average annual store sales for this group grow by 9.67% for 15 quarters. At the same time, the expansion of square footage in all Brazilian malls has grown by 8% per annum over the last four years, and is projected to grow by a similar amount over the next three, according to ABRASCE, the Brazilian Mall Association. Thus, Alpine expects the publically traded Brazilian shopping mall companies should be able to grow their earnings before interest, taxes, depreciation and amortization (EBITDA) by almost 55% over the next two years, in comparison with domestic and major international mall companies which are expected to grow by little more than 11% over this period. In other terms, Merrill Lynch has calculated that by 2012 the implied cap rate of five Brazilian malls will be 11.1% versus a global average of 6.5%. Since many of the Brazilian malls have in fact presented development plans which extend through 2014, we believe that the long term growth prospects of this sector present a unique opportunity to buy into the real estate value creation process at the ground floor. Since Brazilian malls are listed on the BOVESPA stock exchange, they must pay out 25% of their income in the form of dividends which we think will offer meaningful dividend growth potential, as well as price appreciation for the Fund over the next few years. For these reasons, Brazilian Mall stocks constitute 38% of the Funds 18.4% exposure to Brazil.

EQUITIES LEAD INDICES

It should be noted that major global real estate indices do not include meaningful exposure to emerging market (EM) stocks in their global composites, although that might have to change. The annualized growth over the five years including 2005 through 2009, of the market capitalization of stocks in the S&P 500 shrank by 1.5% while the MSCI World Index grew by 1.9%. During this period, the growth of all emerging market stocks was evidenced by a compound annual growth rate of 24% for the market capitalization of such stocks. A similar pattern has held true in real estate equities with U.S. equity REITs shrinking by -2.0% per year, while global real estate grew by a healthy 12% compound annual growth rate during this period, and emerging market real estate expanded by 34%. By Alpine’s calculations, emerging market equities constitute roughly 25% of all real estate stocks outstanding market capitalization. Nonetheless, the major global real estate indices provided by Dow Jones, S&P, and the FTSE EPRA/NAREIT series all have less than 1% EM exposure through the third quarter of 2010. We believe that for the indices to remain credible, they will eventually begin to include more emerging market exposure. As mentioned previously, EGLRX had an

historically high 63.5% exposure to emerging markets at the end of the fiscal period.

Globally, the fundamental demand equation for real estate is gradually improving in most, if not all, markets. For over 20 years, this Fund has had at least modest exposure (7% minimum) of its international and global portfolios in emerging markets. We believe that since the middle of the last decade through the current period, and for the foreseeable future, this is potentially the most favorable climate for long term investment in emerging markets. Because the growth dynamic is far superior in these regions, we believe that underlying real estate demand will continue to support rising rents, which can produce rising investment yields. Over time, we could see rising dividend yields for real estate equity investors, but medium term demand for high quality buildings should sustain development over multiple cycles, emphasizing the creation of real estate value. Although capital appreciation remains the primary focus, this does not preclude the Fund from generating dividend income. With the obvious exception of 2008, the Fund has paid useful dividends since 2000, totaling $3.97. For 2010, we anticipate a dividend of approximately $0.68 per share with a large portion of this dividend derived from Passive Foreign Investment Company (PFIC) income, which is dependent upon many variables. We would not want shareholders to extrapolate a trend from this dividend level. PFIC income is not actual income from a company but rather a derivation of the company’s stock appreciation during the Fund’s fiscal year. PFIC classification may apply to any foreign stock subject to certain asset and income tests. However, real estate companies are often structured in a manner which fits the ‘passive’ test, even if the company is very active. It should be noted that PFICs are not unique to this Fund, and are true of most funds which invest outside the United States. Unlike conventional gains, PFIC income cannot be offset by capital losses realized from sales of other positions.

Alpine continues to believe that there will also be opportunities for companies to grow their assets and income levels in the developed economies of the U.S., Europe and even Japan, even though the next few years may be a bit challenging. We think that those investors who can take a three to five year view will be well served by this portfolio in terms of potential for growth and income to be derived from global real estate equities markets, especially during the value creation phase of this cycle.

Sincerely,

Samuel A. Lieber

Portfolio Manager

| |

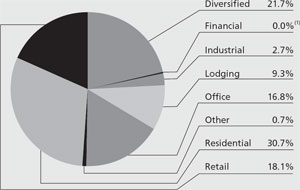

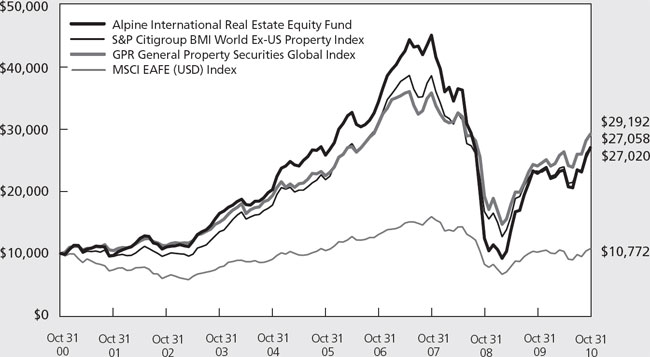

Alpine International Real Estate Equity Fund |

|

| | |

| |

| |

Past performance is not a guarantee of future results. |

Please refer to the schedule of portfolio investments for fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Funds that concentrate their investments in a specific sector, such as real estate, tend to experience more volatility and be exposed to greater risk than more diversified funds.

Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment.

The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Additionally, foreign securities also involve currency fluctuation risk, possible imposition of withholding or confiscatory taxes and adverse political or economic developments. These risks may be greater in emerging markets.

The Fund regularly makes short sales of securities, which involve the risk that losses may exceed the original amount invested. The Fund may include equity-linked securities and various other derivative instruments, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may magnify gains or increase losses in the Fund’s portfolio.

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of a variety of factors including those related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry) or due to other factors such as a rise in interest rates, for example.

Diversification does not assure a profit or protect against loss in a declining market.

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

A Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

EBITDA stands for earnings before interest, taxes, depreciation and amortization and is an approximate measure of a company’s operating cash flow based on data from the company’s income statement. It is calculated by looking at earnings before the deduction of interest expenses, taxes, depreciation and amortization.

Dividend Yield represents the trailing 12-month dividend yield aggregating all income distributions per share over the past year, divided by the period ending fund share price. It does not reflect capital gains distributions.

Return on Equity is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Compound Annual Growth Rate is the year-over-year growth rate of an investment over a specified period of time.

The Bovespa Index is a total return index weighted by traded volume and is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The MSCI World Index is a stock market index of 1,500 ‘world’ stocks. It is maintained by MSCI Inc., formerly Morgan Stanley Capital International, and is often used as a common benchmark for ‘world’ or ‘global’ stock funds.

The FTSE EPRA/NAREIT Global Real Estate Index Series is designed to represent general trends in eligible real estate equities worldwide.

One cannot invest directly in an index.

