UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05629

Voya Investors Trust

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-366-0066

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2023

Classes ADV, I, R6, S and S2

Voya Investors Trust

| ■ | Voya Government Liquid Assets Portfolio | | ■ | VY® Morgan Stanley Global Franchise Portfolio |

| ■ | VY® CBRE Global Real Estate Portfolio | | ■ | VY® T. Rowe Price Capital Appreciation Portfolio |

| ■ | VY® Invesco Growth and Income Portfolio | | ■ | VY® T. Rowe Price Equity Income Portfolio |

| ■ | VY® JPMorgan Emerging Markets Equity Portfolio | | |

Effective January 24, 2023, the U.S. Securities and Exchange Commission adopted rule and form amendments to require mutual funds to transmit concise and visually engaging streamlined annual and semi-annual reports to shareholders that highlight key information deemed important for investors to assess and monitor their fund investments. Other information, including financial statements, will no longer appear in the funds’ streamlined shareholder reports but must be available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024.

This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

|  | E-Delivery Sign-up – details inside |

INVESTMENT MANAGEMENT voyainvestments.com | |  |

TABLE OF CONTENTS

| Go Paperless with E-Delivery! |  |

| Sign up now for on-line prospectuses, fund reports, and proxy statements. |

| Just go to individuals.voya.com/page/e-delivery, follow the directions and complete the quick 5 Steps to Enroll. |

| You will be notified by e-mail when these communications become available on the internet. |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month year ended June 30 is available without charge on the Portfolios’ website at www. voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-P. The Portfolios’ Forms NPORT-P are available on the SEC’s website at www.sec.gov. Each Portfolio’s complete schedule of portfolio holdings is available at: www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180. Voya Government Liquid Assets Portfolio does not file on Form N-PORT.

The Voya Government Liquid Assets Portfolio files its complete schedule of portfolio holdings with the SEC monthly on Form N-MFP. The Portfolio’s Form N-MFP is available on the SEC’s website at www.sec.gov or the monthly schedule of portfolio holdings are also available at: www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180.

Benchmark Descriptions

| Index | Description |

| Bloomberg U.S. Government/Credit Index | An index made up of the Barclays Government and Credit indices, including securities issued by the U.S. government and its agencies and publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. |

| FTSE EPRA Nareit Developed Index | The index is designed to track the performance of listed real estate companies and real- estate investment trusts (REITs) worldwide. Relevant activities are defined as the ownership, disposal and development of income-producing real estate. Constituents are classified into distinct property sectors based on gross invested book assets, as disclosed in the latest published financial statement. Index constituents are free-float adjusted, liquidity, size and revenue screened. |

| iMoneyNet Government Institutional Index | The average return for a category of money market funds that includes all government institutional funds: Treasury Institutional, Treasury and Repo Institutional and Government and Agencies Institutional. |

| MSCI Emerging Markets IndexSM (“MSCI EM IndexSM”) | An index that measures the performance of securities listed on exchanges in developing nations throughout the world. It includes the reinvestment of dividends and distributions net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. |

| MSCI World IndexSM (“MSCI World”) | An index that measures the performance of over 1,600 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. |

| Russell 1000® Value Index | An index that measures the performance of those Russell 1000T securities with lower price- to-book ratios and lower forecasted growth values. |

| S&P 500® Index | An index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. |

| Voya Government Liquid Assets Portfolio | | Portfolio Managers’ Report |

Voya Government Liquid Assets Portfolio (the “Portfolio’’) seeks a high level of current income consistent with the preservation of capital and liquidity. The Portfolio is managed by David S. Yealy, Portfolio Manager of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.

Performance*: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 4.68% compared to the iMoneyNet Government Institutional Index, which returned 4.83% for the same period.

Portfolio Specifics: 2023 was a year of uncertainty, from the banking crisis early in the year to the U.S. Federal Reserve’s unexpected pivot on interest rates in December. The U.S. economy remained surprisingly resilient, driven by low unemployment, rising wages, robust consumer spending and increased investment in manufacturing. Volatility persisted in the U.S. bond market but ended the year on a strong note.

The yield on the U.S. Treasury 10-year note remained in a tight range for the first seven months of the year before spiking in August following news of a red-hot jobs market and then ultimately falling in December to near where it began the year as inflation and employment both moderated.

The Portfolio maintained a shorter than normal weighted average maturity (“WAM”) for the majority of the reporting period. Early in the year, we anticipated further hikes after 2022’s aggressive moves. The Fed raised rates four out of its first five meetings for a total of 100 basis points, before pausing and ending the year in the range of 5.25–5.50%.

In addition to the Portfolio’s shorter WAM, it held floating rate Treasuries tied to the three-month Treasury bill, which added yield early in the year. The Portfolio then shifted to floating rate agencies tied to the secured overnight funding rate (“SOFR”). At the time, we believed the SOFR would be higher than the three-month Treasury bill as the market priced in rate cuts. This belief persists for 2024.

Current Strategy and Outlook: As the market focus shifts from inflation to growth concerns, we believe duration will become an effective offset to risky asset drawdowns. It is our opinion that rate volatility, though receding from recent peaks, will remain above pre-pandemic levels due to uncertainty about the timing of rate cuts and concerns about government debt levels. Elevated real rates we believe will incent investors to increase allocations to fixed income, creating opportunities during bouts of volatility.

That said, in our opinion, many corners of the market appear to be priced for a soft landing. While this has become a more likely outcome, we believe the risks to this outcome materializing are being ignored. Labor markets are coming into better balance which, while good news for inflation, could cause concern among workers that a turn in the cycle is approaching. This in turn could compel workers to boost savings rates which would limit consumption and act as a challenge to growth.

As such, we think the Fed will cut rates in 2024, although not as soon as or by as much as the market is currently pricing in. We will look for opportunities to extend WAM if the market moves in line with our view. We expect ample openings over the year to make that shift as inflation and labor data trend smoothly. Until then, we will keep a shorter WAM and continue to buy floating-rate agencies.

| Portfolio Managers’ Report | | Voya Government Liquid Assets Portfolio |

_________

* Please see Note 5 for more information regarding the contractual waiver in place to reimburse certain expenses of the Portfolio to the extent necessary to assist the Portfolio in maintaining a net yield of not less than 0.00%.

You could lose money by investing in the Portfolio. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Portfolio’s sponsor has no legal obligation to provide financial support to the Portfolio, and you should not expect that the sponsor will provide financial support to the Portfolio at any time.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| VY® CBRE Global Real Estate Portfolio | | Portfolio Managers’ Reports |

VY® CBRE Global Real Estate Portfolio (the ‘‘Portfolio’’) seeks high total return consisting of capital appreciation and current income. The Portfolio is managed by Joseph P. Smith, CFA, President and Chief Investment Officer, Christopher S. Reich, CFA, and Kenneth S. Weinberg, CFA, Portfolio Managers of CBRE Investment Management Listed Real Assets LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 12.33% compared to the FTSE EPRA Nareit Developed Index and S&P 500® Index, which returned 9.68% and 26.29%, respectively, for the same period.

Portfolio Specifics: Global real estate stocks delivered a positive total return in 2023, aided by strong fourth quarter performance to close out the year as Fed Chair Powell announced the FOMC will cut rates in 2024. Inflation continues to decelerate in most markets, consumers remain resilient and property company fundamentals have been improving. Meanwhile, economic growth remains positive in most developed economies. For the year, real estate stocks returned +9.7% as regional performance was mixed. Europe was the best-performing region (+20.0%), followed by the Americas (+11.6%), while the Asia-Pacific region was the notable laggard (-1.2%), weighed down by a decelerating Chinese economy.

| | Geographic Diversification | |

| | as of December 31, 2023 | |

| | (as a percentage of net assets) | |

| | United States | 63.1% | |

| | Japan | 8.6% | |

| | Hong Kong | 4.6% | |

| | Singapore | 4.5% | |

| | Australia | 4.2% | |

| | United Kingdom | 3.4% | |

| | France | 2.9% | |

| | Canada | 2.5% | |

| | Switzerland | 1.3% | |

| | Belgium | 1.2% | |

| | Countries between 0.3% - 1.2%^ | 2.9% | |

| | Assets in Excess of Other Liabilities* | 0.8% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. | | |

| | ^ Includes 5 countries, which each 0.3% - 1.2% of net assets. | |

| Portfolio holdings are subject to change daily. |

The Portfolio outperformed the benchmark during the period as stock selection and sector allocation decisions have each added value. By region, the Americas has been the primary source of relative outperformance while Asia-Pacific region provided a modest contribution. Meanwhile, performance in Europe was a modest drag on relative performance, although absolute returns were quite strong for the year.

In the Americas, sector allocation was the main driver of relative outperformance. In the U.S., an underweight to the underperforming net lease sector along with an overweight to the outperforming mall, data center, storage and hotel sectors were the primary contributors to performance. Stock selection in the region was strong, led by strong stock selection in the storage, net lease and mall sectors.

Stock selection in the Asia-Pacific region benefited performance but was somewhat offset by sub-par sector allocation in the region. Stock selection was positive in all markets within the region, except for Hong Kong. From a sector allocation perspective, an overweight to the underperforming Hong Kong market detracted from relative performance.

Although absolute performance was strong, positioning decisions in Europe modesty detracted from relative performance during the period. Positive contributions from sector allocation on the Continent were more than offset by sub-par stock selection on the Continent as well as in the U.K.

Current Strategy and Outlook: Investment returns during the past two years have been largely driven by the market adapting to higher interest rates, which has resulted in a material drop in commercial real estate pricing from peak valuations in early 2022. Underlying property valuations in the listed market have ‘dislocated’ further from valuations in the private market, with REITs currently trading at double-digit discounts to private market valuations.

REITs have typically outperformed equities, bonds and private real estate at the end of Fed tightening cycles. In our opinion, real estate stocks remain attractively valued and offer above-average and growing dividend yields as well as resilient earnings growth. We believe investors committing capital to listed real estate at this time have the potential to earn an attractive absolute and relative long-term total return.

