UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05742

| | | | |

Name of Fund: | | BlackRock Funds | | |

| | All-Cap Global Resources Portfolio Asset Allocation Portfolio Aurora Portfolio Capital Appreciation Portfolio Exchange Portfolio Global Opportunities Portfolio Global Resources Portfolio Global Science & Technology Opportunities Portfolio Health Sciences Opportunities Portfolio International Opportunities Portfolio Mid-Cap Value Equity Portfolio Mid-Cap Growth Equity Portfolio Money Market Portfolio Municipal Money Market Portfolio New Jersey Municipal Money Market Portfolio North Carolina Municipal Money Market Portfolio Ohio Municipal Money Market Portfolio Pennsylvania Municipal Money Market Portfolio Small Cap Core Equity Portfolio Small Cap Growth Equity Portfolio Small Cap Value Equity Portfolio Small/Mid-Cap Growth Portfolio U.S. Opportunities Portfolio U.S. Treasury Money Market Portfolio Virginia Municipal Money Market Portfolio |

| | |

Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 | | |

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock Funds, 800

Scudders Mill Road, Plainsboro, NJ, 08536. Mailing address: P.O. Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2008

Date of reporting period: 10/01/2007 – 03/31/2008

| | | | |

| Item 1 | | – | | Report to Stockholders |

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

| | | | |

| |

| BlackRock | |  |

| Equity Portfolios | | |

| | |

| SEMI-ANNUAL REPORT | | | MARCH 31, 2008 (UNAUDITED) | | |

Capital Appreciation

Mid-Cap Value Equity

Mid-Cap Growth Equity

Aurora

Small/Mid-Cap Growth

Small Cap Value Equity

Small Cap Core Equity

Small Cap Growth Equity

Global Science & Technology Opportunities

Global Resources

All-Cap Global Resources

Health Sciences Opportunities

U.S. Opportunities

Global Opportunities

International Opportunities

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| | | | | | |

| 2 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

A Letter to Shareholders

Dear Shareholder

Financial markets endured severe bouts of volatility during the reporting period, particularly as the calendar turned to 2008. It was then that fears of an economic recession swelled and credit market strains intensified, producing calamity in the financial system and, ultimately, the demise of major Wall Street firm Bear Stearns.

The Federal Reserve Board (the “Fed”), after cutting the target federal funds rate 100 basis points (1%) between September 2007 and year-end, stepped up its efforts to support the ailing financial sector in the first three months of 2008. The central bank cut interest rates 125 basis points in January alone, and followed with another 75-basis-point cut on March 18, bringing the target rate to 2.25%. In an unprecedented move, the Fed also extended its financing operations directly to broker/dealers and assisted JPMorgan in its buyout of ill-fated Bear Stearns.

Against this backdrop, investor anxiety has been acute and equity markets have struggled. The S&P 500 Index of U.S. stocks was down in March, marking the fifth consecutive month of negative returns. International markets outperformed the U.S. for much of 2007, but that trend changed in more recent months as investors grew increasingly reluctant to take on the risks of foreign investing.

In fixed income markets, an ongoing investor flight to quality continued to drive Treasury yields lower and their prices higher. The yield on 10-year Treasury issues, which touched 5.30% in June 2007 (its highest level in five years), fell to 4.04% by year-end and to 3.45% by March 31. Investors largely shunned bonds associated with the housing and credit markets, and the riskier high yield sector landed in negative territory year-to-date. Meanwhile, the municipal bond market has struggled with concerns around the creditworthiness of monoline bond insurers and the failure of auctions for auction rate securities, driving yields higher and prices lower across the curve. At period-end, municipal bonds were trading at higher yields than their Treasury counterparts, a very unusual occurrence by historical standards.

Overall, the major benchmark indexes posted mixed results for the current reporting period, generally reflecting heightened investor risk aversion:

| | | | | | |

Total Returns as of March 31, 2008 | | 6-month | | | 12-month | |

U.S. equities (S&P 500 Index) | | (12.46 | )% | | (5.08 | )% |

Small cap U.S. equities (Russell 2000 Index) | | (14.02 | )% | | (13.00 | )% |

International equities (MSCI Europe, Australasia, Far East Index) | | (10.50 | )% | | (2.70 | )% |

Fixed income (Lehman Brothers U.S. Aggregate Index) | | 5.23 | % | | 7.67 | % |

Tax-exempt fixed income (Lehman Brothers Municipal Bond Index) | | 0.75 | % | | 1.90 | % |

High yield bonds (Lehman Brothers U.S. Corporate High Yield 2% Issuer Capped Index) | | (4.01 | )% | | (3.47 | )% |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

As you navigate today’s volatile markets, we encourage you to review your investment goals with your financial professional and to make portfolio changes, as needed. For more up-to-date commentary on the economy and financial markets, we invite you to visit www.blackrock.com/funds. As always, we thank you for entrusting BlackRock with your investment assets, and we look forward to continuing to serve you in the months and years ahead.

|

| Sincerely, |

|

|

| Rob Kapito |

| President, BlackRock Advisors, LLC |

THIS PAGE NOT PART OF YOUR FUND REPORT

3

Portfolio Summary (Unaudited) | Capital Appreciation Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | Portfolio results outperformed that of the benchmark Russell 1000 Growth Index for the six-month period. |

What factors influenced performance?

| • | | Stock selection accounted for the majority of the Portfolio’s relative outperformance over the period. Selection gains were most advantageous in the healthcare sector, where the Portfolio held top performers across many sub-sectors. Pharmaceutical giant Abbott Laboratories and biotechnology firms Gilead Sciences Inc. and Celgene Corp. were the most notable contributors. |

| • | | Strength among the Portfolio’s energy holdings, namely, EOG Resources Inc. and CONSOL Energy, Inc., also enhanced results. Shares of both companies surged higher during the period, driving the Portfolio’s 30% gain in the sector. |

| • | | Additionally, favorable stock selection in materials and consumer staples boosted relative performance. Relative strength in the materials sector was attributable to long-time Portfolio holding, Monsanto, as the agricultural biotechnology company has benefited from strong global demand for its seed and trait products. Within consumer staples, our emphasis on multinational, stable growth companies has had a positive impact. Wal-Mart was the top individual contributor in this group. |

| • | | In contrast, negative stock selection in information technology and consumer discretionary limited the Portfolio’s relative gains over the past six months. Semiconductor holdings PMC-Sierra Inc. and Broadcom Corp. hindered results in information technology, while gaming operator Las Vegas Sands Corp. and footwear manufacturer Crocs Inc. accounted for much of the underperformance in the consumer discretionary sector. |

Describe recent Portfolio activity.

| • | | During the period, we increased the Portfolio’s weighting in consumer staples and energy, while we reduced the allocation to financials and industrials. |

Describe Portfolio positioning at period-end.

| • | | Throughout the six-month period, we continued to emphasize a number of the large, steady growth companies in our universe, with a focus on stocks that have non-cyclical growth potential, as we believe these firms are best suited to weather a slowdown in global growth. |

| • | | Sector weights continued to be driven by our bottom-up stock selection decisions. At period-end, the Portfolio’s largest overweights versus the benchmark Russell 1000 Growth Index were in healthcare and consumer staples, while it was relatively underexposed to the struggling consumer discretionary and financials sectors. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Apple Computer, Inc. | | 4 | % |

The Coca-Cola Co. | | 4 | |

Wal-Mart Stores, Inc. | | 4 | |

QUALCOMM, Inc. | | 3 | |

Adobe Systems, Inc. | | 3 | |

Microsoft Corp. | | 3 | |

Philip Morris International, Inc. | | 3 | |

Google, Inc. - Class A | | 3 | |

Honeywell International, Inc. | | 3 | |

Monsanto Co. | | 3 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Computer Software & Services | | 13 | % |

Pharmaceuticals | | 9 | |

Manufacturing | | 9 | |

Telecommunications | | 7 | |

Retail Merchandising | | 7 | |

Oil & Gas | | 7 | |

Computer & Office Equipment | | 6 | |

Medical Instruments & Supplies | | 5 | |

Beverages & Bottling | | 5 | |

Food & Agriculture | | 4 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 4 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Capital Appreciation Portfolio |

