UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05639

Pacholder High Yield Fund, Inc.

(Exact name of registrant as specified in charter)

| | |

245 Park Avenue New York, NY | | 10167 |

|

| (Address of principal executive offices) | | (Zip code) |

Frank J. Nasta

245 Park Avenue

New York, NY 10167

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (513) 985-3200

Date of fiscal year end: December 31

Date of reporting period: January 1, 2009 through June 30, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

PACHOLDER HIGH YIELD FUND, INC.

Directors and Officers

| | |

Fergus Reid, III Chairman and Director William J. Armstrong Director John F. Finn Director Dr. Matthew Goldstein Director Robert J. Higgins Director Frankie D. Hughes Director Peter C. Marshall Director Marilyn McCoy Director William G. Morton, Jr. Director | | Robert A. Oden, Jr. Director Frederick W. Ruebeck Director James J. Schonbachler Director Leonard M. Spalding, Jr. Director George C.W. Gatch President Robert L. Young Senior Vice President Patricia A. Maleski Vice President, Chief Administrative Officer and Treasurer Stephen M. Ungerman Chief Compliance Officer Frank J. Nasta Secretary |

Investment Objective

A closed-end fund seeking a high level of total return

through current income and capital appreciation by

investing primarily in high-yield, fixed income securities

of domestic companies.

Investment Advisor

J.P. Morgan Investment Management Inc.

Administrator

JPMorgan Funds Management, Inc.

Custodian

JPMorgan Chase Bank, N.A.

Transfer Agent

Computershare Investor Services, LLC

Legal Counsel

Ropes & Gray LLP

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

Independent Directors’ Counsel

Kramer Levin Naftalis & Frankel LLP

Executive Offices

Pacholder High Yield Fund, Inc.

245 Park Avenue

New York, NY 10167

Shareholder Services

(877) 217-9502

Please visit our web site, www.phf-hy.com, for information on the Fund’s NAV, share price, news releases, and SEC filings. We created this site to provide stockholders quick and easy access to the timeliest information available regarding the Fund.

This report is for the information of stockholders of Pacholder High Yield Fund, Inc. It is not a prospectus, offering circular or other representation intended for use in connection with the purchase or sale of shares of the Fund or any securities mentioned in this report.

PACHOLDER HIGH YIELD FUND, INC.

SEMI-ANNUAL REPORT

JUNE 30, 2009

(UNAUDITED)

PACHOLDER HIGH YIELD FUND, INC.

(Unaudited)

Dear Stockholders:

Second Quarter and Semi-annual Review

Despite concerns about the economic recovery in mid-June amid rising mortgage rates and gasoline prices, high-yield bond markets managed to trade higher for the fifth time in the last six months. A surprising positive in 2009 has been the dramatic increase in the ability of high-yield issuers to access the market for funds. In response to strong demand for income and an increased appetite for total return during the first half of 2009, high-yield issuers managed to raise $60 billion of capital, 39% ahead of the first six months of 2008.

For the quarter ended June 30, 2009, the Pacholder High Yield Fund, Inc. (the “Fund”) returned 42.35%, based on Net Asset Value (NAV), compared to the 20.21% return of the Credit Suisse High Yield Index, Developed Countries Only (the “Index”), and the 25.45% average total return of the Morningstar Closed-End High Yield Category. Year to date, the Fund returned 54.54%, based on NAV, compared to the 27.23% return of the Index and the 27.21% average total return of the Morningstar Closed-End High Yield Category.

The Fund’s relative outperformance in the second quarter and six-month period was due primarily to the leverage obtained through its Auction-Rate Preferred Shares (ARPS). Other contributors to outperformance included the media/telecommunication, information technology and financial market segments. Performance in the services, housing, and metals/minerals segments detracted from overall performance.

According to Moody’s, the global speculative grade, issuer-based default rate hit a seven-year high at the end of May, reaching 10.10%. In its June 2009 Default Report, Moody’s predicted that the global default rate will peak at 12.8% in the fourth quarter of 2009 and decline to 6.0% by the end of June next year.

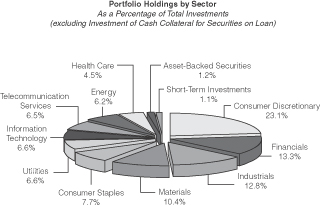

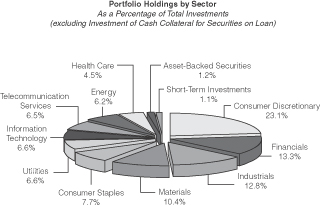

The Fund was well diversified at the end of the reporting period, with investments in 356 securities in 60 industries. As of June 30, 2009, the Fund’s largest industry sector concentration was in media, which accounted for 10.2% of its market value. For the quarter, the average price of the index rose 13.99 points from 63.66 to 77.65, the average yield (calculated to the worst call date) dropped 477 basis points (bps) from 17.09% to 12.32% and the spread over the comparable Treasury tightened 519 bps from 1,500 bps to 981 bps. For the six months ended June 30, 2009, the average price of the index rose 16.06 points from 61.59 to 77.65, the average yield dropped 663 bps from 18.95% to 12.32% and the spread over the comparable Treasury tightened 726 bps from 1,707 bps to 981 bps.

Auction Rate Preferred Shares and Dividend

Since February 2008, most auctions for preferred shares of closed-end funds and auction-rate securities of other issuers failed. The weekly auction for the ARPS failed since February 13, 2008. Since that time, a number of broker-dealers announced that they will offer to repurchase auction-rate securities from certain of their clients. Any action taken by the Fund to provide liquidity to the ARPS must be in the best interest of the Fund as a whole. The Fund has not been able to identify financing to redeem the ARPS that satisfies this requirement. As indicated below, the Fund made two voluntary redemptions totaling 920 shares of the 2,640 outstanding shares of the ARPS. To the extent that the Fund determines that additional redemptions are in the best interest of the Fund as a whole, we will post additional information on the Fund’s website and keep shareholders informed.

On November 26, 2008, the Fund announced that it was not permitted to pay the November monthly dividend on December 9, 2008, because the Fund’s asset coverage was less than 200% for its ARPS. The Fund also indicated that it would be unable to resume the declaration and payment of dividends until the asset coverage requirements were met. During December, the Fund issued notices to redeem 920 shares of ARPS, allowing the Fund to resume the declaration and payment of monthly dividends. The Fund declared a dividend of $0.13 on December 11, 2008, consisting of $0.075 in lieu of the cancelled November dividend and $0.055 for the December dividend.

Since January 2009, the Fund has paid a monthly dividend of $0.055. The Board of Directors has authorized the Fund to pay a monthly dividend of $0.055 subject to the Fund’s compliance with its asset coverage requirements. It is expected that the Fund would redeem additional shares of ARPS to the extent necessary for the Fund to maintain an asset coverage of at least 200% for the ARPS after payment of all dividends. As of June 30, 2009, the Fund’s asset coverage was 279%.

In the event that the Fund does not meet its asset coverage requirements and is not able to declare or pay a dividend, shareholders will be notified. The Fund has posted question and answers on the Fund’s website at www.phf-hy.com, which is intended to provide shareholders with additional information concerning asset coverage requirements and the impact that such requirements have on the ability to declare and pay dividends.

Fund Strategy

During the period, signs of the economy bottoming presented the opportunity to selectively add credit volatility in lower-rated and more

PACHOLDER HIGH YIELD FUND, INC.

(Unaudited)

cyclical issuers that we believed had staying power in an environment of prolonged weak credit fundamentals. However, we believe that investors should be selective, even at current spreads and prices.

As always, we appreciate your interest in the Fund and look forward to your continued support.

Sincerely,

George C.W. Gatch

President

The performance quoted is past performance and is not a guarantee of future results. Closed-end funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown.

J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management, Inc., JPMorgan Investment Advisors, Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc.

Securities rated below investment grade are called “high-yield bonds,” “non-investment grade bonds,” “below investment-grade bonds,” or “junk bonds.” They generally are rated in the fifth or lower rating categories of Standard & Poor’s and Moody’s Investors Service. Although these securities tend to provide higher yields than higher-rated securities, there is a greater risk that the Fund’s share value will decline. Because this Fund primarily invests in bonds, it is subject to interest rate risks. Bond prices generally fall when interest rates rise.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting and legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Portfolio Holdings Availability

No sooner than 10 days after the end of each month, the Fund’s uncertified complete schedule of its portfolio holdings will be available on its website (www.phf-hy.com). In addition, the Fund files its certified, complete schedule of its portfolio holdings with the U.S. Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Qs are available, without charge, on the SEC’s website at www.sec.gov. The Fund’s Form N-Qs may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

No sooner than 10 calendar days after the end of each month, the Fund’s top 10 holdings as of the last day of each month, as well as certain other fund facts and statistical information, will also be available on the Fund’s website.

PACHOLDER HIGH YIELD FUND, INC.

(Unaudited)

Figure 1

| | | | | | | | |

Total Return ** | | Net Asset Value

(NAV) | | | Market

Price | |

Six Months# | | | 54.54 | % | | | 52.88 | % |

1 Year | | | (15.15 | )% | | | (26.13 | )% |

5 Year | | | 3.41 | % | | | 0.99 | % |

10 Year | | | 3.69 | % | | | 2.41 | % |

Price per share at June 30, 2009 | | $ | 5.95 | | | $ | 5.23 | |

| | | | | | | | |

| ** | | Total returns assume the reinvestment off all dividends and capital gains, if any. Total returns shown are average annual returns unless otherwise noted. |

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

CORPORATE BONDS — 121.8% | | | | | | |

ADVERTISING — 0.2% | | | | | | |

Interpublic Group of Cos., Inc., Private Placement, 10.000%, 07/15/172 | | $ | 150 | | $ | 151,125 | | 0.2 | % |

| | | | | | | | | |

AEROSPACE & DEFENSE — 0.2% | | | | | | |

DigitalGlobe, Inc., Private Placement,

Sr Nt, 10.500%, 05/01/142 | | | 125 | | | 129,375 | | 0.2 | |

| | | | | | | | | |

AIRLINES — 3.2% | | | | | | |

American Airlines, Inc., Nt,

3.363%, 10/18/093,9 | | | 236 | | | 214,059 | | 0.3 | |

American Airlines, Pass Through Trust 1991, Collateral Trust Notes, Series 91A2, 10.180%, 01/02/139 | | | 1,054 | | | 674,442 | | 0.9 | |

American Airlines, Pass Through Trust 1991, Private Placement, Nt, Series 91B2, 10.320%, 07/30/142,9 | | | 670 | | | 335,137 | | 0.4 | |

Continental Airlines, Inc.,

9.000%, 07/08/16 | | | 200 | | | 200,000 | | 0.3 | |

Continental Airlines, Inc., Pass Thru Cert, Series ERJ1, 9.798%, 04/01/2110 | | | 1,457 | | | 947,336 | | 1.2 | |

Delta Air Lines, Inc., 8.300%, 12/15/291,4 | | | 1,145 | | | 8,015 | | 0.0 | 12 |

