Exhibit 1

Province of Nova Scotia

(Canada)

| | | | |

| | | | This description of the Province of Nova Scotia is dated as of December 14, 2012 and appears as Exhibit (1) to the Province of Nova Scotia’s Annual Report on Form 18-K to the U.S. Securities and Exchange Commission for the fiscal year ended March 31, 2012. |

This document (otherwise than as a prospectus contained in a registration statement filed under the Securities Act of 1933) does not constitute an offer to sell or the solicitation of an offer to buy any Securities of the Province of Nova Scotia. The delivery of this document at any time does not imply that the information herein is correct as of any time subsequent to its date.

TABLE OF CONTENTS

| | | | |

| | | Page | |

| |

Further Information | | | 2 | |

Forward-Looking Statements | | | 3 | |

Summary | | | 4 | |

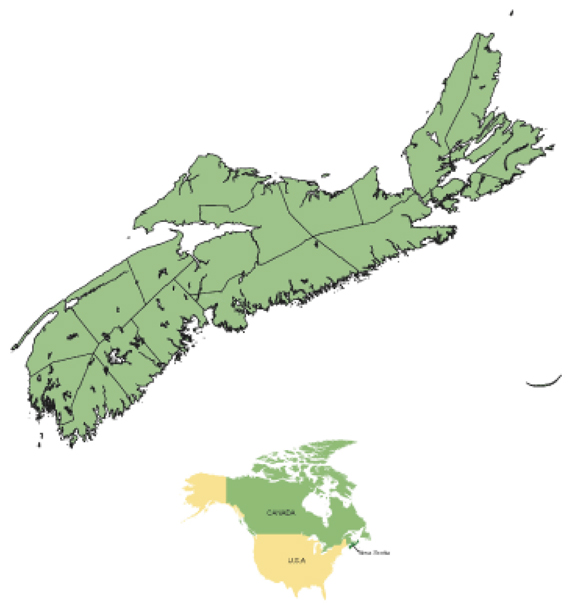

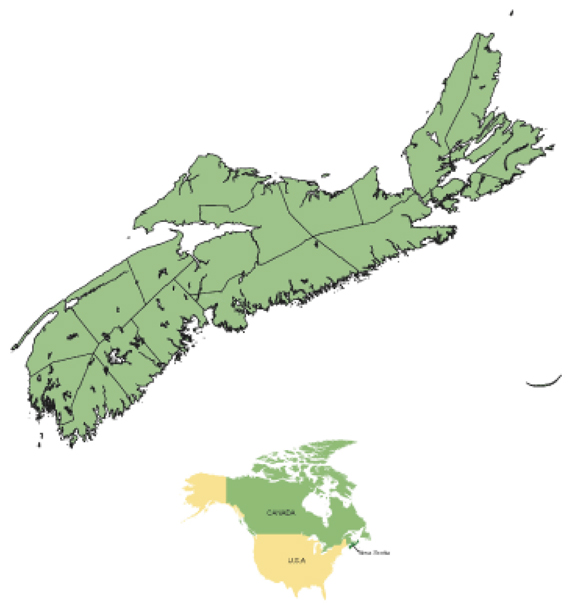

Map of Nova Scotia | | | 5 | |

Introduction | | | | |

Overview | | | 6 | |

Political System | | | 6 | |

Constitutional Framework | | | 7 | |

General Issues | | | 8 | |

Economy | | | | |

Principal Economic Indicators | | | 9 | |

Recent Developments | | | 11 | |

Economic Structure | | | 12 | |

Population and Labor Force | | | 13 | |

Income and Prices | | | 15 | |

Capital Expenditures | | | 16 | |

Goods Producing Industries | | | 18 | |

Exports | | | 22 | |

Service Sector | | | 24 | |

Energy | | | 25 | |

Government Finance | | | | |

Overview | | | 28 | |

Specific Accounting Policies | | | 28 | |

Accounting Changes | | | 30 | |

Summary of Budget Transactions and Borrowing Requirements | | | 32 | |

Revenue | | | 33 | |

Program Expenditures/Expenses | | | 38 | |

Loans and Investments | | | 42 | |

| | | | |

| | | Page | |

| |

Provincial Debt | | | | |

Funded Debt | | | 45 | |

Derivative Financial Instruments | | | 46 | |

Debt Maturities and Sinking Funds | | | 46 | |

Current Liabilities | | | 49 | |

Guaranteed Debt | | | 49 | |

Pension Funds | | | 50 | |

Public Sector Debt | | | | |

Public Sector Funded Debt | | | 55 | |

Certain Crown Corporations and Agencies | | | | |

Sydney Steel Corporation | | | 56 | |

Sydney Tar Ponds Agency | | | 56 | |

Nova Scotia Municipal Finance Corporation | | | 56 | |

Nova Scotia Power Finance Corporation | | | 56 | |

Foreign Exchange | | | 57 | |

Official Statements | | | | |

Table 1 – Statement of Debentures Outstanding | | | 59 | |

FURTHER INFORMATION

This document appears as an exhibit to the Province of Nova Scotia’s Annual Report to the U.S. Securities and Exchange Commission (“SEC”) on the Form 18-K for the fiscal year ended March 31, 2012. Additional information with respect to the Province of Nova Scotia is available in such Annual Report, the other exhibits to such Annual Report, and in amendments thereto. Such Annual Report, exhibits and amendments can be inspected and copied at the public reference facility maintained by the SEC at: 100 F Street, NE, Washington, D.C. 20549. Copies of such documents may also be obtained at prescribed rates from the Public Reference Section of the Commission at its Washington address or, without charge, from Province of Nova Scotia, Department of Finance, Deputy Minister of Finance, PO Box 187, 7th Floor, 1723 Hollis Street, Halifax, Nova Scotia, Canada, B3J 2N3.

The SEC maintains an Internet site that contains reports, statements and other information regarding issuers that file electronically with the SEC. The address for the SEC’s Internet site is http://www.sec.gov.

In this document, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. On December 14, 2012 the closing spot rate for the U.S. dollar in Canada, as reported by the Bank of Canada, expressed in Canadian dollars, was $0.9865. See “Foreign Exchange” for information

2

regarding the rates of conversion of U.S. dollars and other foreign currencies into Canadian dollars. The fiscal year of the Province of Nova Scotia ends March 31. “Fiscal 2012” and “2011-2012” refers to the fiscal year ending March 31, 2012, and unless otherwise indicated, “2011” means the calendar year ended December 31, 2011. Other fiscal and calendar years are referred to in a corresponding manner. Any discrepancies between the amounts listed and their totals in the tables set forth in this document are due to rounding.

FORWARD-LOOKING STATEMENTS

This exhibit includes forward-looking statements. The Province of Nova Scotia has based these forward-looking statements on its current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties, and assumptions about the Province of Nova Scotia, including, among other things:

| | • | | the Province of Nova Scotia’s economic and political trends; and |

| | • | | the Province of Nova Scotia’s ability to control expenses and maintain revenues. |

In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this annual report might not occur.

3

SUMMARY

The information below is qualified in its entirety by the detailed information provided elsewhere in this document.

PROVINCE OF NOVA SCOTIA

| | | | | | | | | | | | | | | | | | | | |

| Economy | | Year Ended December 31 | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | (in millions unless otherwise indicated) | |

Gross Domestic Product at Market Prices | | $ | 33,852 | | | $ | 35,394 | | | $ | 34,921 | | | $ | 36,350 | | | $ | 37,015 | |

Personal Income | | | 28,420 | | | | 29,505 | | | | 30,348 | | | | 31,243 | | | | 32,247 | |

Capital Expenditures | | | 6,628.3 | | | | 6,198.8 | | | | 6,538.9 | | | | 7,305.7 | | | | 6,564.0 | |

Annual Increase in Consumer Price Index | | | 1.9 | % | | | 3.0 | % | | | -0.2 | % | | | 2.2 | % | | | 3.8 | % |

Population by July 1 (in thousands) | | | 936.0 | | | | 937.5 | | | | 940.6 | | | | 945.2 | | | | 948.5 | |

Unemployment Rate | | | 8.0 | % | | | 7.7 | % | | | 9.2 | % | | | 9.3 | % | | | 8.8 | % |

| |

| Revenues and Expenses – Consolidated Entity | | Fiscal Year Ended March 31 | |

| | | | | | | | | Restated | | | Restated | | | | |

| | | 2008 | | | 2009 (1) | | | 2010 (2) | | | 2011 (3) | | | 2012 | |

| | | | | |

Revenues | | $ | 8,908.4 | | | $ | 8,836.2 | | | $ | 8,872.0 | | | $ | 9,561.3 | | | $ | 9,303.1 | |

Current Expenses | | | 8,833.6 | | | | 9,169.8 | | | | 9,499.3 | | | | 9,333.8 | | | | 9,921.9 | |

| | | | | | | | | | | | | | | | | | | | |

Surplus (Deficit) from Governmental Units | | | 74.8 | | | | (333.6 | ) | | | (627.2 | ) | | | 227.4 | | | | (618.8 | ) |

Net Income from Government Business Enterprises | | | 344.2 | | | | 359.6 | | | | 358.7 | | | | 358.0 | | | | 370.3 | |

| | | | | | | | | | | | | | | | | | | | |

Provincial Surplus/(Deficit) | | $ | 418.9 | | | $ | 26.0 | | | ($ | 268.5 | ) | | $ | 585.4 | | | ($ | 248.5 | ) |

| | | | | | | | | | | | | | | | | | | | |

| |

| Public Sector Funded Debt | | As at March 31 | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| | | (in millions unless otherwise indicated) | |

Total Provincial Funded Debt | | $ | 11,032.7 | | | $ | 12,181.8 | | | $ | 13,333.5 | | | $ | 14,613.7 | | | $ | 14,985.5 | |

Total Guaranteed Debt | | | 380.7 | | | | 201.6 | | | | 194.1 | | | | 171.9 | | | | 155.1 | |

