UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05742

Name of Fund: BlackRock Funds

| | |

All-Cap Energy & Resources Portfolio Asset Allocation Portfolio Aurora Portfolio Capital Appreciation Portfolio Energy & Resources Portfolio Global Opportunities Portfolio Health Sciences Opportunities Portfolio International Opportunities Portfolio Mid-Cap Growth Equity Portfolio Mid-Cap Value Equity Portfolio Science & Technology Opportunities Portfolio Small Cap Core Equity Portfolio Small Cap Growth Equity Portfolio Small Cap Value Equity Portfolio Small/Mid-Cap Growth Portfolio U.S. Opportunities Portfolio | | |

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock Funds, 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing address: P.O. Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2009

Date of reporting period: 03/31/2009

| | | | |

| Item 1 | | – | | Report to Stockholders |

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

| | |

| BlackRock FundsSM | |  |

| SEMI-ANNUAL REPORT | MARCH 31, 2009 (UNAUDITED) | | |

BlackRock All-Cap Energy & Resources Portfolio

BlackRock Aurora Portfolio

BlackRock Capital Appreciation Portfolio

BlackRock Energy & Resources Portfolio

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| | | | | | |

2 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

A Letter to Shareholders

The past 12 months have been a period investors would like to forget, but instead will vividly remember, as the global financial crisis erupted into the worst recession in decades. Daily headlines recounted the downfalls of storied financial firms, volatile swings in the world’s financial markets and monumental government actions, including the recent passage of the nearly $800 billion American Recovery and Reinvestment Act of 2009.

The economic data generally deteriorated throughout the reporting period. US gross domestic product (“GDP”) contracted at an annual rate of 6.3% in the fourth quarter of 2008, and economic activity appears on pace to be negative in the first quarter of 2009 as well. The Federal Reserve Board (the “Fed”) took forceful action to revive the global economy and ailing financial system. In addition to slashing the federal funds target rate from 3.0% to a record low range of 0% to 0.25%, the central bank provided enormous cash infusions and radically expanded its balance sheet through a range of lending and acquisition programs.

Against this backdrop, US equities contended with high levels of volatility and posted steep losses, notwithstanding a powerful rally in the final month of the reporting period. International markets also experienced sharp downturns, with some regions declining as much or more than the United States. Risk aversion remained the dominant theme in fixed income markets, as investors sought out the haven of Treasury issues at the expense of virtually all other asset classes. High yield issues, in particular, faced unprecedented challenges and posted severe underperformance; that said, the sector pared its losses in the first quarter of 2009, as both liquidity and investor sentiment toward lower-quality debt improved. At the same time, the start of the new year brought somewhat of a return to normalcy for the tax-exempt market, which registered one of its worst years on record in 2008.

In all, investors continued to gravitate toward relative safety, as evidenced in the six- and 12-month returns of the major benchmark indexes:

| | | | | | |

Total Returns as of March 31, 2009 | | 6-month | | | 12-month | |

US equities (S&P 500 Index) | | (30.54 | )% | | (38.09 | )% |

Small cap US equities (Russell 2000 Index) | | (37.17 | ) | | (37.50 | ) |

International equities (MSCI Europe, Australasia, Far East Index) | | (31.11 | ) | | (46.50 | ) |

US Treasury securities (Merrill Lynch 10-Year US Treasury Index) | | 11.88 | | | 10.46 | |

Taxable fixed income (Barclays Capital US Aggregate Bond Index) | | 4.70 | | | 3.13 | |

Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | | 5.00 | | | 2.27 | |

High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | | (12.65 | ) | | (18.56) | |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Through periods of market turbulence, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. We thank you for entrusting BlackRock with your investments and look forward to continuing to serve you in the months and years ahead.

|

| Sincerely, |

|

|

| Rob Kapito |

| President, BlackRock Advisors, LLC |

Seeking additional investment insights?

Visit BlackRock’s award-winning Shareholder® magazine, now available exclusively online at www.blackrock.com/shareholdermagazine. In this issue:

| • | | Discover why portfolio diversification still matters – even as nearly every financial asset class lost value over the past year. |

| • | | Learn how adding commodities to a more traditional mix of assets can help you to balance risks and access new potential rewards. |

| • | | Assuage your fears about higher taxes and discover how municipal bonds may offer some relief. |

| • | | Find out if there’s still value to be found in dividend-paying stocks. |

THIS PAGE NOT PART OF YOUR FUND REPORT

| | |

| Portfolio Summary as of March 31, 2009 | | All-Cap Energy & Resources Portfolio (formerly All-Cap Global Resources Portfolio) |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio underperformed the broad-market S&P 500 Index and the Lipper Natural Resources Funds Index, its sector benchmark, for the six-month period. |

What factors influenced performance?

| | • | | Detracting from performance was the Portfolio’s aggressive positioning (i.e., being fully invested); this hurt performance as we entered a period of financial turmoil and extreme global economic weakness. We remained almost fully invested as the market collapsed during the fourth quarter of 2008. Oil prices fell from more than $100/barrel to about $30/barrel, before rebounding recently. As a result, energy stocks were particularly weak toward the end of 2008, causing the Portfolio to underperform. Coal producers and natural-gas-related stocks were among the hardest hit, as pricing weakened significantly within these segments. As such, the Portfolio’s overweight in exploration & production and coal & consumable fuels detracted considerably from results. |

| | • | | Relative to the broad market, the lack of exposure to financials contributed to the Portfolio’s relative performance over the six months. However, given the broad nature of the market decline in the fourth quarter of 2008, none of the subsectors in the Portfolio contributed significantly to returns. Notably, we did witness a rebound in the stocks in the first quarter of 2009. The Portfolio posted positive absolute and relative returns during that period, led by a mid-cap focus and a rebound in oil-related names and metals & mining companies, as oil and industrial metals prices strengthened. |

Describe recent Portfolio activity.

| | • | | No significant changes were made to the Portfolio during the period. We modestly increased exposure to the metals complex on concerns over future inflation due to the current amount of monetary and fiscal stimulus. |

Describe Portfolio positioning at period-end.

| | • | | Overall, we continue to believe oil, natural gas and coal stocks offer compelling value, even with relatively muted growth expectations. As cuts to exploration and production projects take hold in the coming months, we expect supply-demand dynamics to come back into balance sooner than many may anticipate. Similar to 1998/1999, dramatic downward price moves will likely take too much supply off the market at a time when economies are beginning to stabilize, resulting in significantly higher prices. As this unfolds, we expect the stocks to participate in a meaningful upward revaluation. In anticipation, we have positioned the Portfolio in those stocks and industries that should have the most leverage toward upward-moving prices, while ensuring that the Portfolio’s holdings should be somewhat stable in a flat commodity price environment. We continue to emphasize oil and gas exploration & production, oil service and coal producers. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Range Resources Corp. | | 3 | % |

CONSOL Energy, Inc. | | 3 | |

Potash Corp. of Saskatchewan, Inc. | | 3 | |

Occidental Petroleum Corp. | | 3 | |

FMC Technologies, Inc. | | 3 | |

Bill Barrett Corp. | | 3 | |

Southwestern Energy Co. | | 3 | |

BG Group Plc - ADR | | 3 | |

Silver Wheaton Corp. | | 3 | |

Hess Corp. | | 3 | |

| | | |

Industry Representation | | Percent of

Long-Term

Investments | |

Oil, Gas & Consumable Fuels | | 61 | % |

Energy Equipment & Services | | 21 | |

Metals & Mining | | 11 | |

Gas Utilities | | 4 | |

Chemicals | | 3 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

4 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Portfolio Summary as of March 31, 2009 | | All-Cap Energy & Resources Portfolio |

| |

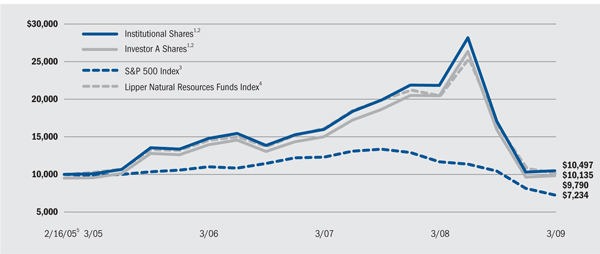

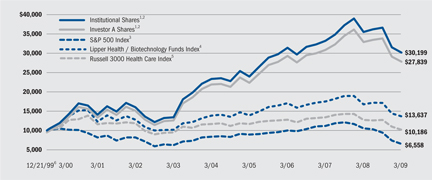

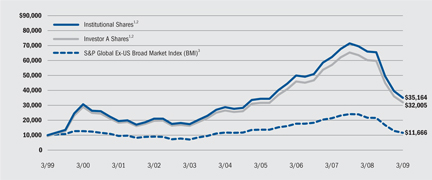

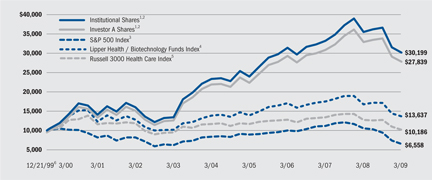

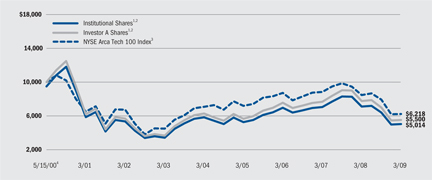

Total Return Based on a $10,000 Investment | | |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Portfolio invests at least 80% of its total assets in securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| 3 | This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly NYSE issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. S&P 500 is a trademark of the McGraw-Hill Companies. |

| 4 | An equally weighted index of typically the 30 largest mutual funds within its respective investment objective. |

| 5 | Commencement of operations. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns6 | |

| | | | | | 1 Year | | | From Inception7 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | (38.48 | )% | | (52.01 | )% | | N/A | | | 1.19 | % | | N/A | |

