UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2002

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-17551

DYNAMIC OIL & GAS, INC.

(formerly Dynamic Oil Limited)

(Exact name of Registrant as specified in its charter)

Province of British Columbia (Canada)

(Jurisdiction of incorporation or organization)

205 - 10711 Cambie Road

Richmond, British Columbia V6X 3G5, Canada

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock Without Par Value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report:

| Title of Each Class | Outstanding at August 19, 2002 |

| Common Stock Without Par Value | 20,462,230 Shares |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark which financial statement item the Company has elected to follow. Item 17. X Item 18.

TABLE OF CONTENTS

| Page

|

| Glossary of Terms | 3 |

| | |

| Part I. | |

| Item 1. Identity of Directors, Senior Management and Advisers | N/A |

| Item 2. Offer Statistics and Expected Timetable | N/A |

| Item 3. Key Information | 6 |

| Item 4. Our Information | 13 |

| Item 5. Operating and Financial Review and Prospects | 31 |

| Item 6. Directors, Senior Management and Employees | 42 |

| Item 7. Major Shareholders and Related Party Transactions | 51 |

| Item 8. Financial Information | 51 |

| Item 9. The Offer and Listing | 52 |

| Item 10. Additional Information | 53 |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 62 |

| Item 12. Description of Securities Other than Equity Securities | 64 |

| | |

| Part II. | |

| Item 13. Defaults, Dividend Arrearages and Delinquencies | 65 |

| Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 65 |

| Item 15. [Reserved] | n/a |

| Item 16. [Reserved] | n/a |

| | |

| Part III. | |

| Item 17. Financial Statements | 65 |

| Item 18. Financial Statements | 65 |

| Item 19. Exhibits | 65 |

Glossary of Terms

|

Air drilling | A method of drilling that uses compressed air as a medium for transporting drill cuttings to surface. |

Basal Quartz zone

| A name generally applied to the Ellerslie formation as it occupies the “bottom” sandstone of the Mannville Group of lower Cretaceous age about 124 millions years of age. |

| Bbl or Barrel | 42 U.S. gallons liquid volume of crude oil or natural gas liquids. |

| Bcf | Billion cubic feet of gas. Usual expression of proved reserve gas volume. |

Belly River formation | Late Cretaceous Age sandstones and shales deposited from 75 to 84 million years ago. |

Blairmore formation | Formation encompassing clastic sediments deposited in the Early Cretaceous Age from about 100 to 120 million years ago. |

Blue Sky formation | Sandstones of the Lower Cretaceous, about 112 million years old, occurring in Northern Alberta and NE BC. |

BOE

| Barrels of Oil Equivalent. Generally one barrel of oil equals six mcf of gas. Allows reserves of oil and gas to be added together. |

| BOE/d | An expression of barrels of oil equivalent produced per day. |

Carbonates | Rocks composed predominantly of Calcium Carbonate (CaCO3). |

Condensate

| A mixture comprising pentanes and heavier hydrocarbons recovered as a liquid from field separators, scrubbers or other gathering facilities or at the inlet of a processing plant before the gas is processed. |

| Cretaceous Age | Rocks from 144 million to 66.4 million years of age. |

Crown royalty | An amount payable to the government of the applicable Canadian province in relation to the production of petroleum, natural gas or related hydrocarbons from an oil or gas well located on Crown lands. |

Crude oil

| A mixture, consisting mainly of pentanes and heavier hydrocarbons that may contain sulphur compounds, that is liquid at the conditions under which its volume is measured or estimated, but excluding such liquids obtained from the processing of natural gas. |

| Depletion | The reduction in petroleum reserves due to production. |

| Development or developed | Refers to the phase in which a proven oil or gas field is brought into production by drilling and completing production wells and the wells, in most cases, are connected to a petroleum gathering system. |

| Devonian Age | Rocks from 408 million to 360 million years of age. |

Discovery | The location, learned through drilling of a well, where there exists an accumulation of gas, condensate or oil reserves. The size of the reserves may be estimated but not precisely quantified and may or may not be commercially economic, depending on a number of factors. |

Drill stem test

| A method of packing off the pressure of drilling mud weight to allow a prospective oil or gas formation to flow into the drill stem pipe. Drill stem test results assist in evaluating the potential of the zone to flow or to be pumped commercially. |

Dry hole | A well drilled without finding commercially economic quantities of hydrocarbons. |

Ellerlsie zone or formation

| A name applied to a group of sandstones that are clear and quartzose with good porosity and permeability for oil and gas about 124 millions years of age. |

Exploration well | A well drilled in a prospect without knowledge of the underlying sedimentary rock or the contents of the underlying rock. |

Farmin

| By way of agreement, a party earns (farmin) an interest in lands comprising petroleum and natural gas rights from another party by drilling a well or similar activity which evaluates, explores or develops the lands for the production of petroleum substances. |

Farmout | By way of agreement, a party gives up (farmout) an interest in lands comprising petroleum and natural gas rights to another party who earns the interest by drilling a well or similar activity which evaluates, explores or develops the lands for the production of petroleum substances. |

Field | An area that is producing, or has been proven to be capable of producing, hydrocarbons. |

Field netbacks | Revenues from the sale of all commodities produced, less applicable resource and production royalties, less operating costs. |

| Formation | A reference to a group of rocks of the same age extending over a substantial area of a basin. |

Freehold royalty | An amount payable to a mineral rights holder in relation to the production of petroleum, natural gas or related hydrocarbons from an oil or gas well located on non-Crown lands. |

GAAP | Generally accepted accounting principles. |

Geology | The science relating to the history and development of the Earth. |

Glauconite

| A sand group from the Upper Mannville (Lower Cretaceous Age) about 110 million years ago with a green mineral constituent. |

| Gross acres | The total acreage in which the Company has an interest. |

Hackett formation | A sand package that occurs at the base of the Mannville Formation (Lower Cretaceous Age), 118 to 120 million years old. |

Hectare | A land measurement equaling 2.471 acres. |

Horizontal well

| A vertical well bore which is gradually deviated (usually horizontally to 90 0) in order to intersect the targeted formation. |

| Hydrocarbon | The general term for oil, gas, condensate, liquids and other petroleum products. |

| Jean Marie formation | A patch reef carbonate reservoir within the Winterburn Group of the Upper Devonian Age, about 367 to 369 million years old. The Jean Marie is found in NE British Columbia and is the stratigraphic equivalent to the lower Nisku formation in Alberta. |

| kilometer | A measurement of distance equaling 0.621 miles or 3,281 feet. |

| Leduc (D-3) formation | An reefal carbonate reservoir found within Woodbend Group of the Upper Devonian Age, about 369 to 373 million years old. These ancient Leduc reefs were the initial target for oil and gas exploration in Alberta. Leduc No. 1, approximately 30 km. South of St. Albert, was the discovery well for conventional oil in Western Canada. |

| Logs | Recordings from electrical and radioactive source devices that are run down wellbores to measure petrophysical properties of the adjacent rocks. |

| Lower Mannville gas | Any gas sands found in the lower half of the Lower Cretaceous Age zones, about 110 million years old. These sands may comprise the Ostracod, Basal Quartz or Ellerlsie zones. |

| mbbl | 1,000 barrels of oil and/or natural gas liquids. |

| mboe | 1,000 barrels of oil equivalent. See ‘BOE’ for further details. |

| mcf | 1,000 cubic feet of natural gas. |

| mcf/d | 1,000 cubic feet of natural gas production per day. Usually used to express the production rate of a group of gas wells. |

| meter | A physical measurement equaling 3.281 feet. |

| Mineral taxes (freehold) | An amount levied by the government of Alberta in relation to the production of petroleum, natural gas or related hydrocarbons from an oil or gas well located on non-government (freehold) lands in Alberta. |

| mmcf | 1,000,000 cubic feet of natural gas. |

mmcf/d

| 1,000,000 cubic feet of natural gas production per day. Usually used to express the production rate of a gas well or group of gas wells. |

Natural gas

| The lighter hydrocarbons and associated non-hydrocarbon substances occurring naturally in an underground reservoir, which under atmospheric conditions are essentially a gas, but which may contain liquids. |

| NGL’s | Natural gas liquids. Hydrocarbon components recovered from raw natural gas as liquids by processing through extraction plants or recovered from field separators, scrubbers or other gathering facilities. These liquids include the hydrocarbon components ethane, propane, butane and pentane plus, or combinations thereof. |

| Net acres | The percentage of gross acreage in which the Company has a working interest. |

| Nisku (D-2) formation | A reefal carbonate reservoir in the Winterburn Group of the Upper Devonian Age, about 367 to 369 million years old. The Nisku is found exclusively within Alberta but it is a stratigraphic equivalent to the Jean Marie formation in British Columbia. |

Ostracod zone

| Rocks from the Lower Cretaceous Age approximately 119 million years ago comprised of sandstones and marlstones which contain a small fossil named Ostracod. |