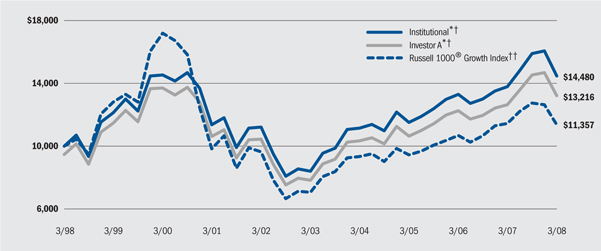

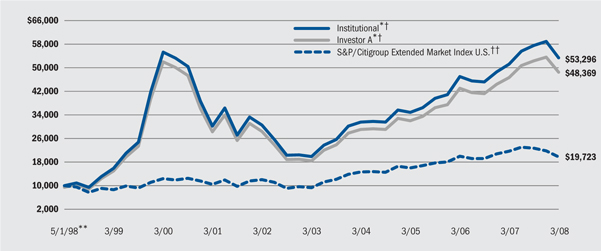

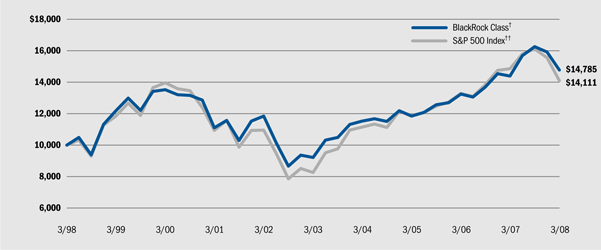

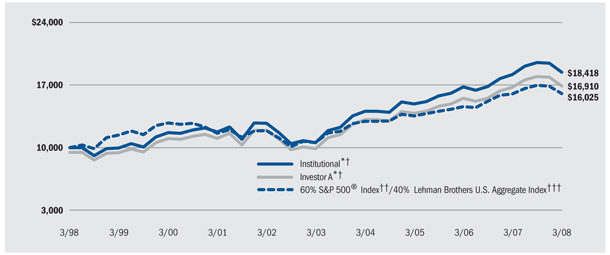

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | Under normal market conditions, the Portfolio invests at least 80% of total assets in common and preferred stock and securities convertible into common and preferred stock of mid- and large-size companies. |

†† | An index composed of those Russell 1000® securities with greater-than-average growth orientation, generally having higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (8.84 | )% | | 5.06 | % | | — | | | 11.46 | % | | — | | | 3.77 | % | | — | |

Investor A | | (9.05 | )% | | 4.52 | % | | (0.99 | )% | | 11.04 | % | | 9.86 | % | | 3.38 | % | | 2.83 | % |

Investor B | | (9.42 | )% | | 3.71 | % | | (0.79 | )% | | 10.22 | % | | 9.94 | % | | 2.72 | % | | 2.72 | % |

Investor C | | (9.34 | )% | | 3.92 | % | | 2.92 | % | | 10.29 | % | | 10.29 | % | | 2.65 | % | | 2.65 | % |

Russell 1000® Growth Index. | | (10.87 | )% | | (0.75 | )% | | — | | | 9.96 | % | | — | | | 1.28 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 911.59 | | $ | 3.35 | | $ | 1,000.00 | | $ | 1,021.46 | | $ | 3.54 |

Investor A | | $ | 1,000.00 | | $ | 909.46 | | $ | 5.73 | | $ | 1,000.00 | | $ | 1,018.93 | | $ | 6.07 |

Investor B | | $ | 1,000.00 | | $ | 905.76 | | $ | 9.92 | | $ | 1,000.00 | | $ | 1,014.46 | | $ | 10.54 |

Investor C | | $ | 1,000.00 | | $ | 906.59 | | $ | 8.95 | | $ | 1,000.00 | | $ | 1,015.49 | | $ | 9.51 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (0.70% for Institutional, 1.20% for Investor A, 2.08% for Investor B and 1.88% for Investor C), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 5 |

| | |

Portfolio Summary (Unaudited) | | Mid-Cap Value Equity Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | The Portfolio outperformed the benchmark Russell Midcap Value Index for the six-month period ended March 31, 2008. |

What factors influenced performance?

| • | | Portfolio performance benefited from favorable stock selection in utilities, where Equitable Resources (gas utilities), Entergy Corp. (electric utilities) and Constellation Energy (independent power producers) added value. In energy, exploration & production companies performed particularly well, especially EOG Resources, Southwestern Energy, CONSOL Energy, Inc. and Massey Energy. In industrials, armored car and home security provider Brink’s was a standout performer. |

| • | | Stock selection and an underweight in financials also added value, with key contributions from People’s United Financial in thrift & mortgage finance; good stock selection and an underweight in commercial banks, particularly Cullen/Frost Bankers; stock selection in real estate investment trusts (REITs); and an underweight in insurance. |

| • | | Although an underweight and stock selection among media names added value in the consumer discretionary sector, these gains were overshadowed by disappointing performance from select specialty retailers and apparel manufacturers, specifically Borders Group and Jones Apparel Group. |

| • | | Other detractors included stock selection in information technology, healthcare and consumer staples. Stocks that disappointed included Electronics for Imaging, a producer of printing and imaging products, managed care provider Coventry Healthcare and Constellation Brands and Pilgrim’s Pride within consumer staples. |

Describe recent Portfolio activity.

| • | | During the six months, we increased the Portfolio’s exposure to materials, healthcare and consumer staples. In materials, we established a position in chemicals company Hercules. In healthcare, we added to equipment & supply manufacturers (Cooper Cos.) and healthcare providers (with new positions in Laboratory Corp. of America and DaVita). In consumer staples, we added to tobacco and personal products (with a new position in Estee Lauder) and beverage producers (Constellation Brands). |

| • | | We reduced exposure to consumer discretionary, industrials and financials. In consumer discretionary, we trimmed specialty retailers (with the sale of Office Depot and Borders Group) and apparel manufacturers. In industrials, we trimmed construction & engineering, electric equipment and aerospace & defense, and in financials, we reduced exposure to REITs and commercial banks. |

Describe Portfolio positioning at period-end.

| • | | The Portfolio ended the period overweight in healthcare (particularly healthcare providers and equipment & supply manufacturers) and consumer staples (notably tobacco, food & staples retailers). Underweights at period-end included financials (particularly REITs and insurance) and consumer discretionary (primarily household durables and media). |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Safeway, Inc. | | 2 | % |

The Brink’s Co. | | 2 | |

Grant Prideco, Inc. | | 2 | |

Simon Property Group, Inc. (REIT) | | 2 | |

The Cooper Cos., Inc. | | 2 | |

Del Monte Foods Co. | | 2 | |

People’s United Financial, Inc. | | 2 | |

Newfield Exploration Co. | | 2 | |

HCC Insurance Holdings, Inc. | | 2 | |

Edison International | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Energy & Utilities | | 13 | % |

Insurance | | 8 | |

Oil & Gas | | 8 | |

Retail Merchandising | | 8 | |

Banks | | 7 | |

Finance | | 6 | |

Medical & Medical Services | | 5 | |

Manufacturing | | 5 | |

Chemicals | | 4 | |

Real Estate | | 3 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 6 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Mid-Cap Value Equity Portfolio |

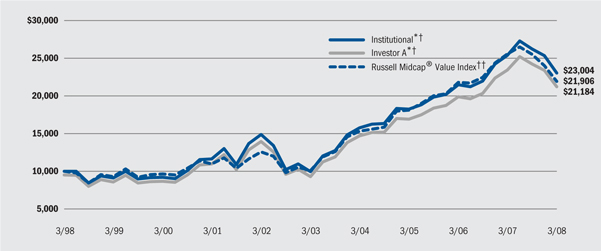

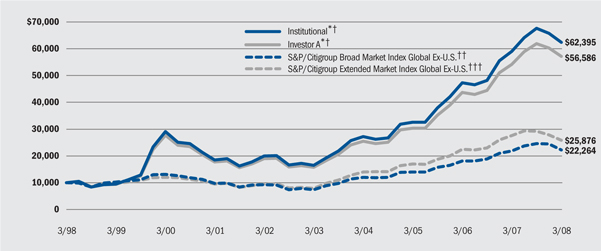

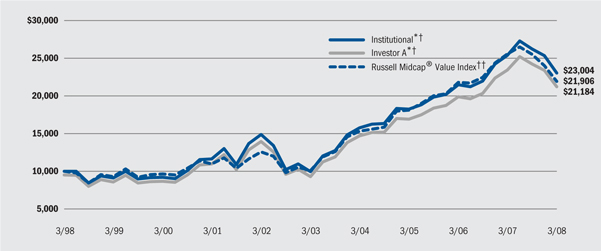

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | The Portfolio normally invests at least 80% of its net assets in equity securities issued by U.S. mid-capitalization value companies. |

†† | An index that consists of the bottom 800 securities of the Russell 1000® Index with less-than-average growth orientation as ranked by total market capitalization. Securities in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields and lower forecasted growth values. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (12.21 | )% | | (9.24 | )% | | — | | | 18.28 | % | | — | | | 8.69 | % | | — | |

Service | | (12.38 | )% | | (9.50 | )% | | — | | | 17.94 | % | | — | | | 8.38 | % | | — | |

Investor A | | (12.37 | )% | | (9.53 | )% | | (14.27 | )% | | 17.94 | % | | 16.68 | % | | 8.38 | % | | 7.80 | % |

Investor B | | (12.65 | )% | | (10.14 | )% | | (13.67 | )% | | 17.10 | % | | 16.88 | % | | 7.68 | % | | 7.68 | % |

