|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

FORM N-CSR |

|

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

|

Investment Company Act file number 811-05684 |

|

Alpine Equity Trust |

(Exact name of registrant as specified in charter) |

|

615 East Michigan Street |

3rd Floor |

Milwaukee, WI 53202 |

(Address of principal executive offices) (Zip code) |

|

Samuel A. Lieber |

Alpine Woods Capital Investors, LLC |

2500 Westchester Avenue, Suite 215 |

Purchase, NY 10577 |

(Name and address of agent for service) |

|

1-888-785-5578 |

Registrant’s telephone number, including area code |

|

Date of fiscal year end: 10/31/2008 |

|

Date of reporting period: 10/31/2008 |

|

Item 1. Reports to Stockholders. |

REAL ESTATE FUNDS

Annual Report

October 31, 2008

Alpine U.S. Real Estate Equity Fund

Alpine Realty Income & Growth Fund

Alpine International Real Estate Equity Fund

|

TABLE OF CONTENTS |

|

|

|

|

|

|

|

|

EQUITY MANAGER REPORTS |

|

|

|

|

|

|

|

| 6 |

| |

|

|

|

|

| 11 |

| |

|

|

|

|

| 18 |

| |

|

|

|

|

| 24 |

| |

|

|

|

|

| 30 |

| |

|

|

|

|

| 31 |

| |

|

|

|

|

| 32 |

| |

|

|

|

|

| 33 |

| |

|

|

|

|

| 36 |

| |

|

|

|

|

| 39 |

| |

|

|

|

|

| 45 |

| |

|

|

|

|

| 46 |

|

|

|

|

|

|

|

|

|

| Alpine’s Investment Outlook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dear Investor:

We are currently afflicted by a crisis of confidence which has deflated asset values, constrained capital markets, and threatened the livelihoods of millions of Americans. Wealth and prosperity have rapidly eroded. Employment and retirement prospects are diminished. Fear of a prolonged downturn has paralyzed many corporate, municipal and individual investment initiatives. Our government’s capital injections or ‘bailouts’, have been the initial response aimed at a coherent public/private sector program which can tackle immediate problems, as well as support long term solutions. If properly designed, this could be an investment in the potential, the ingenuity and the entrepreneurial spirit of America. If rapidly deployed, it could begin to restore investor confidence, rally capital markets and commence a rational reflation of long term asset values.

The credit crisis has reduced our economy’s potential capital availability. Investors’ worst fears are largely discounted in prices of stocks and bonds alike. This reflects the inability of the world’s financial institutions to fend off the contagion of crisis on their own. Into the breach have stepped the world’s Central Banks and sovereign Treasuries to save the day, if they can! The government’s use of capital injections, perceived by the market as ‘bailouts’, have called into question the proper role of government both through regulation and ownership of our entrepreneurial free market system. Some view bailouts as a necessary intrusion into our capital market system, others view them as inappropriate in the evolution of market forces even though it might avert a depression. These disparate views appear to have created an element of paralysis evidenced by our present Administration’s inability to seize the day with a comprehensive plan. Perhaps the next Administration will be inspired to do more. We need to jump-start our Nation’s capacity to reinvigorate itself when called upon by crisis. The ability to energize our collective dynamism has been a hallmark of our society and economy, in part historically positioning the U.S. for global leadership.

WHAT CAUSED THE FOURTH QUARTER CAPITAL MARKETS MELTDOWN?

September and October of 2008 will likely be remembered by economic historians as a time when the defenses protecting our banking system succumbed to a hundred year flood of fear and uncertainty. Globalization and excessive risk tolerance has exposed weaknesses in the structure of the global credit delivery system, both precipitating and exacerbating an erosion of confidence. While underlying problems in the U.S. have been brewing for 15 months since the subprime mortgage valuation problem arose, the current state of rampant risk avoidance became a global pandemic following the bankruptcy of Lehman Brothers on September 15. As a result, capital has become scarce and credit for even the most creditworthy has become very expensive. Potential corporate debt maturities and covenant limitations were scrutinized from all angles, forcing major discounts of stock prices. In effect, corporate deleveraging is being forced on many public companies by eroding share prices.

While relative stability was maintained into early 2008, there were still deflationary waves of capital erosion during which liquidity was sucked out of the global capital markets. This was most prominent as the price of oil and other commodities soared to record levels by mid-year. Commodity producing countries made plans for great expansion just as the historic 77% collapse in the price of oil forced the closure of steel mills, mines and production facilities. At the same time, the maelstrom induced by the collapse of Lehman Brothers, froze certain investments in bankruptcy proceedings, which led several major money market funds to ‘break the buck’. In turn, this induced capital flight and maximum risk avoidance by both institutional and individual investors, accelerating the de-leveraging, de-risking process. Thus, foreign currencies, emerging market equities, and financial commodities were dumped as investors around the world sought safe haven in U.S. Treasury bills, actually pushing 90-day Treasury bill yields to 0.06% two days after Lehman’s bankruptcy! Now, central banks around the world are using massive injections of capital and

1

sovereign guarantees to stabilize money markets and induce bank lending.

Even though subprime home mortgages in the U.S. were the proverbial ‘straw which broke the camel’s back’, real estate has not been the root of the problem in the sense that excess supply has not necessarily created an overhang. Rather, excess liquidity which stimulated demand beyond historical levels is the root of the problem. Home price appreciation, slack investment standards and minimal risk premiums enabled Wall Street to engineer both the origination and distribution mechanisms which created even more liquidity. Alas, these distribution systems were interlaced into critical contact with weak links in our financial system. It is safe to assume that there will be less capital available over the near term even after a successful stabilization of the markets. This should lead to reduction in the development of new capacity or excess supply of products or even raw materials. Over time, this will likely offset diminution of demand resulting from the economic impact on business staffing or expansion. Longer term, it should be an important stimulus to price levels as growth returns to the economy in ensuing years, limiting new supply to meet rising demand.

WHAT MIGHT A RECOVERY LOOK LIKE?

In assessing investment strategy to identify potential outperformance from these beaten down equity markets, the most important questions are, first, whether the current effort to revitalize our stricken credit delivery system will be effective; second, what long-term changes will be needed to revitalize the interbank lending system and the flawed debt-securitization process; third, what will be the impact on global liquidity over the next few years; fourth, how will this crisis impact both consumer and investor confidence over time; and fifth, how can we best position the portfolio to take advantage of opportunities created by this unprecedented global crisis?

We are confident that the current effort to stabilize the global banking system is well in hand. The recapitalization process should permit banks over the next couple of years to either dispose of, or work out of, impaired loans. Unfortunately, the prospective near term continuation of global economy weakness will likely lead to further asset devaluation and income degradation, bringing additional pressures to delever corporate balance sheets. This may create more poor performing loans. Thus, it might be a while before we see a strong, competitive lending environment. Meanwhile, we anticipate that banks will extend credit to their largest and strongest existing relationships, amplifying the

ongoing consolidation within the banking system itself. We expect banks will require higher margins with more limited lending. Thus, capital for new business creation and or expansion will probably have to come from nontraditional financial investors who require a significantly higher return on invested capital than traditional bank debt. Clearly, risk premiums required for future capital will likely be more expensive.

Banks’ future requirement of higher net interest margins should over time permit them to take on greater risk, albeit not at the level of the past decade when they faced considerable competition from the capital markets. Over the next several years, flawed asset-backed debt securitizations will come to maturity and require refinancing. In many cases the future cost of refinancing will be much higher. The requirements for interest coverage and excess collateral value will likely be greater than has historically been the norm.

