| OMB APPROVAL |

OMB Number: 3235-0570 �� Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05646

New Century Portfolios

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

| 100 William Street, Suite 200 | Wellesley, Massachusetts | 02481 |

| (Address of principal executive offices) | (Zip code) | |

Nicole M. Tremblay, Esq.

Weston Financial Group, Inc. 100 William Street, Suite 200 Wellesley, MA 02481

(Name and address of agent for service)

(Name and address of agent for service)

Registrant's telephone number, including area code: (781) 235-7055

Date of fiscal year end: October 31, 2014

Date of reporting period: October 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

New Century Capital New Century Balanced New Century International New Century Alternative Strategies ANNUAL REPORT Year Ended October 31, 2014 100 William Street, Suite 200, Wellesley MA 02481 781-239-0445 888-639-0102 Fax 781-237-1635 |

CONTENTS

| LETTER TO SHAREHOLDERS | 2-4 |

| PERFORMANCE CHARTS | 5-8 |

| NEW CENTURY PORTFOLIOS | |

| New Century Capital Portfolio | |

| Portfolio Information | 9 |

| Schedule of Investments | 10-11 |

| New Century Balanced Portfolio | |

| Portfolio Information | 12 |

| Schedule of Investments | 13-14 |

| New Century International Portfolio | |

| Portfolio Information | 15 |

| Schedule of Investments | 16-17 |

| New Century Alternative Strategies Portfolio | |

| Portfolio Information | 18 |

| Schedule of Investments | 19-21 |

| Statements of Assets and Liabilities | 22 |

| Statements of Operations | 23 |

| Statements of Changes in Net Assets | 24-27 |

| Financial Highlights | 28-31 |

| Notes to Financial Statements | 32-42 |

| Report of Independent Registered Public Accounting Firm | 43 |

| Board of Trustees and Officers | 44-45 |

| About Your Portfolios’ Expenses | 46-48 |

| Trustees’ Approval of Investment Advisory Agreements | 49-55 |

| LETTER TO SHAREHOLDERS | December 2014 |

Dear Fellow Shareholders:

We are pleased to present our 25th Annual Report. This report summarizes the 12-month period ended October 31, 2014. This report presents important financial information for each of the New Century Portfolios. We invite you to visit our website at www.newcenturyportfolios.com for additional information.

For the 12-months ended October 31, 2014, U.S. ma

See accompanying notes to financial statements.

rkets continued to trend to record highs with the S&P 500 Composite Index recording a gain of 17% and the Russell 1000 Index following closely behind. Even as the quantitative easing program, in the form of bond purchases, came to a close on October 29, 2014 the market was fueled by low rates and increasing company profitability. Of note has been the leadership of the mega-cap companies which outperformed regular large-cap, as well as mid- and small-caps. Abroad (ex-U.S.), the developed market, as represented by the MSCI EAFE Index, was negative by 60 basis points for the 12-months ended October 31, 2014, while the MSCI ACWI-ex USA Index, which includes emerging markets, was close to flat.During the year we continued to closely monitor domestic employment, with the overall unemployment rate falling from above 7% to a low of 5.8% in the October report. Although this is promising, wage increases have been slow to demonstrate meaningful improvement. We believe that in the coming 12 months, wage inflation will pick up as the “slack” in the system continues to decrease. This is an important item we continually monitor as wage inflation is a leading indicator of price inflation, an item closely watched by the Federal Reserve in determining interest rate policy. Also of note, lower fuel prices have acted as a tailwind for consumer sentiment going into the pivotal holiday shopping season.

Internationally, global markets saw a pickup of returns after a difficult Q1 2014. Divergent growth patterns are emerging with a slowdown in China, flat growth in the E.U., and a borderline recession in Japan. Growth has been present and is stable in the U.K., while periphery countries and several emerging and frontier nations have experienced higher levels of growth, with India leading the way. One notable trend has emerged – the rise of the middle and upper classes in emerging countries, including much of Asia. This growing population has fueled returns in both consumer staples and discretionary goods. We view the opening of the Shanghai Stock-connect, allowing easier foreign investment into Chinese corporations’ stock, as very positive for future investments in China and the region.

Our thoughts on Central Banks are in line with consensus, which reflects that the U.S., U.K., and potentially Australia will likely begin an interest rate tightening cycle in the coming 12 months. While the timing of the first domestic rate hike is a point of debate, we believe it will take place during one of four Federal Open Market Committee meetings with previously scheduled press conferences and we are currently targeting the June or September meeting. With this forthcoming divergence between the U.S. and European and Japanese Central Banks, we continue to see a strong case for further appreciation in the U.S. dollar during the next 12 months against both the Euro and Yen.

2

With these conditions in mind, we anticipate continued strength for equity markets with a bias towards U.S. markets over developed international markets. Possible headwinds for mega-cap U.S.-based export companies exist as they face a stronger dollar, diminishing the value and demand of overseas sales. In this type of environment, a tilt towards active managers is seen as beneficial. As such, we continue to evaluate current managers and introduce new managers to the New Century Portfolios.

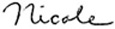

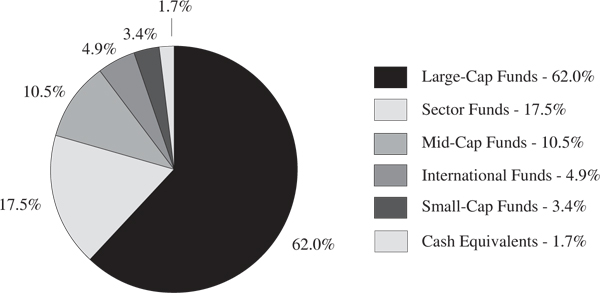

New Century Capital Portfolio (NCCPX) gained 11.53% from November 1, 2013 through October 31, 2014 versus 17.27% for the S&P 500 Composite Index. Over the year, the Portfolio continued to identify active managers within both the large-cap growth and small-cap allocations where we believe active strategies can provide alpha. We also maintained a tilt to growth over value where we believe there to be more relative opportunity in the current and forthcoming market cycle. In addition, a full review of our international holdings and Energy sector, both of which lagged the S&P 500 Composite Index, was completed during the year. International allocations were reduced as U.S. markets continued to show leadership. We believe that the coming year will show opportunities, both on a relative and absolute basis, for strategic allocations in international funds as the domestic environment settles into a lower return basis than previous years. We also continue to favor allocations to both mid- and small-cap sectors versus the mega-cap dominant S&P 500 Composite Index both for diversification and alpha opportunities. We are keeping a close eye on Federal Reserve tightening, and more so the implications that a strong dollar will have on multi-national companies.

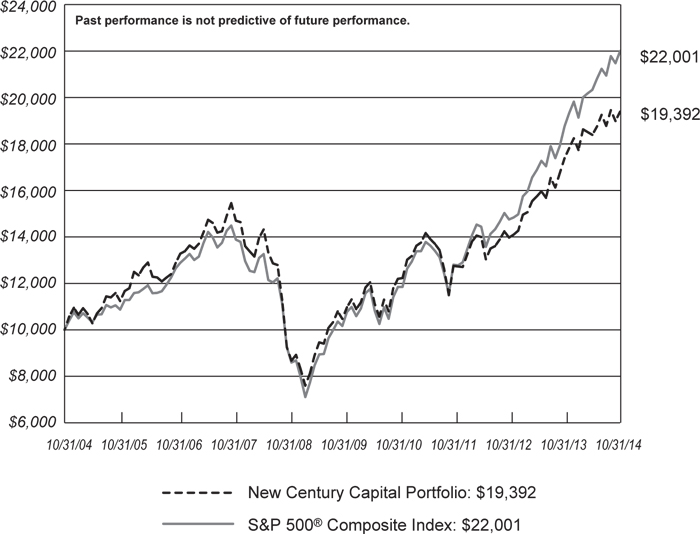

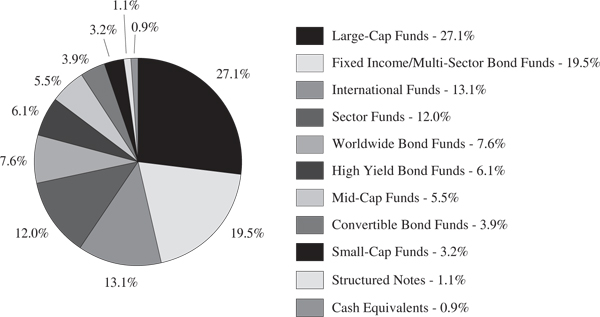

New Century Balanced Portfolio (NCIPX) performed in line with its peers for the 12-month period ended October 31, 2014, returning 7.81% compared to an average return of 8.27% for the Morningstar Moderate Allocation Category. The Portfolio continues to be managed with an approximate 60/40 strategic split between equities and fixed income. Over the past year, the Portfolio has maintained an overweight to equities (~65%) and an underweight to fixed income (~35%). During the end of 2013 and early 2014, the Portfolio strategically trimmed holdings from top performing sectors such as Health Care and Consumer Staples. Given the surge in equities, and several sector allocations in particular, the equity allocation continued to grow during the fiscal year. In anticipation of market volatility and rich equity valuations, the focus shifted to a slight rebalancing to move closer to our currently targeted 60/40 allocation. Additional shifts from equity to non-traditional fixed income (see below) occurred just prior to the end of the fiscal year. In fact, the markets did experience a pick-up in volatility towards the end of September. One of the high impact areas of this volatility was the Energy sector. As oil prices tumbled, so too did various equity indices. The Portfolio’s overweight to Energy did have an impact on performance. We continue to hold Master Limited Partnership (“MLP”) positions as part of our Energy exposure, and that asset class continues to perform well despite the recent volatility in the Energy sector. The Portfolio ended the period with an overweight to equities. Within the equities, a strong bias remains towards large-caps, and particularly a tilt towards growth stocks. Fixed income remains broadly diversified, with a focus on non-traditional sectors such as Convertibles, Global Bonds, and High Yield.