Ostracod well

| A gas well capable of producing commercially from the Lower Cretaceous Age Ostracod zone. |

| Operator | That party to a joint venture agreement whose responsibility it is to carry out all exploratory, development, maintenance and record-keeping duties on behalf of other joint venture partners in relation to hydrocarbon extraction on the joint-ventured lands. |

| Overriding royalty | An amount payable to a third party other than crown or freehold in relation to the production of petroleum, natural gas or related hydrocarbons from an oil or gas well located on lands in which the interest of the third party usually arises out of a separate agreement. |

| Pentanes | A hydrocarbon by-product of natural gas generally referred to as condensate that is of the paraffin series having a chemical formula of C5H12 and having all its carbon atoms joined in a straight chain. |

| Permeability | Capacity of a rock for transmitting a fluid. |

| Permit or licence area | An area that is granted for a prescribed period of time for exploration, development or production under specific contractual or legislative conditions. |

| Pipeline | A system of interconnected pipes that gather and transport hydrocarbons from a well or field to a processing plant or to a facility that is built to take the hydrocarbons for further transport, such as a gas liquefaction plant. |

Probable reserves

| Those reserves which analysis of drilling, geological, geophysical and engineering data do not demonstrate to be proved with current technology and under existing economic conditions, but where such analysis suggests the likelihood of their existence and future recovery. Probable reserves to be obtained will be the increased recovery beyond estimated proved reserves that can be realistically estimated for the pool through enhanced recovery processes which can reasonably be expected to be instituted in the future. |

Proved reserves

| Those reserves estimated as recoverable with current technology and under existing economic conditions, from that portion of a reservoir which can be reasonably evaluated as economically productive through analysis of drilling, geological, geophysical and engineering data. This includes the reserves to be obtained by enhanced recovery processes demonstrated to be economically and technically successful in the subject reservoir. |

| Quartzose | Rocks composed of mostly quartz. |

Raw gas

| Gaseous effluent from a wellhead or pipeline that is not processed. Contains water vapor, carbon dioxide, nitrogen and possibly hydrogen sulphide (H2S) gas. |

Reservoir rock

| Porous limestones, dolomites or sandstones which can trap oil and/or gas in interconnected holes, like a sponge. |

| Royalty | A stated or determinable percentage of the proceeds received from the sale of hydrocarbons calculated as prescribed in applicable legislation or in the agreement with the royalty holder. |

| Seals | Impermeable barriers to hydrocarbon flow such as shale, lime muds, salt or anhydrite. |

| Seismic | A geophysical technique using low frequency sound waves to determine the subsurface structure of sedimentary rocks. |

Sour gas

| Raw gas with an amount of hydrogen sulphide (H2S) gas above pipeline requirements of 10 parts H2S per million raw gas. |

| Source rock | Usually shales and clays with a high carbon content deposited in a marine environment. |

| Sweet gas | Natural gas containing no hydrogen sulphide (H2S) gas. |

| Stabilized absolute open flow | The maximum rate of gas production that a wellhead will produce assuming no back pressure when the well is stable. |

| Tertiary sediment | Soft rock of sands, clays, coals and siltstones from 66.4 to 1.6 million years old. |

| Undeveloped | Prior to the time in which a proven oil or gas field is brought into production by drilling and completing production wells. |

| Vertical well | A well bore that intersects the section(s) containing hydrocarbons at about 900. |

Viking gas well

| A well capable of commercial gas production from the Upper Cretaceous Viking sands deposited about 97.5 million years ago. |

| Wabamun (D-1) formation | Cyclical ramp carbonates deposited approximately 360 – 367 million years ago during the Upper Devonian Age period. |

| Working interest | Those lands in which the Company receives its share acreage net production revenues. |

Item 1. Identity of Directors, Senior Management and Advisers

Item 2. Offer Statistics and Expected Timetable

Selected Financial Data

The following table summarizes certain of our financial information that is derived from and should be read in conjunction with our financial statements and “Item 5 – Operating and Financial Review and Prospects” included elsewhere in this report. The selected financial data has been prepared in accordance with Canadian Generally Accepted Accounting Principles (Canadian GAAP). The financial statements and the notes thereto included in Item 17 in this report are also prepared under Canadian GAAP. Included in Note 11 to the financial statements is the reconciliation between Canadian GAAP and United States generally accepted accounting principles (U.S. GAAP). Unless otherwise stated in this report, all references to dollars are to Canadian dollars.

Selected Financial Data Presented According to Canadian GAAP

|

| For the years ended March 31 ($ 000’s) | 2002 | 2001 | 2000 | 1999 | 1998 |

| Statements of Operations | | | | | |

| Gross revenues | 26,402 | 34,463 | 15,770 | 9,495 | 2,149 |

| Net revenues | 14,215 | 20,524 | 7,438 | 3,857 | 892 |

| Funds flow from operations | 11,337 | 18,168 | 5,634 | 2,634 | (143) |

| Funds flow per share, basic ($) | 0.55 | 0.91 | 0.29 | 0.13 | (0.01) |

| Funds flow per share, diluted ($) | 0.55 | 0.89 | 0.28 | 0.13 | (0.01) |

| (Loss) earnings before taxes | (5,420) | 14,449 | 2,871 | 1,212 | (2,361) |

| Net (loss) earnings | (3,519) | 9,714 | 4,079 | 1,212 | (2,361) |

| Common shares – weighted avg. (# 000’s) | 20,365 | 19,938 | 19,710 | 19,892 | 16,253 |

Net (loss) earnings per share, basic ($)

Net (loss) earnings per share, diluted ($) | (0.17)

(0.17) | 0.49

0.48 | 0.21

0.20 | 0.06

0.06 | (0.15)

(0.13) |

| | | | | | |

| Balance Sheets | | | | | |

| Working capital (deficiency) | (13,281) | 1,969 | (3,716) | (1,225) | (4,233) |

| Total assets | 37,152 | 29,991 | 18,811 | 12,487 | 13,185 |

| Current liabilities | 19,625 | 6,210 | 7,717 | 3,950 | 7,532 |

| Long-term liabilities | 824 | 540 | 402 | 404 | 370 |

| Deferred gain on sale | 109 | 340 | 652 | 997 | - |

| Future income tax liability | - | 2,955 | - | - | - |

Net assets

Share capital | 16,593

20,915 | 19,947

20,642 | 10,041

20,420 | 7,136

21,080 | 5,283

20,195 |

| Deficit | (4,322) | (695) | (10,379) | (13,944) | (14,912) |

Selected Financial Data Presented According to U.S. GAAPThe following table reflects the major differences in the application of Canadian GAAP and U.S. GAAP:

| |

| For the years ended March 31 ($ 000’s) | 2002 | 2001 | 2000 | 1999 | 1998 |

| Statements of Operations | | | | | |

| Net (loss) earnings under Canadian GAAP | (3,519) | 9,714 | 4,079 | 1,212 | (2,361) |

| Reconciling adjustments * | �� | | | | |

| Compensatory stock options issued | - | - | - | (8) | - |

| Options issued for services | - | (20) | - | - | - |

| Ceiling test adjustment to natural gas properties | (216) | - | (145) | - | - |

| Income taxes | 669 | (577) | - | - | - |

| Net (loss) earnings under U.S. GAAP | (3,066) | 9,117 | 3,934 | 1,204 | (2,361) |

| Net (loss) earnings/share, U.S. GAAP basic ($) | (0.15) | 0.46 | 0.20 | 0.06 | (0.15) |

| Net (loss) earnings/share, U.S. GAAP diluted ($) | (0.15) | 0.45 | 0.19 | 0.06 | (0.13) |

|

| After adjusting for certain differences, selected balance sheet items under U.S. GAAP would become: |

| Balance Sheets | | | | | |

| Future income tax liability | - | 3,532 | - | - | - |

| Share capital * | 21,883 | 21,610 | 21,368 | 21,802 | 21,152 |

| Deficit | (5,422) | (2,356) | (11,473) | (14,896) | (15,869) |

* For complete explanations of the reconciling adjustments shown below, see Note 11 attached to the Financial

Statements presented under Item 17 to this report. |

Dividends

We have never paid or declared dividends on our shares of common stock and we do not intend to do so for the foreseeable future. We intend to use our retained earnings to finance growth.

Our financial statements, as provided under Items 8 and 17, are presented in Canadian dollars. For comparison purposes, exchange rates into U.S. dollars (the host country currency) are provided. The following tables set forth the average, end, high and low exchange rates for the months indicated and the average exchange rates for the years indicated, based on the noon U.S. dollar buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York (Canadian Dollar = U.S. $1.00).