Total Public Sector Funded Debt | | | 11,413.5 | | | | 12,383.3 | | | | 13,527.6 | | | | 14,785.6 | | | | 15,140.6 | |

| | | | | | | | | | | | | | | | | | | | |

Less: Sinking Funds, Public Debt Retirement Fund | | | 2,011.9 | | | | 2,211.7 | | | | 2,204.2 | | | | 2,394.6 | | | | 2,539.0 | |

| | | | | | | | | | | | | | | | | | | | |

Net Public Sector Funded Debt | | $ | 9,401.6 | | | $ | 10,171.7 | | | $ | 11,323.4 | | | $ | 12,391.0 | | | $ | 12,601.6 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per Capita ($) | | $ | 10,044.4 | | | $ | 10,849.8 | | | $ | 12,038.5 | | | $ | 13,109.4 | | | $ | 13,285.9 | |

As a Percentage of: | | | | | | | | | | | | | | | | | | | | |

Household Income (4) | | | 31.4 | % | | | 32.7 | % | | | 35.7 | % | | | 38.0 | % | | | 37.5 | % |

Gross Domestic Product at Current Market Prices | | | 27.8 | % | | | 28.7 | % | | | 32.4 | % | | | 34.1 | % | | | 34.0 | % |

| (1) | Restated to reflect accounting changes in fiscal year 2009-2010. See “Government Finance – Accounting Changes and Corrections to the 2010 Accounts”. |

| (2) | Restated to reflect Accounting Changes and corrections to errors to personal income tax and corporate income tax revenues contained in originally released financial statements for 2009-2010. See “Government Finance – Accounting Changes and Corrections to the 2010 Accounts. |

| (3) | Restated to reflect accounting changes in fiscal year 2011-2012. See “Government Finance – Accounting Changes to the 2012 Accounts”. |

| (4) | Population as of July 1 of the preceding calendar year Household Income (Personal Income has been replaced with Household Income by Statistics Canada, the concepts are similar) and Gross Domestic Product at market prices are for the previous calendar year. |

4

MAP

Nova Scotia

5

INTRODUCTION

Overview

The Province of Nova Scotia (“Nova Scotia” or the “Province”) is the most populous of the four Atlantic Provinces of Canada (“Atlantic Canada”) and covers 20,402 square miles. It extends 360 miles in length and varies in width from 50 miles to 105 miles.

According to estimates issued by Statistics Canada, the population of Nova Scotia was 948.7 thousand as of July 1, 2012, and represented 2.7% of Canada’s population of 34.9 million. The largest urban concentration in Atlantic Canada is the Halifax Regional Municipality (“Halifax”). Halifax Census Metropolitan Area, situated centrally on the Atlantic coast of the province, had a population of 408.2 thousand as of July 1, 2011. Halifax, the capital of Nova Scotia, is the commercial, governmental, educational, and financial center of the province, and is also the location of an important naval base.

Political System

The Legislature of Nova Scotia consists of the Lieutenant Governor and the Nova Scotia House of Assembly. The Nova Scotia House of Assembly is elected by the people for a term not to exceed five years. It may be dissolved at any time by the Lieutenant Governor on the advice of the Premier of the Province, who is traditionally the leader of the majority party in the Nova Scotia House of Assembly.

The last Provincial general election was held on June 9, 2009. The New Democratic Party was elected to a majority government and holds 31 seats in the House of Assembly. The official opposition in the House of Assembly is the Liberal Party with 13 seats and the Progressive Conservative party holds 7 seats. There is one independent member of the Legislature.

The executive power in the Province is vested in the Governor-in-Council, comprising the Lieutenant Governor acting on the advice of the Executive Council. The Executive Council is responsible to the House of Assembly. The Governor General of Canada in Council appoints the Lieutenant Governor, who is the representative of the Queen in the Province. Members of the Executive Council are appointed by the Lieutenant Governor, normally from members of the House of Assembly, on the nomination of the Premier.

The Parliament of Canada is composed of the Queen represented by the Governor General, the Senate, whose members are appointed by the Governor General upon the recommendation of the Prime Minister of Canada, and the House of Commons, whose members are elected by the people. The people of Nova Scotia are entitled to send 11 elected representatives to the 308 member House of Commons. Ten Senators represent Nova Scotia in the Senate.

There are five levels of courts in the province. The Nova Scotia Court of Appeal is the general court of appeal in both civil and criminal matters. The Supreme Court of Nova Scotia is a court of original jurisdiction and as such has jurisdiction in all cases, civil and criminal, arising in the province except those matters or cases expressly excluded by statute. The Provincial Court is a court of record and every judge thereof has jurisdiction throughout the province to exercise all the power and perform all the duties conferred or imposed on a judge of the Provincial Court. In addition to hearing matters relating to provincial statutes and municipal by-laws, the Provincial Court is specifically authorized to hear certain matters under the Criminal Code of Canada. The Family Court is a court of summary procedure with jurisdiction in family matters including maintenance, child protection, child custody and family violence. The Family Court is designated as a Youth Court for hearing matters involving young people aged 12-15 inclusive. The Probate Court has jurisdiction and power to carry out the judicial administration of the estates of deceased persons and to hear and determine all questions, matters and things in relation thereto and necessary for such administration.

6

Constitutional Framework

Similar to the British Constitution, the Constitution of Canada (the “Constitution”) is not contained in a single document, but consists of a number of statutes, orders, and conventions. Canada is a federation of ten provinces and three Federal territories, with a constitutional division of responsibilities between the Federal and provincial governments, as set forth in The Constitution Acts, 1867 to 1982. The Constitution Acts are divided into two fundamental documents. The Constitution Act, 1867 (formerly the British North America Act, 1867), provides for the federation of British North America provinces, and the Constitution Act, 1982 (the “1982 Act”), enacted by the parliament of the United Kingdom, provides, among other things, that amendments to the Constitution be effected in Canada according to terms of an amending formula.

The 1982 Act also includes a Charter of Rights and Freedoms, which encompasses language rights, Aboriginal rights, principles of the reduction of regional economic disparities, and the making of fiscal equalization payments to the provinces by the Government of Canada, including an enumeration of other Acts and orders which are part of the Constitution.

Under the Constitution, each provincial government has exclusive jurisdiction to regulate:

| | • | | municipal institutions; |

| | • | | property and civil rights; |

| | • | | forestry and non-renewable natural resources; |

| | • | | other matters of purely provincial or local concern; |

| | • | | raise revenue through direct taxation within its territorial limits; and |

| | • | | borrow monies on the credit of the province. |

The Federal Parliament of Canada is empowered to raise revenue by any system of taxation, and generally has jurisdiction over matters or subjects not assigned exclusively to the provincial legislatures. It has exclusive authority over such enumerated matters as:

| | • | | the Federal public debt and property; |

| | • | | the borrowing of money on the public credit of Canada; |

| | • | | the regulation of trade and commerce; |

As a province of Canada, Nova Scotia could be affected by political events in another province. For instance, on September 7, 1995, the Government of Quebec presented a Bill to the National Assembly entitled An Act respecting the future of Quebec (the “Act”) that included, among others, provisions authorizing the National Assembly to proclaim the sovereignty of Quebec. The Act was to be enacted only following a favorable vote in a referendum. Such a referendum was held on October 30, 1995. The results were 49.4% in favor and 50.6% against.

In 1996, the Government of Canada, by way of reference to the Supreme Court of Canada (the “Supreme Court”), asked the court to determine the legality of a unilateral secession of the Province of Quebec from Canada, either under the Canadian Constitution or international law. On August 20, 1998, the Supreme Court of Canada ruled that the Province of Quebec did not have the unilateral right of secession, and that any proposal to secede authorized by a clear majority in response to a clear question in the referendum should be construed as a proposal to amend the Constitution, which would require negotiations. These negotiations would have to deal with a wide array of issues, such as the interest of the other provinces, the Federal Government, the Province of Quebec, and the rights of all Canadians both within and outside the Province of Quebec, and specifically, the rights of minorities, including Aboriginal peoples.

7

General Issues

Current Issues Concerning Native Persons

The Mi’kmaq are the First Nations peoples of Nova Scotia and are descendants of the aboriginal people who resided in Nova Scotia prior to European contact.

In 1999, the Supreme Court of Canada delivered two decisions in the case of R. v. Marshall that acknowledge, and at the same time, place limits upon, Mi’kmaq treaty rights to obtain a moderate livelihood from fishing, hunting, and gathering. See “Economy – Goods Producing Industries – Fisheries” for further details.

In February 2007, the Mi’kmaq of Nova Scotia, the Federal Government and the Province signed a Framework Agreement that established a long-term negotiation process to resolve issues pertaining to Mi’kmaq treaty rights, Aboriginal rights and Aboriginal title. The Framework Agreement identifies the issues to be negotiated, goals, procedures and a time-table for negotiations. The first step in the negotiations will be to conduct a preliminary review of each topic and develop the key questions and issues in more detail. The Province, Canada and the Mi’kmaq signed a Consultation Terms of Reference in August of 2010 which provides a non-binding process for negotiations among the parties. This process is continuing.

Litigation

Residents and former residents of neighborhoods surrounding the former steel plant and coke ovens in Sydney, Nova Scotia have brought a class action against the Province. Canada is co-defendant. The plaintiffs seek damages for harm to property based on soil contamination and risk of health issues related to air emissions and soil contamination as a result of emissions from the operation of the steel plant and coke ovens owned and operated by Sydney Steel Corporation. The plaintiffs also seek establishment of a fund for health education for the public and medical community, and for an epidemiology study to establish health risks. Additional claims include negligence, strict liability, nuisance, battery and trespass related to the air emissions, breach of fiduciary duty based on public statements that it was as safe to live in Sydney as any urban area. The Province is unable to assess the likelihood of loss or estimate the amount of ultimate loss at this time.

