UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock Disciplined Small Cap Core Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd

Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2016

Date of reporting period: 11/30/2015

Item 1 – Report to Stockholders

NOVEMBER 30, 2015

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

| | | | |

| | BlackRock Disciplined Small Cap Core Fund | | of BlackRock FundsSM |

| | | | |

| | BlackRock Small Cap Growth Fund II | | of BlackRock Series, Inc. |

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | |

| | |

| | Shareholders can sign up for e-mail notifications of quarterly statements, annual and semi-annual shareholder reports and prospectuses by enrolling in the electronic delivery program. Electronic copies of shareholder reports and prospectuses are also available on BlackRock’s website. TO ENROLL IN ELECTRONIC DELIVERY: Shareholders Who Hold Accounts with Investment Advisors, Banks or Brokerages: Please contact your financial advisor. Please note that not all investment advisors, banks or brokerages may offer this service. Shareholders Who Hold Accounts Directly with BlackRock: 1. Access the BlackRock website at blackrock.com 2. Select “Access Your Account” 3. Next, select “eDelivery” in the “Related Resources” box and follow the sign-up instructions |

| | | | | | |

| 2 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

Dear Shareholder,

Diverging monetary policies and shifting economic outlooks across regions have been the overarching themes driving financial markets over the past couple of years. With U.S. growth outpacing the global economic recovery in 2015, the Federal Reserve (the “Fed”) has been posturing for a change from its low-rate policy while the European Central Bank (ECB) and the Bank of Japan have taken a more accommodative stance. In this environment, the U.S. dollar strengthened considerably, causing profit challenges for U.S. exporters and high levels of volatility in emerging market currencies and commodity prices. After plunging in late 2014, oil prices have been particularly volatile and below the historical norm due to an ongoing imbalance in global supply and demand.

Global market volatility increased in the summer of 2015, beginning with a sharp, but temporary, sell-off in June as Greece’s long-brewing debt troubles came to an impasse. These concerns abated with the passing of austerity and reform measures in July, but the market’s calm was short-lived as signs of weakness in China’s economy sparked a significant decline in Chinese equities. Higher volatility spread through markets globally in the third quarter as further indications of a deceleration in China stoked worries about the broader global economy, resulting in the worst quarterly performance for equities since 2011. Given a dearth of evidence of global growth, equity markets became more reliant on central bank policies to drive performance. As such, equities powered higher in October when China’s central bank provided more stimulus, the ECB poised for more easing and soft U.S. data pushed back expectations for a Fed rate hike. As the period came to a close, volatility crept higher and asset prices again weakened as investors digested more mixed economic data against a backdrop of generally high valuations.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | | | |

| Total Returns as of November 30, 2015 |

| | | 6-month | | 12-month |

U.S. large cap equities (S&P 500® Index) | | | | (0.21 | )% | | | | 2.75 | % |

U.S. small cap equities (Russell 2000® Index) | | | | (3.21 | ) | | | | 3.51 | |

International equities (MSCI Europe, Australasia, Far East Index) | | | | (7.42 | ) | | | | (2.94 | ) |

Emerging market equities (MSCI Emerging Markets Index) | | | | (17.67 | ) | | | | (16.99 | ) |

3-month Treasury bills (BofA Merrill Lynch

3-Month U.S. Treasury Bill Index) | | | | 0.01 | | | | | 0.02 | |

U.S. Treasury securities (BofA Merrill Lynch 10-Year U.S. Treasury Index) | | | | (0.21 | ) | | | | 1.60 | |

U.S. investment-grade bonds (Barclays U.S. Aggregate Bond Index) | | | | (0.12 | ) | | | | 0.97 | |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | | 2.24 | | | | | 3.14 | |

U.S. high yield bonds (Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | | (5.80 | ) | | | | (3.38 | ) |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

| Fund Summary as of November 30, 2015 | | | BlackRock Disciplined Small Cap Core Fund | |

BlackRock Disciplined Small Cap Core Fund’s (the “Fund”) investment objective is to seek capital appreciation over the long term.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended November 30, 2015, the Fund outperformed its benchmark, the Russell 2000® Index. |

What factors influenced performance?

| • | | The most significant positive contributions to the Fund’s performance came from stock selection within the health care and telecommunication services (“telecom”) sectors. Within health care, Sucampo Pharmaceuticals, Inc. appreciated significantly early in the period on the company’s plans to submit an application with the U.S. Food and Drug Administration (FDA) for pediatric use of its constipation drug Amitiza. Shares of the company were further boosted by a revision in the FDA’s draft guidance for generic drugmakers regarding bioequivalence to Amitiza. An overweight position in over-the-counter health care product company Prestige Brands Holdings, Inc. rose on news that the company would acquire privately held DenTek Oral Care in a deal expected to increase revenues by $60 million a year. Within telecom, Inteliquent, Inc., a carrier for communication service providers, saw its shares rise on news of a breakthrough business agreement with T-Mobile, the fastest growing provider of wireless services to U.S. consumers. The benefits from the agreement were seen in Inteliquent, Inc.’s third quarter results, which exceeded estimates as the company quickly transitioned a significant portion of the total expected traffic from T-Mobile. |

| • | | The most significant detractor from the Fund’s performance was stock selection within the industrials sector. In particular, an overweight posi- |

| | tion in ARC Document Solutions, Inc., a provider of specialized document solutions to architecture, engineering and construction firms, fell sharply after the company missed third quarter earnings and revenue estimates, and lowered its full-year earnings forecast. Also within industrials, an overweight in commercial interior flooring and carpet manufacturer Interface, Inc. declined due to the negative impact of weaker foreign currencies on overseas sales revenues. An overweight position in Virginia-based manufacturer of wallboard and gypsum-based products Continental Building Products, Inc. fell considerably on weaker-than-expected industrywide wallboard shipments, lower research analyst estimates and extreme weather and flooding along the eastern coast of the United States. |

Describe recent portfolio activity.

| • | | During the six-month period, the Fund decreased its overall weightings in the consumer discretionary and telecom sectors and increased its overall weighting in financials and industrials. |

Describe portfolio positioning at period end.

| • | | Relative to the Russell 2000® Index, the Fund ended the period with its largest sector overweight in consumer discretionary and its most significant underweight in utilities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Net Assets |

Umpqua Holdings Corp. | | | | 2 | % |

Manhattan Associates, Inc. | | | | 2 | |

Fidelity Southern Corp. | | | | 2 | |

South State Corp. | | | | 2 | |

EverBank Financial Corp. | | | | 2 | |

Jack in the Box, Inc. | | | | 2 | |

Central Pacific Financial Corp. | | | | 2 | |

Masimo Corp. | | | | 1 | |

LogMeIn, Inc. | | | | 1 | |

Seacoast Banking Corp. | | | | 1 | |

| | | | | |

| Sector Allocation | | Percent of

Net Assets |

Financials | | | | 25 | % |

Information Technology | | | | 18 | |

Health Care | | | | 17 | |

Consumer Discretionary | | | | 14 | |

Industrials | | | | 13 | |

Energy | | | | 4 | |

Materials | | | | 3 | |

Utilities | | | | 3 | |

Consumer Staples | | | | 2 | |

Short-Term Securities | | | | 3 | |

Liabilities in Excess of Other Assets | | | | (2 | ) |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| 4 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | | | |

| | | | BlackRock Disciplined Small Cap Core Fund | |

|

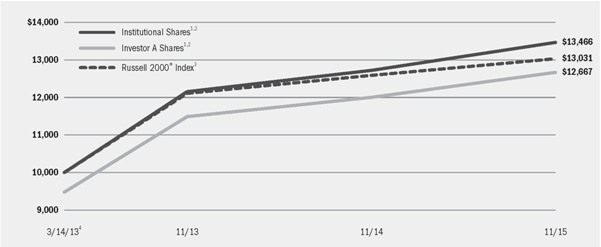

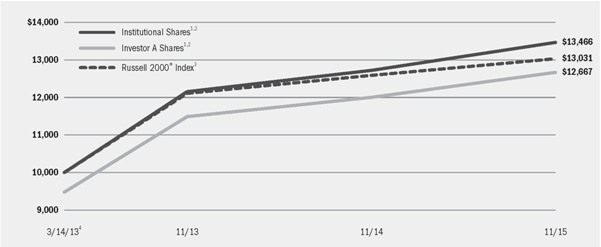

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | Under normal circumstances, the Fund seeks to invest at least 80% of its net assets plus any borrowings for investment purposes in equity securities or other financial instruments that are components of, or have market capitalizations similar to, the securities included in the Russell 2000® Index. |

| | 3 | An unmanaged index that is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended November 30, 2015 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns5 |

| | | | | | | 1 Year | | | | Since Inception6 |

| | | 6-Month

Total Returns | | | | w/o sales

charge | | w/ sales

charge | | | | w/o sales

charge | | w/ sales

charge |

Institutional | | (2.53)% | | | | 5.88% | | N/A | | | | 11.58% | | N/A |

Investor A | | (2.70) | | | | 5.58 | | 0.04% | | | | 11.29 | | 9.10% |

Investor C | | (3.08) | | | | 4.71 | | 3.71 | | | | 10.44 | | 10.44 |

Russell 2000® Index | | (3.21) | | | | 3.51 | | N/A | | | | 10.26 | | N/A |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on March 14, 2013. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | |

| | | Actual | | | | Hypothetical8 | | |

| | | Beginning

Account Value

June 1, 2015 | | Ending

Account Value

November 30, 2015 | | Expenses Paid

During the Period7 | | | | Beginning

Account Value

June 1, 2015 | | Ending

Account Value

November 30, 2015 | | Expenses Paid

During the Period7 | | Annualized

Expense

Ratio9 |

Institutional | | $1,000.00 | | $974.70 | | $3.51 | | | | $1,000.00 | | $1,021.45 | | $3.59 | | 0.71% |