Service | | (38.56 | ) | | (52.16 | ) | | N/A | | | 0.79 | | | N/A | |

Investor A | | (38.56 | ) | | (52.16 | ) | | (54.67 | )% | | 0.79 | | | (0.51 | )% |

Investor B | | (38.76 | ) | | (52.51 | ) | | (54.27 | ) | | 0.06 | | | (0.32 | ) |

Investor C | | (38.80 | ) | | (52.53 | ) | | (52.92 | ) | | 0.08 | | | 0.08 | |

S&P 500 Index | | (30.54 | ) | | (38.09 | ) | | N/A | | | (7.73 | ) | | N/A | |

Lipper Natural Resources Funds Index | | (19.76 | ) | | (17.57 | ) | | N/A | | | 0.33 | | | N/A | |

| 6 | Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Portfolio Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 7 | The Portfolio commenced operations on February 16, 2005. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical9 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period8 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period8 |

Institutional | | $ | 1,000.00 | | $ | 615.20 | | $ | 3.75 | | $ | 1,000.00 | | $ | 1,020.30 | | $ | 4.70 |

Service | | $ | 1,000.00 | | $ | 614.40 | | $ | 5.39 | | $ | 1,000.00 | | $ | 1,018.23 | | $ | 6.77 |

Investor A | | $ | 1,000.00 | | $ | 614.40 | | $ | 5.39 | | $ | 1,000.00 | | $ | 1,018.23 | | $ | 6.77 |

Investor B | | $ | 1,000.00 | | $ | 612.40 | | $ | 8.20 | | $ | 1,000.00 | | $ | 1,014.70 | | $ | 10.30 |

Investor C | | $ | 1,000.00 | | $ | 612.00 | | $ | 8.20 | | $ | 1,000.00 | | $ | 1,014.70 | | $ | 10.30 |

| 8 | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (0.93% for Institutional, 1.34% for Service, 1.34% for Investor A, 2.04% for Investor B and 2.04% for Investor C), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 9 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 5 |

| | |

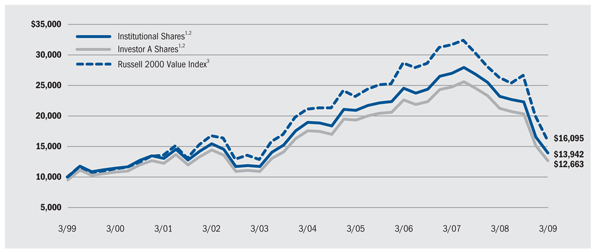

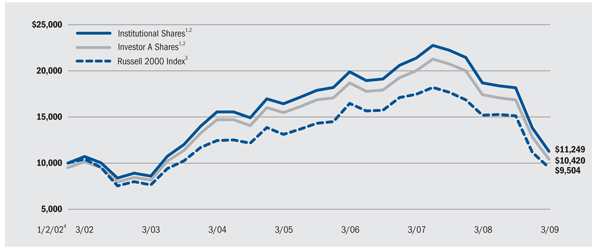

| Portfolio Summary as of March 31, 2009 | | Aurora Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio outperformed the benchmark Russell 2500 Value Index for the six-month period. |

What factors influenced performance?

| | • | | In an extremely volatile period for financial stocks, the Portfolio’s relative performance benefited most directly from strong stock selection in the financials sector. PHH Corp., Annaly Capital Management, Inc. and Fidelity National Financial were among the standout individual contributors. A significant underweight in real estate investment trusts (REITs), which sold off sharply during the period, also added value to Portfolio returns. |

| | • | | In industrials, positive stock selection among commercial services and supplies names, including The Brink’s Co. and pest control services provider Rollins, Inc., benefited relative returns. The Portfolio’s machinery holdings also outperformed their benchmark counterparts, contributing to favorable performance comparisons. |

| | • | | While overweight positions in the information technology and consumer discretionary sectors created value, these relative gains were overshadowed by the negative impact of weak stock selection. Customer management services provider Convergys and specialty retailer Collective Brands, Inc. were among the key individual detractors from Portfolio performance, and both of these positions were eliminated during the period. |

| | • | | The utilities sector outperformed the broader market during the period as investors preferred the more defensive areas of the market. Accordingly, an underweight among utilities stocks detracted from the Portfolio’s relative performance. |

Describe recent Portfolio activity.

| | • | | Given the difficult credit environment and ongoing deterioration in the housing market, the Portfolio was significantly underweight in the financials sector at the beginning of the period. However, we added to the Portfolio’s exposure in this area, particularly during the fourth quarter of 2008, in response to unprecedented fiscal and monetary stimulus and historically-attractive valuations within the sector. |

| | • | | More broadly, we reduced the Portfolio’s defensive positioning later in the period, trimming overweight positions in the consumer staples and healthcare sectors, while adding to the Portfolio’s weighting in consumer discretionary. |

Describe Portfolio positioning at period-end.

| | • | | At period-end, the Portfolio was overweight relative to the benchmark in consumer discretionary, primarily within the hotels, restaurant and leisure and apparel and luxury goods sub-sectors. Other Portfolio overweights included consumer staples and healthcare, particularly among healthcare providers and services names. Key underweights included financials, specifically REITs, insurance companies and commercial banks, and utilities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Cullen/Frost Bankers, Inc. | | 4 | % |

PHH Corp. | | 4 | |

Ralcorp Holdings, Inc. | | 2 | |

First Niagara Financial Group, Inc. | | 2 | |

SkillSoft Plc - ADR | | 2 | |

Magellan Health Services, Inc. | | 2 | |

Darden Restaurants, Inc. | | 2 | |

DaVita, Inc. | | 2 | |

The Brink’s Co. | | 2 | |

Sybase, Inc. | | 2 | |

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Financials | | 24 | % |

Consumer Discretionary | | 18 | |

Information Technology | | 13 | |

Industrials | | 11 | |

Health Care | | 10 | |

Consumer Staples | | 9 | |

Materials | | 6 | |

Energy | | 5 | |

Utilities | | 4 | |

For Portfolio compliance purposes, the Portfolio’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease.