The Pictou Landing First Nation has commenced a lawsuit against the Province, Northern Pulp (the current owner of the pulp mill located at Abercrombie, Pictou County, Nova Scotia) and all former owners of the mill. The claim relates to effluent which has contaminated Boat Harbor near the Pictou Landing First Nation. Pictou Landing First Nation has filed and served a statement of claim, but has taken no further steps at this point. The Province is unable to assess the likelihood of loss or estimate the amount of ultimate loss at this time.

Residents and spouses of residents of nursing homes (or their estates) in the Province have commenced a class action lawsuit against the Province seeking damages for misfeasance in public office, fraudulent misrepresentation and deceit, negligent misrepresentation, breach of fiduciary duty, equitable fraud, unjust enrichment and various Charter claims resulting from the introduction of the Single Entry Access System (SEA) between February 1, 2001 and January 1, 2005 that required payment by the residents of their health care costs while in a nursing home. Approximately 100 people have joined in the class action lawsuit to date. The plaintiffs filed a motion to certify the case as a class action. The proceeding has been certified, in part, as a class proceeding. The media and mail campaign proposed by the Plaintiffs to notify class members of the class proceeding has been approved by the Court. The Province is preparing its Affidavit of Documents which is due on April 1, 2013. The litigation is ongoing and the Province will continue to vigorously defend these claims. The Province is unable to assess the likelihood of loss at this time.

8

ECONOMY

Nova Scotia has a diversified economy. The geographic location of Nova Scotia, being surrounded almost completely by water with more than 7,400 kilometers of coastline, has significantly contributed to the economy. The importance of the sea to the economy is witnessed in many industries such as fishing and aquaculture, oil and gas, naval defense, tourism, transportation and research.

While many of the goods and services producing industries are directly or indirectly related to the processing of Nova Scotia’s natural resources such as pulp and paper products, natural gas and seafood products, the provincial economy is also diversified into information age technologies and other goods as diverse as motor vehicle tires.

Exports are important to the economy of Nova Scotia as roughly 50% of all goods produced in Nova Scotia are exported, and, of that figure, approximately 75% are exported to the United States.

Nova Scotia’s economy features the general characteristics of developed economies. Nova Scotia’s service sector is disproportionately larger than that of Canada. This represents Nova Scotia’s long-established position as the principal private sector service center for Atlantic Canada and the center for regional public administration and defense.

Principal Economic Indicators

The economy of Nova Scotia is influenced by the economic situation of its principal trading partners in Canada and abroad, particularly the United States. In 2011, Nova Scotia’s gross domestic product (“GDP”) at market prices was $37.0 billion, or 2.1% of Canada’s GDP. Compared with the levels for 2010, real GDP at market prices in chained 2007 dollars for Nova Scotia and Canada increased by 0.6% and 2.4%, respectively, in 2011. Total exports of goods and services from Nova Scotia, to both international and inter-provincial destinations, in 2011 increased by 6.0%.

Manufacturers’ shipments in 2011 increased by 10.3% for Nova Scotia compared to an increase of 7.8% for Canada.

9

The following table sets forth certain information about economic activity in Nova Scotia and, where provided, Canada, for the calendar years 2007 through 2011.

SELECTED ECONOMIC INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Compound

Annual rate of growth (1) | |

| | | (In millions unless otherwise indicated) | | | | |

| | | | | | |

Gross Domestic Product (Nova Scotia) | | | | | | | | | | | | | | | | | | | | | | | | |

At Market Prices (2) | | $ | 33,852 | | | $ | 35,394 | | | $ | 34,921 | | | $ | 36,350 | | | $ | 37,015 | | | | 2.3 | % |

Chained 2007 Dollars | | | 33,852 | | | | 34,710 | | | | 34,641 | | | | 35,350 | | | | 35,557 | | | | 1.2 | % |

GDP at Basic Prices (2007) | | | 31,056 | | | | 31,757 | | | | 31,611 | | | | 32,277 | | | | 32,456 | | | | 1.1 | % |

Gross Domestic Product (Canada) | | | | | | | | | | | | | | | | | | | | | | | | |

At Market Prices (2) | | | 1,566,015 | | | | 1,645,875 | | | | 1,564,790 | | | | 1,664,762 | | | | 1,762,432 | | | | 3.0 | % |

Chained 2007 Dollars | | | 1,566,015 | | | | 1,581,965 | | | | 1,532,779 | | | | 1,582,417 | | | | 1,620,398 | | | | 0.9 | % |

Household Income | | | 29,975 | | | | 31,097 | | | | 31,709 | | | | 32,583 | | | | 33,594 | | | | 2.9 | % |

Household Income per capita (3) | | | 32,025 | | | | 33,170 | | | | 33,712 | | | | 34,472 | | | | 35,418 | | | | 2.5 | % |

Capital Expenditures | | | 6,628.3 | | | | 6,198.8 | | | | 6,538.9 | | | | 7,305.7 | | | | 6,564.0 | | | | 3.6 | % |

Retail Trade | | | 11,616.2 | | | | 12,089.0 | | | | 12,102.2 | | | | 12,652.2 | | | | 13,096.6 | | | | 3.0 | % |

Value of Manufacturers’ Shipments | | $ | 9,762 | | | $ | 10,643 | | | $ | 8,819 | | | $ | 9,799 | | | $ | 10,813 | | | | 2.6 | % |

Unemployment Rate | | | 8.0 | % | | | 7.7 | % | | | 9.2 | % | | | 9.3 | % | | | 8.8 | % | | | | |

Annual Increase in Consumer Price Index: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Nova Scotia | | | 1.9 | % | | | 3.0 | % | | | -0.2 | % | | | 2.2 | % | | | 3.8 | % | | | 2.2 | % |

| | | | | | |

Canada | | | 2.2 | % | | | 2.3 | % | | | 0.3 | % | | | 1.8 | % | | | 2.9 | % | | | 1.8 | % |

| (1) | Compound annual rate of growth is computed by distributing the aggregate amount of growth during the period on the basis of a single annual rate of growth compounded annually. These rates are not adjusted for inflation unless otherwise indicated. |

| (2) | Gross Domestic Product (“GDP”) at market prices represents the value added by each of the factors of production plus indirect taxes less subsidies. |

Sources: Statistics Canada, Catalogue No 13-213, 13-001, 31-001, 63-005 and CANSIM Table 029-0005, 080-0020, 304-0015,304-0014 and 326-0021.

10

Recent Developments

The following table sets forth the most recently available information with respect to certain economic indicators for Nova Scotia and Canada.

RECENT DEVELOPMENTS

| | | | | | | | | | |

| | | | | Percentage Change, except where

noted | |

| | Period | | Nova Scotia | | | Canada | |

Retail Trade (1) | | Jan. – Sep. 2012/

Jan. – Sep. 2011 | | | 1.5 | % | | | 3.2 | % |

| | | |

Manufacturing Shipments (1) | | Jan. – Oct. 2012/

Jan. – Oct. 2011 | | | -2.2 | % | | | 4.7 | % |

| | | |

Housing Starts (all areas) (2) | | Jan. – Dec. 2011/

Jan. – Dec. 2010 | | | 12.8 | % | | | 5.7 | % |

| | | |

Employment Growth (3) | | Jan. – Oct. 2011/

Jan. – Oct. 2012 | | | 1.1 | % | | | 0.9 | % |

| | | |

Unemployment Rate (3) | | Jan. – Oct. 2012 | | | 7.3 | % | | | 9.0 | % |

| | | |

Consumer Price Index | | Jan. – Oct. 2012/

Jan. – Oct. 2011 | | | 2.0 | % | | | 1.7 | % |

| (2) | These figures represent residential housing starts in both urban and rural areas, seasonally adjusted at annual rates |

| (3) | These figures reflect the seasonally adjusted rate of unemployment. |

Sources: Statistics Canada, Catalogue No. 71-001 PPB and CANSIM Tables 080-0020, 027-0054 and 326-0020.

11

Economic Structure

Nova Scotia’s economy features the general characteristics of developed economies. Nova Scotia’s service sector is disproportionately larger than that of Canada. This represents Nova Scotia’s long-established position as the principal private sector service center for Atlantic Canada and the center for regional public administration and defense.

The following table shows the relative contribution of each sector to GDP in basic prices (chained 2007 dollars) for Nova Scotia and Canada for the calendar years indicated.

NOVA SCOTIA GROSS DOMESTIC PRODUCT BY INDUSTRY IN BASIC PRICES

(CHAINED 2007 DOLLARS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Compound Annual

Rate of Growth | | | % of GDP

in Basic Prices,

2011 | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2007-2011 | | |

| | | (In millions) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Nova

Scotia | | | Canada | |

Primary Sector: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Agriculture, Forestry, Fishing, and Hunting | | $ | 673.2 | | | $ | 763.5 | | | $ | 731.3 | | | $ | 803.9 | | | $ | 808.9 | | | | 4.7 | % | | | 2.5 | % | | | 2.3 | % |

Mining and Oil, and Gas Extraction | | | 1,342.7 | | | | 1,381.7 | | | | 1,020.4 | | | | 849.3 | | | | 713.6 | | | | -14.6 | % | | | 2.2 | % | | | 4.5 | % |

Utilities | | | 717.4 | | | | 769.8 | | | | 730.5 | | | | 742.3 | | | | 738.4 | | | | 0.7 | % | | | 2.3 | % | | | 2.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2,733.3 | | | | 2,915.0 | | | | 2,482.2 | | | | 2,395.5 | | | | 2,260.9 | | | | -4.6 | % | | | 7.0 | % | | | 9.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Secondary Sector: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Manufacturing | | | 2,644.1 | | | | 2,638.7 | | | | 2,329.2 | | | | 2,498.2 | | | | 2,605.6 | | | | -0.4 | % | | | 8.0 | % | | | 12.8 | % |