10.125%, 05/15/101,4 | | | 500 | | | 3,500 | | 0.0 | 12 |

UAL Pass Through Trust, Series 2007-1, Private Placement, Nt, VAR, 3.361%, 07/02/142,9 | | | 177 | | | 69,188 | | 0.1 | |

7.336%, 07/02/192 | | | 89 | | | 46,261 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 2,497,938 | | 3.2 | |

AUTO COMPONENTS — 0.2% | | | | | | |

Delphi Corp., 7.125%, 05/01/291,4 | | | 725 | | | 906 | | 0.0 | 12 |

Tenneco, Inc., Series B, 10.250%, 07/15/13 | | | 146 | | | 138,335 | | 0.2 | |

| | | | | | | | | |

| | | | | | 139,241 | | 0.2 | |

AUTOMOBILES — 0.6% | | | | | | |

Ford Holdings LLC,

9.300%, 03/01/30 | | | 112 | | | 66,080 | | 0.1 | |

9.375%, 03/01/20 | | | 150 | | | 88,500 | | 0.1 | |

Ford Motor Co., Nt, 9.980%, 02/15/47 | | | 125 | | | 65,000 | | 0.1 | |

General Motors Corp., Series B, 5.250%, 03/06/32 | | | 4 | | | 11,000 | | 0.0 | 12 |

General Motors Corp., Debentures, 6.750%, 05/01/281,4 | | | 50 | | | 6,000 | | 0.0 | 12 |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

AUTOMOBILES (continued) | | | | | | |

8.100%, 06/15/241,4 | | $ | 1,725 | | $ | 202,688 | | 0.2 | % |

8.375%, 07/15/331,4,6 | | | 450 | | | 57,375 | | 0.1 | |

| | | | | | | | | |

| | | | | | 496,643 | | 0.6 | |

BEVERAGES — 0.7% | | | | | | |

Constellation Brands, Inc.,

Sr Nt, 8.375%, 12/15/14 | | | 390 | | | 390,975 | | 0.5 | |

FBG Finance Ltd., Private Placement, (Australia), 5.125%, 06/15/152 | | | 175 | | | 163,935 | | 0.2 | |

| | | | | | | | | |

| | | | | | 554,910 | | 0.7 | |

BROADCASTING & CABLE TV — 0.1% | | | | | | |

Adelphia Communications Corp.,

6.000%, 02/15/061,4 | | | 125 | | | 12 | | 0.0 | 12 |

Adelphia Communications Corp., Sr Nt, 8.125%, 07/15/031,4 | | | 750 | | | 14,063 | | 0.0 | 12 |

9.375%, 11/15/091,4 | | | 560 | | | 10,500 | | 0.0 | 12 |

Adelphia Recovery Trust, Contingent

Value 12/31/491,4 | | | 1,297 | | | 38,907 | | 0.1 | |

| | | | | | | | | |

| | | | | | 63,482 | | 0.1 | |

BUILDING PRODUCTS — 0.2% | | | | | | |

AMH Holdings, Inc., Sr Nt,

11.250%, 03/01/147 | | | 400 | | | 176,000 | | 0.2 | |

| | | | | | | | | |

CHEMICALS — 3.2% | | | | | | |

PolyOne Corp., Nt, 8.875%, 05/01/1210 | | | 1,750 | | | 1,470,000 | | 1.9 | |

Sterling Chemicals, Inc.,

10.250%, 04/01/15 | | | 350 | | | 318,500 | | 0.4 | |

Terra Capital, Inc., Sr Nt, Series B, 7.000%, 02/01/17 | | | 525 | | | 479,719 | | 0.6 | |

Westlake Chemical Corp.,

6.625%, 01/15/16 | | | 250 | | | 218,750 | | 0.3 | |

| | | | | | | | | |

| | | | | | 2,486,969 | | 3.2 | |

COMMERCIAL BANKS — 1.5% | | | | | | |

Bank of America Corp.,

5.250%, 12/01/15 | | | 550 | | | 484,313 | | 0.6 | |

BankAmerica Capital II, Nt, Series 2, 8.000%, 12/15/26 | | | 30 | | | 24,897 | | 0.1 | |

Wachovia Capital Trust III,

5.800%, 03/15/1114 | | | 1,060 | | | 636,000 | | 0.8 | |

| | | | | | | | | |

| | | | | | 1,145,210 | | 1.5 | |

| | | | | | | | | |

4

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

COMMERCIAL SERVICES & SUPPLIES — 2.5% | | | | | | |

Cenveo Corp., Private Placement, 10.500%, 08/15/162 | | $ | 1,000 | | $ | 750,000 | | 1.0 | % |

Cenveo Corp., Sr Sub Nt,

7.875%, 12/01/13 | | | 325 | | | 227,500 | | 0.3 | |

Harland Clarke Holdings Corp., VAR, | | | | | | | | | |

5.633%, 05/15/15 | | | 350 | | | 210,875 | | 0.3 | |

9.500%, 05/15/15 | | | 625 | | | 482,812 | | 0.6 | |

Quebecor World Capital Corp., Private Placement, Sr Nt, (Canada), 8.750%, 03/15/161,2,4 | | | 810 | | | 72,900 | | 0.1 | |

Quebecor World Capital Corp., Sr Nt, (Canada), 6.125%, 11/15/131,4 | | | 1,415 | | | 120,275 | | 0.1 | |

Quebecor World, Inc., Private Placement, Sr Nt, (Canada), 9.750%, 01/15/151,2,4 | | | 585 | | | 52,650 | | 0.1 | |

| | | | | | | | | |

| | | | | | 1,917,012 | | 2.5 | |

COMMUNICATIONS EQUIPMENT — 0.7% | | | | | | |

Avaya, Inc., Private Placement, Sr Nt, 9.750%, 11/01/152 | | | 800 | | | 560,000 | | 0.7 | |

| | | | | | | | | |

COMPUTERS & PERIPHERALS — 0.7% | | | | | | |

Seagate Technology HDD Holdings, (Cayman Islands), 6.800%, 10/01/166 | | | 250 | | | 214,375 | | 0.3 | |

Seagate Technology International, Private Placement, (Cayman Islands), 10.000%, 05/01/142 | | | 320 | | | 330,000 | | 0.4 | |

| | | | | | | | | |

| | | | | | 544,375 | | 0.7 | |

CONSTRUCTION ENGINEERING — 2.0% | | | | | | |

RSC Equipment Rental, Inc.,

9.500%, 12/01/14 | | | 618 | | | 495,945 | | 0.6 | |

United Rentals North America, Inc., Co Guar, 6.500%, 02/15/12 | | | 975 | | | 945,750 | | 1.2 | |

United Rentals North America, Inc., Private Placement, 10.875%, 06/15/162 | | | 175 | | | 168,000 | | 0.2 | |

| | | | | | | | | |

| | | | | | 1,609,695 | | 2.0 | |

CONSTRUCTION MATERIALS — 1.3% | | | | | | |

Hanson Australia Funding Ltd., (Australia), 5.250%, 03/15/13 | | | 484 | | | 380,569 | | 0.5 | |

Hanson Ltd., (United Kingdom), 6.125%, 08/15/16 | | | 655 | | | 489,613 | | 0.7 | |

7.875%, 09/27/10 | | | 100 | | | 96,500 | | 0.1 | |

| | | | | | | | | |

| | | | | | 966,682 | | 1.3 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

CONSUMER FINANCE — 6.5% | | | | | | |

ACE Cash Express, Inc., Private Placement, Sr Nt, 10.250%, 10/01/142,9 | | $ | 1,000 | | $ | 450,000 | | 0.6 | % |

Ford Motor Credit Co. LLC, VAR, 3.889%, 01/13/12 | | | 1,000 | | | 773,750 | | 1.0 | |

7.800%, 06/01/12 | | | 200 | | | 172,084 | | 0.2 | |

Ford Motor Credit Co. LLC, Nt, 8.000%, 12/15/1610 | | | 700 | | | 535,170 | | 0.7 | |

8.625%, 11/01/1010 | | | 555 | | | 521,658 | | 0.7 | |

GMAC LLC, Private Placement, VAR,

2.868%, 12/01/142 | | | 307 | | | 214,900 | | 0.3 | |

6.625%, 05/15/122 | | | 158 | | | 131,930 | | 0.2 | |

7.000%, 02/01/122,6 | | | 300 | | | 254,400 | | 0.3 | |

8.000%, 11/01/312 | | | 1,592 | | | 1,114,400 | | 1.4 | |

SLM Corp., VAR, 0.829%, 03/15/11 | | | 350 | | | 300,245 | | 0.4 | |

VAR, 1.392%, 01/27/14 | | | 100 | | | 69,512 | | 0.1 | |

5.400%, 10/25/11 | | | 143 | | | 128,613 | | 0.2 | |

8.450%, 06/15/18 | | | 390 | | | 333,639 | | 0.4 | |

Series MTNA, 5.000%, 06/15/18 | | | 30 | | | 19,901 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 5,020,202 | | 6.5 | |

CONSUMER PRODUCTS — 2.1% | | | | | | |

Central Garden and Pet Co., 9.125%, 02/01/13 | | | 215 | | | 205,594 | | 0.3 | |

Jarden Corp., 7.500%, 05/01/176 | | | 550 | | | 481,250 | | 0.6 | |

Spectrum Brands, Inc., Sr Nt, 7.375%, 02/01/151,4 | | | 625 | | | 418,750 | | 0.5 | |

12.500%, 10/02/131,4,6 | | | 725 | | | 500,250 | | 0.7 | |

| | | | | | | | | |

| | | | | | 1,605,844 | | 2.1 | |

CONTAINERS & PACKAGING — 2.5% | | | | | | |

Berry Plastics Corp., VAR, 5.881%, 02/15/15 | | | 400 | | | 353,000 | | 0.5 | |

Berry Plastics Holding Corp., Nt, 8.875%, 09/15/14 | | | 400 | | | 337,000 | | 0.4 | |

BWAY Corp., Private Placement, 10.000%, 04/15/142 | | | 100 | | | 99,750 | | 0.1 | |

Constar International, Inc., Co. Guar., VAR, 4.258%, 02/15/12 | | | 750 | | | 582,187 | | 0.8 | |

Plastipak Holdings, Inc., Private Placement, Sr Nt, 8.500%, 12/15/152 | | | 300 | | | 268,875 | | 0.3 | |

Portola Packaging, Inc., Sr Nt, 8.250%, 02/01/121,3,4,9 | | | 270 | | | 62,100 | | 0.1 | |

5

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

CONTAINERS & PACKAGING (continued) | | | | | | |

Solo Cup Co., Sr Nt, 8.500%, 02/15/14 | | $ | 250 | | $ | 205,000 | | 0.3 | % |

| | | | | | | | | |

| | | | | | 1,907,912 | | 2.5 | |

DISTRIBUTORS — 0.8% | | | | | | |

American Tire Distributors, Inc., Nt, 10.750%, 04/01/13 | | | 435 | | | 353,981 | | 0.4 | |

