Name, Address and Age

| | | | Position(s) Held

With the Trust

| | Term of Office and Length

of Time Served(1)

| | Principal Occupation(s) —

During the Past 5 Years

|

|---|

| |

Micheline S. Faver

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 40 | | | | Vice President | | September 2016–Present | | Vice President, Head of Fund Compliance, Voya Investments LLC, and Chief Compliance Officer for Voya Investments, LLC and Directed Services, LLC (June 2016–Present). Formerly, Vice President, Mutual Fund Compliance (March 2014–June 2016); Assistant Vice President, Mutual Fund Compliance (May 2013–March 2014); Assistant Vice President, Senior Project Manager (May 2008–May 2013). |

| |

Robyn L. Ichilov

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 50 | | | | Vice President | | November 1999–Present | | Vice President, Voya Funds Services, LLC (November 1995–Present) and Voya Investments, LLC (August 1997–Present). |

| |

Jason Kadavy

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 41 | | | | Vice President | | September 2012–Present | | Vice President, Voya Investments, LLC (October 2015–Present) and Voya Funds Services, LLC (July 2007–Present). |

| |

Kimberly K. Springer

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 60 | | | | Vice President | | March 2006–Present | | Vice President — Mutual Fund Product Development, Voya Investments, LLC (July 2012–Present); Vice President, Voya Family of Funds (March 2010–Present) and Vice President, Voya Funds Services, LLC (March 2006–Present). |

| |

Craig Wheeler

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 48 | | | | Vice President | | May 2013–Present | | Vice President — Director of Tax, Voya Investments, LLC (October 2015–Present). Formerly, Vice President — Director of Tax, Voya Funds Services, LLC (March 2013–October 2015). Formerly, Assistant Vice President — Director of Tax, Voya Funds Services, LLC (March 2008–February 2013). |

| |

Huey P. Falgout, Jr.

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 54 | | | | Secretary | | August 2003–Present | | Senior Vice President and Chief Counsel, Voya Investment Management — Mutual Fund Legal Department (March 2010–Present). |

| |

Paul A. Caldarelli

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 66 | | | | Assistant Secretary | | June 2010–Present | | Vice President and Senior Counsel, Voya Investment Management — Mutual Fund Legal Department (March 2010–Present). |

| |

Theresa K. Kelety

7337 East Doubletree Ranch Rd.

Suite 100

Scottsdale, Arizona 85258

Age: 55 | | | | Assistant Secretary | | August 2003–Present | | Vice President and Senior Counsel, Voya Investment Management — Mutual Fund Legal Department (March 2010–Present). |

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED)

BOARD CONSIDERATION AND APPROVAL OF INVESTMENT MANAGEMENT CONTRACTS AND SUB-ADVISORY CONTRACTS

At a meeting held on November 16, 2017, the Board, including a majority of the Independent Trustees, considered and approved the renewal of the investment management contracts (the “Management Contracts”) between Voya Investments, LLC (the “Manager”) and Voya Investors Trust (the “Trust”), on behalf of Voya Government Liquid Assets Portfolio, VY® Clarion Global Real Estate Portfolio, VY® Invesco Growth and Income Portfolio, VY® JPMorgan Emerging Markets Equity Portfolio, VY® Morgan Stanley Global Franchise Portfolio, VY® T. Rowe Price Capital Appreciation Portfolio, VY® T. Rowe Price Equity Income Portfolio, and VY® T. Rowe Price International Stock Portfolio, each a series of the Trust (the “Portfolios”), and the sub-advisory contracts (the “Sub-Advisory Contracts”) with the sub-adviser to each Portfolio (the “Sub-Adviser”), and the sub-sub-advisory contracts (the “Sub-Sub-Advisory Contracts”) with the sub-sub-adviser to VY® Morgan Stanley Global Franchise Portfolio and VY® T. Rowe Price International Stock Portfolio (each a “Sub-Sub-Adviser” and together, the “Sub-Sub-Advisers”), for an additional one year period ending November 30, 2018. In determining to renew such contracts, the Board took into account information furnished to it throughout the year at meetings of the Board and its committees, including regarding performance, expenses, and other matters.

In addition to the Board meeting on November 16, 2017, the Independent Trustees also held meetings outside the presence of personnel representing the Manager, Sub-Advisers, or Sub-Sub-Advisers (collectively, such persons are referred to herein as “Management”) on October 12, 2017, and November 14, 2017, specifically to review and consider materials related to the proposed continuance of each Management Contract, Sub-Advisory Contract, and Sub-Sub-Advisory Contract that they believed to be relevant to the renewal of the Management Contracts, Sub-Advisory Contracts, and Sub-Sub-Advisory Contracts in light of the legal advice furnished to them by K&L Gates LLP, their independent legal counsel, and their own business judgment. Subsequent references herein to factors considered and determinations made by the Independent Trustees and/or the Board include, as applicable, factors considered and determinations made at those meetings by the Independent Trustees. While the Board considered the renewal of the management contracts, sub-advisory contracts, and sub-sub-advisory contracts for all of the applicable investment companies in the Voya family of funds at the same meetings, the Board considered each Voya fund’s investment management, sub-advisory and sub-sub-advisory relationships separately.

The Board follows a structured process pursuant to which it seeks and considers relevant information when it evaluates whether to renew existing investment management, sub-advisory, and sub-sub-advisory contracts for the Voya funds. The Board has established a Contracts Committee and three Investment Review Committees (the “IRCs”), each of which includes only Independent Trustees as members. The Contracts Committee provides oversight with respect to the management, sub-advisory, and sub-sub-advisory contracts approval and renewal process, and each IRC provides oversight throughout the year regarding the investment performance of the sub-advisers and sub-sub-advisers, as well as the Manager’s role in monitoring the sub-advisers and sub-sub-advisers, with respect to each Voya fund that is assigned to that IRC.

