UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-5583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

| | |

| One Franklin Parkway, San Mateo, CA | | 94403-1906 |

| (Address of principal executive offices) | | (Zip code) |

Murray L. Simpson, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/03

Item 1. Reports to Stockholders

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST ANNUAL REPORT

TABLEOF CONTENTS

| | |

A Word About Risk | | i |

Important Notes to Performance Information | | ii |

Regulatory Update | | iii |

Fund Summaries | | |

Templeton Developing Markets Securities Fund | | TD-1 |

Templeton Foreign Securities Fund | | TF-1 |

Templeton Global Asset Allocation Fund | | TGA-1 |

*Prospectus Supplement | | TGA-6 |

Templeton Global Income Securities Fund | | TGI-1 |

*Prospectus Supplement | | TGI-7 |

Templeton Growth Securities Fund | | TG-1 |

*Prospectus Supplement | | TG-5 |

Index Descriptions | | IND-1 |

Board Members and Officers | | BOD-1 |

Proxy Voting Policies and Procedures | | PV-1 |

*Not part of the annual report

| | |

| |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| |

PHOENIX CL1 A03 02-04 TIP

A WORDABOUT RISK

All of the funds are subject to certain risks, which will cause investment returns and the value of your principal to increase or decrease. Generally, investments offering the potential for higher returns are accompanied by a higher degree of risk. Stocks and other equities, representing an ownership interest in an individual company, historically have outperformed other asset classes over the long term, but tend to fluctuate more dramatically over the shorter term. Securities of smaller companies, and companies involved in reorganization or bankruptcy, may have greater price swings and greater credit and other risks. By having significant investment in particular sectors from time to time, some funds carry greater risk of adverse developments in those sectors than a fund that always invests in a wider variety of sectors. The technology sector can be among the most volatile market sectors.

Bonds and other debt obligations are affected by the creditworthiness of their issuers, and changes in interest rates, with prices declining as interest rates increase. High yield, lower-rated (“junk”) bonds generally have greater price swings and higher default risks than investment grade bonds.

Foreign investing, especially in emerging market countries, has additional risks such as changes in currency values, market price swings, and economic, political or social instability. These and other risks pertaining to specific funds, such as specialized industry or geographical sectors or use of complex securities, are discussed in the Franklin Templeton Variable Insurance Products Trust prospectus. Your investment representative can help you determine which funds may be right for you.

i

IMPORTANT NOTESTO

PERFORMANCE INFORMATION

Total return of the funds is the percentage change in value of a hypothetical $10,000 investment over the indicated periods and includes reinvestment of dividends and capital gains. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts, or their availability in all states. Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

ii

REGULATORY UPDATE

As of February 12, 2004

To Our Valued Contract Owners:

In our efforts to fulfill our ongoing commitment to providing you with timely and accurate information, we have prepared this statement to give you an overview of current industry issues as they pertain to Franklin Resources, Inc. (Franklin Templeton Investments) and our subsidiary companies (the “Company”). Any further updates on these and other matters will be disclosed on the Company’s website at franklintempleton.com under “Statement on Current Industry Issues.”

On February 4, 2004, the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts filed an administrative complaint against Franklin Resources, Inc. and certain of its subsidiaries, alleging violations of the Massachusetts Uniform Securities Act. The complaint arises from activity that occurred in 2001 during which time an officer of a Company subsidiary was negotiating an agreement with an investor relating to investments in a mutual fund and a hedge fund.

The Company, in addition to other entities within Franklin Templeton Investments, has been named in shareholder class actions related to the matter described above. The Company believes that the claims made in the lawsuit are without merit and it intends to defend vigorously against the allegations. The Company and the Fund(s) may be named in similar civil actions related to the matter described above.

In addition, as part of ongoing investigations by the U.S. Securities and Exchange Commission (the “SEC”), the U.S. Attorney for the Northern District of California, the New York Attorney General, the California Attorney General, the U.S. Attorney for the District of Massachusetts, the Florida Department of Financial Services, and the Commissioner of Securities and the Attorney General of the State of West Virginia, relating to certain practices in the mutual fund industry, including late trading, market timing and sales compensation arrangements, the Company and its subsidiaries, as well as certain current or former executives and employees of the Company, have received requests for information and/or subpoenas to testify or produce documents. The Company and its current employees are providing documents and information in response to these requests and subpoenas. In addition, the Company has responded to requests for similar kinds of information from regulatory authorities in some of the foreign countries where the Company conducts its global asset management business.

The Staff of the SEC has informed the Company that it intends to recommend that the Commission authorize an action against the Funds’ investment adviser and/or an affiliate adviser and a senior executive officer relating to the frequent trading issues that are the subject of the SEC’s investigation. These issues were previously disclosed as being under investigation by government authorities and the subject of an internal inquiry by the Company in its Annual Report on Form 10-K and on its public website. The Company currently is in discussions with the SEC Staff in an effort to resolve the issues raised in their investigation. Such discussions are preliminary and the Company cannot predict the likelihood of whether those discussions will result in a settlement and, if so, the terms of such settlement. The impact, if any, of these matters on a fund is uncertain at this time. If it is found that the Company bears responsibility for any unlawful or improper conduct, we have committed to making a fund or its shareholders whole, as appropriate.

iii

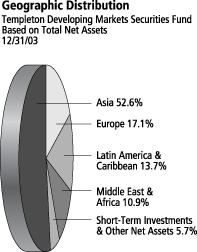

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Fund Goal and Primary Investments: Templeton Developing Markets Securities Fund seeks long-term capital appreciation. The Fund invests primarily in emerging markets investments.

This annual report for Templeton Developing Markets Securities Fund covers the period ended December 31, 2003.

Performance Overview

You can find the Fund’s one-year total return in the Performance Summary following this report. The Fund underperformed its benchmarks, the Morgan Stanley Capital International (MSCI) Emerging Markets Free (EMF) Index and the Standard & Poor’s/International Finance Corporation Investable (S&P/IFCI) Composite Index, which returned 56.28% and 57.16% for the year under review.1 Please note that the index performance numbers are purely for reference and that Templeton does not index its funds, but rather undertakes investments on the basis of careful, fundamental research.

Economic and Market Overview

For the year ended December 31, 2003, generally improving economic growth worldwide had favorable effects on many emerging market economies, which exhibited faster growth than many developed countries. Many emerging country financial markets seemed to reflect the strengthening global economic conditions. Early in 2003, concerns about military conflicts in Afghanistan and Iraq, as well as high oil prices, rattled investor confidence, and most equity markets experienced losses in the first quarter. However, a quicker-than-expected end to major combat in Iraq relieved some market concerns, and many emerging markets rebounded in the second quarter. The severe acute respiratory syndrome (SARS) outbreak in early spring greatly impacted Asian market performance as regional tourism suffered, particularly the airline and hospitality sectors. However, the containment of SARS in following months allowed concerns to subside, and investors returned from the sidelines. Largely as a result, emerging markets generally outperformed the U.S., European and Japanese markets for the 12 months under review. For example, the MSCI EMF Index returned 56.28% for the year ended December 31, 2003. The Standard & Poor’s 500 Composite Index (S&P 500), a broad measure of U.S. equity performance, returned 28.67%, while the MSCI Europe Australasia Far

1. Source: Standard & Poor’s Micropal. One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

TD-1

East (EAFE) Index and MSCI Japan Index returned 39.17% and 36.15% for the same one-year period.2

During the Fund’s fiscal year, Latin American markets were some of the world’s strongest performing as political and financial issues that engulfed the region in 2002 subsided. Brazil and Argentina experienced renewed investor interest as their governments strove to implement key structural reforms and sealed agreements with the International Monetary Fund. Asian markets rebounded sharply in 2003’s second half largely due to strong macroeconomic data. In Africa, South Africa ended years of ongoing debate, and the government agreed to provide free AIDS-related treatments, creating the world’s largest such program. Eastern European equity markets’ upward trend continued as prospective European Union (EU) candidates successfully passed referendums for accession into the EU in 2004. In Russia, an investigation and subsequent arrest of Michail Khodorkovsky, the CEO and major shareholder of oil company Yukos, as well as the breakup of the Sibneft-Yukos merger, contributed to some severe market fluctuations during 2003’s fourth quarter. For the year, however, Russia’s market outperformed its regional peers. To the south, Turkey’s market appeared to take recent terrorist attacks in stride and continued its upward trend as investor confidence seemed to remain largely unshaken.