Asbury Automotive Group, Inc., Sr Nt, 8.000%, 03/15/14 | | | 63 | | | 52,290 | | 0.1 | |

KAR Holdings, Inc., Sr Nt, 8.750%, 05/01/14 | | | 150 | | | 128,625 | | 0.2 | |

10.000%, 05/01/15 | | | 123 | | | 100,860 | | 0.1 | |

| | | | | | | | | |

| | | | | | 635,756 | | 0.8 | |

DIVERSIFIED CONSUMER SERVICES — 2.3% | | | | | | |

Knowledge Learning Corp., Inc., Private Placement, Sr Sub Nt, 7.750%, 02/01/152 | | | 700 | | | 651,000 | | 0.9 | |

Mac-Gray Corp., Sr Nt, 7.625%, 08/15/15 | | | 650 | | | 618,312 | | 0.8 | |

Sotheby’s, 7.750%, 06/15/15 | | | 250 | | | 186,250 | | 0.2 | |

Stewart Enterprises, Inc., Sr Nt, 6.250%, 02/15/1310 | | | 324 | | | 301,320 | | 0.4 | |

| | | | | | | | | |

| | | | | | 1,756,882 | | 2.3 | |

DIVERSIFIED FINANCIAL SERVICES — 3.0% | | | | | | |

CIT Group Funding Co. of Canada, Sr Nt, (Canada), 5.600%, 11/02/11 | | | 393 | | | 288,429 | | 0.4 | |

CIT Group, Inc., 5.600%, 04/27/116 | | | 325 | | | 243,699 | | 0.3 | |

5.800%, 07/28/116 | | | 873 | | | 654,534 | | 0.8 | |

CIT Group, Inc., Private Placement, 12.000%, 12/18/182 | | | 300 | | | 140,940 | | 0.2 | |

Deluxe Corp., Nt, Series B, 5.125%, 10/01/14 | | | 600 | | | 459,000 | | 0.6 | |

Goldman Sachs Group, Inc. (The), 6.750%, 10/01/37 | | | 604 | | | 536,952 | | 0.7 | |

| | | | | | | | | |

| | | | | | 2,323,554 | | 3.0 | |

DIVERSIFIED MANUFACTURING — 1.8% | | | | | | |

Polypore, Inc., Sr Sub Nt, 8.750%, 05/15/12 | | | 1,539 | | | 1,363,939 | | 1.8 | |

| | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 3.0% | | | |

Frontier Communications Corp., 8.250%, 05/01/14 | | | 50 | | | 47,250 | | 0.1 | |

Level 3 Financing, Inc., Co. Guar, 9.250%, 11/01/1410 | | | 800 | | | 656,000 | | 0.9 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES (continued) | | | |

Level 3 Financing, Inc., Sr Nt, 12.250%, 03/15/136 | | $ | 200 | | $ | 190,000 | | 0.2 | % |

Qwest Corp., Sr Nt, 7.625%, 06/15/1510 | | | 1,015 | | | 954,100 | | 1.2 | |

Time Warner Telecom Holdings, Inc., Sr Nt, 9.250%, 02/15/1410 | | | 500 | | | 496,250 | | 0.6 | |

| | | | | | | | | |

| | | | | | 2,343,600 | | 3.0 | |

ELECTRIC UTILITIES — 0.2% | | | | | | |

Calpine Construction Finance Co. LP and CCFC Finance Corp., Private Placement, 8.000%, 06/01/162 | | | 200 | | | 191,500 | | 0.2 | |

| | | | | | | | | |

ELECTRICAL EQUIPMENT — 0.2% | | | | | | |

Belden, Inc., Private Placement, Sr Nt, 9.250%, 06/15/192 | | | 125 | | | 121,094 | | 0.2 | |

| | | | | | | | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 1.9% | |

Flextronics International Ltd., Debentures, (Singapore), 6.250%, 11/15/14 | | | 210 | | | 196,350 | | 0.3 | |

Intcomex, Inc., Sec’d Nt, 11.750%, 01/15/119 | | | 1,100 | | | 442,750 | | 0.6 | |

Sanmina-SCI Corp., 6.750%, 03/01/136 | | | 200 | | | 155,000 | | 0.2 | |

Sanmina-SCI Corp., Private Placement, Sr Nt, VAR, 3.379%, 06/15/142 | | | 300 | | | 246,000 | | 0.3 | |

Smart Modular Technologies WWH, Inc., Sr Nt, (Cayman Islands), VAR, 6.097%, 04/01/123,9 | | | 423 | | | 389,043 | | 0.5 | |

| | | | | | | | | |

| | | | | | 1,429,143 | | 1.9 | |

ENERGY EQUIPMENT & SERVICES — 3.8% | | | | | | |

Bristow Group, Inc., Co Guar, 6.125%, 06/15/13 | | | 250 | | | 226,250 | | 0.3 | |

Calfrac Holdings LP, Private Placement, Debentures, 7.750%, 02/15/152 | | | 250 | | | 215,000 | | 0.3 | |

Forbes Energy Services LLC/Forbes Energy Capital, Inc., 11.000%, 02/15/15 | | | 750 | | | 555,000 | | 0.7 | |

Helix Energy Solutions Group, Inc., Private Placement, 9.500%, 01/15/162 | | | 1,000 | | | 912,500 | | 1.2 | |

Key Energy Services, Inc., Sr Nt, 8.375%, 12/01/14 | | | 338 | | | 298,285 | | 0.4 | |

6

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

ENERGY EQUIPMENT & SERVICES (continued) | | | | | | |

PHI, Inc., Co Guar, 7.125%, 04/15/13 | | $ | 783 | | $ | 696,870 | | 0.9 | % |

| | | | | | | | | |

| | | | | | 2,903,905 | | 3.8 | |

FOOD & STAPLES RETAILING — 3.8% | | | | | | |

Golden State Foods Corp., Private Placement, Sr Sub Nt, 9.240%, 01/10/122,8,9 | | | 1,550 | | | 1,582,937 | | 2.1 | |

Ingles Markets, Inc., Private Placement, 8.875%, 05/15/172 | | | 190 | | | 187,150 | | 0.2 | |

Rite Aid Corp., 10.375%, 07/15/16 | | | 800 | | | 720,000 | | 0.9 | |

Rite Aid Corp., Debentures, 7.500%, 03/01/17 | | | 600 | | | 469,500 | | 0.6 | |

| | | | | | | | | |

| | | | | | 2,959,587 | | 3.8 | |

FOOD PRODUCTS — 2.3% | | | | | | |

Chiquita Brands International, Inc., Sr Nt, 8.875%, 12/01/156 | | | 699 | | | 602,888 | | 0.8 | |

Dole Food Co., Inc., Private Placement,

Sr Nt, 13.875%, 03/15/142,6 | | | 250 | | | 275,000 | | 0.3 | |

Eurofresh, Inc., Private Placement, Nt,

11.500%, 01/15/131,2,4,9 | | | 2,367 | | | 150,896 | | 0.2 | |

JBS USA LLC/JBS USA Finance, Inc., Private Placement,

11.625%, 05/01/142 | | | 150 | | | 141,750 | | 0.2 | |

Smithfield Foods, Inc., Nt, Series B,

7.750%, 05/15/13 | | | 750 | | | 615,000 | | 0.8 | |

Tom’s Foods, Inc., Sr Nt,

10.500%, 11/01/041,3,4,9 | | | 872 | | | 8,718 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 1,794,252 | | 2.3 | |

GAMING — 4.9% | | | | | | |

FireKeepers Development Authority, Private Placement,

13.875%, 05/01/152 | | | 75 | | | 69,188 | | 0.1 | |

Harrah’s Operating Co., Inc., Private Placement, Series A144,

10.000%, 12/15/182 | | | 500 | | | 287,500 | | 0.4 | |

Harrahs Operating Escrow LLC/Harrahs Escrow Corp., Private Placement,

11.250%, 06/01/172 | | | 250 | | | 236,250 | | 0.3 | |

Isle of Capri Casinos, Inc., Sr Nt,

7.000%, 03/01/14 | | | 400 | | | 322,000 | | 0.4 | |

Mandalay Resort Group, Sr Nt,

6.375%, 12/15/11 | | | 500 | | | 372,500 | | 0.5 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

GAMING (continued) | | | | | | |

Mashantucket Western Pequot Tribe, Private Placement, 8.500%, 11/15/152 | | $ | 1,320 | | $ | 660,000 | | 0.8 | % |

MGM Mirage, 8.500%, 09/15/10 | | | 250 | | | 226,875 | | 0.3 | |

MGM Mirage, Co Guar,

7.625%, 01/15/176 | | | 150 | | | 97,125 | | 0.1 | |

MGM Mirage, Sr Nt, 6.750%, 09/01/12 | | | 172 | | | 122,120 | | 0.2 | |

Seminole Hard Rock Entertainment, Inc., Private Placement, VAR,

3.129%, 03/15/142 | | | 500 | | | 345,000 | | 0.4 | |

Shingle Springs Tribal Gaming Authority, Private Placement, Sr Nt,

9.375%, 06/15/152 | | | 1,000 | | | 600,000 | | 0.8 | |

Wynn Las Vegas Capital Corp., Nt,

6.625%, 12/01/146 | | | 500 | | | 440,000 | | 0.6 | |

| | | | | | | | | |

| | | | | | 3,778,558 | | 4.9 | |

| | | | | | | | | |

HEALTH CARE PROVIDERS & SERVICES — 5.3% | | | |

Apria Healthcare Group, Inc.,

Private Placement,

11.250%, 11/01/142 | | | 165 | | | 159,225 | | 0.2 | |

CHS/Community Health Systems, Inc.,

8.875%, 07/15/15 | | | 800 | | | 784,000 | | 1.0 | |

HCA, Inc.,

5.750%, 03/15/14 | | | 195 | | | 156,000 | | 0.2 | |

6.375%, 01/15/15 | | | 407 | | | 330,688 | | 0.4 | |

HCA, Inc., Sec’d Nt, 9.250%, 11/15/16 | | | 1,000 | | | 985,000 | | 1.3 | |

Multiplan, Inc., Private Placement,

10.375%, 04/15/162 | | | 750 | | | 721,875 | | 0.9 | |

TeamHealth, Inc., Sr Sub Nt,

11.250%, 12/01/13 | | | 225 | | | 230,062 | | 0.3 | |

Tenet Healthcare Corp.,

Private Placement,

8.875%, 07/01/192 | | | 750 | | | 753,750 | | 1.0 | |

| | | | | | | | | |

| | | | | | 4,120,600 | | 5.3 | |

| | | | | | | | | |

HOTELS, RESTAURANTS & LEISURE — 2.0% | | | | | | |

Royal Caribbean Cruises Ltd.,

Sr Nt, (Liberia), 11.875%, 07/15/15 | | | 200 | | | 194,798 | | 0.3 | |

Six Flags Operations, Inc., Private Placement,

12.250%, 07/15/161,2,4,6 | | | 1,122 | | | 779,790 | | 1.0 | |

7

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

HOTELS, RESTAURANTS & LEISURE (continued) | | | |

Speedway Motorsports, Inc., Sr Nt, Private Placement, 8.750%, 06/01/162 | | $ | 300 | | $ | 303,750 | | 0.4 | % |

