Trade payables are generally not interest-bearing but interest may be charged by suppliers on overdue accounts.

Derivative financial instruments are held in relation to the Group’s financial risk management policy which is described in note 33. The Group does not hold or issue derivatives for speculative purposes.

The carrying amount of derivative financial instruments held by the Group was as follows:

|

| 107 |

| Group Financial Statements | |

B. Currency derivatives

As at 2 January 2010, the notional principal amount of outstanding foreign exchange contracts that are used to manage the currency profile of the Group’s net assets was $796.6 million (3 January 2009: $888.7 million). Where necessary, the Group has designated these contracts as net investment hedges. During 2009, the net fair value loss of $3.1 million (2008: net gain of $57.2 million; 2007: net loss of $31.0 million) in relation to designated net investment hedges was recognised in other comprehensive income.

Prior to the change in its presentation currency at the beginning of 2008, the Group also designated as net investment hedges the US dollar borrowings under the multi-currency revolving credit facility and, before their redemption in July 2007, the Company’s US dollar denominated preference shares. During 2007, the net currency translation gain of $3.8 million arising on these instruments was recognised in other comprehensive income.

The currency profile of the Group’s net assets after taking into account translation hedges is presented in note 33.

Also during 2009, a net fair value gain of $12.2 million (2008: net loss of $9.4 million; 2007: net loss of $4.0 million) was recognised within operating profit in respect of currency derivatives that were held to provide an economic hedge of transactional currency exposures but were not designated as hedges for accounting purposes.

C. Interest rate swaps

Interest rate swaps are used to swap borrowings under the Group’s EMTN Programme from fixed interest rates to floating interest rates. As at 2 January 2010, the nominal value of the contracts outstanding was £400 million (3 January 2009: £400 million). The Group has designated these contracts as fair value hedges in relation to the borrowings.

During 2009, the Group recognised a net fair value loss of $13.3 million (2008: net gain of $75.7 million; 2007: net gain of $7.0 million) in relation to these contracts and the carrying amount of the hedged borrowings was decreased by $12.3 million (2008: increased by $75.6 million; 2007: increased by $5.4 million) to reflect the change in the fair value of the borrowings attributable to the hedged risk and the amortisation of the transitional adjustment that was recognised on adoption of IAS 39. During 2009, a net loss of $1.0 million (2008: net gain of $0.1 million; 2007: net gain of $1.6 million) was, therefore, recognised within other finance expense in relation to these hedges.

Until December 2009, when the remaining contracts matured, interest rate swaps were held to restrict the amount of floating rate US dollar debt. During 2009, a net fair value gain of $2.3 million (2008: net loss of $2.1 million; 2007: net loss of $3.8 million) was recognised within other finance expense in relation to these contracts that did not qualify for hedge accounting under IAS 39.

The profile of interest rate swaps held by the Group was as follows:

| | | | | | | | | | | | Interest rate | |

| | | | | | Payable | | | | Receivable | | | |

| | Notional

principal amount

million | | Variable | | Fixed | | Variable | | Fixed | | Variable

rate index | |

As at 2 January 2010 | | | | | | | | | | | | | |

Maturity date: | | | | | | | | | | | | | |

– December 2011 | | £150.0 | | 3.4% | | – | | – | | 8.0% | | 6 month LIBOR | |

– September 2015 | | £250.0 | | 1.7% | | – | | – | | 6.1% | | 3 month LIBOR | |

As at 3 January 2009 | | | | | | | | | | | | | |

Maturity date: | | | | | | | | | | | | | |

– December 2011 | | £150.0 | | 5.7% | | – | | – | | 8.0% | | 6 month LIBOR | |

– September 2015 | | £250.0 | | 4.0% | | – | | – | | 6.1% | | 3 month LIBOR | |

– December 2009 | | $65.0 | | – | | 4.6% | | 1.5% | | – | | 3 month LIBOR | |

D. Currency translation loss on hedging instruments

Certain of the translational hedging instruments held by the Group are denominated in sterling but the Group is unable to apply hedge accounting to the gains and losses that arise on the translation of the carrying amount of those instruments into US dollars. During 2009, a net currency translation loss of $1.6 million (2008: net loss of $17.9 million; 2007: net loss of $3.0 million) was recognised within other finance expense in relation to those instruments.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

33. Financial risk management

A. Risk management policies

The Group’s central treasury function is responsible for procuring the Group’s capital resources and maintaining an efficient capital structure, together with managing the Group’s liquidity, foreign exchange and interest rate exposures.

All treasury operations are conducted within strict policies and guidelines that are approved by the Board. Compliance with those policies and guidelines is monitored by the regular reporting of treasury activities to the Board.

A key element of the Group’s treasury philosophy is that funding, interest rate and currency decisions and the location of cash and debt balances are determined independently from each other. The Group’s borrowing requirements are met by raising funds in the most favourable markets. Management aims to retain net debt in proportion to the currencies in which the net assets of the Group’s operations are denominated. The desired currency profile of net debt is achieved by entering into currency derivative contracts. The proportion of investments in foreign operations effectively funded by shareholders’ equity is not hedged. While the net income of foreign operations is not hedged, the effect of currency fluctuations on the Group’s reported net income is partly offset by interest payable on net debt denominated in foreign currencies.

From time to time, the Group also enters into currency derivative contracts to manage currency transaction exposures.

Where necessary, the desired interest rate profile of net debt in each currency is achieved by entering into interest rate derivative contracts.

The Group’s portfolio of cash and cash equivalents is managed such that there is no significant concentration of credit risk in any one bank or other financial institution. Management monitors closely the credit quality of the institutions with which it holds deposits. Similar considerations are given to the Group’s portfolio of derivative financial instruments.

The Group’s borrowing facilities are monitored against forecast requirements and timely action is taken to put in place, renew or replace credit lines. Management’s policy is to reduce liquidity risk by diversifying the Group’s funding sources and by staggering the maturity of its borrowings.

The Group has established long-term credit ratings of Baa3 Stable with Moody’s and BBB Stable with Standard & Poor’s and short-term credit ratings of P-3 with Moody’s and A-2 with Standard & Poor’s. Management aims to achieve an appropriate mix of debt and equity to ensure an efficient capital structure and to preserve these ratings.

Disclosures about the Group’s capital are set out in note 40.

B. Financial assets and liabilities

The following table analyses financial assets and liabilities by the categories defined in IAS 39. Financial instruments held at fair value, have been categorised into one of three levels to reflect the degree to which observable inputs are used in determining the fair values:

– | ‘Level 1’ fair value measurements are those derived without adjustment from quoted prices in active markets for identical assets or liabilities. |

– | ‘Level 2’ fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices). |

– | ‘Level 3’ fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are not based on observable market data (unobservable inputs). |

During 2009, there were no transfers of financial instruments between Level 1 and Level 2.

|

| 109 |

| Group Financial Statements |

| | | | | | | | Fair value

through profit or loss | | | | | | |

| | Loans and

receivables

$ million | | Available-

for-sale

$ million | | Liabilities

at amortised

cost

$ million | | Designated

hedging

relationships

$ million | | Trading

$ million | | Total

carrying

value

$ million | | | Fair

value

$ million | |

As at 2 January 2010 | | | | | | | | | | | | | | | | |

Financial assets not held at fair value | | | | | | | | | | | | | | | | |

Trade and other receivables: | | | | | | | | | | | | | | | | |

– Non-derivative assets | | 722.1 | | – | | – | | – | | – | | 722.1 | | | 722.1 | |

Cash and cash equivalents | | 445.0 | | – | | – | | – | | – | | 445.0 | | | 445.0 | |

| | 1,167.1 | | – | | – | | – | | – | | 1,167.1 | | | 1,167.1 | |

Financial assets held at fair value | | | | | | | | | | | | | | | | |

Level 1: | | | | | | | | | | | | | | | | |

– Available-for-sale investments | | – | | 1.2 | | – | | – | | – | | 1.2 | | | 1.2 | |

Level 2: | | | | | | | | | | | | | | | | |

– Trade and other receivables: | | | | | | | | | | | | | | | | |

Derivative assets | | – | | – | | – | | 56.9 | | 1.2 | | 58.1 | | | 58.1 | |

| | – | | 1.2 | | – | | 56.9 | | 1.2 | | 59.3 | | | 59.3 | |

Total financial assets | | 1,167.1 | | 1.2 | | – | | 56.9 | | 1.2 | | 1,226.4 | | | 1,226.4 | |

| | | | | | | | | | | | | | | | |

Financial liabilities not held at fair value | | | | | | | | | | | | | | | | |

Trade and other payables: | | | | | | | | | | | | | | | | |

– Non-derivative liabilities | | – | | – | | (506.2 | ) | – | | – | | (506.2 | ) | | (506.2 | ) |

Bank overdrafts | | – | | – | | (4.8 | ) | – | | – | | (4.8 | ) | | (4.8 | ) |

Bank and other loans: | | | | | | | | | | | | | | | | |

– Current | | – | | – | | (11.2 | ) | – | | – | | (11.2 | ) | | (10.2 | ) |

– Non-current | | – | | – | | (642.3 | ) | (45.0 | ) | – | | (687.3 | ) | | (655.3 | ) |

Obligations under finance leases | | – | | – | | (4.6 | ) | – | | – | | (4.6 | ) | | (4.6 | ) |

| | – | | – | | (1,169.1 | ) | (45.0 | ) | – | | (1,214.1 | ) | | (1,181.1 | ) |

| | | | | | | | | | | | | | | | |

Financial liabilities held at fair value | | | | | | | | | | | | | | | | |

Level 2: | | | | | | | | | | | | | | | | |

– Trade and other payables: | | | | | | | | | | | | | | | | |

Derivative liabilities | | – | | – | | – | | (3.6 | ) | (2.6 | ) | (6.2 | ) | | (6.2 | ) |

| | – | | – | | – | | (3.6 | ) | (2.6 | ) | (6.2 | ) | | (6.2 | ) |

Total financial liabilities | | – | | – | | (1,169.1 | ) | (48.6 | ) | (2.6 | ) | (1,220.3 | ) | | (1,187.3 | ) |

| | 1,167.1 | | 1.2 | | (1,169.1 | ) | 8.3 | | (1.4 | ) | 6.1 | | | 39.1 | |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

