UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05642 |

|

Nuveen Multi-Market Income Fund |

(Exact name of registrant as specified in charter) |

|

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606 |

(Address of principal executive offices) (Zip code) |

|

Kevin J. McCarthy Nuveen Investments 333 West Wacker Drive Chicago, IL 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 917-7700 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | December 31, 2014 | |

| | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Nuveen Investments

Closed-End Funds

Semi-Annual Report December 31, 2014

JMM

Nuveen Multi-Market Income Fund

NUVEEN INVESTMENTS ACQUIRED BY TIAA-CREF

On October 1, 2014, TIAA-CREF completed its previously announced acquisition of Nuveen Investments, Inc., the parent company of your fund's investment adviser, Nuveen Fund Advisors, LLC ("NFAL") and the Nuveen affiliates that act as sub-advisers to the majority of the Nuveen Funds. TIAA-CREF is a national financial services organization with approximately $851 billion in assets under management as of December 31, 2014 and is a leading provider of retirement services in the academic, research, medical and cultural fields. Nuveen is operating as a separate subsidiary within TIAA-CREF's asset management business.

Chairman's Letter to Shareholders | | | 4 | | |

Portfolio Managers' Comments | | | 5 | | |

Fund Leverage | | | 8 | | |

Share Information | | | 9 | | |

Risk Considerations | | | 11 | | |

Performance Overview and Holding Summaries | | | 12 | | |

Shareholder Meeting Report | | | 14 | | |

Portfolio of Investments | | | 17 | | |

Statement of Assets & Liabilities | | | 25 | | |

Statement of Operations | | | 26 | | |

Statement of Changes in Net Assets | | | 27 | | |

Statement of Cash Flows | | | 28 | | |

Financial Highlights | | | 30 | | |

Notes to Financial Statements | | | 32 | | |

Additional Fund Information | | | 41 | | |

Glossary of Terms Used in this Report | | | 42 | | |

Reinvest Automatically, Easily and Conveniently | | | 43 | | |

Annual Investment Agreement Approval Process | | | 44 | | |

Nuveen Investments

3

Chairman's Letter

to Shareholders

Dear Shareholders,

A pattern of divergence has emerged in the past year. Steady and moderate growth in the U.S. economy helped sustain the stock market's bull run another year. U.S. bonds also performed well, amid subdued inflation, interest rates that remained unexpectedly low and concerns about the economic well-being of the rest of the world. The stronger domestic economy enabled the U.S. Federal Reserve (Fed) to gradually reduce its large scale bond purchases, known as quantitative easing (QE), without disruption to the markets, as well as begin to set expectations for a transition into tightening mode.

The story outside the U.S., however, was different. European growth was stagnating and Japan fell into a recession, contributing to the bouts of volatility in their markets. China's economy decelerated and, despite running well above the rate of other major global economies, investors feared it looked slow by China's standards. Compounding these concerns were a surprisingly steep decline in oil prices, the U.S. dollar's rally and an increase in geopolitical tensions, including the Russia-Ukraine crisis and terrorist attacks across the Middle East and Africa, as well as more recently in Europe.

While a backdrop of healthy economic growth in the U.S. and the continuation of accommodative monetary policy (with the central banks of Japan and potentially Europe stepping in where the Fed has left off) bodes well for the markets, the global outlook has become more uncertain. Indeed, volatility is likely to feature more prominently in the investment landscape going forward. Such conditions underscore the importance of professional investment management. Experienced investment teams have weathered the market's ups and downs in the past and emerged with a better understanding of the sensitivities of their asset class and investment style, particularly in times of turbulence. We recognize the importance of maximizing gains, while striving to minimize volatility.

And, the same is true for investors like you. Maintaining an appropriate time horizon, diversification and relying on practiced investment teams are among your best strategies for achieving your long-term investment objectives. Additionally, I encourage you to communicate with your financial consultant if you have questions about your investment in a Nuveen Fund. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

William J. Schneider

Chairman of the Board

February 23, 2015

Nuveen Investments

4

Portfolio Managers'

Comments

Nuveen Multi-Market Income Fund (JMM)

Nuveen Multi-Market Income Fund (JMM) is advised by Nuveen Fund Advisors, LLC (NFAL) and features portfolio management by Nuveen Asset Management, LLC (NAM). Prior to September 8, 2014, the Fund was named American Income Fund, Inc. (MRF), and was advised by U.S. Bancorp Asset Management, Inc. (USBAM) and sub-advised by NFAL and NAM. The Fund's investment strategy and portfolio management team remained unchanged after the transition from USBAM to NFAL.

The Fund's performance, distribution and pricing history dates back to the Fund's inception on December 30, 1988.

All three members of the Fund's current portfolio management team previously served as managers for MRF. The portfolio management team includes Jason J. O'Brien, CFA, Chris J. Neuharth, CFA, and John T. Fruit, CFA. Here they discuss their management strategy and the performance of the Fund for the six-month reporting period ended December 31, 2014.

What key strategies were used to manage the Fund during this six-month reporting period ended December 31, 2014?

The Fund's investment objective is to achieve high monthly income consistent with prudent risk to capital. The management team invests the Fund's assets primarily in taxable fixed income securities including, but not limited to: U.S. agency and privately issued mortgage-backed securities; high yield and investment grade corporate bonds; and asset-backed securities.

How did the Fund perform during this six-month reporting period ended December 31, 2014?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month, one-year, five-year and ten-year periods ended December 31, 2014. For the six-month reporting period ended December 31, 2014, the Fund's total return at net asset value (NAV) modestly underperformed its blended benchmark, which is composed of 75% Barclays U.S. Government/Mortgage Index and 25% Barclays High Yield Index.

Global growth concerns, ongoing geopolitical unrest and the sharp drop in commodity prices led to volatile financial markets, especially in the final months of this reporting period. In the bond market, risk assets had a difficult period as the market focused on the negative impact of a decline in oil prices on energy related corporate and sovereign credits. Corporate market spreads widened significantly, while Treasury rates declined. The Treasury yield curve flattened led by a strong move lower in 30-year yields and a modest increase in short rates, as the Federal Reserve (Fed) affirmed its intention to remove policy accommodation, even with low inflation and declining inflation expectations. This move

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's (S&P), Moody's Investors Service, Inc. (Moody's) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Nuveen Investments

5

Portfolio Managers' Comments (continued)

helped longer maturity Treasuries post the strongest returns among various fixed income asset classes during the six-month period. The high yield segment lagged as the average spread versus Treasuries widened dramatically by 145 basis points, led by the severe weakness seen among energy issuers. Not surprisingly, the higher quality, BB-rated portion of the high yield market vastly outperformed the lower quality CCC-rated segment, particularly after an October sell-off as risk aversion grew and interest rates trended lower, supporting the more rate-sensitive BB sector.

Spreads for investment grade credit versus Treasuries widened throughout the reporting period to their cheapest levels of 2014 as growing geopolitical concerns and a heavy new issue calendar caused the corporate market to weaken. Liquidity was challenged as dealers managed their balance sheets tightly as the end of the year approached. Also, issuer specific risk was heightened and the market had little tolerance for negative news or downgrades. Spread volatility was magnified and all credit sectors and quality buckets underperformed Treasuries. Not surprisingly, energy was the worst performer, lagging Treasuries by more than 600 basis points, followed closely by the metals and mining sectors. Financial names held up fairly well relative to industrials as fundamental credit trends remained intact and the sector traded with better liquidity and lower volatility than the broad credit market.

Securitized sectors were seemingly far enough removed from the downdraft in oil and other commodity prices and posted solid results. Agency mortgage-backed securities (MBS) issued by government agencies such as Fannie Mae, Ginnie Mae and Freddie Mac struggled to keep pace with Treasuries early in the reporting period as concerns about Fed tapering and policy normalization pushed spreads wider. After widening in July and August, agency MBS spreads were attractive enough, particularly against a backdrop of stable rates and positive technicals, to attract buying interest from relative value investors. As the reporting period progressed, technicals were more balanced as the Fed's reinvestment of pay downs offset supply, while money managers added agency MBS exposure to escape volatility in the corporate market. Improving credit metrics and continued modest improvements in home prices created a positive fundamental backdrop for non-agency MBS. This sector was quite stable and outperformed other higher volatility fixed income risk sectors during the reporting period. Risk premiums for commercial mortgage-backed securities (CMBS) were fairly stable, capping a solid year for the sector overall. Driven by improving commercial real estate fundamentals and relative immunity from energy related spread volatility, investor demand for CMBS was strong, absorbing the heavy amount of new issuance during the reporting period. CMBS outpaced investment grade credit and performed in line with mortgage-backed securities (MBS), while posting negative excess returns versus Treasuries.

The Fund's performance benefited from our continued exposure to non-agency MBS and mortgage-related asset-backed securities (ABS), which are not included in the blended benchmark but represent approximately one-third and one-tenth of the portfolio's net assets, respectively. Non-agency MBS and ABS were the only two spread sectors that offered positive excess returns over Treasuries during the reporting period. Both sectors were well insulated from the negative effects of falling oil prices, while the non-agency MBS market also had additional technical support in the form of a lack of new issuance in this market. In addition, the Fund benefited from a neutral weight to a modest underweight in the high yield sector, compared to the 25% weighting in the blended benchmark. Within the Fund's high yield exposure, our emphasis on higher quality, lower volatility names from the energy sector also proved helpful.