Speedway Motorsports, Inc., Sr Sub Nt,

6.750%, 06/01/13 | | | 250 | | | 240,000 | | 0.3 | |

| | | | | | | | | |

| | | | | | 1,518,338 | | 2.0 | |

HOUSEHOLD DURABLES — 1.1% | | | | | | |

K Hovnanian Enterprises, Inc., Debentures, 11.500%, 05/01/13 | | | 500 | | | 432,500 | | 0.5 | |

KB Home, Sr Nt, 5.875%, 01/15/15 | | | 250 | | | 211,250 | | 0.3 | |

Meritage Homes Corp., Sr Nt,

7.000%, 05/01/14 | | | 250 | | | 205,000 | | 0.3 | |

| | | | | | | | | |

| | | | | | 848,750 | | 1.1 | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 6.6% | |

Calpine Generating Co. LLC, Sec’d Nt, VAR, 4,823.931%, 04/01/111,4 | | | 1,000 | | | 75,000 | | 0.1 | |

Dynegy Holdings, Inc., Sr Unsec’d Nt,

7.125%, 05/15/18 | | | 500 | | | 340,000 | | 0.4 | |

Dynegy Roseton/Danskammer Pass Through Trust, Series B,

7.670%, 11/08/16 | | | 500 | | | 438,750 | | 0.6 | |

Edison Mission Energy, Sr Nt,

7.750%, 06/15/16 | | | 1,000 | | | 815,000 | | 1.1 | |

Mirant Americas Generation LLC, Sr Nt, 8.500%, 10/01/21 | | | 500 | | | 395,000 | | 0.5 | |

NRG Energy, Inc.,

Sr Nt, 7.250%, 02/01/14 | | | 250 | | | 242,500 | | 0.3 | |

7.375%, 01/15/17 | | | 1,375 | | | 1,295,937 | | 1.7 | |

RRI Energy, Inc., 6.750%, 12/15/146 | | | 841 | | | 810,514 | | 1.0 | |

7.625%, 06/15/14 | | | 500 | | | 457,500 | | 0.6 | |

Texas Competitive Electric Holdings Co. LLC, Series A, 10.250%, 11/01/15 | | | 350 | | | 217,875 | | 0.3 | |

| | | | | | | | | |

| | | | | | 5,088,076 | | 6.6 | |

INDUSTRIAL CONGLOMERATES — 2.2% | | | | | | |

JB Poindexter & Co., Inc., Co Guar, 8.750%, 03/15/1410 | | | 2,084 | | | 1,604,680 | | 2.1 | |

Milacron Escrow Corp., Sec’d Nt, 11.500%, 05/15/111,3,4 | | | 1,215 | | | 85,050 | | 0.1 | |

| | | | | | | | | |

| | | | | | 1,689,730 | | 2.2 | |

INDUSTRIAL MACHINERY — 1.8% | | | | | | |

General Cable Corp., VAR,

2.972%, 04/01/15 | | | 250 | | | 202,500 | | 0.2 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

INDUSTRIAL MACHINERY (continued) | | | | | | |

RBS Global, Inc. & Rexnord Corp., Sr Sub Nt, 11.750%, 08/01/16 | | $ | 410 | | $ | 302,375 | | 0.4 | % |

RBS Global, Inc./Rexnord LLC, Private Placement, Series 144a,

9.500%, 08/01/142 | | | 1,063 | | | 908,865 | | 1.2 | |

| | | | | | | | | |

| | | | | | 1,413,740 | | 1.8 | |

INSURANCE — 4.7% | | | | | | |

Crum and Forster Holdings Corp., 7.750%, 05/01/17 | | | 600 | | | 520,500 | | 0.7 | |

HUB International Holdings, Inc., Private Placement, 9.000%, 12/15/142 | | | 500 | | | 408,125 | | 0.5 | |

10.250%, 06/15/152 | | | 500 | | | 368,125 | | 0.5 | |

Liberty Mutual Group, Inc., Private Placement, 7.500%, 08/15/362 | | | 250 | | | 172,285 | | 0.2 | |

VAR, 10.750%, 06/15/582 | | | 1,670 | | | 1,202,400 | | 1.6 | |

MetLife, Inc., 10.750%, 08/01/39 | | | 400 | | | 399,924 | | 0.5 | |

USI Holdings Corp., Private Placement, Sr Sub Nt, 9.750%, 05/15/152 | | | 830 | | | 556,100 | | 0.7 | |

| | | | | | | | | |

| | | | | | 3,627,459 | | 4.7 | |

IT Services — 0.4% | | | | | | |

Unisys Corp., Sr Nt, 8.000%, 10/15/12 | | | 500 | | | 300,000 | | 0.4 | |

| | | | | | | | | |

Leisure Equipment & Products — 0.1% | | | | | | |

Eastman Kodak Co., 7.250%, 11/15/13 | | | 60 | | | 36,600 | | 0.1 | |

True Temper Sports, Inc., Sr Nt, 8.375%, 09/15/111,4,9 | | | 490 | | | 4,900 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 41,500 | | 0.1 | |

MARINE — 0.7% | | | | | | |

Ultrapetrol Bahamas Ltd., 1st Mtg, (Bahamas), 9.000%, 11/24/14 | | | 700 | | | 575,750 | | 0.7 | |

| | | | | | | | | |

MEDIA — 11.2% | | | | | | |

Barrington Broadcasting Group LLC and Barrington Broadcasting Capital Corp., Sr Sub Nt, 10.500%, 08/15/14 | | | 700 | | | 238,000 | | 0.3 | |

Block Communications, Inc., Private Placement, Sr Nt, 8.250%, 12/15/152 | | | 800 | | | 700,000 | | 0.9 | |

CanWest MediaWorks LP, Private Placement, Sr Nt, (Canada), 9.250%, 08/01/152 | | | 750 | | | 75,000 | | 0.1 | |

8

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

MEDIA (continued) | | | | | | |

CCO Holdings LLC/CCO Holdings Capital Corp., 8.750%, 11/15/131,4,6 | | $ | 800 | | $ | 760,000 | | 1.0 | % |

Charter Communications Holdings LLC/Charter Communications Operating Capital, 10.875%, 09/15/14 | | | 500 | | | 517,500 | | 0.7 | |

Fisher Communications, Inc.,

Sr Nt, 8.625%, 09/15/14 | | | 500 | | | 438,750 | | 0.6 | |

HSN, Inc., Private Placement,

Sr Nt, 11.250%, 08/01/162 | | | 251 | | | 231,234 | | 0.3 | |

Intelsat Subsidiary Holding Co., Ltd., Private Placement, (Bermuda),

8.875%, 01/15/152 | | | 1,250 | | | 1,206,250 | | 1.6 | |

Lamar Media Corp., Sr Sub Nt,

7.250%, 01/01/136 | | | 39 | | | 37,099 | | 0.0 | 12 |

6.625%, 08/15/15 | | | 250 | | | 211,250 | | 0.3 | |

LBI Media, Inc., Sr Disc Nt, 11.000%, 10/15/137 | | | 625 | | | 288,281 | | 0.4 | |

Nexstar Finance Holdings LLC/Nexstar Finance Holdings, Inc., Sr Disc Nt, 11.375%, 04/01/137 | | | 479 | | | 173,777 | | 0.2 | |

Quebecor Media, Inc., Sr Nt, (Canada), 7.750%, 03/15/1610 | | | 750 | | | 679,688 | | 0.9 | |

Radio One, Inc., Sr Sub Nt, 6.375%, 02/15/13 | | | 500 | | | 150,625 | | 0.2 | |

RH Donnelley, Inc., Private Placement,

11.750%, 05/15/151,2,4 | | | 795 | | | 365,700 | | 0.5 | |

Valassis Communications, Inc., 8.250%, 03/01/15 | | | 1,500 | | | 1,081,875 | | 1.4 | |

Virgin Media Finance plc, Sr Nt, (United Kingdom), 9.125%, 08/15/16 | | | 1,250 | | | 1,203,125 | | 1.5 | |

WMG Acquisition Corp., Sr Nt, Private Placement, 9.500%, 06/15/162 | | | 100 | | | 99,500 | | 0.1 | |

WMG Holdings Corp., Nt, 0.000%, 12/15/147 | | | 250 | | | 196,250 | | 0.2 | |

| | | | | | | | | |

| | | | | | 8,653,904 | | 11.2 | |

METALS & MINING — 1.5% | | | | | | |

FMG Finance Pty Ltd., Private Placement, (Australia), 10.625%, 09/01/162 | | | 250 | | | 240,000 | | 0.3 | |

Wolverine Tube, Inc., Sr Nt, PIK, 15.000%, 03/31/123 | | | 1,145 | | | 881,650 | | 1.2 | |

| | | | | | | | | |

| | | | | | 1,121,650 | | 1.5 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

MULTILINE RETAIL — 0.5% | | | | | | |

Dollar General Corp., PIK, 11.875%, 07/15/17 | | $ | 100 | | $ | 108,000 | | 0.1 | % |

Dollar General Corp., Sr Nt, 10.625%, 07/15/15 | | | 250 | | | 270,000 | | 0.4 | |

| | | | | | | | | |

| | | | | | 378,000 | | 0.5 | |

MULTI-UTILITIES — 0.4% | | | | | | |

Energy Future Holdings Corp., Nt, 10.875%, 11/01/17 | | | 450 | | | 328,500 | | 0.4 | |

| | | | | | | | | |

OIL, GAS & CONSUMABLE FUELS — 6.8% | | | | | | |

Arch Western Finance LLC, 6.750%, 07/01/13 | | | 100 | | | 91,250 | | 0.1 | |

El Paso Performance-Linked Trust, Private Placement, Sr Nt, 7.750%, 07/15/112 | | | 500 | | | 490,693 | | 0.6 | |

Encore Acquisition Co., Sr Nt, 6.000%, 07/15/1510 | | | 1,000 | | | 825,000 | | 1.1 | |

Forest Oil Corp., Nt, 7.250%, 06/15/19 | | | 269 | | | 240,755 | | 0.3 | |

Gibson Energy ULC/GEP Midstream Finance Corp., Private Placement, (Canada), 11.750%, 05/27/142 | | | 200 | | | 198,000 | | 0.3 | |

Massey Energy Co., Nt, 6.875%, 12/15/13 | | | 450 | | | 411,750 | | 0.5 | |

Newfield Exploration Co., Nt, 6.625%, 09/01/14 | | | 200 | | | 184,250 | | 0.3 | |

