UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

| | |

| One Franklin Parkway, San Mateo, CA | | 94403-1906 |

| (Address of principal executive offices) | | (Zip code) |

Murray L. Simpson, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2100

Date of fiscal year end: 12/31

Date of reporting period: 12/31/04

| Item 1. | Reports to Stockholders. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST ANNUAL REPORT

TABLEOF CONTENTS

*Not part of the annual report

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

MASTER CLASS - 3

IMPORTANT NOTESTOPERFORMANCE INFORMATION

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts, or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

i

SUPPLEMENT DATED FEBRUARY 9, 2005

TOTHE PROSPECTUSES DATED MAY 1, 2004,OF:

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

FRANKLIN GROWTH AND INCOME SECURITIES FUND

FRANKLIN HIGH INCOME FUND

FRANKLIN INCOME SECURITIES FUND

FRANKLIN LARGE CAP GROWTH SECURITIES FUND

FRANKLIN MONEY MARKET FUND

FRANKLIN REAL ESTATE FUND

FRANKLIN RISING DIVIDENDS SECURITIES FUND

FRANKLIN SMALL CAP FUND

FRANKLIN SMALL CAP VALUE SECURITIES FUND

FRANKLIN STRATEGIC INCOME SECURITIES FUND

FRANKLIN U.S. GOVERNMENT FUND

FRANKLIN ZERO COUPON FUND 2005

FRANKLIN ZERO COUPON FUND 2010

MUTUAL DISCOVERY SECURITIES FUND

MUTUAL SHARES SECURITIES FUND

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

TEMPLETON FOREIGN SECURITIES FUND

TEMPLETON GLOBAL ASSET ALLOCATION FUND

TEMPLETON GLOBAL INCOME SECURITIES FUND

TEMPLETON GROWTH SECURITIES FUND

(FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST)

The prospectuses for shares of Class 1, Class 2 and Class 3 are amended by replacing the “Regulatory Update” section under “Additional Information, All Funds” (or under “Additional Information”) with the following:

On February 4, 2004, the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts filed an administrative complaint against Franklin Resources, Inc. and certain of its subsidiaries (the Company) claiming violations of the Massachusetts Uniform Securities Act (Massachusetts Act) with respect to an alleged arrangement to permit market timing (the Massachusetts Proceeding). On September 20, 2004, Franklin Resources, Inc. announced that an agreement had been reached by two of its subsidiaries, Franklin Advisers, Inc. (Advisers) and Franklin Templeton Alternative Strategies, Inc. (FTAS), with the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts (the State of Massachusetts) related to the Massachusetts Proceeding. Under the terms of the settlement consent order issued by the State of Massachusetts, Advisers and FTAS have consented to the entry of a cease and desist order and agreed to pay a $5 million administrative fine to the State of Massachusetts. The administrative complaint addressed one instance of market timing that was also a subject of the August 2, 2004 settlement that Advisers reached with the Securities and Exchange Commission described below.

SUPP-1

On November 19, 2004, the Company reached a second agreement with the State of Massachusetts regarding an administrative complaint filed on October 25, 2004. The second complaint alleged that the Company’s Form 8-K filing describing the original settlement failed to state the company had admitted the Statements of Fact portion of the settlement order when it stated, “Franklin did not admit or deny engaging in any wrongdoing.”

As a result of the November 19, 2004 settlement with the State of Massachusetts, the Company filed a new Form 8-K. The terms of the original settlement did not change and there was no monetary fine associated with this second settlement.

On November 17, 2004, the Company announced that Franklin Templeton Distributors, Inc. (Distributors) (the principal underwriter of shares of the Franklin Templeton mutual funds) reached an agreement with the California Attorney General’s Office (CAGO), resolving the issues resulting from the CAGO’s investigation concerning marketing support payments to securities dealers who sell fund shares. Under the terms of the settlement with the CAGO, Distributors has agreed to pay $2 million as a civil penalty, $14 million to Franklin Templeton funds and $2 million to the CAGO.

The Company, in addition to most of the mutual funds within Franklin Templeton Investments, has been named in shareholder class actions related to the matter described above that were filed in the United States District Courts in California, Florida, Nevada, New Jersey and New York. These parties, as well as certain of the mutual funds’ trustees/directors, have also been named in a shareholder class action filed in March 2004 in the United States District Court in New Jersey. This lawsuit alleges violations of certain provisions of the federal securities laws and state common law fiduciary obligations in connection with Rule 12b-1 fees and brokerage commissions paid by the mutual funds. These lawsuits seek damages of unspecified amounts. The Company believes that the claims made in the lawsuits are without merit and it intends to defend vigorously against the allegations. It is anticipated that additional similar civil actions related to the matters described above may be filed in the future.

On August 2, 2004, Franklin Resources, Inc. announced that Advisers (adviser to many of the funds within Franklin Templeton Investments, and an affiliate of the adviser to the other funds) had reached a settlement with the U.S. Securities and Exchange Commission (SEC) that resolved an SEC investigation of market timing activity in the Franklin Templeton Investments funds. As part of the settlement, on August 2, 2004, the SEC issued an “Order instituting administrative and cease-and-desist proceedings pursuant to sections 203(e) and 203(k) of the Investment Advisers Act of 1940 and sections 9(b) and 9(f) of the Investment Company Act of 1940, making findings and imposing remedial sanctions and a cease and desist order” (the August Order). The SEC’s August Order concerns the activities of a limited number of third parties that ended in 2000 and those that are the subject of the Massachusetts Proceeding described above.

SUPP-2

Under the terms of the SEC’s August Order, Advisers, while neither admitting nor denying any of the findings therein, has agreed to pay $50 million, of which $20 million is a civil penalty, to be distributed to fund shareholders in accordance with a plan to be developed by an Independent Distribution Consultant. Because the distribution methodology has not yet been developed, it is presently not possible to say which particular funds will be determined to have been affected or which particular groups of fund shareholders will receive distributions or in what proportion and amounts. In the August Order, the SEC notes that the Company has generally sought to detect, discourage and prevent market timing in its funds and began to increase its efforts to control market timing in 1999. The August Order also requires Advisers to, among other things:

| • | | Enhance and periodically review compliance policies and procedures, and establish a corporate ombudsman; |

| • | | Establish a new internal position whose responsibilities shall include compliance matters related to conflicts of interests; and |

| • | | Retain an Independent Distribution Consultant to develop a plan to distribute the $50 million settlement to fund shareholders. |

On December 13, 2004, the Company announced that it reached an agreement with the SEC, resolving the issues resulting from the SEC’s investigation concerning marketing support payments to securities dealers who sell fund shares. The settlement agreement relates to an order (December Order) the SEC issued instituting administrative and cease-and-desist proceedings, making findings, and imposing remedial sanctions against Distributors and Advisers. In connection with this settlement, Advisers and Distributors also agreed to implement certain measures and undertakings relating to marketing support payments to broker-dealers for the promotion or sale of Fund shares, and to make additional disclosures in the Funds’ Prospectuses and Statements of Additional Information.

Under the terms of the SEC’s December Order, Advisers and Distributors, while neither admitting nor denying any of the findings therein, agreed to pay $20 million as a civil penalty, and $1 as restitution to be distributed to Franklin Templeton funds in accordance with a plan to be developed by an Independent Distribution Consultant. Because the distribution methodology has not yet been developed, it is presently not possible to say which particular funds will be determined to have been affected or will receive distributions or in what proportion and amounts.

These issues were previously disclosed by the Company as being under investigation by government authorities and the subject of an internal inquiry by the Company in its regulatory filings and on its public website. Any further updates on these matters will be disclosed on the Company’s website at franklintempleton.com under “Statement on Current Industry Issues.”