Investor A | | $1,000.00 | | $973.00 | | $4.74 | | | | $1,000.00 | | $1,020.20 | | $4.85 | | 0.96% |

Investor C | | $1,000.00 | | $969.20 | | $8.42 | | | | $1,000.00 | | $1,016.45 | | $8.62 | | 1.71% |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). |

| | 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | 9 | | Includes certain tax expenses which are included in miscellaneous expenses in the Statements of Operations. Excluding such tax expenses, the annualized expense ratios would have been 0.70%, 0.95% and 1.70%, respectively. |

| | | | See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 5 |

| | | | |

| Fund Summary as of November 30, 2015 | | | BlackRock Small Cap Growth Fund II | |

��

BlackRock Small Cap Growth Fund II’s (the “Fund”) investment objective is to seek long-term capital growth. In other words, the Fund tries to choose investments that will increase in value. Current income from dividends and interest will not be an important consideration in selecting portfolio securities.

|

| Portfolio Management Commentary |

On June 23, 2015, the Fund’s Investor B Shares converted to Investor A Shares.

How did the Fund perform?

| • | | For the six-month period ended November 30, 2015, through its investment in BlackRock Master Small Cap Growth Portfolio (the “Master Portfolio”), the Fund underperformed its benchmark, the Russell 2000® Growth Index. |

What factors influenced performance?

| • | | The underperformance of the Master Portfolio was attributable mostly to stock selection within the information technology sector. In particular, an overweight position in storage hardware and systems company Quantum Corp. depreciated sharply after the release of disappointing earnings and revenue results and reduced forward earnings guidance, driven by overall weakness in the general-purpose storage market. An underweight position in public sector-focused software solution firm Tyler Technologies, Inc. also detracted from performance. Shares of Tyler Technologies, Inc. rose sharply on news of plans to acquire computer-aided dispatch software firm New World Systems in a deal that would immediately add to earnings per share, and the stock price was further supported as the company’s third quarter earnings and revenues exceeded estimates. An overweight position in gaming product and cash access solutions company Everi Holdings, Inc., formerly known as Global Cash Access Holdings, Inc., depreciated significantly after second quarter earnings came in under expectations. The company also lowered its guidance for full year 2015, citing headwinds from ongoing product development costs and one-time costs related to rebranding activities. |

| • | | Conversely, stock selection within the health care and telecommunication services (“telecom”) sectors contributed to performance. Within health care, Sucampo Pharmaceuticals, Inc. appreciated significantly early in the period on the company’s plans to submit an application with the U.S. Food and Drug Administration (FDA) for pediatric use of its constipation drug Amitiza. Shares of the company were further boosted by a revision in the FDA’s draft guidance for generic drugmakers regarding bioequivalence to Amitiza. An overweight position in over-the-counter health care product company Prestige Brands Holdings, Inc. rose on news that the company would acquire privately held DenTek Oral Care in a deal expected to increase revenues by $60 million a year. Within telecom, Inteliquent, Inc., a carrier for communication service providers, saw its shares rise on news of a breakthrough business agreement with T-Mobile, the fastest growing provider of wireless services to U.S. consumers. The benefits from the agreement were seen in Inteliquent, Inc.’s third quarter results, which exceeded estimates as the company quickly transitioned a significant portion of the total expected traffic from T-Mobile. |

Describe recent portfolio activity.

| • | | During the six-month period, the Master Portfolio increased its overall weighting in the materials sector and decreased its overall weighting in financials. |

Describe portfolio positioning at period end.

| • | | Relative to the Russell 2000® Growth Index, the Master Portfolio ended the period with its largest sector overweight in consumer discretionary and its most significant underweight in consumer staples. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 6 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | | | |

| | | | BlackRock Small Cap Growth Fund II | |

|

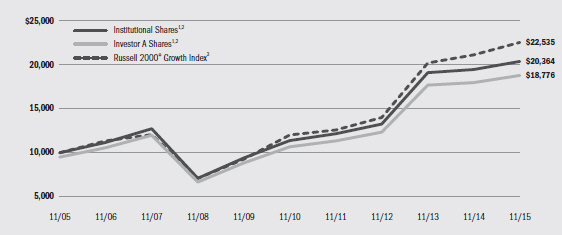

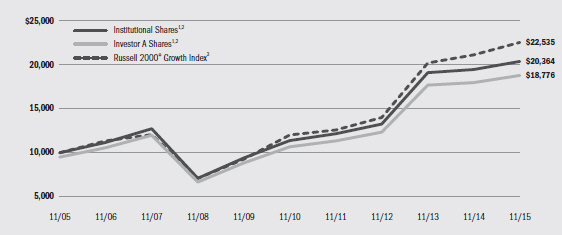

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | The Fund invests all of its assets in the Master Portfolio. The Master Portfolio will, under normal circumstances, invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small cap companies and at least 80% of its net assets (plus any borrowings for investment purposes) in securities or instruments of issuers located in the United States. |

| | 3 | An unmanaged index that measures performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® Index companies with higher price-to-value ratios and higher forecasted growth values. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended November 30, 2015 | | | | | | |

| | | | | Average Annual Total Returns4 |

| | | | | 1 Year | | 5 Years | | 10 Years |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | (5.44 | )% | | | | 4.63 | % | | | | N/A | | | | | 12.36 | % | | | | N/A | | | | | 7.37 | % | | | | N/A | |

Investor A | | | | (5.50 | ) | | | | 4.44 | | | | | (1.04 | )% | | | | 12.03 | | | | | 10.83 | % | | | | 7.08 | | | | | 6.50 | % |

Investor C | | | | (5.98 | ) | | | | 3.49 | | | | | 2.54 | | | | | 11.04 | | | | | 11.04 | | | | | 6.10 | | | | | 6.10 | |

Class R | | | | (5.67 | ) | | | | 4.17 | | | | | N/A | | | | | 11.72 | | | | | N/A | | | | | 6.72 | | | | | N/A | |

Russell 2000® Growth Index | | | | (3.48 | ) | | | | 6.63 | | | | | N/A | | | | | 13.41 | | | | | N/A | | | | | 8.46 | | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | |

| Expense Example | | | | | | | | | | | | | | |

| | | Actual | | | | Hypothetical6 | | |

| | | Beginning Account Value June 1, 2015 | | Ending Account Value November 30, 2015 | | Expenses Paid During the Period5 | | | | Beginning Account Value June 1, 2015 | | Ending Account Value November 30, 2015 | | Expenses Paid During the Period5 | | Annualized Expense Ratio |

Institutional | | $1,000.00 | | $945.60 | | $ 5.69 | | | | $1,000.00 | | $1,019.15 | | $ 5.91 | | 1.17% |

Investor A | | $1,000.00 | | $945.00 | | $ 6.86 | | | | $1,000.00 | | $1,017.95 | | $ 7.11 | | 1.41% |

Investor C | | $1,000.00 | | $940.20 | | $11.06 | | | | $1,000.00 | | $1,013.60 | | $11.48 | | 2.28% |

Class R | | $1,000.00 | | $943.30 | | $ 8.11 | | | | $1,000.00 | | $1,016.65 | | $ 8.42 | | 1.67% |

| | 5 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 183/ 366 (to reflect the one-half year period shown). Because the Fund invests all of its assets in the Master Portfolio, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invests. |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 7 |

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

On June 23, 2015, all issued and outstanding Investor B Shares, which were previously available only in BlackRock Small Cap Growth Fund II, were converted into Investor A Shares with the same relative aggregate net asset value (“NAV”).

| • | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

| • | | Class R Shares (available only in BlackRock Small Cap Growth Fund II) are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at NAV on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), BlackRock Disciplined Small Cap Core Fund’s investment advisor, has contractually agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 6 of the Notes to Financial Statements for additional information on waivers and/or reimbursements.

