UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Cytyc Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Set forth below are the transcript and the presentation made by management of Cytyc at the Needham Biotechnology and Medical Technology Conference on June 14, 2007 at 2:00 p.m. (Eastern).

Cytyc Corporation (CYTC)

The Needham & Company 6th Annual Biotechnology & Medical Technology Conference

June 14, 2007

<<Timothy Adams, Chief Financial Officer>>

I’m Tim Adams, the CFO of Cytyc, thank you for joining us. With me today I have Ilene Moss (Ph), who is going to assist us in the breakout session. So we’re going to save all the tough questions for her. She heads up our Commercial Operations for the surgical business. Before we get started, there are seven pages of disclaimers on forward-looking statements and I would refer you to our 10-Ks and our 10-Qs that are on file. And I promise you I will not take you through all of these pages here. So let me go through these quickly so we can…

So first we’ll talk about our business. I think its important to tell the Cytyc story, as you know, Hologic has made a bid to acquire our company. We announced that probably about a month ago and at the back of the presentation I will share with you some of our thoughts on why we think the merger does make sense. But when you look at the Cytyc story, when we think about our business what we have committed to do is grow this business 20% top line growth, bottom line growth over the next several years.

That growth, we think it’s important that it comes from a diversified base. We will grow organically so we take all the products that we have in-house today. Over the past couple of years they have grown very nicely. We have great products in a lot of different areas in women’s health and we still think there is room for organic growth and I’ll take you through some of that.

We historically have not been a large investor in R&D. We have made a couple of smaller acquisitions in the past year and we’ll touch on a couple of those that have brought new technology into the company where we will invest some additional R&D dollars and provides another leg of growth. And then as you know we have been very acquisitive. We closed two deals ourselves in the first quarter of this year, the acquisition of Adeza Biomedical, which has a great product that we’re very thrilled to have in our diagnostics division. And then also a product that is pre FDA approval called Adiana. We’ll talk a little bit more about those.

So we focus on growing the top line that’s where it starts, but we also think a lot about growing our PBIT margins, which we think is very important. When we gave our guidance for 2007, we would you know show operating leverage out of the business. The revenue this year original guidance says we grow about 100 million and that our PBIT margin would grow a couple of points. So for that incremental revenue that came in the door it has a much higher PBIT yield is what we call it in the base business.

And our CEO, Pat Sullivan, when investors ask him Pat, what keeps you up at night? And he really talks about people in process to really grow this business overtime. He knows he has to have the right people on board and we’ve made a lot of hires recently of some folks and Tony Kingsley, who is a newcomer to Cytyc from about a year ago is also with us today. He is the President of our diagnostic products division.