Exchange Rates for Canadian Versus U.S. Dollars

The exchange rate as of August 13, 2002 was CDN $1.5658 per U.S. $1.00.

| Exchange Rates for Canadian Versus U.S. Dollars |

| (High/Low Rates for Recent Months) | High | Low |

| July, 2002 | 1.5880 | 1.5145 |

| June, 2002 | 1.5499 | 1.5108 |

| May, 2002 | 1.5708 | 1.5275 |

| April, 2002 | 1.5995 | 1.5632 |

| March, 2002 | 1.5958 | 1.5767 |

| February, 2002 | 1.6112 | 1.5885 |

| Exchange Rates for Canadian Versus U.S. Dollars |

| Years Ended March 31 | Average ($) |

| 2002 | 1.57 |

| 2001 | 1.50 |

| 2000 | 1.47 |

| 1999 | 1.50 |

| 1998 | 1.40 |

Capitalization and Indebtedness

Reasons for the Offer and Use of Proceeds

Risk Factors

Commodity Price Fluctuations

Our products, including natural gas, NGL’s and oil, and other hydrocarbon products, are commodities. Because our contracts do not fix a long-term price for the products we purchase or sell, market changes in the price of such products have a direct and immediate effect (whether favorable or adverse) upon our revenues and profitability. Prices for products may be subject to material change in response to relatively minor changes in supply and demand, general economic conditions and other market conditions over which we have no control. Other conditions affecting our business include the level of domestic oil and gas production, the availability and prices of competing commodities and of alternative energy sources, the availability of local, intraprovincial and interprovincial transportation systems with adequate capacity, the proximity of gas production to gas pipelines and facilities, the availabili ty of pipeline capacity, government regulation, the seasons, the weather and the impact of energy conservation efforts.

Availability of Natural Gas Supply

We must connect new wells to our gathering systems, contract for new natural gas supplies with third party pipelines or acquire additional gathering systems in order to maintain or increase throughput levels to offset current annual production volumes. Historically, while certain individual facilities have experienced decreases in dedicated reserves, we have connected new wells and contracted for new supplies with third-party pipelines which more than offset production depletion of our existing wells. Our ability to connect new wells to existing facilities is dependent upon levels of our oil and gas development activity near existing facilities. Significant competition for connections to newly drilled wells exists in every geographic area served by us. Significant competition also exists for the acquisition of existing gathering systems. There can be no assurance that we will renew our existing supply contracts or that we will be able to acquire new supplies of natural gas at a rate necessary to offset depletion of wells currently under contract. In the event such circumstances were to occur, our field netbacks would decrease until, and if, such circumstances could be resolved.

Dependence on Third Party Pipelines

In fiscal 2002, substantially all our sales of natural gas were effected through deliveries to local third party gathering systems to processing plants in Alberta owned by ATCO Midstream Ltd. and Northwestern Utilities Limited. In addition, we rely on access to interprovincial pipelines for the sale and distribution of substantially all of our gas. As a result, a curtailment of our sale of natural gas by pipelines or by third-party gathering systems, an impairment of our ability to transport natural gas on interprovincial pipelines or a material increase in the rates charged to us for the transportation of natural gas by reason of a change in federal or provincial regulations or for any other reason, could have a material adverse effect upon us. In such event, we would have to obtain other transportation arrangements or we would have to construct alternative pipelines. There c an be no assurance that we would have economical transportation

alternatives or that it would be feasible for us to construct pipelines. In the event such circumstances were to occur, our field netbacks from the affected wells would be suspended until, and if, such circumstances could be resolved.

Operating History and Significant Historical Operating Losses

We commenced operations in 1979. We have one major property, which began as a one-well producing property in 1985. By fiscal 1999, the property became our major producing property with up to twenty-four producing natural gas and oil wells. Due to the relatively short four-year production history from the majority of wells on the property, proved reserves and future production attributable to this property are somewhat more susceptible to estimation discrepancies than fields with longer production histories.

We first experienced earnings in fiscal 1999 of $1,211,638 as compared with losses of $2,361,280 and $910,926 in fiscal years 1998 and 1997, respectively. In fiscals 2000 and 2001, we reported earnings of $4,078,577 and $9,714,030 respectively and in fiscal 2002, we returned to a loss of $3,519,085. As of March 31, 2002, we had an accumulated deficit of $4,321,539. Our future viability must continue to be considered in light of the risks and difficulties frequently encountered by companies engaged in the junior stages of oil and gas exploration, development and production activities.

Dependence on Key Personnel

Our success depends in large part on the personal efforts of our President & Chief Executive Officer, Wayne J. Babcock, our Vice President & Chief Operating Officer, Donald K. Umbach, our Vice President of Exploration, James R. Britton, and our Chief Financial Officer & Corporate Secretary, Michael A. Bardell. The loss of the services of any of these persons could have a material adverse effect on us.

Risks Pertaining to Acquisitions and Joint Ventures

Part of our business strategy is to expand through acquisitions. Our future growth is partially dependent upon our ability to complete suitable acquisitions and effectively integrate acquired assets into our operations. Suitable acquisitions, on terms acceptable to us, may not be available in the future or may require us to assume certain liabilities, including, without limitation, environmental liabilities, known or unknown.

Potential Variability in Quarterly Operating Results

Demand for our products will generally increase during the winter because they are often used as heating fuels. The amount of such increased demand will depend to some extent upon the severity of winter. Accordingly, our net operating revenues are likely to increase during winter months although the amount of increase and its effect on profitability cannot be predicted. Because of the seasonality of our business and continuous fluctuations in the prices of our products, our operating results for any past quarterly period may not necessarily be indicative of results for future periods and there can be no assurance that we will be able to maintain steady levels of profitability on a quarterly or annual basis in the future.

Dependence on One Major Property

Currently, our major producing asset is our property located at St. Albert, Alberta. While the St. Albert property as of March 31, 2002 has developed into 16 separate, mutually-exclusive oil and gas pools stacked in 7 productive formations (3 oil and 4 gas), each pool has its own reserves and future production risk, and thus it is important for us to establish producing fields in other areas. Unless we can successfully drill for or acquire economically viable reserves of oil and/or natural gas in other areas, as our production depletes the reserves at St. Albert, our revenue may be materially adversely affected.

Limited Financial Resources We expect to continue to produce enough cash flow, along with our bank credit facility, to support land acquisitions, drilling operations, facilities construction and general /administration costs. At this time, we believe that our cash flow and credit facility will be sufficient to support our business activities without securing significant

|

additional financing in the near future. If it were to become necessary to raise significant additional financing, any arrangements that may be entered into could be expensive to us. There can be no assurance that we will be able to raise additional capital in light of factors such as the market demand for our securities, the state of financial markets for independent oil companies (including the markets for debt), oil and gas prices and general market conditions. (See "Operating and Financial Review and Prospects" for a discussion of our capital budget). We expect to continue using our bank credit facility to borrow funds to supplement our available cash. The amount we may borrow under the credit facility may not exceed a borrowing base determined by the lender based on its projections of our future production, future costs of production, taxes, commodity prices and other factors. We cannot control the assumptions the lender uses to calculate the borrowing base. The lender may, without our consent, adjust the borrowing base at any time. If our borrowings under the credit facility exceed the borrowing base, the lender may require that we repay the excess. If this were to occur, we may have to sell assets or seek financing from other sources. We can make no assurances that we would be successful in selling assets at prices acceptable to us or arranging substitute financing. For a description of our bank credit facility and its principal terms and conditions, see "Operating and Financial Review and Prospects” under Item 5, and Note 3 attached to the Financial Statements under Item 17 of this report.

Exploration and Development Risks

Exploration and development of natural gas and oil involves a high degree of risk that no commercial production will be obtained or that the production will be insufficient to recover drilling and completion costs. The costs of drilling, completing and operating wells is sometimes uncertain, and cost overruns in exploration and development operations can adversely affect the economics of a project. Our drilling operations may be curtailed, delayed or canceled as a result of numerous factors, including title problems, equipment failures, weather conditions, marine accidents, fires and explosions, compliance with governmental requirements, and shortages or delays in the delivery of equipment. Furthermore, completion of a well does not ensure a profit on the investment or a recovery of drilling, completion and tie-in costs.

We have historically invested a significant portion of our capital budget in drilling exploratory wells in search of unproved oil and gas reserves. We cannot be certain that the exploratory wells we drill will be productive or that we will recover all or any portion of our investments. In order to increase the chances for exploratory success, we often invest in seismic or other geoscience data to assist us in identifying potential drilling objectives. Additionally, the cost of drilling, completing and testing exploratory wells is often uncertain at the time of our initial investment. Depending on complications encountered while drilling, the final cost of the well may significantly exceed that which we originally estimated.

Operating Hazards and Uninsured Risks

The oil and gas business involves a variety of operating risks, including fire, explosion, pipe failure, casing collapse, abnormally pressured formations, and environmental hazards such as oil spills, gas leaks and discharges of toxic gases. The occurrence of any of these events with respect to any property operated or owned (in whole or in part) by us could have a material adverse impact on us. We, and the operators of our properties, maintain insurance in accordance with customary industry practices and in amounts that we believe to be reasonable. However, insurance coverage is not always economically feasible and is not obtained to cover all types of operational risks. The occurrence of a significant event that is not fully insured could have a material adverse effect on our financial condition.