Investor C | | (12.65 | )% | | (10.22 | )% | | (11.00 | )% | | 17.09 | % | | 17.09 | % | | 7.60 | % | | 7.60 | % |

Russell Midcap® Value Index | | (14.09 | )% | | (14.12 | )% | | — | | | 16.77 | % | | — | | | 8.16 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 877.88 | | $ | 4.41 | | $ | 1,000.00 | | $ | 1,020.24 | | $ | 4.76 |

Service | | $ | 1,000.00 | | $ | 876.18 | | $ | 5.84 | | $ | 1,000.00 | | $ | 1,018.69 | | $ | 6.31 |

Investor A | | $ | 1,000.00 | | $ | 876.30 | | $ | 5.86 | | $ | 1,000.00 | | $ | 1,018.67 | | $ | 6.33 |

Investor B | | $ | 1,000.00 | | $ | 873.52 | | $ | 9.37 | | $ | 1,000.00 | | $ | 1,014.88 | | $ | 10.12 |

Investor C | | $ | 1,000.00 | | $ | 873.49 | | $ | 9.37 | | $ | 1,000.00 | | $ | 1,014.87 | | $ | 10.13 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (0.94% for Institutional, 1.25% for Service, 1.25% for Investor A, 2.00% for Investor B and 2.00% for Investor C), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 7 |

| | |

Portfolio Summary (Unaudited) | | Mid-Cap Growth Equity Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | The Portfolio posted strong relative returns amid a challenging investment backdrop, outperforming the benchmark Russell Mid Cap Growth Index for the six-month period. |

What factors influenced performance?

| • | | The majority of the Portfolio’s outperformance of the benchmark is attributed to strong stock selection in the energy and materials sectors. |

| • | | Within energy, exploration & production names were the most significant industry contributors. Coal companies Massey Energy and CONSOL Energy, Inc. posted outsized gains, as prices for coal increased on rising foreign demand. Additionally, oil and natural gas company EOG Resources advanced more than 60% during the period on increased production possibilities. |

| • | | Within the materials sector, chemicals company Agrium continued to post strong financial results on increasing demand for its fertilizer products. Industrials companies Joy Global and IHS Incorporated also posted double-digit returns, bolstering Portfolio performance. |

| • | | These positives were offset by weak stock selection in the information technology and financials sectors. In technology, the communications equipment industry was the most significant industry detractor. Foundry Networks and Juniper Networks accounted for much of the underperformance, as worries over decreased corporate spending pressured the stocks. Within financials, larger holding CME Group was down almost 20% for the period on news of a possible industry reorganization. |

Describe recent Portfolio activity.

| • | | We made no major changes to the Portfolio’s composition during the six-month period. We selectively trimmed and added holdings throughout the Portfolio. Among stocks added were Broadcom, Intuit and DeVry Incorporated. Notable eliminations were JCPenney, Lam Research and Precision Castparts. |

Describe Portfolio positioning at period-end.

| • | | As of March 31, 2008, the Portfolio’s most significant overweight was in the information technology sector, where we maintain a diverse group of holdings. The most significant underweight at period-end was in the financials sector. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Thermo Electron Corp. | | 3 | % |

Pediatrix Medical Group, Inc. | | 3 | |

GameStop Corp. | | 3 | |

Ametek, Inc. | | 3 | |

Bare Escentuals, Inc. | | 2 | |

IHS, Inc. | | 2 | |

Celanese Corp. - Series A | | 2 | |

Amphenol Corp. | | 2 | |

Adobe Systems, Inc. | | 2 | |

CME Group, Inc. | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Computer Software & Services | | 11 | % |

Oil & Gas | | 10 | |

Medical & Medical Services | | 6 | |

Electronics | | 6 | |

Retail Merchandising | | 5 | |

Business Services | | 5 | |

Telecommunications | | 5 | |

Finance | | 4 | |

Entertainment & Leisure | | 4 | |

Metal & Mining | | 4 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 8 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Mid-Cap Growth Equity Portfolio |

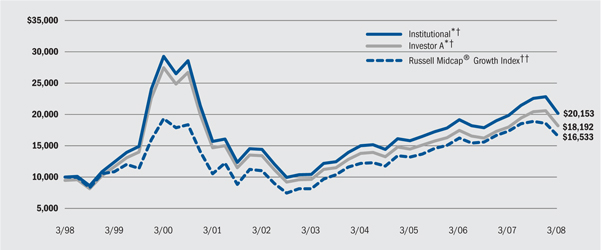

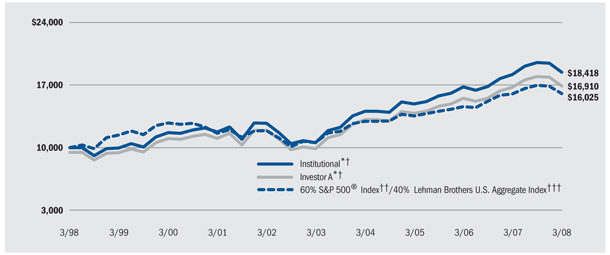

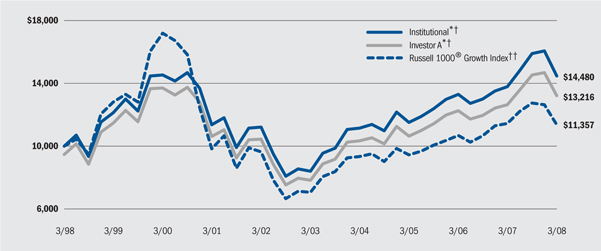

Total Return on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | The Portfolio normally invests at least 80% of its net assets in equity securities issued by U.S. mid-capitalization growth companies which the portfolio management team believes have above-average earnings growth potential. |

†† | An index that consists of the bottom 800 securities of the Russell 1000® Index with greater-than-average growth orientation as ranked by total market capitalization. Securities in this index generally have higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (10.45 | )% | | 1.68 | % | | — | | | 14.04 | % | | — | | | 7.26 | % | | — | |

Service | | (10.68 | )% | | 1.50 | % | | — | | | 13.66 | % | | — | | | 6.94 | % | | — | |

Investor A | | (10.76 | )% | | 1.08 | % | | (4.19 | )% | | 13.48 | % | | 12.27 | % | | 6.74 | % | | 6.17 | % |

Investor B | | (11.04 | )% | | 0.40 | % | | (4.10 | )% | | 12.65 | % | | 12.40 | % | | 6.13 | % | | 6.13 | % |

Investor C | | (11.04 | )% | | 0.40 | % | | (0.60 | )% | | 12.65 | % | | 12.65 | % | | 5.97 | % | | 5.97 | % |

R | | (10.68 | )% | | 1.17 | % | | — | | | 13.45 | % | | — | | | 6.70 | % | | — | |

Russell Midcap® Growth Index | | (10.05 | )% | | (4.55 | )% | | — | | | 15.20 | % | | — | | | 5.16 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 895.48 | | $ | 5.07 | | $ | 1,000.00 | | $ | 1,019.59 | | $ | 5.41 |

Service | | $ | 1,000.00 | | $ | 893.18 | | $ | 6.81 | | $ | 1,000.00 | | $ | 1,017.71 | | $ | 7.29 |

Investor A | | $ | 1,000.00 | | $ | 892.43 | | $ | 7.33 | | $ | 1,000.00 | | $ | 1,017.16 | | $ | 7.84 |

Investor B | | $ | 1,000.00 | | $ | 889.57 | | $ | 11.00 | | $ | 1,000.00 | | $ | 1,013.21 | | $ | 11.79 |

Investor C | | $ | 1,000.00 | | $ | 889.57 | | $ | 10.67 | | $ | 1,000.00 | | $ | 1,013.57 | | $ | 11.43 |

R | | $ | 1,000.00 | | $ | 893.22 | | $ | 7.32 | | $ | 1,000.00 | | $ | 1,017.17 | | $ | 7.83 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.07% for Institutional, 1.44% for Service, 1.55% for Investor A, 2.33% for Investor B, 2.26% for Investor C and 1.55% for R), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 9 |

| | |

Portfolio Summary (Unaudited) | | Aurora Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | Portfolio results lagged that of the benchmark Russell 2500 Value Index for the six-month period ended March 31, 2008. |

What factors influenced performance?

| • | | Stock selection in information technology (IT) and financials detracted from the Portfolio’s relative results. Within IT, key laggards included Tessera Technologies, RF Micro Devices, Trident Microsystems and PMC-Sierra (all semiconductor names), and Electronics for Imaging, a producer of printing and imaging products. Within financials, we saw disappointing results from holdings in capital markets (notably, Piper Jaffray and Affiliated Managers Group), insurance and real estate investment trusts (particularly Boardwalk Real Estate Investment Trust). |

| • | | In a challenging market for consumer-related stocks, an overweight position and stock selection in consumer discretionary also detracted from performance. Key laggards were Scientific Games, Pinnacle Entertainment, Penn National Gaming and Morgans Hotel Group (all in hotels, restaurants & leisure), as well as multiline retailer Saks. |

| • | | Bright spots during the period included stock selection in industrials and healthcare. Within industrials, top performers were Brink’s and Copart (both in commercial services), marine shipper Kirby Corp. and construction & engineering firm Chicago Bridge & Iron. Healthcare provider Kindred Healthcare performed well, as did Axcan Pharma, which was taken private by TPG Capital, and biotechnology company Dyax Corp. |

| • | | Stock selection and an overweight position in consumer staples also proved advantageous. Key contributors included food & staples retailers BJ’s Wholesale Club and Ruddick Corp., operator of the Harris Teeter supermarket chain. |

