Grant Park Fund January 2014 Update

February 24, 2014

| Supplement dated February 24, 2014 to Prospectus dated April 30, 2013 |

| Class | January ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | -4.8% | -4.8% | $20.3M | $1,113.82 |

| B | -4.8% | -4.8% | $203.9M | $932.15 |

| Legacy 1 | -4.6% | -4.6% | $3.5M | $821.23 |

| Legacy 2 | -4.6% | -4.6% | $4.7M | $808.66 |

| Global 1 | -4.6% | -4.6% | $8.9M | $796.88 |

| Global 2 | -4.6% | -4.6% | $14.9M | $785.48 |

| Global 3 | -4.8% | -4.8% | $161.4M | $720.12 |

| ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES |

Sector Commentary

Currencies: Emerging market currencies were highly volatile throughout the month as the potential impact of reduced bond-buying by the U.S. Federal Reserve created significant investor concerns. Ultimately, investors sought to purchase currencies issued by stable national governments. That action caused the Japanese yen to reverse a long-term trend and to rise in value against its counterparts. The Canadian dollar fell by more than 4% against the U.S. dollar, driven, in part, by speculation the country’s central bank may favor future cuts in interest rates.

Energy: Natural gas prices surged over 16% higher as a result of extremely cold temperatures across much of the U.S. and by smaller-than-expected inventories. Heating oil prices rose more than 6% because of supply shortages in the Northeastern U.S.

Equities: Global equities markets sold off in reaction to a number of events throughout the month. The concern about the Federal Reserve’s tapering of its bond-buying program and worse-than-expected corporate earnings reports in the U.S., combined with weaker-than-expected data concerning Chinese manufacturing data, caused investors to shift their tendencies from “risk-on” to “risk-off”.

Fixed Income: U.S. Treasury and German Bund prices registered considerable gains as investors moved towards safe-haven assets in response to the selloff in the equity markets.

Grains/Foods: Wheat prices declined significantly after the USDA reported wheat production is on track to produce a world record for crop yield. Coffee prices increased over 13%, driven by concerns unseasonably dry conditions in Brazil could potentially damage the existing crop.

Metals: Gold prices were driven higher as demand for safe-haven assets increased in reaction to poor economic data out of China, the U.S., and Europe. Copper prices decreased as demand fell after China reported data showing manufacturing activity had slowed towards the end of 2013.

Additional Information: The general partner has historically attempted to reduce Grant Park’s fees and expenses whenever feasible. Effective January 1, 2014, the general partner has reduced the brokerage charge for all classes by 0.50%. Please refer to the Fund’s current prospectus and supplements for complete information.

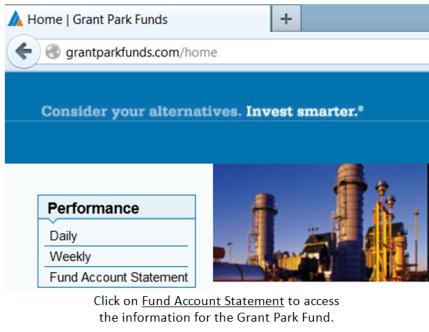

For the Fund’s monthly Account Statement, including the net asset value per unit, and related information, please visit our website at www.grantparkfunds.com.

Sincerely,

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.

Account Statement

(Prepared from books without audit)

For the month ended January 31, 2014

| STATEMENT OF INCOME | | | | | | | |

| Trading Income (Loss) | | | Monthly Performance | Year to Date Performance | |

| Realized Trading Income (Loss) | | -$6,733,333 | | -$6,733,333 | | |

| Change In Unrealized Income (Loss) | | -12,189,974 | | -12,189,974 | | |

| Brokerage Commission | | | -130,293 | | -130,293 | | |

| Exchange, Clearing Fee and NFA Charges | | 0 | | 0 | | |

| Other Trading Costs | | | -415,440 | | -415,440 | | |

| Change in Accrued Commission | | 9,996 | | 9,996 | | |

| Net Trading Income (Loss) | | | -19,459,044 | | -19,459,044 | | |

| | | | | | | | |

| Other Income | | | Monthly Performance | Year to Date Performance | |

| Interest, U.S. Obligations | | | $56,328 | | $56,328 | | |

| Interest, Other | | | 43,107 | | 43,107 | | |

| U.S. Government Securities Gain (Loss) | | 0 | | 0 | | |

| Dividend Income | | | 0 | | 0 | | |

| Total Income (Loss) | | | -19,359,609 | | -19,359,609 | | |

| | | | | | | | |

| Expenses | | | Monthly Performance | Year to Date Performance | |

| Management Fee | | | $0 | | $0 | | |

| Incentive Fee | | | 4,977 | | 4,977 | | |

| Operating Expenses | | | 89,289 | | 89,289 | | |

| Organization and Offering Expenses | | 103,738 | | 103,738 | | |

| Brokerage Expenses | | | 1,821,247 | | 1,821,247 | | |

| Dividend Expenses | | | 0 | | 0 | | |

| Total Expenses | | | 2,019,251 | | 2,019,251 | | |

| | | | | | | | |

| Net Income (Loss) | | | -$21,378,860 | | -$21,378,860 | | |

| | | | | | | | |

| Statement of Changes in Net Asset Value | | Monthly Performance | Year to Date Performance | |

| Beginning Balance | | | $447,372,009 | | $447,372,009 | | |

| Additions | | | 161,400 | | 161,400 | | |

| Net Income (Loss) | | | -21,378,860 | | -21,378,860 | | |

| Redemptions | | | -8,527,033 | | -8,527,033 | | |

| Balance at January 31, 2014 | | | $417,627,516 | | $417,627,516 | | |

To the best of my knowledge and belief the information contained herein is accurate and complete.

__________________________________________________________

David Kavanagh, President

For Dearborn Capital Management, LLC

General Partner of Grant Park Futures Fund, Limited Partnership