SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g)

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED: APRIL 30, 2002

COMMISSION FILE NUMBER: 0-17140

Tomkins plc

(Exact name of Registrant as specified in its charter)

England

(Jurisdiction of incorporation or organization)

East Putney House, 84 Upper Richmond Road

London SW15 2ST, United Kingdom

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | | Name of each exchange |

| Ordinary Shares, nominal value 5p per share | | New York Stock Exchange * |

| American Depositary Shares, each of | | |

| which represents four Ordinary Shares | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act

None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Ordinary Shares, nominal value 5p per share | | 771,698,555 |

| Convertible Cumulative Preference Shares, nominal value US$50 per share | | 10,508,499 |

| Redeemable Convertible Cumulative | | |

| Preference Shares, nominal value US$50 per share | | 12,439,527 |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yes x No ¨

Indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 x Item 18 ¨

| * | | Not for trading, but only in connection with the registration of American Depositary Shares representing such Ordinary Shares |

| | | | | Page

|

|

| PART I | | | | |

|

| Item 1. | | | | 2 |

|

| Item 2. | | | | 2 |

|

| Item 3. | | | | 2 |

|

| Item 4. | | | | 11 |

|

| Item 5. | | | | 23 |

|

| Item 6. | | | | 38 |

|

| Item 7. | | | | 53 |

|

| Item 8. | | | | 55 |

|

| Item 9. | | | | 56 |

|

| Item 10. | | | | 58 |

|

| Item 11. | | | | 65 |

|

| Item 12. | | | | 68 |

|

| PART II | | | | |

|

| Item 13. | | | | 68 |

|

| Item 14. | | | | 68 |

|

| Item 15. | | | | 68 |

|

| Item 16. | | | | 68 |

|

| PART III | | | | |

|

| Item 17. | | | | 68 |

|

| Item 18. | | | | 68 |

|

| Item 19. | | | | 69 |

In this Annual Report (the “Annual Report”) on Form 20-F/A for the fiscal year ended April 30, 2002 (“fiscal 2002”), all references to “Tomkins”, the “Tomkins Group”, the “Group”, the “Company”, “we”, “us” and “our” include Tomkins plc and its consolidated subsidiaries, unless the context otherwise requires.

The consolidated financial statements of Tomkins plc appearing in this Annual Report are presented in pounds sterling (“£”) and are prepared in accordance with accounting principles generally accepted in the United Kingdom (“U.K. GAAP”). U.K. GAAP differs in certain respects from accounting principles generally accepted in the United States of America (“U.S. GAAP”). The significant differences between U.K. GAAP and U.S. GAAP relevant to Tomkins plc are explained in Note 27 of Notes to the consolidated financial statements.

In this Annual Report, references to “U.S. dollars”, “$”, “cents” and “c” are to United States currency and references to “pounds sterling”, “£”, “pence” and “p” are to British currency. Solely for the convenience of the reader, this Annual Report contains translations of certain pound sterling amounts into U.S. dollars. These translations should not be construed as representations that the pound sterling amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated or at any other rates. Unless otherwise stated, the translations of pounds sterling into U.S. dollars have been made at $1.4565 to £1, the noon buying rate in New York City for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on April 30, 2002 provided, however, that the amounts associated with acquisitions and dispositions are translated at the Noon Buying Rate on the date of completion. On October 11, 2002, the Noon Buying Rate was $1.5605 to £1.

Pursuant to the meaning of forward-looking statements in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), this Annual Report contains assumptions, anticipations, expectations and forecasts concerning the Company’s future business plans, products, services, financial results, performance, future events and information relevant to our business, industries and operating environments. When used in this document the words “anticipate”, “believe”, “estimate”, “assume”, “could”, “should”, “expect” and similar expressions, as they relate to the Company or its management, are intended to identify forward-looking statements. Such statements reflect the current views of Tomkins with respect to future events and are subject to certain risks, uncertainties and assumptions. The forward-looking statements contained herein represent a good-faith assessment of our future performance for which we believe there is a reasonable basis. Many factors could cause the actual results, performance or achievements of Tomkins to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, adverse changes or uncertainties in general economic conditions in the markets we serve, regulatory developments adverse to us or difficulties we may face in maintaining necessary licenses or other governmental approvals, changes in the competitive position or introduction of new competitors or new competitive products, lack of acceptance of new products or services by the Company’s targeted customers, changes in business strategy, any management level or large-scale employee turnover, any major disruption in production at our key facilities, adverse changes in foreign exchange rates, and acts of terrorism or war, and various other factors, both referenced and not referenced in this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated or expected. For more discussion of the risks affecting us, please refer to Item 3D. “Key Information – Risk factors”.

These forward-looking statements represent our view only as of the date they are made, and we disclaim any obligation to update forward-looking statements contained herein, except as may be otherwise required by law.

1

PART I

Item 1. Identity of Directors, Senior Management and Advisers Not applicable.

Item 2. Offer Statistics and Expected Timetable Not applicable.

A. Selected financial data

The selected financial data set out below has been derived from previously published consolidated financial statements of the Company and from the consolidated financial statements of the Company which appear elsewhere in this Form 20-F/A. The selected financial data set forth below should be read in conjunction with, and are qualified in their entirety by reference to, such consolidated financial statements and Notes thereto. The selected financial data does not comprise “statutory accounts” within the meaning of Section 240 of the Companies Act 1985 of England and Wales (the “Companies Act”), but has been based upon the full published accounts of the Company for the five fiscal years to April 30, 2002. The published accounts for the five years to April 30, 2002, upon which unqualified auditors’ reports have been given, have been delivered to the Registrar of Companies in England and Wales.

The consolidated financial statements of the Company are prepared in accordance with U.K. GAAP which differs in certain significant respects from U.S. GAAP. The principal differences between U.K. GAAP and U.S. GAAP, as they relate to the Company, are presented in Note 27 of Notes to the consolidated financial statements.

Consolidated income statement data

| | | Fiscal Year Ended

| |

| | | April 30, 2002(5) (365 days) | | | April 30, 2002 (365 days) | | | April 30, 2001(3) (366 days) | | | April 29, 2000(3) (364 days) | | | May 1, 1999(3) (364 days) | | | May 2, 1998(3) (364 days) | |

| | |

|

|

| | | (In millions except per Ordinary Share and per ADS data) | |

| | |

|

|

Amounts in accordance with U.K.GAAP | | $ | | | £ | | | £ | | | £ | | | £ | | | £ | |

| Net sales | | | | | | | | | | | | | | | | | | |

| Continuing operations | | 4,913.9 | | | 3,373.8 | | | 3,335.1 | | | 3,161.7 | | | 2,818.2 | | | 2,710.2 | |

| Discontinued operations | | - | | | - | | | 770.4 | | | 2,478.7 | | | 2,541.1 | | | 2,351.9 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 4,913.9 | | | 3,373.8 | | | 4,105.5 | | | 5,640.4 | | | 5,359.3 | | | 5,062.1 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Operating income(1) | | | | | | | | | | | | | | | | | | |

| Continuing operations | | 387.3 | | | 265.9 | | | 308.5 | | | 341.6 | | | 300.1 | | | 287.5 | |

| Discontinued operations | | - | | | - | | | 11.5 | | | 184.4 | | | 197.7 | | | 196.5 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 387.3 | | | 265.9 | | | 320.0 | | | 526.0 | | | 497.8 | | | 484.0 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Income before taxes and minority interests | | 385.1 | | | 264.4 | | | 144.0 | | | 252.6 | | | 461.6 | | | 500.4 | |

| Income before preference dividend | | 273.1 | | | 187.5 | | | 53.3 | | | 105.1 | | | 296.7 | | | 316.7 | |

| Preference dividend | | (57.2 | ) | | (39.3 | ) | | (37.6 | ) | | (34.4 | ) | | (34.2 | ) | | (34.5 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income attributable to Ordinary Shareholders | | 215.9 | | | 148.2 | | | 15.7 | | | 70.7 | | | 262.5 | | | 282.2 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net income:(2) | | | | | | | | | | | | | | | | | | |

| Per ordinary share | | 27.91 | c | | 19.16p | | | 1.83p | | | 7.46p | | | 22.69p | | | 23.80p | |

