Filed pursuant to Rule 424(b)(3)

File No. 333-179641

Grant Park Fund September 2013 Update

October 18, 2013

Supplement dated October 18, 2013 to Prospectus dated April 30, 2013

| Class | September ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | -0.9% | -8.3% | $22.8M | $1,115.75 |

| B | -0.9% | -8.7% | $236.4M | $935.67 |

| Legacy 1 | -0.7% | -6.7% | $3.8M | $817.48 |

| Legacy 2 | -0.7% | -6.9% | $8.0M | $805.33 |

| Global 1 | -0.6% | -6.3% | $9.7M | $792.55 |

| Global 2 | -0.6% | -6.4% | $18.5M | $781.69 |

| Global 3 | -0.8% | -7.7% | $182.0M | $720.19 |

| ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES |

Sector Commentary

Currencies: The U.S. dollar declined sharply against global counterparts after the Federal Reserve implied monetary stimulus may continue into 2014. The Canadian dollar rallied due to increases in commodity prices and in anticipation ongoing quantitative easing in the U.S. will benefit the Canadian economy. The British pound strengthened as economic indicators provided support for a bullish economic outlook.

Energy: Crude oil markets rallied sharply during early September over fears a possible intervention by the U.S. in the Syrian conflict could disrupt Middle Eastern supplies. As the likelihood of U.S. involvement fell, concerns began to ease and drove crude oil prices sharply lower. Forecasts for weak industrial demand added further pressure and caused crude oil prices to finish the month lower.

Equities: Global equity markets rallied on upbeat economic data in Europe and hopes for ongoing stimulus in the U.S.

Fixed Income: U.S. Treasury markets finished higher as uncertainty surrounding the U.S. fiscal policy decisions shifted investor focus towards safe-haven debt instruments. German Bund markets finished lower due to losses fostered by sharp rallies in the global equity markets and early-month bullish economic data in the U.S.

Grains/Foods: Corn and soybean prices fell over 10% as U.S. Department of Agriculture data forecasted stronger-than-expected supplies. Wheat markets rallied due to strong U.S. exports data. Cocoa markets moved higher because of increased global demand and unfavorable weather conditions in West Africa.

Metals: Precious metals markets fell as investors liquidated dollar-hedging assets in anticipation U.S. policy makers will continue quantitative easing initiatives. Conversely, base metals markets moved sharply higher as speculators believed ongoing stimulus would bode well for industrial production.

Additional information:

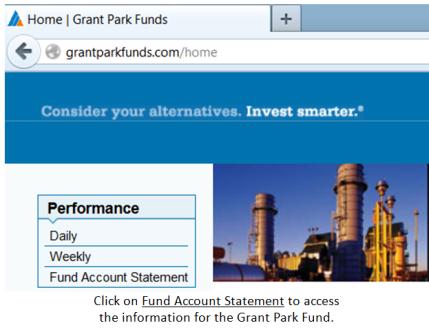

The Fund’s Account Statement, including the net asset value per share, and related information is available to all investors online at www.grantparkfunds.com.

Sincerely,

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.

Account Statement

(Prepared from books without audit)

| For the month ended September 30, 2013 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| STATEMENT OF INCOME | | | | | | | |

| Trading Income (Loss) | | | Month to Date Total | Year to Date Total | |

| Realized Trading Income (Loss) | | $1,661,321 | | -$7,587,747 | | |

| Change In Unrealized Income (Loss) | | -2,861,211 | | -6,517,270 | | |

| Brokerage Commission | | | -154,859 | | -2,124,865 | | |

| Exchange, Clearing Fee and NFA Charges | | 0 | | -22,608 | | |

| Other Trading Costs | | | -479,505 | | -4,415,135 | | |

| Change in Accrued Commission | | 6,512 | | 12,372 | | |

| Net Trading Income (Loss) | | | -1,827,742 | | -20,655,253 | | |

| | | | | | | | |

| Other Income | | | Month to Date Total | Year to Date Total | |

| Interest, U.S. Obligations | | | $77,349 | | $533,840 | | |

| Interest, Other | | | 30,716 | | 432,401 | | |

| U.S. Government Securities Gain (Loss) | | 0 | | 0 | | |

| Dividend Income | | | 0 | | 0 | | |

| Total Income (Loss) | | | -1,719,677 | | -19,689,012 | | |

| | | | | | | | |

| Expenses | | | Month to Date Total | Year to Date Total | |

| Management Fee | | | $0 | | $0 | | |

| Incentive Fee | | | 0 | | 339,818 | | |

| Operating Expenses | | | 104,642 | | 1,091,706 | | |

| Organization and Offering Expenses | | 121,458 | | 1,264,968 | | |

| Brokerage Expenses | | | 2,345,825 | | 24,549,669 | | |

| Dividend Expenses | | | 0 | | 0 | | |

| Total Expenses | | | 2,571,925 | | 27,246,161 | | |

| | | | | | | | |

| Net Income (Loss) | | | -$4,291,602 | | -$46,935,173 | | |

| | | | | | | | |

| Statement of Changes in Net Asset Value | | Month to Date Total | Year to Date Total | |

| Beginning Balance | | | $499,019,122 | | $636,740,049 | | |

| Additions | | | 4,502,245 | | 26,206,065 | | |

| Net Income (Loss) | | | -4,291,602 | | -46,935,172 | | |

| Redemptions | | | -18,071,953 | | -134,853,130 | | |

| Balance at September 30, 2013 | | $481,157,812 | | $481,157,812 | | |

| PERFORMANCE SUMMARY BY CLASS | | | | | | | |

| Class | Net Asset Value per Unit | Units | Net Asset Value | ROR – Month to Date | ROR – Year to Date |

| A | $1,115.752 | | 20,395.81816 | $22,756,675 | | -0.87% | -8.27% | |

| B | $935.668 | | 252,629.15045 | $236,377,138 | | -0.93% | -8.71% | |

| Legacy 1 | $817.484 | | 4,663.94142 | $3,812,696 | | -0.68% | -6.69% | |

| Legacy 2 | $805.333 | | 9,987.99641 | $8,043,658 | | -0.70% | -6.86% | |

| Global 1 | $792.551 | | 12,183.28536 | $9,655,880 | | -0.63% | -6.26% | |

| Global 2 | $781.692 | | 23,716.88620 | $18,539,302 | | -0.65% | -6.44% | |

| Global 3 | $720.193 | | 252,671.78213 | $181,972,464 | | -0.79% | -7.66% | |

| | | | | | | | | |

To the best of my knowledge and belief the information contained herein is accurate and complete.

__________________________________________________________

David Kavanagh, President

For Dearborn Capital Management, LLC

General Partner of Grant Park Futures Fund, Limited Partnership