We are of the opinion that the long-term nature of leases in most real estate property sectors combined with the current pricing power for many property sectors (demand is outstripping supply) limits the impact of the macroeconomic and geopolitical headwinds on forward earnings. Additionally, the economic landscape continues to evidence modest growth and we believe that a positive low-to-mid single-digit earnings growth rate is achievable given the significant pricing power and embedded organic growth present in many property sectors.

We believe we own a well-balanced portfolio of securities that have been screened for their growth prospects in combination with the quality of their business models, assets, balance sheets, and management teams. We are positive on property types, regions, and stocks that offer these qualities at reasonable valuations.

| Portfolio Managers’ Reports | | VY® CBRE Global Real Estate Portfolio |

| | Top Ten Holdings |

| | as of December 31, 2023 |

| | (as a percentage of net assets) |

| | Simon Property Group, Inc. | 6.7% |

| | Public Storage | 6.4% |

| | Welltower, Inc. | 5.4% |

| | Equinix, Inc. | 4.6% |

| | AvalonBay Communities, Inc. | 3.7% |

| | Prologis, Inc. | 3.4% |

| | Rexford Industrial Realty, Inc. | 2.7% |

| | Link REIT | 2.6% |

| | Realty Income Corp. | 2.4% |

| | Alexandria Real Estate Equities, Inc. | 2.4% |

| Portfolio holdings are subject to change daily. |

In North America, we are modestly overweight Canadian real estate stocks with an emphasis on residential, industrial, and retail. In the U.S., we are overweight malls, storage, healthcare, hotels, and towers. In Japan, we prefer mid-cap diversified, industrial and hotel J-REITs that are providing earnings growth and resiliency at very attractive relative valuations and select Japanese REOCs that have committed to improving their corporate governance. In Hong Kong, we are overweight diversified companies with a commercial bias and non-discretionary retail. In Australia, we prefer industrial, data centers, retail, farmland, and a few select diversified companies. In the U.K., we favor the industrial, retail, storage and student housing sectors, as well as attractively priced diversified companies. Within Continental Europe, we have a positive bias to retail, industrial, storage, and select diversified companies.

_________

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| VY® CBRE GLOBAL REAL ESTATE PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

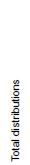

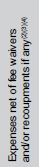

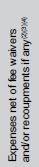

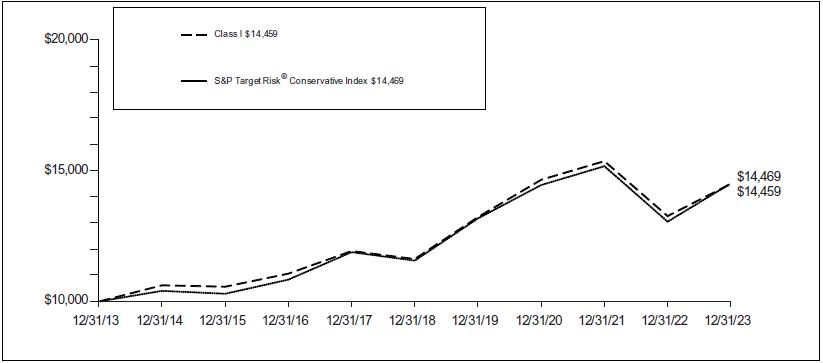

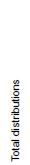

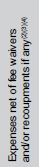

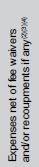

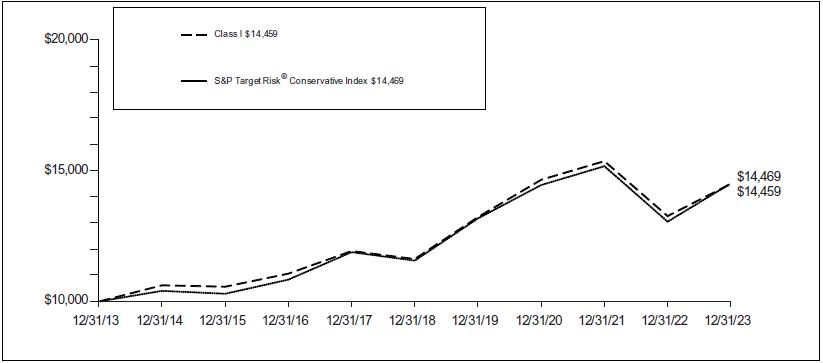

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year | |

| Class ADV | 11.97% | 5.54% | 3.86% | |

| Class I | 12.59% | 6.17% | 4.48% | |

| Class S | 12.33% | 5.90% | 4.23% | |

| Class S2 | 12.11% | 5.72% | 4.06% | |

| FTSE EPRA Nareit Developed Index | 9.68% | 2.81% | 3.57% | |

| S&P 500® Index | 26.29% | 15.69% | 12.03% | |

Based on a $10,000 initial investment the graph and table above illustrate the total return of VY® CBRE Global Real Estate Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in the index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| PORTFOLIO MANAGERS’ REPORTS | VY® INVESCO

GROWTH AND INCOME PORTFOLIO |

VY® Invesco Growth and Income Portfolio (the ‘‘Portfolio’’) seeks long- term growth of capital and income. The Portfolio is managed by Brian Jurkash, co-lead portfolio manager, Matthew Titus, co-lead portfolio manager and Sergio Marcheli, portfolio manager, of Invesco Advisers, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 12.34%, compared to the Russell 1000® Value Index, which returned 11.46%, for the same period.

Portfolio Specifics: For the year ended December 31, 2023, the Portfolio outperformed the index.

Stock selection in the information technology sector was the largest contributor to relative performance, due in part to Intel, Lam Research and Splunk. Intel reported broad revenue increases which resulted in earnings that came in above consensus expectations. Lam Research traded higher amid improving investor sentiment for semiconductors, as the cyclical slowdown in the industry appeared to be nearing an end. In September, Cisco announced its intent to acquire Splunk, which sent shares sharply higher, and we sold our position following the announcement.

| | Sector Diversification |

| | as of December 31, 2023 |

| | (as a percentage of net assets) |

| | Financials | 21.6% |

| | Health Care | 15.5% |

| | Industrials | 13.1% |

| | Information Technology | 11.5% |

| | Energy | 8.5% |

| | Communication Services | 7.9% |

| | Consumer Discretionary | 5.8% |

| | Consumer Staples | 5.0% |

| | Materials | 3.3% |

| | Real Estate | 3.0% |

| | Utilities | 2.8% |

| | Assets in Excess of Other Liabilities* | 2.0% |

| | Net Assets | 100.0% |

| | * Includes short-term investments. | |

| Portfolio holdings are subject to change daily. |

Selection in consumer discretionary also contributed to relative returns, due largely to Amazon. The company reported better than expected earnings and revenues and a reacceleration of growth in its Amazon Web Services (AWS) business.

Stock selection and an underweight in utilities and consumer staples also aided relative performance, as these were among the weakest sectors within the benchmark for the fiscal year.

Selection in industrials was the largest detractor from relative performance, primarily due to Johnson Controls and RTX. Johnson Controls’ earnings were generally in line with expectations, but growth decelerated, and the company provided weaker forward guidance. Aerospace and defense firm RTX announced a recall of engines made by subsidiary Pratt & Whitney. The recalled engines were thought to contain contaminated metal, impacting hundreds of Airbus jets. Though not a safety issue, the recall sent shares lower.

The communication services sector also detracted from relative performance. Specifically, the Portfolio’s underweight in Meta in the first half of the year hurt relative performance as the stock significantly outperformed the overall sector. Meta was later removed from the Russell 1000® Value Index in the annual rebalance in June, but the Portfolio held Meta at year end.

Financials also detracted from relative returns, as the failure of several regional banks in March weighed on the overall banking industry and portfolio holdings in banks such as Citizens Financial. Similarly, Charles Schwab was affected by the bank crisis as investors became concerned about the company’s banking operation’s access to capital.

The Portfolio held currency forward contracts for the purpose of hedging currency exposure of non-US-based companies held in the Portfolio. These derivative positions had negligible impact on the Portfolio’s relative performance.

Current Strategy and Outlook: During the period, we increased exposure to communication services, industrials, materials and utilities, and reduced exposure to health care and financials. At year end, the Portfolio’s largest relative overweights were in communication services and IT, while the largest underweights were in consumer staples and utilities.

Top Ten Holdings |

| as of December 31, 2023* |

| (as a percentage of net assets) |

| | Wells Fargo & Co. | 4.0% |

| | Bank of America Corp. | 3.1% |

| | CBRE Group, Inc. - Class A | 3.0% |

| | ConocoPhillips | 2.5% |

| | Alphabet, Inc. - Class A | 2.3% |

| | American International Group, Inc. | 2.2% |

| | Amazon.com, Inc. | 2.0% |

| | Exxon Mobil Corp. | 2.0% |

| | Johnson & Johnson | 1.9% |

| | Ferguson PLC | 1.9% |

| | * Excludes short-term investments. | |

| Portfolio holdings are subject to change daily. |

We believe normalizing interest rates should reduce the risk of a deep recession; however, higher bank lending standards and rising corporate defaults may weaken the economy in 2024. Regardless, we seek to invest in companies with attractive valuations and strong fundamentals, qualities that we believe will ultimately be reflected in those companies’ stock prices.