| | | | | | |

6 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

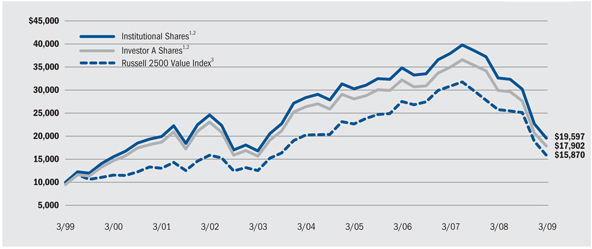

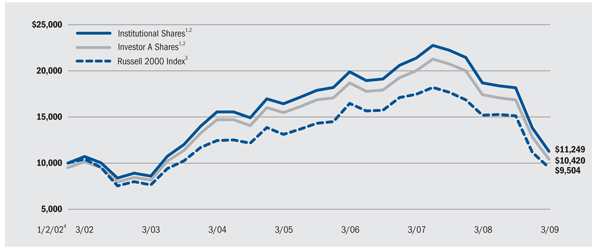

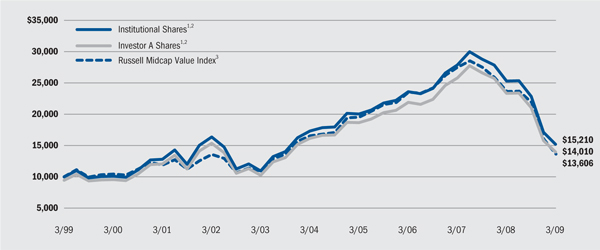

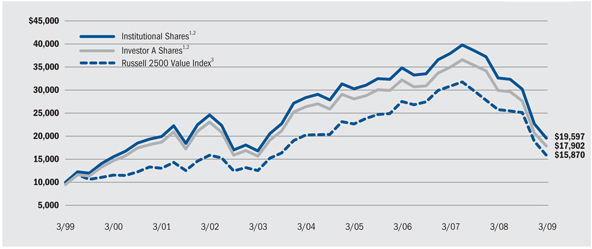

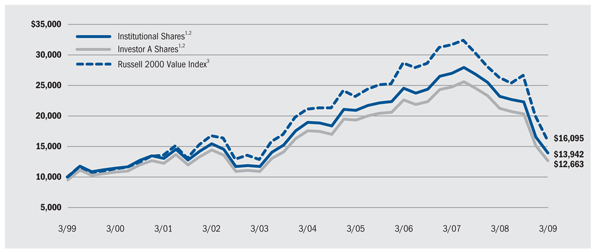

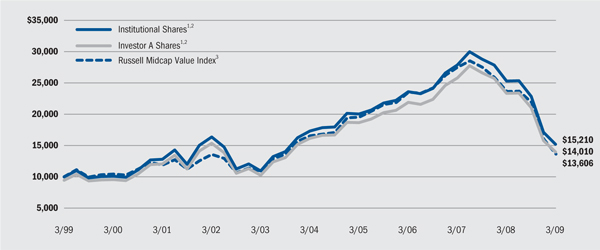

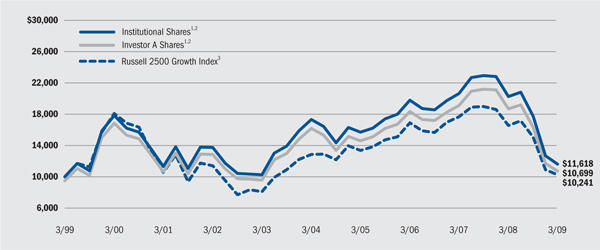

Aurora Portfolio

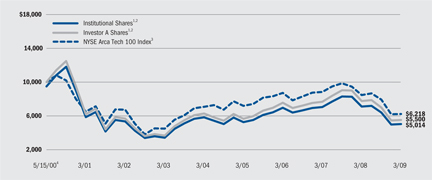

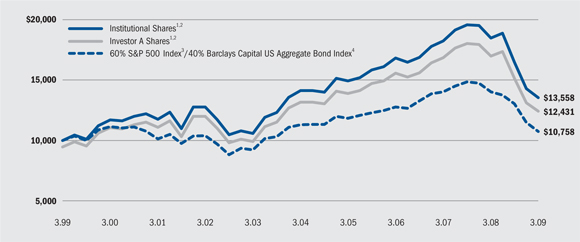

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Portfolio invests at least 80% of its total assets in small- and mid-capitalization common and preferred stocks and securities convertible into common and preferred stocks. |

| 3 | An index composed of the Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | (35.30 | )% | | (40.10 | )% | | N/A | | | (7.17 | )% | | N/A | | | 6.96 | % | | N/A | |

Investor A | | (35.39 | ) | | (40.30 | ) | | (43.43 | )% | | (7.49 | ) | | (8.48 | )% | | 6.57 | | | 6.00 | % |

Investor B | | (35.69 | ) | | (40.80 | ) | | (43.46 | ) | | (8.19 | ) | | (8.33 | ) | | 5.95 | | | 5.95 | |

Investor C | | (35.65 | ) | | (40.72 | ) | | (41.32 | ) | | (8.18 | ) | | (8.18 | ) | | 5.79 | | | 5.79 | |

R | | (35.44 | ) | | (40.26 | ) | | N/A | | | (7.64 | ) | | N/A | | | 6.38 | | | N/A | |

Russell 2500 Value Index | | (37.13 | ) | | (38.66 | ) | | N/A | | | (4.79 | ) | | N/A | | | 4.73 | | | N/A | |

| 4 | Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Portfolio Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period5 |

Institutional | | $ | 1,000.00 | | $ | 647.00 | | $ | 4.31 | | $ | 1,000.00 | | $ | 1,019.70 | | $ | 5.30 |

Investor A | | $ | 1,000.00 | | $ | 646.10 | | $ | 5.91 | | $ | 1,000.00 | | $ | 1,017.73 | | $ | 7.27 |

Investor B | | $ | 1,000.00 | | $ | 643.10 | | $ | 8.97 | | $ | 1,000.00 | | $ | 1,013.94 | | $ | 11.06 |

Investor C | | $ | 1,000.00 | | $ | 643.50 | | $ | 8.97 | | $ | 1,000.00 | | $ | 1,013.94 | | $ | 11.06 |

R | | $ | 1,000.00 | | $ | 645.60 | | $ | 6.56 | | $ | 1,000.00 | | $ | 1,016.92 | | $ | 8.08 |

| 5 | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.05% for Institutional, 1.44% for Investor A, 2.19% for Investor B, 2.19% for Investor C and 1.60% for R), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 7 |

| | |

| Portfolio Summary as of March 31, 2009 | | Capital Appreciation Portfolio |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio outperformed the benchmark Russell 1000 Growth Index for the six-month period. |

What factors influenced performance?

| | • | | The US stock market was under heavy pressure during the last six months. Poor economic and housing data, combined with a shuttered credit market and continued doubts about financial institutions, produced extreme levels of fear and volatility. However, toward the end of the six months, we saw significant rallies, and the period ended up closing on a relatively high note. Stocks of every size and style were negatively affected, and the benchmark Russell 1000 Growth Index lost 26% over the period. Against this backdrop, the Portfolio also registered a large decline, but managed to outperform the index thanks to sector strategy and excellent stock selection in the consumer discretionary sector. These positive factors overshadowed negative results in the healthcare and energy sectors. |

| | • | | Stock selection in the consumer discretionary sector provided the greatest source of absolute and relative strength, with the Portfolio’s holdings collectively delivering a positive return for the period, despite the strongly-negative market. Top contributors included education services provider Apollo Group, Inc. and several value-oriented retailers, including Ross Stores, Inc., Kohl’s Corp. and Amazon.com. The Portfolio’s sector positioning also added value, with significant overweights in consumer staples and healthcare held earlier in the period boosting relative returns. |

| | • | | Conversely, stock selection in the energy sector detracted from relative returns during the period. While the Portfolio’s energy services stocks slightly outperformed, its investments in exploration and production companies underperformed significantly. Investments in coal producer Massey Energy Co. and natural gas producer EOG Resources, Inc. significantly underperformed the benchmark allocation, which was dominated by oil producers. In healthcare, we missed out on significant upside by not holding Genentech Inc. and Schering-Plough Corp., which were both acquired at significant premiums during the period. |

Describe recent Portfolio activity.

| | • | | During the six months, we began to neutralize the defensive positioning that characterized the Portfolio for the majority of 2008. We accomplished this by significantly reducing the Portfolio’s investments in the defensive healthcare and consumer staples sectors, while increasing its exposure to opportunistic investments in the more cyclical consumer discretionary and information technology sectors. |

Describe Portfolio positioning at period-end.

| | • | | At period-end, the Portfolio’s largest overweights relative to the benchmark were in the consumer discretionary and telecommunication services sectors, while its most substantial underweights were in the consumer staples and utilities sectors. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

QUALCOMM, Inc. | | 4 | % |

Cisco Systems, Inc. | | 3 | |

Wal-Mart Stores, Inc. | | 3 | |

Google, Inc. - Class A | | 3 | |

The Coca-Cola Co. | | 3 | |

Abbott Laboratories | | 3 | |

Apple, Inc. | | 3 | |

Danaher Corp. | | 3 | |

Kohl’s Corp. | | 2 | |

American Tower Corp. - Class A | | 2 | |

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Information Technology | | 31 | % |

Health Care | | 16 | |

Consumer Discretionary | | 13 | |

Industrials | | 11 | |

Consumer Staples | | 11 | |

Energy | | 8 | |

Financials | | 4 | |

Telecommunication Services | | 3 | |

Materials | | 3 | |

For Portfolio compliance purposes, the Portfolio’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease.

| | | | | | |

8 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

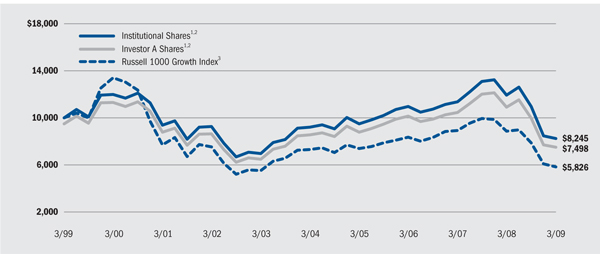

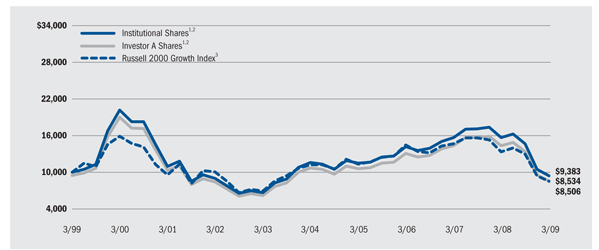

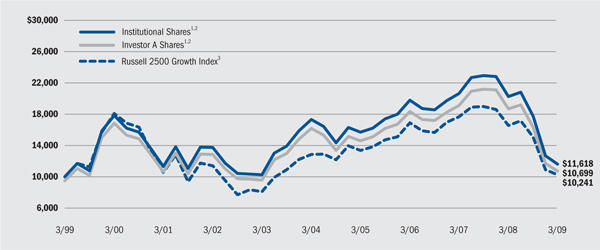

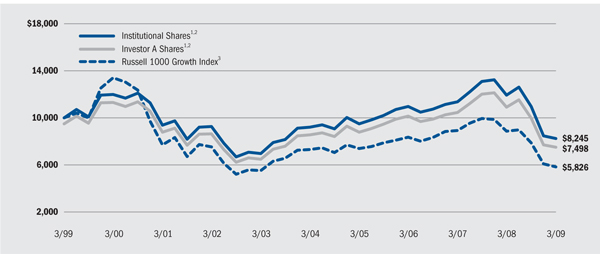

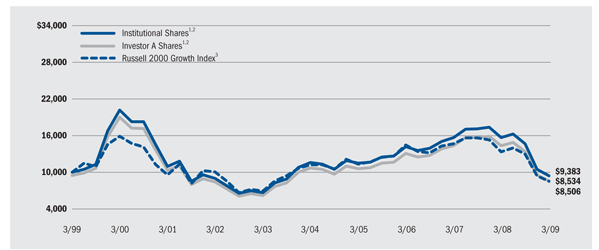

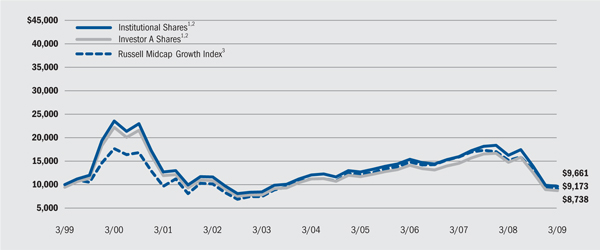

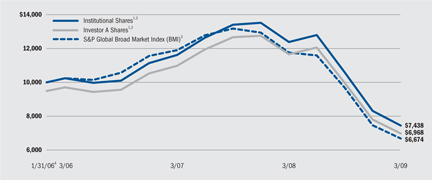

Capital Appreciation Portfolio

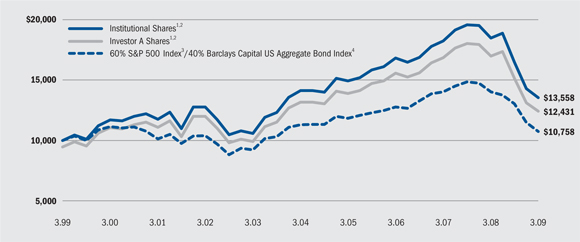

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Portfolio invests at least 80% of total assets in common and preferred stock and securities convertible into common and preferred stock of mid- and large-size companies. |