Please keep this supplement for future reference.

SUPP-3

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

This annual report for Templeton Developing Markets Securities Fund covers the fiscal year ended December 31, 2004.

Performance Summary as of 12/31/04

Average annual total return of Class 3 shares* represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same as year-by-year results.

Periods ended 12/31/04

| | | | | | |

| | | 1-Year | | 5-Year | | Since

Inception

(3/4/96) |

Average Annual Total Return | | +24.85% | | +3.57% | | -0.45% |

*Performance prior to the 5/1/00 merger reflects the historical performance of Templeton Developing Markets Fund. Additionally, Class 3 and Class 2 shares were not offered until 5/1/04 and 5/1/97, respectively. As a result, Class 3 Fund performance for periods prior to 5/1/04 represents the historical results of Class 2 shares which, for periods prior to 5/1/97, reflects the historical results of Class 1 shares. For periods beginning on 5/1/97, Class 2’s results reflect an additional 12b-1 fee expense, which also affects future performance. The 12b-1 fee rate is currently the same for Classes 2 and 3. Since 5/1/04 (effective date), the average annual total return of Class 3 shares was +24.15%.

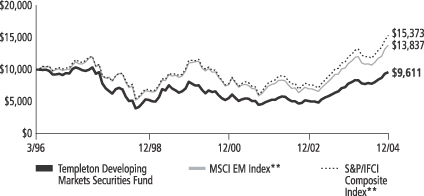

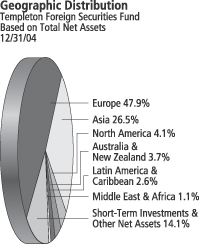

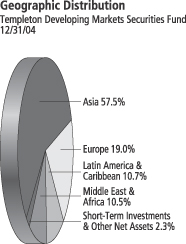

Total Return Index Comparison for Hypothetical $10,000 Investment (3/4/96–12/31/04)

The graph below shows the change in value of a hypothetical $10,000 investment in the Fund over the indicated period and includes reinvestment of any income or distributions. The Fund’s performance* is compared to the performance of the Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index and the Standard & Poor’s/International Finance Corporation Investable (S&P/IFCI) Composite Index. One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Important Notes to Performance Information preceding the Fund Summaries.

**Source: Standard & Poor’s Micropal. Please see Index Descriptions following the Fund Summaries.

Templeton Developing Markets Securities Fund Class 3

Performance reflects the Fund’s Class 3 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data quoted represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

TD-1

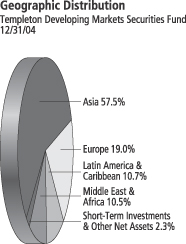

Fund Goals and Main Investments: Templeton Developing Markets Securities Fund seeks long-term capital appreciation. The Fund invests predominantly in emerging markets investments.

Performance Overview

You can find the Fund’s one-year total return in the Performance Summary. The Fund underperformed its benchmarks, the MSCI EM Index and the S&P/IFCI Composite Index, which returned 25.95% and 28.11% for the year under review.1 Please note that the index performance numbers are purely for reference and that we do not attempt to track the index, but rather undertake investments on the basis of careful fundamental research.

Economic and Market Overview

Economically, 2004 was another positive year for emerging markets. Most Latin American economies recorded strong economic growth. In Eastern Europe, new member countries began seeing positive developments in the form of higher investment inflows as a result of European Union (EU) accession.

On December 26, the largest earthquake in 40 years struck in the Indian Ocean, just north of Sumatra. The earthquake created monster tidal waves, also known as tsunamis, that devastated coastal areas of Indonesia, Sri Lanka, Thailand, India and the Maldives. The remoteness of some of these areas complicated aid relief to the victims. While the tsunamis took a terrible toll on the people in the region, analysts estimated that their economic impact would not be significant.

Emerging markets stocks generally performed well during the year under review. The MSCI EM Index gained 25.95% in U.S. dollar terms as strong share prices and a sliding U.S. dollar boosted performance in the fourth quarter.1 Latin America and Eastern Europe outperformed their emerging market counterparts as both regions continued to attract greater investor interest. In particular, local stock markets of new EU members such as Poland, the Czech Republic, Hungary and Slovakia reached all-time highs. Turkey also recorded strong gains as investors reacted favorably toward the EU’s approval to begin formal accession talks for October 2005 and the Turkish government’s new US$10 billion standby agreement with the International Monetary Fund

1. Source: Standard & Poor’s Micropal. One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

Fund Risks: Stocks offer the potential for long-term gains but can be subject to short-term up-and-down price movements. Investing in emerging markets involves special considerations, including market and currency fluctuations, economic instability, adverse social and political developments, and the relatively smaller size and lesser liquidity of these markets. All investments in the Fund should be considered long-term investments, which could experience significant volatility in any given year. The Fund is designed for the aggressive portion of a well-diversified portfolio. The Fund’s prospectus also includes a description of the main investment risks.

TD-2

(IMF).2 However, the Russian market underperformed as foreign investors remained cautious due to the Russian government’s actions against YUKOS and new tax claims on Vimpelcom.

Despite recording double-digit gains, Asian stock markets did not perform as well as those in other emerging markets regions as rising interest rates in the U.S., high commodity prices and concerns over China’s overheating economy continued to affect investor sentiment. In Africa, the South African market benefited from a strengthening rand, which greatly enhanced that market’s performance in U.S. dollars.

Investment Strategy

Our investment philosophy is bottom-up, value-oriented and long-term. In choosing investments, we may make onsite visits to companies to assess critical factors such as management strength and local conditions. In addition, we focus on the market price of a company’s securities relative to its evaluation of the company’s potential long-term (typically 5 years) earnings, asset value, cash flow, and balance sheet. Among factors we consider are a company’s historical value measures, including price/earnings ratio, book value, profit margins and liquidation value. We perform in-depth research to construct an action list from which we make our investment decisions.

Manager’s Discussion

In terms of performance, the Fund derived positive results from its underweighted position, relative to the MSCI EM Index, in Russia as well as overweighted positions in Austria and Singapore. The Fund’s decision not to hold YUKOS in Russia helped performance as that company’s stock price continued to tumble mainly due to concerns about the Russian government’s treatment of its assets. In Austria, the strongest contributors to Fund performance were OMV and Bank Austria Creditanstalt. We felt that both companies were well positioned to benefit from their large exposure to fast-growing central and Eastern European economies. However, the Fund’s underweighted positions in Brazil, Mexico and South Africa negatively impacted relative performance. All three markets recorded strong U.S. dollar performances in 2004, resulting in increasingly expensive valuations.

With regard to sectors, the energy sector, whose Fund weighting was about on par with that of the index, performed well.3 Our overweighted positions in MOL, OMV and SK Corp. drove the Fund’s relative energy

2. Source: The Economist Intelligence Unit Ltd., “Turkey Economy: Plumper,” 12/20/04.

3. The energy sector comprises energy equipment and services, and oil and gas in the SOI.

Top 10 Countries

Templeton Developing Markets Securities Fund 12/31/04

| | |

| | | % of Total

Net Assets |

| |

| South Korea | | 17.4% |

| |

| Taiwan | | 13.2% |

| |

| South Africa | | 10.5% |

| |

| China | | 10.1% |

| |

| Brazil | | 7.1% |

| |

| Singapore | | 6.0% |

| |

| Poland | | 3.5% |

| |

| Turkey | | 3.5% |

| |

| India | | 3.5% |

| |

| Mexico | | 3.3% |

TD-3

sector performance. Our overweighted positions in the consumer staples and diversified financial services sectors also reaped significant benefits.4 For example, SABMiller, Remgro and Ambev contributed the most to relative performance. The Fund’s underweighted position in commercial banks and overweighted exposure to telecommunication services hampered relative performance during the year.5

In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended December 31, 2004, the U.S. dollar declined in value relative to most non-U.S. currencies. At the end of the period, the Fund’s portfolio was invested predominantly in securities with non-U.S. currency exposure, which resulted in a positive effect on Fund performance. However, one cannot expect the same result in future periods.