12

| |

Alpine Realty Income & Growth Fund |

|

|

| | | | | | | | | | | | | | | | | | | |

| |

Comparative Annualized Returns as of 10/31/10 (Unaudited) | | | | | |

| | 6 Months(1) | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception

(12/29/1998) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alpine Realty Income & Growth Fund | | 8.18 | % | | 43.51 | % | | -7.83 | % | | 0.29 | % | | 10.03 | % | | 10.81 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley REIT Index | | 6.33 | % | | 43.39 | % | | -4.99 | % | | 3.33 | % | | 11.25 | % | | 10.55 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S&P 500 Index | | 0.74 | % | | 16.52 | % | | -6.49 | % | | 1.73 | % | | -0.02 | % | | 1.37 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Real Estate Funds Average(2) | | 5.98 | % | | 42.04 | % | | -5.94 | % | | 2.34 | % | | 10.08 | % | | 9.98 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Real Estate Funds Rank(2) | | N/A | (3) | | 57/222 | | | 163/203 | | | 150/172 | | | 47/80 | | | 19/62 | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio: 1.39%(4) | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.39%(4) | | | | | | | | | | | | | | | | | | | |

| |

| |

|

|

| (1) Not annualized. |

| (2) The since inception data represents the period beginning 12/31/1998. |

| (3) FINRA does not recognize rankings for less than one year. |

| (4) As disclosed in the prospectus dated February 27, 2010. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The Morgan Stanley REIT Index (the “RMS Index”) is a total return index comprising of the most actively traded real estate investment trusts and designed to be a measure of real estate equity performance. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. Lipper rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The Morgan Stanley REIT Index, the S&P 500 Index and the Lipper Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Realty Income & Growth Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

13

| |

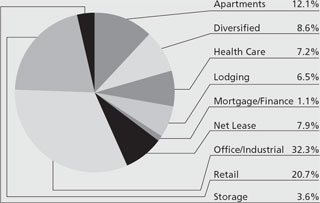

Alpine Realty Income & Growth Fund |

|

| | |

| | | | | | | |

| | | | | | | |

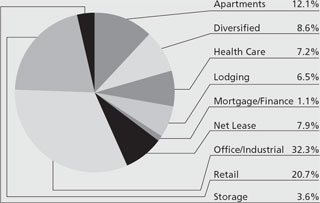

Portfolio Distributions* (Unaudited) | | Top 10 Holdings* (Unaudited) | | | |

| | 1. | | Simon Property Group, Inc. | | 6.13% | |

| 2. | | Boston Properties, Inc. | | 5.47% | |

| 3. | | Vornado Realty Trust | | 5.19% | |

| 4. | | Entertainment Properties Trust | | 3.66% | |

| 5. | | CBL & Associates Properties, Inc. | | 3.63% | |

| 6. | | Alexandria Real Estate Equities, Inc. | | 3.61% | |

| 7. | | SL Green Realty Corp. | | 3.36% | |

| 8. | | Entertainment Properties Trust, Series D, 7.375% | | 3.10% | |

| 9. | | Equity Residential | | 3.05% | |

| 10. | | Public Storage | | 2.98% | |

|

| | | |

| * Portfolio holdings and sector distributions are as of 10/31/10 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Portfolio Distributions and Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments less short-term investments and Top 10 Holdings percentages are based on total net assets. | |

| | | | | | |

| | | | | | | |

| | | | | | | |

|

| |

|

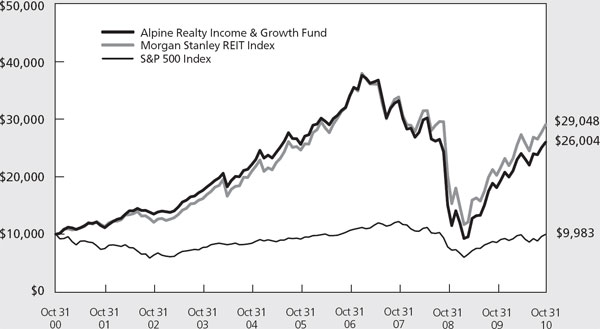

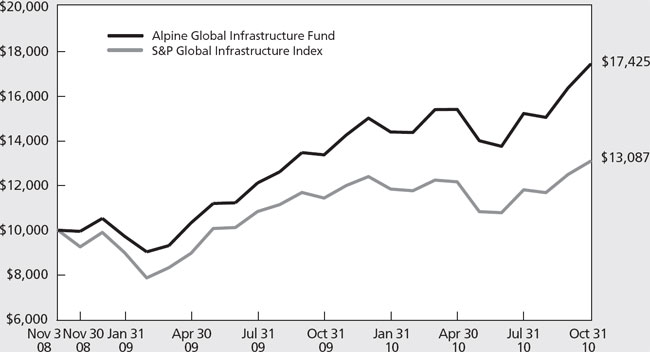

Value of a $10,000 Investment (Unaudited) |

|

|

|

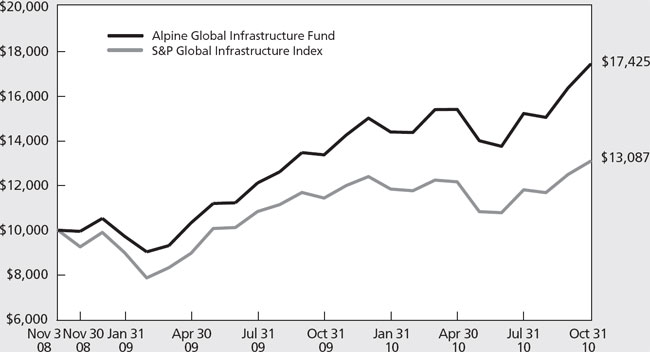

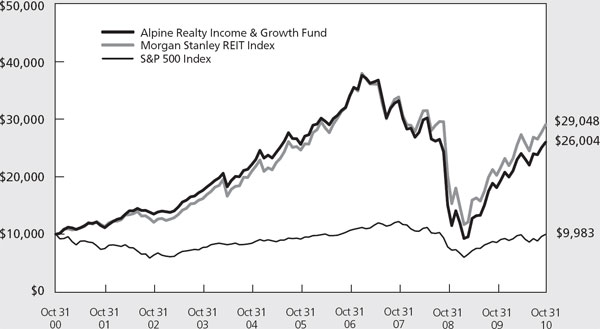

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus similar investments in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s return reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total returns would have been lower.

14

| |

Alpine Realty Income & Growth Fund |

|

| | |

Dear Investor

We are pleased to report the results of the Alpine Realty Income and Growth Fund for the fiscal annual period that ended October 31, 2010. During this period, the Fund produced a total return of +43.51% which compares to the +42.04% return of the Lipper Real Estate Funds Average, the +43.39% return of the Morgan Stanley REIT Index (the “RMS Index”), and the +16.52% return of the Standard & Poor’s 500 Index (the “S&P”).

At October 31, 2010, the Fund’s net asset value per share had increased to $14.79 from $10.89 one year prior. During the fiscal period, the Fund paid four quarterly distributions totaling $.72 per share. Since its inception on December 29, 1998 through October 31, 2010, the Fund has delivered a cumulative total return to shareholders of +237.19% (+10.81% on an annualized basis) including cumulative distributions of $13.29. During the same period, the RMS Index increased +227.85% (+10.54% on an annualized basis) and the S&P increased +17.45% (+1.37% on an annualized basis). The performance chart on page 13 presents the Fund’s returns for the latest six-month, one-year, three-year, five-year, ten-year, and since inception periods.

A SLOW AND STEADY RECOVERY

The healthy rebound in real estate investment trust (“REIT”) stock pricing has occurred despite a sluggish recovery in economic conditions. While profit growth in corporate America has been relatively strong, job creation remains anemic. Corporations have benefited from increased productivity and cost cutting, in part from reducing workforces, but have yet to exhibit sufficient confidence to meaningfully ratchet up capital spending and to resume hiring. The headline unemployment rate reported by the Bureau of Labor Statistics continues to be stubbornly high at 9.6% and, moreover, is argued by many analysts to profoundly underestimate the “true” unemployment figure. That unemployment rate has been estimated at approximately 17% if part-time workers who want to work full-time and individuals who have applied for a job within six months are included in the mix.

