UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5639

Pacholder High Yield Fund, Inc

(Exact name of registrant as specified in charter)

| | |

| 8044 Montgomery Road, Ste. 555, Cincinnati, OH | | 45236 |

|

| (Address of principal executive offices) | | (Zip code) |

William J. Morgan

8044 Montgomery Road, Ste. 555

Cincinnati, OH 45236

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-985-3200

Date of fiscal year end: December 31, 2004

Date of reporting period: January 1, 2005 through June 30, 2005

Item 1. Reports to Stockholders.

PACHOLDER HIGH YIELD FUND, INC.

Dear Stockholders:

The Pacholder High Yield Fund, Inc. (the “Fund”) rebounded from a weaker first quarter of 2005 with reasonable second quarter performance. The positive momentum in the high yield market has continued through July and has held its ground into mid-August. The high yield market was very volatile in the second quarter. All of April and the first half of May produced negative total returns in the high yield market. The negative volatility early in the second quarter was driven by Ford and GM being downgraded from investment grade to high yield by Standard & Poor’s, high energy prices and no sign that the Fed would stop increasing the Fed Funds overnight lending rates. Beginning with the Consumer Price Index report on May 18, which showed inflation to be relatively low, the high yield market steadily rebounded. For the quarter ended June 30, 2005, the Fund returned +1.55% on a NAV return basis (i.e., net of expenses, including preferred stock dividends, and the effect of the Fund’s leveraged capital structure), and the Fund’s portfolio (gross of leverage and expenses) returned +1.78%. The Fund’s return on a NAV return basis lagged the average total return of all closed-end high yield funds of +2.31%, as reported by Morningstar, and the +1.83% return of the CS First Boston High Yield Index, Developed Countries Only (the “Index”).

For the six months ended June 30, 2005 the Fund’s return on a NAV return basis was +0.28%, and the Fund’s portfolio returned +1.44%. The NAV return is in line with the average total return of all closed-end high yield funds of +0.40%, as reported by Morningstar, and the Fund’s portfolio return compares favorably to the +0.64% return of the Index.

Overview of the Second Quarter

During the second quarter the high yield market performance was volatile as the Index showed first a negative April return of -1.04%, followed by increasingly stronger returns in May (+1.21%) and June (+1.67%). The GM downgrade announcement, and parallel concerns about Ford, two of the largest issuers in the investment grade corporate market, accelerated a repricing of corporate credit in the bond market that began in March and did not abate until the Consumer Price Index news on May 18. During the second quarter, BB-rated securities showed the best results in the high yield market, followed by B and CCC-rated securities. Although the market turned positive during the quarter, the return results demonstrated a traditional correction/risk aversion profile with BB-rated securities outperforming B- and CCC-rated credits, with the weakest credits generally suffering the worst. This market correction also manifested across industry sectors, as cyclical sectors such as Transportation (Auto) and Consumer Durables underperformed the market as a whole. As the positive market continued through July and into August, the CCC and B-rated sectors have outperformed BB-rated securities.

Helping to pull the high yield market out of its market correction has been the very low default rate and the outlook for low default rates to continue in the near term. The trailing twelve-month default rate for below investment grade issuers, as measured by Moody’s Investor Services, dropped from 2.20% in December 2004 to 1.8% in July 2005. As recently as March 2005 Moody’s was projecting the twelve-month default rate to come in at 2.80% by December 2005, but Moody’s has now moved the December 2005 projected twelve-month default rate down to 1.8% and expects the benign default environment to continue into 2006. The default rate has declined sharply in large part because of the continued economic growth, strong corporate profits and the liquidity available in the capital markets, which has allowed many high yield issuers to refinance near-term maturities and significantly lower their cost of borrowing.

Most companies are reporting second quarter operating results that have met or exceeded expectations. Similar to the first quarter of this year, the credit quality of high yield issuers generally has continued to improve as revenues and cash flows have grown during the current economic expansion. However, there are a number of sectors, such as Transportation (Airlines) and (Auto), which continue to suffer margin pressures due to limited pricing power and increasing costs, particularly for energy and raw materials.

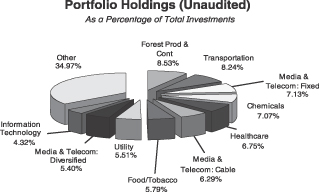

The second quarter showed consistent positive performance across most of the Index’s industry sectors as 16 of 19 sectors posted positive returns. Industry sectors of the high yield market that performed relatively well during the quarter were Utility, Energy, Retail and Communications — Fixed and Wireless. Sectors that provided weak relative performance included Transportation (Auto), Consumer Durables and Forest Products. The Fund’s portfolio is well diversified, with investments in 179 issuers in 19 different industries. The Fund’s largest industry sector concentration is in Forest Products/Containers, which accounted for 8.3% of the portfolio’s long-term market value as of June 30, 2005 (see Figure 1 — Portfolio Holdings). We overweighted this sector because we increased our exposure in a number of investments, at levels we thought relatively attractive, that had come under pressure in the market due to raw material and energy increases.

The positive performance of the high yield market during the second quarter of 2005 was evident in the Index’s average price, yield, and spread over Treasuries. For the quarter, the average price of the Index rose 0.38 points from 99.59 to 99.97, its average yield dropped 2 basis points from 7.82% to 7.80% and its spread over the comparable Treasury increased by 35 basis points from 372 to 407 basis points, as Treasury yields fell sharply during the quarter.

Investor sentiment with regard to high yield was mixed during the second quarter but improved as the quarter progressed. It appeared that

PACHOLDER HIGH YIELD FUND, INC.

institutional buyers remained cautious as the market traded down during the first seven weeks and then came into the market during the last six weeks. The quarter saw heavy outflows in both April and May out of open-end funds, and a total of $2.2 billion cash came out of the market via mutual funds during the quarter.

Second quarter returns for the broad equity indices also were mostly positive. The Russell 2000 returned +4.37%, the S&P 500 returned +1.37%, the NASDAQ Composite returned +3.07, and the Dow returned -1.63%. The rebound in most equity markets is positive for high yield because a positive equity market can provide issuers with more financial flexibility and tends to reflect higher values for business assets to support leveraged capital structures.

Portfolio Strategy and Outlook

The Fund’s theme for investing during the second quarter of 2005 continued to be individual security selection with an eye toward upgrading the overall credit quality of the portfolio while maintaining a competitive yield. The sell discipline was directed toward underperforming credits and securities that were fully valued and presented little upside potential, particularly if the issuer had a lower overall credit rating. Because the strength and duration of the economic expansion and the current market correction is not known, we will change the composition of the portfolio gradually over time, predicated on bottom-up fundamental analysis of the opportunities available in the market.

As always, we appreciate your interest in the Fund and look forward to your continued support.

Sincerely,

William J. Morgan

President

August 26, 2005

Figure 1

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders

June 30, 2005 (Unaudited)

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

CORPORATE DEBT SECURITIES — 145.1% | | | | | |

AEROSPACE — 4.6% | | | | | | | |

American Airlines, Inc., Pass Thru Cert, 9.71%, 1/2/07 | | $383 | | $358,863 | | 0.3 | % |

American Airlines, Inc., Collateral Trust Notes, 10.18%, 1/2/13 | | 300 | | 216,351 | | 0.2 | |

American Airlines, Inc., Pass Thru Cert, 7.379%, 5/23/16 | | 1,052 | | 750,693 | | 0.6 | |

American Airlines, Inc., Pass Thru Cert, 7.8%, 10/1/06 | | 1,000 | | 950,322 | | 0.8 | |

American Airlines, Inc., Sec’d

7.25%, 2/5/09 | | 500 | | 475,000 | | 0.4 | |

Continental Airlines, Inc., Pass Thru Cert, 7.568%, 12/1/06 | | 50 | | 43,053 | | 0.0 | |

Continental Airlines, Inc., Bank Debt, 2.9375%, 12/31/069 | | 318 | | 273,972 | | 0.2 | |

Continental Airlines, Inc., Sec’d,

10.45%, 12/6/07 | | 750 | | 757,500 | | 0.7 | |

Northwest Airlines Corp., Pass Thru Cert, 7.626%, 4/1/10 | | 1,016 | | 686,741 | | 0.6 | |

Wyle Laboratories, Inc., 1st Lien Bank Debt, 5.5%, 2/4/11 | | 500 | | 506,250 | | 0.4 | |

Wyle Laboratories, Inc., 2nd Lien Bank Debt, 9.25%, 8/4/11 | | 500 | | 505,000 | | 0.4 | |

| | | | |

| |

|

|

| | | | | 5,523,745 | | 4.6 | |

CHEMICALS — 10.3% | | | | | | | |

BCP Caylux Holdings, Sr Sub Nt,

9.625%, 6/15/14 | | 132 | | 147,840 | | 0.1 | |

Crompton Corp., Sr Nt,

9.875%, 8/1/12 | | 750 | | 870,000 | | 0.7 | |

Crompton Corp., FRN, Sr Nt,

9.164% 8/1/10 | | 300 | | 336,000 | | 0.3 | |

Crystal US Holdings/US Sub, Sr Disc Nt, 10.5%, 10/1/147 | | 325 | | 225,875 | | 0.2 | |