Construction | | | 1,523.8 | | | | 1,548.4 | | | | 1,871.7 | | | | 1,915.8 | | | | 1,789.2 | | | | 4.1 | % | | | 5.5 | % | | | 6.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 4,167.9 | | | | 4,187.1 | | | | 4,200.9 | | | | 4,414.0 | | | | 4,394.8 | | | | 1.3 | % | | | 13.5 | % | | | 18.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Service Sector: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Transportation and Warehousing | | | 1,109.9 | | | | 1,134.8 | | | | 1,054.9 | | | | 1,085.5 | | | | 1,110.9 | | | | 0.0 | % | | | 3.4 | % | | | 4.7 | % |

Wholesale Trade | | | 1,328.5 | | | | 1,341.1 | | | | 1,290.8 | | | | 1,389.4 | | | | 1,390.3 | | | | 1.1 | % | | | 4.3 | % | | | 5.6 | % |

Retail Trade | | | 2,132.6 | | | | 2,189.0 | | | | 2,179.0 | | | | 2,253.1 | | | | 2,266.6 | | | | 1.5 | % | | | 7.0 | % | | | 6.1 | % |

Finance and Insurance | | | 1,800.8 | | | | 1,769.5 | | | | 1,783.3 | | | | 1,797.2 | | | | 1,802.0 | | | | 0.0 | % | | | 5.6 | % | | | 20.9 | % (1) |

Real Estate, rental and leasing | | | 4,316.1 | | | | 4,437.8 | | | | 4,569.5 | | | | 4,698.2 | | | | 4,835.3 | | | | 2.9 | % | | | 14.9 | % | | | | |

Management of Companies | | | 135.5 | | | | 147.2 | | | | 151.8 | | | | 152.2 | | | | 152.4 | | | | 3.0 | % | | | 0.5 | % | | | | |

Professional, scientific and technical services | | | 1,232.8 | | | | 1,275.3 | | | | 1,283.9 | | | | 1,281.3 | | | | 1,284.0 | | | | 1.0 | % | | | 4.0 | % | | | 4.9 | % |

Administrative and support, waste management and remediation services | | | 736.4 | | | | 726.8 | | | | 718.2 | | | | 751.5 | | | | 750.2 | | | | 0.5 | % | | | 2.3 | % | | | 2.4 | % |

Information and Cultural Industries | | | 1,104.2 | | | | 1,115.4 | | | | 1,131.9 | | | | 1,132.8 | | | | 1,145.5 | | | | 0.9 | % | | | 3.5 | % | | | 3.6 | % |

Education Services | | | 2,014.6 | | | | 2,106.7 | | | | 2,117.7 | | | | 2,162.5 | | | | 2,191.4 | | | | 2.1 | % | | | 6.8 | % | | | 5.0 | % |

Health Care and Social Assistance | | | 2,773.7 | | | | 2,847.7 | | | | 2,975.7 | | | | 2,991.1 | | | | 3,026.8 | | | | 2.2 | % | | | 9.3 | % | | | 6.7 | % |

Accommodation and Food Services | | | 731.7 | | | | 746.9 | | | | 752.0 | | | | 757.2 | | | | 756.1 | | | | 0.8 | % | | | 2.3 | % | | | 2.2 | % |

Arts, entertainment, and recreation | | | 183.1 | | | | 180.6 | | | | 176.1 | | | | 174.8 | | | | 171.7 | | | | -1.6 | % | | | 0.5 | % | | | 0.9 | % |

Other Services (except Public Administration) | | | 650.8 | | | | 673.3 | | | | 675.0 | | | | 679.2 | | | | 691.7 | | | | 1.5 | % | | | 2.1 | % | | | 2.6 | % |

Public Administration | | | 3,904.0 | | | | 3,970.4 | | | | 4,024.3 | | | | 4,067.3 | | | | 4,084.3 | | | | 1.1 | % | | | 12.6 | % | | | 6.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 24,154.7 | | | | 24,662.5 | | | | 24,884.1 | | | | 25,373.3 | | | | 25,659.2 | | | | 1.5 | % | | | 79.1 | % | | | 71.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Gross Domestic Product at Basic Prices | | $ | 31,055.7 | | | $ | 31,756.6 | | | $ | 31,611.4 | | | $ | 32,277.3 | | | $ | 32,455.7 | | | | 1.1 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada, CANSIM Table 379-0030, 379-0027

| (1) | For Canada, this comprises the three sectors: Finance and Insurance, Real Estate, rental and leasing, and the management of companies. |

12

Population and Labor Force

According to estimates by Statistics Canada, at July 1, 2011, the population of Nova Scotia was 948.5 thousand or 2.8% of Canada’s population of 34.5 million. Over the period July 2007 to July 2011, the population of Nova Scotia increased by 1.3%, as compared to growth of 4.7 per cent for Canada. Nova Scotia’s labor force grew at a compounded annual rate of 0.5% compared to 1.1% for Canada for the 2007 to 2011 calendar year period.

According to Statistics Canada data for 2011, the Province’s labor force averaged 496,600 persons, representing 63.7% of the population 15 years of age and over. This level is a decrease of 0.5 percentage points in the participation rate compared to 2010. The figures for the calendar year 2011 show a decrease in the unemployment rate to 8.8% from 9.3% in 2010. Annual employment in 2011 remained relatively unchanged from the level observed in 2010. Annual labor supply for 2011 reveals a 0.4% decrease from 2010. For 2011, the annual estimate for unemployment stands at 43,800 compared to 46,300 in 2010, a decrease of 5.4%.

Nova Scotia’s unemployment rate increased to 8.8% in November 2012, on a seasonally adjusted basis, versus the November 2011 level of 8.6%. The unemployment rate over the same period for Canada experienced a decline in rates to 7.2% from 7.5% a year earlier. The unemployment rate for Nova Scotia in November 2012 reflects an increase of 0.2% in the labor force from a year earlier and an increase in the number of individuals employed of 0.1%, combined with an increase in the reported number of unemployed of 2.1%, compared to the same month in 2011.

The following table sets forth Nova Scotia’s population and labor force for the 2007 to 2011 calendar years.

POPULATION AND LABOR FORCE

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Compound

Annual

Rate of

Growth | |

| | | (In thousands unless otherwise indicated) | | | | |

Total Population (July 1) | | | 936 | | | | 938 | | | | 941 | | | | 945 | | | | 949 | | | | 0.3 | % |

Population 15 Years of Age and Over | | | 766 | | | | 769 | | | | 773 | | | | 777 | | | | 779 | | | | 0.4 | % |

Labor Force | | | 487 | | | | 489 | | | | 497 | | | | 499 | | | | 497 | | | | 0.5 | % |

Labor Force Employed | | | 448 | | | | 452 | | | | 451 | | | | 453 | | | | 453 | | | | 0.3 | % |

Participation Rate (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Nova Scotia | | | 63.5 | % | | | 63.6 | % | | | 64.3 | % | | | 64.2 | % | | | 63.7 | % | | | | |

Canada | | | 67.4 | % | | | 67.7 | % | | | 67.1 | % | | | 67.0 | % | | | 66.8 | % | | | | |

Unemployment Rate (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Nova Scotia | | | 8.0 | % | | | 7.7 | % | | | 9.2 | % | | | 9.3 | % | | | 8.8 | % | | | | |

Canada | | | 6.0 | % | | | 6.1 | % | | | 8.3 | % | | | 8.0 | % | | | 7.4 | % | | | | |

Sources: Statistics Canada, Catalogue Number 71F0004-XCB91-002-XWE-XPB , 91-213-XIB, and CANSIM Tables 051-0001, 282-0002 , and 282-0087.

13

The following table illustrates the distribution of employment in Nova Scotia by industry for the calendar years 2007 through 2011, and the compound annual rate of growth over the period 2007 to 2011.

EMPLOYMENT BY INDUSTRY

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Compound

Annual Rate

of Growth | |

| | (In thousands) | |

Agriculture | | | 5.5 | | | | 6.2 | | | | 6.6 | | | | 5.8 | | | | 5.2 | | | | -1.4 | % |

Forestry, Fishing, Mining, Oil, and Gas | | | 12.0 | | | | 12.7 | | | | 12.5 | | | | 12.0 | | | | 11.2 | | | | -1.7 | % |

Utilities | | | 1.9 | | | | 3.2 | | | | 3.1 | | | | 4.2 | | | | 4.0 | | | | 20.5 | % |

Construction | | | 27.4 | | | | 31.1 | | | | 30.0 | | | | 32.1 | | | | 31.1 | | | | 3.2 | % |

Manufacturing | | | 41.3 | | | | 38.8 | | | | 33.0 | | | | 32.7 | | | | 32.9 | | | | -5.5 | % |

Wholesale and Retail Trade | | | 77.7 | | | | 79.8 | | | | 77.2 | | | | 76.3 | | | | 77.5 | | | | -0.1 | % |

Wholesale Trade | | | 13.4 | | | | 13.9 | | | | 13.7 | | | | 11.8 | | | | 14.8 | | | | 2.5 | % |

Retail Trade | | | 64.2 | | | | 65.9 | | | | 63.5 | | | | 64.5 | | | | 62.6 | | | | -0.6 | % |

Transportation and Warehousing | | | 18.4 | | | | 18.5 | | | | 20.4 | | | | 18.5 | | | | 20.7 | | | | 3.0 | % |

Finance, Insurance, Real Estate, and Leasing | | | 23.1 | | | | 22.1 | | | | 22.8 | | | | 24.4 | | | | 23.0 | | | | -0.1 | % |

Professional, Scientific, and Technical Services | | | 17.5 | | | | 21.2 | | | | 22.8 | | | | 23.7 | | | | 23.8 | | | | 8.0 | % |

Business, Building and Other Support Services | | | 27.2 | | | | 25.4 | | | | 23.4 | | | | 23.6 | | | | 20.9 | | | | -6.4 | % |

Educational Services | | | 36.4 | | | | 33.8 | | | | 38.0 | | | | 33.6 | | | | 35.9 | | | | -0.3 | % |

Health Care and Social Assistance | | | 61.7 | | | | 60.9 | | | | 62.9 | | | | 68.7 | | | | 68.1 | | | | 2.5 | % |

Information, Culture, and Recreation | | | 19.5 | | | | 20.0 | | | | 18.3 | | | | 19.4 | | | | 20.1 | | | | 0.8 | % |

Accommodation and Food Services | | | 30.3 | | | | 29.0 | | | | 28.7 | | | | 28.5 | | | | 28.3 | | | | -1.7 | % |

Other Services | | | 20.1 | | | | 19.3 | | | | 19.7 | | | | 18.5 | | | | 19.0 | | | | -1.4 | % |

Public Administration | | | 28.2 | | | | 30.2 | | | | 32.0 | | | | 30.7 | | | | 31.1 | | | | 2.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total – All Industries | | | 448.0 | | | | 452.0 | | | | 451.4 | | | | 452.5 | | | | 452.8 | | | | 0.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada, Table 282-0002

14

Income and Prices

Household income in Nova Scotia increased by 3.1% to $33,594 million in 2011 from 2010, and average weekly wages in 2011 were $767.61, up 1.0% from the level in 2010.

