UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Cytyc Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Set forth below are the transcript and presentation made by management of Cytyc at the Piper Jaffray London Health Care Conference on June 20, 2007 at 8:40 a.m., London time (3:40 a.m. Eastern).

|

|

|

| Jun. 20. 2007 / 3:40AM, CYTC - Cytyc Corporation at Piper Jaffray Second Annual London Health Care Conference |

CORPORATE PARTICIPANTS

Thom Gunderson

Piper Jaffray & Co. - Analyst

Pat Sullivan

Cytyc Corporation - Chairman, President and CEO

PRESENTATION

Thom Gunderson - Piper Jaffray & Co. - Analyst

Next on the agenda, we are very pleased to have the Chairman and CEO – Chairman of the Board and CEO of Cytyc Corporation. As you all know, Cytyc made a recent announcement that they will be merging with another public company in the US called Hologic to form the largest pure play woman’s health care company out there. It’s an interesting combination. The two companies are about 15 miles apart geographically. Hologic is best known, I would argue, for their digital mammography machines but also have a lot of disposables products that they’ve acquired over the time period.

Cytyc, possibly best known for its ThinPrep – basically an improvement on cervical cancer diagnosis and is the standard of care; going from virtually nothing to standard of care with what I would argue is 80% market share in the 50 million plus Pap smears that are done annually in the United States, and rapidly, if not already, become the standard of care in the UK as well. A lot of different businesses. I’ll let Pat talk about that.

This is likely the last of about 100 times that I’ve introduced Pat Sullivan. If you were to look back 10, 12 years ago when these guys were first getting started and the class of Medtech companies that were just getting started at that time and said, you know, a dozen years from now they’ll be creating a $6 billion valuation here and this one is the winner. It makes quite a case history. So, maybe you can give us just your 25 words or less on the last 12 years and how you did that. Thanks, Pat.

Pat Sullivan - Cytyc Corporation - Chairman, President and CEO

Well, Thom, thank you very much for those kind words. I think I’ll save that perhaps for my case study at Harvard or the book that I hope to write some day. It has been quite an interesting ride. And what I’d like to do today is give you a brief overview of Cytyc and then a further preview of what we believe the future holds with the merger with Hologic, which we are very excited about. I will give you a little preview of the history of the Company as well.

Before I do that, the lawyers require me to go through — this is a record. It may be the last time you introduce me, Thom, but it’s probably the last time I hope. I have seven slides here on forward-looking statements so please review our 10-K’s and 10-Q’s and forward prospectuses, the S-4’s, et cetera, to review prospectus associated with not only Hologic and Cytyc but the Hologic/Cytyc’s transaction. And with that, give you a little bit of the history of the Company.

We are company based in Boston as Thom mentioned. We were founded in 1987 and the principal product was the ThinPrep Pap test. And if you look at our history, historically we have provided in excess of 20% topline and bottom-line sales and earnings growth. Going from literally zero sales in 1995, 1996, we went public; $4 million in sales in 1996. I joined in 1991; we had $400,000 in sales and that has grown to this year around $750 million in total topline sales. And I would say it has been quite an interesting ride that is probably worthy of a book someday.

But I think when we look at Cytyc independently, we have — consistently we have a high margin value, high margin business with principally disposables. 80 plus percent gross margins in recurring revenue, our razor/razor blade business. And we have always been consistently looking to improve our profit before income tax and really leverage the overall business, particularly the very strong sales and distribution channel that we built over the years; principally in the OB/GYN, the gynecology (inaudible) and obstetrician channel.