Per ADS(4) | | 111.63 | c | | 76.64p | | | 7.32p | | | 29.84p | | | 90.76p | | | 95.20p | |

Diluted net income:(2) | | | | | | | | | | | | | | | | | | |

| Per ordinary share | | 27.35 | c | | 18.78p | | | 1.83p | | | 11.07p | | | 21.44p | | | 22.30p | |

Per ADS(4) | | 109.41 | c | | 75.12p | | | 7.32p | | | 44.28p | | | 85.76p | | | 89.20p | |

| Dividends: | | | | | | | | | | | | | | | | | | |

| Per ordinary share | | 17.48 | c | | 12.00p | | | 12.00p | | | 17.45p | | | 15.15p | | | 13.17p | |

Per ADS(4) | | 69.91 | c | | 48.00p | | | 48.00p | | | 69.80p | | | 60.60p | | | 52.68p | |

| | |

|

|

| | | (in thousands) | |

| | |

|

|

| Average number of ordinary shares outstanding – basic | | 773,464 | | | 773,464 | | | 857,686 | | | 947,774 | | | 1,156,877 | | | 1,185,873 | |

| Average number of ordinary shares outstanding – diluted | | 998,355 | | | 998,355 | | | 857,712 | | | 949,793 | | | 1,383,752 | | | 1,420,178 | |

(1) | | Operating income includes the Company’s share of income from associates and is before goodwill amortization. See table below for a reconciliation to operating income as reported in the financial statements. |

(2) | | Net income and diluted net income per Ordinary Share has been adjusted for 1998 to reflect the adoption of FRS 14. |

(3) | | FY 2001, 2000, 1999 and 1998 have been restated to reflect the adoption of FRS 19. See Note 2 (a) Accounting Policies of the consolidated financial statements. |

(4) | | Net income and dividend per ADS is calculated per Ordinary Share multiplied by four, as discussed in Item 9.C. “Markets.” |

(5) | | The Noon Buying Rate at April 30, 2002 of $1.4565 = £1.00 has been used to provide a convenience translation into U.S. dollars. |

2

Consolidated income statement data (continued) | |

| | |

|

|

| | | Fiscal Year Ended

| |

| | | April 30, | | | April 30, | | | April 30, | | | April 29, | | | May 1, | | | May 2, | |

| | | 2002(5) (365 days) | | | 2002 (365 days) | | | 2001 (366 days) | | | 2000 (364 days) | | | 1999 (364 days) | | | 1998 (364 days) | |

| | |

|

|

| | | (In millions except per Ordinary Share and per ADS data)

| |

Amounts in accordance with U.S.GAAP | | $ | | | £ | | | £ | | | £ | | | £ | | | £ | |

| Net sales | | | | | | | | | | | | | | | | | | |

| Continuing operations | | 4,913.9 | | | 3,373.8 | | | 3,335.1 | | | 3,161.7 | | | 2,818.2 | | | 2,710.2 | |

| Discontinued operations | | - | | | - | | | 770.4 | | | 2,478.7 | | | 2,541.1 | | | 2,351.9 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 4,913.9 | | | 3,373.8 | | | 4,105.5 | | | 5,640.4 | | | 5,359.3 | | | 5,062.1 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Operating Income(1) | | | | | | | | | | | | | | | | | | |

| Continuing operations | | 367.6 | | | 267.9 | | | 323.2 | | | 357.9 | | | 306.4 | | | 292.1 | |

| Discontinued operations | | - | | | - | | | 11.5 | | | 180.6 | | | 203.2 | | | 180.6 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 367.6 | | | 267.9 | | | 334.7 | | | 538.5 | | | 509.6 | | | 472.7 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Income before taxes and minority interests | | 337.5 | | | 248.0 | | | 155.3 | | | 356.5 | | | 421.4 | | | 443.5 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Income before preference dividend and effects of change in accounting principle | | 215.3 | | | 147.8 | | | 64.4 | | | 193.5 | | | 256.7 | | | 259.6 | |

| Effects of change in accounting principle, net of tax | | 2.6 | | | 1.8 | | | - | | | - | | | - | | | - | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income attributable to shareholders | | 217.9 | | | 149.6 | | | 64.4 | | | 193.5 | | | 256.7 | | | 259.6 | |

| Preference share dividends | | (57.2 | ) | | (39.3 | ) | | (37.6 | ) | | (34.4 | ) | | (34.2 | ) | | (34.5 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income attributable to Ordinary Shareholders | | 160.7 | | | 110.3 | | | 26.8 | | | 159.1 | | | 222.5 | | | 225.1 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net Income per Ordinary Share | | | | | | | | | | | | | | | | | | |

Basic: | | | | | | | | | | | | | | | | | | |

| Net income from continuing operations before change in accounting principle | | 20.43c | | | 14.03 | p | | 16.27 | p | | 13.04p | | | 10.78p | | | 9.59p | |

| Cumulative effect of change in accounting principle | | 0.34c | | | 0.23 | p | | - | | | - | | | - | | | - | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income from continuing operations | | 20.77c | | | 14.26 | p | | 16.27 | p | | 13.04p | | | 10.78p | | | 9.59p | |

| Net income from discontinued operations | | - | | | - | | | (13.15 | )p | | 3.75p | | | 8.45p | | | 9.39p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Total | | 20.77c | | | 14.26 | p | | 3.12 p | | | 16.79p | | | 19.23p | | | 18.98p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Diluted:(as restated for 2002)(6) | | | | | | | | | | | | | | | | | | |

| Net income from continuing operations before change in accounting principle | | 20.42c | (6) | | 14.02p | (6) | | 16.27 p | | | 13.01p | | | 10.75p | | | 9.52p | |

| Cumulative effect of change in accounting principle | | 0.33c | (6) | | 0.23p | (6) | | - | | | - | | | - | | | - | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income from continuing operations | | 20.75c | (6) | | 14.25p | (6) | | 16.27 p | | | 13.01p | | | 10.75p | | | 9.52p | |

| Net income from discontinued operations | | - | | | - | | | (13.15)p | | | 3.74p | | | 8.42p | | | 9.32p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Total | | 20.75c | (6) | | 14.25p | (6) | | 3.12 p | | | 16.75p | | | 19.17p | | | 18.84p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net income per ADS(4) | | | | | | | | | | | | | | | | | | |

Basic: | | | | | | | | | | | | | | | | | | |

| Net income from continuing operations before change in accounting principle | | 81.74c | | | 56.12p | | | 65.08 p | | | 52.16p | | | 43.12p | | | 38.36p | |

| Cumulative effect of change in accounting principle | | 1.34c | | | 0.92p | | | - | | | - | | | - | | | - | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income from continuing operations | | 83.08c | | | 57.04p | | | 65.08 p | | | 52.16p | | | 43.12p | | | 38.36p | |

| Net income from discontinued operations | | - | | | - | | | (52.60 | )p | | 15.00p | | | 33.80p | | | 37.56p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Total | | 83.08c | | | 57.04p | | | 12.48 p | | | 67.16p | | | 76.92p | | | 75.92p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Diluted:(as restated for 2002)(6) | | | | | | | | | | | | | | | | | | |

| Net income from continuing operations before change in accounting principle | | 81.68c | (6) | | 56.08p | (6) | | 65.08 p | | | 52.04p | | | 43.00p | | | 38.08p | |

| Cumulative effect of change in accounting principle | | 1.34c | (6) | | 0.92p | (6) | | - | | | - | | | - | | | - | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Net income from continuing operations | | 83.02c | (6) | | 57.00p | (6) | | 65.08 p | | | 52.04p | | | 43.00p | | | 38.08p | |

| Net income from discontinued operations | | - | | | - | | | (52.60 | )p | | 14.96p | | | 33.68p | | | 37.28p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Total | | 83.02c | (6) | | 57.00p | (6) | | 12.48 p | | | 67.00p | | | 76.68p | | | 75.36p | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Dividends per ordinary share | | 17.48c | | | 12.00p | | | 12.00 p | | | 17.45p | | | 15.15p | | | 13.17p | |