Investment Strategy

Our investment philosophy is bottom-up, value-oriented and long-term. In choosing investments, we may make onsite visits to companies to assess critical factors such as management strength and local conditions. In addition, we focus on the market price of a company’s securities relative to our evaluation of the company’s potential long-term (typically 5 years) earnings, asset value, cash flow and balance sheet. Among factors we consider are a company’s historical value measures, including price/earnings ratio, book value, profit margins and liquidation value. We perform in-depth research to construct an action list from which we make our investment decisions.

Manager’s Discussion

During the year under review, the Fund’s performance benefited from underweighted positions, relative to the MSCI EMF Index, in South Korea and Malaysia because those countries underperformed the index. Also helping Fund performance were relatively overweighted positions in China, Turkey and Austria, which outperformed the index.

2. Source: Standard & Poor’s Micropal. Please see Index Descriptions following the Fund Summaries.

TD-2

By industry, the Fund’s holdings in banks (including commercial banks), information technology (IT) services and industrial conglomerates provided the greatest contribution to Fund performance relative to the MSCI EMF Index during the period. Individual contributors included Turkey’s Akbank and Brazil’s Banco Bradesco. Within IT services, Satyam Computers, an Indian IT services company with strong working relationships with multinationals, led performance. Industrial conglomerates that helped the Fund’s relative performance included India’s Grasim Industries and Singapore’s Keppel.

Areas that hindered Fund performance during the period included a relatively overweighted position in the Philippines and underweighted positions in Brazil and Russia. The Fund’s Philippine position is concentrated in San Miguel Corp., one of the largest beverage companies in the Asia-Pacific region. The company and its subsidiaries have broad exposure in the Asia-Pacific region and operate more than 100 facilities in the Philippines, China and other Southeast Asian countries. We believe Asia’s economic recovery could bode well for the company; therefore, consistent with our investment strategy, we continued to hold the stock. Poor liquidity made additional investments in Russia difficult, while Brazil’s strong market performance led to increasingly expensive valuations.

During the Fund’s fiscal year, we made investments in several Asian countries, including Taiwan, Singapore and China (Red Chip shares, Hong Kong-listed companies with significant exposure to China, and H shares, Hong Kong-listed Chinese companies). Consistent with our investment strategy, we purchased shares of China Mobile, a dominant wireless telecommunications operator in China; China Telecom and Taiwan Cellular, key integrated telecommunications services providers in China and Taiwan, respectively; and Singapore Telecommunications, one of Asia’s leading communications companies. Conversely, we undertook selective sales in strong performers in Indonesia and Thailand as some stock valuations became expensive.

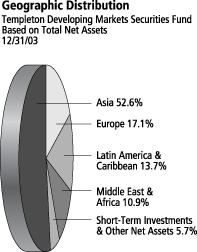

Top 10 Countries

Templeton Developing Markets Securities Fund

12/31/03

| | |

South Korea | | 11.7% |

| |

South Africa | | 11.1% |

| |

China | | 9.8% |

| |

Taiwan | | 9.6% |

| |

Brazil | | 7.7% |

| |

Singapore | | 6.4% |

| |

Hong Kong | | 5.7% |

| |

Mexico | | 5.1% |

| |

India | | 3.9% |

| |

Turkey | | 3.4% |

TD-3

Consistent with our strategy, in Latin America we added to our shares of Telefonos de Mexico, the country’s largest integrated telecommunications services provider, which increased our overall Mexican holdings. We decreased our Argentina position during the period and repositioned our Brazil holdings by adding to our shares of Embraer-Empresa Brasileira de Aeronautica, one of the world’s largest aircraft manufacturers, and reducing our position and taking profits in Cia Vale Do Rio Doce.

We purchased shares in several European companies during the fiscal year, including Poland’s Telekomunikacja Polska SA, Greece’s Hellenic Telecommunications Organization SA (OTE) and the Czech Republic’s Cesky Telecom. Largely as a result of these purchases and some of our Asian investments, the Fund’s exposure to telecommunications increased during the period. We sold some of our Turkey holdings before the terrorist attacks there, locking in gains.

Thank you for your participation in Templeton Developing Markets Securities Fund. We look forward to serving your future investment needs.

This discussion reflects our analysis, opinions and portfolio holdings as of December 31, 2003, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the advisor makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Top 10 Equity Holdings

Templeton Developing Markets

Securities Fund

12/31/03

| | |

Company Sector/Industry,

Country | | % of Total Net Assets |

|

| |

Anglo American PLC Metals & Mining,

South Africa | | 3.6% |

| |

SABMiller PLC Beverages, South Africa | | 2.5% |

| |

Citic Pacific Ltd. Industrial Conglomerates, Hong Kong | | 2.1% |

| |

Hyundai Motor Co. Ltd. Automobiles, South Korea | | 2.0% |

| |

China Mobile (Hong Kong) Ltd., fgn. Wireless Telecommunication Services, China | | 2.0% |

| |

Lukoil Holdings, ADR Oil & Gas, Russia | | 1.8% |

| |

Petroleo Brasileiro SA, ADR, pfd. Oil & Gas, Brazil | | 1.7% |

| |

Telefonos de Mexico SA de CV (Telmex), L, ADR Diversified Telecommunication Services, Mexico | | 1.6% |

| |

Banco Bradesco SA, ADR, pfd. Banks, Brazil | | 1.6% |

| |

Kimberly Clark de Mexico SA de CV, A Household Products, Mexico | | 1.6% |

The dollar value, number of shares or principal amount, and complete legal titles of all portfolio holdings are listed in the Fund’s Statement of Investments.

TD-4

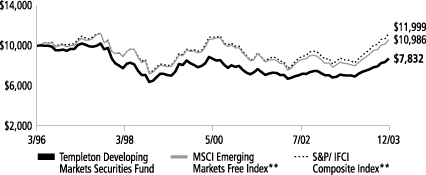

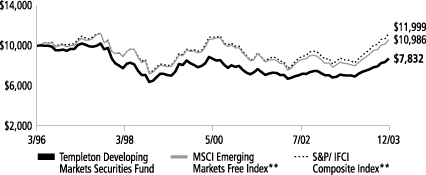

PERFORMANCE SUMMARYASOF 12/31/03

Total return of Class 1 shares represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same as year-by-year results.

Templeton Developing Markets Securities Fund – Class 1*

Periods ended 12/31/03

| | | | | | |

| | | 1-Year | | 5-Year | | Since

Inception (3/4/96) |

|

| | | |

Average Annual Total Return | | +53.74% | | +8.22% | | -3.07% |

*Performance prior to the 5/1/00 merger reflects the historical performance of Templeton Developing Markets Fund.

Ongoing market volatility can significantly affect short-term performance; recent returns may differ.

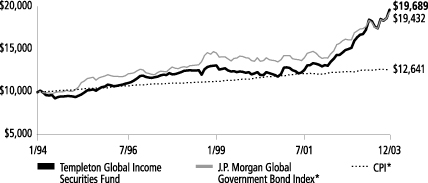

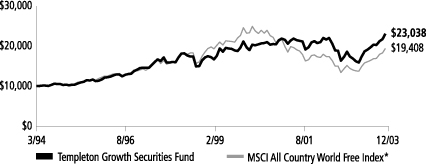

Total Return Index Comparison

for Hypothetical $10,000 Investment (3/4/96–12/31/03)

The graph compares the performance of Templeton Developing Markets Securities Fund – Class 1,* the MSCI Emerging Markets Free Index and the S&P/IFCI Composite Index. One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Important Notes to Performance Information preceding the Fund Summaries.

**Source: Standard & Poor’s Micropal. Please see Index Descriptions following the Fund Summaries.

Templeton Developing Markets Securities Fund – Class 1

Performance reflects the Fund’s Class 1 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges

and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Since markets can go down as well as up, investment return and the value of your principal will fluctuate with market conditions, and you may have a gain or loss when you sell your shares.