Drilling and Operating Risks

Our oil and gas operations are subject to all of the risks and hazards typically associated with drilling for, and production and transportation of, oil and gas. These risks include the necessity of spending large amounts of money for identification and acquisition of properties and for drilling and completion of wells. In the drilling of exploratory or development wells, failures and losses may occur before any deposits of oil or gas are found. The presence of unanticipated pressure or irregularities in formations, blowouts or accidents may cause such activity to be unsuccessful, resulting in a loss of our investment in such activity. If we find oil or gas we cannot assume that it can be produced in economic quantities sufficient to justify the cost of continuing such operations or that it can be marketed satisfactorily.

Drilling Plans Subject to Change

This report includes descriptions of our future drilling plans with respect to our prospects. A prospect is a property on which our geoscientists have identified what they believe, based on available seismic and geological information, to be indications of hydrocarbons. Our prospects are in various stages of review. Whether or not we ultimately drill a prospect may depend on the following factors: receipt of additional seismic data or reprocessing of existing data; material changes in oil or gas prices; the costs and availability of drilling equipment; success or failure of wells drilled in similar formations or which would use the same production facilities; availability and cost of capital; changes in the estimates of costs to drill or complete wells; our ability to attract other industry partners to acquire a portion of the working interest to reduce exposure to costs and drilling risks; decisions of our joint working interest owne rs; and restrictions imposed by governmental agencies. We will continue to gather data about our prospects, and it is possible that additional information may cause us to alter our drilling schedule or determine that a prospect should not be pursued at all.

Replacement of Reserves

In general, the rate of production from natural gas and oil properties declines as reserves are depleted. The rate of decline depends on reservoir characteristics and other factors. Except to the extent we acquire properties containing proved reserves or conduct successful exploration and development activities, or both, our estimated proved reserves will decline as reserves are produced. Our future natural gas and oil production, and therefore cash flow and income, are highly dependent upon our level of success in finding or acquiring additional economically recoverable reserves. The business of exploring for, developing and acquiring reserves is capital intensive. To the extent cash flow from operations is reduced and external sources of capital become limited or unavailable, our ability to make the necessary capital investment to maintain or expand our asset base of natural gas and oil reserves could be materially impair ed.

Dependence on Few Customers

In fiscal 2002, the majority of our total natural gas sales were split evenly between two customers and our total natural gas liquids, between three different customers. We do not believe that the loss of one of our customers would have a material adverse effect on us because of the availability of other customers willing or interested in purchasing our products.

Information relating to proved natural gas and oil reserves owned by us and those attributable to our producing properties is based upon engineering estimates. Reserve engineering is a subjective process of estimating the recovery from underground accumulations of natural gas and oil that cannot be measured in an exact manner, and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. Estimates of economically recoverable oil and gas reserves depend upon a number of variable factors and assumptions, such as historical production from the area compared with production from other producing areas, the effects of governmental regulations, future oil and gas prices, future operating costs, excise taxes, development costs and workover and remedial costs, all of which may vary considerably from actual results. Because all reserve estimates are to some degree speculative, th e quantities of natural gas and oil that are ultimately recovered, production and operating costs, the amount and timing of future development expenditures and future natural gas and oil sales prices may all vary from those assumed in these estimates and such variances may be material. Additionally, different reserve engineers may make different estimates of reserve quantities based on the same data.

Shortage of Supplies and Equipment

Our ability to conduct operations in a timely and cost effective manner is subject to the availability of oil and gas field supplies, rigs, equipment and service crews. Although none are expected currently, any shortage of certain types of supplies and equipment could result in delays in our operations as well as in higher operating and capital costs.

Government Regulation and Environmental Matters

We are subject to various federal and provincial laws and regulations including environmental laws and regulations. We believe that we are in substantial compliance with such laws and regulations, however, such laws and regulations may change in the future in a manner which will increase the burden and cost of compliance. In addition, we could incur significant liability for damages, cleanup costs and penalties in the event of certain discharges into the environment.

Certain laws and governmental regulations may impose liability on us for personal injuries, clean-up costs, environmental damages and property damages, as well as administrative, civil and criminal penalties. We maintain limited insurance coverage for sudden and accidental environmental damages, but do not maintain insurance coverage for the full potential liability that could be caused by sudden and accidental environmental damage. Accordingly, we may be subject to liability or may be required to cease production from properties in the event of such damages.

The main bodies of regulations that apply to us in the areas in which we have significant field operations are The Oil and Gas Conservation Act of Alberta and The Petroleum and Natural Gas Act of British Columbia.

Interruption From Severe Weather

Presently, our operations are conducted principally in the central region of Alberta and the northeastern region of British Columbia. The weather during colder seasons in these areas can be extreme and can cause interruption or delays in our drilling and construction operations.

Competition

The natural gas and oil industry is highly competitive. We experience competition in all aspects of our business, including acquiring reserves, leases, licenses and concessions, obtaining the equipment and labor needed to conduct operations and market natural gas and oil. Our competitors include multinational energy companies, other independent natural gas and oil concerns and individual producers and operators. Because both natural gas and oil are fungible commodities, the principal form of competition with respect to product sales is price competition. Many competitors have financial and other resources substantially greater than those available to ours and, accordingly, may be better positioned to acquire and exploit prospects, hire personnel and market production. In addition, many of our larger competitors may be better able to respond to factors such as changes in worldwide natural gas or oi l prices or levels of production, the cost and availability of alternative fuels or the application of government regulations. Such factors, which are beyond our control, may affect demand for our natural gas and oil production. We expect a high degree of competition to continue.

Item 4. Our Information

Our History and Development

Dynamic Oil & Gas, Inc. (formerly Dynamic Oil Limited) was incorporated under the Company Act of the Province of British Columbia, Canada on March 27, 1979. We have one wholly-owned, inactive subsidiary incorporated in Texas, called Seabird Oil & Gas, Inc.

Our principal executive office is located in rented space at Suite 205-10711 Cambie Road, Richmond, British Columbia V6X 3G5 Canada. Our telephone number is (800) 663-8072.

Capital Expenditures and Exploration Expenses Over the Past Three Years

Over the past three fiscal years, our capital expenditures aggregated $39.4 million, with the major expenditures as follows:

| $ | | $14.7 million for the acquisition of additional working interest holdings in our producing assets at St. Albert, Alberta. Through this acquisition, our interests increased to 75% from 50% in the majority of gas-related assets and to 75% from 25% in all oil-related assets;

|

| $ | | $7.8 million on the continuing development of the St. Albert, Alberta, Canada property. This money was spent on drilling, re-completing and tying-in of natural gas wells, as well as constructing several new production-enhancing facilities;

|

| $ | | $8.3 million on land acquisitions, exploratory drilling and facilities construction at Peavey/Morinville in Alberta, Canada; and

|

| $ | | $2.9 million (net) on land acquisitions and exploration of a prospective natural gas property at Orion in northeast British Columbia, Canada.

|

During the last three fiscal years, we spent $7.9 million on exploration expenses. Exploration expenses are mainly comprised of costs for seismic, new property investigations and unsuccessful drilling attempts. Under our ‘successful efforts’ accounting policy, we reclassify costs for unsuccessful drilling attempts from capital expenditures to exploration expenses. The $7.9 million is itemized as follows:

| $ | | $5.5 million on unsuccessful drilling attempts;

|

| $ | | $1.9 million on conducting seismic surveys or acquiring seismic survey data; and

|

| $ | | $0.5 million on investigating new properties.

|

Capital Expenditures and Exploration Expenses Anticipated in Fiscal 2003

On April 11, 2002, our Board of Directors approved our capital budget which authorized us to spend a total of $17.0 million in capital expenditures for fiscal 2003 as follows:

| $ | | $0.7 million for the acquisition of new prospective lands in the central region of Alberta and in the northeastern region of British Columbia;

|

| $ | | $7.3 million on drilling, re-completions, tie-ins and facilities at St. Albert, our main property in central Alberta;

|

| $ | | $1.5 million on drilling, tie-ins and facilities on our properties at Halkirk in central Alberta;

|

| $ | | $6.0 million on exploratory drilling and tie-ins on our land interests at Orion and Cypress (see “Recent Material Event” below) in northeastern British Columbia; and

|

| $ | | $1.5 million on drilling on two central Alberta land interests owned by us.

|

We have also approved an exploration expense budget of $1.1 million to acquire seismic data on our land interests in central Alberta and northeastern British Columbia.

We expect funds for our capital expenditure and exploration expense plans for fiscal 2003 to be sourced from funds flow from our operations and from our bank credit facility (see Note 3 to the Financial Statements under Item 17 in this report). In the event that our funding sources are insufficient to accomplish the expenditure and exploration plans for fiscal 2003, we will be forced to curtail certain of such expenditures.