VY® INVESCO

GROWTH AND INCOME PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

_________

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| PORTFOLIO MANAGERS’ REPORTS | VY® INVESCO

GROWTH AND INCOME PORTFOLIO |

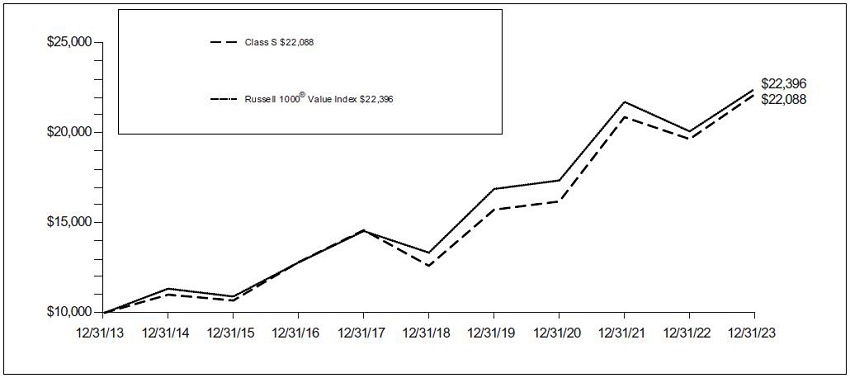

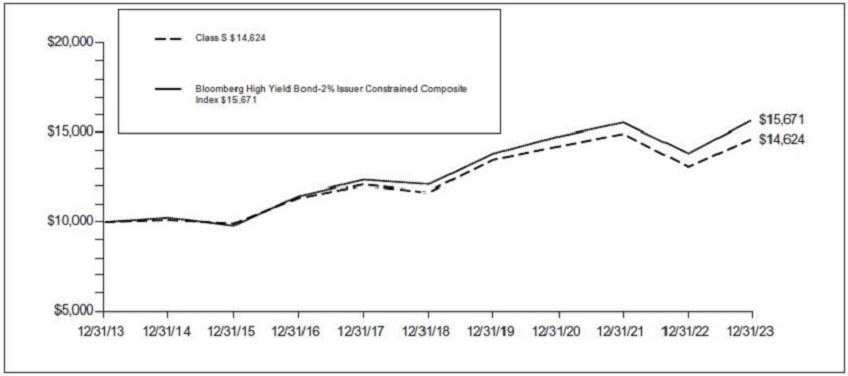

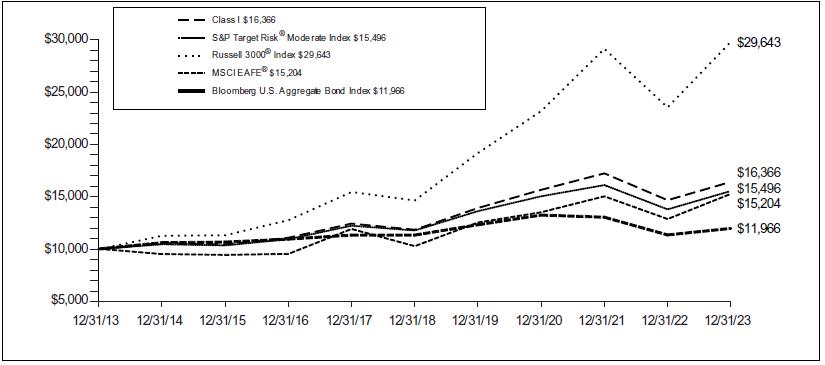

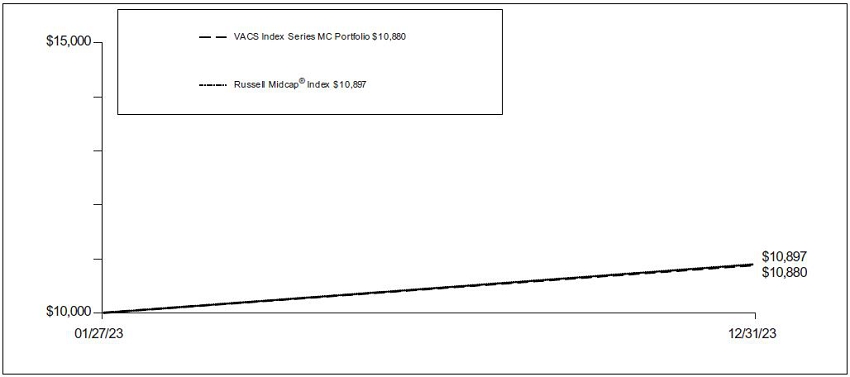

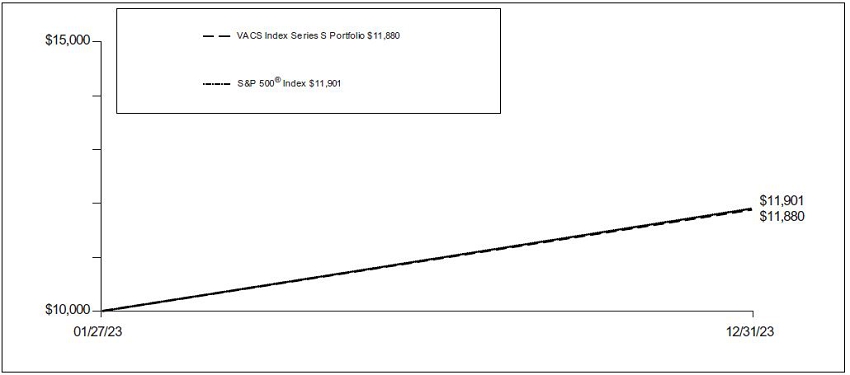

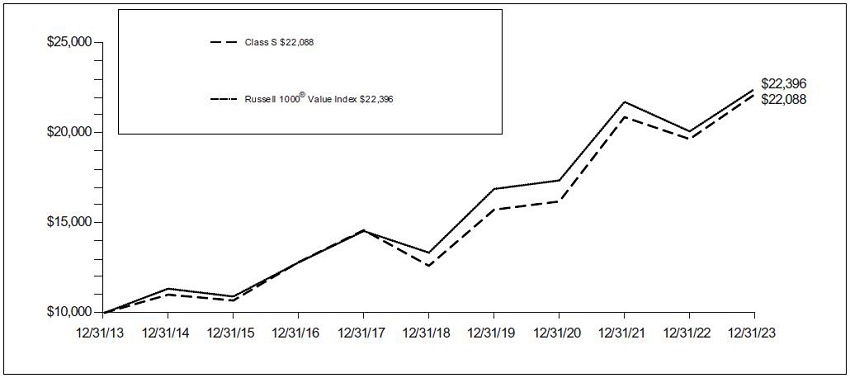

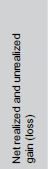

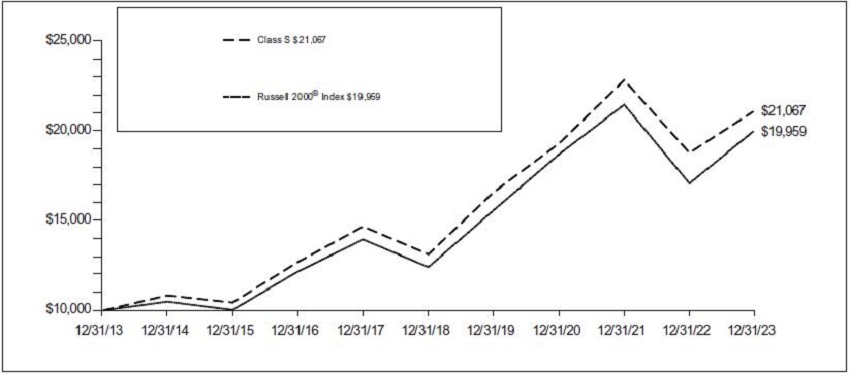

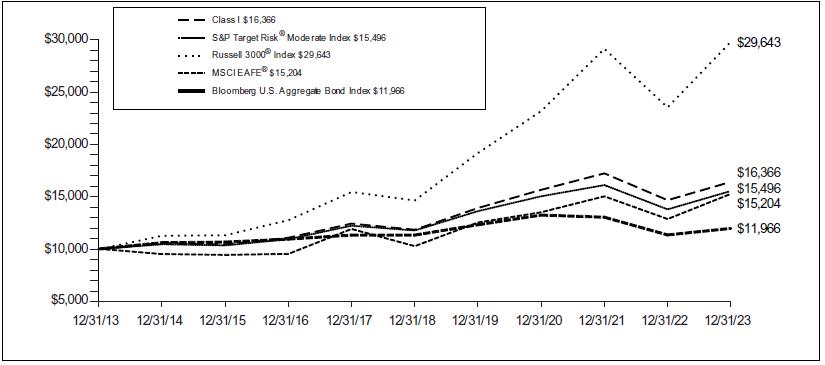

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year | |

| Class ADV | 11.93% | 11.46% | 7.87% | |

| Class I | 12.62% | 12.12% | 8.52% | |

| Class S | 12.34% | 11.85% | 8.25% | |

| Class S2 | 12.17% | 11.68% | 8.08% | |

| Russell 1000® Value Index | 11.46% | 10.91% | 8.40% | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Invesco Growth and Income Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

VY® JPMORGAN EMERGING

MARKETS EQUITY PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

VY® JPMorgan Emerging Markets Equity Portfolio (the “Portfolio”) seeks capital appreciation. The Portfolio is managed by Austin Forey, Managing Director, Leon Eidelman, CFA and Managing Director, and Amit Mehta, CFA and Executive Director; each a Portfolio Manager of J.P. Morgan Investment Management Inc.— the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S Shares provided a total return of 6.38% compared to the MSCI Emerging Markets IndexSM (“MSCI EM IndexSM”), which returned 9.83% for the same period.

Portfolio Specifics: The Portfolio underperformed the benchmark during the period, stock selection detracted from relative returns while country allocation contributed.