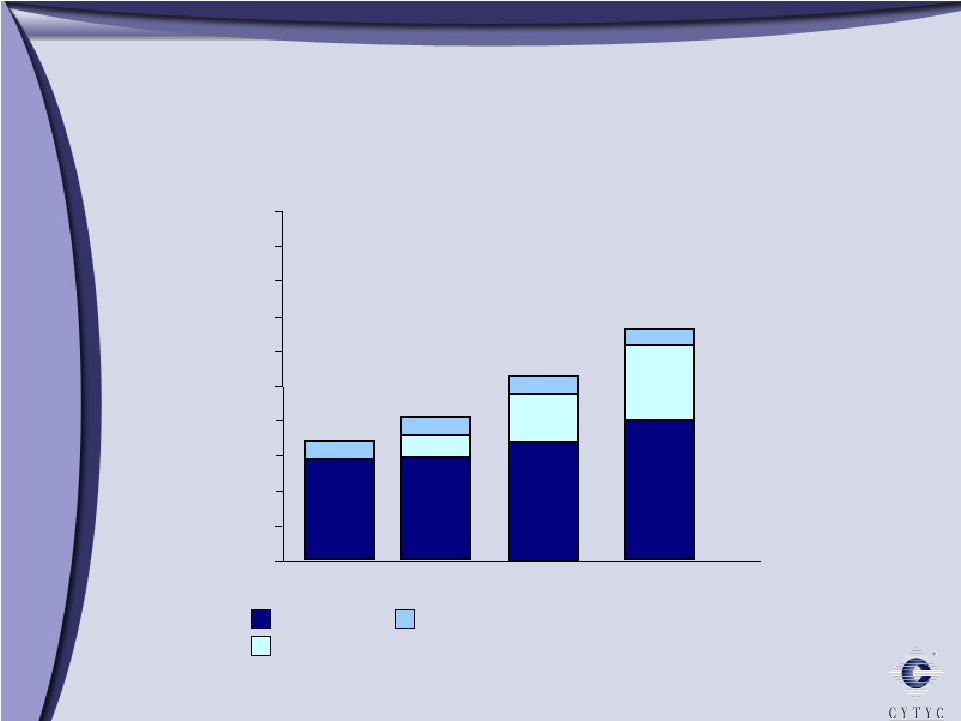

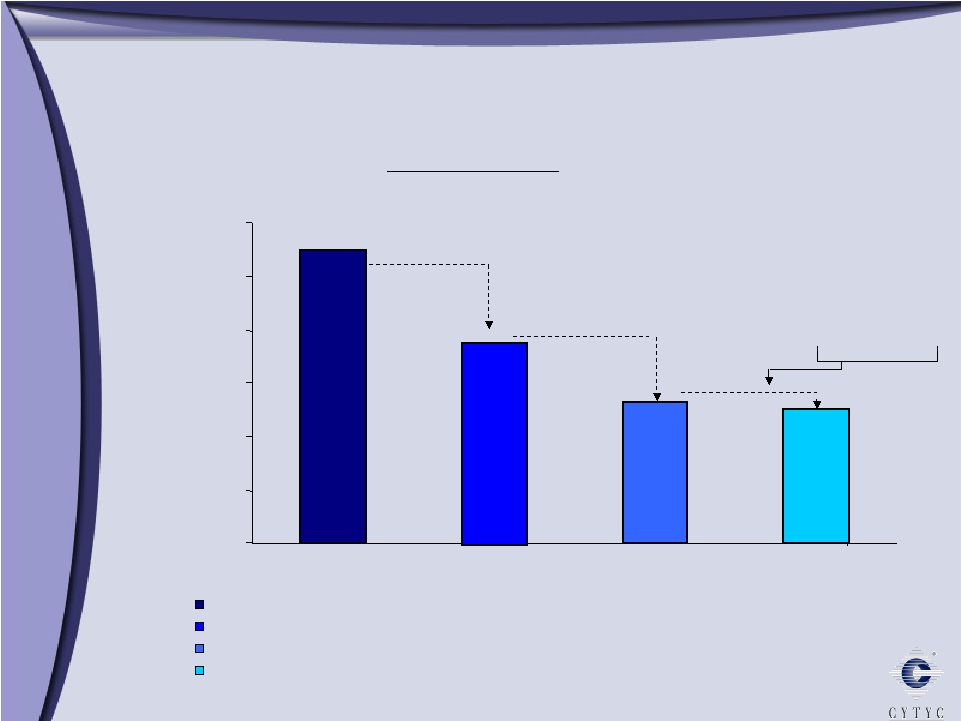

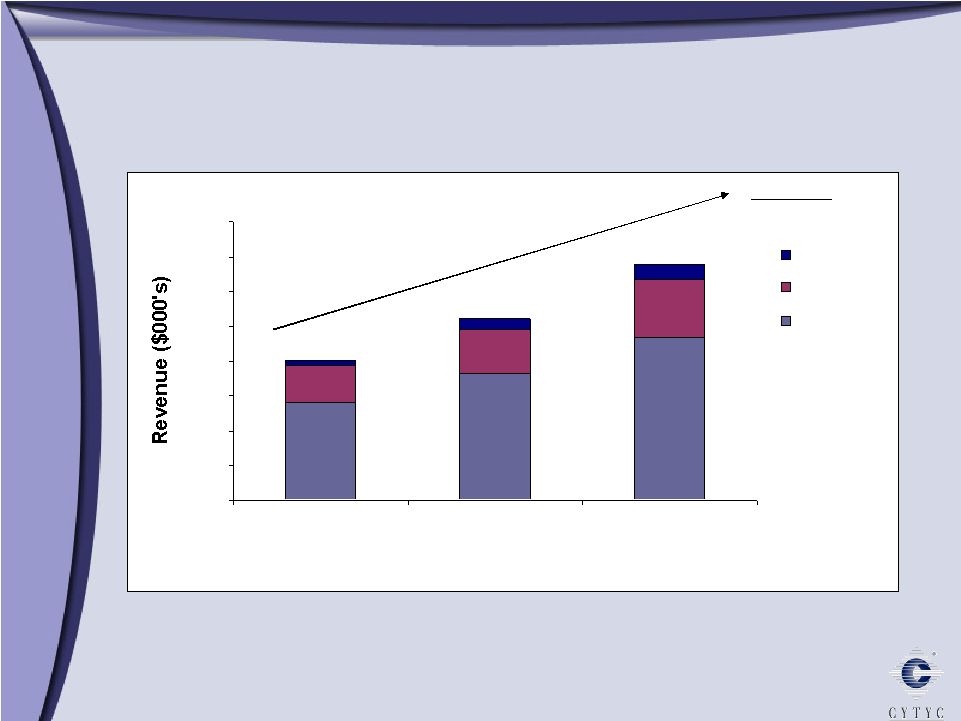

So Cytyc story I think is a great one. When you look at our track record of growing, we’ve grown about $100 million a year over the past few years. If we go back to 2003, the knock on Cytyc from Wall Street was you’re a one product company. We have the ThinPrep Pap Test, great product two-thirds market share in the US, but Pat where you’re going to take this company from here and we did about 10% of our revenue outside the US and that was all in the ThinPrep Pap Test.

If we fast-forward to last year 2006, we’ve doubled the size of the company. But what’s new in this slide here is this light shaded blue bar is our surgical products division. So we have acquired a couple of companies along the way that really got us into the surgical products division. So when you look at us now there are three divisions that we talk about. The domestic surgical products division, we have the NovaSure product, MammoSite and GliaSite. These are all products that we acquired overtime.

The domestic diagnostics products division, this is ThinPrep Pat Test, the Imaging System and a new product Cellient, which was acquired technology that we’re rolling out and the full term FFN test that was the Adeza acquisition. And we have an international development, international business as well, which sells all other products that we sell in the US. So on surgical products, again large market opportunities for the products that we do have.

NovaSure is the flagship product that we have in surgical products. About 175 million in revenue last year when we acquired the company Novacept in 2003 it was about $40 million product. This is a surgical device that is used for treating women with excessive uterine bleeding. It is a condition that is very prevalent. There are many women that are suffering and very few women that are seeking treatment and we have the best product on the market. And I’ll show you comparison with some of the other products in a second here.

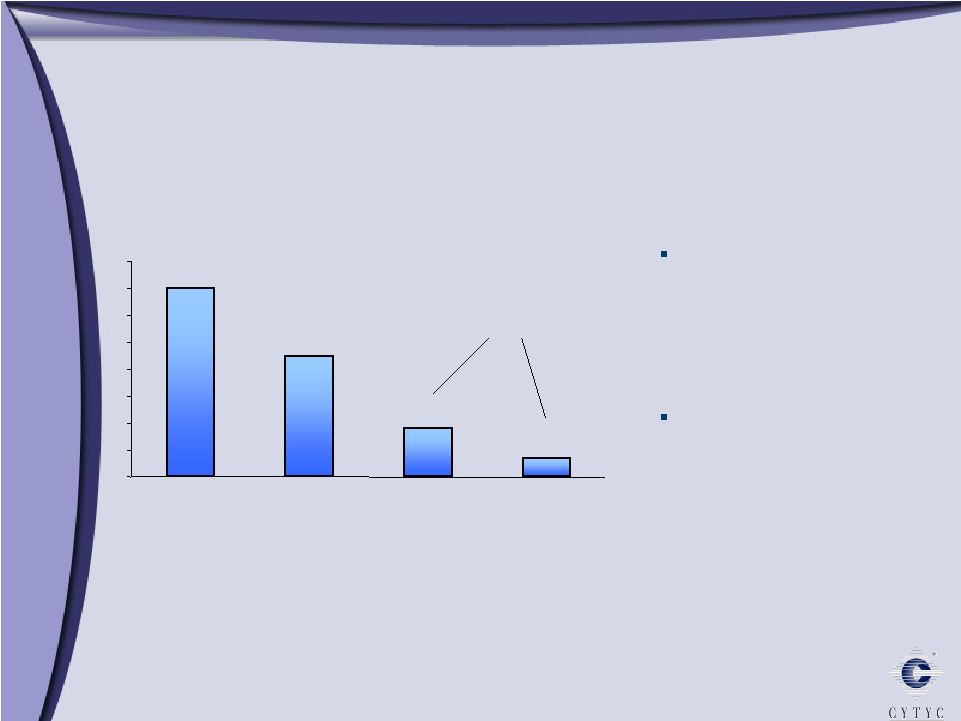

So when we think of the market opportunity on the far left there are 7 million women who suffer from this condition every year. Most of those women, 4.5 million women we call them the silent sufferers; they do nothing about the condition. I have this condition of excessive bleeding, my mother had it, my sister had it. It must be hereditary and its going to go away with menopause, so there is nothing that I can do, which is a sad condition, because there are 2.5 million women who are doing something about it. But most of those women are on hormonal therapy and there have been recent publications that have come out that say hormonal therapy is about 50% effective.

So half of these patients come back to the doc after 90 days or 180 days they were on some form of birth control pill and it didn’t work. The category today what we call the

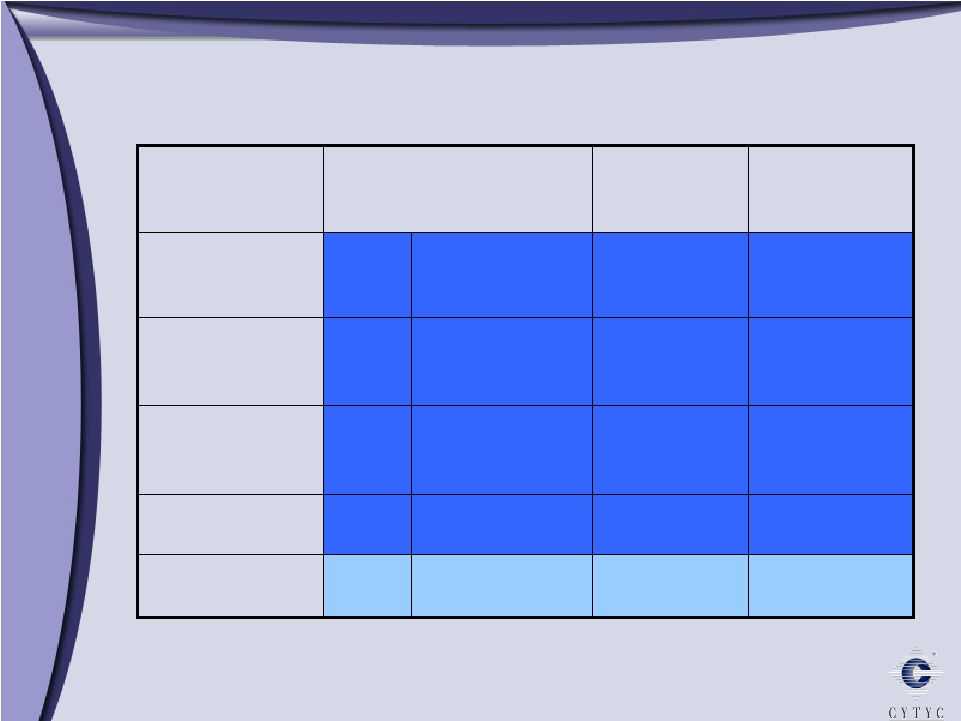

global endometrial ablation category, its about 700,000 women, 700,000 procedures between hysterectomy, dilation and curettage and we’re the leader in that market. What we try to do on this slide is to layout the competition.

So its names that we are all familiar with, J&J, Boston Scientific, American Medical, with each of these competitive products in that first column they require some form of pre-treatment, whether it’s a D&C procedure, which is quite painful or a dose of Lupron which really puts the patient in a pharmacological state of menopause, which is very painful. When you look at procedure time and treatment time, the competition is in the half hour range. Ours is four minutes from start to finish and we use a radio frequency energy to apply for the NovaSure procedure and its 90 seconds.