The Contracts Committee oversees, and annually recommends Board approval of updates to, a methodology guide for the Voya funds (“Methodology Guide”). The Methodology Guide sets out a framework pursuant to which the Independent Trustees request, and Management provides, certain information that the Independent Trustees deem to be important or potentially relevant. The Independent Trustees retain the services of an independent consultant with experience in the mutual fund industry to assist the Contracts Committee in developing and recommending to the Board: (1) a selected peer group of investment companies for each Portfolio (“Selected Peer Group”) based on that Portfolio’s particular attributes, such as fund type and size, fund category (as determined by Morningstar, Inc., an independent provider of mutual fund data (“Morningstar”)), sales channels and structure and the Portfolio share class being compared to the Selected Peer Group, and (2) updates to the Methodology Guide with respect to the content and format of various data including, but not limited to, investment performance, fee structure, and expense information prepared in connection with the renewal process.

Provided below is an overview of certain material factors that the Board considered at its meetings regarding the renewal of the Management Contracts, Sub-Advisory Contracts and Sub-Sub-Advisory Contracts and the compensation to be paid thereunder. Board members did not identify any particular information or factor that was overarching, and each Board member may have accorded different weight to the various factors in reaching his or her conclusions with respect to each Portfolio’s investment management, sub-advisory, and sub-sub-advisory arrangements.

Nature, Extent and Quality of Services

The Manager oversees, subject to the authority of the Board, the provision of all investment advisory and portfolio management services for the Portfolios, but may delegate

92

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

certain of these responsibilities to one or more sub-advisers or sub-sub-advisers. In addition, the Manager provides administrative services reasonably necessary for the operation of the Portfolios as set forth in the Management Contracts, including oversight of the Portfolios’ operations and risk management and the oversight of their various other service providers.

The Board considered the “manager-of-managers” platform of the Voya funds that has been developed by the Manager pursuant to which the Manager selects, subject to the Board’s approval, experienced sub-advisers or sub-sub-advisers to provide day-to-day management services to all or a portion of each Voya fund. The Board recognized that the Manager is responsible for monitoring the investment program, performance, developments, ongoing operations, and regulatory compliance of the Sub-Advisers and Sub-Sub-Advisers with respect to the Portfolios under this manager-of-managers arrangement. The Board also considered the techniques and resources that the Manager has developed to provide this ongoing oversight and due diligence with respect to the sub-advisers and sub-sub-advisers and to advocate or recommend, when it believes appropriate, changes in investment strategies or investment sub-advisers and sub-sub-advisers designed to assist in improving a Voya fund’s performance. The Board was advised that, in connection with the Manager’s performance of these duties, the Manager has developed an oversight process formulated by its Manager Research & Selection Group which reviews, among other matters, performance data, each Sub-Adviser’s and Sub-Sub-Adviser’s management team, portfolio data and attribution analysis related to each Sub-Adviser and Sub-Sub-Adviser through various means, including, but not limited to, in-person meetings, on-site visits, and telephonic meetings with the Sub-Adviser and Sub-Sub-Adviser.

Further, the Board considered periodic compliance reports it receives from the Trust’s Chief Compliance Officer evaluating whether the regulatory compliance systems and procedures of the Manager, Sub-Advisers and Sub-Sub-Advisers are reasonably designed to ensure compliance with the federal securities laws and whether the investment policies and restrictions for each Portfolio are consistently complied with, and other periodic reports covering related matters.

The Board considered the portfolio management team assigned by the Sub-Advisers and Sub-Sub-Advisers to the Portfolios and the level of resources committed to the Portfolios (and other relevant funds in the Voya funds) by the Manager, Sub-Advisers and/or Sub-Sub-Advisers, and whether those resources are sufficient to provide high-quality services to the Portfolios.

Based on their deliberations and the materials presented to them, the Board concluded that the nature, extent and quality of the overall services provided by the Manager and each Sub-Adviser and Sub-Sub-Adviser under the Management Contracts, Sub-Advisory Contracts and Sub-Sub-Advisory Contracts were appropriate.

Portfolio Performance

In assessing investment management, sub-advisory and sub-sub-advisory relationships, the Board placed emphasis on the investment returns of each Portfolio, including its investment performance over certain time periods compared to the Portfolio’s Morningstar category, Selected Peer Group and primary benchmark. The Board also considered information from the Manager Research & Selection Group and received reports summarizing a separate analysis of each Portfolio’s performance and risk, including risk-adjusted investment return information, by the Trust’s Chief Investment Risk Officer.

Economies of Scale

When evaluating the reasonableness of management fee schedules, the Board considered whether economies of scale have been or likely will be realized by the Manager and each Sub-Adviser and Sub-Sub-Adviser, as applicable, as a Portfolio grows larger and the extent to which any such economies are reflected in contractual fee schedules. In this regard, the Board noted any breakpoints in management fee schedules that will result in a lower management fee rate when a Portfolio achieves sufficient asset levels to receive a breakpoint discount. The Board also considered that the Portfolios may have fee waiver and/or expense reimbursement arrangements. The Board considered the extent to which economies of scale realized by the Manager and each Sub-Adviser and Sub-Sub-Adviser, as applicable, could be shared with each Portfolio through such fee waivers, expense reimbursements or other expense reductions. In evaluating these matters, the Independent Trustees also considered periodic management reports, Selected Peer Group comparisons, and industry information regarding economies of scale. In the case of sub-advisory and sub-sub-advisory fee rates, the Board considered that any breakpoints would inure to the benefit of the Manager and applicable Sub-Adviser, respectively.

Information Regarding Services to Other Clients

The Board considered information regarding the nature of services, performance, and fee schedules offered by the Manager and each Sub-Adviser, and Sub-Sub-Adviser, as applicable, to other clients with similar investment objectives, if applicable, including other registered investment companies and relevant institutional accounts. When the fee schedules offered to or the performance of other clients differed materially from a Portfolio, the Board

93

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

took into account the underlying rationale provided by the Manager, the Sub-Adviser or Sub-Sub Adviser, as applicable, for these differences. For the non-Voya-affiliated Sub-Advisers and Sub-Sub-Advisers, the Board viewed the information related to any material differences in the fee schedules as not being a key factor in its deliberations because of the arm’s-length nature of negotiations between the Manager and non-Voya-affiliated Sub-Advisers with respect to sub-advisory fee schedules and that each applicable Sub-Adviser is responsible for paying the fees of the Sub-Sub-Adviser. The Board also considered that the fee schedules charged to the Portfolios and other institutional clients of the Manager or the Sub-Advisers and Sub-Sub-Advisers (including other investment companies) and the performance of the Portfolios and the other accounts, as applicable, may differ materially due to, among other reasons: differences in services; different regulatory requirements associated with registered investment companies; market differences in fee schedules that existed when a Portfolio first was organized; differences in the original sponsors; investment capacity constraints that existed when certain contracts were first agreed upon or that might exist at present; and different pricing structures that are necessary to be competitive in different marketing channels.