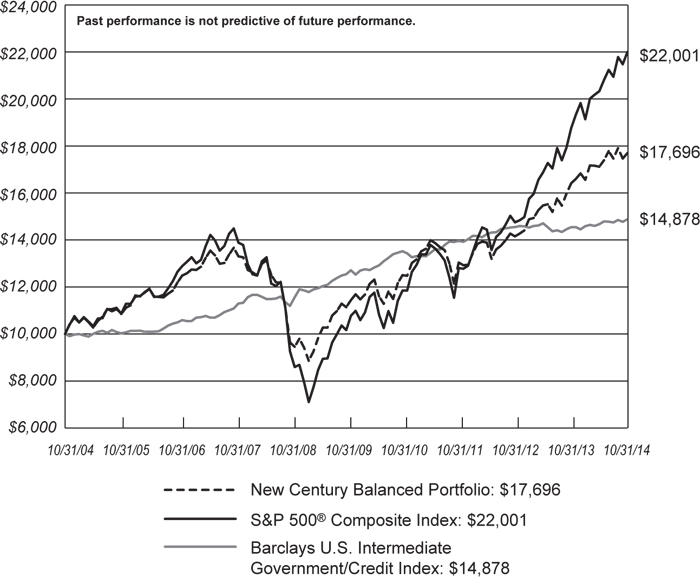

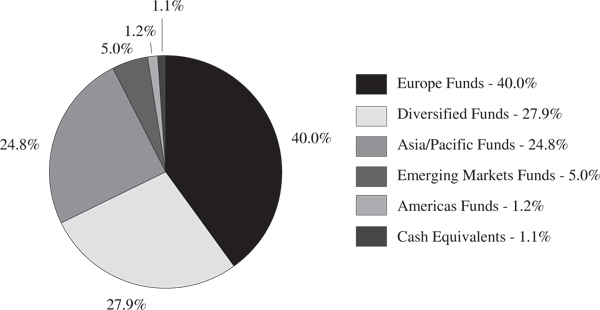

New Century International Portfolio (NCFPX) performed in line with our benchmark, the MSCI EAFE Index, during the 12-month period ended October 31, 2014, returning -0.89% versus -0.61% for the MSCI EAFE Index, which was also in line with the Morningstar

3

Foreign Large Blend category. The Portfolio focused on core countries in Europe, while tilting exposure towards Japan and the Emerging Markets during the year. A key contributor was our strategic underweight to Australia, where falling iron ore prices and demand from China have become a headwind. The Portfolio also gained from increasing our Japan position, which is largely hedged against the deteriorating yen. We continue to believe Central Bank policies in Japan and the Euro-zone are diverging from the U.S. and U.K., and we have hedged part of our currency exposure on a regional level. While emerging markets were disappointing over the 12-month period, we believe strong demand from China, as they convert to a consumption economy, coupled with the opening of the Shanghai Stock-connect, will be a positive driver for emerging markets and the Portfolio. We have been reducing exposure to Brazil, as the re-election of President Dilma and subsequent Petrobras scandal weigh heavily on the region. With respect to market cap, the Portfolio has increased exposure to small-caps as we view their opportunities very favorable, although this remains a small allocation within the total Portfolio.

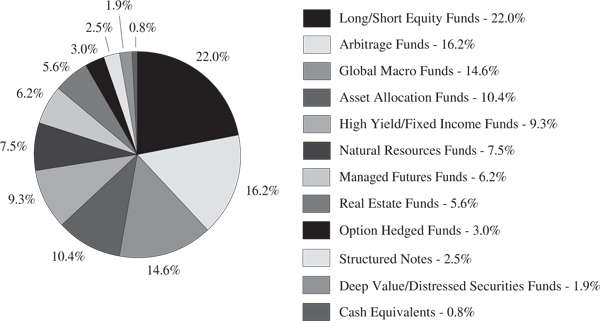

New Century Alternative Strategies Portfolio (NCHPX) returned 1.53% versus 2.66% for the Morningstar Multi-Alternative category from November 1, 2013 through October 31, 2014. The Portfolio has outperformed the Multi-Alternative category for the 3- and 5-year periods ended October 31, 2014. The Portfolio’s exposure to commodities and natural resources detracted from performance during the 12 months ended October 31, 2014, whereas exposure to real estate and MLPs have had a positive effect on the overall performance of the Portfolio. In the fixed income category, duration has been kept short using credit and currency investments to enhance returns. Management believes the Portfolio is well positioned to face potential rising equity market volatility.

We appreciate and thank you for your trust in New Century Portfolios.

Sincerely,

|  |

Nicole M. Tremblay, Esq. President, CEO | Susan K. Arnold Portfolio Manager |

|  |

Andre M. Fernandes Portfolio Manager | Ronald A. Sugameli Portfolio Manager |

Investors should take into consideration the investment objectives, risks, charges and expenses of the New Century Portfolios carefully before investing. The prospectus contains these details and other information and should be read carefully before investing. Principal value of an investment will fluctuate and shares when redeemed may be worth more or less than your original investment. Past performance is not indicative of future results. Portfolio holdings and opinions expressed herein are subject to change.

4

NEW CENTURY CAPITAL PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century Capital Portfolio and S&P 500® Composite Index

in New Century Capital Portfolio and S&P 500® Composite Index

Average Annual Total Returns For Periods Ended October 31, 2014 | |||

| 1 Year | 5 Years | 10 Years | |

New Century Capital Portfolio (a) | 11.53% | 13.11% | 6.85% |

S&P 500® Composite Index* | 17.27% | 16.69% | 8.20% |

| (a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

| * | The S&P 500® Composite Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

5

NEW CENTURY BALANCED PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century Balanced Portfolio, S&P 500® Composite Index and

Barclays U.S. Intermediate Government/Credit Index

in New Century Balanced Portfolio, S&P 500® Composite Index and

Barclays U.S. Intermediate Government/Credit Index

Average Annual Total Returns For Periods Ended October 31, 2014 | |||

| 1 Year | 5 Years | 10 Years | |

New Century Balanced Portfolio (a) | 7.81% | 9.70% | 5.87% |

S&P 500® Composite Index* | 17.27% | 16.69% | 8.20% |

| Barclays U.S. Intermediate Government/Credit Index* | 2.28% | 3.47% | 4.05% |

| (a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

| * | The S&P 500® Composite Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Barclays U.S. Intermediate Government/Credit Index is the non-securitized component of the U.S. Aggregate Index, and includes Treasuries, government-related issues, and corporates. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

6

NEW CENTURY INTERNATIONAL PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century International Portfolio, MSCI EAFE Index

and MSCI ACWI ex-USA Index

in New Century International Portfolio, MSCI EAFE Index

and MSCI ACWI ex-USA Index

Average Annual Total Returns For Periods Ended October 31, 2014 | |||

| 1 Year | 5 Years | 10 Years | |

New Century International Portfolio (a) | -0.89% | 5.48% | 6.50% |

| MSCI EAFE Index* | -0.61% | 6.52% | 5.81% |

| MSCI ACWI ex-USA Index* | 0.06% | 6.09% | 6.59% |

| (a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

| * | The MSCI EAFE (Europe, Australasia and Far East) Index is a free float weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI ACWI ex-USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The index consists of 46 country indices comprising 22 developed and 23 emerging market country indices. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

7

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century Alternative Strategies Portfolio, S&P 500® Composite Index

and Barclays U.S. Intermediate Government/Credit Index

in New Century Alternative Strategies Portfolio, S&P 500® Composite Index

and Barclays U.S. Intermediate Government/Credit Index

Average Annual Total Returns For Periods Ended October 31, 2014 | |||

| 1 Year | 5 Years | 10 Years | |

New Century Alternative Strategies Portfolio (a) | 1.53% | 4.48% | 4.01% |

S&P 500® Composite Index* | 17.27% | 16.69% | 8.20% |

| Barclays U.S. Intermediate Government/Credit Index* | 2.28% | 3.47% | 4.05% |

| (a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

| * | The S&P 500® Composite Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Barclays U.S. Intermediate Government/Credit Index is the non-securitized component of the U.S. Aggregate Index, and includes Treasuries, government-related issues, and corporates. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