The following table reflects the percentage increases in average weekly wages and salaries for calendar years 2006 through 2011 as well as the Consumer Price Index (“CPI”) for Nova Scotia and Canada for calendar years 2006 through 2011. On an annual basis in 2011, Nova Scotia’s CPI increased by 3.8% over 2010, while Canada’s CPI increased by 2.9% over 2010.

CPI AND AVERAGE WEEKLY WAGES AND SALARIES, INDUSTRIAL

AGGREGATE (PERCENT INCREASE OVER PREVIOUS YEAR)

| | | | | | | | | | | | | | | | |

| | | Nova Scotia | | | Canada | |

| | Average Weekly

Wages and Salaries | | | CPI | | | Average Weekly

Wages and Salaries | | | CPI | |

2006 | | | 2.5 | % | | | 2.0 | % | | | 2.5 | % | | | 2.0 | % |

2007 | | | 3.1 | % | | | 1.9 | % | | | 4.3 | % | | | 2.2 | % |

2008 | | | 2.6 | % | | | 3.0 | % | | | 2.9 | % | | | 2.3 | % |

2009 | | | 2.3 | % | | | -0.2 | % | | | 1.6 | % | | | 0.3 | % |

2010 | | | 3.9 | % | | | 2.2 | % | | | 3.6 | % | | | 1.8 | % |

2011 | | | 1.0 | % | | | 3.8 | % | | | 2.5 | % | | | 2.9 | % |

Sources: Statistics Canada, Catalogue Number 72F0023-XCB and CANSIM Tables 281-0027 and 326-0021.

15

Capital Expenditures

Capital expenditures consist of investment in new construction, and purchases of machinery and equipment in Nova Scotia by the private sector and all levels of government.

The following table sets forth capital expenditures for the 2008 to 2011 calendar years and investment intentions for 2012.

CAPITAL EXPENDITURES 1

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 (2) | | | 2012 (3) | |

| | (in millions) | |

Agriculture, forestry, and fishing | | $ | 120.6 | | | $ | 94.1 | | | | x | | | | x | | | | x | |

Mining & oil and gas extraction | | | 152.0 | | | | 669.3 | | | | 589.6 | | | | x | | | | x | |

Utilities | | | 263.5 | | | | x | | | | 725.2 | | | | 439.1 | | | | 484.3 | |

Construction | | | 132.3 | | | | 121.9 | | | | 137.8 | | | | 133.4 | | | | 139.6 | |

Manufacturing | | | 418.5 | | | | x | | | | x | | | | 254.2 | | | | x | |

Wholesale trade | | | 110.9 | | | | 134.6 | | | | 131.8 | | | | 131.4 | | | | 148.2 | |

Retail trade | | | 294.2 | | | | 296.9 | | | | 260.2 | | | | 242.0 | | | | 267.8 | |

Transportation & warehousing | | | 326.1 | | | | 265.3 | | | | 236.6 | | | | 307.8 | | | | 396.4 | |

Information & cultural industries | | | 192.6 | | | | 116.2 | | | | 315.7 | | | | 206.6 | | | | 204.7 | |

Finance & insurance | | | 302.4 | | | | 147.6 | | | | 136.8 | | | | x | | | | 129.9 | |

Real estate and rental and lending | | | 406.9 | | | | 282.3 | | | | 334.2 | | | | 253.7 | | | | 245.6 | |

Professional, scientific & technical services | | | 63.2 | | | | 46.9 | | | | 70.6 | | | | 83.2 | | | | 80.2 | |

Management of companies and enterprises | | | 6.7 | | | | 5.9 | | | | x | | | | x | | | | x | |

Administrative support, waste management and remediation services | | | 54.9 | | | | 73.6 | | | | 37.6 | | | | 38.4 | | | | 48.2 | |

Educational services | | | 189.2 | | | | 312.1 | | | | 286.8 | | | | 286.0 | | | | 287.9 | |

Health care and social assistance | | | 173.3 | | | | 211.7 | | | | 294.8 | | | | 253.3 | | | | x | |

Arts, entertainment and recreation | | | 10.4 | | | | x | | | | 40.9 | | | | 97.7 | | | | 55.8 | |

Accommodation and food services | | | 71.1 | | | | x | | | | 43.2 | | | | 49.3 | | | | 47.5 | |

Other services (except public administration) | | | 19.4 | | | | 19.8 | | | | 37.8 | | | | 32.8 | | | | x | |

Public administration | | | 793.6 | | | | 996.3 | | | | 911.3 | | | | 963.0 | | | | 1,027.5 | |

Housing | | | 2,096.9 | | | | 1,938.2 | | | | 2,308.4 | | | | 2,327.5 | | | | 2,442.0 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 6,198.8 | | | $ | 6,538.9 | | | $ | 7,305.7 | | | $ | 6,564.0 | | | $ | 6,704.8 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Private Sector | | | 4,932.6 | | | | 5,043.5 | | | | 5,870.6 | | | | 4,986.2 | | | | 5,093.2 | |

Public Sector | | | 1,266.1 | | | | 1,495.4 | | | | 1,435.1 | | | | 1,577.8 | | | | 1,611.6 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 6,198.8 | | | $ | 6,538.9 | | | $ | 7,305.7 | | | $ | 6,564.0 | | | $ | 6,704.8 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Construction | | $ | 4,012.2 | | | $ | 4,586.3 | | | $ | 5,203.5 | | | $ | 4,385.0 | | | $ | 4,550.0 | |

Machinery and Equipment | | | 2,186.5 | | | | 1,952.5 | | | | 2,102.2 | | | | 2,179.0 | | | | 2,154.8 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 6,198.8 | | | $ | 6,538.9 | | | $ | 7,305.7 | | | $ | 6,564.0 | | | $ | 6,704.8 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Capital Expenditures are classified under the North American Industrial Classification System (“NAICS”), x – suppressed data by Statistics Canada for confidentiality reasons. |

| (3) | Investment Intentions as reported in February 2012. |

Source: Statistics Canada, Catalogue Number 61-205, February 2012 and CANSIM Tables 026-0005 and 032-0002.

16

The Private and Public Investment in Canada, Intentions 2012 survey published in February 2012 by Statistics Canada showed a 2.1% increase in capital expenditures intentions in Nova Scotia in 2012 over 2011, reflecting expectations of increased capital spending in wholesale and retail trade, transportation and warehousing, and public administration. Private sector capital expenditure investment intentions for 2012 are expected to account for 76.0% of the total capital expenditures.

Capital expenditures for 2011 showed a 10.2% decrease compared to 2010. The decrease was entirely in the construction sector as the capital expenditures on machinery and equipment increased by 3.7%. From the data presented for the non-confidential sectors, the decreases were in the following sectors: utilities, information and cultural industries, real estate and rental and lending, educational services, health care and social assistance. These were offset by an increase in capital expenditures for construction in the public administration sector.

Capital expenditures for 2010 showed an 11.7% increase compared to 2009. The increase reflected increases in public administration and decreases in mining, oil and gas and health care and social assistance.

Capital expenditures for 2009 showed a 5.5% increase compared to 2008, reflecting large increases in capital expenditures in mining, oil and gas extraction, education, and public administration. There were major declines in capital expenditures in the finance, insurance, real estate and leasing, and housing.

17

Goods Producing Industries

Manufacturing. The manufacturing industry is the largest contributor to the goods producing portion of Nova Scotia’s economy and accounted for 8.0% of real GDP (basic prices in chained 2007 dollars) in 2011. The gross selling value of manufacturers’ sales rose from $9,762 million in 2007 to an estimated total of $10,813 million in 2011 presenting a compound annual rate of growth of 2.6%. This compares with a compound annual rate of decline of 1.1 % for Canada over the same period.

In 2011, the gross selling value of manufacturers’ sales was 10.3% higher than in 2010. Many components of manufacturers’ sales recovered in 2010 and 2011 after declining in 2009. Food products, plastics/rubber and transportation equipment have all increased from levels observed in 2009.

The employment level in the manufacturing sector in 2011 decreased by 200 persons compared to 2010. The manufacturing sector employed 7.3 per cent of all workers in Nova Scotia in 2011, compared to 10.2 per cent in Canada. Most of the employment in the manufacturing sector occurs outside of the province’s largest urban center (Halifax Regional Municipality) making the sector directly and indirectly a key employer in many of the more rural areas of the province.

The United States is the primary market for Nova Scotia’s international exports of manufactured goods. In 2011, $3.25 billion or 73.2% of the value of Nova Scotia’s exports of manufactured goods went to the United States.

One-third of manufacturers’ sales for Nova Scotia in 2011 was attributable to two major industry groups: food and plastics and rubber products. The food industry accounted for 20.1% of total shipments in 2011. Plastics and rubber products accounted for 13.6%. The latter category is in part related to the three plants operated by Michelin North American (Canada) Inc. The pulp and paper industry and sales from a petroleum refinery (for which the specific output valued are not published but are included by Statistics Canada shown in “Other” in the table below) contribute to significant output within the manufacturing industry.

