UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

| | |

| One Franklin Parkway, San Mateo, CA | | 94403-1906 |

| (Address of principal executive offices) | | (Zip code) |

Murray L. Simpson, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2100

Date of fiscal year end: 12/31

Date of reporting period: 12/31/04

| Item 1. | Reports to Stockholders. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST ANNUAL REPORT

TABLEOF CONTENTS

*Not part of the annual report

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

MASTER CLASS-2

IMPORTANT NOTESTOPERFORMANCE INFORMATION

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts, or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

i

SUPPLEMENT DATED FEBRUARY 9, 2005

TOTHE PROSPECTUSES DATED MAY 1, 2004,OF:

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

FRANKLIN GROWTH AND INCOME SECURITIES FUND

FRANKLIN HIGH INCOME FUND

FRANKLIN INCOME SECURITIES FUND

FRANKLIN LARGE CAP GROWTH SECURITIES FUND

FRANKLIN MONEY MARKET FUND

FRANKLIN REAL ESTATE FUND

FRANKLIN RISING DIVIDENDS SECURITIES FUND

FRANKLIN SMALL CAP FUND

FRANKLIN SMALL CAP VALUE SECURITIES FUND

FRANKLIN STRATEGIC INCOME SECURITIES FUND

FRANKLIN U.S. GOVERNMENT FUND

FRANKLIN ZERO COUPON FUND 2005

FRANKLIN ZERO COUPON FUND 2010

MUTUAL DISCOVERY SECURITIES FUND

MUTUAL SHARES SECURITIES FUND

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

TEMPLETON FOREIGN SECURITIES FUND

TEMPLETON GLOBAL ASSET ALLOCATION FUND

TEMPLETON GLOBAL INCOME SECURITIES FUND

TEMPLETON GROWTH SECURITIES FUND

(FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST)

The prospectuses for shares of Class 1, Class 2 and Class 3 are amended by replacing the “Regulatory Update” section under “Additional Information, All Funds” (or under “Additional Information”) with the following:

On February 4, 2004, the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts filed an administrative complaint against Franklin Resources, Inc. and certain of its subsidiaries (the Company) claiming violations of the Massachusetts Uniform Securities Act (Massachusetts Act) with respect to an alleged arrangement to permit market timing (the Massachusetts Proceeding). On September 20, 2004, Franklin Resources, Inc. announced that an agreement had been reached by two of its subsidiaries, Franklin Advisers, Inc. (Advisers) and Franklin Templeton Alternative Strategies, Inc. (FTAS), with the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts (the State of Massachusetts) related to the Massachusetts Proceeding. Under the terms of the settlement consent order issued by the State of Massachusetts, Advisers and FTAS have consented to the entry of a cease and desist order and agreed to pay a $5 million administrative fine to the State of Massachusetts. The administrative complaint addressed one instance of market timing that was also a subject of the August 2, 2004 settlement that Advisers reached with the Securities and Exchange Commission described below.

SUPP-1

On November 19, 2004, the Company reached a second agreement with the State of Massachusetts regarding an administrative complaint filed on October 25, 2004. The second complaint alleged that the Company’s Form 8-K filing describing the original settlement failed to state the company had admitted the Statements of Fact portion of the settlement order when it stated, “Franklin did not admit or deny engaging in any wrongdoing.”

As a result of the November 19, 2004 settlement with the State of Massachusetts, the Company filed a new Form 8-K. The terms of the original settlement did not change and there was no monetary fine associated with this second settlement.

On November 17, 2004, the Company announced that Franklin Templeton Distributors, Inc. (Distributors) (the principal underwriter of shares of the Franklin Templeton mutual funds) reached an agreement with the California Attorney General’s Office (CAGO), resolving the issues resulting from the CAGO’s investigation concerning marketing support payments to securities dealers who sell fund shares. Under the terms of the settlement with the CAGO, Distributors has agreed to pay $2 million as a civil penalty, $14 million to Franklin Templeton funds and $2 million to the CAGO.

The Company, in addition to most of the mutual funds within Franklin Templeton Investments, has been named in shareholder class actions related to the matter described above that were filed in the United States District Courts in California, Florida, Nevada, New Jersey and New York. These parties, as well as certain of the mutual funds’ trustees/directors, have also been named in a shareholder class action filed in March 2004 in the United States District Court in New Jersey. This lawsuit alleges violations of certain provisions of the federal securities laws and state common law fiduciary obligations in connection with Rule 12b-1 fees and brokerage commissions paid by the mutual funds. These lawsuits seek damages of unspecified amounts. The Company believes that the claims made in the lawsuits are without merit and it intends to defend vigorously against the allegations. It is anticipated that additional similar civil actions related to the matters described above may be filed in the future.

On August 2, 2004, Franklin Resources, Inc. announced that Advisers (adviser to many of the funds within Franklin Templeton Investments, and an affiliate of the adviser to the other funds) had reached a settlement with the U.S. Securities and Exchange Commission (SEC) that resolved an SEC investigation of market timing activity in the Franklin Templeton Investments funds. As part of the settlement, on August 2, 2004, the SEC issued an “Order instituting administrative and cease-and-desist proceedings pursuant to sections 203(e) and 203(k) of the Investment Advisers Act of 1940 and sections 9(b) and 9(f) of the Investment Company Act of 1940, making findings and imposing remedial sanctions and a cease and desist order” (the August Order). The SEC’s August Order concerns the activities of a limited number of third parties that ended in 2000 and those that are the subject of the Massachusetts Proceeding described above.

SUPP-2

Under the terms of the SEC’s August Order, Advisers, while neither admitting nor denying any of the findings therein, has agreed to pay $50 million, of which $20 million is a civil penalty, to be distributed to fund shareholders in accordance with a plan to be developed by an Independent Distribution Consultant. Because the distribution methodology has not yet been developed, it is presently not possible to say which particular funds will be determined to have been affected or which particular groups of fund shareholders will receive distributions or in what proportion and amounts. In the August Order, the SEC notes that the Company has generally sought to detect, discourage and prevent market timing in its funds and began to increase its efforts to control market timing in 1999. The August Order also requires Advisers to, among other things:

| • | | Enhance and periodically review compliance policies and procedures, and establish a corporate ombudsman; |

| • | | Establish a new internal position whose responsibilities shall include compliance matters related to conflicts of interests; and |

| • | | Retain an Independent Distribution Consultant to develop a plan to distribute the $50 million settlement to fund shareholders. |

On December 13, 2004, the Company announced that it reached an agreement with the SEC, resolving the issues resulting from the SEC’s investigation concerning marketing support payments to securities dealers who sell fund shares. The settlement agreement relates to an order (December Order) the SEC issued instituting administrative and cease-and-desist proceedings, making findings, and imposing remedial sanctions against Distributors and Advisers. In connection with this settlement, Advisers and Distributors also agreed to implement certain measures and undertakings relating to marketing support payments to broker-dealers for the promotion or sale of Fund shares, and to make additional disclosures in the Funds’ Prospectuses and Statements of Additional Information.