On the positive side, the trend of layoffs continues to decrease with the most recent initial jobless claims report for the period ending November 20, 2010 showing a decline to 407,000, the lowest level since July 2008. Additionally, and perhaps reflective of greater confidence in employment stability, the University of Michigan Index of Consumer Confidence registered a better than anticipated level in November. At a 71.6 reading this indicator remains woefully lower than its thirty-year average of 87.7 yet significantly higher than

the 55.3 level of only two years ago. Essentially, the economy continues to climb out of the depths of recession but the rate of recovery is frustratingly slow.

Recent minutes from the Federal Reserve’s early November meeting indicate that the central bank’s members believe economic improvements will continue to grind forward at a historically slow speed. The Fed forecasts unemployment to fall only to 8.9%-9.1% in 2011 and to 6.9%-7.4% in 2013, still higher than normal levels. The Fed’s obvious concern about the pace of recovery is reflected in its recent decision to stimulate activity with low interest rates by conducting a second round of quantitative easing through the purchase of an additional $600 billion of long term bonds. A continuation of today’s low rate environment is anticipated to further benefit bank health, hopefully stimulate small business lending which has been constrained, buoy a still challenged housing market, aid business profitability, and lead to employment gains.

As we have stated in previous reports, a more robust improvement in the job picture leading to higher levels of consumer spending in an economy hugely dependent upon such expenditures is, in our opinion, a necessary precondition for real estate equity returns to meaningfully advance from today’s levels. Without such improvements, it is difficult to foresee a broad based turnaround in real estate operating fundamentals benefitting both public and private owners of real estate. While asset valuations have rebounded nicely due to the low interest rate environment and investors’ search for yield, a needed driver for further value appreciation, commercial real estate cash flow growth, has been uneven across property types and regions, as we will highlight later in this report.

COST OF CAPITAL ADVANTAGE

In the current environment, however, public owners of real estate have the clear upperhand in terms of access to capital versus their private market brethren. This advantage provides REIT entities with a competitive edge in attracting and keeping tenants and improving their existing assets relative to more cash constrained owners. Perhaps more importantly, with this cost of capital advantage, REIT entities are successfully refinancing their debt, lowering their average interest costs, raising additional equity, and increasing their transactional activity with new property acquisitions that should be accretive to their future earnings.

Investors’ appetite for yield kept the corporate bond market receptive to new issuances and publicly traded REITs took advantage of the opportunity. According to data from the National Association of Real Estate

15

| |

Alpine Realty Income & Growth Fund |

|

| | |

Investment Trusts (“NAREIT”), REITs issued $17.54 billion of unsecured notes during the period from October 31, 2009 through September 30, 2010. This new capital was typically used to retire and eliminate the risk of any near term maturities, build balance sheet capacity for acquisitions, and lower weighted-average interest costs. In our view, REITs’ activity in the debt markets is reminiscent of the 2001-2003 period when companies similarly were able to offset weakness in property income with reduced interest expenses. For a group where interest expense is typically 35%-45% of EBITDA (Earnings Before Interest Depreciation and Amortization), lowering interest costs can significantly improve earnings trajectories as it did earlier in the decade. Notable transactions during the period included Boston Properties’ issuance of $700 million of 5.625% notes due November 2020, Equity Residential’s $600 million of 4.75% notes due July 2020, and Simon Property Group’s $900 million of 4.375% notes maturing in March 2021. After the end of the Fund’s fiscal period, Boston Properties returned to the market in early November and sold $850 million of 4.20% bonds that mature in May 2021, approximately 140 basis points cheaper than its above referenced April offering, and Ventas issued $400 million of 3.125% notes due 2015.

We anticipate that the debt capital markets will remain friendly to the public real estate companies and to private owners with high quality assets. Life insurance companies have remained active with new mortgage commitments rising sequentially to $9.5 billion in the third quarter and totaling $20.3 billion year-to-date, according to data from ISI. Meanwhile, the CMBS market (Commercial Mortgage Backed Securities), believed by many not long ago to be dead in the water, has shown encouraging signs of revival this year with approximately $10 billion of new issuance expected in 2010 and $45 billion in 2011 per projections from JP Morgan’s Fixed Income Strategy Group. While the availability of new debt capital from the public bond, life insurance, CMBS, and government agency markets remains lower than overall future scheduled maturities, we believe that lenders will continue to modify and extend loans they might not underwrite at current standards and thereby alleviate the market maturity risk to a great extent. Moreover, we would anticipate that the availability of debt capital will broaden in 2011 and benefit a wider group than is currently available. A higher level of foreclosures and property liquidations may occur in 2011 but the calamity feared eighteen months to two years ago will not materialize in our view.

Access to equity capital has also continued to be advantageous to the public real estate entities. During

the Fund’s fiscal period, REITs raised approximately $19 billion through common stock secondary offerings and perpetual preferred stock sales. Meanwhile, eleven new companies conducted initial public offerings and raised over $2 billion in equity capital, though the market’s willingness to fund the aspirations of new entrants to the public market became increasingly selective as the year progressed.

INCREASING TRANSACTIONAL ACTIVITY

Improved availability of equity and especially debt capital combined with a low interest environment has stimulated the transaction market. Property acquisitions by both public companies and institutional owners seeking the relatively attractive yields of commercial real estate have increased markedly, though activity remains well below historic levels. According to data tracked by Real Capital Analytics, transaction volumes through the end of the third quarter of 2010 approximated $60 billion, exceeding 2009’s full year total of $52 billion yet significantly less than the $176 billion yearly average achieved during the past decade. Public REITs have participated across the property spectrum including those entities such as Simon Property Group, Boston Properties, and Ventas whom we noted in our October 2009 report as having created balance sheet strength to take advantage of opportunities arising in 2010. In several of the more notable transactions of 2010, Simon purchased the Prime retail outlet mall portfolio for $2.3 billion, adding to its already dominant position in the outlet mall space; Ventas acquired the portfolio of medical office buildings of Lillibrdge for approximately $350 million and recently announced the $3.1 billion purchase of senior housing assets from Atria Senior Living Group; and Boston Properties acquired three significant office assets totaling $1.4 billion – the iconic John Hancock Tower in Boston, the Bay Colony Corporate Center in suburban Boston, and 510 Madison in New York City. Apartment owning REITs have also been active, taking advantage of historically cheap debt capital provided through Fannie Mae and Freddie Mac, with Equity Residential acquiring $1.4 billion of assets, Home Properties buying $339.1 million, and UDR announcing new investments totaling nearly $600 million.

PERFORMANCE REVIEW

Apartment REITs were the top performing REIT subsector during the fiscal period as reflected in the +62.68% increase in the Bloomberg REIT Apartment Index. Fundamentals for multifamily properties continue to improve at a surprisingly strong pace despite the weak employment picture with the overall group

16

| |

Alpine Realty Income & Growth Fund |

|

| | |

reporting solid occupancies, good expense control, and the ability to raise rents. During the third quarter, the apartment companies delivered weighted-average occupancies of 95.6% and the first positive increases in both revenues and net operating income since the late 2008-early 2009 period. Additionally, the companies collectively reported a return to pricing power as the year progressed, noting that renewal rents for October and November were up +4%-6%. Moreover, several REITs announced that rentals in markets including the New York and Washington, D.C. metropolitan areas were now at levels higher than previous peak rents. With homeownership rates continuing to decline, a lack of confidence in home price direction, and a positive demographic trend of the echo boom generation entering the prime apartment rental age, apartment landlords are confident about future fundamental improvements. During the fiscal period, we added five new positions in apartment companies and ended the fiscal year with approximately 12.5% of assets dedicated to this subsector. Twelve-month returns for the four apartment companies held in the Fund throughout the period included +74.14% for Equity Residential, +60.62% for Avalon Bay, +56.86% for Essex Properties, and +46.37% for Home Properties.

