837s, 2049 | | 765,000 | 491,495 |

| Ser. 07-2, Class A2, 5.634s, 2049 | | 2,590,000 | 2,090,699 |

| Ser. 05-6, Class A2, 5.165s, 2047 | | 250,000 | 226,090 |

| Ser. 07-5, Class XW, Interest only (IO), 0.44s, 2051 | | 233,077,381 | 3,873,230 |

|

| Banc of America Commercial Mortgage, Inc. 144A | | | |

| Ser. 01-1, Class J, 6 1/8s, 2036 | | 1,170,000 | 234,000 |

| Ser. 01-1, Class K, 6 1/8s, 2036 | | 2,633,000 | 1,007,376 |

|

| Banc of America Funding Corp. FRB Ser. 06-D, Class 6A1, | | | |

| 5.948s, 2036 | | 14,038,928 | 6,598,296 |

|

| Bayview Commercial Asset Trust 144A | | | |

| Ser. 07-1, Class S, IO, 2.477s, 2037 | | 13,414,890 | 802,210 |

| Ser. 07-5A, IO, 1.55s, 2037 | | 4,290,844 | 319,239 |

|

| Bear Stearns Alternate Trust | | | |

| FRB Ser. 06-5, Class 2A2, 6 1/4s, 2036 | | 10,451,407 | 4,391,327 |

| FRB Ser. 06-6, Class 2A1, 5.891s, 2036 | | 5,022,264 | 2,288,353 |

| FRB Ser. 05-7, Class 23A1, 5.649s, 2035 | | 9,590,935 | 4,161,333 |

|

| Bear Stearns Commercial Mortgage Securities, Inc. FRB | | | |

| Ser. 00-WF2, Class F, 8.186s, 2032 | | 1,174,000 | 661,539 |

|

| Bear Stearns Commercial Mortgage Securities, Inc. 144A | | | |

| Ser. 07-PW18, Class X1, IO, 0.095s, 2050 | | 273,916,190 | 1,593,453 |

|

| Broadgate Financing PLC sec. FRB Ser. D, 2.417s, 2023 | | | |

| (United Kingdom) | GBP | 2,331,850 | 836,201 |

|

| Citigroup Mortgage Loan Trust, Inc. | | | |

| FRB Ser. 06-AR5, Class 2A5A, 6.198s, 2036 | | $6,748,995 | 3,466,436 |

| FRB Ser. 05-10, Class 1A5A, 5.834s, 2035 | | 2,213,427 | 1,171,788 |

26

| | | |

| MORTGAGE-BACKED SECURITIES (40.5%)* cont. | Principal amount | Value |

|

| Citigroup Mortgage Loan Trust, Inc. | | | |

| FRB Ser. 06-AR7, Class 2A2A, 5.645s, 2036 | | $1,160,226 | $440,886 |

| IFB Ser. 07-6, Class 2A5, IO, 6.128s, 2037 | | 6,772,208 | 524,846 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust 144A | | | |