| 3 | An index composed of those Russell 1000 securities with greater-than-average growth orientation, generally having higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values. |

Past performance is not indicative of future results.

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | (24.85 | )% | | (30.96 | )% | | N/A | | | (2.16 | )% | | N/A | | | (1.91 | )% | | N/A | |

Investor A | | (24.81 | ) | | (31.35 | ) | | (34.97 | )% | | (2.56 | ) | | (3.60 | )% | | (2.31 | ) | | (2.84 | )% |

Investor B | | (25.32 | ) | | (31.82 | ) | | (34.89 | ) | | (3.29 | ) | | (3.68 | ) | | (2.89 | ) | | (2.89 | ) |

Investor C | | (25.30 | ) | | (31.79 | ) | | (32.47 | ) | | (3.22 | ) | | (3.22 | ) | | (3.00 | ) | | (3.00 | ) |

Russell 1000 Growth Index | | (25.97 | ) | | (34.28 | ) | | N/A | | | (4.38 | ) | | N/A | | | (5.26 | ) | | N/A | |

| 4 | Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Portfolio Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period5 |

Institutional | | $ | 1,000.00 | | $ | 751.50 | | $ | 3.06 | | $ | 1,000.00 | | $ | 1,021.47 | | $ | 3.53 |

Investor A | | $ | 1,000.00 | | $ | 751.90 | | $ | 5.68 | | $ | 1,000.00 | | $ | 1,018.44 | | $ | 6.56 |

Investor B | | $ | 1,000.00 | | $ | 746.80 | | $ | 9.15 | | $ | 1,000.00 | | $ | 1,014.40 | | $ | 10.60 |

Investor C | | $ | 1,000.00 | | $ | 747.00 | | $ | 8.19 | | $ | 1,000.00 | | $ | 1,015.51 | | $ | 9.49 |

| 5 | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (0.70% for Institutional, 1.30% for Investor A, 2.10% for Investor B and 1.88% for Investor C), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 9 |

| | |

| Portfolio Summary as of March 31, 2009 | | Energy & Resources Portfolio (formerly Global Resources Portfolio) |

| |

Portfolio Management Commentary | | |

How did the Portfolio perform?

| | • | | The Portfolio underperformed the broad-market S&P 500 Index and the Lipper Natural Resources Funds Index, its sector benchmark, for the six-month period. |

What factors influenced performance?

| | • | | Overall, the Portfolio’s aggressive positioning (i.e., being fully invested) and small-cap orientation hurt returns in an environment in which investors became extraordinarily risk averse. The Portfolio’s emphasis on coal producers and oil and gas exploration and production companies sharply detracted from performance as commodity prices plunged and the global economy slipped into a severe recession. While oil prices have recently rebounded, natural gas and coal pricing remains subdued as electricity demand has declined. These factors continue to pressure many of the Portfolio’s coal and exploration and production holdings. |

| | • | | Energy stocks were among the market leaders on both the upside and the downside during the six months. The Portfolio underperformed the broad market significantly during the fourth quarter of 2008, as did all subsectors, but it outperformed during the first quarter of 2009. While relative leadership was fairly broad-based, energy service names and other oil-related stocks outperformed as the price of oil rebounded due to significant Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC production cuts. Additionally, metals and mining holdings performed relatively well, as base metal prices rebounded and investors flocked to precious metals as a hedge against potential future inflation. |

Describe recent Portfolio activity.

| | • | | Few significant changes were made to the Portfolio during the six-month period. We deployed cash and added to names, such as Penn Virginia Corp., on significant price weakness and attractive valuation. |

Describe Portfolio positioning at period-end.

| | • | | Overall, we continue to believe oil, natural gas and coal stocks offer compelling value, even with relatively muted growth expectations. As cuts to exploration and production projects take hold in the coming months, we expect supply-demand dynamics to come back into balance sooner than many may anticipate. Similar to 1998/1999, dramatic downward price moves will likely take too much supply off the market at a time when economies are beginning to stabilize, resulting in significantly higher prices. As this unfolds, we expect the stocks to participate in a meaningful upward revaluation. In anticipation, we have positioned the Portfolio in those stocks and industries that should have the most leverage toward upward-moving prices, while ensuring that the Portfolio’s holdings should be somewhat stable in a flat commodity price environment. We continue to emphasize oil and gas exploration & production, oil service and coal producers. |

| | • | | Additionally, while investors’ risk aversion is negatively affecting our small cap portfolios in the near term, we believe that fundamentals will dictate a reversal of this trend on a longer-term. Thus, we remain aggressively positioned and believe that we will benefit when the market capitalization performance gap narrows, as it has in past cycles. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Profile as of March 31, 2009

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Southwestern Energy Co. | | 7 | % |

PetroHawk Energy Corp. | | 7 | |

CONSOL Energy, Inc. | | 5 | |

Peabody Energy Corp. | | 4 | |

Newfield Exploration Co. | | 4 | |

Plains Exploration & Production Co. | | 4 | |

Arch Coal, Inc. | | 3 | |

Massey Energy Co. | | 3 | |

Goodrich Petroleum Corp. | | 3 | |

Penn Virginia Corp. | | 3 | |

| | | |

Industry Representation | | Percent of

Long-Term

Investments | |

Oil, Gas & Consumable Fuels | | 74 | % |

Metals & Mining | | 12 | |

Energy Equipment & Services | | 11 | |

Gas Utilities | | 2 | |

Electrical Equipment | | 1 | |

For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

10 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

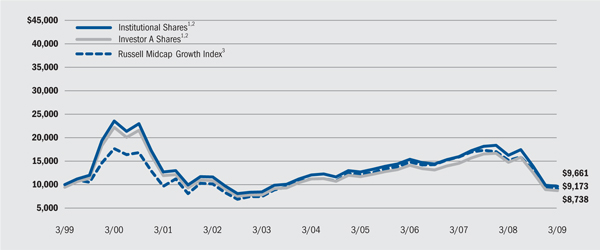

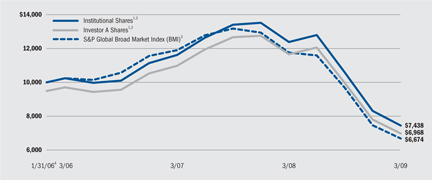

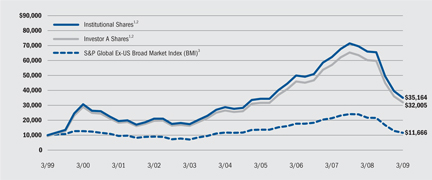

| Portfolio Summary as of March 31, 2009 | | Energy & Resources Portfolio |

| |

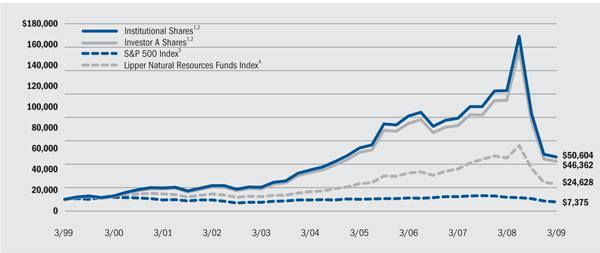

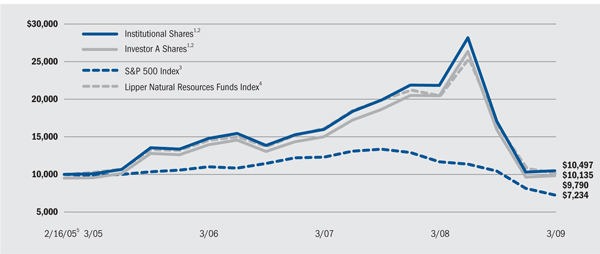

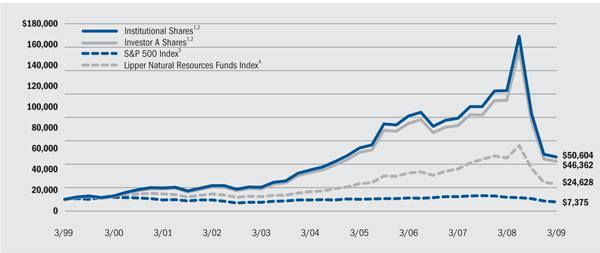

| Total Return Based on a $10,000 Investment | | |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Portfolio invests at least 80% of its total assets in securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| 3 | This unmanaged Index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly NYSE issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. S&P 500 is a trademark of the McGraw-Hill Companies. |

| 4 | An equally weighted index of typically the 30 largest mutual funds within its respective investment objective. Past performance is not indicative of future results. |