Stock selection in China detracted from performance. The first quarter of the year witnessed scrapping of the stringent zero-covid policy but economic data, which witnessed an immediate bounce, lost some of its momentum for the remainder of the year as business and consumer sentiment continued to languish. The portfolio’s exposure to JD.com, an e-commerce player, detracted during the period. Increasing competition along with a proposed subsidy program to regain market share at the beginning of the year impacted returns in the name.

| | Geographic Diversification | |

| | as of December 31, 2023 | |

| | (as a percentage of net assets) | |

| | China | 21.5% | |

| | India | 16.9% | |

| | Taiwan | 13.0% | |

| | South Korea | 9.5% | |

| | Brazil | 7.7% | |

| | Mexico | 6.0% | |

| | South Africa | 4.8% | |

| | Hong Kong | 3.8% | |

| | Indonesia | 3.6% | |

| | Uruguay | 3.1% | |

| | Countries between 1.0% - 2.8%^ | 9.6% | |

| | Assets in Excess of Other Liabilities* | 0.5% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. | | |

| | ^ Includes – countries, which each 1.0% - 2.8% of net assets. | |

| | Portfolio holdings are subject to change daily. | |

Commodities prices remained volatile during the year given conflicts in the Middle East and Russia. While they witnessed a drop from their 2022 peaks, prices remain much higher than their 2015-19 average. Consequently, the Portfolio’s underweight exposure to Energy detracted. Companies in the energy and materials sectors generally struggle to meet our standards on economics, duration, and governance or offer compelling long term expected returns.

On the positive side, stock selection in Argentina contributed during the period. The Portfolio’s off benchmark exposure to MercadoLibre (MELI), Latin America’s leading e-commerce company, aided performance. Increasing synergies with its fin-tech business, reduced competitive intensity in key markets, combined with an improvement in profitability, helped the stock outperform.

| | Top Ten Holdings |

| | as of December 31, 2023 |

| | (as a percentage of net assets) |

| | Taiwan Semiconductor Manufacturing Co. Ltd. | 9.2% |

| | Samsung Electronics Co. Ltd. | 6.9% |

| | HDFC Bank Ltd. | 5.7% |

| | Tencent Holdings Ltd. | 4.2% |

| | MercadoLibre, Inc. | 2.4% |

| | NU Holdings Ltd./Cayman Islands - Class A | 2.3% |

| | Wal-Mart de Mexico SAB de CV | 2.1% |

| | Bank Rakyat Indonesia Persero Tbk PT | 1.9% |

| | AIA Group Ltd. | 1.8% |

| | Grupo Financiero Banorte SAB de CV - Class O | 1.7% |

| Portfolio holdings are subject to change daily. |

The Portfolio’s overweight exposure to the Financials sector contributed to relative returns during the period. Nu Holdings, a Brazilian digital banking platform, was a leading contributor. The bank reported solid results through the year, with strong loan growth, healthy revenue generation and lower expenses. It also experienced stronger than expected client growth in Brazil and Mexico.

Current Strategy and Outlook: 2023 was a relatively better year for EM equities as the index rose 9.8% over the year. An earlier start to hiking cycles helped contain inflation, with a growing number of emerging markets now poised, or starting to cut policy rates. Additionally, while China’s economy is in a multi-year adjustment with weakness in real estate and manufacturing weighing on aggregate activity, consumption looks to be stabilising with signs of a tentative recovery and supportive valuations

While markets have certainly been more volatile, we believe there are reasons to be hopeful for EM equities: falling global inflation provides EM central banks room to cut aggressively, the US dollar is down substantially and China’s economy is growing, even if the recovery has been delayed and may take longer to unfold than had originally been envisaged. Given the volatility within EM, it is even more important that we stick to our framework. Thus we continue to look for opportunities in EM equities where earnings growth can compound over the long-run.

| PORTFOLIO MANAGERS’ REPORTS | VY® JPMORGAN EMERGING

MARKETS EQUITY PORTFOLIO |

________

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

VY® JPMORGAN EMERGING

MARKETS EQUITY PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

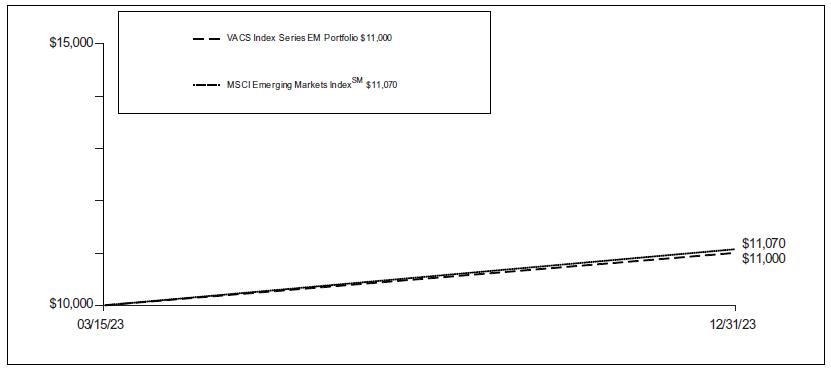

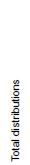

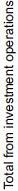

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year | |

| Class ADV | 6.02% | 4.09% | 3.21% | |

| Class I | 6.64% | 4.71% | 3.83% | |

| Class S | 6.38% | 4.45% | 3.57% | |

| Class S2 | 6.25% | 4.30% | 3.42% | |

| MSCI EM IndexSM | 9.83% | 3.68% | 2.66% | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of the VY® JPMorgan Emerging Markets Equity Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will uctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| PORTFOLIO MANAGERS’ REPORTS | VY® MORGAN STANLEY GLOBAL

FRANCHISE PORTFOLIO |

VY® Morgan Stanley Global Franchise Portfolio (the “Portfolio”) seeks long-term capital appreciation. The Portfolio is managed by William D. Lock, Managing Director, Bruno Paulson, Managing Director, Nic Sochovsky, Managing Director, Vladimir A. Demine, Executive Director, Marcus Watson, Executive Director, Alex Gabriele, Executive Director, and Richard Perrott, Executive Director, Portfolio Managers* of Morgan Stanley Investment Management Inc.— the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 15.91% compared to the MSCI World IndexSM (“MSCI World” or the “Index”), which returned 23.79% for the same period.

| | Geographic Diversification as of December 31, 2023 (as a percentage of net assets) | |

| | United States | 74.7% | |

| | United Kingdom | 8.0% | |

| | France | 6.1% | |

| | Germany | 5.9% | |

| | Netherlands | 3.4% | |

| | Italy | 0.3% | |

| | Assets in Excess of Other Liabilities* | 1.6% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. Portfolio holdings are subject to change daily. | |

Portfolio Specifics: For 2023, underperformance was due to both sector allocation and stock selection. Within sector allocation, the main issue was the 20%+ combined overweight in the two defensive sectors, Consumer Staples and Health Care, which both underperformed the Index by over 20%. Looking at the three most successful sectors in the year, Information Technology, Communication Services and Consumer Discretionary, the benefit of the small overweight in IT was outweighed by the larger underweights in the other two. However, the Portfolio did benefit from the underweights in the lower quality, more cyclical sectors, notably Energy. For stock selection, the weakness was largely driven by Information Technology, where the Portfolio’s very healthy 47% gain was behind the 58% recorded by the market, whilst Health Care and Consumer Discretionary also detracted. Another way of looking at allocation is that the Portfolio only owned Microsoft out of the ‘Magnificent Seven’, leaving it with less than half of the 17% weight the Seven had in the index, hitting relative performance by over 400 basis points.

Current Strategy and Outlook: The Index’s current forward multiple does not look cheap, particularly as it is based on an arguably optimistic, double-digit earnings growth assumption for 2024 and 2025. The Index finished 2023 at 17.3x 12-month forward earnings, and the S&P 500® Index at virtually 20x. The overall setup strikes us as an unfavourable asymmetry, with upside limited due to the ambitious earnings estimates and high multiples, while there could be plenty of downside if there is a recession.

Top Ten Holdings |

| as of December 31, 2023 |

| (as a percentage of net assets) |

| | Microsoft Corp. | 8.0% |

| | Philip Morris International, Inc. | 6.1% |

| | Accenture PLC - Class A | 6.0% |

| | SAP SE | 5.9% |

| | Visa, Inc. - Class A | 5.7% |

| | Thermo Fisher Scientific, Inc. | 4.4% |

| | Reckitt Benckiser Group PLC | 4.4% |

| | Intercontinental Exchange, Inc. | 4.3% |

| | Danaher Corp. | 4.0% |

| | RELX PLC | 3.6% |

| Portfolio holdings are subject to change daily. |

We remain “double fussy” – concerned with the sustainability of both the earnings and the multiples. Our view is that the possibility of a downturn is not reflected in today’s earnings expectations, nor in the current market multiple. Given the vulnerability of high earnings and high multiples in the event of an economic slowdown, we would argue that investing in a portfolio of high-quality compounders makes sense.

______

* Effective August 7, 2023, Nathan Wong no longer serves as a portfolio manager for the Portfolio.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