Equistar Chemicals, Sr Nt,

10.625%, 5/1/11 | | 1,000 | | 1,103,750 | | 0.9 | |

Huntsman Advanced Materials, Nt,

11%, 7/15/102 | | 200 | | 226,000 | | 0.2 | |

Innophos, Inc., Sr Sub Nt,

8.875%, 8/15/142 | | 800 | | 816,000 | | 0.7 | |

Johnsondiversey, Inc., Disc Nt,

10.48%, 5/15/137 | | 1,000 | | 711,250 | | 0.6 | |

Koppers Industry, Inc., Sec’d Nt,

9.875%, 10/15/13 | | 175 | | 189,000 | | 0.2 | |

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

CHEMICALS (continued) | | | | | | | |

Lyondell Chemical Co., Co Guar,

10.5%, 6/1/13 | | $1,000 | | $1,143,750 | | 1.0 | % |

OM Group, Sr Sub Nt, 9.25%, 12/15/11 | | 1,000 | | 1,000,000 | | 0.9 | |

Polyone Corp., Sr Nt, 8.875%, 5/1/12 | | 500 | | 493,750 | | 0.4 | |

Polyone Corp., Sr Nt,

10.625%, 5/15/10 | | 1,700 | | 1,797,750 | | 1.5 | |

Terra Capital, Inc., Sr Nt,

12.875%, 10/15/08 | | 1,025 | | 1,209,500 | | 1.0 | |

Terra Capital, Inc., Sr Nt, 11.5%, 6/1/10 | | 956 | | 1,089,840 | | 0.9 | |

United Agri Products, Sr Disc Nt,

10.74%, 7/15/127 | | 1,000 | | 820,000 | | 0.7 | |

| | | | |

| |

|

|

| | | | | 12,180,305 | | 10.3 | |

CONSUMER PRODUCTS — 4.4% | | | | | | | |

Ames True Temper Inc., Nt,

6.64%, 1/15/12 | | 1,000 | | 950,000 | | 0.8 | |

General Nutrition Center, Sr Sub Nt,

8.5%, 12/1/10 | | 125 | | 100,000 | | 0.1 | |

General Nutrition Center, Sr Nt,

8.625%, 1/15/112 | | 250 | | 231,250 | | 0.2 | |

Home Products International, Inc.,

Sr Sub Nt, 9.625%, 5/15/08 | | 932 | | 815,500 | | 0.7 | |

Levi Strauss and Co., FRN, Sr Nt, 7.73%, 4/1/122 | | 500 | | 472,500 | | 0.4 | |

Levi Strauss and Co., Sr Nt,

12.25%, 12/15/12 | | 750 | | 819,375 | | 0.7 | |

Rafealla Apparel Group, Sr Nt,

11.25%, 6/15/112 | | 1,250 | | 1,203,125 | | 1.0 | |

Westpoint Stevens, Inc., Bank Debt, 9.25%, 11/30/044 | | 658 | | 578,986 | | 0.5 | |

Westpoint Stevens, Inc., Sr Nt,

7.875%, 6/15/051,4 | | 1,000 | | 1,250 | | 0.0 | |

| | | | |

| |

|

|

| | | | | 5,171,986 | | 4.4 | |

ENERGY — 4.0% | | | | | | | |

El Paso Corp., Sr Nt, 7.875%, 6/15/126 | | 1,250 | | 1,287,500 | | 1.1 | |

Ocean Rig Norway, Sr Nt,

8.375%, 7/1/132 | | 500 | | 506,250 | | 0.4 | |

Petrobas Int’l Finance, Nt,

7.75%, 9/15/14 | | 1,000 | | 1,050,000 | | 0.9 | |

Secunda Int’l, Ltd., FRN, Sec’d, 11.141%, 9/1/12 | | 500 | | 487,500 | | 0.4 | |

Transmontaigne, Inc., Sr Sub Nt, 9.125%, 6/1/10 | | 1,400 | | 1,456,000 | | 1.2 | |

| | | | |

| |

|

|

| | | | | 4,787,250 | | 4.0 | |

3

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

June 30, 2005 (Unaudited)

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

FINANCE — 5.2% | | | | | | | |

Advanta Capital Trust, Co Guar,

8.99%, 12/17/26 | | $600 | | $585,000 | | 0.5 | % |

Crum & Forster Holding, Inc., Sr Nt, 10.375%, 6/15/13 | | 1,250 | | 1,356,250 | | 1.2 | |

Fairfax Financial, Nt, Add-on,

7.75%, 4/26/12 | | 1,000 | | 950,000 | | 0.8 | |

General Motors Acceptance Corp., Nt, 7.75%, 1/19/10 | | 1,000 | | 977,544 | | 0.8 | |

Providian Capital I, Bank Guar,

9.525%, 2/1/272 | | 1,250 | | 1,368,750 | | 1.2 | |

Refco Finance Holdings, Sr Sub Nt, 9.0%, 8/1/12 | | 800 | | 848,000 | | 0.7 | |

| | | | |

| |

|

|

| | | | | 6,085,544 | | 5.2 | |

FOOD & DRUG — 1.4% | | | | | | | |

Petro Shopping Center, Sec’d Nt,

9%, 2/15/12 | | 900 | | 904,500 | | 0.8 | |

Southern States Coop, Inc., Sr Nt, 10.5%, 10/15/102 | | 750 | | 746,250 | | 0.6 | |

| | | | |

| |

|

|

| | | | | 1,650,750 | | 1.4 | |

FOOD & TOBACCO — 9.2% | | | | | | | |

Alliance One, Nt, 11%, 5/15/122 | | 1,500 | | 1,545,000 | | 1.3 | |

Apple South, Inc., Sr Nt,

9.75%, 6/1/061,4 | | 1,500 | | 135,000 | | 0.1 | |

Avado Brands, Inc., Sr Sub Nt,

11.75%, 6/15/091,3,4 | | 500 | | 0 | | 0.0 | |

Burns Philp Cap Pty/US, Sr Sub Nt, 10.75%, 2/15/11 | | 500 | | 551,250 | | 0.5 | |

Chiquita Brands Int’l, Inc., Sr Nt, 8.875%, 12/1/152 | | 500 | | 496,250 | | 0.4 | |

Cosan SA Industria, Sr Nt,

9%, 11/1/092 | | 300 | | 310,500 | | 0.3 | |

Gold Kist, Inc., Sr Nt, 10.25%, 3/15/14 | | 487 | | 550,310 | | 0.5 | |

Golden State Foods, Sr Sub Nt,

9.24%, 1/10/128 | | 1,250 | | 1,246,875 | | 1.1 | |

Land O Lakes, Inc., Sr Nt,

8.75%, 11/15/116 | | 1,000 | | 1,007,500 | | 0.9 | |

National Beef Packaging, Sr Nt,

10.5%, 8/1/11 | | 750 | | 714,375 | | 0.6 | |

National Wine & Spirits, Inc., Sr Nt, 10.125%, 1/15/09 | | 1,750 | | 1,767,500 | | 1.5 | |

North Atlantic Trading, Sr Nt,

9.25%, 3/1/126 | | 800 | | 604,000 | | 0.5 | |

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

FOOD & TOBACCO (continued) | | | | | | | |

Sbarro, Inc., Sr Nt, 11%, 9/15/096 | | $1,500 | | $1,507,500 | | 1.3 | % |

Swift and Co., Sr Sub Nt,

12.5%, 1/1/10 | | 250 | | 279,062 | | 0.2 | |

| | | | |

| |

|

|

| | | | | 10,715,122 | | 9.2 | |

FOREST PRODUCTS & CONTAINERS — 12.7% | | | | | |

Abitibi-Consolidated Inc., Sr Notes, 8.375%, 4/1/15 | | 2,250 | | 2,295,000 | | 2.0 | |

Anchor Glass Container, Sr Sec’d Nt, 11%, 2/15/136 | | 750 | | 585,000 | | 0.5 | |

Bowater, Inc., Sr Nt, 6.5%, 6/15/136 | | 1,000 | | 987,500 | | 0.8 | |

Buckeye Cellulose Corp., Sr Sub Nt, 9.25%, 9/15/08 | | 1,410 | | 1,410,000 | | 1.2 | |

Consolidated Container, Sr Disc Nt, 10.75%, 6/15/097 | | 600 | | 462,000 | | 0.4 | |

Constar International, FRN, Nt,

6.643%, 2/15/122 | | 250 | | 238,750 | | 0.2 | |

Constar International, Sr Sub Nt,

11%, 12/1/126 | | 1,200 | | 954,000 | | 0.8 | |

Crown Cork & Seal, Sr Sec’d Nt, 10.875%, 3/1/13 | | 500 | | 587,500 | | 0.5 | |

Fibermark, Inc., Sr Nt,

10.75%, 4/15/111,4 | | 720 | | 453,600 | | 0.4 | |

Fraser Papers Inc, Sr Nt,

8.75%, 3/15/152 | | 1,000 | | 915,000 | | 0.8 | |

Norske Skog, Sr Nt, 8.625%, 6/15/11 | | 1,500 | | 1,546,875 | | 1.3 | |

Portola Packaging Inc., Sr Nt,

8.25%, 2/1/126 | | 2,825 | | 1,921,000 | | 1.6 | |

Stone Container, Sr Nt, 9.75%, 2/1/11 | | 350 | | 370,125 | | 0.3 | |

Tembec Industries, Sr Unsec’d Nt, 8.625%, 6/30/09 | | 750 | | 611,250 | | 0.5 | |

Tembec Industries, Sr Nt, 8.5%, 2/1/11 | | 1,025 | | 791,812 | | 0.7 | |

Vitro Envases Norteamerica, Sec’d Nt, 10.75%, 7/23/112 | | 850 | | 824,500 | | 0.7 | |

| | | | |

| |

|

|

| | | | | 14,953,912 | | 12.7 | |

GAMING & LEISURE — 2.9% | | | | | | | |

Bally Total Fitness Holding Corp., Sr Sub Nt, 9.875%, 10/15/076 | | 430 | | 375,175 | | 0.3 | |

Pinnacle Entertainment, Sr Sub Nt, 8.75%, 10/1/13 | | 500 | | 530,000 | | 0.5 | |

Pinnacle Entertainment, Sr Sub Nt, 8.25%, 3/15/12 | | 200 | | 208,000 | | 0.2 | |

4

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

June 30, 2005 (Unaudited)

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

GAMING & LEISURE (continued) | | | | | | | |

True Temper Sports, Inc., Sr Sub Nt, 8.375%, 9/15/11 | | $1,050 | | $973,875 | | 0.8 | % |

Wynn Las Vegas LLC, Mtg,

6.625%, 12/1/142 | | 1,300 | | 1,264,250 | | 1.1 | |

| | | | |

| |

|

|

| | | | | 3,351,300 | | 2.9 | |

HEALTH CARE — 9.3% | | | | | | | |

Ameripath, Inc., Sr Sub Nt,

10.5%, 4/1/13 | | 1,000 | | 1,012,500 | | 0.9 | |

CDRV Investors, Inc., Sr Disc Nt, 9.75%, 1/1/152,7 | | 350 | | 171,500 | | 0.1 | |