In Asia, the Fund’s largest purchases were in South Korea and Taiwan as the Fund increased its exposure to the semiconductors and semiconductor equipment sector. Key purchases included Samsung Electronics, one of the world’s largest electronics manufacturers, and Taiwan Semiconductor Manufacturing, a leading global integrated circuit producer. Additional purchases included Daewoo Shipbuilding, a major player in the global shipbuilding industry, and MediaTek, Taiwan’s biggest integrated circuit design company. We reduced our Indonesian position due to strong performance in 2004 as some stocks reached our sell targets.

The Fund invested in several western European-listed companies with significant business exposure and growth opportunities in emerging markets. They include Oriflame, a cosmetic company with sales operations in over 50 countries as well as market leadership in more than 30 of them; Inbev, the result of a merger between Interbrew and Ambev; and HSBC Holdings, one of the world’s largest banking and financial services organizations.

4. The consumer staples sector comprises food and staples retailing, beverages, food products, tobacco, household products and personal products in the SOI.

5. The telecommunication services sector comprises diversified telecommunication services and

Top 10 Holdings

Templeton Developing Markets Securities Fund 12/31/04

| | |

Company

Sector/Industry,

Country | | % of Total

Net Assets |

| |

Samsung Electronics

Co. Ltd. | | 4.5% |

| Semiconductors & Semiconductor Equipment, South Korea | | |

| |

| China Mobile (Hong Kong) Ltd., fgn. | | 2.4% |

| Wireless Telecommunication Services, China | | |

| |

Telekomunikacja

Polska SA | | 2.2% |

| Diversified Telecommunication Services, Poland | | |

| |

| Remgro Ltd. | | 2.2% |

| Diversified Financial Services, South Africa | | |

| |

| Anglo American PLC | | 2.1% |

| Metals & Mining, South Africa | | |

| |

| SABMiller PLC | | 2.1% |

| Beverages, South Africa | | |

| |

| Kimberly Clark de Mexico SA de CV, A | | 1.9% |

| Household Products, Mexico | | |

| |

Cia De Bebidas Das Americas (Ambev),

ADR, pfd. | | 1.8% |

| Beverages, Brazil | | |

| |

| Inbev | | 1.8% |

| Beverages, Belgium | | |

| |

| Taiwan Cellular Corp. | | 1.7% |

| Wireless Telecommunication Services, Taiwan | | |

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments.

TD-4

We reduced our Latin American exposure during the reporting period as the Fund undertook selective sales in Mexico and Argentina, and sold its only holding in Peru. The Fund realized gains through significant sales such as Carso and Tenaris. Benefiting from a strengthening rand and high commodity prices in 2004, the Fund locked in strong U.S. dollar returns through sales of Anglo American and BHP Billiton.

Thank you for your participation in Templeton Developing Markets Securities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2004, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the adviser makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

TD-5

Fund Expenses

As an investor in a variable insurance contract (“Contract”) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract level.

| • | | Transaction expenses can include sales charges (loads) on purchases, redemption fees, surrender fees, transfer fees and premium taxes. |

| • | | Ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. |

The expenses shown in the table below are meant to highlight ongoing expenses at the Fund level only and do not include ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. If ongoing expenses at the Contract level and transaction expenses at the Fund and Contract levels were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

The table shows Fund-level ongoing expenses and can help you understand these expenses and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Because transaction costs at the Fund level are not included, the second line (Hypothetical) is useful in comparing ongoing expenses only, and will not help you compare the total costs of different funds offered through the Contract. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The first line (Actual) listed in the table below provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of ongoing Fund expenses, but does not include the effect of ongoing Contract expenses.

You can estimate the Fund-level expenses you incurred during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

Templeton Developing Markets Securities Fund Class 3

TD-6

| 2. | Multiply the result by the number under the heading “Fund-Level Expenses Incurred During Period.” |

If Fund-Level Expenses Incurred During Period were $7.50, then 8.6 × $7.50 = $64.50.

In this illustration, the estimated expenses incurred this period at the Fund level are $64.50.

Hypothetical Example for Comparison with Other Mutual Funds

Information in the second line (Hypothetical) in the table can help you compare ongoing expenses of the Fund with those of other mutual funds offered through the Contract. This information may not be used to estimate the actual ending account balance or expenses you incurred during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Fund-Level Expenses Incurred During Period” shows the hypothetical expenses a Fund account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds offered through a Contract.

| | | | | | | | | |

| Class 3 | | Beginning

Account

Value 6/30/04 | | Ending

Account

Value 12/31/04 | | Fund-Level

Expenses Incurred

During Period*

6/30/04-12/31/04 |

Actual | | $ | 1,000 | | $ | 1,238.20 | | $ | 8.95 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,017.14 | | $ | 8.06 |

*Expenses are equal to the annualized expense ratio for the Fund’s Class 3 shares (1.59%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period.

TD-7

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Highlightsa

| | | | | | | | | | | | | | | | | | | | |

| | | Class 1

| |

| | | Year Ended December 31,

| |

| | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | |

|

|

|

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 7.14 | | | $ | 4.71 | | | $ | 4.78 | | | $ | 5.25 | | | $ | 7.77 | |

| | |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | .11 | | | | .13 | | | | .07 | | | | .08 | | | | .07 | |

Net realized and unrealized gains (losses) | | | 1.62 | | | | 2.38 | | | | (.06 | ) | | | (.50 | ) | | | (2.52 | ) |

| | |

|

|

|

Total from investment operations | | | 1.73 | | | | 2.51 | | | | .01 | | | | (.42 | ) | | | (2.45 | ) |

| | |

|

|

|

Less distributions from net investment income | | | (.14 | ) | | | (.08 | ) | | | (.08 | ) | | | (.05 | ) | | | (.07 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 8.73 | | | $ | 7.14 | | | $ | 4.71 | | | $ | 4.78 | | | $ | 5.25 | |

| | |

|

|

|

| | | | | |

Total returnc | | | 24.83% | | | | 53.74% | | | | .04% | | | | (8.08)% | | | | (31.76)% | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 477,290 | | | $ | 359,299 | | | $ | 225,454 | | | $ | 240,289 | | | $ | 301,645 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.54% | | | | 1.55% | | | | 1.58% | | | | 1.57% | | | | 1.56% | |

Net investment income | | | 1.52% | | | | 2.35% | | | | 1.45% | | | | 1.64% | | | | 1.13% | |

Portfolio turnover rate | | | 55.67% | | | | 46.20% | | | | 57.91% | | | | 78.29% | | | | 89.48% | |

| a | Financial highlights presented reflect historical financial information from Templeton Variable Products Series Fund (TVP)-Templeton Developing Markets Fund as a result of a merger on May 1, 2000. |

| b | Based on average daily shares outstanding. |

| c | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

See notes to financial statements.