The following table sets forth the gross selling value of manufacturers’ sales for Nova Scotia by industry group for the calendar years 2007 through 2011.

GROSS SELLING VALUE OF MANUFACTURERS’ SALES

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | (millions $) | |

Food | | $ | 2,043 | | | $ | 1,900 | | | $ | 1,965 | | | $ | 1,984 | | | $ | 2,180 | |

Wood Products | | | 543 | | | | 502 | | | | 450 | | | | 530 | | | | 451 | |

Chemicals | | | 263 | | | | x | | | | x | | | | x | | | | x | |

Plastics & Rubber Products | | | 1,174 | | | | 1,163 | | | | 1,006 | | | | 1,221 | | | | 1,471 | |

Non-metallic Mineral Products | | | 208 | | | | 220 | | | | 198 | | | | 200 | | | | 201 | |

Fabricated Metal Products | | | 224 | | | | x | | | | x | | | | x | | | | x | |

Machinery | | | 154 | | | | x | | | | x | | | | x | | | | x | |

Computer & Electronic Products | | | 165 | | | | 182 | | | | 191 | | | | 195 | | | | 186 | |

Electrical Equipment, Appliances & Components | | | 41 | | | | x | | | | x | | | | x | | | | x | |

Transportation Equipment | | | 712 | | | | 813 | | | | 697 | | | | 759 | | | | 752 | |

Furniture & Related Products | | | 100 | | | | 109 | | | | 86 | | | | 97 | | | | 65 | |

Other | | | 4,135 | | | | x | | | | x | | | | x | | | | x | |

| | | | | | | | | | | | | | | | | | | | |

All Manufacturing Industries | | $ | 9,762 | | | $ | 10,643 | | | $ | 8,819 | | | $ | 9,799 | | | $ | 10,813 | |

| | | | | | | | | | | | | | | | | | | | |

x: Suppressed to meet confidentiality requirements of the Statistics Act.

Source: Statistics Canada, CANSIM Table 304-0015.

18

Construction. The construction industry is the second largest goods-producing industry in Nova Scotia. Its contribution to real GDP (basic prices in chained 2007 dollars) was $1,789.2 million in 2011 and accounted for 5.5% of total real GDP. Construction activity accounted for 67.9% of total capital expenditures in 2011. Compound annual growth in capital expenditures on construction in Nova Scotia was 3.2% for the 2007 to 2011 period, as compared to 4.6% for Canada.

Canada Mortgage and Housing Corporation reported that housing starts in all areas of Nova Scotia increased by 7.8% in 2011 over 2010, compared to an increase of 2.1% at the national level over the same period. Capital expenditures on housing construction in Nova Scotia increased 0.8% in 2011, versus a 2.9% increase in Canada for the same period. Construction associated with housing starts comprises only part of the capital expenditures on housing construction; a significant part of these expenditures are for residential renovations. Renovations in Nova Scotia in 2011 totaled $1.33 billion.

Capital expenditures on non-residential construction decreased 28.9% in 2011 from 2010 in Nova Scotia versus an increase of 9.6% in Canada. From the data presented for the non-confidential sectors, the decreases were in the following sectors: utilities, information and cultural industries, real estate and rental and lending, educational services, health care and social assistance. These were offset by an increase in capital expenditures for construction in the public administration sector.

Employment in the construction sector in 2011 increased by 1,000 persons over 2010.

Fisheries. A large and diverse commercial fish and processing industry exists in Nova Scotia. Nova Scotia harvests over 50 different species of seafood, and exports these products to all major seafood markets. The Federal Government, through detailed stock assessment plans and quotas, manages fisheries resources.

Nova Scotia’s fish landings had a value of $463.4 million in 2011. Shellfish such as lobster, scallops, and snow crab, accounted for 82.9% of the value of landings. Lobster is the predominant species and represented 61.0% of the total landed value. Shrimp and snow crab are the next predominant species at 9.8% and 6.5%, respectively.

Nova Scotia was one of the top provinces (second) exporting seafood in 2011, at $836.5 million. The United States is still Nova Scotia’s top destination, representing 60.5% of seafood exports in 2011. Nova Scotia exports to over 75 countries including China, Japan, France, Russia, Belgium and the Netherlands. The export value of seafood in 2011 increased by 13.6% compared to the total value in 2010.

The harvesting sector employed 6,500 persons throughout all of Nova Scotia in 2011, a decrease of approximately 200 persons from 2010.

In terms of real GDP growth, 2011 saw output increase 6.7% from the 2010 levels. Total volume of commercial fish landings (metric tonnes) was down by 11% in 2011 compared to the level in 2010.

19

The following table sets forth information with respect to the fishing and fish processing industry in Nova Scotia for the calendar years 2007 through 2011.

FISHING AND FISH PROCESSING INDUSTRY

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | Revised

2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | (in Millions) | |

Quantity of Fish Landings (pounds) (1) | | | 579.0 | | | | 563.3 | | | | 576.9 | | | | 623.9 | | | | 555.6 | |

Value of Fish Landings (1) | | $ | 657.6 | | | $ | 677.2 | | | $ | 586.6 | | | $ | 487.0 | | | $ | 463.4 | |

Market Value of Fish Products Produced (2) 25) | | $ | 1,138.5 | | | $ | 1,256.7 | | | $ | 1,027.9 | | | $ | 925.3 | | | $ | 880.5 | |

Capital Investment (4) | | $ | 48.5 | | | $ | 53.6 | | | $ | 47.4 | | | $ | 48.5 | | | | n/a | |

Value of Exports of Fish | | $ | 902.8 | | | $ | 792.3 | | | $ | 771.5 | | | $ | 737.7 | | | $ | 836.5 | |

| (1) | Does not include Aquaculture. |

| (2) | Estimated by Province of Nova Scotia. |

| (3) | Includes an estimate of market value for imported frozen fish processed net of raw material costs. |

| (4) | Includes fishing, hunting, and trapping. |

| Sources: | Department of Fisheries and Oceans, and Nova Scotia Department of Agriculture and Fisheries. |

| | Statistics Canada, Catalogue Number 61-205 and CANSIM Table 29-0005. |

Participation in, and regulation of, the fisheries was the subject of a 1999 decision of the Supreme Court of Canada. In September and November 1999, the Supreme Court held that under the Treaty of 1760, the Mi’kmaq are entitled “to continue to provide for their own sustenance by taking the products of their hunting, fishing and other gathering activities, and trading for what in 1760 termed ‘necessaries,’” which the Supreme Court interpreted as the ability to obtain a “moderate livelihood.” A moderate livelihood was described by the Supreme Court as including basics such as “food, clothing and housing, supplemented by a few amenities” but does not extend to the open-ended accumulation of wealth. The Supreme Court held that the right is subject to regulation. See “Introduction – Current Issues Concerning Native Persons.” The case was fact-specific in relation to eels, and determinations of what are appropriate hunting, fishing and gathering activities for modern Mi’kmaq will be decided by either a court on a case by case, fact specific basis, or through negotiations of the parties. Interim fishing agreements have been entered into by the Federal Department of Fisheries and Oceans with a majority of the native groups dealing with the issuance of limited licenses for specific fisheries, including lobster fishing zones, training, and acquisition of equipment. Licenses issued pursuant to these agreements are available as a result of the Federal Government purchasing non-native licenses.

20

Mining and Mineral Exploration The value of mineral production (excluding oil and gas) in Nova Scotia increased 2.5% to $246.6 million in 2011 from 2010 levels. The major minerals being produced in Nova Scotia in 2011 were gypsum, crushed stone, and sand and gravel. In the past, Nova Scotia has also produced coal, cement, clay, peat, barite, and silica.

Real GDP in the sector, including the oil and gas sector, decreased by 16.0% in 2011 from 2010, showing a continued decline since the peak in 2008. In part, the decline in this sector is due to declines in output from the SOEP natural gas facility. The industry, including the oil and gas sector, employed 2,200 persons in 2011, a decrease of approximately 500 from 2010.

Nova Scotia’s gypsum and anhydrite deposits are among the largest workable deposits in Canada. Nova Scotia is one of the most productive gypsum-mining regions in the world. Gypsum outcrops occur throughout the whole of the northern half of the province’s mainland and Cape Breton Island. In 2011, Nova Scotia produced about 70.5% of Canada’s gypsum. Statistics show the value of gypsum production to be $26.4 million in 2011 with 1.8 million tonnes being produced.

There are currently two surface coal mines operating in Nova Scotia, at Stellarton and Point Aconi, operated by Pioneer Coal. Production information is currently unavailable due to confidentiality requirements of Statistics Canada.

Agriculture Real GDP in 2011 in the agricultural sector decreased by 4.4% compared to 2010. Total farm cash receipts in 2011 increased by 5.3%, comprised of a rise in crop receipts by 5.1%, and receipts for livestock production increased by 4.7%. The number of people employed in the agricultural sector stood at 5,200 persons in 2011, a decrease of about 600 from 2010. The major components of agricultural production in Nova Scotia include dairy products, poultry, eggs and fruit crop production.

Forestry In 2011, the value of manufacturing shipments for wood products was $453.6 million, a decrease of 14.4% from 2010. The logging sector employed 2,500 workers in 2011, a decrease of about 100 from 2010. In 2010, the total provincial harvest of round wood was 4,481,540 cubic metres, an increase of 8.5% from 2009. Of this amount 205,747 cubic meters or 7.0% was exported.

Finished lumber production was 829.6 thousand cubic metres (99.8% softwood), a 6.8% decrease from 2010. Production in 2010 showed a 65.5% gain over 2009 levels. Export sales of lumber grew 6.1% in 2011 from 2010. The majority of exports still go to the United States (38.2% in 2011), though exports to the US declined by 5.2% in 2011 compared to 2010. In 2011, export sales for paper products were up 0.6% from 2010, a deceleration compared to the 6.8% increase over the 2009-2010 period.

