UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Cytyc Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Set forth below are the transcript and presentation made by management of Cytyc at the NASDAQ 19th Investor Program on June 19, 2007 at 5:00 p.m., London time (12:00 noon Eastern).

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

Male Speaker: We are very pleased to have Cytyc with us. We have Pat Sullivan, President and CEO. I am introducing the company on behalf of David Lewis also on our MedTech Team in New York who covers this stuff, but was unable to join us today. So, with that, I will turn it over to Pat.Hey Pat.

Patrick J. Sullivan: Thank you, and good afternoon. It is a pleasure being with all of you here in London. It is quite a beautiful day today. What I would like to do this afternoon is provide you with an overview of Cytyc Corporation as well as some comments on the merger that we just announced, but before I do, since our lawyers require, I need to take you through some forward-looking statements. This is a record, by the way. These are seven forward-looking statements. So, I will just glance through them. There are forward-looking statements in this presentation. I would advise our investors to please refer to our 10-Ks and 10-Qs on file with the SEC regarding forward-looking statements regarding Cytyc as well as forward-looking statements regarding the Hologic and Cytyc transaction as well as important information for shareholders as we look at the upcoming shareholder meetings, etc. Please visit our website for our 10-Ks and 10-Qs.

So, first I would like to talk a little bit about Cytyc as a stand-alone and then address really the opportunity with Hologic. We are a company based in Boston, Massachusetts. Last year, we did about $600 million in revenue and have continued to deliver a 20% topline and 20% bottomline growth specifically dedicated to women’s health. I mean, all of our products focus on women’s healthcare, particularly gynecological health. So, we have embarked on a strategy over the last couple years to continue that growth, to grow our existing businesses as well as acquisitions to allow us to continue growth, and I think one of the challenges that we as well as many other growing companies, improving the PBIT margins as well as attracting talent into the organization to really fuel and sustain our growth.

If you look at Cytyc in 2003, we were actually founded in 1987, the principle product being the ThinPrep Pap Test, and until 2003, we were a one-product company. Our product was the ThinPrep Pap Test, which is the replacement for the conventional Pap smear for screening women for cervical cancer. And so, what we did differently was we rather than smearing the cells in the slide, we had the physician place the sample in a vial of solution such as I have here in my hand, and basically, this was the only product that the company had until 2003.

So, we had developed about a $300 million business, 90% of it inside the United States and 10% outside United States focused specifically on replacing the conventional Pap smear. In 2004, we really started to diversify. We acquired a company called Novacept

1

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

in California that put us into providing a very exciting new product for treating women with abnormal uterine bleeding called NovaSure, and we got into the surgical side of the business, again women’s gynecological health, and then further acquisitions in 2005, put us in breast care with our MammoSite breast care product, and then in 2007, earlier this year, we just recently announced the acquisition of Adiana, which is a permanent sterilization product as well as our Adeza product, which is a diagnostic product for determining whether a woman is at risk for pre-term delivery. So, all of our products were going off a base about $300 million in 2003, doubling by 2007.

They give me one-on-ones all day and I have exercised my voice and then I lose it at the presentation time.

So, this gives you the list of the various products NovaSure and our surgical products, MammoSite Radiation Therapy, the Adiana product is a product for permanent sterilization as well as another product for endometriosis called Helica that we currently have in the pipeline.

Our diagnostics businesses, the flagship product, the ThinPrep Pap Test, the imaging system, which is an additional diagnostic product on top of that as well as two additional products, the Cellient System, which is a product for laboratory customers as well as the Fetal Fibronectin Test for determining a woman’s risk of pre-term delivery. We also market all of our products in the US in separate divisions, surgical and diagnostics. Internationally, they are in one division, international group markets, all of the products.

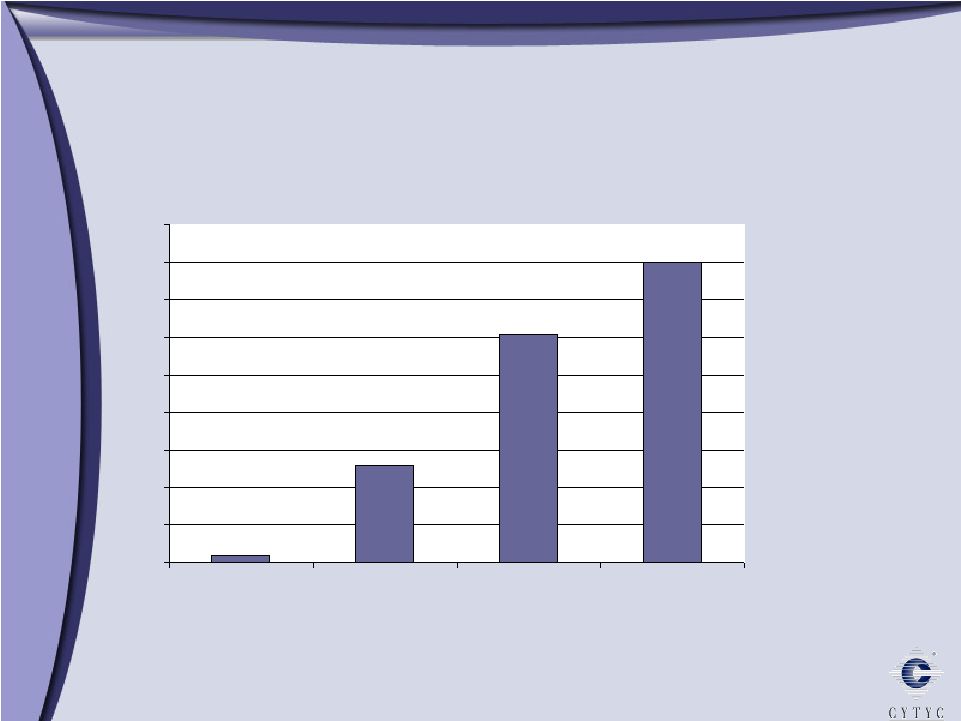

To start off with surgical products, this is the NovaSure product, this is the one we acquired in 2004, a 4-minute outpatient procedure for treating women that have abnormal uterine bleeding during their menstrual cycle. It is the best-in-class product, requires no pretreatment in order to perform the procedure. It is typically done under conscious sedation and recovery is less than an hour. When we acquired the product in the year 2003, they did $38 million in revenue, in ‘04 we did $75, and we are going up by $50 million in revenue each and every year. This year we are expected to do somewhere around $225 million in top-line revenue with our NovaSure device becoming and really is the best-in-class product.

When you look at the opportunity for treating women for abnormal bleeding, it is quite large. On the very left-hand side of the graph, the total number of patients that are affected by this disorder is about 7 million, but unfortunately, only about 2.5 million of those women actually seek treatment. It turns out that about 1.8 million of those women end up going on oral contraceptives or some sort of hormonal therapy to try to mitigate the menstrual flow, but many undergo a hysterectomy, dilation or curettage or the other category that has just emerged, the GEA category called global endometrial ablation. So, today the market has about 300,000 procedures and it is growing at about 50,000 procedures per year over the last several years.