Dividends per ADS(4) | | 69.91c | | | 48.00p | | | 48.00 p | | | 69.80p | | | 60.60p | | | 52.68p | |

| | |

|

|

| | | (in thousands) | |

| | |

|

|

| Average number of ordinary shares outstanding – basic | | 773,464 | | | 773,464 | | | 857,686 | | | 947,774 | | | 1,156,877 | | | 1,185,873 | |

| Average number of ordinary shares outstanding – diluted | | 774,017 | (6) | | 774,017 | (6) | | 857,712 | | | 949,793 | | | 1,383,752 | | | 1,420,178 | |

3

Consolidated balance sheet data

| | | Fiscal Year Ended

|

| | | April 30, | | April 30, | | April 30, | | April 29, | | May 1, | | May 2, |

| | | 2002(5) | | 2002 | | 2001(3) | | 2000(3) | | 1999(3) | | 1998(3) |

| | |

|

| | | (In millions)

|

| | | $ | | £ | | £ | | £ | | £ | | £ |

Amounts in accordance with U.K.GAAP | | | | | | | | | | | | |

| Net assets | | 1,662.0 | | 1,141.1 | | 1,118.9 | | 760.4 | | 675.1 | | 1,092.6 |

| Total assets | | 3,735.5 | | 2,564.7 | | 2,765.7 | | 3,885.1 | | 3,289.9 | | 3,151.8 |

| Ordinary share capital | | 56.2 | | 38.6 | | 39.1 | | 47.5 | | 47.5 | | 58.8 |

| Shareholders’ funds | | 1,612.2 | | 1,106.9 | | 1,084.9 | | 726.4 | | 646.8 | | 1,073.9 |

|

Amounts in accordance with U.S.GAAP | | | | | | | | | | | | |

| Net assets | | 2,630.1 | | 1,805.8 | | 1,866.1 | | 2,280.9 | | 2,245.7 | | 2,712.6 |

| Total assets | | 5,247.6 | | 3,602.9 | | 3,794.9 | | 5,641.1 | | 5,095.2 | | 5,013.0 |

| Shareholders’ equity | | 2,580.3 | | 1,771.6 | | 1,832.7 | | 2,247.4 | | 2,217.7 | | 2,693.9 |

(1) | | Operating income includes the Company’s share of income from associates and is before goodwill amortization. See table below for a reconciliation to operating income as reported in the financial statements. |

(2) | | Net income and diluted net income per Ordinary Share has been adjusted for 1998 to reflect the adoption of FRS 14. |

(3) | | FY 2001, 2000, 1999 and 1998 have been restated to reflect the adoption of FRS 19. See Note 2 (a) Accounting Policies of the consolidated financial statements. |

(4) | | Net income and dividend per ADS is calculated per Ordinary Share multiplied by four, as discussed in Item 9.C. “Markets.”. |

(5) | | The Noon Buying Rate at April 30, 2002 of $1.4565 = £1.00 has been used to provide a convenience translation into U.S. dollars. |

(6) | | Diluted net income per ordinary share amounts have been restated for a computational error. As originally presented, the calculation excluded the preference share dividend but not the ordinary shares into which the corresponding preference shares are convertible. Both should have been excluded from the calculation, as the net effect of their inclusion was anti-dilutive. |

Reconciliation of operating income as reported in the consolidated income statement data to operating income as reported in the financial statements under U.K. GAAP

| | | Continuing

| | | Discontinued

| | | Total

| |

2002: | | | | | | | | | |

| Operating income as in consolidated income statement data | | 265.9 | | | - | | | 265.9 | |

| Goodwill amortization | | (10.5 | ) | | - | | | (10.5 | ) |

| Share of income from associate | | 0.7 | | | - | | | 0.7 | |

| | |

|

| |

|

| |

|

|

| Operating income as in consolidated statements of income | | 256.1 | | | - | | | 256.1 | |

| | |

|

| |

|

| |

|

|

|

2001: | | | | | | | | | |

| Operating income as in consolidated income statement data | | 308.5 | | | 11.5 | | | 320.0 | |

| Goodwill amortization | | (9.3 | ) | | (0.2 | ) | | (9.5 | ) |

| Share of income from associate | | - | | | (0.1 | ) | | (0.1 | ) |

| | |

|

| |

|

| |

|

|

| Operating income as in consolidated statements of income | | 299.2 | | | 11.2 | | | 310.4 | |

| | |

|

| |

|

| |

|

|

|

2000: | | | | | | | | | |

| Operating income as in consolidated income statement data | | 341.6 | | | 184.4 | | | 526.0 | |

| Goodwill amortization | | (4.2 | ) | | (0.5 | ) | | (4.7 | ) |

| Share of income from associate | | (0.9 | ) | | (1.0 | ) | | (1.9 | ) |

| | |

|

| |

|

| |

|

|

| Operating income as in consolidated statements of income | | 336.5 | | | 182.9 | | | 519.4 | |

| | |

|

| |

|

| |

|

|

4

Dividends

The Company has paid cash dividends on its ordinary shares, nominal value 5p per share (“Ordinary Shares”) in respect of every fiscal year since being first listed on the London Stock Exchange Limited (the “London Stock Exchange”) in 1950.

Dividends are paid to shareholders as of record dates that are fixed after consultation between the Company and the London Stock Exchange. An interim dividend is normally declared by the Board of directors in January of each year and paid in March or April. A final dividend is recommended by the Board following the end of each fiscal year and, subject to approval by the shareholders at the Company’s annual general meeting, is paid in October.

The table below sets forth the amounts of interim, final and total dividends paid in respect of each fiscal year indicated. The amounts are shown both in pence per Ordinary Share and translated, solely for convenience, into U.S. cents per American Depositary Share (each representing four Ordinary Shares) at the Noon Buying Rate on each of the respective payment dates for such interim and final dividends.

Fiscal Year | | Pence per Ordinary Share | | | | Translated into U.S. cents per ADS |

|

|

|

|

|

|

|

| | | Interim | | | Final | | | Total | | | | Interim | | Final | | Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1998 | | 3.50 | (1) | | 9.67 | (2) | | 13.17 | | | | 23.48 | | 66.47 | | 89.95 |

| 1999 | | 4.00 | (1) | | 11.15 | | | 15.15 | | | | 25.83 | | 73.69 | | 99.52 |

| 2000 | | 4.60 | | | 12.85 | | | 17.45 | | | | 29.12 | | 74.44 | | 103.56 |

| 2001 | | 4.60 | | | 7.40 | | | 12.00 | | | | 26.46 | | 43.79 | | 70.25 |

| 2002 | | 4.60 | | | 7.40 | | | 12.00 | | | | 26.33 | | 46.30 | | 72.63 |

(1) | | Of which 3.06p was paid in the form of a foreign income dividend. |

(2) | | Of which 8.39p was paid in the form of a foreign income dividend. |

The Company expects to continue to pay dividends in the future. The total amounts of future dividends will be determined by the Board and will depend on the Company’s income, cash flow, financial and economic conditions and other factors.