VY® MORGAN STANLEY GLOBAL

FRANCHISE PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

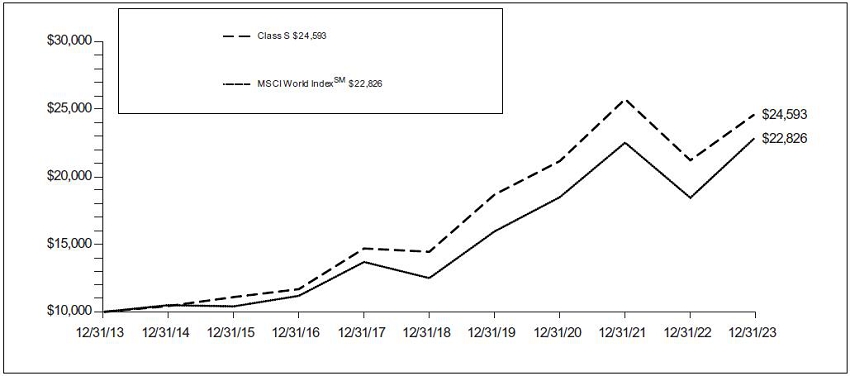

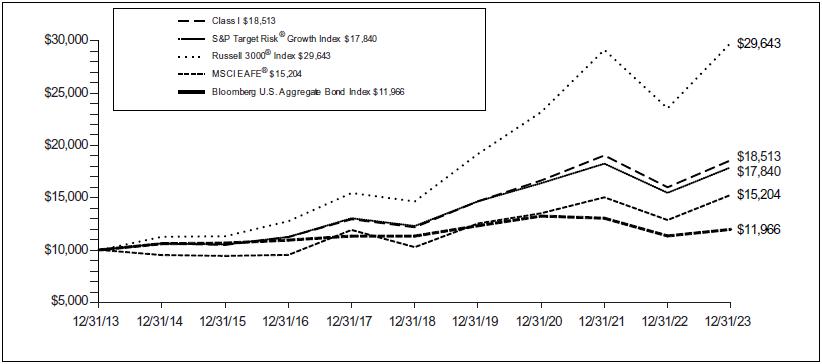

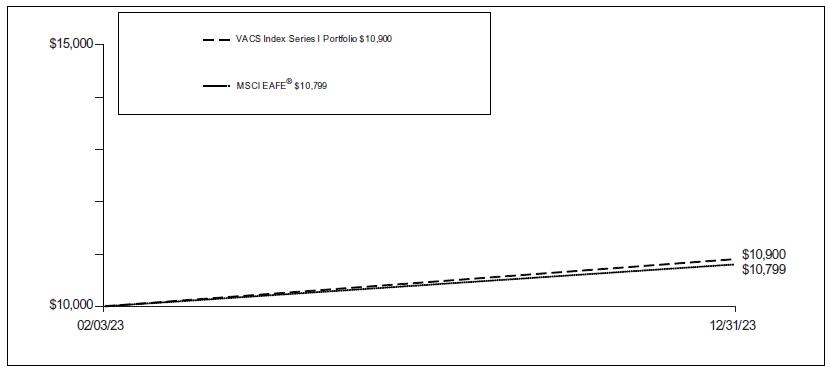

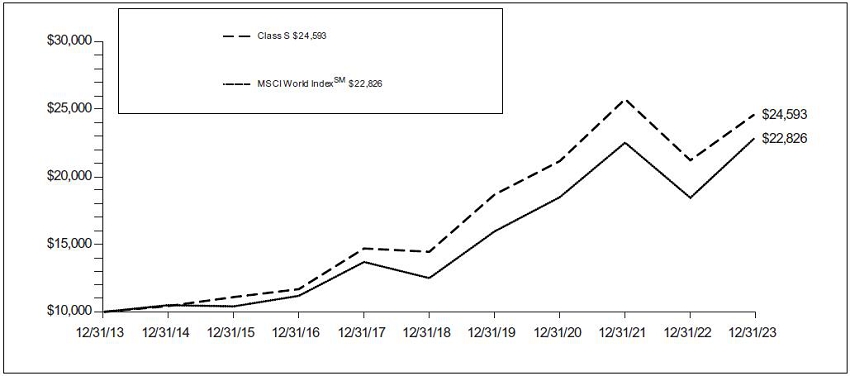

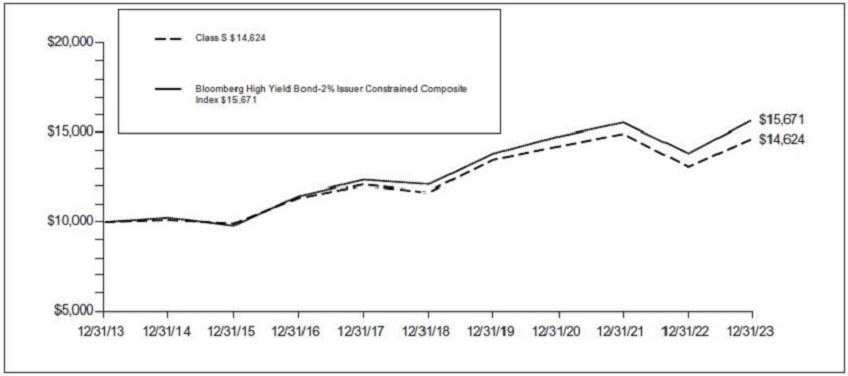

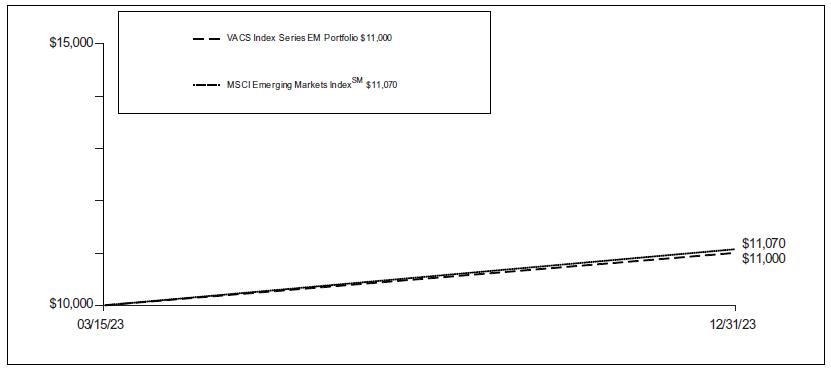

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year | |

| Class ADV | 15.52% | 10.84% | 9.03% | |

| Class R6(1) | 16.30% | 11.53% | 10.68% | |

| Class S | 15.91% | 11.23% | 9.42% | |

| Class S2 | 15.80% | 11.08% | 9.26% | |

| MSCI World IndexSM | 23.79% | 12.80% | 8.60% | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Morgan Stanley Global Franchise Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will uctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

_________

| (1) | Class R6 incepted on May 3, 2016. The class R6 shares performance shown for the period prior to their inception date is the performance of Class S shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different. |

| PORTFOLIO MANAGERS’ REPORTS | VY® T. ROWE PRICE CAPITAL

APPRECIATION PORTFOLIO |

VY® T. Rowe Price Capital Appreciation Portfolio (the “Portfolio”) seeks, over the long-term, a high total investment return, consistent with the preservation of capital and with prudent investment risk. The Portfolio is managed by David R. Giroux, CFA and Vice President of T. Rowe Price Associates, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 18.60%. By comparison, the S&P 500® Index, the Bloomberg U.S. Government/Credit Index, and the 60% S&P 500® Index/40% Bloomberg U.S. Government/Credit Index returned 26.29%, 5.72% and 17.76%, respectively, for the same period.

Portfolio Specifics: The Portfolio posted a positive return but lagged its all-equity S&P 500® Index benchmark in the 2023 calendar year. The Portfolio’s equity holdings posted a positive return but slightly lagged its S&P 500® Index benchmark. The Portfolio’s fixed income holdings posted a positive return during the one-year period and strongly outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index.

| Investment Type Allocation |

| as of December 31, 2023 |

| (as a percentage of net assets) |

| | Common Stock | 61.7% |

| | U.S. Treasury Obligations | 11.3% |

| | Bank Loans | 10.5% |

| | Corporate Bonds/Notes | 9.8% |

| | Preferred Stock | 0.6% |

| | Asset-Backed Securities | 0.1% |

| | Assets in Excess of Other Liabilities* | 6.0% |

| | Net Assets | 100.0% |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. |

The Portfolio’s overall fixed income weight increased compared with the beginning of the year. Within fixed income, we increased the Portfolio’s exposure to U.S. Treasuries, which provide ballast, generate income, and are highly liquid should we decide to add to riskier assets if further market stress arises. We continue to favor high-quality bank loans which offer attractive risk-adjusted return profiles.

Within equities, the health care sector detracted from relative returns due to an overweight allocation. The health care sector continues to play a significant role in the Portfolio, as we believe certain industries offer compelling, relatively stable growth potential. Utilities detracted from relative results due to an overweight position and stock selection. Ameren is a Midwest electric and gas holding company. Shares traded lower in mid-December after Illinois regulators issued a lower- allowed return on equity than was expected. An underweight allocation to the communication services sector also hampered relative returns, which was partially offset by stock selection. Conversely, the consumer staples sector contributed to relative performance due to an underweight position. Consumer staples significantly lagged the broader market during the year, as investors favored high-beta and growth factors, as well as companies with near-term benefits from AI. Industrials and business services aided relative results driven by stock selection. Early in the year, industrial conglomerate GE completed the spinoff of its health care business into GE HealthCare, a separate, publicly traded company. This successful spin, coupled with strong results in the company’s remaining aerospace and power divisions, propelled GE’s shares significantly higher.

During the reporting period, the covered call strategy represented generated a positive return. The covered call strategy's estimated contribution to the Portfolio's total return was 2.10%. Conversely, the estimated return impact from employing options was negative for the reporting period.

| | Top Ten Holdings |

| | as of December 31, 2023* |

| | (as a percentage of net assets) |

| | Microsoft Corp. | 5.0% |

| | United States Treasury Notes, 3.375%, 05/15/33 | 4.4% |

| | United States Treasury Notes, 3.875%, 08/15/33 | 3.2% |

| | Alphabet, Inc. - Class A | 3.0% |

| �� | UnitedHealth Group, Inc. | 2.6% |

| | United States Treasury Notes, 4.500%, 11/15/33 | 2.5% |

| | Amazon.com, Inc. | 2.4% |

| | Fortive Corp. | 2.1% |

| | Becton Dickinson and Co. | 2.1% |

| | PerkinElmer, Inc. | 1.9% |

| | * Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. |

Current Strategy and Outlook: Major stock indexes soared in 2023, led by a return to favor for growth stocks and more cyclical segments of the market. Market sentiment has improved as recession fears have subsided and expectations have increased for the Federal Reserve to cut rates in 2024. While less restrictive monetary policy would likely be a boon for markets, the recent rally has left valuations vulnerable to a pullback, and still-elevated interest rates could pose a headwind to economic growth. At current levels, we have a relatively conservative outlook for markets and have positioned the Portfolio accordingly.