2

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

When you look at NovaSure compared to the other products, we compete with some rather well known companies J&J has a product called Therma Choice, Boston Scientific has a product called Hydro ThermAblator, American Medical Systems has another product that uses freezing technology to ablate the uterus. All of those products require some sort of pre-treatment; either a dilation a curettage or a single or double dose of Lupron. Lupron is a drug that thins the endometrial lining that makes the ablation occur more effectively. In the case of NovaSure, there is no pre-treatment required. The woman could come in in the morning, be identified and be treated in the afternoon. The other significant advantage is one of time. In the OR it takes about a half hour, or the outpatient procedure takes about a half an hour. In the case of NovaSure from start to finish it’s about 4 minutes. In the case of all the other competitive products it takes about 10 minutes to apply the [ ] and in the case of NovaSure it’s literally 90 seconds. So, from start to finish, very quick, very safe and the most effective product on the market. When you look at comparing all of these devices to rollerball ablation, NovaSure is head and shoulders the market leader as well as the best-in-class product.

If you look at the overall market opportunity when you look at just the global endometrial ablation procedures, last year again about 300,000 procedures, we’re about 60% of the market, on a dollar value basis about 70% of the market. But when you look at the women that are undergoing hormone therapy or the women that suffer from this disorder we are barely scratching the surface with 9% and 3%, respectively. So we think we have a tremendous market opportunity to further expand this market. In addition, we are taking this product for elective use, so women who don’t suffer from abnormal bleeding but just have normal periods but want to eliminate this issue in their lives. We are conducting a clinical trial that we expect to start this year to allow us to market the product for elective use, and that in and of itself is about a $1 billion market opportunity.

The second product that we have in our surgical products division is our MammoSite radiation therapy product. And this is a method by which you provide for radiation therapy post-lumpectomy. So, today a woman that has breast cancer would go in and often times a lumpectomy would be performed or only a certain portion of the breast would be removed and she would go on to whole breast radiation. The reason you provide whole breast radiation is because, without it the woman’s risk of recurrence of breast cancer in that same breast at the same site is about 30-40%. If you provide radiation therapy post-lumpectomy, her risk of developing a recurrent breast cancer drops to about 5%. So the standard on the market today is to provide whole breast radiation from the outside in to basically provide radiation to the tumor bed to prevent recurrence. This device has a balloon on the end of it, so at the end of this device is a balloon catheter. This is actually inserted into the site of the lumpectomy in the same place where the tumor was removed, and then what happens is you thread a radiation source through this catheter and you irradiate the cancer or the cancer site from the inside out. And rather than providing this whole breast radiation is 30 days of therapy, in the case of the MammoSite device, it’s 5 days of therapy. So the major benefit for the woman and the physician is you can reduce her risk of developing breast cancer by providing radiation therapy but you’re taking the time of therapy down from 30 days down to 5

3

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

days. In the U.S. there is a big problem with women becoming compliant with the radiation therapy. Many women either opt for a mastectomy because it is such a hassle to go get whole breast radiation, or they just don’t do it at all and then of course you have the 30-40% chance of cancer recurrence. So we think this is a great market opportunity for us. When you look at the overall size of the market as 270,000 breast cancer patients in the United States and then you back down those patients for whom MammoSite is really not appropriate. Where the woman would have a mastectomy is obviously not a candidate as well as women that have a large tumor or who have had lymph node involvement as well as women who have relatively small breasts would not be candidates, so you get the overall market size being about 125,000 procedures on an annual basis. Today, we are about 10% penetrated into that market opportunity, so tremendous growth on our breast cancer product offering. And this is one, when I talk about Hologic, where there is very interesting fit between this product and all of the Hologic products.

The other product that we acquired earlier this year is called Adiana. It’s a permanent sterilization device that is used as an alternative to tubal ligation. And basically what it is is a silicone matrix that is inserted into the fallopian tubes of the woman that prevents the eggs obviously from coming through the fallopian tubes into the uterus. We are in the FDA process. Over the next several weeks we expect to submit this application to the FDA and expect approval in the first quarter of next year. It is extraordinarily complimentary to our NovaSure endometrial ablation system. All women who have had a NovaSure procedure, or any endometrial ablation procedure for that matter, need to be on some sort of contraception, and this product would be marketed and sold by our existing sales force, of which we have about 100 directly to the same physicians that are doing NovaSure, so we think this is a great fit. It is a $1 billion market opportunity, and thanks to a competitor in the market, reimbursement is established on a nationwide basis.

The overall summary of the surgical products, it is our fastest growing in excess of 30% growth year over year, NovaSure being the best-in-class product, the elective use of that product being a $1 billion market opportunity. MammoSite becoming the standard of care versus whole breast radiation in breast cancer radiation therapy. And our hysteroscopic radiation product, Adiana being a significant growth driver in 2007 and beyond, 2008 and beyond.

If you move to diagnostic products, this is the products on which the company was founded back in 1996. The flagship product is the ThinPrep Pap Test. We are the market leader in liquid-based cytology, with about 70% market share. Our imaging system is a diagnostic methodology to better and more efficiently review the ThinPrep slides at the laboratory. Now we have additional products, with the FullTerm product for our OB/GYN sales force for identifying women at risk for pre-term delivery, as well as another product for our laboratory sales force called Cellient.

When you look at the overall superiority of the ThinPrep system, the conventional Pap smear has been around since the late ‘40s and it had done a reasonable job of screening

4

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

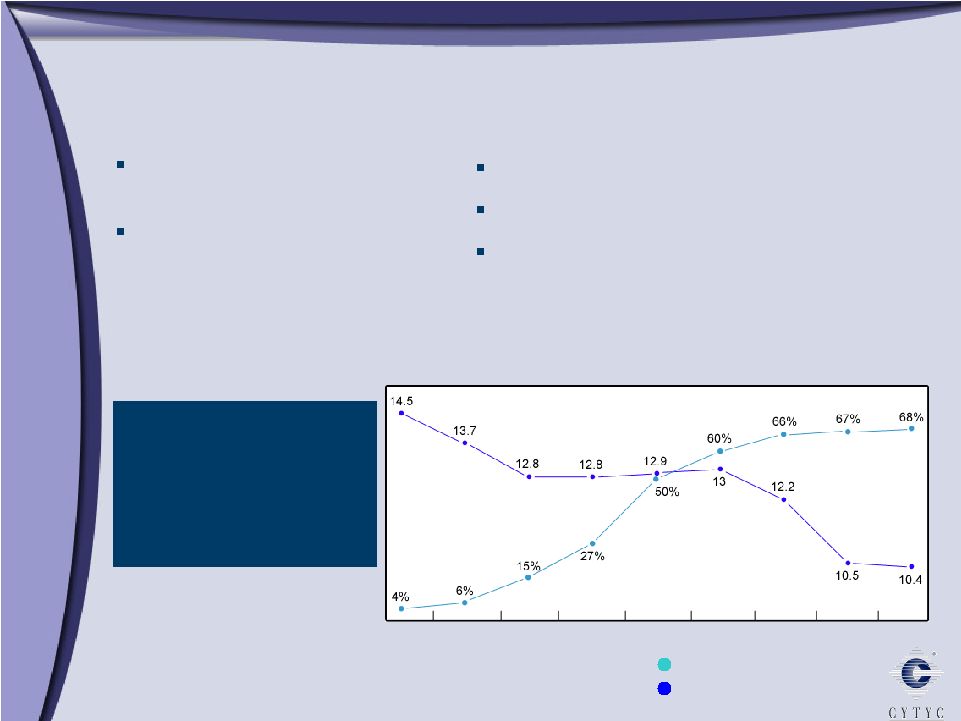

women for cervical cancer. There had really been no improvement until the ThinPrep Pap Test was approved in 1996. So, this graph here in the lower right hand corner shows the market share advancement of ThinPrep; 4%, 6%, 15% and today we are pretty level at about 70% market share, and I would point out by the way this is the same growth pattern that the MammoSite device is on as well. If you look at the reduction in the incidents of cervical cancer in the United States from 1996 through 2005 there has been a 28% reduction in the incidents of cervical cancer, due to, we believe or one of the reasons for that reduction is the widespread adoption of the ThinPrep Pap Test. It is significantly better than the conventional Pap smear for the detection of all lesions as well as all precancerous lesions. The ThinPrep imaging system provides for incremental benefit from both a productivity as well as an accuracy perspective. And we have the ability to do additional tests out of the ThinPrep vial. So, if you think of this as you touch the patient once and you can sample for not only a better Pap test, but you can test the patient for Chlamydia, Gonorrhea, HPV and other STDs as well. So, one vial, many solutions, many tests can be performed using our ThinPrep technology.

