SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 29, 2007

COMMISSION FILE NUMBER: 0-17140

Tomkins plc

(Exact name of Registrant as specified in its charter)

England

(Jurisdiction of incorporation or organization)

East Putney House, 84 Upper Richmond Road

London SW15 2ST, United Kingdom

(Address of principal executive offices)

Contact details of Company Contact Person:

| | |

| Name | | John Zimmerman |

| E-mail | | jzimmerman@tomkins.co.uk |

| Telephone | | +44 (0) 208 877 5155 |

| Address | | Tomkins plc East Putney House 84 Upper Richmond Road London SW15 2ST United Kingdom |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Ordinary Shares, nominal value 5p per share | | New York Stock Exchange * |

| |

American Depositary Shares (each of which represents four Ordinary Shares) | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act

None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| | |

Ordinary Shares, nominal value 5p per share | | 884,106,772 |

| * | Not for trading, but only in connection with the registration of American Depositary Shares representing such Ordinary Shares |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by a check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

| US GAAP | | ¨ |

| International Financial Reporting Standards as issued by the International Accounting Standards Board | | x |

| Other | | ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

1

In this annual report (the “Annual Report”) on Form 20-F for the fiscal year ended December 29, 2007 (“fiscal 2007”), all references to “Tomkins”, the “Tomkins Group”, the “Group”, the “Company”, “we”, “us” and “our” include Tomkins plc and its consolidated subsidiaries, unless the context otherwise requires.

The consolidated financial statements of Tomkins plc appearing in this Annual Report are presented in pounds sterling (“£”) and are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

In this Annual Report, references to “US dollars”, “$” and “cents” are to United States currency, references to “pounds sterling”, “£”, “pence” and “p” are to British currency, references to “Canadian dollars” are to Canadian currency, and “Euros” are to the currency of certain member states of the European Union.

Certain terms and acronyms used in this document are defined in the glossary on page 84.

Special Note Regarding Forward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including assumptions, anticipations, expectations and forecasts concerning the Company’s future business plans, products, services, financial results, performance, future events and information relevant to our business, industries and operating environments. When used in this document, the words “anticipate”, “believe”, “estimate”, “assume”, “could”, “should”, “expect” and similar expressions, as they relate to the Company or its management, are intended to identify forward-looking statements. Such statements reflect the current views of management with respect to future events and are subject to certain risks, uncertainties and assumptions. The forward-looking statements contained herein represent a good-faith assessment of our future performance for which we believe there is a reasonable basis. Many factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, adverse changes or uncertainties in general economic conditions in the markets we serve, regulatory developments adverse to us or difficulties we may face in maintaining necessary licenses or other governmental approvals, changes in the competitive position or introduction of new competitors or new competitive products, lack of acceptance of new products or services by the Company’s targeted customers, changes in business strategy, any management level or large-scale employee turnover, any major disruption in production at our key facilities, adverse changes in foreign exchange rates, and acts of terrorism or war, and other risks described in Item 3D “Key Information – Risk factors”. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated or expected.

These forward-looking statements represent our view only as of the date they are made, and we disclaim any obligation to update forward-looking statements contained herein, except as may be otherwise required by law.

2

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

3

Item 3. Key Information

A. Selected financial data

The selected financial data set out below as at and for fiscal 2007, fiscal 2006, fiscal 2005 and fiscal 2004 has been derived from the Group’s audited consolidated financial statements prepared in accordance with IFRS. The selected financial data set forth below should be read in conjunction with, and is qualified in its entirety by reference to, such consolidated financial statements and notes thereto and Item 5 “Operating and Financial Review and Prospects”.

The Group adopted IFRS with a transition date of January 4, 2004. Accordingly the Group’s consolidated balance sheet as at January 3, 2004 and January 1, 2005 and its consolidated income statement and consolidated cash flow statement for fiscal 2003 that were originally reported in accordance with UK GAAP were restated in accordance with IFRS. However, the Group was not required to restate its consolidated financial statements for periods ended before January 4, 2004 in accordance with IFRS and is therefore unable to provide in the tables below selected financial data for fiscal 2003 prepared in accordance with IFRS.

Consolidated income statement data

| | | | | | | | | | | | |

| | | Fiscal 2007

(364 days) | | | Fiscal 2006(1)

(364 days) | | | Fiscal 2005(1)

(364 days) | | | Fiscal 2004(1)

(364 days) | |

| | | £ million | | | £ million | | | £ million | | | £ million | |

Sales | | 2,941.9 | | | 3,133.8 | | | 2,963.3 | | | 2,736.6 | |

Operating profit | | 293.0 | | | 283.2 | | | 305.6 | | | 283.1 | |

Profit for the period from continuing operations | | 192.7 | | | 208.9 | | | 206.6 | | | 206.6 | |

(Loss)/profit for the period from discontinued operations | | (33.3 | ) | | (11.6 | ) | | (5.4 | ) | | 3.5 | |

| | | | | | | | | | | | |

Total profit for the period from operations | | 159.4 | | | 197.3 | | | 201.2 | | | 210.1 | |

| | | | | | | | | | | | |

Profit for the period attributable to equity shareholders | | 146.9 | | | 186.1 | | | 192.2 | | | 184.4 | |

| | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | |

Basic | | | | | | | | | | | | |

Continuing operations | | 20.71 | p | | 23.57 | p | | 25.62 | p | | 25.5 | 0 p |

Discontinued operations | | (3.83 | )p | | (1.39 | )p | | (0.70 | )p | | 0.45 | p |

| | | | | | | | | | | | |

Total operations | | 16.88 | p | | 22.18 | p | | 24.92 | p | | 25.95 | p |

| | | | | | | | | | | | |

Diluted | | | | | | | | | | | | |

Continuing operations | | 20.45 | p | | 22.98 | p | | 24.41 | p | | 24.19 | p |

Discontinued operations | | (3.77 | )p | | (1.31 | )p | | (0.62 | )p | | 0.40 | p |

| | | | | | | | | | | | |

Total operations | | 16.68 p | | | 21.67 | p | | 23.79 | p | | 24.59 | p |

| | | | | | | | | | | | |

Earnings per ADS(2) | | | | | | | | | | | | |

Basic | | 67.52 | p | | 88.72 | p | | 99.68 | p | | 103.80 | p |

Diluted | | 66.72 | p | | 86.68 | p | | 95.16 | p | | 98.36 | p |

| | | | | | | | | | | | |

Average number of Ordinary Shares outstanding (‘000s) | | | | | | | | | | | | |

Basic | | 870,298 | | | 838,894 | | | 771,417 | | | 770,717 | |

Diluted | | 884,031 | | | 883,826 | | | 876,385 | | | 876,817 | |

| | | | | | | | | | | | |

(1) | These fiscal years have been re-presented for the reclassification of Tridon from discontinued operations to continuing operations. Refer to “Discontinued operations” below. |

(2) | Earnings per ADS represents earnings per Ordinary Share multiplied by four, as discussed in Item 9C “Markets.” |

Consolidated balance sheet data

| | | | | | | | |

| | | As at |

| | | December 29,

2007 | | December

30, 2006 | | December

31, 2005 | | January 1,

2005 |

| | | £ million | | £ million | | £ million | | £ million |

| | | | | | | | |

Total assets | | 2,244.4 | | 2,332.8 | | 2,578.3 | | 2,212.6 |

Net assets | | 1,131.4 | | 954.5 | | 712.9 | | 845.3 |

Ordinary share capital | | 44.2 | | 42.9 | | 38.7 | | 38.7 |

Share premium account | | 397.3 | | 332.1 | | 95.8 | | 94.0 |

Shareholders’ equity | | 1,072.7 | | 903.9 | | 664.5 | | 466.5 |

4

Discontinued operations

During fiscal 2006, the Group classified Trico as a discontinued operation. The sale of Trico was completed on June 29, 2007.