Describe recent Portfolio activity.

| • | | Over the past six months, we increased the Portfolio’s exposure to utilities, primarily electric utilities with a new position in ITC Holdings, and to consumer discretionary. In the latter sector, we established positions in restaurant operators Jack in the Box and CBRL Group. We also added Phillips-Van Heusen and Jarden Corp., while trimming exposure to specialty retailers. |

| • | | Meanwhile, we reduced exposure to industrials, financials and IT. In industrials, we trimmed construction & engineering with the sale of Chicago Bridge & Iron and URS Corp., and aerospace & defense. In financials, we trimmed commercial banks with the sale of Colonial Bancgroup and Wintrust Financial, select REITs and insurance names. In IT, we sold select underperforming semiconductor-related names including RF Micro Devices, Trident Microsystems and Tessera Technologies, and also exited our position in Electronics for Imaging. |

Describe Portfolio positioning at period-end.

| • | | The Portfolio ended the period overweight most notably in consumer discretionary, industrials, consumer staples and healthcare, and underweight primarily in financials, utilities and materials. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

The Brink’s Co. | | 4 | % |

Hain Celestial Group, Inc. | | 3 | |

Magellan Health Services, Inc. | | 3 | |

Boardwalk Real Estate Investment Trust (REIT) | | 3 | |

LKQ Corp. | | 2 | |

Copart, Inc. | | 2 | |

Scientific Games Corp. - Class A | | 2 | |

Affiliated Managers Group, Inc. | | 2 | |

BJ’s Wholesale Club, Inc. | | 2 | |

Ruddick Corp. | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Retail Merchandising | | 13 | % |

Entertainment & Leisure | | 9 | |

Manufacturing | | 9 | |

Medical & Medical Services | | 7 | |

Oil & Gas | | 6 | |

Banks | | 6 | |

Business Services | | 5 | |

Food & Agriculture | | 5 | |

Computer Software & Services | | 5 | |

Aerospace | | 3 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 10 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Aurora Portfolio |

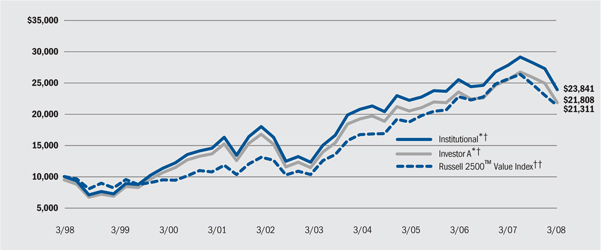

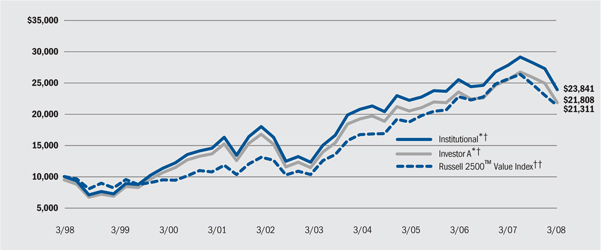

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | Under normal market conditions, the Portfolio invests at least 80% of its total assets in small- and mid-capitalization common and preferred stocks and securities convertible into common and preferred stocks. |

†† | An index composed of the Russell 2500(TM) companies with lower price-to-book ratios and lower forecasted growth values. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (15.36 | )% | | (14.06 | )% | | — | | | 14.17 | % | | — | | | 9.08 | % | | — | |

Investor A | | (15.50 | )% | | (14.34 | )% | | (18.83 | )% | | 13.79 | % | | 12.57 | % | | 8.70 | % | | 8.11 | % |

Investor B | | (15.83 | )% | | (15.02 | )% | | (17.94 | )% | | 12.94 | % | | 12.77 | % | | 8.00 | % | | 8.00 | % |

Investor C | | (15.86 | )% | | (15.01 | )% | | (15.66 | )% | | 12.96 | % | | 12.96 | % | | 7.90 | % | | 7.90 | % |

R | | (15.59 | )% | | (14.52 | )% | | — | | | 13.53 | % | | — | | | 8.45 | % | | — | |

Russell 2500TM Value Index | | (14.88 | )% | | (16.54 | )% | | — | | | 15.56 | % | | — | | | 7.86 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 846.36 | | $ | 4.85 | | $ | 1,000.00 | | $ | 1,019.68 | | $ | 5.32 |

Investor A | | $ | 1,000.00 | | $ | 845.03 | | $ | 6.64 | | $ | 1,000.00 | | $ | 1,017.71 | | $ | 7.29 |

Investor B | | $ | 1,000.00 | | $ | 841.68 | | $ | 10.08 | | $ | 1,000.00 | | $ | 1,013.92 | | $ | 11.08 |

Investor C | | $ | 1,000.00 | | $ | 841.38 | | $ | 10.07 | | $ | 1,000.00 | | $ | 1,013.93 | | $ | 11.07 |

R | | $ | 1,000.00 | | $ | 844.07 | | $ | 7.21 | | $ | 1,000.00 | | $ | 1,017.09 | | $ | 7.91 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.05% for Institutional, 1.44% for Investor A, 2.19% for Investor B, 2.19% for Investor C and 1.56% for R), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 11 |

| | |

| Portfolio Summary (Unaudited) | | Small/Mid-Cap Growth Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | The Portfolio outperformed the benchmark Russell 2500 Growth Index for the six-month period. |

What factors influenced performance?

| • | | Strong stock selection in information technology and energy accounted for the majority of the Portfolio’s outperformance of the benchmark. |

| • | | Within information technology, Internet software & services was the best performing industry. Services names ExlServices and Forrester Research were lifted after posting strong financial results during the period. Top holding SkilSoft continued to execute in a tough environment, and gained more than 16% over the six months. |

| • | | Within the energy sector, exploration & production was the most significant industry contributor. Coal companies Massey Energy and CONSOL Energy, Inc. posted outsized gains for the period, as prices for coal increased on rising foreign demand. Additionally, newer holding Delta Petroleum was up more than 60% on increased production opportunities. |

| • | | Negative stock selection in healthcare and consumer discretionary hindered the Portfolio’s relative returns. Medical devices and equipment was the worst-performing industry within the healthcare sector. Our position in Cutera Incorporated fell after the company reported weaker demand for its end product of cosmetic lasers. Elsewhere in healthcare, pharmaceutical company Medicis Pharmaceutical was down more than 35% on worries over a generic filing for its top-selling acne drug. Within consumer discretionary, holdings Life Time Fitness and Scientific Games both registered sharp declines for the period. |

Describe recent Portfolio activity.

| • | | We significantly increased our underweight in the consumer discretionary sector, eliminating a variety of names, including Dick’s Sporting Goods, Life Time Fitness and Ruth’s Chris Steak House, Inc. |

| • | | Conversely, we increased the Portfolio’s weighting in information technology, adding positions in ComScore, Tivo and Intuit. |

Describe Portfolio positioning at period-end.

| • | | As of March 31, 2008, the Portfolio’s most significant overweight was in the information technology sector, where we maintain a diverse group of holdings. The most significant underweight at period-end was in the consumer discretionary sector. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

SkillSoft Plc - ADR | | 4 | % |

ExlService Holdings, Inc. | | 3 | |

Pediatrix Medical Group, Inc. | | 2 | |

IHS, Inc. | | 2 | |

CKX, Inc. | | 2 | |

SonicWALL, Inc. | | 2 | |

Sykes Enterprises, Inc. | | 2 | |

Shire Plc - ADR | | 2 | |

Delta Petroleum Corp. | | 2 | |

Quanex Corp. | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Computer Software & Services | | 17 | % |

Business Services | | 9 | |

Oil & Gas | | 8 | |

Medical & Medical Services | | 7 | |

Medical Instruments & Supplies | | 6 | |

Pharmaceuticals | | 6 | |

Finance | | 5 | |

Manufacturing | | 5 | |

Entertainment & Leisure | | 4 | |

Electronics | | 4 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 12 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Small/Mid-Cap Growth Portfolio |