Many of the debt securitizations which dominated the real estate finance environment over the past five years will be subject to recapitalizations or workouts over the next few years. These should be not only more expensive for the issuers, but they should provide lower returns for ongoing investors in these investment vehicles. It is likely that significant investment capital will be tied up for an extended period of time with relatively low return on investment. When, or if, investment bankers can devise a new and improved debt securitization process which instills a measure of confidence in wary investors, securitization could once again offer a competitive source of capital.

Consumer and investor confidence will likely be restored over time. However, the combination of elevated risk avoidance and expensive if albeit limited, liquidity suggests that the range of returns required as investors move up the risk spectrum, will likely be significantly higher. Thus, the discount rates and growth assumptions used in assessing projected investment returns suggests that venture capital will also be constrained. Funding for major capital initiatives such as real estate development, plant expansions and new infrastructure projects should also be curtailed unless confidence inducements can be supplied, such as a governmental guarantee or the strongest of corporate covenants.

Given prospects for a world in which capital has become dear and very selectively distributed, the world of investment opportunities has narrowed. The investment decision process will probably lead to an initial market focus on large and strong companies with solid cash flow and controlled capital requirements. The handful of small companies with a good business model and

2

|

|

|

|

important niche markets or dominant positions in regions of strong growth potential will probably attract significant capital. In between these two categories, there will likely be a range of companies in the process of transforming their business model to adapt to the emerging economic environment which could provide significant investment opportunity if they are successful. We would anticipate a number of different investment opportunities over the next few years.

ECONOMIC PROSPECTS: POTENTIAL SCENARIOS FROM MOST LIKELY, TO MOST OPTIMISTIC, TO MOST PESSIMISTIC

Given the great uncertainty over future government economic stimulus packages and housing stimulus or relief, around the world, as well as the potential impact of such capital injections or inducements upon employment, incomes, investment, lending, and currencies, we have chosen to incorporate an overview of the prospective potential for what could prove to be likely scenarios for economic activity. Our most likely best case, is for the U.S. economy to stabilize towards year-end 2009 as home prices begin to improve in certain markets, unemployment stabilizes at a level under 9%, along with the prospect of a modest lift in U.S. GDP. By then, China’s economy should have also turned the corner after a period of working down expensive inventories of raw materials and refocusing its economic activity, permitting both margin expansion and lower priced products for their export market. Then, India and Brazil should also start to see greater growth as global GDP begins to grow at a rate faster than the flat to negative first six months. We anticipate considerable interest rate reductions to accelerate this trend, in the emerging markets.

Our optimistic scenario has the global economy start to pick up mid-year 2009 as a result of a tremendous boost from both fiscal and monetary stimulus to the world’s major economies. Under such a scenario, home prices should begin bottoming by late in the second quarter in the U.S., and we would expect domestic unemployment to peak below 8%. We believe the significant increase in investment flowing into the equity markets in response to the positive stimulus to the economy would in itself help to stimulate renewed capital investment patterns. All of this could provide a sustained lift for the global economy. The pressure on the new Democrat controlled government to fix our economy could lead to such a powerful stimulus plan for the traditional drivers of our economy; cars and housing, that a short-term bounce can be engineered. Similar efforts may also be made abroad.

Our least likely scenario could occur if too few or ineffective stimulus programs failed to impact the economy, resulting in a prolonged and deeper downturn with potential double-digit unemployment rates in the U.S. lasting through 2010, a negative feedback loop of declining consumption, leading to higher unemployment to increased mortgage foreclosures and business failures, could further erode our country’s capital base. Such a deflationary spiral of negative consequence would weigh on global consumption patterns, limit the recovery of the banking system and perhaps destabilize governments and trade alliances, reversing many of the benefits of globalization. We believe that this risk is apparent to pragmatists in central banks and governments around the world, so every effort will likely be made to avoid such decline.

FINAL THOUGHTS: ADJUSTING TO A NEW WORLD

During preceding sections we have discussed how this “hundred year flood” of economic distress has upended the order of things related to both the capital and credit markets. Such traumatic events often lead to investment opportunities. We would like to share our thoughts regarding some of those opportunities as we structure our investment portfolios, discussing how this event has led us, as the Funds’ managers, to initiate new efforts in an attempt to protect the Fund against possible future economic tsunamis.

We believe the consolidation in the banking sector should create a selective group of large capitalization companies with strong balance sheets and entrepreneurial management teams, who have enhanced returns in the past, could be rewarded with premium share prices as well as access to capital markets. Large companies which have poor financial structure, management team or business focus will likely be forced to restructure in an attempt to transform their business to meet current economic demands. The likelihood is that only a few will succeed, and those which fail will be forced to sell assets or portfolios, to the better capitalized premier companies. Smaller companies which have good growth opportunities and solid management may find that capital is very expensive. Some should be able to expand their portfolios in spite of higher cost capital and eventually earn premium recognition from the marketplace.

Since the structured finance markets will probably take between two to four years to restructure and, or, cleanse themselves of poor performing loans, we suspect there will not be significant low cost funding for leveraged buy-outs during this period in the U.S. and Europe. Asia

3

|

|

|

|

and Latin America present a different scenario as we believe their economic growth rates should be sustained at higher levels than growth potential of developed markets enhancing prospective values. Furthermore, they did not receive significant capital from the structured finance underwriters on Wall Street, so there should be very little overhang in those markets. Thus, as the dust settles over the next year, we believe it will become increasingly clear to investors that emerging market trends are still intact for the long term and that development of the capital markets would be required to meet economic demand. In the U.S. and Europe, we believe it will be a slower march back, with investment potential coming from relatively cheap equity valuations and companies’ abilities to transform their business models to position themselves for capital expansion.

Given the current valuation of many real estate, industrial, commodity and financial equities at historic trough levels not seen since 1990, and in some extremes even further back towards the 1970’s, we suspect that the potential for historically strong recovery of valuations off a low basis is present. If equities prove to be cyclically attractive over the next year or two, and stock markets around the world have thoroughly discounted their decline, then we look forward to positioning our portfolios not just for a rebound potential, but also for long term growth potential.

As companies transform their business models, we believe that evolution of our management process is also important and thus we are focusing on adjustments to our existing investment methodologies. In an attempt

to protect our portfolios against future extreme price movement, we would hope to reduce the sort of downside risk which has impacted our portfolios this year. Unlike previous years, broad portfolio diversification failed to cushion the downside for our international portfolios in particular. In response, we are gradually concentrating portfolios to a greater degree, favoring the sort of investment opportunities which we believe might outperform during this period of uncertainty and potential transformation.

While the market is certainly closer to a bottom than just a few months ago, and may have hit its nadir on November 21st, the risk of an extended downturn remains. Thus, we will err on the side of caution, while still hunting for undervalued recovery opportunities and transformational value situations. Anticipating a two to three year investment holding period, many of the downtrodden values of today may become great recoveries or even market leaders for the future.

We appreciate your support and interest. Alpine has been investing in our people, processes and systems in an effort to invest most effectively. We hope to enhance results for you in the New Year.

Sincerely,

Samuel A. Lieber

President, Alpine Mutual Funds

The letter and those that follow represent the opinions of Alpine Funds management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Cash Flow measures the cash generating capability of a company by adding non-cash charges (e.g., depreciation) and interest expense to pretax income.