Management intended that Tridon, a manufacturer of automotive indicator lights, would be included within the Trico sale and it was therefore included within discontinued operations in fiscal 2006. However, Tridon has been retained by the Group and no longer meets the conditions to be classified as held for sale. Accordingly, the Group’s consolidated income statements for fiscal 2006, fiscal 2005 and fiscal 2004 have been re-presented to reflect the re-classification of Tridon to continuing operations in fiscal 2007. During fiscal 2006, Tridon’s revenue was £9.2 million (fiscal 2005: £14.9 million; fiscal 2004: £16.1 million) and it incurred an operating loss of £0.1 million (fiscal 2005: operating profit of £3.6 million; fiscal 2004: operating profit of £4.0 million).

Acquisitions and disposals

Acquisitions and disposals during the three most recent fiscal years are detailed in “Principal acquisitions, disposals, and capital expenditures” under Item 4A “History and development of the Company”.

Foreign exchange rates

The Noon Buying Rate between the US dollar and pound sterling on the Convenience Date was $1.9965 per one pound sterling. The table below sets out the high and low Noon Buying Rate for pound sterling for each month during the previous six months:

| | | | | | | | | | | | | | | | | | |

£1 = | | March

2008 | | February

2008 | | January

2008 | | December

2007 | | November

2007 | | October

2007 |

High | | $ | 2.0311 | | $ | 1.9923 | | $ | 1.9895 | | $ | 2.0658 | | $ | 2.1104 | | $ | 2.0777 |

Low | | $ | 1.9823 | | $ | 1.9405 | | $ | 1.9515 | | $ | 1.9774 | | $ | 2.0478 | | $ | 2.0279 |

The annual average US dollar/pound sterling exchange rates for each fiscal period for which selected financial data has been presented above, are set out in the table below. The rates have been calculated as the average of the month-end Noon Buying Rates for each month during each respective fiscal year.

| | | | | | | | | | | | | | | |

£1 = | | Fiscal

2007 | | Fiscal

2006 | | Fiscal

2005 | | Fiscal

2004 | | Fiscal

2003 |

Annual average | | $ | 2.0080 | | $ | 1.8582 | | $ | 1.8147 | | $ | 1.8356 | | $ | 1.6455 |

Dividends

The Company has paid cash dividends on its Ordinary Shares in respect of every fiscal year since being first listed on the LSE in 1950.

Dividends are paid to shareholders as of record dates that are fixed after consultation between the Company and the LSE. For fiscal 2007, an interim dividend was declared by the Board in August 2007 and was paid in November 2007. A final dividend was recommended by the Board following the end of fiscal 2007 and will, subject to approval by the shareholders at the Company’s annual general meeting on May 1, 2008, be paid on May 15, 2008 to shareholders on the register on April 18, 2008.

The table below sets forth the amounts of interim, final and total dividends paid in respect of each fiscal year indicated.

| | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal year ended | | Pence per Ordinary

Share | | Pence per ADS | | Cents per Ordinary

Share(1) | | Cents per ADS(1) |

| | Interim | | Final | | Total | | Interim | | Final | | Total | | Interim | | Final | | Total | | Interim | | Final | | Total |

January 3, 2004 | | 4.60 | | 7.40 | | 12.00 | | 18.40 | | 29.60 | | 48.00 | | 7.70 | | 13.12 | | 20.82 | | 30.80 | | 52.49 | | 83.29 |

January 1, 2005 | | 4.83 | | 7.77 | | 12.60 | | 19.32 | | 31.08 | | 50.40 | | 8.96 | | 14.15 | | 23.11 | | 35.84 | | 56.60 | | 92.44 |

December 31, 2005 | | 5.07 | | 8.16 | | 13.23 | | 20.28 | | 32.64 | | 52.92 | | 8.80 | | 15.29 | | 24.09 | | 35.20 | | 61.16 | | 96.36 |

December 30, 2006 | | 5.32 | | 8.57 | | 13.89 | | 21.28 | | 34.28 | | 55.56 | | 10.14 | | 17.11 | | 27.25 | | 40.56 | | 68.44 | | 109.00 |

December 29, 2007 | | 5.32 | | 8.57 | | 13.89 | | 21.28 | | 34.28 | | 55.56 | | 10.90 | | 17.11 | | 28.01 | | 43.60 | | 68.44 | | 112.04 |

(1) | Translated from pounds sterling into US dollars at the Noon Buying Rate on the date the dividend was paid (or, if not yet paid, translated at the Noon Buying Rate on the Convenience Date). |

The Company expects to continue to pay dividends in the future. The total amounts of future dividends will be determined by the Board and will depend on the Company’s results of operations, cash flow, financial and economic conditions and other factors. Management expects dividend payments to follow the same pattern in future years and anticipates the weighting of these payments to be approximately 40 percent for the interim dividend and 60 percent for the final dividend. Cash dividends are currently paid by the Company in pounds sterling, and fluctuations in the exchange rate between pounds sterling and US dollars will affect the US dollar amounts received by holders of ADRs upon conversion by the Depositary of such dividends. Moreover, fluctuations in the exchange rates between the pound sterling and the US dollar will affect the US dollar equivalents of the pound sterling price of the Ordinary Shares on the LSE and, as a result, are likely to affect the market prices of the ADSs which are quoted in US dollars.

Subject to the consent of the High Court of Justice in England and Wales, the Company’s Ordinary Shares will be re-denominated in US dollars and future dividends will be declared and paid in US dollars although, unless they elect otherwise, UK shareholders would continue to receive dividends in pounds sterling. It is expected that re-denomination will take place before declaration of the interim dividend for fiscal 2008 in August 2008. The Company’s Ordinary Shares will remain listed on the LSE, where they will continue to be quoted in pounds sterling. The Company will remain listed on the NYSE, where its ADRs will continue to be quoted in US dollars. The Company will continue to have its headquarters in the United Kingdom.

5

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

The Group operates globally in varied markets and is affected by a number of risks inherent in its activities, not all of which are within its control. This section highlights specific areas where we are particularly sensitive to business risk. Our financial condition or results of operations could be materially adversely affected by any of these risks. Additional risks not currently known to us, or risks that we currently regard as immaterial, could also have a material adverse effect on our financial condition and/or the results of operations.

The Group has categorized its risks as those relating to:

| • | | the markets within which the Group operates; |

| • | | the competitive position of the Group and its businesses; and |

| • | | the financial position of the Group. |

The principal risks and uncertainties faced by the Group are set out below.

1. Risks relating to the markets within which the Group operates

There are a number of risks in the markets in which the Group operates which could have a material adverse effect on the Group’s business, financial condition or results of operations:

(a) Cyclical nature of markets

Operating in global markets subjects the Group to risks associated with changes in global economic conditions. The current economic malaise driven by the state of US credit markets may spread globally, dampen demand, increase price pressure, reduce margins and accelerate customer consolidation. These pricing pressures and declining demand risks are particularly acute in our housing, commercial construction and automotive markets, where demand is ultimately affected by consumer spending and consumer preferences. Trends in these markets can be difficult to predict. In fiscal 2007, approximately 21 percent of the Group’s sales were to the automotive OE market. Because the production volumes of automotive OEMs depend on general economic conditions and consumer spending levels, automotive production and sales can be highly cyclical. The volume of automotive production in the United States, the Group’s principal geographic segment, has fluctuated, sometimes significantly, from year to year, and such fluctuations give rise to fluctuations in the demand for the Group’s products.

In fiscal 2007, 22.1 percent of the Group’s sales were to the residential and non-residential construction markets in North America, predominantly the United States. The construction industry in the United States was depressed throughout 2007 and is expected to continue facing challenges in 2008 with the NAHB forecasting that housing starts in 2008 will be down approximately 20 percent in the United States from their 2007 level of 1.4 million. The timing of a recovery in the US residential housing market now seems unlikely to occur until 2009, with this end-market showing greater weakness in the first quarter than commentators had predicted.