The Company’s fiscal year end is to change from April 30 to December 31 with effect from December 31, 2002. It is intended that the current practice of interim and final dividends will be maintained with some transitional arrangements for the eight month accounting period from May 1, 2002 to December 31, 2002 to ensure that shareholders are not disadvantaged by the change. It is currently our intention that:

| | • | | A first interim dividend in respect of the first six months of the eight-month period ending December 31, 2002 will be announced with the interim results in early January 2003 and will be paid in April 2003. |

| | • | | A second interim dividend (in lieu of a final dividend) will be declared in early March in respect of the final two months of the eight-month accounting period ending December 31, 2002. This second interim dividend will be paid, together with the first interim dividend, in April 2003. It is expected that the total of the first interim and second interim dividends will be equivalent to approximately two thirds of the total dividends that would otherwise have been paid for a full twelve-month accounting period. |

| | • | | For the year ending December 31, 2003 (and thereafter), it is expected that an interim dividend will be paid in November of that year and the final dividend will be paid in June of the following year, in line with U.K. market practice. The expected weighting will be 40% for the interim dividend and 60% for the final dividend, as is the case with the present dividend weighting. |

Cash dividends paid by the Company are in pounds sterling, and fluctuations in the exchange rate between pounds sterling and U.S. dollars will affect the U.S. dollar amounts received by holders of American Depository Receipts (“ADRs”) upon conversion by the Depositary of such dividends. Moreover, fluctuations in the exchange rates between the pound sterling and the U.S. dollar will affect the dollar equivalents of the pound sterling price of the Ordinary Shares on the London Stock Exchange and, as a result, are likely to affect the market prices of the American Depositary Shares (“ADSs”) in the United States. For information regarding the exchange rates for pounds sterling into U.S. dollars for the five most recent fiscal years, see “Exchange Rates” below. For a discussion of the historic effects of exchange rate fluctuations on the Company’s financial condition and results of operations, see the section “Effect of Foreign Currency” included in Item 5. “Operating and Financial Review and Prospects” and Item 11. “Quantitative and Qualitative Disclosures about Market Risk”.

5

Exchange Rates

The following table sets forth, for the fiscal years indicated, the average, high, low and period end Noon Buying Rates for pounds sterling, expressed in U.S. dollars per £1.00:

Fiscal Year | | Average* | | High | | Low | | Period End |

|

| 1998 | | 1.65 | | 1.70 | | 1.58 | | 1.67 |

| 1999 | | 1.64 | | 1.72 | | 1.59 | | 1.61 |

| 2000 | | 1.60 | | 1.68 | | 1.55 | | 1.56 |

| 2001 | | 1.47 | | 1.56 | | 1.40 | | 1.43 |

| 2002 | | 1.43 | | 1.48 | | 1.37 | | 1.46 |

| May 1, 2002 through October 11, 2002 | | 1.54 | | 1.58 | | 1.45 | | 1.56 |

| * | | The average of the Noon Buying Rates on the last day of each month during the period. |

The following table sets forth, for the months indicated high and low Noon Buying Rates for pounds sterling, expressed in U.S. dollars per £1.00:

Month | | High | | Low |

|

| April 2002 | | 1.4592 | | 1.4310 |

| May 2002 | | 1.4676 | | 1.4474 |

| June 2002 | | 1.5285 | | 1.4574 |

| July 2002 | | 1.5800 | | 1.5206 |

| August 2002 | | 1.5709 | | 1.5192 |

| September 2002 | | 1.5700 | | 1.5343 |

| October 2002 (through October 11, 2002) | | 1.5708 | | 1.5569 |

See “Operating results” in Item 5 concerning the effect of fluctuations in the exchange rate between the pound sterling and the U.S. dollar on the Company’s results of operations.

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

As a part of the planning, control and performance management framework of the Group, each business considers strategic, operational, commercial and financial risks and identifies risk mitigation actions.

Risk can be considered either as downside risk, the risk that something can go wrong and result in a financial loss or financial exposure for the Group, or volatility risk. Volatility risk is the risk associated with uncertainty, which means there may be an opportunity for financial gain as well as potential for loss.

The risks listed primarily relate to potential downside risks. Actions taken by management to mitigate risks can provide reasonable but not absolute assurance against adverse financial effects on the Group. The nature of the Group’s business means that risks will change as a result of controllable and uncontrollable events occurring in the future.

Risks relating to the industries in which we operate

A potentially changing regulatory environment could limit our business opportunities and profitability.

Existing or future changes in laws, regulations, licenses, decisions, policies or interpretations thereof by the courts, or by regulators, may have a material adverse impact on our business, financial condition and results of operations.

In particular, the industries in which we operate are subject to a variety of environmental regulations, particularly relating to waste water discharges, air emissions, solid waste management and hazardous chemical disposal. These regulations have generally become stricter in recent years and may continue to become more stringent in the future. Any future changes to existing environmental legislation or regulation could have a material adverse effect on our business, financial condition or results of operations. There is a risk that our activities will not continue to be in substantial compliance in the future with applicable environmental legislation or regulation and we are unable to predict the costs of compliance with changes in

6

legislation or regulation.

The cyclical nature of automotive production and sales could adversely affect our business.

Approximately 24 percent of our net sales are to automotive manufacturers in various parts of the world. Sales and production in the automotive industry are cyclical and depend on general economic conditions and other factors, including consumer spending and preferences. A significant reduction in automotive production and sales by our customers could have an adverse effect on our business, financial condition or results of operations.

A continuing improvement in vehicle component life could adversely affect our important aftermarket business.

The success of component manufacturers including ourselves in improving product quality and performance and the demand from the Automotive original equipment makers for ever greater service life and reliability has the potential to lower demand in the aftermarket business segment which could have an adverse effect on our business, financial condition or results of operations.

Some of our customers are experiencing lower levels of business.

Lower levels of economic activity have resulted in a number of our customers reducing demand from past years levels for some of our products and some rescheduling of orders. For example, in fiscal year 2002 estimated production by the world’s automotive manufacturers was down approximately 10 percent in North America, flat in Europe, and slightly lower in the Far East, compared with the prior fiscal year. These lower levels of demand resulting from the lower levels of business currently being experienced, and that may be experienced, by our customers could have an adverse effect on our business, financial condition or results of operations.

Risks related to our business

Deferred consideration in respect of disposals may not be repaid in accordance with original terms.

In May 2001 we disposed of Smith & Wesson Corp. through a stock purchase agreement, which contains deferred terms in respect of $30 million of the proceeds from disposal, which will be repaid over the seven years commencing in May 2006. If the purchaser were unable to fulfill its payment obligations in the future a provision against the deferred consideration receivable would be charged to the income statement of the Company.

We may not be able to raise sufficient additional capital necessary to fund our growth.

We may require significant amounts of capital to grow our business, implement our strategic initiatives and remain competitive. At present, our established sources of funding are through equity, bank debt and cash flow from operations. In addition, we have established a medium-term note program under which £150 million of 10 year bonds were issued in December 2001 and upon which we may draw again in the future. We believe that the sources of funding currently available will be sufficient to fund our operations. If our plans or assumptions regarding our funding requirements change, however, we may need to seek other sources of financing, such as additional lines of credit with commercial banks or vendors or public financing, or to renegotiate existing bank facilities. There is a risk that we will not be able to obtain financing from these sources, or obtain financing, or renegotiate our existing financing on a timely basis, on favorable terms, or at all. If we are unable to obtain financing from these sources, or unable to financing or renegotiate our existing financing on a timely basis or on favorable terms, we may have to delay or abandon some of our development plans or strategic initiatives. Any or all of these developments could have an adverse affect on our business, financial condition and results of operations.

We are dependent on the continued operation of our manufacturing facilities.

Our manufacturing facilities are based principally in the United States and Europe. A major disruption of our critical manufacturing facilities could result in significant interruption to our business and potential loss of customers and sales, which could have an adverse effect on our business, financial condition or results of operations.

Tomkins plc is a holding company that is dependent upon cash flow from its subsidiaries to meet its obligations.

Tomkins plc is a holding company with no independent operations or significant assets other than investments in and advances to subsidiaries. Accordingly, it depends upon the receipt of sufficient funds from its subsidiaries to meet its obligations, including its ability to repay any amounts it borrows under its medium term note program or to pay its dividends. The ability of Tomkins plc to access that cash flow may be limited in some circumstances. For instance, the terms of existing and future indebtedness of its subsidiaries and the laws and jurisdictions under which those subsidiaries are organized may limit the payment of dividends, loan repayments and other distributions to Tomkins plc. Any such limitations could have an adverse affect on our business, financial condition and results of operations.

7

Our automotive customers may seek to obtain price reductions from their suppliers and we may be unable to achieve corresponding reductions in cost.