On the other hand, the Fund's out-of-index exposures to investment grade corporate bonds and CMBS slightly detracted during the reporting period. As mentioned, the investment grade corporate sector was dragged down by dramatically falling oil prices; therefore, our exposure to the sector detracted versus the benchmark. Excess returns for CMBS were modestly negative, but held up much better than the corporate segments. Our interest rate strategy also hindered the Fund's performance during the reporting period. We positioned the Fund with a defensive duration strategy with an underweight to the long (20- to 30-year) end of the yield curve. This strategy proved detrimental during the reporting period as interest rates fell, especially on the long end of the curve, and prices rose, particularly for longer maturities. Our agency MBS exposure, which was basically in line with the index weight, was a non-factor in the Fund's overall results.

Nuveen Investments

6

As of the end of the reporting period, we continued to maintain the Fund's overweights to the investment grade corporate, non-agency MBS and CMBS sectors, which are not included in the benchmark. As has historically been the case, we continue to look for bottom-up opportunities across all security types. We are maintaining the Fund's short duration strategy, as we believe that rates to may move higher as the Fed moves toward normalizing monetary policy in 2015.

We used U.S. Treasury futures as part of an overall portfolio construction strategy to manage portfolio duration and yield curve exposure. The effect of these activities in the period was negative. These derivative exposures are integrated with the overall portfolio construction and as such losses and gains may be naturally related to/may offset impacts elsewhere in the portfolio.

Nuveen Investments

7

IMPACT OF THE FUND'S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Fund relative to its benchmark was the Fund's use of leverage through the use of reverse repurchase agreements and mortgage dollar rolls. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on NAV and total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by the Fund generally are rising. The Fund's use of leverage had a positive impact on performance during this reporting period.

As of December 31, 2014, the Fund's percentages of leverage are shown in the accompanying table.

| | JMM | |

Effective Leverage* | | | 29.28 | % | |

Regulatory Leverage* | | | 0.00 | % | |

* Effective leverage is a Fund's effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund's portfolio that increase the Fund's investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund's capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940.

Nuveen Investments

8

DISTRIBUTION INFORMATION

The following information regarding the Fund's distributions is current as of December 31, 2014. The Fund's distribution levels may vary over time based on the Fund's investment activities and portfolio investment value changes.

During the current reporting period, the Fund's distributions to shareholders were as shown in the accompanying table.

Ex-Dividend Date | | Per

Share

Amounts | |

July 2014 | | $ | 0.0400 | | |

August | | | 0.0400 | | |

September | | | 0.0400 | | |

October | | | 0.0400 | | |

November | | | 0.0400 | | |

December 2014 | | | 0.0400 | | |

Current Distribution Rate* | | | 6.26 | % | |

* Current distribution rate is based on the Fund's current annualized monthly distribution divided by the Fund's current market price. The Fund's monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

The Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If the Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund's NAV. Conversely, if the Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund's NAV. The Fund will, over time, pay all its net investment income as dividends to shareholders.

As of December 31, 2014, the Fund had a positive UNII balance (based upon our best estimate) for income tax purposes and a positive UNII balance for financial reporting purposes.

All monthly dividends paid by the Fund during the six months ended December 31, 2014 were paid from net investment income. If a portion of the Fund's monthly distributions was sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, the Fund's shareholders would have received a notice to that effect. The composition and per share amounts of the Fund's monthly dividends for the reporting period are presented in the Statement of Changes in Net Assets and Financial Highlights, respectively (for financial reporting purposes) and in Note 6 – Income Tax Information within the accompany Notes to Financial Statements (for income tax purposes), later in this report.

SHARE REPURCHASES

During September 2014, the Fund's Board of Trustees authorized the Fund to participate in Nuveen's closed-end fund complex-wide share repurchase program. Under the share repurchase program, the Fund may repurchase up to 10% of its outstanding shares as of the authorization date (approximately 945,000 shares) in open-market transactions at the Adviser's discretion.

Nuveen Investments

9

Share Information (continued)

As of December 31, 2014, and since the inception of the Fund's repurchase program, the Fund did not repurchase any of its outstanding shares.

OTHER SHARE INFORMATION

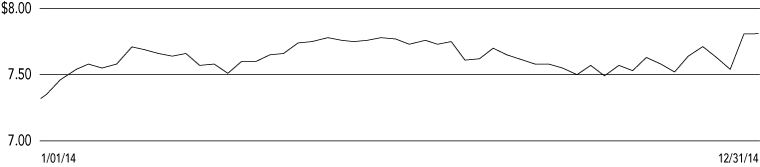

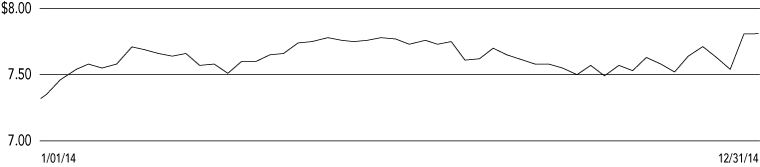

As of December 31, 2014, and during the current reporting period, the Fund's common share price was trading at premium/(discount) to its NAV as shown in the accompanying table.

NAV | | $ | 8.52 | | |

Share Price | | $ | 7.67 | | |

Premium/(Discount) to NAV | | | (9.98 | )% | |

6-Month Average Premium/(Discount) to NAV | | | (11.31 | )% | |

Nuveen Investments

10

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Fund, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like the Fund frequently trade at a discount to their NAV. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations. This is particularly true for funds employing a managed distribution program.

Issuer Credit Risk: This is the risk that a security in a Fund's portfolio will fail to make dividend or interest payments when due.

Interest Rate Risk: Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Call Risk or Prepayment Risk: Issuers may exercise their option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower-yielding securities.

Derivatives Strategy Risk: Derivative securities, such as calls, puts, warrants, swaps and forwards, carry risks different from, and possibly greater than, the risks associated with the underlying investments.

Dividend Income Risk: There is no guarantee that the issuers of common stocks in which the Fund invests will declare dividends in the future or that, if declared, they will remain at current levels or increase over time.

Leverage Risk: Each Fund's use of leverage creates the possibility of higher volatility for the Fund's per share NAV, market price, distributions and returns. There is no assurance that a Fund's leveraging strategy will be successful.

Illiquid Securities Risk: This is the risk that the Fund may not be able to sell securities in its portfolio at the time or price desired by the Fund.

Default Risk: The event in which a bond issuer is unable to make the required payments on their debt obligations.

Mortgage-Backed Securities Risk: Investing in MBS entails various risks, including credit risks inherent in the underlying collateral, the risk that the servicer fails to perform its duties, liquidity risks, interest rate risks, structure risks, and geographical concentration risks.

Nuveen Investments

11

Nuveen Multi-Market Income Fund

Performance Overview and Holding Summaries as of December 31, 2014

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of December 31, 2014

| | | Cumulative | | Average Annual | |

| | 6-Month | | 1-Year | | 5-Year | | 10-Year | |

JMM at NAV | | | 0.46 | % | | | 5.85 | % | | | 9.16 | % | | | 6.59 | % | |

JMM at Share Price | | | 1.83 | % | | | 10.77 | % | | | 8.25 | % | | | 6.91 | % | |

JMM Blended Benchmark | | | 0.85 | % | | | 4.68 | % | | | 5.05 | % | | | 5.43 | % | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund's shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

Nuveen Investments

12

This data relates to the securities held in the Fund's portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's Group, Moody's Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

Convertible Preferred Securities | | | 0.3 | % | |

$25 Par (or similar)

Retail Preferred | | | 1.4 | % | |

Corporate Bonds | | | 31.4 | % | |

$1,000 Par (or similar)

Institutional Preferred | | | 0.6 | % | |

Asset-Backed and

Mortgage-Backed Securities | | | 104.8 | % | |

Investment Companies | | | 0.6 | % | |

Sovereign Debt | | | 0.2 | % | |

Total Long-Term Investments | | | 139.3 | % | |

Short-Term Investments | | | 0.9 | % | |

Other Assets Less Liabilities | | | (12.0 | )% | |

Net Assets Plus Reverse

Repurchase Agreements | | | 128.2 | % | |

Reverse Repurchase Agreements | | | (28.2 | )% | |

Net Assets | | | 100 | % | |

Portfolio Composition

(% of total investments)1

Asset-Backed and

Mortgage-Backed Securities | | | 74.8 | % | |

Oil, Gas & Consumable Fuels | | | 2.9 | % | |

Metals & Mining | | | 1.9 | % | |

Banks | | | 1.8 | % | |

Media | | | 1.3 | % | |

Diversified Telecommunication

Services | | | 1.1 | % | |

Wireless Telecommunication

Services | | | 1.1 | % | |

Other | | | 14.5 | % | |

Short-Term Investments | | | 0.6 | % | |

Total | | | 100 | % | |

Portfolio Credit Quality

(% of total long-term investments)

AAA/U.S. Guaranteed | | | 33.9 | % | |

AA | | | 4.1 | % | |

A | | | 14.2 | % | |

BBB | | | 15.6 | % | |

BB or Lower | | | 29.9 | % | |

N/R (not rated) | | | 1.9 | % | |

N/A (not applicable) | | | 0.4 | % | |

Total | | | 100 | % | |

1 Excluding reverse repurchase agreements and investments in derivatives.

Nuveen Investments

13

Shareholder

Meeting Report

A special shareholder meeting was held in the offices of U.S. Bancorp Asset Management, Inc. on July 28, 2014 for the American Income Fund, LLC; at this meeting the shareholders were asked to vote to approve an investment management agreement between the Fund and Nuveen Fund Advisors, to approve a sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management, LLC, to approve an Agreement and Plan of Reorganization in connection with the change of domicile of the Fund, to approve an amendment to the Articles of Incorporation of the Fund to change the name to Nuveen Multi-Market Income Fund, Inc., to approve a new sub-advisory agreement between USBAM and Nuveen Fund Advisors, to approve a new sub-advisory agreement between USBAM and Nuveen Asset Management, to approve a new investment management agreement between the Fund and Nuveen Fund Advisors, to approve a new sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management and to elect directors to the Board of Directors of the Fund. This meeting was subsequently adjourned to September 30, 2014 for the American Income Fund, LLC.