Recent Material Event

On June 10, 2002, we announced our Farmout and Option Agreement (the “Farmout Agreement”) in the Orion area of northeastern British Columbia. Under the terms of the Farmout Agreement, the farmee will have the right to earn a sliding scale interest in three designated blocks of our Orion acreage, comprising 28,334 gross acres (21,665 net) by drilling up to four horizontal test wells into the Upper Devonian Age, Jean Marie formation. The first well, a commitment well, must be drilled by September 30, 2002. To continue earning under the Farmout Agreement, the farmee has sixty days from rig release date of the first well to commit to drill the first of three option wells. The first option well must be drilled by April 15, 2003. The second and third option wells must be drilled by April 15, 2004. Upon completion of the terms of the Farmout Agreement, we will retain an interest in the three blocks rangin g from 20% to 50%, with a net average working interest of approximately 32%. We continue to hold a total of 1,669 gross acres (1,669 net) in the Orion area that is not subject to the Farmout Agreement.

On July 30, 2002, we announced our Participation and Farmin Agreement (the “Farmin Agreement”) in the Cypress area of northeast British Columbia. Under the Farmin Areement, we will have the right to earn a net average working interest of 35% in two out of eight land blocks comprising approximately 5,120 acres, by paying 50% of the cost to drill two test wells. The first well, a commitment well and the second an option well, are expected to cost us $1.3 million and $0.9 million, respectively. Upon completion of the terms of the Farmin Agreement, we will have the right to earn a 50% working interest in the two test-well land blocks, subject to a convertible 15% gross overriding royalty, and a 30% working interest in the remaining six land blocks.

Share Repurchases

During the last three fiscal years, we spent $1.1 million on the re-purchase and cancellation of over 1.1 million of our outstanding shares of common stock at prices ranging from $1.48 to $2.07 per share.

Business Overview

Our principal business is acquiring, exploring and developing natural gas and oil properties. Our natural gas and oil properties are located in the Canadian provinces of Alberta, British Columbia and Saskatchewan. Over each of the past three years, we have explored for, produced and marketed natural gas, natural gas liquids and oil. We intend to continue this type of business activity.

Concentration of Commodities

We derive our revenue principally from the sale of natural gas and natural gas liquids. As a result, our revenues are determined, to a large degree, by prevailing spot prices for natural gas and natural gas liquids. The market prices for natural gas and natural gas liquids are dictated by supply and demand. Accordingly, our income and cash flows will be greatly affected by changes in prices for natural gas and natural gas liquids. We will experience reduced cash flows and may experience operating losses when prices for natural gas and natural gas liquids are low (see Item 5 Operating and Financial Review Prospects and Item 11 Quantitative and Qualitative Disclosures About Market Risk).

Under extreme circumstances, our natural gas sales may not generate sufficient revenue to meet our financial obligations and to fund planned capital expenditures. Moreover, significant price decreases could negatively affect our reserves by reducing the quantities of reserves that are recoverable on an economic basis, necessitating write-downs to reflect the realizable value of the reserves in the lower-price environment.

We are unable to control the market prices for natural gas, natural gas liquids and oil (collectively, “hydrocarbons”). Such market prices depend on numerous factors that include:

| $ | | the proximity of hydrocarbon pipelines or other economically-feasible transportation;

|

| $ | | the availability of pipeline capacity;

|

| $ | | the demand for hydrocarbons by utilities and other end users;

|

| $ | | the availability of alternative fuel sources;

|

| $ | | the effects of weather variability; and

|

| $ | | the effects of regulations pertaining to the transporting, marketing and exporting of hydrocarbons within Canada.

|

Because of these and other factors, we may be unable to market all of the natural gas, natural gas liquids and oil that we have available for sale. Additionally, we may be unable to obtain favorable prices for the oil and gas that we produce.

Concentration of Operations

Our main producing property is located at St. Albert, Alberta. Of our total production in fiscal 2002, 84% came from the St. Albert property. The remainder originated from six other Alberta fields: Peavey/Morinville, Halkirk, Westlock, Legal, Simonette and Stanmore. In fiscal 2001, 82% of our production came from the St. Albert field, while the remainder came from six other fields: Peavey/Morinville, Westlock, Legal, Simonette, Redwater and Stanmore. In fiscal 2000, 95% of our production came from the St. Albert field, while the remainder originated from five other fields: Peavey/Morinville, Westlock, Legal, Simonette and Redwater.

Revenue Breakdown

During the past three fiscal years, our total revenue was $76.6 million. Of this total, 79% came from the sales of natural gas, 18% came from the sales of natural gas liquids and 3% came from the sales of oil. Additionally, virtually all of such revenue originated from our properties and interests in the Province of Alberta. The breakdown for each of the past three fiscal years is shown in the table below:

| Natural gas, liquids and oil sales $(000’s) | 2002 | 2001 | 2000 |

| Natural gas | 20,944 | 28,006 | 11,660 |

| Natural gas liquids | 4,442 | 5,935 | 3,620 |

| Oil | 1,016 | 522 | 490 |

| Total | 26,402 | 34,463 | 15,770 |

Seasonality and Raw Materials

The seasonality of our main revenue-generating commodity, natural gas, is affected solely by the North American climate. Typically, there are two ‘peak’ seasons and two corresponding ‘shoulder’ seasons for natural gas sales. Winter is generally the higher-demand period due to cold-weather heating requirements. The summer is the next highest period of demand due to hot-weather air conditioning requirements.

Natural gas is becoming increasingly important as an energy source to power natural gas-fired electric power generating facilities (co-gen facilities). We believe that as more co-gen facilities are approved, constructed and put into operation, the demand for natural gas during shoulder seasons will remain relatively strong.

We do not rely on the availability of raw materials, because we operate in an extractive industry.

Marketing

We market our natural gas through direct sales and through the use of aggregators. Aggregators, when used, act as our marketing agents selling natural gas for us via a mix of spot, short term (less than one year) and long term

contracts. We cannot affect the mix of spot, short term and long term contracts that are managed by aggregators, nor are we privy to the exact amount of volume sold into each contract type throughout the year. Based on information provided by aggregators, the table below approximates our mix of contract types for each of the past three fiscal years.

Of our total gas sold during fiscal 2002, 53% was sold into aggregator portfolios. The remaining 47% was sold directly by us into the spot market. In fiscal years 2001 and 2000, the percentage of total gas sold to aggregators was 77% and 86%, respectively, with the remainder sold by us in the spot market. The percentage of total gas sold into aggregator portfolios decreased by 24% in fiscal 2002 from fiscal 2001 due mainly to the fact that in fiscal 2002 we sold more natural gas into the spot market.

The table below combines all contract types, aggregated and not-aggregated, to approximate the percentage of our natural gas being sold into each contract type in each of the three fiscal years.

| Approximate mix of gas contract types | 2002 | 2001 | 2000 |

| Spot market – not aggregated | 47% | 23% | 14% |

| Spot market – aggregated | 27% | 19% | 22% |

| Total spot market | 74% | 42% | 36% |

| Short-term – aggregated (less than one year) | 1% | 9% | 11% |

| Long-term – aggregated | 25% | 49% | 53% |

| Total | 100% | 100% | 100% |

All of our natural gas liquids are sold directly into the non-aggregated spot market under arm’s length contracts.

During fiscal 2002, we increased our percentage of total natural gas sales exposed to spot market pricing by approximately 76% over fiscal 2001. The main reason for this significant increase is the sales of new natural gas production generated from the St. Albert acquisition into the spot market in fiscal 2002. Although the percentage of total natural gas sales exposed to spot market activity increased, weighted average spot prices of natural gas declined in fiscal 2002 from fiscal 2001, thereby contributing to a decrease in total revenues (see “Natural Gas, Liquids and Oil Revenues” below). Total gas sales exposed to spot market pricing in fiscal 2001 increased by 17% over fiscal 2000.

Supply Contracts or Agreements

Under various supply contracts and agreements, the commitment period under which we are required to supply natural gas and natural gas liquids, ranges from terminable within thirty days notice to no termination prior to exhaustion of hydrocarbon reserves. Under these various contracts and agreements, we are not obligated to provide a fixed quantity of supply, as all supply is on a best-efforts basis.

Presently, we regularly compete with other companies in bidding for the acquisition of petroleum interests from the Alberta and British Columbia governments and other corporations or individuals holding such interests. Further, we regularly compete for the availability of drilling rigs, production equipment, processing facilities, pipeline capacity and other transportation services. We do not have a competitive position that allows us any material or significant advantages compared to other companies within the same industry. Many competitors have substantially greater financial and other resources than we do. For example, in the 2002 Canadian Energy Survey of 2001 Results prepared by PriceWaterhouseCoopers, we ranked thirty-sixth and thirty-fifth in size out of one hundred Canadian exploration and production companies according to gross revenues and cash flow from operations, respectively.

Government regulations have a material effect on us to the extent that they require us to conduct field operations and hydrocarbon extraction activities within prescribed environmentally-safe, sensitive regulations. Also, government regulations may restrict the commencement or re-commencement of field activities in certain properties in which we hold an interest for the purpose of exploration.