Under the terms of the SEC’s December Order, Advisers and Distributors, while neither admitting nor denying any of the findings therein, agreed to pay $20 million as a civil penalty, and $1 as restitution to be distributed to Franklin Templeton funds in accordance with a plan to be developed by an Independent Distribution Consultant. Because the distribution methodology has not yet been developed, it is presently not possible to say which particular funds will be determined to have been affected or will receive distributions or in what proportion and amounts.

These issues were previously disclosed by the Company as being under investigation by government authorities and the subject of an internal inquiry by the Company in its regulatory filings and on its public website. Any further updates on these matters will be disclosed on the Company’s website at franklintempleton.com under “Statement on Current Industry Issues.”

Please keep this supplement for future reference.

SUPP-3

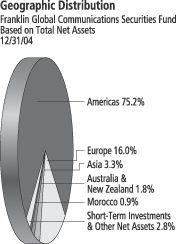

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

We are pleased to bring you Franklin Global Communications Securities Fund’s annual report for the fiscal year ended December 31, 2004.

Performance Summary as of 12/31/04

Average annual total return of Class 2 shares* represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same as year-by-year results.

Periods ended 12/31/04

| | | | | | |

| | | 1-Year | | 5-Year | | 10-Year |

Average Annual Total Return | | +14.18% | | -12.79% | | +3.35% |

*Because Class 2 shares were not offered until 1/6/99, standardized Class 2 Fund performance for prior periods represents the historical results of Class 1 shares. For periods beginning on 1/6/99, Class 2’s results reflect an additional 12b-1 fee expense, which also affects future performance. Since 1/6/99 (effective date), the average annual total return of Class 2 shares was -6.20%.

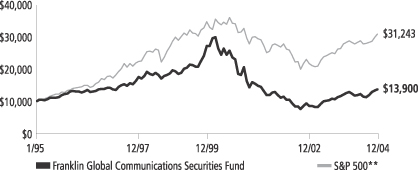

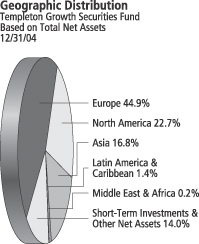

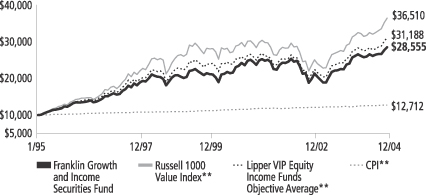

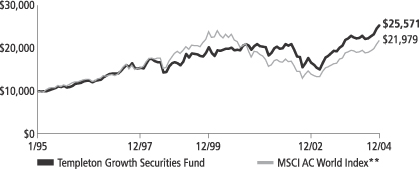

Total Return Index Comparison for Hypothetical $10,000 Investment (1/1/95–12/31/04)

The graph below shows the change in value of a hypothetical $10,000 investment in the Fund over the indicated period and includes reinvestment of any income or distributions. The Fund’s performance* is compared to the performance of the Standard & Poor’s 500 Composite Index (S&P 500). One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Important Notes to Performance Information preceding the Fund Summaries.

**Source: Standard & Poor’s Micropal. Please see Index Descriptions following the Fund Summaries.

Franklin Global Communications Securities Fund – Class 2

Performance reflects the Fund’s Class 2 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data quoted represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

FGC-1

Fund Expenses

As an investor in a variable insurance contract (“Contract”) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract level.

| • | | Transaction expenses can include sales charges (loads) on purchases, redemption fees, surrender fees, transfer fees and premium taxes. |

| • | | Ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. |

The expenses shown in the table below are meant to highlight ongoing expenses at the Fund level only and do not include ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. While the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

The table shows Fund-level ongoing expenses and can help you understand these expenses and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table below provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of ongoing Fund expenses, but does not include the effect of ongoing Contract expenses.

You can estimate the Fund-level expenses you incurred during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

| 2. | Multiply the result by the number under the heading “Fund-Level Expenses Incurred During Period.” |

If Fund-Level Expenses Incurred During Period were $7.50, then 8.6 × $7.50 = $64.50.

Franklin Global Communications Securities Fund – Class 2

FGC-6

In this illustration, the estimated expenses incurred this period at the Fund level are $64.50.

Hypothetical Example for Comparison with Other Mutual Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing expenses of the Fund with those of other mutual funds offered through the Contract. This information may not be used to estimate the actual ending account balance or expenses you incurred during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Fund-Level Expenses Incurred During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds offered through a Contract.

| | | | | | | | | |

| Class 2 | | Beginning

Account

Value 6/30/04 | | Ending

Account

Value 12/31/04 | | Fund-Level

Expenses Incurred

During Period*

6/30/04-12/31/04 |

Actual | | $ | 1,000 | | $ | 1,128.80 | | $ | 4.82 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,020.61 | | $ | 4.57 |

*Expenses are equal to the annualized expense ratio for the Fund’s Class 2 shares (0.90%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period.

FGC-7

Fund Goals and Main Investments: Franklin Global Communications Securities Fund seeks capital appreciation and current income. The Fund invests predominantly in investments of U.S. and foreign communications companies, which are companies that are primarily engaged in providing the distribution, content and equipment related to the creation, transmission or processing of information.

Performance Overview

You can find the Fund’s one-year total return in the Performance Summary. The Fund outperformed its benchmark, the S&P 500, which returned 10.87% for the period under review.1 Given that the Fund invests in only a few sectors found within the S&P 500, the Fund’s results versus the S&P 500 are not directly comparable.

Economic and Market Overview

During the year ended December 31, 2004, the domestic economy expanded solidly and broadly across most industries, sectors and regions as gross domestic product (GDP) rose an estimated 4.4%.2 However, surging energy and other commodity prices had a dampening effect. Although consumer confidence remained below pre-recession levels, consumer spending supported strong auto sales, increased durable goods consumption and a healthy housing market. Similarly, business spending rose substantially even as business confidence wavered. With improving balance sheets and stronger profit margins, many companies entered an upgrade cycle and invested in new technologies, driving equipment spending up 9.5% in the second half of 2004.2 The labor market firmed as employers hired 2.2 million workers in 2004, and unemployment dropped from 5.7% to 5.4% during the year.3 More than one-half of the jobs lost during the recession have been recovered; however, most new jobs were part-time or temporary. Given concerns over rising benefits costs and lingering uncertainties about economic recovery, many companies turned to temporary employment or opted for continued hiring freezes. At year-end, elevated household debt levels and the deepening federal budget and trade deficits were three top concerns for the economy as it headed into 2005.

1. Source: Standard & Poor’s Micropal. One cannot invest directly in an index, nor is an index representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

2. Source: Bureau of Economic Analysis.

3. Source: Bureau of Labor Statistics.

Fund Risks: Stocks offer the potential for long-term gains but can be subject to short-term up-and-down price movements. By concentrating in the industries of the utilities sector and by investing predominantly in communications companies, the Fund carries much greater risk of adverse developments affecting that sector, and among those companies, than a fund that invests more broadly. Foreign investing involves special risks including currency fluctuations, economic instability, and social and political developments. The Fund’s prospectus also includes a description of the main investment risks.

