UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock Multi-Manager Alternative Strategies Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 08/31/2016

Date of reporting period: 02/29/2016

| | |

| Item 1 – | | Report to Stockholders |

FEBRUARY 29, 2016

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

| | | | |

| | BlackRock Multi-Manager Alternative Strategies Fund | | of BlackRock FundsSM |

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | |

| | Shareholders can sign up for e-mail notifications of quarterly statements, annual and semi-annual shareholder reports and prospectuses by enrolling in the electronic delivery program. Electronic copies of shareholder reports and prospectuses are also available on BlackRock’s website. TO ENROLL IN ELECTRONIC DELIVERY: Shareholders Who Hold Accounts with Investment Advisors, Banks or Brokerages: Please contact your financial advisor. Please note that not all investment advisors, banks or brokerages may offer this service. Shareholders Who Hold Accounts Directly with BlackRock: 1. Access the BlackRock website at blackrock.com 2. Select "Access Your Account" 3. Next, select "eDelivery" in the "Related Resources" box and follow the sign-up instructions |

| | | | | | |

| 2 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

Dear Shareholder,

Diverging monetary policies and shifting economic outlooks across regions have been the overarching themes driving financial markets over the past couple of years. With U.S. growth outpacing the global economic recovery while inflationary pressures remained low, investors spent most of 2015 anticipating the curtailment of the Federal Reserve’s near-zero interest rate policy, which ultimately came in December. In contrast, the European Central Bank and the Bank of Japan took measures to stimulate growth. In this environment, the U.S. dollar strengthened considerably, causing profit challenges for U.S. exporters and high levels of volatility in emerging market currencies and commodities.

Global market volatility increased in the latter part of 2015 and continued into early 2016. Oil prices collapsed in mid-2015 due to excess supply, and remained precarious while the world’s largest oil producers sought to negotiate a deal. Developing countries, many of which rely heavily on oil exports to sustain their economies, were particularly affected by falling oil prices. Meanwhile, China, one of the world’s largest oil consumers, exhibited further signs of slowing economic growth. This, combined with a depreciating yuan and declining confidence in the country’s policymakers, stoked worries about the potential impact of China’s weakness on the broader global economy.

Toward the end of the period, volatility abated as investors were relieved to find that conditions were not as bad as previously feared. While the recent selloff in risk assets has resulted in more reasonable valuations and some appealing entry points, investors continue to face mixed economic data and uncertainty relating to oil prices, corporate earnings and an unusual U.S. presidential election season.

For the 12-month period, higher quality assets such as U.S. Treasuries, municipal bonds and investment grade corporate bonds generated positive returns, while risk assets such as equities and high yield bonds broadly declined.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of February 29, 2016 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | (0.92 | )% | | | (6.19 | )% |

U.S. small cap equities

(Russell 2000® Index) | | | (10.16 | ) | | | (14.97 | ) |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | (9.48 | ) | | | (15.18 | ) |

Emerging market equities

(MSCI Emerging Markets

Index) | | | (8.85 | ) | | | (23.41 | ) |

3-month Treasury bill

(BofA Merrill Lynch

3-Month U.S. Treasury

Bill Index) | | | 0.06 | | | | 0.08 | |

U.S. Treasury securities

(BofA Merrill Lynch

10-Year U.S. Treasury

Index) | | | 5.01 | | | | 4.11 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | | 2.20 | | | | 1.50 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | 3.56 | | | | 3.78 | |

U.S. high yield bonds

(Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | | (5.57 | ) | | | (8.26 | ) |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | |

| Fund Summary as of February 29, 2016 | | |

BlackRock Multi-Manager Alternative Strategies Fund’s (the “Fund”) investment objective is to seek total return.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended February 29, 2016, the Fund underperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. |

Underlying Fund Strategies

The Fund seeks to achieve its investment objective by allocating to multiple affiliated and unaffiliated investment managers (“Sub-Advisers”) that employ a variety of alternative investment strategies. Each of the Sub-Advisers generally provides day-to-day management for a portion of the Fund’s assets.

Within the Fund’s positioning, underlying investment strategies are diversified across various asset classes, including equity, fixed income, commodities, foreign exchange, and assets associated with market volatility. However, notwithstanding their categorization for financial reporting purposes, many of the positions held provided exposure to multiple types of underlying strategies. These strategies include:

| | • | | Relative Value Strategies seek to profit from mispricing of financial instruments relative to each other or historical norms. These strategies utilize quantitative and qualitative analysis to identify securities or spreads between securities that deviate from their theoretical fair value and/or historical norms. |

| | • | | Event Driven Strategies concentrate on companies that are subject to corporate events such as mergers, acquisitions, restructurings, spin-offs, shareholder activism, or special situations that alter a company’s financial structure or operating strategy. The intended goal of even driven strategies is to profit when the price of a security changes to reflect more accurately the likelihood and potential impact of the occurrence, or non-occurrence, of the extraordinary event. This can be done by taking a long position in a security or other financial instrument that is believed to be underpriced or a short position in a security or other financial instrument that is believed to be overpriced. |

| | • | | Fundamental Long/Short Strategies involve buying or selling securities believed to be overpriced or underpriced relative to their potential value. Investment strategies within the fundamental long/short discipline include long and short equity- or credit-based strategies that emphasize a fundamental valuation framework and equity active value strategies where an active role is taken to enhance corporate value. |

| | • | | Directional Trading Strategies seek to profit from changes in macro-level exposures, such as interest rates, currencies, equities and commodities. This strategy may involve analyzing fundamental macroeconomic inputs, as well as technical information such as price, to identify investment opportunities across a broad array of asset classes and geographies. These strategies may also include model-driven trading strategies that use technical or fundamental inputs in order to make a trading decision across a portfolio of major global asset classes including fixed income, foreign exchange, equities and commodities. Trading decisions are made systematically using a rules-based investment approach. |

| • | | The Opportunistic Strategy through direct investments seek to enhance returns, or to implement various market hedges and to manage the Fund’s cash and short-term instruments. |

What factors influenced performance?

| • | | The Fund’s fundamental long/short credit and relative value strategies, as well as the opportunistic strategy, detracted from performance for the six-month period. Fundamental long/short credit strategies overall were impacted negatively by markdowns in securities backed by residential mortgages and student loans, as well as by select long exposures to the energy sector. Relative value strategies were impacted in part by slight losses from programs focused on securities with mispriced optionality. The opportunistic strategy also experienced losses, driven partially by select private loans. |

| • | | The Fund’s global macro/directional sub-strategies contributed positive performance during the period, benefiting in part from directional trend models that were bolstered by weakness in global equity markets and strength in developed bond markets in early 2016. |

| • | | The Fund, through its underlying Sub-Advisers, held derivatives during the period. The use of derivatives contributed positive performance during the period, primarily from global macro and relative value strategies. The Fund maintained a position in cash and cash equivalents as collateral against the Fund’s exposure to derivatives including, but not limited to, total return swaps, interest rate swaps, credit default swaps, and futures. The Fund’s cash balance did not have a material impact on performance. |

Describe recent portfolio activity.

| • | | During the six-month period, the Fund added two Sub-Advisers to the portfolio: Pine River Capital Management L.P. (a long/short equity manager), and Marathon Asset Management, LP (a long/short credit manager). In addition, the Fund made an investment in BlackRock Event Driven Equity Fund. The Fund removed two Sub-Advisers during the period: MeehanCombs (a long/short credit manager), and Achievement Capital (a relative value manager). The Fund liquidated its investment in BlackRock Global Long/Short Credit Fund (a long/short credit strategy). The Fund also initiated three trades and closed one trade at a profit in the opportunistic strategy. |

Describe portfolio positioning at period end.

| • | | At the end of the period, the Fund’s six Sub-Advisers, two BlackRock mutual funds and direct opportunistic investments had the following approximate exposures: 31% long-short credit, 18% long-short equity, 15% relative value, 15% global macro/managed futures, 13% event driven and 8% opportunistic. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 4 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

| | | | | |

| Ten Largest Holdings | | Percent of

Total Investments1 |

BlackRock Global Long/Short Equity Fund | | | | 10 | % |

BlackRock Event Driven Equity Fund | | | | 8 | |

Bear Stearns ALT-A Trust, Series 2005-10,

Class 11A1 | | | | 3 | |

VOLT XXIX LLC, Series 2014-NP10, Class A1 | | | | 3 | |

Boussard & Gavaudan Holding Ltd. | | | | 3 | |

Ligado Networks LLC (FKA New LightSquared LLC), Junior Loan | | | | 3 | |

LightSquared LP, Term Loan | | | | 3 | |

GreenPoint Mortgage Funding Trust,

Series 2007-AR1, Class 3A2 | | | | 2 | |

Lockheed Martin Corp. | | | | 2 | |

Bear Stearns ALT-A Trust, Series 2006-4,

Class 23A4 | | | | 2 | |

| |

| Portfolio Composition | | Percent of

Total Investments1 |

Investment Companies | | | | 23 | % |

Common Stocks | | | | 21 | |

Corporate Bonds | | | | 20 | |

Asset-Backed Securities | | | | 11 | |

Non-Agency Mortgage-Backed Securities | | | | 9 | |

Floating Rate Loan Interests | | | | 7 | |

U.S. Government Sponsored Agency Securities | | | | 3 | |

Preferred Securities | | | | 3 | |

Warrants | | | | 2 | |

Foreign Government Obligations | | | | 1 | |

| 1 | | Total Investments exclude short-term securities, options purchased, options written and investments sold short. |