Range Resources Corp., 7.250%, 05/01/18 | | | 25 | | | 23,375 | | 0.0 | 12 |

Range Resources Corp., Sr Sub Nt, 7.500%, 05/15/16 | | | 267 | | | 256,320 | | 0.3 | |

Swift Energy Co., Sr Nt, 7.125%, 06/01/17 | | | 1,260 | | | 888,300 | | 1.2 | |

Targa Resources Partners LP, 8.250%, 07/01/16 | | | 280 | | | 237,300 | | 0.3 | |

W&T Offshore, Inc., Private Placement, Sr Nt, 8.250%, 06/15/142 | | | 1,000 | | | 770,000 | | 1.0 | |

Western Refining, Inc., Private Placement, VAR, | | | | | | | | | |

10.750%, 06/15/142,6 | | | 225 | | | 204,750 | | 0.3 | |

11.250%, 06/15/172 | | | 225 | | | 199,688 | | 0.2 | |

Williams Partners LP/Williams Partners Finance Corp., Sr Nt, 7.250%, 02/01/17 | | | 250 | | | 228,125 | | 0.3 | |

| | | | | | | | | |

| | | | | | 5,249,556 | | 6.8 | |

9

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

PAPER & FOREST PRODUCTS — 2.9% | | | | | | |

Abitibi-Consolidated Co. of Canada, Private Placement, Sr Nt, (Canada), 13.750%, 04/01/111,2,4 | | $ | 160 | | $ | 147,200 | | 0.2 | % |

Abitibi-Consolidated Co. of Canada, Sr Nt, (Canada), 6.000%, 06/20/131,4 | | | 630 | | | 47,250 | | 0.1 | |

8.375%, 04/01/151,4 | | | 1,395 | | | 111,600 | | 0.1 | |

Abitibi-Consolidated, Inc., Sr Nt, (Canada),

8.850%, 08/01/301,4 | | | 25 | | | 2,000 | | 0.0 | 12 |

Bowater Canada Finance Corp., Nt, (Canada),

7.950%, 11/15/111,4 | | | 500 | | | 90,000 | | 0.1 | |

Cascades, Inc., Sr Nt, (Canada), 7.250%, 02/15/13 | | | 268 | | | 233,830 | | 0.3 | |

Domtar Corp., 7.125%, 08/15/15 | | | 500 | | | 417,500 | | 0.5 | |

Georgia-Pacific LLC, Private Placement, Co Guar, 7.000%, 01/15/152 | | | 125 | | | 116,875 | | 0.1 | |

7.125%, 01/15/172 | | | 325 | | | 302,250 | | 0.4 | |

Jefferson Smurfit Corp., Sr Nt, 8.250%, 10/01/121,4 | | | 240 | | | 90,000 | | 0.1 | |

NewPage Corp., Sr Nt, 10.000%, 05/01/12 | | | 408 | | | 195,840 | | 0.3 | |

Norampac Industries, Inc., Sr Nt, (Canada), 6.750%, 06/01/13 | | | 20 | | | 17,100 | | 0.0 | 12 |

Smurfit-Stone Container Enterprises, Inc., 8.375%, 07/01/121,4 | | | 105 | | | 40,162 | | 0.1 | |

Smurfit-Stone Container Enterprises, Inc., Sr Nt, 8.000%, 03/15/171,4 | | | 865 | | | 320,050 | | 0.4 | |

Verso Paper Holdings LLC/Verso Paper, Inc., Sr Nt, 9.125%, 08/01/14 | | | 250 | | | 116,250 | | 0.2 | |

| | | | | | | | | |

| | | | | | 2,247,907 | | 2.9 | |

PHARMACEUTICALS — 2.2% | | | | | | |

Celtic Pharma Phinco B.V., (Bermuda),

17.000%, 06/15/129 | | | 1,461 | | | 949,696 | | 1.2 | |

Elan Finance plc/Elan Finance Corp., Sr Nt, (Ireland), VAR, 4.883%, 11/15/11 | | | 830 | | | 726,250 | | 1.0 | |

| | | | | | | | | |

| | | | | | 1,675,946 | | 2.2 | |

REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.1% | | | |

HRPT Properties Trust, 5.750%, 02/15/14 | | | 63 | | | 54,156 | | 0.1 | |

| | | | | | | | | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

ROAD & RAIL — 2.0% | | | | | | |

Erac USA Finance Co., Private Placement, 6.375%, 10/15/172 | | $ | 149 | | $ | 134,533 | | 0.2 | % |

Kansas City Southern Railway, Sr Nt,

8.000%, 06/01/15 | | | 500 | | | 465,000 | | 0.6 | |

Quality Distribution LLC/QD Capital Corp., Co Guar, VAR, 5.631%, 01/15/129 | | | 850 | | | 524,875 | | 0.7 | |

9.000%, 11/15/109 | | | 750 | | | 397,500 | | 0.5 | |

| | | | | | | | | |

| | | | | | 1,521,908 | | 2.0 | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 2.4% | | | |

Amkor Technology, Inc.,

Sr Nt, 7.750%, 05/15/13 | | | 300 | | | 275,250 | | 0.4 | |

MagnaChip Semiconductor S.A./MagnaChip Semiconductor Finance Co., Sec’d Nt, (Luxembourg),

VAR, 0.000%, 12/15/111,4,9 | | | 735 | | | 367 | | 0.0 | 12 |

6.875%, 12/15/111,4,9 | | | 750 | | | 375 | | 0.0 | 12 |

NXP BV/NXP Funding LLC, Sr Nt, (Netherlands), Series ExCH,

7.875%, 10/15/14 | | | 1,640 | | | 746,200 | | 1.0 | |

Series EXcH, VAR,

3.881%, 10/15/136 | | | 400 | | | 160,000 | | 0.2 | |

Spansion, Inc., Private Placement, VAR, 3.793%, 06/01/131,2,4 | | | 1,000 | | | 650,000 | | 0.8 | |

| | | | | | | | | |

| | | | | | 1,832,192 | | 2.4 | |

SPECIALTY RETAIL — 3.5% | | | | | | | | | |

ACE Hardware Corp., Private Placement, Sr Nt, 9.125%, 06/01/162 | | | 250 | | | 245,625 | | 0.3 | |

Burlington Coat Factory Warehouse Corp., 11.125%, 04/15/146 | | | 1,000 | | | 795,000 | | 1.1 | |

Collective Brands, Inc., 8.250%, 08/01/13 | | | 500 | | | 462,500 | | 0.6 | |

General Nutrition Centers, Inc., VAR,

6.404%, 03/15/14 | | | 461 | | | 368,800 | | 0.5 | |

PEP Boys-Manny Moe & Jack, Sr Nt,

7.500%, 12/15/14 | | | 300 | | | 247,500 | | 0.3 | |

Southern States Cooperative, Inc., Private Placement, Series 144a,

11.000%, 11/01/112,3,9 | | | 500 | | | 460,000 | | 0.6 | |

Toys R Us, Inc., 7.875%, 04/15/13 | | | 113 | | | 94,355 | | 0.1 | |

| | | | | | | | | |

| | | | | | 2,673,780 | | 3.5 | |

10

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS — 1.2% | | | |

Broder Brothers Co., Private Placement, PIK, 12.000%, 10/15/132,3 | | $ | 371 | | $ | 250,497 | | 0.3 | % |

Hanesbrands, Inc., Sr Nt, Series B, VAR, 4.593%, 12/15/14 | | | 500 | | | 402,500 | | 0.5 | |

Quiksilver, Inc., 6.875%, 04/15/15 | | | 500 | | | 265,000 | | 0.4 | |

| | | | | | | | | |

| | | | | | 917,997 | | 1.2 | |

TOBACCO — 2.0% | | | | | | | | | |

Alliance One International, Inc., Private Placement, 10.000%, 07/15/162 | | | 440 | | | 416,900 | | 0.6 | |

Alliance One International, Inc., Sr Nt,

11.000%, 05/15/12 | | | 900 | | | 940,500 | | 1.2 | |

12.750%, 11/15/12 | | | 150 | | | 157,875 | | 0.2 | |

| | | | | | | | | |

| | | | | | 1,515,275 | | 2.0 | |

TRADING COMPANIES & DISTRIBUTORS — 0.2% | |

Noble Group Ltd., Private Placement, Sr Nt, (Bermuda), 6.625%, 03/17/152 | | | 210 | | | 178,500 | | 0.2 | |

| | | | | | | | | |

TRANSPORTATION SERVICES — 0.0%12 | | | | | | |

IdleAire Technologies Corp., Sr Disc Nt, 13.000%, 12/15/121,3,4,7,9 | | | 1,415 | | | 14,150 | | 0.0 | 12 |

| | | | | | | | | |

WIRELESS TELECOMMUNICATION SERVICES — 3.6% | |

American Tower Corp., Private Placement, 7.250%, 05/15/192 | | | 230 | | | 222,525 | | 0.3 | |

CC Holdings GS V LLC/Crown Castle GS III Corp., Private Placement, 7.750%, 05/01/172 | | | 110 | | | 107,250 | | 0.1 | |

Cricket Communications, Inc., Private Placement, 7.750%, 05/15/162 | | | 180 | | | 173,250 | | 0.2 | |

iPCS, Inc., Sr Nt, VAR, 3.153%, 05/01/13 | | | 440 | | | 347,600 | | 0.5 | |

MetroPCS Wireless, Inc., Sr Nt, 9.250%, 11/01/14 | | | 750 | | | 745,313 | | 1.0 | |

Sprint Nextel Corp., Nt, 6.000%, 12/01/16 | | | 1,400 | | | 1,144,500 | | 1.5 | |

| | | | | | | | | |

| | | | | | 2,740,438 | | 3.6 | |

Total Corporate Bonds | | | | | | | | | |

(cost $122,667,095) | | | | | | 93,902,187 | | 121.8 | |

| | | | | | | | | |

LOAN PARTICIPATIONS & ASSIGNMENTS — 29.7% | | | |

AIRLINES — 0.6% | | | | | | |

Delta Airlines, Inc., 1st Lien Term Loan,

0.261%, 04/30/14 | | | 27 | | | 23,595 | | 0.1 | |

2.318%, 04/30/14 | | | 463 | | | 398,878 | | 0.5 | |

| | | | | | | | | |

| | | | | | 422,473 | | 0.6 | |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

AUTOMOBILES — 1.4% | | | | | | |

Ford Motor Co., Term Loan B, 3.320%, 12/15/13 | | $ | 1,128 | | $ | 817,165 | | 1.1 | % |

4.140%, 12/15/13 | | | 353 | | | 256,036 | | 0.3 | |

| | | | | | | | | |

| | | | | | 1,073,201 | | 1.4 | |

BUILDING PRODUCTS — 0.5% | | | | | | |

Jacuzzi Brands, Inc., 1st Lien Term Loan B, 2.560%, 02/07/149 | | | 443 | | | 181,614 | | 0.3 | |

Jacuzzi Brands, Inc., 1st Lien Term Loan, Letter of Credit, 1.120%, 02/07/149 | | | 40 | | | 16,316 | | 0.0 | 12 |

