REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

of Alpine Equity Trust:

We have audited the accompanying statements of assets and liabilities, including the schedules of portfolio investments of Alpine Equity Trust, comprising the Alpine Cyclical Advantage Property Fund, Alpine International Real Estate Equity Fund, Alpine Realty Income & Growth Fund, Alpine Emerging Markets Real Estate Fund, and Alpine Global Infrastructure Fund (collectively the “Funds”) as of October 31, 2009, and the related statements of operations, changes in net assets, and the financial highlights for the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of there internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2009, by correspondence with the custodian and brokers; where replies where not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds as of October 31, 2009, the results of their operations, the changes in their net assets, and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America.

|

|

Milwaukee, WI |

December 30, 2009 |

72

Additional Information (Unaudited)

Expense Examples

October 31, 2009

As a shareholder of the International Real Estate Equity Fund, the Realty Income & Growth Fund, the Cyclical Advantage Property Fund, the Emerging Markets Real Estate Fund or the Global Infrastructure Fund, you will incur two types of cost: (1) redemption fees and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 for the period 5/1/2009-10/31/2009.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. The Funds charge no sales load or transaction fees, but do assess shareholders for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. Shareholders in the Funds will be charged a redemption fee equal to 1.00% of the net amount of the redemption if they redeem their shares less than 2 months after purchase. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Funds invest in shares of other investment companies as a part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Fund. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which does not represent the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

International Real Estate Equity Fund

| | | | | | | |

| | Beginning

Account Value

5/1/09 | | Ending

Account Value

10/31/09 | | Expenses Paid

During Period

5/1/2009-10/31/2009(3)* | |

| |

| |

| |

| |

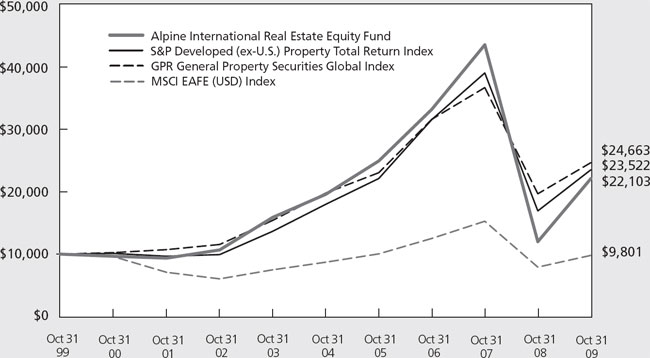

Actual (1) | | $1,000.00 | | $1,667.20 | | $8.13 | |

Hypothetical (2) | | $1,000.00 | | $1,019.11 | | $6.16 | |

| | |

| |

(1) | Ending account values and expenses paid during period based on a 66.72% return. The return is considered after expenses are deducted from the Fund. |

(2) | Ending account values and expenses paid during period based on a 5.00% annual return. The return is considered before expenses are deducted from the Fund. |

(3) | Excluding interest expense of 0.04%, the actual and hypothetical expenses paid during the period were $7.87 and $5.96, respectively. |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.21%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

73

Additional Information (Unaudited)—Continued

Expense Examples

October 31, 2009

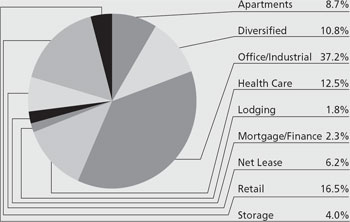

Realty Income & Growth Fund

| | | | | | | |

| | Beginning

Account Value

5/1/09 | | Ending

Account Value

10/31/09 | | Expenses Paid

During Period

5/1/2009-10/31/2009 (3)* | |

| |

| |

| |

| |

Actual (1) | | $ 1,000.00 | | $1,420.30 | | $8.36 | |

Hypothetical (2) | | $ 1,000.00 | | $1,018.30 | | $6.97 | |

| |

|

(1) | Ending account values and expenses paid during period based on a 42.03% return. The return is considered after expenses are deducted from the Fund. |

(2) | Ending account values and expenses paid during period based on a 5.00% annual return. The return is considered before expenses are deducted from the Fund. |