An annual shareholder meeting was held in the offices of U.S. Bancorp Asset Management, Inc. on July 28, 2014 for American Income Fund, LLC; at this meeting the shareholders were asked to vote to elect directors to the Board of Directors of the Fund.

| | | American

Income

Fund, Inc. | |

To approve an investment management agreement between the Fund and Nuveen Fund Advisors. | |

For | | | 5,292,057 | | |

Against | | | 280,418 | | |

Abstain | | | 145,947 | | |

Total | | | 5,718,422 | | |

To approve a sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management, LLC. | |

For | | | 5,271,648 | | |

Against | | | 272,522 | | |

Abstain | | | 174,252 | | |

Total | | | 5,718,422 | | |

To approve an Agreement and Plan of Reorganization in connection with the change of domicile of the Fund. | |

For | | | 6,331,955 | | |

Against | | | 347,945 | | |

Abstain | | | 358,087 | | |

Total | | | 7,037,987 | | |

To approve an amendment to the Articles of Incorporation of the Fund to change the name to Nuveen Multi-Market Income Fund, Inc. | |

For | | | 5,294,385 | | |

Against | | | 276,277 | | |

Abstain | | | 147,760 | | |

Total | | | 5,718,422 | | |

To approve a new sub-advisory agreement between USBAM and Nuveen Fund Advisors. | |

For | | | 5,274,801 | | |

Against | | | 294,560 | | |

Abstain | | | 149,061 | | |

Broker Non-Votes | | | — | | |

Total | | | 5,718,422 | | |

To approve a new sub-advisory agreement between USBAM and Nuveen Asset Management. | |

For | | | 5,271,888 | | |

Against | | | 296,334 | | |

Abstain | | | 150,200 | | |

Total | | | 5,718,422 | | |

To approve a new investment management agreement between the Fund and Nuveen Fund Advisors. | |

For | | | 5,261,628 | | |

Against | | | 303,934 | | |

Abstain | | | 152,860 | | |

Total | | | 5,718,422 | | |

To approve a new sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management. | |

For | | | 5,264,163 | | |

Against | | | 299,095 | | |

Abstain | | | 155,164 | | |

Total | | | 5,718,422 | | |

Nuveen Investments

14

| | | American

Income

Fund, Inc. | |

Approval of the Board Members was reached as follows: | |

William Adams IV | |

For | | | 5,392,079 | | |

Withhold | | | 320,276 | | |

Total | | | 5,712,355 | | |

Robert P. Bremner | |

For | | | 5,391,437 | | |

Withhold | | | 320,918 | | |

Total | | | 5,712,355 | | |

Jack B. Evans | |

For | | | 5,398,082 | | |

Withhold | | | 314,273 | | |

Total | | | 5,712,355 | | |

William C. Hunter | |

For | | | 5,384,764 | | |

Withhold | | | 327,591 | | |

Total | | | 5,712,355 | | |

David J. Kundert | |

For | | | 5,384,848 | | |

Withhold | | | 327,507 | | |

Total | | | 5,712,355 | | |

John K. Nelson | |

For | | | 5,388,704 | | |

Withhold | | | 323,651 | | |

Total | | | 5,712,355 | | |

William J. Schneider | |

For | | | 5,386,413 | | |

Withhold | | | 325,942 | | |

Total | | | 5,712,355 | | |

Thomas S. Schreier, Jr. | |

For | | | 5,385,645 | | |

Withhold | | | 326,710 | | |

Total | | | 5,712,355 | | |

Judith M. Stockdale | |

For | | | 5,390,157 | | |

Withhold | | | 322,198 | | |

Total | | | 5,712,355 | | |

Carole E. Stone | |

For | | | 5,389,042 | | |

Withhold | | | 323,313 | | |

Total | | | 5,712,355 | | |

Virginia L. Stringer | |

For | | | 5,391,515 | | |

Withhold | | | 320,840 | | |

Total | | | 5,712,355 | | |

Terence J. Toth | |

For | | | 5,391,515 | | |

Withhold | | | 320,840 | | |

Total | | | 5,712,355 | | |

Roger A. Gibson | |

For | | | 7,751,034 | | |

Withhold | | | 421,696 | | |

Total | | | 8,172,730 | | |

John P. Kayser | |

For | | | 7,745,576 | | |

Withhold | | | 427,154 | | |

Total | | | 8,172,730 | | |

Nuveen Investments

15

Shareholder Meeting Report (continued)

| | | American

Income

Fund, Inc. | |

Leonard W. Kedrowski | |

For | | | 7,737,936 | | |

Withhold | | | 434,794 | | |

Total | | | 8,172,730 | | |

Richard K. Riederer | |

For | | | 7,732,073 | | |

Withhold | | | 440,657 | | |

Total | | | 8,172,730 | | |

James M. Wade | |

For | | | 7,720,560 | | |

Withhold | | | 452,170 | | |

Total | | | 8,172,730 | | |

Nuveen Investments

16

Nuveen Multi-Market Income Fund

Portfolio of Investments December 31, 2014 (Unaudited)

Shares | |

Description (1) | |

Coupon | | | |

Ratings (2) | |

Value | |

| | | LONG-TERM INVESTMENTS – 139.3% (99.4% of Total Investments) | |

| | | CONVERTIBLE PREFERRED SECURITIES – 0.3% (0.2% of Total Investments) | |

| | | Banks – 0.3% | |

| | 200 | | | Bank of America Corporation | | | 7.250 | % | | | | | | BB | | $ | 232,594 | | |

| | Total Convertible Preferred Securities (cost $159,350) | | | 232,594 | | |

| | | $25 PAR (OR SIMILAR) RETAIL PREFERRED – 1.4% (1.0% of Total Investments) | |

| | | Banks – 0.7% | |

| | 19,000 | | | Bank of America Corporation | | | 4.000 | % | | | | | | BB | | $ | 383,040 | | |

| | 8,000 | | | First Niagara Finance Group | | | 8.625 | % | | | | | | BB | | | 216,000 | | |

| | | Total Banks | | | 599,040 | | |

| | | Capital Markets – 0.4% | |

| | 12,000 | | | Goldman Sachs Group, Inc. | | | 5.500 | % | | | | | | BB | | | 292,800 | | |

| | | Metals & Mining – 0.2% | |

| | 7,500 | | | ArcelorMittal | | | 6.000 | % | | | | | | BB– | | | 129,750 | | |

| | | Real Estate Investment Trust – 0.1% | |

| | 5,000 | | | LaSalle Hotel Properties | | | 7.500 | % | | | | | | N/R | | | 131,350 | | |

| | | Total $25 Par (or similar) Retail Preferred (cost $1,105,506) | | | 1,152,940 | | |

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | CORPORATE BONDS – 31.4% (22.4% of Total Investments) | |

| | | Aerospace & Defense – 0.2% | |

$ | 200 | | | Bombardier Inc., 144A | | | 4.750 | % | | 4/15/19 | | BB– | | $ | 200,750 | | |

| | | Airlines – 0.3% | |

| | 200 | | | Air Canada, 144A | | | 6.750 | % | | 10/01/19 | | BB | | | 208,000 | | |

| | | Auto Components – 0.2% | |

| | 200 | | | Gestamp Funding Luxembourg SA, 144A | | | 5.625 | % | | 5/31/20 | | BB | | | 202,000 | | |

| | | Automobiles – 0.2% | |

| | 100 | | | Ford Motor Company | | | 7.450 | % | | 7/16/31 | | BBB– | | | 135,760 | | |

| | | Banks – 1.4% | |

| | 500 | | | Bank of America Corporation | | | 5.000 | % | | 5/13/21 | | A | | | 557,927 | | |

| | 500 | | | Citigroup Inc. | | | 4.500 | % | | 1/14/22 | | A | | | 546,379 | | |

| | 1,000 | | | Total Banks | | | | | | | | | | | | | | | 1,104,306 | | |

| | | Beverages – 0.3% | |

| | 250 | | | Cott Beverages USA Inc., 144A | | | 6.750 | % | | 1/01/20 | | B– | | | 250,000 | | |

| | | Building Products – 0.5% | |

| | 250 | | | Associated Asphalt Partners LLC, 144A | | | 8.500 | % | | 2/15/18 | | B– | | | 237,500 | | |

| | 150 | | | Building Materials Holdings Corporation, 144A | | | 9.000 | % | | 9/15/18 | | B– | | | 157,500 | | |

| | 400 | | | Total Building Products | | | | | | | | | | | | | | | 395,000 | | |

| | | Capital Markets – 0.7% | |

| | 500 | | | Goldman Sachs Group, Inc. | | | 5.750 | % | | 1/24/22 | | A | | | 578,394 | | |

Nuveen Investments

17

Nuveen Multi-Market Income Fund

Portfolio of Investments (continued) December 31, 2014 (Unaudited)