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on June 1, 2015 and held through November 30, 2015) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

|

| Derivative Financial Instruments |

BlackRock Disciplined Small Cap Core Fund and the Master Portfolio may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative

financial instrument. The Fund’s and Master Portfolio’s ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund and Master Portfolio can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s and Master Portfolio’s investments in these instruments are discussed in detail in the Fund’s and Master Portfolio’s Notes to Financial Statements.

| | | | | | |

| 8 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | | | |

| Schedule of Investments November 30, 2015 (Unaudited) | | | BlackRock Disciplined Small Cap Core Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Aerospace & Defense — 0.7% | | | | | | | | |

AAR Corp. | | | 435 | | | $ | 10,684 | |

Aerojet Rocketdyne Holdings, Inc. (a) | | | 96 | | | | 1,684 | |

DigitalGlobe, Inc. (a) | | | 1,488 | | | | 25,147 | |

Esterline Technologies Corp. (a) | | | 154 | | | | 14,642 | |

Vectrus, Inc. (a) | | | 643 | | | | 15,535 | |

| | | | | | | | |

| | | | | | | | 67,692 | |

Airlines — 0.9% | | | | | | | | |

Hawaiian Holdings, Inc. (a) | | | 46 | | | | 1,665 | |

JetBlue Airways Corp. (a) | | | 3,538 | | | | 87,530 | |

| | | | | | | | |

| | | | | | | | 89,195 | |

Auto Components — 1.6% | | | | | | | | |

American Axle & Manufacturing Holdings, Inc. (a) | | | 1,157 | | | | 26,333 | |

Cooper Standard Holdings, Inc. (a) | | | 214 | | | | 15,823 | |

Horizon Global Corp. (a) | | | 2,855 | | | | 24,810 | |

Lear Corp. | | | 190 | | | | 23,921 | |

Metaldyne Performance Group, Inc. | | | 54 | | | | 1,216 | |

Shiloh Industries, Inc. (a) | | | 145 | | | | 996 | |

Tenneco, Inc. (a) | | | 597 | | | | 32,166 | |

Tower International, Inc. | | | 933 | | | | 28,606 | |

| | | | | | | | |

| | | | | | | | 153,871 | |

Banks — 10.2% | | | | | | | | |

Camden National Corp. | | | 75 | | | | 3,371 | |

Central Pacific Financial Corp. | | | 6,299 | | | | 146,389 | |

Chemical Financial Corp. | | | 23 | | | | 848 | |

Fidelity Southern Corp. | | | 7,156 | | | | 161,869 | |

First Busey Corp. | | | 1,166 | | | | 25,640 | |

First Midwest Bancorp, Inc. | | | 505 | | | | 9,868 | |

Great Western Bancorp, Inc. | | | 890 | | | | 26,896 | |

Heritage Commerce Corp. | | | 3,760 | | | | 40,608 | |

Metro Bancorp, Inc. | | | 66 | | | | 2,243 | |

Seacoast Banking Corp. (a) | | | 8,077 | | | | 129,636 | |

South State Corp. | | | 2,058 | | | | 161,779 | |

Umpqua Holdings Corp. | | | 10,844 | | | | 194,324 | |

Western Alliance Bancorp (a) | | | 948 | | | | 36,773 | |

Wintrust Financial Corp. | | | 1,447 | | | | 76,156 | |

| | | | | | | | |

| | | | | | | | 1,016,400 | |

Beverages — 0.6% | | | | | | | | |

Castle Brands, Inc. (a) | | | 2,255 | | | | 2,977 | |

National Beverage Corp. (a) | | | 104 | | | | 4,519 | |

Primo Water Corp. (a) | | | 5,684 | | | | 50,531 | |

| | | | | | | | |

| | | | | | | | 58,027 | |

Biotechnology — 6.1% | | | | | | | | |

ACADIA Pharmaceuticals, Inc. (a) | | | 116 | | | | 4,402 | |

Acorda Therapeutics, Inc. (a) | | | 762 | | | | 29,101 | |

Anacor Pharmaceuticals, Inc. (a) | | | 373 | | | | 43,540 | |

BioSpecifics Technologies Corp. (a) | | | 259 | | | | 12,549 | |

Catalyst Biosciences, Inc. | | | 617 | | | | 1,808 | |

Cepheid, Inc. (a) | | | 134 | | | | 4,816 | |

Cerulean Pharma, Inc. (a) | | | 1,127 | | | | 3,651 | |

ChemoCentryx, Inc. (a) | | | 2,174 | | | | 16,414 | |

Chiasma, Inc. (a) | | | 140 | | | | 3,107 | |

China Biologic Products, Inc. (a) | | | 154 | | | | 18,098 | |

Clovis Oncology, Inc. (a) | | | 12 | | | | 377 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Biotechnology (continued) | | | | | | | | |

Concert Pharmaceuticals, Inc. (a) | | | 502 | | | $ | 11,511 | |

Cytokinetics, Inc. (a) | | | 1,111 | | | | 13,132 | |

Dyax Corp. (a) | | | 1,234 | | | | 41,536 | |

Dynavax Technologies Corp. (a) | | | 996 | | | | 27,778 | |

Emergent BioSolutions, Inc. (a) | | | 689 | | | | 25,955 | |

Enzon Pharmaceuticals, Inc. | | | 8,722 | | | | 6,331 | |

EPIRUS Biopharmaceuticals, Inc. (a) | | | 345 | | | | 1,680 | |

FibroGen, Inc. (a) | | | 221 | | | | 6,573 | |

Genomic Health, Inc. (a) | | | 744 | | | | 22,558 | |

Halozyme Therapeutics, Inc. (a) | | | 1,697 | | | | 30,207 | |

Histogenics Corp. (a) | | | 540 | | | | 1,777 | |

Ignyta, Inc. (a) | | | 640 | | | | 9,408 | |

Immune Design Corp. (a) | | | 270 | | | | 5,651 | |

Infinity Pharmaceuticals, Inc. (a) | | | 621 | | | | 5,477 | |

Isis Pharmaceuticals, Inc. (a) | | | 61 | | | | 3,723 | |

Ligand Pharmaceuticals, Inc. (a) | | | 214 | | | | 22,915 | |

Merrimack Pharmaceuticals, Inc. (a) | | | 479 | | | | 4,507 | |

MiMedx Group, Inc. (a) | | | 591 | | | | 5,295 | |

Momenta Pharmaceuticals, Inc. (a) | | | 1,371 | | | | 24,486 | |

Myriad Genetics, Inc. (a) | | | 586 | | | | 25,491 | |

Neurocrine Biosciences, Inc. (a) | | | 351 | | | | 19,084 | |

Novavax, Inc. (a) | | | 274 | | | | 2,345 | |

Ocata Therapeutics, Inc. (a)(b) | | | 233 | | | | 1,999 | |

PDL BioPharma, Inc. | | | 3,589 | | | | 13,584 | |

Peregrine Pharmaceuticals, Inc. (a) | | | 2,138 | | | | 2,758 | |

PTC Therapeutics, Inc. (a) | | | 197 | | | | 5,918 | |

Radius Health, Inc. (a) | | | 67 | | | | 4,074 | |

Raptor Pharmaceutical Corp. (a) | | | 1,701 | | | | 10,750 | |

Repligen Corp. (a) | | | 867 | | | | 24,649 | |

Rigel Pharmaceuticals, Inc. (a) | | | 6,610 | | | | 21,681 | |

Strongbridge Biopharma PLC | | | 1,872 | | | | 13,460 | |

Tobira Therapeutics, Inc. (a) | | | 1,614 | | | | 21,628 | |

Trevena, Inc. (a) | | | 695 | | | | 8,750 | |

Ultragenyx Pharmaceutical, Inc. (a) | | | 75 | | | | 7,374 | |

United Therapeutics Corp. (a) | | | 87 | | | | 13,279 | |

| | | | | | | | |

| | | | | | | | 605,187 | |

Building Products — 1.6% | | | | | | | | |

Apogee Enterprises, Inc. | | | 77 | | | | 3,867 | |

Continental Building Products, Inc. (a) | | | 1,648 | | | | 30,060 | |

Gibraltar Industries, Inc. (a) | | | 1,378 | | | | 36,779 | |

Insteel Industries, Inc. | | | 413 | | | | 10,077 | |

Universal Forest Products, Inc. | | | 949 | | | | 73,320 | |

| | | | | | | | |

| | | | | | | | 154,103 | |

Capital Markets — 0.4% | | | | | | | | |

Ashford, Inc. (a) | | | 37 | | | | 2,288 | |

Investment Technology Group, Inc. | | | 597 | | | | 11,982 | |

Janus Capital Group, Inc. | | | 592 | | | | 9,348 | |

Piper Jaffray Cos. (a) | | | 289 | | | | 11,713 | |

Stifel Financial Corp. (a) | | | 60 | | | | 2,722 | |

| | | | | | | | |

| | | | | | | | 38,053 | |

Chemicals — 1.2% | | | | | | | | |

Advanced Emissions Solutions, Inc. (a) | | | 3,745 | | | | 22,077 | |

AgroFresh Solutions, Inc. | | | 1,044 | | | | 6,734 | |

Axiall Corp. | | | 107 | | | | 2,230 | |

Innophos Holdings, Inc. | | | 67 | | | | 1,991 | |

Innospec, Inc. | | | 249 | | | | 14,542 | |

| | | | | | | | | | |

| Portfolio Abbreviations |

| | | | | |

| CVR | | Contingent Value Rights | | | | | | | | |

| REIT | | Real Estate Investment Trust | | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 9 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Disciplined Small Cap Core Fund | |

| | | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Chemicals (continued) | | | | | | | | |