| Ser. 07-CD5, Class XS, IO, 0.077s, 2044 | | 162,666,444 | 569,072 |

|

| Commercial Mortgage Acceptance Corp. Ser. 97-ML1, IO, | | | |

| 0.465s, 2017 | | 16,825,425 | 496,263 |

|

| Countrywide Alternative Loan Trust | | | |

| IFB Ser. 04-2CB, Class 1A5, IO, 7.078s, 2034 | | 7,369,558 | 423,750 |

| Ser. 06-45T1, Class 2A2, 6s, 2037 | | 4,250,546 | 2,228,880 |

| Ser. 06-J8, Class A4, 6s, 2037 | | 10,913,591 | 5,722,815 |

| Ser. 07-HY5R, Class 2A1A, 5.544s, 2047 | | 8,818,582 | 5,649,748 |

|

| Countrywide Home Loans | | | |

| FRB Ser. 05-HYB7, Class 6A1, 5.675s, 2035 | | 16,263,320 | 7,481,127 |

| FRB Ser. 06-HYB1, Class 1A1, 5.316s, 2036 | | 1,690,499 | 782,789 |

| FRB Ser. 05-HYB4, Class 2A1, 4.895s, 2035 | | 22,966,551 | 11,712,941 |

|

| Countrywide Home Loans 144A Ser. 03-R4, Class 1A, | | | |

| Principal only (PO), zero %, 2034 | | 30,373 | 15,716 |

|

| Credit Suisse Mortgage Capital Certificates | | | |

| FRB Ser. 07-C4, Class A2, 5.81s, 2039 | | 3,679,000 | 2,789,082 |

| Ser. 07-3, Class 1A1A, 5.837s, 2037 | | 3,539,935 | 1,716,869 |

| Ser. 07-C5, Class A3, 5.694s, 2040 | | 37,930,000 | 22,681,677 |

|

| CRESI Finance Limited Partnership 144A | | | |

| FRB Ser. 06-A, Class D, 1.322s, 2017 | | 369,000 | 166,050 |

| FRB Ser. 06-A, Class C, 1.122s, 2017 | | 1,093,000 | 601,150 |

|

| Criimi Mae Commercial Mortgage Trust 144A Ser. 98-C1, Class B, | | | |

| 7s, 2033 | | 6,518,502 | 5,810,028 |

|

| CS First Boston Mortgage Securities Corp. 144A | | | |

| FRB Ser. 05-TFLA, Class L, 2.406s, 2020 | | 4,911,000 | 2,455,500 |

| Ser. 98-C2, Class F, 6 3/4s, 2030 | | 8,998,000 | 5,769,592 |

| Ser. 98-C1, Class F, 6s, 2040 | | 7,396,000 | 3,698,000 |

| Ser. 02-CP5, Class M, 5 1/4s, 2035 | | 2,599,000 | 126,183 |

|

| Deutsche Mortgage & Asset Receiving Corp. | | | |

| Ser. 98-C1, Class X, IO, 0.344s, 2031 | | 27,118,341 | 536,181 |

|

| DLJ Commercial Mortgage Corp. Ser. 98-CF2, Class B4, 6.04s, 2031 | | 2,235,111 | 1,229,311 |