[beeping] I hope that wasn’t the timer. In any event, the imaging system is a computer system that provides for automated screening of the ThinPrep Pap Test. It basically helps the human identify areas of interest or cells of interest that the imager picked up that could be cancerous, and then the human makes the final decision as to whether that cell or that particular sample is either abnormal or normal. It significantly improves the accuracy of the screening and also improves the laboratory economics because there is additional reimbursement provided as well as a reduction in labor cost. So, it is not only more efficient, but it is also much more effective. It protects our market share with ThinPrep because our imaging system can only be used with the ThinPrep Pap Test and vice versa, and a significant increases use in the precursor to cancer called high-grade lesions using our technology versus the conventional.

I would point out that in the UK and since that’s where we are today, the National Health Service is basically converting the entire UK system forward to liquid-based cytology. They started this program in 2003, and are going through 2008, to convert all of the conventional Pap smears in the UK to liquid-based cytology, and we believe in the UK we will be essentially about 70% of the overall market within the UK. It is the only country in the world that is converting the entire screening system to the new and more efficient and effective technologies.

When you look at the imaging system in the US, as I mentioned you have to use the ThinPrep Pap Test, when you look at the number of slides, the slides that are going through and being imaged it was 40% at the end of the fourth quarter, it was about 46% at the end of the first quarter. So, we are making significant progress in making the imaging system become the standard of care for screening ThinPrep slide.

The Cellient System, I will not spend a lot of time on this. This is another methodology, another product that we will be marketing to our laboratory customers, that will take residual material that is left behind in the ThinPrep vial and allow the laboratory to do

5

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

additional tests on tissue samples that they would not otherwise be able to do from a ThinPrep sample. So, this is a product we currently have in beta-site testing. It is about a $100 million market opportunity for us in the US and another $100 million worldwide.

The Fetal Fibronectin Test came to us from Adeza. It is, as I mentioned identifies women at risk for pre-term birth. It is FDA approved. They did about $45 or so million last year in revenue. It is about a $500 million market for us worldwide, and it is now in the hands of our sales force, and we expect to do somewhere between $45 and $50 million in incremental revenue over the balance of the last three quarters of this year, taking our total revenue up to around $750 million for the year.

So, when you look at diagnostics, we have the ThinPrep Pap Test. The Pap test itself is relatively flat. We do about nine million tests on a quarterly basis. The imaging system is growing quite nicely. The international opportunity for this product is significant, a 100 million tests worldwide. It is the standard. We have done over 250 million tests since the product was approved. The imaging system is making great advancements not only in the US, but there are a number of systems in the UK and throughout Europe that we think will become the standard here as well, and we have a number of other products that we think will continue the growth on our diagnostics products side.

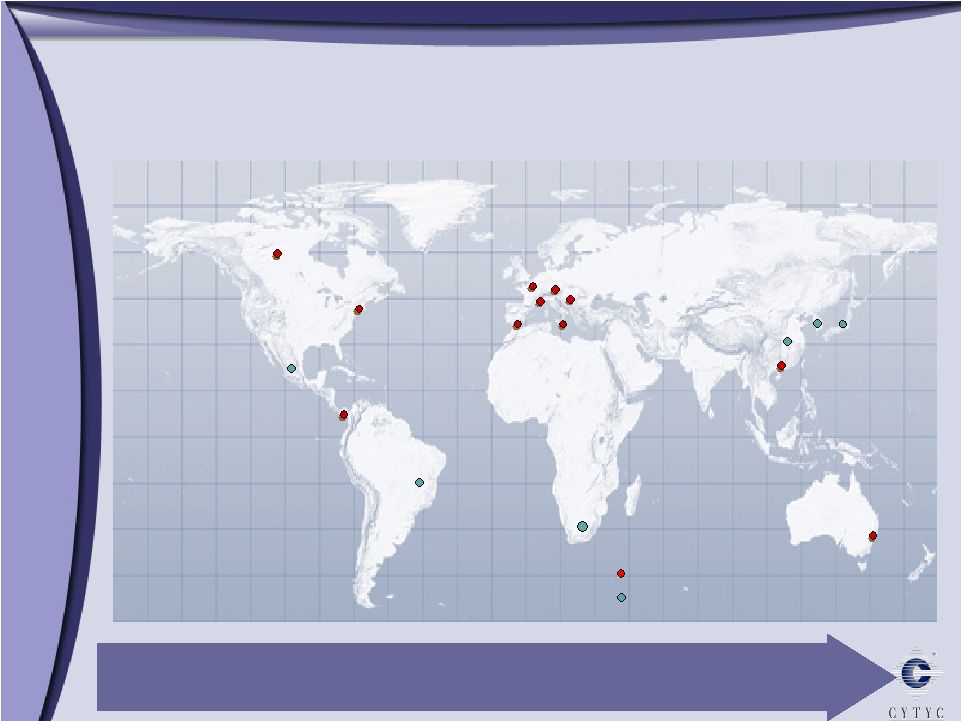

So, when we look at international, we are a company that is operating in over 20 different countries. We are direct in all of Europe. Our headquarters is here in the UK. Direct presence in France, Spain, Germany, Switzerland, Italy, as well as Hong Kong and Australia, and we operate our distributor in China through our Hong Kong office. About 170 people worldwide and about 12% of our revenue and it comes from international and it has been growing quite nicely with a 30% compounded annual growth rate year over year, and we continued. We believe that this trend will continue. It is a huge market opportunity. When you think of the Pap test outside of the United States, there is 44 million Pap tests done in Europe, Asia Pacific, 30 million of the 48 million tests are done in China and that is a significant growth opportunity for us as well as another 22 million in the rest of the world.

So, now, I would like to speak specifically, a little bit of the details, on the Hologic-Cytyc merger that was announced toward the end of May that we are very excited about. We believe that this really creates for the first time a global leader in women’s healthcare. If you search in all of the companies out there with the exception of pharmaceuticals, I think that the Cytyc-Hologic combination will create the premier women’s leading healthcare company with very rapid growth.

So, when you look at the strategic graph rationale, we think that it does expand significantly the product portfolio of both companies. There are two very strong companies coming together to create even a stronger company. We think that there is a significant ability to leverage the OB/GYN sales channel that we are very prominent in as well as direct cross-selling synergies particularly on the breast side, the international as well as the discovery osteoporosis screening product. When you look at the combined

6

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

strengths, we will become a financial powerhouse with close to $500 million in EBITDA, a very significant cash flow generation, proven management teams that have been around for a long period of time, and I have been at Cytyc for about 16 years, Jack has been at Hologic for about seven or so, and I think we have both demonstrated an ability to integrate acquisitions in a meaningful way to provide for value for investors.