So it’s the safest, it’s the fastest and easy to use for physicians and again I think part of the reason why we’ve seen the growth over the past couple of years. Reimbursement in all of our products is very favorable in hospital or in the doctors office you can see the reimbursement is very positive. The selling price of NovaSure is about $1000, so it leaves a very healthy margin to the hospital or to the physician.

So we get a lot of questions from Wall Street that says, NovaSure on the far left in the GEA category we’re 62% market share, how much higher can it go? And Pat Sullivan, our CEO will talk about something like 80%. So the Street thinks there is not a lot of growth left in that category. And that’s why we put this slide together. As you go to the second column here and we’re really looking at the women who are actively seeking treatment today.

The 2.5 million women, we only have a 9% share in that category. So the opportunity for us is to get out to the OB/GYN community and educate them on using NovaSure and not thinking about the birth control prescriptions. And then if you go back to all of those who are suffering we have a 3% market share. So we argue that there is a lot of room for NovaSure to continue to grow overtime.

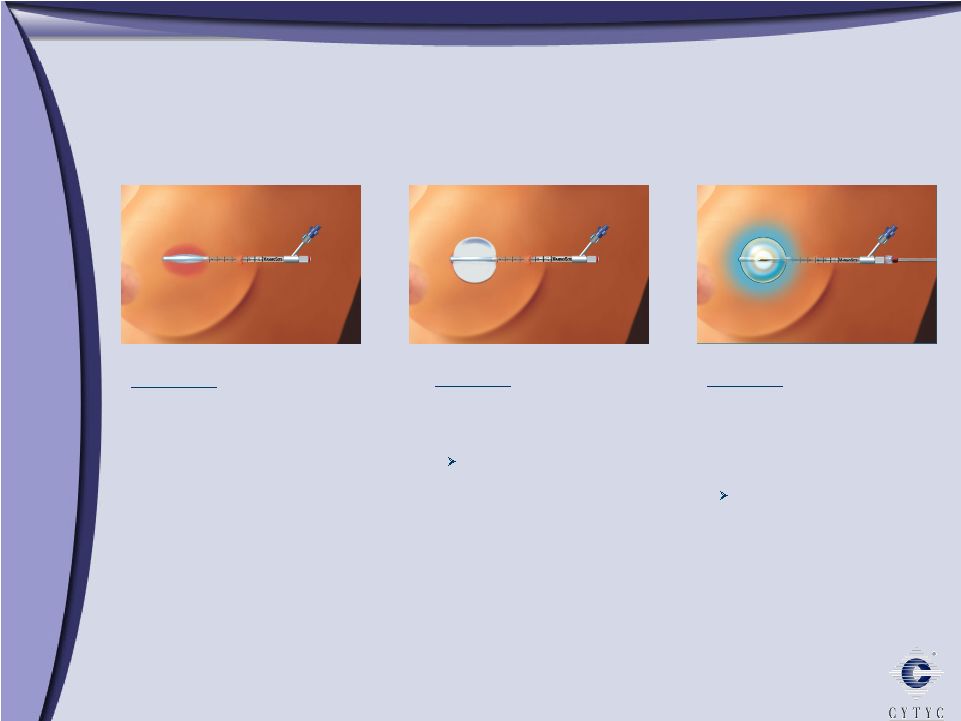

The MammoSite system is a balloon catheter that is used for treating breast cancer patients. If a patient has a lumpectomy, most breast cancer patient should be on radiation therapy whether its whole breast radiation, this is a form of Brachytherapy. We acquired a company called Proxima Therapeutics two years ago and they brought us the MammoSite catheter. The beauty of MammoSite is, this is a catheter that is put into the breast at the site of the incision.

So it applies the radiation therapy to the tumor bed site. So that way you are not irradiating the heart and the lungs and the rest of the body, which happens in the whole breast irradiation. This is a treatment therapy that happens twice a day for five days two 15-minute treatments compared to whole breast irradiation, which is a 30 to 35 day treatment therapy. And so the compliance rates can be very difficult for a patient to go to the cancer centers for 35 consecutive days for treatment with the whole breast irradiation.

This is just a picture of how the balloon is inserted into the breast. Its filled with the saline solution and then the radiation is applied. The MammoSite market opportunity, there are about 275,000 new occurrences of breast cancer a year. That is not the entire opportunity for MammoSite. Over to the far right, its roughly a little bit over a third is the MammoSite opportunity. If the tumor size is too large that patient will not be eligible for MammoSite. If the breast size is too small then we cannot get the clear margins that we need. And there are patients out there still that are having mastectomies versus lumpectomies.

So we take the market opportunity of 275,000 procedures. We break that down to about 126,000 eligible patients, times the average selling price is about a $300 million US market opportunity. Last year, we were just under $30 million of revenue, so we’re about 10% penetrated into this market. The reimbursement for MammoSite is very positive. This is a very busy slide, but the MammoSite reimbursement is about $4,500. This goes to the breast surgeon if the catheter is placed in the breast in office. Down at the bottom we just tried to compare a whole breast radiation for the radiation oncologist and for the facility. It’s somewhat comparable. Now the real headline here is that for the MammoSite for the breast surgeon, for placing the MammoSite catheter, it is $4,500 of reimbursement, which is very, very positive.

One of our acquisitions from Q1 of this year is a privately held company called Adiana. This is a hysteroscopic sterilization device. It is a – what we call a matrix, it looks like a grain of rice that is inserted into the fallopian tube after we have scarred the tube with a radio – with a RF energy. Then it allows the tissue to grow around the matrix and occlude the tube. It is pre-FDA approval. We have two more submissions to the FDA modules that will be submitted this quarter.

We expect about a six-months cycle with the FDA. So we hope this product out in the market early next year. We think it’s a huge market opportunity, about $1 billion. The standard of care today is tubal ligation. We are very excited about this product and one of the advantages of the Cytyc model is we have a sales force of 230 reps that are calling on the OB/GYN’s. This will go to the surgical sales force that is selling NovaSure today. So it’s a product that we’re very excited about and the sales force has been asking for something like this for some time.

So in summary with surgical products, we have large market opportunities. Best in class products in each of their respective categories and reimbursement is very strong. So if I go to the U.S. diagnostics division, this is really where the company was founded almost 20 years ago. We came out with the ThinPrep Pap test. It is the leading cancer screening test in the world, that’s used for cervical cancer screening. We have an imaging system. We acquired full term the Adeza product in Q1 of this year and then something out of technology, we had license coming out of R&D, the Cellient product, which is an automated Cell Block System.

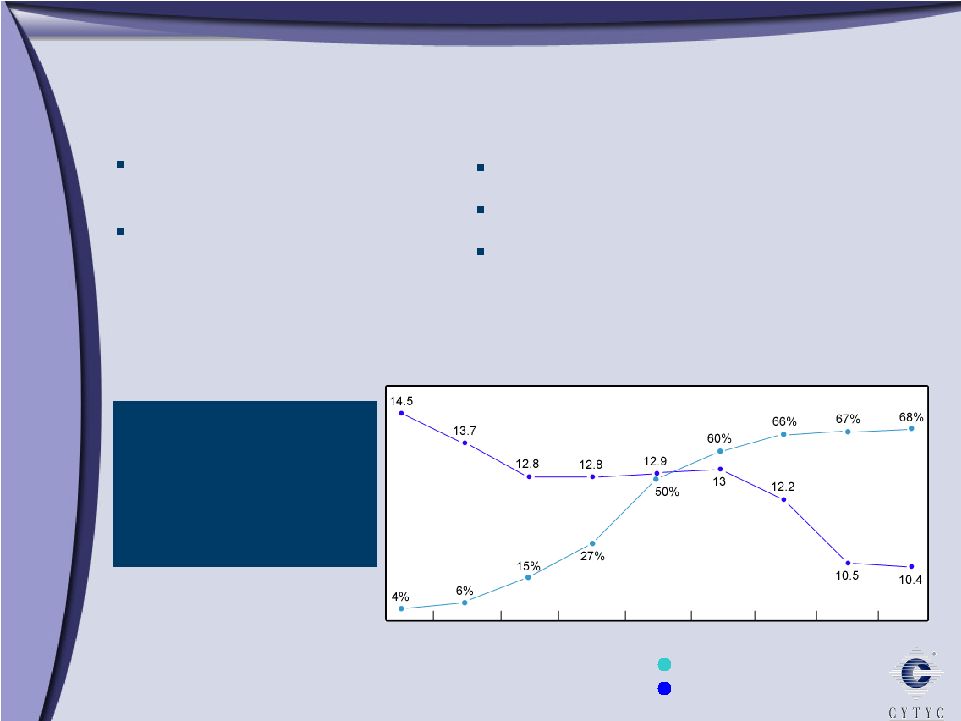

The ThinPrep system, we love this slide, because – and I’ve got my colors straight here. The chart that is growing from the left to the right, this is our market share. So we are

about two-thirds of the market for Pap test screening in the United States. We are the market leader. There are a couple of competitors and there are still some conventional Pap tests. But what’s more interesting about this slide is that the number of incidents of cervical cancer has gone down, as our test has become the market leader.