| | | | | |

| Ten Largest Investments Sold Short | | Percent of

Investments Sold Short |

JPMorgan Chase & Co. | | | | 3 | % |

Schlumberger Ltd. | | | | 3 | |

SPDR S&P 500 ETF Trust | | | | 3 | |

Apple Inc. | | | | 3 | |

Infosys Ltd. — ADR | | | | 2 | |

Corning, Inc. | | | | 2 | |

National Oilwell Varco, Inc. | | | | 2 | |

Chevron Corp. | | | | 2 | |

Occidental Petroleum Corp. | | | | 2 | |

United Technologies Corp. | | | | 2 | |

| |

| Sector Allocation — Investments Sold Short | | Percent of

Investments Sold Short |

Information Technology | | | | 17 | % |

Financials | | | | 15 | |

Energy | | | | 15 | |

Health Care | | | | 11 | |

Investment Companies | | | | 11 | |

Consumer Discretionary | | | | 10 | |

Industrials | | | | 10 | |

Materials | | | | 7 | |

Telecommunication Services | | | | 2 | |

Consumer Staples | | | | 1 | |

Utilities | | | | 1 | |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | 5 |

|

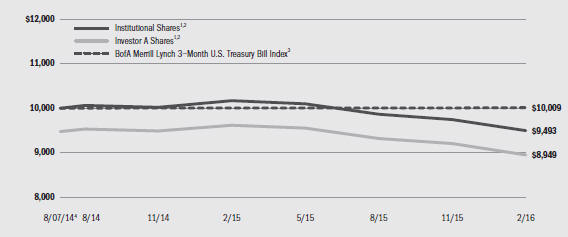

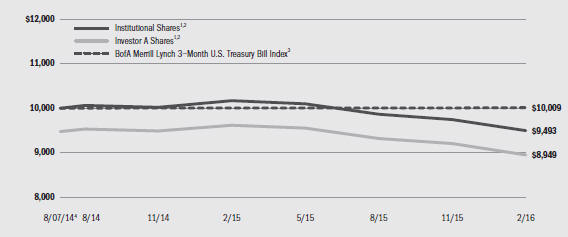

| Total Return Based on a $10,000 Investment |

| | 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory and administration fees. Institutional Shares do not have a sales charge. |

| | 2 | | The Fund allocates assets to multiple affiliated and unaffiliated investment managers that employ a variety of alternative investment strategies. |

| | 3 | | An unmanaged index that tracks 3-month U.S. Treasury securities. |

| | 4 | | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended February 29, 2016 | |

| | | | | Average Annual Total Returns5 |

| | | | | 1 Year | | Since Inception6 |

| | | 6-Month Total Returns | | w/o sales charge | | w/ sales charge | | w/o sales charge | | w/ sales charge |

Institutional | | | | (3.77 | )% | | | | (6.64 | )% | | | | N/A | | | | | (3.28 | )% | | | | N/A | |

Investor A | | | | (3.95 | ) | | | | (6.92 | ) | | | | (11.80 | )% | | | | (3.59 | ) | | | | (6.86 | )% |

Investor C | | | | (4.24 | ) | | | | (7.50 | ) | | | | (8.43 | ) | | | | (4.25 | ) | | | | (4.25 | ) |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | | 0.06 | | | | | 0.08 | | | | | N/A | | | | | 0.06 | | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 7 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on August 7, 2014. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense Example | |

| | | Actual | | Hypothetical9 |

| | | | | | | Expenses Paid During the Period | | | | Including Dividend Expense,

Stock Loan Fees and

Interest Expense | | Excluding Dividend Expense,

Stock Loan Fees and

Interest Expense |

| | | Beginning

Account Value

September 1,

2015 | | Ending Account Value

February 29,

2016 | | Including Dividend

Expense, Stock

Loan Fees and

Interest Expense7 | | Excluding Dividend

Expense, Stock

Loan Fees and

Interest Expense8 | | Beginning

Account Value

September 1,

2015 | | Ending Account Value

February 29,

2016 | | Expenses Paid During the Period7 | | Ending Account Value

February 29,

2016 | | Expenses Paid During the Period8 |

Institutional | | | $ | 1,000.00 | | | | $ | 962.30 | | | | $ | 10.00 | | | | $ | 7.95 | | | | $ | 1,000.00 | | | | $ | 1,014.67 | | | | $ | 10.27 | | | | $ | 1,016.76 | | | | $ | 8.17 | |

Investor A | | | $ | 1,000.00 | | | | $ | 960.50 | | | | $ | 11.65 | | | | $ | 9.26 | | | | $ | 1,000.00 | | | | $ | 1,012.98 | | | | $ | 11.96 | | | | $ | 1,015.42 | | | | $ | 9.52 | |

Investor C | | | $ | 1,000.00 | | | | $ | 957.60 | | | | $ | 14.89 | | | | $ | 12.81 | | | | $ | 1,000.00 | | | | $ | 1,009.65 | | | | $ | 15.29 | | | | $ | 1,011.77 | | | | $ | 13.17 | |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (2.05% for Institutional, 2.39% for Investor A, and 3.06% for Investor C), multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 8 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.63% for Institutional, 1.90% for Investor A, and 2.63% for Investor C), multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year shown). The fees and expenses of the underlying funds in which the Fund invests are not included in the Fund’s annualized expense ratio. |

| | 9 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on page 7 for further information on how expenses were calculated. |

| | | | | | |

| 6 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| • | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance

results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance table on the previous page assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment advisor, has contractually agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 6 of the Notes to Consolidated Financial Statements for additional information on waivers and/or reimbursements.

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense example on the previous page (which is based on a hypothetical investment of $1,000 invested on September 1, 2015 and held through February 29, 2016) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

| | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | 7 |

| | |

| Derivative Financial Instruments | | |

The Fund may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative

financial instrument. The Fund’s ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments are discussed in detail in the Notes to Consolidated Financial Statements.

| | | | | | |

| 8 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

| | | | |

| Consolidated Schedule of Investments February 29, 2016 (Unaudited) | | | (Percentages shown are based on Net Assets) | |

| | | | |

| | | | | | | | | | | | |

| Asset-Backed Securities | | | | | Par

(000) | | | Value | |

Bear Stearns Asset Backed Securities I Trust,

Series 2006-HE1, Class 2M3,

0.90%, 2/25/36 (a) | | | USD | | | | 1,776 | | | $ | 1,287,231 | |

BlueMountain CLO Ltd., Series 2012-1A,

Class E, 6.12%, 7/20/23 (a)(b) | | | | | | | 1,000 | | | | 803,497 | |

Citigroup Mortgage Loan Trust,

Series 2006-HE3, Class A2C,

0.60%, 12/25/36 (a) | | | | | | | 1,157 | | | | 710,407 | |

Countrywide Asset-Backed Certificates,

Series 2005-8, Class M5, 1.09%, 12/25/35 (a) | | | | | | | 1,500 | | | | 1,077,894 | |

Octagon Investment Partners XVII Ltd.,

Series 2013-1A, Class E, 5.12%, 10/25/25 (a)(b) | | | | | | | 2,000 | | | | 1,214,970 | |

VOLT XXIX LLC, Series 2014-NP10,

Class A1, 3.38%, 10/25/54 (b)(c) | | | | | | | 2,144 | | | | 2,112,934 | |

Total Asset-Backed Securities — 7.2% | | | | | | | | | | | 7,206,933 | |

| | | | | | | | | | | | |

| Common Stocks | | | | | Shares | | | | |

Aerospace & Defense — 1.9% | | | | | | | | | | | | |

HEICO Corp., Class A | | | | | | | 1,570 | | | | 68,609 | |

Honeywell International, Inc. | | | | | | | 4,443 | | | | 450,298 | |

Lockheed Martin Corp. (d) | | | | | | | 6,280 | | | | 1,355,161 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,874,068 | |

Auto Components — 0.5% | | | | | | | | | | | | |

Magna International, Inc. | | | | | | | 13,447 | | | | 522,416 | |

Automobiles — 0.0% | | | | | | | | | | | | |

Honda Motor Co Ltd. | | | | | | | 1,242 | | | | 31,932 | |

Beverages — 0.2% | | | | | | | | | | | | |

Constellation Brands, Inc. | | | | | | | 1,431 | | | | 202,386 | |

Biotechnology — 0.2% | | | | | | | | | | | | |

Baxalta, Inc. | | | | | | | 3,754 | | | | 144,604 | |

OncoCyte Corp. (e) | | | | | | | 96 | | | | 369 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 144,973 | |

Capital Markets — 1.0% | | | | | | | | | | | | |

AR Capital Acquisition Corp. (e) | | | | | | | 14,085 | | | | 137,470 | |

Barington/Hilco Acquisition Corp. (e) | | | | | | | 423 | | | | 4,192 | |

Boulevard Acquisition Corp. II (e) | | | | | | | 13,881 | | | | 131,453 | |

Boulevard Acquisition Corp. II (e) | | | | | | | 6,100 | | | | 59,780 | |

Capitol Acquisition Corp. III (e) | | | | | | | 6,800 | | | | 66,776 | |

Credit Suisse Group AG — ADR | | | | | | | 1,456 | | | | 19,408 | |

Double Eagle Acquisition Corp. (e) | | | | | | | 6,989 | | | | 69,191 | |

Gores Holdings, Inc. (e) | | | | | | | 6,000 | | | | 59,400 | |

GP Investments Acquisition Corp. (e) | | | | | | | 7,100 | | | | 68,870 | |

Harmony Merger Corp. (e) | | | | | | | 177 | | | | 1,738 | |

Hennessy Capital Acquisition Corp. II (e) | | | | | | | 9,232 | | | | 90,289 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Capital Markets (continued) | | | | | | | | |