Encore Medical IHC, Inc., Sr Sub Nt, 9.75%, 10/1/12 | | 1,205 | | 1,168,850 | | 1.0 | |

Healthsouth Corp., Sr Nt,

8.375%, 10/1/11 | | 1,000 | | 992,500 | | 0.8 | |

Psychiatric Solutions, Sr Sub Nt, 10.625%, 6/15/13 | | 333 | | 369,630 | | 0.3 | |

Psychiatric Solutions, Sr Sub Nt, 7.75%, 7/15/152 | | 250 | | 250,000 | | 0.2 | |

Res-Care, Inc., Co Guar,

10.625%, 11/15/08 | | 540 | | 576,450 | | 0.5 | |

Tenet Healthcare Corp., Sr Nt,

9.25%, 2/1/152 | | 1,000 | | 1,037,500 | | 0.9 | |

Tenet Healthcare Corp., Sr Nt,

9.875%, 7/1/14 | | 1,250 | | 1,340,625 | | 1.1 | |

US Oncology Inc, Co Guar,

10.75%, 8/15/14 | | 575 | | 626,750 | | 0.5 | |

US Oncology Inc, FRN, Sr Nt,

8.62%, 3/15/152 | | 1,500 | | 1,398,750 | | 1.2 | |

Vanguard Health Holdings II, Sr Sub Nt, 9%, 10/1/14 | | 1,400 | | 1,512,000 | | 1.3 | |

Vanguard Health Holdings I, Sr Disc Nt, 10.43%, 10/1/157 | | 750 | | 532,500 | | 0.5 | |

| | | | |

| |

|

|

| | | | | 10,989,555 | | 9.3 | |

HOUSING — 4.7% | | | | | | | |

Fedders NA, Sr Nt, 9.875%, 3/1/14 | | 1,250 | | 812,500 | | 0.7 | |

Goodman Global Holdings, FRN, Sr Nt, 6.41%, 6/15/122 | | 1,500 | | 1,477,500 | | 1.3 | |

Interface, Inc., Sr Nt, 10.375%, 2/1/10 | | 500 | | 550,000 | | 0.5 | |

Interface, Inc., Sr Sub Nt,

9.5%, 2/1/146 | | 1,100 | | 1,122,000 | | 1.0 | |

RMCC Acquisition Co., Sr Sub Notes, 9.50%, 11/1/122 | | 1,500 | | 1,432,500 | | 1.2 | |

| | | | |

| |

|

|

| | | | | 5,394,500 | | 4.7 | |

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

INFORMATION TECHNOLOGY — 7.0% | | | | | |

Activant Solutions, Sr Nt,

9.0%, 4/1/102 | | $400 | | $414,000 | | 0.4 | % |

Activant Solutions, Sr Nt,

10.5%, 6/15/11 | | 200 | | 217,000 | | 0.2 | |

Advanced Micro Devices, Sr Nt,

7.75%, 11/1/12 | | 500 | | 492,500 | | 0.4 | |

Amkor Technology, Inc., Sr Nt, 7.125%, 5/15/116 | | 1,300 | | 1,124,500 | | 1.0 | |

Celestica, Inc., Sr Sub Nt,

7.625%, 7/1/13 | | 500 | | 501,250 | | 0.4 | |

Danka Business Systems, Sr Nt,

11%, 6/15/10 | | 875 | | 700,000 | | 0.6 | |

Magnachip Semiconductor, FRN, Sec’d Nt, 6.66%, 12/15/112 | | 1,000 | | 990,000 | | 0.8 | |

Magnachip Semiconductor, Sec’d Nt, 6.875%, 12/15/112 | | 750 | | 735,000 | | 0.6 | |

Smart Modular Tech, FRN, Sr Nt, 8.59%, 4/1/122 | | 1,500 | | 1,477,500 | | 1.3 | |

Stratus Technologies, Inc., Sr Nt, 10.375%, 12/1/08 | | 500 | | 485,000 | | 0.4 | |

Viasystems, Sr Sub Nt,

10.5%, 1/15/11 | | 1,150 | | 1,058,000 | | 0.9 | |

| | | | |

| |

|

|

| | | | | 8,194,750 | | 7.0 | |

MANUFACTURING — 5.7% | | | | | | | |

Case New Holland, Inc., Sr Nt,

9.25%, 8/1/112 | | 500 | | 525,000 | | 0.5 | |

Eagle-Picher, Inc., Sr Nt,

9.75%, 9/1/131,4,6 | | 1,250 | | 862,500 | | 0.7 | |

Gardner Denver, Sr Sub Nt,

8%, 5/1/132 | | 500 | | 505,830 | | 0.4 | |

Invensys PLC, Sr Nt, 9.875%, 3/15/112 | | 1,000 | | 955,000 | | 0.8 | |

Milacron Escrow Corp., Sec’d Nt, 11.5%, 5/15/11 | | 1,750 | | 1,837,500 | | 1.6 | |

Polypore, Inc., Sr Sub Nt,

8.75%, 5/15/12 | | 1,550 | | 1,449,250 | | 1.2 | |

Precision Partners, Inc., Sr Sub Nt, 12%, 2/1/073,9 | | 410 | | 410,114 | | 0.3 | |

Thermadyne Holdings Corp., Sr Sub Nt, 9.25%, 2/1/14 | | 200 | | 185,000 | | 0.2 | |

| | | | |

| |

|

|

| | | | | 6,730,194 | | 5.7 | |

5

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

June 30, 2005 (Unaudited)

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

MEDIA & TELECOM: BROADCASTING — 1.1% | | | | | |

Fisher Communications, Inc, Sr Nt,

8.625%, 9/15/14 | | $300 | | $318,375 | | 0.3 | % |

LBI Media, Inc., Sr Disc Nt,

11%, 10/15/137 | | 875 | | 648,594 | | 0.6 | |

Nexstar Fin Hldg LLC, Inc., Sr Disc Nt, 11.36%, 4/1/137 | | 250 | | 187,812 | | 0.2 | |

| | | | |

| |

|

|

| | | | | 1,154,781 | | 1.1 | |

MEDIA & TELECOM: CABLE — 7.5% | | | | | | | |

Adelphia Communications, Corp., Sr Nt, 9.375%, 11/15/091,4,6 | | 1,500 | | 1,327,500 | | 1.1 | |

Adelphia Communications, Corp., Sr Nt, 8.125%, 7/15/031,4,6 | | 750 | | 648,750 | | 0.6 | |

Adelphia Communications, Corp., Sr Nt, 6%, 2/15/061,4 | | 125 | | 6,250 | | 0.0 | |

Charter Communications Holdings LLC, Sr Nt, 10%, 4/1/09 | | 2,000 | | 1,545,000 | | 1.3 | |

Charter Communications Holdings LLC, Sr Disc Nt, 11.75%, 1/15/107 | | 250 | | 196,250 | | 0.2 | |

Charter Communications Holdings LLC, Sr Nt, 11.125%, 1/15/11 | | 200 | | 149,500 | | 0.1 | |

Insight Communications, Inc.,

Sr Disc Nt, 12.52%, 2/15/117 | | 1,000 | | 1,002,500 | | 0.9 | |

Insight Midwest, Sr Nt, 10.5%, 11/1/10 | | 1,050 | | 1,113,000 | | 0.9 | |

Mediacom LLC/Capital Corp., Sr Nt, 9.50%, 1/15/136 | | 1,800 | | 1,795,500 | | 1.5 | |

Panamsat Corp., Sr Nt, 9%, 8/15/14 | | 649 | | 708,221 | | 0.6 | |

Zeus Special Sub Ltd., Disc Nt,

9.25%, 2/1/152,7 | | 600 | | 400,500 | | 0.3 | |

| | | | |

| |

|

|

| | | | | 8,892,971 | | 7.5 | |

MEDIA & TELECOM: FIXED COMMUNICATIONS — 10.8% | | | |

Alaska Comm Sys Hldgs, Inc., Co Guar, 9.875%, 8/15/11 | | 610 | | 646,600 | | 0.5 | |

Cincinnati Bell Telephone, Sr Sub Nt, 8.375%, 1/15/14 | | 1,650 | | 1,691,250 | | 1.4 | |

Global Crossing UK Fin, Co Guar, 10.75%, 12/15/142 | | 850 | | 771,375 | | 0.7 | |

Hawaiian Telecomm Communications, Sr Nt, 9.75%, 5/1/132 | | 1,000 | | 1,060,000 | | 0.9 | |

Intelsat Bermuda Ltd., Sr Nt,

8.25%, 1/15/132 | | 500 | | 516,250 | | 0.4 | |

MCI Communications, Sr Nt,

6.688%, 5/1/09 | | 1,000 | | 1,041,250 | | 0.9 | |

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

MEDIA & TELECOM: FIXED COMMUNICATIONS (continued) | | | |

Mastec, Inc., Sr Sub Nt,

7.75%, 2/1/086 | | $780 | | $766,350 | | 0.7 | % |

Ntelos, Inc., 2nd Lien Bank Debt, 7.62%, 2/24/11 | | 500 | | 501,250 | | 0.4 | |

Primus Telecomm Group, Bank Debt, 11%, 2/18/11 | | 1,000 | | 930,000 | | 0.8 | |

Primus Telecomm Group, Sr Nt,

8%, 1/15/14 | | 500 | | 263,750 | | 0.2 | |

Qwest Communications, FRN, Sr Nt, 7.268%, 2/15/092 | | 1,001 | | 983,482 | | 0.8 | |

Qwest Communications, Sr Nt, 7.875%, 9/1/112 | | 100 | | 104,250 | | 0.1 | |

Qwest Communications, Sr Nt, 7.625%, 6/15/152 | | 250 | | 255,312 | | 0.2 | |

Qwest Communications, FRN, Sr Nt, 6.671%, 6/15/132 | | 1,000 | | 1,023,750 | | 0.9 | |