Examples of types of governmental laws and regulations that may have a material effect on our business include:

| $ | | requirements to acquire permits before commencement of drilling operations;

|

| $ | | requirements to restrict the substances that can be released into the environment in connection with

|

| $ | | drilling and production activities;

|

| $ | | limitations on, or prohibitions to, drilling in protected areas such as offshore areas; and

|

| $ | | requirements to mitigate and remediate the effects caused by drilling and production operations.

|

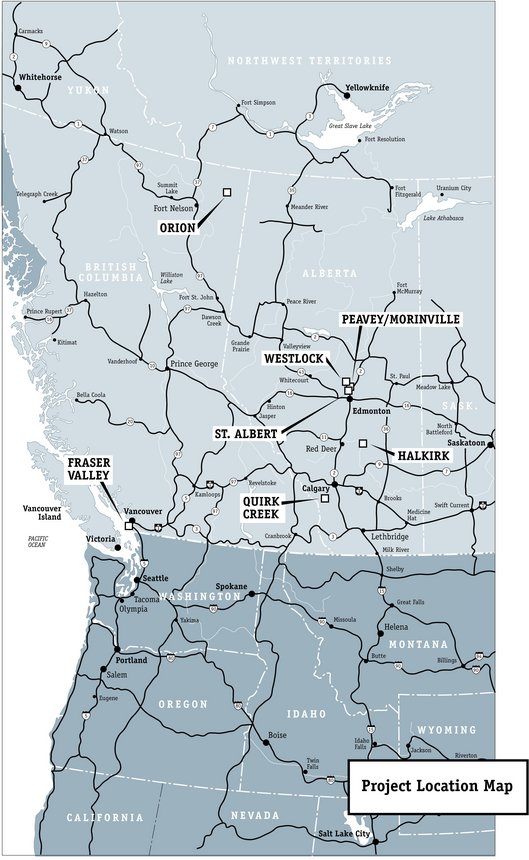

Properties, Plant and Equipment

We own interests in certain properties located in the Western Provinces of Canada. For purposes of identification, discussion and differentiation, we have named them based on their location. They are as follows:

| Central Alberta | British Columbia | Southern Saskatchewan |

| St. Albert | Orion (northeastern B.C.) | Elmore |

| Peavey/Morinville | Cypress (northeastern B.C. | Rapdan |

| Westlock | Fraser Valley (southwestern B.C.) | |

| Simonette | | |

| Redwater | | |

| Virgo | | |

| Stanmore | | |

| Halkirk | | |

| Alexander | | |

| Quirk Creek (Foothills) | | |

As shown in the table below, our land holdings as of March 31, 2002 total 150,171 gross acres and 86,251 net acres. Our weighted average working interest in all of these properties was approximately 57%. The remaining 43% was held by joint venture, industry partners who share a common interest in exploring or developing the property in question. Of total land holdings as of March 31, 2002, our developed acreage comprises 24,110 gross acres (17,089 net) and our undeveloped acreage comprised 126,061 gross acres (69,162 net). In fiscals 2001/2000, our total developed acreage comprised 18,175/16,103 gross acres and 11,078/9,184 net acres, respectively, while our total undeveloped acreage comprised 126,271/103,097 gross acres and 78,949/55,752 net acres, respectively. Our weighted average working interest in all properties was 63% in fiscal 2001 and 54% in fiscal 2000.

Our total land holdings increased during fiscal 2002 by 23,900 gross acres (7,302 net) or 19%, to 150,171 acres (86,251 net) over fiscal 2001. These additions were spread among four properties, Halkirk, Peavey/Morinville, St. Albert and Quirk Creek, and two other central Alberta properties.

| Land Holdings (acres) | | | | | | |

| As at March 31, 2002 | Developed | Undeveloped | Total | Weighted Average |

| Area | Gross | Net | Gross | Net | Gross | Net | Working Interest |

| Halkirk | 3,840 | 3,456 | 3,200 | 3,200 | 7,040 | 6,656 | 95% |

| Peavey/Morinville | 7,363 | 5,037 | 6,630 | 4,405 | 13,993 | 9,442 | 67% |

| St.Albert | 9,057 | 5,884 | 6,293 | 4,319 | 15,350 | 10,203 | 66% |

| Quirk Creek | - | - | 19,040 | 9,520 | 19,040 | 9,520 | 50% |

| Orion | - | - | 30,003 | 23,334 | 30,003 | 23,334 | 78% |

| Fraser Valley | - | - | 54,332 | 18,109 | 54,332 | 18,109 | 33% |

| Other Alberta | 3,850 | 2,712 | 6,563 | 6,275 | 10,413 | 8,987 | 86% |

| Total | 24,110 | 17,089 | 126,061 | 69,162 | 150,171 | 86,251 | 57% |

Using the property names as shown in the above table, details of each property as to its size, productive capacity, extent of utilization of our facilities, location and products produced are described below. Tables including

information about natural gas, natural gas liquids and oil are included near the end of this section. Maps are also included to show the physical location of each property.

St. Albert/Big Lake is located in central Alberta near the City of Edmonton. The area is prospective for remaining recoverable oil from six established oil pools within the Leduc (D-3), Nisku (D-2) and Wabamun (D-1) formations. These formations are underlying multiple pools of stacked, natural gas-bearing sandstones of Cretaceous Age draped over two, underlying reef structures. We own a weighted average working interest of 66% in 15,350 gross acres (10,203 net) of land including 6,293 gross undeveloped acres (4,319 net). In addition, we also own a weighted average 66% share of various overriding royalty interests associated with an additional 4,729 gross acres (3,121 net).

Acquisition Activity in Fiscal 2002

Effective April 1, 2001 as announced on June 29, 2001, we increased our interest at St. Albert under a purchase and sale agreement with Fletcher Challenge Oil & Gas, Inc. (“Fletcher”). Under the agreement, we acquired 50% of Fletcher’s interest in the shallow gas wells and facilities and 67% of Fletcher’s interest in the oil wells and facilities and assumed the duties of Operator effective June 30, 2001.

Wells and facilities

As of the end of fiscal 2002, we owned and operated a 75% working interest in fourteen producing gas wells, six producing oil wells and various working interests ranging between 25% - 83% in four other producing gas wells, five suspended potential gas wells and six additional wells awaiting further evaluation. We own a 25% interest in a ten-mile sales gas pipeline system and in a significant gas processing facility capable of processing 15 mmcf/d of sour gas and 15 mmcf/d of sweet gas. Further, we own a 75% interest in an oil battery capable of processing 2,400 boe/d.

In fiscal 2002, we conducted re-entry/workover operations on five previously suspended or low production wells resulting in four natural gas wells and one unsuccessful attempt. Over the past three years, we focused exploration and development at St. Albert on shallow gas prospects until we pursued a new oil target within the established Devonian Age pools by drilling a successful Nisku (D-2) oil well in February 2002. By the end of fiscal 2002, the Nisku well had averaged 89 boe/d over a 57-day production period.

We increased our average daily production rates at St. Albert in fiscal 2002 by 547 boe/d or 25%, to 2,717 boe/d over fiscal 2001. The increase was primarily due to the acquisition of an additional interest from Fletcher. Production increases at year-end came as a result of a modification to a sour compressor facility and the successful workover of five previously suspended or low producing wells. We exited the year producing 3,224 boe/d from the St. Albert field. At the close of fiscal 2002, our independent proved natural gas, natural gas liquids and oil reserves were estimated at 7,201 mboe and risked probable reserves were estimated at 338 mboe.

Historically, St. Albert has produced in excess of 23 million barrels of oil and 83,000 mmcf of raw gas. Prospectively, we identified several potential targets for additional oil and gas recovery on the property. We have budgeted eight new wells at St. Albert in fiscal 2003, six wells targeting the remaining oil potential in the established oil pools and two wells targeting new gas reserves.

Peavey/Morinville, Alberta

Peavey/Morinville is approximately nineteen kilometres north of the City of Edmonton. The area is prospective for multiple oil and natural gas-bearing sandstones of Cretaceous Age. These sands are stratigraphically controlled and structurally draped over highs in the Leduc reef. Presently, we own a weighted average 67% working interest in approximately twenty-six square kilometers of 3-D seismic data and 13,993 gross acres (9,442 net) of land including 6,630 gross acres (4,405 net) of undeveloped land.

Peavey/Morinville is approximately nineteen kilometres north of the City of Edmonton. The area is prospective for multiple oil and natural gas-bearing sandstones of Cretaceous Age. These sands are stratigraphically controlled and structurally draped over highs in the Leduc reef. Presently, we own a weighted average 67% working interest in approximately twenty-six square kilometers of 3-D seismic data and 13,993 gross acres (9,442 net) of land including 6,630 gross acres (4,405 net) of undeveloped land.

We operate and hold a weighted average working interest of 77% in seven producing gas wells in this area and 100% working interest in a 5.5 mmcf/d compression/dehydrator facility. At the end of fiscal 2002, approximately 0.8 mmcf/d of third party production was being processed through this facility. We hold various working interests ranging between 35% and 96% in eleven shut-in or suspended gas wells, one potential oil well and two wells awaiting abandonment.

