Grant Park Fund February 2014 Update

March 25, 2014

Supplement dated March 25, 2014 to Prospectus dated April 30, 2013

| Class | February ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | 1.2% | -3.6% | $20.4M | $1,127.11 |

| B | 1.1% | -3.7% | $200.8M | $942.76 |

| Legacy 1 | 1.4% | -3.3% | $3.5M | $832.63 |

| Legacy 2 | 1.4% | -3.3% | $4.5M | $819.71 |

| Global 1 | 1.4% | -3.3% | $8.9M | $808.00 |

| Global 2 | 1.4% | -3.3% | $14.5M | $796.27 |

| Global 3 | 1.2% | -3.6% | $160.1M | $728.95 |

ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES

Sector Commentary

Currencies: The British pound strengthened against its counterparts following a reported increase in business investment in the U.K., which boded well for the overall economy and could position the Bank of England to increase interest rates. In Asia, the Japanese yen broke recent downtrends and moved higher. The New Zealand dollar appreciated by more than 4%, driven by positive economic data which investors believed would increase the likelihood the Reserve Bank of New Zealand will raise interest rates.

Energy: Natural gas markets experienced several price reversals due to conflicting weather forecasts throughout the month. Prices rose nearly 24% by mid-month and then sharply declined to finish 7% lower for the entire month. Crude oil prices rose by more than 5% in reaction to lower-than-expected inventory levels.

Equities: Global equities markets rallied on positive U.S. manufacturing data, upbeat earnings reports in Australia and statements by Chairwoman Yellen concerning the Federal Reserve’s perspective on the U.S. economy.

Fixed Income: U.S. Treasury and German Bund prices gained as investors moved towards safe-haven assets due to the escalating conflict between Ukraine and Russia.

Grains/Foods: Coffee prices surged over 43% as a severe drought in Brazil significantly reduced the size of overall supplies. Soybean prices rallied by 10% based on a large grains sale by the U.S. to China and due to concerns about the impact extremely cold temperatures across the U.S. could have on future supplies.

Metals: Precious metal markets rose in response to geopolitical turmoil and uncertainty regarding China’s monetary policy. Aluminum prices advanced over 2% due to weather-related transportation delays.

Additional Information: The general partner has historically attempted to reduce Grant Park’s fees and expenses whenever feasible. Effective January 1, 2014, the general partner has reduced the brokerage charge for all classes by 0.50%. Please refer to the Fund’s current prospectus and supplements for complete information.

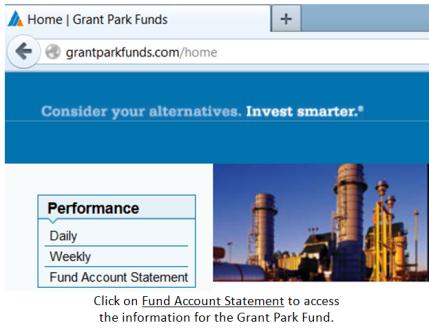

For the Fund’s monthly Account Statement, including the net asset value per unit, and related information, please visit our website at www.grantparkfunds.com.

Sincerely,

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.