TD-8

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Highlightsa (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class 2

| |

| | | Year Ended December 31,

| |

| | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | |

|

|

|

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 7.09 | | | $ | 4.69 | | | $ | 4.76 | | | $ | 5.22 | | | $ | 7.74 | |

| | |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | .09 | | | | .11 | | | | .06 | | | | .07 | | | | .06 | |

Net realized and unrealized gains (losses) | | | 1.63 | | | | 2.35 | | | | (.06 | ) | | | (.49 | ) | | | (2.53 | ) |

| | |

|

|

|

Total from investment operations | | | 1.72 | | | | 2.46 | | | | — | | | | (.42 | ) | | | (2.47 | ) |

| | |

|

|

|

Less distributions from net investment income | | | (.14 | ) | | | (.06 | ) | | | (.07 | ) | | | (.04 | ) | | | (.05 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 8.67 | | | $ | 7.09 | | | $ | 4.69 | | | $ | 4.76 | | | $ | 5.22 | |

| | |

|

|

|

| | | | | |

Total returnc | | | 24.71% | | | | 52.99% | | | | (.15)% | | | | (8.08)% | | | | (32.04)% | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 327,569 | | | $ | 170,953 | | | $ | 80,952 | | | $ | 64,081 | | | $ | 56,617 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.79% | | | | 1.80% | | | | 1.83% | | | | 1.82% | | | | 1.81% | |

Net investment income | | | 1.27% | | | | 2.10% | | | | 1.20% | | | | 1.37% | | | | .88% | |

Portfolio turnover rate | | | 55.67% | | | | 46.20% | | | | 57.91% | | | | 78.29% | | | | 89.48% | |

| a | Financial highlights presented reflect historical financial information from Templeton Variable Products Series Fund (TVP) – Templeton Developing Markets Fund as a result of a merger on May 1, 2000. |

| b | Based on average daily shares outstanding. |

| c | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

See notes to financial statements.

TD-9

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Highlights (continued)

| | | | |

| | | Class 3

| |

| | | Period Ended

December 31, 2004c

| |

Per share operating performance | | | | |

(for a share outstanding throughout the period) | | | | |

Net asset value, beginning of period | | $ | 7.13 | |

| | |

|

|

|

Income from investment operations: | | | | |

Net investment incomea | | | .08 | |

Net realized and unrealized gains (losses) | | | 1.61 | |

| | |

|

|

|

Total from investment operations | | | 1.69 | |

| | |

|

|

|

Less distributions from net investment income | | | (.14 | ) |

| | |

|

|

|

Net asset value, end of period | | $ | 8.68 | |

| | |

|

|

|

| |

Total returnb | | | 24.15% | |

Ratios/supplemental data | | | | |

Net assets, end of period (000’s) | | $ | 12 | |

Ratios to average net assets: | | | | |

Expenses | | | 1.54% | d |

Net investment income | | | 1.52% | d |

Portfolio turnover rate | | | 55.67% | |

| a | Based on average daily shares outstanding. |

| b | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

| c | For the period May 1, 2004 (effective date) to December 31, 2004. |

See notes to financial statements.

TD-10

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2004

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS | | VALUE |

Long Term Investments 97.7% | | | | | | | |

Argentina .3% | | | | | | | |

Tenaris SA, ADR | | Energy Equipment & Services | | 45,434 | | $ | 2,221,723 |

| | | | | | |

|

|

Austria 2.0% | | | | | | | |

Bank Austria Creditanstalt | | Commercial Banks | | 125,852 | | | 11,356,942 |

OMV AG | | Oil & Gas | | 17,363 | | | 5,223,367 |

| | | | | | |

|

|

| | | | | | | | 16,580,309 |

| | | | | | |

|

|

Belgium 1.8% | | | | | | | |

Inbev | | Beverages | | 369,200 | | | 14,298,659 |

| | | | | | |

|

|

Brazil 7.1% | | | | | | | |

Banco Bradesco SA, ADR, pfd. | | Commercial Banks | | 477,270 | | | 11,960,386 |

Centrais Eletricas Brasileiras SA | | Electric Utilities | | 241,544,764 | | | 3,501,307 |

Cia De Bebidas Das Americas (Ambev), ADR, pfd. | | Beverages | | 518,800 | | | 14,697,604 |

Cia Vale do Rio Doce, ADR, pfd., A | | Metals & Mining | | 204,300 | | | 4,980,834 |

Petroleo Brasileiro SA, ADR, pfd. | | Oil & Gas | | 268,264 | | | 9,713,839 |

Souza Cruz SA | | Tobacco | | 430,922 | | | 5,779,157 |

Suzano Bahia Sul Papel e cel, pfd., A | | Paper & Forest Products | | 343,148 | �� | | 1,773,879 |

Unibanco Uniao de Bancos Brasileiros SA, GDR | | Commercial Banks | | 86,400 | | | 2,740,608 |

Usinas Siderurgicas De Minas Gerais SA, pfd. | | Metals & Mining | | 86,920 | | | 1,765,563 |

| | | | | | |

|

|

| | | | | | | | 56,913,177 |

| | | | | | |

|

|

China 10.1% | | | | | | | |

aAir China Ltd., 144A. | | Airlines | | 1,452,000 | | | 560,416 |

Aluminum Corp. of China Ltd., H | | Metals & Mining | | 9,940,000 | | | 5,882,565 |

Anhui Conch Cement Co. Ltd. | | Construction Materials | | 2,740,000 | | | 2,978,721 |

Beijing Enterprises Holdings Ltd. | | Industrial Conglomerates | | 1,420,128 | | | 2,110,241 |

China Mobile (Hong Kong) Ltd., fgn. | | Wireless Telecommunication Services | | 5,602,000 | | | 18,990,930 |

China Petroleum & Chemical Corp., H | | Oil & Gas | | 8,078,000 | | | 3,325,648 |

China Resources Enterprise Ltd. | | Distributors | | 4,574,000 | | | 7,149,817 |

China Travel International Investment Hong Kong Ltd. | | Hotels Restaurants & Leisure | | 15,506,000 | | | 4,987,263 |

China Unicom Ltd. | | Wireless Telecommunication Services | | 2,172,000 | | | 1,718,531 |

CITIC Pacific Ltd. | | Industrial Conglomerates | | 2,013,959 | | | 5,726,185 |

Denway Motors Ltd. | | Automobiles | | 13,090,234 | | | 4,673,400 |

Huadian Power International Corp. Ltd., H | | Electric Utilities | | 7,826,000 | | | 2,315,742 |

Lenovo Group Ltd., H | | Computers & Peripherals | | 13,606,000 | | | 4,069,827 |

PetroChina Co. Ltd., H | | Oil & Gas | | 14,474,000 | | | 7,727,859 |

Shanghai Industrial Holdings Ltd. | | Industrial Conglomerates | | 2,697,000 | | | 5,759,855 |

TCL International Holdings Inc. | | Household Durables | | 3,584,000 | | | 922,190 |

Travelsky Technology Ltd., H | | IT Services | | 3,227,000 | | | 2,615,544 |

| | | | | | |

|

|

| | | | | | | | 81,514,734 |

| | | | | | |

|

|

Croatia .5% | | | | | | | |

Pliva D D, GDR, Reg S | | Pharmaceuticals | | 320,200 | | | 3,986,490 |

| | | | | | |

|

|

Czech Republic .7% | | | | | | | |

Cesky Telecom AS | | Diversified Telecommunication Services | | 323,510 | | | 5,355,743 |

| | | | | | |

|

|

Greece 1.1% | | | | | | | |

Hellenic Telecommunications Organization SA (OTE) | | Diversified Telecommunication Services | | 154,380 | | | 2,769,505 |

Titan Cement Co. | | Construction Materials | | 207,560 | | | 6,140,162 |

| | | | | | |

|

|

| | | | | | | | 8,909,667 |

| | | | | | |

|

|

TD-11

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2004 (cont.)