FGC-2

The U.S. dollar weakened throughout 2004 and hit an all-time low against the euro and a multi-year low versus the yen. The widening trade and current account deficits and possibility for higher import prices contributed to inflationary pressures. The core inflation rate rose 2.2% in 2004, or 3.3% including volatile food and energy costs. Aiming to keep inflation tame, the Federal Reserve Board (Fed) raised the federal funds target rate five times between June and December, from 1.00% to 2.25%, the highest level in more than three years. The Fed said it will respond to changes in economic prospects as needed to fulfill its obligation to maintain price stability, noting in December that it perceived “the upside and downside risks to the attainment of both sustainable growth and price stability for the next few quarters to be roughly equal.”4

Despite a generally robust economy and improving corporate fundamentals, investors had to digest a wide range of information in 2004, including rising inflation, the dollar’s value, a contentious presidential election and ongoing concerns about terrorism, war and reconstruction in Iraq. Domestic equity markets rallied in early 2004 and then fluctuated; however, they were essentially flat through early November. Disappointing earnings from a number of blue chip companies applied downward pressure, but initial public offering (IPO) activity was strong and investor sentiment improved late in the period despite the mixed signals. After the elections concluded, the markets enjoyed another strong rally through year-end. The blue chip stocks of the Dow Jones Industrial Average gained 5.31% for the year under review, while the broader S&P 500 rose 10.87% and the technology-heavy NASDAQ Composite Index increased 9.15%.5

Investment Strategy

We are research driven, fundamental investors pursuing a disciplined blend of growth and value strategies. Relying on a team of analysts to provide in-depth industry expertise, we look for companies that will position the Fund to benefit from potential future technological advances and increasing worldwide demand in the communications industries. As bottom-up investors focusing primarily on individual securities, we will focus on the market price of a company’s securities

4. Source: Federal Reserve. Press Release, 12/14/04.

5. Source: Standard & Poor’s Micropal. Please see Index Descriptions following the Fund Summaries.

FGC-3

relative to our evaluation of the company’s potential long-term earnings, asset value and cash flow. Among the factors we also consider are a company’s historical value measures, including price/earnings ratio, profit margins and liquidation value.

Manager’s Discussion

During the year under review, many of the Fund’s holdings of domestic and global wireless telecommunications companies benefited from strong global trends in cellular and wireless data devices. The wireless sector experienced strong growth globally, driven by many positive factors that we seek in our investments.

Notable performers during the period included Research in Motion, Yahoo!, America Movil and Western Wireless. Research in Motion provides wireless email equipment and service under the Blackberry brand and is the dominant provider in a rapidly growing domestic and international market. Consistent with our strategy, we purchased the stock due to the company’s leading market position and prospects for future growth we felt were strong.

Yahoo! is a global Internet media company offering an online guide to the Web, aggregated information content, communication services and commerce. We purchased shares based on the company’s strong secular growth and leading position as an Internet gatekeeper. Online advertising has become more mainstream in the past year and gained credibility with large, national advertisers, a secular growth trend we believe may continue.

America Movil is Mexico’s leading wireless service provider and has operations in Brazil, Argentina, Ecuador, Venezuela and the U.S. Following our strategy, we believe it is well positioned to take advantage of the rapid growth in cellular phone subscribers throughout Latin America.

Western Wireless has a balanced business franchise in two fast-growing areas: rural domestic wireless and international wireless. Its rural operations have tended to attract less competition than urban markets and experienced stable growth. The firm’s international operations recently underwent dramatic expansion in several markets including Austria and Ireland. Based on our strategy, we selected the company for what we consider strong management, excellent potential growth opportunities and reasonable valuation.

In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go

Top 10 Holdings

Franklin Global Communications Securities Fund 12/31/04

| | |

Company

Sector/Industry,

Country | | % of Total

Net Assets |

| |

America Movil SA de CV,

L, ADR | | 5.6% |

| Wireless Communications, Mexico | | |

| |

| Nokia Corp., ADR | | 4.3% |

| Telecommunications Equipment, Finland | | |

| |

| Grupo Televisa SA, ADR | | 3.9% |

| Broadcasting, Mexico | | |

| |

| Sprint Corp. | | 3.8% |

| Major Telecommunications, U.S. | | |

| |

| Vodafone Group PLC, ADR | | 3.5% |

| Wireless Communications, U.K. | | |

| |

| Research in Motion Ltd. | | 2.8% |

| Telecommunications Equipment, Canada | | |

| |

| Western Wireless Corp., A | | 2.6% |

| Wireless Communications, U.S. | | |

| |

| Nextel Communications Inc., A | | 2.5% |

| Wireless Communications, U.S. | | |

| |

| VeriSign Inc. | | 2.4% |

| Internet Software & Services, U.S. | | |

| |

| NII Holdings Inc., B | | 2.4% |

| Wireless Communications, U.S. | | |

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments.

FGC-4

down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended December 31, 2004, the U.S. dollar declined in value relative to most non-U.S. currencies. At the end of the period, the Fund’s portfolio was invested significantly in securities with non-U.S. currency exposure, which resulted in a positive effect on Fund performance. However, one cannot expect the same result in future periods.

Some consumer services companies in the broadcasting industry detracted from Fund performance, suffering from a slower than expected advertising recovery. Radio broadcasting companies Clear Channel Communications and Entercom Communications hurt the Fund’s performance, and we sold the stocks by period-end. Despite positive economic signs, the radio advertising market had not yet benefited from the recovery to the extent that many expected.

In the computer communications industry, Cisco Systems detracted from Fund performance. The company is the leading supplier of data networking equipment and provides equipment for Voice over Internet Protocol (VoIP) telephony services. We sold our holding largely due to analysts’ concerns over rising inventories and weak sales growth momentum.

Thank you for your participation in Franklin Global Communications Securities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2004, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the adviser makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FGC-5

Fund Expenses

As an investor in a variable insurance contract (“Contract”) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract level.

| • | | Transaction expenses can include sales charges (loads) on purchases, redemption fees, surrender fees, transfer fees and premium taxes. |

| • | | Ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. |

The expenses shown in the table below are meant to highlight ongoing expenses at the Fund level only and do not include ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. While the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

The table shows Fund-level ongoing expenses and can help you understand these expenses and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table below provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of ongoing Fund expenses, but does not include the effect of ongoing Contract expenses.

You can estimate the Fund-level expenses you incurred during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

| 2. | Multiply the result by the number under the heading “Fund-Level Expenses Incurred During Period.” |

If Fund-Level Expenses Incurred During Period were $7.50, then 8.6 × $7.50 = $64.50.

Franklin Global Communications Securities Fund – Class 2

FGC-6

In this illustration, the estimated expenses incurred this period at the Fund level are $64.50.

Hypothetical Example for Comparison with Other Mutual Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing expenses of the Fund with those of other mutual funds offered through the Contract. This information may not be used to estimate the actual ending account balance or expenses you incurred during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Fund-Level Expenses Incurred During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds offered through a Contract.

| | | | | | | | | |

| Class 2 | | Beginning

Account

Value 6/30/04 | | Ending

Account

Value 12/31/04 | | Fund-Level

Expenses Incurred

During Period*

6/30/04-12/31/04 |

Actual | | $ | 1,000 | | $ | 1,128.80 | | $ | 4.82 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,020.61 | | $ | 4.57 |

*Expenses are equal to the annualized expense ratio for the Fund’s Class 2 shares (0.90%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period.