8

NEW CENTURY CAPITAL PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets | |

| Vanguard 500 Index Fund - Admiral Shares | 7.5% | |

| Vanguard Dividend Growth Fund - Investor Shares | 7.3% | |

| Putnam Equity Income Fund - Class Y | 5.9% | |

| Wells Fargo Advantage Growth Fund - Administrator Class | 5.3% | |

| Fidelity Select Health Care Portfolio | 5.0% | |

| American Funds AMCAP Fund - Class A | 4.4% | |

| PowerShares Dynamic Pharmaceuticals Portfolio | 4.0% | |

| Dodge & Cox Stock Fund | 3.9% | |

| Putnam Equity Spectrum Fund - Class Y | 3.7% | |

| MFS Growth Fund - Class I | 3.6% |

9

NEW CENTURY CAPITAL PORTFOLIO

SCHEDULE OF INVESTMENTS

October 31, 2014

SCHEDULE OF INVESTMENTS

October 31, 2014

| INVESTMENT COMPANIES — 98.3% | Shares | Value | ||||||

| Large-Cap Funds — 62.0% | ||||||||

| American Funds AMCAP Fund - Class A | 173,865 | $ | 5,102,948 | |||||

ClearBridge Aggressive Growth Fund - Class I (b) | 9,281 | 2,065,429 | ||||||

| Dodge & Cox Stock Fund | 24,694 | 4,435,983 | ||||||

| Glenmede Large Cap Growth Portfolio | 89,485 | 2,062,640 | ||||||

iShares Core S&P 500 ETF (a) | 8,050 | 1,634,069 | ||||||

iShares MSCI USA Minimum Volatility ETF (a) | 73,200 | 2,874,564 | ||||||

iShares S&P 500 Growth Index Fund (a) | 29,200 | 3,205,868 | ||||||

iShares S&P 500 Value Index Fund (a) | 43,105 | 3,951,866 | ||||||

| JPMorgan Value Advantage Fund - Institutional Class | 122,538 | 3,662,650 | ||||||

| MFS Equity Opportunities Fund - Class I | 58,831 | 1,667,871 | ||||||

| MFS Growth Fund - Class I | 56,732 | 4,118,144 | ||||||

| Putnam Equity Income Fund - Class Y | 305,784 | 6,815,931 | ||||||

| RidgeWorth Large Cap Value Equity Fund - I Shares | 197,873 | 3,571,600 | ||||||

| Vanguard 500 Index Fund - Admiral Shares | 46,473 | 8,663,567 | ||||||

| Vanguard Dividend Growth Fund - Investor Shares | 362,639 | 8,340,708 | ||||||

Weitz Partners Value Fund - Institutional Class (b) | 88,546 | 3,015,883 | ||||||

| Wells Fargo Advantage Growth Fund - Administrator Class | 109,900 | 6,082,965 | ||||||

| 71,272,686 | ||||||||

| Sector Funds — 17.5% | ||||||||

| Fidelity Select Health Care Portfolio | 25,323 | 5,791,343 | ||||||

iShares Dow Jones U.S. Energy Sector Index Fund (a) | 43,900 | 2,178,318 | ||||||

Ivy Science and Technology Fund - Class I (b) | 70,044 | 4,073,742 | ||||||

PowerShares Dynamic Pharmaceuticals Portfolio (a) | 67,000 | 4,602,230 | ||||||

SPDR Gold Shares (a) (b) (c) | 9,000 | 1,013,940 | ||||||

| Tortoise MLP & Pipeline Fund - Institutional Class | 131,857 | 2,428,797 | ||||||

| 20,088,370 | ||||||||

| Mid-Cap Funds — 10.5% | ||||||||

iShares S&P MidCap 400 Growth Index Fund (a) | 12,600 | 1,967,868 | ||||||

iShares S&P MidCap 400 Value Index Fund (a) | 31,600 | 3,960,112 | ||||||

| Putnam Equity Spectrum Fund - Class Y | 96,945 | 4,252,961 | ||||||

SPDR S&P MidCap 400 ETF Trust (a) | 7,102 | 1,833,168 | ||||||

| 12,014,109 | ||||||||

| International Funds — 4.9% | ||||||||

| MFS International Value Fund - Class I | 56,022 | 2,014,006 | ||||||

| Oppenheimer Developing Markets Fund - Class Y | 47,443 | 1,855,956 | ||||||

| Oppenheimer International Growth Fund - Class Y | 49,817 | 1,773,484 | ||||||

| 5,643,446 | ||||||||

| Small-Cap Funds — 3.4% | ||||||||

| Hodges Small Cap Fund - Institutional Class | 109,680 | 2,203,481 | ||||||

iShares S&P SmallCap 600 Value Index Fund (a) | 15,200 | 1,747,088 | ||||||

| 3,950,569 | ||||||||

Total Investment Companies (Cost $78,527,667) | $ | 112,969,180 | ||||||

See accompanying notes to financial statements.

10

NEW CENTURY CAPITAL PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 1.8% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.01% (d) (Cost $2,120,203) | 2,120,203 | $ | 2,120,203 | |||||

Total Investments at Value — 100.1% (Cost $80,647,870) | $ | 115,089,383 | ||||||

| Liabilities in Excess of Other Assets — (0.1%) | (135,612 | ) | ||||||

| Net Assets — 100.0% | $ | 114,953,771 | ||||||

(a) | Exchange-traded fund. |

(b) | Non-income producing security. |

(c) | For federal income tax purposes, structured as a grantor trust. |

(d) | The rate shown is the 7-day effective yield as of October 31, 2014. |

See accompanying notes to financial statements.

11

NEW CENTURY BALANCED PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets | |

| Loomis Sayles Bond Fund - Institutional Class | 7.9% | |

| SPDR S&P MidCap 400 ETF Trust | 5.5% | |

| American Funds AMCAP Fund - Class A | 5.5% | |

| Templeton Global Bond Fund - Class A | 5.3% | |

| Dodge & Cox Income Fund | 5.3% | |

| iShares Core S&P 500 ETF | 5.3% | |

| Harding, Loevner International Equity Portfolio - Institutional Class | 5.0% | |

| PIMCO Income Fund - Institutional Class | 5.0% | |

| JPMorgan Value Advantage Fund - Institutional Class | 4.9% | |

| First Eagle Global Fund - Class A | 4.7% |

12

NEW CENTURY BALANCED PORTFOLIO

SCHEDULE OF INVESTMENTS

October 31, 2014

SCHEDULE OF INVESTMENTS

October 31, 2014

| INVESTMENT COMPANIES — 98.0% | Shares | Value | ||||||

| Large-Cap Funds — 27.1% | ||||||||

| American Funds AMCAP Fund - Class A | 136,996 | $ | 4,020,850 | |||||

ClearBridge Aggressive Growth Fund - Class I (b) | 10,459 | 2,327,611 | ||||||

iShares Core S&P 500 ETF (a) | 19,100 | 3,877,109 | ||||||

| John Hancock Disciplined Value Fund - Class I | 173,563 | 3,363,649 | ||||||

| JPMorgan Value Advantage Fund - Institutional Class | 121,722 | 3,638,271 | ||||||

| Wells Fargo Advantage Growth Fund - Administrator Class | 49,418 | 2,735,302 | ||||||

| 19,962,792 | ||||||||

| Fixed Income/Multi-Sector Bond Funds — 19.5% | ||||||||

| BlackRock Strategic Income Opportunities Portfolio - Institutional Shares | 97,663 | 1,002,022 | ||||||

| Dodge & Cox Income Fund | 279,318 | 3,879,725 | ||||||

| Loomis Sayles Bond Fund - Institutional Class | 376,512 | 5,839,697 | ||||||

| PIMCO Income Fund - Institutional Class | 288,184 | 3,659,939 | ||||||

| 14,381,383 | ||||||||

| International Funds — 13.1% | ||||||||

| First Eagle Global Fund - Class A | 63,248 | 3,472,305 | ||||||

| Harding, Loevner International Equity Portfolio - Institutional Class | 199,902 | 3,660,208 | ||||||

| Lazard Global Listed Infrastructure Portfolio - Institutional Shares | 102,110 | 1,522,464 | ||||||

Pear Tree Polaris Foreign Value Small Cap Fund - Institutional Class | 78,555 | 1,007,856 | ||||||

| 9,662,833 | ||||||||

| Sector Funds — 12.0% | ||||||||

Consumer Staples Select Sector SPDR Fund (a) | 24,000 | 1,121,040 | ||||||

| Fidelity Select Health Care Portfolio | 12,267 | 2,805,404 | ||||||

iShares Dow Jones U.S. Energy Sector Index Fund (a) | 46,500 | 2,307,330 | ||||||

Oppenheimer SteelPath MLP Select 40 Fund - Class Y (b) | 156,246 | 2,049,949 | ||||||

SPDR Gold Shares (a) (b) (c) | 5,300 | 597,098 | ||||||

| 8,880,821 | ||||||||

| Worldwide Bond Funds — 7.6% | ||||||||

| Loomis Sayles Global Bond Fund - Institutional Class | 104,261 | 1,677,565 | ||||||

| Templeton Global Bond Fund - Class A | 292,075 | 3,887,519 | ||||||

| 5,565,084 | ||||||||

| High Yield Bond Funds — 6.1% | ||||||||

| Loomis Sayles Institutional High Income Fund | 311,614 | 2,549,004 | ||||||

| Oppenheimer Senior Floating Rate Fund - Class A | 96,595 | 797,872 | ||||||

| Oppenheimer Senior Floating Rate Fund - Class Y | 136,642 | 1,125,927 | ||||||

| 4,472,803 | ||||||||

| Mid-Cap Funds — 5.5% | ||||||||

SPDR S&P MidCap 400 ETF Trust (a) | 15,780 | 4,073,134 | ||||||

See accompanying notes to financial statements.