Approximately 24 percent of our sales are to automotive manufacturers. It is normal practice for such customers to seek to achieve reductions in their costs from their suppliers over the duration of any committed supply arrangement. To meet any such requests for price reductions we would have to achieve corresponding cost savings in our business by strategic sourcing of raw materials and by improving production and manufacturing efficiencies. The failure to achieve future cost savings to meet the committed price reductions could adversely affect our profitability and net income.

If we are unable to protect our intellectual property rights, the future success of our business could suffer.

Our proprietary technology is protected by patents and trade secrets which could be at risk if:

| | • | | competitors were able to develop similar technology independently; |

| | • | | our patent applications were not approved; |

| | • | | steps taken to prevent misappropriation or infringement of our intellectual property were not successful; or |

| | • | | we do not adequately protect our intellectual property. |

From time to time we may need to litigate in order to enforce our patents, copyrights or other intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others or to defend against significant claims of infringement. Any such litigation, the outcome of which will be uncertain, or its threat, could result in costs and a diversion of our resources.

Approximately 26 percent of our revenues are generated from 10 major customers

Approximately 26 percent of our total revenues come from the top ten customers of our Industrial & Automotive business. The loss of, or a significant decrease in demand from, one or more of these customers could result in an adverse effect on our business, financial condition or results of operations.

Industry consolidation could result in more powerful competitors and fewer customers.

Our customers and competitors in some of our markets, especially in the automotive aftermarket, and to a lesser extent in the markets of the Air Systems Components group, are consolidating to achieve greater scale or market share. Such changes could affect our customers and their relationship with us. If one of our competitors’ customers acquired any of our customers, we may lose its business. Additionally, as our customers become larger and more concentrated, they could exert pricing pressure on all suppliers, including us.

We operate in very competitive markets and could be adversely affected if we fail to keep pace with technological changes.

We operate in very competitive environments in several geographical markets and product areas. The markets for our products and services are characterized by evolving industry standards, rapidly changing technology and increased competition. The continual development of advanced technologies for new products and product enhancements is an important way in which we maintain acceptable pricing levels. If we fail to keep pace with technological changes in the industrial sectors that we serve, we may experience price erosion and lower margins.

Our success is dependent in large part on our ability to:

| | • | | anticipate our customers’ needs and provide products and services to meet those needs; |

| | • | | develop new products and services that are accepted by our customers; |

| | • | | enhance and upgrade our existing products and services; and |

| | • | | price our products and services competitively. |

Our competitors are sophisticated companies with many resources that may develop products and services that are superior to our products and services or may adapt more quickly than we do to new technologies, industry changes or evolving customer requirements. Our failure to anticipate or respond adequately to technological developments or customer requirements, and any delay in accomplishing these goals, could adversely affect our business, financial condition and results of operations.

Reliance on certain raw materials and suppliers for key components could destabilize our productivity levels.

To the extent not reflected in prices for our products, an unexpected increase in the cost of certain raw materials, especially Polymers, aluminum and resins, could lead to lower profit margins. The failure of our key suppliers to maintain and increase production levels could result in our inability to fulfill orders, which could damage relationships with current and prospective customers and have an adverse effect on our business, financial condition and results of operations.

Our business could be adversely affected if we are unable to obtain adequate supplies or equipment in a timely

8

manner from our current suppliers or any alternative supplier, or if there were significant increases in the costs of such equipment.

We are dependent upon our strong relationships with manufacturers’ representatives, distributors and wholesalers.

Many of our businesses have strong established relationships with manufacturers’ representatives, distributors and wholesalers and these relationships are an important ingredient in our strong competitive positions in a number of our markets. Deterioration in these relationships, or a change in our product’s route to market, could have an adverse effect on our business, financial condition or results from operations.

We have a number of businesses in the various regions of the world, which provide additional management challenges.

We operate in many countries around the world, which requires us to take account of cultural and language differences and to assimilate different business practices. Failure to effectively manage our geographically diverse operations could have an adverse effect on our operations, financial condition or results from operations.

Our operations in foreign and emerging markets expose us to risks associated with conditions in those markets.

We operate principally in the automotive, industrial and construction related markets in a number of geographic regions of the world, including emerging markets across the globe. Operations in emerging markets present risks that are not encountered in countries with well established economic and political systems, including: economic and political instability within these markets; boycotts and embargoes imposed by the international community; significant fluctuations in interest rates and currency exchange rates; the imposition of unexpected taxes or other payments on our revenues in these markets; and the introduction of exchange controls and other restrictions by foreign governments.

In addition, the legal and regulatory systems of foreign and emerging markets identified above are often less formalized and less consistently enforced than in industrialized countries. Therefore, our ability to protect our intellectual property and our contractual and other legal rights in those regions could be limited. Changes in demand in any of these markets may have an adverse affect on our business, financial condition or results of operations.

Our international operations expose us to the risk of fluctuations in currency exchange rates.

We have manufacturing facilities in and sell products to many countries worldwide. Consequently our results can be affected by changes in the currency exchange rates. The principal currencies in which we trade are the U.S. dollar, the Euro and Pounds Sterling. Currency exchange movements can give rise to the following risks:

Transaction risk –this arises where sales or purchases are denominated in overseas currencies and exchange rates can change between entering into a purchase or sale commitment and completing the transaction.

Translation risk – this arises where the currency in which the results of an entity are reported differs from the underlying currency in which the business is transacted.

Economic risk – this arises where the manufacturing cost base of a business is denominated in a currency different from the currency of the market into which the products are sold.

Short-term volatility and long-term realignments of currency exchange rates may have an adverse affect on our business, financial condition or results of operations.

Product liability claims may arise due to the nature of our products.

We face an inherent business risk of exposure to product liability claims in the event that a failure of a product results in, or is alleged to result in, bodily injury, property damage or result in consequential losses as a result of a product recall. Any material product liability losses in the future or costs to defend any alleged failures of our products may have a material adverse effect on our business, financial condition or results of operations.

9

If we are unable to implement our strategic initiatives successfully, our ability to achieve optimal market performance may be impaired.

We are pursuing a number of strategic initiatives aimed to ensure we continue to focus on value creating areas, provide the appropriate value offerings to our customers, achieve superior execution of business processes and maintain a low cost position. A number of initiatives are also in place to achieve future growth by developing relationships with global customers, investing in product innovation, expanding into new geographic regions and product adjacent markets. The success of the strategic initiatives depends in part on the changing competitive dynamics of the markets in which we operate and management can provide no assurance that each of the strategic initiatives will be successful in achieving improvement in our financial performance.

If we experience difficulty in implementing our strategic initiatives it may have an adverse effect on our business, financial condition or results from operations.

We operate pension plans throughout the world, covering the majority of employees, which expose us to the risk of fluctuations in the world’s stock markets.

We operate both defined benefit and defined contribution schemes, the majority of which are in the United States of America and the United Kingdom. The schemes were in deficit by £132.7 million at April 30, 2002 as detailed in Note 24 of Notes to the consolidated financial statements. Further deterioration in price levels of securities in global markets could adversely affect our financial position.

We have a number of employees who are members of trade unions or other employment organizations.

A large percentage of our employees are members of trade unions and over many years we have been able to maintain successful relationships with the unions and employment organizations. A deterioration of these relationships in the future may have an adverse effect on our business, financial condition or results from operations.

We are required to secure and maintain operating licenses from the regulators in certain countries in which our manufacturing facilities are located.

In certain countries we are required to secure and maintain operating licenses. If we were to experience difficulties or delays in obtaining licenses in the future or the cost of such licenses increased significantly, this could adversely affect our business, financial condition or results from operations.

Risks related to the securities market and ownership of ADSs and registered shares

Holders of ADSs may be restricted in their ability to exercise voting rights.

As a holder of ADSs, you will generally have the right under the deposit agreement to instruct the depositary to exercise voting rights for the registered shares represented by ADSs.

