| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

| Investment Company Act file number | 811-05646 |

| New Century Portfolios |

| (Exact name of registrant as specified in charter) |

| 100 William Street, Suite 200 Wellesley, Massachusetts | 02481 |

| (Address of principal executive offices) | (Zip code) |

| Weston Financial Group, Inc. 100 William Street, Suite 200 Wellesley, MA 02481 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (781) 235-7055 |

| Date of fiscal year end: | October 31, 2015 | |

| Date of reporting period: | October 31, 2015 |

| Item 1. | Reports to Stockholders. |

New Century Capital

New Century Balanced

New Century International

New Century Alternative Strategies

ANNUAL REPORT

Year Ended October 31, 2015

100 William Street, Suite 200, Wellesley MA 02481 781-239-0445 888-639-0102 Fax 781-237-1635

|

contents

LETTER TO SHAREHOLDERS | 2-5 |

PERFORMANCE CHARTS | 6-9 |

NEW CENTURY PORTFOLIOS | |

New Century Capital Portfolio | |

Portfolio Information | 10 |

Schedule of Investments | 11-12 |

New Century Balanced Portfolio | |

Portfolio Information | 13 |

Schedule of Investments | 14-15 |

New Century International Portfolio | |

Portfolio Information | 16 |

Schedule of Investments | 17-18 |

New Century Alternative Strategies Portfolio | |

Portfolio Information | 19 |

Schedule of Investments | 20-21 |

Statements of Assets and Liabilities | 22 |

Statements of Operations | 23 |

Statements of Changes in Net Assets | 24-27 |

Financial Highlights | 28-31 |

Notes to Financial Statements | 32-41 |

Report of Independent Registered Public Accounting Firm | 42 |

Board of Trustees and Officers | 43-45 |

About Your Portfolios’ Expenses | 46-47 |

Trustees’ Approval of Investment Advisory Agreements | 48-54 |

LETTER TO SHAREHOLDERS | December, 2015 |

Dear Fellow Shareholders:

We are pleased to present our 26th Annual Report. This report summarizes the 12-month period ended October 31, 2015. This report presents important financial information for each of the New Century Portfolios (together, the “Portfolios” and each, a “Portfolio”). We invite you to visit our website at www.newcenturyportfolios.com for additional information.

● ● ●

When I was young I had a fear of the dentist. Sure he had an office with video games, a toy box and bubble gum flavored teeth cleaner to keep kids like me happy; still I would panic every time I was scheduled for a cleaning. Looking back on it I was scared of the unknown even though each cleaning wasn’t the ordeal I made it out to be and most likely helped to avoid more painful future dental work. The markets and the Federal Reserve have had a similar relationship in 2015. Each time the Federal Reserve was ready to move from a zero-rate policy to an extremely accommodative policy the global markets threw a fit. The Federal Reserve would reassure the markets by constantly bringing up the slower normalization path, and numerous reasons why small raises to the Federal Funds rate now could decrease the need for a hastened tightening in the future. Each time, though volatility increased, equities sold off, and the Federal Reserve was forced to keep rate hikes on hold. To nobody’s surprise the global markets also fear the unknown.

Many will point to other factors beside the Federal Reserve for increased volatility and the equity market correction of late Q3 2015 including: China and the Yuan devaluation; the historically long period between U.S. equity market correctionsi; and the bear market in energy and commodities. We believe that while all these factors contributed to volatility, the uncertainty around the Federal Reserve and its ongoing policy is driving the volatility. It is the known unknown that every Federal Reserve meeting is “live,” but will continue to have the ambiguous “data dependent” mandate that we expect will continue to drive volatility during 2016. We view “liftoff” as a positive and believe the Federal Reserve can properly navigate raising short term rates without derailing the economic recovery.

Our observations for the rest of calendar 2015 and the start of 2016 remain cautious and centered on a slower growth environment with the opportunity for international equities to outpace domestic equities. We remain bullish on international equities fueled by Quantitative Easing (QE) and favorable exchange rates. We feel developed international equities in the large and mid-cap spectrum, both international and domestically, should perform well. We expect large U.S. companies will face more scrutiny from investors who are growing tired of hearing about the stronger dollar hurting company earnings and are increasingly looking for top line growth. We favor consumer based technology, and health care sectors for their strong earnings growth and demographic tailwinds. We also continue to favor domestic investments in mid and small capitalization sectors versus solely mega-cap companies as mid- and small-cap investments have less exposure to foreign sales and currency pressure. Fixed-income will be the most interesting asset class, as the Federal Reserve can only control the short end of the curve, creating opportunities for us to take advantage of the belly of the curve. As for energy, it’s anyone’s guess where the commodity goes from here in the near-

2

term. Without a macro event (war, natural disaster), we believe the oversupply story stays intact for 2016; however, we believe the spot price of energyii can recover back into the $50s. If we have one fear, it’s in housing, a lagging indicator sector which, if wage inflation does not increase, could put pressure on current rent prices and home values. For this reason we prefer investments focused on home goods rather than home builders.

Overall, we continue to take a long-term view of the Portfolios in the lower return environment we are currently experiencing. We will be looking for opportunities to increase exposure to developed international markets. We do not believe that chasing headline yield in any asset class is prudent as there are positive returns to be made with proper allocations over time. And don’t fear the dentist, a regular cleaning can ensure a less painful future.

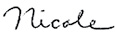

New Century Capital Portfolio (NCCPX) returned 1.20% versus 5.20% for the S&P 500® Composite Index and 2.58% for the Morningstar Large Blend Category for the twelve-months ended October 31, 2015. The major drag on the Portfolio was an overweight to health care. During the equity market correction in August and September 2015, health care was hit especially hard, fueled by news articles about drug pricing, a Hillary Clinton tweet, and a negative report on Valeant. With health care’s above average earnings growth and the prospect of new innovative drugs in the pipeline, we remain bullish on the health care sector’s long-term potential. Based on our feeling regarding the long-term value of this sector, and in an effort to mitigate capital gains distributions from the Portfolio, we made a tactical decision only to trim health care holdings, even if doing so led to short-term underperformance. Investments in mid-cap, consumer, and information technology were all positive contributors to performance. However, small-caps remained under pressure, and therefore we reduced these positions in the Portfolio. We are bullish about international investments with around 10% of the Portfolio invested internationally on a look through basis.

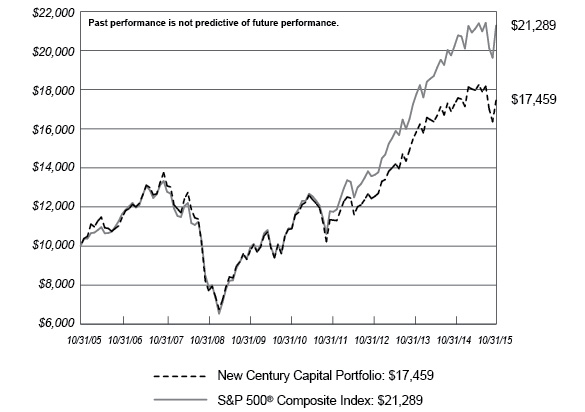

New Century Balanced Portfolio (NCIPX) returned (2.04%) versus 0.07% for the Morningstar Moderate Target Risk Index, 0.45% for the Moderate Allocation Category, 5.20% for the S&P 500® Composite Index, and 1.86% for the Barclays U.S. Intermediate Government/Credit Index for the twelve-months ended October 31, 2015. We were disappointed by the performance of several of our core holdings, most notably in the fixed-income area where non-dollar denominated debt was a major downside contributor. In the face of this underperformance, we reduced allocations to several investments while moving those funds to lower risk fixed-income investments. On the equity side, overweights to health care and energy hurt performance as did an underweight to consumer discretionary. We believe the losses incurred by our MLP investments were overdone and the market did not properly evaluate the differentiated business and yield that MLPs have over traditional integrated energy companies. We identified an opportunity to capitalize on short-term opportunities in the closed-end fund area where discounts to net asset value represented great value opportunities. In addition, a new international fund, which we believe has a great track record and extremely good downside capture, was added to the Portfolio. The Portfolio remains overweight equities compared to our traditional 60/40 stocks/bonds allocation.

3

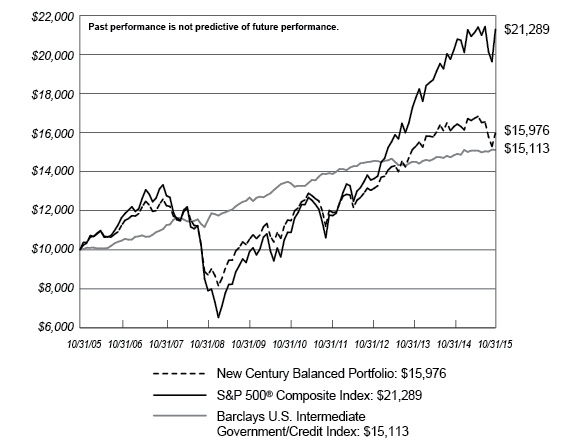

New Century International Portfolio (NCFPX) returned 0.45%, outperforming the (0.07%) for the MSCI EAFE Index, (4.68%) for the MSCI ACWI ex-U.S. Index, and (1.56%) for the Morningstar Foreign Large Blend Category for the twelve-months ended October 31, 2015. We were largely satisfied with the performance of the Portfolio for the last six months as this year has been a very difficult one for foreign large-cap managers, and we are seeing positive divergence between our Portfolio and competitors as our downside capture was superior to the category. U.S. dollar weakness versus the Euro and Yen from mid-March through September 2015 posed a headwind to our dollar hedged positions; however, with the anticipated divergence between the Federal Reserve and other Central Banks, we anticipate continuing to currency hedge to an extent through at least Q1 calendar 2016. Allocations to small and mid-cap equities were a large positive driver as was dividend growth investments. We remain slightly underweight emerging markets compared to the MSCI ACWI-ex U.S. Index, with those investments concentrated in China and India. During the last six-months ended October 31, 2015 we had negligible to no direct exposure to Brazil and Russia, and we are beginning to believe both markets may be over sold.