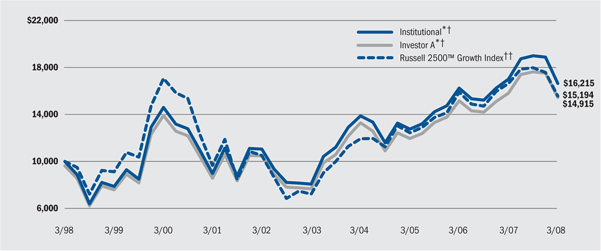

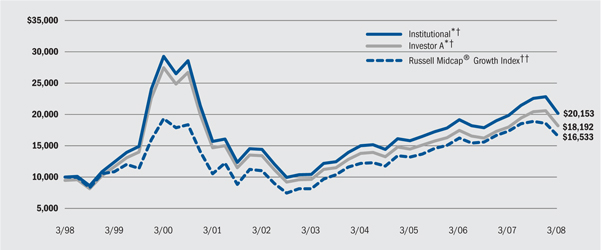

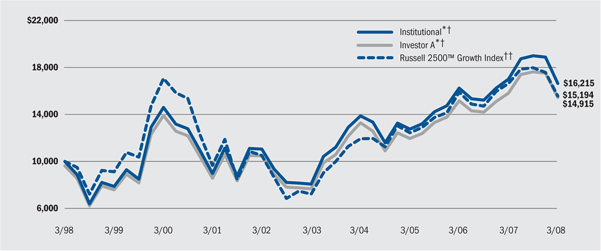

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | Under normal market conditions, the Portfolio invests at least 80% of total assets in small-capitalization and mid-capitalization companies. |

†† | An index composed of the Russell 2500(TM) companies with higher price-to-book ratios and higher forecasted growth values. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (11.85 | )% | | (2.02 | )% | | — | | | 14.63 | % | | — | | | 4.95 | % | | — | |

Investor A | | (11.96 | )% | | (2.20 | )% | | (7.34 | )% | | 14.31 | % | | 13.09 | % | | 4.64 | % | | 4.08 | % |

Investor B | | (12.29 | )% | | (3.04 | )% | | (6.60 | )% | | 13.46 | % | | 13.22 | % | | 4.00 | % | | 4.00 | % |

Investor C | | (12.32 | )% | | (3.09 | )% | | (3.88 | )% | | 13.44 | % | | 13.44 | % | | 3.91 | % | | 3.91 | % |

R | | (12.04 | )% | | (2.50 | )% | | — | | | 13.97 | % | | — | | | 4.33 | % | | — | |

Russell 2500TM Growth Index | | (11.38 | )% | | (6.25 | )% | | — | | | 15.46 | % | | — | | | 4.27 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 881.54 | | $ | 5.17 | | $ | 1,000.00 | | $ | 1,019.43 | | $ | 5.57 |

Investor A | | $ | 1,000.00 | | $ | 880.39 | | $ | 6.33 | | $ | 1,000.00 | | $ | 1,018.18 | | $ | 6.82 |

Investor B | | $ | 1,000.00 | | $ | 877.09 | | $ | 9.85 | | $ | 1,000.00 | | $ | 1,014.37 | | $ | 10.63 |

Investor C | | $ | 1,000.00 | | $ | 876.84 | | $ | 9.85 | | $ | 1,000.00 | | $ | 1,014.37 | | $ | 10.63 |

R | | $ | 1,000.00 | | $ | 879.64 | | $ | 7.47 | | $ | 1,000.00 | | $ | 1,016.96 | | $ | 8.04 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.10% for Institutional, 1.35% for Investor A, 2.10% Investor B, 2.10% for Investor C and 1.59% for R), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 13 |

| | |

| Portfolio Summary (Unaudited) | | Small Cap Value Equity Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | Portfolio returns underperformed that of the benchmark Russell 2000 Value Index for the six-month period ended March 31, 2008. |

What factors influenced performance?

| • | | In terms of performance detractors, the positive impact of an underweight in information technology was overshadowed by poor stock selection. Stocks that disappointed included semiconductor names RF Micro Devices, Trident Microsystems, PNC-Sierra and Cirrus Logic; software companies Lawson Software and Guidance Software; and Electronics for Imaging, a producer of printing and imaging products. |

| • | | Stock selection in materials and financials also hindered the Portfolio’s relative results. Chemicals company H.B. Fuller detracted, as did stock selection and an underweight in metals & mining stocks, which outperformed on spiking commodity prices. In financials, key detractors were commercial banks Boston Private Financial, Sterling Financial and First Midwest Bancorp, and capital markets names Piper Jaffray and TradeStation Group. |

| • | | Contributing to the Portfolio’s relative results was favorable stock selection in the industrials, healthcare and energy sectors, in addition to stock selection and an overweight position in consumer staples. |

| • | | Within industrials, top performers included armored car and home security provider Brink’s and global human resources consulting firm Watson Wyatt Worldwide. Marine shipper Kirby Corp. and aerospace & defense firm Orbital Sciences also added value in the sector. In healthcare, healthcare provider Kindred Healthcare contributed to Portfolio returns, as did pharmaceuticals company Axcan Pharma, which was taken private by TPG Capital. |

| • | | Top stocks in energy included W-H Energy Services, Oil States International and Lufkin Industries within the equipment & services subsector, and Delta Petroleum and Swift Energy within exploration & production. In consumer staples, food and staples retailers BJ’s Wholesale Club and Ruddick Corp., operator of the Harris Teeter supermarket chain, provided positive attribution. |

Describe recent Portfolio activity.

| • | | During the six-month period, we increased exposure to utilities, primarily electric utilities, and consumer discretionary. In the latter sector, we established positions in Jack in the Box, WMS Industries and Scientific Games in the hotels, restaurants & gaming category, while also increasing our position in LeapFrog Enterprises. Meanwhile, we trimmed exposure to specialty retailers and apparel manufacturers. |

| • | | We reduced exposure to financials and information technology. Notable sales included Sterling Financial, Cathay General Bancorp, Umpqua Holdings and Boston Private Financial (all commercial banks), and LaSalle Hotel Properties and Capital Trust (two real estate investment trusts). Within IT, we sold Electronics for Imaging as well as underperforming semiconductor names RF Micro Devices, Trident Microsystems, Tessera Technologies and Cirrus Logic. |

Describe Portfolio positioning at period-end.

| • | | The Portfolio ended the period overweight most notably in consumer discretionary, consumer staples, industrials and healthcare, and underweight primarily in financials and information technology. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

The Brink’s Co. | | 4 | % |

Ruddick Corp. | | 4 | |

Magellan Health Services, Inc. | | 3 | |

LKQ Corp. | | 3 | |

Texas Industries, Inc. | | 2 | |

BJ’s Wholesale Club, Inc. | | 2 | |

Hain Celestial Group, Inc. | | 2 | |

SkillSoft Plc - ADR | | 2 | |

Piper Jaffray Cos., Inc. | | 2 | |

Silgan Holdings, Inc. | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Retail Merchandising | | 10 | % |

Entertainment & Leisure | | 10 | |

Medical & Medical Services | | 9 | |

Banks | | 8 | |

Oil & Gas | | 7 | |

Business Services | | 6 | |

Manufacturing | | 6 | |

Computer Software & Services | | 5 | |

Insurance | | 4 | |

Real Estate | | 4 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 14 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Small Cap Value Equity Portfolio |

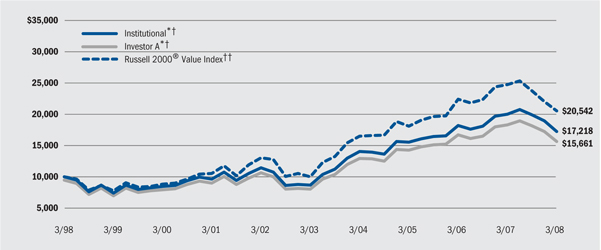

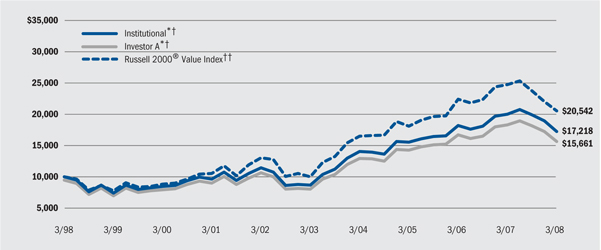

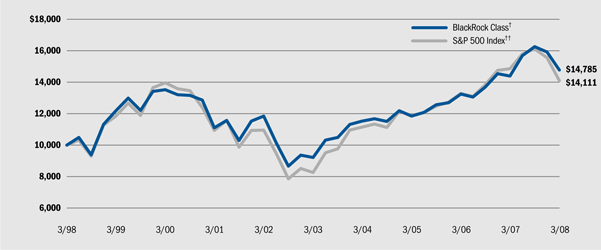

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | The Portfolio normally invests at least 80% of its net assets in equity securities issued by U.S. small capitalization value companies (market capitalizations under $2 billion). |

| †† | An index that contains those securities with less-than-average growth orientations, generally having lower price-to-book and price-to-earnings ratios. |

The Portfolio is closed to new investors. Existing shareholders may make additional investments in current accounts. In addition, new accounts may be opened by (i) any investor if the tax ID number for the new account will be the same as that for a current account and (ii) 401(k), 403(b), 457 and other similar group retirement plan programs or certain discretionary wrap fee programs that have current accounts.