At our request, the depositary will mail you any notice of any shareholders’ meeting received from us together with information explaining how to instruct the depositary to exercise the voting rights of the securities represented by ADSs. If the depositary receives voting instructions for a holder of ADSs on a timely basis, it will endeavor to vote the securities representing the holder’s ADSs in accordance with those voting instructions. The ability of the depositary to carry out voting instructions, however, may be limited by practical limitations, such as time zone differences and delays in mailing.

ADS holders may be unable to participate in rights offerings and similar transactions in the future.

U.S. securities law may restrict the ability of U.S. persons who hold ADSs to participate in certain rights offerings or share or warrant dividend alternatives which we may undertake in the future in the event we are unable to choose not to register those securities under the U.S. securities laws and are unable to rely on an exemption from registration under these laws. While we are not currently planning any transaction of this type, we may take such actions in the future and there is a risk that it will not be feasible to include U.S. persons in those actions. If we issue any securities of this nature in the future, we may issue such securities to the depositary for the ADSs, which may sell those securities for the benefit of the holders of the ADSs. We cannot offer any assurance as to the value, if any, the depositary would receive upon the sale of those securities.

10

Item 4. Information on the Company

A. History and development of the Company

General

Tomkins plc was incorporated in England in 1925, converted from a private company into a public company in March 1950 and re-registered as a public limited company in February 1982. The Company’s Ordinary Shares are listed on the London Stock Exchange and the Company’s Ordinary Shares, in the form of ADSs evidenced by ADRs, have been listed on the New York Stock Exchange (the “NYSE”) since February 1995. Prior to listing on the NYSE, the ADSs had been quoted on the Nasdaq National Market since November 1988. Tomkins plc is registered in England and Wales No. 203531. Its registered office is East Putney House, 84 Upper Richmond Road, London SW15 2ST (Telephone: +44 (0) 20 8871 4544).

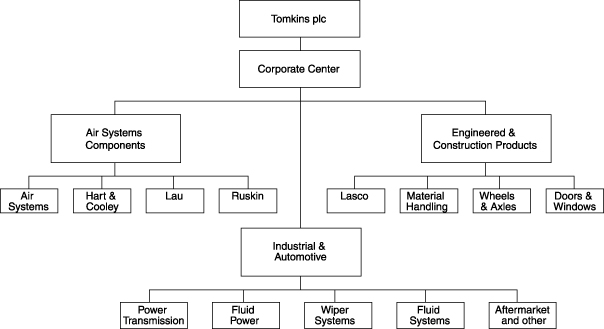

Tomkins is a global engineering group with market and technical leadership. Its activities report in three business segments:

Air Systems Components

The Air Systems Components group manufactures air handling components, supplying the heating, ventilating and air conditioning market. The product range includes fans, grills, registers, diffusers, fan coils and terminal units for residential and commercial applications and dampers for architectural, commercial and industrial use.

Engineered & Construction Products

The Engineered & Construction Products segment manufactures a range of engineered products for a variety of end markets related to the building, construction, truck and trailer and automotive industries.

Industrial & Automotive

This segment manufactures a wide range of automotive products and components through four business areas; Power Transmission, Fluid Power, Fluid Systems and Wiper Systems selling to original equipment manufacturers and replacement markets.

The Company’s continuing operating units manufacture and distribute products throughout the world, including the United States, the United Kingdom, Canada, France, Belgium, the Republic of South Africa, Germany, Mexico, Brazil, Spain, The Netherlands, Korea, Australia, Singapore, Argentina, India, Japan, the Republic of China, Poland and Thailand. The Group’s operating units are based principally in North America, Europe and Asia, employing approximately 40,700 people on average, worldwide, during fiscal 2002.

Strategy

Following the appointment of Jim Nicol as Chief Executive in February 2002, a review of corporate strategy was performed, building on the work already undertaken by management prior to his joining the Group. The review looked in particular at technology (both in products and manufacturing systems), manufacturing initiatives and the role of the corporate center.

While maintaining the financial rigor and cost control that has been a key feature of its financial and operational performance, Tomkins will target long-term value creation through the development of an increasingly more entrepreneurial culture across the Group. In addition to profit maximization and cash control, managers will be encouraged to focus on top line growth. The corporate center will add value in terms of management development, the encouragement of knowledge sharing and technology development, rigorous and transparent financial discipline and the promotion of growth.

Tomkins will concentrate upon the following critical areas:

| | • | | Continuing to build upon its existing strong manufacturing businesses supplying systems and components to industrial, automotive and construction markets worldwide. |

| | • | | Focusing upon the application of technology to meet customer needs. Technology will be developed internally or acquired, either directly or in partnership, to be applied to the creation of new products. |

| | • | | Achieving top line organic growth through focusing upon the development of products, markets and customers. This will be supplemented through bolt on acquisitions where we can add to our competitive positions and larger acquisitions where we believe they can achieve our aim of developing the businesses into higher technology areas. |

| | • | | Creating a management team and culture with the ability to respond rapidly to change, supported by a |

11

compensation structure that encourages and rewards entrepreneurship and is aligned closely to the interests of shareholders.

| | • | | Leveraging our existing customer relationships through the supply of a broader range of systems and products, and developing further our global relationships with customers that have global operations. |

| | • | | Maintaining and improving our position as a low cost producer through strategic manufacturing initiatives, increased application of lean manufacturing and six sigma techniques and the sharing of best practice across all businesses. |

| | • | | Continuing to review rigorously those businesses that fail to make an adequate return in excess of their cost of capital or that do not demonstrate the capability of adding economic value to the Group in the longer term. An exit route will be found for those that are not expected to reach the required standards, allowing resources to be focused into higher value creating areas. |

| | • | | Maintaining the highest standards of financial control and reporting within the businesses and the Group as a whole. |

| | • | | Developing an efficient capital structure which has strength and flexibility to support the growth of the business. |

| | • | | Continuing to communicate transparently with the investment community and other stakeholders. |

The Group already has a good foundation for growth and has many costs and revenue initiatives in place that are coming to fruition during the current year and more importantly in 2003. A focus on new technologies and strategic manufacturing initiatives will provide a platform for continued growth in value in the future. Upon successful completion of the changes outlined above, the Group expects to achieve what many companies seek - a large enterprise of global presence with an entrepreneurial culture that management believes will accelerate growth.

Principal acquisitions, disposals, and capital expenditures

Fiscal 2002

On May 11, 2001 Tomkins sold Smith & Wesson Corp. for consideration of $15.0 million (£10.6 million). The purchaser also paid $20.0 million (£14.1 million) of an outstanding loan of $73.8 million (£52.0 million) due from Smith & Wesson Corp. to Tomkins Corporation. Of the remaining $53.8 million (£37.9 million), $30 million (£21 million) will be repaid on an amortizing basis over the seven years commencing in May 2004 and $23.8 million (£16.8 million) was included in the equity capital acquired by the purchaser. Interest on the outstanding loan balance will continue at nine percent per annum.

Totectors Limited and The Northern Rubber Company Limited were sold on May 25, 2001 and September 11, 2001 respectively for a total consideration, net of costs, of £23.0 million. Sunvic Controls Limited was sold on July 27, 2001 for total consideration, net of costs, of £1.8 million.

Tomkins acquired American Metal Products Company and the business and assets of Superior Rex on November 13, 2001 and November 19, 2001 respectively, for combined consideration of $45.0 million (£31.2 million). These acquisitions are included within the Air Systems Components group, and further information on them within “Item 5. Operating and Financial Review and Prospects.”

On December 17, 2001, the bellows business of Standard-Thomson Corporation was sold for cash consideration, net of costs, of $1.6 million (£1.1 million).

Fiscal 2001

The Company sold the Red Wing Company Inc on July 14, 2000 for cash consideration, net of costs, of $140.9 million (£93.8 million). The Company completed the sale of the remaining Food Manufacturing business segment on August 31, 2000 for total cash consideration of £1,138.0 million. The loss on disposal totaled £216.8 million, of which £215.0 million had been provided for in fiscal 2000.