New Century Alternative Strategies (NCHPX) returned (3.56%) versus 0.07% for the Morningstar Moderate Target Risk Index, (0.67%) for the Multialternative Category, 5.20% for the S&P 500® Composite Index, and 1.86% for the Barclays U.S. Intermediate Government/Credit Index for the twelve-months ended October 31, 2015. Investments in energy, MLPs, and commodities had a significant negative impact on Portfolio performance, despite a reduction to those allocations, however we believe that the Portfolio’s MLP investments have significant long-term appreciation potential given strong cash flows and current depressed valuations. The Portfolio’s positions in long/short equity, market neutral funds, and managed futures funds generated positive absolute returns, and we continue to increase these positions for their low correlation to equity markets. Domestic and multisector fixed-income funds were positive contributors to performance, while global fixed-income had a negative return due in part to the strengthening U.S. dollar. During the past twelve-months we have expanded the Portfolio’s merger arbitrage positions to include funds with participation in the mid- and small-cap market sectors. During Q3 of calendar 2015, the Portfolio has added to positions in fixed-income closed-end funds trading at historically wide discounts to their net asset value. We will continue to take a disciplined approach to create a broadly diversified, low volatility portfolio with multiple sources of return, and containing both inflation and market hedged investments.

We appreciate and thank you for your trust in New Century Portfolios.

Sincerely,

|

|

|

Nicole M. Tremblay, Esq. | Matthew I. Solomon | Ronald A. Sugameli |

4

Investors should take into consideration the investment objectives, risks, charges and expenses of the New Century Portfolios carefully before investing. The prospectus contains these details and other information and should be read carefully before investing. Principal value of an investment will fluctuate and shares when redeemed may be worth more or less than your original investment. Past performance is not indicative of future results. Portfolio holdings and opinions expressed herein are subject to change.

i | Measured by the S&P 500® Composite Index |

ii | Measured by USD West Texas Intermediate (WTI) |

5

NEW CENTURY CAPITAL PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century Capital Portfolio and S&P 500® Composite Index

Average Annual Total Returns For Periods Ended October 31, 2015 | |||

1 Year | 5 Years | 10 Years | |

New Century Capital Portfolio (a) | 1.20% | 9.98% | 5.73% |

S&P 500® Composite Index* | 5.20% | 14.33% | 7.85% |

(a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

* | The S&P 500® Composite Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

6

NEW CENTURY BALANCED PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century Balanced Portfolio, S&P 500® Composite Index and

Barclays U.S. Intermediate Government/Credit Index

Average Annual Total Returns For Periods Ended October 31, 2015 | |||

1 Year | 5 Years | 10 Years | |

New Century Balanced Portfolio (a) | (2.04%) | 6.75% | 4.80% |

S&P 500® Composite Index* | 5.20% | 14.33% | 7.85% |

Barclays U.S. Intermediate Government/Credit Index* | 1.86% | 2.30% | 4.22% |

(a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

* | The S&P 500® Composite Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Barclays U.S. Intermediate Government/Credit Index is the non-securitized component of the U.S. Aggregate Index, and includes Treasuries, government-related issues, and corporates. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

7

NEW CENTURY INTERNATIONAL PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century International Portfolio, MSCI EAFE Index

and MSCI ACWI ex-USA Index

Average Annual Total Returns For Periods Ended October 31, 2015 | |||

1 Year | 5 Years | 10 Years | |

New Century International Portfolio (a) | 0.45% | 2.65% | 4.30% |

MSCI EAFE Index* | (0.07%) | 4.81% | 4.06% |

MSCI ACWI ex-USA Index* | (4.68%) | 2.61% | 4.16% |

(a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

* | The MSCI EAFE (Europe, Australasia and Far East) Index is a free float weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI ACWI ex-USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The index consists of 45 country indices comprising 22 developed and 23 emerging market country indices. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

8

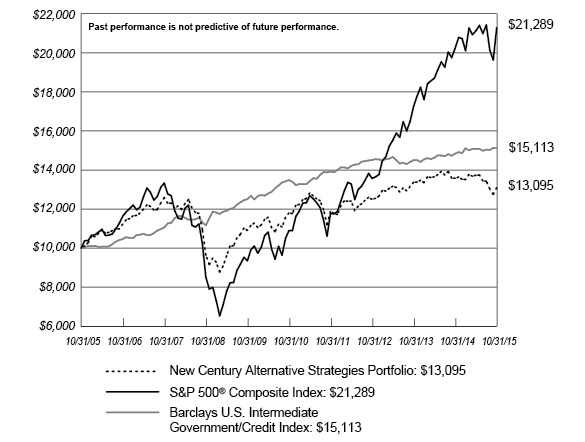

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in New Century Alternative Strategies Portfolio, S&P 500® Composite Index

and Barclays U.S. Intermediate Government/Credit Index

Average Annual Total Returns For Periods Ended October 31, 2015 | |||

1 Year | 5 Years | 10 Years | |

New Century Alternative Strategies Portfolio (a) | (3.56%) | 2.10% | 2.73% |

S&P 500® Composite Index* | 5.20% | 14.33% | 7.85% |

Barclays U.S. Intermediate Government/Credit Index* | 1.86% | 2.30% | 4.22% |

(a) | The total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

* | The S&P 500® Composite Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Barclays U.S. Intermediate Government/Credit Index is the non-securitized component of the U.S. Aggregate Index, and includes Treasuries, government-related issues, and corporates. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

9

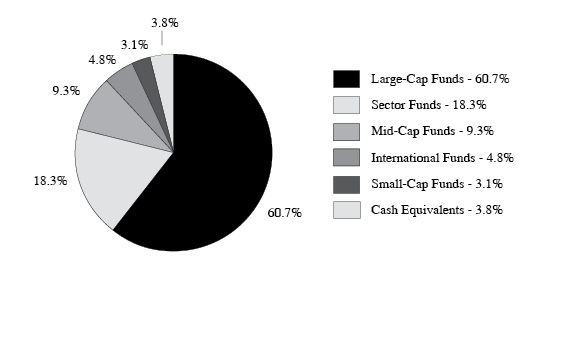

NEW CENTURY CAPITAL PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2015

Asset Allocation (% of Net Assets) |

Top Ten Long-Term Holdings |

Security Description | % of Net Assets |

Vanguard Dividend Growth Fund - Investor Shares | 7.3% |

Vanguard 500 Index Fund - Admiral Shares | 7.3% |

Putnam Equity Income Fund - Class Y | 6.4% |

Wells Fargo Advantage Growth Fund - Institutional Class | 5.4% |

American Funds AMCAP Fund - Class A | 4.3% |

Glenmede Large Cap Growth Portfolio | 4.1% |

Glenmede Large Cap Core Portfolio | 3.9% |

MFS Growth Fund - Class I | 3.8% |

Fidelity Select Health Care Portfolio | 3.5% |

JPMorgan Value Advantage Fund - Institutional Class | 3.5% |

10

NEW CENTURY CAPITAL PORTFOLIO |

INVESTMENT COMPANIES — 96.2% | Shares | Value | ||||||

Large-Cap Funds — 60.7% | ||||||||

American Funds AMCAP Fund - Class A (b) | 167,170 | $ | 4,632,270 | |||||

ClearBridge Aggressive Growth Fund - Class I (b) | 9,452 | 2,051,590 | ||||||

DFA U.S. Large Cap Value Portfolio - Institutional Class | 58,502 | 1,946,376 | ||||||

Dodge & Cox Stock Fund | 14,433 | 2,526,283 | ||||||

Glenmede Large Cap Core Portfolio | 188,967 | 4,221,526 | ||||||

Glenmede Large Cap Growth Portfolio | 179,490 | 4,433,396 | ||||||

iShares MSCI USA Minimum Volatility ETF (a) | 88,200 | 3,700,872 | ||||||

iShares S&P 500 Growth ETF (a) | 29,200 | 3,445,308 | ||||||

iShares S&P 500 Value ETF (a) | 23,105 | 2,084,764 | ||||||

JPMorgan Value Advantage Fund - Institutional Class | 127,086 | 3,736,317 | ||||||

MFS Growth Fund - Class I (b) | 53,430 | 4,087,942 | ||||||

Putnam Equity Income Fund - Class Y | 335,102 | 6,943,323 | ||||||

Vanguard 500 Index Fund - Admiral Shares | 40,754 | 7,827,651 | ||||||

Vanguard Dividend Growth Fund - Investor Shares | 337,036 | 7,846,191 | ||||||

Wells Fargo Advantage Growth Fund - Institutional Class (b) | 112,473 | 5,858,697 | ||||||