Performance Summary for the Period Ended March 31, 2009

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | (45.14 | )% | | (55.73 | )% | | N/A | | | 5.74 | % | | N/A | | | 17.60 | % | | N/A | |

Investor A | | (45.38 | ) | | (55.88 | ) | | (58.19 | )% | | 5.44 | | | 4.31 | % | | 17.20 | | | 16.58 | % |

Investor B | | (45.48 | ) | | (56.19 | ) | | (57.36 | ) | | 4.69 | | | 4.56 | | | 16.55 | | | 16.55 | |

Investor C | | (45.49 | ) | | (56.18 | ) | | (56.44 | ) | | 4.69 | | | 4.69 | | | 16.41 | | | 16.41 | |

S&P 500 Index | | (30.54 | ) | | (38.09 | ) | | N/A | | | (4.77 | ) | | N/A | | | (3.00 | ) | | N/A | |

Lipper Natural Resources Funds Index | | (19.76 | ) | | (17.57 | ) | | N/A | | | 7.35 | | | N/A | | | 9.43 | | | N/A | |

| 5 | Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Portfolio Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 |

| | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2008 | | Ending

Account Value

March 31, 2009 | | Expenses Paid

During the Period6 |

Institutional | | $ | 1,000.00 | | $ | 548.60 | | $ | 3.98 | | $ | 1,000.00 | | $ | 1,019.80 | | $ | 5.20 |

Investor A | | $ | 1,000.00 | | $ | 546.20 | | $ | 5.09 | | $ | 1,000.00 | | $ | 1,018.34 | | $ | 6.66 |

Investor B | | $ | 1,000.00 | | $ | 545.20 | | $ | 7.86 | | $ | 1,000.00 | | $ | 1,014.70 | | $ | 10.30 |

Investor C | | $ | 1,000.00 | | $ | 545.10 | | $ | 7.86 | | $ | 1,000.00 | | $ | 1,014.70 | | $ | 10.30 |

| 6 | For each class of the Portfolio, expenses are equal to the annualized expense ratio for the class (1.03% for Institutional, 1.32% for Investor A, 2.04% Investor B and 2.04% for Investor C), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 11 |

About Portfolio Performance

| | • | | Institutional Shares are not subject to any sales charge (front-end load) or deferred sales charge and are available only to eligible investors. These shares bear no ongoing distribution or service fees. |

| | • | | Service Shares are not subject to any sales charge (front-end load) or deferred sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee). |

| | • | | Investor A Shares incur a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). |

| | • | | Investor B Shares are subject to a maximum contingent deferred sales charge of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. |

| | • | | Investor C Shares are subject to a 1.00% contingent deferred sales charge if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

| | • | | R Shares are not subject to any initial sales charge (front-end load) or deferred sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. R Shares are available only to certain retirement and other similar plans. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Each Portfolio other than the BlackRock Capital Appreciation Portfolio may charge a 2% redemption fee for sales or exchanges of shares within 30 days of purchase or exchange. Performance data does not reflect this potential fee. Figures shown in the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

The performance information on the previous pages includes information for each class of each Portfolio since the commencement of operations of such Portfolio, rather than the date such class was introduced. Performance information for each class introduced after the commencement of operations of a Portfolio is therefore based on the performance history of a predecessor class adjusted to reflect the class specific fees applicable to each class at the time of the launch of such share class. This information may be considered when assessing a Portfolio’s performance, but does not represent the actual performance of this share class.

Performance for the Aurora, Capital Appreciation and Energy & Resources Portfolios for the periods prior to January 31, 2005 is based on performance of certain former State Street Research mutual funds that reorganized with the Portfolios on that date.

The performance information also reflects fee waivers and reimbursements that subsidize and reduce the total operating expenses of each Portfolio. The Portfolios’ returns would have been lower if there were no such waivers and reimbursements. BlackRock Advisors, LLC is under no obligation to waive or continue waiving its fees after February 1, 2010.

| | | | | | |

12 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

Disclosure of Expenses

Shareholders of these Portfolios may incur the following charges: (a) expenses related to transactions, including sales charges and redemption fees; and (b) operating expenses, including advisory fees, service and distribution fees including 12b-1 fees, and other Portfolio expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2008 and held through March 31, 2009) are intended to assist shareholders both in calculating expenses based on an investment in each Portfolio and in comparing these expenses with similar costs of investing in other mutual funds.

The Expense Example tables provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the headings entitled “Expenses Paid During the Period.”

The tables also provide information about hypothetical account values and hypothetical expenses based on the Portfolios’ actual expense ratios and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Portfolios and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical table is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Instruments

The Portfolios may invest in various derivative instruments, including forward currency contracts, and other instruments specified in the Notes to Financials Statements, which constitute forms of economic leverage. Such instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market and/or interest rate risks. Such derivative instruments involve risks, including the imperfect correlation between the value of a derivative instrument and the underlying asset, possible default of the other party to the transaction and illiquidity of the derivative instrument. A Portfolio’s ability to successfully use a derivative instrument depends on the Advisor’s ability to accurately predict pertinent market movements, which cannot be assured. The use of derivative instruments may result in losses greater than if they had not been used, may require a Portfolio to sell or purchase portfolio securities at inopportune times or for prices other than current market values, may limit the amount of appreciation a Portfolio can realize on an investment or may cause a Portfolio to hold a security that it might otherwise sell. The Portfolios’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 13 |

| | |

| Schedule of Investments March 31, 2009 (Unaudited) | | All-Cap Energy & Resources Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | |