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS | | VALUE |

Long Term Investments (cont.) | | | | | | | |

Hong Kong 2.6% | | | | | | | |

Cheung Kong Holdings Ltd. | | Real Estate | | 1,184,000 | | $ | 11,805,270 |

Cheung Kong Infrastructure Holdings Ltd. | | Electric Utilities | | 572,000 | | | 1,652,094 |

Guoco Group Ltd. | | Diversified Financial Services | | 328,000 | | | 3,207,081 |

Henderson Investment Ltd. | | Real Estate | | 1,065,000 | | | 1,555,135 |

MTR Corp. Ltd. | | Road & Rail | | 1,613,901 | | | 2,585,049 |

| | | | | | |

|

|

| | | | | | | | 20,804,629 |

| | | | | | |

|

|

Hungary 3.0% | | | | | | | |

Egis RT | | Pharmaceuticals | | 15,827 | | | 954,700 |

Gedeon Richter Ltd. | | Pharmaceuticals | | 50,356 | | | 6,325,851 |

Matav RT | | Diversified Telecommunication Services | | 1,037,300 | | | 4,965,492 |

MOL Magyar Olaj-Es Gazipari RT | | Oil & Gas | | 172,240 | | | 12,114,944 |

| | | | | | |

|

|

| | | | | | | | 24,360,987 |

| | | | | | |

|

|

India 3.5% | | | | | | | |

Gail (India) Ltd. | | Gas Utilities | | 855,630 | | | 4,564,019 |

Hindustan Lever Ltd. | | Household Products | | 2,477,600 | | | 8,220,476 |

Hindustan Petroleum Corp. Ltd. | | Oil & Gas | | 1,050,804 | | | 9,730,567 |

Tata Motors Ltd. | | Automobiles | | 148,000 | | | 1,728,606 |

Tata Tea Ltd. | | Food Products | | 359,803 | | | 3,937,035 |

| | | | | | |

|

|

| | | | | | | | 28,180,703 |

| | | | | | |

|

|

Indonesia .6% | | | | | | | |

Bk Danamon | | Commercial Banks | | 6,840,000 | | | 3,223,808 |

PT Perusahaan Gas Negara | | Gas Utilities | | 7,557,500 | | | 1,546,916 |

PT Perusahaan Gas Negara, 144A | | Gas Utilities | | 169,500 | | | 34,695 |

| | | | | | |

|

|

| | | | | | | | 4,805,419 |

| | | | | | |

|

|

Malaysia 1.6% | | | | | | | |

Kuala Lumpur Kepong Bhd. | | Food Products | | 390,600 | | | 709,248 |

Resorts World Bhd. | | Hotels Restaurants & Leisure | | 2,046,000 | | | 5,384,211 |

SIME Darby Bhd. | | Industrial Conglomerates | | 2,054,500 | | | 3,243,947 |

Tanjong PLC | | Hotels Restaurants & Leisure | | 241,000 | | | 894,237 |

YTL Corp. Bhd. | | Electric Utilities | | 1,061,000 | | | 1,493,776 |

YTL Power International Bhd. | | Water Utilities | | 2,483,400 | | | 1,176,347 |

| | | | | | |

|

|

| | | | | | | | 12,901,766 |

| | | | | | |

|

|

Mexico 3.3% | | | | | | | |

Fomento Economico Mexicano SA de CV Femsa, ADR | | Beverages | | 140,600 | | | 7,396,966 |

Kimberly Clark de Mexico SA de CV, A | | Household Products | | 4,538,033 | | | 15,690,550 |

Telefonos de Mexico SA de CV (Telmex), L, ADR | | Diversified Telecommunication Services | | 99,982 | | | 3,831,310 |

| | | | | | |

|

|

| | | | | | | | 26,918,826 |

| | | | | | |

|

|

Philippines .6% | | | | | | | |

San Miguel Corp., B | | Beverages | | 3,892,630 | | | 5,201,733 |

| | | | | | |

|

|

Poland 3.5% | | | | | | | |

Polski Koncern Naftowy Orlen SA | | Oil & Gas | | 825,929 | | | 10,363,524 |

Telekomunikacja Polska SA | | Diversified Telecommunication Services | | 2,736,600 | | | 17,986,616 |

| | | | | | |

|

|

| | | | | | | | 28,350,140 |

| | | | | | |

|

|

TD-12

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2004 (cont.)

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS | | VALUE |

Long Term Investments (cont.) | | | | | | | |

Russia .8% | | | | | | | |

bLukoil Holdings, ADR | | Oil & Gas | | 52,307 | | $ | 6,350,070 |

| | | | | | |

|

|

Singapore 6.0% | | | | | | | |

Comfortdelgro Corp. Ltd. | | Road & Rail | | 4,474,000 | | | 4,248,422 |

Dairy Farm International Holdings Ltd. | | Food & Staples Retailing | | 1,132,933 | | | 2,741,698 |

Fraser & Neave Ltd. | | Beverages | | 1,233,681 | | | 12,319,427 |

Keppel Corp. Ltd. | | Industrial Conglomerates | | 2,182,600 | | | 11,499,332 |

Singapore Press Holdings Ltd. | | Media | | 1,179,000 | | | 3,322,551 |

Singapore Technologies Engineering Ltd. | | Aerospace & Defense | | 2,988,000 | | | 4,265,172 |

Singapore Telecommunications Ltd. | | Diversified Telecommunication Services | | 6,052,428 | | | 8,824,835 |

aSuntec Real Estate Investment Trust | | Real Estate | | 1,252,000 | | | 851,388 |

| | | | | | |

|

|

| | | | | | | | 48,072,825 |

| | | | | | |

|

|

South Africa 10.5% | | | | | | | |

Anglo American PLC | | Metals & Mining | | 731,130 | | | 17,229,630 |

Liberty Group Ltd. | | Insurance | | 65,491 | | | 769,938 |

Nedcor Ltd. | | Commercial Banks | | 450,759 | | | 6,190,477 |

Nedcor Ltd., 144A | | Commercial Banks | | 63,958 | | | 878,364 |

Old Mutual PLC | | Insurance | | 4,501,298 | | | 11,448,078 |

Remgro Ltd. | | Diversified Financial Services | | 1,043,070 | | | 17,374,066 |

SABMiller PLC | | Beverages | | 1,016,424 | | | 17,125,803 |

Sappi Ltd. | | Paper & Forest Products | | 401,900 | | | 5,888,385 |

Sasol Ltd. | | Oil & Gas | | 357,400 | | | 7,633,786 |

| | | | | | |

|

|

| | | | | | | | 84,538,527 |

| | | | | | |

|

|

South Korea 17.4% | | | | | | | |

CJ Corp. | | Food Products | | 105,070 | | | 7,186,009 |

Daewoo Shipbuilding & Marine Engineering Co. Ltd. | | Machinery | | 791,700 | | | 11,777,608 |

Hite Brewery Co. Ltd. | | Beverages | | 87,140 | | | 7,197,131 |

Hyundai Development Co. | | Construction & Engineering | | 463,300 | | | 7,384,515 |

Kangwon Land Inc. | | Hotels Restaurants & Leisure | | 784,165 | | | 10,188,388 |

Kia Motors Corp. | | Automobiles | | 309,230 | | | 3,255,996 |

Korea Gas Corp. | | Gas Utilities | | 89,600 | | | 2,778,362 |

LG Chem Ltd. | | Chemicals | | 195,940 | | | 7,807,694 |

LG Electronics Inc. | | Household Durables | | 125,930 | | | 7,797,636 |

LG Household & Health Care Ltd. | | Household Products | | 94,760 | | | 2,512,715 |