(b) Loss of market share by US vehicle manufacturers

In recent years, the Detroit Three have seen a decline in their market share for vehicle sales, particularly in North America, with Asian automobile manufacturers increasing their market share. The automotive industry is characterized by overcapacity and fierce competition. In North America it is also affected by significant pension and healthcare liabilities. In fiscal 2007, the Group derived 10 percent of its worldwide sales from the Detroit Three and therefore if this trend of market share loss by the North American manufacturers continues and the Group’s share of business with other vehicle manufacturers does not increase, it may result in lost market share, lower sales and/or lower profitability.

(c) Improvement in vehicle component life

The greater quality, performance and reliability of the components that the Group manufactures improves service life which could reduce demand for the products the Group sells through the aftermarket business segment.

(d) Regulatory environment

The Group is subject to a variety of environmental regulations in the industries in which it operates, particularly relating to waste water discharges, air emissions, solid waste management and hazardous chemical disposal. The Group may not at all times be in complete compliance with all of these regulations, and it may incur material costs to comply with, or liabilities in connection with, these regulations.

(e) Operations in foreign and emerging markets

The Group operates in a number of geographic regions of the world, including emerging markets, and approximately 41 percent of its sales originate outside the United States. Operations in foreign and emerging markets may subject the Group to the risks inherent in operating in such markets, such as economic and political instability, other disruption of markets, restrictive laws and actions of certain governments, difficulty in obtaining distribution and logistical resources, potential adverse tax consequences and inability to effectively protect intellectual property rights. If we are unable to manage successfully the risks inherent in our international activities, our business, financial condition and results of operations could be materially and adversely affected.

6

2. Risks relating to the competitive position of the Group and its businesses

There are a number of risks to the Group’s competitive position that could have a material adverse effect on its business, financial condition or results of operations.

(a) Industry consolidation may result in more powerful competitors and fewer customers

Some of the Group’s customers and some of its competitors in a number of markets, particularly in the automotive aftermarket, and to a lesser extent in the markets of the Air Systems Components segment, are consolidating to achieve greater scale or market share. Such changes could affect the negotiating leverage of the Group’s customers and their relationship with the Group. As the Group’s customers become larger and more concentrated, they could exert pricing pressure on all suppliers, including the Group, which may materially and adversely affect the Group’s margins.

(b) Significance of revenues generated from the Detroit Three

Approximately 10 percent of the Industrial & Automotive business group’s sales in fiscal 2007 came from direct sales to the Detroit Three. These customers have strong purchasing power as a result of high market concentration and the Group’s reliance on them subjects it to potential pressures on its sale prices that may reduce the Group’s profitability.

(c) Price reductions by customers

It is normal practice for customers to seek reductions in their costs from their suppliers over the duration of any committed supply arrangement. To meet such requests for price reductions whilst maintaining profit margins, the Company has had to achieve corresponding cost savings in the business by strategic sourcing of raw materials and by improving production and manufacturing efficiencies. The Group may be unable to achieve such cost reductions in the future, which could result in lower margins or the loss of customers.

(d) Increased competition from low-cost producers

The Group increasingly faces competition from low-cost sources in the developing economies of the world, which may lead to loss of market share and/or reduced margins.

(e) Increasing raw material and energy costs

Steel, aluminum, oil based resins and energy are a significant part of the Group’s costs. If costs of these raw materials and energy increase, the Group may be unable to sustain margins if it is unable to pass such increases on to its customers. Fiscal 2007 saw no softening of the challenging cost environment for raw materials that has existed for the past three years.

(f) Reliance on certain raw materials and suppliers of key components

The Group’s businesses compete globally for certain raw materials, energy and other key components. Disruptions due to the lack of availability of raw material and energy supplies, particularly as a result of rising demand from rapidly-developing economies, may adversely affect our ability to service our customers and may erode our margins.

(g) Dependence on strong relationships with manufacturers’ representatives, distributors and wholesalers

A significant portion of our sales, particularly in the Power Transmission segment and Building Products business group, is made through manufacturers’ representatives, distributors and wholesalers. A deterioration in the relationships with manufacturers’ representatives, distributors and wholesalers or a change in the Group’s products’ distribution channels could materially and adversely affect the Group’s sales.

(h) Inherent supply chain risks

The Group operates in highly competitive markets and the failure to deliver products within acceptable timeframes could have an adverse effect on the business. Customer driven reductions in lead times, carrier consolidation, reduced capacity from driver shortages, fuel availability/cost and longer supply chains concomitant with sourcing from low-cost countries may all impact service levels resulting in loss of customers or missed opportunities. Additionally, short lead time horizons in many of our businesses exposed to the US consumer can impair forecasting accuracy. This may result in the inability to predict abrupt changes in our US driven end markets.

(i) Product liability claims due to the nature of the Group’s products

The nature of the Group’s products means that we face an inherent risk of product liability claims, including claims for injury, property damage or consequential loss. Fewer suppliers due to vendor consolidation and a less qualified offshore supplier base increase the likelihood of receiving defective components for our products, increasing the risk of product failure and resultant liability claims.

(j) Technological changes

The markets for the Group’s products and services are characterized by evolving industry standards and changing technology which may lead to commoditization of its products, allowing for low switching costs and increased pricing pressures, which could result in loss of customers and reduced margins. Continual development of advanced technologies for new products and product enhancements is an important way in which the Group maintains acceptable pricing levels. If the Group’s core products are displaced or made obsolete, the Group may lose customers, which would have an adverse effect on its results of operations.

(k) Dependence on investment and divestment decisions

The Group is involved in activities and plans relating to restructuring, rationalization, investments and acquisitions. These represent important steps in the expansion of our businesses into attractive markets and improvement in their competitive position. If the Group were to make inappropriate investment and divestment decisions or fail to implement major projects, such as systems development, product development or plant closures, there may be destruction of value, returns below expectations and/or business interruption.

7

(l) Dependence on human resources strategy

If the Group is unable to timely identify, attract and retain excellent non-management, management and executive talent, it may not be able to effectively implement its business strategy, or it may experience delays in the development of, or face difficulty in selling, its products and services.

(m) Dependence on the continued operation of the Group’s manufacturing facilities

While the Group is not heavily dependent on any single manufacturing facility, major disruptions at a number of the Group’s manufacturing facilities, due to labor unrest, natural disasters or mechanical failure of the Group’s facilities, could result in significant interruption of the Group’s business and potential loss of customers and sales.

(n) Capacity, reliability and security of the Group’s computer hardware, software and telecommunications infrastructure

The Group currently secures its networks by means of back up, hardware, virus protection and other measures, but any systems interruption could lead to a reduction in performance or loss of services. The Group’s systems are vulnerable to damage or interruption caused by human error, network failure, natural disasters, sabotage, computer viruses and similar disruptive events. A breach of network security could result in a loss of customers and reduced revenues.

(o) Intellectual property rights

The Group’s proprietary technology is protected by patents and trade secrets which could be at risk if:

| | • | | competitors are able to develop similar technology independently; |

| | • | | patent applications are not approved; |

| | • | | steps taken to prevent misappropriation or infringement of intellectual property are not successful; or |

| | • | | the Group does not adequately protect its intellectual property. |

(p) Work stoppages or other labor issues at our facilities or at our customers’ facilities

Some of the Group’s employees are members of labor unions. While the Group considers its relations with its employees and labor unions to be good, if the Group is unable to maintain these relations, there may be disputes and work stoppages that could affect production of the Group’s products. Some of the Group’s customers, particularly in the automotive industry, have highly unionized workforces and have been involved in major disputes in the past. If any of our customers experiences a work stoppage, that customer may halt or limit the purchase of the Group’s products which could, in turn, force the Group to shut down its own production facilities supplying these products.

3. Financial Risks

Certain financial risks could have a material adverse effect on the Group’s business, financial condition or results of operations.

(a) Pension plans

The Group operates defined benefit pension plans, the majority of which are in the United States and the United Kingdom. The defined benefit schemes were in deficit by £60.7 million as at December 29, 2007. Deterioration in the market value of the assets held by these plans or a reduction in long-term interest rates could lead to an increase in the deficit or give rise to an additional funding requirement.

