Voya Government Liquid Assets Portfolio (the “Portfolio”) seeks a high level of current income consistent with the preservation of capital and liquidity. The Portfolio is managed by David S. Yealy, Portfolio Manager of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets) |

| Deutsche Bank Repurchase Agreement dated 12/31/2019, 1.55%, due 1/2/2020, $111,763,623 to be received upon repurchase (Collateralized by $135,443,927, multiple securities, 0.00%, Market Value plus accrued interest $115,106,620 due 2/15/2028-2/15/2031), 1.550% | | 15.4 | % |

| Federal Home Loan Bank Discount Notes, 14.600%, 01/07/20 | | 14.5 | % |

| United States Treasury Bill, 14.340%, 06/18/20 | | 14.3 | % |

| Deutsche Bank Repurchase Agreement dated 12/31/2019, 1.50%, due 1/2/2020, $101,008,697 to be received upon repurchase (Collateralized by $74,642,100, Bond, 4.500%, Market Value plus accrued interest $103,020,131 due 8/15/2039), 1.550% | | 13.9 | % |

| Deutsche Bank Repurchase Agreement dated 12/31/2019, 1.50%, due 1/2/2020, $101,008,417 to be received upon repurchase (Collateralized by $150,941,745, TINT, 0.00%, Market Value plus accrued interest $104,030,000 due 2/15/2028-3/15/2037), 1.500% | | 13.9 | % |

| BlackRock Liquidity Funds, FedFund, Institutional Class, 1.520%, 01/02/20 | | 4.5 | % |

| Federal Farm Credit Banks, 1.791%, 07/02/20 | | 3.7 | % |

| Federal Home Loan Banks, 1.670%, 10/16/20 | | 3.6 | % |

| Federal Home Loan Banks, 1.782%, 03/25/20 | | 3.3 | % |

| Goldman Sachs Financial Square Government Fund — Institutional Shares, 1.550%, 01/02/20 | | 3.1 | % |

| | | | |

Portfolio holdings are subject to change daily. |

| |

The Portfolio maintained a shorter than normal weighted average maturity (“WAM”) during the majority of the period as the market was pricing in a more dovish Fed monetary policy than what we expected. Market yields were fully pricing in the rate cuts prior to the rate moves, which limited the potential to pick up additional yield by extending maturities. The Portfolio maintained an exposure to floating rate money market securities, shifting out of floaters tied to three-month LIBOR and into floaters tied to either one-month LIBOR or floaters tied to one-day SOFR as the three-month LIBOR rate reflected overly optimistic expectations for future rate cuts in our opinion. The Portfolio took advantage of the cheapness of new issue T-bills from time to time, which allowed the Portfolio to capture some capital gains over and above the yield on those securities, and to add incremental total return.

You could lose money by investing in the Portfolio. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Portfolio’s sponsor has no legal obligation to provide financial support to the Portfolio, and you should not expect that the sponsor will provide financial support to the Portfolio at any time.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| PORTFOLIO MANAGERS’ REPORT | VY® CLARION GLOBAL REAL ESTATE PORTFOLIO |

| | |

Geographic Diversification

as of December 31, 2019

(as a percentage of net assets) |

| United States | | 54.0 | % |

| Japan | | 11.9 | % |

| Hong Kong | | 6.3 | % |

| United Kingdom | | 6.0 | % |

| Germany | | 4.2 | % |

| Australia | | 3.5 | % |

| Sweden | | 2.7 | % |

| France | | 2.7 | % |

| Singapore | | 2.5 | % |

| Canada | | 2.0 | % |

| Countries between 0.4%–0.8%ˆ | | 3.4 | % |

| Assets in Excess of Other Liabilities* | | 0.8 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

ˆ Includes 6 countries, which each represents 0.4%–0.8% of net assets. |

Portfolio holdings are subject to change daily. |

VY® Clarion Global Real Estate Portfolio (the “Portfolio”) seeks high total return consisting of capital appreciation and current income. The Portfolio is managed by T. Ritson Ferguson, CFA, Chief Executive Officer and Global Chief Investment Officer, Steven D. Burton, CFA, Co-Chief Investment Officer, and Joseph P. Smith, CFA, President and Co-Chief Investment Officer, Portfolio Managers of CBRE Clarion Securities LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2019, the Portfolio’s Class S shares provided a total return of 24.35% compared to the FTSE EPRA Nareit Developed Index and S&P 500® Index, which returned 21.91% and 31.49%, respectively, for the same period.

Portfolio Specifics: Real estate stocks generated a strong total return in 2019. After several lackluster performance years, real estate stocks had an impressive bounce-back year in 2019. Performance was broad-based, led by European and North American companies. Overall, real estate stocks were driven by the stock specific attributes of attractive valuations, stable earnings, and well-covered dividends combined with a favorable macro backdrop as exemplified by three 25 basis point (0.25%) cuts in policy rates by the Federal Open Market Committee (to a now 1.50 – 1.75% range), continued accommodative central bank policies around the world, a possible breakthrough in trade negotiations between the U.S. and China, and a U.K. election in December 2019 that appears to have brought clarity to the direction of the Brexit process in 2020. Given that many of the real estate and macro characteristics that defined 2019 are expected to remain in place for the foreseeable future, we expect 2020 to be another attractive total return year for real estate stocks.

We believe the moderate outlook for global economic growth is good for real estate stocks. In our view, the economic expansion should continue in 2020, but we acknowledge that this economic expansion (which is the longest in generations) could be derailed by geopolitical risks including Brexit, U.S. trade policy uncertainty, and a slowing/bottoming Chinese economy. As a result of these geopolitical risks, we believe that central banks around the world will remain accommodative and interest rate increases will be on-hold for 2020. In our view, inflationary pressures appear tame at present. Despite a slowing pace of growth, we believe that labor markets remain tight at this stage of the economic cycle and the capital markets remain receptive to companies that need to raise or refinance attractively priced debt.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets) |

| |

| ProLogis, Inc. | | 5.1 | % |

| Equity Residential | | 3.3 | % |

| Link REIT | | 3.2 | % |

| Simon Property Group, Inc. | | 3.1 | % |

| Invitation Homes, Inc. | | 2.7 | % |

| VEREIT, Inc. | | 2.5 | % |

| Welltower, Inc. | | 2.2 | % |

| Mitsubishi Estate Co., Ltd. | | 2.2 | % |

| Alexandria Real Estate Equities, Inc. | | 2.1 | % |

| GLP J-Reit | | 2.0 | % |

| |

Portfolio holdings are subject to change daily. |

The Portfolio outperformed the FTSE EPRA Nareit Developed Index during the period as value was added in each of the three major geographic regions. Stock selection was the driver of outperformance as sector allocation decisions detracted from relative performance during the period. The Americas region was the top contributor to performance and was led by stock selection in the U.S. Portfolio holdings in the healthcare, technology real estate and net lease sectors were the top contributors. Positions in the office, shopping center and storage sectors also added value. In Europe, holdings in the U.K. and Continental Europe contributed to relative performance. In the U.K., portfolio holdings in the student housing, industrial and storage sectors were the top performers. Selective positioning in German residential and Scandinavian companies drove positive stock selection on the Continent. Stock selection in the Asia-Pacific region was positive during the period as stock selection in Australia, Japan and Singapore contributed to performance, while stock selection in Hong Kong was a modest drag. Sector allocation decisions detracted from relative performance as positioning in the Americas accounted for essentially all of the shortfall. An overweight to the underperforming U.S. technology real estate sector was the primary detractor during the period, while sector allocation in Europe and the Asia-Pacific region was also a slight drag.