There is a competitor, TriPath, they were acquired by BD probably about a year ago. We have a superior labeling claim. So argue, we have the best product in the market. You can have HPV testing, chlamydia and gonorrhea, out of our vial. They do not have that FDA approval and we have – the only FDA approved imaging system in the marketplace as well.

This is a picture of the ThinPrep imaging system. And what this is, is computerized assisted screening. What happens in a regular Pap test is a Cytotec, will look at the slides through the barrels of a microscope and it’s – you know you’re looking for a needle in a haystack. You’re trying to find the cells that could be the early signs of cervical cancer. The imaging system through a series of algorithms that our engineers have written does a pre-screening and it’s trying to highlight cells that appear to have the bad DNA if you will.

It then highlights about 20% of a slide that the Cytotec would then review. If the Cytotec does not find any cancerous cells on that slide, they can check it out as a clean slide. So it’s better disease detection and we have some papers that were published back at the ASC meeting in November that we have a significant increase in their high cell grade lesions, which we think is better medicine. But it also allows for higher reimbursement to the laboratory customer and a greater productivity for the lab as well.

This next slide is a picture of the economics, so the CP—column one is the conventional Pap test. The labs really don’t make much money on that and there’s not much of that test being done today. Column two is the ThinPrep Pap test; it’s reimbursed at $28, it shows a nice profit for the lab. But the real message on this slide is the imaging column here, the TIS column. The reimbursement is about $9 greater, so it’s extra revenue for the lab and because of the way that technology works, they can screen twice the number of slides in a given day and it reduces their screening cost, their manual labor by 50%, so there’s an incremental $8 of profit to the laboratories for using the imaging system.

In Q4 of ‘06, we screened up all the ThinPreps. We ship about nine million ThinPrep tests per quarter. That number has been very consistent for the past 13 quarters. This is the Q4 slide we have here. 40% of all ThinPreps were imaged in the fourth quarter last year. In Q1 of this year, the number went up to 46%, so our objective is to get as close to 100% of all ThinPreps being screened. So what it really does for our model is creates a second revenue stream for the ThinPrep franchise.

Cellient; this is technology that we had licensed from one of the Universities and it is an automated way of creating a Cell Block in the laboratory. We think it’s a couple of $100 million worldwide opportunity. The labs are very excited about this. We have a couple of beta products that are out in the market today. It is a very manual process. It’s different lab by lab and we have the opportunity to come out with the only automated system that would be in the marketplace.

Full term, the FFN test. This is the product that we acquired – when we acquired Adeza in Q1 of this year. This is a diagnostic test used for identifying women that could be at risk for a pre-term birth. It is a great product, big market opportunity, 450 million in the U.S. and another 50 or so outside the U.S. The beauty of this product in the Cytyc channel is we had the 230 reps that column, the OB/GYN’s – 100 of those reps call on the Doc in their office. So when we acquired Adeza, we can immediately take this product, give it to the sales force and we are off to the races. So we closed this deal, we owned the majority percentage in March and we closed the deal in April of this year. So we think again it’s a very exciting product.

Gestiva is a drug that Adeza had. It is a progesterone type drug that if a patient is diagnosed that yes, you are going to deliver early, this is the therapeutic opportunity by prescribing this drug. Right now it’s mixed privately in many pharmacies. We have a – an approvable letter from the FDA. There’s a little more work that we have to do. This is probably second half of 2008 before we get this product down to the market, but one that we think is going to be very exciting.

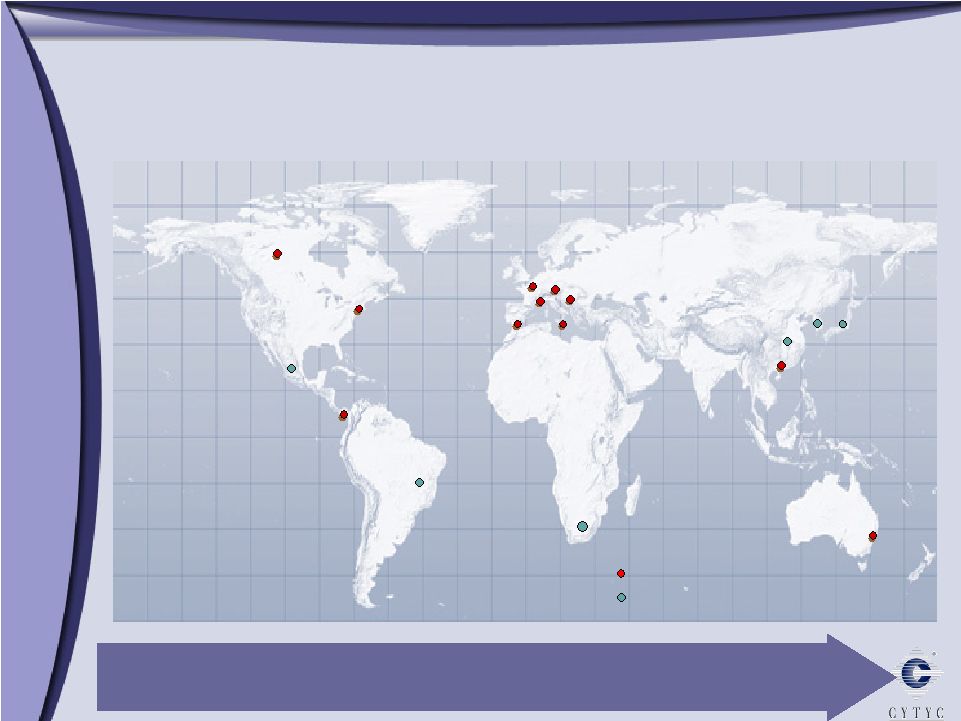

The international business – we operate in Europe, over in Asia, in over 20 countries. The market – the growth opportunity for our business has been 30% a year. That is the guidance that we gave for this year. It is mostly the ThinPrep business. That’s about 90% of our revenue – comes from the diagnostic side of the house. The market opportunity for ThinPrep; it’s about a 114 million tests outside the U.S. In Q1 of this year, on an annualized basis, we did about 10 million tests outside the U.S. So we are barely 10% penetrated in the international market.

So important headline for you is that there is a lot of room for us to grow. In each country you have to market and sell separately in each country, it is very much reimbursement driven. We have reimbursement for the ThinPrep Pap test in the UK. It’s a 4.5 million-test market; we’ll have about two-thirds market share in the UK in the next 12 to 18 months. Our expectation is with reimbursement, there’s no reason why we shouldn’t have two-thirds market share in every country where we do business.

NovaSure that I talked about earlier; this is again a – you know nearly a $200 million market opportunity. We are seeing our most success right now in the UK and Canada. We have a direct presence in the UK. We have about 10 reps that sell this product. We sell through a distributor in Canada and we’re seeing some nice growth in those markets and again it is country by country where we need to roll this out.

So the strategy in international is, we lead with diagnostics. That’s the business we have been in the longest, that is you know creates the franchise in each of these different countries, and then we’re just trying to drive NovaSure and MammoSite usage in other countries as well.

So we announced a merger with Hologic back in May the 20th and we think this one is very exciting. These are two great companies on a standalone basis. We think when we put it together, we have the opportunity to create even a better company. Both companies have a singular focus in women’s health. Both companies are very passionate about improving the lives and saving the lives of women. This will now bring together a company that has a very broad product reach with different call points, there is a lot of leverage with the OB/GYN channel.