Olin Corp. | | | 147 | | | $ | 3,200 | |

Sensient Technologies Corp. | | | 544 | | | | 36,361 | |

Stepan Co. | | | 297 | | | | 15,462 | |

Trinseo SA (b) | | | 489 | | | | 13,966 | |

| | | | | | | | |

| | | | | | | | 116,563 | |

Commercial Services & Supplies — 2.3% | | | | | | | | |

ABM Industries, Inc. | | | 88 | | | | 2,611 | |

ARC Document Solutions, Inc. (a) | | | 11,327 | | | | 57,315 | |

Herman Miller, Inc. | | | 962 | | | | 30,505 | |

Interface, Inc. | | | 3,821 | | | | 75,961 | |

Knoll, Inc. | | | 1,861 | | | | 41,463 | |

Quad/Graphics, Inc. | | | 1,983 | | | | 20,465 | |

| | | | | | | | |

| | | | | | | | 228,320 | |

Communications Equipment — 1.7% | | | | | | | | |

Calix, Inc. (a) | | | 3,133 | | | | 24,813 | |

Digi International, Inc. (a) | | | 696 | | | | 8,707 | |

Ixia (a) | | | 3,345 | | | | 43,686 | |

Lumentum Holdings, Inc. (a) | | | 1,284 | | | | 25,680 | |

MRV Communications, Inc. (a) | | | 194 | | | | 2,782 | |

NETGEAR, Inc. (a) | | | 600 | | | | 26,466 | |

PC-Tel, Inc. | | | 4,682 | | | | 24,955 | |

ShoreTel, Inc. (a) | | | 1,065 | | | | 10,927 | |

| | | | | | | | |

| | | | | | | | 168,016 | |

Construction & Engineering — 1.5% | | | | | | | | |

Comfort Systems U.S.A., Inc. | | | 2,758 | | | | 87,539 | |

Dycom Industries, Inc. (a) | | | 551 | | | | 48,146 | |

Orion Marine Group, Inc. (a) | | | 2,383 | | | | 10,438 | |

| | | | | | | | |

| | | | | | | | 146,123 | |

Construction Materials — 0.1% | | | | | | | | |

Headwaters, Inc. (a) | | | 694 | | | | 13,304 | |

Consumer Finance — 0.8% | | | | | | | | |

Consumer Portfolio Services, Inc. (a) | | | 10,331 | | | | 48,349 | |

Emergent Capital, Inc. (a) | | | 7,494 | | | | 32,074 | |

| | | | | | | | |

| | | | | | | | 80,423 | |

Containers & Packaging — 0.6% | | | | | | | | |

Graphic Packaging Holding Co. | | | 4,242 | | | | 57,988 | |

Diversified Consumer Services — 0.7% | | | | | | | | |

Cambium Learning Group, Inc. (a) | | | 5,248 | | | | 27,237 | |

Collectors Universe, Inc. | | | 790 | | | | 12,608 | |

K12, Inc. (a) | | | 2,832 | | | | 28,716 | |

Steiner Leisure Ltd. (a) | | | 72 | | | | 4,527 | |

| | | | | | | | |

| | | | | | | | 73,088 | |

Diversified Financial Services — 0.2% | | | | | | | | |

Marlin Business Services Corp. | | | 1,110 | | | | 19,403 | |

Diversified Telecommunication Services — 0.4% | | | | | | | | |

Inteliquent, Inc. | | | 1,909 | | | | 36,672 | |

Premiere Global Services, Inc. (a) | | | 261 | | | | 3,620 | |

| | | | | | | | |

| | | | | | | | 40,292 | |

Electric Utilities — 0.7% | | | | | | | | |

Cleco Corp. | | | 339 | | | | 16,987 | |

IDACORP, Inc. | | | 320 | | | | 21,773 | |

Portland General Electric Co. | | | 921 | | | | 34,003 | |

| | | | | | | | |

| | | | | | | | 72,763 | |

Electrical Equipment — 0.1% | | | | | | | | |

SL Industries, Inc. (a) | | | 386 | | | | 13,375 | |

Electronic Equipment, Instruments & Components — 2.4% | | | | | | | | |

Benchmark Electronics, Inc. (a) | | | 829 | | | | 17,790 | |

Fabrinet | | | 376 | | | | 8,998 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Electronic Equipment, Instruments & Components (continued) | |

Kimball Electronics, Inc. (a) | | | 475 | | | $ | 5,444 | |

Littelfuse, Inc. | | | 95 | | | | 10,313 | |

Multi-Fineline Electronix, Inc. (a) | | | 2,323 | | | | 57,332 | |

OSI Systems, Inc. (a) | | | 252 | | | | 23,595 | |

Radisys Corp. (a) | | | 16,757 | | | | 44,406 | |

RealD, Inc. (a) | | | 227 | | | | 2,384 | |

Tech Data Corp. (a) | | | 655 | | | | 44,311 | |

Vishay Precision Group, Inc. (a) | | | 2,192 | | | | 26,370 | |

| | | | | | | | |

| | | | | | | | 240,943 | |

Energy Equipment & Services — 0.9% | | | | | | | | |

Aspen Aerogels, Inc. (a) | | | 4,696 | | | | 30,524 | |

Bristow Group, Inc. | | | 144 | | | | 4,399 | |

Dawson Geophysical Co. (a) | | | 11,309 | | | | 50,099 | |

Gulf Island Fabrication, Inc. | | | 433 | | | | 4,287 | |

Matrix Service Co. (a) | | | 60 | | | | 1,379 | |

North Atlantic Drilling Ltd. | | | 1,416 | | | | 777 | |

PHI, Inc. (a) | | | 116 | | | | 2,479 | |

| | | | | | | | |

| | | | | | | | 93,944 | |

Food & Staples Retailing — 0.5% | | | | | | | | |

SUPERVALU, Inc. (a) | | | 6,671 | | | | 44,829 | |

Food Products — 0.7% | | | | | | | | |

Cal-Maine Foods, Inc. (b) | | | 835 | | | | 45,516 | |

Omega Protein Corp. (a) | | | 143 | | | | 3,515 | |

Pilgrim’s Pride Corp. | | | 992 | | | | 21,358 | |

| | | | | | | | |

| | | | | | | | 70,389 | |

Gas Utilities — 0.4% | | | | | | | | |

Southwest Gas Corp. | | | 546 | | | | 30,620 | |

WGL Holdings, Inc. | | | 84 | | | | 5,179 | |

| | | | | | | | |

| | | | | | | | 35,799 | |

Health Care Equipment & Supplies — 3.8% | | | | | | | | |

Alphatec Holdings, Inc. (a) | | | 5,403 | | | | 1,243 | |

AngioDynamics, Inc. (a) | | | 4,063 | | | | 48,350 | |

ICU Medical, Inc. (a) | | | 702 | | | | 79,635 | |

Lantheus Holdings, Inc. (a) | | | 1,731 | | | | 6,128 | |

Masimo Corp. (a) | | | 3,384 | | | | 140,368 | |

Merit Medical Systems, Inc. (a) | | | 405 | | | | 7,845 | |

NuVasive, Inc. (a) | | | 154 | | | | 8,030 | |

Orthofix International NV (a) | | | 284 | | | | 11,235 | |

RTI Surgical, Inc. (a) | | | 9,434 | | | | 36,981 | |

STERIS PLC | | | 32 | | | | 2,444 | |

SurModics, Inc. (a) | | | 138 | | | | 2,906 | |

Symmetry Surgical, Inc. (a) | | | 3,597 | | | | 32,733 | |

| | | | | | | | |

| | | | | | | | 377,898 | |

Health Care Providers & Services — 3.9% | | | | | | | | |

Alliance HealthCare Services, Inc. (a) | | | 332 | | | | 2,991 | |

AMN Healthcare Services, Inc. (a) | | | 1,745 | | | | 51,478 | |

Cross Country Healthcare, Inc. (a) | | | 173 | | | | 3,157 | |

Five Star Quality Care, Inc. (a) | | | 6,151 | | | | 22,082 | |

Health Net, Inc. (a) | | | 667 | | | | 42,194 | |

Molina Healthcare, Inc. (a) | | | 710 | | | | 42,785 | |

Surgical Care Affiliates, Inc. (a) | | | 983 | | | | 36,538 | |

Team Health Holdings, Inc. (a) | | | 2,085 | | | | 114,967 | |

VCA, Inc. (a) | | | 1,323 | | | | 72,805 | |

| | | | | | | | |

| | | | | | | | 388,997 | |

Hotels, Restaurants & Leisure — 4.2% | | | | | | | | |

BFC Financial Corp., Class A (a) | | | 5,961 | | | | 21,400 | |

Boyd Gaming Corp. (a) | | | 688 | | | | 13,478 | |

Brinker International, Inc. | | | 61 | | | | 2,783 | |

Caesars Acquisition Co., Class A (a) | | | 240 | | | | 1,896 | |

Century Casinos, Inc. (a) | | | 657 | | | | 4,402 | |

Cheesecake Factory, Inc. | | | 128 | | | | 6,033 | |

See Notes to Financial Statements.