Current Strategy and Outlook: We believe that real estate stocks have good earnings growth potential and a 3–4% dividend yield that should grow in line with earnings. In our view, real estate stocks are attractively priced versus the private real estate and fixed income markets. Additionally, in our opinion, there is a significant amount of capital amassing in the private real estate market that could lead to increased M&A activity.

We are positive on property types and markets with valuations that we believe are attractive relative to their growth. In the U.S., we favor data centers, cell towers, West Coast office, grocery anchored shopping centers, medical office, life science, and gaming real estate investment trusts (“REITs”).

In the Asia-Pacific region, we favor Japanese logistics REITs as well as companies that have the potential for corporate governance enhancements. In Hong Kong, given the geopolitical uncertainty, we emphasize companies that have what we believe to be the best in class

5

| VY® CLARION GLOBAL REAL ESTATE PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

management teams and conservatively capitalized balance sheets. In Australia, we prefer diversified real estate companies as well as companies that levered their operating expertise and capital as asset managers.

In Europe, we favor the U.K. niche sectors of student housing, self-storage and the industrial sector, all of which continue to generate superior earnings growth on strong fundamentals. In Continental Europe, we continue to prefer property companies in markets with superior growth, including the Nordic region and Spain. We have selectively added deeply discounted names in the retail and office sectors.

We are cautious and selective in markets and property types which, in our view, screen expensive relative to the rate of earnings growth. This includes Singapore, Canada and the U.S. skilled nursing, and industrial sectors. This also includes Class B mall/shopping center companies globally. In Europe, we are cautious on the German residential sector given its renewed regulatory risk in Berlin. We also remain cautious on retail despite more attractive valuations. In Australia, our outlook is mixed as fundamentals range from a robust industrial market to an uncertain retail market, and a residential market which is finding a bottom. Lastly, we remain cautious in Hong Kong, as the geopolitical uncertainly is weighing on property fundamentals.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

6

| PORTFOLIO MANAGERS’ REPORT | VY® CLARION GLOBAL REAL ESTATE PORTFOLIO |

| | |

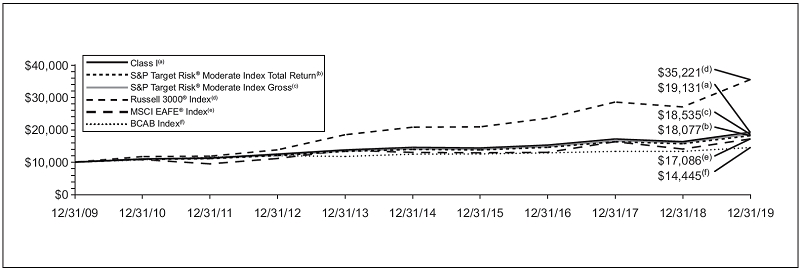

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 23.99 | % | | | 4.06 | % | | | 6.92 | % |

| Class I | | | 24.74 | % | | | 4.68 | % | | | 7.57 | % |

| Class S | | | 24.35 | % | | | 4.40 | % | | | 7.29 | % |

| Class S2 | | | 24.15 | % | | | 4.26 | % | | | 7.13 | % |

| FTSE EPRA Nareit Developed Index | | | 21.91 | % | | | 5.56 | % | | | 8.37 | % |

S&P 500® Index | | | 31.49 | % | | | 11.70 | % | | | 13.56 | % |

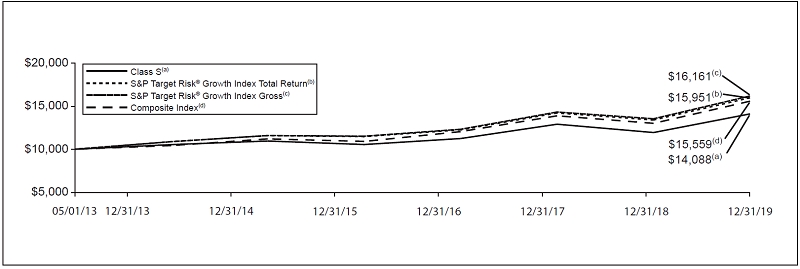

Based on a $10,000 initial investment the graph and table above illustrate the total return of VY® Clarion Global Real Estate Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in the index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service

providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

7

| VY® INVESCO GROWTH AND INCOME PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

Sector Diversification

as of December 31, 2019

(as a percentage of net assets) |

| Financials | | 25.5 | % |

| Health Care | | 16.4 | % |

| Information Technology | | 10.9 | % |

| Energy | | 10.6 | % |

| Consumer Discretionary | | 8.6 | % |

| Consumer Staples | | 7.8 | % |

| Industrials | | 6.6 | % |

| Materials | | 4.1 | % |

| Communication Services | | 4.0 | % |

| Utilities | | 2.1 | % |

| Assets in Excess of Other Liabilities* | | 3.4 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

Portfolio holdings are subject to change daily. |

VY® Invesco Growth and Income Portfolio (the “Portfolio”) seeks long-term growth of capital and income. The Portfolio is managed* by Brian Jurkash, co-lead portfolio manager, Matthew Titus, co-lead portfolio manager and Sergio Marcheli, portfolio manager, of Invesco Advisers, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2019, the Portfolio’s Class S shares provided a total return of 24.73%, compared to the Russell 1000® Value Index, which returned 26.54%, for the same period.

Portfolio Specifics: For the year ended December 31, 2019, the Portfolio underperformed the Russell 1000® Value Index.

Stock selection in consumer discretionary was the largest detractor from relative performance within the Portolio, due largely to Capri Holdings and Carnival Corporation. Capri Holdings’ Michael Kors brand has suffered from declining sales, and the company reduced its outlook for the brand in 2020. Shares of cruise operator Carnival declined in June after the company reported profit declines and a weaker outlook for the remainder of 2019.

The Portfolio’s cash position also detracted from relative returns. While less than 5% on average, cash created a drag in the strong equity market rally.

Materials also detracted from relative returns, due primarily to The Mosaic Company, a potash and phosphate supplier. Mosaic announced plans to reduce phosphate production, which is intended to benefit the company long term, but has the potential to negatively affect short-term earnings.

Security selection in financials, particularly banks, was the largest positive contributor to the Portfolio’s relative returns. Following a sharp sell-off in the fourth quarter of 2018, banks rebounded in the first quarter of 2019, and in our view, performed well throughout the year as revenues have generally improved and companies continue to return capital to shareholders through stock buybacks and increased dividends.

Stock selection in health care also contributed to relative performance. Within the sector, Celgene was a key contributor. The company was acquired by Bristol Meyers Squibb at a significant premium, and shares of the acquisition target rose sharply following the announcement.

Top Ten Holdings

as of December 31, 2019*

(as a percentage of net assets) |

| |

| Johnson & Johnson | | 3.6 | % |

| Bank of America Corp. | | 3.4 | % |

| Philip Morris International, Inc. | | 3.2 | % |

| Citigroup, Inc. | | 3.1 | % |

| American International Group, Inc. | | 2.9 | % |

| Morgan Stanley | | 2.6 | % |

| General Motors Co. | | 2.6 | % |

| PNC Financial Services Group, Inc. | | 2.5 | % |

| General Dynamics Corp. | | 2.2 | % |

| Royal Dutch Shell PLC — Class A | | 2.1 | % |

* Excludes short-term investments. |

Portfolio holdings are subject to change daily. |

| |

The Portfolio held currency forward contracts during the year for the purpose of hedging currency exposure of non-U.S.-based companies held in the Portfolio. These derivatives were not for speculative purposes or leverage, and these positions had a small negative impact on the Portfolio’s relative performance for the year.