FGC-7

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class 1

| |

| | | Year Ended December 31,

| |

| | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | |

|

|

|

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 6.32 | | | $ | 4.53 | | | $ | 6.87 | | | $ | 12.88 | | | $ | 24.86 | |

| | |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment incomea | | | .05 | | | | .06 | | | | .04 | | | | .04 | | | | .11 | |

Net realized and unrealized gains (losses) | | | .87 | | | | 1.78 | | | | (2.33 | ) | | | (3.55 | ) | | | (6.77 | ) |

| | |

|

|

|

Total from investment operations | | | .92 | | | | 1.84 | | | | (2.29 | ) | | | (3.51 | ) | | | (6.66 | ) |

| | |

|

|

|

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.07 | ) | | | (.05 | ) | | | (.05 | ) | | | (.01 | ) | | | (.50 | ) |

Net realized gains | | | — | | | | — | | | | — | | | | (2.49 | ) | | | (4.82 | ) |

| | |

|

|

|

Total distributions | | | (.07 | ) | | | (.05 | ) | | | (.05 | ) | | | (2.50 | ) | | | (5.32 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 7.17 | | | $ | 6.32 | | | $ | 4.53 | | | $ | 6.87 | | | $ | 12.88 | |

| | |

|

|

|

| | | | | |

Total returnb | | | 14.66% | | | | 40.46% | | | | (33.28)% | | | | (29.24)% | | | | (32.85)% | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 142,898 | | | $ | 149,480 | | | $ | 130,255 | | | $ | 265,055 | | | $ | 523,288 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | .64% | | | | .64% | | | | .60% | | | | .55% | | | | .52% | |

Net investment income | | | .85% | | | | 1.08% | | | | .83% | | | | .46% | | | | .54% | |

Portfolio turnover rate | | | 178.52% | | | | 96.60% | | | | 97.75% | | | | 105.36% | | | | 117.99% | |

| a | Based on average daily shares outstanding. |

| b | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

See notes to financial statements.

FGC-8

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Class 2

| |

| | | Year Ended December 31,

| |

| | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | |

|

|

|

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 6.28 | | | $ | 4.51 | | | $ | 6.84 | | | $ | 12.86 | | | $ | 24.78 | |

| | |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment incomea | | | .04 | | | | .05 | | | | .03 | | | | .02 | | | | .05 | |

Net realized and unrealized gains (losses) | | | .84 | | | | 1.77 | | | | (2.32 | ) | | | (3.54 | ) | | | (6.72 | ) |

| | |

|

|

|

Total from investment operations | | | .88 | | | | 1.82 | | | | (2.29 | ) | | | (3.52 | ) | | | (6.67 | ) |

| | |

|

|

|

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.06 | ) | | | (.05 | ) | | | (.04 | ) | | | (.01 | ) | | | (.43 | ) |

Net realized gains | | | — | | | | — | | | | — | | | | (2.49 | ) | | | (4.82 | ) |

| | |

|

|

|

Total distributions | | | (.06 | ) | | | (.05 | ) | | | (.04 | ) | | | (2.50 | ) | | | (5.25 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 7.10 | | | $ | 6.28 | | | $ | 4.51 | | | $ | 6.84 | | | $ | 12.86 | |

| | |

|

|

|

| | | | | |

Total returnb | | | 14.18% | | | | 40.44% | | | | (33.52)% | | | | (29.40)% | | | | (32.97)% | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 23,704 | | | $ | 10,719 | | | $ | 1,490 | | | $ | 312 | | | $ | 499 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | .89% | | | | .89% | | | | .85% | | | | .80% | | | | .77% | |

Net investment income | | | .60% | | | | .83% | | | | .58% | | | | .21% | | | | .29% | |

Portfolio turnover rate | | | 178.52% | | | | 96.60% | | | | 97.75% | | | | 105.36% | | | | 117.99% | |

| a | Based on average daily shares outstanding. |

| b | Total return does not include any fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year. |

See notes to financial statements.

FGC-9

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Statement of Investments, December 31, 2004

| | | | | | | |

| | | COUNTRY | | SHARES | | VALUE |

Common Stocks 96.0% | | | | | | | |

Aerospace & Defense .6% | | | | | | | |

aEssex Corp. | | United States | | 47,500 | | $ | 961,875 |

| | | | | | |

|

|

Broadcasting 10.4% | | | | | | | |

aCumulus Media Inc., A | | United States | | 116,300 | | | 1,753,804 |

aEntravision Communications Corp. | | United States | | 102,600 | | | 856,710 |

Grupo Televisa SA, ADR | | Mexico | | 106,200 | | | 6,425,100 |

aRadio One Inc., D | | United States | | 156,100 | | | 2,516,332 |

aUnivision Communications Inc., A | | United States | | 75,500 | | | 2,209,885 |

aWestwood One Inc. | | United States | | 79,100 | | | 2,130,163 |

aXM Satellite Radio Holdings Inc., A | | United States | | 39,300 | | | 1,478,466 |

| | | | | | |

|

|

| | | | | | | | 17,370,460 |

| | | | | | |

|

|

Computer Communications 3.1% | | | | | | | |

aAvaya Inc. | | United States | | 73,700 | | | 1,267,640 |

aF5 Networks Inc. | | United States | | 46,000 | | | 2,241,120 |

aFinisar Corp. | | United States | | 343,300 | | | 782,724 |

aJuniper Networks Inc. | | United States | | 30,400 | | | 826,576 |

| | | | | | |

|

|

| | | | | | | | 5,118,060 |

| | | | | | |

|

|

Computer Peripherals 2.3% | | | | | | | |

aAdvanced Digital Information Corp. | | United States | | 165,800 | | | 1,661,316 |