| | | | | | |

| 10 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Disciplined Small Cap Core Fund | |

| | | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Hotels, Restaurants & Leisure (continued) | | | | | | | | |

Cracker Barrel Old Country Store, Inc. (b) | | | 563 | | | $ | 70,893 | |

Eldorado Resorts, Inc. (a) | | | 4,050 | | | | 39,245 | |

Intrawest Resorts Holdings, Inc. (a) | | | 3,176 | | | | 29,219 | |

Isle of Capri Casinos, Inc. (a) | | | 614 | | | | 11,322 | |

J. Alexander’s Holdings, Inc. (a) | | | 521 | | | | 5,543 | |

Jack in the Box, Inc. | | | 2,047 | | | | 151,765 | |

Luby’s, Inc. (a) | | | 3,133 | | | | 14,976 | |

Vail Resorts, Inc. | | | 329 | | | | 39,677 | |

| | | | | | | | |

| | | | | | | | 412,632 | |

Household Durables — 1.0% | | | | | | | | |

Installed Building Products, Inc. (a) | | | 108 | | | | 2,706 | |

La-Z-Boy, Inc. | | | 2,037 | | | | 54,612 | |

Lennar Corp., B Shares | | | 94 | | | | 3,910 | |

LGI Homes, Inc. (a) | | | 33 | | | | 1,098 | |

WCI Communities, Inc. (a) | | | 574 | | | | 13,897 | |

ZAGG, Inc. (a) | | | 2,320 | | | | 23,942 | |

| | | | | | | | |

| | | | | | | | 100,165 | |

Household Products — 0.2% | | | | | | | | |

Central Garden & Pet Co., Class A | | | 1,220 | | | | 19,264 | |

Oil-Dri Corp. of America | | | 61 | | | | 1,904 | |

| | | | | | | | |

| | | | | | | | 21,168 | |

Independent Power and Renewable Electricity Producers — 0.4% | |

Dynegy, Inc. (a) | | | 613 | | | | 9,882 | |

Talen Energy Corp. (a) | | | 2,711 | | | | 21,119 | |

TerraForm Global, Inc., Class A | | | 995 | | | | 4,010 | |

| | | | | | | | |

| | | | | | | | 35,011 | |

Insurance — 2.4% | | | | | | | | |

American Equity Investment Life Holding Co. | | | 3,352 | | | | 89,867 | |

American National Insurance Co. | | | 19 | | | | 2,040 | |

CNO Financial Group, Inc. | | | 1,070 | | | | 21,646 | |

Employers Holdings, Inc. | | | 71 | | | | 1,946 | |

Fidelity & Guaranty Life | | | 3,084 | | | | 79,197 | |

First American Financial Corp. | | | 106 | | | | 4,181 | |

National General Holdings Corp. | | | 592 | | | | 12,971 | |

Symetra Financial Corp. | | | 423 | | | | 13,316 | |

Universal Insurance Holdings, Inc. (b) | | | 699 | | | | 13,805 | |

| | | | | | | | |

| | | | | | | | 238,969 | |

Internet & Catalog Retail — 0.1% | | | | | | | | |

U.S. Auto Parts Network, Inc. (a) | | | 2,124 | | | | 5,268 | |

Internet Software & Services — 3.1% | | | | | | | | |

Constant Contact, Inc. (a) | | | 178 | | | | 5,570 | |

Demand Media, Inc. (a) | | | 2,925 | | | | 17,667 | |

IntraLinks Holdings, Inc. (a) | | | 399 | | | | 4,082 | |

Limelight Networks, Inc. (a) | | | 7,655 | | | | 12,937 | |

LogMeIn, Inc. (a) | | | 1,960 | | | | 139,983 | |

Monster Worldwide, Inc. | | | 648 | | | | 4,173 | |

QuinStreet, Inc. (a) | | | 12,978 | | | | 63,462 | |

SciQuest, Inc. (a) | | | 2,614 | | | | 33,747 | |

Tremor Video, Inc. (a) | | | 1,388 | | | | 2,845 | |

Web.com Group, Inc. (a) | | | 817 | | | | 19,780 | |

XO Group, Inc. (a) | | | 435 | | | | 7,325 | |

| | | | | | | | |

| | | | | | | | 311,571 | |

IT Services — 1.9% | | | | | | | | |

Computer Task Group, Inc. | | | 4,137 | | | | 27,842 | |

Convergys Corp. | | | 110 | | | | 2,834 | |

Datalink Corp. (a) | | | 2,672 | | | | 19,639 | |

Euronet Worldwide, Inc. (a) | | | 159 | | | | 12,357 | |

Everi Holdings, Inc. (a) | | | 1,346 | | | | 5,142 | |

Higher One Holdings, Inc. (a) | | | 15,035 | | | | 47,661 | |

Lionbridge Technologies, Inc. (a) | | | 1,589 | | | | 8,422 | |

Net 1 UEPS Technologies, Inc. (a) | | | 1,328 | | | | 20,093 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

IT Services (continued) | | | | | | | | |

Science Applications International Corp. | | | 867 | | | $ | 43,558 | |

| | | | | | | | |

| | | | | | | | 187,548 | |

Leisure Products — 0.9% | | | | | | | | |

Brunswick Corp. | | | 1,184 | | | | 62,314 | |

Marine Products Corp. | | | 1,745 | | | | 12,250 | |

Nautilus, Inc. (a) | | | 740 | | | | 14,215 | |

| | | | | | | | |

| | | | | | | | 88,779 | |

Life Sciences Tools & Services — 0.9% | | | | | | | | |

Harvard Bioscience, Inc. (a) | | | 4,026 | | | | 12,762 | |

INC Research Holdings, Inc., Class A (a) | | | 1,713 | | | | 81,025 | |

| | | | | | | | |

| | | | | | | | 93,787 | |

Machinery — 2.6% | | | | | | | | |

Accuride Corp. (a) | | | 1,385 | | | | 3,573 | |

Blount International, Inc. (a) | | | 1,296 | | | | 7,517 | |

Briggs & Stratton Corp. | | | 1,324 | | | | 25,209 | |

Commercial Vehicle Group, Inc. (a) | | | 7,761 | | | | 26,387 | |

FreightCar America, Inc. | | | 53 | | | | 1,285 | |

Global Brass & Copper Holdings, Inc. | | | 2,094 | | | | 48,706 | |

Greenbrier Cos., Inc. | | | 922 | | | | 31,237 | |

Hardinge, Inc. | | | 96 | | | | 934 | |

Hillenbrand, Inc. | | | 69 | | | | 2,090 | |

Hyster-Yale Materials Handling, Inc. | | | 194 | | | | 11,219 | |

John Bean Technologies Corp. | | | 56 | | | | 2,738 | |

L.B. Foster Co., Class A | | | 286 | | | | 3,546 | |

LS Starrett Co., Class A | | | 525 | | | | 5,807 | |

Meritor, Inc. (a) | | | 98 | | | | 1,053 | |

SPX Corp. | | | 2,037 | | | | 22,488 | |

Supreme Industries, Inc., Class A | | | 4,420 | | | | 35,360 | |

Wabash National Corp. (a) | | | 2,354 | | | | 30,531 | |

| | | | | | | | |

| | | | | | | | 259,680 | |

Media — 0.9% | | | | | | | | |

Crown Media Holdings, Inc., Class A (a) | | | 181 | | | | 1,026 | |

Entercom Communications Corp., Class A (a) | | | 2,548 | | | | 30,856 | |

Harte-Hanks, Inc. | | | 15,923 | | | | 59,870 | |

| | | | | | | | |

| | | | | | | | 91,752 | |

Metals & Mining — 0.5% | | | | | | | | |

Kaiser Aluminum Corp. | | | 71 | | | | 6,086 | |

Worthington Industries, Inc. | | | 1,517 | | | | 46,678 | |

| | | | | | | | |

| | | | | | | | 52,764 | |

Multiline Retail — 0.6% | | | | | | | | |

Burlington Stores, Inc. (a) | | | 1,252 | | | | 60,234 | |

Oil, Gas & Consumable Fuels — 3.0% | | | | | | | | |

Abraxas Petroleum Corp. (a) | | | 11,530 | | | | 15,220 | |

Alon USA Energy, Inc. | | | 266 | | | | 4,679 | |

Archrock, Inc. | | | 1,809 | | | | 19,121 | |

DHT Holdings, Inc. | | | 6,302 | | | | 47,265 | |

Enviva Partners LP | | | 629 | | | | 9,630 | |

Evolution Petroleum Corp. | | | 7,442 | | | | 45,768 | |

Exterran Corp. (a) | | | 288 | | | | 4,715 | |

Gener8 Maritime, Inc. (a) | | | 4,560 | | | | 44,186 | |

Isramco, Inc. (a) | | | 119 | | | | 10,948 | |

Noble Energy, Inc. | | | 203 | | | | 7,444 | |

Nordic American Tankers Ltd. | | | 451 | | | | 6,675 | |

Oasis Petroleum, Inc. (a) | | | 661 | | | | 7,595 | |

PDC Energy, Inc. (a) | | | 447 | | | | 25,251 | |

RSP Permian, Inc. (a) | | | 74 | | | | 2,100 | |

Scorpio Tankers, Inc. | | | 3,742 | | | | 32,368 | |

Transatlantic Petroleum Ltd. | | | 1,890 | | | | 2,930 | |

Triangle Petroleum Corp. (a)(b) | | | 11,937 | | | | 9,144 | |

W&T Offshore, Inc. | | | 343 | | | | 1,286 | |

See Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 11 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Disciplined Small Cap Core Fund | |

| | | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (continued) | | | | | | | | |