Current Strategy and Outlook: During the year, the team reduced the Portfolio’s overweights relative to the Russell 1000® Value Index in financials and energy, and increased exposure to consumer staples, materials and consumer discretionary. At the end of the year, the Portfolio’s largest overweight exposures were in the information technology, health care and financials sectors, while the largest underweight exposures were in the real estate, utilities and communication services sectors.

| * | | Effective December 31, 2019, Thomas B. Bastian was removed as a portfolio manager to the Portfolio. |

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

8

| PORTFOLIO MANAGERS’ REPORT | VY® INVESCO GROWTH AND INCOME PORTFOLIO |

| | |

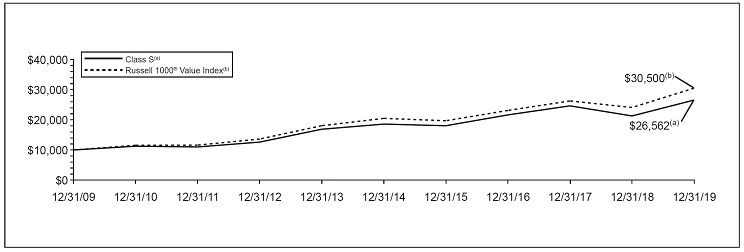

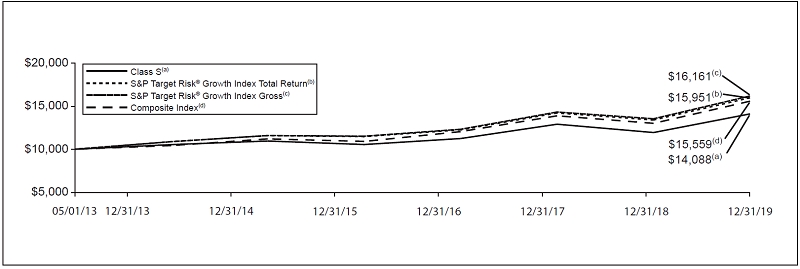

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 24.30 | % | | | 7.02 | % | | | 9.88 | % |

| Class I | | | 24.98 | % | | | 7.67 | % | | | 10.54 | % |

| Class S | | | 24.73 | % | | | 7.40 | % | | | 10.26 | % |

| Class S2 | | | 24.47 | % | | | 7.23 | % | | | 10.09 | % |

Russell 1000® Value Index | | | 26.54 | % | | | 8.29 | % | | | 11.80 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Invesco Growth and Income Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service

providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

9

VY® JPMORGAN EMERGING

MARKETS EQUITY PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

Geographic Diversification

as of December 31, 2019

(as a percentage of net assets) |

| China | | 29.1 | % |

| India | | 19.9 | % |

| Hong Kong | | 7.8 | % |

| Taiwan | | 7.5 | % |

| Brazil | | 6.3 | % |

| South Korea | | 5.2 | % |

| South Africa | | 4.2 | % |

| Mexico | | 3.6 | % |

| Indonesia | | 2.5 | % |

| Russia | | 2.3 | % |

| Countries between 0.2%–2.0%ˆ | | 11.5 | % |

| Assets in Excess of Other Liabilities* | | 0.1 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

ˆ Includes 11 countries, which each represents 0.2%–2.0% of net assets. |

Portfolio holdings are subject to change daily. |

VY® JPMorgan Emerging Markets Equity Portfolio (the “Portfolio”) seeks capital appreciation. The Portfolio is managed by Austin Forey, Managing Director, Leon Eidelman, CFA and Managing Director, and Amit Mehta, CFA and Executive Director; each a Portfolio Manager of J.P. Morgan Investment Management Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2019, the Portfolio’s Class S Shares provided a total return of 31.91% compared to the MSCI Emerging Markets IndexSM (“MSCI EM IndexSM”), which returned 18.42% for the same period.

Portfolio Specifics: The Portfolio outperformed MSCI EM IndexSM for the year ended December 31, 2019, as stock selection and country allocation contributed to results.

Stock selection in China was a significant contributor to returns during the year, specifically driven by the Portfolio’s exposure to New Oriental Education, a provider of private educational services with a presence in over 83 cities across China. The company has continued to benefit from industry consolidation as increased regulatory scrutiny has, in our view, weighed on the smaller players in the space.

Our exposure to MercadoLibre, which is based in Argentina and is Latin America’s leading e-commerce company, was a top contributor in the period. The stock rose 95.3% (in USD terms) during the year, and has continued to benefit from consistently strong quarterly results and growth in its payments platform, MercaoPago.

On the downside, the Portfolio’s lack of exposure to Gazprom, one of the largest producers of gas in the world and a state owned enterprise, was a leading detractor from relative returns during the period. For a number of years, the company has declined to increase its dividend to levels requested by the Russian Government citing CAPEX requirements. The stock price was boosted by the unexpected announcement that the company will raise the 2018 dividend by 60%. Despite what we consider to be appealing change in the company, it has 40 red flags in our checklist of risk factors, a high level, and so is not considered a suitable investment, in our view.

In South Africa, the Portfolio’s exposure to Mr. Price, a discount retail store, weighed on relative performance. The stock fell 20.7% (in USD terms) during the period, on the back of the weak consumer environment in South Africa.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets) |

| |

| Alibaba Group Holding Ltd. ADR | | 5.6 | % |

| Housing Development Finance Corp. | | 4.8 | % |

| AIA Group Ltd. | | 4.6 | % |

| HDFC Bank Ltd. ADR | | 4.1 | % |

| Samsung Electronics Co., Ltd. | | 4.1 | % |

| Tencent Holdings Ltd. | | 4.0 | % |

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | 3.5 | % |

| Ping An Insurance Group Co. of China Ltd. — H Shares | | 2.6 | % |

| Sberbank of Russia PJSC | | 2.3 | % |

| Techtronic Industries Co., Ltd. | | 2.1 | % |

Portfolio holdings are subject to change daily. |

Current Strategy and Outlook: In 2020, in our view, the biggest risks for emerging markets (“EM”) remain slowing global growth, trade tensions, and a stubbornly-strong U.S. dollar. However, over the past six months, key emerging & developed market central banks have cut interest rates a cumulative 41 times, a number comparable to the 2008 financial crisis. We believe this easing has already helped economic indicators improve since the middle of 2019 and could continue to support a recovery.