Office and Industrial property owning companies remain a major focus for the Fund with approximately 29.3% of assets invested in these REIT subsectors and an additional 6.6% invested in the Diversified REITs, Vornado Realty Trust and Verde Realty, who derive a significant portion of their earnings from office and warehouse properties, respectively. In the office subsector, the Fund remains biased towards companies owning office buildings located in the central business districts (CBD) of New York City, Boston, Washington, D.C., San Francisco, and Los Angeles versus their suburban office-owning brethren. Fundamentals have stabilized and shown earlier improvement in CBDs, particularly in New York and Washington where employment gains have helped absorb inventory and stabilize rental pricing. In other markets, demand has been sluggish and uneven with individual property occupancy gains typically accomplished at the detriment of another landlord. Returns for the CBD focused companies which accounted for approximately 18.25% of Fund assets as of October 31, 2010, outstripped those of their suburban counterparts during the fiscal period with Boston Properties increasing +45.61%, Brookfield Properties rising +78.55%, Douglas Emmett returning +55.99%, MPG Office Trust up +53.98%, SL Green improving +70.71%, and Vornado delivering a total return of +52.11%. In contrast, the non-CBD office owning companies, which accounted for approximately

5.7% of Fund assets as of October 31, 2010, delivered lagging returns of +11.41% for Corporate Office Properties, +29.34% by Kilroy Realty, +20.93% from Liberty Property, and +14.67% for Mack-Cali. Alexandria Real Estate Equities, the dominant owner of specialized laboratory/office space, returned +38.51% during the period.

Within the Industrial REIT group, the Fund’s investments are split between companies with global platforms of warehouse/distribution assets and entities specializing in space used for datacenters. Improvements in the fundamentals for the distribution-oriented entities, like the overall economy, are occurring slowly as inventory building remains below trend. In the USA in particular, while vacancy rates appear to have stabilized, rent growth has not resumed and companies continue to face rent rolldowns upon expirations of their lease contracts, albeit at a decelerating pace. Returns for Fund’s investments in the warehouse-owning companies, AMB Property and ProLogis, were +33.97% and +26.47% respectively. The Fund’s investment in the private entity, Verde Realty, which derives a significant portion of its revenues from warehouses located primarily in markets on both sides of the USA/Mexico border, was written down -21.98% over the fiscal period as weakness in the manufacturing economy, soft market conditions, and impairments of land inventory contributed to the decline. Within the data center property type, macro trends of increased online applications, video content, social networking, and cloud computing remained favorable demand drivers. As a result, fundamentals continued to be strong particularly for the wholesale providers with assets in the important Washington, D.C. metro and California markets where demand still far exceeds new supply additions. The Fund increased its investment in this group initiating positions in Coresite Realty Corp. and Digital Realty and adding significantly to our position in Digital subsequent to the end of the fiscal period. DuPont Fabros, owned by the Fund throughout the year, produced a total return of +69.42% over the period.

The Fund’s investments in the retail real estate subsector produced attractive returns during the fiscal period. Retail landlords, particularly in the mall group, experienced slow but steady improvement in their tenants’ sales trends, fewer bankruptcies, less credit loss, and incrementally better occupancies. Community and neighborhood center landlords continue to see weakness in some of their local “mom and pop” retailers but have made significant headway in releasing their “big box” spaces previously vacated by bankrupt retailers such as Circuit City and Linens & Things.

17

| |

Alpine Realty Income & Growth Fund |

|

| | |

Emblematic of the retail turnaround over the past twenty-four months, one REIT executive recently noted that a number of large national retailers were beginning to be concerned that their future expansion plans and store openings might be limited by the availability of space. This phenomenon was contrasted with the environment eighteen months ago when many retailers were scouring leases in an attempt to cancel and decrease their real estate exposure. While fundamental improvements move forward, we continue to believe that even though consumer spending trends can recover the decreases of the past years, they will require a much improved employment picture to make significant advances. Returns for the Fund’s mall-oriented companies, where the majority of our retail investment is biased, included +101.92% for CBL & Associates, +58.79% from Macerich, +45.69% for Simon, +30.43% by Tanger, and +58.56% from Taubman. Within the non-mall group, the Fund’s two investments held throughout the fiscal period, Federal Realty and Saul Centers, delivered similar returns of +43.97% and +43.73%, respectively. We added two new positions during the period, Excel Trust, which conducted its initial public offering on April 22nd and delivered a disappointing -17.49% through October 31st, and Kimco Realty which returned +45.97% on our initial investment from December 8th.

In the traditionally more defensive health care and net lease subsectors, the Fund’s common equity investment at the end of the fiscal period stood collectively at 10.2% of assets, down slightly from 15.4% at October 31, 2009. Benefitting from ready access to debt and equity and a current cost of capital advantage, health care and net lease REITs anticipate a continuation of attractive opportunities for asset growth into 2011. Returns for the Fund’s investments over the fiscal year included +29.25% for HCP, Inc., +61.79% for Omega Healthcare Investors, +39.62% for Ventas, and +45.02% for Entertainment Properties Trust.

The lodging sector has experienced strong operating improvements throughout 2010 as it recovers from unprecedented decreases in occupancy and RevPar (Revenue Per Available Room) realized during the recession. Occupancies continue to rebuild and have allowed operators to selectively raise room rates as business travelers have returned to the road and prospects for group business have increased. Recent data from Smith Travel Research shows that the fourth quarter-to-date RevPar through November 27th for the overall U.S. market and the upper upscale segment rose +10.9% and 9.4%, respectively, albeit against easy comparisons from the comparable period in 2009. The Fund added five new common equity investments

during the fiscal year and realized the following returns from our initial buys through October 31, 2010: +28.76% for LaSalle Hotel Properties from March 2nd, -6.95% from Chatham Lodging Trust (April 15th), +11.82% by Felcor (Jun 16th), +8.43% from Starwood Hotels & Resorts (May 10th), and +17.68% by Sunstone (July 16th). We made subsequent purchases of Felcor (July 2nd) and Starwood (July 16th) and realized 32.16% and +25.91% returns, respectively, on these incremental investments.

At the end of the fiscal period, the Fund’s allocation to REIT preferred stocks totaled 15.7% of assets spread across nineteen different issues, down from 19.2% of assets and twenty-three holdings at the beginning of the period. We exited seven issues, added three new investments, and reduced our shares in twelve of our remaining holdings. Preferred equities have been an attractive investment for the Fund, providing yield enhancement and appreciation over the past several years during a difficult period for common equities. The Fund had previously increased its holdings in preferred equities from only 2.8% of assets as of October 31, 2007 primarily for defensive purposes but also because we believed these investments traded at attractive discounts to underlying value. Over the period from October 31, 2007 through October 31, 2010, the Wells Fargo REIT Preferred Index (the “WHPSR Index”) delivered a +38.60% cumulative return while the RMS Index, representing REIT common equities, decreased -14.13%. Currently, REIT preferred equities have recovered the majority of their discounts to liquidation value and while still providing above average dividend yields, in our view, are no longer significantly more attractive on a risk-adjusted basis than common equity investments and may be more vulnerable, as essentially fixed income investments, to increases in long term interest rates. As a result, we have taken profits in our holdings and have reduced our overall exposure. As of October 31, 2010, the Fund’s preferred investments had a weighted average dividend yield of 7.53% (with a median yield of 7.58%) and traded at a weighted-average discount to an underlying $25.00 liquidation value of only 3.2% (i.e., a weighted-average price of $24.20) and a median discount of 2.0% (or median share price of $24.50). During the latest fiscal period, the WHPSR Index increased +31.06%. Among the sixteen preferred stocks held in the Fund throughout the period, simple returns ranged from +55.82% for Developers Diversified’s Series I to +16.69% for Omega Healthcare’s Series D with a simple non-weighted average return of +34.34% and a median return of +29.49%.