65,342,506 | ||||||||

Sector Funds — 18.3% | ||||||||

Fidelity Select Health Care Portfolio | 17,537 | 3,754,284 | ||||||

Financial Select Sector SPDR Fund (a) | 40,000 | 963,200 | ||||||

First Trust Dow Jones Internet Index Fund (a) (b) | 30,000 | 2,232,000 | ||||||

iShares U.S. Energy ETF (a) | 33,400 | 1,279,554 | ||||||

Ivy Science and Technology Fund - Class I (b) | 58,266 | 3,294,942 | ||||||

Market Vectors Retail ETF (a) | 18,000 | 1,386,000 | ||||||

PowerShares Dynamic Pharmaceuticals Portfolio (a) | 47,000 | 3,310,210 | ||||||

SPDR S&P Regional Banking ETF (a) | 37,400 | 1,601,842 | ||||||

Vanguard Consumer Discretionary ETF (a) | 15,000 | 1,905,150 | ||||||

19,727,182 | ||||||||

Mid-Cap Funds — 9.3% | ||||||||

iShares S&P Mid-Cap 400 Growth ETF (a) | 12,600 | 2,081,268 | ||||||

iShares S&P Mid-Cap 400 Value ETF (a) | 12,100 | 1,481,161 | ||||||

John Hancock Disciplined Value Mid Cap Fund - Class I | 120,540 | 2,491,562 | ||||||

Putnam Equity Spectrum Fund - Class Y | 51,979 | 2,047,975 | ||||||

SPDR S&P MidCap 400 ETF Trust (a) | 7,102 | 1,865,766 | ||||||

9,967,732 | ||||||||

International Funds — 4.8% | ||||||||

iShares Currency Hedged MSCI Japan ETF (a) | 25,000 | 744,250 | ||||||

JOHCM International Select Fund - Class I | 19,227 | 349,937 | ||||||

Lazard International Strategic Equity Portfolio - Institutional Shares | 141,135 | 1,957,546 | ||||||

MFS International Value Fund - Class I | 57,929 | 2,147,449 | ||||||

5,199,182 | ||||||||

See accompanying notes to financial statements.

11

NEW CENTURY CAPITAL PORTFOLIO |

INVESTMENT COMPANIES — 96.2% (Continued) | Shares | Value | ||||||

Small-Cap Funds — 3.1% | ||||||||

Goldman Sachs Small Cap Growth Insights Fund - Institutional Class (b) | 18,364 | $ | 651,190 | |||||

Hodges Small Cap Fund - Institutional Class | 111,104 | 2,139,855 | ||||||

iShares S&P Small-Cap 600 Value ETF (a) | 5,200 | 579,956 | ||||||

3,371,001 | ||||||||

Total Investment Companies (Cost $77,897,876) | $ | 103,607,603 | ||||||

MONEY MARKET FUNDS — 3.9% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.08% (c) (Cost $4,202,489) | 4,202,489 | $ | 4,202,489 | |||||

Total Investments at Value — 100.1% (Cost $82,100,365) | $ | 107,810,092 | ||||||

Liabilities in Excess of Other Assets — (0.1%) | (117,475 | ) | ||||||

Net Assets — 100.0% | $ | 107,692,617 | ||||||

(a) | Exchange-traded fund. |

(b) | Non-income producing security. |

(c) | The rate shown is the 7-day effective yield as of October 31, 2015. |

See accompanying notes to financial statements.

12

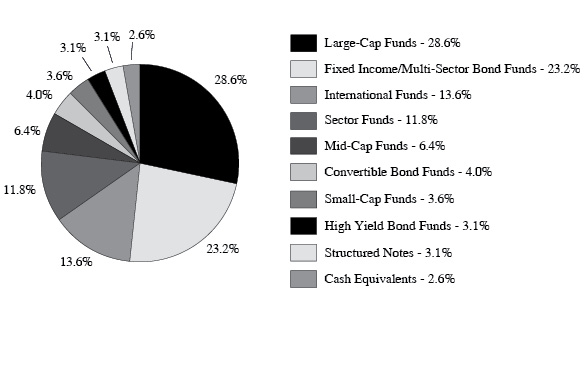

NEW CENTURY BALANCED PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2015

Asset Allocation (% of Net Assets) |

Top Ten Long-Term Holdings |

Security Description | % of Net Assets |

PIMCO Income Fund - Institutional Class | 6.4% |

iShares Core S&P 500 ETF | 5.6% |

JPMorgan Value Advantage Fund - Institutional Class | 5.5% |

American Funds AMCAP Fund - Class A | 5.1% |

Dodge & Cox Income Fund | 4.7% |

Loomis Sayles Bond Fund - Institutional Class | 4.7% |

John Hancock Disciplined Value Fund - Class I | 4.3% |

SPDR S&P MidCap 400 ETF Trust | 4.2% |

First Eagle Global Fund - Class A | 3.8% |

Fidelity Select Health Care Portfolio | 3.6% |

13

NEW CENTURY BALANCED PORTFOLIO |

INVESTMENT COMPANIES — 94.3% | Shares | Value | ||||||

Large-Cap Funds — 28.6% | ||||||||

American Funds AMCAP Fund - Class A (b) | 125,960 | $ | 3,490,344 | |||||

ClearBridge Aggressive Growth Fund - Class I (b) | 9,420 | 2,044,686 | ||||||

iShares Core S&P 500 ETF (a) | 18,100 | 3,783,805 | ||||||

John Hancock Disciplined Value Fund - Class I | 156,480 | 2,904,266 | ||||||

JPMorgan Hedged Equity Fund - Select Class | 73,386 | 1,167,562 | ||||||

JPMorgan Value Advantage Fund - Institutional Class | 126,240 | 3,711,447 | ||||||

Wells Fargo Advantage Growth Fund - Institutional Class (b) | 43,741 | 2,278,494 | ||||||

19,380,604 | ||||||||

Fixed Income/Multi-Sector Bond Funds — 23.2% | ||||||||

Angel Oak Multi-Strategy Income Fund - Class I | 105,783 | 1,241,897 | ||||||

BlackRock Strategic Income Opportunities Portfolio - Institutional Shares | 225,815 | 2,251,372 | ||||||

Dodge & Cox Income Fund | 236,475 | 3,199,509 | ||||||

Loomis Sayles Bond Fund - Institutional Class | 228,436 | 3,195,812 | ||||||

PIMCO Income Fund - Institutional Class | 356,664 | 4,351,301 | ||||||

Western Asset Core Plus Bond Fund - Class I | 129,287 | 1,495,854 | ||||||

15,735,745 | ||||||||

International Funds — 13.6% | ||||||||

Dodge & Cox International Stock Fund | 5,228 | 208,561 | ||||||

First Eagle Global Fund - Class A | 48,265 | 2,562,868 | ||||||

Harding, Loevner International Equity Portfolio - Institutional Class | 120,516 | 2,131,936 | ||||||

JOHCM International Select Fund - Class I | 12,864 | 234,124 | ||||||

John Hancock International Growth Fund - Class I | 71,683 | 1,559,811 | ||||||

Lazard Global Listed Infrastructure Portfolio - Institutional Shares | 104,222 | 1,498,710 | ||||||

Pear Tree Polaris Foreign Value Small Cap Fund - Institutional Shares | 79,722 | 1,006,892 | ||||||

9,202,902 | ||||||||

Sector Funds — 11.8% | ||||||||

Fidelity Select Health Care Portfolio | 11,341 | 2,427,778 | ||||||

iShares U.S. Energy ETF (a) | 14,000 | 536,340 | ||||||

Oppenheimer SteelPath MLP Select 40 Fund - Class Y (b) | 88,540 | 896,908 | ||||||

Putnam Absolute Return 500 Fund - Class Y | 131,926 | 1,530,343 | ||||||

SPDR S&P Regional Banking ETF (a) | 30,000 | 1,284,900 | ||||||

Vanguard Global Minimum Volatility Fund - Admiral Shares | 54,558 | 1,288,664 | ||||||

7,964,933 | ||||||||

Mid-Cap Funds — 6.4% | ||||||||

John Hancock Disciplined Value Mid Cap Fund - Class I | 72,324 | 1,494,937 | ||||||

SPDR S&P MidCap 400 ETF Trust (a) | 10,780 | 2,832,014 | ||||||

4,326,951 | ||||||||

See accompanying notes to financial statements.

14

NEW CENTURY BALANCED PORTFOLIO |

INVESTMENT COMPANIES — 94.3% (Continued) | Shares | Value | ||||||

Convertible Bond Funds — 4.0% | ||||||||

AllianzGI Convertible & Income Fund II (c) | 110,600 | $ | 623,784 | |||||

AllianzGI Convertible Fund - Institutional Class | 63,656 | 2,104,478 | ||||||

2,728,262 | ||||||||

Small-Cap Funds — 3.6% | ||||||||

Brown Capital Management Small Company Fund - Institutional Class (b) | 16,264 | 1,276,101 | ||||||

iShares S&P Small-Cap 600 Value ETF (a) | 10,700 | 1,193,371 | ||||||

2,469,472 | ||||||||

High Yield Bond Funds — 3.1% | ||||||||

Loomis Sayles Institutional High Income Fund | 199,407 | 1,381,892 | ||||||

Western Asset High Income Opportunity Fund, Inc. (c) | 150,000 | 729,000 | ||||||

2,110,892 | ||||||||

Total Investment Companies (Cost $53,269,507) | $ | 63,919,761 | ||||||

STRUCTURED NOTES — 3.1% | Par Value | Value | ||||||

BNP Paribas Return Enhanced Notes Linked to the Performance of PowerShares S&P 500 Low Volatility Portfolio, due 03/31/2017 (b) | $ | 750,000 | $ | 918,017 | ||||

JPMorgan Chase & Co., Certificates of Deposit Linked to the JPMorgan Efficiente Plus DS 5 Index, due 06/23/2020 (b) | 1,250,000 | 1,190,875 | ||||||

Total Structured Notes (Cost $2,000,000) | $ | 2,108,892 | ||||||

MONEY MARKET FUNDS — 2.7% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.08% (d) (Cost $1,809,656) | 1,809,656 | $ | 1,809,656 | |||||

Total Investments at Value — 100.1% (Cost $57,079,163) | $ | 67,838,309 | ||||||

Liabilities in Excess of Other Assets — (0.1%) | (62,509 | ) | ||||||

Net Assets — 100.0% | $ | 67,775,800 | ||||||

(a) | Exchange-traded fund. |

(b) | Non-income producing security. |

(c) | Closed-end fund. |

(d) | The rate shown is the 7-day effective yield as of October 31, 2015. |

See accompanying notes to financial statements.