The folks that know Hologic very well and that did not know Cytyc, they didn’t understand the OB/GYN channel. Again we have the 230 reps that are calling on the Docs selling a variety of our products and what we hope to be able to do, what we think we’re going to be able to do here is with digital mammography. We’re not going to ask our sales force to go out and sell the Selenia capital equipment. We’re going to talk to the OB/GYN’s, are you, you know recommending to your patients of age, that they should go for a mammogram every year?. You realize, digital mammography is the best in the market, Selenia is the best product, and here is the center that offers Selenia.

So we want to drive awareness in utilization ultimately, and I think that’s part of the story when we’ve been on the road with the Hologic folks is really helping their shareholders understand the power of the OB/GYN channel. The international opportunity, most of our business we run through direct sales and offices that have been setup for many years. We’ve had country managers that have been with our company going on ten years. The Hologic business is more of a distributor model, so again not that our reps are going to be selling the Selenia over in the UK, but we have an office, we have a presence and infrastructure up and running, we can hire some Selenia reps if the decision is made to go direct in those markets and they can be hired right into the business and start selling.

The management team on both sides, we think we have some very good, strong people with a proven track record. We have done a handful of deals, they have done a handful of deals, so I think there’s a lot of good experience on doing deals and on integrating deals overtime. Both businesses have a very strong economic model, we are both generating a lot of positive cash flow, you put it together and I’ll show you some numbers in a second that are very, very strong cash flow numbers and this deal is accretive in year one from the Hologic perspective, this is not a GAAP EPS number, we took out the purchase accounting effect, so it’s similar to a cash EPS.

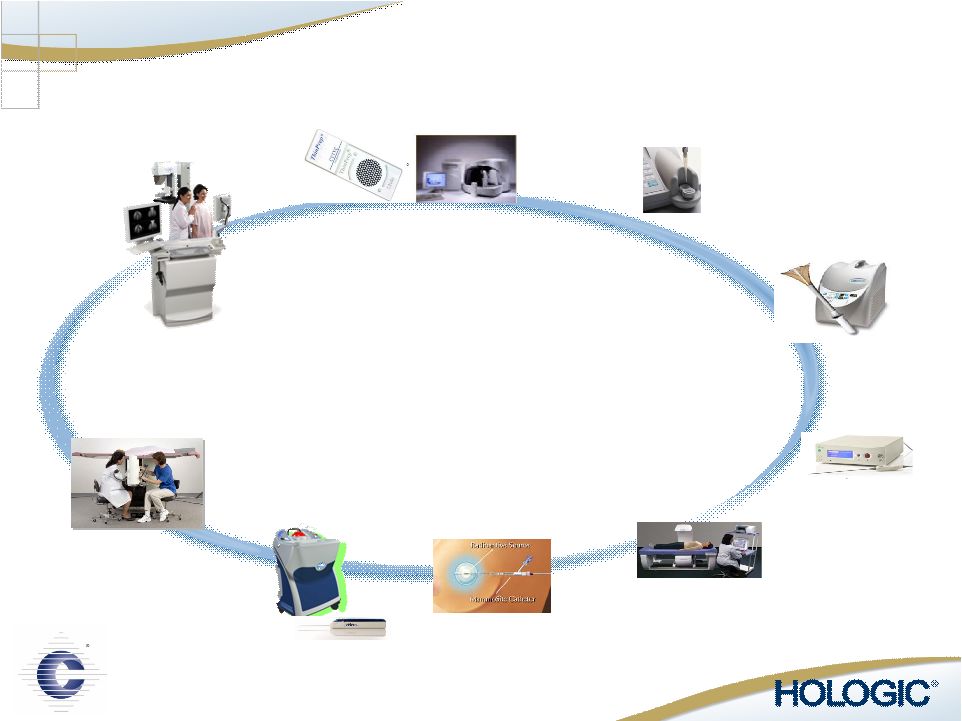

This gives you a picture of this comprehensive suite of product offers, so if you think of when young women go to the doc for the first time and they have their first Pap Test, that is really the first touch point of the products that we have to offer and throughout the life of the patient, whether it’s the Adeza product for a per-term labor, the NovaSure product for excessive uterine bleeding, the digital mammography, we have a suite of products now that touch the women for many years during their life and again the call point of the OB/GYN we think is going to be very powerful here.

What we tried to lay out here is in each of these different market opportunities – unfortunately many women are affected with these different diseases that we ultimately

treat. Most of our products have a number one – is the number one product in market share in it’s category, I think it’s about 90% of the revenue of the combined company comes from being the market leader in those various markets. The market opportunities for each of these products is rather large, I talked about a lot of ours earlier here. Most of the markets are in growth areas, the ThinPrep Pap Test is probably the one that is not a high grower, osteoporosis is not a high grower, but there are many other products in the combined company that are in fast growing market opportunities.

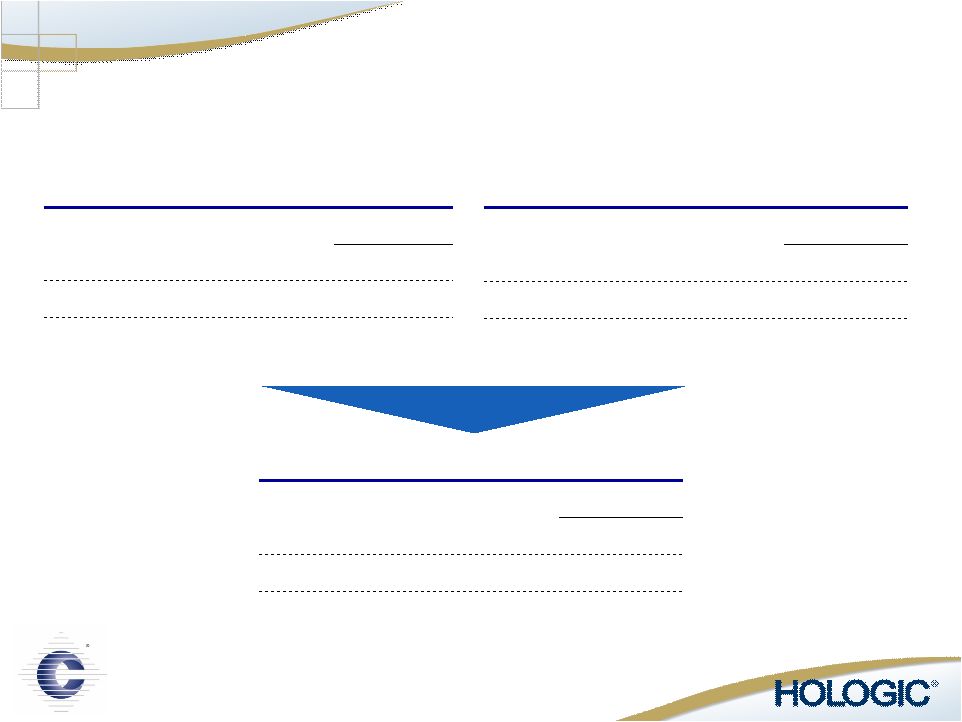

This next page is a little busy, you’ve probably read and seen all of this, Hologic is acquiring us and they are going to give us about two-thirds of the consideration in their stock and about a third in cash, it’s a $6 billion deal. The Cytyc shareholders will own just a little bit over a half of Hologic and at the end of the day, Pat Sullivan our CEO and Chairman will be the Executive Chairman of the Board; Jack Cumming the CEO of Hologic will be the CEO of Hologic. The Board split is six to five, six to Hologic and just customary approvals that we need to go through.

There is a commitment letter from Goldman Sachs to finance the $2.3 billion in debt that’s required and the debt structure is probably half equity linked the permanent financing and the other half is in the pre-payable term loan type feature. And we expect that the transaction will close sometime in the third quarter of this year. Both sides are very focused on running our respective businesses, we both have a quarter to make and we’re working on the S-4, well which we hope to have filed very soon here.

From a financial perspective this deal make a lot of sense, I’ve talked about, the breadth of products, new platforms that are being created, many different call points in women’s healthcare. We think the diversification of the revenue base is going to be very broad, very interesting and it really gives us scale in this business. We pulled some numbers together and the cash flow is very powerful, it’s just under $450 million of EBITDA. If you take Q1 and you annualize that there are revenue and cost synergies that we have talked about, we said, $75 million of revenue opportunities, revenue synergies and $25 million to $30 million of cost synergies effective in year two, year three.