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

4

EQUITY MANAGER REPORTS

|

|

| Alpine U.S. Real Estate Equity Fund |

|

|

| Alpine Realty Income & Growth Fund |

|

|

| Alpine International Real Estate |

|

|

| |

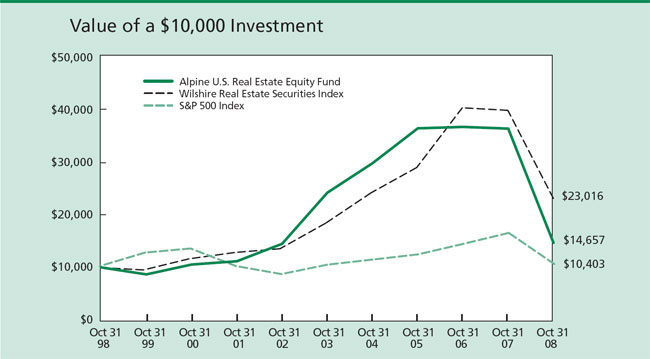

| |

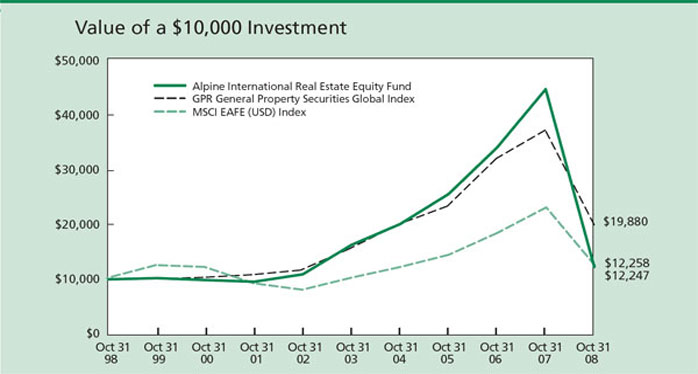

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus similar investments in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s return reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total returns would have been lower.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The Wilshire Real Estate Securities Index is a market capitalization weighted performance index of listed property and real estate securities. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. Lipper rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The Wilshire Real Estate Securities Index, the S&P 500 Index and the Lipper Real Estate Funds Average are unmanaged and do not reflect fees associated with a mutual fund, such as investment adviser fees. The performance for the U.S. Real Estate Equity Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Comparative Annualized Returns as of 10/31/08 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

| 6 Months(1) |

| 1 Year |

| 3 Year |

| 5 Year |

| 10 Year |

| Since Inception |

| ||||||

Alpine U.S. Real Estate Equity Fund |

| -50.76 | % |

| -59.54 | % |

| -26.07 | % |

| -9.48 | % |

| 3.90 | % |

| 6.55 | % |

|

Wilshire Real Estate Securities Index |

| -37.28 | % |

| -42.00 | % |

| -7.28 | % |

| 4.64 | % |

| 8.69 | % |

| 8.57 | % |

|

S&P 500 Index |

| -29.28 | % |

| -36.10 | % |

| -5.21 | % |

| 0.26 | % |

| 0.40 | % |

| 6.95 | % |

|

Lipper Real Estate Funds Average |

| -37.22 | % |

| -41.94 | % |

| -8.00 | % |

| 3.21 | % |

| 8.24 | % |

| 7.98 | % |

|

Lipper Real Estate Fund Rank |

| — |

|

| 228/231 |

|

| 194/194 |

|

| 151/154 |

|

| 65/66 |

|

| 6/7 |

|

|

|

|

| |

(1) Not annualized. FINRA does not recognize rankings for less than one year. | |

6

|

|

Alpine U.S. Real Estate Equity Fund |

|

|

|

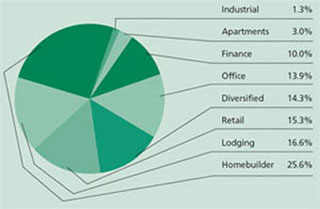

Portfolio Distributions* (Unaudited) | Top 10 Holdings* (Unaudited) |

|

|

|

|

|

|

|

|

| |||||

| 1. |

| Alexander’s, Inc. |

| 10.11% |

| |||||

2. |

| Verde Realty |

| 8.65% |

| ||||||

3. |

| MFA Mortgage Investments, Inc. |

| 5.55% |

| ||||||

4. |

| Alexandria Real Estate |

|

|

| ||||||

|

| Equities, Inc. |

| 4.69% |

| ||||||

5. |

| Annaly Capital Management, Inc. |

| 4.40% |

| ||||||

6. |

| Centex Corp. |

| 4.26% |

| ||||||

7. |

| Desarrolladora Homex SA |

|

|

| ||||||

|

| de C.V. – ADR |

| 4.21% |

| ||||||

8. |

| DiamondRock Hospitality Co. |

| 3.74% |

| ||||||

9. |

| Kilroy Realty Corp. |

| 3.45% |

| ||||||

10. |

| Lennar Corp. – Class A |

| 3.10% |

| ||||||

| |||||||||||

| * | Portfolio holdings and sector distributions are as of 10/31/08 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Portfolio Distributions and Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. | |||||||||

| |||||||||||

|

Commentary |

Dear Investor:

The year-end net asset value per share of $13.86 for the Alpine U.S. Real Estate Equity Fund shows a 12-month decline of -59.54%. The impact of the financial market crisis was most acute during the Fund’s fiscal fourth quarter which is reflected in the six-month returns of -50.76%. Over the course of 12 months, the Wilshire Real Estate Securities Index declined by -42.00%, the S&P Supercomposite Hotel Index declined by -53.66% and the Bloomberg Real Estate Operating Company Index declined by -54.01%. The S&P Supercomposite Homebuilding Index actually outperformed over the course of the year, declining -33.73%. All of these indices represent shared influences on the Fund’s performance. Not as apparent was the decline in Brazilian Homebuilding ADR’s for Cyrela and Gafisa, which also reflected the 19.59% decline in the Brazilian Real currency during the fiscal year. The net effect of this tumble in market prices is that by most measures, stocks are very cheap. By Alpine’s estimation, the markets are overly pessimistic in their valuation of real estate equities.

WHERE IN THE CYCLE ARE WE?

The extraordinary level of volatility within the share markets reflects both upon the nature of the business cycle and the market’s view on its trajectory. This real estate cycle is different from prior experience in that it reflects a destruction in demand as a result of deleveraging the financial structure which had evolved over the prior 30 years. Uncertainty has been

heightened because this deleveraging suggests that the financial system will have to create new ways of delivering credit into the capital markets with a reduced level of risk to investors who provide that credit. The pace with which this structural transition takes place will very much influence both the depth and duration of the current down cycle. When new capital comes into the real estate marketplace and successfully defeases or replaces frozen or failed collateralized or pooled debt structures, we should then have clarity on the prospects for the reacceleration of debt financing, which can contribute towards asset growth. Until that time, debt refinancings or the ability to avoid forced prepayments due to technical covenant defaults will likely remain a factor in the continued pressure on both real estate and real estate equity valuations. Alpine’s estimation is that this process should begin to unfold over the next two or three years. Just as the watchwords for the prior cycle was “Stay alive to ‘95,” this time may be “Look to heaven until 2011”!

THE EQUITY REAL ESTATE SECURITIES CYCLE

Given the historic capacity of equity markets to react in anticipation of the fundamental real estate cycle, it is quite possible that real estate equities have already experienced their cyclical lows. The accompanying table shows that the previous cycle for REITs as represented by the MSCI REIT (RMS) Index began February 10, 1999 and experienced 339.9% appreciation over the eight years until peaking February 9, 2007. From that date in 2007

7

|

|

Alpine U.S. Real Estate Equity Fund |

|

through November 21st, 2008 this index has given back 68.3% of its peak value. Over a similar period the S&P Supercomposite Homebuilder Index rose 810.2% from its prior trough on March 6, 2000 to its earlier peak July 20, 2005 before falling 86.8% through November 21st

of this year. The S&P Supercomposite Hotel Index rose by 199.3% from its prior trough on March 12, 2003 through July 16, 2007, just after Blackstone Group acquired Hilton Hotels Corp. Subsequently, the index has fallen 74.2% to its recent low on November 21st, 2008.