15

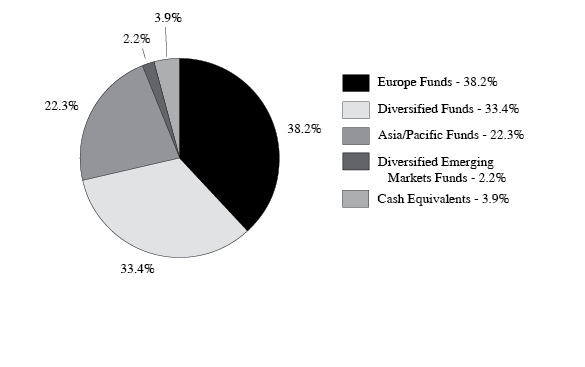

NEW CENTURY INTERNATIONAL PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2015

Asset Allocation (% of Net Assets) |

Top Ten Long-Term Holdings |

Security Description | % of Net Assets |

T. Rowe Price European Stock Fund | 7.1% |

Matthews Japan Fund - Institutional Class | 7.0% |

Franklin Mutual European Fund - Class A | 6.4% |

WisdomTree Japan Hedged Equity Fund | 6.1% |

iShares MSCI United Kingdom ETF | 5.4% |

Oakmark International Fund - Class I | 4.9% |

John Hancock International Growth Fund - Class I | 4.8% |

MFS International Value Fund - Class I | 4.5% |

Matthews Pacific Tiger Fund - Investor Class | 4.3% |

WisdomTree Europe Hedged Equity Fund | 4.3% |

16

NEW CENTURY INTERNATIONAL PORTFOLIO |

INVESTMENT COMPANIES — 96.1% | Shares | Value | ||||||

Europe Funds — 38.2% | ||||||||

Columbia European Equity Fund - Class A | 254,806 | $ | 1,773,450 | |||||

DFA United Kingdom Small Company Portfolio - Institutional Class | 15,655 | 555,743 | ||||||

Franklin Mutual European Fund - Class A | 168,363 | 3,411,048 | ||||||

Invesco European Growth Fund - Class Y | 13,646 | 501,637 | ||||||

iShares MSCI France ETF (a) | 30,000 | 773,700 | ||||||

iShares MSCI Germany ETF (a) | 47,600 | 1,290,436 | ||||||

iShares MSCI Ireland Capped ETF (a) | 25,000 | 986,000 | ||||||

iShares MSCI Switzerland Capped ETF (a) | 45,600 | 1,448,712 | ||||||

iShares MSCI United Kingdom ETF (a) | 165,146 | 2,885,101 | ||||||

T. Rowe Price European Stock Fund | 182,994 | 3,753,203 | ||||||

WisdomTree Europe Hedged Equity Fund (a) | 37,500 | 2,279,250 | ||||||

WisdomTree Europe SmallCap Dividend Fund (a) | 10,000 | 560,400 | ||||||

20,218,680 | ||||||||

Diversified Funds — 33.4% | ||||||||

Deutsche X-Trackers MSCI EAFE Hedged Equity ETF (a) | 40,000 | 1,115,200 | ||||||

DFA International Small Cap Value Portfolio - Institutional Class | 25,433 | 494,415 | ||||||

Dodge & Cox International Stock Fund | 32,631 | 1,301,649 | ||||||

iShares MSCI EAFE Minimum Volatility ETF (a) | 13,500 | 888,570 | ||||||

Ivy International Core Equity Fund - Class I | 66,988 | 1,163,585 | ||||||

JOHCM International Select Fund - Class I | 56,575 | 1,029,665 | ||||||

John Hancock International Growth Fund - Class I | 116,768 | 2,540,869 | ||||||

Lazard Global Listed Infrastructure Portfolio - Institutional Shares | 107,987 | 1,552,850 | ||||||

MFS International Value Fund - Class I | 64,485 | 2,390,465 | ||||||

Oakmark International Fund - Class I | 110,184 | 2,593,730 | ||||||

Pear Tree Polaris Foreign Value Small Cap Fund - Institutional Shares | 69,073 | 872,393 | ||||||

Templeton Institutional Foreign Smaller Companies Series | 82,457 | 1,773,652 | ||||||

17,717,043 | ||||||||

Asia/Pacific Funds — 22.3% | ||||||||

iShares MSCI Australia ETF (a) | 45,100 | 853,292 | ||||||

Matthews China Dividend Fund - Investor Class | 54,010 | 770,179 | ||||||

Matthews India Fund - Investor Class | 34,471 | 945,880 | ||||||

Matthews Japan Fund - Institutional Class | 203,805 | 3,711,290 | ||||||

Matthews Pacific Tiger Fund - Investor Class | 88,092 | 2,300,101 | ||||||

WisdomTree Japan Hedged Equity Fund (a) | 61,000 | 3,250,690 | ||||||

11,831,432 | ||||||||

Diversified Emerging Markets Funds — 2.2% | ||||||||

William Blair Emerging Markets Small Cap Growth Fund - Class I | 73,544 | 1,173,759 | ||||||

Total Investment Companies (Cost $46,119,166) | $ | 50,940,914 | ||||||

See accompanying notes to financial statements.

17

NEW CENTURY INTERNATIONAL PORTFOLIO |

MONEY MARKET FUNDS — 4.0% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.08% (b) (Cost $2,104,593) | 2,104,593 | $ | 2,104,593 | |||||

Total Investments at Value — 100.1% (Cost $48,223,759) | $ | 53,045,507 | ||||||

Liabilities in Excess of Other Assets — (0.1%) | (57,628 | ) | ||||||

Net Assets — 100.0% | $ | 52,987,879 | ||||||

(a) | Exchange-traded fund. |

(b) | The rate shown is the 7-day effective yield as of October 31, 2015. |

See accompanying notes to financial statements.

18

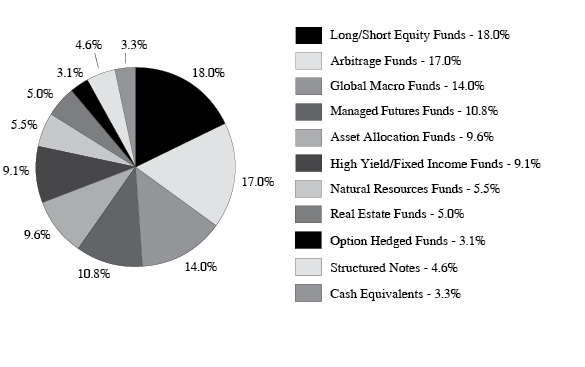

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

PORTFOLIO INFORMATION (Unaudited)

October 31, 2015

Asset Allocation (% of Net Assets) |

Top Ten Long-Term Holdings |

Security Description | % of Net Assets |

Boston Partners Long/Short Research Fund - Institutional Class | 6.0% |

361 Managed Futures Strategy Fund - Class I | 5.5% |

Calamos Market Neutral Income Fund - Class A | 5.3% |

Berwyn Income Fund | 5.3% |

First Eagle Global Fund - Class A | 5.3% |

The Merger Fund - Investor Class | 4.9% |

John Hancock Global Absolute Return Strategies Fund - Class I | 4.8% |

Weitz Partners III Opportunity Fund - Institutional Class | 4.6% |

FPA Crescent Fund | 4.3% |

Touchstone Merger Arbitrage Fund - Institutional Class | 3.6% |

19

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO |

INVESTMENT COMPANIES — 92.1% | Shares | Value | ||||||

Long/Short Equity Funds — 18.0% | ||||||||

Boston Partners Long/Short Research Fund - Institutional Class (b) | 357,014 | $ | 5,580,123 | |||||

Goldman Sachs Long Short Fund - Institutional Shares (b) | 147,128 | 1,353,578 | ||||||

Gotham Absolute Return Fund - Institutional Class | 80,773 | 1,042,775 | ||||||

TFS Market Neutral Fund (b) | 89,616 | 1,398,009 | ||||||

Vanguard Market Neutral Fund - Investor Shares (b) | 253,516 | 3,070,082 | ||||||

Weitz Partners III Opportunity Fund - Institutional Class (b) | 292,520 | 4,273,716 | ||||||

16,718,283 | ||||||||

Arbitrage Funds — 17.0% | ||||||||

Calamos Market Neutral Income Fund - Class A | 380,856 | 4,981,595 | ||||||

Kellner Merger Fund - Institutional Class | 275,681 | 3,002,168 | ||||||

The Merger Fund - Investor Class | 293,037 | 4,553,802 | ||||||

Touchstone Merger Arbitrage Fund - Institutional Class (b) | 308,509 | 3,331,893 | ||||||

15,869,458 | ||||||||

Global Macro Funds — 14.0% | ||||||||

Calamos Global Dynamic Income Fund (d) | 96,000 | 737,280 | ||||||

First Eagle Global Fund - Class A | 93,219 | 4,949,933 | ||||||

Franklin Mutual Global Discovery Fund - Class Z | 90,453 | 2,944,256 | ||||||

John Hancock Global Absolute Return Strategies Fund - Class I | 397,243 | 4,449,117 | ||||||