Time Warner Communications, Sr Nt, 9.25%, 2/15/142 | | 750 | | 723,750 | | 0.6 | |

Time Warner Communications, Sr Nt, 9.75%, 7/15/086 | | 1,000 | | 1,005,000 | | 0.9 | |

Time Warner Communications, Sr Nt, 9.25%, 2/15/14 | | 500 | | 482,500 | | 0.4 | |

| | | | |

| |

|

|

| | | | | 12,766,119 | | 10.8 | |

MEDIA & TELECOM: WIRELESS COMMUNICATIONS — 4.6% | | | |

ACC Escrow Corp., Sr Nt, 10%, 8/1/11 | | 1,000 | | 1,015,000 | | 0.9 | |

Dobson Cellular Systems, FRN, Sec’d, 7.96%, 11/1/112 | | 500 | | 520,000 | | 0.4 | |

Dobson Cellular Systems, Sec’d, 9.875%, 11/1/122 | | 1,000 | | 1,055,000 | | 0.9 | |

Horizon PCS, Inc., Sr Nt,

11.375%, 7/15/12 | | 350 | | 390,250 | | 0.3 | |

Rogers Wireless, Inc., Sec’d Nt, 6.375%, 3/1/14 | | 250 | | 254,375 | | 0.2 | |

Rural Cellular Corp., Sr Sub Nt, 9.625%, 5/15/086 | | 1,300 | | 1,254,500 | | 1.1 | |

SBA Communications Corp., Sr Disc Nt, 9.75%, 12/15/117 | | 391 | | 359,720 | | 0.3 | |

TSI Telecommunications, Inc., Sr Sub Nt, 12.75%, 2/1/09 | | 158 | | 175,183 | | 0.1 | |

US Unwired, Inc., Sr Sec’d Nt,

10%, 6/15/12 | | 450 | | 500,625 | | 0.4 | |

| | | | |

| |

|

|

| | | | | 5,524,653 | | 4.6 | |

6

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

June 30, 2005 (Unaudited)

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

MEDIA & TELECOM: DIVERSIFIED — 7.6% | | | | | |

IMAX Corp., Sr Nt, 9.625%, 12/1/10 | | $2,100 | | $2,205,000 | | 1.9 | % |

Mail-Well I Corp., Sr Sub Nt,

7.875%, 12/1/13 | | 2,000 | | 1,900,000 | | 1.6 | |

Phoenix Color Corp., Sr Sub Nt, 10.375%, 2/1/09 | | 1,730 | | 1,606,738 | | 1.4 | |

Primedia, Inc., Sr Nt, 8.875%, 5/15/11 | | 425 | | 445,188 | | 0.4 | |

Six Flags, Inc., Sr Nt, 9.625%, 6/1/14 | | 1,000 | | 935,000 | | 0.8 | |

Six Flags, Inc., Sr Nt, 8.875%, 2/1/106 | | 600 | | 585,000 | | 0.5 | |

Six Flags, Inc., Sr Nt, 9.75%, 4/15/13 | | 400 | | 377,500 | | 0.3 | |

Universal City Development, Sr Nt, 11.75%, 4/1/10 | | 750 | | 860,625 | | 0.7 | |

| | | | |

| |

|

|

| | | | | 8,915,051 | | 7.6 | |

METALS & MINERALS — 3.5% | | | | | | | |

AK Steel Corp., Co Guar,

7.875%, 2/15/096 | | 1,505 | | 1,369,550 | | 1.2 | |

Chaparral Steel Co., Sr Nt,

10%, 7/15/132 | | 1,200 | | 1,206,000 | | 1.0 | |

Neenah Corp., Sr Sub Nt,

11%, 9/30/102 | | 200 | | 217,000 | | 0.2 | |

US Steel, LLC, Sr Nt, 9.75%, 5/15/10 | | 200 | | 216,000 | | 0.2 | |

Wolverine Tube, Sr Nt,

7.375%, 8/1/082 | | 675 | | 587,250 | | 0.5 | |

Wolverine Tube, Sr Nt, 10.5%, 4/1/096 | | 500 | | 475,000 | | 0.4 | |

| | | | |

| |

|

|

| | | | | 4,070,800 | | 3.5 | |

RETAIL — 4.1% | | | | | | | |

Broder Bros. Co., Sr Nt,

11.25%, 10/15/10 | | 1,000 | | 1,010,000 | | 0.9 | |

Brown Shoe Company, Inc., Sr Unsec’d Nt, 8.375%, 5/1/122 | | 750 | | 781,875 | | 0.7 | |

Gregg Appliances Inc., Sr Nt,

9.0%, 2/1/132 | | 1,325 | | 1,242,188 | | 1.1 | |

Tom’s Foods, Inc., Sr Nt,

10.5%, 11/1/041,4,9 | | 1,000 | | 700,000 | | 0.6 | |

Tom’s Foods, Inc., DIP,

10.25%, 12/31/053,8,9 | | 1,000 | | 1,000,000 | | 0.8 | |

| | | | |

| |

|

|

| | | | | 4,734,063 | | 4.1 | |

SERVICES — 2.8% | | | | | | | |

Allied Waste NA, Co Guar,

9.25%, 9/1/12 | | 824 | | 889,920 | | 0.8 | |

Knowledge Learning Center, Sr Sub Nt, 7.75%, 2/1/152 | | 500 | | 477,500 | | 0.4 | |

| | | | | | | |

| Description | | Par

(000) | | Value | | Percent

of Net

Assets* | |

SERVICES (continued) | | | | | | | |

Nationsrent, Inc., Sr Sec’d Nt,

9.5%, 10/15/10 | | $500 | | $545,000 | | 0.5 | % |

Sac Holdings, Sr Nt, 8.5%, 3/15/14 | | 1,323 | | 1,256,708 | | 1.1 | |

| | | | |

| |

|

|

| | | | | 3,169,128 | | 2.8 | |

TRANSPORTATION — 12.6% | | | | | | | |

Airxcel, Inc., Sr Sub Nt, 11%, 11/15/07 | | 1,584 | | 1,568,160 | | 1.3 | |

American Commercial Lines, Sr Nt, 9.50%, 2/15/152 | | 500 | | 527,500 | | 0.5 | |

Asbury Automotive Group, Sr Sub Nt, 8%, 3/15/14 | | 350 | | 337,750 | | 0.3 | |

Autocam Corp., Sr Sub Nt,

10.875%, 6/15/14 | | 1,775 | | 1,153,750 | | 1.0 | |

CP Ships, Ltd., Sr Sub Nt,

10.375%, 7/15/12 | | 500 | | 560,000 | | 0.5 | |

Delco Remy International, Inc., Sr Sub Nt, 9.375%, 04/15/12 | | 200 | | 160,000 | | 0.1 | |

Delco Remy International, Inc., Sr Sub Nt, 11%, 5/1/096 | | 1,800 | | 1,656,000 | | 1.4 | |

Dura Operating Corp., Co Guar,

9%, 5/1/096 | | 250 | | 173,750 | | 0.1 | |

Dura Operating Corp., Co Guar, 8.625%, 4/15/126 | | 725 | | 652,500 | | 0.6 | |

Ford Motor Co., Nt, 7.45%, 7/15/31 | | 1,000 | | 834,816 | | 0.7 | |

General Motors Acceptance Corp., Nt, 8%, 11/1/31 | | 400 | | 356,937 | | 0.3 | |

General Motors, Debentures,

8.25%, 7/15/236 | | 2,050 | | 1,696,375 | | 1.4 | |

Goodyear Tire and Rubber, Sr Nt,

9%, 7/1/152 | | 1,000 | | 982,500 | | 0.8 | |

Newcor, Inc., Sr Sub Nt, 6.0%, 1/31/13 | | 1,500 | | 1,200,000 | | 1.0 | |

Quality Distribution, Co Guar,

9%, 11/15/10 | | 500 | | 460,000 | | 0.4 | |

TFM SA DE CV, Sr Nt, 12.5%, 6/15/12 | | 1,100 | | 1,287,000 | | 1.1 | |

TFM SA DE CV, Sr Nt, 9.375%, 5/1/122 | | 900 | | 936,000 | | 0.8 | |

Ultrapetrol (Bahamas) Ltd., 1st Mtg, 9%, 11/24/14 | | 450 | | 398,250 | | 0.3 | |

| | | | |

| |

|

|

| | | | | 14,941,288 | | 12.6 | |

UTILITIES — 9.1% | | | | | | | |

Calpine Corp., Sr Nt, 8.5%, 5/1/08 | | 2,250 | | 1,620,000 | | 1.4 | |

Calpine Generating Co., 2nd FRN, Sec’d Nt, 8.861%, 4/1/10 | | 500 | | 490,000 | | 0.4 | |

Calpine Generating Co., 3rd FRN, Sec’d Nt, 12.39%, 4/1/11 | | 1,350 | | 1,228,500 | | 1.0 | |

7

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (continued)

June 30, 2005 (Unaudited)

| | | | | | | |

| Description | | Shares/Par

(000) | | Value | | Percent

of Net

Assets* | |

Utilities (continued) | | | | | |

Edison Mission, Inc., Sr Nt,

9.875%, 4/15/11 | | $2,000 | | $2,342,500 | | 2.0 | % |

Midwest Generation LLC, Sec’d Nt, 8.75%, 5/1/34 | | 500 | | 560,000 | | 0.5 | |

Mirant Americas, Sr Nt,

7.40%, 7/15/041,2,4 | | 600 | | 486,000 | | 0.4 | |

Mirant Americas, Sr Nt,

8.3%, 5/1/111,4 | | 250 | | 286,875 | | 0.2 | |

Mirant Americas Generation LLC, Sr Nt, 8.5%, 10/1/211,4 | | 1,000 | | 1,070,000 | | 0.9 | |

Dynegy/NGC Corp., Debentures, 7.125%, 5/15/18 | | 1,750 | | 1,666,875 | | 1.4 | |