(3) | Excluding interest expense of 0.12%, the actual and hypothetical expenses paid during the period were $7.63 and $6.36, respectively. |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.37%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Cyclical Advantage Property Fund

| | | | | | | |

| | Beginning

Account Value

5/1/09 | | Ending

Account Value

10/31/09 | | Expenses Paid

During Period

5/1/2009-10/31/2009 (3)* | |

| |

| |

| |

| |

Actual (1) | | $ 1,000.00 | | $1,295.70 | | $8.39 | |

Hypothetical (2) | | $ 1,000.00 | | $1,017.90 | | $7.37 | |

| |

|

(1) | Ending account values and expenses paid during period based on a 29.57% return. The return is considered after expenses are deducted from the Fund. |

(2) | Ending account values and expenses paid during period based on a 5.00% annual return. The return is considered before expenses are deducted from the Fund. |

(3) | Excluding interest expense of 0.18%, the actual and hypothetical expenses paid during the period were $7.35 and $6.46, respectively. |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.45%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

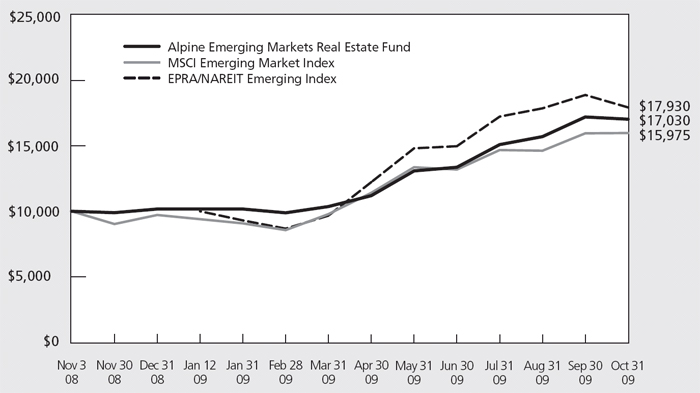

Emerging Markets Real Estate Fund

| | | | | | | |

| | Beginning

Account Value

5/1/09 | | Ending

Account Value

10/31/09 | | Expenses Paid

During Period

5/1/2009-10/31/2009 (3)* | |

| |

| |

| |

| |

Actual (1) | | $ 1,000.00 | | $1,521.90 | | $8.58 | |

Hypothetical (2) | | $ 1,000.00 | | $1,018.40 | | $6.87 | |

| |

|

(1) | Ending account values and expenses paid during period based on a 52.19% return. The return is considered after expenses are deducted from the Fund. |

(2) | Ending account values and expenses paid during period based on a 5.00% annual return. The return is considered before expenses are deducted from the Fund. |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.35%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

74

Additional Information (Unaudited)—Continued

Expense Examples

October 31, 2009

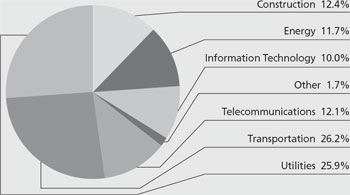

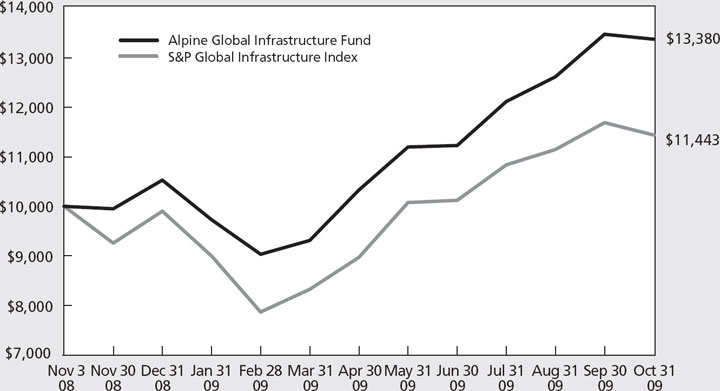

Global Infrastructure Fund

| | | | | | | |

| | Beginning

Account Value

5/1/09 | | Ending

Account Value

10/31/09 | | Expenses Paid

During Period

5/1/2009-10/31/2009 (3)* | |

| |

| |

| |

| |

Actual (1) | | $ 1,000.00 | | $1,295.30 | | $7.87 | |

Hypothetical (2) | | $ 1,000.00 | | $1,018.35 | | $6.92 | |

| |

|

(1) | Ending account values and expenses paid during period based on a 29.53% return. The return is considered after expenses are deducted from the Fund. |