Fee Schedules, Profitability, and Fall-out Benefits

The Board reviewed and considered the contractual management fee schedule payable by each Portfolio to the Manager compared to the Portfolio’s Selected Peer Group and which additional services the Manager pays for on behalf of each applicable Portfolio under the “bundled fee” arrangement in return for a single management fee (“Unified Fee Structure”). The Board also considered the contractual sub-advisory fee schedule payable by the Manager to each Sub-Adviser for sub-advisory services for each Portfolio, including the portion of the contractual management fee rates that are paid to each Sub-Adviser, as compared to the portion retained by the Manager, and the contractual sub-advisory fee schedule payable to the Sub-Sub-Adviser by the respective Sub-Sub-Adviser. In addition, the Board considered any fee waivers, expense limitations, and/or recoupment arrangements that apply to the fees payable by the Portfolios, including whether the Manager intends to propose any changes thereto. For each Portfolio, the Board separately determined that the fees payable to the Manager and the fee schedule payable to each Sub-Adviser and Sub-Sub-Adviser are reasonable for the services that each performs, which were considered in light of the nature, extent and quality of the services that each has performed and is expected to perform.

For each Portfolio, the Board considered information on revenues, costs and profits or losses realized by the Manager and the Voya-affiliated Sub-Adviser. In analyzing the profitability of the Manager and its affiliated service providers in connection with services they render to a Portfolio, the Board took into account the sub-advisory fee rate payable by the Manager to each Sub-Adviser. The Board also considered the profitability of the Manager and its affiliated Sub- Adviser attributable to servicing each Portfolio both with and without taking into account the profitability of the distributor of the Portfolios and both before and after giving effect to any expenses incurred by the Manager or the affiliated Sub- Adviser in making payments to affiliated insurance companies. The Board did not request profitability data from the Sub-Advisers and Sub-Sub-Advisers that were not affiliated with the Manager because the Board did not view this data as being a key factor to its deliberations given the arm’s-length nature of the relationship between the Manager and these non-Voya-affiliated Sub-Advisers and Sub-Sub-Advisers with respect to the negotiation of sub-advisory and sub- sub-advisory fee schedules. In addition, the Board noted that non-Voya-affiliated sub-advisers and sub-sub-advisers may not account for their profits on an account-by-account basis and those that do typically employ different methodologies in connection with these calculations.

Although the Methodology Guide establishes a framework for profit calculation, the Board recognized that there is no uniform methodology within the asset management industry for determining profitability for this purpose. The Board also recognized that the use of different reasonable methodologies can give rise to dramatically different reported profit and loss results with respect to the Manager and the Voya-affiliated Sub-Adviser, as well as other industry participants with whom the profits of the Manager and its affiliated Sub-Adviser could be compared. In addition, the Board recognized that Management’s calculations regarding its costs incurred in establishing the infrastructure necessary for the Portfolios’ operations may not be fully reflected in the expenses allocated to each Portfolio in determining profitability, and that the information presented may not portray all of the costs borne by the Manager or reflect all risks, including entrepreneurial, regulatory, legal and operational risks, associated with offering and managing a mutual fund complex in the current regulatory and market environment.

The Board also considered that the Manager is entitled to earn a reasonable level of profits for the services that it provides to the Portfolios. The Board also received information regarding the potential fall-out benefits to the Manager and each Sub-Adviser and Sub-Sub-Adviser, as applicable, and its affiliates from its association with the applicable Portfolio(s), including its ability to engage in soft-dollar transactions on behalf of the Portfolio(s). Following its reviews, the Board determined that the Manager’s and the Voya-affiliated Sub-Adviser’s profitability with respect to their services to the Portfolios and the Manager’s and

94

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

each Sub-Adviser’s and Sub-Sub-Adviser’s potential fall-out benefits, as applicable, were not unreasonable.

Portfolio-by-Portfolio Analysis

Set forth below are certain of the specific factors that the Board considered, and the conclusions reached, at its October 12, 2017, November 14, 2017, and/or November 16, 2017 meetings in relation to approving each Portfolio’s Management Contracts, Sub-Advisory Contracts and Sub-Sub-Advisory Contracts. These specific factors are in addition to those considerations discussed above. In each case, the Portfolio’s performance was compared to its Morningstar category, as well as its primary benchmark, a broad-based securities market index that appears in the Portfolio’s prospectus. With respect to Morningstar quintile rankings, the first quintile represents the highest (best) performance and the fifth quintile represents the lowest performance. The performance data provided to the Board primarily was for various periods ended March 31, 2017. In addition, the Board also considered at its October 12, 2017, November 14, 2017, and November 16, 2017 meetings certain additional data regarding performance and Portfolio asset levels and flows as of August 31, 2017, and September 30, 2017. Each Portfolio’s management fee and expense ratio were compared to the fees and expense ratios of the funds in its Selected Peer Group.

Voya Government Liquid Assets Portfolio

In considering whether to approve the renewal of the Management and Sub-Advisory Contracts for Voya Government Liquid Assets Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio outperformed its Morningstar category median for all periods presented, with the exception of the year- to-date period, during which it underperformed, and the three-year period, during which it was equal to the performance of this Morningstar category median; and (2) the Portfolio underperformed its primary benchmark for all periods presented, with the exception of the year-to-date and ten-year periods, during which it outperformed.

In analyzing this performance data, the Board took into account Management’s representations that the Portfolio is meeting its investment objective.

In considering the fees payable under the Management and Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the economies of scale benefits to the Portfolio and its shareholders from breakpoint discounts applicable to the Portfolio’s management fee rate, which result in lower fees at higher asset levels; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is below the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and the average net expense ratios of the funds in its Selected Peer Group.