13,080,586 | ||||||||

Managed Futures Funds — 10.8% | ||||||||

361 Managed Futures Strategy Fund - Class I | 453,710 | 5,117,845 | ||||||

AQR Managed Futures Strategy Fund - Class N | 282,922 | 3,041,413 | ||||||

ASG Managed Futures Strategy Fund - Class Y | 179,856 | 1,929,856 | ||||||

10,089,114 | ||||||||

Asset Allocation Funds — 9.6% | ||||||||

Berwyn Income Fund | 378,652 | 4,971,706 | ||||||

FPA Crescent Fund | 118,375 | 3,951,367 | ||||||

8,923,073 | ||||||||

High Yield/Fixed Income Funds — 9.1% | ||||||||

BlackRock Credit Allocation Income Trust (d) | 70,000 | 877,100 | ||||||

PIMCO Corporate & Income Strategy Fund (d) | 16,000 | 220,160 | ||||||

PIMCO Dynamic Credit Income Fund (d) | 60,000 | 1,125,600 | ||||||

PIMCO Income Fund - Institutional Class | 165,240 | 2,015,932 | ||||||

PIMCO Income Strategy Fund II (d) | 126,000 | 1,161,720 | ||||||

Templeton Global Bond Fund - Class A | 38,926 | 458,156 | ||||||

Templeton Global Income Fund (d) | 403,000 | 2,631,590 | ||||||

8,490,258 | ||||||||

Natural Resources Funds — 5.5% | ||||||||

First Eagle Gold Fund - Class I (b) | 72,254 | 909,682 | ||||||

Oppenheimer SteelPath MLP Select 40 Fund - Class Y (b) | 121,727 | 1,233,096 | ||||||

SPDR Gold Trust (a) (b) (c) | 4,800 | 524,640 | ||||||

Tortoise MLP & Pipeline Fund - Institutional Class | 190,751 | 2,422,542 | ||||||

5,089,960 | ||||||||

See accompanying notes to financial statements.

20

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO |

INVESTMENT COMPANIES — 92.1% (Continued) | Shares | Value | ||||||

Real Estate Funds — 5.0% | ||||||||

CBRE Clarion Global Real Estate Income Fund (d) | 147,500 | $ | 1,177,050 | |||||

Vanguard REIT ETF (a) | 17,900 | 1,430,031 | ||||||

Versus Capital Multi-Manager Real Estate Income Fund | 56,370 | 1,502,818 | ||||||

Voya Global Real Estate Fund - Class I | 25,126 | 502,762 | ||||||

4,612,661 | ||||||||

Option Hedged Funds — 3.1% | ||||||||

BlackRock Enhanced Equity Dividend Trust (d) | 120,000 | 918,000 | ||||||

JPMorgan Hedged Equity Fund - Select Class | 121,997 | 1,940,967 | ||||||

2,858,967 | ||||||||

Total Investment Companies (Cost $78,762,012) | $ | 85,732,360 | ||||||

STRUCTURED NOTES — 4.6% | Par Value | Value | ||||||

BNP Paribas Buffered Return Enhanced Notes Linked to the Performance of WTI Crude Oil, due 03/24/2016 (b) | $ | 1,500,000 | $ | 871,731 | ||||

JPMorgan Chase & Co., Certificates of Deposit Linked to the JPMorgan Efficiente Plus DS 5 Index, | 1,600,000 | 1,524,320 | ||||||

JPMorgan Chase & Co., Dual Directional Contingent Buffered Return Enhanced Notes Linked to the EURO STOXX 50 Index, due 12/14/2016 (b) | 1,800,000 | 1,883,160 | ||||||

Total Structured Notes (Cost $4,900,000) | $ | 4,279,211 | ||||||

MONEY MARKET FUNDS — 3.1% | Shares | Value | ||||||

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.08% (e) (Cost $2,893,888) | 2,893,888 | $ | 2,893,888 | |||||

Total Investments at Value — 99.8% (Cost $86,555,900) | $ | 92,905,459 | ||||||

Other Assets in Excess of Liabilities — 0.2% | 218,841 | |||||||

Net Assets — 100.0% | $ | 93,124,300 | ||||||

(a) | Exchange-traded fund. |

(b) | Non-income producing security. |

(c) | For federal income tax purposes, structured as a grantor trust. |

(d) | Closed-end fund. |

(e) | The rate shown is the 7-day effective yield as of October 31, 2015. |

See accompanying notes to financial statements.

21

NEW CENTURY PORTFOLIOS |

| New Century Capital Portfolio | New Century Balanced Portfolio | New Century International Portfolio | New Century Alternative Strategies Portfolio | ||||||||||||

ASSETS | ||||||||||||||||

Investments in securities: | ||||||||||||||||

At acquisition cost | $ | 82,100,365 | $ | 57,079,163 | $ | 48,223,759 | $ | 86,555,900 | ||||||||

At value (Note 1A) | $ | 107,810,092 | $ | 67,838,309 | $ | 53,045,507 | $ | 92,905,459 | ||||||||

Cash | — | — | — | 5,604 | ||||||||||||

Dividends receivable | 283 | 41,256 | 149 | 39,904 | ||||||||||||

Receivable for investment securities sold | — | — | — | 240,213 | ||||||||||||

Receivable for capital shares sold | 592 | 1,456 | 681 | 40,198 | ||||||||||||

Other assets | 6,558 | 4,131 | 3,293 | 5,788 | ||||||||||||

TOTAL ASSETS | 107,817,525 | 67,885,152 | 53,049,630 | 93,237,166 | ||||||||||||

LIABILITIES | ||||||||||||||||

Payable for investment securities purchased | — | 31,360 | — | 3,183 | ||||||||||||

Payable for capital shares redeemed | — | — | — | 17,701 | ||||||||||||

Payable to Adviser (Note 2) | 91,634 | 55,378 | 46,224 | 61,737 | ||||||||||||

Payable to Distributor (Note 3) | 22,500 | 14,300 | 8,346 | 19,720 | ||||||||||||

Other accrued expenses | 10,774 | 8,314 | 7,181 | 10,525 | ||||||||||||

TOTAL LIABILITIES | 124,908 | 109,352 | 61,751 | 112,866 | ||||||||||||

NET ASSETS | $ | 107,692,617 | $ | 67,775,800 | $ | 52,987,879 | $ | 93,124,300 | ||||||||

Net assets consist of: | ||||||||||||||||

Paid-in capital | $ | 72,217,868 | $ | 53,265,898 | $ | 42,792,330 | $ | 86,658,528 | ||||||||

Accumulated net investment income (loss) | 38,193 | 7,281 | 372,796 | (245,556 | ) | |||||||||||

Accumulated net realized gains on investments | 9,726,829 | 3,743,475 | 5,001,005 | 361,769 | ||||||||||||

Net unrealized appreciation on investments | 25,709,727 | 10,759,146 | 4,821,748 | 6,349,559 | ||||||||||||

Net assets | $ | 107,692,617 | $ | 67,775,800 | $ | 52,987,879 | $ | 93,124,300 | ||||||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 5,732,068 | 4,474,474 | 4,042,935 | 7,428,940 | ||||||||||||

Net asset value, offering price and redemption price per share (a) | $ | 18.79 | $ | 15.15 | $ | 13.11 | $ | 12.54 | ||||||||

(a) | Redemption price may differ from the net asset value per share depending upon the length of time held (Note 1B). |

See accompanying notes to financial statements.

22

NEW CENTURY PORTFOLIOS |

| New Century Capital Portfolio | New Century Balanced Portfolio | New Century International Portfolio | New Century Alternative Strategies Portfolio | ||||||||||||

INVESTMENT INCOME | ||||||||||||||||

Dividends | $ | 1,736,888 | $ | 1,795,226 | $ | 1,451,734 | $ | 2,422,944 | ||||||||

EXPENSES | ||||||||||||||||

Investment advisory fees (Note 2) | 1,100,465 | 660,856 | 553,789 | 803,014 | ||||||||||||

Distribution costs (Note 3) | 271,012 | 153,460 | 116,912 | 212,604 | ||||||||||||

Accounting fees | 51,536 | 40,747 | 36,626 | 49,834 | ||||||||||||

Trustees’ fees (Note 2) | 49,373 | 31,055 | 24,097 | 46,134 | ||||||||||||

Legal and audit fees | 41,696 | 29,866 | 25,109 | 40,508 | ||||||||||||

Administration fees (Note 2) | 42,280 | 27,736 | 22,199 | 40,025 | ||||||||||||

Transfer agent fees | 27,670 | 21,876 | 19,657 | 26,797 | ||||||||||||

Custody and bank service fees | 20,358 | 14,615 | 12,793 | 21,435 | ||||||||||||

Insurance expense | 9,469 | 5,991 | 4,838 | 9,563 | ||||||||||||

Postage & supplies | 7,713 | 4,596 | 4,613 | 7,570 | ||||||||||||

Other expenses | 11,716 | 10,050 | 9,271 | 18,246 | ||||||||||||

Total expenses | 1,633,288 | 1,000,848 | 829,904 | 1,275,730 | ||||||||||||

NET INVESTMENT INCOME | 103,600 | 794,378 | 621,830 | 1,147,214 | ||||||||||||

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | ||||||||||||||||

Net realized gains on investments | 6,439,711 | 2,011,401 | 3,643,254 | 1,604,506 | ||||||||||||

Capital gain distributions from regulated investment companies | 3,649,047 | 1,886,686 | 1,358,019 | 2,356,058 | ||||||||||||

Net change in unrealized appreciation (depreciation) on investments | (8,731,786 | ) | (6,100,130 | ) | (5,462,919 | ) | (8,560,792 | ) | ||||||||

NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | 1,356,972 | (2,202,043 | ) | (461,646 | ) | (4,600,228 | ) | |||||||||

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,460,572 | $ | (1,407,665 | ) | $ | 160,184 | $ | (3,453,014 | ) | ||||||

See accompanying notes to financial statements.