LG International Corp. | | Trading Companies & Distributors | | 325,440 | | | 2,530,711 |

LG Petrochemical Co. Ltd. | | Chemicals | | 146,810 | | | 3,687,268 |

POSCO | | Metals & Mining | | 40,480 | | | 7,312,365 |

Samsung Electronics Co. Ltd. | | Semiconductors & Semiconductor Equipment | | 83,368 | | | 36,280,220 |

Samsung Fine Chemicals Co. Ltd. | | Chemicals | | 221,490 | | | 3,808,464 |

Samsung Heavy Industries Co. Ltd. | | Machinery | | 1,757,220 | | | 10,965,650 |

SK Corp. | | Oil & Gas | | 33,410 | | | 1,836,388 |

SK Telecom Co. Ltd. | | Wireless Telecommunication Services | | 31,730 | | | 6,038,263 |

| | | | | | |

|

|

| | | | | | | | 140,345,383 |

| | | | | | |

|

|

Sweden .5% | | | | | | | |

aOriflame Cosmetics, IDR | | Personal Products | | 170,000 | | | 3,940,575 |

| | | | | | |

|

|

Taiwan 13.2% | | | | | | | |

Acer Inc. | | Computers & Peripherals | | 3,583,254 | | | 5,917,610 |

Chunghwa Telecom Co. Ltd. | | Diversified Telecommunication Services | | 3,162,000 | | | 6,216,577 |

TD-13

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2004 (cont.)

| | | | | | | |

| | | INDUSTRY | | SHARES/

RIGHTS | | VALUE |

Long Term Investments (cont.) | | | | | | | |

Taiwan (cont.) | | | | | | | |

D-Link Corp. | | Communications Equipment | | 4,066,787 | | $ | 4,733,285 |

Delta Electronics Inc. | | Electronic Equipment & Instruments | | 5,127,467 | | | 9,032,342 |

Elan Microelectronics Corp. | | Semiconductors & Semiconductor Equipment | | 2,725,776 | | | 1,534,803 |

Kinpo Electronics Inc. | | Office Electronics | | 2,453,200 | | | 1,068,789 |

Lite-on Technology Corp. | | Computers & Peripherals | | 6,440,700 | | | 6,868,189 |

MediaTek Inc. | | Semiconductors & Semiconductor Equipment | | 1,098,000 | | | 7,460,459 |

Mega Financial Holdings Co. Ltd. | | Commercial Banks | | 9,866,503 | | | 6,796,993 |

Premier Image Technology Corp. | | Leisure Equipment & Products | | 1,819,000 | | | 1,790,963 |

President Chain Store Corp. | | Food & Staples Retailing | | 2,986,144 | | | 4,790,605 |

Siliconware Precision Industries Co. Ltd. | | Semiconductors & Semiconductor Equipment | | 5,247,000 | | | 4,324,360 |

Sunplus Technology Co. Ltd. | | Semiconductors & Semiconductor Equipment | | 4,629,100 | | | 6,494,428 |

Synnex Technology International Corp. | | Electronic Equipment & Instruments | | 742,600 | | | 1,095,563 |

Taiwan Cellular Corp. | | Wireless Telecommunication Services | | 12,155,302 | | | 13,573,867 |

Taiwan Semiconductor Manufacturing Co. | | Semiconductors & Semiconductor Equipment | | 7,669,000 | | | 12,182,589 |

UNI-President Enterprises Corp. | | Food Products | | 13,577,600 | | | 7,089,908 |

Yuanta Core Pacific Securities Co. | | Capital Markets | | 7,065,978 | | | 5,356,718 |

| | | | | | |

|

|

| | | | | | | | 106,328,048 |

| | | | | | |

|

|

Thailand 1.8% | | | | | | | |

BEC World Public Co. Ltd., fgn. | | Media | | 7,730,700 | | | 3,122,189 |

aKasikornbank Public Co. Ltd., fgn. | | Commercial Banks | | 3,074,800 | | | 4,429,408 |

Land and House Public Co. Ltd., fgn. | | Real Estate | | 3,624,700 | | | 1,053,638 |

Shin Corp. Public Co. Ltd., fgn. | | Wireless Telecommunication Services | | 1,176,900 | | | 1,203,421 |

Siam Cement Public Co. Ltd., fgn. | | Construction Materials | | 177,100 | | | 1,257,385 |

Thai Airways International Public Co. Ltd., fgn. | | Airlines | | 130,000 | | | 162,191 |

aThai Military Bank Public Co. Ltd., fgn. | | Commercial Banks | | 32,522,400 | | | 3,145,656 |

aTrue Corp., PLC, rts., 3/28/08 | | Diversified Telecommunication Services | | 344,616 | | | — |

| | | | | | |

|

|

| | | | | | | | 14,373,888 |

| | | | | | |

|

|

Turkey 3.5% | | | | | | | |

aArcelik AS, Br. | | Household Durables | | 1,048,826,400 | | | 6,416,624 |

Migros Turk TAS | | Food & Staples Retailing | | 933,539,500 | | | 7,753,536 |

Tupras-Turkiye Petrol Rafineleri AS | | Oil & Gas | | 657,260,000 | | | 6,677,391 |

aTurk Hava Yollari Anonim Ortakligi (THY), 144A | | Airlines | | 188,012,000 | | | 1,108,413 |

Turkiye Is Bankasi AS, C | | Commercial Banks | | 1,143,234,000 | | | 6,315,976 |

| | | | | | |

|

|

| | | | | | | | 28,271,940 |

| | | | | | |

|

|

United Kingdom 1.7% | | | | | | | |

HSBC Holdings PLC | | Commercial Banks | | 543,656 | | | 9,302,471 |

Provident Financial PLC | | Consumer Finance | | 328,500 | | | 4,237,245 |

| | | | | | |

|

|

| | | | | | | | 13,539,716 |

| | | | | | |

|

|

Total Long Term Investments (Cost $573,199,966) | | | | | | | 787,065,677 |

| | | | | | |

|

|

TD-14

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Statement of Investments, December 31, 2004 (cont.)

| | | | | | |

| | | PRINCIPAL

AMOUNT | | VALUE | |

Short Term Investments (Cost $22,458,325) 2.9% | | | | | | |

U.S. Government and Agency Securities | | | | | | |

cU.S. Treasury Bills, 1/06/05 – 3/31/05 | | $22,506,000 | | $ | 22,463,389 | |

| | | | |

|

|

|

Total Investments (Cost $595,658,291) 100.6% | | | | | 809,529,066 | |

Other Assets, less Liabilities (.6)% | | | | | (4,658,286 | ) |

| | | | |

|

|

|

Net Assets 100.0% | | | | $ | 804,870,780 | |

| | | | |

|

|

|

Portfolio Abbreviations

ADR - American Depository Receipt

GDR - Global Depository Receipt

IDR - International Depository Receipt

| b | See Note 7 regarding other considerations. |

| c | Security is traded on a discount basis with no stated coupon rate. |

See notes to financial statements.