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

BlackRock | | (13.46 | )% | | (14.11 | )% | | — | | | 14.53 | % | | — | | | 5.44 | % | | — | |

Institutional | | (13.43 | )% | | (13.94 | )% | | — | | | 14.69 | % | | — | | | 5.58 | % | | — | |

Service | | (13.55 | )% | | (14.07 | )% | | — | | | 14.34 | % | | — | | | 5.27 | % | | — | |

Investor A | | (13.60 | )% | | (14.27 | )% | | (18.78 | )% | | 14.25 | % | | 13.03 | % | | 5.15 | % | | 4.59 | % |

Investor B | | (13.95 | )% | | (14.75 | )% | | (17.89 | )% | | 13.42 | % | | 13.26 | % | | 4.50 | % | | 4.50 | % |

Investor C | | (13.88 | )% | | (14.87 | )% | | (15.56 | )% | | 13.37 | % | | 13.37 | % | | 4.35 | % | | 4.35 | % |

Russell 2000® Value Index | | (13.05 | )% | | (16.88 | )% | | — | | | 15.45 | % | | — | | | 7.46 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During Period* |

BlackRock | | $ | 1,000.00 | | $ | 865.43 | | $ | 5.13 | | $ | 1,000.00 | | $ | 1,019.43 | | $ | 5.57 |

Institutional | | $ | 1,000.00 | | $ | 865.74 | | $ | 4.18 | | $ | 1,000.00 | | $ | 1,020.46 | | $ | 4.54 |

Service | | $ | 1,000.00 | | $ | 864.46 | | $ | 5.88 | | $ | 1,000.00 | | $ | 1,018.61 | | $ | 6.39 |

Investor A | | $ | 1,000.00 | | $ | 864.00 | | $ | 6.13 | | $ | 1,000.00 | | $ | 1,018.34 | | $ | 6.66 |

Investor B | | $ | 1,000.00 | | $ | 860.54 | | $ | 10.12 | | $ | 1,000.00 | | $ | 1,013.99 | | $ | 11.01 |

Investor C | | $ | 1,000.00 | | $ | 861.20 | | $ | 10.08 | | $ | 1,000.00 | | $ | 1,014.04 | | $ | 10.96 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.10% for BlackRock, 0.90% for Institutional, 1.26% for Service, 1.32% for Investor A, 2.18% for Investor B and 2.17% for Investor C), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 15 |

| | |

| Portfolio Summary (Unaudited) | | Small Cap Core Equity Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | Portfolio results lagged that of the benchmark Russell 2000 Index for the six-month period ended March 31, 2008. |

What factors influenced performance?

| • | | Stock selection and an underweight position in financials detracted from Portfolio performance, primarily within the commercial bank, insurance and capital markets categories. Key laggards included Evercore Partners and Piper Jaffray. Stock selection in industrials also hindered fund performance (led by tool manufacturer Hardinge Inc. and auto parts producer Accuride Corp.), as did stock picks in consumer staples. |

| • | | In a challenging market environment for consumer-related stocks, an underweight in consumer discretionary added value. However, these gains were overshadowed by disappointing stock selection, particularly among hotels, restaurants & leisure names, including Pinnacle Entertainment and Morgans Hotel Group, and select specialty retailers. |

| • | | Bright spots during the period included stock selection in healthcare, information technology and telecommunication services. Within healthcare, key contributors included Icon PLC and Kendle International, providers of clinical research and drug development services, healthcare provider Amedisys, biotechnology firm Dyax Corp. and Axcan Pharma, a pharmaceuticals company that was taken private by TPG Capital. In information technology, top performers included Skillsoft PLC, a provider of Web-based education and training; EMS Technologies, a communications equipment company; and Forrester Research in IT services. In telecommunications, Iowa Telecommunications Services was a standout. |

Describe recent Portfolio activity.

| • | | During the six-month period, we increased the Portfolio’s exposure to consumer discretionary, energy and information technology. Within consumer discretionary, we added new positions in specialty retailers AnnTaylor Stores, Coldwater Creek and Christopher & Banks, and household durables company Jarden. In energy, we added to existing holdings in equipment & services and established a position in Penn Virginia Corp. In information technology, we added to our software exposure and established positions in Benchmark Electronics and TTM Technologies (both in electronics equipment). |

| • | | Meanwhile, we reduced exposure to healthcare. We sold equipment & supply manufacturer DJO (upon a takeover), Kendle International and Axcan Pharma (upon the aforementioned private equity takeout). |

Describe Portfolio positioning at period-end.

| • | | The Portfolio ended the period modestly overweight in healthcare (primarily healthcare providers and healthcare technology) and consumer staples (particularly personal products). Notable underweights included financials (thrift & mortgage finance, real estate investment trusts and insurance) and materials (metals & mining and chemicals). |

Performance Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

SkillSoft Plc - ADR | | 3 | % |

Actuant Corp. - Class A | | 2 | |

Copart, Inc. | | 2 | |

Chart Industries, Inc. | | 2 | |

EMS Technologies, Inc. | | 2 | |

First Mercury Financial Corp. | | 2 | |

Blackboard, Inc. | | 2 | |

Elizabeth Arden, Inc. | | 2 | |

Gramercy Capital Corp. (REIT) | | 2 | |

Orient-Express Hotels Ltd. - Class A | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Computer Software & Services | | 15 | % |

Manufacturing | | 10 | |

Retail Merchandising | | 8 | |

Oil & Gas | | 8 | |

Banks | | 8 | |

Real Estate | | 5 | |

Business Services | | 4 | |

Medical Instruments & Supplies | | 4 | |

Entertainment & Leisure | | 4 | |

Medical & Medical Services | | 4 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 16 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Small Cap Core Equity Portfolio |

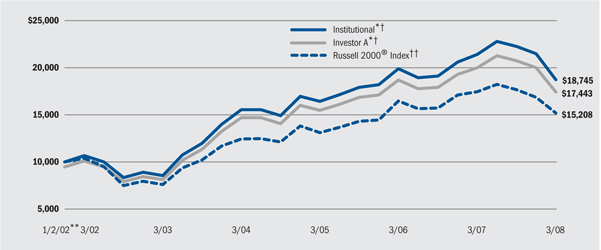

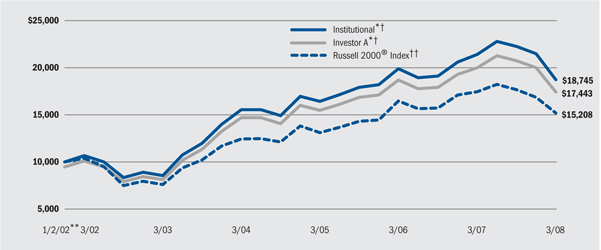

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| ** | Commencement of operations. |

| † | The Portfolio normally invests at least 80% of its net assets in the equity securities of U.S. small capitalization companies (market capitalizations under $2 billion). |

†† | An index that measures the performance of the 2000 smallest companies in the Russell 3000® |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | From Inception** | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (15.95 | )% | | (12.61 | )% | | — | | | 16.95 | % | | — | | | 10.59 | % | | — | |

Service | | (16.06 | )% | | (12.87 | )% | | — | | | 16.74 | % | | — | | | 10.44 | % | | — | |

Investor A | | (16.13 | )% | | (13.01 | )% | | (17.56 | )% | | 16.51 | % | | 15.28 | % | | 10.27 | % | | 9.32 | % |

Investor B | | (16.48 | )% | | (13.70 | )% | | (17.30 | )% | | 15.72 | % | | 15.50 | % | | 9.67 | % | | 9.67 | % |

Investor C | | (16.45 | )% | | (13.63 | )% | | (14.43 | )% | | 15.76 | % | | 15.76 | % | | 9.69 | % | | 9.69 | % |

Russell 2000® Index | | (14.02 | )% | | (13.00 | )% | | — | | | 14.90 | % | | — | | | 6.94 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

| ** | The Portfolio commenced operations on 1/2/02. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 840.51 | | $ | 5.94 | | $ | 1,000.00 | | $ | 1,018.46 | | $ | 6.54 |

Service | | $ | 1,000.00 | | $ | 839.43 | | $ | 7.16 | | $ | 1,000.00 | | $ | 1,017.12 | | $ | 7.88 |

Investor A | | $ | 1,000.00 | | $ | 838.66 | | $ | 8.05 | | $ | 1,000.00 | | $ | 1,016.14 | | $ | 8.86 |

Investor B | | $ | 1,000.00 | | $ | 835.20 | | $ | 11.51 | | $ | 1,000.00 | | $ | 1,012.30 | | $ | 12.70 |