In analyzing this fee data, the Board took into account Management’s representations regarding the expense borne by the Manager for the provision of services, such as transfer agency, custody, accounting and legal services, to the Portfolio pursuant to the Portfolio’s Unified Fee Structure.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser is reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management and Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® Clarion Global Real Estate Portfolio

In considering whether to approve the renewal of the Management and Sub-Advisory Contracts for VY® Clarion Global Real Estate Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio underperformed its Morningstar category average for all periods presented, with the exception of the ten-year period, during which it outperformed; (2) the Portfolio underperformed its primary benchmark for all periods presented, with the exception of the ten-year period, during which it outperformed; and (3) the Portfolio is ranked in the second quintile of its Morningstar category for the ten-year period, the fourth quintile for the three-year and five-year periods, and the fifth (lowest) quintile for the year-to-date and one-year periods.

In analyzing this performance data, the Board took into account: (1) Management’s representations regarding the impact of security selection on the Portfolio’s performance; (2) Management’s representations regarding the Portfolio’s favorable performance during certain periods; (3) Management’s discussion of investment process changes recently implemented by the Sub-Adviser that are designed to enhance performance; (4) Management’s confidence in the ability of the Sub-Adviser to execute the

95

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

Portfolio’s investment objective; and (5) that Management will continue to monitor, and the Board or its IRC will periodically review, the Portfolio’s performance.

In considering the fees payable under the Management and Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the economies of scale benefits to the Portfolio and its shareholders from breakpoint discounts applicable to the Portfolio’s management fee rate, which result in lower fees at higher asset levels; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is above the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and equal to the average net expense ratios of the funds in its Selected Peer Group.

In analyzing this fee data, the Board took into account: (1) Management’s discussion of fee waivers and/or expense reimbursements, which lower the Portfolio’s net effective management fee; and (2) Management’s representations regarding the competitiveness of the Portfolio’s expense ratio.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser is reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management and Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® Invesco Growth and Income Portfolio

In considering whether to approve the renewal of the Management and Sub-Advisory Contracts for VY® Invesco Growth and Income Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio outperformed its Morningstar category average for all periods presented, with the exception of the year- to-date period, during which it underperformed; (2) the Portfolio outperformed its primary benchmark for all periods presented, with the exception of the year-to-date period, during which it underperformed, and the five-year period, during which its performance was equal to that of its primary benchmark; and (3) the Portfolio is ranked in the first (highest) quintile of its Morningstar category for the one-year, three-year, five-year and ten-year periods, and the fifth (lowest) quintile for the year-to-date period.

In considering the fees payable under the Management and Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the economies of scale benefits to the Portfolio and its shareholders from breakpoint discounts applicable to the Portfolio’s management fee rate, which result in lower fees at higher asset levels; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is below the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and the average net expense ratios of the funds in its Selected Peer Group.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser is reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management and Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® JPMorgan Emerging Markets Equity Portfolio

In considering whether to approve the renewal of the Management and Sub-Advisory Contracts for VY® JPMorgan Emerging Markets Equity Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio outperformed its Morningstar category average for all periods presented; (2) the Portfolio outperformed its primary benchmark for all periods presented; and (3) the Portfolio is ranked in the second quintile of its Morningstar category for all periods presented.

In considering the fees payable under the Management and Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the fairness of the compensation under a Management Contract with a level fee rate that does not include breakpoints; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the

96

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is above the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and above the average net expense ratios of the funds in its Selected Peer Group.

In analyzing this fee data, the Board took into account Management’s representations regarding: (1) the expense borne by the Manager for the provision of services, such as transfer agency, custody, accounting and legal services, to the Portfolio pursuant to the Portfolio’s Unified Fee Structure; and (2) the competitiveness of the Portfolio’s net expense ratio.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser is reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management and Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® Morgan Stanley Global Franchise Portfolio

In considering whether to approve the renewal of the Management, Sub-Advisory and Sub-Sub-Advisory Contracts for VY® Morgan Stanley Global Franchise Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio outperformed its Morningstar category average for all periods presented, with the exception of the one-year period, during which it underperformed; (2) the Portfolio outperformed its primary benchmark for all periods presented, with the exception of the one-year period, during which it underperformed; and (3) the Portfolio is ranked in the first (highest) quintile of its Morningstar category for the year-to-date, three-year, five-year and ten-year periods, and the fourth quintile for the one-year period.

In considering the fees payable under the Management, Sub-Advisory and Sub-Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the economies of scale benefits to the Portfolio and its shareholders from breakpoint discounts applicable to the Portfolio’s management fee rate, which result in lower fees at higher asset levels; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is above the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is above the median and the average net expense ratios of the funds in its Selected Peer Group.

In analyzing this fee data, the Board took into account Management’s representations regarding: (1) the expense borne by the Manager for the provision of services, such as transfer agency, custody, accounting and legal services, to the Portfolio pursuant to the Portfolio’s Unified Fee Structure; and (2) the competitiveness of the Portfolio’s management fee and net expense ratio.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser and the Sub-Sub-Advisory fee rate payable by the Sub-Adviser to the Sub-Sub-Adviser are reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management, Sub-Advisory and Sub-Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® T. Rowe Price Capital Appreciation Portfolio

In considering whether to approve the renewal of the Management and Sub-Advisory Contracts for VY® T. Rowe Price Capital Appreciation Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio outperformed its Morningstar category average for all periods presented; (2) the Portfolio underperformed its primary benchmark all periods presented, with the exception of the ten-year period, during which it outperformed; and (3) the Portfolio is ranked in the first (highest) quintile of its Morningstar category for all periods presented.

In considering the fees payable under the Management and Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the economies of scale benefits to the Portfolio and its shareholders from breakpoint discounts applicable to the Portfolio’s management fee rate, which result in lower fees at higher asset levels; and (2) the pricing

97

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is below the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and the average net expense ratios of the funds in its Selected Peer Group.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser is reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management and Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® T. Rowe Price Equity Income Portfolio

In considering whether to approve the renewal of the Management and Sub-Advisory Contracts for VY® T. Rowe Price Equity Income Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio underperformed its Morningstar category average for all periods presented, with the exception of the one-year and ten-year periods, during which it outperformed; (2) the Portfolio underperformed its primary benchmark for all periods presented, with the exception of the one-year period, during which it outperformed; and (3) the Portfolio is ranked in the second quintile of its Morningstar category for the one-year period, the third quintile for the year-to-date and ten-year periods, and the fourth quintile for the three-year and five-year periods.