aEMC Corp. | | United States | | 56,600 | | | 841,642 |

aSynaptics Inc. | | United States | | 40,300 | | | 1,232,374 |

| | | | | | |

|

|

| | | | | | | | 3,735,332 |

| | | | | | |

|

|

Electronic Components .5% | | | | | | | |

aOmniVision Technologies Inc. | | United States | | 47,200 | | | 866,120 |

| | | | | | |

|

|

Electronic Equipment/Instruments 1.6% | | | | | | | |

aJDS Uniphase Corp. | | United States | | 258,100 | | | 818,177 |

Tektronix Inc. | | United States | | 63,200 | | | 1,909,272 |

| | | | | | |

|

|

| | | | | | | | 2,727,449 |

| | | | | | |

|

|

Internet Software/Services 10.9% | | | | | | | |

aAsk Jeeves Inc. | | United States | | 141,100 | | | 3,774,425 |

aGoogle Inc., A | | United States | | 5,600 | | | 1,081,360 |

aInfoSpace Inc. | | United States | | 16,900 | | | 803,595 |

aJAMDAT Mobile Inc. | | United States | | 68,400 | | | 1,412,460 |

aOpenTV Corp., A | | United States | | 207,900 | | | 798,336 |

aRealNetworks Inc. | | United States | | 187,100 | | | 1,238,602 |

aSINA Corp. | | China | | 25,700 | | | 823,942 |

aVeriSign Inc. | | United States | | 121,100 | | | 4,059,272 |

aWebsense Inc. | | United States | | 19,100 | | | 968,752 |

aYahoo! Inc. | | United States | | 86,200 | | | 3,248,016 |

| | | | | | |

|

|

| | | | | | | | 18,208,760 |

| | | | | | |

|

|

Major Telecommunications 11.6% | | | | | | | |

Alltel Corp. | | United States | | 26,200 | | | 1,539,512 |

PT Telekomunikasi Indonesia TBK, B | | Indonesia | | 4,051,000 | | | 2,105,691 |

Portugal Telecom SGPS SA, ADR | | Portugal | | 110,404 | | | 1,359,073 |

Sprint Corp. | | United States | | 252,000 | | | 6,262,200 |

Telecom Corp. of New Zealand Ltd. | | New Zealand | | 665,447 | | | 2,938,620 |

Telefonica SA, ADR | | Spain | | 49,156 | | | 2,777,314 |

Telus Corp. | | Canada | | 20,000 | | | 593,077 |

Verizon Communications Inc. | | United States | | 40,800 | | | 1,652,808 |

| | | | | | |

|

|

| | | | | | | | 19,228,295 |

| | | | | | |

|

|

FGC-10

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Statement of Investments, December 31, 2004 (cont.)

| | | | | | | |

| | | COUNTRY | | SHARES | | VALUE |

Common Stocks (cont.) | | | | | | | |

Media Conglomerates 6.2% | | | | | | | |

aNews Corp. Ltd., A | | United States | | 46,800 | | $ | 873,288 |

aTime Warner Inc. | | United States | | 128,300 | | | 2,494,152 |

Viacom Inc., B | | United States | | 93,900 | | | 3,417,021 |

The Walt Disney Co. | | United States | | 128,400 | | | 3,569,520 |

| | | | | | |

|

|

| | | | | | | | 10,353,981 |

| | | | | | |

|

|

Movies/Entertainment .1% | | | | | | | |

aDreamworks Animation Inc., A | | United States | | 3,300 | | | 123,783 |

| | | | | | |

|

|

Packaged Software .5% | | | | | | | |

aSymantec Corp. | | United States | | 32,000 | | | 824,320 |

| | | | | | |

|

|

Publishing: Newspapers .7% | | | | | | | |

Gannett Co. Inc. | | United States | | 15,100 | | | 1,233,670 |

| | | | | | |

|

|

Semiconductors | | | | | | | |

aFreescale Semiconductor Inc., B | | United States | | 39 | | | 716 |

| | | | | | |

|

|

Specialty Telecommunications 3.9% | | | | | | | |

aAmerican Tower Corp., A | | United States | | 176,000 | | | 3,238,400 |

Citizens Communications Co. | | United States | | 114,000 | | | 1,572,060 |

aCrown Castle International Corp. | | United States | | 96,390 | | | 1,603,929 |

| | | | | | |

|

|

| | | | | | | | 6,414,389 |

| | | | | | |

|

|

Telecommunications Equipment 16.4% | | | | | | | |

aAlcatel SA, ADR | | France | | 161,500 | | | 2,524,245 |

aComverse Technology Inc. | | United States | | 76,800 | | | 1,877,760 |

aMaroc Telecom | | Morocco | | 124,800 | | | 1,424,263 |

Motorola Inc. | | United States | | 215,000 | | | 3,698,000 |

Nokia Corp., ADR | | Finland | | 457,900 | | | 7,175,293 |

aNortel Networks Corp. | | Canada | | 458,600 | | | 1,600,514 |

QUALCOMM Inc. | | United States | | 38,800 | | | 1,645,120 |

aResearch in Motion Ltd. | | Canada | | 57,400 | | | 4,730,908 |

aTrimble Navigation Ltd. | | United States | | 51,500 | | | 1,701,560 |

aViaSat Inc. | | United States | | 41,100 | | | 997,497 |

| | | | | | |

|

|

| | | | | | | | 27,375,160 |

| | | | | | |

|

|

Wireless Communications 27.2% | | | | | | | |

aAlamosa Holdings Inc. | | United States | | 111,000 | | | 1,384,170 |

America Movil SA de CV, L, ADR | | Mexico | | 179,000 | | | 9,370,650 |

aEuropolitan Holdings AB | | Sweden | | 273,500 | | | 1,934,841 |

aInPhonic Inc. | | United States | | 52,300 | | | 1,437,204 |

Mobile Telesystems Ojsc, ADR | | Russia | | 12,200 | | | 1,689,822 |

aNextel Communications Inc., A | | United States | | 137,000 | | | 4,110,000 |

aNextel Partners Inc., A | | United States | | 88,300 | | | 1,725,382 |

aNII Holdings Inc., B | | United States | | 84,000 | | | 3,985,800 |

SK Telecom Co. Ltd., ADR | | South Korea | | 113,900 | | | 2,534,275 |

Turkcell Iletisim Hizmetleri AS, ADR | | Turkey | | 193,281 | | | 3,498,386 |

aUbiquiTel Inc. | | United States | | 269,100 | | | 1,915,992 |

aU.S. Unwired Inc., A | | United States | | 339,900 | | | 1,631,520 |

Vodafone Group PLC, ADR | | United Kingdom | | 210,400 | | | 5,760,752 |

a Western Wireless Corp., A | | United States | | 148,600 | | | 4,353,980 |

| | | | | | |

|

|

| | | | | | | | 45,332,774 |

| | | | | | |

|

|

Total Common Stocks (Cost $123,402,306) | | | | | | | 159,875,144 |

| | | | | | |

|

|

FGC-11

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Statement of Investments, December 31, 2004 (cont.)

| | | | | | | | |

| | | COUNTRY | | SHARES | | VALUE |

Preferred Stocks 1.2% | | | | | | | | |

Major Telecommunications .6% | | | | | | | | |

Telecomunicacoes De Sao Paulo SA, ADR, pfd. | | Brazil | | | 48,500 | | $ | 942,355 |

Specialty Telecommunications .6% | | | | | | | | |

Tele Norte Leste Participacoes SA, ADR, pfd. | | Brazil | | | 59,200 | | | 998,704 |

| | | | | | | |

|

|

Total Preferred Stocks (Cost $1,647,337) | | | | | | | | 1,941,059 |

| | | | | | | |

|

|

Total Long Term Investments (Cost $125,049,643) | | | | | | | | 161,816,203 |

| | | | | | | |

|

|

| | | |

| | | | | PRINCIPAL

AMOUNT

| | |

Short Term Investment (Cost $4,707,141) 2.8% | | | | | | | | |

Repurchase Agreement | | | | | | | | |

bJoint Repurchase Agreement, 1.915%, 1/03/05 (Maturity Value $4,707,892) | | United States | | $ | 4,707,141 | | | 4,707,141 |