33. Financial risk management (continued)

| | | | | | | | Fair value

through profit or loss | | | | | | |

| | Loans and

receivables

$ million | | Available-

for-sale

$ million | | Liabilities

at amortised

cost

$ million | | Designated

hedging

relationships

$ million | | Trading

$ million | | Total

carrying

value

$ million | | | Fair

value

$ million | |

As at 3 January 2009 | | | | | | | | | | | | | | | | |

Financial assets not held at fair value | | | | | | | | | | | | | | | | |

Trade and other receivables: | | | | | | | | | | | | | | | | |

– Non-derivative assets | | 757.7 | | – | | – | | – | | – | | 757.7 | | | 757.7 | |

Cash and cash equivalents | | 291.9 | | – | | – | | – | | – | | 291.9 | | | 291.9 | |

| | 1,049.6 | | – | | – | | – | | – | | 1,049.6 | | | 1,049.6 | |

Financial assets held at fair value | | | | | | | | | | | | | | | | |

Level 1: | | | | | | | | | | | | | | | | |

– Available-for-sale investments | | – | | 0.8 | | – | | – | | – | | 0.8 | | | 0.8 | |

Level 2: | | | | | | | | | | | | | | | | |

– Trade and other receivables: | | | | | | | | | | | | | | | | |

Derivative assets | | – | | – | | – | | 73.4 | | 1.1 | | 74.5 | | | 74.5 | |

| | – | | 0.8 | | – | | 73.4 | | 1.1 | | 75.3 | | | 75.3 | |

Total financial assets | | 1,049.6 | | 0.8 | | – | | 73.4 | | 1.1 | | 1,124.9 | | | 1,124.9 | |

| | | | | | | | | | | | | | | | |

Financial liabilities not held at fair value | | | | | | | | | | | | | | | | |

Trade and other payables: | | | | | | | | | | | | | | | | |

– Non-derivative liabilities | | – | | – | | (452.4 | ) | – | | – | | (452.4 | ) | | (452.4 | ) |

Bank overdrafts | | – | | – | | (13.7 | ) | – | | – | | (13.7 | ) | | (13.7 | ) |

Bank and other loans: | | | | | | | | | | | | | | | | |

– Current | | – | | – | | (29.5 | ) | – | | – | | (29.5 | ) | | (29.0 | ) |

– Non-current | | – | | – | | (711.0 | ) | (51.9 | ) | – | | (762.9 | ) | | (583.4 | ) |

Obligations under finance leases | | – | | – | | (6.9 | ) | – | | – | | (6.9 | ) | | (6.9 | ) |

| | – | | – | | (1,213.5 | ) | (51.9 | ) | – | | (1,265.4 | ) | | (1,085.4 | ) |

| | | | | | | | | | | | | | | | |

Financial liabilities held at fair value | | | | | | | | | | | | | | | | |

Level 2: | | | | | | | | | | | | | | | | |

– Trade and other payables: | | | | | | | | | | | | | | | | |

Derivative liabilities | | – | | – | | – | | (32.5 | ) | (13.6 | ) | (46.1 | ) | | (46.1 | ) |

| | – | | – | | – | | (32.5 | ) | (13.6 | ) | (46.1 | ) | | (46.1 | ) |

Total financial liabilities | | – | | – | | (1,213.5 | ) | (84.4 | ) | (13.6 | ) | (1,311.5 | ) | | (1,131.5 | ) |

| | 1,049.6 | | 0.8 | | (1,213.5 | ) | (11.0 | ) | (12.5 | ) | (186.6 | ) | | (6.6 | ) |

Available-for-sale investments are listed and are valued by reference to quoted market prices.

Cash and cash equivalents and current bank and other loans largely attract floating interest rates. Accordingly, their carrying amounts are considered to approximate to fair value.

Non-current bank and other loans principally comprise any borrowings under the Group’s multi-currency revolving credit facility that attract floating interest rates, the carrying amount of which is considered to approximate to fair value, and the listed bonds issued under the EMTN Programme, the fair value of which is based on their quoted market prices.

Finance lease obligations attract fixed interest rates that are implicit in the lease rentals and their fair value has been assessed by reference to prevailing market interest rates.

Derivative assets and liabilities represent the fair value of foreign currency derivatives and interest rate derivatives held by the Group at the balance sheet date. Foreign currency derivatives are valued by reference to prevailing forward exchange rates. Interest rate derivatives are valued by discounting the related cash flows using prevailing market interest rates.

|

| 111 |

| Group Financial Statements |

C. Credit risk

Credit risk is the risk that a counterparty will default on its contractual obligations resulting in financial loss to the Group.

Management considers the Group’s maximum exposure to credit risk to be as follows:

| | As at

2 January

2010

$ million | | | As at

3 January

2009

$ million | |

Trade and other receivables: | | | | | | |

– Derivative assets | | 58.1 | | | 74.5 | |

– Non-derivative assets | | 722.1 | | | 757.7 | |

| | 780.2 | | | 832.2 | |

Cash and cash equivalents | | 445.0 | | | 291.9 | |

| | 1,225.2 | | | 1,124.1 | |

As at 2 January 2010, 94% (3 January 2009: 92%) of the Group’s cash and cash equivalents were held with institutions rated at least A-1 by Standard & Poor’s and P-1 by Moody’s. Credit risk disclosures with respect to trade receivables are set out in note 25.

D. Liquidity risk

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities.

As at 2 January 2010, the Group had undrawn committed borrowing facilities of $645.0 million (3 January 2009: $455.1 million) available under the multi-currency revolving credit facility that expires on 8 August 2010. Borrowings under this facility are at prevailing LIBOR rates, plus an agreed margin, dependent on the period of drawdown. During 2009, the Group entered into a $450 million forward-start facility that will commence on expiry of the existing facility and will itself expire in May 2012.

In addition, the Group had uncommitted borrowing facilities of $381.2 million (3 January 2009: $495.4 million), of which $6.0 million (3 January 2009: $34.7 million) had been drawn down for cash. Consequently, the Group’s committed borrowing headroom was $639.0 million (3 January 2009: $420.4 million) in addition to cash and cash equivalents of $445.0 million (3 January 2009: $291.9 million). The Group also had outstanding performance bonds, letters of credit and bank guarantees amounting to $80.3 million (3 January 2009: $164.5 million).

The Group is subject to covenants, representations and warranties commonly associated with investment grade borrowings in respect of its committed borrowing facilities and bonds issued under the EMTN Programme.

The Group is subject to two financial covenants in respect of its committed borrowing facilities that are calculated by applying UK GAAP extant as at 31 December 2002. The ratio of net debt to consolidated earnings before interest, tax, depreciation and amortisation must not exceed 2.5 times (at the end of 2009, the ratio was 0.6 times). The ratio of consolidated operating profit to the consolidated net interest charge must not be less than 3.0 times (for 2009, the ratio was 5.5 times).

The Group complied with the borrowing covenants throughout each of the periods presented in the financial statements. Any future non-compliance with the borrowing covenants could, if not waived, constitute an event of default and may, in certain circumstances, lead to an acceleration of the maturity of borrowings drawn down and the inability to access committed facilities.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

33. Financial risk management (continued)

D. Liquidity risk (continued)

Contractual cash flows related to the Group’s financial liabilities are as follows:

| | Within

1 year

$ million | | Between

1 and 2

years

$ million | | Between

2 and 3

years

$ million | | Between

3 and 4

years

$ million | | Between

4 and 5

years

$ million | | After

5 years

$ million | | Total

$ million | |

As at 2 January 2010 | | | | | | | | | | | | | | | |

Bank overdrafts | | (4.8 | ) | – | | – | | – | | – | | – | | (4.8 | ) |

Bank and other loans: | | | | | | | | | | | | | | | |

– Principal | | (0.6 | ) | (241.8 | ) | (0.3 | ) | (0.3 | ) | – | | (403.1 | ) | (646.1 | ) |

– Interest payments | | (44.4 | ) | (44.0 | ) | (24.7 | ) | (24.7 | ) | (24.7 | ) | (24.7 | ) | (187.2 | ) |

Finance lease obligations | | (1.3 | ) | (0.8 | ) | (0.4 | ) | (0.4 | ) | (0.4 | ) | (3.3 | ) | (6.6 | ) |

Trade and other payables: | | | | | | | | | | | | | | | |

– Non-derivative liabilities | | (491.9 | ) | (14.3 | ) | – | | – | | – | | – | | (506.2 | ) |

Cash flows on non-derivative liabilities | | (543.0 | ) | (300.9 | ) | (25.4 | ) | (25.4 | ) | (25.1 | ) | (431.1 | ) | (1,350.9 | ) |

| | | | | | | | | | | | | | | |

Cash flows on derivative liabilities: | | | | | | | | | | | | | | | |

– Payments | | (255.7 | ) | (1.8 | ) | – | | – | | – | | – | | (257.5 | ) |

– Receipts | | 255.6 | | – | | – | | – | | – | | – | | 255.6 | |

| | (0.1 | ) | (1.8 | ) | – | | – | | – | | – | | (1.9 | ) |

Cash flows on financial liabilities | | (543.1 | ) | (302.7 | ) | (25.4 | ) | (25.4 | ) | (25.1 | ) | (431.1 | ) | (1,352.8 | ) |

| | | | | | | | | | | | | | | |

Cash flows on related derivative assets: | | | | | | | | | | | | | | | |

– Payments | | (612.7 | ) | (28.9 | ) | (20.6 | ) | (22.6 | ) | (23.8 | ) | (17.5 | ) | (726.1 | ) |

– Receipts | | 635.4 | | 44.0 | | 24.8 | | 24.6 | | 24.7 | | 24.7 | | 778.2 | |

| | 22.7 | | 15.1 | | 4.2 | | 2.0 | | 0.9 | | 7.2 | | 52.1 | |

| | (520.4 | ) | (287.6 | ) | (21.2 | ) | (23.4 | ) | (24.2 | ) | (423.9 | ) | (1,300.7 | ) |

| | Within

1 year

$ million | | Between

1 and 2

years

$ million | | Between

2 and 3

years

$ million | | Between

3 and 4

years

$ million | | Between

4 and 5

years

$ million | | After

5 years

$ million | | Total

$ million | |

As at 3 January 2009 | | | | | | | | | | | | | | | |

Bank overdrafts | | (13.6 | ) | – | | – | | – | | – | | – | | (13.6 | ) |

Bank and other loans: | | | | | | | | | | | | | | | |

– Principal | | (20.9 | ) | (129.3 | ) | (219.2 | ) | (0.3 | ) | (0.3 | ) | (365.4 | ) | (735.4 | ) |

