File No. 333-179641

Grant Park Fund August 2013 Update

September 27, 2013

Supplement dated September 27, 2013 to Prospectus dated April 30, 2013

| Class | August ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | -2.2% | -7.5% | $24.7M | $1,125.59 |

| B | -2.3% | -7.9% | $248.9M | $944.44 |

| Legacy 1 | -2.0% | -6.0% | $3.9M | $823.11 |

| Legacy 2 | -2.1% | -6.2% | $8.3M | $811.04 |

| Global 1 | -2.0% | -5.7% | $10.1M | $797.54 |

| Global 2 | -2.0% | -5.8% | $19.4M | $786.78 |

| Global 3 | -2.2% | -6.9% | $183.7M | $725.94 |

| | ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES |

Sector Commentary

Currencies: The New Zealand and Australian dollars fell in reaction to the adverse events in the Middle East and central bank actions in the two countries. The Canadian dollar depreciated following reports which showed Canada’s economy grew at a slower-than-expected pace in the second quarter.

Energy: The crude oil complex experienced significant price increases due to regional unrest throughout the Middle East. Natural gas prices rose because of warmer temperatures across the U.S.

Equities: The S&P 500 suffered a 3% correction in response to poor earnings reports from U.S. companies and possible military intervention in the Middle East. The Australian SPI 200 Index gained more than 2% on positive earnings reports from Australian companies.

Fixed Income: German Bund and British Long Gilt markets fell sharply on speculation about the end of the U.S. Federal Reserve’s quantitative easing efforts, as well as actions by other central banks around the world.

Grains/Foods: Wheat prices fell as ideal growing conditions in important growing areas across the U.S. continued to improve the size of this season’s crop. Coffee prices fell to their lowest levels since 2009 in reaction to estimates of rising supplies from South America.

Metals: Precious metal markets surged as investors sought safe-haven assets. Uncertainty about the timing of the Federal Reserve’s tapering of its quantitative easing program and widening unrest in the Middle East caused investors to seek safe-haven assets. Base metal markets also rallied, fueled by increased demand from China.

Additional information:

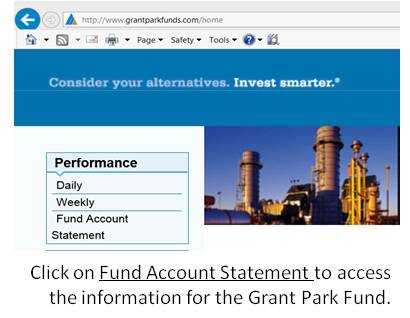

The Fund’s Account Statement, including the net asset value per share, and related information is available to all investors online at www.grantparkfunds.com.

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.