Real Estate Securities Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Index |

| CTRY/Region |

| Start of |

| % Gain |

| Last |

| % decline |

| 1980’s-90’s |

| ||||||

MSCI REIT |

|

| U.S. |

|

| 02/10/99 |

|

| 339.9 |

|

| 02/09/07 |

|

| -68.3 |

| 84 : -28 |

|

|

S&P Supercomposite Homebuilding |

|

| U.S. |

|

| 03/06/00 |

|

| 810.2 |

|

| 07/20/05 |

|

| -86.8 |

| 229 : -49 |

|

|

S&P Supercomposite Hotels |

|

| U.S. |

|

| 03/12/03 |

|

| 199.3 |

|

| 07/06/07 |

|

| -74.2 |

| 403 : -48 |

|

|

Our experience is that most real estate stock cycles up-trends last from three to six years, and the down cycles extend typically from nine to thirty months. While each cycle is different, this experience suggests that the homebuilding sector could be approaching an upturn, even though the prospect for profit growth may be twelve to eighteen months in the future. Since the commercial property cycle tends to lag the residential and lodging cycles due to the extended duration of most leases, it is likely that a nadir for commercial rental profitability may also lag well into 2010 or beyond. However, current valuations continue to reflect liquidation scenarios which Alpine suspects are overly pessimistic and perhaps a bit simplistic in their analysis of liquidity constraints and portfolio risk. Thus, current share prices might well reflect a significant discount to probable real estate valuations once liquidity returns to the marketplace and transaction volumes approach historical levels.

REAL ESTATE VALUATIONS

Since the subprime mortgage meltdown began this crisis of confidence in underlying asset valuations, it is perhaps best to start with home prices. The S&P Case Schiller Composite — 20 City Home Price Index shows a decline of 21.77% nationwide since its peak in June, 2006, although in reality numerous transactions have taken place at levels 30% to 50% below peak market comps going back to 2005. Historically low levels of home sales and a rising level of foreclosure sales has resulted in the lowest number of new home construction permits in over 50 years. Historically, such a reduction in supply in combination with significant price declines during a low interest rate environment would have induced considerable demand as a result of enhanced level of affordability. However, mortgage financing having been impacted by the current credit crisis has made mortgages both more expensive and limited in number. Over the past decade, Wall Street has provided roughly 60% of the capital available for mortgages at a relatively low cost of production. Specifically, most fixed rate mortgages are

priced at historic levels of 150 basis points over the 10-year Treasury Bond. Unfortunately, such mortgages have been priced typically between 250 to 290 basis points over the 10-year Treasury as investors seek higher risk premiums even though today these are conforming to 70% loan-to-value at currently depressed valuations. We believe it is very possible that the government will be able to provide new mortgages at or better than traditional spreads through its now total control of Fannie Mae and Freddie Mac for the new year. Over time, this should begin to resuscitate home values as pent up demand brings homebuyers back to the marketplace.

Commercial valuations are more complicated in that they historically reflect a combination of investors’ expectations for cash-on-cash yields over the life of the investment and the cost of debt financing. During the prior five years, it was easy to obtain mortgage financing for up to 90% of a property’s value at historically low interest rates. Indeed by the end of this cycle, such extensive financing combined with declining cash-on-cash or equity requirements led to property investments where the debt was not going to be covered by rents until either leases were renewed at higher projected levels in future years or the property was sold. This led to an era of 4% to 5% on property acquisition prices for many properties and often 6% to 7% yields for generic real estate. Today, it looks like we are turning back the clock by more than five years, returning to mortgages which rarely exceed two-thirds of conservatively estimated valuations with equity comprising the final third valuations. At such valuations, a meaningful initial cash yield is required by investors.

Given the convoluted construction of most Commercial Mortgage Backed Securities (CMBS), where multiple properties from multiple owners were assembled into a pool and then sold off to a multiplicity of buyers it will be difficult to achieve a consensus on how to revalue, restructure and renegotiate bad loans. This suggests that capital may be tied up in property purgatory for a long time. In turn, this will probably slow the value adjustment process as investment capital may not be

8

|

|

Alpine U.S. Real Estate Equity Fund |

|

readily recycled and redeployed. Thus, portfolio allocations to commercial property loans may include zombie-like portions with inadequate yields for extended duration.

An overriding theme for both commercial and residential property will likely be the inherent limitations on development for at least the next several years and possibly a decade in terms of commercial property needs. This suggests, however, that the combination of environmental and financial constraints upon new development could lead to improved supply and demand characteristics which may drive superior rental and valuation growth over the course of the next cycle.

PORTFOLIO FOCUS

During the past 12 months, there has been considerable adjustment in the overall shape of the portfolio. Only two of the 2007 top-ten holdings remain, including Alexander’s, the New York retail oriented REIT controlled by Vornado, which has risen from the sixth place holding up to number one. Verde Realty, the Fund’s second largest holding, is an El Paso, Texas based cross-border owner and developer of industrial parks and apartment projects. Verde’s unique land portfolio is contiguous with a highway from a newly expanding border-crossing linked to regional rail and air transport hubs. William Sanders and Ron Blankenship co-founded Verde after selling Security Capital to GE and spinning off Prologis and Regency Centers, amongst other companies that were formed within it. The portfolio’s number three and five holdings are mortgage REITs, respectively MFA Mortgage Investments and Annaly Capital Management which are conservatively positioned for producing their high yields from Fannie Mae and Freddie Mac mortgages. Both companies have seasoned managers who survived the prior mortgage market meltdowns during the Russian Ruble crisis and near demise of Long-Term Capital Management in 1998. Alexandria Real Estate Equities is the fourth largest holding. It is a dominant niche REIT, focused on providing office and lab space for biotech and big pharma companies in key centers of medical research across the country. These five companies represent a third of the portfolio’s investments.

Portfolio allocation by property type have also changed considerably as the lodging sector which represented 37.3% of the portfolio last year has diminished to 16.6% as of October, 2008. Homebuilders have stayed relatively constant at 25.6%, however, the breakdown between foreign homebuilder ADR’s and U.S. builders has shifted from roughly 60% foreign in 2007 to approximately 60% domestic as of October, 2008. This reflects both the

decline in the valuation of Brazilian ADR’s, as previously mentioned, as well as the increased weightings in depressed U.S. stocks such as Centex Corp., the Fund’s sixth largest holding, and Lennar Corp., the Fund’s 10th largest company.

While the Fund’s exposure to REITs is relatively similar at 46.8% versus 44.4% of the portfolio, we began at the end of October to increase our exposure to depressed retail REITs, such as General Growth Properties and Kimco Realty Corp, which along side Alexander’s now represents 14.3% of the portfolio, versus the 5.6% holding a year ago. Even though the office/office-industrial component is down somewhat from 17.4% to 13.1% we began to add additional exposure through other depressed REITs such as AMB Property Corp. and ProLogis.

INVESTMENT STRATEGY

We are continuing the essential investment strategy which we utilized last year, however, the nature of the specific investments has been adjusted as the market environment has changed and new opportunities present themselves. Historically the value orientation of the Fund is focused on (1) early cyclical expansion opportunities, (2) individual company or sector recovery, (3) mispriced growth opportunities, and (4) sectors of relative undervaluation. Currently the manager is trying to mix conservative income oriented companies with strong balance sheets and combine those with a particular tilt towards early cyclical companies which we believe should outperform if and when strong stimulus programs are introduced into the economy. In particular, we think housing may well be a strong beneficiary over the next two to three years, and we also believe that commercial real estate, while constrained by limitations in the debt markets, has in a number of cases been mispriced by the equity markets in recent months and may provide opportunities as the stronger players amongst the public REITs begin to consolidate their market share positions. The REIT sector has witnessed such extreme reductions in liquidity that valuations amongst these public companies have become less relevant than equity market related liquidity events and technical factors. Specifically, ETFs have become a significant force in the overall stock market environment in particular with regard to REITs. These vehicles serve a useful purpose for traders seeking sector exposure without making the effort to discern company specific attributes or deficiencies. Thus, intraday trends in trading have created severe volatility in the REIT group, which previously was noted for its stability.