(2) | Ending account values and expenses paid during period based on a 5.00% annual return. The return is considered before expenses are deducted from the Fund. |

(3) | Excluding interest expense of 0.01%, the actual and hypothetical expenses paid during the period were $7.81 and $6.87, respectively. |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.36%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

75

Additional Information (Unaudited)—Continued

October 31, 2009

Information about Trustees and Officers

The business and affairs of the Funds are managed under the direction of the Trusts’ Board of Trustees. Information pertaining to the Trustees and Officers of the Funds is set forth below. The SAI includes additional information about the Funds’ Trustees and Officers and is available, without charge, upon request by calling 1-888-785-5578.

| | | | | | | | | | |

Independent Trustees |

|

|

|

|

|

|

|

|

|

|

|

Name and Age | | Position(s)

Held with

the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation During

Past Five Years | | # of

Portfolios in

Fund

Complex** | | Other Directorships

Held by Trustee |

| |

| |

| |

| |

| |

|

Laurence B. Ashkin (81) | | Independent

Trustee | | Indefinite,

since the

Trust’s

inception | | Real estate developer since 1980; Founder and President of Centrum Properties, Inc. since 1980. | | 16 | | Board of Trustees Chairman, Perspective Charter Schools, Chicago, IL; Director, Chicago Public Radio; Trustee of each of the Alpine Trusts.* |

|

|

|

|

|

|

|

|

|

|

|

H. Guy Leibler (55) | | Independent

Trustee | | Indefinite,

since the

Trust’s

inception | | Private investor, since 2007; Vice Chair & Chief Operating Officer of L&L Acquisitions, LLC (2004-2007); President, Skidmore, Owings & Merrill LLP (2001-2004). | | 16 | | Chairman Emeritus, White Plains Hospital Center; Trustee, each of the Alpine Trusts.* |

|

|

|

|

|

|

|

|

|

|

|

Jeffrey E. Wacksman (49) | | Independent

Trustee | | Indefinite,

since 2004 | | Partner, Loeb, Block & Partners LLP, since 1994. | | 16 | | Director, International Succession Planning Association; Trustee, Larchmont Manor Park Society; Director, Bondi Icebergs Inc. (Women’s Sportswear); Director, MH Properties, Inc.; Trustee, each of the Alpine Trusts.* |

|

|

|

|

|

|

|

|

|

|

|

James A. Jacobson (64) | | Independent

Trustee | | Indefinite,

since July

2009 | | Retired, since November 2008; Vice Chairman and Managing Director, Spear Leeds & Kellogg Specialists, LLC, January 2003 to November 2008. | | 16 | | Trustee, each of the Alpine Trusts.* |

|

|

|

|

|

|

|

|

|

|

|

| |

* | The term “Fund Complex” refers to the Funds in the Alpine Equity Trust, Alpine Series Trust, and Alpine Income Trust, and Alpine Global Dynamic Dividend Fund, Alpine Total Dynamic Dividend Fund, and Alpine Global Premier Properties Fund (the “Alpine Trust”). |

76

Additional Information (Unaudited)—Continued

October 31, 2009

| | | | | | | | | | |

Interested Trustees & Officers |

|

|

|

|

|

|

|

|

|

|

|

Name and Age | | Position(s)

Held with

the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation During

Past Five Years | | # of

Portfolios in

Fund

Complex** | | Other Directorships

Held by Trustee |

| |

| |

| |

| |

| |

|

Samuel A. Lieber* (53) | | Interested

Trustee,

President and

Portfolio

Manager | | Indefinite,

since the

Trust’s

inception | | CEO of Alpine Woods Capital Investors, LLC since November 1997. President of Alpine Trusts since 1998. | | 16 | | Trustee, each of the Alpine Trusts. |

|

|

|

|

|

|

|

|

|

|

|

Stephen A. Lieber*** (84) | | Vice President

and Portfolio

Manager | | Indefinite,

since the

Trust’s

inception | | Chief Investment Officer, Alpine Woods Capital Investors, LLC since 2003; Chairman and Senior Portfolio Manager, Saxon Woods Advisors, LLC since 1999. | | N/A | | None |