TD-15

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Statements

Statement of Assets and Liabilities

December 31, 2004

| | | | |

Assets: | | | | |

Investments in securities: | | | | |

Cost | | $ | 595,658,291 | |

| | |

|

|

|

Value | | | 809,529,066 | |

Cash | | | 8,216 | |

Foreign currency, at value (cost $513,194) | | | 524,635 | |

Receivables: | | | | |

Investment securities sold | | | 89,395 | |

Capital shares sold | | | 811,182 | |

Dividends | | | 926,376 | |

Foreign income tax receivable | | | 159,393 | |

| | |

|

|

|

Total assets | | | 812,048,263 | |

| | |

|

|

|

Liabilities: | | | | |

Payables: | | | | |

Investment securities purchased | | | 4,731,476 | |

Capital shares redeemed | | | 886,683 | |

Affiliates | | | 974,994 | |

Deferred tax liability | | | 441,892 | |

Other liabilities | | | 142,438 | |

| | |

|

|

|

Total liabilities | | | 7,177,483 | |

| | |

|

|

|

Net assets, at value | | $ | 804,870,780 | |

| | |

|

|

|

Net assets consist of: | | | | |

Undistributed net investment income | | $ | 1,637,611 | |

Net unrealized appreciation (depreciation) | | | 213,443,902 | |

Accumulated net realized gain (loss) | | | (147,539,841 | ) |

Capital shares | | | 737,329,108 | |

| | |

|

|

|

Net assets, at value | | $ | 804,870,780 | |

| | |

|

|

|

Class 1: | | | | |

Net assets, at value | | $ | 477,289,957 | |

| | |

|

|

|

Shares outstanding | | | 54,653,947 | |

| | |

|

|

|

Net asset value and offering price per share | | $ | 8.73 | |

| | |

|

|

|

Class 2: | | | | |

Net assets, at value | | $ | 327,568,647 | |

| | |

|

|

|

Shares outstanding | | | 37,791,471 | |

| | |

|

|

|

Net asset value and offering price per share | | $ | 8.67 | |

| | |

|

|

|

Class 3: | | | | |

Net assets, at value | | $ | 12,176 | |

| | |

|

|

|

Shares outstanding | | | 1,403 | |

| | |

|

|

|

Net asset value and offering price per sharea | | $ | 8.68 | |

| | |

|

|

|

| a | Redemption price is equal to net asset value less any redemption fees retained by the Fund. |

See notes to financial statements.

TD-16

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Statements (continued)

Statement of Operations

for the year ended December 31, 2004

| | | | |

Investment income: | | | | |

Dividends (net of foreign taxes of $2,118,707) | | $ | 18,874,239 | |

Interest | | | 357,121 | |

| | |

|

|

|

Total investment income | | | 19,231,360 | |

| | |

|

|

|

Expenses: | | | | |

Management fees (Note 3) | | | 7,848,740 | |

Administrative fees (Note 3) | | | 874,723 | |

Distribution fees - Class 2 (Note 3) | | | 579,458 | |

Transfer agent fees | | | 10,778 | |

Custodian fees (Note 4) | | | 635,519 | |

Reports to shareholders | | | 234,051 | |

Professional fees | | | 71,409 | |

Trustees’ fees and expenses | | | 3,753 | |

Other | | | 26,158 | |

| | |

|

|

|

Total expenses | | | 10,284,589 | |

Expense reductions (Note 4) | | | (1,831 | ) |

| | |

|

|

|

Net expenses | | | 10,282,758 | |

| | |

|

|

|

Net investment income | | | 8,948,602 | |

| | |

|

|

|

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments (net of foreign taxes of $2,007,158) | | | 51,038,207 | |

Foreign currency transactions | | | (577,452 | ) |

| | |

|

|

|

Net realized gain (loss) | | | 50,460,755 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 89,187,217 | |

Translation of assets and liabilities denominated in foreign currencies | | | 34,734 | |

Deferred taxes | | | 1,472,777 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) | | | 90,694,728 | |

| | |

|

|

|

Net realized and unrealized gain (loss) | | | 141,155,483 | |

| | |

|

|

|

Net increase (decrease) in net assets resulting from operations | | $ | 150,104,085 | |

| | |

|

|

|

See notes to financial statements.

TD-17

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Financial Statements (continued)

Statements of Changes in Net Assets

for the years ended December 31, 2004 and 2003

| | | | | | | | |

| | | 2004 | | | 2003 | |

| | |

| |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 8,948,602 | | | $ | 8,383,604 | |

Net realized gain (loss) from investments and foreign currency transactions | | | 50,460,755 | | | | 18,835,829 | |

Net change in unrealized appreciation (depreciation) on investments, translation of assets and liabilities denominated in foreign currencies, and deferred taxes | | | 90,694,728 | | | | 141,314,261 | |

| | |

|

|

|

Net increase (decrease) in net assets resulting from operations | | | 150,104,085 | | | | 168,533,694 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class 1 | | | (7,597,672 | ) | | | (3,521,009 | ) |

Class 2 | | | (4,066,275 | ) | | | (1,068,523 | ) |

Class 3 | | | (190 | ) | | | — | |

| | |

| |

Total distributions to shareholders | | | (11,664,137 | ) | | | (4,589,532 | ) |

Capital share transactions: (Note 2) | | | | | | | | |

Class 1 | | | 32,499,304 | | | | 18,051,739 | |

Class 2 | | | 103,669,110 | | | | 41,851,167 | |

Class 3 | | | 10,000 | | | | — | |

| | |

| |

Total capital share transactions | | | 136,178,414 | | | | 59,902,906 | |

Net increase (decrease) in net assets | | | 274,618,362 | | | | 223,847,068 | |

Net assets: | | | | | | | | |

Beginning of year | | | 530,252,418 | | | | 306,405,350 | |

| | |

| |

End of year | | $ | 804,870,780 | | | $ | 530,252,418 | |

| | |

|

|

|

Undistributed net investment income included in net assets: | | | | | | | | |

End of year | | $ | 1,637,611 | | | $ | 5,951,933 | |

| | |

|

|

|

See notes to financial statements.

TD-18

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton Variable Insurance Products Trust (the Trust) is registered under the Investment Company Act of 1940 as an open-end investment company, consisting of twenty-one separate series (the Funds). The Templeton Developing Markets Securities Fund (the Fund) included in this report is diversified. The financial statements of the remaining funds in the series are presented separately. Shares of the Fund are sold only to insurance company separate accounts to fund the benefits of variable life insurance policies or variable annuity contracts. The Fund’s investment objective is capital growth.

The following summarizes the Fund’s significant accounting policies.

a. Security Valuation

Securities listed on a securities exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter securities and listed securities for which there is no reported sale are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market.

U.S. Government securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund may utilize independent pricing services, quotations from bond dealers, and information with respect to bond and note transactions, to assist in determining a current market value for each security. The Fund’s pricing services may use valuation models or matrix pricing which considers information with respect to comparable bond and note transactions, quotations from bond dealers, or by reference to other securities that are considered comparable in such characteristics as rating, interest rate and maturity date, option adjusted spread models, prepayment projections, interest rate spreads and yield curves, to determine current value.

Foreign securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the foreign security is determined. If no sale is reported at that time, the foreign security will be valued within the range of the most recent quoted bid and ask prices.

The Trust has procedures to determine the fair value of individual securities and other assets for which market prices are not readily available or which may not be reliably priced. Some methods for valuing these securities may include: fundamental analysis, matrix pricing, discounts from market prices of similar securities, or discounts applied due to the nature and duration of restrictions on the disposition of the securities. Occasionally, events occur between the time at which trading in a security is completed and the close of the NYSE that might call into question the availability (including the reliability) of the value of a portfolio security held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services. All security valuation procedures are approved by the Fund’s Board of Trustees.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Fund’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and

TD-19

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (cont.)

b. Foreign Currency Translation (continued)

foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Foreign Currency Contracts

When the Fund purchases or sells foreign securities it may enter into foreign exchange contracts to minimize foreign exchange risk from the trade date to the settlement date of the transactions. A foreign exchange contract is an agreement between two parties to exchange different currencies at an agreed upon exchange rate on a specified date. Realized and unrealized gains and losses on these contracts are included in the Statement of Operations.