13

NEW CENTURY BALANCED PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

SCHEDULE OF INVESTMENTS (Continued)

| INVESTMENT COMPANIES — 98.0% (Continued) | Shares | Value | ||||||

| Convertible Bond Funds — 3.9% | ||||||||

| Allianz AGIC Convertible Fund - Institutional Shares | 79,605 | $ | 2,874,536 | |||||

| Small-Cap Funds — 3.2% | ||||||||

| Brown Capital Management Small Company Fund - Institutional Class | 15,408 | 1,154,043 | ||||||

iShares S&P SmallCap 600 Value Index Fund (a) | 10,700 | 1,229,858 | ||||||

| 2,383,901 | ||||||||

Total Investment Companies (Cost $55,479,967) | $ | 72,257,287 | ||||||

| STRUCTURED NOTES — 1.1% | Par Value | Value | ||||||

BNP Paribas Return Enhanced Notes Linked to the Performance of PowerShares S&P 500 Low Volatility Portfolio, due 03/31/2017 (b) (Cost $750,000) | $ | 750,000 | $ | 831,956 | ||||

| MONEY MARKET FUNDS — 0.6% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.01% (d) (Cost $417,588) | 417,588 | $ | 417,588 | |||||

Total Investments at Value — 99.7% (Cost $56,647,555) | $ | 73,506,831 | ||||||

| Other Assets in Excess of Liabilities — 0.3% | 229,976 | |||||||

| Net Assets — 100.0% | $ | 73,736,807 | ||||||

| (a) | Exchange-traded fund. |

| (b) | Non-income producing security. |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| (d) | The rate shown is the 7-day effective yield as of October 31, 2014. |

See accompanying notes to financial statements.

14

NEW CENTURY INTERNATIONAL PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets | |

| WisdomTree Japan Hedged Equity Fund | 7.3% | |

| Matthews Pacific Tiger Fund - Investor Class | 7.1% | |

| Franklin Mutual European Fund - Class A | 6.8% | |

| T. Rowe Price European Stock Fund | 6.4% | |

| Matthews Japan Fund - Institutional Class | 6.3% | |

| iShares MSCI Switzerland Index Fund | 6.1% | |

| Columbia European Equity Fund - Class A | 5.7% | |

| Oakmark International Fund - Class I | 5.5% | |

| Vanguard MSCI Europe ETF | 5.3% | |

| iShares MSCI Germany Index Fund | 4.8% |

15

NEW CENTURY INTERNATIONAL PORTFOLIO

SCHEDULE OF INVESTMENTS

October 31, 2014

SCHEDULE OF INVESTMENTS

October 31, 2014

| INVESTMENT COMPANIES — 98.9% | Shares | Value | ||||||

| Europe Funds — 40.0% | ||||||||

| Columbia European Equity Fund - Class A | 452,513 | $ | 3,190,215 | |||||

| Franklin Mutual European Fund - Class A | 167,476 | 3,836,884 | ||||||

iShares MSCI Germany Index Fund (a) | 99,600 | 2,712,108 | ||||||

iShares MSCI Switzerland Index Fund (a) | 105,600 | 3,418,272 | ||||||

iShares MSCI United Kingdom Index Fund (a) | 141,146 | 2,683,186 | ||||||

| T. Rowe Price European Stock Fund | 179,970 | 3,604,796 | ||||||

Vanguard MSCI Europe ETF (a) | 55,200 | 2,990,184 | ||||||

| 22,435,645 | ||||||||

| Diversified Funds — 27.9% | ||||||||

| Columbia Acorn International Select Fund - Class A | 44,559 | 1,182,610 | ||||||

| Dodge & Cox International Stock Fund | 31,901 | 1,416,099 | ||||||

| Harbor International Fund - Institutional Class | 17,368 | 1,182,619 | ||||||

Harding, Loevner International Equity Portfolio - Institutional Class | 65,714 | 1,203,223 | ||||||

iShares MSCI EAFE Growth Index Fund (a) | 10,900 | 745,124 | ||||||

iShares MSCI EAFE Value Index Fund (a) | 11,800 | 640,032 | ||||||

| Lazard Global Listed Infrastructure Portfolio - Institutional Shares | 106,308 | 1,585,046 | ||||||

| MFS International Value Fund - Class I | 49,242 | 1,770,232 | ||||||

| Oakmark International Fund - Class I | 123,738 | 3,058,795 | ||||||

| Pear Tree Polaris Foreign Value Small Cap Fund - Institutional Class | 68,061 | 873,228 | ||||||

| Templeton Institutional Funds - Foreign Smaller Companies Series | 92,935 | 1,975,806 | ||||||

| 15,632,814 | ||||||||

| Asia/Pacific Funds — 24.8% | ||||||||

iShares MSCI Australia Index Fund (a) | 30,100 | 765,443 | ||||||

| Matthews China Dividend Fund - Investor Class | 114,473 | 1,583,156 | ||||||

| Matthews Japan Fund - Institutional Class | 213,698 | 3,532,424 | ||||||

| Matthews Pacific Tiger Fund - Investor Class | 138,629 | 3,966,166 | ||||||

WisdomTree Japan Hedged Equity Fund (a) | 76,000 | 4,090,320 | ||||||

| 13,937,509 | ||||||||

| Emerging Markets Funds — 5.0% | ||||||||

| Aberdeen Emerging Markets Fund - Institutional Class | 143,366 | 2,136,161 | ||||||

Vanguard MSCI Emerging Markets ETF (a) | 15,400 | 656,656 | ||||||

| 2,792,817 | ||||||||

| Americas Funds — 1.2% | ||||||||

| JPMorgan Latin America Fund - Select Class | 37,297 | 655,673 | ||||||

Total Investment Companies (Cost $45,169,791) | $ | 55,454,458 | ||||||

See accompanying notes to financial statements.

16

NEW CENTURY INTERNATIONAL PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 1.2% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.01% (b) (Cost $692,353) | 692,353 | $ | 692,353 | |||||

Total Investments at Value — 100.1% (Cost $45,862,144) | $ | 56,146,811 | ||||||

| Liabilities in Excess of Other Assets — (0.1%) | (74,047 | ) | ||||||

| Net Assets — 100.0% | $ | 56,072,764 | ||||||

(a) | Exchange-traded fund. |

(b) | The rate shown is the 7-day effective yield as of October 31, 2014. |

See accompanying notes to financial statements.

17

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

PORTFOLIO INFORMATION (Unaudited)

October 31, 2014

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets | |

| Calamos Market Neutral Income Fund - Class A | 5.8% | |

| FPA Crescent Fund | 5.6% | |

| First Eagle Global Fund - Class A | 5.3% | |

| Touchstone Merger Arbitrage Fund - Institutional Shares | 5.1% | |

| Berwyn Income Fund | 4.8% | |

| 361 Managed Futures Strategy Fund - Class I | 4.7% | |

| MainStay Marketfield Fund - Class I | 4.1% | |

| Merger Fund (The) | 4.0% | |

| AllianceBernstein Select US Long/Short Portfolio - Class I | 4.0% | |

| Weitz Partners III Opportunity Fund - Institutional Class | 3.8% |

18

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS

October 31, 2014

SCHEDULE OF INVESTMENTS

October 31, 2014

| INVESTMENT COMPANIES — 96.7% | Shares | Value | ||||||

| Long/Short Equity Funds — 22.0% | ||||||||

| AllianceBernstein Select US Long/Short Portfolio - Class I | 400,572 | $ | 4,890,981 | |||||

| MainStay Marketfield Fund - Class I | 297,338 | 4,947,709 | ||||||

Robeco Boston Partners Long/Short Research Fund - Institutional Class (b) | 291,285 | 4,398,408 | ||||||

| TFS Market Neutral Fund | 24,838 | 383,750 | ||||||

Vanguard Market Neutral Fund - Investor Shares (b) | 275,350 | 3,147,254 | ||||||