Hydra Industries Acquisition Corp. (e) | | | 2,897 | | | $ | 28,130 | |

Pace Holdings Corp. (e) | | | 6,989 | | | | 69,191 | |

Quinpario Acquisition Corp. 2 (e) | | | 7,100 | | | | 68,870 | |

Terrapin 3 Acquisition Corp., Class A (e) | | | 2,853 | | | | 28,102 | |

WL Ross Holding Corp. (e) | | | 14,169 | | | | 141,690 | |

| | | | | | | | |

| | | | | | | | 1,044,550 | |

Chemicals — 0.7% | | | | | | | | |

LyondellBasell Industries NV, Class A | | | 8,268 | | | | 663,176 | |

Commercial Services & Supplies — 0.0% | | | | | | | | |

ADT Corp. | | | 700 | | | | 28,259 | |

Diversified Financial Services — 0.0% | | | | | | | | |

Industrivarden AB, Class C | | | 2,283 | | | | 35,132 | |

Diversified Telecommunication Services — 0.7% | | | | | | | | |

Verizon Communications, Inc. (d) | | | 12,949 | | | | 656,903 | |

Electronic Equipment, Instruments & Components — 0.0% | |

Kyocera Corp. — ADR | | | 403 | | | | 17,744 | |

Energy Equipment & Services — 0.6% | | | | | | | | |

Halliburton Co. | | | 18,435 | | | | 595,082 | |

Transocean Ltd. | | | 4,338 | | | | 37,524 | |

| | | | | | | | |

| | | | | | | | 632,606 | |

Health Care Equipment & Supplies — 1.0% | | | | | | | | |

Medtronic PLC (d) | | | 5,489 | | | | 424,794 | |

Terumo Corp. | | | 40 | | | | 1,367 | |

Zimmer Biomet Holdings, Inc. (d) | | | 5,719 | | | | 553,656 | |

| | | | | | | | |

| | | | | | | | 979,817 | |

Health Care Providers & Services — 0.7% | | | | | | | | |

Cigna Corp. | | | 1,316 | | | | 183,727 | |

HCA Holdings, Inc. (e) | | | 2,232 | | | | 154,477 | |

Kindred Healthcare, Inc. | | | 1,103 | | | | 11,593 | |

McKesson Corp. (d) | | | 2,407 | | | | 374,577 | |

| | | | | | | | |

| | | | | | | | 724,374 | |

Hotels, Restaurants & Leisure — 0.4% | | | | | | | | |

Carnival Corp. | | | 3,901 | | | | 187,092 | |

Royal Caribbean Cruises Ltd. (f) | | | 791 | | | | 58,827 | |

Starbucks Corp. | | | 2,273 | | | | 132,311 | |

| | | | | | | | |

| | | | | | | | 378,230 | |

Insurance — 0.0% | | | | | | | | |

PartnerRe Ltd. | | | 200 | | | | 28,054 | |

| | | | | | | | | | |

| Portfolio Abbreviations |

| ADR | | American Depositary Receipts | | EURIBOR | | Euro Interbank Offered Rate | | OTC | | Over-the-counter |

| AUD | | Australian Dollar | | FKA | | Formerly Known As | | PIK | | Payment-in-kind |

| CAD | | Canadian Dollar | | GBP | | British Pound | | REIT | | Real Estate Investment Trust |

| CLO | | Collateralized Loan Obligation | | JPY | | Japanese Yen | | S&P | | Standard & Poor’s |

| DJIA | | Dow Jones Industrial Average | | LIBOR | | London Interbank Offered Rate | | SEK | | Swedish Krona |

| ETF | | Exchange-Traded Fund | | NOK | | Norwegian Krone | | SPDR | | Standard & Poor’s Depositary Receipts |

| ETN | | Exchange-Traded Note | | NZD | | New Zealand Dollar | | USD | | U.S. Dollar |

| EUR | | Euro | | | | | | | | |

See Notes to Consolidated Financial Statements.

| | | | | | |

| | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | 9 |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | |

| | | | | | | | |

| Common Stocks | |

Shares | | | Value | |

Internet & Catalog Retail — 0.3% | | | | | | | | |

Amazon.com, Inc. (d)(e) | | | 304 | | | $ | 167,966 | |

Liberty TripAdvisor Holdings, Inc., Class A (e) | | | 4,900 | | | | 99,911 | |

| | | | | | | | |

| | | | | | | | 267,877 | |

Internet Software & Services — 1.6% | | | | | | | | |

Alphabet, Inc. Class C (d)(e) | | | 820 | | | | 572,171 | |

Alphabet, Inc., Class A (e) | | | 176 | | | | 126,231 | |

Baidu, Inc. — ADR (e) | | | 660 | | | | 114,457 | |

Facebook, Inc., Class A (d)(e) | | | 6,677 | | | | 713,905 | |

Qihoo 360 Technology Co. Ltd. — ADR (e) | | | 528 | | | | 37,953 | |

Yahoo!, Inc. (e) | | | 2,137 | | | | 67,935 | |

| | | | | | | | |

| | | | | | | | 1,632,652 | |

IT Services — 0.2% | | | | | | | | |

Cognizant Technology Solutions Corp., Class A (e) | | | 3,857 | | | | 219,772 | |

Machinery — 0.0% | | | | | | | | |

Blount International, Inc. (e) | | | 3,700 | | | | 35,890 | |

Media — 0.5% | | | | | | | | |

Comcast Corp. | | | 2,209 | | | | 127,526 | |

Discovery Communications, Inc., Class A (e) | | | 4,386 | | | | 109,650 | |

Global Eagle Entertainment, Inc. (e) | | | 2,294 | | | | 20,623 | |

Liberty Media Corp., Class C (e) | | | 1,647 | | | | 57,480 | |

News Corp., Class A | | | 3,435 | | | | 37,167 | |

Time Warner Cable, Inc. | | | 383 | | | | 73,099 | |

Viacom, Inc., Class B | | | 1,000 | | | | 36,850 | |

| | | | | | | | |

| | | | | | | | 462,395 | |

Metals & Mining — 0.0% | | | | | | | | |

Industrias Penoles SAB de CV | | | 3,591 | | | | 42,090 | |

Oil, Gas & Consumable Fuels — 2.1% | | | | | | | | |

Anadarko Petroleum Corp. | | | 4,350 | | | | 165,083 | |

Chevron Corp. | | | 239 | | | | 19,942 | |

Exxon Mobil Corp. | | | 2,873 | | | | 230,271 | |

Noble Energy, Inc. | | | 20,947 | | | | 617,937 | |

Pioneer Natural Resources Co. (d) | | | 5,608 | | | | 675,932 | |

Valero Energy Corp. | | | 5,162 | | | | 310,133 | |

WPX Energy, Inc. (e) | | | 8,720 | | | | 35,839 | |

| | | | | | | | |

| | | | | | | | 2,055,137 | |

Semiconductors & Semiconductor Equipment — 0.0% | | | | | | | | |

Fairchild Semiconductor International, Inc. (e) | | | 1,800 | | | | 36,108 | |

Software — 0.2% | | | | | | | | |

Microsoft Corp. | | | 2,570 | | | | 130,762 | |

Solera Holdings, Inc. | | | 600 | | | | 33,420 | |

| | | | | | | | |

| | | | | | | | 164,182 | |

Specialty Retail — 0.4% | | | | | | | | |

AutoZone, Inc. (e) | | | 178 | | | | 137,873 | |

Home Depot, Inc. | | | 1,201 | | | | 149,068 | |

O’Reilly Automotive, Inc. (e) | | | 280 | | | | 72,890 | |

Restoration Hardware Holdings, Inc. (e) | | | 1,089 | | | | 41,371 | |

| | | | | | | | |

| | | | | | | | 401,202 | |

Technology Hardware, Storage & Peripherals — 0.7% | | | | | | | | |

EMC Corp. | | | 5,076 | | | | 132,636 | |

Hewlett-Packard Co. (e) | | | 23,879 | | | | 255,266 | |

Western Digital Corp. | | | 6,613 | | | | 287,864 | |

| | | | | | | | |

| | | | | | | | 675,766 | |

Wireless Telecommunication Services — 0.1% | | | | | | | | |

NII Holdings, Inc. (e) | | | 20,453 | | | | 108,605 | |

Total Common Stocks — 14.0% | | | | | | | 14,066,296 | |

| | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | |

| Corporate Bonds | | | | | Par

(000) | | | Value | |

Aerospace & Defense — 0.7% | | | | | | | | | | | | |

Meccanica Holdings USA, Inc., 7.38%, 7/15/39 (b) | | | USD | | | | 650 | | | $ | 659,750 | |

Automobiles — 0.3% | | | | | | | | | | | | |

Tesla Motors, Inc., 1.50%, 6/01/18 (d)(g) | | | | | | | 200 | | | | 310,250 | |

Building Products — 0.6% | | | | | | | | | | | | |

Apex Tool Group LLC, 7.00%, 2/01/21 (b) | | | | | | | 750 | | | | 562,500 | |

Chemicals — 0.5% | | | | | | | | | | | | |

Hexion, Inc.: | | | | | | | | | | | | |

6.63%, 4/15/20 | | | | | | | 389 | | | | 307,310 | |

10.00%, 4/15/20 | | | | | | | 200 | | | | 172,500 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 479,810 | |

Commercial Services & Supplies — 0.3% | | | | | | | | | | | | |

Harland Clarke Holdings Corp., 9.75%, 8/01/18 (b) | | | | | | | 284 | | | | 274,060 | |

Communications Equipment — 0.0% | | | | | | | | | | | | |

Nortel Networks Ltd., 5.34%, 7/15/11 (e)(h) | | | | | | | 54 | | | | 45,630 | |

Containers & Packaging — 0.7% | | | | | | | | | | | | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 4.25%, 1/15/22 | | | EUR | | | | 400 | | | | 428,658 | |

Reynolds Group Issuer, Inc., 9.88%, 8/15/19 | | | USD | | | | 244 | | | | 251,320 | |

| | | | | | | | | | | | |

| | | | | | | �� | | | | | 679,978 | |

Diversified Consumer Services — 0.3% | | | | | | | | | | | | |

Monitronics International, Inc., 9.13%, 4/01/20 | | | | | | | 400 | | | | 339,000 | |

Diversified Telecommunication Services — 1.9% | | | | | | | | | | | | |

Avaya, Inc., 9.00%, 4/01/19 (b) | | | | | | | 750 | | | | 470,625 | |

Frontier Communications Corp.: | | | | | | | | | | | | |

8.88%, 9/15/20 (b) | | | | | | | 129 | | | | 133,193 | |

10.50%, 9/15/22 (b) | | | | | | | 194 | | | | 195,940 | |

11.00%, 9/15/25 (b) | | | | | | | 434 | | | | 434,543 | |

Intelsat Jackson Holdings SA, 7.25%, 10/15/20 | | | | | | | 455 | | | | 313,950 | |