In an environment where earnings are challenged, we look for the opportunities in EM equities where earnings growth can compound over the long-run. We believe that month-end valuations of 1.70 times book value are no longer as compelling as they were 6 months ago, but remain below the long-term average.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

10

| PORTFOLIO MANAGERS’ REPORT | VY® JPMORGAN EMERGING

MARKETS EQUITY PORTFOLIO |

| | |

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 31.47 | % | | | 7.98 | % | | | 4.85 | % |

| Class I | | | 32.23 | % | | | 8.64 | % | | | 5.48 | % |

| Class S | | | 31.91 | % | | | 8.36 | % | | | 5.22 | % |

| Class S2 | | | 31.64 | % | | | 8.19 | % | | | 5.06 | % |

MSCI EM IndexSM | | | 18.42 | % | | | 5.61 | % | | | 3.68 | % |

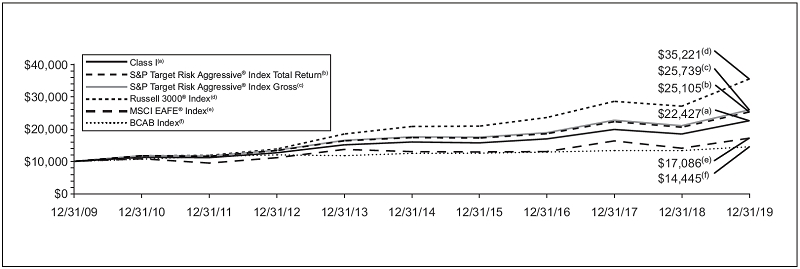

Based on a $10,000 initial investment, the graph and table above illustrate the total return of the VY® JPMorgan Emerging Markets Equity Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service

providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

11

VY® MORGAN STANLEY GLOBAL

FRANCHISE PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

Geographic Diversification

as of December 31, 2019

(as a percentage of net assets) |

| United States | | 64.5 | % |

| United Kingdom | | 18.4 | % |

| France | | 5.7 | % |

| Germany | | 5.6 | % |

| Netherlands | | 3.3 | % |

| Italy | | 0.9 | % |

| Assets in Excess of Other Liabilities* | | 1.6 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

Portfolio holdings are subject to change daily. |

VY® Morgan Stanley Global Franchise Portfolio (the “Portfolio”) seeks long-term capital appreciation. The Portfolio is managed by William D. Lock, Managing Director, Bruno Paulson, Managing Director, Nic Sochovsky, Managing Director, Vladimir A. Demine, Executive Director, Dirk Hoffmann-Becking, Executive Director, Marcus Watson, Executive Director, Alex Gabriele, Executive Director, Nathan Wong, Executive Director, and Richard Perrott, Vice President, Portfolio Managers* of Morgan Stanley Investment Management Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2019, the Portfolio’s Class S shares provided a total return of 29.34% compared to the MSCI World IndexSM (the “Index”), which returned 27.67% for the same period.

Portfolio Specifics: The strong fourth quarter of 2019 rounded off a very strong year, with the Index finishing up 28% in USD (27% local). In sector terms, there were two major outliers, with information technology up a massive 48%, while energy, by contrast, only gained 11%. The other sectors were relatively tightly bunched, although the more defensive sectors such as consumer staples, health care and utilities (all +23%) were a little behind the Index. The U.S. (+31%) once again outperformed the Index, along with Netherlands (+32% USD, +34% local) and Switzerland (+32%, +30%). At the other end of the spectrum, Hong Kong (+10% USD and local), Spain (+12%, +14%) and the UK (+21%, +16%) were affected by political uncertainties, while Singapore (+15%, +13%), Japan (+20%, +18%) and Germany (+21%, +23%) were hit by worries about trade and industrial production.

For the year, sector allocation and stock selection were both positive. The overweight in information technology and the lack of energy stocks were both helpful for sector allocation, more than making up for the overweight in consumer staples and the drag from the small cash allocation in the very strong year for the markets. The outperformance in the health care and financials sectors drove the positive stock selection, despite underperformance in communication services and consumer staples.

Over the year the largest absolute contributors were Microsoft (+3.91%), Philip Morris International (+2.25%) and Accenture (+2.17%). The largest absolute detractors were Fox Corporation (-0.08%) and Altria (-0.05%), while Disney was the smallest absolute contributor (+0.02%).

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets) |

| |

| Microsoft Corp. | | 8.3 | % |

| Philip Morris International, Inc. | | 7.9 | % |

| Reckitt Benckiser Group PLC | | 7.4 | % |

| SAP SE | | 5.6 | % |

| Visa, Inc. — Class A | | 5.4 | % |

| Accenture PLC | | 4.8 | % |

| Automatic Data Processing, Inc. | | 4.2 | % |

| Baxter International, Inc. | | 4.0 | % |

| Danaher Corp. | | 3.8 | % |

| Becton Dickinson & Co. | | 3.7 | % |

Portfolio holdings are subject to change daily. |

Current Strategy and Outlook: We advocate the case for quality by looking for companies with the intangible assets to give them both recurring revenue and pricing power, along with the ability to sustain high returns on capital. We believe one of the pluses such companies offer is resilience in tough times: the recurring revenue protects sales and the pricing power protects margins. In our view, in 2019, the Portfolio’s companies displayed this economic resilience, with the earnings continuing to compound steadily while the market as a whole failed to deliver any earnings growth. At a time of heightened multiples and high uncertainty, we would argue that it makes sense to go with the relative safety and durability of high-quality compounders.

| * | | Effective May 1, 2019, Nathan Wong was added as a portfolio manager to the Portfolio. |

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

12

| PORTFOLIO MANAGERS’ REPORT | VY® MORGAN STANLEY GLOBAL

FRANCHISE PORTFOLIO |

| | |

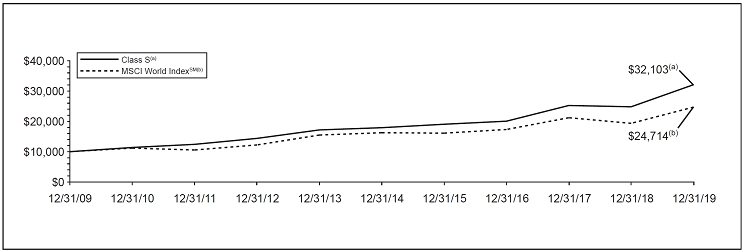

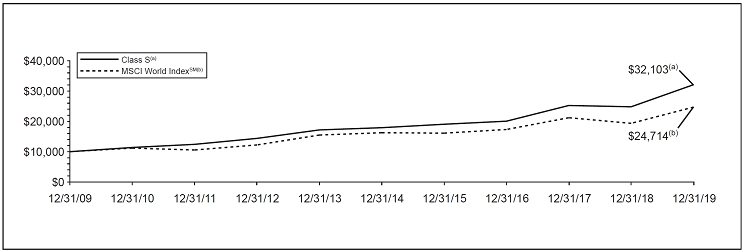

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 28.89 | % | | | 11.98 | % | | | 11.97 | % |

Class R6(1) | | | 29.74 | % | | | 12.59 | % | | | 12.47 | % |

| Class S | | | 29.34 | % | | | 12.37 | % | | | 12.36 | % |

| Class S2 | | | 29.15 | % | | | 12.20 | % | | | 12.20 | % |

MSCI World IndexSM | | | 27.67 | % | | | 8.74 | % | | | 9.47 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Morgan Stanley Global Franchise Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or

a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| (1) | | Class R6 incepted on May 3, 2016. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class S shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different. |

13

VY® T. ROWE PRICE CAPITAL

APPRECIATION PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

Investment Type Allocation

as of December 31, 2019

(as a percentage of net assets) |

| Common Stock | | 63.3 | % |

| Corporate Bonds/Notes | | 16.4 | % |

| Preferred Stock | | 5.3 | % |

| Bank Loans | | 4.6 | % |

| Asset-Backed Securities | | 0.3 | % |

| Assets in Excess of Other Liabilities* | | 10.1 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

Portfolio holdings are subject to change daily. |

VY® T. Rowe Price Capital Appreciation Portfolio (the “Portfolio”) seeks, over the long-term, a high total investment return, consistent with the preservation of capital and with prudent investment risk. The Portfolio is managed by David R. Giroux, CFA and Vice President of T. Rowe Price Associates, Inc. — the Sub-Adviser.