Jacuzzi Brands, Inc., 2nd Lien Term Loan Tranche B-2, 6.810%, 08/07/149 | | | 1,123 | | | 164,665 | | 0.2 | |

| | | | | | | | | |

| | | | | | 362,595 | | 0.5 | |

CHEMICALS — 2.9% | | | | | | |

Cristal Inorganic Chemicals, 1st Lien Term Loan, 2.847%, 05/15/149 | | | 895 | | | 657,662 | | 0.9 | |

Cristal Inorganic Chemicals, 2nd Lien Term Loan, 6.347%, 05/15/149 | | | 500 | | | 300,000 | | 0.4 | |

Lyondell Chemical Co., Dutch Tranche Revolving Credit Loan, 3.815%, 12/20/13 | | | 6 | | | 2,610 | | 0.0 | 12 |

Lyondell Chemical Co., German Tranche B-1 Euro Term Loan, 4.065%, 12/22/14 | | | 17 | | | 7,494 | | 0.0 | 12 |

Lyondell Chemical Co., German Tranche B-2 Euro Term Loan, 4.065%, 12/22/14 | | | 17 | | | 7,494 | | 0.0 | 12 |

Lyondell Chemical Co., German Tranche B-3 Euro Term Loan, 4.065%, 12/22/14 | | | 17 | | | 7,494 | | 0.0 | 12 |

Lyondell Chemical Co., New Money DIP Term Loan, 13.000%, 12/15/09 | | | 89 | | | 91,889 | | 0.1 | |

Lyondell Chemical Co., Roll-Up DIP Term Loan, 5.940%, 12/15/09 | | | 700 | | | 580,738 | | 0.7 | |

Lyondell Chemical Co., Term Loan, 5.940%, 12/15/09 | | | 134 | | | 111,038 | | 0.2 | |

Lyondell Chemical Co., Tranche B-2 Dollar Term Loan, 7.000%, 12/20/14 | | | 75 | | | 32,519 | | 0.1 | |

Lyondell Chemical Co., U.S. Tranche A Dollar Term Loan, | | | | | | | | | |

3.815%, 12/20/13 | | | 43 | | | 18,651 | | 0.0 | 12 |

3.815%, 12/22/13 | | | 14 | | | 6,141 | | 0.0 | 12 |

11

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

CHEMICALS (continued) | | | | | | |

Lyondell Chemical Co., U.S. Tranche B-1 Dollar Term Loan, 7.000%, 12/20/14 | | $ | 75 | | $ | 32,519 | | 0.0 | %12 |

Lyondell Chemical Co., U.S. Tranche B-3 Dollar Term Loan, 7.000%, 12/20/14 | | | 825 | | | 357,164 | | 0.5 | |

Lyondell Chemical Co., U.S. Tranche Primary Revolving Credit Loan, 3.815%, 12/20/14 | | | 23 | | | 9,789 | | 0.0 | 12 |

| | | | | | | | | |

| | | | | | 2,223,202 | | 2.9 | |

COMMERCIAL SERVICES & SUPPLIES — 1.3% | | | | | | |

Clarke American Corp., Term Loan B, 2.810%, 06/27/14 | | | 618 | | | 477,653 | | 0.6 | |

3.098%, 06/27/14 | | | 281 | | | 217,507 | | 0.3 | |

3.708%, 06/27/14 | | | 84 | | | 64,606 | | 0.1 | |

Quebecor World, Inc., Term Loan, 6.597%, 07/10/12 | | | 250 | | | 235,832 | | 0.3 | |

| | | | | | | | | |

| | | | | | 995,598 | | 1.3 | |

DIVERSIFIED MANUFACTURING — 1.0% | | | | | | |

BOC Edwards, 1st Priority Lien Term Loan, 2.310%, 05/31/14 | | | 1,203 | | | 754,743 | | 1.0 | |

| | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.6% | | | |

Level 3 Communications, Term Loan B, 2.571%, 03/13/14 | | | 71 | | | 59,069 | | 0.1 | |

3.389%, 03/13/14 | | | 179 | | | 147,671 | | 0.2 | |

11.500%, 03/13/14 | | | 250 | | | 256,250 | | 0.3 | |

| | | | | | | | | |

| | | | | | 462,990 | | 0.6 | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 1.0% | |

Isola Group S.A.R.L., 1st Lien Term Loan, 11.000%, 12/18/121,4,9 | | | 445 | | | 200,280 | | 0.3 | |

Isola Group S.A.R.L., 2nd Lien Term Loan, 17.750%, 12/18/131,4,9 | | | 250 | | | 50,000 | | 0.1 | |

Sirius Computer Solutions, 2nd Lien Term Loan, 6.598%, 05/30/139 | | | 1,000 | | | 500,000 | | 0.6 | |

| | | | | | | | | |

| | | | | | 750,280 | | 1.0 | |

FOOD & STAPLES RETAILING — 0.6% | | | | | | |

Rite Aid Corp., Term Loan 3,

6.000%, 06/04/14 | | | 497 | | | 432,322 | | 0.6 | |

| | | | | | | | | |

GAMING — 2.6% | | | | | | |

Fontainebleau Las Vegas Holdings LLC, Delayed Draw Term Loan B,

4.316%, 06/06/141,4 | | | 167 | | | 44,457 | | 0.0 | 12 |

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

GAMING (continued) | | | | | | |

Fontainebleau Las Vegas Holdings LLC, Initial Term Loan, 4.527%, 06/06/141,4 | | $ | 333 | | $ | 88,878 | | 0.1 | % |

Harrah’s Operating Co., Inc., Term B-2 Loan, 4.092%, 01/28/15 | | | 1,028 | | | 750,229 | | 1.0 | |

Venetian Macau, Term B Funded Project Loan, 2.570%, 05/25/13 | | | 1,333 | | | 1,127,773 | | 1.5 | |

| | | | | | | | | |

| | | | | | 2,011,337 | | 2.6 | |

HOTELS, RESTAURANTS & LEISURE — 0.7% | | | | | | |

Outback Steakhouse, Prefunded RC Commitment, 0.449%, 06/14/13 | | | 5 | | | 3,833 | | 0.0 | 12 |

Outback Steakhouse, Term Loan B,

2.625%, 06/14/14 | | | 446 | | | 318,472 | | 0.4 | |

Six Flags Theme Parks, Inc., Term Loan B, 3.350%, 04/30/15 | | | 250 | | | 235,448 | | 0.3 | |

| | | | | | | | | |

| | | | | | 557,753 | | 0.7 | |

HOUSEHOLD PRODUCTS — 0.8% | | | | | | |

Spectrum Brands, Inc., Letter of Credit, 0.170%, 03/30/131,4 | | | 15 | | | 12,837 | | 0.0 | 12 |

6.250%, 03/30/131,4 | | | 10 | | | 8,562 | | 0.0 | 12 |

Spectrum Brands, Inc., Term Loan B,

5.398%, 03/30/131,4 | | | 155 | | | 136,875 | | 0.2 | |

6.250%, 03/30/131,4 | | | 515 | | | 455,639 | | 0.6 | |

| | | | | | | | | |

| | | | | | 613,913 | | 0.8 | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 3.1% | |

Calpine Corp., 1st Priority Lien Term Loan, 3.475%, 03/29/14 | | | 1,424 | | | 1,258,962 | | 1.7 | |

Texas Competitive Electric Holdings Co. LLC, Initial Tranche B-2 Term Loan,

3.810%, 10/10/14 | | | 8 | | | 5,354 | | 0.0 | 12 |

3.821%, 10/10/14 | | | 975 | | | 695,906 | | 0.9 | |

TPF Generation Holdings LLC, 2nd Lien Term Loan, 4.560%, 12/15/14 | | | 500 | | | 406,875 | | 0.5 | |

| | | | | | | | | |

| | | | | | 2,367,097 | | 3.1 | |

INDUSTRIAL CONGLOMERATES — 1.0% | | | | | | |

Milacron, Inc., Dip Term Loan,

19.000%, 10/07/093 | | | 477 | | | 805,934 | | 1.0 | |

| | | | | | | | | |

INSURANCE — 0.8% | | | | | | | | | |

HMSC Corp., 1st Lien Term Loan,

2.560%, 04/03/14 | | | 978 | | | 606,050 | | 0.8 | |

| | | | | | | | | |

IT SERVICES — 2.9% | | | | | | |

Compucom Systems, Inc., Term Loan,

3.810%, 08/23/149 | | | 906 | | | 815,580 | | 1.1 | |

12

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | |

| Description | | Par (000) | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | |

IT SERVICES (continued) | | | | | | |

First Data Corp., Initial Tranche B-1 Term Loan, 3.060%, 09/24/14 | | $ | 22 | | $ | 16,098 | | 0.0 | %12 |

3.065%, 09/24/14 | | | 371 | | | 277,670 | | 0.4 | |

First Data Corp., Initial Tranche B-3 Term Loan, 3.060%, 09/24/14 | | | 81 | | | 60,168 | | 0.1 | |

3.065%, 09/24/14 | | | 1,394 | | | 1,039,836 | | 1.3 | |

| | | | | | | | | |

| | | | | | 2,209,352 | | 2.9 | |

LEISURE EQUIPMENT & PRODUCTS — 0.0%12 | | | | | | |

True Temper Sports, Inc., 2nd Lien Term Loan, 6.600%, 06/30/111,4,9 | | | 77 | | | 19,633 | | 0.0 | 12 |

| | | | | | | | | |

MEDIA — 4.3% | | | | | | |

CCO Holdings LLC, 3rd Lien Term Loan, 6.750%, 09/06/14 | | | 600 | | | 474,750 | | 0.6 | |

Cengage Learning Acquisitions, Term Loan, 2.810%, 07/15/14 | | | 499 | | | 416,535 | | 0.5 | |

High Plains Broadcasting Operating Co. LLC, Term Loan, 7.250%, 09/14/16 | | | 194 | | | 133,161 | | 0.2 | |

Idearc, Inc., Term Loan B,

3.220%, 11/17/14 | | | 730 | | | 307,717 | | 0.4 | |

Newport Television LLC, Term Loan, 0.000%, 09/14/16 | | | 485 | | | 333,738 | | 0.5 | |

7.250%, 09/14/16 | | | 249 | | | 170,854 | | 0.2 | |

Sirius Satellite Radio, Term Loan,

2.563%, 12/20/12 | | | 491 | | | 422,475 | | 0.5 | |

Univision Communications, Inc., 1st Lien Term Loan, 2.560%, 09/20/14 | | | 1,500 | | | 1,119,840 | | 1.4 | |

| | | | | | | | | |

| | | | | | 3,379,070 | | 4.3 | |

MULTILINE RETAIL — 0.4% | | | | | | |

Dollar General Corp., Tranche B-1 Term Loan, 3.060%, 07/07/14 | | | 22 | | | 20,517 | | 0.0 | 12 |