Western Refining, Inc. | | | 36 | | | $ | 1,629 | |

| | | | | | | | |

| | | | | | | | 297,954 | |

Paper & Forest Products — 0.5% | | | | | | | | |

Boise Cascade Co. (a) | | | 674 | | | | 21,096 | |

Domtar Corp. | | | 682 | | | | 28,023 | |

| | | | | | | | |

| | | | | | | | 49,119 | |

Personal Products — 0.0% | | | | | | | | |

USANA Health Sciences, Inc. (a) | | | 27 | | | | 3,616 | |

Pharmaceuticals — 1.8% | | | | | | | | |

Endo International PLC (a) | | | 56 | | | | 3,443 | |

Furiex Pharmaceuticals, Inc. — CVR (a) | | | 11 | | | | 110 | |

Juniper Pharmaceuticals, Inc. (a) | | | 1,681 | | | | 19,903 | |

Lannett Co., Inc. (a) | | | 156 | | | | 5,766 | |

Marinus Pharmaceuticals, Inc. (a) | | | 600 | | | | 4,362 | |

Prestige Brands Holdings, Inc. (a) | | | 1,882 | | | | 95,775 | |

SciClone Pharmaceuticals, Inc. (a) | | | 1,359 | | | | 12,462 | |

Sucampo Pharmaceuticals, Inc., Class A (a) | | | 1,410 | | | | 24,182 | |

ZS Pharma, Inc. (a) | | | 101 | | | | 9,086 | |

| | | | | | | | |

| | | | | | | | 175,089 | |

Professional Services — 1.7% | | | | | | | | |

Insperity, Inc. | | | 1,241 | | | | 53,562 | |

Kforce, Inc. | | | 2,018 | | | | 54,365 | |

RPX Corp. (a) | | | 2,852 | | | | 39,557 | |

Volt Information Sciences, Inc. (a) | | | 1,060 | | | | 8,904 | |

Willdan Group, Inc. (a) | | | 1,030 | | | | 9,064 | |

| | | | | | | | |

| | | | | | | | 165,452 | |

Real Estate Investment Trusts (REITs) — 8.3% | | | | | | | | |

Arbor Realty Trust, Inc. | | | 18,671 | | | | 128,456 | |

Armada Hoffler Properties, Inc. | | | 268 | | | | 3,026 | |

Ashford Hospitality Prime, Inc. | | | 359 | | | | 5,098 | |

Chatham Lodging Trust | | | 3,854 | | | | 87,833 | |

Colony Capital, Inc., Class A | | | 461 | | | | 9,432 | |

CoreSite Realty Corp. | | | 63 | | | | 3,690 | |

DiamondRock Hospitality Co. | | | 6,969 | | | | 77,565 | |

DuPont Fabros Technology, Inc. | | | 737 | | | | 24,350 | |

EPR Properties | | | 536 | | | | 30,037 | |

Equity LifeStyle Properties, Inc. | | | 513 | | | | 32,001 | |

FelCor Lodging Trust, Inc. | | | 867 | | | | 6,953 | |

Gramercy Property Trust, Inc. | | | 1,075 | | | | 25,682 | |

Hersha Hospitality Trust | | | 2,422 | | | | 57,183 | |

InfraREIT, Inc. (a) | | | 2,944 | | | | 59,380 | |

LaSalle Hotel Properties | | | 545 | | | | 15,374 | |

Lexington Realty Trust | | | 3,701 | | | | 31,792 | |

New Residential Investment Corp. | | | 951 | | | | 12,097 | |

Northstar Realty Finance Corp. (a) | | | 322 | | | | 5,809 | |

Pebblebrook Hotel Trust | | | 1,506 | | | | 47,966 | |

PS Business Parks, Inc. | | | 782 | | | | 69,144 | |

RLJ Lodging Trust | | | 2,857 | | | | 69,711 | |

Strategic Hotels & Resorts, Inc. | | | 1,507 | | | | 21,339 | |

Summit Hotel Properties, Inc. | | | 192 | | | | 2,559 | |

| | | | | | | | |

| | | | | | | | 826,477 | |

Real Estate Management & Development — 0.7% | | | | | | | | |

AV Homes, Inc. (a) | | | 1,505 | | | | 20,950 | |

FRP Holdings, Inc. (a) | | | 510 | | | | 15,805 | |

Marcus & Millichap, Inc. (a) | | | 885 | | | | 29,037 | |

RE/MAX Holdings, Inc., Class A | | | 137 | | | | 5,139 | |

| | | | | | | | |

| | | | | | | | 70,931 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Road & Rail — 1.0% | | | | | | | | |

Ryder System, Inc. | | | 641 | | | $ | 42,280 | |

Swift Transportation Co. (a) | | | 3,288 | | | | 52,509 | |

| | | | | | | | |

| | | | | | | | 94,789 | |

Semiconductors & Semiconductor Equipment — 3.7% | | | | | | | | |

Ambarella, Inc. (b) | | | 59 | | | | 3,706 | |

Axcelis Technologies, Inc. (a) | | | 8,834 | | | | 23,322 | |

Cascade Microtech, Inc. (a) | | | 1,700 | | | | 27,625 | |

Cirrus Logic, Inc. (a) | | | 312 | | | | 10,315 | |

Fairchild Semiconductor International, Inc. | | | 647 | | | | 12,642 | |

Integrated Device Technology, Inc. (a) | | | 2,063 | | | | 57,847 | |

IXYS Corp. | | | 944 | | | | 12,017 | |

MaxLinear, Inc., Class A (a) | | | 888 | | | | 15,540 | |

Microsemi Corp. (a) | | | 795 | | | | 28,628 | |

MKS Instruments, Inc. | | | 123 | | | | 4,535 | |

Monolithic Power Systems, Inc. | | | 277 | | | | 18,927 | |

OmniVision Technologies, Inc. (a) | | | 326 | | | | 9,519 | |

Photronics, Inc. (a) | | | 390 | | | | 4,278 | |

Sigma Designs, Inc. (a) | | | 381 | | | | 3,309 | |

Synaptics, Inc. (a) | | | 81 | | | | 7,271 | |

Tessera Technologies, Inc. | | | 4,048 | | | | 128,929 | |

Ultra Clean Holdings, Inc. (a) | | | 614 | | | | 3,113 | |

| | | | | | | | |

| | | | | | | | 371,523 | |

Software — 4.7% | | | | | | | | |

Aspen Technology, Inc. (a) | | | 1,269 | | | | 55,773 | |

Exa Corp. (a) | | | 5,290 | | | | 56,973 | |

Gigamon, Inc. (a) | | | 298 | | | | 8,073 | |

Imperva, Inc. (a) | | | 83 | | | | 6,194 | |

Infoblox, Inc. (a) | | | 1,032 | | | | 15,521 | |

Manhattan Associates, Inc. (a) | | | 2,167 | | | | 165,992 | |

MicroStrategy, Inc., Class A (a) | | | 12 | | | | 2,080 | |

Monotype Imaging Holdings, Inc. | | | 585 | | | | 15,462 | |

Pegasystems, Inc. | | | 1,638 | | | | 48,387 | |

Progress Software Corp. (a) | | | 1,231 | | | | 29,532 | |

Take-Two Interactive Software, Inc. (a) | | | 319 | | | | 11,283 | |

Telenav, Inc. (a) | | | 887 | | | | 6,307 | |

Upland Software, Inc. (a) | | | 2,955 | | | | 21,660 | |

Zix Corp. (a) | | | 4,965 | | | | 27,854 | |

| | | | | | | | |

| | | | | | | | 471,091 | |

Specialty Retail — 2.8% | | | | | | | | |

Aaron’s, Inc. (a) | | | 1,200 | | | | 29,124 | |

American Eagle Outfitters, Inc. | | | 2,323 | | | | 36,169 | |

Barnes & Noble, Inc. | | | 3,174 | | | | 40,627 | |

Chico’s FAS, Inc. | | | 5,313 | | | | 63,756 | |

Express, Inc. (a) | | | 1,045 | | | | 17,493 | |

Finish Line, Inc., Class A | | | 198 | | | | 3,285 | |

Group 1 Automotive, Inc. | | | 290 | | | | 23,554 | |

Haverty Furniture Cos., Inc. | | | 156 | | | | 3,766 | |

hhgregg, Inc. (a) | | | 558 | | | | 2,299 | |

Murphy U.S.A., Inc. (a) | | | 183 | | | | 10,899 | |

Rent-A-Center, Inc. | | | 163 | | | | 2,797 | |

Sonic Automotive, Inc., Class A | | | 658 | | | | 15,963 | |

Stage Stores, Inc. | | | 989 | | | | 7,655 | |

Tilly’s, Inc., Class A (a) | | | 859 | | | | 5,300 | |

West Marine, Inc. (a) | | | 1,526 | | | | 14,024 | |

| | | | | | | | |

| | | | | | | | 276,711 | |

Technology Hardware, Storage & Peripherals — 0.0% | | | | | | | | |

Avid Technology, Inc. (a) | | | 415 | | | | 3,150 | |

See Notes to Financial Statements.