The risks of these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the possible inability of the counterparties to fulfill their obligations under the contracts.

d. Income and Deferred Taxes

No provision has been made for U.S. income taxes because the Fund’s policy is to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute substantially all of its taxable income. Fund distributions to shareholders are determined on an income tax basis and may differ from net investment income and realized gains for financial reporting purposes.

The Fund is subject to a tax imposed on net realized gains of securities of certain foreign countries. The Fund records an estimated deferred tax liability for net unrealized gains on these securities as reflected in the accompanying financial statements.

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Dividend income and distributions to shareholders are recorded on the ex-dividend date.

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each fund to the combined net assets. Other expenses are charged to each fund on a specific identification basis.

Realized and unrealized gains and losses and net investment income, other than class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

TD-20

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (cont.)

g. Redemption Fees

Redemptions and exchanges of Class 3 shares held 60 days or less may be subject to the Fund’s redemption fee, which is 1% of the amount redeemed. Such fees are retained by the Fund and accounted for as additional paid-in capital. There were no redemption fees for the year.

h. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

The Fund offers three classes of shares: Class 1 Class 2, and Class 3. Effective May 1, 2004 the Fund began offering a new class of shares, Class 3. Each class of shares differs by its distribution fees, voting rights on matters affecting a single class and its exchange privilege.

At December 31, 2004, there were an unlimited number of shares authorized ($.01 par value). Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2004

| | | 2003

| |

| Class 1 Shares: | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares sold | | 8,940,486 | | | $ | 67,520,469 | | | 10,436,573 | | | $ | 60,506,599 | |

Shares issued in reinvestment of distributions | | 1,105,920 | | | | 7,597,672 | | | 652,039 | | | | 3,521,009 | |

Shares redeemed | | (5,740,464 | ) | | | (42,618,837 | ) | | (8,573,395 | ) | | | (45,975,869 | ) |

| | |

| |

Net increase (decrease) | | 4,305,942 | | | $ | 32,499,304 | | | 2,515,217 | | | $ | 18,051,739 | |

| | |

| |

| Class 2 Shares: | | | | | | | | | | | | |

Shares sold | | 21,331,545 | | | $ | 159,905,301 | | | 30,181,277 | | | $ | 163,641,071 | |

Shares issued in reinvestment of distributions | | 595,355 | | | | 4,066,275 | | | 198,398 | | | | 1,068,523 | |

Shares redeemed | | (8,236,506 | ) | | | (60,302,466 | ) | | (23,541,038 | ) | | | (122,858,427 | ) |

| | |

| |

Net increase (decrease) | | 13,690,394 | | | $ | 103,669,110 | | | 6,838,637 | | | $ | 41,851,167 | |

| | |

| |

| Class 3 Shares: | | | | | | | | | | | | |

Shares sold | | 1,403 | | | $ | 10,000 | | | | | | | | |

| | |

| | | | | | | |

Net increase (decrease) | | 1,403 | | | $ | 10,000 | | | | | | | | |

| | |

| | | | | | | |

3. TRANSACTIONS WITH AFFILIATES

Certain officers and trustees of the Fund are also officers and/or directors of the following entities:

| | |

| Entity | | Affiliation |

Templeton Asset Management Ltd. (TAML) | | Investment manager |

Franklin Templeton Services LLC (FT Services) | | Administrative manager |

Franklin Templeton Distributors Inc. (Distributors) | | Principal underwriter |

Franklin Templeton Investor Services LLC (Investor Services) | | Transfer agent |

TD-21

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES (cont.)

a. Management Fees

The Fund pays an investment management fee to TAML of 1.25% per year of the average daily net assets of the Fund.

b. Administrative Fees

The Fund pays an administrative fee to FT Services based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| .150% | | First $200 million |

| .135% | | Over $200 million, up to and including $700 million |

| .100% | | Over $700 million, up to and including $1.2 billion |

Fees are further reduced on net assets over $1.2 billion.

c. Distribution Fees

The Fund reimburses Distributors up to .25% per year of its average daily net assets of Class 2 and Class 3, for costs incurred in marketing the Fund’s shares under a Rule 12b-1 plan. No payments were made by Class 3 for the period ended December 31, 2004.

d. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund for the services.

e. Other Affiliated Transactions

At December 31, 2004, Franklin Advisers Inc. owned 100% of Class 3.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended December 31, 2004, the custodian fees were reduced as noted in the Statement of Operations.

5. INCOME TAXES

At December 31, 2004, the Fund had tax basis capital losses which may be carried over to offset future capital gains. Such losses expire as follows:

| | | |

Capital loss carryovers expiring in: | | | |

2007 | | $ | 58,738,810 |

2009 | | | 62,323,035 |

2010 | | | 24,246,197 |

| | |

|

|

| | | $ | 145,308,042 |

| | |

|

|

TD-22

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

5. INCOME TAXES (cont.)

At December 31, 2004, the Fund had deferred capital and currency losses occurring subsequent to October 31, 2004 of $650,185 and $142,382, respectively. For tax purposes, such losses will be reflected in the year ending December 31, 2005.

The tax character of distributions paid during the years ended December 31, 2004 and 2003, was as follows:

| | | | | | |

| | | 2004

| | 2003

|

Distributions paid from ordinary income | | $ | 11,664,137 | | $ | 4,589,532 |

| | |

|

Net investment income (loss) differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions and passive foreign investment company shares.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions and passive foreign investment company shares.

At December 31, 2004, the cost of investments, net unrealized appreciation (depreciation), and undistributed ordinary income for income tax purposes were as follows:

| | | | |

Cost of investments | | $ | 607,326,405 | |

| | |

|

|

|

Unrealized appreciation | | $ | 206,582,379 | |

Unrealized depreciation | | | (4,379,718 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 202,202,661 | |

| | |

|

|

|

Distributable earnings - undistributed ordinary income | | $ | 11,866,491 | |

| | |

|

|

|

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short-term securities) for the year ended December 31, 2004, aggregated $480,021,270 and $335,018,988, respectively.

7. OTHER CONSIDERATIONS

TAML, as the Fund’s Manager, may serve as a member on the board of directors of certain companies in which the Fund invests and/or may represent the Fund in certain corporate negotiations. At December 31, 2004, the Manager serves in one or more of these capacities for Lukoil Holdings. As a result of this involvement, the Manager may be in possession of certain material non-public information which, pursuant to the Fund’s policies and the requirements of the federal securities laws, could prevent the Fund from trading in the securities of such companies for limited or extended periods of time.

8. REGULATORY MATTERS

Investigations

As part of various investigations by a number of federal, state, and foreign regulators and governmental entities, including the Securities and Exchange Commission (“SEC”), the California Attorney General’s Office (“CAGO”), and the National Association of Securities Dealers, Inc. (“NASD”), relating to certain practices in the mutual fund industry, including late trading, market timing and marketing support payments to securities dealers who sell fund shares, Franklin Resources, Inc. and certain of its subsidiaries (as used in this section, together, the “Company”), as well as certain current or former executives and employees of the Company, received subpoenas and/or requests for documents, information and/or testimony. The Company and its current employees provided documents and information in response to those requests and subpoenas.

TD-23

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

Notes to Financial Statements (continued)

8. REGULATORY MATTERS (cont.)

Settlements

Beginning in August 2004, the Company entered into settlements with certain regulators investigating the mutual fund industry practices noted above. The Company believes that settlement of each of the matters described in this section is in the best interest of the Company and shareholders of the Franklin, Templeton, and Mutual Series mutual funds (the “funds”).