21

Exports

The total value of exports of goods and services from Nova Scotia in 2011, under Statistics Canada’s Provincial Economic Accounts data system, stood at $15,836 million, giving an annual compound rate of increase of 1.0% over the 2007 to 2011 period. The value of exports of goods and services represented 42.8% of the total value of GDP in 2011.

Of the $15,836 million in exports of goods and services, 48.8% or $7,732 million were shipped to other countries, leaving 51.2% or $8,104 million as exports to other provinces within Canada. Exports of goods accounted for 63.1% of the total exports while exports of services accounted for 36.9%. Most of the goods are exported to other countries (62.2%), while services are mostly exported to other provinces (74.0%).

Over the 2007 to 2011 period, the total value of exports of goods had an annual compound rate of decline of 0.8% compared to growth of 4.6% for the total value of export of services.

Statistics Canada reports in their Provincial Economic Accounts data system that the total value of international exports of goods in 2011 was $6,210 million, experiencing an annual compound rate of decline of 0.4% since 2007. That Provincial Economic Accounts figure can be contrasted with Nova Scotia’s international merchandise exports of goods based on customs clearing data that amounted to $4,459.8 million in 2011. The Provincial Economic Accounts data system adjusts the customs data for other costs such as transportation margins and duties. During the period 2007 to 2011 the Canadian dollar appreciated from $1.1341 CAD/USD in 2007 to $1.0299 in 2011.

For 2011, the customs export figures show an increase of 3.5% over 2010, principally due to an increase of 8.1% in exports from Tire Manufacturing and a 14.8% increase in exports from Seafood Product Preparation and Packaging, offset partially by a 24.2% decline in exports from Oil and Gas Extraction and 15.3% decline in exports from Sawmills and Wood Preservation sector.

The following table sets forth categories of Selected Trade indicators for the calendar years 2007 through 2011.

SELECTED TRADE INDICATORS

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | (In millions $) | |

Exports of goods to other countries | | | 6,317 | | | | 6,754 | | | | 5,112 | | | | 5,696 | | | | 6,210 | |

Export of services to other countries | | | 1,286 | | | | 1,258 | | | | 1,333 | | | | 1,494 | | | | 1,522 | |

| | | | | | | | | | | | | | | | | | | | |

Exports to other countries | | | 7,603 | | | | 8,012 | | | | 6,445 | | | | 7,190 | | | | 7,732 | |

| | | | | | | | | | | | | | | | | | | | |

Exports of goods to other provinces | | | 4,016 | | | | 4,207 | | | | 3,327 | | | | 3,546 | | | | 3,778 | |

Export of services to other provinces | | | 3,596 | | | | 3,932 | | | | 3,819 | | | | 4,198 | | | | 4,326 | |

| | | | | | | | | | | | | | | | | | | | |

Exports to other provinces | | | 7,612 | | | | 8,139 | | | | 7,146 | | | | 7,744 | | | | 8,104 | |

Total Exports of goods and services: | | | 15,215 | | | | 16,151 | | | | 13,591 | | | | 14,934 | | | | 15,836 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Imports of goods from other countries | | | 9,149 | | | | 9,648 | | | | 8,489 | | | | 9,252 | | | | 10,695 | |

Import of services from other countries | | | 1,239 | | | | 1,231 | | | | 1,169 | | | | 1,356 | | | | 1,330 | |

| | | | | | | | | | | | | | | | | | | | |

Imports from other countries | | | 10,388 | | | | 10,879 | | | | 9,658 | | | | 10,608 | | | | 12,025 | |

| | | | | | | | | | | | | | | | | | | | |

Imports of goods from other provinces | | | 5,362 | | | | 5,362 | | | | 5,227 | | | | 5,535 | | | | 5,985 | |

Imports of services from other provinces | | | 6,172 | | | | 6,447 | | | | 6,859 | | | | 7,224 | | | | 7,810 | |

| | | | | | | | | | | | | | | | | | | | |

Imports from other provinces | | | 11,534 | | | | 11,809 | | | | 12,086 | | | | 12,759 | | | | 13,795 | |

| | | | | | | | | | | | | | | | | | | | |

Total Imports of goods and services: | | | 21,922 | | | | 22,688 | | | | 21,744 | | | | 23,367 | | | | 25,820 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Trade Balance | | | 6,707 | | | | 6,537 | | | | 8,153 | | | | 8,433 | | | | 9,984 | |

| | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada

22

The following tables sets forth Nova Scotia’s top ten international merchandise exports by industry and the top ten imports by product for the calendar years 2007 through 2011, and the compound annual growth rate over the 2007 to 2011 period.

INTERNATIONAL MERCHANDISE EXPORTS BY INDUSTRY

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Compound

Annual Rate

of Growth | |

| | | | | (in millions) | | | | | | | | | | |

Tire Manufacturing | | $ | 819.4 | | | $ | 857.9 | | | $ | 783.7 | | | $ | 946.7 | | | $ | 1,023.5 | | | | 5.7 | % |

Paper Mills | | | 512.0 | | | | 619.1 | | | | 426.5 | | | | 455.4 | | | | 441.8 | | | | -3.6 | % |

Seafood Product Preparation and Packaging | | | 503.5 | | | | 430.5 | | | | 391.5 | | | | 409.4 | | | | 469.9 | | | | -1.7 | % |

Fishing | | | 461.6 | | | | 422.9 | | | | 429.4 | | | | 394.2 | | | | 437.4 | | | | -1.3 | % |

Oil and Gas Extraction | | | 1,099.3 | | | | 1,449.6 | | | | 672.6 | | | | 396.1 | | | | 363.1 | | | | -24.2 | % |

Pulp Mills | | | 168.5 | | | | 163.9 | | | | 126.6 | | | | 162.7 | | | | 161.3 | | | | -1.1 | % |

Sawmills and Wood Preservation | | | 158.8 | | | | 98.0 | | | | 68.7 | | | | 108.5 | | | | 81.8 | | | | -15.3 | % |

Frozen Food Manufacturing | | | 111.9 | | | | 108.2 | | | | 78.7 | | | | 90.1 | | | | 143.3 | | | | 6.4 | % |

Aerospace Product and Parts Manufacturing | | | 41.2 | | | | 45.5 | | | | 36.9 | | | | 88.8 | | | | 40.1 | | | | -0.7 | % |

Petroleum Refineries | | | 100.5 | | | | 104.7 | | | | 59.6 | | | | 82.2 | | | | 93.6 | | | | -1.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Sub-total | | | 3,976.6 | | | | 4,300.2 | | | | 3,074.2 | | | | 3,134.1 | | | | 3,255.7 | | | | -4.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other | | | 1,414.0 | | | | 1,423.3 | | | | 1,211.8 | | | | 1,175.2 | | | | 1,204.1 | | | | -3.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Grand total | | $ | 5,390.6 | | | $ | 5,723.4 | | | $ | 4,286.0 | | | $ | 4,309.2 | | | $ | 4,459.8 | | | | -4.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada and Industry Canada.

INTERNATIONAL MERCHANDISE IMPORTS BY PRODUCT

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | Compound

Annual Rate

of Growth | |

| | | | | (in millions) | | | | | | | | | | |

Motor Vehicles For Passenger Transport | | $ | 2,733.5 | | | $ | 3,094.0 | | | $ | 2,688.3 | | | $ | 3,316.4 | | | $ | 2,471.6 | | | | -2.5 | % |

| | | | | | |

Crude Petroleum | | | 1,512.1 | | | | 1,603.4 | | | | 1,198.8 | | | | 1,423.1 | | | | 1,502.0 | | | | -0.2 | % |

| | | | | | |

Machines and Mechanical Appliances | | | 18.3 | | | | 22.4 | | | | 27.5 | | | | 22.4 | | | | 733.7 | | | | 151.6 | % |

| | | | | | |

Natural Rubber; Balata, Gutta-Percha, Guayule, Chicle and Similar Natural Gums | | | 148.2 | | | | 168.0 | | | | 88.3 | | | | 190.1 | | | | 332.6 | | | | 22.4 | % |

Coal & Solid Fuels Manufactured from Coal | | | 145.8 | | | | 201.4 | | | | 204.3 | | | | 186.5 | | | | 189.5 | | | | 6.8 | % |

| | | | | | |

Preparations of non-crude petroleum oils | | | 168.9 | | | | 168.5 | | | | 104.6 | | | | 62.5 | | | | 165.6 | | | | -0.5 | % |

| | | | | | |

Ferry boats, cruise ships and excursion boats, tankers | | | — | | | | 3.7 | | | | 187.7 | | | | 33.2 | | | | 145.5 | | | | n/a | |

| | | | | | |

Trucks and Other Vehicles for Transport of Goods | | | 19.8 | | | | 16.5 | | | | 10.4 | | | | 82.1 | | | | 127.2 | | | | 59.1 | % |

| | | | | | |

Uranium and other Radioactive Elements, Isotopes, Residues and Compounds | | | 43.2 | | | | 8.7 | | | | 15.9 | | | | 166.5 | | | | 102.5 | | | | 24.1 | % |

Fish Fillets and Other Fish Meat – Fresh, Chilled or Frozen | | | 70.4 | | | | 52.9 | | | | 75.9 | | | | 75.7 | | | | 87.8 | | | | 5.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Sub-Total | | | 4,860.2 | | | | 5,339.5 | | | | 4,601.7 | | | | 5,558.5 | | | | 5,857.9 | | | | 4.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Other | | | 2,596.3 | | | | 3,077.3 | | | | 2,216.3 | | | | 2,521.8 | | | | 2,471.3 | | | | -1.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Grand Total | | $ | 7,456.6 | | | $ | 8,416.8 | | | $ | 6,818.0 | | | $ | 8,080.4 | | | $ | 8,329.2 | | | | 2.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada and Industry Canada.