In analyzing this performance data, the Board took into account: (1) Management’s representations regarding the impact of security selection and sector allocation on the Portfolio’s performance; (2) Management’s discussion of the changes implemented to the Portfolio’s portfolio management team in November 2015, which Management represented had improved the Portfolio’s performance since that time; (3) Management’s confidence in the Sub- Adviser’s ability to execute the Portfolio’s investment objective; and (4) Management’s discussion of the Portfolio’s favorable performance during certain periods.

In considering the fees payable under the Management and Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described above and also considered: (1) the economies of scale benefits to the Portfolio and its shareholders from breakpoint discounts applicable to the Portfolio’s management fee rate, which result in lower fees at higher asset levels; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is below the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and the average net expense ratios of the funds in its Selected Peer Group.

In analyzing this fee data, the Board took into account Management’s representations regarding the expense borne by the Manager for the provision of services, such as transfer agency, custody, accounting and legal services, to the Portfolio pursuant to the Portfolio’s Unified Fee Structure.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser is reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management and Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

VY® T. Rowe Price International Stock Portfolio

In considering whether to approve the renewal of the Management, Sub-Advisory and Sub-Sub-Advisory Contracts for VY® T. Rowe Price International Stock Portfolio, the Board considered that, based on performance data for the periods ended March 31, 2017: (1) the Portfolio outperformed its Morningstar category average for all periods presented; (2) the Portfolio outperformed its primary benchmark for all periods presented, with the exception of the one-year period, during which it underperformed; and (3) the Portfolio is ranked in the first (highest) quintile of its Morningstar category for the one-year and three-year periods, the second quintile for the year-to-date period, and the third quintile for the five-year and ten-year periods.

In considering the fees payable under the Management, Sub-Advisory and Sub-Sub-Advisory Contracts for the Portfolio, the Board took into account the factors described

98

ADVISORY AND SUB-ADVISORY CONTRACT APPROVAL DISCUSSION (UNAUDITED) (CONTINUED)

above and also considered: (1) the fairness of the compensation under a Management Contract with a breakpoint fee schedule where the asset level necessary to achieve a breakpoint discount had not been reached by the Portfolio; and (2) the pricing structure (including the net expense ratio to be borne by shareholders) of the Portfolio, as compared to its Selected Peer Group, including that: (a) the contractual management fee for the Portfolio is below the median and the average management fees of the funds in its Selected Peer Group; and (b) the net expense ratio for the Portfolio is below the median and the average net expense ratios of the funds in its Selected Peer Group.

After its deliberation, the Board reached the following conclusions: (1) the Portfolio’s management fee rate is reasonable in the context of all factors considered by the Board; (2) the Portfolio’s net expense ratio is reasonable in the context of all factors considered by the Board; (3) the Portfolio’s performance is reasonable in the context of all factors considered by the Board; and (4) the sub-advisory fee rate payable by the Manager to the Sub-Adviser and the Sub-Sub-Advisory fee rate payable by the Sub-Adviser to the Sub-Sub-Adviser are reasonable in the context of all factors considered by the Board. Based on these conclusions and other factors, the Board voted to renew the Management, Sub-Advisory and Sub-Sub-Advisory Contracts for the Portfolio for the year ending November 30, 2018. During this renewal process, different Board members may have given different weight to different individual factors and related conclusions.

99

Investment Adviser

Voya Investments, LLC

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258

Distributor

Voya Investments Distributor, LLC

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258

Transfer Agent

BNY Mellon Investment Servicing (U.S.) Inc.

301 Bellevue Parkway

Wilmington, Delaware 19809

Independent Registered Public Accounting Firm

KPMG LLP

Two Financial Center

60 South Street

Boston, Massachusetts 02111

Custodian

The Bank of New York Mellon

225 Liberty Street

New York, New York 10286

Legal Counsel

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199

Before investing, carefully consider the investment objectives, risks, charges and expenses of the variable annuity contract or variable life insurance policy and the underlying variable investment options. This and other information is contained in the prospectus for the variable annuity contract or variable life insurance policy and the underlying variable investment options. Obtain these prospectuses from your agent/registered representative and read them carefully before investing.

RETIREMENT | INVESTMENTS | INSURANCE

voyainvestments.com

|

VPAR-VIT1AISS2 (1217-022118) |

Annual Report

December 31, 2017

Classes ADV, I, P2, R6, S and S2

Voya Investors Trust

■

Voya High Yield Portfolio

■

Voya Large Cap Growth Portfolio

■

Voya Large Cap Value Portfolio

■

Voya Limited Maturity Bond Portfolio

■

Voya Multi-Manager Large Cap Core Portfolio

■

Voya U.S. Stock Index Portfolio

■

VY® Clarion Real Estate Portfolio

■

VY® Franklin Income Portfolio

■

VY® JPMorgan Small Cap Core Equity Portfolio

■

VY® Templeton Global Growth Portfolio

| | | This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. | | |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Portfolios’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This report contains a summary portfolio of investments for certain Portfolios. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios’ Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

[This Page Intentionally Left Blank]

After a Strong Year, Positive Expectations

Dear Shareholder,

The U.S. equity market proved resilient throughout 2017, posting a “perfect pitch” year with not one single month of negative returns. A lot of chatter in the markets has focused on the low levels of volatility that prevailed in 2017, and whether 2018 will be the year that volatility returns (witness early February markets). As usual there are also any number of geopolitical or other risks that could cause a sell-off, but we are heartened by the reality of macroeconomic fundamentals, which include strong and synchronous global growth; we believe these would likely be a governor on a rise in volatility.

We believe the United States, Europe and China will continue to dominate the world economy in 2018. Combined, the three account for about $48 trillion of GDP, more than 60% of the $79 trillion global GDP produced each year. And the rest of the world still has its own positive backdrop: The International Monetary Fund projects that 185 of 190 national economies will grow in 2018.

While economic growth may be synchronous across the globe, it is not likely to be uniform — thus, broad global diversification across continents and asset classes remains important for positioning your portfolio to benefit from potential opportunities. Regardless of where individual markets are in their business cycles, we believe investors are best served by following their asset allocation plan and avoiding the temptation to time entry or exit points.