VY® T. ROWE PRICE CAPITAL

APPRECIATION PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

_________

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| PORTFOLIO MANAGERS’ REPORTS | VY® T. ROWE PRICE CAPITAL

APPRECIATION PORTFOLIO |

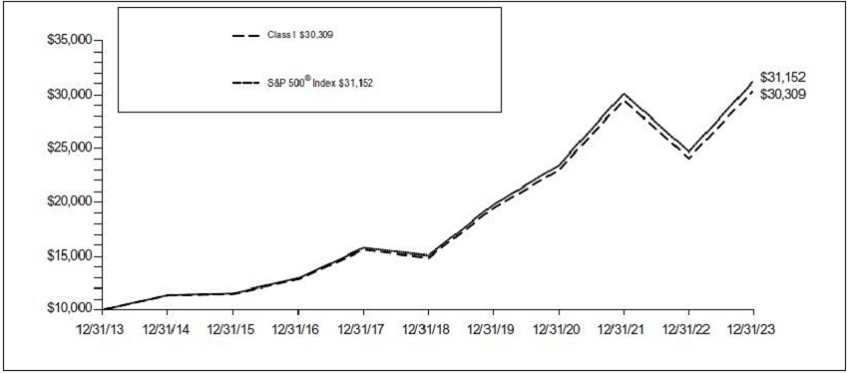

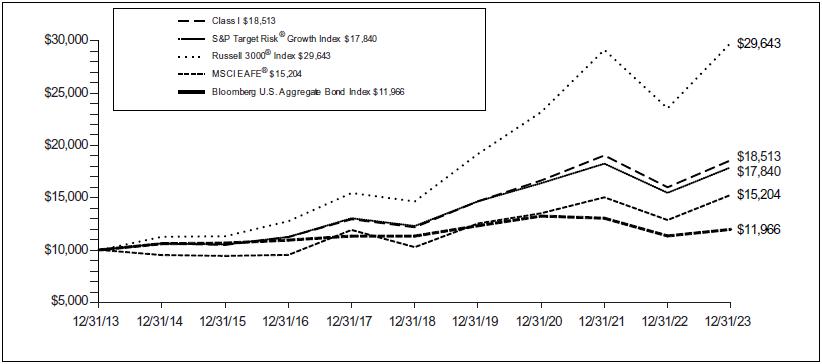

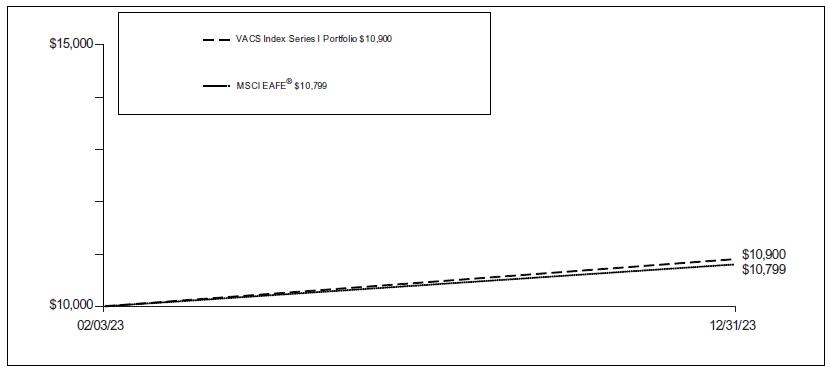

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year | |

| Class ADV | 18.16% | 12.20% | 9.93% | |

| Class I | 18.92% | 12.88% | 10.59% | |

| Class R6 | 18.90% | 12.88% | 11.05% | |

| Class S | 18.60% | 12.59% | 10.31% | |

| Class S2 | 18.42% | 12.43% | 10.15% | |

| S&P 500® Index | 26.29% | 15.69% | 12.03% | |

| Bloomberg U.S. Government/Credit Index | 5.72% | 1.41% | 1.97% | |

| 60% S&P 500® Index / 40% Bloomberg U.S. Government/Credit Bond Index | 17.76% | 10.12% | 8.16% | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® T. Rowe Price Capital Appreciation Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

_________

| (1) | Class R6 incepted on May 3, 2016. The class R6 shares performance shown for the period prior to their inception date is the performance of Class S shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different. |

VY® T. ROWE PRICE

EQUITY INCOME PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

VY® T. Rowe Price Equity Income Portfolio (the “Portfolio”) seeks a high level of dividend income as well as long-term growth of capital primarily through investments in stocks. The Portfolio is managed by John Linehan, CFA, Head of U.S. Equity and Portfolio Manager of T. Rowe Price Associates, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 9.33% compared to the Russell 1000® Value Index and the S&P 500® Index, which returned 11.46% and 26.29% respectively, for the same period.

Portfolio Specifics: Communication services was the leading notable detractor from relative returns, owing to an underweight position and weak stock selection. Our underweight to Meta Platforms was a notable headwind as the stock rose significantly following a renewed focus toward cost discipline and other idiosyncratic drivers in the beginning of 2023. The company continued to perform well as it experienced a rebound in digital ad spending and improved monetization trends. Meta Platforms was removed from the Russell 1000® Value Index in June when the benchmark was reconstituted and has been pared back in the Portfolio.

| | Sector Diversification |

| | as of December 31, 2023 |

| | (as a percentage of net assets) |

| | Financials | 22.9% |

| | Health Care | 15.7% |

| | Industrials | 12.8% |

| | Information Technology | 8.8% |

| | Energy | 8.6% |

| | Consumer Staples | 7.8% |

| | Utilities | 6.3% |

| | Communication Services | 4.7% |

| | Real Estate | 4.2% |

| | Consumer Discretionary | 4.1% |

| | Materials | 3.2% |

| | Assets in Excess of Other Liabilities* | 0.9% |

| | Net Assets | 100.0% |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. |

Unfavorable stock selection in the consumer discretionary sector detracted from relative performance. Early in the period, Porsche AG benefited from increased deliveries management focusing on pricing, and optimism around the company’s upcoming electric vehicle launches. Later in the period, shares were impacted as the company reported declining vehicle deliveries in China, and as the company leaned on volume to drive revenue growth instead of pricing.

The materials sector also hindered relative performance due to poor stock choices. CF Industries, the largest nitrogen fertilizer producer in North America, faced a volatile backdrop for fertilizer demand and pricing throughout the year. Early in the year, weak fertilizer demand impacted shares. The company benefited from improved sentiment around the fertilizer cycle at the midpoint of the year, which benefited shares, but fell to weaker levels during the last quarter.

Conversely, the industrials and business services sector was the significant contributor for the period, due to strong stock selection. General Electric is a global multi-industrial company operating in three segments: aviation, power, and renewables. We built a position in the name on the thesis that shares would benefit from the company simplifying the business and that a recovery in aviation would further propel shares. Over the year, GE trended upward as it made progress toward streamlining the business and benefited from a better-than-expected recovery in the aviation industry, improvement in renewables, and a successful spinoff of its health care business.

Favorable stock choices in the energy sector also aided relative performance. Shares of Total Energies contributed to relative performance over the period, as shares benefited from the company’s continued strong execution and focus on low- cost production and shareholder-friendly capital allocation policies.

| | Top Ten Holdings |

| | as of December 31, 2023 |

| | (as a percentage of net assets) |

| | Wells Fargo & Co. | 3.0% |

| | TotalEnergies SE | 3.0% |

| | Qualcomm, Inc. | 2.9% |

| | Southern Co. | 2.6% |

| | American International Group, Inc. | 2.5% |

| | General Electric Co. | 2.4% |

| | Elevance Health, Inc. | 2.3% |

| | Chubb Ltd. | 2.2% |

| | News Corp. - Class A | 2.1% |

| | L3Harris Technologies, Inc. | 1.8% |

| | Portfolio holdings are subject to change daily. |

Current Strategy and Outlook: The market was data point driven throughout 2023, and the most recent quarter was no exception, as the market rallied sharply on favorable inflation and employment news. While all eyes continue to be on the direction of monetary policy, we believe the Federal Reserve is also being heavily influenced by new data. We therefore expect the market to continue to be volatile, switching between optimism and pessimism depending on the next data point.

In our view, this backdrop creates a wide range of potential outcomes, and the likelihood of a recession versus a “soft landing” is largely unknown. For that reason, we aim to maintain a Portfolio that is balanced for a variety of markets, focusing on counterpunching the market and taking advantage of attractive opportunities as they are presented to us. Ultimately, we believe stock picking will be critical, and our valuation discipline and long-term investment horizon seeks to contribute to the Portfolio’s performance.

| PORTFOLIO MANAGERS’ REPORTS | VY® T. ROWE PRICE

EQUITY INCOME PORTFOLIO |

_________

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward- looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