(b) Health care and workers’ compensation

Healthcare and workers’ compensation are provided by certain subsidiaries to current and former employees in the United States. Healthcare costs in the United States are increasing at a faster rate than general cost inflation and these cost increases have to be absorbed by the business. In fiscal 2007, the medical cost inflation rate relating to the Group’s plans was 7.1 percent.

(c) The Group is subject to multiple tax jurisdictions

The Group operates within multiple tax jurisdictions and is subject to audit in those jurisdictions. These audits can involve complex issues, which may require an extended period of time for resolution. Although provision has been made for such issues, the ultimate resolution may result in additional tax charges and cash outflows.

(d) Funding growth

The Group may require capital to expand its business, implement its strategic initiatives and remain competitive. At present, the Group’s established sources of funding are through equity, corporate bond markets (through the EMTN Program), bank debt and cash flow from operations. Management believes that the sources of funding currently available will be sufficient to fund the Group’s operations. If management’s plans or assumptions regarding the funding requirements change, the Group may need to seek other sources of financing, such as additional lines of credit with commercial banks or vendors or public financing, or to renegotiate existing bank facilities. It is possible that additional funding may not be available on commercially acceptable terms or at all.

(e) Bondholders’ rights

The Group has an EMTN Program under which it has £400 million in principal bonds outstanding and it may issue bonds in the future. The Group’s bondholders have the right to require the Group to redeem its outstanding bonds, at par, in the event of a change of control of the Company and also in the event that the Group’s credit rating falls below investment grade as a result of the Group making either acquisitions or disposals that comprise more than 25 percent of the Group’s operating profit in a twelve calendar month period. The Group may not have sufficient funds to repurchase such notes as required.

8

(f) Fluctuations in currency exchange rates

The Group has manufacturing facilities in, and sells products to customers in, many countries worldwide. The principal currencies in which the Group trades are US dollars, Canadian dollars, Euros and pounds sterling. Currency exchange movements can give rise to the following risks:

| | • | | Transaction risk:arises where sales or purchases are denominated in foreign currencies and exchange rates can change between entering into a purchase or sale commitment and completing the transaction; |

| | • | | Translation risk:arises where the currency in which the results of an entity are reported differs from the underlying currency in which business is transacted; and |

| | • | | Economic risk:arises where the manufacturing cost base of a business is denominated in a currency different from the currency of the market into which the products are sold. |

4. Risks related to the securities market and ownership of ADSs

Holders of ADSs may be restricted in their ability to exercise voting rights

Holders of ADSs will generally have the right under the deposit agreement to instruct the Depositary for the ADSs to exercise their voting rights for the registered shares represented by ADSs. At management’s request, the Depositary will mail to holders of ADSs any notice of any shareholders’ meeting received from the Company together with information explaining how to instruct the Depositary to exercise the voting rights of the securities represented by ADSs. If the Depositary receives voting instructions for a holder of ADSs on a timely basis, it is obligated to endeavor to vote the securities representing the holder’s ADSs in accordance with those voting instructions. The ability of the Depositary to carry out voting instructions, however, may be limited by practical limitations, such as time zone differences and delays in mailing.

ADS holders may be unable to participate in rights offerings and similar transactions in the future

US securities laws may restrict the ability of US persons who hold ADSs to participate in certain rights offerings or share or warrant dividend alternatives which the Company may undertake in the future in the event that the Company does not register such offerings under the US securities laws and is unable to rely on an exemption from registration under these laws. If the Company issues any securities of this nature in the future, it may issue such securities to the Depositary, which may sell those securities for the benefit of the holders of the ADSs. However, the Depositary is not obligated to do so. Management cannot offer any assurance as to the value, if any, the Depositary would receive upon the sale of those securities or if it would sell the securities at all.

9

Item 4. Information on the Company

A. History and development of the Company

General

The Company was incorporated in England in 1925, converted from a private company into a public company in March 1950 and re-registered as a public limited company in February 1982. The Company’s Ordinary Shares are listed on the LSE and have been listed on the NYSE in the form of ADSs evidenced by ADRs since February 1995. Prior to listing on the NYSE, the ADSs had been quoted on the Nasdaq National Market since November 1988. The Company is registered in England and Wales No. 203531 and operates under English law. The Company’s registered office is East Putney House, 84 Upper Richmond Road, London SW15 2ST, United Kingdom (Telephone: +44 (0) 20 8871 4544) and its website is www.tomkins.co.uk.

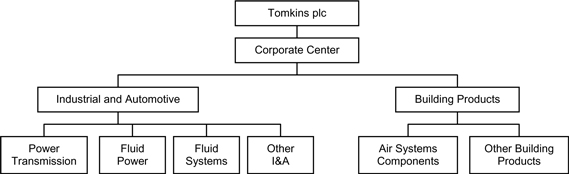

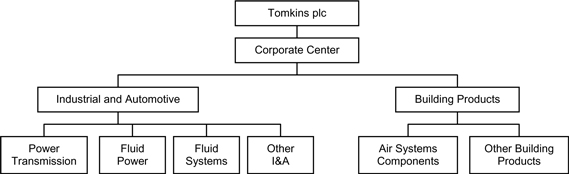

The Company is the ultimate parent of a large number of subsidiaries that are organized in two business groups:

| • | | Industrial & Automotive |

Industrial & Automotive manufactures a wide range of systems and components for car, truck and industrial equipment manufacturing markets, and industrial and automotive aftermarkets throughout the world. During fiscal 2007, Industrial & Automotive operated through five business segments: Power Transmission, Fluid Power, Wiper Systems, Fluid Systems and Other Industrial & Automotive. Trico, which constituted the Wiper Systems business segment, was classified as a discontinued operation during fiscal 2006 and was sold on June 29, 2007.

Building Products is comprised of two business segments: Air Systems Components and Other Building Products. Air Systems Components supplies the industrial and residential HVAC market mainly in North America. Other Building Products manufactures a variety of products for the building and construction industries mainly in North America.

The Group is geographically diverse, operating 142 manufacturing facilities and 55 distribution centers in 24 different countries across the Americas, Europe, Asia, and Australia.

The Industrial & Automotive business group operates in all 24 countries in which the Group operates, while the Building Products business group is located in the United States, Canada, Mexico, the United Kingdom, India and Thailand. Overall, 63 percent of sales in fiscal 2007 was derived from the United States, 16 percent from Europe, and 21 percent from the rest of the world.

Group sales in fiscal 2007 were to the following end markets:

| | | |

| | | Percentage of

total sales | |

Automotive OE | | 20.4 | % |

Automotive aftermarket | | 20.0 | % |

Industrial OE | | 17.4 | % |

Industrial aftermarket | | 13.1 | % |

Residential construction | | 10.5 | % |

Non-residential construction | | 14.2 | % |

Other markets | | 4.4 | % |

History

The Company was founded in 1925 as F.H. Tomkins Buckle Company Limited, a small British manufacturer of buckles and fasteners, which it remained until the 1980s. In the late 1980s, the Company made a number of acquisitions of engineering companies in both the United Kingdom and the United States. In 1992, the Group diversified into food manufacturing, with the acquisition of Ranks Hovis McDougall plc in the United Kingdom.

In fiscal 1996, the Group established the Industrial & Automotive business group with the acquisition of The Gates Corporation.

Between 1997 and 2007, management embarked on a program of disposing of non-core businesses and enhanced its remaining core businesses through a number of bolt-on acquisitions. In the early 2000s, the Group disposed of its Food Manufacturing and Professional, Garden and Leisure Products business groups and became focused on its two remaining business groups: Industrial & Automotive and Building Products. The Industrial & Automotive business group acquired Stant Corporation (1997), ACD Tridon (1999) and Stackpole (2003), and disposed of Trico (2007). The Building Products business group acquired Hart & Cooley (1999) and Selkirk (2006) and disposed of Lasco Fittings (2007).

Principal acquisitions, disposals, and capital expenditures

This section should be read in conjunction with Item 5 “Operating and Financial Review and Prospects” and with Notes 43 and 44 to the Group’s consolidated financial statements.