TD-5

Past performance does not guarantee future results.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Highlightsa

| | | | | | | | | | | | | | | | | | | | |

| | | Class 1

| |

| | | Year Ended December 31,

| |

| | | 2003 | | | 2002 | | | 2001 | | | 2000 | | | 1999 | |

| | |

|

|

|

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(For a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 4.71 | | | $ | 4.78 | | | $ | 5.25 | | | $ | 7.77 | | | $ | 5.13 | |

| | |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | .13 | | | | .07 | | | | .08 | | | | .07 | | | | .05 | |

Net realized and unrealized gains (losses) | | | 2.38 | | | | (.06 | ) | | | (.50 | ) | | | (2.52 | ) | | | 2.67 | |

| | |

|

|

|

Total from investment operations | | | 2.51 | | | | .01 | | | | (.42 | ) | | | (2.45 | ) | | | 2.72 | |

| | |

|

|

|

Less distributions from net investment income | | | (.08 | ) | | | (.08 | ) | | | (.05 | ) | | | (.07 | ) | | | (.08 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 7.14 | | | $ | 4.71 | | | $ | 4.78 | | | $ | 5.25 | | | $ | 7.77 | |

| | |

|

|

|

| | | | | |

Total returnc | | | 53.74% | | | | .04% | | | | (8.08)% | | | | (31.76)% | | | | 53.84% | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 359,299 | | | $ | 225,454 | | | $ | 240,289 | | | $ | 301,645 | | | $ | 297,605 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.55% | | | | 1.58% | | | | 1.57% | | | | 1.56% | | | | 1.50% | |

Net investment income | | | 2.35% | | | | 1.45% | | | | 1.64% | | | | 1.13% | | | | .82% | |

Portfolio turnover rate | | | 46.20% | | | | 57.91% | | | | 78.29% | | | | 89.48% | | | | 60.27% | |

| a | Financial highlights presented reflect historical financial information from Templeton Variable Products Series Fund (TVP)-Templeton Developing Markets Fund as a result of a merger on May 1, 2000. |

| b | Based on average daily shares outstanding. |

| c | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

TD-6

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Highlightsa (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class 2

| |

| | | Year Ended December 31,

| |

| | | 2003 | | | 2002 | | | 2001 | | | 2000 | | | 1999 | |

| | |

|

|

|

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(For a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 4.69 | | | $ | 4.76 | | | $ | 5.22 | | | $ | 7.74 | | | $ | 5.12 | |

| | |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | .11 | | | | .06 | | | | .07 | | | | .06 | | | | .03 | |

Net realized and unrealized gains (losses) | | | 2.35 | | | | (.06 | ) | | | (.49 | ) | | | (2.53 | ) | | | 2.66 | |

| | |

|

|

|

Total from investment operations | | | 2.46 | | | | — | | | | (.42 | ) | | | (2.47 | ) | | | 2.69 | |

| | |

|

|

|

Less distributions from net investment income | | | (.06 | ) | | | (.07 | ) | | | (.04 | ) | | | (.05 | ) | | | (.07 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 7.09 | | | $ | 4.69 | | | $ | 4.76 | | | $ | 5.22 | | | $ | 7.74 | |

| | |

|

|

|

| | | | | |

Total returnc | | | 52.99% | | | | (.15)% | | | | (8.08)% | | | | (32.04)% | | | | 53.27% | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 170,953 | | | $ | 80,952 | | | $ | 64,081 | | | $ | 56,617 | | | $ | 49,654 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.80% | | | | 1.83% | | | | 1.82% | | | | 1.81% | | | | 1.75% | |

Net investment income | | | 2.10% | | | | 1.20% | | | | 1.37% | | | | .88% | | | | .52% | |

Portfolio turnover rate | | | 46.20% | | | | 57.91% | | | | 78.29% | | | | 89.48% | | | | 60.27% | |

| a | Financial highlights presented reflect historical financial information from Templeton Variable Products Series Fund (TVP)-Templeton Developing Markets Fund as a result of a merger on May 1, 2000. |

| b | Based on average daily shares outstanding. |

| c | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

See notes to financial statements.

TD-7

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2003

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS/

WARRANTS | | VALUE |

|

| | | | | | | | |

Long Term Investments 94.3% | | | | | | | |

Argentina 1.0% | | | | | | | |

Tenaris SA, ADR | | Energy Equipment & Services | | 152,914 | | $ | 5,095,095 |

| | | | | | |

|

|

Austria 2.8% | | | | | | | |

aBank Austria Creditanstalt, Reg S | | Banks | | 95,500 | | | 4,878,595 |

OMV AG | | Oil & Gas | | 47,065 | | | 7,009,883 |

Wienerberger AG | | Building Products | | 106,392 | | | 2,842,309 |

| | | | | | |

|

|

| | | | | | | | 14,730,787 |

| | | | | | |

|

|

Brazil 7.7% | | | | | | | |

Banco Bradesco SA, ADR, pfd. | | Banks | | 325,181 | | | 8,588,030 |

Centrais Eletricas Brasileiras SA | | Electric Utilities | | 92,373,000 | | | 1,552,891 |

Centrais Eletricas Brasileiras SA | | Electric Utilities | | 159,745,000 | | | 2,685,488 |

Cia Vale do Rio Doce, ADR, pfd., A | | Metals & Mining | | 82,885 | | | 4,269,406 |

aCompanhia Paranaense de Energia-Copel, ADR, pfd. | | Electric Utilities | | 61,700 | | | 294,309 |

Duratex SA, pfd. | | Building Products | | 24,097,583 | | | 693,359 |

Embraer-Empresa Brasileira de Aeronautica SA, ADR | | Aerospace & Defense | | 205,254 | | | 7,190,048 |

Petroleo Brasileiro SA, ADR, pfd. | | Oil & Gas | | 338,985 | | | 9,037,340 |

Souza Cruz SA | | Tobacco | | 297,200 | | | 3,118,282 |

Unibanco Uniao de Bancos Brasileiros SA, GDR | | Banks | | 135,495 | | | 3,380,600 |

| | | | | | |

|

|

| | | | | | | | 40,809,753 |

| | | | | | |

|

|

China 9.8% | | | | | | | |

Beijing Enterprises Holdings Ltd. | | Industrial Conglomerates | | 1,370,000 | | | 1,605,827 |

China Mobile (Hong Kong) Ltd., fgn. | | Wireless Telecommunication Services | | 3,378,000 | | | 10,377,312 |

China Petroleum & Chemical Corp., H | | Oil & Gas | | 17,520,000 | | | 7,841,980 |

China Resources Enterprise Ltd. | | Distributors | | 4,248,000 | | | 4,815,086 |

China Telecom Corp. Ltd., H | | Diversified Telecommunication Services | | 15,932,000 | | | 6,566,850 |

China Travel International Investment Hong Kong Ltd. | | Hotels Restaurants & Leisure | | 12,082,000 | | | 2,287,668 |

Cofco International Ltd. | | Food Products | | 1,700,000 | | | 1,094,853 |

Huadian Power International Corp Ltd. | | Electric Utilities | | 5,670,000 | | | 2,373,577 |

PetroChina Co. Ltd., H | | Oil & Gas | | 12,300,000 | | | 7,050,209 |

Shanghai Industrial Holdings Ltd. | | Industrial Conglomerates | | 1,829,000 | | | 4,181,662 |

TCL International Holdings Inc. | | Household Durables | | 7,194,000 | | | 3,173,715 |

Travelsky Technology Ltd., H | | IT Consulting & Services | | 802,000 | | | 862,577 |

| | | | | | |

|

|

| | | | | | | | 52,231,316 |

| | | | | | |

|

|

Croatia .7% | | | | | | | |

Pliva D D, GDR, Reg S | | Pharmaceuticals | | 218,000 | | | 3,553,400 |

| | | | | | |

|

|

Czech Republic .6% | | | | | | | |

Cesky Telecom AS | | Diversified Telecommunication Services | | 117,990 | | | 1,341,795 |

CEZ AS | | Electric Utilities | | 350,850 | | | 1,999,052 |

| | | | | | |

|

|

| | | | | | | | 3,340,847 |

| | | | | | |

|

|

Denmark .8% | | | | | | | |

Carlsberg AS, B | | Beverages | | 98,060 | | | 4,518,320 |

| | | | | | |

|

|

Egypt .2% | | | | | | | |

Commercial International Bank Ltd. | | Banks | | 311,380 | | | 1,111,170 |

| | | | | | |

|

|

Greece 1.3% | | | | | | | |

Coca-Cola Hellenic Bottling Co., SA | | Beverages | | 132,757 | | | 2,766,329 |

Hellenic Telecommunications Organization SA (OTE) | | Diversified Telecommunication Services | | 315,390 | | | 4,169,131 |

| | | | | | |

|

|

| | | | | | | | 6,935,460 |

| | | | | | |

|

|

TD-8

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2003 (cont.)