The average annual daily production rate from the property remained steady between fiscals 2001 and 2002 at close to 290 boe/d. However, due to the unexpected influx of water, the year-end exit rate in fiscal 2002 decreased by 269 boe/d or 62%, to 165 boe/d from fiscal 2001. As a result, our independent estimate of proved reserves was revised downward in fiscal 2002 by 1,143 mboe or 61%, to 742 mboe from fiscal 2001.

Presently, we are examining ways to maximize the value in this property. The property contains a substantial network of pipelines including a gas compression facility, eleven shut-in or suspended gas wells, 6,630 gross acres of undeveloped land and is covered by approximately twenty-six square kilometres of 3-D seismic data. Among the possibilities, we are considering the property as prospective for coal bed methane development.

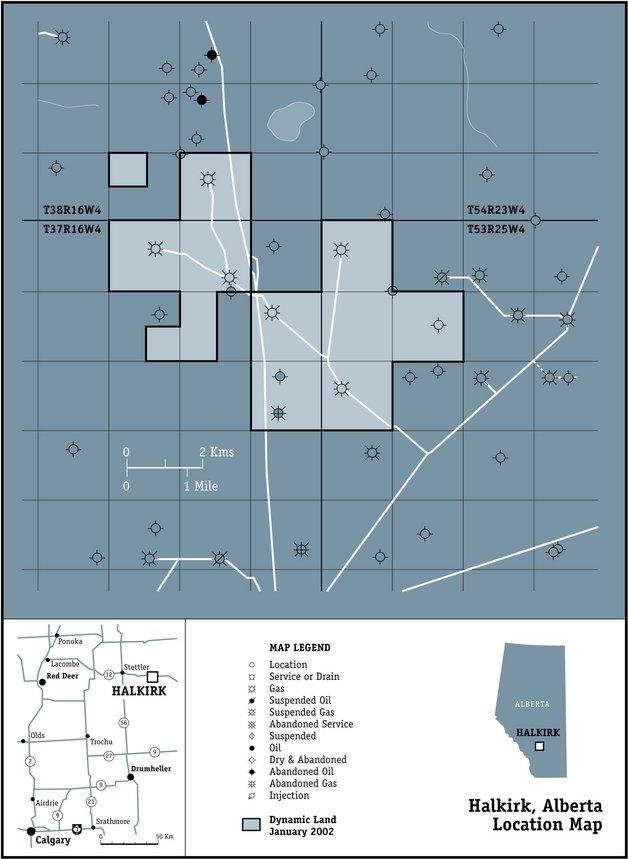

Property Description

Halkirk is located approximately one hundred and seventy kilometers northeast of the City of Calgary, Alberta. The area is prospective for the development of three sweet gas horizons: the Belly River, Viking, and Hackett formations. The primary target for reserves is the Viking “C” sand with an average net pay thickness of 5.3 meters. The area is also close to existing gas processing facilities. We own a weighted average 95% working interest in 7,040 gross acres (6,656 net) of land including 3,200 gross undeveloped acres (3,200 net). We increased our land holdings in the area by 2,880 gross acres (2,880 net) during fiscal 2002.

Wells and Facilities

We operate and own a weighted average working interest of 92% in seven natural gas wells on the property including six producing and one capped gas well. In fiscal 2002, we drilled five of the seven wells resulting in four gas wells and one capped gas well. During the year, six of the wells were connected by pipeline to a third-party gas processing facility in the area.

Production and Reserves

Production from the field began in late October 2001 and closed out fiscal 2002 averaging 252 boe/d. Fiscal 2002 independent, proved natural gas reserves were estimated at 595 mboe and risked probable reserves were estimated at 313 mboe.

The Viking C formation provides access to lower-risk natural gas reserves that we believe to be long-life reserves. Eight additional drilling targets have been identified on the existing land block with four of the eight locations planned for fiscal 2003.

Quirk Creek

Property Description

Quirk Creek is located in the foothills of southern Alberta approximately forty-two kilometers southwest of Calgary. We are targeting new reserves of sweet natural gas in a thick section of sandstones in the Cretaceous Age Blairmore Group at depths up to 1,800 meters. The gas is contained within sediments that are highly fractured due to the presence of northwest/southeast trending thrust faults that run through the area. At the end of fiscal 2002, we held a 50% working interest in 19,040 gross acres (9,520 net) of undeveloped land.

Under a Farmout and Option Agreement with a large integrated oil and gas company, we participated with another junior company in drilling one exploration well at Quirk Creek in March 2002. Under the agreement, we earned a 50% interest in 1,280 gross acres of land, plus an option to drill up to three additional wells in the area to earn 50% in another 7,680 gross acres. The well was drilled to a depth of 1,825 meters using air drilling techniques. Several shows of gas were reported during the drilling operation, although no commercial quantities of gas were encountered or indicated on logs. Post-drilling analysis of the well indicates anticipated rock fractures were encountered, however, these fractures were predominately healed or closed at that location.

In addition to considering our options under the Farmout and Option Agreement, we identified two re-entry opportunities on lands we own that could provide a more cost-effective way to further test this thick Blairmore Group of sediments for commercial quantities of sweet natural gas. Re-entry work is planned in fiscal 2003.

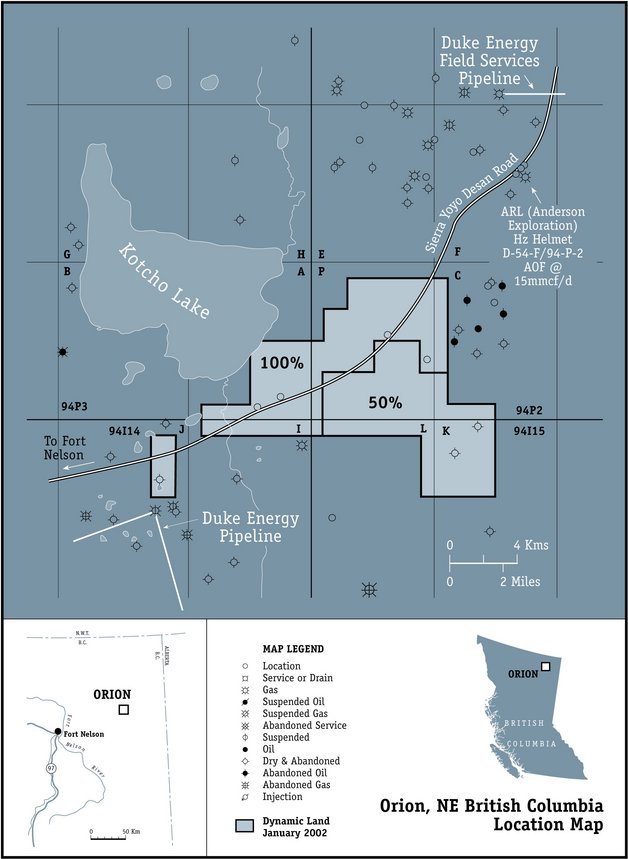

Orion, NE British Columbia

Orion is strategically located between the Sierra and Helmet natural gas fields. Located near Kotcho Lake, the acreage is approximately fifty-six kilometers west of the Alberta border and one hundred and twelve kilometers south of the Northwest Territories. The property is dissected by the Sierra Yoyo Desan Road, which provides year-round access for drilling operations. The Jean Marie formation is considered to be a regional platform carbonate with extensive patch-reef development at sub-surface depths of between 1,000 – 1,400 meters. The formation averages one hundred and ninety meters thick and is draped over deep-seated substructures. A prolific open fracture network enhances reservoir permeability. As at the end of fiscal 2002, we held a weighted average working interest of 78% in 30,003 gross acres (23,334 net) of undeveloped land.

We own a working interest of 100% in one suspended potential natural gas well. In fiscal 2002, we perforated and tested the Bluesky and Wabamun formations in the well. It is currently suspended as a potential natural gas well pending further evaluation and development of a sales pipeline system. The property is located at the termination of two major pipeline systems. The Duke Energy Pipeline System is located seven kilometers south of the property and connects to Fort Nelson, further extending south to Washington State. A second pipeline, the Duke Energy Field Services Pipeline System, is accessible on the north boundary of the property and connects to Tooga Compressor Station, further extending east to Alberta.

Fiscal 2003 Plans

On June 10, 2002 we announced the terms of a Farmout and Option Agreement with a large independent Canadian oil and gas company (the “farmee”) on the Orion property. Under the terms of the Farmout and Option Agreement, the farmee will have the right to earn a sliding scale interest in three designated blocks of the farmee’s Orion acreage comprising 28,334 gross acres (21,665 net) by drilling up to four horizontal test wells into the Upper Devonion Age, Jean Marie formation. The first well, a commitment well, must be drilled by the end of September 2002. To continue earning under the Farmout Agreement, the farmee has sixty days from rig release date of the first well to commit to drill the first of three option wells. The first option well must be drilled by April 15, 2003. The second and third option wells must be drilled by April 15, 2004.