If your goals have changed, thoroughly discuss them with your investment advisor before making any changes to your investment strategy. We seek to remain a reliable partner committed to reliable investing, helping you and your investment advisor achieve your goals. We appreciate your continued confidence in us, and we look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President and Chief Executive Officer

Voya Family of Funds

January 19, 2018

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and the Voya mutual funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for a Voya mutual fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any Voya mutual fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

Market Perspective: Year Ended December 31, 2017

In our semi-annual report we described how global equities, in the form of the MSCI World IndexSM (the “Index”), measured in local currencies, including net reinvested dividends, rose 8.25%, carried higher in what seemed to be the path of least resistance. Investor sentiment was still trying to come to terms with the unexpected result of the U.S. presidential election. For this and perhaps more importantly, other reasons, the Index continued its advance, rising in every month, to end up 18.48% for the fiscal year. (The Index returned 22.40% for the year ended December 31, 2017, measured in U.S. dollars.)

By mid-year most commentators had largely discounted a reflation trade driven by U.S. legislative initiatives. But this did not mean that such initiatives were dead; just that the credibility of anything market friendly coming out of them had fallen very low. The President had said on February 9 that he would announce his pro-growth tax reform plan in the coming weeks. Nothing solid had emerged and by early July the Senate was still pre-occupied with the Affordable Care Act (“ACA”), desperately trying to pass any version of a repeal and replace bill. Such attempts finally foundered in the early hours of July 28.

But investors could still take comfort in a narrative of improving global growth and corporate earnings, with monetary conditions still historically easy, to underpin the prices of risk assets. The evidence was there to see. In August the Wall Street Journal observed that the prices of base metals had recently hit multi-year highs, inferring that investors were increasingly bullish on global growth, and later noted that every country tracked by the Organization for Economic Cooperation and Development was set to grow in 2017.

In the euro zone, unemployment ended November at 8.8%, the lowest since January 2009. Gross domestic product (“GDP”) grew 2.5% year-over-year in the third quarter of 2017, slightly higher than the U.S. (2.3%). The European Central Bank finally confirmed that monthly bond purchases would be halved to €30 billion in 2018. The region’s Economic Sentiment Indicator ended the period at the highest since 2000.

China’s GDP growth in the second quarter of 2017 was a healthy 6.9% year-over-year and 6.8% in the third. Imports were continuing to grow at double-digit year-over-year rates, supporting global demand. Excessive debt remained a problem in financial markets, however. In November the authorities announced curbs on leverage in asset management products and promises of guaranteed returns.

Even Japan contributed some good news with GDP rising in the third quarter of 2017 for the seventh straight quarter.

In the U.S., the Federal Reserve (“Fed”) added 25bp (0.25%) to the federal funds rate in March and did so again in June. But areas of sluggishness, like low core consumer price inflation and wage growth persisted into September, which started with devastating hurricanes and rising geo-political tensions with North Korea. Some commentators suggested that the Fed might be done for the year.

However, the hurricanes subsided, geo-political tensions cooled and yet another forlorn attempt to replace the ACA was shrugged off. The December employment report showed the unemployment rate barely above 4%, near the lowest since February 2001. Third quarter GDP growth was reported at 3.2% (annualized) after 3.1% in the second. The outline of a long-awaited pro-growth tax reform program was finally announced, although moving day by day to bring recalcitrant

senators on board. For investors, its key feature was a reduction in the corporate tax rate to 21%, which many believed would be used to increase share buy-backs and dividends. The Fed duly raised the federal funds rate by another 25bp (0.25%) in December and the tax bill was signed into law on December 22.

In U.S. fixed income markets, the Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Aggregate”) added 3.54% in the fiscal year. The Treasury yield curve became flatter, with yields on maturities up to about nine years rising and those on longer maturities falling. Thus the Bloomberg Barclays U.S. Treasury Bond Index rose 2.31% while the Bloomberg Barclays Long-Term U.S. Treasury sub-index gained 8.53%. Indices of riskier classes generally outperformed Treasuries: the Bloomberg Barclays U.S. Corporate Investment Grade Bond Index climbed 6.42%, the Bloomberg Barclays High-Yield Bond — 2% Issuer Constrained Composite Index (not a part of the Barclays Aggregate) rose 7.50%.

U.S. equities, represented by the S&P 500® Index including dividends, surged 21.83% in 2017. The earnings per share of its constituent companies grew 6.4% year-over-year in the third quarter of 2017, after two quarters of double-digit gains. Technology was the leader, soaring 38.83%. Telecommunications and energy were the laggards, falling 1.25% and 1.01% respectively. Index companies thought to offer comparatively good earnings growth outperformed those considered to offer comparatively good value by more than 12%.

In currencies, the dollar fell 12.37% against the euro, 8.63% against the pound, reflecting some dissipation of the post-election reflation euphoria. In the meantime, the euro zone’s prospects had improved, while some of the panic over Brexit had faded. The dollar slipped 3.65% against the yen, moving within a narrow trading range for most of the year.

In international markets, the MSCI Japan® Index jumped 19.75% over the year, in an environment of improving corporate governance and profitability, with little competition from fixed income investments. The MSCI Europe ex UK® Index rose 13.59%. Aside from the positive developments noted above, corporate earnings were improving and political fears were assuaged by the election of a centrist President in France. But gains were muted by the strengthening euro. The MSCI UK® Index rose 11.94%. GDP growth was down to 0.4% in each of the middle two quarters, Brexit negotiations were slow and inconclusive and we believe by year end it was abundantly clear that the UK’s position was very weak.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 366-0066 or log on to www.voyainvestments.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of Voya Investment Management’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

| | | Index | | | | Description | | |

| | | Bloomberg Barclays High Yield Bond — 2% Issuer Constrained Composite Index | | | | An index that includes all fixed-income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. | | |

| | | Bloomberg Barclays U.S. 1-3 Year

Government/Credit Bond Index | | | | A widely recognized index of publicly issued fixed rate, investment grade debt securities, including Treasuries, Agencies and credit securities with a maturity of one to three years. | | |

| | | Bloomberg Barclays U.S. Aggregate Bond Index | | | | An index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. | | |