ABN AMRO Bank, N.V., New York Branch (Maturity Value $464,810) Banc of America Securities LLC (Maturity Value $174,286) Barclays Capital Inc. (Maturity Value $214,962) Bear, Stearns & Co. Inc. (Maturity Value $366,039) BNP Paribas Securities Corp. (Maturity Value $464,810) Deutsche Bank Securities Inc. (Maturity Value $232,429) Goldman, Sachs & Co. (Maturity Value $464,810) Greenwich Capital Markets Inc. (Maturity Value $464,810) Lehman Brothers Inc. (Maturity Value $466,506) Merrill Lynch Government Securities Inc. (Maturity Value $464,810) Morgan Stanley & Co. Inc. (Maturity Value $464,810) UBS Securities LLC (Maturity Value $464,810) | | | | | | | | |

Collateralized by U.S. Government Agency Securities, 0.00 - 7.125%, 1/05/05 - 9/15/09; cU.S. Treasury Bills, 3/24/05 - 3/31/05; U.S. Treasury Bonds, 9.375 - 12.00%, 5/15/05 - 2/15/06; and U.S. Treasury Notes, 1.50 - 7.00%, 2/28/05 - 6/15/09 | | | | | | | | |

| | | | | | | |

|

|

Total Investments (Cost $129,756,784) 100.0% | | | | | | | | 166,523,344 |

Other Assets, less Liabilities | | | | | | | | 78,505 |

| | | | | | | |

|

|

Net Assets 100.0% | | | | | | | $ | 166,601,849 |

| | | | | | | |

|

|

Portfolio Abbreviation:

ADR - American Depository Receipt

| b | See Note 1(c) regarding joint repurchase agreement. |

| c | Securitiy is traded on a discount basis with no stated coupon rate. |

See notes to financial statements.

FGC-12

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Financial Statements

Statement of Assets and Liabilities

December 31, 2004

| | | | |

Assets: | | | | |

Investments in securities: | | | | |

Cost - Unaffiliated issuers | | $ | 125,049,643 | |

Cost - Repurchase agreements | | | 4,707,141 | |

| | |

|

|

|

Total cost of investments | | $ | 129,756,784 | |

| | |

|

|

|

Value - Unaffiliated issuers | | $ | 161,816,203 | |

Value - Repurchase agreements | | | 4,707,141 | |

| | |

|

|

|

Total value of investments | | | 166,523,344 | |

| | |

|

|

|

Receivables: | | | | |

Capital shares sold | | | 1,827 | |

Dividends | | | 215,681 | |

| | |

|

|

|

Total assets | | | 166,740,852 | |

| | |

|

|

|

Liabilities: | | | | |

Payables: | | | | |

Capital shares redeemed | | | 6,646 | |

Affiliates | | | 84,981 | |

Reports to shareholders | | | 22,951 | |

Professional fees | | | 21,230 | |

Other liabilities | | | 3,195 | |

| | |

|

|

|

Total liabilities | | | 139,003 | |

| | |

|

|

|

Net assets, at value | | $ | 166,601,849 | |

| | |

|

|

|

Net assets consist of: | | | | |

Undistributed net investment income | | $ | 2,164,024 | |

Net unrealized appreciation (depreciation) | | | 36,766,581 | |

Accumulated net realized gain (loss) | | | (263,037,284 | ) |

Capital shares | | | 390,708,528 | |

| | |

|

|

|

Net assets, at value | | $ | 166,601,849 | |

| | |

|

|

|

Class 1: | | | | |

Net assets, at value | | $ | 142,897,624 | |

| | |

|

|

|

Shares outstanding | | | 19,938,891 | |

| | |

|

|

|

Net asset value and offering price per share | | $ | 7.17 | |

| | |

|

|

|

Class 2: | | | | |

Net assets, at value | | $ | 23,704,225 | |

| | |

|

|

|

Shares outstanding | | | 3,338,231 | |

| | |

|

|

|

Net asset value and offering price per share | | $ | 7.10 | |

| | |

|

|

|

See notes to financial statements.

FGC-13

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Financial Statements (continued)

Statement of Operations

for the year ended December 31, 2004

| | | | |

Investment income: | | | | |

Dividends (net of foreign taxes of $119,424) | | | $ 2,263,932 | |

Interest | | | 58,213 | |

| | |

|

|

|

Total investment income | | | 2,322,145 | |

| | |

|

|

|

Expenses: | | | | |

Management fees (Note 3) | | | 902,686 | |

Distribution fees - Class 2 (Note 3) | | | 38,702 | |

Transfer agent fees | | | 1,654 | |

Custodian fees (Note 4) | | | 6,431 | |

Reports to shareholders | | | 54,774 | |

Professional fees | | | 22,843 | |

Trustees’ fees and expenses | | | 995 | |

Other | | | 7,391 | |

| | |

|

|

|

Total expenses | | | 1,035,476 | |

Expense reductions (Note 4) | | | (132 | ) |

| | |

|

|

|

Net expenses | | | 1,035,344 | |

| | |

|

|

|

Net investment income | | | 1,286,801 | |

| | |

|

|

|

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments | | | 3,543,980 | |

Foreign currency transactions | | | 61,915 | |

| | |

|

|

|

Net realized gain (loss) | | | 3,605,895 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 16,204,418 | |

Translation of assets and liabilities denominated in foreign currencies | | | (5,625 | ) |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) | | | 16,198,793 | |

| | |

|

|

|

Net realized and unrealized gain (loss) | | | 19,804,688 | |

| | |

|

|

|

Net increase (decrease) in net assets resulting from operations | | $ | 21,091,489 | |

| | |

|

|

|

See notes to financial statements.

FGC-14

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Financial Statements (continued)

Statements of Changes in Net Assets

for the years ended December 31, 2004 and 2003

| | | | | | | | |

| | | 2004 | | | 2003 | |

| | |

| |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 1,286,801 | | | $ | 1,488,977 | |

Net realized gain (loss) from investments and foreign currency transactions | | | 3,605,895 | | | | 766,036 | |

Net change in unrealized appreciation (depreciation) on investments and translation of assets and liabilities denominated in foreign currencies | | | 16,198,793 | | | | 45,613,944 | |

| | |

| |

Net increase (decrease) in net assets resulting from operations | | | 21,091,489 | | | | 47,868,957 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class 1 | | | (1,418,784 | ) | | | (1,238,199 | ) |

Class 2 | | | (135,885 | ) | | | (30,287 | ) |

| | |

| |

Total distributions to shareholders | | | (1,554,669 | ) | | | (1,268,486) | |

Capital share transactions: (Note 2) | | | | | | | | |

Class 1 | | | (23,869,093 | ) | | | (25,751,370 | ) |

Class 2 | | | 10,735,851 | | | | 7,603,913 | |

| | |

| |

Total capital share transactions | | | (13,133,242 | ) | | | (18,147,457 | ) |

Net increase (decrease) in net assets | | | 6,403,578 | | | | 28,453,014 | |

Net assets: | | | | | | | | |

Beginning of year | | | 160,198,271 | | | | 131,745,257 | |

| | |

| |

End of year | | $ | 166,601,849 | | | $ | 160,198,271 | |

| | |

| |

Undistributed net investment income included in net assets: | | | | | | | | |

End of year | | $ | 2,164,024 | | | $ | 1,434,605 | |

| | |

| |

See notes to financial statements.