The transaction is accretive by $0.10 and there should be a rapid repayment of the debt. So half of this debt is just per-payable term debt and the expectation due to the cash flow is that it’s repaid in three years time. So very powerful model, this is a picture of Hologic on the left, what’s interesting here is both companies are about the same size. If you take calendar Q1 of this year, you annualize that, we’re both over $700 million in revenue, we both have attractive gross margins, powerful EBITDA. Combined company just by adding us together is over $1.4 billion in revenue, 60% gross margin and EBITDA of just under 450.

The guidance that was shared with the Street for 2008, Hologic is a 9/30 year-end, so they’re approaching their ‘07 year-end pretty soon here. $1 billion, in excess of $1.7 billion in revenue, adjusted EPS again taking the purchasing accounting out 2.35 to 2.30 – to 2.40 per share and the gross margin of the combined company at 65%, both Jack Cumming and Pat have been very positive, very optimistic about the deal and they said we’re going to keep growing this combined company 20%, top line and bottom line overtime and again now you’re taking about a base of $1.5 billion of revenue growing at that kind of clip.

So we think a very powerful business when it’s all pulled together, it is complementary in nature, we do not overlap. And it’s really probably in the breast healthcare where our sales forces start to come together, but we think that’s going to be an opportunity for our reps to really better understand the Suros biopsy product to help out with digital mammography and we think it’s going to be a great opportunity for the two companies together, so – and I think we are running out of time.

A Leading Provider of Innovative Medical Technology |

Disclaimer Regarding Forward-Looking Statements Forward-Looking Statements Regarding Cytyc Investors are cautioned that statements in this presentation which are not strictly historical statements, including, without limitation, Cytyc's future financial condition, operating results and economic performance, and management's expectations regarding key customer relationships, future growth opportunities, product acceptance and business strategy, constitute forward-looking statements. These statements are based on current expectations, forecasts and assumptions of Cytyc that are subject to risks and uncertainties, which could cause actual outcomes and results to differ materially from those statements. Risks and uncertainties include, among others, the successful integration of acquired businesses into Cytyc's business, dependence on key personnel and customers as well as reliance on proprietary technology, uncertainty of product development efforts and timelines, management of growth, product diversification, and organizational change, entry into new market segments domestically, such as pharmaceuticals, and new markets internationally, risks associated with litigation, competition and competitive pricing pressures, risks associated with the FDA regulatory approval processes and healthcare reimbursement policies in the United States and abroad, introduction of technologies that are disruptive to Cytyc's business and operations, the potential consequences of the restatement of Cytyc's |

Disclaimer Regarding Forward-Looking Statements (continued) financial statements for the period 1996 through 2002, relating to certain employee stock option exercises, including the impact of the expected any regulatory review or litigation relating to such matters, the impact of new accounting requirements and governmental rules and regulations, as well as other risks detailed in Cytyc's filings with the SEC, including those under the heading "Risk Factors" in Cytyc's 2006 Annual Report on Form 10-K/A and Adeza's 2006 Annual Report on Form 10-K, all as filed with the SEC. Cytyc cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they were made. Cytyc disclaims any obligation to publicly update or revise any such statements to reflect any change in its expectations or events, conditions, or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. |

Disclaimer Regarding Forward-Looking Statements (continued) Forward-Looking Statements Regarding the Proposed Hologic-Cytyc Transaction This presentation also includes forward-looking statements about the timing of the completion of the transaction, the anticipated benefits of the business combination transaction involving Hologic and Cytyc, including future financial and operating results, the expected permanent financing for the transaction, the combined company's plans, objectives, expectations and intentions and other statements that are not historical facts. Hologic and Cytyc caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. These include risks and uncertainties relating to: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the parties may be unable to complete the transaction because conditions to the closing of the transaction may not be satisfied; the risk that the businesses will not be integrated successfully; the transaction may involve unexpected costs or unexpected liabilities; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues; the need to develop new products and adapt to |

Disclaimer Regarding Forward-Looking Statements (continued) significant technological change; implementation of strategies for improving internal growth; use and protection of intellectual property; dependence on customers' capital spending policies and government funding policies, including third-party reimbursement; realization of potential future savings from new productivity initiatives; general worldwide economic conditions and related uncertainties; future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors; and the effect of exchange rate fluctuations on international operations. In addition, the transaction will require the combined company to obtain significant financing. While Hologic has obtained a commitment to obtain such financing, including a bridge to the permanent financing contemplated in the presentation, the combined company’s liquidity and results of operations could be materially adversely affected if such financing is not available on favorable terms. Moreover, the substantial leverage resulting from such financing will subject the combined company’s business to additional risks and uncertainties. The risks included above are not exhaustive. The annual reports on Form 10-K, the quarterly reports on Form 10-Q, current reports on Form 8-K and other documents Hologic and Cytyc have filed with the SEC contain additional factors that could impact the combined company’s businesses and financial performance. The parties expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in the parties’ expectations or any change in events, conditions or circumstances on which any such statement is based. |

Important Information for Investors and Stockholders Hologic and Cytyc will file a joint proxy statement/prospectus with the SEC in connection with the proposed merger. HOLOGIC AND CYTYC URGE INVESTORS AND STOCKHOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY EITHER PARTY WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders will be able to obtain the joint proxy statement/prospectus and other documents filed with the SEC free of charge at the website maintained by the SEC at www.sec.gov. In addition, documents filed with the SEC by Hologic will be available free of charge on the investor relations portion of the Hologic website at www.hologic.com. Documents filed with the SEC by Cytyc will be available free of charge on the investor relations portion of the Cytyc website at www.cytyc.com. |

Participants in the Solicitation Hologic, and certain of its directors and executive officers, may be deemed participants in the solicitation of proxies from the stockholders of Hologic in connection with the merger. The names of Hologic’s directors and executive officers and a description of their interests in Hologic are set forth in the proxy statement for Hologic’s 2006 annual meeting of stockholders, which was filed with the SEC on January 25, 2007. Cytyc, and certain of its directors and executive officers, may be deemed to be participants in the solicitation of proxies from its stockholders in connection with the merger. The names of Cytyc’s directors and executive officers and a description of their interests in Cytyc is set forth in Cytyc’s Annual Report on Form 10-K/A for the fiscal year ended December 31, 2006, which was filed with the SEC on April 30, 2007. Investors and stockholders can obtain more detailed information regarding the direct and indirect interests of Hologic’s and Cytyc’s directors and executive officers in the merger by reading the definitive joint proxy statement/prospectus when it becomes available. |

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use the non-GAAP financial measures "adjusted EPS" and “EBITDA”. Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and tax provisions/benefits related thereto. EBITDA is defined as net earnings (loss) before interest, taxes, depreciation and amortization expense. Neither adjusted EPS nor EBITDA is a measure of operating performance under GAAP. We believe that the use of these non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts. When analyzing our operating performance, investors should not consider these non-GAAP measures as a substitute for net income prepared in accordance with GAAP. |

Growth Objectives and Strategy Growth Objectives and Strategy Deliver 20+% long-term earnings growth through: Global organic growth across divisions Internal research and development Strategic acquisitions and partnerships Grow existing businesses resulting in continued revenue growth and improved PBIT margins Enhance organizational bench strength by attracting, motivating, and retaining top talent to support business needs |