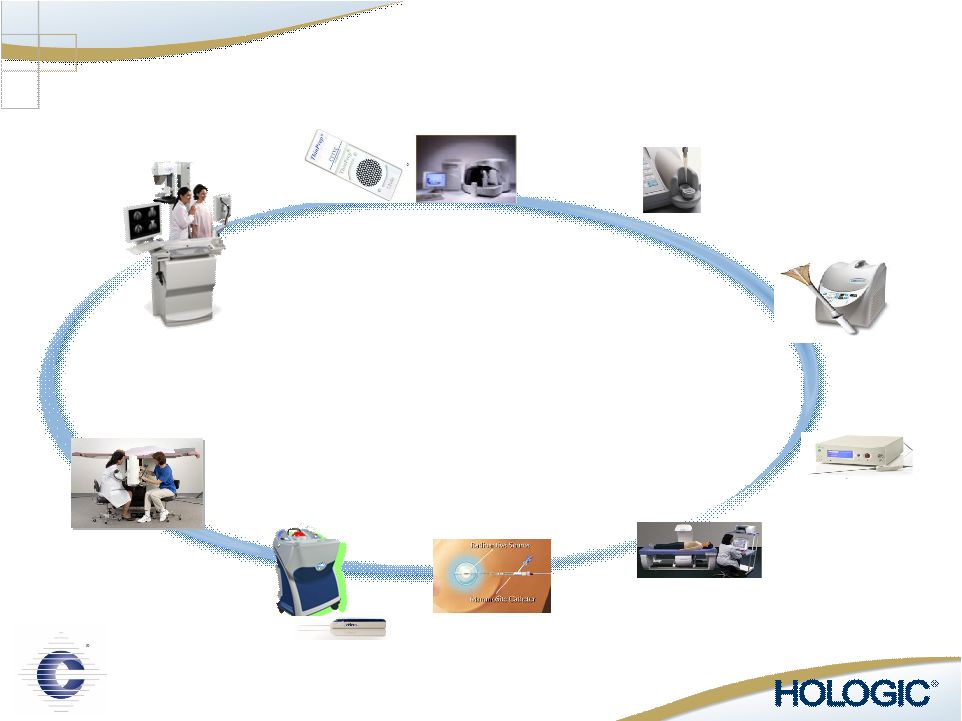

When you look at the comprehensive healthcare platform and you think about breast care, mammography being the discovery or the screening for breast cancer, the Selenia product is an absolute best-in-class product in digital mammography and is taking off, growing extraordinarily fast, tie that together with the stereotactic biopsy, the Suros biopsy systems, the MammoSite Radiation Therapy system, you have a whole suite of products now that are focused principally on women’s breast cancer and breast care. When you tie that together with the gynecological life products, the ThinPrep Pap Test, the NovaSure device for abnormal bleeding, contraception, you have a full suite of best-in-class products for marketing to breast surgeons and OB/GYNs and really a significant suite of products that are best-in-class for women’s health. If you look at the various markets on which we will compete, breast cancer, cervical cancer, menorrhagia, contraception, pre-term labor, endometriosis, the products are number one in each and every one of those categories. We are the market leader in virtually each and every product category in which we compete. Large market opportunities, billion dollar plus market opportunities, and when you add together the combined strengths of the R&D and the sales and marketing organization, we think we will have a very significant women’s healthcare company.

The financial rationales is also, I think, quite strong. We have increased scales with diversification of the revenue stream. If you take the last quarter annualized of EBITDA, it is $436 million, significant revenue and cost synergies as well. We believe $75 million on revenue and about $25 million on cost over the next three years. At the announcement, we talked about $0.10 accretive to the adjusted earnings per share and significantly more accretive thereafter, and when you look at the debt repayment, part of this will be in debt and part in cash and stock. The debt repayment is because the cash flow is very fast.

Both companies are about the same size, now a little over $700 million in revenue. Their margins are about 46%. Ours are around 75%. Combine the two companies together; you have a last-quarter annualized revenue of $1.4 billion, a 60% gross margin and again a $436 million in EBITDA, so I think a very strong financial performance.

So, we think that these two companies coming together really will create a very comprehensive women’s healthcare company focused specifically on women’s health. We will have expanded commercial capabilities across both organizations where we will have expanded sales coverage. International, the two companies together will have significant opportunities. They use principally a distributor model with 25% of the revenues, we are a direct model, with about 12% of our revenues coming from international. And we will have a platform when you think about breast surgery or

7

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

radiation oncology, OB/GYN, there are many opportunities that we think we will be able to layer into that combined strength of the two organizations to really provide better diagnosis, screening, and therapeutics for women’s healthcare.

So, with that I guess what I would like to do is take a drink of water and then ask for some questions or if you have questions now.

Female Speaker: Just hold this. That is all right. Probably just…

Patrick J. Sullivan: I have five minutes on the shot-clock, well four and a half. I think one of the things that I would argue that the market probably does not completely understand or it does not buy into yet is the sales synergy of the OB/GYN channel, and there are really direct sales synergies principally on breast, international and the osteoporosis product, so those products can be sold by the combined sales force. In the case of breast biopsy, the sales product, that they have a handheld device that they now market only to the radiologists as a perfect fit with the breast surgeries. So, we have 58 breast surgery specialists that call on breast surgeons and radiation oncologists selling our MammoSite product. That product can be easily sold by our sales force, that is number one. Number two, we have an international distribution system that we think will be able to capture some of the margins that we are otherwise giving up to the international distributors, and three, the osteoporosis product. It is about a $60 million product for Hologic today that is sold by 12 sales people and through PS&S, Physician Sales and Service in the US. It is a distribution company for physicians’ offices. Those are the direct synergies. The one that I would call the indirect synergy is the ability of our OB/GYN sales force to influence the OB/GYN to send their patients to centers, mammography centers, that have the Hologic digital mammography product. When a women goes in for her well woman visit, she has a pelvic examination, a Pap test as well as a clinical breast examination, and when she leaves the office, the doctor tells her ‘Make sure you go get your mammogram’. 87% of physicians in the United States, OB/GYNs, refer women to the radiologist for mammograms. Report comes back to the OB/GYN as to what the result of that specific mammography was. And we have done this with the ThinPrep Pap Test where we do not sell this device, we do not sell this product to the OB/GYN, we market it to the OB/GYN, we do not sell it. We sell it to the laboratory. We do not sell the imaging systems to the OB/GYN. We market it to the OB/GYN to have them check the box to get the laboratory to do it, and over the years Cytyc has developed a reputation of really moving markets and essentially in some respects forcing the laboratories to provide the ThinPrep Pap Test in 1996, when there was no demand for it. We created the demand for that test, and we think we will be able to have a significant impact in the use and utilization of digital mammography with our OB/GYN sales force. So, that is what I would classify you have got your direct synergies with pure-play products into existing sales channel and a more indirect sales presence.

8

CYTYC CORPORATION

NASDAQ 19TH INVESTOR PROGRAM

June 19th at 12:00 PM Eastern

So, there are about 40 million mammograms done in the United States this year. If you look at digital mammography, the most recent numbers are that there has only been about 19% conversion to digital mammography and Hologic has, I think about half of that. So, we think we are going to be able…and the parallels between the ThinPrep Pap Test being a better test and digital mammography being a better mammogram, the parallels between cervical cancer and breast cancer are very simple and easy for our sales force alone to market OB/GYN.