23

NEW CENTURY PORTFOLIOS |

New Century | ||||||||

| Year Ended October 31, 2015 | Year Ended October 31, 2014 | ||||||

FROM OPERATIONS | ||||||||

Net investment income (loss) | $ | 103,600 | $ | (65,407 | ) | |||

Net realized gains from security transactions | 6,439,711 | 12,309,795 | ||||||

Capital gain distributions from regulated investment companies | 3,649,047 | 2,163,549 | ||||||

Net change in unrealized appreciation (depreciation) on investments | (8,731,786 | ) | (1,938,516 | ) | ||||

Net increase in net assets from operations | 1,460,572 | 12,469,421 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

From net realized gains on security transactions (Note 1E) | (14,111,794 | ) | (10,250,145 | ) | ||||

FROM CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 2,018,578 | 1,834,772 | ||||||

Proceeds from redemption fees collected (Note 1B) | 450 | 136 | ||||||

Net asset value of shares issued in reinvestment of distributions to shareholders | 13,577,593 | 9,899,484 | ||||||

Payments for shares redeemed | (10,206,553 | ) | (11,828,041 | ) | ||||

Net increase (decrease) in net assets from capital share transactions | 5,390,068 | (93,649 | ) | |||||

TOTAL INCREASE (DECREASE) IN NET ASSETS | (7,261,154 | ) | 2,125,627 | |||||

NET ASSETS | ||||||||

Beginning of year | 114,953,771 | 112,828,144 | ||||||

End of year | $ | 107,692,617 | $ | 114,953,771 | ||||

ACCUMULATED NET INVESTMENT INCOME (LOSS) | $ | 38,193 | $ | (65,407 | ) | |||

CAPITAL SHARE ACTIVITY | ||||||||

Shares sold | 103,562 | 90,311 | ||||||

Shares reinvested | 720,297 | 497,461 | ||||||

Shares redeemed | (525,929 | ) | (576,155 | ) | ||||

Net increase in shares outstanding | 297,930 | 11,617 | ||||||

Shares outstanding, beginning of year | 5,434,138 | 5,422,521 | ||||||

Shares outstanding, end of year | 5,732,068 | 5,434,138 | ||||||

See accompanying notes to financial statements.

24

NEW CENTURY PORTFOLIOS |

New Century | ||||||||

| Year Ended October 31, 2015 | Year Ended October 31, 2014 | ||||||

FROM OPERATIONS | ||||||||

Net investment income | $ | 794,378 | $ | 637,899 | ||||

Net realized gains from security transactions | 2,011,401 | 3,628,603 | ||||||

Capital gain distributions from regulated investment companies | 1,886,686 | 1,240,264 | ||||||

Net change in unrealized appreciation (depreciation) on investments | (6,100,130 | ) | (62,987 | ) | ||||

Net increase (decrease) in net assets from operations | (1,407,665 | ) | 5,443,779 | |||||

DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

From net investment income (Note 1E) | (819,672 | ) | (790,570 | ) | ||||

From net realized gains on security transactions (Note 1E) | (4,869,042 | ) | (3,999,254 | ) | ||||

Decrease in net assets from distributions to shareholders | (5,688,714 | ) | (4,789,824 | ) | ||||

FROM CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 3,042,189 | 3,165,864 | ||||||

Proceeds from redemption fees collected (Note 1B) | 69 | — | ||||||

Net asset value of shares issued in reinvestment of distributions to shareholders | 5,346,443 | 4,582,522 | ||||||

Payments for shares redeemed | (7,253,329 | ) | (6,122,526 | ) | ||||

Net increase in net assets from capital share transactions | 1,135,372 | 1,625,860 | ||||||

TOTAL INCREASE (DECREASE) IN NET ASSETS | (5,961,007 | ) | 2,279,815 | |||||

NET ASSETS | ||||||||

Beginning of year | 73,736,807 | 71,456,992 | ||||||

End of year | $ | 67,775,800 | $ | 73,736,807 | ||||

ACCUMULATED NET INVESTMENT INCOME | $ | 7,281 | $ | 32,950 | ||||

CAPITAL SHARE ACTIVITY | ||||||||

Shares sold | 194,377 | 191,900 | ||||||

Shares reinvested | 345,600 | 286,766 | ||||||

Shares redeemed | (455,573 | ) | (373,561 | ) | ||||

Net increase in shares outstanding | 84,404 | 105,105 | ||||||

Shares outstanding, beginning of year | 4,390,070 | 4,284,965 | ||||||

Shares outstanding, end of year | 4,474,474 | 4,390,070 | ||||||

See accompanying notes to financial statements.

25

NEW CENTURY PORTFOLIOS |

New Century | ||||||||

| Year Ended October 31, 2015 | Year Ended October 31, 2014 | ||||||

FROM OPERATIONS | ||||||||

Net investment income | $ | 621,830 | $ | 393,493 | ||||

Net realized gains from security transactions | 3,643,254 | 5,452,098 | ||||||

Capital gain distributions from regulated investment companies | 1,358,019 | 589,544 | ||||||

Net change in unrealized appreciation (depreciation) on investments | (5,462,919 | ) | (6,883,739 | ) | ||||

Net increase (decrease) in net assets from operations | 160,184 | (448,604 | ) | |||||

DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

From net investment income (Note 1E) | (642,401 | ) | (361,371 | ) | ||||

From net realized gains on security transactions (Note 1E) | (6,041,792 | ) | (4,279,496 | ) | ||||

Decrease in net assets from distributions to shareholders | (6,684,193 | ) | (4,640,867 | ) | ||||

FROM CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 2,686,446 | 1,123,604 | ||||||

Proceeds from redemption fees collected (Note 1B) | 363 | 2 | ||||||

Net asset value of shares issued in reinvestment of distributions to shareholders | 6,541,948 | 4,538,606 | ||||||

Payments for shares redeemed | (5,789,633 | ) | (7,207,518 | ) | ||||

Net increase (decrease) in net assets from capital share transactions | 3,439,124 | (1,545,306 | ) | |||||

TOTAL DECREASE IN NET ASSETS | (3,084,885 | ) | (6,634,777 | ) | ||||

NET ASSETS | ||||||||

Beginning of year | 56,072,764 | 62,707,541 | ||||||

End of year | $ | 52,987,879 | $ | 56,072,764 | ||||

ACCUMULATED NET INVESTMENT INCOME | $ | 372,796 | $ | 393,443 | ||||

CAPITAL SHARE ACTIVITY | ||||||||

Shares sold | 196,264 | 73,873 | ||||||

Shares reinvested | 507,915 | 296,060 | ||||||

Shares redeemed | (423,665 | ) | (467,703 | ) | ||||

Net increase (decrease) in shares outstanding | 280,514 | (97,770 | ) | |||||

Shares outstanding, beginning of year | 3,762,421 | 3,860,191 | ||||||

Shares outstanding, end of year | 4,042,935 | 3,762,421 | ||||||

See accompanying notes to financial statements.

26

NEW CENTURY PORTFOLIOS |

New Century Alternative Strategies Portfolio | ||||||||

| Year Ended October 31, 2015 | Year Ended October 31, 2014 | ||||||

FROM OPERATIONS | ||||||||

Net investment income | $ | 1,147,214 | $ | 817,361 | ||||

Net realized gains from security transactions | 1,604,506 | 1,346,766 | ||||||

Capital gain distributions from regulated investment companies | 2,356,058 | 1,612,359 | ||||||

Net change in unrealized appreciation (depreciation) on investments | (8,560,792 | ) | (1,966,593 | ) | ||||

Net increase (decrease) in net assets from operations | (3,453,014 | ) | 1,809,893 | |||||

DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

From net investment income (Note 1E) | (1,227,530 | ) | (748,917 | ) | ||||

FROM CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 7,355,390 | 12,507,050 | ||||||

Proceeds from redemption fees collected (Note 1B) | 2,417 | 335 | ||||||

Net asset value of shares issued in reinvestment of distributions to shareholders | 1,192,680 | 721,862 | ||||||

Payments for shares redeemed | (32,292,139 | ) | (16,154,264 | ) | ||||

Net decrease in net assets from capital share transactions | (23,741,652 | ) | (2,925,017 | ) | ||||

TOTAL DECREASE IN NET ASSETS | (28,422,196 | ) | (1,864,041 | ) | ||||

NET ASSETS | ||||||||

Beginning of year | 121,546,496 | 123,410,537 | ||||||

End of year | $ | 93,124,300 | $ | 121,546,496 | ||||

ACCUMULATED NET INVESTMENT LOSS | $ | (245,556 | ) | $ | (165,240 | ) | ||

CAPITAL SHARE ACTIVITY | ||||||||

Shares sold | 567,487 | 950,486 | ||||||

Shares reinvested | 92,099 | 55,358 | ||||||

Shares redeemed | (2,483,406 | ) | (1,229,535 | ) | ||||

Net decrease in shares outstanding | (1,823,820 | ) | (223,691 | ) | ||||

Shares outstanding, beginning of year | 9,252,760 | 9,476,451 | ||||||

Shares outstanding, end of year | 7,428,940 | 9,252,760 | ||||||

See accompanying notes to financial statements.