– Interest payments | | (41.6 | ) | (39.9 | ) | (39.9 | ) | (22.4 | ) | (22.4 | ) | (38.2 | ) | (204.4 | ) |

Finance lease obligations | | (1.9 | ) | (1.5 | ) | (1.1 | ) | (0.8 | ) | (0.6 | ) | (3.6 | ) | (9.5 | ) |

Trade and other payables: | | | | | | | | | | | | | | | |

– Non-derivative liabilities | | (434.7 | ) | (17.7 | ) | – | | – | | – | | – | | (452.4 | ) |

Cash flows on non-derivative liabilities | | (512.7 | ) | (188.4 | ) | (260.2 | ) | (23.5 | ) | (23.3 | ) | (407.2 | ) | (1,415.3 | ) |

| | | | | | | | | | | | | | | |

Cash flows on derivative liabilities: | | | | | | | | | | | | | | | |

– Payments | | (677.0 | ) | (5.9 | ) | – | | – | | – | | – | | (682.9 | ) |

– Receipts | | 655.9 | | 7.9 | | – | | – | | – | | – | | 663.8 | |

| | (21.1 | ) | 2.0 | | – | | – | | – | | – | | (19.1 | ) |

Cash flows on financial liabilities | | (533.8 | ) | (186.4 | ) | (260.2 | ) | (23.5 | ) | (23.3 | ) | (407.2 | ) | (1,434.4 | ) |

| | | | | | | | | | | | | | | |

Cash flows on related derivative assets: | | | | | | | | | | | | | | | |

– Payments | | (328.8 | ) | (27.2 | ) | (29.2 | ) | (17.3 | ) | (18.2 | ) | (31.7 | ) | (452.4 | ) |

– Receipts | | 353.9 | | 39.8 | | 39.9 | | 22.4 | | 22.4 | | 44.5 | | 522.9 | |

| | 25.1 | | 12.6 | | 10.7 | | 5.1 | | 4.2 | | 12.8 | | 70.5 | |

| | (508.7 | ) | (173.8 | ) | (249.5 | ) | (18.4 | ) | (19.1 | ) | (394.4 | ) | (1,363.9 | ) |

|

| 113 |

| Group Financial Statements | |

Information on the Group’s exposure to liquidity risk analysed by currency is presented below.

| | Within

1 year

$ million | | Between

1 and 2

years

$ million | | Between

2 and 3

years

$ million | | Between

3 and 4

years

$ million | | Between

4 and 5

years

$ million | | After

5 years

$ million | | Total

$ million | |

As at 2 January 2010 | | | | | | | | | | | | | | | |

Cash flows on financial liabilities: | | | | | | | | | | | | | | | |

– US dollar | | (380.2 | ) | (10.7 | ) | – | | – | | – | | – | | (390.9 | ) |

– Sterling | | 75.0 | | (287.9 | ) | (25.0 | ) | (24.7 | ) | (24.7 | ) | (427.8 | ) | (715.1 | ) |

– Euro | | (68.2 | ) | (1.2 | ) | (0.4 | ) | (0.4 | ) | (0.4 | ) | (3.3 | ) | (73.9 | ) |

– Canadian dollar | | (37.9 | ) | – | | – | | – | | – | | – | | (37.9 | ) |

– Other | | (131.8 | ) | (2.9 | ) | – | | (0.3 | ) | – | | – | | (135.0 | ) |

| | (543.1 | ) | (302.7 | ) | (25.4 | ) | (25.4 | ) | (25.1 | ) | (431.1 | ) | (1,352.8 | ) |

| | | | | | | | | | | | | | | |

Cash flows on related financial assets: | | | | | | | | | | | | | | | |

– US dollar | | (330.1 | ) | – | | – | | – | | – | | – | | (330.1 | ) |

– Sterling | | 479.4 | | 15.1 | | 4.2 | | 2.0 | | 0.9 | | 7.2 | | 508.8 | |

– Euro | | (44.2 | ) | – | | – | | – | | – | | – | | (44.2 | ) |

– Canadian dollar | | (62.3 | ) | – | | – | | – | | – | | – | | (62.3 | ) |

– Other | | (20.1 | ) | – | | – | | – | | – | | – | | (20.1 | ) |

| | 22.7 | | 15.1 | | 4.2 | | 2.0 | | 0.9 | | 7.2 | | 52.1 | |

| | Within

1 year

$ million | | Between

1 and 2

years

$ million | | Between

2 and 3

years

$ million | | Between

3 and 4

years

$ million | | Between

4 and 5

years

$ million | | After

5 years

$ million | | Total

$ million | |

As at 3 January 2009 | | | | | | | | | | | | | | | |

Cash flows on financial liabilities: | | | | | | | | | | | | | | | |

– US dollar | | (771.2 | ) | (114.6 | ) | (0.4 | ) | (0.4 | ) | (0.2 | ) | – | | (886.8 | ) |

– Sterling | | 480.0 | | (75.8 | ) | (259.1 | ) | (22.7 | ) | (22.4 | ) | (403.5 | ) | (303.5 | ) |

– Euro | | (39.6 | ) | 6.4 | | (0.7 | ) | (0.4 | ) | (0.4 | ) | (3.7 | ) | (38.4 | ) |

– Canadian dollar | | (37.8 | ) | – | | – | | – | | – | | – | | (37.8 | ) |

– Other | | (165.2 | ) | (2.4 | ) | – | | – | | (0.3 | ) | – | | (167.9 | ) |

| | (533.8 | ) | (186.4 | ) | (260.2 | ) | (23.5 | ) | (23.3 | ) | (407.2 | ) | (1,434.4 | ) |

| | | | | | | | | | | | | | | |

Cash flows on related financial assets: | | | | | | | | | | | | | | | |

– US dollar | | 289.6 | | – | | – | | – | | – | | – | | 289.6 | |

– Sterling | | 2.0 | | 12.6 | | 10.7 | | 5.1 | | 4.2 | | 12.8 | | 47.4 | |

– Euro | | (97.8 | ) | – | | – | | – | | – | | – | | (97.8 | ) |

– Canadian dollar | | (105.6 | ) | – | | – | | – | | – | | – | | (105.6 | ) |

– Other | | (63.1 | ) | – | | – | | – | | – | | – | | (63.1 | ) |

| | 25.1 | | 12.6 | | 10.7 | | 5.1 | | 4.2 | | 12.8 | | 70.5 | |

Maturities in all of the liquidity tables above are based on the earliest date on which the Group could be required to settle the liabilities.

Floating interest payments and payments and receipts on interest rate derivatives are estimated based on market interest rates prevailing at the balance sheet date.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

33. Financial risk management (continued)

E. Interest rate risk

Interest rate risk is the risk that the fair value of, or future cash flows associated with, a financial instrument will fluctuate because of changes in market interest rates.

The interest rate profile of the Group’s financial assets and liabilities, after taking into account the effect of the Group’s interest rate hedging activities, was as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | |

| | Interest-bearing | | | | | | | Interest-bearing | | | | | |

| | Floating

rate

$ million | | Fixed

rate

$ million | | Non-interest

bearing

$ million | | Total

$ million | | | Floating

rate

$ million | | Fixed

rate

$ million | | Non-interest

bearing

$ million | | Total

$ million | |

Financial assets | | | | | | | | | | | | | | | | | | |

Trade and other receivables | | 16.0 | | – | | 764.2 | | 780.2 | | | 3.8 | | – | | 828.4 | | 832.2 | |

Available-for-sale investments | | – | | – | | 1.2 | | 1.2 | | | – | | – | | 0.8 | | 0.8 | |

Cash and cash equivalents (see note 27) | | 378.9 | | – | | 66.1 | | 445.0 | | | 252.0 | | – | | 39.9 | | 291.9 | |

| | 394.9 | | – | | 831.5 | | 1,226.4 | | | 255.8 | | – | | 869.1 | | 1,124.9 | |

Financial liabilities | | | | | | | | | | | | | | | | | | |

Trade and other payables | | – | | – | | (512.4 | ) | (512.4 | ) | | – | | – | | (498.5 | ) | (498.5 | ) |

Borrowings (see note 29) | | (701.3 | ) | (0.3 | ) | (1.7 | ) | (703.3 | ) | | (739.4 | ) | (65.3 | ) | (1.4 | ) | (806.1 | ) |

Obligations under finance leases | | – | | (4.6 | ) | – | | (4.6 | ) | | – | | (6.9 | ) | – | | (6.9 | ) |

| | (701.3 | ) | (4.9 | ) | (514.1 | ) | (1,220.3 | ) | | (739.4 | ) | (72.2 | ) | (499.9 | ) | (1,311.5 | ) |

| | (306.4 | ) | (4.9 | ) | 317.4 | | 6.1 | | | (483.6 | ) | (72.2 | ) | 369.2 | | (186.6 | ) |

On the assumption that the change in interest rates is applied to the risk exposures in existence at the balance sheet date and that designated fair value hedges are 100% effective, an increase/decrease of 100 basis points in the interest rates applying to financial assets and liabilities would increase/decrease the Group’s profit before tax by $2.7 million (3 January 2009: $4.0 million). No amounts would be taken directly to equity.

F. Currency risk

Currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. Currency risk arises on financial assets and liabilities that are denominated in a currency other than the functional currency of the entity by which they are held.