Male Speaker: Yeah, it has worked on the ThinPrep side, so look forward to seeing how it works on the Hologic side.

Patrick J. Sullivan: Absolutely.

Male Speaker: With that I think we are out of time, and I would like to thank Pat again for joining us. Have a good evening.

Patrick J. Sullivan: Thank you.

9

A Leading Provider of Innovative Medical Technology NASDAQ 19 th Investor Program June 19, 2007 |

Disclaimer Regarding Forward-Looking Statements Forward-Looking Statements Regarding Cytyc Investors are cautioned that statements in this presentation which are not strictly historical statements, including, without limitation, Cytyc's future financial condition, operating results and economic performance, and management's expectations regarding key customer relationships, future growth opportunities, product acceptance and business strategy, constitute forward-looking statements. These statements are based on current expectations, forecasts and assumptions of Cytyc that are subject to risks and uncertainties, which could cause actual outcomes and results to differ materially from those statements. Risks and uncertainties include, among others, the successful integration of acquired businesses into Cytyc's business, dependence on key personnel and customers as well as reliance on proprietary technology, uncertainty of product development efforts and timelines, management of growth, product diversification, and organizational change, entry into new market segments domestically, such as pharmaceuticals, and new markets internationally, risks associated with litigation, competition and competitive pricing pressures, risks associated with the FDA regulatory approval processes and healthcare reimbursement policies in the United States and abroad, introduction of technologies that are disruptive to Cytyc's business and operations, the potential consequences of the restatement of Cytyc's |

Disclaimer Regarding Forward-Looking Statements (continued) financial statements for the period 1996 through 2002, relating to certain employee stock option exercises, including the impact of the expected any regulatory review or litigation relating to such matters, the impact of new accounting requirements and governmental rules and regulations, as well as other risks detailed in Cytyc's filings with the SEC, including those under the heading "Risk Factors" in Cytyc's 2006 Annual Report on Form 10-K/A and Adeza's 2006 Annual Report on Form 10-K, all as filed with the SEC. Cytyc cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they were made. Cytyc disclaims any obligation to publicly update or revise any such statements to reflect any change in its expectations or events, conditions, or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. |

Disclaimer Regarding Forward-Looking Statements (continued) Forward-Looking Statements Regarding the Proposed Hologic-Cytyc Transaction This presentation also includes forward-looking statements about the timing of the completion of the transaction, the anticipated benefits of the business combination transaction involving Hologic and Cytyc, including future financial and operating results, the expected permanent financing for the transaction, the combined company's plans, objectives, expectations and intentions and other statements that are not historical facts. Hologic and Cytyc caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. These include risks and uncertainties relating to: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the parties may be unable to complete the transaction because conditions to the closing of the transaction may not be satisfied; the risk that the businesses will not be integrated successfully; the transaction may involve unexpected costs or unexpected liabilities; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues; the need to develop new products and adapt to |

Disclaimer Regarding Forward-Looking Statements (continued) significant technological change; implementation of strategies for improving internal growth; use and protection of intellectual property; dependence on customers' capital spending policies and government funding policies, including third-party reimbursement; realization of potential future savings from new productivity initiatives; general worldwide economic conditions and related uncertainties; future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors; and the effect of exchange rate fluctuations on international operations. In addition, the transaction will require the combined company to obtain significant financing. While Hologic has obtained a commitment to obtain such financing, including a bridge to the permanent financing contemplated in the presentation, the combined company’s liquidity and results of operations could be materially adversely affected if such financing is not available on favorable terms. Moreover, the substantial leverage resulting from such financing will subject the combined company’s business to additional risks and uncertainties. The risks included above are not exhaustive. The annual reports on Form 10-K, the quarterly reports on Form 10-Q, current reports on Form 8-K and other documents Hologic and Cytyc have filed with the SEC contain additional factors that could impact the combined company’s businesses and financial performance. The parties expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in the parties’ expectations or any change in events, conditions or circumstances on which any such statement is based. |

Important Information for Investors and Stockholders Hologic and Cytyc will file a joint proxy statement/prospectus with the SEC in connection with the proposed merger. HOLOGIC AND CYTYC URGE INVESTORS AND STOCKHOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY EITHER PARTY WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders will be able to obtain the joint proxy statement/prospectus and other documents filed with the SEC free of charge at the website maintained by the SEC at www.sec.gov. In addition, documents filed with the SEC by Hologic will be available free of charge on the investor relations portion of the Hologic website at www.hologic.com. Documents filed with the SEC by Cytyc will be available free of charge on the investor relations portion of the Cytyc website at www.cytyc.com. |

Participants in the Solicitation Hologic, and certain of its directors and executive officers, may be deemed participants in the solicitation of proxies from the stockholders of Hologic in connection with the merger. The names of Hologic’s directors and executive officers and a description of their interests in Hologic are set forth in the proxy statement for Hologic’s 2006 annual meeting of stockholders, which was filed with the SEC on January 25, 2007. Cytyc, and certain of its directors and executive officers, may be deemed to be participants in the solicitation of proxies from its stockholders in connection with the merger. The names of Cytyc’s directors and executive officers and a description of their interests in Cytyc is set forth in Cytyc’s Annual Report on Form 10-K/A for the fiscal year ended December 31, 2006, which was filed with the SEC on April 30, 2007. Investors and stockholders can obtain more detailed information regarding the direct and indirect interests of Hologic’s and Cytyc’s directors and executive officers in the merger by reading the definitive joint proxy statement/prospectus when it becomes available. |

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use the non-GAAP financial measures "adjusted EPS" and “EBITDA”. Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and tax provisions/benefits related thereto. EBITDA is defined as net earnings (loss) before interest, taxes, depreciation and amortization expense. Neither adjusted EPS nor EBITDA is a measure of operating performance under GAAP. We believe that the use of these non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts. When analyzing our operating performance, investors should not consider these non-GAAP measures as a substitute for net income prepared in accordance with GAAP. |

Growth Objectives and Strategy Growth Objectives and Strategy Deliver 20+% long-term earnings growth through: Global organic growth across divisions Internal research and development Strategic acquisitions and partnerships Grow existing businesses resulting in continued revenue growth and improved PBIT margins Enhance organizational bench strength by attracting, motivating, and retaining top talent to support business needs |