|

| European Loan Conduit 144A FRB Ser. 22A, Class D, 3.043s, 2014 | | | |

| (United Kingdom) | GBP | 2,461,000 | 706,012 |

|

| European Prime Real Estate PLC 144A FRB Ser. 1-A, Class D, | | | |

| 3.019s, 2014 (United Kingdom) | GBP | 1,696,395 | 486,662 |

|

| Fannie Mae | | | |

| FRB Ser. 05-91, Class EF, zero %, 2035 | | $388,630 | 358,021 |

| FRB Ser. 06-54, Class CF, zero %, 2035 | | 337,696 | 332,462 |

| FRB Ser. 05-77, Class HF, zero %, 2034 | | 939,933 | 891,361 |

| IFB Ser. 06-70, Class SM, 50.389s, 2036 | | 669,355 | 1,002,720 |

| IFB Ser. 07-W7, Class 1A4, 36.049s, 2037 | | 2,147,918 | 2,749,334 |

| IFB Ser. 06-104, Class GS, 31.905s, 2036 | | 1,528,678 | 1,990,690 |

| IFB Ser. 05-115, Class NQ, 22.98s, 2036 | | 1,243,753 | 1,450,404 |

| IFB Ser. 05-74, Class CP, 22.836s, 2035 | | 2,381,795 | 2,665,443 |

| IFB Ser. 06-8, Class WK, 22.653s, 2036 | | 5,529,349 | 7,007,880 |

| IFB Ser. 05-99, Class SA, 22.653s, 2035 | | 2,772,403 | 3,460,760 |

| IFB Ser. 05-95, Class OP, 18.743s, 2035 | | 1,799,590 | 2,125,222 |

27

| | |

| MORTGAGE-BACKED SECURITIES (40.5%)* cont. | Principal amount | Value |

|

| Fannie Mae | | |

| IFB Ser. 05-74, Class CS, 18.585s, 2035 | $2,715,793 | $3,308,870 |

| IFB Ser. 05-95, Class CP, 18.306s, 2035 | 362,040 | 420,772 |

| IFB Ser. 05-83, Class QP, 16.037s, 2034 | 987,653 | 1,051,648 |

| IFB Ser. 07-W6, Class 6A2, IO, 7.278s, 2037 | 3,669,369 | 339,417 |

| IFB Ser. 06-90, Class SE, IO, 7.278s, 2036 | 8,222,629 | 903,108 |

| IFB Ser. 04-51, Class XP, IO, 7.178s, 2034 | 8,207,247 | 694,089 |

| IFB Ser. 03-66, Class SA, IO, 7.128s, 2033 | 5,041,139 | 453,098 |

| IFB Ser. 08-7, Class SA, IO, 7.028s, 2038 | 20,311,059 | 2,455,749 |

| IFB Ser. 07-W6, Class 5A2, IO, 6.768s, 2037 | 5,183,450 | 453,552 |

| IFB Ser. 07-W2, Class 3A2, IO, 6.758s, 2037 | 5,047,226 | 441,632 |

| IFB Ser. 06-115, Class BI, IO, 6.738s, 2036 | 5,235,775 | 418,794 |

| IFB Ser. 05-113, Class AI, IO, 6.708s, 2036 | 2,602,817 | 205,454 |

| IFB Ser. 06-125, Class SM, IO, 6.678s, 2037 | 4,954,088 | 427,061 |

| IFB Ser. 06-58, Class SP, IO, 6.678s, 2036 | 3,132,599 | 223,292 |

| IFB Ser. 06-58, Class SQ, IO, 6.678s, 2036 | 12,897,362 | 953,502 |

| IFB Ser. 08-36, Class YI, IO, 6.678s, 2036 | 8,873,358 | 810,883 |

| IFB Ser. 06-43, Class SU, IO, 6.678s, 2036 | 1,672,254 | 151,122 |

| IFB Ser. 06-24, Class QS, IO, 6.678s, 2036 | 3,860,729 | 439,621 |

| IFB Ser. 06-60, Class SI, IO, 6.628s, 2036 | 12,647,139 | 1,274,688 |

| IFB Ser. 06-60, Class UI, IO, 6.628s, 2036 | 2,335,381 | 176,767 |

| IFB Ser. 04-24, Class CS, IO, 6.628s, 2034 | 1,825,751 | 143,735 |

| IFB Ser. 04-12, Class WS, IO, 6.628s, 2033 | 2,658,290 | 203,371 |

| IFB Ser. 07-W7, Class 3A2, IO, 6.608s, 2037 | 7,220,723 | 675,282 |

| IFB Ser. 06-60, Class DI, IO, 6.548s, 2035 | 5,899,409 | 430,691 |

| IFB Ser. 03-130, Class BS, IO, 6.528s, 2033 | 11,918,023 | 1,108,865 |

| IFB Ser. 03-34, Class WS, IO, 6.478s, 2029 | 11,277,828 | 890,012 |

| IFB Ser. 08-20, Class SA, IO, 6.468s, 2038 | 2,531,874 | 213,079 |

| IFB Ser. 08-10, Class LI, IO, 6.458s, 2038 | 11,438,398 | 1,175,679 |

| IFB Ser. 08-41, Class S, IO, 6.278s, 2036 | 11,910,677 | 920,286 |

| IFB Ser. 05-42, Class SA, IO, 6.278s, 2035 | 5,103,928 | 522,366 |

| IFB Ser. 07-39, Class LI, IO, 6.248s, 2037 | 12,912,942 | 1,118,390 |