18

| |

Alpine Realty Income & Growth Fund |

|

| | |

MOVING FORWARD

As the year has progressed, we have become incrementally more positive on overall commercial real estate fundamentals even as we remain frustrated at the sluggish pace of economic recovery. As a result, on the margin, we have become less defensive in our portfolio construction, reducing our investments in the health care and net lease sectors and in our preferred equity allocation. We expect that 2011 will witness a continuation of a slow but steady recovery in operating conditions, more attractive acquisition opportunities for the public real estate companies, and a growing level of dividend increases by the REIT group which should keep real estate as a relatively attractive investment alternative for investors. Moreover, as we have stated above, we believe the likelihood for meaningful

appreciation in the near term for the REIT group from current pricing will be highly dependent on the pace of economic recovery and the absence of any significant rise in long term interest rates. If the economy recovers at a quicker pace than we anticipate, then capital flows may shift towards other stock alternatives and REIT returns while remaining positive may lag the broader market somewhat as they have since mid-summer. We look forward to providing an update on Fund performance after the end of the semi-annual period in April, 2011.

Sincerely,

Robert W. Gadsden

Portfolio Manager

Past performance is not a guarantee of future results.

Please refer to the schedule of portfolio investments for fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Because the Fund concentrates its investments in the real estate industry, the portfolio may experience more volatility and be exposed to greater risk than the portfolios of many other mutual funds. Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment. The Fund may include equity-linked securities and various other derivative instruments, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may magnify gains or increase losses in the Fund’s portfolio.

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry.)

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

Dividend Yield represents the trailing 12-month dividend yield aggregating all income distributions per share over the past year, divided by the period ending fund share price. It does not reflect capital gains distributions.

The University of Michigan Consumer Sentiment Index Thomson Reuters/University of Michigan Surveys of Consumers is a consumer confidence index published monthly by the University of Michigan and Thomson Reuters. The index is normalized to have a value of 100 in December 1964. At least 500 telephone interviews are conducted each month of a United States sample which excludes Alaska and Hawaii. 50 core questions are asked.

EBITDA is essentially Net Income with interest, taxes, depreciation, and amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. However, this is a non-GAAP measure that allows a greater amount of discretion

19

| |

Alpine Realty Income & Growth Fund |

|

| | |

as to what is (and is not) included in the calculation. This also means that companies often change the items included in their EBITDA calculation from one reporting period to the next.

National Association Of Real Estate Investment Trusts — NAREIT NAREIT is made up of a community of industry professionals, academics and companies that work together to promote the real estate industry and REITs. Through NAREIT, individuals are able to access comprehensive industry data on the overall real estate industry and the performance of member REITs.

Commercial Mortgage-Backed Securities (CMBS) A type of mortgage-backed security that is secured by the loan on a commercial property. A CMBS can provide liquidity to real estate investors and to commercial lenders. As with other types of MBS, the increased use of CMBS can be attributable to the rapid rise in real estate prices over the years.

Wells Fargo REIT Preferred Index WHPS SM REIT Index was created to benchmark the performance of the REIT Preferred Market and is a member of the Wells Fargo Hybrid and Preferred Securities family. The Bloomberg Apartment REIT Index is a capitalization-weighted sub-index of the Bloomberg REIT Index and is based on apartment properties comprising 75% or more of invested assets. Please note that an investor cannot invest directly in an index.

Simple Rate of Return — Measure of profitability obtained by dividing the expected future annual net income by the required investment; also called Accounting Rate of Return or unadjusted rate of return. Sometimes the average investment rather than the original initial investment is used as the required investment, which is called average rate of return.

20

| |

Alpine Cyclical Advantage Property Fund |

|

|

| | | | | | | | | | | | | | | | | | | |

| |

Comparative Annualized Returns as of 10/31/10 (Unaudited) | | |

| | 6 Months(1) | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception

(9/1/1993) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

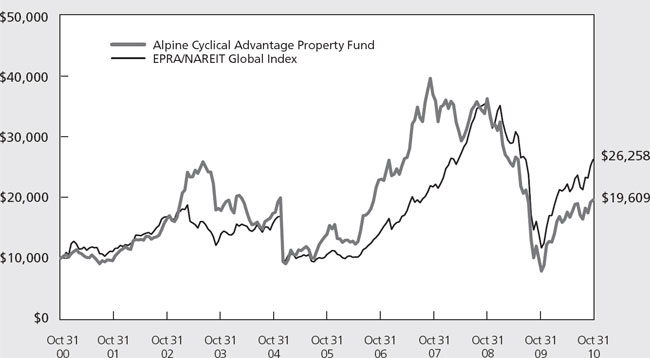

Alpine Cyclical Advantage Property Fund | | 3.26 | % | | 23.36 | % | | -15.44 | % | | -9.60 | % | | 7.58 | % | | 8.27 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPRA/NAREIT Global Index | | 10.86 | % | | 24.74 | % | | -9.26 | % | | 4.07 | % | | 10.71 | % | | 9.04 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S&P Developed BMI Property Index(2) | | 9.70 | % | | 23.96 | % | | -10.01 | % | | 2.76 | % | | N/A | | | N/A | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Global Real Estate Funds Average(3) | | 9.59 | % | | 25.40 | % | | -9.51 | % | | 2.06 | % | | 10.78 | % | | 9.33 | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lipper Global Real Estate Funds Rank(3) | | N/A | (4) | | 63/99 | | | 67/67 | | | 31/31 | | | 15/15 | | | 2/2 | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio: 1.45%(5) | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.45%(5) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | |

|

| |

| (1) Not annualized. |

| (2) Index commenced on 12/29/2000. |

| (3) The since inception data represents the period beginning 9/2/1993. |

| (4) FINRA does not recognize rankings for less than one year. |

| (5) As disclosed in the prospectus dated February 27, 2010. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The EPRA/NAREIT Global Index is designed to represent general trends in eligible real estate equities worldwide. Relevant real estate activities are defined as the ownership, disposure and development of income-producing real estate. The S&P Developed BMI Property Index is an unmanaged market-weighted total return index available on a monthly basis. The index consists of many companies from developed markets whose floats are larger than $100 million and derive more than half of their revenue from property related activities. The Lipper Global Real Estate Funds Average is an average of funds that invest at least 25% of their equity portfolio in shares of companies engaged in the real estate industry that are strictly outside of the U.S. or whose securities are principally traded outside of the U.S. Lipper rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The EPRA/NAREIT Global Index, the S&P Developed BMI Property Index and the Lipper Global Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Cyclical Advantage Property Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