VY® T. ROWE PRICE

EQUITY INCOME PORTFOLIO | PORTFOLIO MANAGERS’ REPORTS |

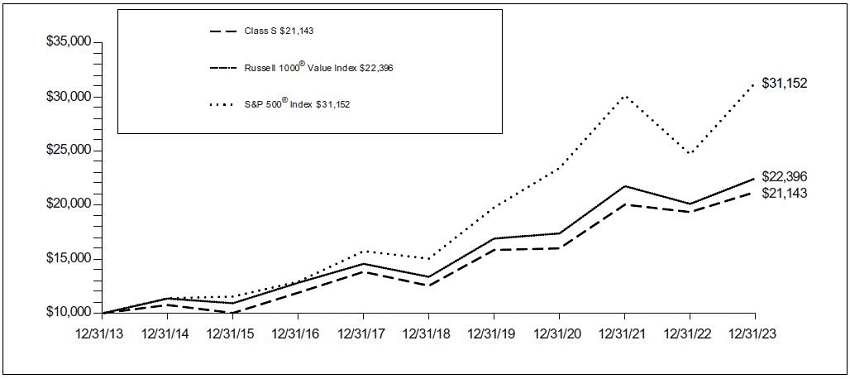

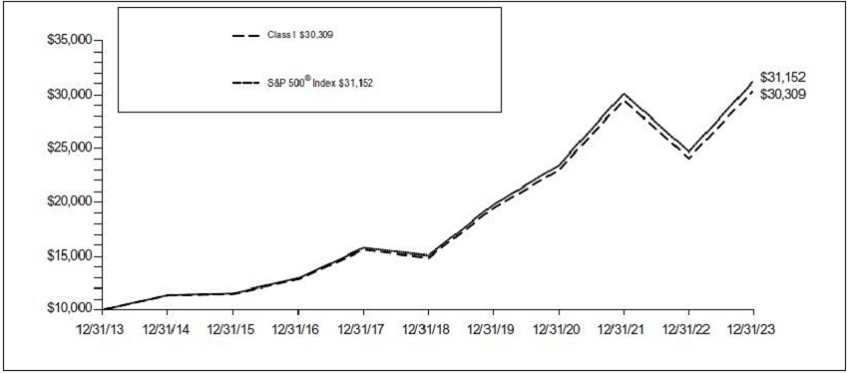

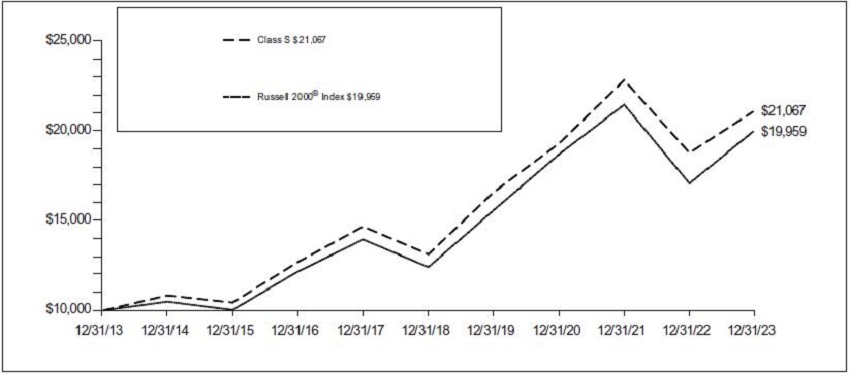

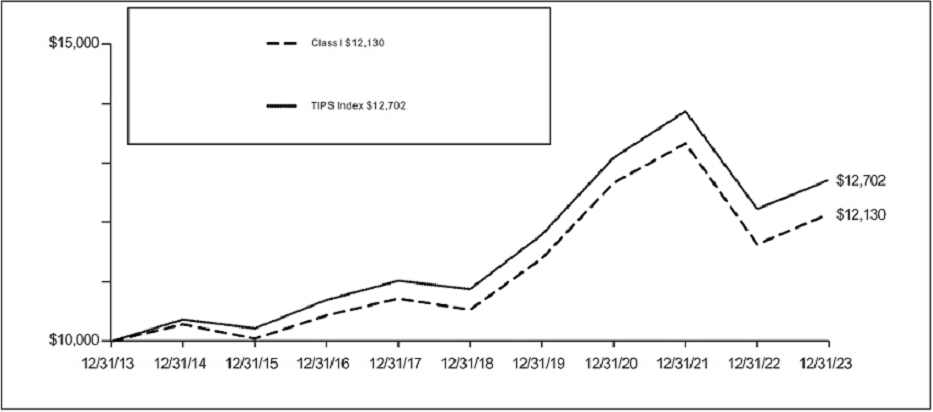

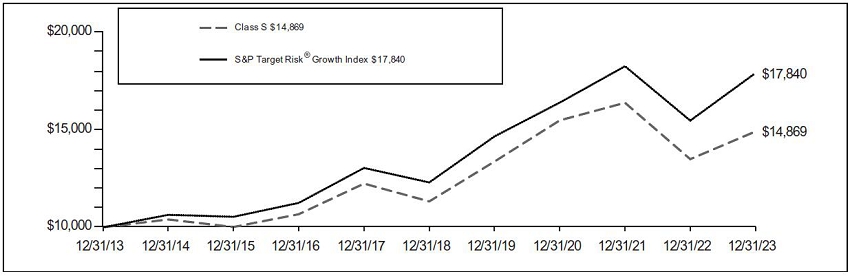

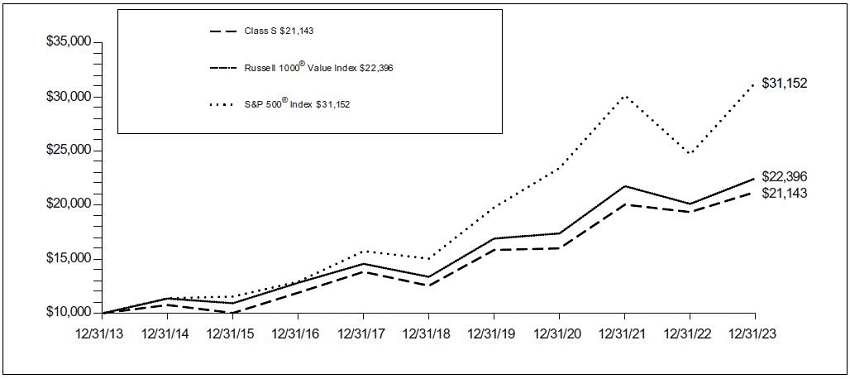

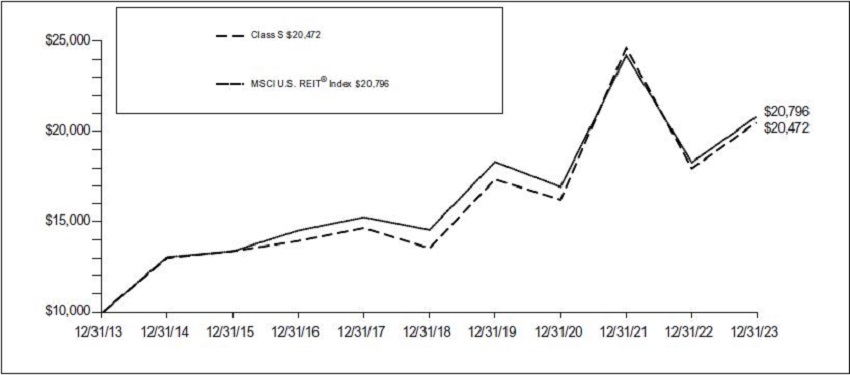

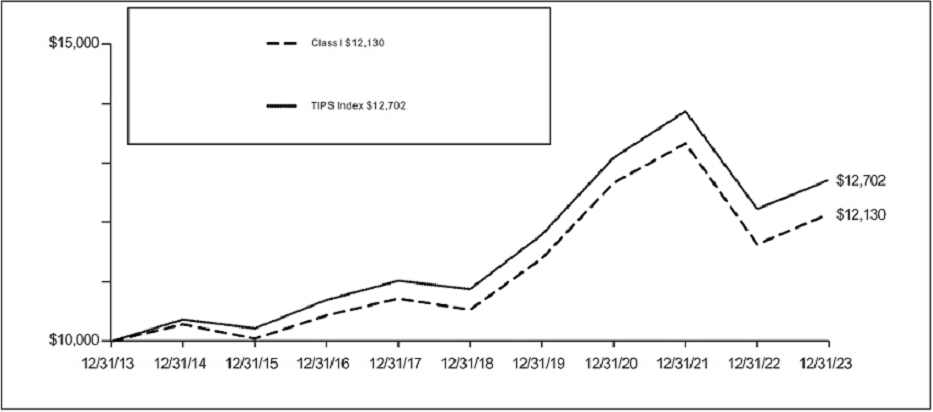

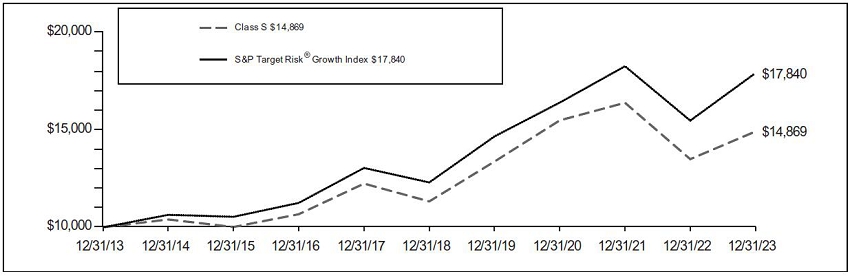

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year | |

| Class ADV | 8.94% | 10.66% | 7.40% | |

| Class I | 9.57% | 11.32% | 8.05% | |

| Class S | 9.33% | 11.04% | 7.77% | |

| Class S2 | 9.12% | 10.87% | 7.61% | |

| Russell 1000® Value Index | 11.46% | 10.91% | 8.40% | |

| S&P 500® Index | 26.29% | 15.69% | 12.03% | |

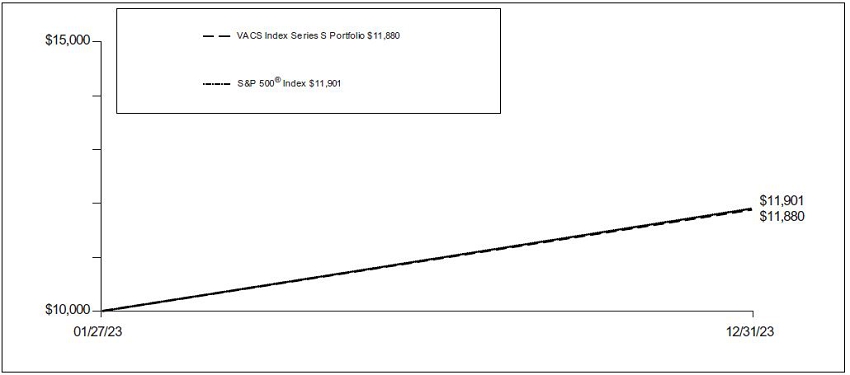

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® T. Rowe Price Equity Income Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2023 to December 31, 2023. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension, or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Actual Portfolio Return | | Hypothetical (5% return before expenses) | |