Oi Brasil Holdings Cooperatief UA, 5.75%, 2/10/22 | | | | | | | 522 | | | | 125,280 | |

Telemar Norte Leste SA, 5.50%, 10/23/20 | | | | | | | 510 | | | | 153,000 | |

Zayo Group LLC/Zayo Capital, Inc., 6.00%, 4/01/23 | | | | | | | 113 | | | | 111,305 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,937,836 | |

Electric Utilities — 0.4% | | | | | | | | | | | | |

Energy Future Intermediate Holding Co. LLC/EFIH Finance, Inc., 11.75%, 3/01/22 (b)(e)(h) | | | | | | | 337 | | | | 355,752 | |

Energy Equipment & Services — 0.1% | | | | | | | | | | | | |

SeaDrill Ltd., 6.13%, 9/15/17 (b) | | | | | | | 300 | | | | 99,375 | |

Hotels, Restaurants & Leisure — 0.8% | | | | | | | | | | | | |

Caesars Entertainment Resort Properties LLC/Caesars Entertainment Resort Properties, 8.00%, 10/01/20 | | | | | | | 818 | | | | 799,595 | |

Household Durables — 0.1% | | | | | | | | | | | | |

Toll Brothers Finance Corp., 0.50%, 9/15/32 (g) | | | | | | | 100 | | | | 95,937 | |

Internet & Catalog Retail — 1.3% | | | | | | | | | | | | |

Ctrip.com International Ltd., 1.25%, 10/15/18 (d)(g) | | | | | | | 250 | | | | 307,969 | |

Netflix, Inc., 5.75%, 3/01/24 | | | | | | | 448 | | | | 469,840 | |

Priceline Group, Inc., 1.00%, 3/15/18 (g) | | | | | | | 150 | | | | 210,281 | |

Vipshop Holdings Ltd., 1.50%, 3/15/19 (g) | | | | | | | 300 | | | | 290,063 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,278,153 | |

See Notes to Consolidated Financial Statements.

| | | | | | |

| 10 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | |

| | | | | | | | | | | | |

| Corporate Bonds | | | | | Par

(000) | | | Value | |

Internet Software & Services — 0.4% | | | | | | | | | | | | |

j2 Global, Inc., 3.25%, 6/15/29 (d)(g) | | | USD | | | | 200 | | | $ | 243,750 | |

Monster Worldwide, Inc., 3.50%, 10/15/19 (d)(g) | | | | | | | 150 | | | | 125,906 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 369,656 | |

Media — 1.4% | | | | | | | | | | | | |

Altice Luxembourg SA: | | | | | | | | | | | | |

7.75%, 5/15/22 (b) | | | | | | | 419 | | | | 405,383 | |

7.63%, 2/15/25 (b) | | | | | | | 400 | | | | 366,000 | |

iHeartCommunications, Inc.: | | | | | | | | | | | | |

9.00%, 9/15/22 | | | | | | | 45 | | | | 30,150 | |

10.63%, 3/15/23 | | | | | | | 593 | | | | 391,380 | |

Neptune Finco Corp., 10.13%, 1/15/23 (b) | | | | | | | 208 | | | | 223,860 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,416,773 | |

Metals & Mining — 0.1% | | | | | | | | | | | | |

AK Steel Corp., 8.75%, 12/01/18 | | | | | | | 144 | | | | 131,040 | |

Multiline Retail — 0.1% | | | | | | | | | | | | |

Bon-Ton Department Stores, Inc., 8.00%, 6/15/21 | | | | | | | 400 | | | | 146,000 | |

Oil, Gas & Consumable Fuels — 1.8% | | | | | | | | | | | | |

Berry Petroleum Co. LLC: | | | | | | | | | | | | |

6.75%, 11/01/20 | | | | | | | 65 | | | | 7,150 | |

6.38%, 9/15/22 | | | | | | | 661 | | | | 71,058 | |

Buckeye Partners LP, 5.60%, 10/15/44 | | | | | | | 330 | | | | 248,731 | |

NGPL PipeCo LLC, 7.77%, 12/15/37 (b) | | | | | | | 513 | | | | 364,230 | |

Sabine Pass Liquefaction LLC, 6.25%, 3/15/22 | | | | | | | 750 | | | | 714,375 | |

Williams Partners LP, 3.35%, 8/15/22 | | | | | | | 545 | | | | 403,305 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,808,849 | |

Pharmaceuticals — 0.2% | | | | | | | | | | | | |

Concordia Healthcare Corp., 9.50%, 10/21/22 (b) | | | | | | | 125 | | | | 121,250 | |

Valeant Pharmaceuticals International, Inc.,

6.13%, 4/15/25 (b) | | | | | | | 69 | | | | 57,917 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 179,167 | |

Real Estate Investment Trusts (REITs) — 0.2% | | | | | | | | | | | | |

SL Green Operating Partnership LP,

3.00%, 10/15/17 (b)(g) | | | | | | | 150 | | | | 178,687 | |

Semiconductors & Semiconductor Equipment — 0.5% | | | | | | | | | |

NVIDIA Corp., 1.00%, 12/01/18 (d)(g) | | | | | | | 200 | | | | 321,500 | |

SunPower Corp., 4.00%, 1/15/23 (b)(g) | | | | | | | 211 | | | | 218,253 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 539,753 | |

Software — 0.3% | | | | | | | | | | | | |

Solera LLC/Solera Finance, Inc., 10.50%, 3/01/24 (b) | | | | | | | 285 | | | | 270,750 | |

Specialty Retail — 0.2% | | | | | | | | | | | | |

Chinos Intermediate Holdings A, Inc., 7.75% (7.75% Cash or 8.50% PIK), 5/01/19 (b)(i) | | | | | | | 113 | | | | 27,685 | |

Restoration Hardware Holdings, Inc.,

0.00%, 7/15/20 (b)(d)(g)(j) | | | | | | | 250 | | | | 174,687 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 202,372 | |

Wireless Telecommunication Services — 0.2% | | | | | | | | | | | | |

America Movil BV, 5.50%, 9/17/18 (g) | | | EUR | | | | 200 | | | | 220,965 | |

Total Corporate Bonds — 13.4% | | | | | | | | | | | 13,381,638 | |

| | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (a) | | | | | Par

(000) | | | Value | |

Commercial Services & Supplies — 0.0% | | | | | | | | | | | | |

Cory Environmental (Denmark HoldCo) (LIBOR + 3.25% PIK), Term Loan-Junior Loan,

3.83%, 12/31/19 (i) | | | GBP | | | | 1 | | | $ | 1,160 | |

Cory Environmental (Viking Consortium) (LIBOR + 3.25% PIK), Term Loan, 0.66%, 12/31/19 (i) | | | | | | | 2 | | | | 2,630 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 3,790 | |

Diversified Telecommunication Services — 3.6% | | | | | | | | | |

Ligado Networks LLC (FKA New LightSquared LLC), Junior Loan, 13.50%, 12/07/20 | | | USD | | | | 2,700 | | | | 1,863,000 | |

LightSquared LP, Term Loan, 9.75%, 6/15/20 | | | | | | | 2,000 | | | | 1,740,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 3,603,000 | |

Electric Utilities — 0.1% | | | | | | | | | | | | |

Texas Competitive Electric Holdings Co. LLC (TXU), 2017 Term Loan (Extending),

4.91%, 10/10/17 | | | | | | | 550 | | | | 150,150 | |

Hotels, Restaurants & Leisure — 0.4% | | | | | | | | | | | | |

Caesars Entertainment Operating Co., Term

Loan B, 0.00%, 10/31/17 | | | | | | | 443 | | | | 387,625 | |

Specialty Retail — 0.4% | | | | | | | | | | | | |

Toys ’R’ Us-Delaware, Inc., Term B-4 Loan,

8.75%, 4/24/20 | | | | | | | 499 | | | | 385,625 | |

Total Floating Rate Loan Interests — 4.5% | | | | 4,530,190 | |

| | | | | | | | | | | | |

| Foreign Government Obligations | | | | | | | | | |

Canada — 0.3% | | | | | | | | | | | | |

Canadian Government Bond, 1.75%, 9/01/19 | | | CAD | | | | 359 | | | | 276,364 | |

Greece — 0.3% | | | | | | | | | | | | |

Hellenic Republic Government Bond,

4.75%, 4/17/19 | | | EUR | | | | 400 | | | | 346,243 | |

Total Foreign Government Obligations — 0.6% | | | | 622,607 | |

| | | | | | | | | | | | |

| Investment Companies | | | | | Shares | | | | |

Advent Claymore Convertible Securities & Income Fund | | | | | | | 2,805 | | | | 35,147 | |

AllianzGI Convertible & Income Fund | | | | | | | 6,852 | | | | 33,712 | |

AllianzGI Convertible & Income Fund II | | | | | | | 6,785 | | | | 30,261 | |

AllianzGI NFJ Dividend Interest & Premium Strategy Fund | | | | | | | 4,400 | | | | 51,172 | |

Alpine Global Premier Properties Fund | | | | | | | 7,000 | | | | 35,420 | |

BlackRock Event Driven Equity Fund (k) | | | | | | | 584,112 | | | | 5,128,505 | |

BlackRock Global Long/Short Equity Fund (e)(k) | | | | | | | 627,932 | | | | 6,863,291 | |

Boussard & Gavaudan Holding Ltd. (e) | | | | | | | 117,500 | | | | 2,079,680 | |

Calamos Dynamic Convertible & Income Fund | | | | | | | 1,268 | | | | 20,580 | |

Cohen & Steers REIT and Preferred Income Fund, Inc. | | | | | | | 4,657 | | | | 81,404 | |