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | Chemicals – 0.8% | |

$ | 100 | | | Hexion US Finance | | | 6.625 | % | | 4/15/20 | | B3 | | $ | 98,000 | | |

| | 375 | | | NOVA Chemicals Corporation, 144A | | | 5.000 | % | | 5/01/25 | | BB+ | | | 372,188 | | |

| | 150 | | | Taminco Global Chemical Corporation, 144A | | | 9.750 | % | | 3/31/20 | | N/R | | | 164,250 | | |

| | 625 | | | Total Chemicals | | | | | | | | | | | | | | | 634,438 | | |

| | | Commercial Services & Supplies – 0.9% | |

| | 175 | | | ADT Corporation | | | 6.250 | % | | 10/15/21 | | BBB– | | | 179,813 | | |

| | 275 | | | Clean Harbors Inc. | | | 5.250 | % | | 8/01/20 | | BB+ | | | 276,375 | | |

| | 250 | | | Covanta Energy Corporation | | | 6.375 | % | | 10/01/22 | | Ba3 | | | 265,000 | | |

| | 700 | | | Total Commercial Services & Supplies | | | | | | | | | | | | | | | 721,188 | | |

| | | Construction Materials – 0.5% | |

| | 385 | | | Norbord Inc., 144A | | | 5.375 | % | | 12/01/20 | | Ba2 | | | 373,450 | | |

| | | Consumer Finance – 0.5% | |

| | 250 | | | Covenant Surgical Partners Inc., 144A | | | 8.750 | % | | 8/01/19 | | B– | | | 252,500 | | |

| | 162 | | | First Data Corporation | | | 6.750 | % | | 11/01/20 | | BB– | | | 172,935 | | |

| | 412 | | | Total Consumer Finance | | | | | | | | | | | | | | | 425,435 | | |

| | | Containers & Packaging – 0.2% | |

| | 200 | | | Ardagh Packaging Finance / MP HD USA, 144A | | | 6.750 | % | | 1/31/21 | | CCC+ | | | 199,000 | | |

| | | Diversified Consumer Services – 0.2% | |

| | 200 | | | Nine West Holdings Incorporated, 144A | | | 8.250 | % | | 3/15/19 | | CCC | | | 167,000 | | |

| | | Diversified Financial Services – 0.5% | |

| | 200 | | | Jefferies Finance LLC Corporation, 144A | | | 6.875 | % | | 4/15/22 | | B1 | | | 183,000 | | |

| | 250 | | | Nationstar Mortgage LLC Capital Corporation | | | 7.875 | % | | 10/01/20 | | B+ | | | 240,000 | | |

| | 450 | | | Total Diversified Financial Services | | | | | | | | | | | | | | | 423,000 | | |

| | | Diversified Telecommunication Services – 1.6% | |

| | 250 | | | CenturyLink Inc. | | | 6.750 | % | | 12/01/23 | | BB+ | | | 273,750 | | |

| | 200 | | | CenturyLink Inc. | | | 7.650 | % | | 3/15/42 | | BB+ | | | 199,000 | | |

| | 410 | | | IntelSat Jackson Holdings | | | 6.625 | % | | 12/15/22 | | B– | | | 421,275 | | |

| | 390 | | | SBA Tower Trust, 144A | | | 3.598 | % | | 4/15/43 | | BBB | | | 390,954 | | |

| | 1,250 | | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 1,284,979 | | |

| | | Electric Utilities – 0.9% | |

| | 225 | | | FirstEnergy Corporation | | | 4.250 | % | | 3/15/23 | | Baa3 | | | 232,158 | | |

| | 350 | | | Intergen NV, 144A | | | 7.000 | % | | 6/30/23 | | B+ | | | 332,500 | | |

| | 200 | | | RJS Power Holdings LLC, 144A | | | 5.125 | % | | 7/15/19 | | BB– | | | 197,500 | | |

| | 775 | | | Total Electric Utilities | | | | | | | | | | | | | | | 762,158 | | |

| | | Energy Equipment & Services – 0.8% | |

| | 250 | | | Compressco Partners LP / Compressco Finance Corporation, 144A | | | 7.250 | % | | 8/15/22 | | B | | | 215,000 | | |

| | 500 | | | Drill Rigs Holdings Inc., 144A | | | 6.500 | % | | 10/01/17 | | B | | | 412,500 | | |

| | 750 | | | Total Energy Equipment & Services | | | | | | | | | | | | | | | 627,500 | | |

| | | Food Products – 0.2% | |

| | 200 | | | JBS Investments GmbH, 144A | | | 7.250 | % | | 4/03/24 | | BB | | | 196,500 | | |

| | | Gas Utilities – 0.9% | |

| | 250 | | | Ferrellgas LP | | | 6.750 | % | | 1/15/22 | | B+ | | | 244,375 | | |

| | 250 | | | LBC Tank Terminals Holdings Netherlands BV, 144A | | | 6.875 | % | | 5/15/23 | | B | | | 251,250 | | |

| | 250 | | | Suburban Propane Partners LP | | | 5.500 | % | | 6/01/24 | | BB– | | | 241,250 | | |

| | 750 | | | Total Gas Utilities | | | | | | | | | | | | | | | 736,875 | | |

| | | Health Care Equipment & Supplies – 0.4% | |

| | 350 | | | Tenet Healthcare Corporation | | | 6.875 | % | | 11/15/31 | | B3 | | | 329,000 | | |

Nuveen Investments

18

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | Health Care Providers & Services – 1.5% | |

$ | 500 | | | Community Health Systems, Inc. | | | 6.875 | % | | 2/01/22 | | B | | $ | 529,688 | | |

| | 400 | | | Mallinckrodt International Finance SA, 144A | | | 5.750 | % | | 8/01/22 | | BB– | | | 411,000 | | |

| | 250 | | | Select Medical Corporation | | | 6.375 | % | | 6/01/21 | | B– | | | 253,750 | | |

| | 1,150 | | | Total Health Care Providers & Services | | | | | | | | | | | | | | | 1,194,438 | | |

| | | Hotels, Restaurants & Leisure – 0.5% | |

| | 200 | | | Aramark Corporation | | | 5.750 | % | | 3/15/20 | | BB– | | | 206,500 | | |

| | 200 | | | Wynn Macau Limited, 144A | | | 5.250 | % | | 10/15/21 | | BB | | | 188,000 | | |

| | 400 | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 394,500 | | |

| | | Household Durables – 0.9% | |

| | 250 | | | Brookfield Residential Properties Inc., 144A | | | 6.500 | % | | 12/15/20 | | BB– | | | 261,250 | | |

| | 250 | | | KB Home | | | 7.000 | % | | 12/15/21 | | B+ | | | 262,969 | | |

| | 200 | | | William Lyon Homes Incorporated | | | 8.500 | % | | 11/15/20 | | B– | | | 215,500 | | |

| | 700 | | | Total Household Durables | | | | | | | | | | | | | | | 739,719 | | |

| | | Independent Power & Renewable Electricity Producers – 0.9% | |

| | 200 | | | AES Corporation | | | 5.500 | % | | 3/15/24 | | BB | | | 202,960 | | |

| | 200 | | | Dynegy Inc. | | | 5.875 | % | | 6/01/23 | | B+ | | | 190,000 | | |

| | 300 | | | GenOn Energy Inc. | | | 9.500 | % | | 10/15/18 | | B | | | 298,500 | | |

| | 700 | | | Total Independent Power & Renewable Electricity Producers | | | | | | | | | | | | | | | 691,460 | | |

| | | Machinery – 0.3% | |

| | 250 | | | Commercial Vehicle Group | | | 7.875 | % | | 4/15/19 | | B | | | 258,125 | | |

| | | Media – 1.8% | |

| | 200 | | | Altice S.A, 144A | | | 7.750 | % | | 5/15/22 | | B | | | 200,375 | | |

| | 300 | | | DIRECTV Holdings LLC | | | 3.800 | % | | 3/15/22 | | BBB | | | 305,211 | | |

| | 200 | | | Midcontinent Communications Finance Company, 144A | | | 6.250 | % | | 8/01/21 | | B– | | | 202,000 | | |

| | 200 | | | Quebecor Media Inc. | | | 5.750 | % | | 1/15/23 | | B+ | | | 204,500 | | |

| | 250 | | | Sinclair Television Group | | | 5.375 | % | | 4/01/21 | | B+ | | | 248,125 | | |

| | 300 | | | WMG Acquisition Group, 144A | | | 6.000 | % | | 1/15/21 | | B+ | | | 300,000 | | |

| | 1,450 | | | Total Media | | | | | | | | | | | | | | | 1,460,211 | | |

| | | Metals & Mining – 2.6% | |

| | 350 | | | Alcoa Inc. | | | 5.400 | % | | 4/15/21 | | BBB– | | | 379,062 | | |

| | 200 | | | Anglogold Holdings PLC | | | 5.125 | % | | 8/01/22 | | Baa3 | | | 182,503 | | |

| | 200 | | | Coeur d'Alene Mines Corporation | | | 7.875 | % | | 2/01/21 | | B+ | | | 157,500 | | |

| | 200 | | | Eldorado Gold Corporation, 144A | | | 6.125 | % | | 12/15/20 | | BB | | | 194,000 | | |

| | 500 | | | Freeport McMoRan, Inc. | | | 3.550 | % | | 3/01/22 | | BBB | | | 472,555 | | |

| | 200 | | | Lundin Mining Corporation, 144A | | | 7.500 | % | | 11/01/20 | | Ba2 | | | 198,000 | | |

| | 300 | | | Vale Overseas Limited | | | 4.375 | % | | 1/11/22 | | A– | | | 287,552 | | |

| | 200 | | | Vedanta Resources PLC, 144A | | | 6.000 | % | | 1/31/19 | | BB | | | 195,000 | | |

| | 2,150 | | | Total Metals & Mining | | | | | | | | | | | | | | | 2,066,172 | | |