The Group’s exposure to currency risk was as follows:

| | Net foreign currency financial assets/(liabilities) | |

| | US dollar

$ million | | Sterling

$ million | | Euro

$ million | | Canadian dollar

$ million | | Other

$ million | | Total

$ million | |

As at 2 January 2010 | | | | | | | | | | | | | |

Functional currency of entity: | | | | | | | | | | | | | |

– US dollar | | – | | (12.5 | ) | (1.1 | ) | – | | (1.8 | ) | (15.4 | ) |

– Sterling | | 1.8 | | – | | (2.6 | ) | – | | (3.7 | ) | (4.5 | ) |

– Euro | | (2.7 | ) | (0.2 | ) | – | | (0.1 | ) | (0.1 | ) | (3.1 | ) |

– Canadian dollar | | (3.0 | ) | – | | – | | – | | (0.2 | ) | (3.2 | ) |

– Other | | (5.1 | ) | (0.9 | ) | 15.2 | | (0.6 | ) | – | | 8.6 | |

| | (9.0 | ) | (13.6 | ) | 11.5 | | (0.7 | ) | (5.8 | ) | (17.6 | ) |

| | | | | | | | | | | | | |

As at 3 January 2009 | | | | | | | | | | | | | |

Functional currency of entity: | | | | | | | | | | | | | |

– US dollar | | – | | (7.0 | ) | (1.4 | ) | – | | 6.4 | | (2.0 | ) |

– Sterling | | 3.7 | | – | | 0.5 | | – | | 12.3 | | 16.5 | |

– Euro | | (2.3 | ) | (0.1 | ) | – | | (0.6 | ) | – | | (3.0 | ) |

– Canadian dollar | | (1.4 | ) | – | | – | | – | | (0.1 | ) | (1.5 | ) |

– Other | | (11.2 | ) | (0.7 | ) | 19.7 | | 31.7 | | – | | 39.5 | |

| | (11.2 | ) | (7.8 | ) | 18.8 | | 31.1 | | 18.6 | | 49.5 | |

|

| 115 |

| Group Financial Statements | |

Currency exposures shown above take into account the effect of the Group’s transaction hedging activities.

On the assumption that the change in exchange rates is applied to the risk exposures in existence at the balance sheet date and that designated net investment hedges are 100% effective, an increase/decrease of 10% in the value of the functional currencies of the entities concerned against the currencies in which the financial assets and liabilities are denominated would increase/decrease the Group’s profit before tax by $1.8 million (3 January 2009: $5.0 million).

Currency exposures on the Group’s net assets, after taking into account the translation hedges applied to the Group’s borrowings, were as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | |

| | Net assets

excluding net

(debt)/funds

$ million | | Net

(debt)/funds

$ million | | Net

assets

$ million | | | Net assets

excluding net

(debt)/funds

$ million | | Net

(debt)/funds

$ million | | Net

Assets

$ million | |

Currency: | | | | | | | | | | | | | | |

– US dollar | | 930.8 | | (343.6 | ) | 587.2 | | | 1,164.2 | | (305.8 | ) | 858.4 | |

– Sterling | | 76.2 | | 87.8 | | 164.0 | | | 101.9 | | (12.7 | ) | 89.2 | |

– Euro | | 150.6 | | (33.4 | ) | 117.2 | | | 229.9 | | (94.6 | ) | 135.3 | |

– Canadian dollar | | 137.7 | | (42.8 | ) | 94.9 | | | 171.6 | | (104.4 | ) | 67.2 | |

– Other | | 590.2 | | 124.5 | | 714.7 | | | 548.1 | | 41.1 | | 589.2 | |

| | 1,885.5 | | (207.5 | ) | 1,678.0 | | | 2,215.7 | | (476.4 | ) | 1,739.3 | |

34. Post-employment benefit obligations

A. Background

The Group operates pension plans throughout the world, covering the majority of its employees. The plans are structured to accord with local conditions and practices in each country and include defined contribution plans and defined benefit plans.

The Group provides defined contribution pension benefits in most of the countries in which it operates; in particular, the majority of the Group’s employees in the US are entitled to such benefits. Contributions payable by the Group to these plans amounted to $33.4 million (2008: $37.9 million; 2007: $47.6 million). At the balance sheet date, the Group had not paid over to the plans contributions due amounting to $14.8 million (3 January 2009: $15.1 million). All amounts due for the period were paid over subsequent to the balance sheet date.

The Group operates defined benefit pension plans in several countries; in particular, in the US and the UK. Generally, the pension benefits provided under these plans are based upon pensionable salary and the period of service of the individual employees. The assets of the plans are held separately from those of the Group in funds that are under the control of trustees. All of the defined benefit pension plans operated by the Group are closed to new entrants. In addition to the funded defined benefit pension plans, the Group has unfunded defined benefit obligations to certain current and former employees.

The Group also provides other post-employment benefits, principally health and life insurance cover, to certain of its employees in North America. These plans, which are unfunded, are defined benefit plans.

As discussed in note 7, during 2009, the Group recognised a gain of $63.0 million on the amendment of pension and post-retirement healthcare plans in North America.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

34. Post-employment benefit obligations (continued)

B. Summary of financial effect

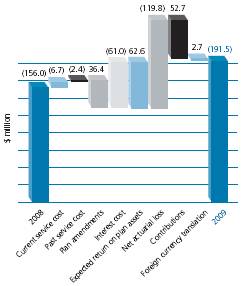

An analysis of the effect of providing post-employment benefits on the Group’s results is set out below.

Year ended 2 January 2010

| | Pensions | | Other post-employment benefits | |

| | Operating | | Finance | | | | Operating | | Finance | | | |

| | profit | | charges | | Total | | profit | | charges | | Total | |

| | $ million | | $ million | | $ million | | $ million | | $ million | | $ million | |

Defined contribution plans | | 33.4 | | – | | 33.4 | | – | | – | | – | |

| | | | | | | | | | | | | |

Defined benefit plans | | | | | | | | | | | | | |

Recognised in profit or loss: | | | | | | | | | | | | | |

– Current service cost | | 6.7 | | – | | 6.7 | | 0.4 | | – | | 0.4 | |

– Past service cost | | 2.7 | | – | | 2.7 | | – | | – | | – | |

– Negative past service cost | | (0.3 | ) | – | | (0.3 | ) | (17.2 | ) | – | | (17.2 | ) |

– Settlement and curtailments | | (36.4 | ) | – | | (36.4 | ) | (10.5 | ) | – | | (10.5 | ) |

– Interest cost | | – | | 61.0 | | 61.0 | | – | | 9.0 | | 9.0 | |

– Expected return on plan assets | | – | | (62.6 | ) | (62.6 | ) | – | | – | | – | |

| | (27.3 | ) | (1.6 | ) | (28.9 | ) | (27.3 | ) | 9.0 | | (18.3 | ) |

Recognised in equity: | | | | | | | | | | | | | |

– Net actuarial loss | | | | | | 119.8 | | | | | | 24.0 | |

– Effect of the asset ceiling | | | | | | (18.6 | ) | | | | | – | |

| | | | | | 101.2 | | | | | | 24.0 | |

| | | | | | 72.3 | | | | | | 5.7 | |

Year ended 3 January 2009

| | Pensions | | Other post-employment benefits | |

| | Operating | | Finance | | | | Operating | | Finance | | | |

| | profit | | charges | | Total | | profit | | charges | | Total | |

| | $ million | | $ million | | $ million | | $ million | | $ million | | $ million | |

Defined contribution plans | | 37.9 | | – | | 37.9 | | – | | – | | – | |

| | | | | | | | | | | | | |

Defined benefit plans | | | | | | | | | | | | | |

Recognised in profit or loss: | | | | | | | | | | | | | |

– Current service cost | | 8.7 | | – | | 8.7 | | 0.5 | | – | | 0.5 | |

– Past service cost | | – | | – | | – | | 0.6 | | – | | 0.6 | |

– Settlement and curtailments | | (2.4 | ) | – | | (2.4 | ) | – | | – | | – | |

– Interest cost | | – | | 67.9 | | 67.9 | | – | | 10.5 | | 10.5 | |

– Expected return on plan assets | | – | | (75.5 | ) | (75.5 | ) | – | | – | | – | |

| | 6.3 | | (7.6 | ) | (1.3 | ) | 1.1 | | 10.5 | | 11.6 | |

Recognised in equity: | | | | | | | | | | | | | |

– Net actuarial loss/(gain) | | | | | | 122.4 | | | | | | (23.6 | ) |

– Effect of the asset ceiling | | | | | | (12.3 | ) | | | | | – | |

| | | | | | 110.1 | | | | | | (23.6 | ) |

| | | | | | 108.8 | | | | | | (12.0 | ) |

|

| 117 |

| Group Financial Statements | |

Year ended 29 December 2007

| | Pensions | | Other post-employment benefits | |

| | | | | | Loss from | | | | | | | | | |

| | Operating | | Finance | | discontinued | | | | Operating | | Finance | | | |

| | profit | | charges | | operations | | Total | | profit | | charges | | Total | |

| | $ million | | $ million | | $ million | | $ million | | $ million | | $ million | | $ million | |

Defined contribution plans | | 46.8 | | – | | 0.8 | | 47.6 | | – | | – | | – | |

| | | | | | | | | | | | | | | |

Defined benefit plans | | | | | | | | | | | | | | | |

Recognised in profit or loss: | | | | | | | | | | | | | | | |

– Current service cost | | 11.6 | | – | | 0.2 | | 11.8 | | 0.4 | | – | | 0.4 | |

– Past service cost | | 0.2 | | – | | – | | 0.2 | | – | | – | | – | |

– Settlement and curtailments | | (3.8 | ) | – | | (2.4 | ) | (6.2 | ) | – | | – | | – | |

– Interest cost | | – | | 66.1 | | 1.0 | | 67.1 | | – | | 10.2 | | 10.2 | |

– Expected return on plan assets | | – | | (75.0 | ) | (1.2 | ) | (76.2 | ) | – | | – | | – | |

| | 8.0 | | (8.9 | ) | (2.4 | ) | (3.3 | ) | 0.4 | | 10.2 | | 10.6 | |

Recognised in equity: | | | | | | | | | | | | | | | |

– Net actuarial gain | | | | | | | | (89.9 | ) | | | | | (6.0 | ) |

– Effect of the asset ceiling | | | | | | | | 43.8 | | | | | | – | |

| | | | | | | | (46.1 | ) | | | | | (6.0 | ) |

| | | | | | | | (49.4 | ) | | | | | 4.6 | |

The net liability recognised in the Group’s balance sheet in respect of defined benefit plans was as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | |

| | Pensions | | Other benefits | | Total | | | Pensions | | Other benefits | | Total | |

| | $ million | | $ million | | $ million | | | $ million | | $ million | | $ million | |