| | | Beginning

Account

Value

July 1, 2023 | | Ending

Account

Value

December 31, 2023 | | Annualized

Expense Ratio | | Expenses Paid

During the

Period Ended

December 31, 2023* | | Beginning

Account

Value

July 1, 2023 | | Ending

Account

Value

December 31, 2023 | | Annualized

Expense Ratio | | Expenses Paid

During the

Period Ended

December 31, 2023* | |

| | | | | | | | | | | | | | | | | | |

| | Voya Government Liquid Assets Portfolio | |

| | Class I | $1,000.00 | | $1,026.00 | | 0.28% | | $1.43 | | $1,000.00 | | $1,023.79 | | 0.28% | | $1.43 | |

| | Class S | 1,000.00 | | 1,024.70 | | 0.53 | | 2.70 | | 1,000.00 | | 1,022.53 | | 0.53 | | 2.70 | |

| | Class S2 | 1,000.00 | | 1,023.90 | | 0.68 | | 3.47 | | 1,000.00 | | 1,021.78 | | 0.68 | | 3.47 | |

| | VY® CBRE Global Real Estate Portfolio | |

| | Class ADV | $1,000.00 | | $1,095.70 | | 1.47% | | $7.76 | | $1,000.00 | | $1,017.80 | | 1.47% | | $7.48 | |

| | Class I | 1,000.00 | | 1,099.10 | | 0.87 | | 4.60 | | 1,000.00 | | 1,020.82 | | 0.87 | | 4.43 | |

| | Class S | 1,000.00 | | 1,097.50 | | 1.12 | | 5.92 | | 1,000.00 | | 1,019.56 | | 1.12 | | 5.70 | |

| | Class S2 | 1,000.00 | | 1,096.80 | | 1.27 | | 6.71 | | 1,000.00 | | 1,018.80 | | 1.27 | | 6.46 | |

| | | | | | | | | | | | | | | | | | |

| | VY® Invesco Growth and Income Portfolio | |

| | Class ADV | $1,000.00 | | $1,074.80 | | 1.21% | | $6.33 | | $1,000.00 | | $1,019.11 | | 1.21% | | $6.16 | |

| | Class I | 1,000.00 | | 1,078.50 | | 0.61 | | 3.20 | | 1,000.00 | | 1,022.13 | | 0.61 | | 3.11 | |

| | Class S | 1,000.00 | | 1,077.00 | | 0.86 | | 4.50 | | 1,000.00 | | 1,020.87 | | 0.86 | | 4.38 | |

| | Class S2 | 1,000.00 | | 1,076.30 | | 1.01 | | 5.29 | | 1,000.00 | | 1,020.11 | | 1.01 | | 5.14 | |

| | VY® JPMorgan Emerging Markets Equity Portfolio | |

| | Class ADV | $1,000.00 | | $1,004.00 | | 1.81% | | $9.14 | | $1,000.00 | | $1,016.08 | | 1.81% | | $9.20 | |

| | Class I | 1,000.00 | | 1,007.60 | | 1.21 | | 6.12 | | 1,000.00 | | 1,019.11 | | 1.21 | | 6.16 | |

| | Class S | 1,000.00 | | 1,005.70 | | 1.46 | | 7.38 | | 1,000.00 | | 1,017.85 | | 1.46 | | 7.43 | |

| | Class S2 | 1,000.00 | | 1,005.60 | | 1.61 | | 8.14 | | 1,000.00 | | 1,017.09 | | 1.61 | | 8.19 | |

| | | | | | | | | | | | | | | | | | |

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) (CONTINUED)

| | | Actual Portfolio Return | | Hypothetical (5% return before expenses) | |

| | | Beginning

Account

Value

July 1, 2023 | | Ending

Account

Value

December 31, 2023 | | Annualized

Expense Ratio | | Expenses Paid

During the

Period Ended

December 31, 2023* | | Beginning

Account

Value

July 1, 2023 | | Ending

Account

Value

December 31, 2023 | | Annualized

Expense Ratio | | Expenses Paid

During the

Period Ended

December 31, 2023* | |

| | VY® Morgan Stanley Global Franchise Portfolio | |

| | Class ADV | $1,000.00 | | $1,037.80 | | 1.56% | | $8.01 | | $1,000.00 | | $1,017.34 | | 1.56% | | $7.93 | |

| | Class R6 | 1,000.00 | | 1,041.30 | | 0.96 | | 4.94 | | 1,000.00 | | 1,020.37 | | 0.96 | | 4.89 | |

| | Class S | 1,000.00 | | 1,039.50 | | 1.21 | | 6.22 | | 1,000.00 | | 1,019.11 | | 1.21 | | 6.16 | |

| | Class S2 | 1,000.00 | | 1,039.70 | | 1.36 | | 6.99 | | 1,000.00 | | 1,018.35 | | 1.36 | | 6.92 | |

| | VY® T. Rowe Price Capital Appreciation Portfolio |

| | Class ADV | $1,000.00 | | $1,065.40 | | 1.24% | | $6.46 | | $1,000.00 | | $1,018.95 | | 1.24% | | $6.31 | |

| | Class I | 1,000.00 | | 1,069.10 | | 0.64 | | 3.34 | | 1,000.00 | | 1,021.98 | | 0.64 | | 3.26 | |

| | Class R6 | 1,000.00 | | 1,068.60 | | 0.64 | | 3.34 | | 1,000.00 | | 1,021.98 | | 0.64 | | 3.26 | |

| | Class S | 1,000.00 | | 1,067.40 | | 0.89 | | 4.64 | | 1,000.00 | | 1,020.72 | | 0.89 | | 4.53 | |

| | Class S2 | 1,000.00 | | 1,066.90 | | 1.04 | | 5.42 | | 1,000.00 | | 1,019.96 | | 1.04 | | 5.30 | |

| | VY® T. Rowe Price Equity Income Portfolio |

| | Class ADV | $1,000.00 | | $1,066.20 | | 1.21% | | $6.30 | | $1,000.00 | | $1,019.11 | | 1.21% | | $6.16 | |

| | Class I | 1,000.00 | | 1,069.90 | | 0.61 | | 3.18 | | 1,000.00 | | 1,022.13 | | 0.61 | | 3.11 | |

| | Class S | 1,000.00 | | 1,068.00 | | 0.86 | | 4.48 | | 1,000.00 | | 1,020.87 | | 0.86 | | 4.38 | |

| | Class S2 | 1,000.00 | | 1,067.10 | | 1.01 | | 5.26 | | 1,000.00 | | 1,020.11 | | 1.01 | | 5.14 | |

_____________

| * | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Voya Government Liquid Assets Portfolio, VY® CBRE Global Real Estate Portfolio, VY® Invesco Growth and Income Portfolio, VY® JPMorgan Emerging Markets Equity Portfolio, VY® Morgan Stanley Global Franchise Portfolio, VY® T. Rowe Price Capital Appreciation Portfolio and VY® T. Rowe Price Equity Income Portfolio and the Board of Trustees of Voya Investors Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Voya Government Liquid Assets Portfolio, VY® CBRE Global Real Estate Portfolio, VY® Invesco Growth and Income Portfolio, VY® JPMorgan Emerging Markets Equity Portfolio, VY® Morgan Stanley Global Franchise Portfolio, VY® T. Rowe Price Capital Appreciation Portfolio and VY® T. Rowe Price Equity Income Portfolio (collectively referred to as the “Portfolios”) (seven of the portfolios constituting Voya Investors Trust (the “Trust”)), including the portfolios of investments, as of December 31, 2023, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the four years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Portfolios (seven of the portfolios constituting Voya Investors Trust) at December 31, 2023, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the four years in the period then ended, in conformity with U.S. generally accepted accounting principles.

The financial highlights for the period ended December 31, 2019, were audited by another independent registered public accounting firm whose report, dated February 21, 2020, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Portfolios’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian, brokers and others; when replies were not received from brokers and others, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Voya investment companies since 2019.

Boston, Massachusetts

February 28, 2024

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2023

| | | Voya

Government

Liquid Assets

Portfolio | | | VY®

CBRE Global

Real Estate

Portfolio | | | VY®

Invesco

Growth and

Income

Portfolio | | | VY®

JPMorgan

Emerging

Markets Equity

Portfolio | |

| ASSETS: | | | | | | | | | | | | | | | | |

| Investments in securities at fair value+* | | $ | – | | | $ | 180,430,449 | | | $ | 374,689,207 | | | $ | 293,921,824 | |

| Short-term investments at fair value† | | | – | | | | 3,980,090 | | | | 7,452,012 | | | | 1,245,656 | |

| Short-term investments at amortized cost | | | 859,198,595 | | | | – | | | | – | | | | – | |

| Repurchase agreements | | | 185,388,000 | | | | – | | | | – | | | | – | |

| Cash | | | 41,341 | | | | – | | | | – | | | | – | |

| Foreign currencies at value‡ | | | – | | | | – | | | | 72,518 | | | | 1,725,193 | |

| Receivables: | | | | | | | | | | | | | | | | |

| Investment securities and currencies sold | | | – | | | | 111,118 | | | | – | | | | 1,089,977 | |

| Fund shares sold | | | 5,145,180 | | | | 41,443 | | | | 53,067 | | | | 284,464 | |

| Dividends | | | 8,834 | | | | 898,036 | | | | 454,033 | | | | 457,236 | |

| Interest | | | 5,296,559 | | | | – | | | | – | | | | – | |

| Foreign tax reclaims | | | – | | | | 259,492 | | | | 25,991 | | | | 61,000 | |

| Unrealized appreciation on forward foreign currency contracts | | | – | | | | – | | | | 29,001 | | | | – | |

| Prepaid expenses | | | – | | | | 1,450 | | | | – | | | | – | |

| Reimbursement due from Investment Adviser | | | – | | | | 40,793 | | | | – | | | | 14,609 | |

| Other assets | | | 21,354 | | | | 11,978 | | | | 22,500 | | | | 24,169 | |

| Total assets | | | 1,055,099,863 | | | | 185,774,849 | | | | 382,798,329 | | | | 298,824,128 | |

| LIABILITIES: | | | | | | | | | | | | | | | | |

| Payable for investment securities and currencies purchased | | | – | | | | 200,633 | | | | – | | | | 1,838,009 | |