| | | Shares | | Value |

Common Stocks | | | | | |

Chemicals — 2.8% | | | | | |

Potash Corp. of Saskatchewan, Inc. | | 154,900 | | $ | 12,517,469 |

| | | | | |

Energy Equipment & Services — 20.8% | | | | | |

Cameron International Corp. (a) | | 212,930 | | | 4,669,555 |

Core Laboratories NV | | 148,850 | | | 10,889,866 |

ENSCO International, Inc. | | 124,838 | | | 3,295,723 |

FMC Technologies, Inc. (a) | | 391,390 | | | 12,277,904 |

Halliburton Co. | | 259,000 | | | 4,006,730 |

Helmerich & Payne, Inc. | | 334,330 | | | 7,612,694 |

Noble Corp. | | 212,310 | | | 5,114,548 |

Oceaneering International, Inc. (a) | | 137,310 | | | 5,062,620 |

Pride International, Inc. (a) | | 230,580 | | | 4,145,828 |

Schlumberger Ltd. | | 198,480 | | | 8,062,258 |

Smith International, Inc. | | 164,340 | | | 3,530,023 |

Transocean Ltd. (a) | | 187,240 | | | 11,017,202 |

Unit Corp. (a) | | 279,340 | | | 5,843,793 |

Weatherford International Ltd. (a) | | 694,870 | | | 7,692,211 |

| | | | | |

| | | | | 93,220,955 |

| | | | | |

Gas Utilities — 4.2% | | | | | |

EQT Corp. | | 351,410 | | | 11,009,675 |

Questar Corp. | | 272,030 | | | 8,005,843 |

| | | | | |

| | | | | 19,015,518 |

| | | | | |

Metals & Mining — 10.3% | | | | | |

Agnico-Eagle Mines Ltd. | | 147,590 | | | 8,400,823 |

BHP Billiton Ltd. - ADR | | 239,510 | | | 10,682,146 |

Eldorado Gold Corp. (a) | | 570,620 | | | 5,159,476 |

Goldcorp, Inc. | | 242,852 | | | 8,091,829 |

Silver Wheaton Corp. (a) | | 1,370,824 | | | 11,281,881 |

Teck Cominco Ltd. - Class B | | 438,290 | | | 2,450,781 |

| | | | | |

| | | | | 46,066,936 |

| | | | | |

Oil, Gas & Consumable Fuels — 60.4% | | | | | |

Apache Corp. | | 173,630 | | | 11,127,947 |

Arch Coal, Inc. | | 333,500 | | | 4,458,895 |

BG Group Plc - ADR | | 155,110 | | | 11,678,232 |

Bill Barrett Corp. (a) | | 543,621 | | | 12,090,131 |

Cameco Corp. | | 76,770 | | | 1,318,141 |

Canadian Natural Resources Ltd. | | 173,340 | | | 6,683,990 |

CONSOL Energy, Inc. | | 543,530 | | | 13,718,697 |

Crescent Point Energy Trust | | 275,870 | | | 5,767,714 |

Denbury Resources, Inc. (a) | | 671,190 | | | 9,973,883 |

Devon Energy Corp. | | 190,120 | | | 8,496,463 |

EnCana Corp. | | 234,260 | | | 9,513,299 |

EOG Resources, Inc. | | 167,970 | | | 9,198,037 |

Forest Oil Corp. (a) | | 319,590 | | | 4,202,608 |

Galleon Energy, Inc. - Class A (a) | | 720,094 | | | 2,061,817 |

Gasco Energy, Inc. (a)(b) | | 1,525,000 | | | 594,750 |

Heritage Oil Ltd. (a) | | 491,250 | | | 2,340,159 |

Hess Corp. | | 207,470 | | | 11,244,874 |

Hugoton Royalty Trust | | 1 | | | 10 |

Massey Energy Co. | | 624,639 | | | 6,321,347 |

Murphy Oil Corp. | | 137,890 | | | 6,173,335 |

Newfield Exploration Co. (a) | | 358,000 | | | 8,126,600 |

Nexen, Inc. | | 605,754 | | | 10,272,066 |

Noble Energy, Inc. | | 173,800 | | | 9,364,344 |

Occidental Petroleum Corp. | | 222,350 | | | 12,373,778 |

OGX Petroleo e Gas Participacoes SA (a) | | 11,200 | | | 3,481,113 |

Patriot Coal Corp. (a)(b) | | 64,116 | | | 237,870 |

Peabody Energy Corp. | | 409,390 | | | 10,251,126 |

PetroChina Co. Ltd. - ADR | | 33,390 | | | 2,661,183 |

Petroleo Brasileiro SA - ADR | | 365,240 | | | 11,128,863 |

Plains Exploration & Production Co. (a) | | 283,710 | | | 4,888,323 |

Range Resources Corp. | | 374,800 | | | 15,426,768 |

Rex Energy Corp. (a) | | 310,500 | | | 891,135 |

Southwestern Energy Co. (a) | | 404,400 | | | 12,006,636 |

StatoilHydro ASA | | 373,222 | | | 6,603,389 |

StatoilHydro ASA - ADR | | 157,440 | | | 2,745,754 |

Suncor Energy, Inc. | | 245,980 | | | 5,463,216 |

TriStar Oil & Gas Ltd. (a) | | 259,114 | | | 1,896,908 |

Whiting Petroleum Corp. (a) | | 277,130 | | | 7,163,810 |

XTO Energy, Inc. | | 310,671 | | | 9,512,746 |

| | | | | |

| | | | | 271,459,957 |

| | | | | |

Total Long-Term Investments

(Cost — $598,523,002) — 98.5% | | | | | 442,280,835 |

| | | | | |

| | | | | | |

| | | Shares/

Beneficial

Interest | | | |

Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, | | | | | | |

0.60% (c)(d) | | 6,493,941 | | | 6,493,941 | |

BlackRock Liquidity Series, LLC Money Market Series, 1.17% (c)(d)(e) | | 440,000 | | | 440,000 | |

| | | | | | |

Total Short-Term Securities

(Cost — $6,933,941) — 1.5% | | | | | 6,933,941 | |

| | | | | | |

Total Investments

(Cost — $605,456,943*) — 100.0% | | | | | 449,214,776 | |

Liabilities in Excess of Other Assets — (0.0)% | | | | | (88,174 | ) |

| | | | | | |

Net Assets — 100.0% | | | | $ | 449,126,602 | |

| | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of March 31, 2009, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 599,976,130 | |

| | | | |

Gross unrealized appreciation | | $ | 48,757,328 | |

Gross unrealized depreciation | | | (199,518,682 | ) |

| | | | |

Net unrealized depreciation | | $ | (150,761,354 | ) |

| | | | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

Portfolios Abbreviations

| | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names of certain securities have been abbreviated according to the list on the right. | | ADR CAD | | American Depository Receipts Canadian Dollar |

| | | | | | |

14 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments (concluded) | | All-Cap Energy & Resources Portfolio |

| (c) | Investments in companies considered to be an affiliate of the Portfolio, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | |

Affiliate | | Net

Activity | | | Income |

BlackRock Liquidity Funds, TempFund | | $ | 6,493,941 | ** | | $ | 14,983 |

BlackRock Liquidity Series, LLC Money Market Series | | $ | (41,358,000 | )*** | | $ | 66,934 |

| ** | Represents net purchase cost. |

| *** | Represents net sales cost. |

| (d) | Represents current yield as of report date. |

| (e) | Security purchased with the cash proceeds from securities loans. |

| • | | For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. |

| • | | Effective October 1, 2008, the Portfolio adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 clarifies the definition of fair value, establishes a framework for measuring fair values and requires additional disclosures about the use of fair value measurements. Various inputs are used in determining the fair value of investments, which are as follows: |

| | • | | Level 1 – price quotations in active markets/exchanges for identical securities |

| | • | | Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market – corroborated inputs) |

| | • | | Level 3 – unobservable inputs based on the best information available in the circumstance, to the extent observable inputs are not available (including the Portfolio’s own assumptions used in determining the fair value of investments. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For information about the Portfolio’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of March 31, 2009 in determining the fair valuation of the Portfolio’s investments:

| | | |

Valuation Inputs | | Investments

in Securities |

| | | Assets |

Level 1 | | $ | 440,342,970 |

Level 2 | | | 8,871,806 |

Level 3 | | | — |

| | | |

Total | | $ | 449,214,776 |

| | | |

See Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 15 |

| | |

| Schedule of Investments March 31, 2009 (Unaudited) | | Aurora Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | |

| | | Shares | | Value |

Common Stocks | | | | | |

Aerospace & Defense — 0.4% | | | | | |

Orbital Sciences Corp.(a) | | 140,277 | | $ | 1,667,894 |

| | | | | |

Biotechnology — 0.5% | | | | | |

Dyax Corp.(a) | | 805,326 | | | 2,021,368 |

| | | | | |

Building Products — 0.3% | | | | | |

Lennox International, Inc.(b) | | 54,325 | | | 1,437,439 |

| | | | | |

Capital Markets — 1.0% | | | | | |

Jefferies Group, Inc.(b) | | 296,900 | | | 4,097,220 |

| | | | | |

Chemicals — 3.0% | | | | | |

Airgas, Inc. | | 122,700 | | | 4,148,487 |

FMC Corp. | | 95,300 | | | 4,111,242 |

The Scotts Miracle-Gro Co. - Class A | | 127,000 | | | 4,406,900 |

| | | | | |

| | | | | 12,666,629 |

| | | | | |

Commercial Banks — 5.8% | | | | | |

Associated Banc-Corp. | | 220,200 | | | 3,399,888 |

City National Corp. | | 133,600 | | | 4,511,672 |

Cullen/Frost Bankers, Inc. | | 320,200 | | | 15,030,188 |

TCF Financial Corp.(b) | | 176,800 | | | 2,079,168 |

| | | | | |

| | | | | 25,020,916 |

| | | | | |

Commercial Services & Supplies — 4.3% | | | | | |

The Brink’s Co. | | 301,251 | | | 7,971,101 |

The GEO Group, Inc.(a) | | 270,400 | | | 3,582,800 |

Rollins, Inc. | | 196,253 | | | 3,365,739 |

Waste Connections, Inc.(a) | | 142,100 | | | 3,651,970 |

| | | | | |

| | | | | 18,571,610 |

| | | | | |

Communications Equipment — 0.7% | | | | | |

Polycom, Inc.(a) | | 188,600 | | | 2,902,554 |

| | | | | |

Computers & Peripherals — 0.6% | | | | | |

Teradata Corp.(a) | | 166,800 | | | 2,705,496 |

| | | | | |

Construction & Engineering — 0.5% | | | | | |

URS Corp.(a) | | 51,700 | | | 2,089,197 |

| | | | | |

Containers & Packaging — 3.1% | | | | | |

Crown Holdings, Inc.(a) | | 281,100 | | | 6,389,403 |

Silgan Holdings, Inc. | | 130,300 | | | 6,845,962 |

| | | | | |

| | | | | 13,235,365 |

| | | | | |

Diversified Consumer Services — 1.1% | | | | | |

Brink’s Home Security Holdings, Inc.(a) | | 201,951 | | | 4,564,093 |

| | | | | |

Diversified Financial Services — 3.4% | | | | | |

PHH Corp.(a) | | 1,043,841 | | | 14,665,966 |

| | | | | |

Electric Utilities — 1.3% | | | | | |

ITC Holdings Corp. | | 126,158 | | | 5,503,012 |

| | | | | |

Electrical Equipment — 1.8% | | | | | |

AMETEK, Inc. | | 174,800 | | | 5,465,996 |

Roper Industries, Inc. | | 51,400 | | | 2,181,930 |

| | | | | |

| | | | | 7,647,926 |

| | | | | |

Electronic Equipment, Instruments & Components — 1.9% | | | | | |

Amphenol Corp. - Class A | | 154,500 | | | 4,401,705 |

Anixter International, Inc.(a) | | 115,600 | | | 3,662,208 |

| | | | | |

| | | | | 8,063,913 |

| | | | | |

Energy Equipment & Services — 2.2% | | | | | |

Core Laboratories NV | | 81,200 | | | 5,940,592 |

Lufkin Industries, Inc. | | 90,774 | | | 3,438,519 |

| | | | | |

| | | | | 9,379,111 |

| | | | | |

Food & Staples Retailing — 2.0% | | | | | |

BJ’s Wholesale Club, Inc.(a) | | 200,300 | | | 6,407,597 |

Spartan Stores, Inc. | | 135,300 | | | 2,084,973 |

| | | | | |

| | | | | 8,492,570 |

| | | | | |

Food Products — 5.0% | | | | | |

Fresh Del Monte Produce, Inc.(a) | | 228,800 | | | 3,756,896 |

Hain Celestial Group, Inc.(a) | | 382,308 | | | 5,444,066 |

Ralcorp Holdings, Inc.(a) | | 188,870 | | | 10,176,316 |

Sanderson Farms, Inc. | | 60,200 | | | 2,260,510 |

| | | | | |

| | | | | 21,637,788 |

| | | | | |

Gas Utilities — 0.9% | | | | | |

EQT Corp. | | 119,500 | | | 3,743,935 |

| | | | | |

Health Care Equipment & Supplies — 2.2% | | | | | |

The Cooper Cos., Inc. | | 137,900 | | | 3,646,076 |

Hologic, Inc.(a) | | 265,900 | | | 3,480,631 |

Teleflex, Inc. | | 58,100 | | | 2,271,129 |

| | | | | |

| | | | | 9,397,836 |

| | | | | |

Health Care Providers & Services — 6.4% | | | | | |

DaVita, Inc.(a) | | 204,800 | | | 9,000,960 |

HMS Holdings Corp.(a) | | 139,900 | | | 4,602,710 |

Magellan Health Services, Inc.(a) | | 253,618 | | | 9,241,840 |

MEDNAX, Inc.(a) | | 76,200 | | | 2,245,614 |

Omnicare, Inc. | | 92,600 | | | 2,267,774 |

| | | | | |

| | | | | 27,358,898 |

| | | | | |

Hotels, Restaurants & Leisure — 7.0% | | | | | |

Darden Restaurants, Inc. | | 265,265 | | | 9,087,979 |

Penn National Gaming, Inc.(a) | | 178,200 | | | 4,303,530 |

Scientific Games Corp. - Class A(a) | | 528,574 | | | 6,401,031 |

Starwood Hotels & Resorts Worldwide, Inc. | | 333,000 | | | 4,229,100 |

Wendy’s/Arby’s Group, Inc. - Class A | | 1,174,300 | | | 5,906,729 |

| | | | | |

| | | | | 29,928,369 |

| | | | | |

Household Durables — 1.7% | | | | | |

Jarden Corp.(a) | | 574,100 | | | 7,273,847 |

| | | | | |

Insurance — 6.0% | | | | | |

Aspen Insurance Holdings Ltd. | | 76,900 | | | 1,727,174 |

Fidelity National Financial, Inc. - Class A | | 369,713 | | | 7,213,101 |

First American Corp. | | 119,600 | | | 3,170,596 |

The Hanover Insurance Group, Inc. | | 223,030 | | | 6,427,724 |

HCC Insurance Holdings, Inc. | | 112,800 | | | 2,841,432 |

Platinum Underwriters Holdings Ltd. | | 157,977 | | | 4,480,228 |

| | | | | |

| | | | | 25,860,255 |

| | | | | |

Internet & Catalog Retail — 0.8% | | | | | |

priceline.com, Inc.(a)(b) | | 44,300 | | | 3,489,954 |

| | | | | |

Internet Software & Services — 2.2% | | | | | |

SkillSoft Plc - ADR(a) | | 1,411,281 | | | 9,441,470 |

| | | | | |

IT Services — 1.6% | | | | | |

Hewitt Associates, Inc. - Class A(a) | | 149,400 | | | 4,446,144 |

Lender Processing Services, Inc. | | 76,900 | | | 2,353,909 |

| | | | | |

| | | | | 6,800,053 |

| | | | | |

| | | | | | |

16 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments (continued) | | Aurora Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Shares | | Value | |

Common Stocks | | | | | | |

Leisure Equipment & Products — 1.2% | | | | | | |

Hasbro, Inc. | | 202,800 | | $ | 5,084,196 | |

| | | | | | |

Life Sciences Tools & Services — 0.9% | | | | | | |

Life Technologies Corp. (a) | | 114,100 | | | 3,705,968 | |

| | | | | | |

Machinery — 2.3% | | | | | | |

Dover Corp. | | 78,300 | | | 2,065,554 | |

IDEX Corp. | | 189,300 | | | 4,139,991 | |

Pentair, Inc. | | 177,800 | | | 3,852,926 | |

| | | | | | |

| | | | | 10,058,471 | |

| | | | | | |

Multi-Utilities — 1.6% | | | | | | |

Wisconsin Energy Corp. | | 169,500 | | | 6,978,315 | |

| | | | | | |

Oil, Gas & Consumable Fuels — 2.4% | | | | | | |

Foundation Coal Holdings, Inc. | | 220,800 | | | 3,168,480 | |

Peabody Energy Corp. | | 124,100 | | | 3,107,464 | |

PetroHawk Energy Corp. (a) | | 94,200 | | | 1,811,466 | |

Range Resources Corp. | | 50,700 | | | 2,086,812 | |

| | | | | | |

| | | | | 10,174,222 | |

| | | | | | |

Personal Products — 1.7% | | | | | | |

Alberto-Culver Co. | | 154,900 | | | 3,502,289 | |

Chattem, Inc. (a)(b) | | 65,700 | | | 3,682,485 | |

| | | | | | |

| | | | | 7,184,774 | |

| | | | | | |

Real Estate Investment Trusts — 4.0% | | | | | | |

Annaly Capital Management, Inc. | | 498,600 | | | 6,915,582 | |

Essex Property Trust, Inc. (b) | | 59,500 | | | 3,411,730 | |

Mack-Cali Realty Corp. | | 128,800 | | | 2,551,528 | |

Redwood Trust, Inc. (b) | | 282,000 | | | 4,328,700 | |

| | | | | | |

| | | | | 17,207,540 | |

| | | | | | |

Road & Rail — 1.3% | | | | | | |

Genesee & Wyoming, Inc. - Class A (a) | | 147,000 | | | 3,123,750 | |

Landstar System, Inc. | | 75,800 | | | 2,537,026 | |

| | | | | | |

| | | | | 5,660,776 | |

| | | | | | |

Semiconductors & Semiconductor Equipment — 2.1% | | | | | | |

Intersil Corp. - Class A | | 289,500 | | | 3,329,250 | |

ON Semiconductor Corp. (a) | | 634,700 | | | 2,475,330 | |

Varian Semiconductor Equipment Associates, Inc. (a) | | 152,100 | | | 3,294,486 | |

| | | | | | |

| | | | | 9,099,066 | |

| | | | | | |

Software — 2.8% | | | | | | |

Lawson Software, Inc. (a) | | 1,004,100 | | | 4,267,425 | |

Sybase, Inc. (a) | | 262,700 | | | 7,957,183 | |

| | | | | | |

| | | | | 12,224,608 | |

| | | | | | |

Specialty Retail — 3.2% | | | | | | |

PetSmart, Inc. | | 223,100 | | | 4,676,176 | |

Tractor Supply Co. (a) | | 97,400 | | | 3,512,244 | |

Urban Outfitters, Inc. (a) | | 329,900 | | | 5,400,463 | |

| | | | | | |

| | | | | 13,588,883 | |

| | | | | | |

Textiles, Apparel & Luxury Goods — 2.1% | | | | | | |

Carter’s, Inc. (a) | | 208,200 | | | 3,916,242 | |

VF Corp. (b) | | 86,300 | | | 4,928,593 | |

| | | | | | |

| | | | | 8,844,835 | |

| | | | | | |

Thrifts & Mortgage Finance — 2.3% | | | | | | |

First Niagara Financial Group, Inc. | | 919,400 | | | 10,021,460 | |

| | | | | | |

Total Long-Term Investments

(Cost — $428,144,763) — 95.6% | | | | | 409,497,798 | |

| | | | | | |

| | |

| | | Shares/

Beneficial

Interest | | | |

Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, | | | | | | |

0.60% (c)(d) | | 21,883,965 | | | 21,883,965 | |

BlackRock Liquidity Series, LLC Money Market Series, | | | | | | |

1.17% (c)(d)(e) | | 22,332,800 | | | 22,332,800 | |

| | | | | | |

Total Short-Term Securities

(Cost — $44,216,765) — 10.3% | | | | | 44,216,765 | |

| | | | | | |

Total Investments

(Cost — $472,361,528*) — 105.9% | | | | | 453,714,563 | |

Liabilities in Excess of Other Assets — (5.9)% | | | | | (25,232,887 | ) |

| | | | | | |

Net Assets — 100.0% | | | | $ | 428,481,676 | |

| | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of March 31, 2009, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 489,919,946 | |

| | | | |

Gross unrealized appreciation | | $ | 25,880,760 | |

Gross unrealized depreciation | | | (62,086,143 | ) |

| | | | |

Net unrealized depreciation | | $ | (36,205,383 | ) |

| | | | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

| (c) | Investments in companies considered to be an affiliate of the Portfolio, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | |