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS/

WARRANTS | | VALUE |

|

| | | | | | | | |

Long Term Investments (cont.) | | | | | | | |

Hong Kong 5.7% | | | | | | | |

Cheung Kong Holdings Ltd. | | Real Estate | | 528,000 | | $ | 4,199,598 |

Cheung Kong Infrastructure Holdings Ltd. | | Construction Materials | | 580,000 | | | 1,299,912 |

Citic Pacific Ltd. | | Industrial Conglomerates | | 4,360,000 | | | 11,119,584 |

Dairy Farm International Holdings Ltd. | | Food & Drug Retailing | | 1,655,833 | | | 2,773,520 |

Guoco Group Ltd. | | Diversified Financials | | 130,000 | | | 954,454 |

Hang Lung Group Ltd. | | Real Estate | | 1,279,000 | | | 1,598,009 |

Henderson Investment Ltd. | | Real Estate | | 1,344,000 | | | 1,549,384 |

Hong Kong Land Holdings Ltd. | | Real Estate | | 675,000 | | | 1,147,500 |

aHopewell Highway Infrastructure Ltd., wts., 08/05/06 | | Transportation Infrastructure | | 30,000 | | | 5,835 |

Hopewell Holdings Ltd. | | Transportation Infrastructure | | 282,000 | | | 434,064 |

HSBC Holdings PLC | | Banks | | 38,800 | | | 612,216 |

MTR Corp. Ltd. | | Road & Rail | | 1,558,707 | | | 2,057,904 |

Tack Fat Group International Ltd. | | Specialty Retail | | 5,042,000 | | | 513,058 |

Tingyi (Cayman Islands) Holding Corp. | | Food Products | | 8,138,000 | | | 1,907,770 |

VTech Holdings Ltd. | | Communications Equipment | | 32,000 | | | 45,546 |

| | | | | | |

|

|

| | | | | | | | 30,218,354 |

| | | | | | |

|

|

Hungary 2.7% | | | | | | | |

Egis RT | | Pharmaceuticals | | 50,884 | | | 2,070,522 |

Gedeon Richter Ltd. | | Pharmaceuticals | | 40,592 | | | 4,805,479 |

Matav RT | | Diversified Telecommunication Services | | 493,000 | | | 1,877,718 |

MOL Magyar Olaj-Es Gazipari RT | | Oil & Gas | | 188,140 | | | 5,728,102 |

| | | | | | |

|

|

| | | | | | | | 14,481,821 |

| | | | | | |

|

|

India 3.9% | | | | | | | |

Container Corp. of India Ltd. | | Road & Rail | | 34,944 | | | 509,666 |

HCL Technologies Ltd. | | IT Consulting & Services | | 131,500 | | | 883,104 |

Hero Honda Motors Ltd. | | Automobiles | | 261,869 | | | 2,576,217 |

Hindustan Petroleum Corp. Ltd. | | Oil & Gas | | 362,004 | | | 3,471,271 |

aIndraprastha Gas Ltd. | | Gas Utilities | | 125,000 | | | 406,438 |

ITC Ltd. | | Tobacco | | 48,300 | | | 1,042,274 |

Mahanagar Telephone Nigam Ltd. | | Diversified Telecommunication Services | | 1,468,285 | | | 4,431,405 |

aMaruti Udyog Ltd. | | Automobiles | | 249,000 | | | 2,053,670 |

Nestle India Ltd. | | Food Products | | 12,000 | | | 181,348 |

Satyam Computers Services Ltd. | | IT Consulting & Services | | 459,421 | | | 3,699,031 |

Union Bank of India Ltd. | | Banks | | 881,400 | | | 990,066 |

Videsh Sanchar Nigam Ltd. | | Diversified Telecommunication Services | | 203,030 | | | 656,371 |

| | | | | | |

|

|

| | | | | | | | 20,900,861 |

| | | | | | |

|

|

Indonesia 2.2% | | | | | | | |

PT Gudang Garam TBK | | Tobacco | | 1,672,000 | | | 2,699,816 |

PT Indosat (Persero) TBK | | Diversified Telecommunication Services | | 3,410,500 | | | 6,073,909 |

aPT Perusahaan Gas Negara, 144A | | Oil & Gas | | 1,731,000 | | | 318,557 |

PT Telekomunikasi Indonesia TBK, B | | Diversified Telecommunication Services | | 3,194,645 | | | 2,560,268 |

| | | | | | |

|

|

| | | | | | | | 11,652,550 |

| | | | | | |

|

|

Israel | | | | | | | |

Elbit Systems Ltd. | | Aerospace & Defense | | 12,476 | | | 224,540 |

| | | | | | |

|

|

TD-9

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2003 (cont.)

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS/

WARRANTS | | VALUE |

|

| | | | | | | | |

Long Term Investments (cont.) | | | | | | | |

Malaysia .4% | | | | | | | |

Tanjong PLC | | Hotels Restaurants & Leisure | | 14,000 | | $ | 39,789 |

YTL Power International Bhd. | | Electric Utilities | | 2,259,100 | | | 1,997,520 |

| | | | | | |

|

|

| | | | | | | | 2,037,309 |

| | | | | | |

|

|

Mexico 5.1% | | | | | | | |

Alfa SA | | Industrial Conglomerates | | 7,000 | | | 20,993 |

Embotelladoras Arca SA | | Food & Drug Retailing | | 132,000 | | | 252,553 |

Embotelladoras Arca SA, 144A | | Food & Drug Retailing | | 294,833 | | | 564,098 |

Fomento Economico Mexicano SA de CV Femsa, ADR | | Beverages | | 86,020 | | | 3,172,417 |

Grupo Bimbo SA de CV, A | | Food Products | | 496,100 | | | 931,519 |

Grupo Carso SA de CV | | Industrial Conglomerates | | 703,500 | | | 2,472,869 |

Grupo Continental SA | | Beverages | | 494,359 | | | 835,865 |

Grupo Televisa SA, ADR | | Media | | 36,000 | | | 1,434,960 |

Kimberly Clark de Mexico SA de CV, A | | Household Products | | 3,273,400 | | | 8,389,412 |

Telefonos de Mexico SA de CV (Telmex), L, ADR | | Diversified Telecommunication Services | | 263,882 | | | 8,716,022 |

| | | | | | |

|

|

| | | | | | | | 26,790,708 |

| | | | | | |

|

|

Peru | | | | | | | |

Credicorp Ltd. | | Banks | | 5,100 | | | 68,085 |

| | | | | | |

|

|

Philippines .8% | | | | | | | |

San Miguel Corp., B | | Beverages | | 3,892,630 | | | 4,487,182 |

| | | | | | |

|

|

Poland 2.4% | | | | | | | |

aBRE Bank SA | | Banks | | 34,625 | | | 855,704 |

Polski Koncern Naftowy Orlen SA | | Oil & Gas | | 887,238 | | | 5,926,140 |

Telekomunikacja Polska SA | | Diversified Telecommunication Services | | 1,498,800 | | | 6,066,638 |

| | | | | | |

|

|

| | | | | | | | 12,848,482 |

| | | | | | |

|

|

Russia 1.9% | | | | | | | |

Aeroflot | | Airlines | | 25,100 | | | 17,319 |

bLukoil Holdings, ADR | | Oil & Gas | | 102,807 | | | 9,569,276 |

Yuzhnaya Telecommunication Co. | | Diversified Telecommunication Services | | 2,913,300 | | | 282,590 |

| | | | | | |

|

|

| | | | | | | | 9,869,185 |

| | | | | | |

|

|

Singapore 6.4% | | | | | | | |

Comfortdelgro Corp. Ltd. | | Road & Rail | | 4,474,000 | | | 2,147,036 |

DBS Group Holdings Ltd. | | Banks | | 430,000 | | | 3,721,957 |

Fraser & Neave Ltd. | | Beverages | | 1,005,681 | | | 7,461,332 |

Keppel Corp. Ltd. | | Industrial Conglomerates | | 2,032,600 | | | 7,300,748 |

Singapore Airlines Ltd. | | Airlines | | 702,000 | | | 4,629,571 |

Singapore Press Holdings Ltd. | | Media | | 54,000 | | | 600,954 |

Singapore Technologies Engineering Ltd. | | Aerospace & Defense | | 2,069,000 | | | 2,485,285 |