| | | Bloomberg Barclays U.S. Corporate Investment Grade Bond Index | | | | An index consisting of publicly issued, fixed rate, nonconvertible, investment grade debt securities. | | |

| | | Bloomberg Barclays Long-Term U.S. Treasury Index | | | | This index measures the performance of U.S. Treasury bills with long-term maturity. The credit level for this index is investment grade. The rebalance scheme is monthly. | | |

| | | Bloomberg Barclays U.S. Treasury Bond Index | | | | A market capitalization-weighted index that measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of one year or more. | | |

| | | MSCI Europe ex UK® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. | | |

| | | MSCI Japan® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. | | |

| | | MSCI U.S. REIT® Index | | | | A free float-adjusted market capitalization weighted index that is comprised of equity real estate investment trusts that are included in the MSCI U.S. Investable Market 2500 Index (with the exception of specialty REITs that do not generate a majority of their revenue and income from real estate rental and leasing obligations). The index represents approximately 85% of the U.S. REIT market. | | |

| | | MSCI UK® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. | | |

| | | MSCI World IndexSM | | | | An index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. | | |

| | | Russell 1000® Index | | | | A comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies. | | |

| | | Russell 1000® Growth Index | | | | Measures the performance of the 1,000 largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth. | | |

| | | Russell 1000® Value Index | | | | An index that measures the performance of those Russell 1000® securities with lower price-to-book ratios and lower forecasted growth values. | | |

| | | Russell 2000® Index | | | | An index that measures the performance of securities of small U.S. companies. | | |

| | | S&P 500® Index | | | | An index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. | | |

| Voya High Yield Portfolio | Portfolio Managers’ Report |

| | Investment Type Allocation

as of December 31, 2017

(as a percentage of net assets) | |

| | | | | | |

| | Corporate Bonds/Notes | | | 96.7% | |

| | Bank Loans | | | 0.6% | |

| | Convertible Bonds/Notes | | | 0.0% | |

| | Assets in Excess of Other Liabilities* | | | 2.7% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Voya High Yield Portfolio (the “Portfolio”) seeks to provide investors with a high level of current income and total return. The Portfolio is managed by Rick Cumberledge, CFA, Matthew Toms, CFA, and Randall Parrish, CFA, Portfolio Managers of Voya Investment Management Co. LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2017, the Portfolio’s Class S shares provided a total return of 6.20% compared to the Bloomberg Barclays High Yield Bond — 2% Issuer Constrained Composite Index, which returned 7.50% for the same period.

Portfolio Specifics: After two years of a market dominated by commodity-related sectors, the high yield market experienced greater dispersion of returns in 2017 — both within and across sectors. While pharmaceuticals, chemicals and utilities posted double-digit returns, wireline telecom, retailers and supermarkets sector returns were all sub-2%. There were both winners and losers within the energy space, as the march toward $60 a barrel for oil at year-end was not a straight line through the year and did not benefit all companies equally.

Much of the Portfolio’s underperformance during the reporting period was driven by our holdings in retailers and supermarkets that underperformed the market as investors adopted a view that Amazon.com would end retail as we know it — a view we do not share. Encouraging holiday sales reports lifted the retail sector a bit at year-end. However, the damage was done earlier in the year and holdings such as PetSmart, Inc. Neiman Marcus Group Ltd. and Tops Markets did not recoup all their losses. We added selectively to our exposure late in the year as we gained confidence in holiday sales trends.

The largest positive contributor to performance was the energy sector, where we continued to focus on exploration and production companies operating high quality assets and those with manageable balance sheets. As we gained confidence that OPEC’s rebalancing plan was drawing down inventories and supporting oil prices, we added to oil-focused producers such as California Resources Corp. during the second half of the year.

Current Strategy and Outlook: The backdrop for corporate credit has continued to improve with strong global growth, the

| | Top Ten Holdings

as of December 31, 2017*

(as a percentage of net assets) | |

| | | | | | |

| | Sprint Communications, Inc., 6.000%, 11/15/22 | | | 0.9% | |

| | HCA, Inc., 7.500%, 02/15/22 | | | 0.7% | |

| | First Data Corp., 7.000%, 12/01/23 | | | 0.7% | |

| | Hot Topic, Inc., 9.250%, 06/15/21 | | | 0.6% | |

| | WPX Energy, Inc., 6.000%, 01/15/22 | | | 0.6% | |

| | Sprint Corp., 7.125%, 06/15/24 | | | 0.6% | |

| | Valeant Pharmaceuticals International, Inc., 6.750%, 08/15/21 | | | 0.6% | |

| | Vizient, Inc., 10.375%, 03/01/24 | | | 0.6% | |

| | SFR Group SA, 6.250%, 05/15/24 | | | 0.5% | |

| | Telecom Italia Capital SA, 6.375%, 11/15/33 | | | 0.5% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

passage of corporate tax reform in the United States and still accommodative monetary policy. With stock prices higher and earnings estimates being revised upward, we believe that risk assets (including high yield bonds) should remain well supported even as the U.S. Federal Reserve Board gradually pulls back its monetary policy support. Spreads are near their post-crisis tights, which we believe leaves little room for negative geopolitical events or the prospect of the European Central Bank and/or Bank of Japan pulling back on monetary accommodation as we move through the back half of 2018. In our opinion, we are likely to see continued volatility in the retail, health care and energy sectors, which we believe will present opportunities for outperformance in the coming year.