21

| |

Alpine Cyclical Advantage Property Fund |

|

| | |

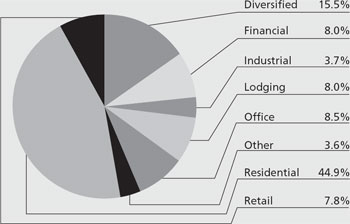

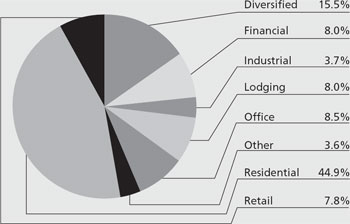

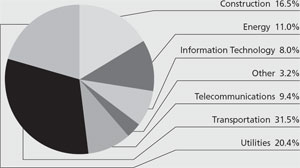

Portfolio Distributions* (Unaudited)

| | | | |

Top 10 Holdings* (Unaudited) | | | |

1. | Verde Realty | | 4.20 | % |

2. | Iguatemi Empresa de Shopping Centers SA | | 3.29 | % |

3. | CB Richard Ellis Group, Inc. - Class A | | 3.25 | % |

4. | Direcional Engenharia SA | | 2.80 | % |

5. | Altisource Portfolio Solutions SA | | 2.53 | % |

6. | General Growth Properties, Inc. | | 2.35 | % |

7. | Lennar Corp. - Class A | | 2.34 | % |

8. | PDG Realty SA Empreendimentos e Participacoes | | 2.33 | % |

9. | Toll Brothers, Inc. | | 2.31 | % |

10. | NVR, Inc. | | 2.31 | % |

* Portfolio holdings and sector distributions are as of 10/31/10 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments less short-term investments and Top 10 Holdings percentages are based on total net assets.

|

|

|

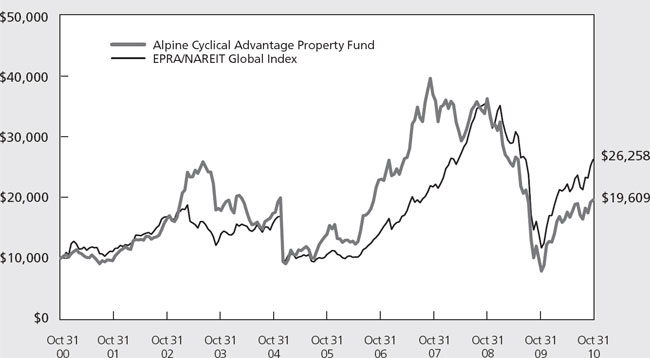

Value of a $10,000 Investment (Unaudited) |

|

|

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus similar investments in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s return reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total returns would have been lower.

22

| |

Alpine Cyclical Advantage Property Fund |

|

| | |

Dear Shareholders:

We are pleased to report that the October 31, 2010 fiscal year total return for the Alpine Cyclical Advantage Property Fund was 23.36%. This compares with the EPRA/NAREIT Global Index total return of 24.74% and the S&P Developed BMI Property Index total return of 23.96% for the same one year period ending October 31, 2010. During the course of the year, management sought to diversify the portfolio in light of transforming the prior emphasis on U.S. stocks into a more balanced global portfolio. Thus, the current 71 holdings of the Fund is the product of the sale of 34 prior holdings and the addition of 44 new stocks. The essential character remains, but the Fund has been modified to fit management’s view of the medium term prospects for the real estate equity markets as suggested by the name of the Fund.

INVESTMENT LANDSCAPE

Over the past five years, Alpine has observed what could be described as a two-speed world in which the developed economies have produced only modest rates of growth in comparison with so called emerging economies which were growing their GDP (Gross Domestic Product) at roughly two to three times as fast. Since the ‘great recession’ of 2008/2009 this divergence has accelerated. The large developed markets have in fact experienced deflationary trends associated with deleveraging high-priced assets through (often dilutive) re-equitization, forced sales or bankruptcy/foreclosures. However, cheap money (low interest rates) has protected asset values and rekindled signs of recovery. In contrast, a number of emerging markets have benefited from strong growth leading to rising employment, income and consumption trends which have been followed by increased inflationary pressures. A number of emerging markets, including Brazil, India and, notably, China, have responded by raising interest rates and/or taxing capital flows, so capital values have been constrained, despite positive demand/supply imbalances. Domestic demand in emerging countries is focusing a greater percentage of GDP growth away from exports as local incomes can now fuel aspirations for a better life in many of the rapidly expanding young populations throughout the emerging world. As a result, underlying demand for real estate from both tenants and investors is expanding in spite of higher cost of capital due to inflation propelled bond yields in many emerging countries. This is in stark comparison with rather stagnant tenant demand for property in most major cities of the developed world. However, real estate markets in the developed economies have benefited from improved liquidity and investor demand for property, with transaction volumes returning to levels last experienced early in the last cycle.

In all but the strongest property markets, prices are below replacement cost, so new development is still two-four years out with the exception of residential property. Given the historic low level of interest rates and a normalized spread of 200 to 400 basis points above medium term (five to ten year) debt, the initial yields (or capitalization rate) derived from premier income producing properties have fallen back to the levels last seen in the debt fueled growth environment of 2005 -2007. Investor assumptions regarding future tenant demand, the pace at which vacancy is absorbed, and the potential for new supply must be considered in light of possible increases in interest rates over the expected investment period. It should be noted that an inflationary period with rising interest rates in the developed markets in future years could be detrimental if it raises capitalization rates, and hence, lowers values. Occupancy rates in most markets are slowly improving from the cyclical trough of 2009, but different markets around the world may face varied levels of potential new supply over the next few years. Thus, the relationship between economic growth which could underpin rising tenant demand and the timing of new supply could have a significant influence over rental trends around the world, as can changes in interest rates.

Growth through accretive acquisitions has been a source of growth for many public real estate companies for decades. Over the past two years, many REITs, first in Australia, then the U.S., U.K., and Singapore recapitalized their balance sheets in anticipation of great buying opportunities. To date, a number of attractive transactions have taken place in these markets, although perhaps none could be described as great, because low interest rates have put a floor under prices. Despite the large number of questionable loans and real estate financings which are approaching maturity, banks have not been forced to foreclose or sell loans at deep discounts.

The intersection of the debt capital markets and the real estate market runs through major banks, so this is where we see the prospect for new supply of reasonably priced potential purchases for well capitalized companies and investors. British and U.S. banks are most likely to increase the flow of bad loans off their books and into the property market beginning this year. We expect European and Japanese banks may move more slowly. The banks would also likely provide significant financing for mergers and acquisitions of corporate portfolios, for both private and publicly traded entities. Alpine anticipates that large, well capitalized buyers, often in conjunction with an equity partner such as a pension or sovereign wealth fund, could be aggressive buyers. However, holding periods for many investors may require more patience than historic five to seven years due to modest medium growth prospects and/or low initial returns.

23

| |

Alpine Cyclical Advantage Property Fund |

|

| | |

Emerging markets are typically characterized by a limited supply of high quality properties which often leads to rent/price spikes during surges in demand. This naturally sets the stage for new development to not only meet demand, but match the requirements of a broader spectrum of tenants and investors. In markets where vacancy rates shot up into the double-digit levels during the ‘great recession’, the current rapid rate of economic progress has led to relatively quick absorption of vacant quality space, pushing occupancy levels and rents higher. In many markets, rents have returned to levels which make new development increasingly profitable, however, the first major projects will not be delivered for at least two years, and others under design now may take three to five years. Cities such as Sao Paulo, Hong Kong and London currently enjoy strong rental demand, while others including Beijing, Shanghai, Oslo, Paris, Washington, New York and New Delhi have benefited from stabilization, so all could see solid rental growth for several years, barring any major economic disruptions. Rents should trend favorably over the next three to five years throughout both the developed and emerging market countries, potentially justifying the relatively low acquisition yields of properties today. However, the velocity of tenant demand may only be strong enough in certain emerging markets to sustain rental growth through a longer period of new development which might traverse an interest rate cycle.