Singapore Telecommunications Ltd. | | Diversified Telecommunication Services | | 4,819,000 | | | 5,561,585 |

| | | | | | |

|

|

| | | | | | | | 33,908,468 |

| | | | | | |

|

|

South Africa 11.1% | | | | | | | |

Anglo American PLC | | Metals & Mining | | 893,410 | | | 19,139,720 |

Barloworld Ltd. | | Industrial Conglomerates | | 202,350 | | | 2,126,570 |

BHP Billiton PLC | | Metals & Mining | | 286,200 | | | 2,486,831 |

Imperial Holdings Ltd. | | Air Freight & Couriers | | 289,177 | | | 2,902,601 |

Nampak Ltd. | | Containers & Packaging | | 291,200 | | | 567,131 |

TD-10

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2003 (cont.)

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS/

WARRANTS | | VALUE |

|

| | | | | | | | |

Long Term Investments (cont.) | | | | | | | |

South Africa (cont.) | | | | | | | |

Nedcor Ltd. | | Banks | | 92,000 | | $ | 854,945 |

Old Mutual PLC | | Insurance | | 2,773,960 | | | 4,568,560 |

Remgro Ltd. | | Industrial Conglomerates | | 680,270 | | | 7,195,065 |

SABMiller PLC | | Beverages | | 1,304,424 | | | 13,290,476 |

Sasol Ltd. | | Oil & Gas | | 410,087 | | | 5,836,444 |

| | | | | | |

|

|

| | | | | | | | 58,968,343 |

| | | | | | |

|

|

South Korea 11.7% | | | | | | | |

CJ Corp. | | Food Products | | 67,200 | | | 3,502,409 |

Dong-A Pharmaceutical Co. Ltd. | | Pharmaceuticals | | 55,633 | | | 866,129 |

Hite Brewery Co. Ltd. | | Beverages | | 49,490 | | | 3,630,236 |

Hyundai Development Co. | | Construction & Engineering | | 463,020 | | | 4,799,242 |

Hyundai Motor Co. Ltd. | | Automobiles | | 247,460 | | | 10,488,233 |

Kangwon Land Inc. | | Hotels Restaurants & Leisure | | 574,055 | | | 6,841,444 |

Korea Electric Power Corp. | | Electric Utilities | | 306,189 | | | 5,499,324 |

Korea Gas Corp. | | Gas Utilities | | 92,390 | | | 1,919,138 |

KT Corp. | | Diversified Telecommunication Services | | 71,340 | | | 2,670,385 |

KT&G Corp. | | Tobacco | | 68,990 | | | 1,198,567 |

LG Card Co. Ltd. | | Consumer Finance | | 299,013 | | | 764,158 |

LG Chem Ltd. | | Chemicals | | 440 | | | 20,311 |

LG Home Shopping Inc. | | Internet & Catalog Retail | | 12,830 | | | 648,230 |

LG Household & Health Care Ltd. | | Household Products | | 88,940 | | | 2,321,472 |

LG International Corp. | | Trading Companies & Distributors | | 75,000 | | | 503,567 |

Poongsan Corp. | | Metals & Mining | | 28,970 | | | 306,355 |

POSCO | | Metals & Mining | | 16,330 | | | 2,233,982 |

Samsung Corp. | | Trading Companies & Distributors | | 268,540 | | | 2,231,260 |

Samsung Fine Chemicals | | Chemicals | | 221,490 | | | 3,039,330 |

Samsung Heavy Industries Co. Ltd. | | Machinery | | 779,620 | | | 4,311,956 |

SK Corp. | | Oil & Gas | | 183,880 | | | 4,228,546 |

| | | | | | |

|

|

| | | | | | | | 62,024,274 |

| | | | | | |

|

|

Taiwan 9.6% | | | | | | | |

Acer Inc. | | Computers & Peripherals | | 1,675,000 | | | 2,491,532 |

Amtran Technology Co. Ltd. | | Computers & Peripherals | | 575,000 | | | 484,389 |

Cheng Shin Rubber Industry Co. Ltd. | | Auto Components | | 327,000 | | | 417,057 |

Chinatrust Financial Holding Co. Ltd. | | Banks | | 2,438,980 | | | 2,449,756 |

Chunghwa Telcom Co. Ltd. | | Diversified Telecommunication Services | | 1,570,000 | | | 2,279,853 |

D-Link Corp. | | Communications Equipment | | 3,870,000 | | | 5,163,800 |

Delta Electronics Inc. | | Electronic Equipment & Instruments | | 3,453,255 | | | 4,424,642 |

Elan Microelectronics Corp. | | Software | | 2,555,000 | | | 2,295,361 |

Elite Semiconductor Memory Technology Inc. | | Electrical Equipment | | 759,400 | | | 1,465,116 |

Fubon Financial Holding Co. Ltd. | | Diversified Financials | | 1,092,000 | | | 1,045,361 |

Lite-on Technology Corp. | | Computers & Peripherals | | 4,404,000 | | | 4,669,926 |

Mega Financial Holdings Co. Ltd. | | Banks | | 4,070,503 | | | 2,445,899 |

Micro-Star International Co. Ltd. | | Computers & Peripherals | | 104,000 | | | 153,166 |

Phoenixtec Power Co. Ltd. | | Electrical Equipment | | 1,487,270 | | | 1,743,545 |

President Chain Store Corp. | | Food & Drug Retailing | | 1,276,000 | | | 1,954,403 |

Sunplus Technology Co. Ltd. | | Semiconductors & Semiconductor Equipment | | 3,426,000 | | | 6,407,982 |

Taiwan Cellular Corp. | | Wireless Telecommunication Services | | 5,285,302 | | | 4,592,530 |

Taiwan Glass Industrial Corp. | | Building Products | | 235,000 | | | 177,894 |

TD-11

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2003 (cont.)

| | | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS/

WARRANTS | | VALUE |

|

| | | | | | | | | |

Long Term Investments (cont.) | | | | | | | | |

Taiwan (cont.) | | �� | | | | | | |

aTatung Co. Ltd. | | Industrial Conglomerates | | | 4,438,000 | | $ | 1,124,206 |

Tsann Kuen Enterprise Co. Ltd. | | Household Durables | | | 1,008,000 | | | 1,466,722 |

UNI-President Enterprises Corp. | | Food Products | | | 3,218,600 | | | 1,322,518 |

Yuanta Core Pacific Securities Co. | | Diversified Financials | | | 3,488,212 | | | 2,085,735 |

| | | | | | | |

|

|

| | | | | | | | | 50,661,393 |

| | | | | | | |

|

|

Thailand 2.1% | | | | | | | | |

Delta Electronics (Thailand) Public Co. Ltd. | | Electronic Equipment & Instruments | | | 1,295,000 | | | 879,185 |

Hana Microelectronics Co. Ltd., fgn. | | Electronic Equipment & Instruments | | | 283,000 | | | 892,801 |

Krung Thai Bank Public Co. Ltd., fgn. | | Banks | | | 1,200,000 | | | 372,515 |

National Finance Public Co. Ltd., fgn. | | Consumer Finance | | | 1,023,700 | | | 431,467 |

PTT Exploration & Production Public Co. Ltd., fgn. | | Oil & Gas | | | 1,004,200 | | | 6,792,242 |

Shin Corporation Public Co. Ltd., fgn. | | Wireless Telecommunication Services | | | 260,000 | | | 255,915 |