Investor C | | $ | 1,000.00 | | $ | 835.53 | | $ | 11.37 | | $ | 1,000.00 | | $ | 1,012.45 | | $ | 12.55 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.29% for Institutional, 1.56% for Service, 1.75% for Investor A, 2.51% for Investor B and 2.48% for Investor C), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 17 |

| | |

Portfolio Summary (Unaudited) | | Small Cap Growth Equity Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | Against a challenging investment backdrop, the Portfolio posted strong relative performance, outpacing the return of the benchmark Russell 2000 Growth Index. |

What factors influenced performance?

| • | | Strong stock selection in information technology (IT) and industrials accounted for the majority of the Portfolio’s outperformance of the benchmark. IT software & services was an important contributor. Top holding SkilSoft continued to execute in a tough environment, gaining 16% during the period. Likewise, IT services was a top industry contributor, led by strong performance from ExlService and Forrester Research. |

| • | | Stock selection in industrials also boosted fund returns, as commercial services names IHS Incorporated, Watson Wyatt Worldwide and Clean Harbors all posted double-digit gains for the period. Machinery holding Bucyrus International was the largest overall contributor to the Portfolio. |

| • | | Coal company Massey Energy also added significant value, as increased coal spot prices and rising foreign demand lifted the stock. |

| • | | Stock selection in consumer discretionary and consumer staples detracted from relative returns. In consumer discretionary, the hotels and leisure industry accounted for most of the weakness. Scientific Games and Ameristar Casinos both posted significant declines for the six-month period. Within consumer staples, our holding in Green Mountain Coffee was down more than 20% on worries of decreased consumer spending and rising costs of coffee beans. |

Describe recent Portfolio activity.

| • | | During the period, we significantly increased our underweight position in the consumer discretionary sector, eliminating a variety of names, including Vail Resorts, Life Time Fitness and Pinnacle Entertainment. |

| • | | We increased our weighting in the healthcare sector, adding positions in LifeCell, Martek Biosciences and ArthroCare. |

Describe Portfolio positioning at period-end.

| • | | As of March 31, 2008, the Portfolio’s most significant overweight was in the information technology sector, with a diverse group of holdings. The most significant underweight was in the consumer discretionary sector. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

SkillSoft Plc - ADR | | 4 | % |

IHS, Inc. | | 3 | |

Sykes Enterprises, Inc. | | 3 | |

Pediatrix Medical Group, Inc. | | 3 | |

ExlService Holdings, Inc. | | 3 | |

Wright Medical Group, Inc. | | 2 | |

Atwood Oceanics, Inc. | | 2 | |

Forrester Research, Inc. | | 2 | |

Quanex Corp. | | 2 | |

Orient-Express Hotels Ltd. - Class A | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Computer Software & Services | | 20 | % |

Business Services | | 10 | |

Medical Instruments & Supplies | | 10 | |

Medical & Medical Services | | 9 | |

Oil & Gas | | 8 | |

Manufacturing | | 7 | |

Entertainment & Leisure | | 4 | |

Semiconductors & Related Devices | | 4 | |

Finance | | 3 | |

Aerospace | | 3 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 18 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Small Cap Growth Equity Portfolio |

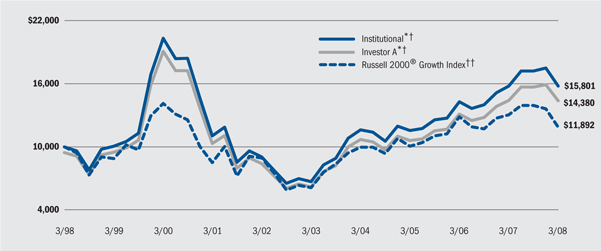

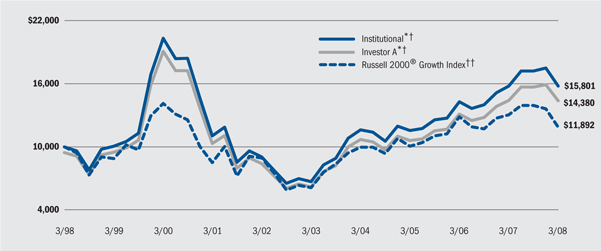

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| † | The Portfolio normally invests at least 80% of its net assets in equity securities issued by U.S. small capitalization growth companies which the portfolio management team believes offer superior prospects for growth. |

| †† | An index that contains those securities with greater-than-average growth orientations, generally having higher price-to-book and price-to-earnings ratios. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (8.31 | )% | | 0.09 | % | | — | | | 18.77 | % | | — | | | 4.68 | % | | — | |

Service | | (8.46 | )% | | (0.15 | )% | | — | | | 18.46 | % | | — | | | 4.39 | % | | — | |

Investor A | | (8.47 | )% | | (0.20 | )% | | (5.45 | )% | | 18.38 | % | | 17.11 | % | | 4.26 | % | | 3.70 | % |

Investor B | | (8.94 | )% | | (0.95 | )% | | (5.40 | )% | | 17.40 | % | | 17.19 | % | | 3.65 | % | | 3.65 | % |

Investor C | | (8.89 | )% | | (1.17 | )% | | (2.15 | )% | | 17.41 | % | | 17.41 | % | | 3.46 | % | | 3.46 | % |

Russell 2000® Growth Index | | (14.66 | )% | | (8.95 | )% | | — | | | 14.24 | % | | — | | | 1.75 | % | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 916.91 | | $ | 3.79 | | $ | 1,000.00 | | $ | 1,020.99 | | $ | 4.01 |

Service | | $ | 1,000.00 | | $ | 915.41 | | $ | 5.29 | | $ | 1,000.00 | | $ | 1,019.41 | | $ | 5.59 |

Investor A | | $ | 1,000.00 | | $ | 915.35 | | $ | 5.40 | | $ | 1,000.00 | | $ | 1,019.29 | | $ | 5.71 |

Investor B | | $ | 1,000.00 | | $ | 910.58 | | $ | 10.27 | | $ | 1,000.00 | | $ | 1,014.11 | | $ | 10.89 |

Investor C | | $ | 1,000.00 | | $ | 911.10 | | $ | 9.86 | | $ | 1,000.00 | | $ | 1,014.56 | | $ | 10.44 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (0.79% for Institutional, 1.11% for Service, 1.13% for Investor A, 2.15% for Investor B and 2.06% for Investor C), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 19 |

| | |

Portfolio Summary (Unaudited) | | Global Science & Technology Opportunities Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

| • | | Returns for the Portfolio’s Institutional and Investor A shares were generally in line with that of the benchmark NYSE ARCA Tech 100 Index for the six-month period, while Service, Investor B and Investor C shares lagged the benchmark return. |

What factors influenced performance?

| • | | Portfolio underperformance during the reporting period was the result of negative stock selection effects, while sector allocation contributed positively to results. |

| • | | Stock selection within information technology was the biggest detractor from performance. In particular, results were weak within semiconductors and technology hardware & equipment. Within healthcare, stock selection in the life sciences tools & services hindered relative results. |

| • | | From an individual stock point of view, the Portfolio’s lack of exposure to Genzyme Corp. and Genentech Inc. proved most unfavorable, as these biotechnology stocks performed strongly in a declining market, which hurt relative comparisons. A position in Google Inc. also detracted from results during the period, as company shares declined more than 20%. |

| • | | Conversely, an underweight relative to the benchmark in information technology and an allocation to telecommunication services, which is not a component of the benchmark, contributed positively. Within information technology, relative positioning also was a positive contributor. Underweight positions in semiconductors & semiconductor equipment and data processing & outsourced services and an overweight in Internet software & services supported relative results during the period. |

| • | | Elsewhere, an overweight in healthcare equipment contributed to alpha generation. Additionally, we benefited from our stock positioning within the software & services and capital goods industry groups. |

| • | | The stocks contributing most significantly to outperformance included global pharmaceutical company Pharmion and business intelligence software developer Business Objects. Despite a weak overall market environment, these companies experienced strong gains during the period. |

Describe recent Portfolio activity.

| • | | Portfolio positioning shifted in some areas during the quarter consistent with our investment process. Specifically, we added to Portfolio holdings in healthcare equipment, systems software and computer hardware. In contrast, the Portfolio’s exposure to biotechnology, capital goods, application software and internet software & services declined over the period. |

Describe Portfolio positioning at period-end.

| • | | At the end of the reporting period, the Portfolio was most overweight relative to the benchmark in healthcare equipment and home entertainment software and had an allocation to telecommunication services, which is not included in the benchmark. Underweighted sectors included biotechnology and life science tools & services, application software and aerospace & defense. |

| • | | Geographically, approximately 20% of the Portfolio’s net assets was allocated to non-U.S. companies. |

Portfolio Profile as of March 31, 2008

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Apple Computer, Inc. | | 5 | % |