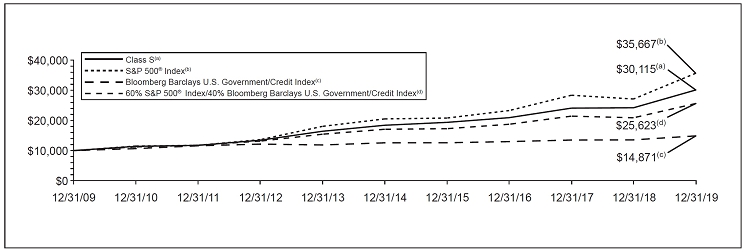

Performance: For the year ended December 31, 2019, the Portfolio’s Class S shares provided a total return of 24.36%. By comparison, the S&P 500® Index, the Bloomberg Barclays U.S. Government/Credit Index, and the 60% S&P 500® Index/40% Bloomberg Barclays U.S. Government/Credit Index returned 31.49%, 9.71% and 22.64% for the same period.

Portfolio Specifics: In 2019, the Portfolio posted a positive return but underperformed its all-equity benchmark, the S&P 500® Index. The Portfolio’s equity and fixed income allocations had positive returns and outperformed their benchmarks, the S&P 500® Index and the Bloomberg Barclays U.S. Government/Credit Index, respectively.

Our overall fixed income weight declined from the prior year, as we eliminated our position in U.S. Treasuries on strength. Our largest exposure in fixed income remains high yield, where we are focused on short duration and/or idiosyncratic issues.

Within equities, the information technology sector detracted from relative returns due to stock picks, such as Maxim Integrated Products, although the negative impact was partially offset by a beneficial overweight. Despite delivering a double-digit return, the analog semiconductor company trailed the broader information technology sector on soft demand in its industrial segment, including in China, and slower auto sales. No other sector detracted from relative results. Conversely, the financials sector drove relative gains due to strong security selection. S&P Global, which provides credit ratings, benchmarks, analytics, and data platforms related to the capital and commodities markets, outperformed during the year amid strong corporate debt issuance and a healthy equity market backdrop. Security choices in the health care sector, such as Danaher, also aided relative results, although a detrimental overweight position partially tempered the gains. Danaher outperformed on continued strong execution and news in February it will buy GE’s biopharma business, which sells supplies and equipment for developing and producing biologic drugs, for $21 billion.

Top Ten Holdings

as of December 31, 2019*

(as a percentage of net assets) |

| |

| Microsoft Corp. | | 4.2 | % |

| Visa, Inc. — Class A | | 3.6 | % |

| General Electric Co. | | 3.6 | % |

| PerkinElmer, Inc. | | 3.1 | % |

| Fiserv, Inc. | | 3.2 | % |

| Marsh & McLennan Cos., Inc. | | 3.0 | % |

| Danaher Corp. | | 2.6 | % |

| Becton Dickinson & Co. | | 2.5 | % |

| Alphabet, Inc. — Class C | | 2.3 | % |

| Thermo Fisher Scientific, Inc. | | 2.3 | % |

* Excludes short-term investments. |

Portfolio holdings are subject to change daily. |

During the reporting period, the covered call strategy represented, on average, 11.88% of the overall Portfolio and generated a return of approximately 20.85%. The covered call strategy’s estimated contribution to the Portfolio’s total return was 2.51%. The estimated return impact from employing options was –78 basis points (–0.78%) for the reporting period December 31, 2018, through December 31, 2019.

Current Strategy and Outlook: Risk assets persevered to deliver a strong rally from the marked downturn at the end of 2018, in our opinion, seeming to shrug off the myriad of risks that headlined 2019, from Brexit concerns and U.S.-China trade tensions to sluggish global growth and disappointing manufacturing data. While we believe that current valuations suggest markets expect headwinds to recede and growth to accelerate, modest earnings growth expectations, upcoming U.S. election uncertainty, and the muted impact from accommodative monetary policy have created a scenario where we believe risk is skewed to the downside. Given our position late in the cycle and the risks facing the global economy, we have a cautious view and continue to position the Portfolio conservatively.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

14

| PORTFOLIO MANAGERS’ REPORT | VY® T. ROWE PRICE CAPITAL

APPRECIATION PORTFOLIO |

| | |

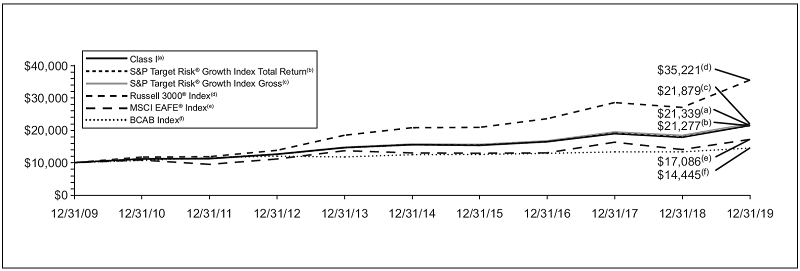

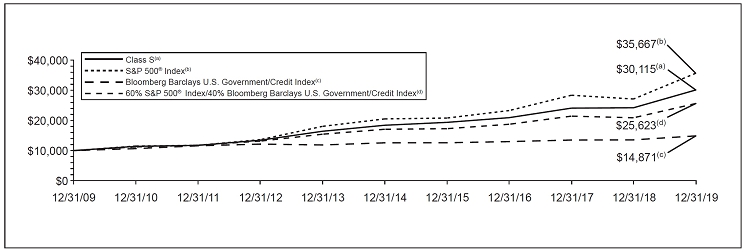

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 23.99 | % | | | 9.95 | % | | | 11.27 | % |

| Class I | | | 24.71 | % | | | 10.61 | % | | | 11.93 | % |

Class R6(1) | | | 24.74 | % | | | 10.62 | % | | | 11.94 | % |

| Class S | | | 24.36 | % | | | 10.33 | % | | | 11.65 | % |

| Class S2 | | | 24.19 | % | | | 10.17 | % | | | 11.49 | % |

S&P 500® Index | | | 31.49 | % | | | 11.70 | % | | | 13.56 | % |

| Bloomberg Barclays U.S. Government/Credit Index | | | 9.71 | % | | | 3.23 | % | | | 3.96 | % |

60% S&P 500® Index/40% Bloomberg Barclays U.S. Government/Credit Index | | | 22.64 | % | | | 8.45 | % | | | 9.87 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® T. Rowe Price Capital Appreciation Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a

variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| (1) | | Class R6 incepted on May 3, 2016. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different. |

15

| VY® T. ROWE PRICE EQUITY INCOME PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

Sector Diversification

as of December 31, 2019

(as a percentage of net assets) |

| Financials | | 23.9 | % |

| Health Care | | 13.4 | % |

| Industrials | | 11.9 | % |

| Energy | | 8.7 | % |

| Utilities | | 8.4 | % |

| Information Technology | | 8.0 | % |

| Consumer Staples | | 7.9 | % |

| Communication Services | | 6.1 | % |

| Materials | | 4.5 | % |

| Real Estate | | 3.5 | % |

| Consumer Discretionary | | 2.4 | % |

| Assets in Excess of Other Liabilities* | | 1.3 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

Portfolio holdings are subject to change daily. |

VY® T. Rowe Price Equity Income Portfolio (the “Portfolio”) seeks a high level of dividend income as well as long-term growth of capital primarily through investments in stocks. The Portfolio is managed by John Linehan, Head of U.S. Equity and Portfolio Manager of T. Rowe Price Associates, Inc. — the Sub-Adviser.