| Wasatch Long/Short Fund | 273,491 | 4,411,407 | ||||||

Weitz Partners III Opportunity Fund - Institutional Class (b) | 275,137 | 4,564,527 | ||||||

| 26,744,036 | ||||||||

| Arbitrage Funds — 16.2% | ||||||||

| Calamos Market Neutral Income Fund - Class A | 536,301 | 7,041,628 | ||||||

| Gabelli ABC Fund - Advisor Class | 150,288 | 1,531,429 | ||||||

| Merger Fund (The) | 304,742 | 4,915,491 | ||||||

| Touchstone Merger Arbitrage Fund - Institutional Shares | 591,053 | 6,194,238 | ||||||

| 19,682,786 | ||||||||

| Global Macro Funds — 14.6% | ||||||||

| BlackRock Global Allocation Fund - Class A | 83,985 | 1,818,268 | ||||||

| First Eagle Global Fund - Class A | 117,036 | 6,425,243 | ||||||

| Ivy Asset Strategy Fund - Class A | 82,653 | 2,556,443 | ||||||

| John Hancock Global Absolute Return Strategies Fund - Class I | 255,921 | 2,945,651 | ||||||

| Mutual Global Discovery Fund - Class Z | 115,374 | 4,030,007 | ||||||

| 17,775,612 | ||||||||

| Asset Allocation Funds — 10.4% | ||||||||

| Berwyn Income Fund | 405,709 | 5,761,061 | ||||||

| FPA Crescent Fund | 200,036 | 6,845,243 | ||||||

| 12,606,304 | ||||||||

| High Yield/Fixed Income Funds — 9.3% | ||||||||

Aberdeen Asia-Pacific Income Fund, Inc. (d) | 160,000 | 940,800 | ||||||

BlackRock Credit Allocation Income Trust (d) | 70,000 | 947,800 | ||||||

PIMCO Dynamic Income Fund (d) | 76,000 | 2,438,840 | ||||||

| PIMCO Income Fund - Institutional Class | 168,974 | 2,145,975 | ||||||

| Templeton Global Bond Fund - Class A | 183,514 | 2,442,570 | ||||||

Templeton Global Income Fund (d) | 312,000 | 2,442,960 | ||||||

| 11,358,945 | ||||||||

| Natural Resources Funds — 7.5% | ||||||||

Market Vectors Gold Miners ETF (a) | 43,000 | 740,030 | ||||||

Oppenheimer SteelPath MLP Select 40 Fund - Class Y (b) | 134,993 | 1,771,108 | ||||||

| PIMCO CommoditiesPLUS Strategy Fund - Institutional Class | 114,957 | 1,116,233 | ||||||

| RS Global Natural Resources Fund - Class A | 26,957 | 832,693 | ||||||

See accompanying notes to financial statements.

19

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

SCHEDULE OF INVESTMENTS (Continued)

| INVESTMENT COMPANIES — 96.7% (Continued) | Shares | Value | ||||||

| Natural Resources Funds — 7.5% (Continued) | ||||||||

SPDR Gold Shares (a) (b) (c) | 10,500 | $ | 1,182,930 | |||||

| Tortoise MLP & Pipeline Fund - Institutional Class | 186,357 | 3,432,695 | ||||||

| 9,075,689 | ||||||||

| Managed Futures Funds — 6.2% | ||||||||

| 361 Managed Futures Strategy Fund - Class I | 498,606 | 5,689,095 | ||||||

| AQR Managed Futures Strategy Fund - Class N | 182,654 | 1,894,125 | ||||||

| 7,583,220 | ||||||||

| Real Estate Funds — 5.6% | ||||||||

CBRE Clarion Global Real Estate Income Fund (d) | 154,000 | 1,362,900 | ||||||

Vanguard REIT ETF (a) | 41,000 | 3,238,590 | ||||||

| Voya Global Real Estate Fund - Class I | 106,081 | 2,166,177 | ||||||

| 6,767,667 | ||||||||

| Option Hedged Funds — 3.0% | ||||||||

BlackRock Enhanced Equity Dividend Trust (d) | 120,000 | 1,002,000 | ||||||

| Swan Defined Risk Fund - Class I | 222,589 | 2,613,198 | ||||||

| 3,615,198 | ||||||||

| Deep Value/Distressed Securities Funds — 1.9% | ||||||||

| Third Avenue Focused Credit Fund - Institutional Class | 220,414 | 2,336,391 | ||||||

Total Investment Companies (Cost $102,331,547) | $ | 117,545,848 | ||||||

| STRUCTURED NOTES — 2.5% | Par Value | Value | ||||||

BNP Paribas Buffered Return Enhanced Notes Linked to the Performance of WTI Crude Oil, due 03/24/2016 (b) | $ | 1,500,000 | $ | 1,348,870 | ||||

JPMorgan Chase & Co., Dual Directional Contingent Buffered Return Enhanced Notes Linked to the EURO STOXX 50 Index, due 12/14/2016 (b) | 1,800,000 | 1,647,180 | ||||||

Total Structured Notes (Cost $3,300,000) | $ | 2,996,050 | ||||||

See accompanying notes to financial statements.

20

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 1.1% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.01% (e) (Cost $1,320,900) | 1,320,900 | $ | 1,320,900 | |||||

Total Investments at Value — 100.3% (Cost $106,952,447) | $ | 121,862,798 | ||||||

| Liabilities in Excess of Other Assets — (0.3%) | (316,302 | ) | ||||||

| Net Assets — 100.0% | $ | 121,546,496 | ||||||

| (a) | Exchange-traded fund. |

| (b) | Non-income producing security. |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| (d) | Closed-end fund. |

| (e) | The rate shown is the 7-day effective yield as of October 31, 2014. |

See accompanying notes to financial statements.

21

NEW CENTURY PORTFOLIOS

STATEMENTS OF ASSETS AND LIABILITIES

October 31, 2014

STATEMENTS OF ASSETS AND LIABILITIES

October 31, 2014

New Century Capital Portfolio | New Century Balanced Portfolio | New Century International Portfolio | New Century Alternative Strategies Portfolio | |||||||||||||

| ASSETS | ||||||||||||||||

| Investments in securities: | ||||||||||||||||

| At acquisition cost | $ | 80,647,870 | $ | 56,647,555 | $ | 45,862,144 | $ | 106,952,447 | ||||||||

| At value (Note 1A) | $ | 115,089,383 | $ | 73,506,831 | $ | 56,146,811 | $ | 121,862,798 | ||||||||

| Cash | — | — | — | 16,812 | ||||||||||||

| Dividends receivable | 19 | 23,845 | 6 | 24,186 | ||||||||||||

| Receivable for investment securities sold | — | 304,779 | — | — | ||||||||||||

| Receivable for capital shares sold | 3,191 | 3,456 | 681 | 8,338 | ||||||||||||

| Other assets | 5,653 | 3,591 | 2,929 | 6,137 | ||||||||||||

| TOTAL ASSETS | 115,098,246 | 73,842,502 | 56,150,427 | 121,918,271 | ||||||||||||

| LIABILITIES | ||||||||||||||||

| Payable for investment securities purchased | — | 23,065 | — | 260,044 | ||||||||||||

| Payable for capital shares redeemed | 11,294 | 2,344 | 9,309 | 2,191 | ||||||||||||

| Payable to Adviser (Note 2) | 94,528 | 58,103 | 47,910 | 79,956 | ||||||||||||

| Payable to Distributor (Note 3) | 23,500 | 10,900 | 10,600 | 13,500 | ||||||||||||

| Other accrued expenses | 15,153 | 11,283 | 9,844 | 16,084 | ||||||||||||

| TOTAL LIABILITIES | 144,475 | 105,695 | 77,663 | 371,775 | ||||||||||||

| NET ASSETS | $ | 114,953,771 | $ | 73,736,807 | $ | 56,072,764 | $ | 121,546,496 | ||||||||

| Net assets consist of: | ||||||||||||||||

| Paid-in capital | $ | 66,827,800 | $ | 52,130,526 | $ | 39,353,206 | $ | 110,400,180 | ||||||||

| Accumulated net investment income (loss) | (65,407 | ) | 32,950 | 393,443 | (165,240 | ) | ||||||||||

| Accumulated net realized gains (losses) on investments | 13,749,865 | 4,714,055 | 6,041,448 | (3,598,795 | ) | |||||||||||

| Net unrealized appreciation on investments | 34,441,513 | 16,859,276 | 10,284,667 | 14,910,351 | ||||||||||||

| Net assets | $ | 114,953,771 | $ | 73,736,807 | $ | 56,072,764 | $ | 121,546,496 | ||||||||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 5,434,138 | 4,390,070 | 3,762,421 | 9,252,760 | ||||||||||||

Net asset value, offering price and redemption price per share (a) | $ | 21.15 | $ | 16.80 | $ | 14.90 | $ | 13.14 | ||||||||

| (a) | Redemption price may differ from the net asset value per share depending upon the length of time held (Note 1B). |

See accompanying notes to financial statements.

