Filed pursuant to Rule 424(b)(3)

File No. 333-179641

Grant Park Fund December 2013 Update

January 17, 2014

Supplement dated January 17, 2014 to Prospectus dated April 30, 2013

| Class | December ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | 0.9% | -3.8% | $21.4M | $1,169.66 |

| B | 0.8% | -4.4% | $218.2M | $979.42 |

| Legacy 1 | 1.1% | -1.8% | $3.7M | $860.76 |

| Legacy 2 | 1.0% | -1.9% | $5.2M | $847.76 |

| Global 1 | 1.2% | -1.2% | $9.4M | $835.24 |

| Global 2 | 1.1% | -1.4% | $16.4M | $823.45 |

| Global 3 | 1.0% | -3.1% | $173.1M | $756.03 |

ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES

Sector Commentary

Currencies: The Australian dollar fell against counterparts after the Reserve Bank of Australia announced its preference to stimulate the economy by devaluing the currency, rather than by further reducing interest rates. The Japanese yen continued to fall as a consequence of the Japanese central bank’s continued monetary expansion.

Energy: Crude oil prices gained more than 6%, driven by an increase in overall demand and an unexpected decline in the inventory of U.S. supplies. A fall in the number of applications for unemployment benefits in the U.S. was seen as a sign of increased economic strength and was also a factor in the rally. Natural gas prices rose to their highest levels in over two years due to increased demand driven by lower temperatures across the U.S.

Equities: The Nikkei 225 gained more than 3% as the continued falling value of the yen created positive effects on the country’s export industries. The Dow Jones Industrial Average advanced more than 2% as investors reacted to the Federal Reserve’s decision to taper its bond buying program as a sign of improving economic conditions in the U.S.

Fixed Income: U.S. Treasury prices fell substantially as investors reduced their bond holdings ahead of the Federal Reserve’s announcement to begin tapering its bond buying program. Prices for British Gilts decreased by 3% as investors left the fixed-income markets for the equities sector based on an improved economic outlook for the U.S. and Great Britain.

Grains/Foods: Cotton prices advanced by more than 8% as demand from Indian mills rose because of improved export conditions. Wheat prices lost more than 7% after reports confirmed the recent harvest was the largest global harvest ever recorded.

Metals: Gold prices fell due to the Federal Reserve’s decision to taper its bond buying program, which decreased demand for safe haven assets. Copper prices extended gains following a better-than-expected report about the U.S. labor market which improved the overall outlook for the economy.

Additional Information: On November 18, 2013, we filed a supplement to the Fund’s Prospectus that includes information about a number of changes that have been made in the operation of the Fund and provides an updated conflict of interest to announce a minority investment by the Fund’s general partner, Dearborn Capital Management, LLC in EMC Capital Advisors, LLC. EMC is one of the CTA’s who trades on the Fund’s behalf.

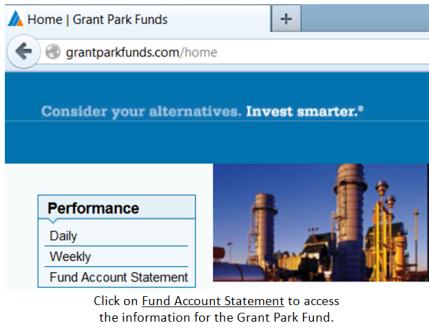

To obtain a copy of supplement and the Fund’s December monthly Account Statement, including the net asset value per unit, and related information, please visit our website at www.grantparkfunds.com.

Sincerely,

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.

Account Statement

(Prepared from books without audit)

| For the month ended December 31, 2013 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| STATEMENT OF INCOME | | | | | | | |

| Trading Income (Loss) | | | Monthly Performance | Year to Date Performance | |

| Realized Trading Income (Loss) | | $10,623,216 | | -$3,286,886 | | |

| Change In Unrealized Income (Loss) | | -2,933,460 | | 21,767,769 | | |

| Brokerage Commission | | | -181,752 | | -2,579,850 | | |

| Exchange, Clearing Fee and NFA Charges | | 0 | | -22,608 | | |

| Other Trading Costs | | | -412,631 | | -5,750,544 | | |

| Change in Accrued Commission | | 8,596 | | -3,959 | | |

| Net Trading Income (Loss) | | | 7,103,969 | | 10,123,922 | | |

| | | | | | | | |

| Other Income | | | Monthly Performance | Year to Date Performance | |

| Interest, U.S. Obligations | | | $56,128 | | $749,162 | | |

| Interest, Other | | | 60,120 | | 576,138 | | |

| U.S. Government Securities Gain (Loss) | | 0 | | 0 | | |

| Dividend Income | | | 0 | | 0 | | |

| Total Income (Loss) | | | 7,220,217 | | 11,449,222 | | |

| | | | | | | | |

| Expenses | | | Monthly Performance | Year to Date Performance | |

| Management Fee | | | $0 | | $0 | | |

| Incentive Fee | | | 533,345 | | 1,511,083 | | |

| Operating Expenses | | | 97,632 | | 1,392,827 | | |

| Organization and Offering Expenses | | 113,427 | | 1,614,953 | | |

| Brokerage Expenses | | | 2,185,979 | | 31,293,188 | | |

| Dividend Expenses | | | 0 | | 0 | | |

| Total Expenses | | | 2,930,383 | | 35,812,051 | | |

| | | | | | | | |

| Net Income (Loss) | | | $4,289,834 | | -$24,362,829 | | |

| | | | | | | | |

| Statement of Changes in Net Asset Value | | Monthly Performance | Year to Date Performance | |

| Beginning Balance | | | $460,599,291 | | $636,740,049 | | |

| Additions | | | 399,000 | | 27,782,076 | | |

| Net Income (Loss) | | | 4,289,834 | | -24,362,829 | | |

| Redemptions | | | -17,916,116 | | -192,787,287 | | |

| Balance at December 31, 2013 | | $447,372,009 | | $447,372,009 | | |

PERFORMANCE SUMMARY BY CLASS

| Class | Net Asset Value per Unit | Units | Net Asset Value | Monthly ROR Year to Date ROR |

| A | $1,169.659 | | 18,256.45229 | $21,353,819 | | 0.89% | -3.84% | |

| B | $979.420 | | 222,772.45494 | $218,187,750 | | 0.84% | -4.44% | |

| Legacy 1 | $860.764 | | 4,338.22882 | $3,734,192 | | 1.06% | -1.75% | |

| Legacy 2 | $847.762 | | 6,130.95613 | $5,197,590 | | 1.04% | -1.95% | |

| Global 1 | $835.244 | | 11,311.64911 | $9,447,981 | | 1.16% | -1.22% | |

| Global 2 | $823.452 | | 19,877.90685 | $16,368,509 | | 1.14% | -1.44% | |

| Global 3 | $756.033 | | 228,934.56178 | $173,082,168 | | 1.01% | -3.06% | |

| | | | | | | | | |

To the best of my knowledge and belief the information contained herein is accurate and complete.

__________________________________________________________

David Kavanagh, President

For Dearborn Capital Management, LLC

General Partner of Grant Park Futures Fund, Limited Partnership