The Company sold Murray Inc and Hayter Limited on October 5, 2000 for consideration of $219.3 million (£148.3 million). Of the proceeds, the Company has received $206.3 million (£139.5 million) in cash and $13.0 million (£8.8 million) in a secured subordinated loan note, repayable in 2006. The loss on disposal was £76.2 million.

On November 3, 2000, the Company acquired the business and net assets of Care Free Aluminum Products, Inc. for a cash consideration of $11.2 million (£7.8 million). The Company sold Homer of Redditch Limited,

12

Twiflex Limited and T. A. Knight Limited on May 18, 2000, June 23, 2000 and February 16, 2001 respectively for total cash consideration, net of costs, of £3.1 million. The loss on disposal totaled £1.8 million.

Fiscal 2000

Tomkins sold Shipham and Company Limited and The Premier Screw and Repetition Company Limited on April 17, 2000 and April 27, 2000 respectively, for total consideration of £2.6 million.

On June 25, 1999 the Company completed the acquisition of ACD Tridon, a manufacturer of fully integrated windshield wiper systems, for CAD$159 million (£68.7 million) including acquired debt of CAD$105 million (£45.2 million) and on August 9, 1999 completed the acquisition of Hayden’s Bakeries Limited, a high quality patisserie and dessert manufacturer, for £5.2 million, including the repayment of £1.7 million debt.

On November 10, 1999 Tomkins acquired the 14% of the ordinary shares in Anand Gates (India) Private Limited held by a minority shareholder of that company for cash consideration of £0.8 million.

On December 30, 1999 Tomkins acquired the assets of Hart & Cooley, a leading U.S. producer of grilles, registers and diffusers used in residential and light commercial applications, for cash consideration of $322 million (£197.5 million) including acquired debt. On January 9, 2000 the Company completed the acquisition of Air Diffusion Limited, and the business of Actionair, both of which have a leading position market in the U.K. air handling industry for cash consideration of £8.0 million and acquired debt of £2.8 million.

Recent events

On May 15, 2002 Tomkins sold the consumer and industrial division of Gates (U.K.) Limited for cash consideration of £24.0 million. On May 24, 2002, Tomkins sold Lasco Composites for cash consideration of $43.5 million (£29.8 million). On September 11, 2002 Tomkins acquired Ward Industries, Inc. for provisional consideration of $10.8 million (£7.0) million. On October 2, 2002, Tomkins plc acquired the HVAC dampers business of Johnson Controls, Inc. for a maximum consideration of $12 million (£7.7 million).

13

B. Business overview

Segment contribution to net sales and operating income

Comparative figures show operating income including the Company’s share of income from associates and is before goodwill amortization. The contribution of each segment to the Company’s net sales and operating income under U.K. GAAP is set out below.

| | | Fiscal Year Ended |

| | |

|

In £ millions | | April 30, | | April 30, | | April 29,

|

| | | 2002 | | 2001 | | 2000 |

| | | (365 days) | | (366 days) | | (364 days) |

| | |

|

By Business Segment | | | | | | |

|

Air Systems Components | | | | | | |

| Net Sales | | 516.4 | | 487.9 | | 321.6 |

Operating Income(1) | | 53.8 | | 55.3 | | 42.4 |

Engineered & Construction Products | | | | | | |

| Net Sales | | 871.5 | | 878.9 | | 918.8 |

Operating Income (1) | | 77.8 | | 85.4 | | 120.4 |

Industrial & Automotive | | | | | | |

| Net Sales | | 1,985.9 | | 1,968.3 | | 1,921.3 |

Operating Income(1) | | 146.9 | | 191.8 | | 200.8 |

Food Manufacturing | | | | | | |

| Net Sales | | - | | 562.1 | | 1,898.6 |

Operating Income (1) | | - | | 26.0 | | 162.0 |

Professional, Garden & Leisure Products | | | | | | |

| Net Sales | | - | | 208.3 | | 580.1 |

Operating Income(1) | | - | | (14.5) | | 22.4 |

Central Costs(3) | | | | | | |

| Net Sales | | - | | - | | - |

Operating Income(1) | | (12.6) | | (24.0) | | (21.3) |

Total | | | | | | |

| |

|

|

|

|

|

|

| Net Sales | | 3,373.8 | | 4,105.5 | | 5,640.4 |

| |

|

|

|

|

|

|

Operating Income(1) | | 265.9 | | 320.0 | | 526.0 |

| |

|

|

|

|

|

|

By Geographic Region | | Net Sales

| | % of Total

| | Net Sales

| | % of Total

| | Net Sales

| | % of Total

|

|

United States(2) | | 2,380.5 | | 70.6 | | 2,498.1 | | 60.9 | | 2,884.3 | | 51.1 |

| United Kingdom | | 237.7 | | 7.0 | | 787.4 | | 19.2 | | 1,908.6 | | 33.8 |

| Rest of Europe | | 290.3 | | 8.6 | | 309.8 | | 7.5 | | 341.0 | | 6.1 |

| Rest of World | | 465.3 | | 13.8 | | 510.2 | | 12.4 | | 506.5 | | 9.0 |

| | |

| |

| |

| |

| |

| |

|

| | | 3,373.8 | | 100.0 | | 4,105.5 | | 100.0 | | 5,640.4 | | 100.0 |

(1) | | Operating income includes the Company’s share of income from associates and is before goodwill amortization. See table in Item 3. Key Information for a reconciliation to operating income in total as reported in the financial statements. |

(2) | | Translated at the Tomkins weighted average weekly rate for fiscal 2002 of £1 = $1.4330 (2001- hedged rate of £1 = $1.59; 2000 – hedged rate of £1 = $1.61). See item 11 for a description of hedging of profits of overseas subsidiaries. |

(3) | | Includes the cost of the corporate center function, which carries out corporate functions for the Group as a whole. |

Notes 5(a), 5(b) and 5(c) of the consolidated financial statements provide more detailed business segment and geographic information concerning the Company’s operations.

14

Air Systems Components

Fiscal year ended April 30, 2002 | | | |

| Net Sales | | £ | 516.4 | m |

| Operating income including income from associates and before goodwill amortization | | £ | 53.8 | m |

| Operating margin | | | 10.4 | % |

| Net operating assets | | £ | 144.9 | m |

| Return on net operating assets | | | 37.1 | % |

| Capital expenditure | | £ | 16.1 | m |

| Depreciation (net of government grants) | | £ | 17.9 | m |

| Employees | | | 6,909 | |

| Business unit | | Proportion of 2002 net sales | | Products | | Primary Markets |

|

Hart &

Cooley | | 32% | | · · | | Grilles, registers and diffusers Flex ducting and venting | | · | | Residential construction |

|

| Air Systems | | 26% | | · · · | | Grilles, registers and diffusers Terminal boxes Fan coils | | · | | Commercial and industrial construction |

|

| Ruskin | | 23% | | · · | | Louvers, dampers, grilles and screens Fire, smoke and air control dampers and

airside and waterside control fan coil units | | · | | Commercial and industrial construction |

|

| Lau | | 19% | | · · | | Axial and centrifugal fan components and systems Exhaust fans | | · | | Heating, ventilating and air-conditioning manufacturers and commercial and industrial construction |

|

The Air Systems Components group’s products are primarily sold throughout the United States, Canada and the United Kingdom. Competition is based principally on price, quality, service and breadth of product line. Just under half our sales pass through manufacturers’ representatives and approximately 35 percent are sold through wholesalers, principally in the residential market. The balance of sales is direct to original equipment manufacturers (“OEMs”).

Hart & Cooley

Hart & Cooley is a market leader in the U.S., in residential and light commercial grilles, registers, and diffusers (“GRD”). Hart & Cooley also produces flexible duct systems and chimney and gas venting systems which are marketed primarily through wholesale distribution with the GRD products.

Air Systems

Air Systems design and manufacture diffusers, variable air volume terminal boxes (with or without fan power) (“VAV boxes”), grilles, registers, duct heaters, and fan coils for use in heating, ventilating and air conditioning systems in industrial, institutional and commercial applications. It also sells digital controls with its lines of VAV boxes. These products are sold directly to contractors or to manufacturers’ representatives or distributors for resale to contractors.