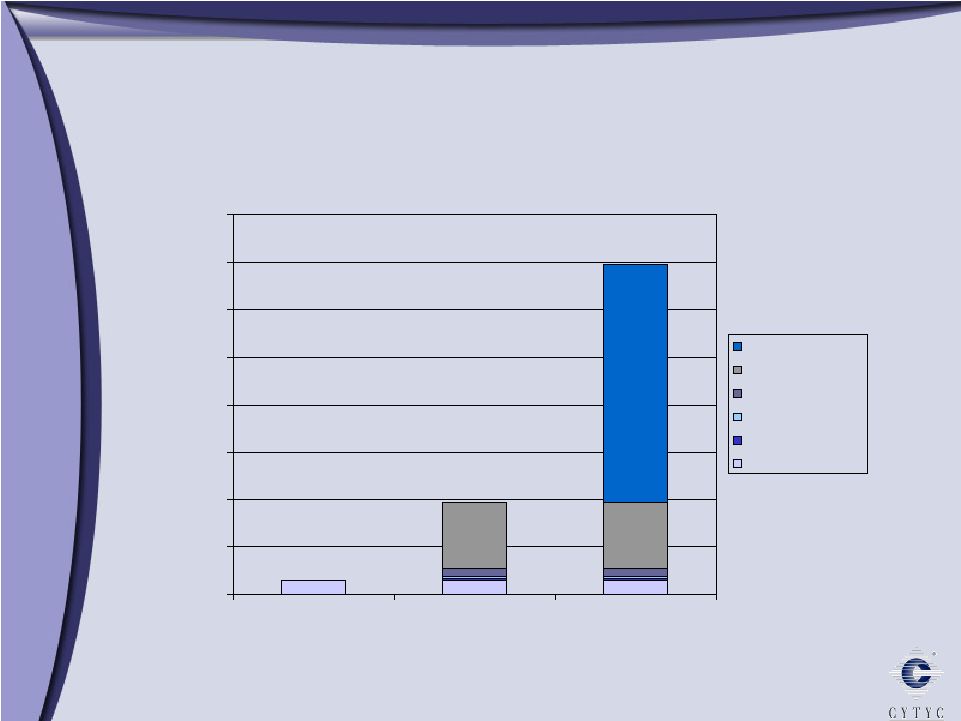

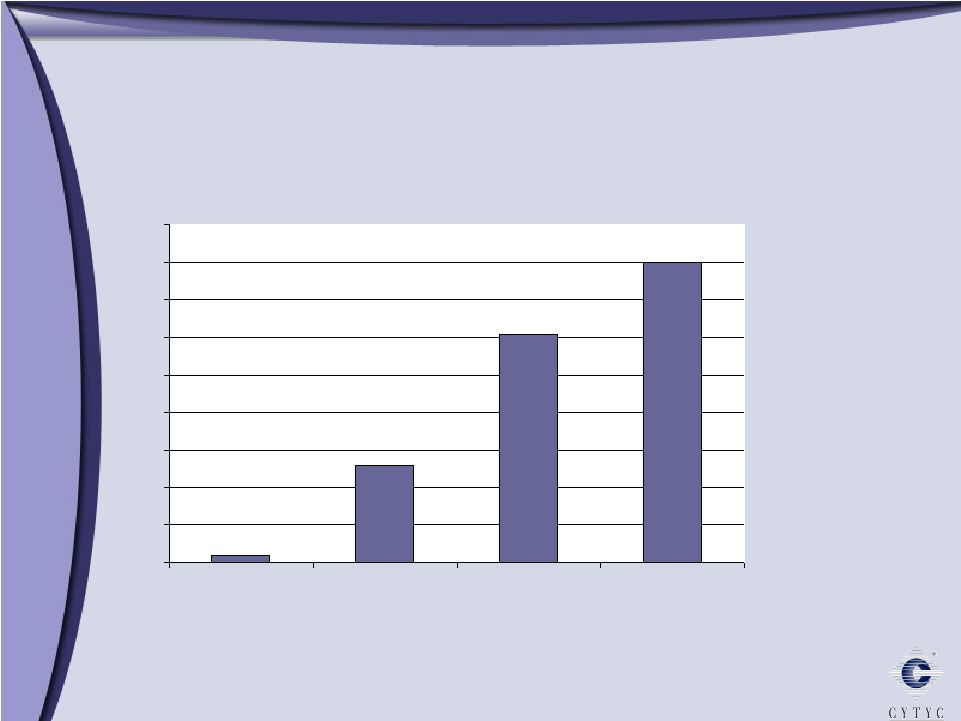

0 100 200 300 400 500 600 700 800 900 1 Billion Growth through Diversification Growth through Diversification 2003 2005 2006 Diagnostic International Surgical $303 Millions $ $508 $608 10% 90% 61% 29% 10% 11% 34% 55% 73% 16% 11% 2004 $394 |

Corporate Structure Corporate Structure Domestic Surgical Products Division NovaSure ® Endometrial Ablation MammoSite ® Radiation Therapy Gliasite ® System Domestic Diagnostic Products Division ThinPrep ® Pap Test ThinPrep ® Imaging System Cellient ™ Automated Cell Block System Full Term ® : The Fetal Fibronectin Test International Division Cytyc Development Company |

A Leading Provider of Innovative Medical Technology Surgical Products |

Domestic Surgical Products Domestic Surgical Products Changing medical practice with innovative medical technology NovaSure Endometrial Ablation • Treatment for excessive menstrual bleeding: $2.5 B market opportunity MammoSite Radiation Therapy • Treatment of early-stage breast cancer: $300 M opportunity GliaSite System • Post-surgical radiation therapy for malignant brain tumors: $100 M market opportunity |

NovaSure Procedure NovaSure Procedure 4-minute, outpatient procedure No pretreatment drugs required Conscious sedation Recovery = 1 hour Highest success rates Reimbursement established nationwide |

Endometrial Ablation: A Large and Underserved Market Endometrial Ablation: A Large and Underserved Market Estimates per Cytyc Corporation *All age groups Hysterectomy, D&C, GEA 0 1 2 3 4 5 6 7 8 Total Suffering Silent Sufferers Hormonal Therapy 7m 4.5m 1.8m 0.7m 1 in 5 women suffers from Abnormal Uterine Bleeding 2.5 million women seek treatment* In Millions 2.5 m |

NovaSure’s Competitive Advantage 1.4 4.2 None No NovaSure RadioFrequency 3.5 39.3 Lupron Yes Microsulis Microwave 10-12 24 Lupron Single Yes AMS Her Option Cryotherapy 8 26.4 Lupron Double Yes BSC HTA Hot water 10 27.4 D&C Yes J&J Therma Choice Hot water Treatment Time* Procedure Time* Pre-Treatment Modality Product *minutes |

Favorable Reimbursement: 2007 Favorable Reimbursement: 2007 CPT Code 58563: Endometrial Ablation ~ $1,185 $336 ~ $1,090 Margin ~ $1,000 0 ~ $1,000 Product cost $2,185 $336 $2,090 Reimbursement M.D. Institution M.D. Office Outpatient Hospital (Illustrative) |

GEA Market Opportunity 2006 NovaSure Market Share and Total Procedure Potential GEA Market Opportunity 2006 NovaSure Market Share and Total Procedure Potential NS Share = 62%* NS Share = 9% NS Share = 3% * Note:US NovaSure dollar share equals 69% 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 2006 - Current GEA 2006- Treatment Pathway 2006 - Silent Sufferers Silent Sufferers Hormones Hysterectomy Rollerball D&C GEA |

MammoSite Radiation Therapy MammoSite Radiation Therapy Creating new standard of care Deliver optimal dose of radiation to tissue at highest risk of cancer recurrence Minimize damage to healthy tissue Expanding data supports partial breast radiation and MammoSite Clinical trial (5-year data; 43 patients): 0 recurrences ASBS registry (2-year data; 1,400 patients) MammoSite RTS afterloader accessories MammoSite RTS applicator |

MammoSite Procedure MammoSite Procedure STEP 1: After tumor removal, uninflated balloon placed in the tumor resection cavity STEP 2: Fill balloon with saline solution to create a symmetric sphere Allows for calculation of the radiation treatment STEP 3: Deliver radiation by placing a radioactive seed into the catheter using commercially available afterloaders Two 15-minute procedures per day for 5 days |

0 50,000 100,000 150,000 200,000 250,000 300,000 MammoSite Market Opportunity 275,221 189,490 131,695 126,002 MammoSite Primary U.S. Cases of Breast Cancer and DCIS (.4% Incidence, 40+) Patients Eligible for Breast Conserving Therapy (Excludes >3cm, Size A) Patients Receiving Breast Conserving Therapy (70%) Patients Eligible for Mammosite (Excludes women <45, Pathology) Market Opportunity Large tumors 70% elect BCT Surgical margins or lymph node involvement |

MammoSite Reimbursement: 2007 MammoSite Reimbursement: 2007 5-6 days 30-35 days Treatment Time $12,660 $10,545 Professional Fee: Free- standing Center (radiation oncologist) $ 1,705 $ 2,565 Professional Fee Hospital (radiation oncologist) $12,445 $ 8,725 Hospital Facility Fee MammoSite Radiation Whole Breast Radiation Radiation Delivery $ 4,490 NA Office (breast surgeon/ radiation oncologist $ 190 $90 Hospital (breast surgeon) Separate Procedure At Time of Lumpectomy Placement of Catheter Illustrative 19297 19296 |