22

NEW CENTURY PORTFOLIOS

STATEMENTS OF OPERATIONS

For the Year Ended October 31, 2014

STATEMENTS OF OPERATIONS

For the Year Ended October 31, 2014

New Century Capital Portfolio | New Century Balanced Portfolio | New Century International Portfolio | New Century Alternative Strategies Portfolio | |||||||||||||

| INVESTMENT INCOME | ||||||||||||||||

| Dividends | $ | 1,547,232 | $ | 1,651,504 | $ | 1,269,509 | $ | 2,217,897 | ||||||||

| Interest | — | — | — | 22,963 | ||||||||||||

| Total investment income | 1,547,232 | 1,651,504 | 1,269,509 | 2,240,860 | ||||||||||||

| EXPENSES | ||||||||||||||||

| Investment advisory fees (Note 2) | 1,105,990 | 695,522 | 596,722 | 933,159 | ||||||||||||

| Distribution costs (Note 3) | 268,376 | 143,359 | 126,665 | 235,714 | ||||||||||||

| Accounting fees | 50,514 | 40,343 | 37,181 | 53,030 | ||||||||||||

| Administration fees (Note 2) | 40,040 | 26,509 | 22,343 | 43,348 | ||||||||||||

| Legal and audit fees | 35,248 | 27,420 | 22,458 | 37,818 | ||||||||||||

| Trustees’ fees (Note 2) | 36,774 | 23,537 | 19,166 | 40,524 | ||||||||||||

| Transfer agent fees | 26,779 | 21,382 | 19,725 | 28,114 | ||||||||||||

| Custody and bank service fees | 20,528 | 14,688 | 12,939 | 21,838 | ||||||||||||

| Insurance expense | 8,673 | 5,550 | 4,672 | 9,818 | ||||||||||||

| Postage & supplies | 7,582 | 4,863 | 4,324 | 6,733 | ||||||||||||

| Other expenses | 12,135 | 10,432 | 9,821 | 13,403 | ||||||||||||

| Total expenses | 1,612,639 | 1,013,605 | 876,016 | 1,423,499 | ||||||||||||

| NET INVESTMENT INCOME (LOSS) | (65,407 | ) | 637,899 | 393,493 | 817,361 | |||||||||||

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | ||||||||||||||||

| Net realized gains on investments | 12,309,795 | 3,628,603 | 5,452,098 | 1,346,766 | ||||||||||||

| Capital gain distributions from regulated investment companies | 2,163,549 | 1,240,264 | 589,544 | 1,612,359 | ||||||||||||

| Net change in unrealized appreciation (depreciation) on investments | (1,938,516 | ) | (62,987 | ) | (6,883,739 | ) | (1,966,593 | ) | ||||||||

| NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | 12,534,828 | 4,805,880 | (842,097 | ) | 992,532 | |||||||||||

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $ | 12,469,421 | $ | 5,443,779 | $ | (448,604 | ) | $ | 1,809,893 | |||||||

See accompanying notes to financial statements.

23

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

STATEMENTS OF CHANGES IN NET ASSETS

New Century Capital Portfolio | ||||||||

Year Ended October 31, 2014 | Year Ended October 31, 2013 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (65,407 | ) | $ | (3,885 | ) | ||

| Net realized gains from security transactions | 12,309,795 | 10,120,888 | ||||||

| Capital gain distributions from regulated investment companies | 2,163,549 | 440,532 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (1,938,516 | ) | 11,827,607 | |||||

| Net increase in net assets from operations | 12,469,421 | 22,385,142 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From net realized gains on security transactions (Note 1E) | (10,250,145 | ) | (4,174,787 | ) | ||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||

| Net assets received in conjunction with fund merger (Note 1) | — | 12,773,191 | ||||||

| Proceeds from shares sold | 1,834,772 | 3,510,261 | ||||||

| Proceeds from redemption fees collected (Note 1B) | 136 | 724 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 9,899,484 | 4,040,782 | ||||||

| Payments for shares redeemed | (11,828,041 | ) | (13,370,844 | ) | ||||

| Net increase (decrease) in net assets from capital share transactions | (93,649 | ) | 6,954,114 | |||||

| TOTAL INCREASE IN NET ASSETS | 2,125,627 | 25,164,469 | ||||||

| NET ASSETS | ||||||||

| Beginning of year | 112,828,144 | 87,663,675 | ||||||

| End of year | $ | 114,953,771 | $ | 112,828,144 | ||||

| ACCUMULATED NET INVESTMENT LOSS | $ | (65,407 | ) | $ | — | |||

| CAPITAL SHARE ACTIVITY | ||||||||

| Shares issued in conjunction with fund merger (Note 1) | — | 708,515 | ||||||

| Shares sold | 90,311 | 191,859 | ||||||

| Shares reinvested | 497,461 | 236,580 | ||||||

| Shares redeemed | (576,155 | ) | (708,926 | ) | ||||

| Net increase in shares outstanding | 11,617 | 428,028 | ||||||

| Shares outstanding, beginning of year | 5,422,521 | 4,994,493 | ||||||

| Shares outstanding, end of year | 5,434,138 | 5,422,521 | ||||||

See accompanying notes to financial statements.

24

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

STATEMENTS OF CHANGES IN NET ASSETS

New Century Balanced Portfolio | ||||||||

Year Ended October 31, 2014 | Year Ended October 31, 2013 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 637,899 | $ | 797,755 | ||||

| Net realized gains from security transactions | 3,628,603 | 4,244,536 | ||||||

| Capital gain distributions from regulated investment companies | 1,240,264 | 432,660 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (62,987 | ) | 4,608,660 | |||||

| Net increase in net assets from operations | 5,443,779 | 10,083,611 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From net investment income (Note 1E) | (790,570 | ) | (794,645 | ) | ||||

| From net realized gains on security transactions (Note 1E) | (3,999,254 | ) | — | |||||

| Decrease in net assets from distributions to shareholders | (4,789,824 | ) | (794,645 | ) | ||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from shares sold | 3,165,864 | 2,946,146 | ||||||

| Proceeds from redemption fees collected (Note 1B) | — | 1 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 4,582,522 | 768,274 | ||||||

| Payments for shares redeemed | (6,122,526 | ) | (8,371,973 | ) | ||||

| Net increase (decrease) in net assets from capital share transactions | 1,625,860 | (4,657,552 | ) | |||||

| TOTAL INCREASE IN NET ASSETS | 2,279,815 | 4,631,414 | ||||||

| NET ASSETS | ||||||||

| Beginning of year | 71,456,992 | 66,825,578 | ||||||

| End of year | $ | 73,736,807 | $ | 71,456,992 | ||||

| ACCUMULATED NET INVESTMENT INCOME | $ | 32,950 | $ | 185,621 | ||||

| CAPITAL SHARE ACTIVITY | ||||||||

| Shares sold | 191,900 | 193,485 | ||||||

| Shares reinvested | 286,766 | 52,478 | ||||||

| Shares redeemed | (373,561 | ) | (552,033 | ) | ||||

| Net increase (decrease) in shares outstanding | 105,105 | (306,070 | ) | |||||

| Shares outstanding, beginning of year | 4,284,965 | 4,591,035 | ||||||

| Shares outstanding, end of year | 4,390,070 | 4,284,965 | ||||||

See accompanying notes to financial statements.

25

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

STATEMENTS OF CHANGES IN NET ASSETS

New Century International Portfolio | ||||||||

Year Ended October 31, 2014 | Year Ended October 31, 2013 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 393,493 | $ | 400,696 | ||||

| Net realized gains from security transactions | 5,452,098 | 7,854,026 | ||||||

| Capital gain distributions from regulated investment companies | 589,544 | 225,293 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (6,883,739 | ) | 1,406,537 | |||||

| Net increase (decrease) in net assets from operations | (448,604 | ) | 9,886,552 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From net investment income (Note 1E) | (361,371 | ) | (642,497 | ) | ||||

| From net realized gains on security transactions (Note 1E) | (4,279,496 | ) | — | |||||

| Decrease in net assets from distributions to shareholders | (4,640,867 | ) | (642,497 | ) | ||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from shares sold | 1,123,604 | 2,276,174 | ||||||

| Proceeds from redemption fees collected (Note 1B) | 2 | 3 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 4,538,606 | 631,930 | ||||||

| Payments for shares redeemed | (7,207,518 | ) | (6,710,756 | ) | ||||

| Net decrease in net assets from capital share transactions | (1,545,306 | ) | (3,802,649 | ) | ||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (6,634,777 | ) | 5,441,406 | |||||

| NET ASSETS | ||||||||

| Beginning of year | 62,707,541 | 57,266,135 | ||||||

| End of year | $ | 56,072,764 | $ | 62,707,541 | ||||

| ACCUMULATED NET INVESTMENT INCOME | $ | 393,443 | $ | 361,321 | ||||

| CAPITAL SHARE ACTIVITY | ||||||||

| Shares sold | 73,873 | 152,928 | ||||||

| Shares reinvested | 296,060 | 43,581 | ||||||

| Shares redeemed | (467,703 | ) | (449,438 | ) | ||||

| Net decrease in shares outstanding | (97,770 | ) | (252,929 | ) | ||||

| Shares outstanding, beginning of year | 3,860,191 | 4,113,120 | ||||||

| Shares outstanding, end of year | 3,762,421 | 3,860,191 | ||||||

See accompanying notes to financial statements.