Present value of the benefit obligation: | | | | | | | | | | | | | | |

– Funded | | 1,071.7 | | – | | 1,071.7 | | | 978.9 | | – | | 978.9 | |

– Unfunded | | 44.3 | | 142.1 | | 186.4 | | | 39.2 | | 147.7 | | 186.9 | |

| | 1,116.0 | | 142.1 | | 1,258.1 | | | 1,018.1 | | 147.7 | | 1,165.8 | |

Fair value of plan assets | | (924.5 | ) | – | | (924.5 | ) | | (862.1 | ) | – | | (862.1 | ) |

| | 191.5 | | 142.1 | | 333.6 | | | 156.0 | | 147.7 | | 303.7 | |

Effect of the asset ceiling | | 8.6 | | – | | 8.6 | | | 24.6 | | – | | 24.6 | |

Net liability | | 200.1 | | 142.1 | | 342.2 | | | 180.6 | | 147.7 | | 328.3 | |

The net liability is presented in the Group’s balance sheet as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | |

| | Pensions | | Other benefits | | Total | | | Pensions | | Other benefits | | Total | |

| | $ million | | $ million | | $ million | | | $ million | | $ million | | $ million | |

Surpluses | | (1.3 | ) | – | | (1.3 | ) | | (5.3 | ) | – | | (5.3 | ) |

Deficits | | 201.4 | | 142.1 | | 343.5 | | | 185.9 | | 147.7 | | 333.6 | |

Net liability | | 200.1 | | 142.1 | | 342.2 | | | 180.6 | | 147.7 | | 328.3 | |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

34. Post-employment benefit obligations (continued)

C. Pensions

The principal assumptions used in the actuarial valuations of the defined benefit pension plans were as follows:

| | | | | | Other | |

| | UK | | US | | countries | |

| | % per annum | | % per annum | | % per annum | |

Valuation as at 2 January 2010 | | | | | | | |

Salary increases | | 4.50% | | 3.36% | | 3.70% | |

Increase to pensions in payment | | 3.50% | | n/a | | n/a | |

Increase to deferred pensions | | 3.50% | | n/a | | n/a | |

Long-term rate of return on plan assets | | 6.31% | | 7.75% | | 6.02% | |

Discount rate | | 5.75% | | 5.75% | | 4.80% | |

Inflation rate | | 3.50% | | n/a | | 1.39% | |

Valuation as at 3 January 2009 | | | | | | | |

Salary increases | | 4.00% | | 5.65% | | 3.28% | |

Increase to pensions in payment | | 3.00% | | n/a | | n/a | |

Increase to deferred pensions | | 3.00% | | n/a | | n/a | |

Long-term rate of return on plan assets | | 6.64% | | 8.00% | | 5.97% | |

Discount rate | | 6.50% | | 5.88% | | 5.95% | |

Inflation rate | | 3.00% | | 0.00% | | 1.34% | |

The current life expectancies underlying the benefit obligations of the Group’s principal pension plans were as follows:

| | | UK | | US | | Other countries | |

As at 2 January 2010 | | | | | | | | |

Current pensioners (at age 65) | – male | | 21.2 years | | 17.7 years | | 19.1 years | |

| – female | | 24.2 years | | 20.3 years | | 21.6 years | |

Future pensioners (at age 65) | – male | | 22.2 years | | 17.7 years | | 19.1 years | |

| – female | | 25.2 years | | 20.3 years | | 21.6 years | |

As at 3 January 2009 | | | | | | | | |

Current pensioners (at age 65) | – male | | 21.2 years | | 17.7 years | | 19.1 years | |

| – female | | 24.2 years | | 20.3 years | | 21.6 years | |

Future pensioners (at age 65) | – male | | 22.2 years | | 17.7 years | | 19.1 years | |

| – female | | 25.2 years | | 20.3 years | | 21.6 years | |

The net liability recognised in the Group’s balance sheet in respect of defined benefit pension plans was as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | |

| | | | | | Other | | | | | | | | | Other | | | |

| | UK | | US | | countries | | Total | | | UK | | US | | countries | | Total | |

| | $ million | | $ million | | $ million | | $ million | | | $ million | | $ million | | $ million | | $ million | |

Present value of benefit obligation: | | | | | | | | | | | | | | | | | | |

– Funded | | 366.7 | | 565.3 | | 139.7 | | 1,071.7 | | | 280.5 | | 586.5 | | 111.9 | | 978.9 | |

– Unfunded | | 0.1 | | 36.6 | | 7.6 | | 44.3 | | | 5.1 | | 32.4 | | 1.7 | | 39.2 | |

| | 366.8 | | 601.9 | | 147.3 | | 1,116.0 | | | 285.6 | | 618.9 | | 113.6 | | 1,018.1 | |

Fair value of plan assets | | (353.7 | ) | (458.1 | ) | (112.7 | ) | (924.5 | ) | | (294.0 | ) | (479.5 | ) | (88.6 | ) | (862.1 | ) |

| | 13.1 | | 143.8 | | 34.6 | | 191.5 | | | (8.4 | ) | 139.4 | | 25.0 | | 156.0 | |

Effect of the asset ceiling | | 8.6 | | – | | – | | 8.6 | | | 24.6 | | – | | – | | 24.6 | |

Net liability | | 21.7 | | 143.8 | | 34.6 | | 200.1 | | | 16.2 | | 139.4 | | 25.0 | | 180.6 | |

|

| 119 |

| Group Financial Statements |

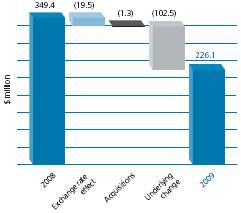

Changes in the present value of the benefit obligation were as follows:

| | Year ended 2 January 2010 | | | Year ended 3 January 2009 | |

| | UK

$ million | | US

$ million | | Other

countries

$ million | | Total

$ million | | | UK

$ million | | US

$ million | | Other

countries

$ million | | Total

$ million | |

At the beginning of the period | | 285.6 | | 618.9 | | 113.6 | | 1,018.1 | | | 433.2 | | 617.8 | | 145.5 | | 1,196.5 | |

Transfer of plans | | (5.0 | ) | 5.0 | | – | | – | | | – | | – | | – | | – | |

Current service cost | | 0.6 | | 2.0 | | 4.1 | | 6.7 | | | 1.1 | | 2.9 | | 4.7 | | 8.7 | |

Past service cost | | – | | – | | 2.7 | | 2.7 | | | – | | – | | – | | – | |

Negative past service cost | | – | | (0.3 | ) | – | | (0.3 | ) | | – | | – | | – | | – | |

Curtailments | | – | | (29.1 | ) | (7.3 | ) | (36.4 | ) | | (0.6 | ) | (2.0 | ) | – | | (2.6 | ) |

Settlements | | – | | (0.3 | ) | – | | (0.3 | ) | | – | | (0.4 | ) | (3.4 | ) | (3.8 | ) |

Interest cost | | 19.5 | | 34.6 | | 6.9 | | 61.0 | | | 23.4 | | 37.3 | | 7.2 | | 67.9 | |

Special termination benefits | | – | | – | | – | | – | | | – | | 0.2 | | – | | 0.2 | |

Net actuarial loss/(gain) | | 54.1 | | 22.6 | | 24.7 | | 101.4 | | | (35.2 | ) | 28.5 | | (16.4 | ) | (23.1 | ) |

| | 354.8 | | 653.4 | | 144.7 | | 1,152.9 | | | 421.9 | | 684.3 | | 137.6 | | 1,243.8 | |

Disposal of subsidiaries | | – | | – | | – | | – | | | – | | (15.9 | ) | – | | (15.9 | ) |

Employees’ contributions | | 0.1 | | – | | 0.2 | | 0.3 | | | 0.2 | | – | | 0.2 | | 0.4 | |

Benefits paid | | (17.2 | ) | (51.5 | ) | (8.2 | ) | (76.9 | ) | | (19.8 | ) | (49.5 | ) | (6.4 | ) | (75.7 | ) |

Foreign currency translation | | 29.1 | | – | | 10.6 | | 39.7 | | | (116.7 | ) | – | | (17.8 | ) | (134.5 | ) |

At the end of the period | | 366.8 | | 601.9 | | 147.3 | | 1,116.0 | | | 285.6 | | 618.9 | | 113.6 | | 1,018.1 | |

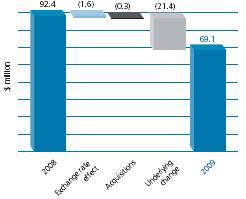

Changes in the fair value of plan assets were as follows:

| | Year ended 2 January 2010 | | | Year ended 3 January 2009 | |

| | UK

$ million | | US

$ million | | Other

countries

$ million | | Total

$ million | | | UK

$ million | | US

$ million | | Other

countries

$ million | | Total

$ million | |

At the beginning of the period | | 294.0 | | 479.5 | | 88.6 | | 862.1 | | | 449.8 | | 558.8 | | 116.4 | | 1,125.0 | |

Expected return on plan assets | | 21.2 | | 35.5 | | 5.9 | | 62.6 | | | 29.3 | | 39.4 | | 6.8 | | 75.5 | |

Settlements | | – | | (0.3 | ) | – | | (0.3 | ) | | – | | (0.4 | ) | (3.4 | ) | (3.8 | ) |

Net actuarial gain/(loss) | | 6.5 | | (31.8 | ) | 6.9 | | (18.4 | ) | | (49.6 | ) | (79.1 | ) | (16.8 | ) | (145.5 | ) |

| | 321.7 | | 482.9 | | 101.4 | | 906.0 | | | 429.5 | | 518.7 | | 103.0 | | 1,051.2 | |

Disposal of subsidiaries | | – | | – | | – | | – | | | – | | (16.2 | ) | – | | (16.2 | ) |

Employer’s contributions | | 18.7 | | 26.7 | | 7.3 | | 52.7 | | | 8.5 | | 26.5 | | 10.4 | | 45.4 | |