We should note that we are continuing with the

9

|

|

Alpine U.S. Real Estate Equity Fund |

|

portfolio’s exposure to Latin American ADRs as we believe that these companies are acutely underpriced by the markets after global investors pulled away from emerging markets in particular. While no part of the planet remained unscathed by this global credit crisis, we do believe that growth should continue to be greater in the emerging markets than in the U.S. Thus, at current valuations we believe these companies retain considerable upside.

2009: A MARKET ODYSSEY

It is hard to say at this time whether 2009 will provide a significant capacity to rebound from the highly depressed environment of 2008. It is possible that the global malaise of valuation uncertainty will linger. This could have negative implications for business capital investment, and expenditures on the part of municipalities and individuals, which could extend declines in employment. Obviously this would have negative implications for real estate if it continues into 2010. On the other hand the extraordinary infusion of capital by governments around the world in combination with historic low interest rates could fuel a

significant rebound to be followed by several years of inflation. This could provide a very interesting dynamic for real estate equities. Given the prospect of a positive real estate cycle commencing in the next twelve to twenty-four months, we will be looking for the equity markets to build a bridge across to the up-side in advance of improvements on the ground.

We look forward to reporting on the market’s progress in our next report to shareholders.

Sincerely,

Samuel A. Lieber

Portfolio Manager

|

|

| |

Funds that concentrate their investments in a specific sector, such as real estate, tend to experience more volatility and be exposed to greater risk than more diversified funds. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Fund regularly makes short sales of securities, which involves the risk that losses may exceed the original amount invested. | |

Please refer to the schedule of portfolio investments for fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

A Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Standard & Poors (“S&P”) Supercomposite Hotel Index is a market capitalization weighted performance index of publicly traded hotel companies.

S&P Supercomposite Homebuilding Index is a market capitalization weighted performance index of publicly traded homebuilding companies.

Bloomberg Real Estate Operating Company Index is a capitalization-weighted index of Real Estate Operating Companies having a market capitalization of $15 million or greater.

MSCI REIT (RMS) Index is a total return index comprising the most actively traded real estate investment trusts and designed to be a measure of real estate equity performance.

S&P Case Schiller Composite – 20 City Home Price Index is a value-weighted average of 20 metro area indices constructed to accurately track the price path of typical single-family homes located in each metropolitan area provided.

10

|

|

|

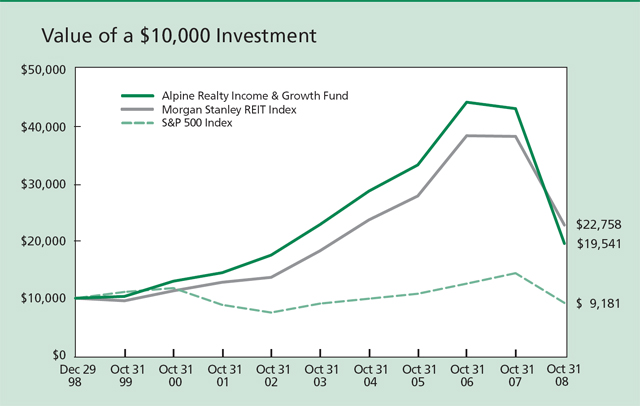

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus similar investments in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s return reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total returns would have been lower.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The Morgan Stanley REIT Index (the “RMS Index”) is a total return index comprising of the most actively traded real estate investment trusts and designed to be a measure of real estate equity performance. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. Lipper rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The Morgan Stanley REIT Index, the S&P 500 Index and the Lipper Real Estate Funds Average are unmanaged and do not reflect fees associated with a mutual fund, such as investment adviser fees. The performance for the Realty Income & Growth Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comparative Annualized Returns as of 10/31/08 |

|

|

|

|

|

|

|

| |||||||||

| ||||||||||||||||||

|

|

| 6 Months(1) |

| 1 Year |

| 3 Year |

| 5 Year |

| Since Inception |

| ||||||

| Alpine Realty Income & Growth Fund |

|

| -49.59 | % |

| -54.62 | % |

| -16.23 | % |

| -3.08 | % |

| 7.05 | % |

|

| Morgan Stanley REIT Index |

|

| -35.92 | % |

| -40.46 | % |

| -6.48 | % |

| 4.49 | % |

| 8.72 | % |

|

| S&P 500 Index |

|

| -29.28 | % |

| -36.10 | % |

| -5.21 | % |

| 0.26 | % |

| -0.87 | % |

|

| Lipper Real Estate Funds Average |

|

| -37.22 | % |

| -41.94 | % |

| -8.00 | % |

| 3.21 | % |

| 8.36 | % |

|

| Lipper Real Estate Fund Rank |

|

| — |

|

| 223/231 |

|

| 185/194 |

|

| 141/154 |

|

| 56/67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

| ||

| (1) | Not annualized. FINRA does not recognize rankings for less than one year. |

11

|

|

Alpine Realty Income & Growth Fund |

|

|

|

|

|

|

|

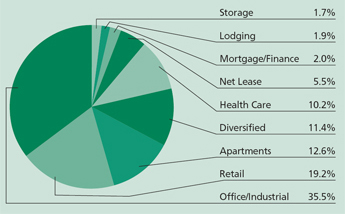

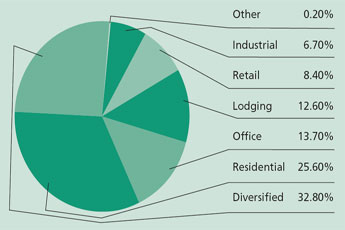

Portfolio Distributions* (Unaudited) | Top 10 Holdings* (Unaudited) |

|

| ||

| |||||

| 1. |

| Vornado Realty Trust | 5.82 | % |

| 2. |

| Simon Property Group, Inc. | 5.37 | % |

3. |

| Boston Properties, Inc. | 5.13 | % | |

4. |

| Alexandria Real Estate Equities, Inc. | 4.96 | % | |

5. |

| Entertainment Properties Trust | 4.25 | % | |

6. |

| Kimco Realty Corp. | 3.81 | % | |

7. |

| Douglas Emmett, Inc. | 3.64 | % | |

8. |

| Omega Healthcare Investors, Inc. | 3.58 | % | |

9. |

| Essex Property Trust, Inc. | 3.49 | % | |

10. |

| Home Properties, Inc. | 3.27 | % | |

| |||||

* Portfolio holdings and sector distributions are as of 10/31/08 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Portfolio Distributions and Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. | |||||

|

|

|

|

|

|

|

Commentary |

|

Dear Investor:

During the annual fiscal period that ended October 31, 2008, the Alpine Realty Income & Growth Fund experienced a total return of - -54.62% as increasing weakness in the overall economy and a frozen debt market led to a collapse in the pricing of public real estate equities. At October 31, 2008, net asset value per share was $9.95. During the fiscal period, the Fund paid four quarterly income dividends per share totaling $.99 as well as a long term gain distribution of $1.7114 in December 2007. Since its inception on December 29, 1998 at $10 per share through October 31, 2008, the Fund produced a total cumulative return of +95.41% (+7.05% on an annualized basis) and has made cumulative distributions to shareholders of $11.78 per share. The preceding table presents the Fund’s returns for the latest one-year, three-year, five-year, and since inception periods relative to the Morgan Stanley REIT Index (the “RMS Index”) and the S&P 500 Index (“the S&P”).