FGC-15

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton Variable Insurance Products Trust (the Trust) is registered under the Investment Company Act of 1940 as an open-end investment company, consisting of twenty-one separate series (the Funds). Franklin Global Communications Securities Fund (the Fund) included in this report is diversified. The financial statements of the remaining funds in the series are presented separately. Shares of the Fund are sold only to insurance company separate accounts to fund the benefits of variable life insurance policies or variable annuity contracts. As of December 31, 2004, 99% of the Fund’s shares were sold through one insurance company. The Fund’s investment objective is growth and income.

The following summarizes the Fund’s significant accounting policies.

a. Security Valuation

Securities listed on a securities exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter securities and listed securities for which there is no reported sale are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Repurchase agreements are valued at cost.

Foreign securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the foreign security is determined. If no sale is reported at that time, the foreign security will be valued within the range of the most recent quoted bid and ask prices.

The Trust has procedures to determine the fair value of individual securities and other assets for which market prices are not readily available or which may not be reliably priced. Some methods for valuing these securities may include: fundamental analysis, matrix pricing, discounts from market prices of similar securities, or discounts applied due to the nature and duration of restrictions on the disposition of the securities. Occasionally, events occur between the time at which trading in a security is completed and the close of the NYSE that might call into question the availability (including the reliability) of the value of a portfolio security held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services. All security valuation procedures are approved by the Trust’s Board of Trustees.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Occasionally events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Trust’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

FGC-16

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (cont.)

c. Joint Repurchase Agreement

The Fund may enter into a joint repurchase agreement whereby its uninvested cash balance is deposited into a joint cash account to be used to invest in one or more repurchase agreements. The value and face amount of the joint repurchase agreement are allocated to the Fund based on its pro-rata interest. A repurchase agreement is accounted for as a loan by the Fund to the seller, collateralized by securities which are delivered to the Fund’s custodian. The market value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the Fund, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. At December 31, 2004, all repurchase agreements held by the Fund had been entered into on that date.

d. Foreign Currency Contracts

When the Fund purchases or sells foreign securities it may enter into foreign exchange contracts to minimize foreign exchange risk from the trade date to the settlement date of the transactions. A foreign exchange contract is an agreement between two parties to exchange different currencies at an agreed upon exchange rate on a specified date. Realized and unrealized gains and losses on these contracts are included in the Statement of Operations.

The risks of these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the possible inability of the counterparties to fulfill their obligations under the contracts.

e. Income Taxes

No provision has been made for U.S. income taxes because the Fund’s policy is to qualify as a regulated investment company under Sub Chapter M of the Internal Revenue Code and to distribute substantially all of its taxable income. Fund distributions to shareholders are determined on an income tax basis and may differ from net investment income and realized gains for financial reporting purposes.

f. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets. Other expenses are charged to each fund on a specific identification basis.

Realized and unrealized gains and losses and net investment income, other than class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class.

g. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

FGC-17

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (cont.)

h. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

The Fund offers two classes of shares: Class 1 and Class 2. Each class of shares differs by its distribution fees, voting rights on matters affecting a single class and its exchange privilege.

At December 31, 2004, there were an unlimited number of shares authorized ($.01 par value). Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2004

| | | 2003

| |

| Class 1 Shares: | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares sold | | 36,176 | | | $ | 234,808 | | | 135,529 | | | $ | 698,512 | |

Shares issued in reinvestment of distributions | | 231,827 | | | | 1,418,784 | | | 230,149 | | | | 1,238,199 | |

Shares redeemed | | (3,966,244 | ) | | | (25,522,685 | ) | | (5,451,344 | ) | | | (27,688,081 | ) |

| | |

| |

Net increase (decrease) | | (3,698,241 | ) | | $ | (23,869,093 | ) | | (5,085,666 | ) | | $ | (25,751,370 | ) |

| | |

| |

| Class 2 Shares: | | | | | | | | | | | | |

Shares sold | | 2,205,007 | | | $ | 14,315,821 | | | 1,509,954 | | | $ | 8,281,081 | |

Shares issued in reinvestment of distributions | | 22,350 | | | | 135,885 | | | 5,671 | | | | 30,287 | |

Shares redeemed | | (596,789 | ) | | | (3,715,855 | ) | | (138,375 | ) | | | (707,455 | ) |

| | |

| |

Net increase (decrease) | | 1,630,568 | | | $ | 10,735,851 | | | 1,377,250 | | | $ | 7,603,913 | |

| | |

| |

3. TRANSACTIONS WITH AFFILIATES

Certain officers and trustees of the Fund are also officers and/or directors of the following entities:

| | |

| Entity | | Affiliation |

Franklin Advisers Inc. (Advisers) | | Investment manager |

Franklin Templeton Services LLC (FT Services) | | Administrative manager |

Franklin Templeton Distributors Inc. (Distributors) | | Principal underwriter |

Franklin Templeton Investor Services LLC (Investor Services) | | Transfer agent |

a. Management Fees

The Fund pays an investment management fee to Advisers based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| .625% | | First $100 million |

| .500% | | Over $100 million, up to and including $250 million |

| .450% | | Over $250 million, up to and including $10 billion |

FGC-18

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES (cont.)

a. Management Fees (cont.)

Fees are further reduced on net assets over $10 billion.

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on the average daily net assets of the Fund, and is not an additional expense of the Fund.

c. Distribution Fees

The Fund reimburses Distributors up to .25% per year of its average daily net asset of Class 2, for costs incurred in marketing the Fund’s shares under a Rule 12b-1 plan.

d. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund for the services.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended December 31, 2004, the custodian fees were reduced as noted in the Statement of Operations.

5. INCOME TAXES

At December 31, 2004, the Fund had tax basis capital losses which may be carried over to offset future capital gains. Such losses expire as follows:

| | | |

Capital loss carryovers expiring in: | | | |

2009 | | $ | 153,666,768 |

2010 | | | 108,979,162 |

| | |

|

| | | $ | 262,645,930 |

| | |

|

At December 31, 2004, the Fund had deferred currency losses occurring subsequent to October 31, 2004 of $2,223. For tax purposes, such losses will be reflected in the year ending December 31, 2005.

The tax character of distributions paid during the years ended December 31, 2004 and 2003, was as follows:

| | | | | | |

| | | 2004

| | 2003

|

Distributions paid from ordinary income | | $ | 1,554,669 | | $ | 1,268,486 |

| | |

|

| |

|

|

Net investment income (loss) differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions and passive foreign investment company shares.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions and passive foreign investment company shares.

FGC-19

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements (continued)

5. INCOME TAXES (cont.)

At December 31, 2004, the cost of investments, net unrealized appreciation (depreciation), and undistributed ordinary income for income tax purposes were as follows:

| | | | |

Cost of investments | | $ | 131,872,781 | |

| | |

|

|

|

Unrealized appreciation | | $ | 36,233,002 | |

Unrealized depreciation | | | (1,582,439 | ) |

| | |

|

|

|

Net unrealized appreciation (depreciation) | | $ | 34,650,563 | |

| | |

|

|

|

Distributable earnings – undistributed ordinary income | | $ | 3,890,891 | |

| | |

|

|

|

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short-term securities) for the year ended December 31, 2004, aggregated $269,393,710 and $273,103,964, respectively.