Siam City Cement Public Co. Ltd., fgn. | | Construction Materials | | | 58,000 | | | 333,750 |

Siam Makro Public Co. Ltd., fgn. | | Food & Drug Retailing | | | 96,000 | | | 111,452 |

aTelecomasia Corp. Public Co. Ltd., purch. rts. | | Diversified Telecommunication Services | | | 344,616 | | | — |

Thai Airways International Public Co. Ltd., fgn. | | Airlines | | | 401,600 | | | 463,706 |

aThai Military Bank Public Co. Ltd., fgn. | | Banks | | | 1,680,000 | | | 290,441 |

Thai Union Frozen Products Ltd., fgn. | | Food Products | | | 110,000 | | | 88,838 |

| | | | | | | |

|

|

| | | | | | | | | 10,912,312 |

| | | | | | | |

|

|

Turkey 3.4% | | | | | | | | |

Akbank | | Banks | | | 497,801,261 | | | 2,604,158 |

Arcelik AS, Br. | | Household Durables | | | 1,103,826,400 | | | 6,128,003 |

Migros Turk T.A.S. | | Food & Drug Retailing | | | 178,149,000 | | | 2,548,608 |

Tupras-Turkiye Petrol Rafineleri AS | | Oil & Gas | | | 781,213,000 | | | 6,505,473 |

| | | | | | | |

|

|

| | | | | | | | | 17,786,242 |

| | | | | | | |

|

|

Total Long Term Investments

(Cost $375,486,632) | | | | | | | | 500,166,257 |

| | | | | | | |

|

|

| | | | | PRINCIPAL

AMOUNT | | |

|

Short Term Investment (Cost $29,789,752) 5.6% | | | | | | | | |

U.S. Treasury Bill, .845% to .92%, 1/2/04 - 3/25/04 | | | | $ | 29,835,000 | | | 29,793,685 |

| | | | | | | |

|

|

Total Investments (Cost $405,276,384) 99.9% | | | | | | | | 529,959,942 |

Other Assets, less Liabilities .1% | | | | | | | | 292,476 |

| | | | | | | |

|

|

Net Assets 100.0% | | | | | | | $ | 530,252,418 |

| | | | | | | |

|

|

| b | See Note 6 regarding other considerations. |

TD-12

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Statements

Statement of Assets and Liabilities

December 31, 2003

| | | |

Assets: | | | |

Investments in securities: | | | |

Cost | | $ | 405,276,384 |

| | |

|

|

Value | | | 529,959,942 |

Foreign currency, at value (cost $1,032,821) | | | 1,035,766 |

Receivables: | | | |

Investment securities sold | | | 1,610,393 |

Capital shares sold | | | 905,555 |

Dividends and interest | | | 1,117,412 |

| | |

|

|

Total assets | | | 534,629,068 |

| | |

|

|

Liabilities: | | | |

Payables: | | | |

Investment securities purchased | | | 1,194,914 |

Capital shares redeemed | | | 400,623 |

Affiliates | | | 654,802 |

Deferred tax liability (Note 1f) | | | 1,922,971 |

Funds advanced by custodian | | | 4,457 |

Other liabilities | | | 198,883 |

| | |

|

|

Total liabilities | | | 4,376,650 |

| | |

|

|

Net assets, at value | | $ | 530,252,418 |

| | |

|

|

Net assets consist of: | | | |

Undistributed net investment income | | $ | 5,951,933 |

Net unrealized appreciation (depreciation) | | | 122,749,174 |

Accumulated net realized gain (loss) | | | (199,577,235) |

Capital shares | | | 601,128,546 |

| | |

|

|

Net assets, at value | | $ | 530,252,418 |

| | |

|

|

Class 1: | | | |

Net assets, at value | | $ | 359,299,298 |

| | |

|

|

Shares outstanding | | | 50,348,005 |

| | |

|

|

Net asset value and offering price per share | | $ | 7.14 |

| | |

|

|

Class 2: | | | |

Net assets, at value | | $ | 170,953,120 |

| | |

|

|

Shares outstanding | | | 24,101,077 |

| | |

|

|

Net asset value and offering price per share | | $ | 7.09 |

| | |

|

|

See notes to financial statements.

TD-13

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Statements (continued)

Statement of Operations

for the year ended December 31, 2003

| | | | |

Investment income: (net of foreign taxes and fees of $1,154,374) | | | | |

Dividends | | $ | 14,244,030 | |

Interest | | | 93,559 | |

| | |

|

|

|

Total investment income | | | 14,337,589 | |

| | |

|

|

|

Expenses: | | | | |

Management fees (Note 3) | | | 4,585,327 | |

Administrative fees (Note 3) | | | 525,214 | |

Distribution fees – Class 2 (Note 3) | | | 257,460 | |

Transfer agent fees | | | 2,054 | |

Custodian fees | | | 373,147 | |

Reports to shareholders | | | 148,264 | |

Professional fees | | | 35,822 | |

Trustees’ fees and expenses | | | 3,447 | |

Other | | | 23,250 | |

| | |

|

|

|

Total expenses | | | 5,953,985 | |

| | |

|

|

|

Net investment income | | | 8,383,604 | |

| | |

|

|

|

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments (net of foreign taxes of $468,507) (Note 1f) | | | 19,346,500 | |

Foreign currency transactions | | | (510,671 | ) |

| | |

|

|

|

Net realized gain (loss) | | | 18,835,829 | |

Net unrealized appreciation (depreciation) on: | | | | |

Investments | | | 143,243,426 | |

Translation of assets and liabilities denominated in foreign currencies | | | (14,496 | ) |

Deferred taxes (Note 1f) | | | (1,914,669 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | | 141,314,261 | |

| | |

|

|

|

Net realized and unrealized gain (loss) | | | 160,150,090 | |

| | |

|

|

|

Net increase (decrease) in net assets resulting from operations | | $ | 168,533,694 | |

| | |

|

|

|

See notes to financial statements.

TD-14

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Statements (continued)

Statements of Changes in Net Assets

For the years ended December 31, 2003 and 2002

| | | | | | | | |

| | | 2003 | | | 2002 | |

| | |

| |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 8,383,604 | | | $ | 4,455,928 | |

Net realized gain (loss) from investments and foreign currency transactions | | | 18,835,829 | | | | (9,268,738 | ) |

Net unrealized appreciation (depreciation) on investments and translation of assets and liabilities denominated in foreign currencies | | | 141,314,261 | | | | 6,877,309 | |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets resulting from operations | | | 168,533,694 | | | | 2,064,499 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class 1 | | | (3,521,009 | ) | | | (3,878,945 | ) |

Class 2 | | | (1,068,523 | ) | | | (1,149,535 | ) |

| | |

|

|

| |

|

|

|

Total distributions to shareholders | | | (4,589,532 | ) | | | (5,028,480 | ) |

Capital share transactions: (Note 2) | | | | | | | | |

Class 1 | | | 18,051,739 | | | | (12,115,583 | ) |

Class 2 | | | 41,851,167 | | | | 17,115,195 | |

| | |

|

|

| |

|

|

|

Total capital share transactions | | | 59,902,906 | | | | 4,999,612 | |

Net increase (decrease) in net assets | | | 223,847,068 | | | | 2,035,631 | |

Net assets: | | | | | | | | |

Beginning of year | | | 306,405,350 | | | | 304,369,719 | |

| | |

|

|

| |

|

|

|

End of year | | $ | 530,252,418 | | | $ | 306,405,350 | |

| | |

| |

Undistributed net investment income included in net assets: | | | | | | | | |

End of year | | $ | 5,951,933 | | | $ | 3,131,753 | |

| | |

|

|

| |

|

|

|

See notes to financial statements.

TD-15

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton Variable Insurance Products Trust (the Trust) is registered under the Investment Company Act of 1940 as an open-end investment company, consisting of twenty-two separate series (the Funds). The Templeton Developing Markets Securities Fund (the Fund) included in this report is diversified. Shares of the Fund are sold only to insurance company separate accounts to fund the benefits of variable life insurance policies or variable annuity contracts. The Fund’s investment objective is capital growth.