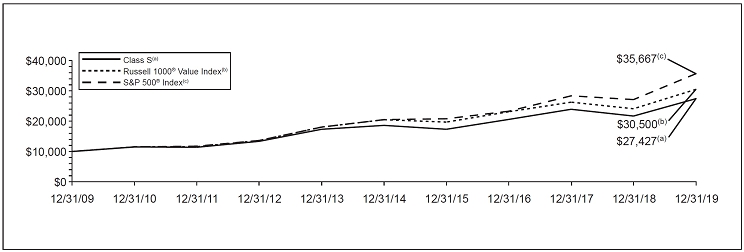

Performance: For the year ended December 31, 2019, the Portfolio’s Class S shares provided a total return of 26.42% compared to the Russell 1000® Value Index and the S&P 500® Index, which returned 26.54% and 31.49% respectively, for the same period.

Portfolio Specifics: Gross of fees and expenses, the Portfolio performed in line with the Russell 1000® Value Index for the reporting period. Stock selection in consumer staples was the leading contributor to relative returns for the reporting period, including Tyson Foods and Conagra Brands. Shares of Tyson Foods continued to benefit from the ongoing effects of African swine fever, causing global protein prices to rise in wake of the outbreak, and the reopening of the Chinese market to U.S. poultry sales later in the year.

Stock selection in information technology also boosted relative returns. Shares of Qualcomm finished higher as a result of the chip manufacturer reaching a multibillion-dollar settlement with Apple in the second quarter, followed by a strong revenue beat later in the year, as MSM shipments exceeded expectations.

The energy sector bolstered returns due to favorable stock selection, driven by TC Energy.

In contrast, stock selection in the communication services sector was the largest detractor from relative results. Shares of Telefonica underperformed during the year resulting from structural foreign exchange risk pertaining to Argentina and Great Britain and less than favorable performance of the broader Spanish telecommunications sector due to an increasingly competitive landscape.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets) |

| |

| Wells Fargo & Co. | | 3.8 | % |

| JPMorgan Chase & Co. | | 3.4 | % |

| Qualcomm, Inc. | | 2.5 | % |

| Total S.A. ADR | | 2.4 | % |

| Southern Co. | | 2.4 | % |

| Johnson & Johnson | | 2.3 | % |

| Morgan Stanley | | 1.9 | % |

| Chubb Ltd. | | 1.9 | % |

| Tyson Foods, Inc. | | 1.8 | % |

| General Electric Co. | | 1.8 | % |

Portfolio holdings are subject to change daily. |

The materials sector also hindered relative returns due to stock selection, particularly an investment in DuPont de Nemours. Shares of the company traded lower as a result of falling commodity chemical input prices, slowing demand in end markets, and the announced merger of DuPont’s Nutrition & Biosciences segment with International Flavors & Fragrances via a Reverse Morris Trust.

Current Strategy and Outlook: We believe the current balance of risks in the marketplace suggests caution is warranted. While a strong consumer and what we believe to be a more accommodative monetary policy provide support, we believe regulatory and political risks will be elevated in 2020. Given neutral valuations, we expect positive but muted returns for the equity market in 2020 coupled with the potential for more extreme outcomes. Share price appreciation in recent periods has made pockets of what we believe to be attractive investment opportunities tougher to come by. Despite this challenging environment, we have identified, in our view, attractively valued investment opportunities through bottom-up, fundamental analysis and continue to maintain a disciplined, longer-term approach while also taking advantage of volatility to selectively add shares of what we believe are high-quality companies.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

16

| PORTFOLIO MANAGERS’ REPORT | VY® T. ROWE PRICE EQUITY INCOME PORTFOLIO |

| | |

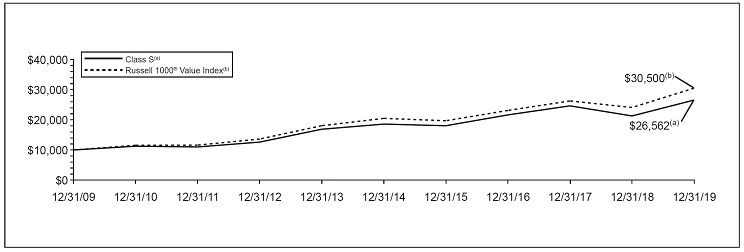

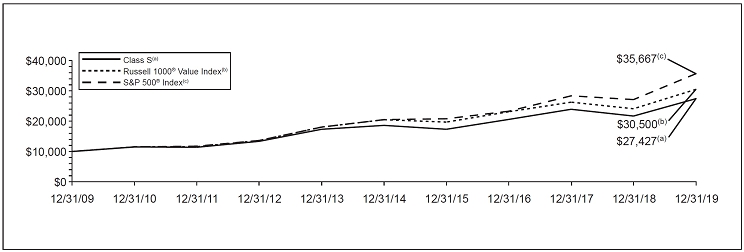

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 25.93 | % | | | 7.66 | % | | | 10.22 | % |

| Class I | | | 26.66 | % | | | 8.31 | % | | | 10.88 | % |

| Class S | | | 26.42 | % | | | 8.06 | % | | | 10.62 | % |

| Class S2 | | | 26.13 | % | | | 7.88 | % | | | 10.44 | % |

Russell 1000® Value Index | | | 26.54 | % | | | 8.29 | % | | | 11.80 | % |

S&P 500® Index | | | 31.49 | % | | | 11.70 | % | | | 13.56 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® T. Rowe Price Equity Income Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

Effective May 25, 2018, the Portfolio changed its benchmark from the S&P 500® Index to the Russell 1000® Value Index because the Russell 1000® Value Index is considered by the Sub-Adviser to be a more appropriate benchmark that better aligns with the Portfolio’s value-focused investment style.

17

VY® T. ROWE PRICE INTERNATIONAL

STOCK PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | |

Geographic Diversification

as of December 31, 2019

(as a percentage of net assets) |

| Japan | | 14.5 | % |

| Netherlands | | 8.3 | % |

| Switzerland | | 7.6 | % |

| France | | 7.1 | % |

| China | | 6.8 | % |

| United Kingdom | | 6.4 | % |

| India | | 5.0 | % |

| Germany | | 4.6 | % |

| South Korea | | 4.4 | % |

| Canada | | 4.1 | % |

| Countries between 0.2%–3.0%ˆ | | 29.3 | % |

| Assets in Excess of Other Liabilities* | | 1.9 | % |

| Net Assets | | 100.0 | % |

* Includes short-term investments. |

ˆ Includes 21 countries, which each represents 0.2%–3.0% of net assets. |

Portfolio holdings are subject to change daily. |

| |

VY® T. Rowe Price International Stock Portfolio (the “Portfolio”) seeks long-term growth of capital. The Portfolio is managed by Richard N. Clattenburg, CFA and Vice President, Portfolio Manager of T. Rowe Price Associates, Inc. — the Sub-Adviser.