Employees’ contributions | | 0.1 | | – | | 0.2 | | 0.3 | | | 0.2 | | – | | 0.2 | | 0.4 | |

Benefits paid | | (17.2 | ) | (51.5 | ) | (8.2 | ) | (76.9 | ) | | (19.8 | ) | (49.5 | ) | (6.4 | ) | (75.7 | ) |

Foreign currency translation | | 30.4 | | – | | 12.0 | | 42.4 | | | (124.4 | ) | – | | (18.6 | ) | (143.0 | ) |

At the end of the period | | 353.7 | | 458.1 | | 112.7 | | 924.5 | | | 294.0 | | 479.5 | | 88.6 | | 862.1 | |

The fair value of plan assets by asset category was as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | |

| | UK

$ million | | US

$ million | | Other

Countries

$ million | | Total

$ million | | | UK

$ million | | US

$ million | | Other

countries

$ million | | Total

$ million | |

Equity instruments | | 166.2 | | 288.7 | | 44.1 | | 499.0 | | | 151.5 | | 268.9 | | 32.8 | | 453.2 | |

Debt instruments | | 187.4 | | 153.0 | | 46.9 | | 387.3 | | | 141.4 | | 184.7 | | 36.9 | | 363.0 | |

Other assets | | 0.1 | | 16.4 | | 21.7 | | 38.2 | | | 1.1 | | 25.9 | | 18.9 | | 45.9 | |

| | 353.7 | | 458.1 | | 112.7 | | 924.5 | | | 294.0 | | 479.5 | | 88.6 | | 862.1 | |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

34. Post-employment benefit obligations (continued)

C. Pensions (continued)

Plan assets do not include any of the Group’s own financial instruments, nor any property occupied by, or other assets used by, the Group.

The return and risk expectations for each asset class incorporate assumptions about historical return relationships, current financial market conditions and the degree of global capital market integration. The assumptions used have been derived from rigorous historical performance analysis combined with forward-looking views of the financial markets as revealed through the yield on long-term bonds and the price earnings ratios of the major stock market indices. The actuaries review analyses of historical risk and the correlation of the return on asset classes and apply subjective judgment based on their knowledge of the Group’s plans. The result of this analysis is incorporated into a risk matrix from which expected long-term risk premiums for each asset class are developed. The nominal return expectations are determined by combining the asset class risk premiums with expected inflation and real risk-free rate assumptions. As a final consideration, the nominal return assumptions are blended with current market conditions to develop long-term equilibrium expectations.

The Group’s investment strategy for pension plan assets includes diversification to minimise interest and market risks. Accordingly, the interest rate risk inherent in the benefit obligation of the Group’s US funded pension plans is hedged using a combination of bonds and interest rate swaps with a combined average duration of 10.1 years. In general, the investment strategy for the Group’s pension plans outside the US does not involve the use of derivative financial instruments.

Plan assets are rebalanced periodically to maintain target asset allocations. Maturities of investments are not necessarily related to the timing of expected future benefit payments, but adequate liquidity to make immediate and medium-term benefit payments is ensured.

The weighted averages of the expected returns on plan assets were as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | | As at 29 December 2007 | |

| | UK | | US | | Other

countries | | | UK | | US | | Other

countries | | UK | | US | | Other

countries | |

Equity instruments | | 7.80% | | 8.70% | | 8.80% | | | 8.00% | | 9.51% | | 9.13% | | 7.95% | | 9.31% | | 9.39% | |

Debt instruments | | 4.92% | | 5.20% | | 5.31% | | | 4.83% | | 6.40% | | 4.87% | | 5.65% | | 6.30% | | 5.11% | |

Other assets | | 4.20% | | 3.30% | | 2.00% | | | 4.30% | | 3.90% | | 1.00% | | 4.85% | | 4.80% | | 1.00% | |

The actual return on plan assets was as follows:

| | Year ended

2 January

2010

Number | | | Year ended

3 January

2009

Number | | Year ended

29 December

2007

Number | |

UK | | 9.4% | | | (4.5)% | | 6.0% | |

US | | 0.8% | | | (7.1)% | | 8.3% | |

Other countries | | 7.1% | | | (8.6)% | | 3.1% | |

Actuarial gains and losses recognised in relation to defined benefit pension plans were as follows:

| | Year ended

2 January

2010

$ million | | | Year ended

3 January

2009

$ million | | Year ended

29 December

2007

$ million | | Year ended

30 December

2006

$ million | | Year ended

31 December

2005

$ million | |

At the end of the period: | | | | | | | | | | | | |

Present value of benefit obligation | | 1,116.0 | | | 1,018.1 | | 1,196.5 | | 1,270.0 | | 1,216.9 | |

Fair value of plan assets | | (924.5 | ) | | (862.1 | ) | (1,125.0 | ) | (1,041.8 | ) | (904.9 | ) |

Deficit in the plans | | 191.5 | | | 156.0 | | 71.5 | | 228.2 | | 312.0 | |

Recognised in the period: | | | | | | | | | | | | |

– Net actuarial (loss)/gain on plan assets | | (18.4 | ) | | (145.5 | ) | (3.0 | ) | 15.1 | | 25.9 | |

– Net actuarial (loss)/gain on benefit obligation | | (101.4 | ) | | 23.1 | | 92.9 | | 25.6 | | (104.7 | ) |

| | (119.8 | ) | | (122.4 | ) | 89.9 | | 40.7 | | (78.8 | ) |

As at 2 January 2010, the cumulative net actuarial loss recognised in other comprehensive income amounted to $213.8 million (3 January 2009: loss of $94.0 million).

The Group expects to contribute approximately $40 million to defined benefit pension plans in 2010.

|

| 121 |

| Group Financial Statements |

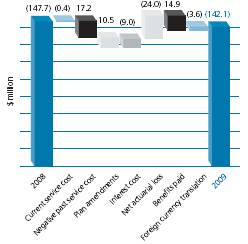

D. Other post-employment benefits

The weighted averages of the principal assumptions used in the actuarial valuations of the other post-employment benefit plans were as follows:

| | As at

2 January

2010

% per annum | | | As at

3 January

2009

% per annum | | As at

29 December

2007

% per annum | |

Discount rate | | 5.63% | | | 6.08% | | 6.28% | |

Medical cost inflation rate | | 12.64% | | | 8.20% | | 7.13% | |

The Group’s other post-employment benefit plans are unfunded. Accordingly, the liability recognised in the Group’s balance sheet in respect of these plans represents the present value of the benefit obligation.

Changes in the present value of the benefit obligation were as follows:

| | Year ended

2 January

2010

$ million | | | Year ended

3 January

2009

$ million | |

At the beginning of the period | | 147.7 | | | 180.8 | |

Current service cost | | 0.4 | | | 0.5 | |

Past service cost | | – | | | 0.6 | |

Negative past service cost | | (17.2 | ) | | – | |

Curtailments | | (10.5 | ) | | – | |

Interest cost | | 9.0 | | | 10.5 | |

Net actuarial loss/(gain) | | 24.0 | | | (23.6 | ) |

| | 153.4 | | | 168.8 | |

Disposal of subsidiaries | | – | | | (2.2 | ) |

Benefits paid | | (14.9 | ) | | (13.0 | ) |

Foreign currency translation | | 3.6 | | | (5.9 | ) |

At the end of the period | | 142.1 | | | 147.7 | |

Actuarial gains and losses recognised in relation to other post-employment benefit plans were as follows:

| | Year ended

2 January

2010

$ million | | | Year ended

3 January

2009

$ million | | Year ended

29 December

2007

$ million | | Year ended

30 December

2006

$ million | | Year ended

31 December

2005

$ million | |

At the end of the period: | | | | | | | | | | | | |

Present value of benefit obligation | | 142.1 | | | 147.7 | | 180.8 | | 189.7 | | 193.5 | |

| | | | | | | | | | | | |

Recognised in the period: | | | | | | | | | | | | |

– Actuarial (loss)/gain on benefit obligation | | (24.0 | ) | | 23.6 | | 6.0 | | (2.7 | ) | 3.1 | |

As at 2 January 2010, the cumulative net actuarial gain recognised in other comprehensive income amounted to $51.7 million (3 January 2009: net gain of $75.7 million).

Sensitivity to change in the assumed medical cost inflation rate used in the actuarial valuations as at 2 January 2010 is as follows:

| | Increase of one

percentage point

$ million | | Decrease of one

percentage point

$ million | |

Effect on the aggregate of the current service cost and the interest cost | | 0.5 | | (0.5 | ) |

Effect on the accumulated benefit obligation | | 9.1 | | (7.7 | ) |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

35. Share-based incentives

A. Background

The Company operates a number of share-based compensation arrangements to provide incentives to the Group’s senior executives and other eligible employees.

Although the Company’s ordinary shares are denominated in US dollars, they are quoted in sterling on the London Stock Exchange.

B. Share options

Options are granted from time to time under the Company’s Sharesave Scheme, which is restricted to employees who are resident for tax purposes in the UK. It offers eligible employees the option to buy ordinary shares in Tomkins plc after a period of three, five or seven years, funded from the proceeds of a savings contract to which employees may contribute up to £250 per month.

Vested options are still outstanding under the Company’s executive share option schemes which lapsed for the purpose of new awards in 2005. The final unvested options under these schemes vested during 2007.

In 2009, the compensation expense recognised in respect of share options was $1.0 million (2008: $0.8 million; 2007: $3.1 million).

Changes in the total number of share options outstanding during the period were as follows:

| | Year ended 2 January 2010 | | | Restated*

Year ended 3 January 2009 |

|

| | Options

Number | | Weighted

average

exercise price

Pence | | | Options

Number | | Weighted

average

exercise price

Pence | |

Outstanding at the beginning of the period | | 18,131,583 | | 238.60 | | | 19,602,926 | | 242.71 | |

Granted during the period | | 2,228,492 | | 96.00 | | | 803,274 | | 140.20 | |

Cancelled during the period | | (634,716 | ) | 157.70 | | | (391,195 | ) | 206.68 | |

Forfeited during the period | | (34,770 | ) | 202.88 | | | (98,587 | ) | 198.79 | |

Exercised during the period | | (45,000 | ) | 170.50 | | | (45,000 | ) | 170.50 | |

Lapsed during the period | | (2,397,288 | ) | 232.61 | | | (1,739,835 | ) | 250.65 | |

Outstanding at the end of the period | | 17,248,301 | | 224.24 | | | 18,131,583 | | 238.60 | |

| | | | | | | | | | |

Exercisable at the end of the period | | 14,544,405 | | 245.19 | | | 16,341,128 | | 244.64 | |

On the date on which options were exercised during 2009, the market price of the Company’s ordinary shares was 178.90p per share (2008: 184.00p per share).