In keeping with our view of solid U.S. growth, we maintain a slight cyclical bias and an overweight to B-rated and CCC-rated bonds. In our view, there will continue to be winners and losers within retail and we believe we will have an opportunity to buy the winners at attractive levels. We have become more positive on energy as oil inventories have declined. That being said, we believe credit selection will be key as we do not expect outcomes to be uniform across the sector. Health care is more difficult to gauge given the impact of changes in laws and regulations, but we continue to monitor developments in search of opportunities.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | Voya High Yield Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2017 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Class ADV | | | | | 5.83% | | | | | | 4.60% | | | | 6.84% | | |

| | | Class I | | | | | 6.58% | | | | | | 5.23% | | | | 7.49% | | |

| | | Class S | | | | | 6.20% | | | | | | 4.97% | | | | 7.21% | | |

| | | Class S2 | | | | | 6.04% | | | | | | 4.79% | | | | 7.05% | | |

| | | Bloomberg Barclays High Yield Bond - 2% Issuer Constrained Composite Index | | | | | 7.50% | | | | | | 5.78% | | | | 8.09% | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya High Yield Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable

annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Prior to February 5, 2014, the Portfolio was managed by a different sub-adviser.

| Voya Large Cap Growth Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2017

(as a percentage of net assets) | |

| | | | | | |

| | Information Technology | | | 37.9% | |

| | Consumer Discretionary | | | 18.3% | |

| | Industrials | | | 12.9% | |

| | Health Care | | | 12.9% | |

| | Consumer Staples | | | 6.7% | |

| | Financials | | | 4.0% | |

| | Materials | | | 3.3% | |

| | Real Estate | | | 2.5% | |

| | Energy | | | 0.8% | |

| | Assets in Excess of Other Liabilities* | | | 0.7% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Voya Large Cap Growth Portfolio (the “Portfolio”) seeks long-term capital growth. The Portfolio is managed by Christopher F. Corapi, Jeffrey Bianchi, CFA, and Michael Pytosh, Portfolio Managers of Voya Investment Management Co. LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2017, the Portfolio’s Class S shares, provided a total return of 29.42% compared to the Russell 1000® Growth Index, which returned 30.21% for the same period.

Portfolio Specifics: The Portfolio outperformed the Russell 1000® Growth Index before the deduction of fees and expenses, but underperformed net of fees and expense during the reporting period. Security selection in the health care and materials sectors detracted the most from results. An allocation to cash, while within the typical range, was also a headwind during the period. The most significant contributors for the period included stock selection within the consumer staples and real estate sectors.

The biggest detractors included O’Reilly Automotive, Inc., Boeing Company and Foot Locker, Inc.

An overweight position in O’Reilly Automotive, Inc. generated unfavorable results. The stock sold off significantly after pre-announcing negative quarterly results which included weaker than expected same store sales growth. The disappointing sales growth, combined with little visibility on when trends would improve, fueled concerns about online encroachment on the space and an eventual structural decline in margins.

Not owning aerospace company Boeing Company detracted from performance during the period. The company’s shares advanced following strong second quarter 2017 results and an increase in full year guidance. Investors have been skeptical on the company’s ability to generate strong free cash flow. However, Boeing Company showed strong upside to estimates in the second quarter and raised full year cash generation on the heels of good order flow and better execution on its 787 program.

Our overweight in specialty retailer Foot Locker, Inc. detracted from results. Despite reporting better than expected comps in March and April, the

| | Top Ten Holdings

as of December 31, 2017

(as a percentage of net assets) | |

| | | | | | |

| | Microsoft Corp. | | | 6.4% | |

| | Apple, Inc. | | | 5.8% | |

| | Amazon.com, Inc. | | | 3.6% | |

| | UnitedHealth Group, Inc. | | | 3.1% | |

| | Home Depot, Inc. | | | 3.0% | |

| | Comcast Corp. – Class A | | | 2.9% | |

| | Facebook, Inc. | | | 2.9% | |

| | Alphabet, Inc. - Class A | | | 2.6% | |

| | Texas Instruments, Inc. | | | 2.5% | |

| | Johnson & Johnson | | | 2.2% | |

| | Portfolio holdings are subject to change daily. | |

company lowered second quarter 2017 sales and earnings growth guidance due to a shift in the athletic cycle. The multiple contracted significantly on a 4% reduction to consensus estimates and we believe investors were skeptical that growth would reaccelerate in the second half of the year.

The top contributors during the reporting period included an overweight in VMware, Inc., coupled with underweights in Walt Disney Company and General Electric Company.

An overweight position in VMware, Inc. contributed to results during the period. Its shares outperformed following strong quarterly results and a raise 2018 guidance as momentum continues in the company’s hybrid cloud business.

Within the consumer services sector, not owning Walt Disney Company was beneficial during the period. The stock was negatively impacted by weak first quarter 2017 results which saw accelerating subscriber declines at ESPN and decelerating advertising growth, reigniting concerns over the impact of online competition on the cable space.

Not owning shares of General Electric Company contributed to performance during the year. The company’s shares sharply declined following a substantial third quarter 2017 earnings shortfall and lowered guidance, which led to investor uncertainty as to the timing of a turnaround.

Current Strategy and Outlook: We believe that the U.S. economy is continuing its trend of self-sustaining, if modest, economic recovery. Amidst improving economic conditions in the U.S. and increased optimism about the outlook for economic growth, the U.S. Federal Reserve Board is expected to move toward a normalized interest rate environment. We believe, the health of U.S. corporations remains intact, as evidenced by significant amounts of free cash flow and record high incremental margins. U.S. corporations are also actively returning capital to shareholders via dividend increases and share buybacks.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | Voya Large Cap Growth Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2017 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Class ADV | | | | | 29.01% | | | | | | 15.73% | | | | 11.20% | | |

| | | Class I | | | | | 29.74% | | | | | | 16.38% | | | | 11.87% | | |

| | | Class R6(1) | | | | | 29.80% | | | | | | 16.39% | | | | 11.88% | | |

| | | Class S | | | | | 29.42% | | | | | | 16.09% | | | | 11.59% | | |

| | | Class S2 | | | | | 29.22% | | | | | | 15.92% | | | | 11.43% | | |

| | | Russell 1000® Growth Index | | | | | 30.21% | | | | | | 17.33% | | | | 10.00% | | |

| | | | | |

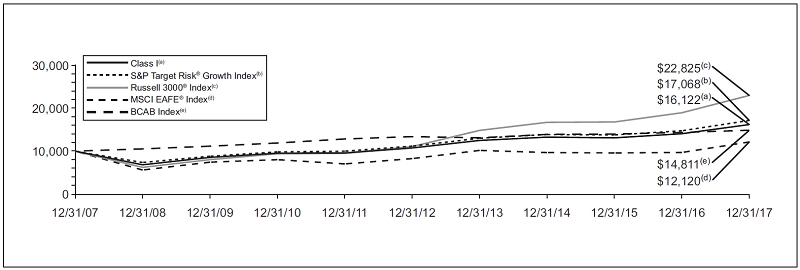

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Large Cap Growth Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is

not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.