7. REGULATORY MATTERS

Investigations

As part of various investigations by a number of federal, state, and foreign regulators and governmental entities, including the Securities and Exchange Commission (“SEC”), the California Attorney General’s Office (“CAGO”), and the National Association of Securities Dealers, Inc. (“NASD”), relating to certain practices in the mutual fund industry, including late trading, market timing and marketing support payments to securities dealers who sell fund shares, Franklin Resources, Inc. and certain of its subsidiaries (as used in this section, together, the “Company”), as well as certain current or former executives and employees of the Company, received subpoenas and/or requests for documents, information and/or testimony. The Company and its current employees provided documents and information in response to those requests and subpoenas.

Settlements

Beginning in August 2004, the Company entered into settlements with certain regulators investigating the mutual fund industry practices noted above. The Company believes that settlement of each of the matters described in this section is in the best interest of the Company and shareholders of the Franklin, Templeton, and Mutual Series mutual funds (the “funds”).

On August 2, 2004, Franklin Resources, Inc. announced that its subsidiary, Franklin Advisers, Inc., reached an agreement with the SEC that resolved the issues resulting from the SEC investigation into market timing activity. In connection with that agreement, the SEC issued an “Order Instituting Administrative and Cease-and-Desist Proceedings Pursuant to Sections 203(e) and 203(k) of the Investment Advisers Act of 1940 and Sections 9(b) and 9(f) of the Investment Company Act of 1940, Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order” (the “Order”). The SEC’s Order concerned the activities of a limited number of third parties that ended in 2000 and those that were the subject of the first Massachusetts administrative complaint described below.

Under the terms of the SEC’s Order, pursuant to which Franklin Advisers, Inc. neither admitted nor denied any of the findings contained therein, Franklin Advisers, Inc. agreed to pay $50 million, of which $20 million is a civil penalty, to be distributed to shareholders of certain funds in accordance with a plan to be developed by an independent distribution consultant. At this time, it is unclear which funds or which shareholders of any particular fund will receive distributions. The Order also required Franklin Advisers, Inc. to, among other things, enhance and periodically review compliance policies and procedures.

FGC-20

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements (continued)

7. REGULATORY MATTERS (cont.)

Settlements (cont.)

On September 20, 2004, Franklin Resources, Inc. announced that two of its subsidiaries, Franklin Advisers, Inc. and Franklin Templeton Alternative Strategies, Inc. (“FTAS”), reached an agreement with the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts (the “State of Massachusetts”) related to its administrative complaint filed on February 4, 2004, concerning one instance of market timing that was also a subject of the August 2, 2004 settlement that Franklin Advisers, Inc. reached with the SEC, as described above.

Under the terms of the settlement consent order issued by the State of Massachusetts, Franklin Advisers, Inc. and FTAS consented to the entry of a cease-and-desist order and agreed to pay a $5 million administrative fine to the State of Massachusetts (the “Massachusetts Consent Order”). The Massachusetts Consent Order included two different sections: “Statements of Fact” and “Violations of Massachusetts Securities Laws.” Franklin Advisers, Inc. and FTAS admitted the facts in the Statements of Fact.

On October 25, 2004, the State of Massachusetts filed a second administrative complaint, alleging that Franklin Resources, Inc.’s Form 8-K filing (in which it described the Massachusetts Consent Order and stated that “Franklin did not admit or deny engaging in any wrongdoing”) failed to state that Franklin Advisers, Inc. and FTAS admitted the Statements of Fact portion of the Massachusetts Consent Order (the “Second Complaint”). Franklin Resources, Inc. reached a second agreement with the State of Massachusetts on November 19, 2004, resolving the Second Complaint. As a result of the November 19, 2004 settlement, Franklin Resources, Inc. filed a new Form 8-K. The terms of the Massachusetts Consent Order did not change and there was no monetary fine associated with this second settlement.

On November 17, 2004, Franklin Resources, Inc. announced that Franklin/Templeton Distributors, Inc. (“FTDI”) reached an agreement with the CAGO, resolving the issues resulting from the CAGO’s investigation concerning sales and marketing support payments. Under the terms of the settlement, FTDI neither admitted nor denied the allegations in the CAGO’s complaint and agreed to pay $2 million to the State of California as a civil penalty, $14 million to the funds, to be allocated by an independent distribution consultant to be paid for by FTDI, and $2 million to the CAGO for its investigative costs.

On December 13, 2004, Franklin Resources, Inc. announced that its subsidiaries FTDI and Franklin Advisers, Inc. reached an agreement with the SEC, resolving the issues resulting from the SEC’s investigation concerning marketing support payments to securities dealers who sell fund shares. In connection with that agreement, the SEC issued an “Order Instituting Administrative and Cease-and-Desist Proceedings, Making Findings, and Imposing Remedial Sanctions Pursuant to Sections 203(e) and 203(k) of the Investment Advisers Act of 1940, Sections 9(b) and 9(f) of the Investment Company Act of 1940, and Section 15(b) of the Securities Exchange Act of 1934” (the “Second Order”).

Under the terms of the Second Order, in which FTDI and Franklin Advisers, Inc. neither admitted nor denied the findings contained therein, they agreed to pay the funds a penalty of $20 million and disgorgement of $1 (one dollar). FTDI and Franklin Advisers, Inc. also agreed to implement certain measures and undertakings relating to marketing support payments to broker-dealers for the promotion or sale of fund shares, including making additional disclosures in the funds’ Prospectuses and Statements of Additional Information. The Second Order further requires the appointment of an independent distribution consultant, at the Company’s expense, who shall develop a plan for the distribution of the penalty and disgorgement to the funds.

Other Legal Proceedings

The Trust, in addition to the Company and other funds, and certain current and former officers, employees, and directors have been named in multiple lawsuits in different federal courts in Nevada, California, Illinois, New York and Florida, alleging violations of various federal securities laws and seeking, among other relief, monetary damages, restitution, removal of fund trustees, directors, advisers, administrators, and distributors, rescission of management contracts and 12b-1 Plans, and/or attorneys’ fees and costs. Specifically, the lawsuits claim breach of duty with respect to alleged arrangements to permit market

FGC-21

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FRANKLIN GLOBAL COMMUNICATIONS SECURITIES FUND

Notes to Financial Statements (continued)

7. REGULATORY MATTERS (cont.)

Other Legal Proceedings (cont.)

timing and/or late trading activity, or breach of duty with respect to the valuation of the portfolio securities of certain Templeton funds managed by Franklin Resources, Inc. subsidiaries, resulting in alleged market timing activity. The majority of these lawsuits duplicate, in whole or in part, the allegations asserted in the February 4, 2004 Massachusetts administrative complaint and the findings in the SEC’s August 2, 2004 Order, as described above. The lawsuits are styled as class actions, or derivative actions on behalf of either the named funds or Franklin Resources, Inc.