27

NEW CENTURY CAPITAL PORTFOLIO |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year | ||||||||||||||||||||

| Years Ended October 31, | |||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

Net asset value, beginning of year | $ | 21.15 | $ | 20.81 | $ | 17.55 | $ | 16.11 | $ | 15.41 | ||||||||||

Income (loss) from investment operations: | ||||||||||||||||||||

Net investment income (loss) | 0.02 | (0.01 | ) | (0.00 | )(a) | (0.01 | ) | (0.04 | ) | |||||||||||

Net realized and unrealized gains on investments | 0.24 | 2.29 | 4.11 | 1.54 | 0.74 | |||||||||||||||

Total from investment operations | 0.26 | 2.28 | 4.11 | 1.53 | 0.70 | |||||||||||||||

Less distributions: | ||||||||||||||||||||

Distributions from net realized gains | (2.62 | ) | (1.94 | ) | (0.85 | ) | (0.09 | ) | — | |||||||||||

Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | — | — | ||||||||||||

Net asset value, end of year | $ | 18.79 | $ | 21.15 | $ | 20.81 | $ | 17.55 | $ | 16.11 | ||||||||||

TOTAL RETURN (b) | 1.20 | % | 11.53 | % | 24.45 | % | 9.57 | % | 4.54 | % | ||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

Net assets, end of year (000’s) | $ | 107,693 | $ | 114,954 | $ | 112,828 | $ | 87,664 | $ | 88,602 | ||||||||||

Ratio of expenses to average net assets (c) | 1.44 | % | 1.41 | % | 1.43 | % | 1.46 | % | 1.42 | % | ||||||||||

Ratio of net investment income (loss) to average net assets (d) | 0.09 | % | (0.06 | %) | (0.00 | %) | (0.05 | %) | (0.25 | %) | ||||||||||

Portfolio turnover | 32 | % | 26 | % | 28 | % | 7 | % | 60 | % | ||||||||||

(a) | Amount rounds to less than $0.01 per share. |

(b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

(c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

(d) | Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

28

NEW CENTURY BALANCED PORTFOLIO |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year | ||||||||||||||||||||

| Years Ended October 31, | |||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

Net asset value, beginning of year | $ | 16.80 | $ | 16.68 | $ | 14.56 | $ | 13.59 | $ | 13.22 | ||||||||||

Income (loss) from investment operations: | ||||||||||||||||||||

Net investment income | 0.19 | 0.15 | 0.18 | 0.17 | 0.20 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | (0.51 | ) | 1.10 | 2.12 | 0.97 | 0.37 | ||||||||||||||

Total from investment operations | (0.32 | ) | 1.25 | 2.30 | 1.14 | 0.57 | ||||||||||||||

Less distributions: | ||||||||||||||||||||

Distributions from net investment income | (0.19 | ) | (0.19 | ) | (0.18 | ) | (0.17 | ) | (0.20 | ) | ||||||||||

Distributions from net realized gains | (1.14 | ) | (0.94 | ) | — | — | — | |||||||||||||

Total distributions | (1.33 | ) | (1.13 | ) | (0.18 | ) | (0.17 | ) | (0.20 | ) | ||||||||||

Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | — | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | |||||||||||

Net asset value, end of year | $ | 15.15 | $ | 16.80 | $ | 16.68 | $ | 14.56 | $ | 13.59 | ||||||||||

TOTAL RETURN (b) | (2.04 | %) | 7.81 | % | 15.97 | % | 8.54 | % | 4.29 | % | ||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

Net assets, end of year (000’s) | $ | 67,776 | $ | 73,737 | $ | 71,457 | $ | 66,826 | $ | 64,582 | ||||||||||

Ratio of expenses to average net assets (c) | 1.40 | % | 1.40 | % | 1.43 | % | 1.45 | % | 1.43 | % | ||||||||||

Ratio of net investment income to average net assets (d) | 1.11 | % | 0.88 | % | 1.17 | % | 1.18 | % | 1.39 | % | ||||||||||

Portfolio turnover | 33 | % | 16 | % | 21 | % | 13 | % | 17 | % | ||||||||||

(a) | Amount rounds to less than $0.01 per share. |

(b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

(c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

(d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

29

NEW CENTURY INTERNATIONAL PORTFOLIO |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year | ||||||||||||||||||||

| Years Ended October 31, | |||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

Net asset value, beginning of year | $ | 14.90 | $ | 16.24 | $ | 13.92 | $ | 13.41 | $ | 14.53 | ||||||||||

Income (loss) from investment operations: | ||||||||||||||||||||

Net investment income | 0.16 | 0.11 | 0.11 | 0.15 | 0.10 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | (0.13 | ) | (0.22 | ) | 2.37 | 0.46 | (1.14 | ) | ||||||||||||

Total from investment operations | 0.03 | (0.11 | ) | 2.48 | 0.61 | (1.04 | ) | |||||||||||||

Less distributions: | ||||||||||||||||||||

Distributions from net investment income | (0.17 | ) | (0.10 | ) | (0.16 | ) | (0.10 | ) | (0.08 | ) | ||||||||||

Distributions from net realized gains | (1.65 | ) | (1.13 | ) | — | — | — | |||||||||||||

Total distributions | (1.82 | ) | (1.23 | ) | (0.16 | ) | (0.10 | ) | (0.08 | ) | ||||||||||

Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | ||||||||||

Net asset value, end of year | $ | 13.11 | $ | 14.90 | $ | 16.24 | $ | 13.92 | $ | 13.41 | ||||||||||

TOTAL RETURN (b) | 0.45 | % | (0.89 | %) | 17.95 | % | 4.60 | % | (7.22 | %) | ||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

Net assets, end of year (000’s) | $ | 52,988 | $ | 56,073 | $ | 62,708 | $ | 57,266 | $ | 61,262 | ||||||||||

Ratios of expenses to average net assets (c) | 1.50 | % | 1.47 | % | 1.43 | % | 1.50 | % | 1.46 | % | ||||||||||

Ratios of net investment income to average net assets (d) | 1.12 | % | 0.66 | % | 0.67 | % | 1.03 | % | 0.63 | % | ||||||||||

Portfolio turnover | 54 | % | 22 | % | 32 | % | 4 | % | 13 | % | ||||||||||

(a) | Amount rounds to less than $0.01 per share. |

(b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

(c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

(d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

30

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year | ||||||||||||||||||||

| Years Ended October 31, | |||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

PER SHARE OPERATING PERFORMANCE | ||||||||||||||||||||

Net asset value, beginning of year | $ | 13.14 | $ | 13.02 | $ | 12.24 | $ | 11.80 | $ | 11.87 | ||||||||||

Income (loss) from investment operations: | ||||||||||||||||||||

Net investment income | 0.12 | 0.09 | 0.05 | 0.14 | 0.17 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | (0.58 | ) | 0.11 | 0.80 | 0.47 | (0.09 | ) | |||||||||||||

Total from investment operations | (0.46 | ) | 0.20 | 0.85 | 0.61 | 0.08 | ||||||||||||||

Less distributions: | ||||||||||||||||||||

Distributions from net investment income | (0.14 | ) | (0.08 | ) | (0.07 | ) | (0.17 | ) | (0.15 | ) | ||||||||||

Proceeds from redemption fees collected (Note 1B) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | ||||||||||

Net asset value, end of year | $ | 12.54 | $ | 13.14 | $ | 13.02 | $ | 12.24 | $ | 11.80 | ||||||||||

TOTAL RETURN (b) | (3.56 | %) | 1.53 | % | 6.99 | % | 5.26 | % | 0.62 | % | ||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

Net assets, end of year (000’s) | $ | 93,124 | $ | 121,546 | $ | 123,411 | $ | 117,272 | $ | 114,841 | ||||||||||

Ratio of expenses to average net assets (c) | 1.19 | % | 1.14 | % | 1.13 | % | 1.11 | % | 1.09 | % | ||||||||||

Ratio of net investment income to average net assets (d) | 1.07 | % | 0.66 | % | 0.39 | % | 1.15 | % | 1.48 | % | ||||||||||

Portfolio turnover | 40 | % | 29 | % | 25 | % | 32 | % | 31 | % | ||||||||||

(a) | Amount rounds to less than $0.01 per share. |

(b) | Total return is a measure of the change in the value of an investment in the Portfolio over the years covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

(c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests (Note 2). |

(d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

31

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS

October 31, 2015

(1) | SIGNIFICANT ACCOUNTING POLICIES |

New Century Portfolios (“New Century”) is organized as a Massachusetts business trust which is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company and currently offers shares of four series: New Century Capital Portfolio, New Century Balanced Portfolio, New Century International Portfolio and New Century Alternative Strategies Portfolio (together, the “Portfolios” and each, a “Portfolio”). New Century Capital Portfolio and New Century Balanced Portfolio commenced operations on January 31, 1989. New Century International Portfolio commenced operations on November 1, 2000, and New Century Alternative Strategies Portfolio commenced operations on May 1, 2002.

Weston Financial Group, Inc. (the “Adviser”), a wholly-owned subsidiary of The Washington Trust Company, serves as the investment adviser to each Portfolio. Weston Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Washington Trust Bancorp, Inc., serves as the distributor and principal underwriter to each Portfolio.

The investment objective of New Century Capital Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of other registered investment companies, including exchange-traded funds (“ETFs”), that emphasize investments in equity securities (domestic and foreign).