| | | | | | |

| 12 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Disciplined Small Cap Core Fund | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Textiles, Apparel & Luxury Goods — 1.3% | | | | | | | | |

Columbia Sportswear Co. | | | 76 | | | $ | 3,559 | |

Culp, Inc. | | | 1,402 | | | | 39,508 | |

Deckers Outdoor Corp. (a) | | | 882 | | | | 43,165 | |

Skechers U.S.A., Inc., Class A (a) | | | 1,327 | | | | 40,075 | |

| | | | | | | | |

| | | | | | | | 126,307 | |

Thrifts & Mortgage Finance — 2.8% | | | | | | | | |

Anchor BanCorp Wisconsin, Inc. (a) | | | 638 | | | | 26,790 | |

EverBank Financial Corp. | | | 8,872 | | | | 153,131 | |

Flagstar Bancorp, Inc. (a) | | | 3,558 | | | | 87,384 | |

MGIC Investment Corp. (a) | | | 872 | | | | 8,319 | |

Radian Group, Inc. | | | 385 | | | | 5,486 | |

| | | | | | | | |

| | | | | | | | 281,110 | |

Tobacco — 0.4% | | | | | | | | |

Vector Group Ltd. | | | 1,535 | | | | 38,851 | |

Trading Companies & Distributors — 0.6% | | | | | | | | |

CAI International, Inc. (a) | | | 1,796 | | | | 20,079 | |

Neff Corp., Class A (a) | | | 4,552 | | | | 37,827 | |

| | | | | | | | |

| | | | | | | | 57,906 | |

Water Utilities — 1.4% | | | | | | | | |

California Water Service Group | | | 5,560 | | | | 125,267 | |

Connecticut Water Service, Inc. | | | 149 | | | | 5,410 | |

Middlesex Water Co. | | | 215 | | | | 5,510 | |

| | | | | | | | |

| | | | | | | | 136,187 | |

Wireless Telecommunication Services — 0.0% | | | | | | | | |

Leap Wireless International, Inc. — CVR (a) | | | 216 | | | | 544 | |

Total Common Stocks — 99.4% | | | | | | | 9,871,120 | |

| | | | | | | | |

| Other Interests (c) | | Beneficial

Interest

(000) | | | Value | |

Professional Services — 0.0% | | | | | | | | |

Dolan Co., Escrow (a) | | | $ 2 | | | | $ 39 | |

Total Other Interests — 0.0% | | | | | | | 39 | |

Total Long-Term Investments (Cost — $9,508,228) — 99.4% | | | | | | | 9,871,159 | |

| | | | | | | | |

| Short-Term Securities | | Shares | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.14% (d)(e) | | | 128,665 | | | | 128,665 | |

| | | Beneficial

Interest

(000) | | | | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.27% (d)(e)(f) | | | $166 | | | | 166,267 | |

Total Short-Term Securities (Cost — $294,932) — 3.0% | | | | | | | 294,932 | |

Total Investments (Cost — $9,803,160) — 102.4% | | | | | | | 10,166,091 | |

Liabilities in Excess of Other Assets — (2.4)% | | | | | | | (235,721 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 9,930,370 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

| (c) | Other interests represent beneficial interests in liquidation trusts and other reorganization or private entities. |

| (d) | During the six months ended November 30, 2015, investments in issuers considered to be affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/

Beneficial

Interest

Held at

May 31, 2015 | | | Net

Activity | | | Shares/ Beneficial Interest Held at

November 30, 2015 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 161,872 | | | | (33,207 | ) | | | 128,665 | | | $ | 84 | |

BlackRock Liquidity Series, LLC, Money Market Series | | | $129,625 | | | | $36,642 | | | | $166,267 | | | $ | 1,373 | 1 |

| | 1 | | Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| (e) | Represents the current yield as of period end. |

| (f) | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

See Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 13 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Disciplined Small Cap Core Fund | |

|

| Derivative Financial Instruments Outstanding as of Period End |

| | | | | | | | | | | | |

| Financial Futures Contracts | | | | | | | | |

Contracts

Long | | Issue | | Expiration | | Notional

Value | | | Unrealized

Appreciation | |

| 1 | | E-Mini Russell 2000 Futures | | December 2015 | | $ | 119,590 | | | | $5,417 | |

|

| Derivative Financial Instruments Categorized by Risk Exposure |

As of period end, fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Commodity

Contracts | | Credit

Contracts | | Equity

Contracts | | Foreign

Currency

Exchange

Contracts | | Interest Rate

Contracts | | Other

Contracts | | Total |

Assets — Derivative Financial Instruments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial futures contracts | | Net unrealized appreciation1 | | | | — | | | | | — | | | | | $5,417 | | | | | — | | | | | — | | | | | — | | | | $ | 5,417 | |

| | 1 | | Includes cumulative appreciation (depreciation) on financial futures contracts, if any, as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statements of Assets and Liabilities. |

For the six months ended November 30, 2015, the effect of derivative financial instruments in the Statements of Operations were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Realized Loss from: | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Currency

Exchange

Contracts | | | Interest Rate

Contracts | | | Other

Contracts | | | Total | |

Financial futures contracts | | | — | | | | — | | | | $(4,002 | ) | | | — | | | | — | | | | — | | | $ | (4,002 | ) |

Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial futures contracts | | | — | | | | — | | | | $ 5,419 | | | | — | | | | — | | | | — | | | $ | 5,419 | |

|

| Average Quarterly Balances of Outstanding Derivative Financial Instruments |

| | | | |

Financial futures contracts: | | | | |

Average notional value of contract — long | | $ | 117,670 | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

|

| Fair Value Hierarchy as of Period End |

Various inputs are used in determining the fair value of investments and derivative financial instruments. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, refer to the Notes to Financial Statements.

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments1 | | | $ | 9,870,466 | | | | | — | | | | $ | 693 | | | | $ | 9,871,159 | |

Short-Term Securities | | | | 128,665 | | | | $ | 166,267 | | | | | — | | | | | 294,932 | |

| | | | | |

Total | | | $ | 9,999,131 | | | | $ | 166,267 | | | | $ | 693 | | | | $ | 10,166,091 | |

| | | | | |

1 See above Schedule of Investments for values in each industry. Investments categorized as Level 3 are included in Pharmaceuticals, Wireless Telecommunications Services and Other Interests. | |

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Derivative Financial Instruments2 | | | | | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | | | | | |

Equity contracts | | | $ | 5,417 | | | | | — | | | | | — | | | | $ | 5,417 | |

2 Derivative financial instruments are financial futures contracts, which are valued at the unrealized appreciation (depreciation) on the instrument. | |

See Notes to Financial Statements.

| | | | | | |

| 14 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Disciplined Small Cap Core Fund | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, such assets and/or liabilities are categorized within the disclosure hierarchy as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | | | | | | | | | | |

Cash pledged for financial futures contracts | | | $ | 6,000 | | | | | — | | | | | — | | | | $ | 6,000 | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Collateral on securities loaned at value | | | | — | | | | $ | (166,267 | ) | | | | — | | | | | (166,267 | ) |

Total | | | $ | 6,000 | | | | $ | (166,267 | ) | | | | — | | | | $ | (160,267 | ) |

| | | | | |

During the six months ended November 30, 2015, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 15 |

| | |

| Statements of Assets and Liabilities | | |

| | | | | | | | |

| November 30, 2015 (Unaudited) | | BlackRock

Disciplined Small

Cap Core Fund | | | BlackRock

Small Cap

Growth Fund II | |

| | | | | | | | |

| Assets | | | | | | | | |

Investments at value — unaffiliated (including securities loaned at value of $157,312) (cost — $9,508,228) | | $ | 9,871,159 | | | | — | |

Investments at value — affiliated (cost — $294,932) | | | 294,932 | | | | — | |

Investments at value — Master Portfolio (cost — $185,658,346) | | | — | | | $ | 196,548,022 | |