The increasing likelihood of a global recession compounded by a financial system in crisis has driven equity prices dramatically lower worldwide in 2008,with U.S. real estate stocks particularly hard hit during October and November. Despite massive government intervention, credit availability for businesses and consumers has remained constricted since mid-2007. However, credit became virtually non-existent this fall after the near death experiences of insurance giant AIG, Fannie Mae, and Freddie Mac, the bankruptcy of Lehman Brothers, and the near failures and forced takeovers of Merrill Lynch, Washington Mutual, and Wachovia. Fears of a collapse of the banking system and a prolonged recession caused both institutional and individual

investors to shed the perceived risk of equities and seek shelter in U.S. Treasury securities. Indeed, risk aversion has been exemplified by demand for 3-month U.S. Treasury bills for which yields approached 0% in the days following Lehman’s announced bankruptcy on September 15th and have remained as low as .015% as recently as December 11th. Equity prices, meanwhile, collapsed rapidly, aggravated incrementally by forced selling from leveraged investors, with the S&P 500 Index dropping -39.58% from September 12th through its recent low on November 20th and real estate investment trusts represented by the RMS Index decreasing a dramatic -61.93% over the same timeframe. While both the S&P and the RMS Index rebounded from their November 20th lows, both indices remain significantly depressed with the S&P down -39.16% and the RMS Index down -49.58% on a 2008 year-to-date basis as of the December 11th date of this report.

Volatility within the publicly traded REIT sector has been unprecedented. During 2008 (through December 11th), the average and median daily moves on an absolute basis in the RMS Index have been 3.20% and 2.00% respectively, with increases or decreases greater than 1% occurring on 181 trading days (74.8% frequency), greater than 3% on 84 days (34.7% frequency), and greater than 5% on 47 days (19.4% frequency). Volatility since September 15th has been even more extreme. The average and median absolute daily moves have been 6.83% and 6.48%, respectively with 61 days greater than 1% (93.8% frequency), 51 days greater than 3% (78.5% frequency), and 39 days greater than 5% (60.0% frequency). This level of volatility when compared to the first thirteen years experience of the RMS Index, from 1995 through 2007, is truly extraordinary. During the first thirteen years, the

12

|

|

Alpine Realty Income & Growth Fund |

|

average and median daily moves were .61% and .42%, with only 1.3% of trading days experiencing increases or decreases greater than 3%. Moreover, according to REIT Zone Publications’ “REIT Wrap”, 24 of the 25 best days and 23 of the 25 worst days in the history of the RMS Index have all occurred in 2008, with the two remaining “worst” days occurring in the 4th quarter of 2007!

The extreme volatility of the group stems in part from the perceived heightened risk of the group in the face of a steep economic slowdown and a severely constricted debt market. However, in our view, the volatility has been exaggerated by (i) the increased short interest in the sector, which according to Citigroup stood at 9.6% of the shares outstanding as of November 28th, the highest of any sector listed on the New York Stock Exchange, and (ii) the proliferation of exchange traded funds (“ETFs”) which afford macro-strategists the means to efficiently place bets with or against the sector. The ETFs’ collective scale and daily trading volumes have increased meaningfully over the past two years. Consequently, their impact has become significant compared to the relatively small market capitalization and daily trading volumes of the REIT group, increasing directional moves in the indices as a result of buying and selling constituents’ shares and/or rebalancing their own portfolios. [Note that the common share market capitalization of the 114 constituents of the Equity REIT sector according to NAREIT (the National Association of Real Estate Investment Trusts) was only $151.7 billion as of November 30th, less than the nearly $200 billion individual market capitalizations of either General Electric or Microsoft]. Indeed, on a recent above average volume trading day, December 3rd, the total volume of New York Stock Exchange (“NYSE”) trades for the members of the RMS Index was exceeded by one real estate ETF and nearly exceeded by another. On that day, the NYSE trading volume for the RMS components was only approximately $1.9 billion according to data provided by Bloomberg. This total compares to that of the iShares Dow Jones U.S. Real Estate Index Fund (the “IYR”, approximately $1.6 billion) and the UltraShort Real Estate ProShares Fund (the “SRS”) which seeks returns that correspond to twice (200%) the inverse of the Dow Jones U.S. Real Estate Index’s returns (approximately $2 billion).

In our opinion, high levels of volatility will likely remain in the near term until there is evidence of stabilization and improvement to the same factors we highlighted in our report one year ago. Namely, we believe the significant downturn of the public real estate sector derives from (i) the sector being highly financial capital intensive, (ii) uncertainty regarding valuations of companies’ assets, and (iii) concerns of slowing earnings growth, all of which we will discuss in sequence below. While the current volatility can provide attractive buying opportunities, there is no debate that the real estate industry, public and private, faces near term headwinds of capital availability and weakening fundamentals. The primary question is whether market fears are justified or whether they are exaggerated, thereby pushing valuations below appropriate levels.

While frozen financial markets are impacting all industries, commercial real estate’s reliance on a liquid debt market for transactions and for refinancing upcoming maturities is a major concern for owners and thereby investors. Traditional sources of debt have either stopped or significantly curtailed their lending. Commercial banks, overwhelmed by weak balance sheets and significant exposure to real estate construction and land loans, are conserving capital. The securitized mortgage debt market, or CMBS market, is virtually shut down, issuing only $12.1 billion year-to-date in 2008, compared to over $200 billion in 2007, with $0 issuance in the third quarter. Indeed, according to Prudential Real Estate Investors’ research, in early October, the yield on senior AAA bonds topped swaps plus 500 basis points, up from swaps plus 22 basis points in early 2007, and moved higher in November, reflecting the extreme dislocation in the capital markets and making any new debt unprofitable for either borrowers or issuers. The two other traditional sources of mortgage capital, life insurance companies and the GSEs, Fannie Mae and Freddie Mac, however, remained active during 2008, though each slowed their lending considerably in the 4th quarter. With less competition, life insurance companies were able to issue low loan-to-value loans to strong sponsors at attractive spreads during the past year but, given their own balance sheet exposures to depressed residential mortgage backed paper, 2009 new loan originations may be lower than in 2008. Fannie and Freddie’s continued lending to the multi-family sector, albeit at higher spreads (250-300 basis points) than in previous periods, has thus far provided stability to the apartment sector. How much capital the GSEs will provide in 2009 outside their primary single family home mandate remains similarly uncertain, though historically it has been a very profitable business segment for them.

Over the longer term, we strongly believe real estate will garner its fair share of capital, given the relative stability of well underwritten cash flows and debt providers’ needs for long lived assets. In the near term, before the void created by the shutdown of the CMBS market in particular is filled, capital availability will likely remain tight and borrowers will probably have limited options to refinance existing debt maturities. Loan delinquencies should undoubtedly rise from today’s below average levels recently reported in October by CB Richard Ellis, .57% for CMBS and .03% for life insurance companies, as aggressively underwritten loans from 2006 and 2007 encounter difficulties and poorly capitalized sponsors are unable to meet loan payoff requirements. Additionally, real estate operating companies including REITs should experience increases in their weighted-average costs of debt capital which typically stand at a low 5.50%-6.25% level currently. However, we believe the pervasive market fear that companies’ debt maturity schedules are time bombs that will lead to foreclosures and forced liquidations of company assets is overblown and inappropriately imbedded in the stock valuations of many real estate entities. Particularly for higher quality publicly traded REITs, it is our view that the on-balance sheet secured

13

|

|

Alpine Realty Income & Growth Fund |

|

lenders and perhaps even many unsecured bondholders will be compelled under current market conditions to modify and extend debt obligations and keep the assets in the hands of these operators rather than commence legal actions to control the properties themselves. New loan originations will likely occur selectively but we believe the majority of existing loans should not implode. Loans securitized and backing CMBS bonds are likely to have more difficulty achieving modifications from third party servicers and this market could be tested essentially for the first time in its history in 2010.