The following summarizes the Fund’s significant accounting policies.

a. Security Valuation

Securities listed or traded on a recognized national exchange or NASDAQ are valued at the last reported sales price. Over-the-counter securities and listed securities for which no sale is reported are valued within the range of the latest quoted bid and asked prices. Foreign securities are valued at the close of trading of the foreign exchange or the NYSE, whichever is earlier. If events occur that materially affect the values of securities after the prices or foreign exchange rates are determined, or if market quotations are not readily available, the securities will be valued at fair value as determined following procedures approved by the Board of Trustees.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Foreign Currency Contracts

When the Fund purchases or sells foreign securities it may enter into foreign exchange contracts to minimize foreign exchange risk from the trade date to the settlement date of the transactions. A foreign exchange contract is an agreement between two parties to exchange different currencies at an agreed upon exchange rate on a specified date. Realized and unrealized gains and losses are included in the Statement of Operations.

The risks of these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the possible inability of the counterparties to fulfill their obligations under the contracts.

d. Income Taxes

No provision has been made for income taxes because the Fund’s policy is to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable income.

TD-16

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (cont.)

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Certain income from foreign securities is recorded as soon as information is available to the Fund. Interest income and estimated expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date.

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each fund to the combined net assets. Other expenses are charged to each fund on a specific identification basis.

Realized and unrealized gains and losses and net investment income, other than class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class.

f. Deferred Taxes

The Fund is subject to a tax imposed on net realized gains of securities of certain foreign countries. The Fund records an estimated deferred tax liability for net unrealized gains on these securities as reflected in the accompanying financial statements.

g. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

h. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

TD-17

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

2. SHARES OF BENEFICIAL INTEREST

The Fund offers two classes of shares: Class 1 and Class 2. Each class of shares differs by its distribution fees, voting rights on matters affecting a single class, and its exchange privilege.

At December 31, 2003, there were an unlimited number of shares authorized ($.01 par value). Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2003

| | | 2002

| |

| Class 1 Shares: | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares sold | | 10,436,573 | | | $ | 60,506,599 | | | 20,100,040 | | | $ | 96,134,388 | |

Shares issued in reinvestment of distributions | | 652,039 | | | | 3,521,009 | | | 751,734 | | | | 3,878,945 | |

Shares redeemed | | (8,573,395 | ) | | | (45,975,869 | ) | | (23,322,593 | ) | | | (112,128,916 | ) |

| | |

| |

Net increase (decrease) | | 2,515,217 | | | $ | 18,051,739 | | | (2,470,819 | ) | | $ | (12,115,583 | ) |

| | |

| |

| Class 2 Shares: | | | | | | | | | | | | |

Shares sold | | 30,181,277 | | | $ | 163,641,071 | | | 65,809,894 | | | $ | 323,925,644 | |

Shares issued in reinvestment of distributions | | 198,398 | | | | 1,068,523 | | | 223,645 | | | | 1,149,535 | |

Shares redeemed | | (23,541,038 | ) | | | (122,858,427 | ) | | (62,244,002 | ) | | | (307,959,984 | ) |

| | |

| |

Net increase (decrease) | | 6,838,637 | | | $ | 41,851,167 | | | 3,789,537 | | | $ | 17,115,195 | |

| | |

| |

3. TRANSACTIONS WITH AFFILIATES

Certain officers and trustees of the Fund are also officers and/or directors of the following entities:

| | |

| Entity | | Affiliation |

|

Franklin Templeton Services LLC (FT Services) | | Administrative manager |

Templeton Asset Management Ltd. (TAML) | | Investment manager |

Franklin/Templeton Distributors Inc. (Distributors) | | Principal underwriter |

Franklin/Templeton Investor Services LLC (Investor Services) | | Transfer agent |

The Fund pays an investment management fee to TAML of 1.25% per year of the average daily net assets of the fund.

The Fund pays an administrative fee to FT Services based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

|

.15% | | First $200 million |

.135% | | Over $200 million, up to and including $700 million |

.10% | | Over $700 million, up to and including $1.2 billion |

Fees are further reduced on net assets over $1.2 billion.

The Fund reimburses Distributors up to .25% per year of its average daily net assets of Class 2, for costs incurred in marketing the Fund’s shares.

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund.

TD-18

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

4. INCOME TAXES

At December 31, 2003, the Fund had tax basis capital losses of $197,860,620, which may be carried over to offset future capital gains. Such losses expire as follows:

| | | |

Capital loss carryovers expiring in: | | | |

2006 | | $ | 19,633,396 |

2007 | | | 91,657,992 |

2009 | | | 62,323,035 |

2010 | | | 24,246,197 |

| | |

|

| | | $ | 197,860,620 |

| | |

|

At December 31, 2003, the Fund had deferred currency losses occurring subsequent to October 31, 2003 of $115,389. For tax purposes, such losses will be reflected in the year ending December 31, 2004.

Net investment income differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions and passive foreign investment company shares.

Net realized gains and losses differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions, and passive foreign investment company shares.

The tax character of distributions paid during the years ended December 31, 2003 and 2002, was as follows:

| | | | | | |

| | | 2003

| | 2002

|

Distributions paid from: | | | | | | |

Ordinary income | | $ | 4,589,532 | | $ | 5,028,480 |

Long term capital gain | | | — | | | — |

| | |

|

| | | $ | 4,589,532 | | $ | 5,028,480 |

| | |

|

At December 31, 2003, the cost of investments, net unrealized appreciation (depreciation), undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| | | | |

Cost of investments | | $ | 411,565,787 | |

| | |

| |

Unrealized appreciation | | $ | 128,486,746 | |

Unrealized depreciation | | | (10,092,591 | ) |

| | |

| |

Net unrealized appreciation (depreciation) | | $ | 118,394,155 | |

| | |

| |

Undistributed ordinary income | | $ | 10,640,108 | |

Undistributed long term capital gains | | | — | |

Distributable earnings | | $ | 10,640,108 | |

| | |

| |

5. INVESTMENT TRANSACTIONS

Purchases and sales of securities (excluding short-term securities) for the year ended December 31, 2003 aggregated $202,924,854 and $165,313,499, respectively.

6. OTHER CONSIDERATIONS

TAML, as the Fund’s Manager, may serve as a member on the board of directors of certain companies in which the Fund invests and/or may represent the Fund in certain corporate negotiations. Currently, the Manager serves in one or more of these capacities for Lukoil Holdings. As a result of this involvement, the Manager may be in possession of certain material non-public information which, pursuant to the Fund’s policies and the requirements of the federal securities laws, could prevent the Fund from trading in the securities of such companies for limited or extended periods of time.

TD-19

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

7. REGULATORY MATTERS

On February 4, 2004, the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts filed an administrative complaint against Franklin Resources, Inc. and certain of its subsidiaries (the “Company”), alleging violations of the Massachusetts Uniform Securities Act. The complaint arises from activity that occurred in 2001 during which time an officer of a Company subsidiary was negotiating an agreement with an investor relating to investments in a mutual fund and a hedge fund.

The Company, in addition to other entities within Franklin Templeton Investments, has been named in shareholder class actions related to the matter described above. The Company believes that the claims made in the lawsuit are without merit and it intends to defend vigorously against the allegations. The Company and the Fund may be named in similar civil actions related to the matter described above.

In addition, as part of ongoing investigations by the U.S. Securities and Exchange Commission (the “SEC”), the U.S. Attorney for the Northern District of California, the New York Attorney General, the California Attorney General, the U.S. Attorney for the District of Massachusetts, the Florida Department of Financial Services and the Commissioner of Securities and the Attorney General of the State of West Virginia, relating to certain practices in the mutual fund industry, including late trading, market timing and sales compensation arrangements, the Company and its subsidiaries, as well as certain current or former executives and employees of the Company, have received requests for information and/or subpoenas to testify or produce documents. The Company and its current employees are providing documents and information in response to these requests and subpoenas. In addition, the Company has responded to requests for similar kinds of information from regulatory authorities in some of the foreign countries where the Company conducts its global asset management business.