| IFB Ser. 07-23, Class SI, IO, 6.248s, 2037 | 1,498,499 | 109,926 |

| IFB Ser. 07-54, Class CI, IO, 6.238s, 2037 | 5,430,308 | 519,311 |

| IFB Ser. 07-39, Class PI, IO, 6.238s, 2037 | 3,509,224 | 256,846 |

| IFB Ser. 07-42, Class SD, IO, 6.238s, 2037 | 1,497,168 | 98,469 |

| IFB Ser. 07-28, Class SE, IO, 6.228s, 2037 | 932,165 | 88,402 |

| IFB Ser. 07-22, Class S, IO, 6.228s, 2037 | 15,665,282 | 1,448,469 |

| IFB Ser. 06-128, Class SH, IO, 6.228s, 2037 | 3,926,888 | 297,671 |

| IFB Ser. 06-79, Class SI, IO, 6.228s, 2036 | 2,592,021 | 245,689 |

| IFB Ser. 05-90, Class SP, IO, 6.228s, 2035 | 2,550,021 | 235,206 |

| IFB Ser. 05-12, Class SC, IO, 6.228s, 2035 | 3,173,976 | 334,579 |

| IFB Ser. 05-45, Class PL, IO, 6.228s, 2034 | 5,240,870 | 489,178 |

| IFB Ser. 07-W5, Class 2A2, IO, 6.218s, 2037 | 1,736,001 | 142,442 |

| IFB Ser. 07-30, Class IE, IO, 6.218s, 2037 | 10,748,543 | 1,521,198 |

| IFB Ser. 06-123, Class CI, IO, 6.218s, 2037 | 10,109,182 | 951,416 |

| IFB Ser. 06-123, Class UI, IO, 6.218s, 2037 | 9,818,074 | 931,620 |

| IFB Ser. 07-15, Class BI, IO, 6.178s, 2037 | 16,253,031 | 1,437,711 |

| IFB Ser. 06-126, Class CS, IO, 6.178s, 2037 | 8,529,289 | 699,598 |

| IFB Ser. 06-16, Class SM, IO, 6.178s, 2036 | 9,723,769 | 1,076,042 |

| IFB Ser. 05-95, Class CI, IO, 6.178s, 2035 | 6,365,405 | 685,109 |

| IFB Ser. 05-84, Class SG, IO, 6.178s, 2035 | 10,005,531 | 874,114 |

28

| | |

| MORTGAGE-BACKED SECURITIES (40.5%)* cont. | Principal amount | Value |

|

| Fannie Mae | | |

| IFB Ser. 05-57, Class NI, IO, 6.178s, 2035 | $2,071,689 | $146,548 |

| IFB Ser. 05-29, Class SX, IO, 6.178s, 2035 | 5,667,795 | 412,453 |

| IFB Ser. 05-57, Class DI, IO, 6.178s, 2035 | 4,406,955 | 356,154 |

| IFB Ser. 05-7, Class SC, IO, 6.178s, 2035 | 6,070,760 | 451,482 |

| IFB Ser. 04-92, Class S, IO, 6.178s, 2034 | 15,257,879 | 1,153,615 |

| IFB Ser. 06-104, Class EI, IO, 6.168s, 2036 | 5,787,339 | 503,510 |

| IFB Ser. 05-83, Class QI, IO, 6.168s, 2035 | 1,757,613 | 146,888 |

| IFB Ser. 06-128, Class GS, IO, 6.158s, 2037 | 6,081,597 | 566,774 |

| IFB Ser. 06-114, Class IS, IO, 6.128s, 2036 | 4,221,096 | 347,333 |

| IFB Ser. 06-116, Class ES, IO, 6.128s, 2036 | 767,286 | 57,052 |

| IFB Ser. 04-92, Class SQ, IO, 6.128s, 2034 | 6,301,841 | 620,501 |

| IFB Ser. 06-115, Class IE, IO, 6.118s, 2036 | 3,269,999 | 275,786 |

| IFB Ser. 06-117, Class SA, IO, 6.118s, 2036 | 4,875,824 | 405,244 |

| IFB Ser. 06-121, Class SD, IO, 6.118s, 2036 | 587,877 | 52,092 |

| IFB Ser. 06-109, Class SG, IO, 6.108s, 2036 | 1,392,867 | 116,011 |

| IFB Ser. 06-104, Class SY, IO, 6.098s, 2036 | 1,246,372 | 91,430 |

| IFB Ser. 06-109, Class SH, IO, 6.098s, 2036 | 4,605,921 | 523,684 |

| IFB Ser. 06-111, Class SA, IO, 6.098s, 2036 | 29,259,819 | 2,759,523 |

| IFB Ser. 07-W6, Class 4A2, IO, 6.078s, 2037 | 23,799,266 | 2,082,436 |

| IFB Ser. 06-128, Class SC, IO, 6.078s, 2037 | 5,130,014 | 433,845 |

| IFB Ser. 06-43, Class SI, IO, 6.078s, 2036 | 11,298,230 | 943,278 |

| IFB Ser. 06-8, Class JH, IO, 6.078s, 2036 | 16,254,366 | 1,452,815 |

| IFB Ser. 05-122, Class SG, IO, 6.078s, 2035 | 4,930,127 | 489,315 |

| IFB Ser. 05-57, Class MS, IO, 6.078s, 2035 | 4,468,390 | 309,417 |

| IFB Ser. 06-101, Class SA, IO, 6.058s, 2036 | 12,412,209 | 1,035,302 |

| IFB Ser. 06-92, Class LI, IO, 6.058s, 2036 | 4,872,119 | 404,030 |

| IFB Ser. 06-99, Class AS, IO, 6.058s, 2036 | 1,479,024 | 137,616 |