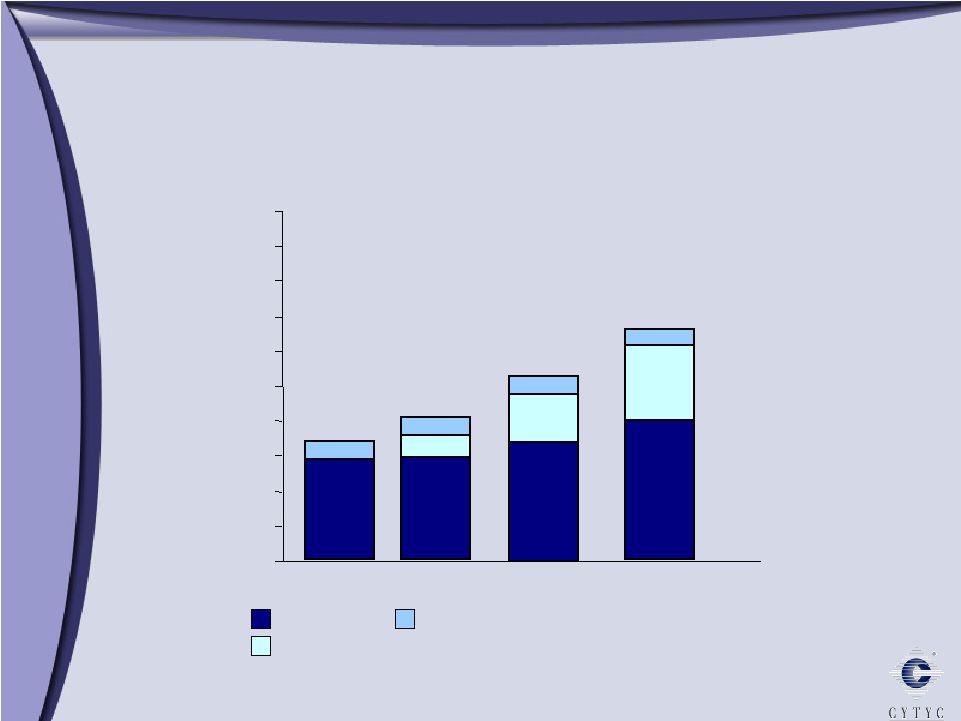

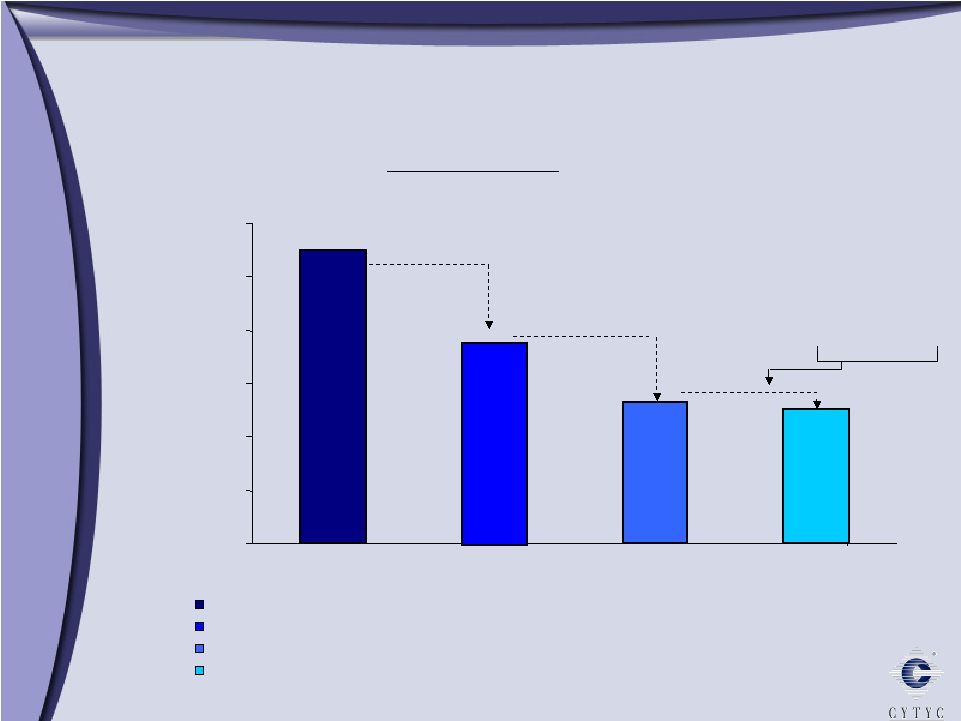

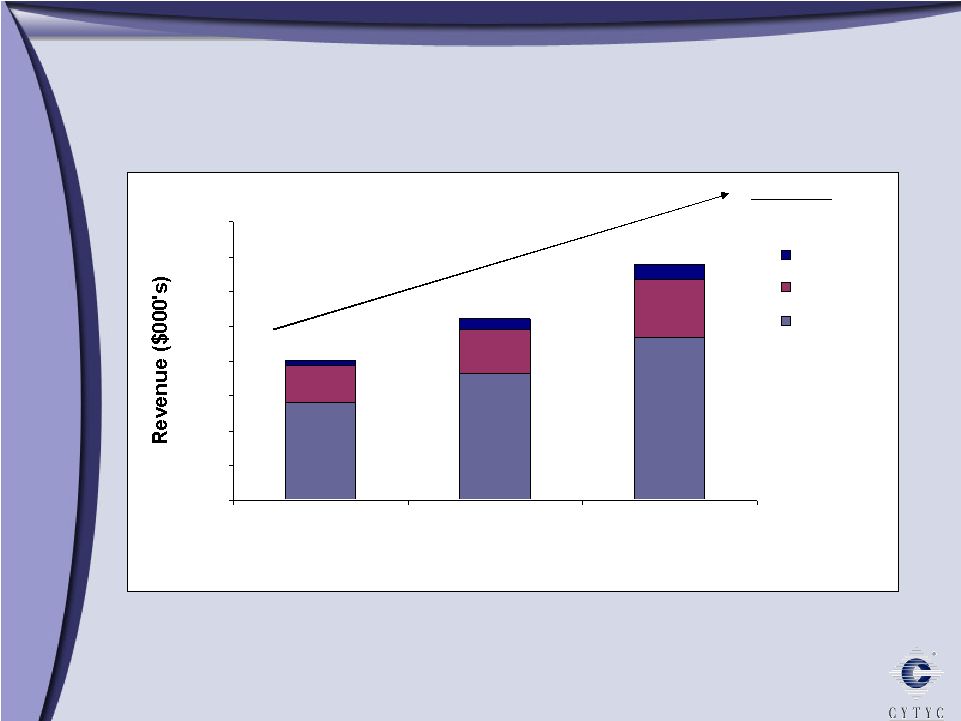

0 100 200 300 400 500 600 700 800 900 1 Billion Growth through Diversification Growth through Diversification 2003 2005 2006 Diagnostic International Surgical $303 Millions $ $508 $608 10% 90% 61% 29% 10% 11% 34% 55% 73% 16% 11% 2004 $394 |

Operating Divisions Operating Divisions Domestic Surgical Products Division NovaSure ® Endometrial Ablation MammoSite ® Radiation Therapy Adiana Helica Domestic Diagnostic Products Division ThinPrep ® Pap Test ThinPrep ® Imaging System Cellient ™ Automated Cell Block System Full Term ® : The Fetal Fibronectin Test International Division |

A Leading Provider of Innovative Medical Technology Surgical Products |

NovaSure Procedure 4-minute, outpatient procedure No pretreatment drugs required Conscious sedation Recovery = 1 hour Highest success rates Reimbursement established nationwide |

Endometrial Ablation: A Large and Underserved Market Endometrial Ablation: A Large and Underserved Market Estimates per Cytyc Corporation *All age groups Hysterectomy, D&C, GEA 0 1 2 3 4 5 6 7 8 Total Suffering Silent Sufferers Hormonal Therapy 7m 4.5m 1.8m 0.7m 1 in 5 women suffers from Abnormal Uterine Bleeding 2.5 million women seek treatment* In Millions 2.5 m |

NovaSure’s Competitive Advantage 1.4 4.2 None No NovaSure RadioFrequency 3.5 39.3 Lupron Yes Microsulis Microwave 10-12 24 Lupron Single Yes AMS Her Option Cryotherapy 8 26.4 Lupron Double Yes BSC HTA Hot water 10 27.4 D&C Yes J&J Therma Choice Hot water Treatment Time* Procedure Time* Pre-Treatment Modality Product *minutes |