| | | Oil, Gas & Consumable Fuels – 4.1% | |

| | 150 | | | Antero Resources Finance Corporation, 144A | | | 5.125 | % | | 12/01/22 | | BB | | | 141,375 | | |

| | 250 | | | Blue Racer Midstream LLC / Blue Racer Finance Corporation, 144A | | | 6.125 | % | | 11/15/22 | | B | | | 241,250 | | |

| | 200 | | | Chesapeake Energy Corporation | | | 6.875 | % | | 11/15/20 | | BB+ | | | 215,000 | | |

| | 240 | | | Concho Resources Inc. | | | 5.500 | % | | 10/01/22 | | BB+ | | | 242,400 | | |

| | 150 | | | Energy XXI Gulf Coast Inc., 144A | | | 9.250 | % | | 12/15/17 | | B | | | 97,500 | | |

| | 125 | | | Gastar Exploration Inc. | | | 8.625 | % | | 5/15/18 | | B– | | | 111,250 | | |

| | 200 | | | Gibson Energy, 144A | | | 6.750 | % | | 7/15/21 | | BB | | | 199,500 | | |

| | 100 | | | Hiland Partners LP/ Hiland Partners Finance Corp., 144A | | | 5.500 | % | | 5/15/22 | | B | | | 88,000 | | |

| | 200 | | | Niska Gas Storage Canada ULC Finance Corporation, 144A | | | 6.500 | % | | 4/01/19 | | B | | | 150,500 | | |

| | 250 | | | PBF Holding Company LLC | | | 8.250 | % | | 2/15/20 | | BB+ | | | 251,250 | | |

| | 125 | | | PetroBakken Energy Limited, 144A | | | 8.625 | % | | 2/01/20 | | B– | | | 87,500 | | |

| | 175 | | | Rose Rock Midstream LP / Rose Rock Finance Corporation | | | 5.625 | % | | 7/15/22 | | B1 | | | 163,625 | | |

| | 250 | | | Sanchez Energy Corporation | | | 7.750 | % | | 6/15/21 | | B– | | | 232,500 | | |

| | 100 | | | Tesoro Logistics LP Finance Corporation, 144A | | | 6.250 | % | | 10/15/22 | | BB | | | 99,750 | | |

| | 500 | | | Transocean Inc. | | | 3.800 | % | | 10/15/22 | | BBB– | | | 405,162 | | |

| | 150 | | | Vanguard Natural Resources Finance | | | 7.875 | % | | 4/01/20 | | B | | | 129,412 | | |

Nuveen Investments

19

Nuveen Multi-Market Income Fund

Portfolio of Investments (continued) December 31, 2014 (Unaudited)

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | Oil, Gas & Consumable Fuels (continued) | |

$ | 450 | | | Western Refining Inc. | | | 6.250 | % | | 4/01/21 | | B+ | | $ | 438,750 | | |

| | 3,615 | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 3,294,724 | | |

| | | Paper & Forest Products – 1.3% | |

| | 250 | | | Domtar Corporation | | | 4.400 | % | | 4/01/22 | | BBB– | | | 256,593 | | |

| | 200 | | | Millar Western Forest Products Ltd | | | 8.500 | % | | 4/01/21 | | B– | | | 207,000 | | |

| | 375 | | | Resolute Forest Products | | | 5.875 | % | | 5/15/23 | | BB– | | | 356,250 | | |

| | 200 | | | Sappi Papier Holding GMBH, 144A | | | 6.625 | % | | 4/15/21 | | BB | | | 205,000 | | |

| | 1,025 | | | Total Paper & Forest Products | | | | | | | | | | | | | | | 1,024,843 | | |

| | | Personal Products – 0.3% | |

| | 250 | | | Albea Beauty Holdings SA, 144A | | | 8.375 | % | | 11/01/19 | | B+ | | | 262,500 | | |

| | | Real Estate Investment Trust – 0.7% | |

| | 300 | | | CommomWealth REIT | | | 5.875 | % | | 9/15/20 | | BBB– | | | 330,038 | | |

| | 225 | | | Realogy Group LLC / Realogy Co-Issuer Corporation, 144A | | | 4.500 | % | | 4/15/19 | | B | | | 222,750 | | |

| | 525 | | | Total Real Estate Investment Trust | | | | | | | | | | | | | | | 552,788 | | |

| | | Real Estate Management & Development – 0.3% | |

| | 250 | | | Mattamy Group Corporation, 144A | | | 6.500 | % | | 11/15/20 | | BB | | | 251,250 | | |

| | | Road & Rail – 0.3% | |

| | 250 | | | Watco Companies LLC Finance, 144A | | | 6.375 | % | | 4/01/23 | | B3 | | | 247,500 | | |

| | | Semiconductors & Semiconductor Equipment – 0.3% | |

| | 250 | | | Micron Technology, Inc., 144A | | | 5.875 | % | | 2/15/22 | | BB | | | 262,500 | | |

| | | Software – 1.3% | |

| | 1,000 | | | Computer Sciences Corporation | | | 4.450 | % | | 9/15/22 | | BBB+ | | | 1,022,912 | | |

| | | Specialty Retail – 0.5% | |

| | 150 | | | Neiman Marcus Mariposa Borrower / Merger Sub LLC, 144A | | | 8.000 | % | | 10/15/21 | | CCC+ | | | 158,625 | | |

| | 200 | | | The Men's Warehouse Inc., 144A | | | 7.000 | % | | 7/01/22 | | B2 | | | 205,500 | | |

| | 350 | | | Total Specialty Retail | | | | | | | | | | | | | | | 364,125 | | |

| | | Wireless Telecommunication Services – 1.6% | |

| | 175 | | | FairPoint Communications Inc., 144A | | | 8.750 | % | | 8/15/19 | | B | | | 175,875 | | |

| | 250 | | | Frontier Communications Corporation | | | 8.500 | % | | 4/15/20 | | BB | | | 278,750 | | |

| | 200 | | | Frontier Communications Corporation | | | 7.625 | % | | 4/15/24 | | BB | | | 206,000 | | |

| | 200 | | | Sprint Corporation | | | 7.250 | % | | 9/15/21 | | BB– | | | 198,250 | | |

| | 200 | | | T-Mobile USA Inc. | | | 6.731 | % | | 4/28/22 | | BB | | | 206,000 | | |

| | 200 | | | Wind Acquisition Finance SA, 144A | | | 4.750 | % | | 7/15/20 | | Ba3 | | | 187,000 | | |

| | 1,225 | | | Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 1,251,875 | | |

$ | 25,437 | | | Total Corporate Bonds (cost $25,795,138) | | | | | | | | | | | | | | | 25,294,375 | | |

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | $1,000 PAR (OR SIMILAR) INSTITUTIONAL PREFERRED – 0.6% (0.5% of Total Investments) | |

| | | Banks – 0.1% | |

$ | 100 | | | Lloyd's Banking Group PLC | | | 7.500 | % | | | N/A (3) | | | BB | | $ | 101,750 | | |

| | | Insurance – 0.5% | |

| | 250 | | | Genworth Financial Inc. | | | 6.150 | % | | 11/15/66 | | Ba1 | | | 153,750 | | |

| | 250 | | | Lincoln National Corporation | | | 6.050 | % | | 4/20/67 | | BBB | | | 250,000 | | |

| | | Total Insurance | | | 403,750 | | |

| | | Total $1,000 Par (or similar) Institutional Preferred (cost $550,231) | | | | | | | | | | | | | | | 505,500 | | |

Nuveen Investments

20

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | ASSET-BACKED AND MORTGAGE-BACKED SECURITIES – 104.8% (74.8% of Total Investments) | |

$ | 500 | | | 321 Henderson Receivables LLC, Series 2012-1A | | | 7.140 | % | | 2/15/67 | | Baa2 | | $ | 619,688 | | |

| | 461 | | | 321 Henderson Receivables LLC., Series 2010-1A | | | 9.310 | % | | 7/15/61 | | Aa2 | | | 597,684 | | |

| | 500 | | | 321 Henderson Receivables Trust Series 2012-2A | | | 6.770 | % | | 10/17/61 | | Baa2 | | | 609,922 | | |

| | 424 | | | ACE Securities Corporation, Manufactured Housing Trust Series 2003-MH1 | | | 6.500 | % | | 8/15/30 | | AA | | | 466,073 | | |

| | 405 | | | AmeriCold LLC Trust, Series 2010 | | | 6.811 | % | | 1/14/29 | | A+ | | | 469,168 | | |

| 500

| | | Bank of America Commercial Mortgage Inc., Commercial Mortgage

Pass-Through Certificates, Series 2005-4 | | | 4.997

| % | | 7/10/45

| | AAA

| | | 508,940

| | |

| | 308 | | | Bank of America Funding Trust, Mortgage Pass-Through Certificates, Series 2007-4 | | | 5.500 | % | | 6/25/37 | | C | | | 79,918 | | |

| | 689 | | | Barclays BCAP LLC Trust, Resecuritized Series 2009-RR14 | | | 6.000 | % | | 5/26/37 | | BBB | | | 731,888 | | |

| | 234 | | | Bayview Financial Acquisition Trust 2003-AA | | | 6.072 | % | | 2/25/33 | | A+ | | | 234,778 | | |

| | 293 | | | Bayview Financial Acquisition Trust Series 2006-C | | | 5.852 | % | | 11/28/36 | | CCC | | | 290,766 | | |

| | 239 | | | Bayview Financial Acquisition Trust, Series 2006-C | | | 5.638 | % | | 11/28/36 | | Ba1 | | | 240,451 | | |

| | 183 | | | Bayview Financial Acquisition Trust, Series 2006-D | | | 5.660 | % | | 12/28/36 | | Aaa | | | 183,214 | | |