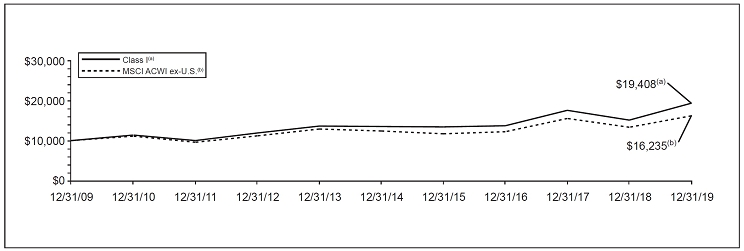

Performance: For the year ended December 31, 2019, the Portfolio’s Class I shares provided a total return of 28.04% compared to the MSCI All Country World (ex-U.S.) IndexSM (“MSCI ACWI ex-U.S.”), which returned 21.51% for the same period.

Portfolio Specifics: The Portfolio outperformed its benchmark, the MSCI ACWI ex-U.S., for the period ended December 31, 2019. Broadly speaking, stock selection and sector allocation aided performance. On the sector level, information technology was the largest contributor due to stock selection and an overweight allocation. Financials and communication services also aided relative returns due to stock selection. In contrast, holdings within industrials and business services detracted. Utilities also hindered relative performance due to stock choices, although an underweight allocation partially offset the negative impact.

Regionally, the Portfolio found relative success in Pacific ex Japan — particularly China — due to favorable security selection. Holdings in Canada were the source of underperformance.

Within the information technology sector, NXP Semiconductors was one of the top relative contributors to the Portfolio in 2019. Strong earnings in April and July helped drive relative outperformance. Much of the strength came from NXP’s mobile division — where mobile payment design efforts paid off — and the communications infrastructure business, which is benefitting more and more from the 5G build-out. Both businesses rely on NXP-specific designs, which also points to ongoing design innovation investments, a major positive in our view. The company continued to deliver good results even amid a challenging environment for semiconductor makers in the latter half of the year. NXP also issued encouraging guidance for the fourth quarter that defied the gloomier expectations from competitors.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets) |

| |

| Thales S.A. | | 2.6 | % |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | 2.2 | % |

| Alibaba Group Holding Ltd. ADR | | 2.2 | % |

| Takeda Pharmaceutical Co., Ltd. | | 2.1 | % |

| Housing Development Finance Corp. | | 2.0 | % |

| NXP Semiconductor NV — NXPI — US | | 2.0 | % |

| Naspers Ltd. | | 2.0 | % |

| Essity AB | | 2.0 | % |

| Samsung Electronics Co., Ltd. | | 1.9 | % |

| NAVER Corp. | | 1.9 | % |

Portfolio holdings are subject to change daily. |

The Portfolio’s weakness in the industrials and business services sector was largely explained by Thales, a global aerospace and defense company that specializes in electrical systems. The stock was weak in the third quarter of 2019 as the market continued to worry about falling revenues within Thales’ space division, which builds systems for satellites. That division’s problems in part led the company to cut its guidance in early October on free cash flow conversion. Just a few weeks later it issued poor earnings showing that the headwinds in the space division were larger than anticipated, while execution problems in the defense & security segment in our view, spooked investors as well. The Portfolio held currency forwards and equity options generating gross exposure of approximately 0.6%.

Current Strategy and Outlook: Significant moves by global central banks to loosen monetary policy have eased financial conditions, which we believe is supportive of global economic activity. Indeed, the most recent global manufacturing purchasing managers’ surveys suggest that activity may have turned up recently, such as in Europe, where we have seen early signs of green shoots. While slowing Chinese demand and geopolitical tensions, including protests in Hong Kong and U.S. impeachment proceedings, continue to weigh on global activity, the fading risk of a no-deal Brexit and manageable trade tensions will likely support a rebound in global growth, in our view.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

18

| PORTFOLIO MANAGERS’ REPORT | VY® T. ROWE PRICE INTERNATIONAL

STOCK PORTFOLIO |

| | |

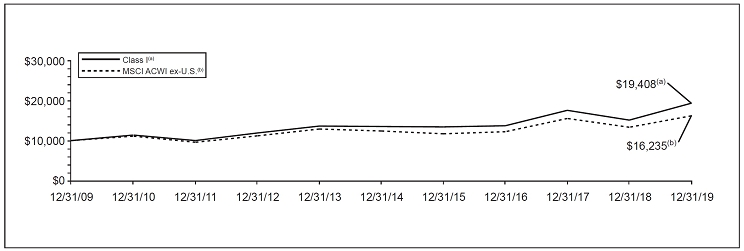

| Average Annual Total Returns for the Periods Ended December 31, 2019 |

|---|

| | 1 Year | | 5 Year | | 10 Year |

|---|

| Class ADV | | | 27.20 | % | | | 6.80 | % | | | 6.22 | % |

| Class I | | | 28.04 | % | | | 7.46 | % | | | 6.86 | % |

| Class S | | | 27.64 | % | | | 7.19 | % | | | 6.60 | % |

| MSCI ACWI ex-U.S. | | | 21.51 | % | | | 5.51 | % | | | 4.97 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® T. Rowe Price International Stock Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service

providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

19

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2019 to December 31, 2019. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension, or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Actual Portfolio Return | | Hypothetical (5% return before expenses) | |

|---|

| | | | Beginning

Account

Value

July 1,

2019 | | Ending

Account

Value

December 31,

2019 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2019* | | Beginning

Account

Value

July 1,

2019 | | Ending

Account

Value

December 31,

2019 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2019* | |

|---|

| | Voya Government Liquid Assets Portfolio |

| | Class I | | $ | 1,000.00 | | | $ | 1,009.00 | | | | 0.29 | % | | $ | 1.47 | | | $ | 1,000.00 | | | $ | 1,023.74 | | | | 0.29 | % | | $ | 1.48 | | |

| | Class S | | | 1,000.00 | | | | 1,007.70 | | | | 0.54 | | | | 2.73 | | | | 1,000.00 | | | | 1,022.48 | | | | 0.54 | | | | 2.75 | | |

| | Class S2 | | | 1,000.00 | | | | 1,006.90 | | | | 0.69 | | | | 3.49 | | | | 1,000.00 | | | | 1,021.73 | | | | 0.69 | | | | 3.52 | | |

| | VY® Clarion Global Real Estate Portfolio |

| | Class ADV | | | 1,000.00 | | | | 1,068.40 | | | | 1.49 | % | | | 7.77 | | | | 1,000.00 | | | | 1,017.69 | | | | 1.49 | % | | | 7.58 | | |

| | Class I | | | 1,000.00 | | | | 1,071.90 | | | | 0.89 | | | | 4.65 | | | | 1,000.00 | | | | 1,020.72 | | | | 0.89 | | | | 4.53 | | |

| | Class S | | | 1,000.00 | | | | 1,069.50 | | | | 1.14 | | | | 5.95 | | | | 1,000.00 | | | | 1,019.46 | | | | 1.14 | | | | 5.80 | | |

| | Class S2 | | | 1,000.00 | | | | 1,069.90 | | | | 1.29 | | | | 6.73 | | | | 1,000.00 | | | | 1,018.70 | | | | 1.29 | | | | 6.56 | | |

| | VY® Invesco Growth and Income Portfolio |

| | Class ADV | | | 1,000.00 | | | | 1,072.60 | | | | 1.24 | % | | | 6.48 | | | | 1,000.00 | | | | 1,018.95 | | | | 1.24 | % | | | 6.31 | | |

| | Class I | | | 1,000.00 | | | | 1,075.90 | | | | 0.64 | | | | 3.35 | | | | 1,000.00 | | | | 1,021.98 | | | | 0.64 | | | | 3.26 | | |

| | Class S | | | 1,000.00 | | | | 1,074.50 | | | | 0.89 | | | | 4.65 | | | | 1,000.00 | | | | 1,020.72 | | | | 0.89 | | | | 4.53 | | |

| | Class S2 | | | 1,000.00 | | | | 1,073.50 | | | | 1.04 | | | | 5.44 | | | | 1,000.00 | | | | 1,019.96 | | | | 1.04 | | | | 5.30 | | |