PORTFOLIO STRUCTURE

The Alpine Cyclical Advantage Property Fund (EUEYX) portfolio has been rebalanced in terms of geographic concentration, property type distribution and underlying stock selection. The overall spread of the portfolio has shifted to the South and to the West, with significant increase in Asian exposure from 13.2% to 21.0%, and Latin America from 12.4% to 19.7% over the course of the fiscal year. With this shift, the emerging market exposure of the Fund has increased from 25.5% to 40% over the past year. The three countries with the most significant adjustments were the United States, where we reduced the Fund’s holdings from 66.1% to 40.9%. In Brazil, the Fund expanded its exposure from 12.4% up to 19.7%. Proportionately, the most significant change was the U.K., up from 0.4% to 5.6%. The underlying shift in stock selection also led to notable changes in the makeup of the property exposure of the Fund. Specifically, financial related stocks, including mortgage REITs were decreased from 16.8% to 8.0% of the portfolio, while residential properties increased from 17.3% to 44.9% of the portfolio.

It is worth noting that of the significant residential exposure, approximately 12.5% has been invested in Brazilian home builders, 12.2% in U.S. housing stocks, including senior living developers, and 7% has been invested in Chinese home builders. Each country

allocation to the home builders represents a different facet of the cyclical opportunity that we perceive for these real estate companies. Brazil is in mid-cycle growth phase in which financial modernization of the country has led to the introduction of mortgages over the past several years. Mortgage rates in Brazil are tied to medium term inflation adjusted rates and not the central bank’s SELIC rate (overnight lending rate) which can be more volatile over time as the central bank adjusts monetary policy with short term rates which are designed to impact commerce and the financial industry, not housing. In addition, the government has expanded a significant subsidized mortgage program, which in tandem with the strong growth in incomes and investment which the country is enjoying could lead to a multiyear extended cycle with stimulus lasting beyond the World Cup in 2014 and even the Olympics in 2016.

The Fund’s 12.2% exposure to U.S. homebuilders and senior housing developers reflects Alpine’s view that the U.S. housing market is at or near bottom (indeed prices and sales volumes have begun trending higher in select markets). While we do not expect a strong recovery until the foreclosure overhang is more fully absorbed, we believe that the stocks of domestic home builders could move in anticipation of a new earning cycle beginning late next year. The potential power of that earnings cycle should not be underestimated in light of a couple of factors. First, examining the dollar value of existing home sales (number of units sold times average price) smoothed by taking the average of the trailing six months through October, 2010 in comparison with peak levels of May 2005 show that the value of existing home sales are down 48%. By comparison, the dollar value of new home sales using the same formula has dropped by 80%. This has fundamentally shifted the historic relationship between existing home sales and new home sales in that new home sales have typically been about 18% of the total sales for new and existing homes, going back over a decade. However, new home sales now represent only about 8% of total homes sold. We believe that once the inventory pressure of low priced foreclosed and damaged homes dissipates from the market place, the historical price relationship of existing homes to new homes of roughly 90% (plus or minus 3%) will be reestablished, compared with the current 81% level which reflects lower priced foreclosed homes. The return to historic valuation and volume levels could be a major factor in a rapid recovery in the market share for new home sales in the U.S.

With regard to the Chinese builders, it is important to know that five of the Fund’s seven holdings have been newly acquired this year reflecting the changing impact of restrictive government regulations with particular regard to financing options in some of the hotter markets, such as Shanghai and Beijing. Hence the portfolio’s orientation has been directed towards second and third tier cities (of more than a million inhabitants) and the builders whom

24

| |

Alpine Cyclical Advantage Property Fund |

|

| | |

we believe are well positioned to generate steady growth in those markets. In comparison with the early cycle focus on U.S. builders and the mid-cycle phase in Brazil, China’s builders are facing a relatively mature phase of the cycle, however, the smaller cities are typically one to three years behind the fast paced coastal cities where the monetary slowing combined with regulatory measures is having more pronounced effect on volumes and eventually prices. We believe the valuations of the Fund’s holdings in Chinese builders does not reflect the ongoing cyclical strength in their distinct markets.

TOP TEN HOLDINGS

The top ten holdings in the portfolio are reflective of the portfolio adjustments described above. Consistent with the broader diversification of the portfolio, the same is true with the top ten holdings of which eight are new to the top ten, constituting 27.7% of the total portfolio, versus last fiscal year’s top ten equating to 37.9%. For fiscal year 2010, these stocks contributed over 9% of the 23.36% total return for the portfolio. (Holdings information included below are for the one-year period ending October 31, 2010.) The largest stock is Verde Realty, the Tex/Mex residential apartment and industrial property owner/developer. Current problems with drug cartels on the boarder have impacted the near term prospects for the company’s business model leading to an early stage of transformation with a broader U.S. focus on apartments and industrial properties. A valuation of Verde shares declined over the year by - 21.98%. In comparison, the Brazilian shopping mall developer, Iguatemi produced a total return of 58.44%, reflecting their current strong rents and new mall developments in progress. C.B. Richard Ellis, the global real estate brokerage, research, and management company provided a return of 79.26%. The fourth largest holding Direcional Engenharia is focused on low income government subsidized housing in Brazil and generated a 26.27% total return. Altisource Portfolio Solutions, a U.S. mortgage analytics, and consulting company provided a 71.54% total return. This paled in comparison with the 322.19% total return of General Growth Properties, which emerged from Chapter 11 protection as its debt maturities were extended and balance sheet restructured with new equity. The Fund’s number seven slot rather belongs to the major U.S. home builder, Lennar Corp., which gained 20.46% on the year. This was followed by another builder, Brazil’s PDG Realty, which has adroitly expanded its business through acquisitions to become the largest developer in Brazil. It provided a 61.7% total return to the Fund. In contrast, Toll Brothers, the upscale U.S. home builder declined by

-18.21%. While the number ten holding, NVR Inc., the preeminent Washington D.C. regional home builder declined -7.19%. We are hoping for a greater number of robust returns in the new year from our top ten holdings.

EQUITIES LEAD INDICES

It should be noted that major global real estate indices do not include meaningful exposure to emerging market (EM) stocks in their global composites, although that might have to change. The annualized growth over the five years including 2005 through 2009, of the market capitalization of stocks in the S&P 500 shrank by -1.5% while the MSCI World Index grew by 1.9%. During this period, the growth of all emerging market stocks was evidenced by a compound annual growth rate of 24% for the market capitalization of such stocks. A similar pattern has held true in real estate equities with U.S. equity REIT’s shrinking by -2.0% per year, while global real estate grew by a healthy 12% compound annual growth rate during this period, while emerging market real estate expanded by 34%. By Alpine’s calculations, emerging market equities constitute roughly 25% of all real estate stocks outstanding market capitalization. Nonetheless, the major global real estate indices provided by Dow Jones, S&P, and the FTSE EPRA/NAREIT series all have less than 1% EM exposure through the third quarter of 2010. We believe that for the indices to remain credible, they will eventually begin to include more emerging market exposure. As mentioned previously, EUEYX had an historically high 40% exposure to emerging markets at the end of the fiscal period.