| 750

| | | Bayview Financial Mortgage Pass-Through Trust, Mortgage Pass-Through

Certificate Series 2005-D | | | 5.500 | % | |

12/28/35 | |

BB | | | 738,083 | | |

| 441

| | | Bayview Financial Mortgage Pass-Through Trust, Mortgage Pass-Through

Certificate Series 2006-A | | | 5.704 | % | |

2/28/41 | |

AAA | | | 454,659 | | |

| 500

| | | Bear Stearns Commercial Mortgage Securities Trust, Commercial Mortgage

Pass-Through Certificates, Series 2006-PW13 AM | | | 5.582 | % | |

9/11/41 | |

AAA | | | 528,064 | | |

| | 324 | | | CAM Mortgage Trust 2013-1 | | | 5.500 | % | | 12/15/53 | | N/R | | | 323,948 | | |

| 500

| | | CarFinance Capital Auto Trust, Automobile Receivables-Backed Notes,

Series 2013-1, 144A | | | 3.450

| % | | 3/15/19

| | Baa1

| | | 505,230

| | |

| | 301 | | | Chase Funding Mortgage Loan Asset-Backed Certificates, Series 2003-3 | | | 4.660 | % | | 3/25/33 | | A+ | | | 310,157 | | |

| 500

| | | Citigroup Commercial Mortgage Trust, Commercial Mortgage Pass-Through

Certificates, Series 2006-CD3 | | | 5.688

| % | | 10/15/48

| | B+

| | | 486,655

| | |

| | 352 | | | CountryWide Alternative Loan Trust 2005-86CB A10 | | | 5.500 | % | | 2/25/36 | | Caa3 | | | 312,337 | | |

| | 246 | | | Countrywide Alternative Loan Trust, Mortgage Pass Through Certificates, Series 2004-J2 | | | 6.500 | % | | 3/25/34 | | A+ | | | 258,957 | | |

| | 322 | | | Countrywide Alternative Loan Trust, Mortgage Pass-Through Certificates, Series 2005-47CB | | | 5.500 | % | | 10/25/35 | | Caa3 | | | 293,442 | | |

| | 987 | | | Countrywide Alternative Loan Trust, Mortgage Pass-Through Certificates, Series 2007-6 A4 | | | 5.750 | % | | 4/25/47 | | Ca | | | 846,566 | | |

| | 496 | | | Countrywide Asset Backed Certificates, Series 2007-4 A2 | | | 5.530 | % | | 4/25/47 | | Caa1 | | | 488,134 | | |

| | 1,158 | | | Credit Suisse Commercial Mortgage Trust 2009-3R | | | 6.000 | % | | 1/27/37 | | BBB | | | 1,211,987 | | |

| | 494 | | | Credit Suisse CSMC Mortgage-Backed Trust, Pass-Through Certificates, Series 2006-7 | | | 6.000 | % | | 8/25/36 | | Caa3 | | | 428,410 | | |

| 753

| | | Credit Suisse First Boston Mortgage Securities Corporation, Mortgage-Backed

Pass-Through Certificates, Series 2003-8 | | | 6.186

| % | | 4/25/33

| | A

| | | 722,993

| | |

| 861

| | | Credit Suisse First Boston Mortgage Securities Corporation, Mortgage-Backed

Pass-Through Certificates, Series 2005-11 6A7 | | | 6.000

| % | | 12/25/35

| | CC

| | | 313,704

| | |

| 519

| | | Credit Suisse First Boston Mortgage Securities, Home Equity Mortgage Pass- Through

Certificates, Series 2004-6 | | | 5.821

| % | | 4/25/35

| | BB+

| | | 530,485

| | |

| | 1,325 | | | Credit-Based Asset Servicing and Securitization Pool 2007-SP1 | | | 6.020 | % | | 12/25/37 | | A+ | | | 1,386,268 | | |

| | 500 | | | Fannie Mae Connecticut Avenue Securities , Series 2014-C04 | | | 5.068 | % | | 11/25/24 | | N/R | | | 507,797 | | |

| | 30 | | | Fannie Mae Mortgage Pool, (5) | | | 7.000 | % | | 7/01/17 | | Aaa | | | 31,417 | | |

| | 55 | | | Fannie Mae Mortgage Pool, (5) | | | 5.000 | % | | 11/01/18 | | Aaa | | | 57,995 | | |

| | 96 | | | Fannie Mae Mortgage Pool, (5) | | | 5.000 | % | | 2/01/21 | | Aaa | | | 103,078 | | |

| | 1,891 | | | Fannie Mae Mortgage Pool, (5) | | | 3.500 | % | | 12/01/26 | | Aaa | | | 2,000,711 | | |

| | 1,815 | | | Fannie Mae Mortgage Pool, (5) | | | 3.500 | % | | 1/01/27 | | Aaa | | | 1,920,446 | | |

| | — | (4) | | Fannie Mae Mortgage Pool | | | 3.078 | % | | 7/01/27 | | Aaa | | | 368 | | |

| | 75 | | | Fannie Mae Mortgage Pool, (5) | | | 6.000 | % | | 5/01/29 | | Aaa | | | 86,571 | | |

| | 40 | | | Fannie Mae Mortgage Pool, (5) | | | 7.000 | % | | 9/01/31 | | Aaa | | | 46,368 | | |

| | 51 | | | Fannie Mae Mortgage Pool, (5) | | | 5.500 | % | | 6/01/33 | | Aaa | | | 56,949 | | |

| | 100 | | | Fannie Mae Mortgage Pool, (5) | | | 6.000 | % | | 1/01/34 | | Aaa | | | 113,439 | | |

| | 256 | | | Fannie Mae Mortgage Pool, (5) | | | 5.500 | % | | 2/01/34 | | Aaa | | | 289,974 | | |

| | 148 | | | Fannie Mae Mortgage Pool, (5) | | | 6.000 | % | | 3/01/34 | | Aaa | | | 167,242 | | |

| | 156 | | | Fannie Mae Mortgage Pool, (5) | | | 6.000 | % | | 1/01/35 | | Aaa | | | 178,543 | | |

| | 127 | | | Fannie Mae Mortgage Pool, (5) | | | 5.000 | % | | 7/01/35 | | Aaa | | | 140,141 | | |

| | 64 | | | Fannie Mae Mortgage Pool, (5) | | | 5.500 | % | | 3/01/36 | | Aaa | | | 71,410 | | |

| | 237 | | | Fannie Mae Mortgage Pool, (5) | | | 6.000 | % | | 6/01/36 | | Aaa | | | 270,531 | | |

| | 197 | | | Fannie Mae Mortgage Pool, (5) | | | 5.500 | % | | 4/01/37 | | Aaa | | | 220,446 | | |

| | 225 | | | Fannie Mae Mortgage Pool, (5) | | | 5.000 | % | | 6/01/37 | | Aaa | | | 248,620 | | |

| | 196 | | | Fannie Mae Mortgage Pool, (5) | | | 5.500 | % | | 6/01/38 | | Aaa | | | 218,805 | | |

| | 2,888 | | | Fannie Mae Mortgage Pool, (5) | | | 3.500 | % | | 2/01/44 | | Aaa | | | 3,013,731 | | |

| | 162 | | | Fannie Mae REMIC Pass-Through Certificates | | | 6.509 | % | | 2/25/42 | | Aaa | | | 189,244 | | |

| | 754 | | | Fannie Mae REMIC Pass-Through Certificates | | | 4.436 | % | | 12/25/42 | | B1 | | | 625,744 | | |

| | 801 | | | Fannie Mae REMIC Pass-Through Certificates | | | 5.613 | % | | 7/25/44 | | CC | | | 315,819 | | |

| | 2,975 | | | Fannie Mae TBA Mortgage Pool, (MDR), (WI/DD) | | | 4.500 | % | | TBA | | Aaa | | | 3,229,270 | | |

| | 4,605 | | | Fannie Mae TBA Mortgage Pool, (MDR), (WI/DD) | | | 4.000 | % | | TBA | | Aaa | | | 4,914,704 | | |

Nuveen Investments

21

Nuveen Multi-Market Income Fund

Portfolio of Investments (continued) December 31, 2014 (Unaudited)

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | ASSET-BACKED AND MORTGAGE-BACKED SECURITIES (continued) | |

$ | 2,500 | | | Fannie Mae TBA Mortgage Pool, (MDR), (WI/DD) | | | 3.000 | % | | TBA | | Aaa | | $ | 2,528,906 | | |

| | 4,539 | | | Federa Home Loan Mortgage Corporation, Mortgage Pool, (5) | | | 3.000 | % | | 4/01/43 | | Aaa | | | 4,593,320 | | |

| 345

| | | First Horizon Alternative Mortgage Securities Trust, Pass-Through

Certificates, Series 2005-FA5 | | | 5.500

| % | | 8/25/35

| | C

| | | 28,879

| | |

| | 3,635 | | | Freddie Mac Gold Mortgage Pool, (5) | | | 3.000 | % | | 1/01/29 | | Aaa | | | 3,777,374 | | |

| | 50 | | | Freddie Mac Mortgage Pool, Various, (5) | | | 6.500 | % | | 11/01/28 | | Aaa | | | 56,665 | | |

| | 2,493 | | | Freddie Mac Mortgage Pool, (5) | | | 3.500 | % | | 1/01/44 | | Aaa | | | 2,594,469 | | |

| | 2,495 | | | Freddie Mac Mortgage Pool, (5) | | | 3.500 | % | | 2/01/44 | | Aaa | | | 2,596,608 | | |

| | 282 | | | Freddie Mac Mortgage Trust 2012-K708 | | | 3.759 | % | | 2/25/45 | | A | | | 289,967 | | |

| | 644 | | | Freddie Mac Mortgage Trust 2013-KF02 | | | 3.169 | % | | 12/25/45 | | Baa3 | | | 663,973 | | |

| 255

| | | Freddie Mac Mortgage Trust, Multifamily Mortgage Pass-Through Certificates,