Credit Suisse Asset Management Income Fund, Inc. | | | | | | | 9,686 | | | | 26,249 | |

ETRACS Monthly Pay 2xLeveraged Closed-End Fund ETN | | | | | | | 2,970 | | | | 41,402 | |

Franklin Limited Duration Income Trust | | | | | | | 2,550 | | | | 27,413 | |

Invesco Dynamic Credit Opportunities Fund | | | | | | | 7,900 | | | | 78,763 | |

iPath S&P 500 VIX Short-Term Futures ETN (e)(l) | | | | | | | 5,600 | | | | 139,160 | |

See Notes to Consolidated Financial Statements.

| | | | | | |

| | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | 11 |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | |

| | | | | | | | | | | | |

| Investment Companies | | | | | Shares | | | Value | |

iShares 20+ Year Treasury Bond ETF (k) | | | | | | | 891 | | | $ | 116,703 | |

iShares 3-7 Year Treasury Bond ETF (k) | | | | | | | 518 | | | | 65,144 | |

iShares iBoxx $ High Yield Corporate Bond ETF (k) | | | | | | | 2,913 | | | | 233,273 | |

iShares Russell 2000 ETF (k) | | | | | | | 889 | | | | 91,345 | |

LMP Capital & Income Fund, Inc. | | | | | | | 3,672 | | | | 41,677 | |

Madison Covered Call & Equity Strategy Fund | | | | | | | 10,163 | | | | 73,072 | |

Market Vectors Gold Miners ETF | | | | | | | 5,103 | | | | 98,896 | |

New America High Income Fund, Inc. | | | | | | | 7,237 | | | | 53,699 | |

Royce Micro-Cap Trust, Inc. | | | | | | | 3,279 | | | | 21,773 | |

Swiss Helvetia Fund, Inc. | | | | | | | 3,229 | | | | 30,998 | |

Western Asset/Claymore Inflation-Linked Opportunities & Income Fund | | | | | | | 5,892 | | | | 59,863 | |

Western Asset/Claymore Inflation-Linked Securities & Income Fund | | | | | | | 2,670 | | | | 28,249 | |

Total Investment Companies — 15.6% | | | | 15,586,851 | |

| | | | | | | | | | | | |

| Non-Agency Mortgage-Backed Securities | | | | | Par

(000) | | | | |

Collateralized Mortgage Obligations — 6.0% | | | | | | | | | | | | |

Bear Stearns ALT-A Trust: | | | | | | | | | | | | |

Series 2005-10, Class 11A1, 0.94%, 1/25/36 (a) | | | USD | | | | 2,938 | | | | 2,320,180 | |

Series 2006-4, Class 23A4, 2.63%, 8/25/36 (a) | | | | | | | 2,254 | | | | 1,334,007 | |

Countrywide Alternative Loan Trust, Series 2007-OA6, Class A1B, 0.64%, 6/25/37 (a) | | | | | | | 943 | | | | 793,340 | |

GreenPoint Mortgage Funding Trust,

Series 2007-AR1, Class 3A2, 0.60%, 2/25/37 (a) | | | | | | | 1,876 | | | | 1,535,617 | |

Total Non-Agency Mortgage-Backed Securities — 6.0% | | | | 5,983,144 | |

| | | | | | | | | | | | |

| Preferred Securities | | | | | | | | | |

Capital Trusts | | | | | | | | | | | | |

Banks — 0.1% | | | | | | | | | | | | |

HSH Nordbank AG, 7.25% (m) | | | | | | | 497 | | | | 102,819 | |

Diversified Financial Services — 0.1% | | | | | | | | | | | | |

RESPARCS Funding LP I, 8.00% (m) | | | | | | | 419 | | | | 84,345 | |

Semiconductors & Semiconductor Equipment — 0.2% | | | | | | | | | |

Intel Corp., 3.25%, 8/01/39 (d)(g) | | | | | | | 150 | | | | 222,563 | |

Total Capital Trusts — 0.4% | | | | | | | | | | | 409,727 | |

Preferred Stocks | | | | | | | Shares | | | | | |

Banks — 0.1% | | | | | | | | | | | | |

Citigroup, Inc., 6.88% | | | | | | | 1,511 | | | | 40,057 | |

Citigroup, Inc., 7.13% | | | | | | | 1,700 | | | | 44,897 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 84,954 | |

Capital Markets — 0.1% | | | | | | | | | | | | |

Goldman Sachs Group, Inc., 5.50% | | | | | | | 1,700 | | | | 41,905 | |

Morgan Stanley, 7.13% | | | | | | | 1,600 | | | | 45,008 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 86,913 | |

Commercial Services & Supplies — 0.1% | | | | | | | | | | | | |

Stericycle, Inc., 5.25% | | | | | | | 1,000 | | | | 87,400 | |

Diversified Telecommunication Services — 0.0% | | | | | | | | | | | | |

Intelsat SA, 5.75% (g) | | | | | | | 5,000 | | | | 25,650 | |

| | | | | | | | | | | | |

| Preferred Stocks | | | | | Shares | | | Value | |

Food Products — 0.0% | | | | | | | | | | | | |

Tyson Foods, Inc., 4.75% | | | | | | | 4 | | | $ | 288 | |

Health Care Providers & Services — 0.2% | | | | | | | | | | | | |

Amsurg Corp., 5.25% | | | | | | | 1,000 | | | | 133,780 | |

Anthem, Inc., 5.25% | | | | | | | 813 | | | | 35,967 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 169,747 | |

Insurance — 0.2% | | | | | | | | | | | | |

Maiden Holdings Ltd., 7.25% (g) | | | | | | | 3,920 | | | | 175,616 | |

Multi-Utilities — 0.2% | | | | | | | | | | | | |

Black Hills Corp., 7.75% | | | | | | | 3,000 | | | | 191,880 | |

Oil, Gas & Consumable Fuels — 0.0% | | | | | | | | | | | | |

Southwestern Energy Co., 6.25% (d) | | | | | | | 1,299 | | | | 18,524 | |

Pharmaceuticals — 0.4% | | | | | | | | | | | | |

Allergan PLC, 5.50% (g) | | | | | | | 250 | | | | 241,495 | |

Teva Pharmaceutical Industries Ltd., 7.00% | | | | | | | 200 | | | | 181,500 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 422,995 | |

Real Estate Investment Trusts (REITs) — 0.2% | | | | | | | | | | | | |

Crown Castle International Corp., 4.50% (d) | | | | | | | 1,267 | | | | 134,619 | |

Invesco Mortgage Capital, Inc., 7.75% | | | | | | | 1,750 | | | | 35,070 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 169,689 | |

Real Estate Management & Development — 0.2% | | | | | |

Forestar Group, Inc., 6.00% | | | | | | | 15,000 | | | | 200,850 | |

Semiconductors & Semiconductor Equipment — 0.0% | | | | | | | | | |

SunEdison, Inc., 6.75% | | | | | | | 250 | | | | 29,500 | |

Thrifts & Mortgage Finance — 0.1% | | | | | | | | | | | | |

Fannie Mae, 8.25% | | | | | | | 27,000 | | | | 84,240 | |

Wireless Telecommunication Services — 0.0% | | | | | | | | | | | | |

T-Mobile U.S., Inc., 5.50% | | | | | | | 1,000 | | | | 64,070 | |

Total Preferred Stocks — 1.8% | | | | | | | | | | | 1,812,316 | |

Total Preferred Securities — 2.2% | | | | | | | | | | | 2,222,043 | |

| | | | | | | | | | | | |

| U.S. Government Sponsored Agency Securities | | | | | Par

(000) | | | | |

Interest Only Collateralized Mortgage Obligations — 2.4% | | | | | |

Fannie Mae: | | | | | | | | | | | | |

Series 1997-85, Class M, 6.50%, 12/25/27 | | | USD | | | | 904 | | | | 147,471 | |

Series 2001-61, Class SH, 7.47%, 11/18/31 (a) | | | | | | | 160 | | | | 34,322 | |

Series 2006-115, Class EI, 6.20%, 12/25/36 (a) | | | | | | | 671 | | | | 139,297 | |

Series 2006-126, Class CS, 6.26%, 1/25/37 (a) | | | | | | | 678 | | | | 123,539 | |

Series 2007-77, Class SK, 5.43%, 8/25/37 (a) | | | | | | | 669 | | | | 103,678 | |

Series 2007-88, Class VI, 6.10%, 9/25/37 (a) | | | | | | | 590 | | | | 124,743 | |

Series 2008-87, Class AS, 7.21%, 7/25/33 (a) | | | | | | | 266 | | | | 56,773 | |

Series 2011-129, Class S, 5.06%, 3/25/37 (a) | | | | | | | 1,090 | | | | 69,268 | |

Series 2015-42, Class AI, 1.74%, 6/25/55 (a) | | | | | | | 1,682 | | | | 114,219 | |

Series 2015-64, Class SK, 1.71%, 9/25/55 | | | | | | | 1,812 | | | | 122,172 | |

Series 345, Class 15, 6.00%, 3/25/34 (a) | | | | | | | 763 | | | | 172,656 | |

See Notes to Consolidated Financial Statements.

| | | | | | |

| 12 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | |

| | | | | | | | | | | | |

| U.S. Government Sponsored Agency Securities | | | | | Par

(000) | | | Value | |

Interest Only Collateralized Mortgage Obligations (continued) | | | | | |

Freddie Mac: | | | | | | | | | | | | |

Series 2416, Class SV, 7.32%, 5/15/31 (a) | | | USD | | | | 529 | | | $ | 98,929 | |

Series 4413, Class WI, 1.69%, 10/15/41 (a) | | | | | | | 1,227 | | | | 80,610 | |

Ginnie Mae: | | | | | | | | | | | | |

Series 2004-46, Class S, 6.67%, 6/20/34 (a) | | | | | | | 476 | | | | 101,703 | |

Series 2005-69, Class SY, 6.32%, 11/20/33 (a) | | | | | | | 254 | | | | 47,650 | |