The fair value of options granted under the Sharesave Scheme was measured at their respective grant dates using the Black-Scholes option pricing formula based on the following assumptions:

| | Year ended

2 January

2010 | | | Year ended

3 January

2009 | | Year ended

29 December

2007 | |

Weighted average fair value | | 68.34p | | | 37.99p | | 73.81p | |

Weighted average assumptions: | | | | | | | | |

– Share price | | 161.75p | | | 176.75p | | 264.25p | |

– Exercise price | | 96.00p | | | 140.20p | | 211.40p | |

– Expected volatility | | 33.44% | | | 24.59% | | 25.40% | |

– Expected life | | 4.47 years | | | 4.57 years | | 4.66 years | |

– Risk-free interest rate | | 3.76% | | | 4.55% | | 5.23% | |

– Expected dividends | | 6.25p | | | 13.89p | | 13.89p | |

Expected volatility was determined based on the historical volatility of the market price of the Company’s ordinary shares over the expected life of the options. Adjustments have been made to the expected life used in the model to reflect the effects of non-transferability, exercise restrictions and behavioural considerations.

|

| 123 |

| Group Financial Statements |

The weighted average contractual life of share options outstanding at the end of the period was as follows:

| | As at 2 January 2010 | | | As at 3 January 2009 | | As at 29 December 2007 | |

| | Outstanding

Number | | Weighted

average

remaining

contractual life

Years | | | Outstanding

Number | | Weighted

average

remaining

contractual life

Years | | Outstanding

Number | | Weighted

average

remaining

contractual life

Years | |

Range of exercise prices: | | | | | | | | | | | | | | |

– Less than 100p | | 2,186,005 | | 4.13 | | | – | | – | | – | | – | |

– 100p to 150p | | 287,096 | | 3.21 | | | 723,947 | | 4.23 | | – | | – | |

– 151p to 200p | | 3,242,072 | | 2.06 | | | 3,454,072 | | 2.99 | | 3,519,072 | | 3.94 | |

– 201p to 250p | | 5,909,124 | | 4.08 | | | 7,773,617 | | 4.61 | | 9,244,600 | | 5.39 | |

– 251p to 300p | | 4,608,776 | | 3.31 | | | 5,164,719 | | 4.35 | | 5,821,026 | | 5.01 | |

– 301p and higher | | 1,015,228 | | 2.11 | | | 1,015,228 | | 3.10 | | 1,018,228 | | 4.11 | |

| | 17,248,301 | | | | | 18,131,583 | | | | 19,602,926 | | | |

C. Other awards

The Group’s principal ongoing share-based compensation arrangements are the ABIP and the PSP. Both are restricted to the Group’s senior executives. In 2009, the IBP was introduced as a temporary, one-year substitute for the ABIP.

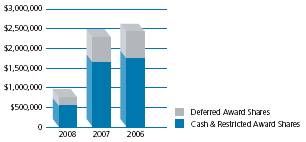

The ABIP provides awards of Restricted Award Shares and Deferred Award Shares based on the ‘bonusable profit’ of the business for which the participants have responsibility. Restricted Award Shares normally vest after a period of three years. Dividends are paid on the Restricted Award Shares. Deferred Award Shares normally vest after a period of three years, conditional on the participant’s continued employment with the Group. Dividends are not paid on the Deferred Award Shares until they have vested. During 2009, awards were granted over 999,108 ordinary shares (2008: 1,789,628 ordinary shares; 2007: 1,727,352 ordinary shares) under the ABIP in relation to bonuses earned in 2008. The IBP differs from the ABIP only in that awards made under the plan are based on the trading cash flow of the business for which the participants have responsibility and on the attainment of strategic achievement milestones that are set for each of the participants. Awards over shares under the IBP are expected to be made in March 2010. In 2009, an accrual of $2.0 million was recognised in respect of the Restricted Award Shares to be awarded under the IBP.

The PSP provides awards of shares which vest after a period of three years, conditional on the Group’s total shareholder return relative to its cost of equity over the vesting period and the participant’s continued employment with the Group. During 2009, awards were granted over 6,864,193 ordinary shares under the PSP (2008: 7,115,194 ordinary shares; 2007: 5,852,671 ordinary shares).

The fair value of awards made under the ABIP is measured based on the market price of the Company’s ordinary shares on the date of the award. Where the awards do not attract dividends during the vesting period, the market price is reduced by the present value of the dividends expected to be paid during the expected life of the awards. The weighted average fair value of awards made under these schemes during the period was 130.46p (2008: 125.66p; 2007: 211.93p).

The fair value of awards made under the PSP was measured at their respective grant dates using a Monte Carlo valuation model based on the following assumptions:

| | Year ended

2 January

2010 | | | Year ended

3 January

2009 | | Year ended

29 December

2007 | |

Weighted average fair value | | 41.92p | | | 43.92p | | 66.45p | |

Weighted average assumptions: | | | | | | | | |

– Expected volatility | | 45.36% | | | 36.41% | | 27.67% | |

– Expected life | | 3.00 years | | | 3.00 years | | 3.00 years | |

– Risk-free interest rate | | 2.00% | | | 4.71% | | 4.88% | |

– Dividend yield | | 4.87% | | | 8.84% | | 5.00% | |

Expected volatility was determined based on the historical volatility of the market price of the Company’s ordinary shares over the expected life of the awards.

In 2009, the compensation expense recognised in respect of other awards was $10.3 million (2008: $11.2 million; 2007: $13.2 million).

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

36. Deferred tax

Movements in the net deferred tax assets and (liabilities) recognised by the Group were as follows:

| | Post-

Employment

benefits

$ million | | Tax

losses

$ million | | Net

investment in

subsidiaries

$ million | | Accrued

expenses

$ million | | Long-lived

assets

$ million | | Inventories

$ million | | Other

items

$ million | | Total

$ million | |

As at 29 December 2007 | | 90.7 | | 9.6 | | (2.8 | ) | 45.4 | | (122.4 | ) | (40.8 | ) | 23.3 | | 3.0 | |

Disposal of subsidiaries | | (0.8 | ) | – | | – | | (1.7 | ) | 5.2 | | 0.8 | | (1.2 | ) | 2.3 | |

(Charge)/credit to profit or loss | | (16.9 | ) | (4.2 | ) | (0.5 | ) | (0.4 | ) | 19.9 | | (4.3 | ) | 5.2 | | (1.2 | ) |

Credited outside profit or loss | | 25.3 | | – | | – | | – | | – | | – | | 5.8 | | 31.1 | |

Currency translation differences | | (0.6 | ) | (0.8 | ) | – | | (1.3 | ) | 1.4 | | 0.2 | | 1.0 | | (0.1 | ) |

As at 3 January 2009 | | 97.7 | | 4.6 | | (3.3 | ) | 42.0 | | (95.9 | ) | (44.1 | ) | 34.1 | | 35.1 | |

Acquisition of subsidiaries | | – | | – | | – | | – | | (6.9 | ) | – | | – | | (6.9 | ) |

(Charge)/credit to profit or loss | | (15.5 | ) | 11.5 | | (2.0 | ) | 0.3 | | 2.5 | | 15.0 | | 1.9 | | 13.7 | |

Credited outside profit or loss | | 14.9 | | – | | – | | – | | – | | – | | 0.7 | | 15.6 | |

Currency translation differences | | 0.1 | | 0.4 | | – | | 0.6 | | (0.8 | ) | 0.1 | | (0.3 | ) | 0.1 | |

As at 2 January 2010 | | 97.2 | | 16.5 | | (5.3 | ) | 42.9 | | (101.1 | ) | (29.0 | ) | 36.4 | | 57.6 | |

Deferred tax assets and liabilities presented in the Group’s balance sheet are as follows:

| | As at

2 January

2010

$ million | | | As at

3 January

2009

$ million | |

Deferred tax assets | | 82.9 | | | 64.8 | |

Deferred tax liabilities | | (25.3 | ) | | (29.7 | ) |

| | 57.6 | | | 35.1 | |

As at 2 January 2010, the Group had operating tax losses amounting to $1,918.6 million, of which $1,654.1 million can be carried forward indefinitely and $264.5 million have expiry dates between 2010 and 2029. As at 2 January 2010, the Group recognised a deferred tax asset of $16.2 million in respect of these losses.

As at 2 January 2010, the Group had capital tax losses amounting to $838.8 million, of which $449.3 million can be carried forward indefinitely, $3.1 million expire in 2012 and $386.4 million expire in 2013. As at 2 January 2010, the Group recognised a deferred tax asset of $0.3 million in respect of these losses.

As at 2 January 2010, the Group had foreign and other tax credits amounting to $35.3 million, of which $10.2 million can be carried forward indefinitely and $25.1 million expire between 2013 and 2027. As at 2 January 2010, the Group recognised a deferred tax asset in respect of these tax credits of $5.2 million.