Reliant Resources, Inc., Sec’d Nt, 9.5%, 7/15/13 | | 1,000 | | 1,110,000 | | 0.9 | |

| | | | |

| |

|

|

| | | | | 10,860,750 | | 9.1 | |

Total Corporate Debt Securities | | | | | |

(amortized cost $172,238,615) | | | | 170,758,517 | | 145.1 | |

| | | | |

| |

|

|

CORPORATE CONVERTIBLE DEBT SECURITIES — 0.2% | | | |

PACKAGING — 0.2% | | | | | | | |

Indesco International, Inc., Conv, Sr Sub Nt, 10%, 3/15/083,9 | | 291 | | 232,423 | | 0.2 | |

| | | | |

| |

|

|

| | | | | 232,423 | | 0.2 | |

Total Convertible Corporate Debt Securities | | | | | |

(amortized cost $290,529) | | 291 | | 232,423 | | 0.2 | |

| | | | |

| |

|

|

Total Debt Securities | | | | | |

(amortized cost $172,529,144) | | | | 170,990,940 | | 145.3 | |

PREFERRED STOCKS — 3.8% | | | | | | | |

Glasstech, Inc., Series C, Pfd1,3,9 | | 5 | | 0 | | 0.0 | |

HLI Operating Co., Inc., Series A, Pfd, 8%, 12/31/491 | | 74 | | 3,552 | | 0.0 | |

Kaiser Group Holdings, Inc., Pfd,

7%, 12/31/07 | | 13,829 | | 762,324 | | 0.6 | |

Oglebay Norton Company, Series A, Pfd, 14.8% | | 189,370 | | 2,887,893 | | 2.5 | |

Rural Cellular Corp., Pfd,

11.375% PIK, 5/15/101,4 | | 500 | | 460,000 | | 0.4 | |

| | | | | | | |

| Description | | Shares/Par

(000) | | Value | | Percent

of Net

Assets* | |

PREFERRED STOCKS (continued) | | | | | | | |

Spanish Broadcasting Systems, Pfd, 10.75%, 10/15/13 | | $289 | | $309,230 | | 0.3 | % |

XO Communications, Inc., Pfd,

13.5% PIK, 6/1/101,4 | | 1,580 | | 16 | | 0.0 | |

| | | | |

| |

|

|

Total Preferred Stocks | | | | | | | |

(cost $4,759,254) | | | | 4,423,015 | | 3.8 | |

| | | | |

| |

|

|

COMMON STOCKS — 4.6% | | | | | | | |

Abovenet, Inc., Common Stock1 | | 1,702 | | 47,656 | | 0.0 | |

Cincinnati Bell, Inc.,

Common Stock1,6 | | 16,370 | | 70,391 | | 0.1 | |

Frank’s Nursery, Common Stock1 | | 11,252 | | 12,377 | | 0.0 | |

Glasstech, Inc., Class C,

Common Stock1,3,9 | | 5 | | 0 | | 0.0 | |

Indesco International, Inc.,

Common Stock1,3,9 | | 60,345 | | 36,207 | | 0.0 | |

Kaiser Group Holdings, Inc.,

Common Stock1 | | 58,011 | | 2,088,396 | | 1.8 | |

Lexington Coal Company,

Common Stock1 | | 25,311 | | 7,340 | | 0.0 | |

Mattress Discounters,

Common Stock1,3,9 | | 8,329 | | 8,329 | | 0.0 | |

Oglebay Norton Company,

Common Stock1 | | 32,992 | | 418,998 | | 0.4 | |

Precision Partners, Inc.,

Common Stock1,3,9 | | 1,367 | | 546,800 | | 0.5 | |

Simonds Industries, Inc.,

Common Stock1,3,9 | | 8,236 | | 280,024 | | 0.2 | |

Telewest PLC, Common Stock1 | | 85,210 | | 1,941,084 | | 1.6 | |

WHX Corp., Common Stock1 | | 8 | | 6 | | 0.0 | |

| | | | |

| |

|

|

Total Common Stocks | | | | | |

(cost $10,804,442) | | | | 5,457,608 | | 4.6 | |

| | | | |

| |

|

|

WARRANTS — 0.0% | | | | | | | |

Abovenet, Inc., Warrants, 8/9/081,3,9 | | 584 | | 5,834 | | 0.0 | |

Abovenet, Inc., Warrants, 8/9/101,3,9 | | 687 | | 4,115 | | 0.0 | |

XO Communications, Series A, Warrants1 | | 3,047 | | 1,066 | | 0.0 | |

8

PACHOLDER HIGH YIELD FUND, INC.

Statement of Net Assets Applicable to Common Stockholders (concluded)

June 30, 2005 (Unaudited)

| | | | | | | | |

| Description | | Shares/Par

(000) | | Value | | | Percent

of Net

Assets* | |

WARRANTS (continued) | | | | | | | | |

XO Communications, Series B, Warrants1 | | $2,285 | | $594 | | | 0.0 | % |

XO Communications, Series C, Warrants1 | | 2,285 | | 480 | | | 0.0 | |

| | | | |

|

| |

|

|

Total Warrants | | | | | | |

(cost $417,200) | | | | 12,089 | | | 0.0 | |

| | | | |

|

| |

|

|

Total Equity Investments | | | | | | |

(cost $15,980,896) | | | | 9,892,712 | | | 8.4 | |

INVESTMENTS OF CASH COLLATERAL FOR SECURITIES LOANED — 19.5% | |

Lehman Brothers, Inc. — Repurchase Agreements5a 3.5375%, dated 6/30/05, matures 7/1/05 repurchase

price $3,000,879 | | 3,000 | | 3,000,584 | | | 2.5 | |

Lehman Brothers, Inc. — Repurchase Agreements5b 3.6175%, dated 6/30/05, matures 7/1/05 repurchase

price $20,002,010 | | 20,000 | | 20,000,000 | | | 17.0 | |

| | | | |

|

| |

|

|

Total Investments of Cash

Collateral for Securities

Loaned | | | | | | |

(cost $23,000,584) | | | | 23,000,584 | | | 19.5 | |

TOTAL INVESTMENTS | | | | | | |

(cost $211,510,624) | | | | $203,884,236 | | | 173.2 | |

Payable Upon Return of Securities Loaned | | (23,000,584 | ) | | (19.5 | ) |

Payable to Advisor | | | | (892,970 | ) | | (0.8 | ) |

Payable to Administrator | | | | (30,383 | ) | | 0.0 | |

Accounting Fees Payable | | | | (9,127 | ) | | 0.0 | |

Custody Fees Payable | | | | (4,617 | ) | | 0.0 | |

Unrealized Appreciation/(Depreciation) on Swap Agreements | | (140,683 | ) | | (0.1 | ) |

Other Assets in Excess of Other Liabilities | | 3,917,857 | | | 3.3 | |

Less: Outstanding Preferred Stock (2,640 shares at $25,000 per share) at

liquidation value. | | (66,000,000 | ) | | (56.1 | ) |

| | | | |

|

| |

|

|

| | | | | | | | |

| Description | | Shares/Par

(000) | | | Value | | Percent

of Net

Assets* | |

Net Assets Applicable to Common Stockholders: | | | | | | |

Common Stock, $.01 par value; 49,996,320 shares authorized 12,902,202 shares issued and outstanding | | $ 129,022 | | | | | | |

Capital in excess of par value | | 179,535,113 | | | | | | |

Undistributed net investment income | | 778,147 | | | | | | |

Accumulated net realized loss from security transactions | | (54,951,482 | ) | | | | | |

Net unrealized depreciation on investments | | (7,767,071 | ) | | | | | |

Net Assets Applicable to Common Stockholders | | | | | $117,723,729 | | 100.0 | % |

| | | | | |

| | | |

Net Asset Value Per Common Share

($117,723,729 /12,902,202) | | | $9.12 | | | |

| | | | | |

| | | |

| * | | Applicable to common stockholders. |

| 1 | | Non-income producing security. |

| 2 | | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities amounted to $37,391,937. |

| 3 | | Board valued security. These securities amounted to $2,523,846. |

| 5a | | Fully collateralized by investment grade commercial paper with a fair market value of $3,060,630. |

| 5b | | Fully collateralized by non-investment grade corporate bonds with a fair market value of $20,690,501 |

| 6 | | All or a portion of the security is on loan. Securities on loan have a fair market value of $22,588,902. |

| 7 | | Step-up bond. Interest rate is effective rate. |

| 8 | | Restricted security. These securities amounted to $2,246,875. (See Note 8 for schedule of securities.) |

| 9 | | Security deemed to be illiquid. |

| FRN | | Floating Rate Note. Rate shown is rate in effect at June 30, 2005. |

| DIP | | Debtor in Possession Financing |

See accompanying Notes to Financial Statements.

9

PACHOLDER HIGH YIELD FUND, INC.