Affiliate | | Net

Activity | | | Income |

BlackRock Liquidity Funds, TempFund | | $ | 21,883,965 | ** | | $ | 23,432 |

BlackRock Liquidity Series, LLC Money Market Series | | $ | (34,022,600 | )*** | | $ | 149,576 |

| ** | Represents net purchase cost. |

| *** | Represents net sales cost. |

| (d) | Represents current yield as of report date. |

| (e) | Security purchased with the cash proceeds from securities loans. |

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 17 |

| | |

| Schedule of Investments (concluded) | | Aurora Portfolio |

| • | | For Portfolio compliance purposes, the Portfolio’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Portfolio management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. |

| • | | Effective October 1, 2008, the Portfolio adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, “Fair Value Measurements”. FAS 157 clarifies the definition of fair value, establishes a framework for measuring fair values and requires additional disclosures about the use of fair value measurements. Various inputs are used in determining the fair value of investments, which are as follows: |

| | • | | Level 1 – price quotations in active markets/exchanges for identical securities |

| | • | | Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market – corroborated inputs) |

| | • | | Level 3 – unobservable inputs based on the best information available in the circumstance, to the extent observable inputs are not available (including the Portfolio’s own assumptions used in determining the fair value of investments. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For information about the Portfolio’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of March 31, 2009 in determining the fair valuation of the Portfolio’s investments:

| | | |

Valuation Inputs | | Investments

in Securities |

| | | Assets |

Level 1 | | $ | 453,714,563 |

Level 2 | | | — |

Level 3 | | | — |

| | | |

Total | | $ | 453,714,563 |

| | | |

See Notes to Financial Statements.

| | | | | | |

18 | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | |

| | |

| Schedule of Investments March 31, 2009 (Unaudited) | | Capital Appreciation Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | |

| | | Shares | | Value |

Common Stocks | | | | | |

Aerospace & Defense — 2.1% | | | | | |

General Dynamics Corp. | | 38,300 | | $ | 1,592,897 |

Honeywell International, Inc. | | 109,618 | | | 3,053,957 |

| | | | | |

| | | | | 4,646,854 |

| | | | | |

Air Freight & Logistics — 0.7% | | | | | |

United Parcel Service, Inc. - Class B | | 32,000 | | | 1,575,040 |

| | | | | |

Airlines — 0.9% | | | | | |

Delta Air Lines, Inc.(a) | | 344,900 | | | 1,941,787 |

| | | | | |

Beverages — 3.7% | | | | | |

The Coca-Cola Co. | | 132,954 | | | 5,843,328 |

PepsiCo, Inc. | | 44,324 | | | 2,281,800 |

| | | | | |

| | | | | 8,125,128 |

| | | | | |

Biotechnology — 3.8% | | | | | |

Celgene Corp.(a) | | 52,600 | | | 2,335,440 |

Genzyme Corp.(a) | | 36,477 | | | 2,166,369 |

Gilead Sciences, Inc.(a) | | 84,300 | | | 3,904,776 |

| | | | | |

| | | | | 8,406,585 |

| | | | | |

Capital Markets — 0.8% | | | | | |

The Goldman Sachs Group, Inc. | | 17,400 | | | 1,844,748 |

| | | | | |

Chemicals — 0.8% | | | | | |

Ecolab, Inc. | | 51,900 | | | 1,802,487 |

| | | | | |

Commercial Services & Supplies — 0.9% | | | | | |

Waste Management, Inc. | | 72,600 | | | 1,858,560 |

| | | | | |

Communications Equipment — 7.0% | | | | | |

Cisco Systems, Inc.(a) | | 393,321 | | | 6,595,993 |

QUALCOMM, Inc. | | 225,423 | | | 8,771,209 |

| | | | | |

| | | | | 15,367,202 |

| | | | | |

Computers & Peripherals — 6.2% | | | | | |

Apple, Inc.(a) | | 53,118 | | | 5,583,764 |

Hewlett-Packard Co. | | 112,600 | | | 3,609,956 |

International Business Machines Corp. | | 45,400 | | | 4,398,806 |

| | | | | |

| | | | | 13,592,526 |

| | | | | |

Construction & Engineering — 0.7% | | | | | |

Fluor Corp. | | 44,900 | | | 1,551,295 |

| | | | | |

Diversified Consumer Services — 1.5% | | | | | |

Apollo Group, Inc. - Class A(a) | | 40,600 | | | 3,180,198 |

| | | | | |

Diversified Financial Services — 1.9% | | | | | |

CME Group, Inc. | | 9,220 | | | 2,271,716 |

JPMorgan Chase & Co. | | 67,300 | | | 1,788,834 |

| | | | | |

| | | | | 4,060,550 |

| | | | | |

Diversified Telecommunication Services — 0.5% | | | | | |

AT&T, Inc. | | 46,848 | | | 1,180,570 |

| | | | | |

Energy Equipment & Services — 2.1% | | | | | |

Schlumberger Ltd. | | 49,017 | | | 1,991,071 |

Transocean Ltd.(a) | | 42,705 | | | 2,512,762 |

| | | | | |

| | | | | 4,503,833 |

| | | | | |

Food & Staples Retailing — 4.1% | | | | | |

The Kroger Co. | | 58,300 | | | 1,237,126 |

Safeway, Inc. | | 74,300 | | | 1,500,117 |

Wal-Mart Stores, Inc. | | 120,886 | | | 6,298,161 |

| | | | | |

| | | | | 9,035,404 |

| | | | | |

Health Care Equipment & Supplies — 0.7% | | | | | |

C.R. Bard, Inc. | | 18,600 | | | 1,482,792 |

| | | | | |

Health Care Providers & Services — 3.1% | | | | | |

Henry Schein, Inc.(a) | | 47,300 | | | 1,892,473 |

Medco Health Solutions, Inc.(a) | | 80,522 | | | 3,328,779 |

UnitedHealth Group, Inc. | | 72,700 | | | 1,521,611 |

| | | | | |

| | | | | 6,742,863 |

| | | | | |

Hotels, Restaurants & Leisure — 2.9% | | | | | |

Burger King Holdings, Inc. | | 139,100 | | | 3,192,345 |

McDonald’s Corp. | | 56,400 | | | 3,077,748 |

| | | | | |

| | | | | 6,270,093 |

| | | | | |

Household Durables — 0.8% | | | | | |

D.R. Horton, Inc. | | 175,900 | | | 1,706,230 |

| | | | | |

Household Products — 1.1% | | | | | |

Clorox Co. | | 29,000 | | | 1,492,920 |

The Procter & Gamble Co. | | 17,986 | | | 846,961 |

| | | | | |

| | | | | 2,339,881 |

| | | | | |

Industrial Conglomerates — 1.1% | | | | | |

3M Co. | | 48,100 | | | 2,391,532 |

| | | | | |

Insurance — 1.1% | | | | | |

The Travelers Cos., Inc. | | 57,400 | | | 2,332,736 |

| | | | | |

Internet & Catalog Retail — 1.7% | | | | | |

Amazon.com, Inc.(a) | | 49,840 | | | 3,660,250 |

| | | | | |

Internet Software & Services — 2.7% | | | | | |

Google, Inc. - Class A(a) | | 17,254 | | | 6,005,427 |

| | | | | |

IT Services — 0.4% | | | | | |

Accenture Ltd. - Class A | | 32,800 | | | 901,672 |

| | | | | |

Life Sciences Tools & Services — 0.9% | | | | | |

Thermo Fisher Scientific, Inc.(a) | | 56,300 | | | 2,008,221 |

| | | | | |

Machinery — 4.4% | | | | | |

Cummins, Inc. | | 84,200 | | | 2,142,890 |

Danaher Corp. | | 102,022 | | | 5,531,633 |

Deere & Co. | | 60,100 | | | 1,975,487 |

| | | | | |

| | | | | 9,650,010 |

| | | | | |

Metals & Mining — 2.2% | | | | | |

Agnico-Eagle Mines Ltd. | | 42,900 | | | 2,441,868 |

Freeport-McMoRan Copper & Gold, Inc. - Class B | | 62,737 | | | 2,390,907 |

| | | | | |

| | | | | 4,832,775 |

| | | | | |

Multiline Retail — 2.3% | | | | | |

Kohl’s Corp.(a) | | 121,068 | | | 5,123,598 |

| | | | | |

Oil, Gas & Consumable Fuels — 6.0% | | | | | |

Apache Corp. | | 13,700 | | | 878,033 |

EOG Resources, Inc. | | 22,620 | | | 1,238,671 |

Exxon Mobil Corp. | | 50,600 | | | 3,445,860 |

Massey Energy Co. | | 91,986 | | | 930,898 |

PetroHawk Energy Corp.(a) | | 69,500 | | | 1,336,485 |

Petroleo Brasileiro SA - ADR | | 74,300 | | | 2,263,921 |

Range Resources Corp. | | 41,800 | | | 1,720,488 |

Valero Energy Corp. | | 74,500 | | | 1,333,550 |

| | | | | |

| | | | | 13,147,906 |

| | | | | |

Pharmaceuticals — 6.9% | | | | | |

Abbott Laboratories | | 120,300 | | | 5,738,310 |

Johnson & Johnson | | 56,100 | | | 2,950,860 |

Schering-Plough Corp. | | 133,200 | | | 3,136,860 |

Teva Pharmaceutical Industries Ltd. - ADR | | 73,100 | | | 3,293,155 |

| | | | | |

| | | | | 15,119,185 |

| | | | | |

| | | | | | |

| | | SEMI-ANNUAL REPORT | | MARCH 31, 2009 | | 19 |

| | |

| Schedule of Investments (concluded) | | Capital Appreciation Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

| | | Shares | | Value | |

Common Stocks | | | | | | |

Semiconductors & Semiconductor Equipment — 5.2% | | | | | | |

Broadcom Corp. - Class A(a) | | 170,927 | | $ | 3,415,121 | |

Lam Research Corp.(a) | | 107,617 | | | 2,450,439 | |

NVIDIA Corp.(a) | | 213,400 | | | 2,104,124 | |

PMC-Sierra, Inc.(a) | | 531,457 | | | 3,390,696 | |

| | | | | | |