The investment objective of New Century Balanced Portfolio is to provide income, with a secondary objective to provide capital growth, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of other registered investment companies, including ETFs, that emphasize investments in equity securities (domestic and foreign), fixed income (domestic and foreign), or in a composite of such securities. This Portfolio maintains at least 25% of its assets in fixed income securities by selecting registered investment companies that invest in such securities.

The investment objective of New Century International Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of registered investment companies, including ETFs, which emphasize investments in equities but which focus on securities in foreign and emerging markets, and with less emphasis on securities in domestic markets.

The investment objective of New Century Alternative Strategies Portfolio is to provide total return while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of other registered investment companies, including ETFs and closed-end funds, that emphasize alternative strategies and have low correlation to the securities in the S&P 500 Composite Index.

32

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2015

The price of shares of each Portfolio fluctuates daily and there is no assurance that the Portfolios will be successful in achieving their stated investment objectives.

As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, each Portfolio follows accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of significant accounting policies followed by the Portfolios in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

A. | Investment Valuation |

Investments in shares of other open-end investment companies are valued at their net asset value as reported by such companies. The net asset value as reported by open-end investment companies may be based on fair value pricing; to understand the fair value pricing process used by such companies, consult their most current prospectus. The Portfolios may also invest in closed-end investment companies, ETF’s, and to a certain extent, directly in securities when the Adviser deems it appropriate. Investments in closed-end investment companies, ETF’s and direct investments in securities are valued at market prices, as described in the paragraph below.

Investments in securities traded on a national securities exchange or included in NASDAQ are generally valued at the last reported sales price, the closing price or the official closing price; and securities traded in the over-the-counter market and listed securities for which no sale is reported on that date are valued at the last reported bid price. It is expected that fixed income securities will ordinarily be traded in the over-the-counter market. When market quotations are not readily available, fixed income securities may be valued on the basis of prices provided by an independent pricing service. Other assets and securities for which no quotations are readily available or for which quotations the Adviser believes do not reflect market value are valued at their fair value as determined in good faith by the Adviser under the procedures established by the Board of Trustees, and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Factors considered in determining the value of portfolio investments subject to fair value determination include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; infrequency of sales; thinness of market; the size of reported trades; a temporary lapse in the provision of prices by any reliable pricing source; and actions of the securities or future markets, such as the suspension or limitation of trading.

33

NEW CENTURY PORTFOLIOS |

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. Various inputs are used in determining the value of the Portfolios’ investments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

Structured Notes held by New Century Balanced and New Century Alternative Strategies Portfolios are typically classified as Level 2 since the values for such securities are customarily based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities, underlying index values and interest rates, among other factors.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level of the fair value hierarchy within which the fair value measurement of that security is determined to fall in its entirety is the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value each Portfolio’s investments by security type as of October 31, 2015:

New Century Capital Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Investment Companies | $ | 103,607,603 | $ | — | $ | — | $ | 103,607,603 | ||||||||

Money Market Funds | 4,202,489 | — | — | 4,202,489 | ||||||||||||

Total | $ | 107,810,092 | $ | — | $ | — | $ | 107,810,092 | ||||||||

New Century Balanced Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Investment Companies | $ | 63,919,761 | $ | — | $ | — | $ | 63,919,761 | ||||||||

Structured Notes | — | 2,108,892 | — | 2,108,892 | ||||||||||||

Money Market Funds | 1,809,656 | — | — | 1,809,656 | ||||||||||||

Total | $ | 65,729,417 | $ | 2,108,892 | $ | — | $ | 67,838,309 | ||||||||

34

NEW CENTURY PORTFOLIOS |

New Century International Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Investment Companies | $ | 50,940,914 | $ | — | $ | — | $ | 50,940,914 | ||||||||

Money Market Funds | 2,104,593 | — | — | 2,104,593 | ||||||||||||

Total | $ | 53,045,507 | $ | — | $ | — | $ | 53,045,507 | ||||||||

New Century Alternative Strategies Portfolio | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Investment Companies | $ | 85,732,360 | $ | — | $ | — | $ | 85,732,360 | ||||||||

Structured Notes | — | 4,279,211 | — | 4,279,211 | ||||||||||||

Money Market Funds | 2,893,888 | — | — | 2,893,888 | ||||||||||||

Total | $ | 88,626,248 | $ | 4,279,211 | $ | — | $ | 92,905,459 | ||||||||

Refer to each Portfolio’s Schedule of Investments for a listing of the securities using Level 1 and Level 2 inputs. As of October 31, 2015, the Portfolios did not have any transfers into and out of any Level. In addition, the Portfolios did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of October 31, 2015. It is the Portfolios’ policy to recognize transfers into and out of any Level at the end of the reporting period.

B. | Share Valuation |

The net asset value per share of each Portfolio is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Portfolio is equal to the net asset value per share, except that shares of each Portfolio are subject to a redemption fee of 2% if redeemed within 30 days of the date of purchase. This redemption fee applies to all shareholders and accounts; however, each Portfolio reserves the right to waive such redemption fees on employer sponsored retirement accounts. No redemption fee is imposed on the exchange of shares among the various Portfolios of the Trust, the redemption of shares representing reinvested dividends or capital gain distributions, or on amounts representing capital appreciation of shares. During the years ended October 31, 2015 and 2014, proceeds from redemption fees totaled $450 and $136, respectively, for New Century Capital Portfolio; $69 and $0, respectively, for New Century Balanced Portfolio; $363 and $2, respectively, for New Century International Portfolio; and $2,417 and $335, respectively, for New Century Alternative Strategies Portfolio. Any redemption fees collected are credited to paid-in capital of the applicable Portfolio.

C. | Investment Transactions |

Investment transactions are recorded on a trade date basis for financial reporting purposes. Gains and losses on securities sold are determined on a specific identification method.

35

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2015

D. | Income Recognition |

Interest income, if any, is accrued on portfolio investments daily. Dividend income and capital gain distributions are recorded on the ex-dividend date or as soon as the information is available if after the ex-dividend date.

E. | Distributions to Shareholders |

Dividends arising from net investment income, if any, are declared and paid semi-annually to shareholders of New Century Balanced and New Century Alternative Strategies Portfolios. Dividends from net investment income, if any, are declared and paid annually to shareholders of New Century Capital and New Century International Portfolios. Net realized short-term capital gains, if any, may be distributed throughout the year and net realized long-term capital gains, if any, are distributed annually. Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

The tax character of distributions paid during the years ended October 31, 2015 and 2014 was as follows:

Year Ended | Ordinary Income | Long-Term Capital Gains | Total Distributions | |||||||||

New Century Capital Portfolio | ||||||||||||

October 31, 2015 | $ | — | $ | 14,111,794 | $ | 14,111,794 | ||||||

October 31, 2014 | $ | 100,544 | $ | 10,149,601 | $ | 10,250,145 | ||||||

New Century Balanced Portfolio | ||||||||||||

October 31, 2015 | $ | 912,546 | $ | 4,776,168 | $ | 5,688,714 | ||||||

October 31, 2014 | $ | 790,570 | $ | 3,999,254 | $ | 4,789,824 | ||||||

New Century International Portfolio | ||||||||||||

October 31, 2015 | $ | 699,568 | $ | 5,984,625 | $ | 6,684,193 | ||||||

October 31, 2014 | $ | 361,371 | $ | 4,279,496 | $ | 4,640,867 | ||||||

New Century Alternative Strategies Portfolio | ||||||||||||

October 31, 2015 | $ | 1,227,530 | $ | — | $ | 1,227,530 | ||||||

October 31, 2014 | $ | 748,917 | $ | — | $ | 748,917 | ||||||

F. | Cost of Operations |

The Portfolios bear all costs of their operations other than expenses specifically assumed by the Adviser. Expenses directly attributable to a Portfolio are charged to that Portfolio; other expenses are allocated proportionately among the Portfolios in relation to the net assets of each Portfolio.

36

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

October 31, 2015

G. | Use of Estimates |

In preparing financial statements in accordance with GAAP, management is required to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities, and revenues and expenses during the reporting period. Actual results could differ from those estimates.

(2) | INVESTMENT ADVISORY AGREEMENT, ADMINISTRATION AGREEMENT AND TRUSTEES’ FEES |

Each Portfolio has entered into an Investment Advisory Agreement with the Adviser. Investment advisory fees for each Portfolio are computed daily and paid monthly. The investment advisory fees for each of New Century Capital and New Century International Portfolios are computed at an annualized rate of 1.00% (100 basis points) on the first $100 million of average daily net assets and 0.75% (75 basis points) of average daily net assets exceeding that amount. The investment advisory fees for New Century Balanced Portfolio are computed at an annualized rate of 1.00% (100 basis points) on the first $50 million of average daily net assets and 0.75% (75 basis points) of average daily net assets exceeding that amount. The investment advisory fees for New Century Alternative Strategies Portfolio are computed at an annualized rate of 0.75% (75 basis points) of average daily net assets. The advisory fees are calculated based on the net assets of each Portfolio separately, and not on the total net assets of the Portfolios combined.

The Adviser has contractually agreed to limit the total expenses of each Portfolio (excluding interest, taxes, brokerage, acquired fund fees and expenses and extraordinary expenses) to an annual rate of 1.50% of average net assets. The limitation on total expenses does not include a Portfolio’s proportionate share of expenses of the underlying investment companies (i.e. acquired fund fees and expenses) in which such Portfolio invests. This contractual agreement is in place until March 1, 2016. During the year ended October 31, 2015, no reduction of advisory fees was necessary with respect to any Portfolio.