Statement of Operations

For the Six Months Ended June 30, 2005 (Unaudited)

| | | | |

| | | | |

INVESTMENT INCOME: | | | | |

Interest | | $ | 8,389,290 | |

Dividends | | | 79,753 | |

Securities lending | | | 108,394 | |

| | |

|

|

|

Total Income | | | 8,577,437 | |

EXPENSES: | | | | |

Investment advisory fees (Note 6) | | | 1,209,316 | |

Administrative fees (Note 6) | | | 92,146 | |

Printing and other | | | 49,588 | |

Stock exchange listing fees | | | 12,397 | |

Accounting fees (Note 6) | | | 22,897 | |

Custodian fees (Note 6) | | | 9,450 | |

Transfer agent fees | | | 12,893 | |

Legal fees | | | 84,301 | |

Directors’ fees and expenses | | | 49,588 | |

Audit fee | | | 31,736 | |

Insurance | | | 26,988 | |

| | |

|

|

|

Operating Expenses | | | 1,601,300 | |

Commissions on auction rate preferred stock | | | 83,281 | |

| | |

|

|

|

Expenses Related to Leverage | | | 83,281 | |

Total Expenses | | | 1,684,581 | |

| | |

|

|

|

Net Investment Income | | | 6,892,856 | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

Net realized gain/(loss): | | | | |

Investments | | | (6,421,098 | ) |

Swaps | | | (366,294 | ) |

| | |

|

|

|

Net realized gain/(loss) on investments | | | (6,787,392 | ) |

Net change in unrealized appreciation/(depreciation): | | | | |

Investments | | | 688,960 | |

Swaps | | | 430,151 | |

| | |

|

|

|

Net change in unrealized appreciation/(depreciation) on investments | | | 1,119,111 | |

| | |

|

|

|

Net realized and unrealized gain/(loss) on investments | | | (5,668,281 | ) |

| | |

|

|

|

Net Increase/(Decrease) Resulting from Operations | | | 1,224,575 | |

DISTRIBUTIONS TO PREFERRED STOCKHOLDERS FROM NET INVESTMENT INCOME | | | (940,870 | ) |

| | |

|

|

|

NET INCREASE/(DECREASE) IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 283,705 | |

| | |

|

|

|

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets Applicable to Common Stockholders

| | | | | | | | |

| | | For the Six

Months Ended

June 30, 2005

(Unaudited) | | | For the Year

Ended

December 31,

2004 | |

INCREASE/(DECREASE) IN NET ASSETS: | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 6,892,856 | | | $ | 13,936,587 | |

Net realized gain/(loss) on investments | | | (6,787,392 | ) | | | (3,455,954 | ) |

Net change in unrealized appreciation/(depreciation) on investments | | | 1,119,111 | | | | 15,334,674 | |

Cumulative effect on change in fixed income valuation (Note 1) | | | 0 | | | | (854,808 | ) |

Distributions to preferred stockholders from net investment income | | | (940,870 | ) | | | (998,354 | ) |

| | |

|

|

| |

|

|

|

Net increase/(decrease) in net assets resulting from operations | | | 283,705 | | | | 23,962,145 | |

| | |

|

|

| |

|

|

|

DISTRIBUTIONS TO COMMON STOCKHOLDERS FROM: | | | | | | | | |

Net investment income | | | (5,804,611 | ) | | | (11,590,343 | ) |

Return of Capital | | | 0 | | | | 0 | |

| | |

|

|

| |

|

|

|

Total distributions to common stockholders | | | (5,804,611 | ) | | | (11,590,343 | ) |

| | |

|

|

| |

|

|

|

FUND SHARE TRANSACTIONS (NOTE 2): | | | | | | | | |

Value of 6,882 and 36,675 shares issued in reinvestment of dividends to common stockholders in 2005 and 2004, respectively | | | 64,774 | | | | 332,007 | |

| | |

|

|

| |

|

|

|

Total increase in net assets derived from fund share transactions | | | 64,774 | | | | 332,007 | |

| | |

|

|

| |

|

|

|

Total net increase/(decrease) in net assets applicable to common stockholders | | | (5,456,132 | ) | | | 12,703,809 | |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: | | | | | | | | |

Beginning of period | | | 123,179,861 | | | | 110,476,052 | |

| | |

|

|

| |

|

|

|

End of period | | $ | 117,723,729 | | | $ | 123,179,861 | |

| | |

|

|

| |

|

|

|

Undistributed Net Investment Income | | $ | 778,147 | | | $ | 630,772 | |

See accompanying Notes to Financial Statements.

10

PACHOLDER HIGH YIELD FUND, INC.

Financial Highlights

(Contained below is per share operating performance data for a share of common stock outstanding, total return performance, ratios to average net assets and other supplemental data. This information has been derived from information provided in the financial statements and market price data for the Fund’s shares calculated using average shares outstanding.)

| | | | | | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

June 30, 2005

(Unaudited) | | | Year Ended December 31,

| |

| | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net asset value, beginning of period | | $ | 9.55 | | | $ | 8.59 | | | $ | 5.73 | | | $ | 7.78 | | | $ | 10.03 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net investment income | | | 0.53 | | | | 1.08 | | | | 1.10 | | | | 1.41 | | | | 1.87 | |

Net realized and unrealized gain/(loss) on investments | | | (0.44 | ) | | | 0.93 | | | | 2.77 | | | | (2.15 | ) | | | (1.78 | ) |

Cumulative effect on change in fixed income valuation (Note 1) | | | — | | | | (0.07 | ) | | | — | | | | — | | | | — | |

Distributions to preferred stockholders from net investment income | | | (0.07 | ) | | | (0.08 | ) | | | (0.07 | ) | | | (0.12 | ) | | | (0.37 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net increase/(decrease) in net asset value resulting from operations | | | 0.02 | | | | 1.86 | | | | 3.80 | | | | (0.86 | ) | | | (0.28 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Distributions to Common Stockholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.45 | ) | | | (0.90 | ) | | | (0.89 | ) | | | (1.15 | ) | | | (1.65 | ) |

Return of capital | | | — | | | | — | | | | (0.05 | ) | | | (0.04 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions to common stockholders | | | (0.45 | ) | | | (0.90 | ) | | | (0.94 | ) | | | (1.19 | ) | | | (1.65 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Common and Preferred Shares Offering Costs Charged to Paid-In Capital: | | | | | | | | | | | | | | | | | | | | |

Common Shares | | | — | | | | — | | | | — | | | | — | | | | (0.10 | ) |

Preferred Shares | | | — | | | | — | | | | — | | | | — | | | | (0.22 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.32 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net asset value, end of period | | $ | 9.12 | | | $ | 9.55 | | | $ | 8.59 | | | $ | 5.73 | | | $ | 7.78 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Market value per share, end of period | | $ | 9.47 | | | $ | 9.82 | | | $ | 9.14 | | | $ | 6.16 | | | $ | 9.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL INVESTMENT RETURN (1): | | | | | | | | | | | | | | | | | | | | |

Based on market value per common share(2) | | | 1.26 | % | | | 18.67 | % | | | 67.19 | % | | | (19.91 | %) | | | 1.37 | % |

Based on net asset value per common share(3) | | | 0.28 | % | | | 22.79 | % | | | 68.92 | % | | | (13.05 | %) | | | (8.07 | %) |

RATIOS TO AVERAGE NET ASSETS(4): | | | | | | | | | | | | | | | | | | | | |

Expenses (prior to expenses related to leverage)(5) | | | 1.76 | % | | | 1.83 | % | | | 1.80 | % | | | 0.83 | % | | | 0.75 | % |

Applicable to common stockholders only(6)(7) | | | 2.75 | % | | | 2.88 | % | | | 3.08 | % | | | 1.65 | % | | | 1.32 | % |

Expenses (including expenses related to leverage)(5) | | | 1.85 | % | | | 1.92 | % | | | 1.91 | % | | | 0.95 | % | | | 0.81 | % |

Applicable to common stockholders only(6)(7) | | | 2.89 | % | | | 3.03 | % | | | 3.26 | % | | | 1.90 | % | | | 1.43 | % |

Net investment income applicable to common stockholders only(6)(7) | | | 11.98 | % | | | 12.14 | % | | | 17.17 | % | | | 21.49 | % | | | 20.65 | % |

SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period, net of preferred stock (000) | | $ | 117,724 | | | $ | 123,180 | | | $ | 110,476 | | | $ | 73,307 | | | $ | 99,067 | |

Portfolio turnover rate | | | 50 | % | | | 73 | % | | | 51 | % | | | 40 | % | | | 32 | % |

SENIOR SECURITIES: | | | | | | | | | | | | | | | | | | | | |

Number of preferred shares outstanding at end of period | | | 2,640 | | | | 2,640 | | | | 2,640 | | | | 2,640 | | | | 3,680 | |

Asset coverage per share of preferred stock outstanding at end of period(8) | | $ | 69,592 | | | $ | 71,660 | | | $ | 66,853 | | | $ | 52,768 | | | $ | 51,920 | |

Involuntary liquidation preference and average market value per share of preferred stock | | $ | 25,000 | | | $ | 25,000 | | | $ | 25,000 | | | $ | 25,000 | | | $ | 25,000 | |

| 1 | | Total investment return excludes the effects of commissions. Dividends and distributions to common stockholders, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed, for purposes of this calculation, to be fully subscribed under the terms of the rights offering. |

| 2 | | Assumes an investment at the common share market value at the beginning of the period indicated and sale of all shares at the closing common share market value at the end of the period indicated. |

| 3 | | Assumes an investment at the common share net asset value at the beginning of the period indicated and sale of all shares at the closing common share net asset value at the end of the period indicated. |

| 4 | | Ratios calculated on an annualized basis of expenses and net investment income. Ratios do not include the effect of dividends to preferred stock. |

| 5 | | Ratios calculated relative to the average net assets of both common and preferred stockholders. |

| 6 | | Ratios calculated relative to the average net assets of common stockholders only. |

| 7 | | Information for the years 2001 through 2003 is not audited by previous auditors. Ratios have been derived from audited financial statements for the respective year. |

| 8 | | Calculated by subtracting the Fund’s total liabilities (not including the preferred stock) from the Fund’s total assets, and dividing this by the number of preferred shares outstanding. |

See accompanying Notes to Financial Statements.

11

PACHOLDER HIGH YIELD FUND, INC.