Acquisitions and disposals

Fiscal 2007

In fiscal 2007, the Industrial & Automotive business group increased its interest in Schrader Engineered Products (Kunshan) Co Ltd, a manufacturer of valves and fittings, from 60 percent to 100 percent, and it also acquired Swindon Silicon Systems Ltd, a UK company that designs, develops and supplies integrated circuits.

10

During fiscal 2007, the Industrial & Automotive business group sold Dearborn, a manufacturer of automotive assembly lines and materials handling equipment and Tridon’s indicator and side object detection businesses. The Building Products business group sold the business and assets of Lasco Fittings Inc., a manufacturer of injection moulded fittings. Also during fiscal 2007, the Group completed the sale of Trico, which constituted the Group’s discontinued Wiper Systems segment.

Fiscal 2006

In fiscal 2006, the Industrial & Automotive business group acquired a 60 percent interest in Gates Winhere (which, through a wholly-owned subsidiary, acquired the business and assets of a water pump manufacturer in China) and a 100 percent interest in ENZED Fleximak Ltd, a supplier of engineering, fabrication, testing and service operations for flexible fluid transfer products in the Arabian Gulf region. The Building Products business group acquired Selkirk Americas L.P., a manufacturer of chimney, venting and air distribution products, Eastern Sheet Metal, a manufacturer of commercial HVAC systems and Heat-Fab Inc, a US-based manufacturer of high efficiency residential and commercial venting systems. The Group also acquired a 20 percent interest in e-business and logistics services provider, CoLinx LLC, which paved the way for the launch of an online store for industrial power transmission products in January 2007.

No businesses were sold in fiscal 2006.

Fiscal 2005

In fiscal 2005, the Industrial & Automotive business group acquired L.E. Technologies, a recreational vehicle frame manufacturer and EMB, a manufacturer of high-performance hydraulic tube fittings, adapters and accessories. The Building Products business group acquired Milcor Inc, a multi-brand manufacturer of building products and NRG Industries Inc., a multi brand manufacturer of commercial building accessories.

In fiscal 2005, the Industrial & Automotive business group sold Unified Industries, Inc, the Air Springs division and the business and assets of the North American Curved Hose business. The Building Products business group sold the business and assets of Gutter Helmet, part of the Hart & Cooley residential construction business.

Disposals in each of the above fiscal years were executed as part of management’s program to dispose of all non-core businesses.

Capital expenditure

Due to the diverse nature of the business, there is no individual item of capital expenditure that has had a material impact on the position of the Company and no individually significant capital expenditure project that is currently in progress.

11

B. Business overview

Segment analysis

The segment information presented below is prepared in accordance with IFRS.

The Group determines its reportable segments based on the structure of the internal financial reports that are used by senior management for decision-making purposes and its primary segment reporting format is by business segment. The Group is organized for management reporting purposes into two principal business groups: Industrial & Automotive and Building Products.

During fiscal 2007, Industrial & Automotive operated through five business segments: Power Transmission, Fluid Power, Wiper Systems, Fluid Systems and Other Industrial & Automotive. Trico, which constituted the Wiper Systems business segment, was classified as a discontinued operation during fiscal 2006 and was sold on June 29, 2007.

Building Products is comprised of two business segments: Air Systems Components and Other Building Products.

Additional segmental information is provided in Note 4 to the Group’s consolidated financial statements.

| | | | | | |

Analysis by business segment | | Fiscal

2007 | | Fiscal

2006 | | Fiscal

2005 |

| | | £ million | | £ million | | £ million |

Sales | | | | | | |

Industrial & Automotive | | | | | | |

Power Transmission | | 1,031.2 | | 1,009.6 | | 969.9 |

Fluid Power | | 374.0 | | 383.8 | | 358.0 |

Fluid Systems | | 291.8 | | 244.0 | | 245.2 |

Other Industrial & Automotive | | 458.5 | | 535.4 | | 506.4 |

| | | | | | |

| | 2,155.5 | | 2,172.8 | | 2,079.5 |

| | | | | | |

Building Products | | | | | | |

Air Systems Components | | 541.6 | | 583.9 | | 485.4 |

Other Building Products | | 244.8 | | 377.1 | | 398.4 |

| | | | | | |

| | 786.4 | | 961.0 | | 883.8 |

| | | | | | |

| | 2,941.9 | | 3,133.8 | | 2,963.3 |

| | | | | | |

Segment result | | | | | | |

Industrial & Automotive | | | | | | |

Power Transmission | | 130.1 | | 137.5 | | 127.9 |

Fluid Power | | 28.7 | | 30.0 | | 38.4 |

Fluid Systems | | 25.5 | | 9.5 | | 20.4 |

Other Industrial & Automotive | | 49.7 | | 53.5 | | 56.7 |

| | | | | | |

| | 234.0 | | 230.5 | | 243.4 |

| | | | | | |

Building Products | | | | | | |

Air Systems Components | | 45.6 | | 53.8 | | 57.3 |

Other Building Products | | 32.2 | | 25.9 | | 29.2 |

| | | | | | |

| | 77.8 | | 79.7 | | 86.5 |

| | | | | | |

| | 311.8 | | 310.2 | | 329.9 |

| | | | | | |

| | | |

Analysis by geographical origin | | Fiscal

2007 | | Fiscal

2006 | | Fiscal

2005 |

| | | £ million | | £ million | | £ million |

Sales | | | | | | |

United States | | 1,727.8 | | 2,028.1 | | 1,961.5 |

United Kingdom | | 204.0 | | 140.0 | | 130.9 |

Rest of Europe | | 366.8 | | 349.7 | | 312.6 |

Rest of the World | | 643.3 | | 616.0 | | 558.3 |

| | | | | | |

| | 2,941.9 | | 3,133.8 | | 2,963.3 |

| | | | | | |

12

Reconciliation of the total segment result to operating profit:

| | | | | | | | | |

| | | Fiscal

2007 | | | Fiscal

2006 | | | Fiscal

2005 | |

| | | £ million | | | £ million | | | £ million | |

Segment result | | 311.8 | | | 310.2 | | | 329.9 | |

| | | | | | | | | |

Unallocated corporate activities | | (19.5 | ) | | (28.7 | ) | | (25.3 | ) |

Gain on available-for-sale investments | | 0.3 | | | 0.2 | | | 0.4 | |

Share of profit of associates | | 0.4 | | | 1.5 | | | 0.6 | |

| | | | | | | | | |

Operating profit | | 293.0 | | | 283.2 | | | 305.6 | |

| | | | | | | | | |

Industrial & Automotive

| | | | | | | | |

Sales by end markets | | | Sales by major product category | |

Automotive OE | | 27.9 | % | | Power Transmission: | | | |

Automotive aftermarket | | 27.4 | % | | Belts and tensioners | | 41 | % |

Industrial OE | | 23.8 | % | | Powertrain | | 6 | % |

Industrial aftermarket | | 18.0 | % | | Fluid Power: | | | |

Other | | 2.9 | % | | Hydraulics and hose | | 17 | % |

| | | | | Fluid Systems: | | | |

| | | | | Remote Tire Pressure Monitoring System | | 6 | % |

| | | | | Other Fluid Systems | | 8 | % |

| | | | | Other | | | |

| | | | | Utility trailers | | 6 | % |

| | | | | Other | | 16 | % |

| | | | | | | | |

| | 100 | % | | | | 100 | % |

| | | | | | | | |

The Industrial & Automotive business group has corporate offices in the United States and Canada. It supplies industrial and automotive parts, components and systems, serving a wide variety of industries, including the industrial and automotive OE and replacement markets, transportation, energy and natural resources and agricultural markets.

The Industrial & Automotive business group operates 79 manufacturing facilities and 46 distribution centers in 24 countries. It has businesses in North America, Europe, Asia, South America, Australia and the Middle East, with more than half of the manufacturing facilities located in North America and Mexico. European operations include 16 manufacturing facilities and the Asian businesses operate 13 facilities, seven of which are in China.