Uncertainty about valuations of real estate assets also continues to weigh on the sector. With lower debt capital available, transaction volumes are significantly lower in 2008, providing few data points for investors. Not atypical, apartment and industrial warehouse sales are off 50% and 55% respectively year-over-year through October according to Real Capital Analytics (“RCA”). In the absence of sufficient price discovery and with increased risk premiums across all asset classes, much speculation has occurred regarding the ultimate level of capitalization rates, the inverse of operating income multiples, used by many as a quick tool for valuations. Actual, albeit limited, private market transactional data tracked by RCA for a broad quality spectrum of real estate sales through October, 2008 has shown that on average capitalization rates have already moved up 75 to 100 basis points from their 2006-2007 lows (e.g. to approximately 6.50% nationally for apartments and 7.75% for industrial warehouses). Meanwhile, Property & Portfolio Research (“PPR”) data shows that such rates for a higher caliber of institutional quality property at the end of the third quarter were on average 5.75% for apartments, 6.7% for office and retail assets, and 6.8% for warehouses. In our view, average capitalization rates, particularly for B and C quality assets, are likely to continue to move higher into 2009, reflecting increased stress due to tight debt capital markets. Nevertheless, uncertainty in the market and fears about capital availability have led many market participants to conclude that capitalization rates must move significantly higher, perhaps several hundred basis points higher, dramatically impacting valuations in the private real estate markets. Moreover, some investors have concluded that implied capitalization rates for REITs could move to peak levels of 10%-11% achieved during the 1999 to early 2000 timeframe when REITs were clearly out of favor.

While we acknowledge that the real estate industry faces serious headwinds, we believe market fears have pushed valuation assumptions to extremes inappropriately. First, current levels for Treasuries or risk free rates must be considered in deriving what required risk premiums and ultimate returns are required for commercial real estate investment. While, in several years, today’s massive injection of money supply may lead to inflationary pressures and higher long term rates, in the near term rates are likely to remain historically low as deflationary pressures continue and global monetary policy pushes to liquify and revive the economy. Meanwhile, Prudential Real Estate Investors’

research on historical capitalization rate trends since 1990 notes that average commercial property capitalization rate spreads over Ten Year Treasuries barely exceeded 400 basis points during the timeframe and had a mean of 252 basis points over risk free rates for real estate tracked by NCREIF, the National Council of Real Estate Investment Fiduciaries. Such institutional quality property is comparable to that owned by public REIT entities but often operates without the benefit of the management platforms of higher quality REITs. Additionally, PPR historic data for a somewhat broader selection of property reflects that, since the first quarter of 1982, there have been no quarters when capitalization rate spreads over Ten Year Treasuries even exceeded 300 basis points for apartments and only limited periods when such spreads exceeded 400 basis points for office (five quarters), retail (four quarters) and warehouses (two quarters), with the highest spread, 480 basis points, occurring for office assets in the third quarter of 2003. Weighing these factors and the economic and debt market outlook, we believe capitalization rates for institutional quality real estate will likely rise from today’s levels. However, they should not approach the levels believed by some market participants, even if Ten Year Treasuries move up 100 basis points from their current 2.60% level and risk premiums exceed previous historic maximums by 100 basis points, and, perhaps more importantly, they should not remain at such levels for an extended time period.

We also believe that market participants’ overemphasized focus on public companies’ liquidation values is as unsound today as it was during the 2006-2007 timeframe when debt capital was in oversupply and privatizations were rampant. That form of analysis assumed all companies were not going concerns but only baskets of assets to harvest in a frothy investment market. By extension, it also pushed valuations to unwarranted premiums using historically low capitalization rates that implicitly implied above trend revenue growth far into the future. In our view, since the majority of public companies in the sector will neither choose to or be forced to sell significant levels of assets in this environment, contrary to fears of debt maturity time bombs, it is equally inappropriate to focus on liquidation values using speculative capitalization assumptions. By emphasizing a simplistic capitalization rate/liquidation methodology and only focusing on today’s spot pricing for debt costs, other valuation metrics are ignored and a longer term view is absent. Indeed, such analyses gives no value to management platforms and franchise values and negates the fact that REIT dividend and AFFO (“Adjusted Funds From Operations”) yields are at their widest spreads to Ten Year Treasury rates (720 and 668 basis points, respectively vs. long term averages of 107 and 268) in fifteen years, according to Merrill Lynch’s December 5th data. Few industries, if any, are subject to or could withstand a similar form of liquidation analysis at this point in the markets.

While we take objection to the extreme valuation and liquidity conclusions imbedded in REIT valuations today,

14

|

|

Alpine Realty Income & Growth Fund |

|

we believe fundamental headwinds are significant for the sector. Real estate operating performance is obviously derivative of the economy, locally and globally, and will be negatively impacted by declining employment, lower capital investment by businesses, and declining consumer confidence. The economy has lost 1.9 million jobs thus far in 2008 with the unemployment rate rising to a 15-year high of 6.7% and expected to go higher. Meanwhile, consumer confidence as tracked by the University of Michigan dropped in November to its lowest level since May, 1980. As noted in our semi-annual report, given our cautiousness on the outlook for property fundamentals, we have continued to rebalance the portfolio to increase the Fund’s defensive characteristics in the midst of a difficult economic and real estate operating environment. Our intent remains to provide superior risk adjusted returns with a high level of current income and below average volatility relative to other real estate fund alternatives. In the remainder of this report, we will provide our outlook for individual property subsector fundamentals, describe how we have modified the portfolio in consideration of this fundamental outlook, and discuss as well what hurt Fund performance during the last fiscal year.

The most significant modification to the portfolio continues to be our increased investment allocation to cumulative preferred stocks which we commenced approximately one year ago for defensive purposes as well as for income stability and yield enhancement. As of the date of this report, we hold twenty-six different positions accounting for 22.33% of Fund assets, up from 16.4% at the end of the fiscal period and only 2.8% as of October 31, 2007. Since our last semi-annual report, we sold one lodging related issue, Hospitality Properties Trust Series C, and acquired four new positions at the following discounts to par and yields on cost: BRE Properties, Series C, at 62.2% of par, 10.86% yield; Kilroy Realty Corp., Series F, at 63.9% of par, 11.73% yield; SL Green Realty, Series D, 51.7% of par, 15.24% yield; and Public Storage, Series W, 64.4% of par, 10.08% yield. In light of the recent wave of common share dividend cuts and eliminations by real estate companies (26 different companies since September, 2008), we are pleased with our efforts to protect and potentially enhance the Fund’s yield by this rebalancing. Additionally, given our preferred investments’ current sizable trading discounts, we are confident such positions will provide attractive appreciation returns, as the fixed income markets recover first and real estate fundamentals follow. During the fiscal period, however, the Fund’s preferred investments did not provide their intended defensiveness and in fact detracted from Fund performance. Fixed income spreads widened across all industries and impacted preferred valuations. Even more significant, in or view, was a steady wave of selling from closed-end income funds that were forced to reduce overall fund leverage and had to shed these securities in a relatively illiquid market.