3.068%, 07/07/14 | | | 5 | | | 4,451 | | 0.0 | 12 |

3.069%, 07/07/14 | | | 5 | | | 5,123 | | 0.0 | 12 |

3.789%, 07/07/14 | | | 32 | | | 30,472 | | 0.1 | |

Dollar General Corp., Tranche B-2 Term Loan, 3.060%, 07/07/14 | | | 250 | | | 234,715 | | 0.3 | |

| | | | | | | | | |

| | | | | | 295,278 | | 0.4 | |

PAPER & FOREST PRODUCTS — 2.1% | | | | | | |

Abitibi-Consolidated Co. of Canada, Term Loan, 9.500%, 03/31/111,4 | | | 694 | | | 556,773 | | 0.7 | |

New Page Corp., Term Loan,

4.062%, 12/21/14 | | | 733 | | | 630,697 | | 0.8 | |

Smurfit Stone Container, Term Loan, 0.000%, 11/01/11 | | | 500 | | | 452,085 | | 0.6 | |

| | | | | | | | | |

| | | | | | 1,639,555 | | 2.1 | |

| | | | | | | | | | |

| Description | | Shares/

Par (000) | | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 0.6% | |

Freescale Semiconductor, Inc., Incremental Term Loan,

12.500%, 12/15/14 | | $ | 150 | | | $ | 130,081 | | 0.2 | % |

Freescale Semiconductor, Inc., Term Loan, 2.070%, 11/29/13 | | | 493 | | | | 357,256 | | 0.4 | |

| | | | | | | | | | |

| | | | | | | 487,337 | | 0.6 | |

SPECIALTY RETAIL — 0.5% | |

Burlington Coat Factory, Term Loan, 2.560%, 05/28/13 | | | 500 | | | | 391,174 | | 0.5 | |

| | | | | | | | | | |

Total Loan Participations & Assignments | | | | | | | |

(cost $28,207,662) | | | | | | | 22,860,887 | | 29.7 | |

| | | | | | | | | | |

ASSET-BACKED SECURITIES — 1.9% | | | | | | | |

Countrywide Asset-Backed Certificates, Series 2004-13, Class MV8, VAR, 2.014%, 01/25/359 | | | 115 | | | | 6,171 | | 0.0 | 12 |

Long Beach Mortgage Loan Trust, Series 2004-5, Class M6, VAR,

2.814%, 09/25/349 | | | 67 | | | | 4,070 | | 0.0 | 12 |

Unipac IX LLC, 13.000%, 04/11/133,9 | | | 1,500 | | | | 1,462,960 | | 1.9 | |

| | | | | | | | | | |

Total Asset-Backed Securities | | | | | | | | | | |

(cost $1,637,216) | | | | | | | 1,473,201 | | 1.9 | |

| | | | | | | | | | |

Total Fixed Income Investments | | | | | | | | | | |

(cost $152,511,973) | | | | | | | 118,236,275 | | 153.4 | |

| | | | | | | | | | |

COMMON STOCKS — 0.7% | | | | | | | |

AIRLINES — 0.0%12 | | | | | | | |

Delta Air Lines, Inc.1 | | | 3 | | | | 14,689 | | 0.0 | 12 |

| | | | | | | | | | |

AUTO COMPONENTS — 0.0% | | | | | | | |

Glasstech, Inc., Class C1,3 | | | — | 11 | | | — | | 0.0 | |

| | | | | | | | | | |

BROADCASTING & CABLE TV — 0.0%12 | | | | | | | |

Adelphia Recovery Trust1,3 | | | 157 | | | | 2 | | 0.0 | 12 |

| | | | | | | | | | |

BUILDING PRODUCTS — 0.0%12 | | | | | | | |

Lexington Coal Co.1,3 | | | 25 | | | | 27,083 | | 0.0 | 12 |

| | | | | | | | | | |

CONTAINERS & PACKAGING — 0.2% | | | | | | | |

Constar International, Inc.1 | | | 8 | | | | 118,500 | | 0.2 | |

| | | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.3% | | | |

AboveNet, Inc.1,6 | | | 3 | | | | 208,961 | | 0.3 | |

XO Holdings, Inc.1 | | | 1 | | | | 158 | | 0.0 | 12 |

| | | | | | | | | | |

| | | | | | | 209,119 | | 0.3 | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 0.0%12 | |

Mirant Corp.1 | | | 1 | | | | 14,701 | | 0.0 | 12 |

| | | | | | | | | | |

MEDIA — 0.2% | | | | | | | | | | |

Time Warner Cable, Inc. | | | 5 | | | | 162,530 | | 0.2 | |

| | | | | | | | | | |

13

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (continued)

As of June 30, 2009 (Unaudited)

| | | | | | | | | | |

| Description | | Shares (000) | | | Value | | Percent

of Net

Assets* | |

| | | | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS — 0.0% | | | |

Broder Brothers Co.1 | | $ | 38 | | | $ | — | | 0.0 | % |

Westpoint Stevens, Inc.1,3 | | | 14 | | | | — | | 0.0 | |

| | | | | | | | | | |

| | | | | | | — | | 0.0 | |

Total Common Stocks | | | | | | | | | | |

(cost $2,924,396) | | | | | | | 546,624 | | 0.7 | |

| | | | | | | | | | |

PREFERRED STOCKS — 2.4% | | | | | | | |

AUTO COMPONENTS — 0.0% | | | | | | | |

Glasstech, Inc., Pfd, Series C 3 | | | — | 11 | | | — | | 0.0 | |

| | | | | | | | | | |

COMMERCIAL BANKS — 2.3% | | | | | | | |

CoBank ABC, Pfd, Private Placement, 7.814%2,14 | | | 40 | | | | 1,395,480 | | 1.8 | |

Royal Bank of Scotland Group plc, Pfd, (United Kingdom), Series 1, ADR, 9.118%, 03/31/10 | | | 500 | | | | 407,500 | | 0.5 | |

| | | | | | | | | | |

| | | | | | | 1,802,980 | | 2.3 | |

MEDIA — 0.1% | | | | | | | |

Spanish Broadcasting System, Inc., Pfd1,3 | | | 481 | | | | 1,215 | | 0.0 | 12 |

Spanish Broadcasting System, Inc., Pfd, Series B, PIK,

10.750%, 05/04/093,14 | | | — | 11 | | | 76,508 | | 0.1 | |

| | | | | | | | | | |

| | | | | | | 77,723 | | 0.1 | |

Total Preferred Stocks | | | | | | | | | | |

(cost $1,654,795) | | | | | | | 1,880,703 | | 2.4 | |

| | | | | | | | | | |

RIGHTS — 0.0% | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS — 0.0% | | | |

Westpoint Stevens, Inc., expiring 04/25/141,3 (cost $184,476) | | | 13 | | | | — | | 0.0 | |

| | | | | | | | | | |

WARRANTS — 0.1% | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.1% | |

AboveNet, Inc., Class CW10,

expiring 09/08/10

(Strike Price $24.00)1,3,9 | | | 1 | | | | 45,046 | | 0.1 | |

XO Holdings, Inc., Series A,

expiring 01/16/10

(Strike Price $6.25)1 | | | 1 | | | | 11 | | 0.0 | 12 |

XO Holdings, Inc., Series B,

expiring 01/16/10

(Strike Price $7.50)1 | | | 1 | | | | 2 | | 0.0 | 12 |

| | | | | | | | | | |

| Description | | Shares (000) | | Value | | | Percent

of Net

Assets* | |

| | | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES (continued) | |

XO Holdings, Inc., Series C, expiring 01/16/10

(Strike Price $10.00)1 | | $ | 1 | | $ | 8 | | | 0.0 | 12% |

| | | | | | | | | | |

| | | | | | 45,067 | | | 0.1 | |

TRANSPORTATION SERVICES — 0.0% | | | | | | | |

IdleAire Technologies Corp., expiring 12/15/15

(Strike Price $1.00)1,3 | | | 1 | | | — | | | 0.0 | |

Total Warrants | | | | | | | | | | |

(cost $208,600) | | | | | | 45,067 | | | 0.1 | |

| | | | | | | | | | |

Total Equity Investments | | | | | | | | | | |

(cost $4,972,267) | | | | | | 2,472,394 | | | 3.2 | |

| | | | | | | | | | |

SHORT-TERM INVESTMENT — 1.7% | | | | | | | |

INVESTMENT COMPANY — 1.7% | | | | | | | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 0.410%5,13 (cost 1,301,422) | | | 1,301 | | | 1,301,422 | | | 1.7 | |

| | | | | | | | | | |

INVESTMENTS OF CASH COLLATERAL FOR SECURITIES ON LOAN — 9.4% | |

INVESTMENT COMPANY — 9.4% | | | | | | | |

JPMorgan Prime Money Market Fund, Capital Shares, 0.450%5,13

(cost $7,246,366) | | | 7,246 | | | 7,246,366 | | | 9.4 | |

| | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | | |

(cost $166,032,028) | | | | | | 129,256,457 | | | 167.7 | |

Other Liabilities in Excess of Other Assets | | | (52,172,273 | ) | | (67.7 | ) |

| | | | | | | | | | |

NET ASSETS | | | | | $ | 77,084,184 | | | 100.0 | % |

| | | | | | | | | | |

| ADR | | American Depositary Receipt |

| VAR | | Variable Rate Security. The interest rate shown is the rate in effect as of June 30, 2009. |

14

PACHOLDER HIGH YIELD FUND, INC.

Schedule of Portfolio Investments (concluded)

As of June 30, 2009 (Unaudited)

| * | | Applicable to common stockholders. |

| 1 | | Non-income producing security. |

| 2 | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. Unless otherwise indicated, this security has been determined to be liquid under procedures established by the Board of Directors and may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities amounted to $28,292,521 and 36.7% of net assets. |

| 3 | | Fair valued security. These securities amounted to $4,784,015 and 6.2% of net assets. |

| 5 | | Investment in affiliate. Money market fund registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

| 6 | | All or a portion of the security is on loan. Securities on loan have a fair market value of $7,205,213. |

| 7 | | Step-up bond. Interest rate is effective rate as of June 30, 2009. |

| 8 | | Restricted security. These securities amounted to $1,582,937 and 2.1% of net assets. |

| 9 | | Security deemed to be illiquid. These securities amounted to $11,155,131 and 14.5% of net assets. |

| 10 | | All or a portion of the security is reserved for current or potential holdings of swaps, TBAs, when-issued securities and delayed delivery securities. |

| 11 | | Amount rounds to less than 1,000 shares. |

| 12 | | Amount rounds to less than 0.1%. |

| 13 | | The rate shown is the current yield as of June 30, 2009. |

| 14 | | Security is perpetual and, thus, does not have a predetermined maturity date. The coupon rate for this security is fixed for a period of time and may be structured to adjust thereafter. The date shown reflects the next call date. The coupon rate shown is the rate in effect as of June 30, 2009. |

See Notes to Financial Statements.

15

PACHOLDER HIGH YIELD FUND, INC.