The Industrial & Automotive business group employed on average 21,296 people around the world in fiscal 2007. Its products are sold directly to industrial and automotive OEMs and, through a network of approximately 150,000 distributors worldwide, to the industrial and automotive replacement markets.

Power Transmission

| | | | | | | | | | | | |

Brands | |  |

| | | | |

Products | | Gates: Synchronous drive belts, V-belts, pulleys, tensioners, engine modules, and electromechanical drive systems |

| |

| | Gates Mectrol:Polyurethane timing belts and motion control components |

| |

| | Stackpole:Planetary carrier systems, powder metal power transmission and pump components, engine and transmission oil pumps |

| | | | | | | | | | | | |

Manufacturing facilities | | 34 | | % of business group sales | | 47.8% | | % of Group sales | | 35.1% | | |

Power Transmission produces a comprehensive global product line ranging from automotive synchronous belt and accessory belt drive systems to heavy-duty industrial belt drives. A variety of process and material technologies are used to design, manufacture, market, and distribute complete power transmission systems to both OEM and replacement markets. Power Transmission is globally integrated to standardize product and process technology, maximizing resource utilization. The segment supports and supplies customers globally through regional management in the Americas, Europe and Asia.

Gates is the world’s largest manufacturer of power transmission belts for problem-solving applications, with manufacturing and research facilities in 20 countries. Its products are sold directly to industrial and automotive OEMs and through a global network of dealers.

Gates Mectrol was acquired by the business group in December 2004 and currently employs more than 180 people operating manufacturing and sales facilities in the United States, Germany and Mexico.

Stackpole is a Canadian-based manufacturer of powertrain components, systems and assemblies primarily for use in automotive engines and transmissions. The company has more than 1,500 employees at six operating facilities in Canada and the United Kingdom.

13

Fluid Power

| | | | |

Brands | |  |

| | |

| Products | | Gates Automotive: | | Moulded hoses, curved radiator hoses, coolant hoses, fuel line and oil system hoses, air and defroster system hoses, vacuum line hose and tubing |

| | |

| | Gates Industrial: | | Hoses for handling oil, water, air, grease sprays, paraffin waxes, salt solutions and an assortment of chemicals |

| | |

| |

| | EMB: cutting rings, flared coupling systems, sealing elements, and total hydraulic systems solutions |

| | | | | | | | | | |

| | | | | |

Manufacturing facilities | | 13 | | % of business group sales | | 17.4% | | % of Group sales | | 12.7% |

The Fluid Power segment is a manufacturer of engineered hose, fittings and accessories for hydraulic power transmission systems used in both mobile and stationary industrial equipment, focusing primarily on the petroleum, chemical and food/beverage sectors. The segment also produces a wide range of products used in engine cooling, power steering, braking and fuel system applications. The development of next-generation products is focused on evolving the existing product line into a full port-to-port sub-system capable of providing systems and design concepts that reduce leaks, warranty and assembly labor costs.

The segment serves customers in North America, South America, Europe and Asia. The fiscal 2005 acquisition of German-based EMB, a manufacturer of hydraulic tube connection systems for a variety of applications, has resulted in an expanded product range and geographic presence in Eastern Europe and Asia.

Fluid Systems

| | | | | | |

Brands | |

|

| | | |

Products | | Other brands include: | | | | Lev-R-Vent, Pre-Vent, Weir-Stat, Superstat, Amflo, Camel, Tru-Flate, Syracuse |

| | | | |

| | |

| | Schrader Electronics: | | Remote Tire Pressure Monitoring Systems |

| | | | | | |

| | | |

| | Other: | | | | Gas caps, closure caps, automotive thermostats, on-board refueling vapor recovery (ORVR) valves, tire valves and gauges, fuel delivery system components, air conditioning components, automotive chassis components, air-conditioning and injection valves and connectors, industrial valves, inflating gauges, and tire repair pieces |

| | | | | | | | | | |

| | | | | |

Manufacturing facilities | | 14 | | % of business group sales | | 13.5% | | % of Group sales | | 9.9% |

The Fluid Systems segment is a designer, manufacturer and distributor of a broad range of automotive fluid conveyance and fluid management components and modules. Applications include fuel delivery, emission control, engine management, braking, power steering, coolant, air conditioning and windshield washing. Products are sold primarily for use as original equipment by manufacturers of cars and trucks and in the automotive replacement market as repair parts and accessories. Fluid Systems’ products are also sold in wholesale and retail automotive parts and distribution outlets in North America, Europe and Latin America including the service departments of OEM dealers.

Through Schrader Electronics, the Fluid Systems segment is the technology leader in RTPMS, a driver information and passenger security system that is economically and ergonomically integrated into vehicle electronic information systems. Stant Manufacturing designs, manufactures and markets a variety of valves and fuel, oil and radiator closure caps. Standard-Thomson is a manufacturer of engine thermostats used in automotive cooling systems. Schrader-Bridgeport International provides a wide range of tire valve, hardware and specialty valve products worldwide.

14

Other Industrial & Automotive

| | | | | | | | | | | | |

Brands | |  |

| |

| | Other brands include: LubriMatic, Tru-Flate, Tridon, |

| | | | | | | | | | | | |

Products | | DexterAxle: | | High specification non-drive axles and wheels, frames and trailers |

| | | | | | | | | | | | |

| | Dexter Chassis Group: | | Trailer chassis and components, fabricated metal parts, and high-end coatings for military and general industries |

| | | | | | | | | | | | |

| | Aftermarket: | | Automotive accessories, grease guns, power steering hose assemblies, air power pneumatic components and systems, lubrication equipment, stainless and carbon steel hose clamps, tire repair products, air line products, brass and plastic fittings, brake lines, oils and greases |

| | | | | | | | | | | | |

Manufacturing facilities | | 18 | | % of business group sales | | 21.3% | | % of Group sales | | 15.6% | | |

Other Industrial & Automotive includes the trailer axles, materials handling and aftermarket businesses.

Dexter Axle and the Dexter Chassis Group produce and market their products primarily in the United States directly to OEMs and through distributors. The product line is focused on the general utility, recreational vehicle, highway trailer and manufactured housing markets.

Dearborn designs, fabricates and installs various conveyor systems for the automotive, industrial and utilities industries. During fiscal 2006, Dearborn was classified as held for sale, and its sale was completed on November 23, 2007.

The aftermarket business integrates the manufacture, marketing, sales and distribution of products destined for both the aftermarket and OE markets, under a variety of brands. Ideal is a designer and clamp manufacturer based in the United States, with additional operations in Mexico and China. Also based in the United States, Plews-Edelmann is a designer, manufacturer and distributor of a broad range of automotive parts and tools that are sold worldwide.

Building Products

| | | | | | | | |

Sales by end markets | | | Sales by major product category | |

Residential construction | | 39 | % | | Air handling components | | | |

Commercial Construction | | 46 | % | | Grilles, registers and diffusers | | 22 | % |

Other | | 15 | % | | Venting/ducts | | 17 | % |

| | | | | Dampers | | 9 | % |

| | | | | Hydraulics and hose | | 21 | % |

| | | | | Bathtubs, showers and whirlpools | | 18 | % |

| | | | | Doors and windows | | 12 | % |

| | | | | Other | | 1 | % |

| | | | | | | | |

| | 100 | % | | | | 100 | % |

| | | | | | | | |

The Building Products business group manufactures a range of products for residential and commercial buildings, supplying both the new-build and refurbishment sectors. Its product portfolio comprises air systems components (manufacturing a wide range of components for the HVAC markets, principally in North America), bathware (manufacturing a range of baths, shower cubicles and luxury whirlpools for the North American residential market), and doors and windows (manufacturing uPVC doors and windows for the residential and manufactured housing markets in North America).

The Building Products business group operates 63 manufacturing facilities and nine distribution centers in six countries. 59 of the manufacturing facilities are in the United States, Mexico and Canada, with two in the United Kingdom and one in Thailand and India, respectively. The distribution centers are all based in Canada and the United States.