|

|

|

|

|

|

|

|

|

|

|

Robert W. Gadsden (52) | | Vice President

and Portfolio

Manager | | Indefinite,

since 1999 | | Portfolio Manager and Senior Real Estate Analyst of Alpine Woods Capital Investors, LLC since 1999. Formerly Vice President, Prudential Realty Group (1990-1999). | | N/A | | None |

|

|

|

|

|

|

|

|

|

|

|

John Megyesi (48) | | Chief

Compliance

Officer | | Indefinite,

since January

2009 | | Chief Compliance Officer, Alpine Woods Capital Investors, LLC since January 2009; Vice President and Manager, Trade Surveillance, Credit Suisse Asset Management, LLC (2006-2009); Manager, Trading and Surveillance, Allianze Global Investors (2004-2006). | | N/A | | None |

|

|

|

|

|

|

|

|

|

|

|

Meimei Li (45) | | Treasurer | | Indefinite,

since March

2009 | | Controller, Alpine Woods Capital Investors, LLC since February 2007; Senior Accountant Pinnacle Group (2005-2007); Senior Auditor, Eisner & Lubin (2001-2005). | | N/A | | None |

|

|

|

|

|

|

|

|

|

|

|

Andrew Pappert (29) | | Secretary | | Indefinite,

since March

2009 | | Director of Fund Operations, Alpine Woods Capital Investors, LLC since September 2008; Assistant Vice President, Mutual Fund Operations, Credit Suisse Asset Management, LLC (2003-2009). | | N/A | | None |

|

|

|

|

|

|

|

|

|

|

|

| |

* | Denotes Trustees who are “interested persons” of the Trust or Fund under the 1940 Act. |

| |

** | The term “Fund Complex” refers to the Funds in the Alpine Equity Trust, Alpine Series Trust, and Alpine Income Trust, and Alpine Global Dynamic Dividend Fund, Alpine Total Dynamic Dividend Fund, and Alpine Global Premier Properties Fund (the “Alpine Trust”). |

| |

*** | Stephen A. Lieber is the father of Samuel A. Lieber. |

77

Additional Information (Unaudited)—Continued

October 31, 2009

Tax Information

The Funds designated the following percentages of dividends declared from net investment income for the fiscal year ended October 31, 2009 as qualified dividend income under the Jobs & Growth Tax Relief Reconciliation Act of 2003.

| | | | |

International Real Estate Equity Fund | | | 0 | % |

Realty Income & Growth Fund | | | 16 | % |

Cyclical Advantage Property Fund | | | 24 | % |

Emerging Markets Real Estate Fund | | | 0 | % |

Global Infrastructure Fund | | | 0 | % |

The Funds designated the following percentages of dividends declared during the fiscal year ended October 31, 2009 as dividends qualifying for the dividends received deduction available to corporate shareholders.

| | | | |

International Real Estate Equity Fund | | | 0 | % |

Realty Income & Growth Fund | | | 10 | % |

Cyclical Advantage Property Fund | | | 17 | % |

Emerging Markets Real Estate Fund | | | 0 | % |

Global Infrastructure Fund | | | 0 | % |

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended October 31, 2009.

Availability of Proxy Voting Information

Information regarding how each Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at 1-888-785-5578 and on the SEC’s website at www.sec.gov. Information regarding how each Fund voted proxies relating to portfolio securities during the most recent twelve month period ended June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

Availability of Quarterly Portfolio Schedule

Beginning with each Fund’s fiscal quarter ended July 31, 2004, each Fund filed its complete schedules of portfolio holdings on Form N-Q with the SEC. Going forward, each Fund will file Form N-Q for the first and third quarters of each fiscal year on Form N-Q. Each Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090.

Privacy Policy

The Funds collect non-public information about you from the following sources:

| | |

| • | information we receive about you on applications or other forms; |

| • | information you give us orally; and |

| • | information about your transactions with others or us. |

The Funds do not disclose any non-public personal information about our customers or former customers without the customer’s authorization, except as required by law or in response to inquiries from governmental authorities. The Funds restrict access to your personal and account information to those employees who need to know that information to provide products and services to you. The Funds also may disclose that information to unaffiliated third parties (such as to brokers or custodians) only as permitted by law and only as needed for us to provide agreed services to you. The Funds maintain physical, electronic and procedural safeguards to guard your non-public personal information.