Series 2012-K706 | | | 4.027

| % | | 11/25/44

| | A2

| | | 265,283

| | |

| 500

| | | Freddie Mac Mortgage Trust, Multifamily Mortgage Pass-Through Certificates,

Series 2012-K711 | | | 3.562

| % | | 8/25/45

| | A–

| | | 510,940

| | |

| 750

| | | Freddie Mac Mortgage Trust, Multifamily Mortgage-Pass Through Certificates,

Series 2012-K709 | | | 3.741

| % | | 4/25/45

| | BBB

| | | 754,318

| | |

| | 235 | | | Freddie Mac Mortgage Trust, Series 2010-K7 | | | 5.435 | % | | 4/25/20 | | A3 | | | 261,701 | | |

| | 500 | | | Freddie Mac Multifamily Mortgage Trust, Series 2011-K704, 144A | | | 4.533 | % | | 10/25/30 | | Baa1 | | | 528,597 | | |

| | — | (4) | | Freddie Mac Non Gold Participation Certificates | | | 2.111 | % | | 9/01/18 | | Aaa | | | 7 | | |

| | 500 | | | GMAT Trust Mortgage Pool 2013-1A | | | 5.000 | % | | 11/25/43 | | N/R | | | 473,807 | | |

| 1,000

| | | Goldman Sachs Mortgage Securities Corporation II, Commercial Mortgage

Pass -Through Certificates, Series 2014-GSFL | | | 2.417

| % | | 7/15/31

| | A–

| | | 995,584

| | |

| 451

| | | Goldman Sachs Mortgage Securities Corporation II, Commercial Mortgage

Pass-Through Certificates, Series 2007-GG10 | | | 5.796

| % | | 8/10/45

| | A

| | | 488,686

| | |

| 146

| | | Goldman Sachs Mortgage Securities Corporation, GSMPS Mortgage Pass

Through Certificates, Series 2001-2 | | | 7.500

| % | | 6/19/32

| | B

| | | 153,511

| | |

| 1,346

| | | Goldman Sachs Mortgage Securities Corporation, GSMPS Mortgage Pass Through

Certificates, Series 2006-RP2 B1 | | | 6.032

| % | | 4/25/36

| | CC

| | | 220,760

| | |

| 1,161

| | | Goldman Sachs Mortgage Securities Corporation, GSMPS Mortgage Pass Through

Certificates, Series 2006-RP2 B2 | | | 6.032

| % | | 4/25/36

| | CC

| | | 64,574

| | |

| 1,223

| | | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates,

Series 2003-1 B2 | | | 6.643

| % | | 3/25/43

| | Caa2

| | | 32,523

| | |

| 128

| | | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates,

Series 2003-10 1A1 | | | 2.553

| % | | 10/25/33

| | BBB+

| | | 127,735

| | |

| 516

| | | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates,

Series 2005-RP2 1A2 | | | 7.500

| % | | 3/25/35

| | B1

| | | 535,583

| | |

| 514

| | | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates,

Series 2005-RP3 1A2 | | | 7.500

| % | | 9/25/35

| | B1

| | | 534,799

| | |

| | 98 | | | Government National Mortgage Association Pool, (5) | | | 1.625 | % | | 12/20/22 | | Aaa | | | 101,657 | | |

| | 385 | | | Government National Mortgage Association Pool, (5) | | | 5.500 | % | | 8/15/33 | | Aaa | | | 439,090 | | |

| | 229 | | | Government National Mortgage Association Pool, (5) | | | 6.000 | % | | 7/15/34 | | Aaa | | | 266,682 | | |

| 210

| | | Greenwich Capital Commercial Funding Corporation, Commercial Mortgage Pass Through

Certificates, Series 2007-GG11 | | | 5.736

| % | | 12/10/49

| | AAA

| | | 227,440

| | |

| | 900 | | | Home Loan Servicing Solutions, HLSS Servicer Advance Receivables Backed Notes 2012-T1 | | | 4.458 | % | | 1/15/48 | | BBB | | | 902,250 | | |

| | 750 | | | Home Loan Servicing Solutions, HLSS Servicer Advance Receivables Backed Notes 2012-T2 | | | 4.940 | % | | 10/15/45 | | BBB | | | 760,650 | | |

| | 376 | | | Impac Secured Assets Corporation, Mortgage Pass-Through Certificates, Series 2000-3 | | | 8.000 | % | | 10/25/30 | | CCC | | | 364,440 | | |

| | 888 | | | IndyMac INDX Mortgage Loan Trust, Series 2006-AR13 A3 | | | 4.669 | % | | 7/25/36 | | Caa1 | | | 803,595 | | |

| 509

| | | IndyMac MBS Inc., Residential Asset Securitization Trust, Mortgage Pass Through Certificates,

Series 2003-A15 | | | 4.250

| % | | 2/25/34

| | A

| | | 509,546

| | |

| | 108 | | | Jeffries & Company Securitization Trust 2009-R4 | | | 5.750 | % | | 1/26/36 | | A | | | 108,766 | | |

| | 516 | | | JP Morgan Alternative Loan Trust 2006-S1, Mortgage Pass-Through Certificates | | | 6.500 | % | | 3/25/36 | | D | | | 455,219 | | |

| 750

| | | JP Morgan Chase Commercial Mortgage Securities Corporation, Commercial Mortgage

Pass-Through Certificates, Series 2011-C4 C | | | 5.277

| % | | 7/15/46

| | A

| | | 833,549

| | |

| | 270 | | | Lavender Trust, Mortgage Pass Through Certificates, Series 2010-R10A | | | 6.250 | % | | 9/26/36 | | Caa2 | | | 276,541 | | |

| 451

| | | LB-UBS Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates,

Series 2007-C7 | | | 5.866

| % | | 9/15/45

| | AAA

| | | 495,421

| | |

| 210

| | | LB-UBS Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates,

Series 2008-C1 AM | | | 6.158

| % | | 4/15/41

| | BBB–

| | | 231,591

| | |

| | 211 | | | Lehman ABS Manufactured Houing Contract Asset Backed Certificates, Series 2001B | | | 4.350 | % | | 4/15/40 | | AA | | | 221,893 | | |

| | 92 | | | Lehman Mortgage Trust, Mortgage Pass Through Certificates, Series 2008-6 | | | 5.581 | % | | 7/25/47 | | BB+ | | | 93,706 | | |

| | 572 | | | Master RePerforming Loan Trust 2005-1 | | | 7.500 | % | | 8/25/34 | | Ba3 | | | 585,243 | | |

| | 743 | | | Master Resecuritization Trust 2009-1 | | | 6.000 | % | | 10/25/36 | | A | | | 787,774 | | |

| | 514 | | | Merrill Lynch Alternative Note Asset, 2007-F1 2A7 | | | 6.000 | % | | 3/25/37 | | Caa3 | | | 413,849 | | |

| | 802 | | | Mid-State Capital Corporation Trust Notes, Series 2004-1 A | | | 6.005 | % | | 8/15/37 | | AAA | | | 839,087 | | |

| | 1,006 | | | Mid-State Capital Corporation Trust Notes, Series 2005-1 | | | 5.745 | % | | 1/15/40 | | AA | | | 1,083,717 | | |

| | 297 | | | Mid-State Trust 2010-1 | | | 7.000 | % | | 12/15/45 | | A | | | 319,423 | | |

Nuveen Investments

22

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | |

Ratings (2) | |

Value | |

| | | ASSET-BACKED AND MORTGAGE-BACKED SECURITIES (continued) | |

$ | 1,212 | | | Mid-State Trust 2010-1 | | | 5.250 | % | | 12/15/45 | | AA | | $ | 1,256,257 | | |

| | 380 | | | Mid-State Trust XI | | | 5.598 | % | | 7/15/38 | | A+ | | | 399,587 | | |

| 250

| | | Morgan Stanley Capital I Trust, Commercial Mortgage Pass-Through Certificates,

Series 2011-C1 C | | | 5.251 | % | |

9/15/47 | |

A+ | | | 275,746 | | |

| | 245 | | | Morgan Stanley Mortgage Loan Trust, Pass Through Certificates, 2006-2 | | | 5.750 | % | | 2/25/36 | | Caa2 | | | 231,221 | | |

| | 500 | | | Morgan Stanley Re REMIC Trust Series 2009-GG10 | | | 5.796 | % | | 8/12/45 | | A | | | 538,074 | | |

| 551

| | | Mortgage Asset Securitization Transaction Inc., Adjustable Rate Mortgage Pass-Through

Certificates, Series 2003-5 | | | 2.094

| % | | 11/25/33

| | A+

| | | 528,005

| | |

| 377

| | | Mortgage Asset Securitization Transaction Inc., Alternative Loan Trust Mortgage

Pass-Through Certificates Series 2004-1 | | | 7.000 | % | |

1/25/34 | |

BBB+ | | | 389,728 | | |

| 658

| | | Mortgage Asset Securitization Transaction Inc., Alternative Loan Trust Mortgage

Pass-Through Certificates, 2004-5 6A1 | | | 7.000

| % | | 6/25/34

| | A+

| | | 708,627

| | |

| 203

| | | Mortgage Asset Securitization Transaction Inc., Mortgage Pass Through Certificates,