15

Air Systems Components

| | | | | | | | | | | | |

| Brands | |  |

| | | | | | | | | | |

| |

| Other brands include: | | Industrial Air, Bayley, Supreme Fan, Classics, Rezzin, J & J Register, AmeriVent, AmeriFlow, AMPCO, Home Details, Ward, Milcor, Portals Plus, Roof Products & Systems (RPS), Eastern Sheet Metal, Swartwout, Lau, Rooftop Systems, National Duct Systems and Glass Master, Supervent, Superpro |

| | | | | | | | | | |

| |

| Products Air Systems: | | Grilles, registers, diffusers, terminal units, fan coils and related products, dampers, power roof ventilators, inline duct fans, ceiling fans, food service ventilators, blower and cabinet fans, centrifugal inline roof/wall fans, propeller roof/wall fans, louvers, dampers, fan accessories and axial fans |

| | | | | | | | | | |

| |

| Hart & Cooley: | | Vents, grilles, registers, diffusers, all-fuel chimneys, chimney liners, dampers, louvers vents, flexible ducts, duct systems, duct connection systems, fire dampers, ductwork vanes & rails, ductwork slips & drives, ductwork access doors, roof & floor access hatches, rooftop heat & smoke vents, wall & ceiling access doors, custom roof curbs & supports, rooftop adapter curbs, roof drains, roof flashing systems, expansion joint systems, vents and breathers |

| | | | | | | | | | |

| |

| Selkirk: | | Gas vents, chimney vents and grilles, registers and diffusers |

| | | | | | | | | | |

| |

| Ruskin: | | Louvers, dampers, air measuring stations, OEM axial prop fans, OEM centrifugal fans, sunshades, free-cooling economizers, roof curbs, curb adapters, energy recovery ventilators, concentric diffusers, metal ductwork for sheet metal contractors and specialty equipment used for cutting, forming, and assembling fiberglass ductwork |

| | | | | | | | | | |

| |

| Ruskin Air Management: | | Fire, smoke & control dampers, airside and waterside control fan coil units, grilles, registers and diffusers, glass/metal louvres and Brise Soleil (sunscreens) |

| | | | | | | | | | |

| | | | | |

Manufacturing facilities | | 46 | | % of business group sales | | 68.9% | | % of Group sales | | 18.4% |

Air Systems Components designs and manufactures products for industrial, commercial and residential applications that are primarily sold in the United States, Canada, Mexico and the United Kingdom. Slightly less than half of the segment’s sales pass through manufacturers’ representatives and approximately 35 percent are sold through wholesalers, principally in the residential market. The balance of sales is direct to OEMs, national accounts and retail customers.

Air Systems designs and manufactures a range of air system products for industrial, institutional and commercial applications. These products are sold primarily to manufacturers’ representatives for resale to contractors. Hart & Cooley and Selkirk supply the residential and light commercial markets in the United States, Canada and Mexico, marketing their products primarily through wholesale distributors and retail customers.

Ruskin produces and markets commercial and industrial air system components that are sold directly to manufacturers of HVAC equipment and to contractors and commercial users principally through manufacturers’ representatives. Ruskin Air Management, a United Kingdom business, markets its products principally in the United Kingdom and continental Europe.

Other Building Products

| | | | |

Brands | |  |

| | | | |

| | |

| | Other brands include: | | Ventadome, Northern Breeze |

| | | | |

| | |

Products | | Lasco Bathware: | | Luxury whirlpool baths, tub/showers, showers, steam baths, shower bases, door enclosures |

| | | | |

| | |

| | Philips Products: | | Aluminum and vinyl windows and doors, exhaust hoods, bathroom fans, roof vents and monitoring systems |

| | | | | | | | | | |

| | | | | |

Manufacturing facilities | | 17 | | % of business group sales | | 31.1% | | % of Group sales | | 8.3% |

Lasco Bathware manufactures one quarter of all baths in the United States as well as an extensive range of luxury whirlpools. It operates from nine facilities across the United States with national distribution to home centers and wholesalers. Products are also sold directly to builders who use the company installation services. Aquatic Industries, a division of Lasco Bathware, produces up-market acrylic whirlpools, principally for the dealer/distributor market in the United States and also supplies standard and customized products for hotel and resort developments internationally.

16

Lasco Fittings manufactures plastic fittings used in irrigation, water works, swimming pools and spas, for commercial and industrial applications as well as for residential plumbing. Lasco Fittings was classified as held for sale during fiscal 2006, and was sold on February 23, 2007.

Philips Products is based in the United States and produces windows, doors and venting products for the residential, manufactured housing, recreational vehicle and specialty trailer markets. Its products are manufactured in seven plants across the United States and are sold primarily through distributors to builders in the new housing and refurbishment sectors. The business has received Florida/coastal state building code and hurricane approvals for its current residential vinyl window products allowing for growth in these regional coastal markets.

Raw Materials and Energy Supplies

The Group purchases a broad range of raw materials, components and products from around the world in connection with its activities. The ability of the Group’s suppliers to meet performance and quality specifications and delivery schedules is important to its operations, but the Company is not dependent on any single source of supply for critical materials. The energy and materials required for the Group’s manufacturing operations tend to be readily available, however, basic raw materials such as steel, aluminum, nickel, polymers and resins can be subject to significant fluctuations in price.

Generally, the Group has secured sales price increases that have enabled it to pass on the increased cost of raw materials to its customers. The ability to procure lower-cost materials and to re-source materials used in our products is an ongoing priority, particularly with the challenging cost environment for raw materials that has existed for the past three years. We have established functions in both China and India to source low-cost materials for businesses across the Group and the Group engages in multiple-source and geographically diverse procurement policies, strategic customer pricing reviews and expanded geographic diversity in buying.

Seasonality

Industrial & Automotive

Sales to Automotive OEMs do not tend to exhibit seasonal patterns. Sales into the aftermarket are generally stronger during the winter months reflecting higher levels of demand for replacement parts for vehicles during this period. Sales to Industrial OEMs are strongest from October to April for outdoor power equipment and from February to June for agricultural equipment.

In the Fluid Power OEM segment, moderate seasonality is primarily driven by consumer demand and crop-related seasonal activities. Production of construction equipment declines in the summer months followed by a resurgence of activity in the late fall, early winter and spring. Farm equipment production levels are driven by purchases prior to the relevant planting and harvesting seasons. The remaining markets served by the Fluid Power segment do not exhibit significant seasonal patterns.

Building Products

Sales to the construction industry generally slow down in November and December before the Thanksgiving, Christmas and New Year holiday season and are generally stronger in the spring and summer months. Sales can also be affected regionally by severe weather. Heating product sales are more concentrated in the fall and cooling product sales in the spring.

Patents and Trademarks

Management believes that the Group’s operations are not dependent to any significant degree upon any single or series of related patents or licenses, or any single commercial or financial contract. Management also believes that the Group’s operations are not dependent upon any single trademark or trade name, although trademarks and trade names are identified with a number of the Group’s products and services and are of importance in the sale and marketing of such products and services.

Governmental Regulation

The Company’s subsidiaries are regulated by governmental authorities in a number of countries. Many of the products produced by the Company’s subsidiaries are subject to governmental regulation regarding their production (including environmental regulations), sale, advertising, safety, labeling and raw materials. Management believes that the Company’s subsidiaries have taken sufficient measures to comply with applicable local, federal and/or national regulations.

Some of the regulations applicable to the Company’s subsidiaries include regulations that would allow local, national or federal authorities to mandate product recalls, or provide for the seizure of products, as well as other sanctions. Management believes that the controls implemented by subsidiaries minimize the risk of the occurrence of such events and that such risks do not pose a material threat to the Company. It is standard practice for contracts with OEMs to limit compensation arising from product recalls to direct costs (recall notification and replacement). Warranty limitations and exclusions are printed on all customer-facing material.

The Company maintains worldwide insurance coverage for product liability claims and believes that its level of insurance coverage is adequate.