Notes to Financial Statements (Unaudited)

| 1. | | SIGNIFICANT ACCOUNTING POLICIES — Pacholder High Yield Fund, Inc. (the “Fund”) is a closed-end, diversified management investment company with a leveraged capital structure. The Fund’s investment objective is to provide a high level of total return through current income and capital appreciation. Under normal circumstances, the Fund invests at least 80% of the value of its assets in high yield securities. The Fund invests primarily in fixed income securities of domestic companies. The Fund was incorporated under the laws of the State of Maryland in August 1988. |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

| | A. | | SECURITY VALUATIONS — Fixed income securities generally are priced at the bid side of the market by an independent pricing service or broker. Equity securities listed on an exchange are valued at the closing prices as determined by the primary exchange where the securities are traded. Restricted securities, portfolio securities not priced by the independent pricing service and other assets are valued at fair value as determined under procedures established and monitored by the Board of Directors. At June 30, 2005, there were board-valued securities of $2,523,846. Original obligations with maturities of 60 days or less at the date of purchase are valued at amortized cost, which approximates market value. |

Prior to January 1, 2004, the Fund valued fixed income securities based on the mean of bid and asked prices. Effective January 1, 2004, the Fund changed its valuation policy to value fixed income securities based on bid prices, as bid prices are believed to be more representative of the price that could be obtained in sales transactions in the market for such securities. Bid prices generally are lower that those based on the mean of bid and asked prices. The cumulative effect of this accounting change on January 1, 2004 was to decrease the value of investments and net assets applicable to common stockholders by approximately $854,808 ($0.07 per common share). The effect of this change for the year ended December 31, 2004 was to increase the value of investments, change in unrealized appreciation/depreciation and net assets applicable to common stockholders by approximately $2,059 ($0.00 per common share). The cumulative effect of this accounting change had it been applied on January 1, 2003, would have been to decrease the value of investments and net assets applicable to common stockholders by approximately $900,459 ($0.07 per common share). The effect of this change for the year ended December 31, 2003 would have been to increase the value of investments, change in unrealized appreciation/depreciation and net assets applicable to common stockholders by approximately $45,651 ($0.00 per common share). The statement of changes in net assets and financial highlights have not been restated to reflect this change in accounting policy.

| | B. | | REPURCHASE AGREEMENTS — Each repurchase agreement is valued at amortized cost. In connection with transactions in repurchase agreements, it is the Fund’s policy that a tri-party custodian take possession of the underlying collateral securities in a manner sufficient to enable the Fund to obtain collateral in the event of a counterparty default. If the counterparty defaults and the fair value of the collateral declines, realization of the collateral by the Fund may be delayed or limited. The repurchase agreements are fully collateralized by either or all of the following: A1/P1 commercial paper, U.S. Government agency securities, investment grade corporate bonds, and non-investment grade corporate bonds. |

| | C. | | FEDERAL TAXES — It is the Fund’s policy to make sufficient distributions to stockholders of net investment income and net realized capital gains to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. |

The Fund intends to continue to qualify as a regulated investment company by complying with the appropriate provisions of the Internal Revenue Code and to distribute to stockholders each year all of its taxable income, if any, and tax-exempt income, including realized gains on investments.

| | D. | | SECURITIES TRANSACTIONS AND INVESTMENT INCOME — Securities transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses on securities transactions are determined on an identified cost basis. Interest income is recorded on an accrual basis. The Fund accretes discounts or amortizes premiums on all fixed income securities for financial reporting purposes. Dividends are recorded on the ex-dividend date. |

| | E. | | SECURITY LENDING — To generate additional income, the Fund lends its securities, through its custodian (an affiliate of the Advisor), to approved brokers and receives cash as collateral to secure the loans. The Fund receives payments from borrowers equivalent to the dividends and interest that would have been earned on securities lent while simultaneously seeking to earn income on the investment of collateral. Although the risk of lending is mitigated by the |

12

PACHOLDER HIGH YIELD FUND, INC.

Notes to Financial Statements (Unaudited) (continued)

| | collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return them. Loans are subject to termination by the Fund or the borrower at any time, and are, therefore, not considered to be illiquid investments. As of June 30, 2005, the Fund loaned securities having a value of approximately $22,588,902. Collateral is marked to market daily to provide a level of collateral at not less than 102% of the value of loaned securities. The cash collateral received by the Fund at June 30, 2005 was invested in repurchase agreements (with interest rates ranging from 3.5375% to 3.6175% and maturity dates of July 1, 2005). Information on the investment of cash collateral is shown in the Statement of Net Assets Applicable to Common Stockholders. The Fund had received cash collateral of $23,000,584 for the loans and invested the collateral in repurchase agreements. |

The custodian retained $15,958 in fees for services rendered in lending of securities during the first six months of 2005.

| | F. | | EXPENSES AND DISTRIBUTIONS — Expenses are accrued as incurred. Dividends to common stockholders are paid from net investment income monthly, and distributions of net realized capital gains, if any, are paid at least annually. Dividends to preferred stockholders are accrued daily based on a variable interest rate set at weekly auctions and are paid weekly from net investment income. Distributions are determined in accordance with federal income tax regulations, which may differ from generally accepted accounting principles. |

| | G. | | WHEN, AS AND IF ISSUED SECURITIES — The Fund may engage in “when-issued” or “delayed delivery” transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis begin earning interest on the settlement date. |

The Fund had no when-issued or delayed-delivery purchase commitments as of June 30, 2005.

| | H. | | ESTIMATES — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. |

| | I. | | INTEREST RATE SWAPS — Unrealized gains are reported as an asset and unrealized losses are reported as a liability on the Statement of Net Assets Applicable to Common Stockholders. The change in value of swaps, including the periodic amounts of interest to be paid or received on swaps, is reported as unrealized gains or losses in the Statement of Operations. A realized gain or loss is recorded upon payment or receipt of a periodic payment or termination of swap agreements. Swap agreements are stated at fair value. |

| | J. | | INDEMNIFICATIONS — The Fund’s officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote. |

| 2. | | COMMON STOCK — At June 30, 2005, there were 49,996,320 shares of common stock with a $.01 par value authorized and 12,902,202 shares outstanding. During the six months ended June 30, 2005 and the year ended December 31, 2004, the Fund issued 6,882 and 36,675 shares of common stock, respectively, in connection with its dividend reinvestment plan. |

| 3. | | PREFERRED STOCK — On June 29, 2001, the Fund issued 3,680 shares of Series W Auction Rate Cumulative Preferred Stock (ARPS) at an offering price of $25,000 per share. Dividends on these shares are paid weekly at an annual rate determined by a weekly auction. The Fund is required to maintain certain asset coverages as set forth in the Fund’s Articles Supplementary Creating and Fixing the Rights of Auction Rate Cumulative Preferred Stock. The preferred stock is subject to mandatory redemption at a redemption price of $25,000 per share, plus accumulated and unpaid dividends, if the Fund is not in compliance with the required asset coverage (minimum 2 to 1) tests and restrictions. In general, the holders of the ARPS and the common stock vote together as a single class, except that the ARPS stockholders, as a separate class, vote to elect two members of the Board of Directors, and separate votes are required on certain matters that affect the respective interests of the ARPS and common stock. The ARPS has a liquidation preference of $25,000 per share, plus accumulated and unpaid dividends. At June 30, 2005, accrued ARPS dividends were $45,238. |

13

PACHOLDER HIGH YIELD FUND, INC.

Notes to Financial Statements (Unaudited) (continued)

During 2002, the Fund redeemed a total of $26,000,000 or 1,040 shares of Series W ARPS at various intervals and amounts. No redemptions have occurred since 2002.

| 4. | | INTEREST RATE SWAPS — The Fund entered into interest payment swap arrangements with Citibank, N. A. New York (Citibank) for the purpose of partially hedging its dividend payment obligations with respect to the ARPS. Pursuant to each of the swap arrangements, the Fund makes payments to Citibank on a monthly basis at fixed annual rates. In exchange for such payments Citibank makes payments to the Fund on a monthly basis at a variable rate determined with reference to the one month London Interbank Offered Rate (LIBOR). The variable rates ranged from 2.21% to 3.39% for the six months ended June 30, 2005. The effective date, notional amount, maturity and fixed rates of the swaps are as follows: |

| | | | | | | | | | | | |

Effective Date

| | Notional

Contract Amount

| | Maturity

| | Fixed

Annual Rate

| | Floating

Annual Rate*

| | Unrealized Mark to

Market

| |

7/16/2001 | | $10 million | | 7/18/2005 | | 5.31% | | 3.23625% | | $ | (18,402 | ) |

7/16/2001 | | $10 million | | 7/17/2006 | | 5.52% | | 3.23625% | | | (184,544 | ) |

11/13/2001 | | $ 5 million | | 11/14/2005 | | 3.77% | | 3.21% | | | (4,627 | ) |

11/13/2001 | | $ 5 million | | 11/13/2006 | | 4.07% | | 3.21% | | | (15,980 | ) |

10/1/2004 | | $10 million | | 10/1/2007 | | 3.30% | | 3.11125% | | | 135,842 | |

6/1/2005 | | $ 5 million | | 6/2/2008 | | 4.10% | | 3.11125% | | | (23,128 | ) |

6/1/2005 | | $ 5 million | | 6/2/2009 | | 4.15% | | 3.11125% | | | (29,844 | ) |

| | | | | | | | | | |

|

|

|

| | | | | | | | | | | $ | (140,683 | ) |

| * | | Represents rate in effect at June 30, 2005. |

Swap transactions, which involve future settlement, give rise to credit risk. Credit risk is the amount of loss the Fund would incur in the event counterparties failed to perform according to the terms of the contractual commitments. The Fund is exposed to credit loss in the event of nonperformance by the counterparty on interest rate swaps, but the Fund does not anticipate nonperformance by the counterparty. While notional contract amounts are used to express the volume of interest rate swap agreements, the amounts potentially subject to credit risk, in the event of nonperformance by counterparties, are substantially smaller.

For the six months ended June 30, 2005, the Fund’s receipts under the swap agreements were less than the amount paid and accrued to Citibank by $366,294 and are included as realized loss in the accompanying Statement of Operations.