Statement of Assets and Liabilities

As of June 30, 2009 (Unaudited)

| | | | |

ASSETS: | | | | |

Investments in non-affiliates, at value | | $ | 120,708,669 | |

Investments in affiliates, at value | | | 8,547,788 | |

| | | | |

Total investment securities, at value | | | 129,256,457 | |

Cash | | | 27,382 | |

Receivables: | | | | |

Investment securities sold | | | 1,237,611 | |

Interest and dividends | | | 2,066,554 | |

Unrealized appreciation on unfunded commitments | | | 1,246 | |

Due from Administrator | | | 35,037 | |

Prepaid expenses and other assets | | | 23,613 | |

| | | | |

Total Assets | | | 132,647,900 | |

| | | | |

LIABILITIES: | | | | |

Payables: | | | | |

Dividends | | | 4,054 | |

Investment securities purchased | | | 4,071,712 | |

Collateral for securities lending program | | | 7,246,366 | |

Outstanding swap contracts, at value | | | 916,895 | |

Accrued liabilities: | | | | |

Investment advisory fees | | | 250,099 | |

Administration fees | | | 4,961 | |

Custodian and accounting fees | | | 4,680 | |

Trustees’ and Chief Compliance Officer’s fees | | | 3,671 | |

Other | | | 61,278 | |

| | | | |

Total Liabilities | | | 12,563,716 | |

| | | | |

Less: Outstanding Preferred Stock (1,720 shares at $25,000 per share) at liquidation value | | | 43,000,000 | |

| | | | |

Net Assets Applicable to Common Stockholders | | $ | 77,084,184 | |

| | | | |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: | | | | |

Common Stock, $0.01 par value; 49,996,320 shares authorized 12,950,905 shares issued and outstanding | | $ | 129,509 | |

Capital in excess of par | | | 172,778,010 | |

Undistributed net investment income | | | 3,058,445 | |

Accumulated net realized gains (losses) | | | (61,190,560 | ) |

Net unrealized appreciation (depreciation) | | | (37,691,220 | ) |

| | | | |

Total Net Assets applicable to common stockholders | | $ | 77,084,184 | |

| | | | |

Shares Outstanding | | | 12,950,905 | |

Net asset value per Common Share ($77,084,184/12,950,905) | | $ | 5.95 | |

Cost of investments in non-affiliates | | $ | 157,484,240 | |

Cost of investments in affiliates | | | 8,547,788 | |

Value of securities on loan | | | 7,205,213 | |

See Notes to Financial Statements.

Statement of Operations

For the Six Months Ended June 30, 2009 (Unaudited)

| | | | |

INVESTMENT INCOME: | | | | |

Interest income from non-affiliates | | $ | 5,142,905 | |

Dividend income from non-affiliates | | | 268,441 | |

Dividend income from affiliates | | | 9,128 | |

Income from securities lending (net) | | | 17,588 | |

| | | | |

Total Investment Income | | | 5,438,062 | |

EXPENSES: | | | | |

Investment advisory fees (Note 6) | | | 466,226 | |

Administration fees (Note 6) | | | 52,105 | |

Custodian and accounting fees (Note 6) | | | 16,857 | |

Audit fees | | | 37,744 | |

Legal fees | | | 26,253 | |

Director’s fees and expenses | | | 15,442 | |

Printing and mailing costs | | | 33,884 | |

Transfer agent fees | | | 9,412 | |

Stock exchange listing fees | | | 9,888 | |

Insurance | | | 14,436 | |

Board restructuring and related proxy expenses | | | 104,433 | |

| | | | |

Operating Expenses | | | 786,680 | |

Commissions on auction rate preferred stock | | | 90,231 | |

| | | | |

Total Expenses | | | 876,911 | |

Less amounts waived | | | (104,433 | ) |

Less earnings credits | | | (17 | ) |

| | | | |

Net Expenses | | | 772,461 | |

| | | | |

Net Investment Income (loss) | | | 4,665,601 | |

REALIZED/UNREALIZED GAINS (LOSSES): | | | | |

Net realized gain (loss) on transactions from: | | | | |

Investments in non-affiliates | | | (6,722,212 | ) |

Swaps | | | (495,478 | ) |

| | | | |

Net realized gain (loss) | | | (7,217,690 | ) |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investments in non-affiliates | | | 29,933,955 | |

Swaps | | | 353,453 | |

Unfunded commitments | | | 106,791 | |

| | | | |

Change in net unrealized appreciation (depreciation) | | | 30,394,199 | |

| | | | |

Net realized/unrealized gains (losses) | | | 23,176,509 | |

| | | | |

Change in net assets resulting from operations | | | 27,842,110 | |

DISTRIBUTIONS TO PREFERRED STOCKHOLDERS FROM NET INVESTMENT INCOME | | | (32,713 | ) |

| | | | |

NET INCREASE/(DECREASE) IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 27,809,397 | |

| | | | |

See Notes to Financial Statements.

16

PACHOLDER HIGH YIELD FUND, INC.

Statement of Changes in Net Assets

| | | | | | | | |

| | | Six Months

Ended

6/30/2009

(Unaudited) | | | Year Ended

12/31/2008 | |

INCREASE/(DECREASE) IN NET ASSETS: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 4,665,601 | | | $ | 15,538,444 | |

Net realized gain (loss) | | | (7,217,690 | ) | | | (11,009,018 | ) |

Change in net unrealized appreciation (depreciation) | | | 30,394,199 | | | | (55,922,165 | ) |

Distributions to preferred stockholders from net investment income | | | (32,713 | ) | | | (2,124,511 | ) |

| | | | | | | | |

Net increase/(decrease) in net assets resulting from operations applicable to common stockholders | | | 27,809,397 | | | | (53,517,250 | ) |

| | | | | | | | |

DISTRIBUTIONS TO COMMON STOCKHOLDERS FROM: | | | | | | | | |

Net investment income | | | (4,273,662 | ) | | | (11,391,518 | ) |

| | | | | | | | |

Total distributions to common stockholders | | | (4,273,662 | ) | | | (11,391,518 | ) |

| | | | | | | | |

FUND SHARE TRANSACTIONS (NOTE 2): | | | | | | | | |

Value of 2,494 and 6,196 shares issued in reinvestment of dividends to common stockholders in 2009 and 2008, respectively | | | 11,098 | | | | 43,683 | |

| | | | | | | | |

Total increase in net assets derived from fund share transactions | | | 11,098 | | | | 43,683 | |

| | | | | | | | |

Total net increase/(decrease) in net assets applicable to common stockholders | | | 23,546,833 | | | | (64,865,085 | ) |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: | | | | | | | | |

Beginning of period | | | 53,537,351 | | | | 118,402,436 | |

| | | | | | | | |

End of period | | $ | 77,084,184 | | | $ | 53,537,351 | |

| | | | | | | | |

Undistributed Net Investment Income | | $ | 3,058,445 | | | $ | 2,699,219 | |

| | | | | | | | |

See Notes to Financial Statements.

Statement of Cash Flows

For the Six Months Ended June 30, 2009 (Unaudited)

| | | | |

INCREASE (DECREASE) IN CASH | | | | |

Cash flows provided (used) by operating activities: | | | | |

Net increase in net assets from operations | | $ | 27,842,110 | |

Adjustments to reconcile net increase/decrease in net assets from operations to net cash provided (used) by operating activities: | | | | |

Purchase of investment securities | | | (32,751,093 | ) |

Proceeds from disposition of investment securities | | | 28,233,580 | |

Proceeds of short-term investments, net | | | 229,605 | |

Purchases of collateral for securities on loan, net | | | (7,042,403 | ) |

Unrealized appreciation/depreciation on swap contracts | | | (353,453 | ) |

Unrealized appreciation/depreciation on investments | | | (29,933,955 | ) |

Unrealized appreciation/depreciation on unfunded commitments | | | (106,791 | ) |

Realized gain/loss on investments | | | 6,722,212 | |

Realized gain/loss on swap contracts | | | 495,478 | |

Increase in due from Administrator | | | (35,037 | ) |

Increase in receivable for investments sold | | | (979,856 | ) |

Decrease in interest and dividends receivable | | | 627,387 | |

Increase in prepaid expenses and other assets | | | (3,844 | ) |

Increase in payable for investments purchased | | | 3,963,504 | |

Increase in collateral for securities lending payable | | | 7,042,403 | |

Increase in dividends and distributions payable | | | 1,009 | |

Decrease in excise tax payable | | | (69,200 | ) |

Increase in accrued expenses and other liabilities | | | 147,831 | |

Net (amortization)/accretion of income | | | (257,137 | ) |

| | | | |

Net cash provided (used) by operating activities | | | 3,772,350 | |

| | | | |

Cash flows provided (used) by financing activities: | | | | |

Cash distributions paid to common stockholders (net of reinvestments of $11,098) | | | (4,262,564 | ) |

Cash distributions paid to preferred stockholders | | | (32,713 | ) |

| | | | |

Net cash provided (used) by financing activities | | | (4,295,277 | ) |

| | | | |

Net decrease in cash | | | (522,927 | ) |

| | | | |

Cash: | | | | |

Beginning of period | | | 550,309 | |

| | | | |

End of period | | $ | 27,382 | |

| | | | |

For purposes of reporting the Statement of Cash Flows, the Fund considers all cash accounts that are not subject to withdrawal restrictions or penalties to be cash equivalents.

17

PACHOLDER HIGH YIELD FUND, INC.

Financial Highlights

(Contained below is per share operating performance data for a share of common stock outstanding, total return performance, ratios to average net assets and other supplemental data. This information has been derived from information provided in the financial statements calculated using average shares outstanding and market price data for the Fund’s shares.)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

June 30, 2009

(Unaudited) | | | For the Year Ended December 31, | |

| | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net asset value, beginning of period | | $ | 4.14 | | | $ | 9.15 | | | $ | 9.95 | | | $ | 8.94 | | | $ | 9.55 | | | $ | 8.59 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.36 | | | | 1.21 | | | | 1.21 | | | | 1.09 | | | | 1.12 | | | | 1.08 | |

Net realized and unrealized gain/(loss) on investments | | | 1.78 | | | | (5.18 | ) | | | (0.84 | ) | | | 1.07 | | | | (0.67 | ) | | | 0.93 | |

Cumulative effect on change in fixed income valuation (Note 1) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.07 | ) |

Distributions to preferred stockholders from net investment income | | | — | (13) | | | (0.16 | ) | | | (0.27 | ) | | | (0.25 | ) | | | (0.16 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase/(decrease) in net asset value resulting from operations | | | 2.14 | | | | (4.13 | ) | | | 0.10 | | | | 1.91 | | | | 0.29 | | | | 1.86 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to Common Stockholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.33 | ) | | | (0.88 | ) | | | (0.90 | ) | | | (0.90 | ) | | | (0.90 | ) | | | (0.90 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 5.95 | | | $ | 4.14 | | | $ | 9.15 | | | $ | 9.95 | | | $ | 8.94 | | | $ | 9.55 | |

| | | | | | | | | | | | | | | | | | | | | | | | |