Series 2003-5 | | | 5.000

| % | | 6/25/18

| | AA

| | | 210,022

| | |

| | 525 | | | Nationstar Agency Fund Trust, Series 2013-T2A | | | 7.385 | % | | 2/18/48 | | A | | | 524,722 | | |

| | 350 | | | Nationstar Agency Fund Trust, Series 2013-T2A | | | 4.212 | % | | 2/18/48 | | BBB | | | 350,091 | | |

| | 1,400 | | | Nationstar Mortgage Advance Receivables Trust 2013-T3 | | | 3.819 | % | | 6/22/48 | | BBB | | | 1,396,220 | | |

| | 676 | | | Nomura Asset Acceptance Corporation, Series 2004-R2, (6) | | | 6.740 | % | | 10/25/34 | | Ca | | | 442,895 | | |

| | 195 | | | Origen Manufactured Housing Contract Trust Collateralized Notes Series 2004-B MI | | | 5.730 | % | | 11/15/35 | | AA | | | 203,834 | | |

| | 414 | | | Origen Manufactured Housing Contract Trust Collaterlized Notes Series 2005B | | | 5.990 | % | | 1/15/37 | | A+ | | | 434,223 | | |

| | 479 | | | Origen Manufactured Housing Contract Trust Notes, Series 2004A | | | 6.640 | % | | 1/15/35 | | A | | | 520,177 | | |

| | 552 | | | Renaissance Home Equity Loan Trust Asset Backed Certificates, Series 2005-4 A6 | | | 5.749 | % | | 2/25/36 | | Caa1 | | | 508,811 | | |

| 540

| | | Residential Asset Mortgage Products Inc., Mortgage Asset-Backed Pass-Through

Certificates, Series 2003-SL1 M2 | | | 7.356

| % | | 4/25/31

| | CC

| | | 15,148

| | |

| 850

| | | Residential Asset Securities Corporation , Home Equity Mortgage Asset Backed Pass

Through Certificates, Series 2004-KS1 | | | 5.221

| % | | 2/25/34

| | BBB–

| | | 883,856

| | |

| | 240 | | | Residential Funding Mortgage Securities II, Inc., Home Loan Backed Notes Trust 2003-HI4 | | | 6.030 | % | | 2/25/29 | | A+ | | | 253,357 | | |

| | 397 | | | Residential Funding Mortgage Trust I, 2007-S9 | | | 6.000 | % | | 10/25/37 | | D | | | 337,838 | | |

| 373

| | | Salomon Brothers Commercial Mortgage Trust Pass-Through VII Certificates,

Series 2003-1 A2 | | | 6.000

| % | | 9/25/33

| | BB

| | | 369,715

| | |

| | 500 | | | Springleaf Mortgage Loan Trust 2013-2A | | | 3.520 | % | | 12/25/65 | | AA | | | 510,120 | | |

| | 750 | | | Springleaf Mortgage Loan Trust, Series 2012-3 | | | 5.300 | % | | 12/25/59 | | BBB | | | 773,596 | | |

| | 770 | | | Springleaf Mortgage Loan Trust, Series 2013-1A | | | 4.440 | % | | 6/25/58 | | BBB | | | 778,042 | | |

| | 500 | | | V Mortgage LLC, Pass Through Certificate , Series 2014-NPL1 | | | 4.750 | % | | 4/25/54 | | CCC | | | 480,749 | | |

| | 500 | | | Vericrest Opportunity Loan Transferee, Series 2014-NPL7 | | | 4.750 | % | | 8/27/57 | | N/R | | | 490,802 | | |

| 267

| | | Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through

Certificates, Series 2007-C30 | | | 5.246

| % | | 12/15/43

| | AAA

| | | 271,962

| | |

| | 594 | | | Walter Investment Management Company Capital Trust, Series 2012-AA | | | 4.549 | % | | 10/16/50 | | BBB | | | 600,882 | | |

| 221

| | | Washington Mutual Mortgage Securities Corporation, Mortgage Pass-Through Certificates,

Series 2003-AR3 B1 | | | 2.347

| % | | 6/25/33

| | B

| | | 202,858

| | |

| 67

| | | Washington Mutual Mortgage Securities Corporation, Mortgage Pass-Through Certificates,

Series 2004-RA3 | | | 6.385

| % | | 8/25/38

| | AA

| | | 69,735

| | |

| 751

| | | Wells Fargo-RBS Commercial Mortgage Trust, Commercial Mortgage Pass-Through

Certificates, Series 2011-C3 | | | 5.335

| % | | 3/15/44

| | A2

| | | 817,260

| | |

| 251

| | | WF-RBS Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates,

Series 2011-C2 | | | 5.392

| % | | 2/15/44

| | A2

| | | 274,064

| | |

| | 87,642 | | | Total Asset-Backed and Mortgage-Backed Securities (cost $84,982,777) | | | | | | | | | | | | | | | 84,439,854 | | |

| Shares | | Description (1), (7) | | | | | | | | Value | |

| | | INVESTMENT COMPANIES – 0.6% (0.4% of Total Investments) | |

| | 32,000 | | | Blackrock Credit Allocation Income Trust IV | | | | | | | | | | | | | | $ | 413,440 | | |

| | 7,000 | | | Pioneer Floating Rate Trust | | | | | | | | | | | | | | | 79,660 | | |

| | | | | Total Investment Companies (cost $486,936) | | | 493,100 | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | SOVEREIGN DEBT – 0.2% (0.1% of Total Investments) | |

| | | Uruguay – 0.2% | |

$ | 123 | | | Republic of Uruguay | | | 8.000 | % | | 11/18/22 | | Baa2 | | $ | 161,577 | | |

| | 123 | | | Total Sovereign Debt (cost $126,062) | | | | | | | | | | | | | | | 161,577 | | |

| | | Total Long-Term Investments (cost $113,206,000) | | | 112,279,940 | | |

Nuveen Investments

23

Nuveen Multi-Market Income Fund

Portfolio of Investments (continued) December 31, 2014 (Unaudited)

Principal

Amount (000) | |

Description (1) | |

Coupon | |

Maturity | | | |

Value | |

| | | SHORT-TERM INVESTMENTS – 0.9% (0.6% of Total Investments) | |

$ | 737

| | | Repurchase Agreement with State Street Bank, dated 12/31/14,

repurchase price $737,300, collateralized by $540,000 U.S. Treasury Bonds,

8.000%, due 11/15/21, value $756,005 | | | 0.000

| % | | 1/02/14

| |

| | $ | 737,300

| | |

| | | Total Short-Term Investments (cost $737,300) | | | 737,300 | | |

| | | Total Investments (cost $113,943,300) – 140.2% | | | 113,017,240 | | |

| | | Reverse Repurchase Agreements – (28.2)% | | | (22,697,000 | ) | |

| | | Other Assets Less Liabilities – (12.0)% (8) | | | (9,705,308 | ) | |

| | | Net Assets – 100% | | $ | 80,614,932 | | |

Investments in Derivatives as of December 31, 2014

Futures Contracts outstanding:

Description | | Contract

Position | | Number of

Contracts | | Contract

Expriation | | Notional

Amount at

Value | | Unrealized

Appreciation

(Depreciation) | |

U.S. Treasury 2-Year Note | | Short | | | (3 | ) | | 3/15 | | $ | (655,781 | ) | | $ | 963 | | |

U.S. Treasury 5-Year Note | | Short | | | (112 | ) | | 3/15 | | | (13,320,125 | ) | | | (5,131 | ) | |

U.S. Treasury 10-Year Note | | Short | | | (82 | ) | | 3/15 | | | (10,397,344 | ) | | | (62,617 | ) | |

U.S. Treasury Long Bond | | Short | | | (15 | ) | | 3/15 | | | (2,168,438 | ) | | | (53,543 | ) | |

| | | | | | | | | $ | (26,541,688 | ) | | $ | (120,328 | ) | |

For Fund portfolio compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

(1) All percentages shown in the Portfolio of Investments are based on net assets applicable to Common shares unless otherwise noted.

(2) Ratings: Using the highest of Standard & Poor's Group ("Standard & Poor's"), Moody's Investors Service, Inc. ("Moody's") or Fitch, Inc. ("Fitch") rating. Ratings below BBB by Standard & Poor's, Baa by Moody's or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies.

(3) Perpetual security. Maturity date is not applicable.

(4) Principal Amount (000) rounds to less than $1,000.

(5) Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in reverse repurchase agreements.

(6) At or subsequent to the end of the reporting period, this security is non-income producing. Non-income producing, in the case of a fixed-income security, generally denotes that the issuer has (1) defaulted on the payment of principal or interest, (2) is under the protection of the Federal Bankruptcy Court or (3) the Fund's Adviser has concluded that the issue is not likely to meet its future interest payment obligations and has directed the Fund's custodian to cease accruing additional income on the Fund's records.

(7) A copy of the most recent financial statements for these investment companies in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov.

(8) Other assets less liabilities includes the unrealized appreciation (depreciation) of the over-the-counter derivatives as presented on the Statement of Assets and Liabilities. The unrealized appreciation (depreciation) of exchange-cleared and exchange-traded derivatives is recognized as part of the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities.

N/A Not applicable.

TBA To be announced. Maturity date not known prior to settlement of this transaction.

WI/DD Investment, or portion of investment, purchased on a when-issued or delayed delivery basis.

144A Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers.

REIT Real Estate Investment Trust.

MDR Denotes investment is subject to dollar roll transactions.

See accompanying notes to financial statements.

Nuveen Investments

24

Statement of

Assets and Liabilities December 31, 2014 (Unaudited)

Assets | |