Series 2012-16, Class NI, 6.00%, 5/20/39 | | | | | | | 497 | | | | 98,264 | |

Series 2013-44, Class IB, 5.00%, 5/16/42 | | | | | | | 515 | | | | 118,943 | |

Series 2014-183, Class IM, 5.00%, 6/20/35 | | | | | | | 689 | | | | 168,491 | |

Series 2014-2, Class TI, 5.50%, 1/20/44 | | | | | | | 597 | | | | 107,955 | |

Series 2015-102, Class IT, 0.10%, 7/16/41 (a) | | | | | | | 22,787 | | | | 97,237 | |

Series 2015-80, Class IH, 1.00%, 5/20/44 (a) | | | | | | | 3,542 | | | | 123,974 | |

Series 2015-95, Class KI, 6.00%, 2/20/43 | | | | | | | 449 | | | | 107,103 | |

Series 2016-12, Class KI, 5.00%, 9/20/38 | | | | | | | 295 | | | | 74,764 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,433,761 | |

Total U.S. Government Sponsored Agency Securities — 2.4% | | | | 2,433,761 | |

| | | | | | | | | | | | |

| U.S. Treasury Obligations — 0.2% | | | | | | | | | |

U.S. Treasury Notes, 1.63%, 2/15/26 | | | | | | | 210 | | | | 207,802 | |

| | | | | | | | | | | | |

| Warrants (e) | | | | | Shares | | | | |

Aerospace & Defense — 0.0% | | | | | | | | | | | | |

Tempus Applied Solutions Holdings, Inc. (Issued/exercisable 2/01/13, 1 Share for 1 Warrant, Expires 7/31/20, Strike Price $11.50) | | | | | | | 14,552 | | | | 2,328 | |

Banks — 0.6% | | | | | | | | | | | | |

Associated Banc-Corp. (Issued/exercisable 12/01/11, 1 Share for 1 Warrant, Expires 11/21/18,

Strike Price $19.77) | | | | | | | 14,897 | | | | 31,135 | |

JPMorgan Chase & Co. (Issued/exercisable 10/28/08, 1 Share for 1 Warrant, Expires 10/28/18,

Strike Price $42.25) | | | | | | | 16,311 | | | | 265,543 | |

M&T Bank Corp. (Issued 12/10/12, exercisable 12/12/12, 1 Share for 1 Warrant, Expires 12/23/18, Strike Price $73.86) | | | | | | | 243 | | | | 7,776 | |

SunTrust Banks, Inc. (Issued/exercisable 11/14/08, 1 Share for 1 Warrant, Expires 11/14/18,

Strike Price $44.15) | | | | | | | 32,120 | | | | 89,936 | |

TCF Financial Corp. (Issued/exercisable 11/14/08, 1 Share for 1 Warrant, Expires 11/14/18,

Strike Price $16.93) | | | | | | | 31,271 | | | | 48,470 | |

Texas Capital Bancshares, Inc. (Issued/exercisable 1/16/09, 1 Share for 1 Warrant, Expires 1/16/19,

Strike Price $14.84) | | | | | | | 359 | | | | 6,405 | |

Valley National Bancorp (Issued/exercisable 11/14/08, 1.1025 Shares for 1 Warrant, Expires 11/14/18,

Strike Price $16.11) | | | | | | | 28,275 | | | | 4,241 | |

| | | | | | | | |

| Warrants (e) | | Shares | | | Value | |

Banks (continued) | | | | | | | | |

Wells Fargo & Co. (Issued/exercisable 10/28/08, 1 Share for 1 Warrant, Expires 10/28/18, Strike Price $33.90) | | | 2,095 | | | $ | 31,425 | |

Wintrust Financial Corp. (Issued/exercisable 12/19/08, 1 Share for 1 Warrant, Expires 12/19/18, Strike Price $22.82) | | | 1,586 | | | | 32,909 | |

Zions Bancorporation (Issued/exercisable 11/14/08, 1 Share for 1 Warrant, Expires 11/14/18, Strike Price $36.27) | | | 907 | | | | 544 | |

Zions Bancorporation (Issued/exercisable 5/20/10, 1.016 Shares for 1 Warrant, Expires 5/22/20, Strike Price $36.25) | | | 56,463 | | | | 98,810 | |

| | | | | | | | |

| | | | | | | | 617,194 | |

Biotechnology — 0.0% | | | | | | | | |

BioTime, Inc. (Issued/exercisable 10/02/14, 1.1 Shares for 1 Warrant, Expires 10/01/18, Strike Price $4.55) | | | 51,137 | | | | 28,125 | |

CEL-SCI Corp. (Issued/exercisable 12/09/13, 1 Share for 1 Warrant, Expires 10/11/18, Strike Price $1.25) | | | 15,250 | | | | 3,506 | |

ContraFect Corp. (Issued/exercisable 9/12/14, 1 Share for 1 Warrant, Expires 1/31/17, Strike Price $4.80) | | | 2,174 | | | | 1,304 | |

| | | | | | | | |

| | | | | | | | 32,935 | |

Capital Markets — 0.0% | | | | | | | | |

Arowana, Inc. (Issued/exercisable 5/14/15, 1 Share for 1 Warrant, Expires 5/01/20, Strike Price $12.50) | | | 25,946 | | | | 2,104 | |

Chemicals — 0.0% | | | | | | | | |

AgroFresh Solutions, Inc. (Issued 3/31/14,exercisable 4/07/14, 1 Share for 1 Warrant, Expires 2/19/19, Strike Price $11.50) | | | 11,724 | | | | 7,264 | |

Construction Materials — 0.2% | | | | | | | | |

U.S. Concrete, Inc. (Issued 8/31/13, exercisable 9/27/13, 1 Share for 1 Warrant, Expires 8/31/17, Strike Price $26.68) | | | 5,782 | | | | 162,879 | |

Consumer Finance — 0.1% | | | | | | | | |

Capital One Financial Corp. (Issued/exercisable 11/14/08, 1 Share for 1 Warrant, Expires 11/14/18, Strike Price $42.07) | | | 1,869 | | | | 47,790 | |

Electronic Equipment, Instruments & Components — 0.0% | |

Applied DNA Sciences, Inc. (Issued/exercisable 11/14/14, 1 Share for 1 Warrant, Expires 11/14/19, Strike Price $3.50) | | | 36,729 | | | | 41,504 | |

Hotels, Restaurants & Leisure — 0.1% | | | | | | | | |

Del Taco Restaurants, Inc. (Issued/exercisable 1/03/14, 1 Share for 1 Warrant, Expires 6/30/20, Strike Price $11.50) | | | 46,643 | | | | 125,470 | |

Machinery — 0.0% | | | | | | | | |

Blue Bird Corp. (Issued/exercisable 3/10/14, 0.5 Shares for 1 Warrant, Expires 2/24/20, Strike Price $5.75) | | | 32,334 | | | | 24,251 | |

Media — 0.0% | | | | | | | | |

Hemisphere Media Group, Inc. (Issued/exercisable 8/19/11, 0.5 Shares for 1 Warrant, Expires 4/04/18, Strike Price $12.00) | | | 16,482 | | | | 17,141 | |

See Notes to Consolidated Financial Statements.

| | | | | | |

| | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | 13 |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | |

| | | | | | | | |

Warrants (e) | | Shares | | | Value | |

Metals & Mining — 0.1% | | | | | | | | |

Franco-Nevada Corp. (Issued/exercisable 6/16/09, 1 Share for 1 Warrant, Expires 6/16/17, Strike Price $75.00) | | | 7,508 | | | $ | 82,127 | |

New Gold, Inc. (Issued/exercisable 6/28/07, 1 Share for 1 Warrant, Expires 6/28/17, Strike Price $15.00) | | | 13,128 | | | | 922 | |

| | | | | | | | |

| | | | | | | | 83,049 | |

Oil, Gas & Consumable Fuels — 0.0% | | | | | | | | |

FieldPoint Petroleum Corp. (Issued/exercisable 3/28/12, 1 Share for 1 Warrant, Expires 3/23/18, Strike Price $4.00) | | | 56,448 | | | | 2,258 | |

Kinder Morgan, Inc. (Issued/exercisable 2/15/12, 1 Share for 1 Warrant, Expires 5/25/17, Strike Price $40.00) | | | 16,215 | | | | 1,330 | |

| | | | | | | | |

| | | | | | | | 3,588 | |

Pharmaceuticals — 0.1% | | | | | | | | |

EyeGate Pharmaceuticals, Inc. (Issued/exercisable 7/31/15, 1 Share for 1 Warrant, Expires 7/31/20, Strike Price $10.62) | | | 46,688 | | | | 26,192 | |

Kitov Pharmaceuticals Holdings Ltd. — ADR (Issued/exercisable 11/20/15, 1 Share for 1 Warrant, Expires 11/20/20, Strike Price $4.13) | | | 17,125 | | | | 9,933 | |

Oculus Innovative Sciences, Inc. (Issued/exercisable 1/16/15, 1 Share for 1 Warrant, Expires 1/21/20, Strike Price $1.30) | | | 22,190 | | | | 5,772 | |

| | | | | | | | |

| | | | | | | | 41,897 | |

Semiconductors & Semiconductor Equipment — 0.0% | |

Solar3D, Inc. (Issued/exercisable 3/03/15, 1 Share for 1 Warrant, Expires 3/09/20, Strike Price $4.15) | | | 23,197 | | | | 17,630 | |

Software — 0.0% | | | | | | | | |

RMG Networks Holding Corp. (Issued/exercisable 5/18/11, 1 Share for 1 Warrant, Expires 4/08/18, Strike Price $11.50) | | | 6,100 | | | | 61 | |

Technology Hardware, Storage & Peripherals — 0.0% | |

Eastman Kodak Co. (Issued/exercisable 10/29/13, 1 Share for 1 Warrant, Expires 9/03/18, Strike Price $14.93) | | | 2,166 | | | | 4,354 | |