The estimated fair value of the interest rate swap agreements at June 30, 2005, amounted to approximately $140,683 in unrealized depreciation and is included in the accompanying Statement of Net Assets Applicable to Common Stockholders. Swap transactions present risk of loss in excess of the related amounts included in the Statement of Net Assets Applicable to Common Stockholders.

| 5. | | PURCHASES AND SALES OF SECURITIES — Purchases and sales of securities (excluding short-term securities) for the six months ended June 30, 2005 aggregated $91,055,346 and $90,979,649, respectively. |

| 6. | | TRANSACTIONS WITH INVESTMENT ADVISOR, ADMINISTRATOR, ACCOUNTING SERVICES AGENT AND CUSTODIAN — The Fund has an investment advisory agreement with Pacholder & Company, LLC (the “Advisor”), an Ohio limited liability company, which is wholly-owned by JPMorgan Investment Advisors, Inc. effective March 1, 2005, pursuant to which the Advisor serves as the Fund’s investment advisor. Prior to March 1, 2005, an affiliate of JPMorgan Investment Advisors, Inc. owned 49% of the Advisor. The Fund pays the Advisor an advisory fee that varies based on the total return investment performance of the Fund for the prior twelve-month period relative to the percentage change in the Credit Suisse First Boston High Yield Index, Developed Countries Only (formerly known as the Credit Suisse First Boston Domestic+ High Yield Index). The fee, which is accrued at least weekly and paid monthly, ranges from a maximum of 1.40% to a minimum of 0.40% (on an annualized basis) of the Fund’s average net assets. For purposes of calculating the amount of the advisory fee, the Fund’s average net assets shall be determined by taking the average of all determinations of such net assets during the applicable 12-month period and the Fund’s net assets shall mean the total assets of the Fund minus accrued liabilities of the Fund other than the principal amount of any outstanding senior securities representing indebtedness (within the meaning of Section 18 of the 1940 Act). Notwithstanding the foregoing, during the 12-month period following March 1, 2005, the date on which the investment advisory agreement took effect, the Fund is obligated to pay the Advisor the minimum fee payable under the investment advisory agreement and any balance due based on the Fund’s investment performance during the period shall be paid to the Advisor upon completion of the 12-month period. For the six months ended June 30, 2005, the advisory fee is calculated based on 1.40% of average weekly net assets (as defined above) of the Fund. At June 30, 2005, accrued advisory fees were $892,970. Certain officers and directors of the Fund are also members of the Board of Managers or officers (or both) of the Advisor. |

14

PACHOLDER HIGH YIELD FUND, INC.

Notes to Financial Statements (Unaudited) (concluded)

Effective March 1, 2005, the Fund has an administrative services agreement with JPMorgan Funds Management, Inc. (“JPMFM”) (an affiliate of the Advisor) pursuant to which JPMFM provides administrative services to the Fund. Under the agreement, JPMFM receives from the Fund a fee, accrued at least weekly and paid monthly, at the annual rate of 0.10% of the average weekly net assets of the Fund. At June 30, 2005, accrued administrative fees were $30,383.

Effective March 1, 2005, the Fund also has an agreement with JPMFM to provide portfolio accounting and net asset value calculations for the Fund. Under the agreement, JPMFM receives from the Fund a fee, accrued at least weekly and paid monthly, at the annual rate of 0.025% of the first $100 million of the Fund’s average weekly net assets and 0.015% of such assets in excess of $100 million. At June 30, 2005, accrued accounting fees were $9,127.

Prior to March 1, 2005, administrative and accounting services to the Fund were provided at the same rates by Pacholder Associates, Inc. and Kenwood Administrative Management, Inc., affiliates of the Advisor, which were subsequently purchased by JPMFM.

The Fund has an agreement with Bank One Trust Company, N.A. (an affiliate of the Advisor) to provide custodial services for the Fund. Under the agreement, Bank One Trust Company, N.A. receives from the Fund a fee, accrued at least weekly and paid monthly, at the annual rate of 0.01% of the Fund’s average weekly net assets. At June 30, 2005, accrued custodial fees were $4,617.

As of June 30, 2005, liabilities for the Fund, other than those previously identified, included:

| | | |

Securities purchased payable | | $ | 2,865,626 |

Other liabilities | | | 1,237,398 |

| 7. | | TAX INFORMATION — At December 31, 2004, the Fund had available a capital loss carryforward of $47,975,744, of which $2,513,330 expires in 2006, $5,237,176 expires in 2007, $4,746,544 expires in 2008, $4,438,792 expires in 2009, $8,135,473 expires in 2010, $20,873,746 expires in 2011, $2,030,683 expires in 2012, to offset any future net capital gains. |

| 8. | | SCHEDULE OF RESTRICTED SECURITIES — |

| | | | | | | | | | |

Security

| | Description

| | Acquisition

Date

| | Cost of

Security

| | Cost per

Unit

|

Golden State Foods | | Bond | | 2/26/04 | | $ | 1,250,000 | | $ | 100.00 |

Tom’s Foods, Inc. | | Term Loan | | 5/6/05 | | | 1,000,000 | | | 100.00 |

Tom’s Foods, Inc. (unrestricted) | | Bond | | 5/15/02 | | | 897,500 | | | 89.75 |

15

PACHOLDER HIGH YIELD FUND, INC.

Annual Meeting Results (Unaudited)

The Fund held its 2004 annual meeting of shareholders on February 25, 2005, to elect directors of the Fund and to approve a New Advisory Agreement.

The results of voting were as follows (by number of shares):

For nominees to the Board of Directors:

| | |

William J. Morgan1 | | |

In favor: | | 501 |

Withheld: | | 2 |

| |

George D. Woodard1 | | |

In favor: | | 501 |

Withheld: | | 2 |

| |

John F. Williamson2 | | |

In favor: | | 11,753,205 |

Withheld: | | 190,434 |

| |

Daniel A. Grant2 | | |

In favor: | | 11,751,807 |

Withheld: | | 191,832 |

| 1 | | Elected by holders of the Fund’s Auction Rate Preferred Stock voting separately as a class. |

| 2 | | Elected by holders of the Fund’s Auction Rate Preferred Stock and Common Stock voting together as a single class. |

For approval of New Advisory Agreement:

| | |

For: | | 11,680,480 |

Against: | | 168,079 |

Abstain: | | 95,079 |

16

PACHOLDER HIGH YIELD FUND, INC.

Supplemental Information (Unaudited)

Portfolio Holdings Information

The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge, on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund’s website at www.phf-hy.com contains schedules of portfolio investments of the Fund.

Proxy Voting

A description of the policies and procedures used by the Fund to vote proxies relating to portfolio securities, a well as information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, on the Fund’s website at www.phf-hy.com and (ii) on the SEC’s website at www.sec.gov.

Renewal of the Investment Advisory Contract

On May 23, 2005, the Fund’s Board of Directors (the “Board”) considered renewal of the investment advisory agreement between the Fund and the Advisor. The agreement had been previously approved by shareholders of the Fund on February 25, 2005, and was implemented on March 1, 2005.

In its consideration of renewal of the investment advisory agreement, the Board, including the Board’s directors who are not “interested persons” (as defined in the Investment Company Act of 1940) of the Fund or the Advisor (the “Independent Directors”), reviewed the nature, extent and quality of the services provided, and to be provided, by the Advisor, the investment performance of the Fund, and the costs of the services and estimated profits realized by the Advisor and its affiliates from the relationship with the Fund. As discussed below, the Independent Directors relied upon comparisons of the advisory fee payable by the Fund to the investment advisory arrangements of other comparable closed-end funds. In addition, the Independent Directors considered that no change was being proposed in the terms of the agreement. Because the Fund is a closed-end fund without daily inflows or outflows of new capital and because the investment advisory fee is a “fulcrum fee”, the Independent Directors did not give special consideration to whether economies of scale might be realized in managing the Fund’s assets.

The Independent Directors considered and found the following specific factors in support of renewal of the investment advisory agreement:

| | • | | The Advisor’s performance of its obligations under the agreement and the expectation that there would not be in any significant change with respect to the Advisor’s personnel or day-to-day management of the Fund; |

| | • | | The expectation that the Advisor will continue to execute its obligations under the agreement consistently over time; |

| | • | | The Advisor has the requisite expertise and experience, as well as sufficient financial resources, to fulfill its commitments to the Fund under the agreement; |

| | • | | The Fund’s performance for the past 1, 3, 5 and 10-year periods was above average compared to other closed-end funds in the Fund’s Morningstar peer group; |

| | • | | The Fund’s average annual total returns between 1989 and 2004 were above the average annual total returns for other closed-end funds in the Fund’s Morningstar peer group; and |

| | • | | The Advisor’s estimated profitability in respect of the agreement has been reasonable and appears to be in line with general industry standards. |

The Independent Directors relied on comparisons of the advisory fee under the agreement to advisory fees paid by other closed-end high yield funds and found the following:

| | • | | The agreement’s 90 basis point fulcrum fee is somewhat higher than the average fixed advisory fee paid by other closed-end high yield funds, although the Fund’s overall expense ratio (at the fulcrum fee) is slightly below the average expense ratio; |

| | • | | Although the Advisor earned the maximum 140 basis point fee in 2003 and 2004, in 2001 and 2002 the Advisor earned the minimum 40 basis point fee, and the Fund’s actual advisory fee and expense ratio in those years were materially lower than most other closed-end high yield funds; and |

| | • | | The two largest closed-end high yield funds have fixed advisory fees of 90 basis points and 115 basis points, respectively. |

Based on these comparisons, the Independent Directors found the compensation paid to the Advisor under the agreement to be fair and reasonable in relation to the services provided by the Advisor. Because the Advisor does not have any advisory clients other than the Fund, the

17

PACHOLDER HIGH YIELD FUND, INC.

Supplemental Information (Unaudited) (concluded)

Independent Directors did not compare the advisory services provided to the Fund under the agreement to the investment advisory services provided by the Advisor to other clients. However, they did consider the advisory fees charged by the Advisor and its affiliates to other client accounts investing in high yield securities.

The Independent Directors also considered information concerning J.P. Morgan Chase & Co. and its affiliates (“JPMorgan”), including, among other matters, the nature and extent of its investment advisory businesses, its financial and other resources, its high yield assets under management, its investment company business, its fund support capabilities and any significant legal proceedings involving JPMorgan.

During the course of their deliberations, the Independent Directors reached the following conclusions, among others: (i) the Advisor is qualified to manage the assets of the Fund in accordance with the investment advisory agreement based in part on the Fund’s experience with the Advisor in the past; (ii) the Fund’s performance over time has been above average compared to other closed-end funds in the Fund’s Morningstar peer group; and (iii) the compensation paid to the Advisor under the agreement is fair and reasonable in relation to the services provided by the Advisor and various industry averages for comparable funds.