20

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) (CONTINUED)

| | | | Actual Portfolio Return | | Hypothetical (5% return before expenses) | |

|---|

| | | | Beginning

Account

Value

July 1,

2019 | | Ending

Account

Value

December 31,

2019 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2019* | | Beginning

Account

Value

July 1,

2019 | | Ending

Account

Value

December 31,

2019 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2019* | |

|---|

| | VY® JPMorgan Emerging Markets Equity Portfolio |

| | Class ADV | | $ | 1,000.00 | | | $ | 1,082.20 | | | | 1.86 | % | | $ | 9.76 | | | $ | 1,000.00 | | | $ | 1,015.83 | | | | 1.86 | % | | $ | 9.45 | | |

| | Class I | | | 1,000.00 | | | | 1,085.70 | | | | 1.26 | | | | 6.62 | | | | 1,000.00 | | | | 1,018.85 | | | | 1.26 | | | | 6.41 | | |

| | Class S | | | 1,000.00 | | | | 1,084.50 | | | | 1.51 | | | | 7.93 | | | | 1,000.00 | | | | 1,017.59 | | | | 1.51 | | | | 7.68 | | |

| | Class S2 | | | 1,000.00 | | | | 1,083.30 | | | | 1.66 | | | | 8.72 | | | | 1,000.00 | | | | 1,016.84 | | | | 1.66 | | | | 8.44 | | |

| | VY® Morgan Stanley Global Franchise Portfolio |

| | Class ADV | | | 1,000.00 | | | | 1,067.80 | | | | 1.54 | % | | | 8.03 | | | | 1,000.00 | | | | 1,017.44 | | | | 1.54 | % | | | 7.83 | | |

| | Class R6 | | | 1,000.00 | | | | 1,071.20 | | | | 0.94 | | | | 4.91 | | | | 1,000.00 | | | | 1,020.47 | | | | 0.94 | | | | 4.79 | | |

| | Class S | | | 1,000.00 | | | | 1,070.10 | | | | 1.19 | | | | 6.21 | | | | 1,000.00 | | | | 1,019.21 | | | | 1.19 | | | | 6.06 | | |

| | Class S2 | | | 1,000.00 | | | | 1,069.20 | | | | 1.34 | | | | 6.99 | | | | 1,000.00 | | | | 1,018.45 | | | | 1.34 | | | | 6.82 | | |

| | VY® T. Rowe Price Capital Appreciation Portfolio |

| | Class ADV | | | 1,000.00 | | | | 1,058.80 | | | | 1.24 | % | | | 6.43 | | | | 1,000.00 | | | | 1,018.95 | | | | 1.24 | % | | | 6.31 | | |

| | Class I | | | 1,000.00 | | | | 1,061.90 | | | | 0.64 | | | | 3.33 | | | | 1,000.00 | | | | 1,021.98 | | | | 0.64 | | | | 3.26 | | |

| | Class R6 | | | 1,000.00 | | | | 1,061.90 | | | | 0.64 | | | | 3.33 | | | | 1,000.00 | | | | 1,021.98 | | | | 0.64 | | | | 3.26 | | |

| | Class S | | | 1,000.00 | | | | 1,060.50 | | | | 0.89 | | | | 4.62 | | | | 1,000.00 | | | | 1,020.72 | | | | 0.89 | | | | 4.53 | | |

| | Class S2 | | | 1,000.00 | | | | 1,059.60 | | | | 1.04 | | | | 5.40 | | | | 1,000.00 | | | | 1,019.96 | | | | 1.04 | | | | 5.30 | | |

| | VY® T. Rowe Price Equity Income Portfolio |

| | Class ADV | | | 1,000.00 | | | | 1,089.80 | | | | 1.21 | % | | | 6.37 | | | | 1,000.00 | | | | 1,019.11 | | | | 1.21 | % | | | 6.16 | | |

| | Class I | | | 1,000.00 | | | | 1,093.20 | | | | 0.61 | | | | 3.22 | | | | 1,000.00 | | | | 1,022.13 | | | | 0.61 | | | | 3.11 | | |

| | Class S | | | 1,000.00 | | | | 1,093.30 | | | | 0.86 | | | | 4.54 | | | | 1,000.00 | | | | 1,020.87 | | | | 0.86 | | | | 4.38 | | |

| | Class S2 | | | 1,000.00 | | | | 1,090.90 | | | | 1.01 | | | | 5.32 | | | | 1,000.00 | | | | 1,020.11 | | | | 1.01 | | | | 5.14 | | |

| | VY® T. Rowe Price International Stock Portfolio |

| | Class ADV | | | 1,000.00 | | | | 1,093.10 | | | | 1.36 | % | | | 7.18 | | | | 1,000.00 | | | | 1,018.35 | | | | 1.36 | % | | | 6.92 | | |

| | Class I | | | 1,000.00 | | | | 1,096.90 | | | | 0.76 | | | | 4.02 | | | | 1,000.00 | | | | 1,021.37 | | | | 0.76 | | | | 3.87 | | |

| | Class S | | | 1,000.00 | | | | 1,095.00 | | | | 1.01 | | | | 5.33 | | | | 1,000.00 | | | | 1,020.11 | | | | 1.01 | | | | 5.14 | | |

| * | | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

21

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Shareholders of the Funds and Board of Trustees

Voya Investors Trust:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Voya Government Liquid Assets Portfolio, VY® Clarion Global Real Estate Portfolio, VY® Invesco Growth and Income Portfolio, VY® JPMorgan Emerging Markets Equity Portfolio, VY® Morgan Stanley Global Franchise Portfolio, VY® T. Rowe Price Capital Appreciation Portfolio, VY® T. Rowe Price Equity Income Portfolio, and VY® T. Rowe Price International Stock Portfolio (the Funds), each a series of Voya Investors Trust, including the summary portfolios and portfolios of investments, as of December 31, 2019, the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years or periods in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of December 31, 2019, the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of December 31, 2019, by correspondence with the custodian, transfer agent and brokers or by other appropriate auditing procedures when replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Voya investment companies since 1975.

Boston, Massachusetts

February 21, 2020

22

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2019 | | Voya

Government

Liquid Assets

Portfolio | | VY®

Clarion Global

Real Estate

Portfolio | | VY®

Invesco

Growth and Income

Portfolio | | VY®

JPMorgan Emerging

Markets Equity

Portfolio |

|---|

ASSETS: | | | | | | | | | | | | | | | | |

| Investments in securities at fair value+* | | $ | — | | | $ | 232,525,859 | | | $ | 428,207,839 | | | $ | 511,109,746 | |

| Short-term investments at fair value** | | | — | | | | 632,792 | | | | 18,754,732 | | | | 5,671,239 | |

| Repurchase agreements | | | 313,754,000 | | | | — | | | | — | | | | — | |

| Short-term investments at amortized cost | | | 410,608,687 | | | | — | | | | — | | | | — | |

| Cash | | | 8,639 | | | | 638,241 | | | | 27,479 | | | | — | |

| Foreign currencies at value*** | | | — | | | | — | | | | 244,833 | | | | 411 | |

| Receivables: | | | | | | | | | | | | | | | | |