In the event that you hold shares of the Funds through a financial intermediary, including, but not limited to a broker-dealer, bank or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared with unaffiliated third parties.

78

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

|

TRUSTEES |

Samuel A. Lieber |

Laurence B. Ashkin |

James A. Jacobson |

H. Guy Leibler |

Jeffrey E. Wacksman |

|

CUSTODIAN |

U.S. Bank, N.A. |

1555 N. Rivercenter Dr. Suite 302 |

Milwaukee, WI 53212 |

|

SUB-CUSTODIAN |

The Bank of New York Mellon |

One Wall Street |

New York, NY 10286 |

|

INDEPENDENT REGISTERED |

PUBLIC ACCOUNTING FIRM |

Deloitte & Touche LLP |

555 East Wells Street |

Milwaukee, WI 53202 |

|

FUND COUNSEL |

Blank Rome LLP |

The Chrysler Building |

405 Lexington Avenue |

New York, NY 10174 |

|

DISTRIBUTOR |

Quasar Distributors, LLC |

615 East Michigan Street |

Milwaukee, WI 53202 |

|

INVESTMENT ADVISER |

Alpine Woods Capital Investors, LLC |

2500 Westchester Ave., Suite 215 |

Purchase, NY 10577 |

|

TRANSFER AGENT & |

ADMINISTRATOR |

US Bancorp Fund Services, LLC |

615 East Michigan Street |

Milwaukee, WI 53202 |

|

|

|

SHAREHOLDER | INVESTOR INFORMATION |

|

1(888)785.5578 |

www.alpinefunds.com |

This material must be preceded or accompanied by a current prospectus.

Item 2. Code of Ethics.

The registrant has adopted a Senior Officer Code of Ethics that applies to the registrant’s president and chief financial officer. The registrant has not made any amendments to its Senior Officer Code of Ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Senior Officer Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Laurence Ashkin is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. “Other services” provided by the principal accountant were for fair valuation services analysis. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | | | | | | |

|

|

|

|

|

|

| | FYE 10/31/2009 | | FYE 10/31/2008 | |

|

|

|

|

|

|

Audit Fees | | $ | 104,550 | | $ | 74,050 | |

Audit-Related Fees | | $ | 0 | | $ | 0 | |

Tax Fees | | $ | 17,425 | | $ | 11,400 | |

All Other Fees | | $ | 13,545 | | $ | 0 | |

|

|

|

|

|

|

|

|

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by Deloitte & Touche LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | | | | | | |

|

|

|

|

|

|

| | FYE 10/31/2009 | | FYE 10/31/2008 | |

|

|

|

|

|

|

Audit-Related Fees | | 0 | % | | 0 | % | |

Tax Fees | | 0 | % | | 0 | % | |

All Other Fees | | 0 | % | | 0 | % | |

|

|

|

|

|

|

|

|

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

| | | | | |

|

|

|

|

|

|

Non-Audit Related Fees | | FYE 10/31/2009 | | FYE 10/31/2008 | |

|

|

|

|

|

|

Registrant | | $13,545 | | $0 | |

Registrant’s Investment Adviser | | $0 | | $0 | |

|

|

|

|

|

|

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| |

(a) | The Registrant’s President and Chief Financial Officer have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| |

(b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

| |

Item 12. Exhibits. |

|

(a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Filed herewith. |

| |

| (2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

| |

| (3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies. |

| |

(b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| | (Registrant) Alpine Equity Trust |

| | |

| |

| |

| By (Signature and Title)* /s/ Samuel A. Lieber | |

| | |

| |

| | | Samuel A. Lieber, President | |

| | | | |

| Date | 1/8/2010 | | |

| |

| |

| | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | | |

| |

| By (Signature and Title)* /s/ Samuel A. Lieber | |

| | |

| |

| | | Samuel A. Lieber, President | |

| | | | |

| Date | 1/8/2010 | | |

| |

| |

| | |

| By (Signature and Title)* /s/ Ron Palmer | |

| | |

| |

| | | Ron Palmer, Chief Financial Officer | |

| | | | |

| Date | 1/8/2010 | | |

| |

| |

* Print the name and title of each signing officer under his or her signature.