Ruskin

Ruskin produces and markets commercial and industrial air control dampers, fire and smoke dampers, architectural louvers, sound absorbers, rooftop fire and smoke hatches and vents for use in air conditioning, heating, ventilating and pollution control systems contained in office buildings, hotels, shopping centers, power plants, paper mills and other manufacturing plants. These products are sold directly to manufacturers of heating, ventilating and air conditioning equipment and to contractors and commercial users principally through manufacturers’ representatives. Ruskin Air Management, a U.K. business, markets its damper, louver and grilles, register and diffuser products principally in the United Kingdom and continental Europe. This business gives the Company an important entry to these markets for its other air distribution products.

Lau

Lau manufactures and supplies fans and blowers for residential forced air heating systems and air conditioners, fans for commercial and industrial use and central heating humidifiers for use with home and light commercial heating equipment. Lau’s Conaire division provides aftermarket distribution of spare parts primarily for the residential heating and air conditioning market. These products are sold directly to OEMs, contractors and manufacturers’ representatives. Lau also produces a comprehensive line of centrifugal and axial fans for both commercial and industrial applications. The lines comprise power roof ventilators, inline duct fans, ceiling fans, cabinet fans, propeller roof and wall fans, and fan accessories. Products are marketed primarily through manufacturers’ representatives to the commercial and industrial sectors. Lau’s Barry Blower and Supreme divisions produce heavy-duty axial and centrifugal fans and blowers and food service exhausters.

15

Engineered & Construction Products

Fiscal year ended April 30, 2002 | | | |

| Net Sales | | £871.5 | m |

| Operating income including income from associates and before goodwill amortization | | £77.8 | m |

| Operating margin | | 8.9 | % |

| Net operating assets | | £231.3 | m |

| Return on net operating assets | | 33.6 | % |

| Capital expenditure | | £16.3 | m |

| Depreciation (net of government grants) | | £25.2 | m |

| Employees | | 10,104 | |

| Business unit | | Proportion of 2002 net sales | | Products | | Primary markets |

|

| Lasco | | 33% | | · · · | | Baths and whirlpools PVC, CPVC and HDPE pipe fittings Composite panels | | · · · | | Residential, manufactured housing Commercial, residential and industrial construction Recreational vehicles, truck trailers |

|

Wheels and Axles | | 21% | | · | | Non-drive axles and wheels | | · | | Industrial and general utility, manufactured housing and recreational vehicles |

|

Doors and Windows | | 19% | | · | | Vinyl and aluminum windows, venting and doors | | · | | Residential construction, manufactured housing and recreational vehicles |

|

Material Handling | | 16% | | · · | | Automotive conveyors Scrap handling systems and conveyor belts | | · · | | Automotive factories, parcel/postal facilities Automotive and industrial primary metal working |

|

| Other | | 11% | | · | | Valves and pumps | | · | | Commercial, industrial, residential and institutional construction |

|

Lasco

Lasco Bathware designs, manufactures and markets fiberglass and acrylic showers, bathtubs, tub/shower combinations and whirlpools used in residential (including manufactured) housing and some commercial construction. Included in the product line are assisted care showers and tub/shower combinations designed to meet the needs of senior citizens and the special requirements of the disabled. Products are sold primarily through distributors but also directly to builders and through do-it-yourself channels in the United States. Aquatic Industries, a division of Lasco Bathware, is a maker of up-market acrylic whirlpools, principally for the dealer/distributor market. The facility has been expanded and new equipment added to increase capacity and reduce costs.

Lasco Fittings manufactures plastic fittings used in agricultural irrigation, turf irrigation, water works, swimming pools and spas, for commercial and industrial applications as well as for residential housing purposes. These products are sold through distributors and, to a lesser extent, hardware stores.

Lasco Composites, which produced fiberglass panels for use in construction of buildings, recreational vehicles and truck trailers, was disposed of in May 2002.

In the United States, there are at least four principal producers, including Lasco, in each of the bathware and fittings businesses. Competition is based on price, quality, availability and service.

Wheels and Axles

Dexter Axle produces and markets its products primarily in the United States directly to OEMs and distributors. Dexter Axle has two product lines, axles and complete trailer running gear for the general utility, highway trailer, heavy hauler trailer, manufactured housing and recreational vehicle markets and steel wheels and rims for incorporation in its products or for sale as components.

The general utility market includes horse and livestock trailers, light duty equipment trailers and boat trailers. Running gear assemblies, consisting of axles with capabilities ranging from 800 pounds to 40,000 pounds, wheels and various component suspension and break systems are made for movement of manufactured housing units, recreational vehicle trailers and utility, equipment hauling, heavy hauling and highway trailers. Used axles, which are recycled by regional operators for re-use, provide strong competition in the manufactured housing industry. Competition is based on price, quality, safety, product performance and service.

16

Doors and Windows

Philips Products is a U.S. producer of aluminum and vinyl windows, doors and venting products for the manufactured housing and recreational vehicle markets. The majority of these products are sold to OEMs of manufactured housing and recreational vehicles. Philips Products also produces aluminum and vinyl windows and doors for the residential markets, principally for use in new on-site construction and in the replacement and remodeling markets. These products are sold primarily to distributors, contractors, homebuilders and mass merchandisers.

Material handling

Dearborn Mid-West Conveyor Company designs, fabricates and installs overhead conveyor systems and inverted power and free conveyor systems, skillet systems, automatic electrified monorail systems for the automotive industry, conveyors for bulk materials and various unit handling systems for parcel movement applications.

Mayfran America and Mayfran Europe manufacture and market conveyor and material handling systems principally for the movement of scrap generated in metal working industries. Conveyor systems are also manufactured for the solid waste processing and recycling industries.

Other

Hattersley Newman Hender Limited manufactures heating, ventilating and air conditioning valves for the commercial, industrial, residential and institutional construction industries. The company supplies its products, directly and through distributors, to end users, including utilities, local authorities, industrial and commercial users, contractors and heating engineers. Sales of valves in the United Kingdom, where Tomkins enjoys a leading market position, represented 76% of total valve sales in fiscal 2002, with other sales being made principally in the Middle and Far East, the Americas, Africa and the rest of Europe. Investment will continue in new product development, product cost reduction and advanced production techniques in order to ensure that quality and price competitiveness are maintained.

Pegler Limited is a United Kingdom based manufacturer of ball valves, thermostatic and manual radiator valves as well as faucets and mixers for the United Kingdom and international markets. Faucets, mixers and valves are marketed under brand names such as “Bulldog”, “Terrier”, “Sequel” and “Recollections”. The company traditionally operates via distributor trade routes but has extended distribution of luxury faucets and mixers by the development of a retail sales structure for the U.K. market. Although its major focus remains in the U.K. construction market, Pegler generates sales to all major continents and has significant sales in the U.S., Middle and Far East markets.

Cobra Investments (Pty) Limited, a 62.4 percent owned subsidiary, is a manufacturer of non-ferrous plumbing products in South Africa and a major supplier to all sectors of the housing and commercial markets.

17

Industrial & Automotive

Fiscal year ended April 30, 2002 | | | |

| Net Sales | | £1,985.9 | m |

| Operating income including income from associates and before goodwill amortization | | £146.9 | m |

| Operating margin | | 7.4 | % |

| Net operating assets | | £780.6 | m |

| Return on net operating assets | | 18.8 | % |

| Capital expenditure | | £98.4 | m |

| Depreciation (net of government grants) | | £86.7 | m |

| Employees | | 23,596 | |

| Business unit | | Proportion of 2002 net sales | | Products | | Primary markets |

|

|

|

|

|

|

|

Power

Transmission | | 40% | | · | | | Synchronous belts, V-belts, multi V-ribbed belts, accessory drive systems, synchronous drive systems | | · | | | Automotive original equipment and aftermarket (timing and accessory drives); industrial original equipment and aftermarket (outdoor power equipment, office machines etc.) |

|