| IFB Ser. 06-17, Class SI, IO, 6.058s, 2036 | 4,540,113 | 385,610 |

| IFB Ser. 06-98, Class SQ, IO, 6.048s, 2036 | 11,162,732 | 965,841 |

| IFB Ser. 06-60, Class YI, IO, 6.048s, 2036 | 8,389,861 | 805,259 |

| IFB Ser. 06-85, Class TS, IO, 6.038s, 2036 | 11,697,718 | 863,116 |

| IFB Ser. 07-75, Class PI, IO, 6.018s, 2037 | 6,605,124 | 492,841 |

| IFB Ser. 07-88, Class MI, IO, 5.998s, 2037 | 2,556,611 | 228,786 |

| IFB Ser. 07-103, Class AI, IO, 5.978s, 2037 | 23,716,404 | 1,888,774 |

| IFB Ser. 07-15, Class NI, IO, 5.978s, 2022 | 9,687,040 | 749,357 |

| IFB Ser. 07-106, Class SM, IO, 5.938s, 2037 | 14,232,571 | 1,052,513 |

| IFB Ser. 08-3, Class SC, IO, 5.928s, 2038 | 37,971,366 | 3,580,581 |

| IFB Ser. 07-109, Class XI, IO, 5.928s, 2037 | 4,040,680 | 367,536 |

| IFB Ser. 07-109, Class YI, IO, 5.928s, 2037 | 5,064,644 | 367,911 |

| IFB Ser. 07-W8, Class 2A2, IO, 5.928s, 2037 | 9,879,944 | 624,768 |

| IFB Ser. 07-88, Class JI, IO, 5.928s, 2037 | 7,989,516 | 665,007 |

| IFB Ser. 06-79, Class SH, IO, 5.928s, 2036 | 8,468,473 | 892,566 |

| IFB Ser. 07-54, Class KI, IO, 5.918s, 2037 | 2,654,640 | 208,546 |

| IFB Ser. 07-30, Class JS, IO, 5.918s, 2037 | 9,517,319 | 861,435 |

| IFB Ser. 07-30, Class LI, IO, 5.918s, 2037 | 8,597,794 | 699,516 |

| IFB Ser. 07-14, Class ES, IO, 5.918s, 2037 | 5,725,277 | 410,557 |

| IFB Ser. 07-W2, Class 1A2, IO, 5.908s, 2037 | 4,674,670 | 368,598 |

| IFB Ser. 07-106, Class SN, IO, 5.888s, 2037 | 5,820,909 | 422,452 |

| IFB Ser. 07-54, Class IA, IO, 5.888s, 2037 | 4,765,133 | 421,405 |

| IFB Ser. 07-54, Class IB, IO, 5.888s, 2037 | 4,765,133 | 421,405 |

| IFB Ser. 07-54, Class IC, IO, 5.888s, 2037 | 4,765,133 | 421,405 |

29

| | |

| MORTGAGE-BACKED SECURITIES (40.5%)* cont. | Principal amount | Value |

|

| Fannie Mae | | |

| IFB Ser. 07-54, Class ID, IO, 5.888s, 2037 | $4,765,133 | $421,405 |

| IFB Ser. 07-54, Class IE, IO, 5.888s, 2037 | 4,765,133 | 421,405 |

| IFB Ser. 07-54, Class IF, IO, 5.888s, 2037 | 7,547,540 | 613,087 |

| IFB Ser. 07-54, Class NI, IO, 5.888s, 2037 | 4,709,924 | 352,556 |

| IFB Ser. 07-54, Class UI, IO, 5.888s, 2037 | 7,016,488 | 630,993 |

| IFB Ser. 07-91, Class AS, IO, 5.878s, 2037 | 4,037,590 | 304,099 |

| IFB Ser. 07-91, Class HS, IO, 5.878s, 2037 | 4,168,126 | 360,152 |

| IFB Ser. 07-15, Class CI, IO, 5.858s, 2037 | 18,197,747 | 1,609,500 |

| IFB Ser. 06-115, Class JI, IO, 5.858s, 2036 | 13,088,540 | 1,072,594 |

| IFB Ser. 07-109, Class PI, IO, 5.828s, 2037 | 6,499,009 | 516,349 |

| IFB Ser. 06-123, Class LI, IO, 5.798s, 2037 | 9,109,340 | 684,840 |

| IFB Ser. 08-1, Class NI, IO, 5.728s, 2037 | 10,639,677 | 930,658 |

| IFB Ser. 08-10, Class GI, IO, 5.708s, 2038 | 7,721,675 | 577,604 |

| IFB Ser. 08-13, Class SA, IO, 5.698s, 2038 | 23,446,674 | 1,676,109 |

| IFB Ser. 07-39, Class AI, IO, 5.598s, 2037 | 8,343,697 | 598,744 |

| IFB Ser. 07-32, Class SD, IO, 5.588s, 2037 | 5,574,325 | 413,937 |

| IFB Ser. 07-30, Class UI, IO, 5.578s, 2037 | 4,653,474 | 419,632 |

| IFB Ser. 07-32, Class SC, IO, 5.578s, 2037 | 7,960,901 | 666,710 |

| IFB Ser. 07-1, Class CI, IO, 5.578s, 2037 | 5,304,578 | 439,012 |

| IFB Ser. 05-92, Class US, IO, 5.578s, 2025 | 13,427,958 | 912,649 |

| IFB Ser. 05-14, Class SE, IO, 5.528s, 2035 | 5,062,175 | 359,769 |

| IFB Ser. 04-46, Class PJ, IO, 5.478s, 2034 | 3,892,526 | 341,484 |