26

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

STATEMENTS OF CHANGES IN NET ASSETS

New Century Alternative Strategies Portfolio | ||||||||

Year Ended October 31, 2014 | Year Ended October 31, 2013 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 817,361 | $ | 467,373 | ||||

| Net realized gains from security transactions | 1,346,766 | 1,535,433 | ||||||

| Capital gain distributions from regulated investment companies | 1,612,359 | 889,507 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (1,966,593 | ) | 5,147,864 | |||||

| Net increase in net assets from operations | 1,809,893 | 8,040,177 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From net investment income (Note 1E) | (748,917 | ) | (668,997 | ) | ||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from shares sold | 12,507,050 | 15,300,515 | ||||||

| Proceeds from redemption fees collected (Note 1B) | 335 | 2,722 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 721,862 | 656,678 | ||||||

| Payments for shares redeemed | (16,154,264 | ) | (17,192,246 | ) | ||||

| Net decrease in net assets from capital share transactions | (2,925,017 | ) | (1,232,331 | ) | ||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (1,864,041 | ) | 6,138,849 | |||||

| NET ASSETS | ||||||||

| Beginning of year | 123,410,537 | 117,271,688 | ||||||

| End of year | $ | 121,546,496 | $ | 123,410,537 | ||||

| ACCUMULATED NET INVESTMENT LOSS | $ | (165,240 | ) | $ | (233,684 | ) | ||

| CAPITAL SHARE ACTIVITY | ||||||||

| Shares sold | 950,486 | 1,205,497 | ||||||

| Shares reinvested | 55,358 | 53,258 | ||||||

| Shares redeemed | (1,229,535 | ) | (1,360,199 | ) | ||||

| Net decrease in shares outstanding | (223,691 | ) | (101,444 | ) | ||||

| Shares outstanding, beginning of year | 9,476,451 | 9,577,895 | ||||||

| Shares outstanding, end of year | 9,252,760 | 9,476,451 | ||||||

See accompanying notes to financial statements.

27

NEW CENTURY CAPITAL PORTFOLIO

FINANCIAL HIGHLIGHTS

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| Years Ended October 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 20.81 | $ | 17.55 | $ | 16.11 | $ | 15.41 | $ | 13.26 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment loss | (0.01 | ) | (0.00 | ) | (0.01 | ) | (0.04 | ) | (0.03 | ) | ||||||||||

| Net realized and unrealized gains on investments | 2.29 | 4.11 | 1.54 | 0.74 | 2.21 | |||||||||||||||

| Total from investment operations | 2.28 | 4.11 | 1.53 | 0.70 | 2.18 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||

| Distributions from net investment income | — | — | — | — | (0.03 | ) | ||||||||||||||

| Distributions from net realized gains | (1.94 | ) | (0.85 | ) | (0.09 | ) | — | — | ||||||||||||

| Total distributions | (1.94 | ) | (0.85 | ) | (0.09 | ) | — | (0.03 | ) | |||||||||||

| Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | 0.00 | (a) | — | — | 0.00 | (a) | ||||||||||||

| Net asset value, end of year | $ | 21.15 | $ | 20.81 | $ | 17.55 | $ | 16.11 | $ | 15.41 | ||||||||||

TOTAL RETURN (b) | 11.53 | % | 24.45 | % | 9.57 | % | 4.54 | % | 16.47 | % | ||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (000’s) | $ | 114,954 | $ | 112,828 | $ | 87,664 | $ | 88,602 | $ | 93,266 | ||||||||||

Ratio of expenses to average net assets (c) | 1.41 | % | 1.43 | % | 1.46 | % | 1.42 | % | 1.40 | % | ||||||||||

Ratio of net investment loss to average net assets (d) | (0.06 | %) | (0.00 | %) | (0.05 | %) | (0.25 | %) | (0.20 | %) | ||||||||||

| Portfolio turnover | 26 | % | 28 | % | 7 | % | 60 | % | 10 | % | ||||||||||

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

| (d) | Recognition of net investment loss by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

28

NEW CENTURY BALANCED PORTFOLIO

FINANCIAL HIGHLIGHTS

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| Years Ended October 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 16.68 | $ | 14.56 | $ | 13.59 | $ | 13.22 | $ | 11.93 | ||||||||||

| Income from investment operations: | ||||||||||||||||||||

| Net investment income | 0.15 | 0.18 | 0.17 | 0.20 | 0.15 | |||||||||||||||

| Net realized and unrealized gains on investments | 1.10 | 2.12 | 0.97 | 0.37 | 1.30 | |||||||||||||||

| Total from investment operations | 1.25 | 2.30 | 1.14 | 0.57 | 1.45 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||

| Distributions from net investment income | (0.19 | ) | (0.18 | ) | (0.17 | ) | (0.20 | ) | (0.16 | ) | ||||||||||

| Distributions from net realized gains | (0.94 | ) | — | — | — | — | ||||||||||||||

| Total distributions | (1.13 | ) | (0.18 | ) | (0.17 | ) | (0.20 | ) | (0.16 | ) | ||||||||||

| Proceeds from redemption fees collected (Note 1B) | — | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | — | ||||||||||||

| Net asset value, end of year | $ | 16.80 | $ | 16.68 | $ | 14.56 | $ | 13.59 | $ | 13.22 | ||||||||||

TOTAL RETURN (b) | 7.81 | % | 15.97 | % | 8.54 | % | 4.29 | % | 12.23 | % | ||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (000’s) | $ | 73,737 | $ | 71,457 | $ | 66,826 | $ | 64,582 | $ | 64,880 | ||||||||||

Ratio of expenses to average net assets (c) | 1.40 | % | 1.43 | % | 1.45 | % | 1.43 | % | 1.44 | % | ||||||||||

Ratio of net investment income to average net assets (d) | 0.88 | % | 1.17 | % | 1.18 | % | 1.39 | % | 1.20 | % | ||||||||||

| Portfolio turnover | 16 | % | 21 | % | 13 | % | 17 | % | 7 | % | ||||||||||

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

| (d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

29

NEW CENTURY INTERNATIONAL PORTFOLIO

FINANCIAL HIGHLIGHTS

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| Years Ended October 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 16.24 | $ | 13.92 | $ | 13.41 | $ | 14.53 | $ | 12.70 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income | 0.11 | 0.11 | 0.15 | 0.10 | 0.09 | |||||||||||||||

| Net realized and unrealized gains (losses) on investments | (0.22 | ) | 2.37 | 0.46 | (1.14 | ) | 1.82 | |||||||||||||

| Total from investment operations | (0.11 | ) | 2.48 | 0.61 | (1.04 | ) | 1.91 | |||||||||||||

| Less distributions: | ||||||||||||||||||||

| Distributions from net investment income | (0.10 | ) | (0.16 | ) | (0.10 | ) | (0.08 | ) | (0.08 | ) | ||||||||||

| Distributions from net realized gains | (1.13 | ) | — | — | — | — | ||||||||||||||

| Total distributions | (1.23 | ) | (0.16 | ) | (0.10 | ) | (0.08 | ) | (0.08 | ) | ||||||||||

| Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | ||||||||||

| Net asset value, end of year | $ | 14.90 | $ | 16.24 | $ | 13.92 | $ | 13.41 | $ | 14.53 | ||||||||||

TOTAL RETURN (b) | (0.89 | %) | 17.95 | % | 4.60 | % | (7.22 | %) | 15.07 | % | ||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (000’s) | $ | 56,073 | $ | 62,708 | $ | 57,266 | $ | 61,262 | $ | 68,947 | ||||||||||

Ratios of expenses to average net assets (c) | 1.47 | % | 1.43 | % | 1.50 | % | 1.46 | % | 1.45 | % | ||||||||||

Ratios of net investment income to average net assets (d) | 0.66 | % | 0.67 | % | 1.03 | % | 0.63 | % | 0.57 | % | ||||||||||

| Portfolio turnover | 22 | % | 32 | % | 4 | % | 13 | % | 4 | % | ||||||||||

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

| (d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

30

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

FINANCIAL HIGHLIGHTS

FINANCIAL HIGHLIGHTS

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| Years Ended October 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 13.02 | $ | 12.24 | $ | 11.80 | $ | 11.87 | $ | 11.11 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income | 0.09 | 0.05 | 0.14 | 0.17 | 0.08 | |||||||||||||||

| Net realized and unrealized gains (losses) on investments | 0.11 | 0.80 | 0.47 | (0.09 | ) | 0.83 | ||||||||||||||

| Total from investment operations | 0.20 | 0.85 | 0.61 | 0.08 | 0.91 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||

| Distributions from net investment income | (0.08 | ) | (0.07 | ) | (0.17 | ) | (0.15 | ) | (0.15 | ) | ||||||||||

| Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | ||||||||||

| Net asset value, end of year | $ | 13.14 | $ | 13.02 | $ | 12.24 | $ | 11.80 | $ | 11.87 | ||||||||||