23

Merchandise imports by commodity are assessed based on their port of clearance, rather than their intended destination in Canada (or beyond). Of note in the table on imports into Nova Scotia by product grouping is the large amount of motor vehicle for passenger transport. Most of these vehicles arrive from Europe, and are then shipped across Canada.

Service Sector

Overview. The Halifax metropolitan area is the largest financial and commercial service center in Atlantic Canada. The area is also one of Canada’s major medical and scientific communities, and the location of several federally sponsored scientific research institutions, including the Bedford Institute of Oceanography. The Halifax region is also home to several universities as it is a major education center for Atlantic Canada.

The Halifax region accounted for 49.4% of the total employment in Nova Scotia in 2011 producing an unemployment rate of 6.0% for 2011 compared to the 8.8% unemployment rate for the province as a whole, and 8.0% unemployment rate for Canada.

The following table sets forth the percentage contribution to the GDP for the service sector by component for the calendar years 2007 through 2011.

SERVICE INDUSTRIES AS A PERCENTAGE OF TOTAL SERVICE PRODUCING INDUSTRIES

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | | | |

Transportation and Warehousing | | | 4.6 | % | | | 4.6 | % | | | 4.2 | % | | | 4.3 | % | | | 4.3 | % |

Wholesale Trade | | | 5.5 | % | | | 5.4 | % | | | 5.2 | % | | | 5.5 | % | | | 5.4 | % |

Retail Trade | | | 8.8 | % | | | 8.9 | % | | | 8.8 | % | | | 8.9 | % | | | 8.8 | % |

Finance and Insurance | | | 7.5 | % | | | 7.2 | % | | | 7.2 | % | | | 7.1 | % | | | 7.0 | % |

Real Estate, rental and leasing | | | 17.9 | % | | | 18.0 | % | | | 18.4 | % | | | 18.5 | % | | | 18.8 | % |

Management of Companies | | | 0.6 | % | | | 0.6 | % | | | 0.6 | % | | | 0.6 | % | | | 0.6 | % |

Professional , scientific and technical services | | | 5.1 | % | | | 5.2 | % | | | 5.2 | % | | | 5.0 | % | | | 5.0 | % |

Administrative and support, waste management and remediation services | | | 3.0 | % | | | 2.9 | % | | | 2.9 | % | | | 3.0 | % | | | 2.9 | % |

Information and Cultural Industries | | | 4.6 | % | | | 4.5 | % | | | 4.5 | % | | | 4.5 | % | | | 4.5 | % |

Education Services | | | 8.3 | % | | | 8.5 | % | | | 8.5 | % | | | 8.5 | % | | | 8.5 | % |

Health Care and Social Assistance | | | 11.5 | % | | | 11.5 | % | | | 12.0 | % | | | 11.8 | % | | | 11.8 | % |

Accommodation and Food Services | | | 3.0 | % | | | 3.0 | % | | | 3.0 | % | | | 3.0 | % | | | 2.9 | % |

Arts, entertainment, and recreation | | | 0.8 | % | | | 0.7 | % | | | 0.7 | % | | | 0.7 | % | | | 0.7 | % |

Other Services (except Public Administration) | | | 2.7 | % | | | 2.7 | % | | | 2.7 | % | | | 2.7 | % | | | 2.7 | % |

Public Administration | | | 16.2 | % | | | 16.1 | % | | | 16.2 | % | | | 16.0 | % | | | 15.9 | % |

Total (3) | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Includes Pipeline Transportation – See “Offshore Exploration and Development”. |

| (2) | Includes the following industrial categories: Professional, Scientific and Technical Services; Administrative and Support, Waste Management and Remediation; and Other Services. |

| (3) | Numbers may not add up due to rounding. |

Source: Statistics Canada, CANSIM Table 379-0030.

Trade. In 2011, retail trade increased 3.5% in Nova Scotia compared to an increase of 4.1% in Canada over 2010. The value of retail sales in 2011 in Nova Scotia was $13,097 million. The compound annual rate of growth in retail sales was 3.0% in Nova Scotia and 2.6% in Canada during the 2007 to 2011 period. Employment in the retail sector stood at 62,600 persons in 2011, a decrease of approximately 1,900 persons compared to 2010.

24

The value of wholesale trade was $7,864 million in 2011, an increase of 2.1% compared to 2010. The sector had an employment level of 14,800 in 2011, an increase of approximately 3,000 from 2010. In 2011, the wholesale sector had a real GDP rate of change of 0.1%. As noted in the above table, the combined wholesale and retail trade sector accounts for 15.5% of the total value of GDP for the service producing sector.

Transportation and Warehousing. Transportation and warehousing have been important factors in the economy of Nova Scotia throughout its history. Halifax harbor and the Strait of Canso are deep-water, ice-free harbors. The Port of Halifax is capable of handling vessels up to 150,000 metric tonnes, and the Strait of Canso can accommodate the world’s largest super-tankers.

The sector’s real GDP (chained 2007 dollars) in 2011 increased 2.3% over 2010. Over the time period of 2007 to 2011, the sector has experienced no growth. In 2011, the sector employed about 20,700 persons, an increase of 2,200 from 2010.

Port facilities at Halifax include 35 deep-water berths that are complemented by rail, air, and motor freight services. With two container terminals, each capable of berthing two container ships simultaneously, Halifax is Canada’s third largest container port and the only port on the east coast of North America capable of handling fully laden Post-Panamax vessels. The total volume of cargo handled by the Port of Halifax in 2011 was 9.5 million metric tonnes. In 2011, containerized cargo tonnage amounted to 3.3 million metric tonnes. Bulk cargo, chiefly consisting of petroleum products and gypsum, totaled 5.8 million metric tonnes. Ro/Ro (roll-on/roll-off) and break-bulk accounted for the rest of the cargo tonnage shipped through the Port of Halifax. This port serves as a trans-shipment point for automobile distribution throughout Atlantic Canada via ship and rail. The Port of Halifax also serves more container lines, with more direct calls to Europe, the Mediterranean, Middle East, Asia, South America, Central America, and the Caribbean than any other Canadian port. The Port of Halifax had visitation by 122 cruise vessels in 2011 with 243,577 passengers.

Tourism. Approximately 1.95 million tourists visited Nova Scotia during 2011, a level unchanged from the number of visitors in 2010. Overall in 2011, the majority of visitors, 87.5%, came from other parts of Canada, 8.8% from the United States, and 3.7% from overseas. About 66.4% of visitors to Nova Scotia travelled by road with the remaining 33.6% arriving by air. The number of visitors from other parts of Canada decreased by 0.7% (12,800) in 2011. There was a 12.3% increase in overseas visitors in 2011 compared to 2010. The downward trend of American visitors to Canada continued in 2011, with 2.5% fewer visitors from the United States.

Energy

There is one petroleum refinery operating in Nova Scotia. Crude oil for the refinery is obtained from foreign sources.

The majority of electricity generated in Nova Scotia is from coal and oil-fired facilities. Overall total electricity production in Nova Scotia for 2011 was 10,938 gigawatt hours, a 4.2% decrease in production from 2010. Total utility generation in 2011 was 10,125 gigawatt hours, a 13.2% decrease from 2010. Total hydro generation was 2,169 gigawatt hours, a 10.3% increase from 2010. The Province of Nova Scotia’s regulations require that nearly 25 per cent of the Province’s electricity supply come from renewable sources (wind, solar, tidal and biomass technology) by 2015.

Offshore Exploration and Development

Since the beginning of exploration activity in the late 1960’s, substantial gas reserves and modest oil reserves have been discovered, including the six fields that are part of the Sable Offshore Energy Project (“SOEP”), and also the Deep Panuke Project. As of July 31, 2012, there were 1,793,555 hectares of land in the offshore region under active exploration licenses, 76,680 hectares under significant discovery licenses and 39,441 hectares under production licenses. SOEP expenditures in Canada through December 31, 2011 on development and operations have been $3,498 million; 69.1% of this amount was spent in Nova Scotia.

SOEP is a natural gas project located on the Scotia Shelf that commenced production on December 31, 1999. SOEP’s natural gas production averaged 274.5 mmcf/d in 2011, and condensate production was 30,480.4

25

cubic metres per day in 2011. The Sable Offshore Energy Project is divided into two ‘tiers’ of offshore development. The first tier was completed in December 1999 and involved the development of the Thebaud, North Triumph, and Venture fields, as well as the construction of three offshore platforms, an onshore gas plant and an onshore fractionation plant. Natural gas production from the SOEP facility commenced on December 31, 1999. Alma, the first Tier II platform was on-stream in late 2003 while production from South Venture, the second field began late in 2004.

A compression unit was installed on the SOEP project’s central processing platform in 2006, and was operational in mid-November of that year. SOEP continues to produce natural gas with production at lower levels as the compression platform only boosted production for a short period. In 2011, the production of natural gas from the SOEP continued to decline, with the production level in 2011 down 14.2% from 2010. In addition to the producing gas field, the SOEP project includes a gas plant at Goldboro and a fractionation plant at Point Tupper. The Maritimes & Northeast Pipeline provides transportation of SOEP gas to markets in Nova Scotia, New Brunswick, and the northeastern United States. This pipeline originates at the “tailgate” of the gas plant in Goldboro, Nova Scotia, continues in a westerly direction and crosses the New Brunswick-Nova Scotia border near Tidnish, Nova Scotia.

SOEP NATURAL GAS PRODUCTION

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | | | |

Total Production (mmcf/d) | | | 426.0 | | | | 448.6 | | | | 347.6 | | | | 320.1 | | | | 274.5 | |

ExxonMobil Canada Properties Ltd., Shell Canada Ltd., Imperial Oil Reserves, Pengrowth Energy Trust and Mosbacher Operating Ltd. are interest holders in SOEP. In 1999, the project partners signed a royalty agreement for this project with the Province. The royalty income from offshore gas and natural gas liquids for the fiscal year 2010-2011 was $197.0 million.