Eastman Kodak Co. (Issued/exercisable 10/29/13, 1 Share for 1 Warrant, Expires 9/03/18, Strike Price $16.12) | | | 5,249 | | | | 6,666 | |

| | | | | | | | |

| | | | | | | | 11,020 | |

Thrifts & Mortgage Finance — 0.1% | | | | | | | | |

Washington Federal, Inc. (Issued/exercisable 11/14/08, 1 Share for 1 Warrant, Expires 11/14/18, Strike Price $17.57) | | | 13,013 | | | | 57,517 | |

Total Warrants — 1.3% | | | | | | | 1,295,622 | |

Total Long-Term Investments (Cost — $73,122,765) — 67.4% | | | | | | | 67,536,887 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

Money Market Funds — 24.9% | | | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.37% (k)(n) | | | 24,988,576 | | | | 24,988,576 | |

Total Short-Term Securities (Cost — $24,988,576) — 24.9% | | | | | | | 24,988,576 | |

| | | | | | | | |

| | | | | | | |

| | | | | | | | |

| Options Purchased | | | | | Value | |

(Cost — $391,554) — 0.4% | | | | | | $ | 452,401 | |

Total Investments Before Options Written and Investments Sold Short

(Cost — $98,502,895) — 92.7% | | | | 92,977,864 | |

| | | | | | | | |

| Options Written | | | | | | |

(Premiums Received — $38,603) — (0.0)% | | | | | | | (33,630 | ) |

| | | | | | | | |

| Investments Sold Short | | | | | | |

| | |

| Common Stocks | | Shares | | | | |

Aerospace & Defense — (0.7)% | | | | | | | | |

Boeing Co. | | | 1,882 | | | | (222,415 | ) |

HEICO Corp. | | | 1,570 | | | | (90,291 | ) |

United Technologies Corp. | | | 4,263 | | | | (411,891 | ) |

| | | | | | | | |

| | | | | | | | (724,597 | ) |

Auto Components — (0.1)% | | | | | | | | |

Delphi Automotive PLC | | | 1,311 | | | | (87,417 | ) |

Automobiles — (0.4)% | | | | | | | | |

Ferrari NV | | | 1,786 | | | | (67,832 | ) |

Tesla Motors, Inc. | | | 1,453 | | | | (278,874 | ) |

Toyota Motor Corp. — ADR | | | 290 | | | | (30,189 | ) |

| | | | | | | | |

| | | | | | | | (376,895 | ) |

Banks — (1.7)% | | | | | | | | |

Associated Banc-Corp. | | | 4,750 | | | | (81,700 | ) |

JPMorgan Chase & Co. | | | 12,893 | | | | (725,872 | ) |

M&T Bank Corp. | | | 196 | | | | (20,100 | ) |

SunTrust Banks, Inc. | | | 8,730 | | | | (289,661 | ) |

TCF Financial Corp. | | | 8,763 | | | | (99,372 | ) |

Texas Capital Bancshares, Inc. | | | 320 | | | | (10,346 | ) |

Wells Fargo & Co. | | | 1,992 | | | | (93,465 | ) |

Wintrust Financial Corp. | | | 1,466 | | | | (62,305 | ) |

Zions Bancorporation | | | 13,207 | | | | (281,573 | ) |

| | | | | | | | |

| | | | | | | | (1,664,394 | ) |

Biotechnology — (0.0)% | | | | | | | | |

BioTime, Inc. | | | 1,510 | | | | (3,473 | ) |

ContraFect Corp. | | | 390 | | | | (1,326 | ) |

OncoCyte Corp. | | | 96 | | | | (369 | ) |

| | | | | | | | |

| | | | | | | | (5,168 | ) |

Chemicals — (0.6)% | | | | | | | | |

AgroFresh Solutions, Inc. | | | 3,279 | | | | (16,034 | ) |

Air Products & Chemicals, Inc. | | | 861 | | | | (114,057 | ) |

PPG Industries, Inc. | | | 2,280 | | | | (220,088 | ) |

Praxair, Inc. | | | 2,396 | | | | (243,889 | ) |

| | | | | | | | |

| | | | | | | | (594,068 | ) |

Commercial Services & Supplies — (0.1)% | | | | | | | | |

Stericycle, Inc. | | | 618 | | | | (70,409 | ) |

Construction Materials — (0.3)% | | | | | | | | |

U.S. Concrete, Inc. | | | 5,023 | | | | (269,986 | ) |

Consumer Finance — (0.1)% | | | | | | | | |

Capital One Financial Corp. | | | 1,455 | | | | (95,637 | ) |

Diversified Financial Services — (0.0)% | | | | | | | | |

Industrivarden AB, Class A | | | 2,285 | | | | (39,128 | ) |

See Notes to Consolidated Financial Statements.

| | | | | | |

| 14 | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Diversified Telecommunication Services — (0.2)% | |

Intelsat SA | | | 13,890 | | | $ | (23,891 | ) |

Koninklijke KPN NV | | | 40,000 | | | | (147,403 | ) |

| | | | | | | | |

| | | | | | | | (171,294 | ) |

Electronic Equipment, Instruments & Components — (0.6)% | |

Applied DNA Sciences, Inc. | | | 17,031 | | | | (48,879 | ) |

AVX Corp. | | | 141 | | | | (1,655 | ) |

Corning, Inc. | | | 29,352 | | | | (537,142 | ) |

| | | | | | | | |

| | | | | | | | (587,676 | ) |

Energy Equipment & Services — (1.0)% | |

National Oilwell Varco, Inc. | | | 14,826 | | | | (433,957 | ) |

Schlumberger Ltd. | | | 8,341 | | | | (598,217 | ) |

| | | | | | | | |

| | | | | | | | (1,032,174 | ) |

Food & Staples Retailing — (0.1)% | |

Costco Wholesale Corp. | | | 307 | | | | (46,059 | ) |

CVS Health Corp. | | | 1,135 | | | | (110,288 | ) |

| | | | | | | | |

| | | | | | | | (156,347 | ) |

Food Products — (0.0)% | |

Mondelez International, Inc., Class A | | | 1,042 | | | | (42,232 | ) |

Tyson Foods, Inc., Class A | | | 5 | | | | (324 | ) |

| | | | | | | | |

| | | | | | | | (42,556 | ) |

Health Care Equipment & Supplies — (0.7)% | |

Abbott Laboratories | | | 4,874 | | | | (188,819 | ) |

Baxter International, Inc. | | | 3,995 | | | | (157,842 | ) |

Edwards Lifesciences Corp. | | | 593 | | | | (51,591 | ) |

Stryker Corp. | | | 3,015 | | | | (301,138 | ) |

| | | | | | | | |

| | | | | | | | (699,390 | ) |

Health Care Providers & Services — (0.8)% | |

AmerisourceBergen Corp. | | | 2,425 | | | | (210,054 | ) |

Amsurg Corp. | | | 1,740 | | | | (118,407 | ) |

Anthem, Inc. | | | 163 | | | | (21,302 | ) |

DaVita HealthCare Partners, Inc. | | | 1,224 | | | | (80,747 | ) |

Humana, Inc. | | | 1,392 | | | | (246,342 | ) |

UnitedHealth Group, Inc. | | | 835 | | | | (99,449 | ) |

| | | | | | | | |

| | | | | | | | (776,301 | ) |

Health Care Technology — (0.0)% | |

Cerner Corp. | | | 909 | | | | (46,414 | ) |

Hotels, Restaurants & Leisure — (0.5)% | |

Carnival PLC — ADR | | | 4,064 | | | | (201,452 | ) |

Chipotle Mexican Grill, Inc. | | | 34 | | | | (17,311 | ) |

Del Taco Restaurants, Inc. | | | 16,585 | | | | (179,616 | ) |

Marriott International, Inc. — Class A | | | 580 | | | | (39,527 | ) |

Restaurant Brands International, Inc. | | | 811 | | | | (28,434 | ) |

| | | | | | | | |

| | | | | | | | (466,340 | ) |

Insurance — (0.3)% | |

Aon PLC | | | 1,503 | | | | (143,221 | ) |

Maiden Holdings Ltd. | | | 9,745 | | | | (116,648 | ) |

| | | | | | | | |

| | | | | | | | (259,869 | ) |

Internet & Catalog Retail — (0.8)% | |

Ctrip.com International Ltd. — ADR | | | 4,501 | | | | (184,181 | ) |

Netflix, Inc. | | | 2,840 | | | | (265,284 | ) |

Priceline Group, Inc. | | | 129 | | | | (163,212 | ) |

TripAdvisor, Inc. | | | 2,028 | | | | (126,953 | ) |

Vipshop Holdings Ltd. — ADR | | | 5,209 | | | | (57,872 | ) |

| | | | | | | | |

| | | | | | | | (797,502 | ) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Internet Software & Services — (0.4)% | | | | | | | | |