A second defensive step in portfolio construction has been the increase in the Fund’s investment in health care REITs’ common shares which as of the date of this

report comprise 11.01% of Fund assets, up from 4.1% on October 31, 2007, and collectively provide a current 8.66% dividend yield. The three investments were one of the few relative bright spots in a very difficult year with HealthCare REIT increasing +4.90%, Omega Healthcare Investors returning -3.10%, and Ventas declining -12.00%, all significantly better than the overall RMS Index decline of -40.46%. We believe these companies’ cash flows should be among the most durable in the REIT sector in the near term and, while not offering as much potential upside, should provide a more stable dividend yield than other property sectors more leveraged to the economy.

Additionally, we have eliminated all of common share investments in the lodging and mortgage finance subsectors, selling our entire positions in DiamondRock Hospitality, FelCor Lodging Trust, Host Hotels & Resorts, Marriott International, Starwood Hotels & Resorts, CBRE Realty Finance, Gramercy Capital, iStar Financial, and NorthStar Realty Finance. Within the lodging sector, while industry Revenue Per Available Room (“RevPar”) growth had remained positive through the third quarter of 2008, albeit on a decelerating basis, the speed and severity of the economic downturn from mid-September caused RevPar growth to turn negative precipitously as both business and leisure travel declined in rapid fashion. While extreme uncertainty exists with respect to 2009 operations, a recent forecast by PKF Hospitality Research, a noted industry consultant, predicts a 7.8% decrease year-over-year in industry RevPar which is consistent with several industry operators assessments of probable 4th quarter 2008 results. Though we had reduced lodging investment in the fund from 12.9% of assets at October 31, 2007 to 4.4% at the April 30th end of our semi-annual period and sold the remaining investments at average prices significantly higher than where they traded on the December 11th date of this report (FelCor — $6.39 vs. $1.38 per share, DiamondRock — $6.60 vs. $4.24, Starwood — $38.63 vs. $16.15, Host —$14.03 vs. $6.32, and Marriott — $26.63 vs. $16.59), we frankly held on to these investments too long and they had a significantly negative impact on our performance. The commercial mortgage finance subsector also faces difficult issues with companies facing higher delinquencies and much lower valuations for their assets on one hand and very difficult capital availability on the other. Most entities have been forced to eliminate or severely reduce their dividend while experiencing dramatic decreases in economic book value. Similar to the experience with our lodging investments, we sold all our positions remaining at April 30th at average prices higher than where they currently trade (Gramercy —$2.20 vs $1.24, NorthStar — $8.54 vs $3.87, iStar — $4.02 vs $1.63, and CBRE — $1.18 vs $.03) but nevertheless incurred significant capital losses before exiting these holdings.

In the apartment sector, the Fund has essentially maintained its same aggregate allocation but has developed a more concentrated and selective focus. Current investment includes five holdings totaling 11.25% of assets versus ten holdings totaling 12.4% at

15

|

|

Alpine Realty Income & Growth Fund |

|

the beginning of the 2008 fiscal year, as we reduced and eliminated holdings with the most exposure to low cost and/or distressed housing markets, with stretched balance sheets, and with problematic development projects. In large part due to the single family housing crisis, owners with middle-market projects or those operating in high cost home markets have been able to maintain strong occupancies. In fact, apartment REITs actually saw sequential increases in tenancies from the 2nd to the 3rd quarters ending with near record same store occupancies of 95.4%. Returns of Fund holdings during the fiscal period were better on a relative basis than the overall -40.46% decline of the RMS Index due to more durable fundamentals to date and fewer concerns about capital availability given the presence of Fannie Mae and Freddie Mac’s lending programs. Returns of our top three apartment investments were -16.99% for Home Properties, -18.25% for Essex Property Trust, Inc., and -12.24% for Equity Residential while AvalonBay and Post Properties, accounting for less than two-percent of assets collectively, returned -39.88% and -42.50%, respectively. While to date rent growth has generally remained positive in many markets, the impacts of rising unemployment are expected to pressure companies’ revenues in the 4th quarter and into 2009 but we still expect less falloff in results for apartment owners than most other property types and will likely maintain a similar allocation to this group.

Fundamentals for office and industrial property have weakened with the contraction in the economy resulting in nationwide office vacancy rates increasing as of the end of the 3rd quarter of 2008 to 14.1% from 12.6% one year prior and industrial availability increasing to 11.4% from 9.90%, according to CB Richard Ellis. After years of landlord negotiating strength, most office markets have become tenant friendly. Continued decreases in employment and business confidence have dramatically slowed demand for office space while the well publicized contraction in financial services has caused large increases in the amount of space available for sublet. We have biased our office holdings to those companies with the strongest asset quality and management teams, soundest balance sheets, longest average lease durations, and resultant lowest lease expirations through 2009. Though our holdings have an above average asset concentration in New York City, near term 2009 lease expirations in New York City represent less than 1% of total revenues for Boston Properties, less than 3% for Vornado, and less than 6% for SL Green. Further potentially cushioning the companies’ New York City based revenues are still positive spreads between current market rents and expiring rent levels. Maintaining occupancies for these landlords as well as our other office owning companies will be the largest focus and challenge in the near term. During the fiscal period, returns for our current five largest office owning investments were as follows: Alexandria Real Estate (-35.02%), Boston Properties (-28.34%), Douglas Emmett (-40.74%), Kilroy Realty (-48.23%), and Vornado Realty (-35.02%) with the remaining four companies producing with a wider spread of returns, Corporate Office

Properties (-21.72%), Mack-Cali (-38.23%), Maguire Properties (-86.79%) and SL Green Realty (-63.80%). The current overall allocation to the sector, including Vornado, is 29.39% of assets. We will continue to assess the relative benefits of investing in companies with long lease durations, strong management platforms, and sound balance sheets, which could enable attractive acquisition opportunities, against the risks of central business district exposure to financial services. We will stand ready to reduce and/or rebalance the scale of our current office investment.

Returns for the Fund’s three industrial holdings were significantly negative during the period as the rapid decrease in global trade expectations and freeze-up in the debt capital markets impacted the stock valuations of AMB Property, ProLogis, and DuPont Fabros Technology. Fiscal period returns for the three companies were -56.87% for AMB, -67.12% for DuPont Fabros, and -77.27% for ProLogis, which collectively had a disproportionately negative impact on Fund returns. For AMB and ProLogis, the premier industrial warehouse owners, prospects for fee and development gain income derived from their global platforms were dramatically reduced which along with overall weakening industrial fundamentals in the U.S. caused very diminished earnings expectations. While decreased earnings forecasts were certainly responsible for a large portion of these companies’ negative stock performance (-66.08% for ProLogis and -46.25% for AMB in the month of October alone), we believe unabated fears regarding their abilities to fund future construction commitments and debt maturities have driven these entities’ valuations to irrational levels. Consequently, we increased our investment in ProLogis by approximately 44% in early November. Both of these companies quickly implemented plans to conserve cash and reduce future funding commitments, have strong operating platforms and franchise values, maintain solid relationships with private capital sources, and have better-than-average prospects in achieving funding commitments in a capital constrained environment in our opinion. DuPont Fabros is an owner and developer of state of the art data centers whose near term growth prospects were significantly reduced when it curtailed development of several new projects due to unavailability of long term financing commitments. The company has currently reduced its focus to the lease-up of one recently completed center outside of Chicago and will await an improved debt market before resuming any further construction. In our view, the market has overly discounted their long term prospects, inappropriately focused on a current liquidation analysis, and significantly undervalued their existing asset base which is 94.5% leased with 69% of lease revenues coming from Microsoft and Yahoo and an additional 24% from IAC/InterActiveCorp, UBS, Google, and Fox Interactive Media.

The Fund’s investment in retail center owning companies accounts for 15.42% of assets as of the December 11th date of this report, down from 21.1% of assets as of the beginning of the fiscal year. Retail

16

|

|

Alpine Realty Income & Growth Fund |

|