The Company’s subsidiaries are subject to regulation under various and changing federal, state and local laws and regulations relating to the environment and to employee health and safety. These environmental laws and regulations govern the generation, storage, transportation, disposal and emission of various substances. Permits are required for operation of certain businesses carried out by the Company’s subsidiaries (particularly air emission permits) and these permits are subject to renewal, modification and, in certain circumstances, revocation. Management believes that the Company’s subsidiaries are in substantial compliance with laws and regulations that could allow regulatory authorities to compel (or seek reimbursement for) clean-up of environmental contamination at its subsidiary-owned sites and at facilities where its waste is stored or disposed of.

17

C. Organizational structure

The Company is the parent of a large number of subsidiaries that are organized into two principal business groups managed through a Corporate Center. The Group’s organizational structure is as follows:

A list of the Company’s principal subsidiaries, including their name, country of incorporation and the Group’s ownership interest, is set forth in Exhibit 8.1.

D. Property, plant and equipment

The Group’s principal executive offices are located in London, England. The Group’s plants, warehouses and offices are located in various countries throughout the world, with a large proportion in North America. The Group owns many of these properties and continues to improve and replace properties when considered appropriate to meet the needs of its individual operations. There are no individually significant properties that were under-utilized during fiscal 2007.

The net book value as at December 29, 2007 of the Group’s property, plant and equipment was £709.7 million, of which £6.3 million related to assets held under finance leases. The table below provides an analysis of the geographic spread of the Group’s total property, plant and equipment. As at December 29, 2007, the Group operated 142 manufacturing facilities and 63 sales offices or distribution centers in 24 countries across the Americas, Europe, Asia, and Australia. With the exception of assets held under finance leases with a carrying amount of £6.3 million, which are secured by a lessor’s charge over the leased assets, there were no encumbrances over the Group’s property, plant and equipment as at December 29, 2007.

| | | | | |

| | | Net book

value

£ million | | Percentage

of total

net book value | |

United States | | 286.7 | | 40.4 | % |

United Kingdom | | 60.9 | | 8.6 | % |

Rest of Europe | | 102.4 | | 14.4 | % |

Rest of the World | | 259.7 | | 36.6 | % |

| | | | | |

Total | | 709.7 | | 100.0 | % |

| | | | | |

Included in “Rest of the World” in the table above are assets with a net book value of £147.3 million and £31.9 million located in Canada and China respectively.

Due to the diverse nature of the business, management believes that there is no individual fixed asset at December 29, 2007, the loss of which would have a material impact on the position of the Group as a whole. Similarly there are no plans to construct, expand or improve facilities that would, on completion or cancellation, significantly affect the Group’s operations.

Item 4A. Unresolved Staff Comments

None.

18

Item 5. Operating and Financial Review and Prospects

A. Operating results

Basis of preparation

The Group’s consolidated financial statements set out on pages F-2 to F-62 of this document are prepared in accordance with IFRS. Selected financial data, also prepared in accordance with IFRS, is set forth in Item 3A “Selected Financial Data”.

The operating and financial review presented below refers to adjusted operating profit. This is a non-GAAP measure used by management and the Board for the purposes of making decisions about allocating resources within the Group and assessing the performance of each segment.

Reconciliations are provided below for the Group and each business group of segment result to operating profit (both GAAP measures) and of operating profit to adjusted operating profit.

Additional segment information is provided in Note 4 to the Group’s consolidated financial statements.

Fiscal 2007 results compared with fiscal 2006 results

Group overview

The diversity of the Group, particularly as it has grown in new markets around the world, gives the Group both strength and resilience. This diversity enabled the Group to maintain a strong operating profit margin in fiscal 2007, despite the challenging end markets. Highlights in fiscal 2007 included:

| • | | continued rationalization of some of the older facilities in North America and Europe and investment in new plants and equipment, especially in Asia and Eastern Europe; |

| • | | completion of the disposal of three non-core businesses (Lasco Fittings, Trico and Dearborn); |

| • | | completion of a bolt-on acquisition for Schrader Electronics; and |

| • | | continued disposal of non-productive real estate. |

| | | | | | | | | | | | |

Analysis of movements from fiscal 2006 to fiscal 2007 | | Sales | | | Adjusted operating profit | |

| | | £ million | | | Change | | | £ million | | | Change | |

Fiscal 2006 | | 3,133.8 | | | | | | 295.8 | | | | |

Exchange rate effect | | (191.9 | ) | | | | | (19.3 | ) | | | |

Disposals | | (58.4 | ) | | | | | (4.7 | ) | | | |

Acquisitions | | 32.4 | | | | | | 3.3 | | | | |

| | | | | | | | | | | | |

Underlying change(1) | | 26.0 | | | 0.9 | % | | (10.4 | ) | | (3.8 | )% |

| | | | | | | | | | | | |

Fiscal 2007 | | 2,941.9 | | | | | | 264.7 | | | | |

| | | | | | | | | | | | |

Reconciliation of segment result to adjusted operating profit

| | | | | | |

| | | Fiscal

2007 | | | Fiscal

2006 | |

Segment result | | 311.8 | | | 310.2 | |

– Unallocated corporate activities | | (19.5 | ) | | (28.7 | ) |

– Gain on sale of available-for-sale investments | | 0.3 | | | 0.2 | |

– Share of results of associates | | 0.4 | | | 1.5 | |

| | | | | | |

Operating profit | | 293.0 | | | 283.2 | |

– Restructuring costs | | 13.8 | | | 13.0 | |

– Disposals and exit of businesses | | (45.7 | ) | | (3.1 | ) |

– Amortization of intangible assets arising on acquisition | | 3.6 | | | 2.7 | |

| | | | | | |

Adjusted operating profit | | 264.7 | | | 295.8 | |

| | | | | | |

| | |

Operating margin(2) | | 9.0 | % | | 9.4 | % |

| | | | | | |

(1) | Underlying change excludes the effect of currency fluctuations and acquisitions and disposals |

(2) | Operating margin is the adjusted operating profit expressed as a percentage of sales |

Sales were £2,941.9 million for fiscal 2007, a decrease of £191.9 million (6.1 percent) from sales of £3,133.8 million for fiscal 2006. Cost of sales dropped from £2,272.0 million in fiscal 2006 (representing 72.5 percent of sales) to £2,141.5 million for fiscal 2007 (representing 72.8 percent of sales). Distribution and administration expenses decreased by 5.3 percent to £539.7 million in fiscal 2007 from £570.2 million in fiscal 2006, representing 18.3 percent of sales for fiscal 2007 and 18.2 percent of sales for fiscal 2006.

Adjusted operating profit was £264.7 million (fiscal 2006: £295.8 million), reflecting the economic weakness across a number of the Group’s markets. This translated into a 0.4 percent decrease in the Group’s operating margin from 9.4 percent in fiscal 2006 to 9.0 percent in fiscal 2007.

19

Restructuring initiatives

Management has undertaken various restructuring activities to streamline operations, consolidate and take advantage of available capacity and resources, and ultimately to achieve net cost reductions. Restructuring activities include efforts to integrate and rationalize the Group’s businesses and to relocate manufacturing operations to lower cost markets. During fiscal 2007 there was a gain of £31.9 million from restructuring initiatives compared with a loss of £9.9 million in fiscal 2006. Restructuring initiatives comprise restructuring costs and gains/losses on disposals and exits of businesses.

Restructuring costs

In fiscal 2007, the restructuring costs of £13.8 million principally related to the rationalization of production facilities within the Lasco Bathware and Philips Products businesses in the United States (£2.4 million), the outsourcing of information technology services (£2.7 million), and the initiatives within the Fluid Power and Air Systems Components segments that began in fiscal 2006 (£7.4 million). The fiscal 2006 restructuring costs were lower at £13.0 million, and included the transfer of the activities of Fluid Power’s facility at St. Neots in the United Kingdom to a new facility in the Czech Republic, the closure of Air Systems Components’ Holland, Michigan facility and the cost-saving initiatives within Stackpole and the Air Systems Components segment that began in fiscal 2005.