GEA Market Opportunity 2006 NovaSure Market Share and Total Procedure Potential GEA Market Opportunity 2006 NovaSure Market Share and Total Procedure Potential NS Share = 62%* NS Share = 9% NS Share = 3% * Note:US NovaSure dollar share equals 69% 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 2006 - Current GEA 2006- Treatment Pathway 2006 - Silent Sufferers Silent Sufferers Hormones Hysterectomy Rollerball D&C GEA |

MammoSite Radiation Therapy MammoSite Radiation Therapy Creating new standard of care Deliver optimal dose of radiation to tissue at highest risk of cancer recurrence Minimize damage to healthy tissue Expanding data supports partial breast radiation and MammoSite Clinical trial (5-year data; 43 patients): 0 recurrences ASBS registry (2-year data; 1,400 patients) MammoSite RTS afterloader accessories MammoSite RTS applicator |

0 50,000 100,000 150,000 200,000 250,000 300,000 MammoSite Market Opportunity 275,221 189,490 131,695 126,002 MammoSite Primary U.S. Cases of Breast Cancer and DCIS (.4% Incidence, 40+) Patients Eligible for Breast Conserving Therapy (Excludes >3cm, Size A) Patients Receiving Breast Conserving Therapy (70%) Patients Eligible for Mammosite (Excludes women <45, Pathology) Market Opportunity Large tumors 70% elect BCT Surgical margins or lymph node involvement |

Hysteroscopic Sterilization -- Adiana Hysteroscopic Sterilization -- Adiana Alternative to tubal ligation Radiofrequency generator One-time-use delivery catheter FDA process underway Complementary to NovaSure Endometrial Ablation System $1 billion U.S. market opportunity Reimbursement established |

Cytyc Surgical Products - Summary Cytyc Surgical Products - Summary Changing medical practice with products that address potential US markets > $5B NovaSure best-in-class product addressing a $2.5B market NovaSure Elective use > $1B MammoSite creating a new standard of care with $300MM US opportunity Hysteroscopic sterilization – Adiana • $1B U.S. market opportunity |

A Leading Provider of Innovative Medical Technology Diagnostic Products |

Domestic Diagnostic Products Domestic Diagnostic Products ThinPrep ® Pap Test ThinPrep ® Imaging System FullTerm ® : The Fetal Fibronectin Test Cellient ™ Automated Cell Block System |

ThinPrep System Advantages ThinPrep System Advantages Superiority to Conventional Pap ThinPrep Imaging System ThinPrep Pap Test Market Share (%) Estimated New Cases (1,000) HPV FDA approved CT/NG FDA approved Glandular claim Since ThinPrep introduction in 1996, estimated number of cervical cancer cases in the US decreased 28% 1997 1998 1999 2000 2001 2002 2003 2004 2005 |

ThinPrep Imaging System ThinPrep Imaging System Advanced computerized imaging Dual screening approach Improves accuracy Improves lab economics Increases reimbursement Decreases labor costs Improves workflow Protects ThinPrep market share Significant increase in HSIL |

ThinPrep Imaging System: Becoming the Standard of Care ThinPrep Imaging System: Becoming the Standard of Care Notes: Imaging started in Q2 of 2003 Percent Slides Imaged 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% Q4 2003 Q4 2004 Q4 2005 Q4 2006 1% 13% 30% 40% |

Cellient ™ Automated Cell Block System Cellient ™ Automated Cell Block System Allows individual cells or small tissue samples (<2mm diameter) to be processed for histological examination Eliminates operator dependence Provides standardized, consistent preparations in less than one hour, and ensures sample chain of custody Market launch: Second half 2007 Sold by existing lab sales force Market opportunity up to $200 million worldwide |

Full Term: The Fetal Fibronectin Test Full Term: The Fetal Fibronectin Test Identifies women at risk of preterm birth FDA approved Reimbursement established Market opportunity: $500 million worldwide |

Domestic Diagnostic Products - Summary Domestic Diagnostic Products - Summary ThinPrep ® Pap Test Leading test for cervical cancer screening US opportunity: 50-55 million tests annually International: >100 million tests 250 million tests since approval Platform technology ThinPrep ® Imaging System Advanced computerized imaging 46% ThinPrep Pap Test slides imaged Q1 2007 FullTerm: The Fetal Fibronectin Test Cellient ™ Automated Cell Block System Automated system to prepare individual cells or small tissue samples for histological examination Market launch: Second half 2007 FullTerm: The Fetal Fibronectin Test Predictor of preterm birth |

A Leading Provider of Innovative Medical Technology International |

Marlborough Cytyc International – Driving Growth Worldwide Legend Australia UK Spain France Italy Germany Switzerland Hong Kong Costa Rica China Mexico Brazil South Africa So. Korea Company presence Key distributors Japan Operating in over 20 countries Canada |

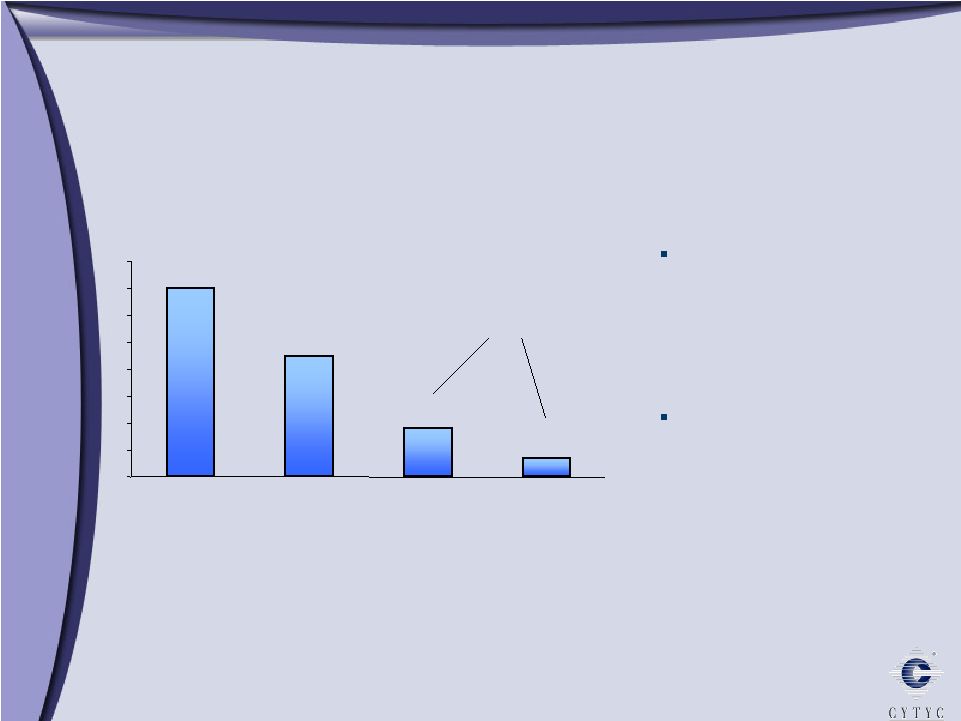

International Revenue 2004 – 2006 International Revenue 2004 – 2006 0 10000 20000 30000 40000 50000 60000 70000 80000 2004 2005 2006 ROW AsiaPac Europe Total CAGR 30% $40m $52m $68m |

Europe 44 Asia - Pacific 48 Rest of World 22 Total: 114 $500+ million annual revenue opportunity Additional upside from Imager Tests (Millions) Global ThinPrep Market Opportunity Less than 10% market penetration worldwide |

