Filed pursuant to Rule 424(b)(3)

File No. 333-179641

Grant Park Fund October 2013 Update

November 26, 2013

Supplement dated November 26, 2013 to Prospectus dated April 30, 2013

| Class | October ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | 1.6% | -6.8% | $21.9M | $1,133.97 |

| B | 1.6% | -7.3% | $230.8M | $950.44 |

| Legacy 1 | 1.8% | -5.0% | $3.8M | $832.14 |

| Legacy 2 | 1.8% | -5.2% | $6.0M | $819.71 |

| Global 1 | 1.8% | -4.6% | $9.6M | $806.55 |

| Global 2 | 1.8% | -4.8% | $17.7M | $795.40 |

| Global 3 | 1.6% | -6.1% | $179.8M | $732.02 |

| | ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES |

Sector Commentary

Currencies: The Australian dollar appreciated by more than 2% after a U.S. government shutdown decreased the chances of a reduction of the U.S. Federal Reserve’s bond buying program, which spurred demand for safe haven currencies. The Canadian dollar depreciated by more than 1% because the governor of the Bank of Canada voiced his intention to keep interest rates subdued.

Energy: Natural gas prices were whip-sawed throughout the month as weather forecasts shifted and reduced overall demand, but still managed to gain more than 1%. Crude oil prices fell after data from the Energy Information Administration showed a sharp rise in oil inventories in the U.S.

Equities: The S&P 500 continued its bullish run to record highs after the U.S. government shutdown increased the chances of sustained expansionary monetary policy from the Federal Reserve. Equities markets in Europe and China made gains on the same news.

Fixed Income: 30-Year U.S. Treasury Bonds gained more than 1% as sluggish economic data supported the Federal Reserve’s stance on continued capital injections. U.K. government bond prices appreciated materially on the same news.

Grains/Foods: Cotton prices experienced material losses after data released from India, the second largest producer of cotton, showed a near-record harvest. Declines in the cotton markets were accelerated by low demand out of China. Coffee prices continued to fall and have entered their longest slump since 1972 due to an oversupply in Latin American countries.

Metals: Silver prices appreciated by more than 1% after overall demand was increased following the Indian government’s decision to put a limit on the amount of gold that can be imported to India. The policy was put in place to narrow India’s large and growing trade gap. Copper prices fell slightly, reacting to poor economic data out of China at the end of the month which reduced overall demand for the base metal.

Additional information:

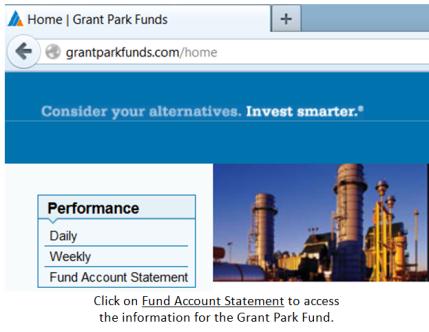

The Fund’s Account Statement, including the net asset value per share, and related information is available to all investors online at www.grantparkfunds.com.

Sincerely,

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.

Account Statement

(Prepared from books without audit)

| For the month ended October 31, 2013 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| STATEMENT OF INCOME | | | | | | | |

| Trading Income (Loss) | | | Month to Date Total | Year to Date Total | |

| Realized Trading Income (Loss) | | -$7,386,583 | | -$14,974,330 | | |

| Change In Unrealized Income (Loss) | | 18,281,666 | | 11,764,397 | | |

| Brokerage Commission | | | -142,296 | | -2,267,161 | | |

| Exchange, Clearing Fee and NFA Charges | | 0 | | -22,608 | | |

| Other Trading Costs | | | -457,869 | | -4,873,004 | | |

| Change in Accrued Commission | | -15,720 | | -3,348 | | |

| Net Trading Income (Loss) | | | 10,279,198 | | -10,376,054 | | |

| | | | | | | | |

| Other Income | | | Month to Date Total | Year to Date Total | |

| Interest, U.S. Obligations | | | $86,774 | | $620,614 | | |

| Interest, Other | | | 39,328 | | 471,729 | | |

| U.S. Government Securities Gain (Loss) | | 0 | | 0 | | |

| Dividend Income | | | 0 | | 0 | | |

| Total Income (Loss) | | | 10,405,300 | | -9,283,711 | | |

| | | | | | | | |

| Expenses | | | Month to Date Total | Year to Date Total | |

| Management Fee | | | $0 | | $0 | | |

| Incentive Fee | | | 76,644 | | 416,462 | | |

| Operating Expenses | | | 102,647 | | 1,194,353 | | |

| Organization and Offering Expenses | | 119,298 | | 1,384,266 | | |

| Brokerage Expenses | | | 2,297,968 | | 26,847,637 | | |

| Dividend Expenses | | | 0 | | 0 | | |

| Total Expenses | | | 2,596,557 | | 29,842,718 | | |

| | | | | | | | |

| Net Income (Loss) | | | $7,808,743 | | -$39,126,429 | | |

| | | | | | | | |

| Statement of Changes in Net Asset Value | | Month to Date Total | Year to Date Total | |

| Beginning Balance | | | $481,157,812 | | $636,740,049 | | |

| Additions | | | 686,511 | | 26,892,576 | | |

| Net Income (Loss) | | | 7,808,743 | | -39,126,429 | | |

| Redemptions | | | -20,077,998 | | -154,931,128 | | |

| Balance at October 31, 2013 | | | $469,575,068 | | $469,575,068 | | |

| PERFORMANCE SUMMARY BY CLASS |

| Class | Net Asset Value per Unit | Units | Net Asset Value | ROR – Month to Date | ROR – Year to Date |

| A | $1,133.967 | 19,270.25140 | $21,851,820 | 1.63% | -6.77% |

| B | $950.439 | 242,865.00930 | $230,828,440 | 1.58% | -7.27% |

| Legacy 1 | $832.139 | 4,605.44698 | $3,832,372 | 1.79% | -5.02% |

| Legacy 2 | $819.705 | 7,358.68369 | $6,031,945 | 1.78% | -5.19% |

| Global 1 | $806.550 | 11,897.97997 | $9,596,318 | 1.77% | -4.61% |

| Global 2 | $795.395 | 22,210.93572 | $17,666,460 | 1.75% | -4.80% |

| Global 3 | $732.015 | 245,579.35004 | $179,767,714 | 1.64% | -6.14% |

To the best of my knowledge and belief the information contained herein is accurate and complete.

__________________________________________________________

David Kavanagh, President

For Dearborn Capital Management, LLC

General Partner of Grant Park Futures Fund, Limited Partnership