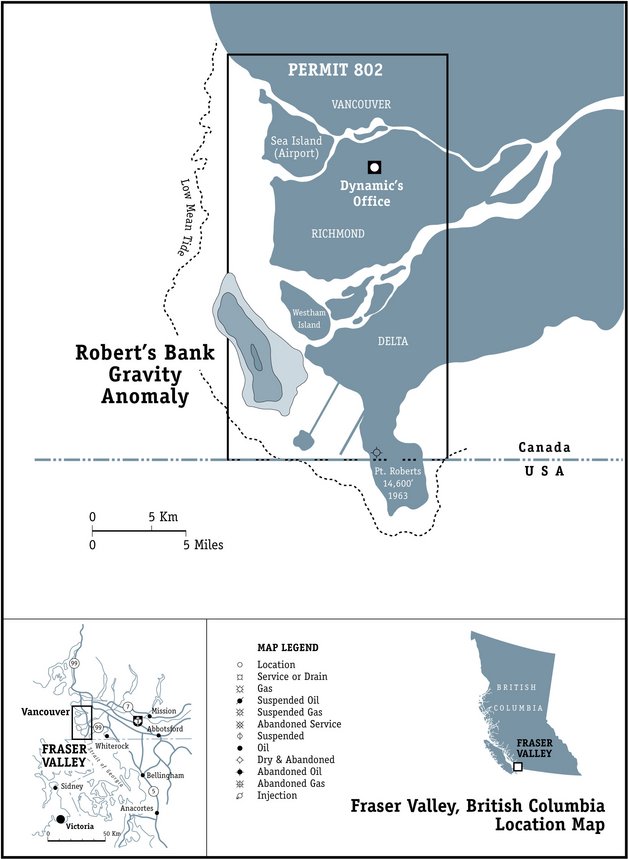

Fraser Valley, British Columbia

Permit 802, located in the southwestern area of the Province of British Columbia, includes all petroleum and natural gas rights onshore in an area known as the Fraser Valley and in adjacent offshore area. Although structural control is limited, government gravity and proprietary on-shore seismic data support the presence of a large structural feature approximately nineteen square kilometers in area lying just offshore within the boundaries of the Permit.

Fiscal 2002 Project Status

We were inactive in the Fraser Valley during fiscal 2002. Under a joint venture agreement with Conoco Canada Limited, we continue to own a 33% working interest in approximately 54,332 gross undeveloped acres (18,109 net) of onshore and offshore petroleum and natural gas rights associated with Permit 802, a validated British Columbia Exploration Permit.

While commercial gas is yet to be discovered in this area, we have identified additional drill targets that we believe are prospective for natural gas accumulation.

Presently, areas offshore are subject to a restricted access moratorium for petroleum and natural gas activities. More recently, the British Columbia Government has established a task force to study the possibility of removing this moratorium and has begun the public consultation process. We will continue to monitor any changes in the legislation that may apply to Permit 802 and adjacent areas of potential interest.

Other producing properties outside of St. Albert, Peavey/Morinville and Halkirk comprise 10,412 gross acres and 8,987 net acres for a weighted average working interest of 86%. They produced 29 mboe of natural gas and oil during fiscal 2002, representing approximately 2% of our total fiscal 2002 production. This production was generated from six properties: Alexander; Elmore; Rapdan; Simonette; Stanmore and Westlock. The majority of this production was natural gas from Stanmore and Westlock, two single-well properties in Alberta.

Reserves of Natural Gas, Natural Gas Liquids and Oil

Our independent reserve estimates effective April 1 for each of the last three fiscal years prepared by Status Engineering Associates of Calgary, Alberta (“Status”) are shown in the following tables:

| Petroleum and natural gas reserves | | |

| (Before royalties) | Natural Gas | NGL’s / Oil | Equivalent * |

Fiscal 2002 | (mmcf)

| (mbbls) | (mboe)

|

| Proved producing | 31,099 | 1,908 | 7,091 |

| Proved non-producing | 8,972 | 229 | 1,724 |

| Probable (50% risked) | 4,669 | 321 | 1,099 |

| Total Fiscal 2002 | 44,740 | 2,458 | 9,915 |

Fiscal 2001

Proved producing | 30,885 | 1,387 | 6,535 |

| Proved non-producing | 8,586 | 127 | 1,558 |

| Probable (50% risked) | 6,326 | 27 | 1,081 |

| Total Fiscal 2001 | 45,797 | 1,541 | 9,174 |

Increase (decrease) % (net of production) from 2001 to 2002 | (2%) | 60% | 8% |

Fiscal 2000

Proved producing | 29,243 | 1,758 | 6,632 |

| Proved non-producing | 11,518 | 448 | 2,368 |

| Probable (50% risked) | 4,004 | 11 | 678 |

| Total Fiscal 2000 | 44,765 | 2,217 | 9,678 |

Increase (decrease) % (net of production) from 2000 to 2001 | 2% | (31)% | (5)% |

* Natural gas is converted into barrels of oil equivalent on the basis of 6 mcf = 1 barrel.

During fiscal 2002, our estimated reserves of natural gas decreased by 1,057 mmcf or 2% to 44,740 mmcf from fiscal 2001. Factors contributing to this decrease were our total annual production, and a downward revision in the previous reserve estimates made on the Peavey/Morinville property. These factors were largely offset by new reserves added through the acquisition of additional working interests at St. Albert.

Most of the natural gas production at St. Albert contains natural gas liquids, while gas from Peavey/Morinville does not. It is for this reason that estimated reserves of natural gas liquids (“NGL’s”) increased, net of annual production, by 424 mbbls or 29%, to 1,901 mbbls (total NGL’s/oil = 2,458 mbbls) over fiscal 2001.

We produced from six St. Albert oil wells during fiscals 2002 and 2001. The acquisition of additional interests at St. Albert during fiscal 2002 was the principal reason that estimated oil reserves, net of annual production, increased by 493 mbbls or 770%, to 557 mbbls (total NGL’s/oil = 2,458 mbbls) over fiscal 2001.

New extensions and discoveries at St. Albert and Halkirk during fiscal 2002 added 623 mboe to our estimated reserve base, 62% of which was oil and 38% natural gas and natural gas liquids.

On an equivalent basis, our total estimated reserves increased in fiscal 2002 by 741 mboe or 8%, to 9,915 mboe over fiscal 2001.

During fiscal 2001, estimated reserves of natural gas increased (net of annual production) by 2% over fiscal 2000. Of the fiscal 2001 increase in natural gas reserves, most of it was lower in natural gas liquids content than gas reserves of fiscal 2000, which explains the 31% decrease of reserves of natural gas liquids between the two years.

| Petroleum and natural gas reserves reconciliations | |

| | Natural Gas | NGL’s/Oil | Equivalent |

| | (mmcf) | (mbbls) | (mboe) |

| Opening reserves, fiscal 2000 | 44,765 | 2,217 | 9,678 |

| Revisions of Previous Estimates | (2,351) | (497) | (889) |

| Production * | (4,557) | (206) | (965) |

| Extensions and discoveries | 7,940 | 27 | 1,350 |

| Reserves, fiscal 2001 | 45,797 | 1,541 | 9,174 |

| Acquisitions | 12,359 | 804 | 2,864 |

| Revisions of Previous Estimates | (9,185) | (38) | (1,569) |

| Production * | (5,514) | (258) | (1,177) |

| Extensions and discoveries | 1,283 | 409 | 623 |

| Year end reserves, fiscal 2002 | 44,740 | 2,458 | 9,915 |

* For production history of fiscal years 2001 and 2000, see section entitled, “Production Volumes” under Item 5, Operating and

Financial Review and Prospects in this report.

Our net present value (“NPV”) was determined according to the Canadian Provincial Securities Administrators’ National Policy No. 2-B, using estimated constant prices for commodities and associated operating costs. This determination closely aligns with NPV determinations in the U.S., where actual year-end constant prices/costs are used.

Discounted net present value $(000’s) | | | |

| (Before taxes, after royalties) | 0% | 10% | 15% | 20% |

| Proved producing | 87,581 | 59,874 | 52,110 | 46,344 |

| Proved non-producing | 18,242 | 10,608 | 8,513 | 6,984 |

| Total proved | 105,823 | 70,482 | 60,623 | 53,328 |

| Total probable | 10,687 | 6,044 | 4,616 | 3,522 |

| Total proved and probable, fiscal 2002 | 116,510 | 76,526 | 65,239 | 56,850 |

| Total proved and probable, fiscal 2001 | 224,918 | 142,273 | 120,047 | 103,873 |

| Total proved and probable, fiscal 2000 | 84,231 | 54,404 | 46,107 | 39,960 |

In determining the “NPV” at the end of fiscal 2002, Status used a constant estimated natural gas price of $3.77/mcf, based on 1,000 BTU per standard cubic foot. For oil, a constant estimated price of $29.35/barrel was used, based on 40 API oil priced at $30.90 at Edmonton, Alberta. These prices represent Status’ expectations of our weighted average prices achievable over the nine-month period April to December 2002, using contract terms and conditions in existence at our March 31, 2002 fiscal year end. Our actual weighted average prices for the month of March 2002 were $3.24/mcf for natural gas and $33.27/barrel for oil.