Globally, the fundamental demand equation for real estate is gradually improving in most, if not all, markets. For over 20 years, Alpine has had at least modest exposure (7% minimum) of its international and global portfolios in emerging markets, and the current period is potentially the most favorable for long term investment. Because the growth dynamic is far superior in these regions, we believe that underlying real estate demand will continue to support rising rents, which can produce rising investment yields. This may lead to rising dividend yields for real estate equity investors, but the demand for high quality buildings should sustain development over multiple cycles, emphasizing the creation of real estate value. Alpine continues to believe that there will also be opportunities for companies to grow their assets and income levels in the developed economies of the U.S., Europe and even Japan, even though the next few years may be a bit challenging. We think that those investors who can take a three to five year view may be well served by this portfolio in terms of potential for growth and income to be derived from global real estate equities markets, especially during the early phases of this cycle, when value creation can be the greatest driver of total return.

Sincerely,

Samuel A. Lieber

Portfolio Manager

25

| |

Alpine Cyclical Advantage Property Fund |

|

| | |

| |

| |

Past performance is not a guarantee of future results. |

Please refer to the schedule of portfolio investments for fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Funds that concentrate their investments in a specific sector, such as real estate, tend to experience more volatility and be exposed to greater risk than more diversified funds.

Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment.

The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The Fund regularly makes short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may include equity-linked securities and various other derivative instruments, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may magnify gains or increase losses in the Fund’s portfolio.

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of a variety of factors including those related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry) or due to other factors such as a rise in interest rates, for example.

Diversification does not assure a profit or protect against loss in a declining market.

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

A Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Dividend Yield represents the trailing 12-month dividend yield aggregating all income distributions per share over the past year, divided by the period ending fund share price. It does not reflect capital gains distributions.

Capitalization rate (or “cap rate”) is the ratio between the net operating income produced by an asset and its capital cost (the original price paid to buy the asset) or alternatively its current market value.

Compound Annual Growth Rate is the year-over-year growth rate of an investment over a specified period of time.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The MSCI World Index is a stock market index of 1,500 ‘world’ stocks. It is maintained by MSCI Inc., formerly Morgan Stanley Capital International, and is often used as a common benchmark for ‘world’ or ‘global’ stock funds.

The FTSE EPRA/NAREIT Global Real Estate Index Series is designed to represent general trends in eligible real estate equities worldwide.

One cannot invest directly in an index.

26

| |

Alpine Emerging Markets Real Estate Fund |

|

|

| | | | | | | | | | |

| |

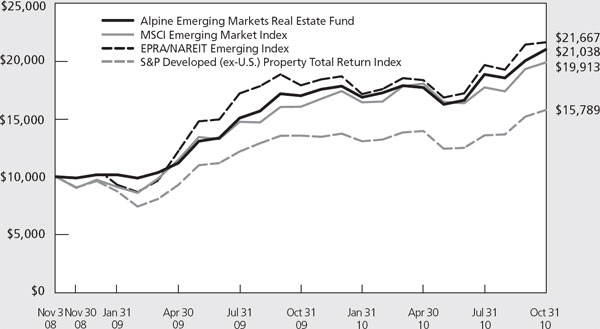

Comparative Annualized Returns as of 10/31/10 (Unaudited) | | | | |

| | 6 Months(1) | | 1 Year | | Since Inception

(11/03/2008) | |

|

|

|

|

|

|

|

|

|

|

|

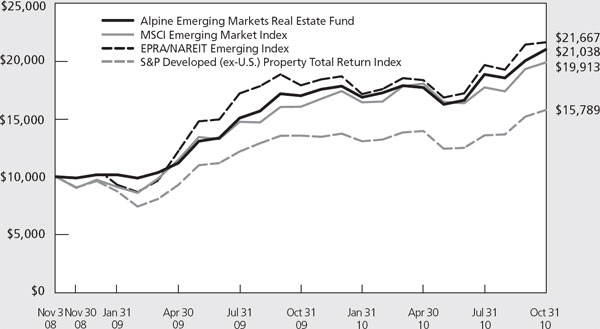

Alpine Emerging Markets Real Estate Fund | | 18.59 | % | | 23.53 | % | | 45.27 | % | |

|

|

|

|

|

|

|

|

|

|

|

EPRA/NAREIT Emerging Index(2) | | 18.57 | % | | 20.34 | % | | N/A | | |

|

|

|

|

|

|

|

|

|

|

|

MSCI Emerging Markets Index | | 10.12 | % | | 23.71 | % | | 44.00 | % | |

|

|

|

|

|

|

|

|

|

|

|

S&P Developed (ex. U.S.) Property Total Return Index | | 13.03 | % | | 16.38 | % | | 25.77 | % | |

|

|

|

|

|

|

|

|

|

|

|

Lipper Global Real Estate Funds Average(3) | | 9.59 | % | | 25.40 | % | | 26.04 | % | |

|

|

|

|

|

|

|

|

|

|

|

Lipper Global Real Estate Funds Rank(3) | | N/A | (4) | | 60/99 | | | 1/84 | | |

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio: 4.52%(5) | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.51%(5) | | | | | | | | | | |

| |

| | |

|

| |

| (1) Not annualized. |

| (2) Index commenced on 1/12/2009. |

| (3) The since inception data represents the period beginning 11/6/2008. |

| (4) FINRA does not recognize rankings for less than one year. |

| (5) As disclosed in the prospectus dated February 27, 2010. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The EPRA/NAREIT Emerging Index is an unmanaged index designed to track the performance of listed real estate companies in emerging countries worldwide. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of global emerging markets. The S&P Developed (ex. U.S.) Property Total Return Index is an unmanaged market-weighted total return index available on a monthly basis. The index consists of companies from developed markets, excluding the U.S., whose floats are larger than 100 million U.S. dollars and derive more than half of its revenue from property-related activities. The Lipper Global Real Estate Funds Average is an average of funds that invest at least 25% of their equity portfolio in shares of companies engaged in the real estate industry that are strictly outside of the U.S. or whose securities are principally traded outside of the U.S. Lipper rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The EPRA/NAREIT Emerging Index, the MSCI Emerging Markets Index, the S&P Developed (ex. U.S.) Property Total Return Index and the Lipper Global Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Emerging Markets Real Estate Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

The adviser contractually agreed to waive a portion of its fees and to absorb certain fund expenses. This arrangement will remain in effect unless and until the Board of Trustees approves its modification or termination.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

27

| |

Alpine Emerging Markets Real Estate Fund |

|

| | |

| | | | | | | |

| | | | | | | |

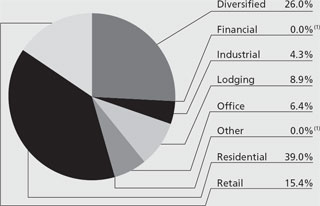

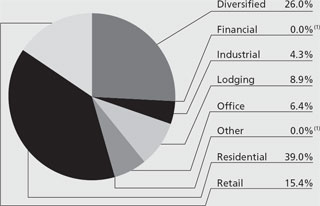

Portfolio Distributions* (Unaudited) | | Top 10 Holdings* (Unaudited) | | | |

| | 1. | | PDG Realty SA | | 3.63% | |

| 2. | | BHG SA Brazil Hospital | | 3.48% | |

| 3. | | Brasil Brokers Participacoes SA | | 3.38% | |

| 4. | | MRV Engenharia | | 2.77% | |

| 5. | | LSR Group OJSC - GDR | | 2.60% | |

| 6. | | Iguatemi Empresa de Shopping

Centers SA | | 2.32% | |

| 7. | | General Shopping Brasil SA | | 2.26% | |

| 8. | | T M G Holding | | 2.25% | |

| 9. | | Direcional Engenharia SA | | 2.19% | |

| 10. | | Multiplan Empreendimentos

Imobiliarios SA | | 2.13% | |

|

| | | |