Hysteroscopic Sterilization -- Adiana Hysteroscopic Sterilization -- Adiana Alternative to tubal ligation Radiofrequency generator One-time-use delivery catheter FDA process underway Complementary to NovaSure Endometrial Ablation System $1 billion U.S. market opportunity Reimbursement established |

Cytyc Surgical Products - Summary Cytyc Surgical Products - Summary Changing medical practice with products that address potential US markets > $5B NovaSure best-in-class product addressing a $2.5B market NovaSure Elective use > $1B MammoSite creating a new standard of care with $300MM US opportunity Hysteroscopic sterilization – Adiana • $1B U.S. market opportunity |

A Leading Provider of Innovative Medical Technology Diagnostic Products |

Domestic Diagnostic Products Domestic Diagnostic Products ThinPrep ® Pap Test ThinPrep ® Imaging System FullTerm ® : The Fetal Fibronectin Test Cellient ™ Automated Cell Block System |

ThinPrep System Advantages ThinPrep System Advantages Superiority to Conventional Pap ThinPrep Imaging System ThinPrep Pap Test Market Share (%) Estimated New Cases (1,000) HPV FDA approved CT/NG FDA approved Glandular claim Since ThinPrep introduction in 1996, estimated number of cervical cancer cases in the US decreased 28% 1997 1998 1999 2000 2001 2002 2003 2004 2005 |

ThinPrep Imaging System ThinPrep Imaging System Advanced computerized imaging Dual screening approach Improves accuracy Improves lab economics Increases reimbursement Decreases labor costs Improves workflow Protects ThinPrep market share Significant increase in HSIL |

ThinPrep Economic Advantage ~$8.00 ~$20.00 $12.00 $ 3.70 Profit ~$1.00 ~$17.00 $16.00 $11.00 Total Cost 5-6 5-6 0.00 0.00 Imaging Fee 0.00 7.00 7.00 2.00 Supplies, etc. (4.50) 4.50 9.00 9.00 Manual Review Costs $9.00 $37.00 $28.00 $14.70 Reimbursement TIS TPPT CP Illustrative |

ThinPrep Imaging System: Becoming the Standard of Care ThinPrep Imaging System: Becoming the Standard of Care Notes: Imaging started in Q2 of 2003 Percent Slides Imaged 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% Q4 2003 Q4 2004 Q4 2005 Q4 2006 1% 13% 30% 40% |

Cellient ™ Automated Cell Block System Cellient ™ Automated Cell Block System Allows individual cells or small tissue samples (<2mm diameter) to be processed for histological examination Eliminates operator dependence Provides standardized, consistent preparations in less than one hour, and ensures sample chain of custody Market launch: Second half 2007 Sold by existing lab sales force Market opportunity up to $200 million worldwide |

Full Term: The Fetal Fibronectin Test Full Term: The Fetal Fibronectin Test Identifies women at risk of preterm birth FDA approved Reimbursement established Market opportunity: $500 million worldwide |

Gestiva Gestiva Drug candidate for prevension of preterm birth Orphan drug status Approvable letter October 2006 Market opportunity: $100 million worldwide |

A Leading Provider of Innovative Medical Technology International |

Marlborough Cytyc International – Driving Growth Worldwide Legend Australia UK Iberia France Italy Germany Switzerland Hong Kong Costa Rica China Mexico Brazil South Africa So. Korea Company presence Key distributors Japan Operating in over 20 countries Canada |

International Revenue 2004 – 2006 International Revenue 2004 – 2006 0 10000 20000 30000 40000 50000 60000 70000 80000 2004 2005 2006 ROW AsiaPac Europe Total CAGR 30% $40m $52m $68m |

Europe 44 Asia - Pacific 48 Rest of World 22 Total: 114 $500+ million annual revenue opportunity Additional upside from Imager Tests (Millions) Global ThinPrep Market Opportunity Global ThinPrep Market Opportunity Less than 10% market penetration worldwide |

$130+ million annual revenue opportunity EA Procedures (Thousands) Large Market Opportunity for Large Market Opportunity for NovaSure NovaSure Less than 5% market penetration world wide Europe 140 Asia - Pacific 22 Rest of World 32 Total: 194 |

Cytyc International Summary Cytyc International Summary Pursue 3 key growth levers Capture and solidify diagnostic share Expand Gyn surgery share and market size Lay foundation for MammoSite growth Strengthen our infrastructure to better serve customers and capture market opportunities |

Creating a Global Leader in Women’s Healthcare Continuing a legacy of leading technology, innovation and rapid growth May 21, 2007 |

Expanded Product Portfolio Comprehensive Sales Coverage Ability to Leverage OB/GYN Channel Significant Cross-Selling Synergies Enhanced International Presence Creating a Global Leader in Women’s Healthcare Market Share Leader in Major Product Lines Proven Management Team Significant Cash Flow Generation Accretive to Adjusted EPS 1 Within the First Full Year After Close Strategic Rationale Combined Strengths 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

MultiCare Stereotactic Biopsy Discovery Osteoporosis Screening Selenia Breast Cancer Screening MammoSite Radiation Therapy ThinPrep Pap Test & Imaging System Cervical Cancer Screening NovaSure Endometrial Ablation Adiana Contraception FullTerm - Adeza Preterm Labor Best-in-Class Solutions in Women’s Healthcare Suros Biopsy Systems Comprehensive Women’s Healthcare Platform |

Solutions for Major Women’s Healthcare Issues Helica Unpenetrated 1 in 3 Gestiva International ThinPrep Imaging System International Tomosynthesis Suros Celero Additional Opportunities Adiana FullTerm Fetal Fibronectin Discovery Sahara NovaSure ThinPrep Pap Test Selenia MultiCare Suros ATEC MammoSite Combined Offering High Medium Low High Medium High Market Growth $100M $1B+ $400M $110M $2.5B+ $550M $1B U.S. Market Size 1 in 4 1 in 2 Pregnancies 1 in 2 1 in 5 1 in 138 1 in 8 U.S. Women Affected Endometriosis Permanent Contraception Preterm Labor Osteoporosis Menorrhagia Cervical Cancer Breast Cancer International NM NM #1 #1 #1 #1 #1 U.S. Market Position International International International International Source: Market research and company estimates. |

Permanent financing anticipated to be combination of pre-payable term loan and equity-linked securities Financing: Hologic, Inc. (NASDAQ: HOLX), continue Cytyc name Name of NewCo: Third Quarter of CY2007 Timing to Close: Shareholders of both companies, customary closing conditions and HSR anti-trust clearance Customary Approvals: Chief Executive Officer: Jack Cumming Management: Chairman of the Board: Patrick Sullivan Hologic: 6 Directors Cytyc: 5 Directors Board Composition: Hologic: 45% Cytyc: 55% Pro Forma Ownership: 0.520 Hologic shares and $16.50 for each Cytyc share valued at $46.46 per share or 33% premium, for approximate total consideration of $2.2B in cash and $4.0B in stock (as of announcement date) Purchase Consideration: Transaction Overview |

Multiple platforms to enhance top and bottom line growth Increased scale through diversification of revenue and strong margin profile Enhanced cash flow; LQA EBITDA of ~$436M Revenue and cost synergy opportunities Estimated more than $0.10 accretive to adjusted EPS 1 within the first full year after close, significantly more accretive thereafter Rapid debt repayment, incremental earnings growth Financial Rationale 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

Combined Financial Strength 46% Gross Margin $161M EBITDA $724M Revenue LQA Hologic 75% Gross Margin $275M EBITDA $720M Revenue LQA Cytyc 60% Gross Margin $436M EBITDA $1.44B Revenue LQA Combined Company |

FY2008 Guidance and Long Term Outlook 2008 Guidance Revenue: In excess of $1.70B Adjusted EPS 1 : $2.35-2.40 / share Gross margin: 65% Long-Term Outlook Revenue Growth: 20% Adjusted EPS 1 Growth: 20%+ 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

Creating a Global Leader in Women’s Healthcare Comprehensive Women’s Healthcare Product Portfolio – Complementary best-in-class technologies Expanded Commercial Capabilities – Expansive U.S. sales channel coverage – Enhanced presence in key international markets – Platform for entry into new markets Opportunity to offer Integrated Solutions – Screening – Diagnostics – Therapeutics |

A Leading Provider of Innovative Medical Technology |