International Business Machines Corp. | | 3 | |

Microsoft Corp. | | 2 | |

DST Systems, Inc. | | 2 | |

Hewlett-Packard Co. | | 2 | |

Lockheed Martin Corp. | | 2 | |

Gilead Sciences, Inc. | | 2 | |

Oracle Corp. | | 2 | |

Intel Corp. | | 2 | |

Becton, Dickinson & Co. | | 2 | |

| |

Ten Largest Industries | | Percent of

Long-Term

Investments | |

Computer Software & Services | | 30 | % |

Computer & Office Equipment | | 13 | |

Telecommunications | | 12 | |

Semiconductors & Related Devices | | 11 | |

Medical Instruments & Supplies | | 10 | |

Pharmaceuticals | | 7 | |

Electronics | | 4 | |

Aerospace | | 4 | |

Medical & Medical Services | | 2 | |

Manufacturing | | 2 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 20 | | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | |

| | |

| Portfolio Summary (concluded) | | Global Science & Technology Opportunities Portfolio |

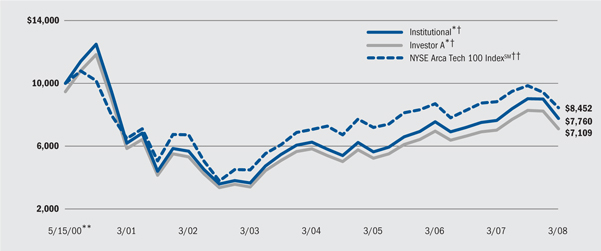

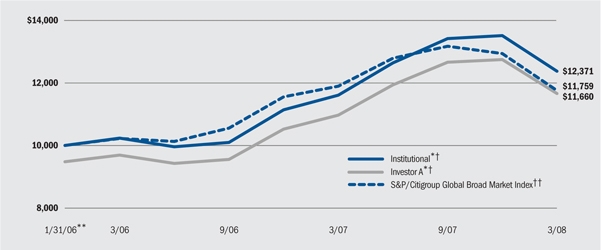

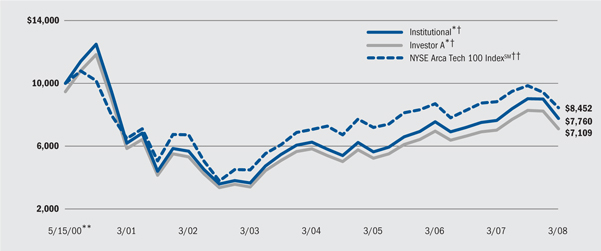

Total Return Based on a $10,000 Investment

| * | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. |

| ** | Commencement of operations. |

| † | The Portfolio will invest primarily in equity securities of U.S. and non-U.S. companies in all capitalization ranges selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology. |

| †† | A price-weighted index comprised of not more than 100 individual stocks listed on the NYSE, AMEX or NASDAQ. The index is modeled to represent a broad spectrum of companies engaged principally in manufacturing products and/or providing services within technology fields. |

Performance Summary for the Period Ended March 31, 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns* | |

| | | | | | 1 Year | | | 5 Years | | | From Inception** | |

| | | 6-Month

Total Returns | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | | | w / o sales

charge | | | w / sales

charge | |

Institutional | | (14.06 | )% | | 1.44 | % | | — | | | 16.22 | % | | — | | | (3.17 | )% | | — | |

Service | | (14.27 | )% | | 0.93 | % | | — | | | 15.83 | % | | — | | | (3.47 | )% | | — | |

Investor A | | (14.19 | )% | | 1.08 | % | | (4.21 | )% | | 15.75 | % | | 14.51 | % | | (3.59 | )% | | (4.24 | )% |

Investor B | | (14.65 | )% | | 0.14 | % | | (4.36 | )% | | 14.84 | % | | 14.61 | % | | (4.34 | )% | | (4.34 | )% |

Investor C | | (14.67 | )% | | 0.00 | % | | (1.00 | )% | | 14.80 | % | | 14.80 | % | | (4.36 | )% | | (4.36 | )% |

NYSE Arca Tech 100 IndexSM | | (14.15 | )% | | (4.26 | )% | | — | | | 13.45 | % | | — | | | (2.11 | )% | | — | |

| * | Assuming maximum sales charges. See “About Portfolios’ Performance” on page 34 for a detailed description of share classes, including any related sales charges and fees. |

| ** | The Portfolio commenced operations on 5/15/00. |

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical** |

| | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* | | Beginning

Account Value

October 1, 2007 | | Ending

Account Value

March 31, 2008 | | Expenses Paid

During the Period* |

Institutional | | $ | 1,000.00 | | $ | 859.36 | | $ | 6.28 | | $ | 1,000.00 | | $ | 1,018.17 | | $ | 6.83 |

Service | | $ | 1,000.00 | | $ | 857.30 | | $ | 8.04 | | $ | 1,000.00 | | $ | 1,016.24 | | $ | 8.76 |

Investor A | | $ | 1,000.00 | | $ | 858.12 | | $ | 8.13 | | $ | 1,000.00 | | $ | 1,016.14 | | $ | 8.86 |

Investor B | | $ | 1,000.00 | | $ | 853.51 | | $ | 12.25 | | $ | 1,000.00 | | $ | 1,011.61 | | $ | 13.39 |

Investor C | | $ | 1,000.00 | | $ | 853.33 | | $ | 12.00 | | $ | 1,000.00 | | $ | 1,011.89 | | $ | 13.11 |

| * | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.35% for Institutional, 1.73% for Service, 1.75% for Investor A, 2.64% for Investor B and 2.59% for Investor C), multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| ** | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366. |

See “Disclosure of Expenses” on page 35 for further information on how expenses were calculated.

| | | | | | |

| | SEMI-ANNUAL REPORT | | MARCH 31, 2008 | | 21 |

| | |

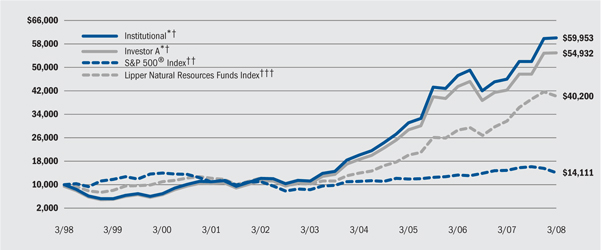

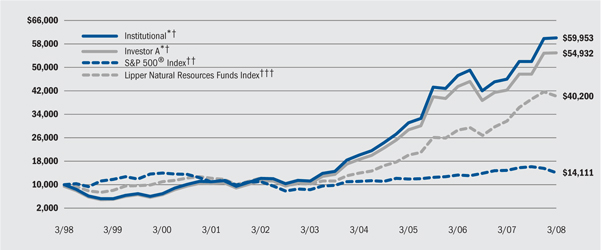

Portfolio Summary (Unaudited) | | Global Resources Portfolio |

Portfolio Management Commentary

How did the Portfolio perform?

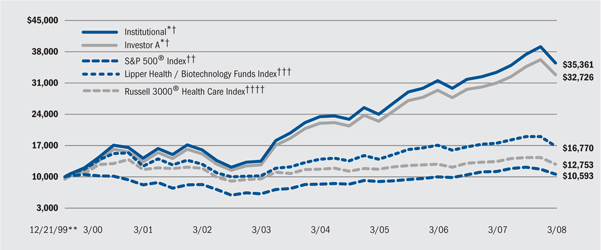

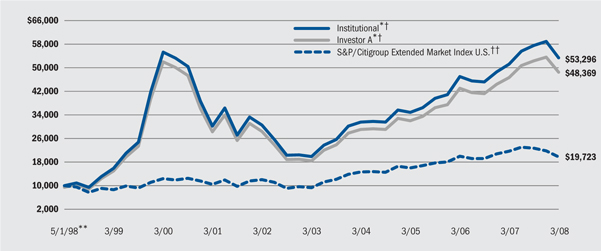

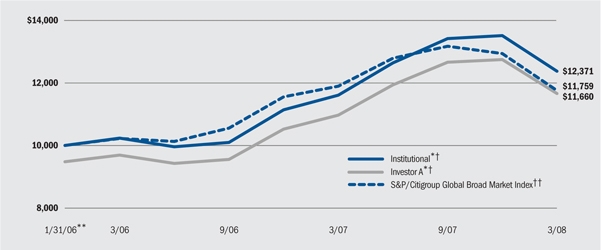

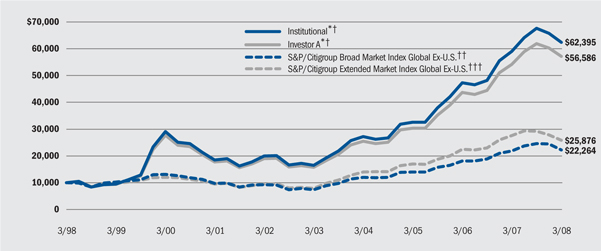

| • | | The Portfolio produced strong absolute and relative returns, outperforming the broad-market S&P 500 Index and the Lipper Natural Resources Funds Index, its sector benchmark, for the six-month period. |