The Staff of the SEC has informed the Company that it intends to recommend that the Commission authorize an action against an affiliate of the Fund’s adviser and a senior executive officer relating to the frequent trading issues that are the subject of the SEC’s investigation. These issues were previously disclosed as being under investigation by government authorities and the subject of an internal inquiry by the Company in its Annual Report on Form 10-K and on its public website. The Company currently is in discussions with the SEC Staff in an effort to resolve the issues raised in their investigation. Such discussions are preliminary and the Fund’s management has been advised that the Company cannot predict the likelihood of whether those discussions will result in a settlement and, if so, the terms of such settlement. The impact, if any, of these matters on the Fund is uncertain at this time. If the Company finds that it bears responsibility for any unlawful or improper conduct, it has committed to making the Fund or its shareholders whole, as appropriate.

TD-20

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Independent Auditors’ Report

To the Board of Trustees and Shareholders of

Franklin Templeton Variable Insurance Products Trust

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Templeton Developing Markets Securities Fund (the Fund) (one of the funds constituting the Franklin Templeton Variable Insurance Products Trust) at December 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States of America, which require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2003 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

February 5, 2004, except for Note 7 as to which the date is February 12, 2004

TD-21

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Tax Designation (unaudited)

At December 31, 2003, more than 50% of the Fund’s total assets were invested in securities of foreign issuers. In most instances, foreign taxes were withheld from dividends paid to the Fund on these investments. The Fund elects to treat foreign taxes paid under Section 853 of the Internal Revenue Code. This election will allow shareholders of record in June, 2004, to treat their proportionate share of foreign taxes paid by the Fund as having been paid directly by them. The shareholder shall consider these amounts as foreign taxes paid in the tax year in which they receive the Fund distribution.

The foreign tax information will be disclosed in the June 30, 2004 semi-annual report of the Fund.

TD-22

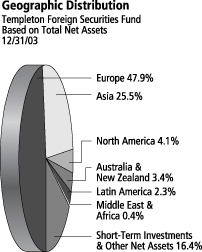

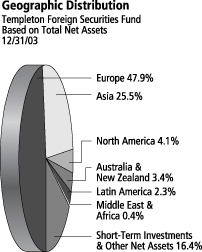

TEMPLETON FOREIGN SECURITIES FUND

Fund Goal and Primary Investments: Templeton Foreign Securities Fund seeks long-term capital growth. The Fund invests primarily in investments of issuers located outside the U.S., including those in emerging markets.

This annual report for Templeton Foreign Securities Fund covers the fiscal year ended December 31, 2003.

Performance Overview

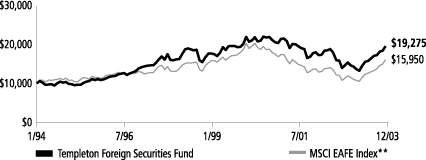

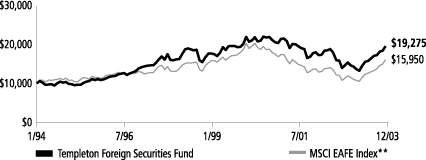

You can find the Fund’s one-year total return in the Performance Summary following this report. The Fund underperformed its benchmark, the Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) Index, which returned 39.17% for the year under review.1

Economic and Market Overview

In spring 2003, the end of major conflict in Iraq coincided with the start of a global equity market rally that produced the strongest annual total returns since 1986. The rally’s main catalyst was an improving global economy, underpinned by expansionary fiscal and monetary policies, corporate restructuring and consolidation, and more than two years of declining equity valuations that created potential opportunities in Asia, Europe and the Americas.

In many countries, including the U.S., China and Japan, gross domestic product (GDP) growth accelerated in 2003, particularly in the second half of the year. In the U.S., GDP grew at annualized rates of 3.1% and 8.2% in the second and third quarters. Over the same periods, consumer spending rose at annualized rates of 3.3% and 6.9% spurred largely by tax cuts, car-buying incentives and mortgage refinancing, as interest rates remained at the lowest level in more than four decades. Industrial production increased in the U.S., China, Japan and South Korea in the second half of the year, as did consumer sentiment in the U.S., U.K., Germany and Sweden, and business sentiment in the U.S., Australia, Germany and Japan. In short, a synchronized global economic recovery gained momentum in the second half of 2003.

Further evidence of this recovery was the continued rise in the prices of base metals and other commodities. This was due, in part, to greater demand in China. On December 31, 2003, contracts for aluminum and other metals such silver, gold, copper and zinc were anywhere from

1. Source: Standard & Poor’s Micropal. One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

TF-1

19% to 50% higher than 12 months before.2 While gold crossed the $400-an-ounce threshold for the first time in more than seven years, such agricultural commodities as cotton and soybeans gained approximately 40%.2 Despite rising commodities prices, global inflation remained subdued throughout the year.

In 2003, the value of the U.S. dollar fell against most major currencies, including a 17% decline versus the euro.3 While the decline magnified top-line and earnings-per-share growth in the U.S., it had the opposite effect in Europe. The dollar decline also benefited U.S. investors in international equities because it increased the returns of investments denominated in currencies that appreciated against the dollar, such as the euro. Although the dollar’s decline significantly affected equity market returns, it was not the only reason for the past year’s gains. Equity markets in many countries, including emerging market countries, produced stronger gains than the U.S. equity market, even in their local currencies. These countries benefited from the improving economic and financial market conditions in 2003.

Investment Strategy

Our investment philosophy is bottom-up, value-oriented and long-term. In choosing investments, we generally focus on the market price of a company’s securities relative to our evaluation of the company’s potential long-term earnings, asset value and cash flow. Among factors we consider are a company’s historical value measures, including price/earnings ratio, profit margins and liquidation value. We do in-depth research to construct a bargain list from which we buy.

Manager’s Discussion

During the 12 months under review, the Fund’s overweighted position in the industrials sector relative to the MSCI EAFE Index benefited performance as that sector outperformed the overall index, and the Fund’s industrials sector holdings posted better overall returns than the index’s overall industrials sector return. The Fund’s overweighted utilities sector exposure also helped performance because our utilities stocks outperformed the index’s overall utilities return. In addition, the Fund’s overweighted position in materials aided performance, as the materials sector outperformed the overall MSCI EAFE Index for the year under review.

2. Source: Reuters, Commodity Research Bureau Index; London Metal Exchange.

3. Source: European Central Bank.

TF-2

Despite the Fund’s double-digit return, some sector positioning dampened performance. Detractors from Fund performance during the year included our underweighted position in the financials sector, and our financials sector holdings’ underperformance relative to the index. The underperformance of the Fund’s energy and consumer staples holdings also hindered relative performance during the reporting period. In addition, the Fund held more than 10% of its total net assets in short-term investments and other net assets (cash) during the period, which constrained performance.

Thank you for your participation in Templeton Foreign Securities Fund. We look forward to serving your future investment needs.

This discussion reflects our analysis, opinions and portfolio holdings as of December 31, 2003, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the advisor makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Top 10 Holdings

Templeton Foreign Securities Fund 12/31/03

| | |

Company Sector/Industry,

Country | | % of Total

Net Assets |

|

| |

| Samsung Electronics Co. Ltd. | | 1.8% |

| Semiconductors & Semiconductor Equipment, South Korea | | |

| |

| Denso Corp. | | 1.8% |

| Auto Components, Japan | | |

| |

| Nippon Telegraph & Telephone Corp. | | 1.8% |

| Diversified Telecommunication Services, Japan | | |

| |

| Sony Corp. | | 1.7% |

| Household Durables, Japan | | |

| |

| Aventis SA | | 1.6% |

| Pharmaceuticals, France | | |

| |

Koninklijke Philips

Electronics NV | | 1.5% |

| Household Durables, Netherlands | | |

| |

| Cheung Kong Holdings Ltd. | | 1.5% |

| Real Estate, Hong Kong | | |

| |

| Volkswagen AG, ord. & pfd. | | 1.4% |

| Automobiles, Germany | | |

| |

| Eni SpA | | 1.4% |

| Oil & Gas, Italy | | |

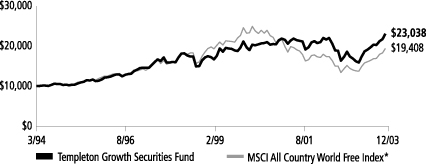

| |