Alibaba Group Holding Ltd. — ADR | | | 791 | | | $ | (54,429 | ) |

Alphabet, Inc., Class A | | | 100 | | | | (71,722 | ) |

j2 Global, Inc. | | | 2,255 | | | | (164,795 | ) |

LinkedIn Corp., Class A | | | 700 | | | | (82,033 | ) |

Monster Worldwide, Inc. | | | 23,236 | | | | (69,243 | ) |

| | | | | | | | |

| | | | | | | | (442,222 | ) |

IT Services — (0.8)% | | | | | | | | |

Infosys Ltd. — ADR | | | 31,986 | | | | (538,005 | ) |

International Business Machines Corp. | | | 2,231 | | | | (292,328 | ) |

| | | | | | | | |

| | | | | | | | (830,333 | ) |

Machinery — (0.7)% | | | | | | | | |

Blue Bird Corp. | | | 1,364 | | | | (12,317 | ) |

Caterpillar, Inc. | | | 4,063 | | | | (275,065 | ) |

Deere & Co. | | | 688 | | | | (55,164 | ) |

Parker-Hannifin Corp. | | | 3,422 | | | | (346,306 | ) |

| | | | | | | | |

| | | | | | | | (688,852 | ) |

Media — (0.4)% | | | | | | | | |

Charter Communications, Inc., Class A | | | 207 | | | | (37,169 | ) |

Discovery Communications, Inc., Class C | | | 4,384 | | | | (108,066 | ) |

Liberty Media Corp., Class A | | | 1,647 | | | | (58,666 | ) |

News Corp., Class B | | | 3,351 | | | | (38,235 | ) |

Omnicom Group, Inc. | | | 1,150 | | | | (89,482 | ) |

Sirius XM Holdings, Inc. | | | 7,552 | | | | (28,093 | ) |

Viacom, Inc., Class A | | | 943 | | | | (39,097 | ) |

| | | | | | | | |

| | | | | | | | (398,808 | ) |

Metals & Mining — (0.3)% | | | | | | | | |

Franco-Nevada Corp. | | | 4,315 | | | | (257,529 | ) |

Fresnillo PLC | | | 3,565 | | | | (49,427 | ) |

| | | | | | | | |

| | | | | | | | (306,956 | ) |

Multi-Utilities — (0.2)% | | | | | | | | |

Black Hills Corp. | | | 3,033 | | | | (169,878 | ) |

Oil, Gas & Consumable Fuels — (1.9)% | | | | | | | | |

Apache Corp. | | | 7,213 | | | | (276,114 | ) |

California Resources Corp. | | | 567 | | | | (319 | ) |

Chevron Corp. | | | 5,163 | | | | (430,801 | ) |

ConocoPhillips | | | 2,600 | | | | (87,958 | ) |

Enterprise Products Partners LP | | | 3,063 | | | | (71,582 | ) |

EOG Resources, Inc. | | | 1,691 | | | | (109,475 | ) |

Exxon Mobil Corp. | | | 250 | | | | (20,039 | ) |

Hess Corp. | | | 3,837 | | | | (167,293 | ) |

Kinder Morgan, Inc. | | | 8,919 | | | | (161,345 | ) |

Marathon Petroleum Corp. | | | 1,954 | | | | (66,925 | ) |

Occidental Petroleum Corp. | | | 6,064 | | | | (417,324 | ) |

Phillips 66 | | | 1,707 | | | | (135,519 | ) |

Southwestern Energy Co. | | | 613 | | | | (3,543 | ) |

| | | | | | | | |

| | | | | | | | (1,948,237 | ) |

Paper & Forest Products — (0.4)% | | | | | | | | |

International Paper Co. | | | 10,201 | | | | (364,176 | ) |

See Notes to Consolidated Financial Statements.

| | | | | | |

| | | BLACKROCK MULTI-MANAGER ALTERNATIVE STRATEGIES FUND | | FEBRUARY 29, 2016 | | 15 |

| | |

| Consolidated Schedule of Investments (continued) | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Pharmaceuticals — (0.6)% | | | | | | | | |

Allergan PLC | | | 567 | | | $ | (164,492 | ) |

EyeGate Pharmaceuticals, Inc. | | | 10,100 | | | | (36,360 | ) |

Johnson & Johnson | | | 2,164 | | | | (227,674 | ) |

Shire PLC — ADR | | | 556 | | | | (86,797 | ) |

Teva Pharmaceutical Industries Ltd. — ADR | | | 2,400 | | | | (133,440 | ) |

| | | | | | | | |

| | | | | | | | (648,763 | ) |

Professional Services — (0.1)% | | | | | | | | |

Nielsen Holdings PLC | | | 2,144 | | | | (107,929 | ) |

Real Estate Investment Trusts (REITs) — (0.6)% | | | | | | | | |

Crown Castle International Corp. | | | 3,052 | | | | (263,999 | ) |

Equinix, Inc. | | | 662 | | | | (201,043 | ) |

SL Green Realty Corp. | | | 1,386 | | | | (122,217 | ) |

| | | | | | | | |

| | | | | | | | (587,259 | ) |

Real Estate Management & Development — (0.2)% | |

Forestar Group, Inc. | | | 19,227 | | | | (187,463 | ) |

Semiconductors & Semiconductor Equipment — (0.6)% | |

Intel Corp. | | | 5,605 | | | | (165,852 | ) |

NVIDIA Corp. | | | 8,867 | | | | (278,069 | ) |

SunEdison, Inc. | | | 16,410 | | | | (32,492 | ) |

SunPower Corp. | | | 5,573 | | | | (131,634 | ) |

| | | | | | | | |

| | | | | | | | (608,047 | ) |

Software — (0.6)% | | | | | | | | |

Activision Blizzard, Inc. | | | 2,131 | | | | (67,489 | ) |

Adobe Systems, Inc. | | | 3,082 | | | | (262,432 | ) |

Electronic Arts, Inc. | | | 3,559 | | | | (228,630 | ) |

Tableau Software, Inc., Class A | | | 343 | | | | (15,658 | ) |

Workday, Inc., Class A | | | 843 | | | | (50,959 | ) |

| | | | | | | | |

| | | | | | | | (625,168 | ) |

Technology Hardware, Storage & Peripherals — (0.6)% | |

Apple Inc. | | | 5,829 | | | | (563,606 | ) |

Eastman Kodak Co. | | | 2,750 | | | | (25,988 | ) |

| | | | | | | | |

| | | | | | | | (589,594 | ) |

Textiles, Apparel & Luxury Goods — (0.0)% | | | | | | | | |

Under Armour, Inc., Class A | | | 620 | | | | (51,888 | ) |

Thrifts & Mortgage Finance — (0.2)% | | | | | | | | |

Washington Federal, Inc. | | | 9,273 | | | | (196,495 | ) |

Wireless Telecommunication Services — (0.1)% | | | | | | | | |

KDDI Corp. — ADR | | | 367 | | | | (4,683 | ) |

T-Mobile U.S., Inc. | | | 1,500 | | | | (55,650 | ) |

| | | | | | | | |

| | | | | | | | (60,333 | ) |

Total Common Stocks — (17.7)% | | | | | | | (17,775,963 | ) |

| | | | | | | | |

| | | | | | | |

| | | | | | | | |

| Corporate Bonds | | Par

(000) | | | Value | |

Banks — (0.3)% | | | | | | | | |

Canadian Western Bank, 3.46%, 12/17/24 (a) | | CAD | 359 | | | $ | (257,668 | ) |

Oil, Gas & Consumable Fuels — (0.3)% | | | | | | | | |

Occidental Petroleum Corp., 3.50%, 6/15/25 | | USD | 263 | | | | (256,541 | ) |

Pharmaceuticals — (0.2)% | | | | | | | | |

Valeant Pharmaceuticals International, Inc., 6.13% | | | 276 | | | | (231,669 | ) |

Trading Companies & Distributors — (0.5)% | | | | | | | | |

BlueLine Rental Finance Corp., 7.00%, 2/01/19 (b) | | | 323 | | | | (236,598 | ) |

United Rentals North America, Inc., 6.13%, 6/15/23 | | | 261 | | | | (267,658 | ) |

| | | | | | | | |

| | | | | | | | (504,256 | ) |

Wireless Telecommunication Services — (0.2)% | | | | | | | | |

Sprint Communications, Inc., 8.38%, 8/15/17 | | | 260 | | | | (252,850 | ) |

Total Corporate Bonds — (1.5)% | | | | (1,502,984 | ) |

| | | | | | | | |

| Investment Companies | | Shares | | | | |

Consumer Discretionary Select Sector SPDR Fund | | | 4,369 | | | | (325,228 | ) |

Consumer Staples Select Sector SPDR Fund | | | 3,406 | | | | (173,434 | ) |

Direxion Daily Emerging Markets Bear 3X Shares | | | 700 | | | | (36,183 | ) |

Direxion Daily Financial Bear 3X Shares | | | 700 | | | | (37,450 | ) |

Direxion Daily Financial Bull 3X Shares | | | 1,400 | | | | (28,252 | ) |

Direxion Daily Gold Miners Index Bull 3X Shares | | | 1,200 | | | | (69,648 | ) |

Direxion Daily Small Cap Bear 3X Shares | | | 1,000 | | | | (55,500 | ) |

iShares 3-7 Year Treasury Bond ETF (k) | | | 518 | | | | (65,144 | ) |

iShares iBoxx $ High Yield Corporate Bond ETF (k) | | | 3,981 | | | | (318,798 | ) |

iShares MSCI Switzerland Capped ETF (k) | | | 823 | | | | (23,316 | ) |

iShares TIPS Bond ETF (k) | | | 836 | | | | (94,267 | ) |

iShares U.S. Preferred Stock ETF (k) | | | 5,713 | | | | (218,922 | ) |

SPDR Barclays Convertible Securities ETF | | | 1,366 | | | | (56,279 | ) |

SPDR S&P 500 ETF Trust | | | 3,063 | | | | (592,874 | ) |

Vanguard FTSE Emerging Markets ETF | | | 3,100 | | | | (95,263 | ) |

Vanguard REIT ETF | | | 1,569 | | | | (120,358 | ) |

Total Investment Companies — (2.3)% | | | | (2,310,916 | ) |

Total Investments Sold Short (Proceeds — $22,681,004) — (21.5)% | | | | (21,589,863 | ) |

Total Investments Net of Options Written and Investments Sold Short — 71.2% | | | | 71,354,371 | |

Other Assets Less Liabilities — 28.8% | | | | 28,902,088 | |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 100,256,459 | |

| | | | | | | | |

|

| Notes to Consolidated Schedule of Investments |

| (a) | Variable rate security. Rate as of period end. |

| (b) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | Step-up bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate as of period end. |

| (d) | All or a portion of security has been pledged as collateral in connection with short sales. |

| (e) | Non-income producing security. |

| (f) | All or a portion of security has been pledged and/or segregated as collateral in connection with outstanding exchange-traded options written. |

| (h) | Issuer filed for bankruptcy and/or is in default of interest payments. |

| (i) | Payment-in-kind security which may pay interest/dividends in additional par/shares and/or in cash. Rates shown are the current rate and possible payment rates. |