Deferred tax is not provided on the undistributed earnings of foreign subsidiaries where management has the ability, and intends, to reinvest such amounts indefinitely. As at 2 January 2010, the Group’s share of the undistributed earnings of foreign subsidiaries on which deferred tax was not provided was $3,225.7 million (3 January 2009: $3,180.5 million). A determination of the amount of the unrecognised deferred tax liability has not been made because it is not practical to do so. A portion of these earnings can be distributed without incurring additional taxes.

|

| 125 |

| Group Financial Statements |

37. Provisions

| | Restructuring

costs

$ million | | Environmental

remediation

$ million | | Workers’

compensation

$ million | | Warranty

provisions

$ million | | Product

liability

provisions

$ million | | Insurance

provisions

$ million | | Total

$ million | |

As at 29 December 2007 | | 10.0 | | 9.1 | | 28.9 | | 15.2 | | 7.5 | | 8.2 | | 78.9 | |

Charge/(credit) for the period | | 15.6 | | 2.6 | | 13.6 | | 4.8 | | 8.3 | | (2.2 | ) | 42.7 | |

Utilised during the period | | (9.5 | ) | (4.1 | ) | (16.5 | ) | (8.0 | ) | (8.3 | ) | – | | (46.4 | ) |

Acquisition of subsidiaries | | – | | – | | – | | 0.3 | | – | | – | | 0.3 | |

Disposal of subsidiaries | | – | | – | | (0.4 | ) | – | | (0.1 | ) | – | | (0.5 | ) |

Foreign currency translation | | (0.2 | ) | (0.2 | ) | (0.1 | ) | (0.8 | ) | – | | (1.7 | ) | (3.0 | ) |

As at 3 January 2009 | | 15.9 | | 7.4 | | 25.5 | | 11.5 | | 7.4 | | 4.3 | | 72.0 | |

Charge for the period | | 117.8 | | 4.4 | | 8.9 | | 5.3 | | 15.6 | | – | | 152.0 | |

Utilised during the period | | (58.4 | ) | (5.6 | ) | (11.1 | ) | (4.7 | ) | (11.7 | ) | – | | (91.5 | ) |

Released during the period | | (8.1 | ) | (0.1 | ) | (1.4 | ) | (1.1 | ) | (1.4 | ) | (4.1 | ) | (16.2 | ) |

Foreign currency translation | | 1.7 | | 0.4 | | 0.1 | | 0.3 | | 0.1 | | 0.6 | | 3.2 | |

As at 2 January 2010 | | 68.9 | | 6.5 | | 22.0 | | 11.3 | | 10.0 | | 0.8 | | 119.5 | |

Provisions are presented in the Group’s balance sheet as follows:

| | As at

2 January

2010

$ million | | | As at

3 January

2009

$ million | |

Ongoing businesses: | | | | | | |

– Current liabilities | | 100.3 | | | 48.8 | |

– Non-current liabilities | | 19.2 | | | 23.2 | |

| | 119.5 | | | 72.0 | |

Provisions for restructuring costs principally relate to the restructuring initiatives under projects Eagle and Cheetah and are expected largely to be utilised during 2010.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

38. Share capital and reserves

A. Authorised and issued, fully paid shares

| | Ordinary shares of 9c each | | Ordinary shares of 5p each | | Deferred shares of £1 each | |

| | Authorised

Number

of shares | | Issued

Number of

shares | | Authorised

Number

of shares | | Issued

Number of

shares | | Authorised

Number

of shares | | Issued

Number of

shares | |

As at 30 December 2006 | | – | | – | | 1,585,164,220 | | 858,209,522 | | – | | – | |

Year ended 29 December 2007 | | | | | | | | | | | | | |

Shares issued during the period: | | | | | | | | | | | | | |

– Conversion of preference shares | | – | | – | | – | | 25,411,499 | | – | | – | |

– Exercise of employee share options | | – | | – | | – | | 485,751 | | – | | – | |

| | – | | – | | – | | 25,897,250 | | – | | – | |

As at 29 December 2007 | | – | | – | | 1,585,164,220 | | 884,106,772 | | – | | – | |

| | | | | | | | | | | | | |

Year ended 3 January 2009 | | | | | | | | | | | | | |

Shares issued before redenomination: | | | | | | | | | | | | | |

– Exercise of employee share options | | – | | – | | – | | 45,000 | | – | | – | |

Redenomination: | | | | | | | | | | | | | |

– Cancellation of 5p ordinary shares | | – | | – | | (1,585,164,220 | ) | (884,151,772 | ) | – | | – | |

– Issue of 9c ordinary shares | | 1,585,164,220 | | 884,151,772 | | – | | – | | – | | – | |

– Issue of deferred shares | | – | | – | | – | | – | | 50,000 | | 50,000 | |

As at 3 January 2009 | | 1,585,164,220 | | 884,151,772 | | – | | – | | 50,000 | | 50,000 | |

| | | | | | | | | | | | | |

Year ended 2 January 2010 | | | | | | | | | | | | | |

Shares issued during the period: | | | | | | | | | | | | | |

– Exercise of employee share options | | – | | 45,000 | | – | | – | | – | | – | |

Cancellation of deferred shares | | – | | – | | – | | – | | (50,000 | ) | (50,000 | ) |

As at 2 January 2010 | | 1,585,164,220 | | 884,196,772 | | – | | – | | – | | – | |

B. Ordinary shares

On 22 May 2008, the Company’s ordinary shares were redenominated from sterling to US dollars. The redenomination did not affect the rights of the holders of ordinary shares.

Ordinary shareholders have no entitlement to share in the profits of the Company, except for dividends that have been declared and in the event of the liquidation of the Company.

Ordinary shareholders have the right to attend, and vote at, general meetings of the Company or to appoint a proxy to attend and vote at such meetings on their behalf. Ordinary shareholders have one vote for every share held.

Ordinary share capital represents the nominal value of ordinary shares issued.

C. Deferred shares

When the Company redenominated its ordinary shares from sterling to US dollars, it was required by law to have a minimum share capital of £50,000 denominated in sterling. The deferred shares were issued to meet this requirement, which was removed on the implementation of section 542 of the Companies Act 2006 on 1 October 2009. Accordingly, the Company bought back and cancelled the deferred shares on 16 December 2009 and transferred the nominal amount of the shares to the capital redemption reserve in accordance with the applicable capital maintenance rules.

The deferred shares were not listed on any investment exchange and had extremely limited rights such that they effectively had no value.

D. Share premium account

The share premium account records the difference between the nominal value of shares issued and the fair value of the consideration received. The share premium account is not distributable but may be used for certain purposes specified by UK law, including to write off expenses on any issue of shares or debentures and to pay up fully paid bonus shares. The share premium account may be reduced by special resolution of the Company’s shareholders and with the approval of the court.

E. Capital redemption reserve

The capital redemption reserve records the cost of shares purchased by the Company for cancellation or redeemed in excess of the proceeds of any fresh issue of shares made specifically to fund the purchase or redemption. The capital redemption reserve is not distributable but may be reduced by special resolution of the Company’s shareholders and with the approval of the court.

|

| 127 |

| Group Financial Statements |

39. Own shares

| | Year ended

2 January

2010

Number of shares | | | Year ended

3 January

2009

Number of shares | | Year ended

29 December

2007

Number of shares | |

At the beginning of the period | | 3,658,550 | | | 4,205,841 | | 4,205,248 | |

Own shares purchased | | 636,762 | | | 1,506,518 | | 1,597,500 | |

Transfer of own shares | | (1,752,118 | ) | | (2,053,809 | ) | (1,596,907 | ) |

At the end of the period | | 2,543,194 | | | 3,658,550 | | 4,205,841 | |

Own shares represent the cost of the Company’s ordinary shares acquired to meet the Group’s expected obligations under employee share schemes. Dividends relating to own shares held have been waived with the exception of those that are payable to participants in the relevant schemes.

As at 2 January 2010, 904,632 ordinary shares (3 January 2009: 1,143,076 ordinary shares) were held in trust and 1,638,562 ordinary shares (3 January 2009: 2,515,474 ordinary shares) were held as treasury shares.

As at 2 January 2010, the market value of own shares held was $7.9 million (3 January 2009: $7.1 million).

40. Capital

Management considers that the Group’s capital comprises shareholders’ equity plus net debt.

The Group’s capital was as follows:

| | As at

2 January

2010

$ million | | | As at

3 January

2009

$ million | | As at

29 December

2007

$ million | |

Shareholders’ equity | | 1,536.6 | | | 1,610.8 | | 2,137.8 | |

Net debt: | | | | | | | | |

– Cash and cash equivalents | | (445.0 | ) | | (291.9 | ) | (295.9 | ) |

– Collateralised cash | | (2.1 | ) | | (3.8 | ) | (5.8 | ) |

– Bank overdrafts | | 4.8 | | | 13.7 | | 15.7 | |

– Bank and other loans | | 698.5 | | | 792.4 | | 860.3 | |

– Obligations under finance leases | | 4.6 | | | 6.9 | | 9.6 | |

– Derivatives hedging translational exposures | | (53.3 | ) | | (40.9 | ) | 7.6 | |

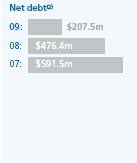

| | 207.5 | | | 476.4 | | 591.5 | |

| | 1,744.1 | | | 2,087.2 | | 2,729.3 | |

We manage the Group’s capital structure to maximise shareholder value whilst retaining flexibility to take advantage of opportunities that arise to grow the Group’s business.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

41. Acquisitions

A. Current year acquisitions

Industrial & Automotive

Fluid Power

On 7 July 2009, the Group acquired a 100% interest in Hydrolink, a fluid engineering services provider to the oil and gas and marine sectors in the Middle East. Provisional goodwill of $16.5 million was recognised on the acquisition, which represents the expected benefits to the Group from accelerating the market penetration of its products in this high-growth region. Goodwill is provisional pending the finalisation of the fair valuation of acquired intangible assets.

Building Products

Air Distribution

On 7 July 2009, the Group acquired the remaining 40% minority interest in Rolastar Pvt Ltd, a duct manufacturer based in India. Goodwill of $4.6 million was recognised on the acquisition of the minority interest. Overall, the Group recognised goodwill of $8.5 million on the acquisition of its 100% interest in the business, which represents the expected benefits from the expansion of its air distribution business in India.

B. Prior year acquisitions

2008

Industrial & Automotive

Fluid Power

On 3 March 2008, the Group acquired a 100% interest in A.E. Hydraulic (Pte) Ltd., a Singapore-based provider of hydraulic and industrial hose solutions and services for the oil exploration industry in Asia. Goodwill of $8.1 million was recognised on the acquisition which represents the expected benefits to the Group from the acceleration of its expansion into the high-growth oil and gas exploration market made possible by the acquisition.

Building Products

Air Distribution

On 22 February 2008, the Group acquired a 60% interest in Rolastar Pvt Ltd, a duct manufacturer based in India. Goodwill of $0.9 million was recognised on the acquisition.