Cash pledged for financial futures contracts | | | 6,000 | | | | — | |

Receivables: | | | | | | | | |

Investments sold | | | 117,586 | | | | — | |

Securities lending income — affiliated | | | 559 | | | | — | |

Capital shares sold | | | 28 | | | | 116,149 | |

Dividends | | | 10,486 | | | | — | |

From the Manager | | | 27,972 | | | | — | |

Withdrawals from the Master Portfolio | | | — | | | | 216,778 | |

Prepaid expenses | | | 14,165 | | | | 39,005 | |

| | | | |

Total assets | | | 10,342,887 | | | | 196,919,954 | |

| | | | |

| | | | | | | | |

| Liabilities | | | | | | | | |

Collateral on securities loaned at value | | | 166,267 | | | | — | |

Payables: | | | | | | | | |

Investments purchased | | | 149,404 | | | | — | |

Administration fees | | | — | | | | 32,095 | |

Capital shares redeemed | | | 1,000 | | | | 332,927 | |

Officer’s and Trustees’/Directors’ fees | | | 1,129 | | | | 165 | |

Other accrued expenses | | | 38,260 | | | | 31,779 | |

Other affiliates | | | — | | | | 3,438 | |

Professional fees | | | 54,365 | | | | 36,769 | |

Service and distribution fees | | | 1,005 | | | | 54,345 | |

Transfer agent fees | | | 597 | | | | 129,592 | |

Variation margin payable on financial futures contracts | | | 490 | | | | — | |

| | | | |

Total liabilities | | | 412,517 | | | | 621,110 | |

| | | | |

Net Assets | | $ | 9,930,370 | | | $ | 196,298,844 | |

| | | | |

| | | | | | | | |

| Net Assets Consist of | | | | | | | | |

Paid-in capital | | $ | 9,276,456 | | | $ | 180,175,021 | |

Undistributed (accumulated) net investment income (loss) | | | 41,932 | | | | (577,912 | ) |

Undistributed net realized gain | | | 243,634 | | | | — | |

Undistributed net realized gain allocated from the Master Portfolio | | | — | | | | 5,812,059 | |

Net unrealized appreciation (depreciation) | | | 368,348 | | | | — | |

Net unrealized appreciation (depreciation) allocated from the Master Portfolio | | | — | | | | 10,889,676 | |

| | | | |

Net Assets | | $ | 9,930,370 | | | $ | 196,298,844 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| 16 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | |

| Statements of Assets and Liabilities (concluded) | | |

| | | | | | | | |

| November 30, 2015 (Unaudited) | | BlackRock

Disciplined Small

Cap Core Fund | | | BlackRock

Small Cap

Growth Fund II | |

| | | | | | | | |

| Net Asset Value | | | | | | | | |

Institutional | | | | | | | | |

Net assets | | $ | 5,948,809 | | | $ | 65,582,653 | |

| | | | |

Shares outstanding | | | 528,416 | 1 | | | 4,986,189 | 2 |

| | | | |

Net asset value | | $ | 11.26 | | | $ | 13.15 | |

| | | | |

Investor A | | | | | | | | |

Net assets | | $ | 3,579,372 | | | $ | 70,221,164 | |

| | | | |

Shares outstanding | | | 318,879 | 1 | | | 5,656,061 | 2 |

| | | | |

Net asset value | | $ | 11.22 | | | $ | 12.42 | |

| | | | |

Investor C | | | | | | | | |

Net assets | | $ | 402,189 | | | $ | 38,674,505 | |

| | | | |

Shares outstanding | | | 36,256 | 1 | | | 3,866,312 | 2 |

| | | | |

Net asset value | | $ | 11.09 | | | $ | 10.00 | |

| | | | |

Class R | | | | | | | | |

Net assets | | | — | | | $ | 21,820,522 | |

| | | | |

Shares outstanding | | | — | | | | 1,922,951 | 2 |

| | | | |

Net asset value | | | — | | | $ | 11.35 | |

| | | | |

| | 1 | | Unlimited number of shares authorized, $0.001 par value. |

| | 2 | | 100 million shares authorized, $0.0001 par value. |

See Notes to Financial Statements.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | 17 |

| | | | | | | | |

| Six Months Ended November 30, 2015 (Unaudited) | | BlackRock

Disciplined Small

Cap Core Fund | | | BlackRock

Small Cap

Growth Fund II | |

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends — unaffiliated | | $ | 79,228 | | | | — | |

Securities lending — affiliated — net | | | 1,373 | | | | — | |

Dividends — affiliated | | | 84 | | | | — | |

Net investment income allocated from the Master Portfolio: | | | | | | | | |

Dividends — unaffiliated | | | — | | | $ | 914,209 | |

Securities lending — affiliated — net | | | — | | | | 83,128 | |

Dividends — affiliated | | | — | | | | 1,043 | |

Expenses | | | — | | | | (834,324 | ) |

Fees waived | | | — | | | | 167,835 | |

| | | | |

Total income | | | 80,685 | | | | 331,891 | |

| | | | |

| | | | | | | | |

| Expenses | | | | | | | | |

Professional | | | 51,541 | | | | 26,832 | |

Registration | | | 23,767 | | | | 33,638 | |

Investment advisory | | | 21,268 | | | | — | |

Printing | | | 11,637 | | | | 21,460 | |

Custodian | | | 9,227 | | | | — | |

Pricing | | | 5,956 | | | | — | |

Service and distribution — class specific | | | 5,600 | | | | 355,031 | |

Accounting services | | | 4,376 | | | | — | |

Officer and Trustees/Directors | | | 3,759 | | | | 71 | |

Transfer agent — class specific | | | 2,865 | | | | 268,963 | |

Administration | | | 2,009 | | | | 207,522 | |

Administration — class specific | | | 944 | | | | — | |

Miscellaneous | | | 5,480 | | | | 6,425 | |

| | | | |

Total expenses | | | 148,429 | | | | 919,942 | |

Less: | | | | | | | | |

Fees waived and/or reimbursed by the Manager | | | (103,713 | ) | | | — | |

Administration fees waived | | | (2,009 | ) | | | — | |

Administration fees waived — class specific | | | (942 | ) | | | — | |

Transfer agent fees reimbursed — class specific | | | (2,803 | ) | | | — | |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 38,962 | | | | 919,942 | |

| | | | |

Net investment income (loss) | | | 41,723 | | | | (588,051 | ) |

| | | | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | |

Investments | | | 277,826 | | | | — | |

Financial futures contracts | | | (4,002 | ) | | | — | |

Investments and financial futures contracts allocated from the Master Portfolio | | | — | | | | 7,334,584 | |

| | | | |

| | | 273,824 | | | | 7,334,584 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (529,389 | ) | | | — | |

Financial futures contracts | | | 5,419 | | | | — | |

Investments and financial futures contracts allocated from the Master Portfolio | | | — | | | | (18,859,164 | ) |

| | | | |

| | | (523,970 | ) | | | (18,859,164 | ) |

| | | | |

Net realized and unrealized loss | | | (250,146 | ) | | | (11,524,580 | ) |

| | | | |

Net Decrease in Net Assets Resulting from Operations | | $ | (208,423 | ) | | $ | (12,112,631 | ) |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| 18 | | SEMI-ANNUAL REPORT | | NOVEMBER 30, 2015 | | |

| | |

| Statements of Changes in Net Assets | | |

| | | | | | | | | | | | | | | | |

| | | BlackRock Disciplined

Small Cap Core Fund | | | BlackRock Small Cap

Growth Fund II | |

| Increase (Decrease) in Net Assets: | | Six Months

Ended

November 30,

2015

(Unaudited) | | | Year Ended

May 31, 2015 | | | Six Months

Ended

November 30,

2015

(Unaudited) | | | Year Ended

May 31, 2015 | |

| | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 41,723 | | | $ | 45,249 | | | $ | (588,051 | ) | | $ | (1,468,865 | ) |

Net realized gain | | | 273,824 | | | | 307,278 | | | | 7,334,584 | | | | 19,291,678 | |

Net change in unrealized appreciation (depreciation) | | | (523,970 | ) | | | 411,992 | | | | (18,859,164 | ) | | | 9,638,941 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (208,423 | ) | | | 764,519 | | | | (12,112,631 | ) | | | 27,461,754 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| Distributions to Shareholders1 | | | | | | | | | | | | | | | | |

From net investment income: | | | | | | | | | | | | | | | | |

Institutional | | | (16,321 | ) | | | (19,895 | ) | | | — | | | | — | |

Investor A | | | (5,331 | ) | | | (2,806 | ) | | | — | | | | — | |

From net realized gain: | | | | | | | | | | | | | | | | |

Institutional | | | (84,851 | ) | | | (581,949 | ) | | | (3,727,177 | ) | | | (9,205,191 | ) |

Investor A | | | (39,508 | ) | | | (98,084 | ) | | | (3,893,386 | ) | | | (9,863,810 | ) |