TOTAL RETURN (b) | 1.53 | % | 6.99 | % | 5.26 | % | 0.62 | % | 8.21 | % | ||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (000’s) | $ | 121,546 | $ | 123,411 | $ | 117,272 | $ | 114,841 | $ | 135,287 | ||||||||||

Ratio of expenses to average net assets (c) | 1.14 | % | 1.13 | % | 1.11 | % | 1.09 | % | 1.10 | % | ||||||||||

Ratio of net investment income to average net assets (d) | 0.66 | % | 0.39 | % | 1.15 | % | 1.48 | % | 0.74 | % | ||||||||||

| Portfolio turnover | 29 | % | 25 | % | 32 | % | 31 | % | 22 | % | ||||||||||

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

| (d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

31

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS

October 31, 2014

NOTES TO FINANCIAL STATEMENTS

October 31, 2014

(1) SIGNIFICANT ACCOUNTING POLICIES

New Century Portfolios (“New Century”) is organized as a Massachusetts business trust which is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company and currently offers shares of four series: New Century Capital Portfolio, New Century Balanced Portfolio, New Century International Portfolio and New Century Alternative Strategies Portfolio (together, the “Portfolios” and each, a “Portfolio”). New Century Capital Portfolio and New Century Balanced Portfolio commenced operations on January 31, 1989. New Century International Portfolio commenced operations on November 1, 2000, and New Century Alternative Strategies Portfolio commenced operations on May 1, 2002.

Weston Financial Group, Inc. (the “Adviser”), a wholly-owned subsidiary of The Washington Trust Company, serves as the investment adviser to each Portfolio. Weston Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Washington Trust Bancorp, Inc., serves as the distributor and principal underwriter to each Portfolio.

On February 28, 2013, New Century Capital Portfolio consummated a tax-free merger with New Century Opportunistic Portfolio, a former series of New Century. Pursuant to the terms of the merger agreement, each share of New Century Opportunistic Portfolio was converted into an equivalent dollar amount of shares of New Century Capital Portfolio, based on each Portfolio’s respective net asset value as of February 28, 2013 ($11.52 and $18.03, respectively), resulting in each share of New Century Opportunistic Portfolio receiving 0.638960 shares of New Century Capital Portfolio. New Century Capital Portfolio issued 708,515 shares to shareholders of New Century Opportunistic Portfolio. Net assets of New Century Capital and New Century Opportunistic Portfolios as of the merger date were $92,126,682 and $12,773,191, respectively, including unrealized appreciation on investments of $26,607,892 and $3,792,313, respectively. In addition, New Century Opportunistic Portfolio’s net assets included accumulated net realized capital losses on investments of $1,123,635. Total net assets of New Century Capital Portfolio immediately after the merger were $104,899,873.

The investment objective of New Century Capital Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of other registered investment companies, including exchange traded funds (“ETFs”), that emphasize investments in equity securities (domestic and foreign).

The investment objective of New Century Balanced Portfolio is to provide income, with a secondary objective to provide capital growth, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of other registered investment companies, including ETFs, that emphasize investments in equity securities (domestic

32

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

and foreign), fixed income (domestic and foreign), or in a composite of such securities. This Portfolio maintains at least 25% of its assets in fixed income securities by selecting registered investment companies that invest in such securities.

The investment objective of New Century International Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of registered investment companies, including ETFs, that emphasize investments in equity and fixed income securities (foreign, with less emphasis on domestic, worldwide, emerging markets and domestic).

The investment objective of New Century Alternative Strategies Portfolio is to provide long-term capital appreciation, with a secondary objective to earn income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of other registered investment companies, including ETFs and closed-end funds, that emphasize alternative strategies and have low correlation to the securities in the S&P 500 Composite Index.

The price of shares of each Portfolio fluctuates daily and there is no assurance that the Portfolios will be successful in achieving their stated investment objectives.

The following is a summary of significant accounting policies consistently followed by the Portfolios in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

| A. | Investment Valuation |

Investments in shares of other open-end investment companies are valued at their net asset value as reported by such companies. The net asset value as reported by open-end investment companies may be based on fair value pricing; to understand the fair value pricing process used by such companies, consult their most current prospectus. The Portfolios may also invest in closed-end investment companies, exchange-traded funds, and to a certain extent, directly in securities when the Adviser deems it appropriate. Investments in closed-end investment companies, exchange-traded funds and direct investments in securities are valued at market prices, as described in the paragraph below.

Investments in securities traded on a national securities exchange or included in NASDAQ are generally valued at the last reported sales price, the closing price or the official closing price; and securities traded in the over-the-counter market and listed securities for which no sale is reported on that date are valued at the last reported bid price. It is expected that fixed income securities will ordinarily be traded in the over-the-counter market. When market quotations are not readily available, fixed income securities may be valued on the basis of prices provided by an independent pricing service. Other assets and securities for which no quotations are readily available or for which quotations the Adviser believes do not reflect market value are valued at their fair value as determined in good faith by the Adviser under

33

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

the procedures established by the Board of Trustees, and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Factors considered in determining the value of portfolio investments subject to fair value determination include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; infrequency of sales; thinness of market; the size of reported trades; a temporary lapse in the provision of prices by any reliable pricing source; and actions of the securities or future markets, such as the suspension or limitation of trading.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. Various inputs are used in determining the value of the Portfolios’ investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

Structured Notes held by New Century Balanced and New Century Alternative Strategies Portfolios are typically classified as Level 2 since the values for such securities are customarily based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities, underlying index values and interest rates, among other factors.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level of the fair value hierarchy within which the fair value measurement of that security is determined to fall in its entirety is the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value each Portfolio’s investments by security type as of October 31, 2014:

| New Century Capital Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investment Companies | $ | 112,969,180 | $ | — | $ | — | $ | 112,969,180 | ||||||||

| Money Market Funds | 2,120,203 | — | — | 2,120,203 | ||||||||||||

| Total | $ | 115,089,383 | $ | — | $ | — | $ | 115,089,383 | ||||||||

34

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

| New Century Balanced Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investment Companies | $ | 72,257,287 | $ | — | $ | — | $ | 72,257,287 | ||||||||

| Structured Notes | — | 831,956 | — | 831,956 | ||||||||||||

| Money Market Funds | 417,588 | — | — | 417,588 | ||||||||||||

| Total | $ | 72,674,875 | $ | 831,956 | $ | — | $ | 73,506,831 | ||||||||

| New Century International Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investment Companies | $ | 55,454,458 | $ | — | $ | — | $ | 55,454,458 | ||||||||

| Money Market Funds | 692,353 | — | — | 692,353 | ||||||||||||

| Total | $ | 56,146,811 | $ | — | $ | — | $ | 56,146,811 | ||||||||

| New Century Alternative Strategies Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investment Companies | $ | 117,545,848 | $ | — | $ | — | $ | 117,545,848 | ||||||||

| Structured Notes | — | 2,996,050 | — | 2,996,050 | ||||||||||||

| Money Market Funds | 1,320,900 | — | — | 1,320,900 | ||||||||||||

| Total | $ | 118,866,748 | $ | 2,996,050 | $ | — | $ | 121,862,798 | ||||||||

Refer to each Portfolio’s Schedule of Investments for a listing of the securities using Level 1 and Level 2 inputs. As of October 31, 2014, the Portfolios did not have any transfers in and out of any Level. In addition, the Portfolios did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of October 31, 2014. It is the Portfolios’ policy to recognize transfers into and out of any Level at the end of the reporting period.

| B. | Share Valuation |

The net asset value per share of each Portfolio is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Portfolio is equal to the net asset value per share, except that shares of each Portfolio are subject to a redemption fee of 2% if redeemed within 30 days of the date of purchase. This redemption fee applies to all shareholders and accounts; however, each Portfolio reserves the right to waive such redemption fees on employer sponsored retirement accounts. No redemption fee is imposed on the exchange of shares among the various Portfolios of the Trust, the redemption of shares representing reinvested dividends or capital gain distributions, or on amounts representing capital appreciation of shares. During the years ended October 31, 2014 and 2013, proceeds from redemption fees totaled $136 and $724, respectively, for New Century Capital Portfolio; $0 and $1,

35

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2014

respectively, for New Century Balanced Portfolio; $2 and $3, respectively, for New Century International Portfolio; and $335 and $2,722, respectively, for New Century Alternative Strategies Portfolio. Any redemption fees collected are credited to paid-in capital of the applicable Portfolio.

| C. | Investment Transactions |

Investment transactions are recorded on a trade date basis for financial reporting purposes. Gains and losses on securities sold are determined on a specific identification method.

| D. | Income Recognition |