Creating a Global Leader in Women’s Healthcare Continuing a legacy of leading technology, innovation and rapid growth May 21, 2007 |

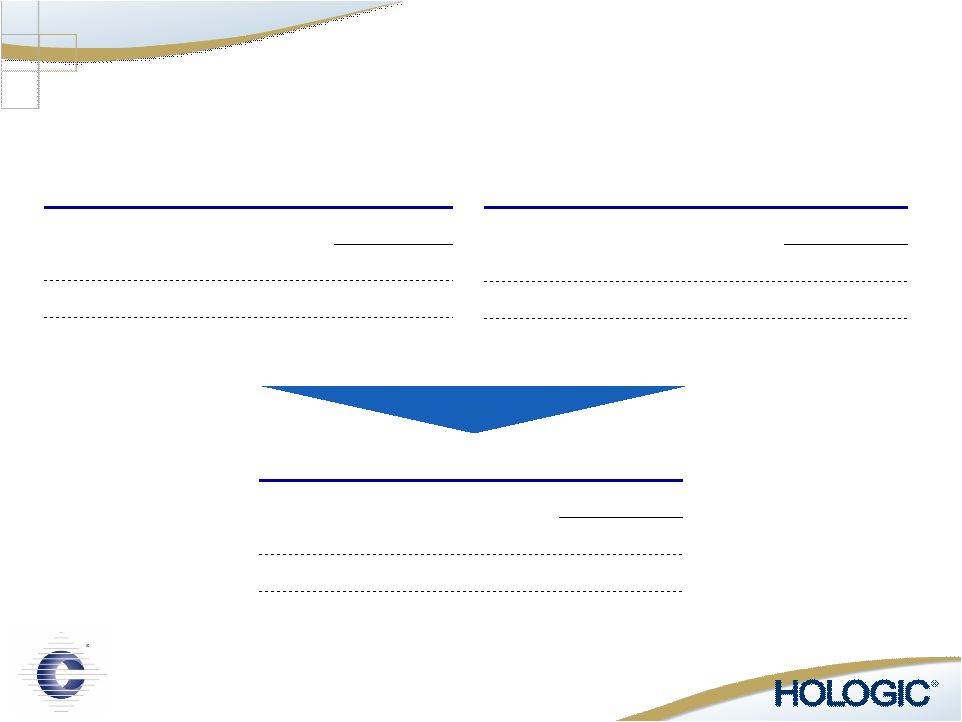

Expanded Product Portfolio Comprehensive Sales Coverage Ability to Leverage OB/GYN Channel Significant Cross-Selling Synergies Enhanced International Presence Creating a Global Leader in Women’s Healthcare Market Share Leader in Major Product Lines Proven Management Team Significant Cash Flow Generation Accretive to Adjusted EPS 1 Within the First Full Year After Close Strategic Rationale Combined Strengths 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

MultiCare Stereotactic Biopsy Discovery Osteoporosis Screening Selenia Breast Cancer Screening MammoSite Radiation Therapy ThinPrep Pap Test & Imaging System Cervical Cancer Screening NovaSure Endometrial Ablation Adiana Contraception FullTerm - Adeza Preterm Labor Best-in-Class Solutions in Women’s Healthcare Suros Biopsy Systems Comprehensive Women’s Healthcare Platform |

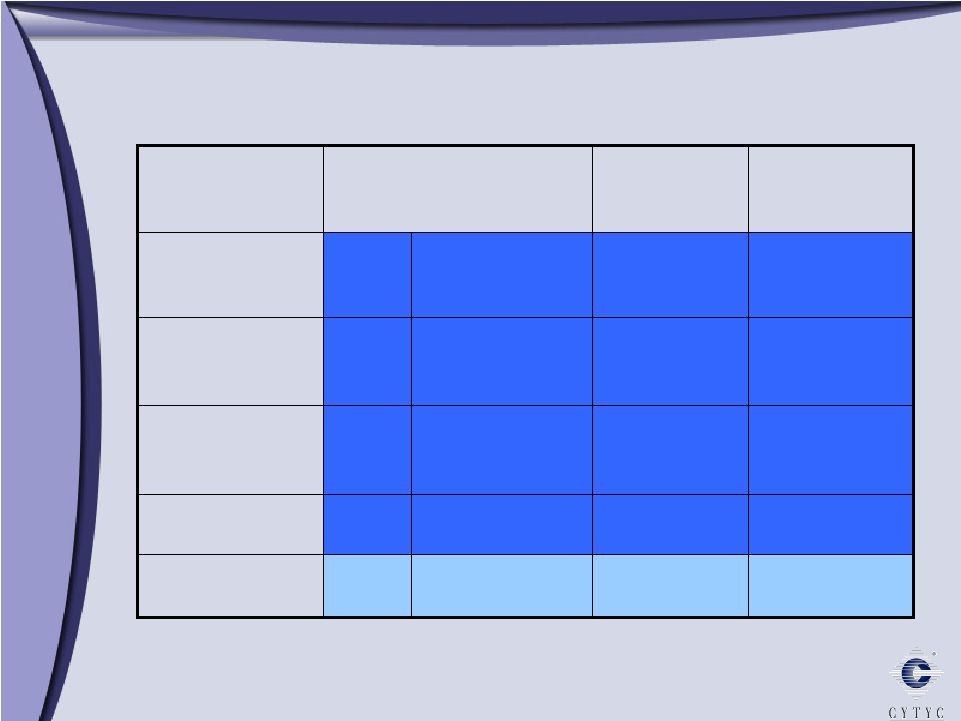

Solutions for Major Women’s Healthcare Issues Helica Unpenetrated 1 in 3 Gestiva International ThinPrep Imaging System International Tomosynthesis Suros Celero Additional Opportunities Adiana FullTerm Fetal Fibronectin Discovery Sahara NovaSure ThinPrep Pap Test Selenia MultiCare Suros ATEC MammoSite Combined Offering High Medium Low High Medium High Market Growth $100M $1B+ $400M $110M $2.5B+ $550M $1B U.S. Market Size 1 in 4 1 in 2 Pregnancies 1 in 2 1 in 5 1 in 138 1 in 8 U.S. Women Affected Endometriosis Permanent Contraception Preterm Labor Osteoporosis Menorrhagia Cervical Cancer Breast Cancer International NM NM #1 #1 #1 #1 #1 U.S. Market Position International International International International Source: Market research and company estimates. |

Multiple platforms to enhance top and bottom line growth Increased scale through diversification of revenue and strong margin profile Enhanced cash flow; LQA EBITDA of ~$436M Revenue and cost synergy opportunities Estimated more than $0.10 accretive to adjusted EPS 1 within the first full year after close, significantly more accretive thereafter Rapid debt repayment, incremental earnings growth Financial Rationale 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

Combined Financial Strength 46% Gross Margin $161M EBITDA $724M Revenue LQA Hologic 75% Gross Margin $275M EBITDA $720M Revenue LQA Cytyc 60% Gross Margin $436M EBITDA $1.44B Revenue LQA Combined Company |

Creating a Global Leader in Women’s Healthcare Comprehensive Women’s Healthcare Product Portfolio – Complementary best-in-class technologies Expanded Commercial Capabilities – Expansive U.S. sales channel coverage – Enhanced presence in key international markets – Platform for entry into new markets Opportunity to offer Integrated Solutions – Screening – Diagnostics – Therapeutics |

A Leading Provider of Innovative Medical Technology |