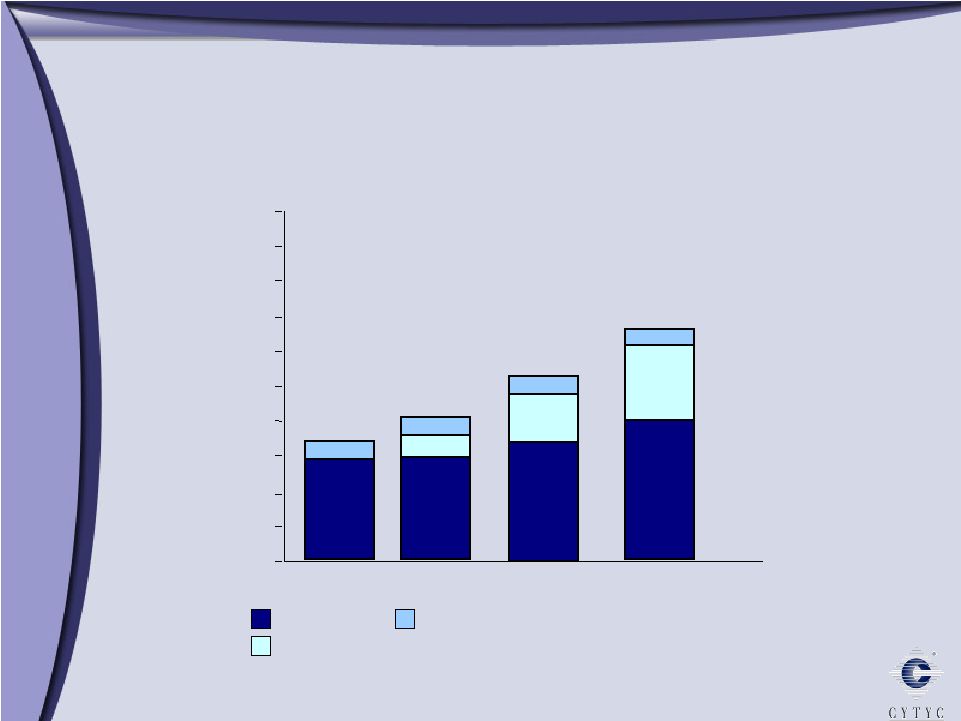

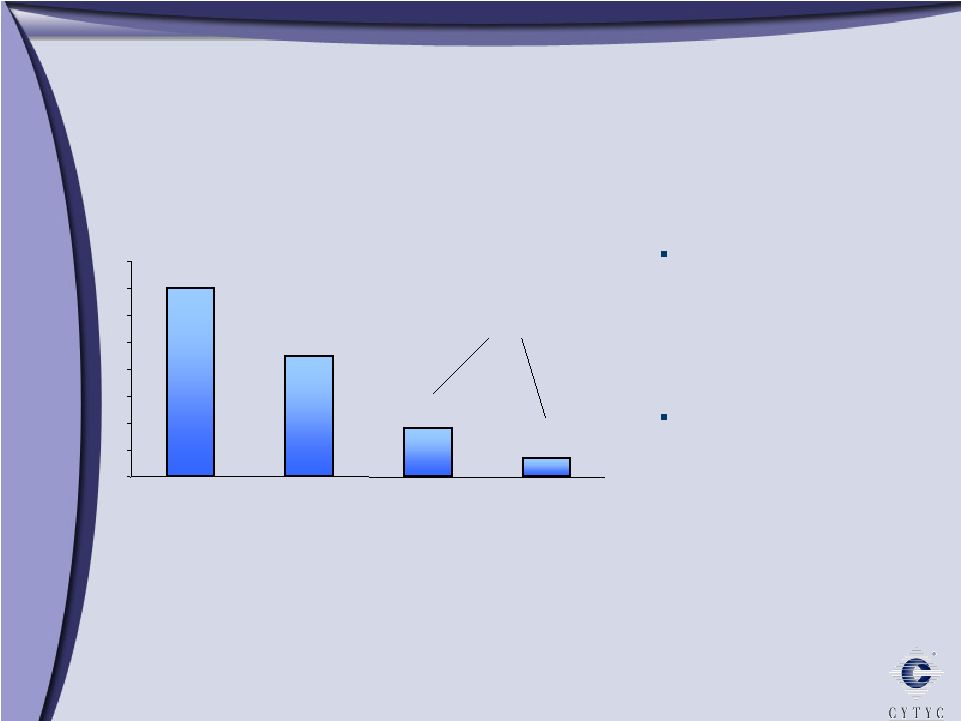

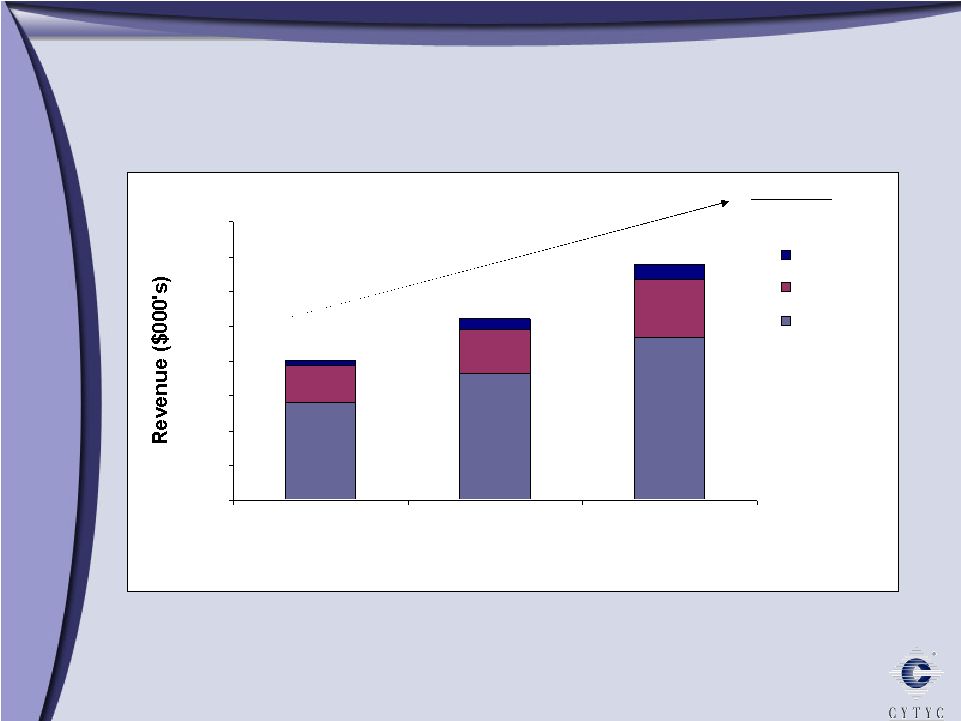

One of the other things that I have really embarked on over the last couple of years is to grow the management team within the organization to allow us to do acquisitions and grow both the top line and the bottom line. If you go back to 2003, we were a one-product company. And the one product company was the ThinPrep Pap test as Thom mentioned. It’s a replacement for the Pap smear. And what we do differently is we, rather than having the physician smear the cells on the glass microscope slide, they rinse it into a vial of our ThinPrep solution. So in 2003, $300 million worth of revenue came from this file. 10% of it was outside the United States, principally in Europe; about two-thirds within the European community and obviously 90% within the United States.

We have grown that over the last couple of years. In 2004, we made an acquisition of Novacept, a California-based company that put us into a very exciting product for treating women with abnormal uterine bleeding. That product has gone from $38 million in 2003 when they were an independent company to, we believe, $225 million contribution to our topline revenue this year.

In 2005, we made an acquisition that put us into breast cancer care called Proxima Therapeutics. It gave us a very interesting, exciting product for radiation therapy for treating women who have had lumpectomy following a diagnosis of breast cancer.

So last year we had grown — we’ve grown over 30% topline since 2003, finishing the year with about a little over $600 million in revenue; about two-thirds of that coming from the ThinPrep Pap test and about one-third coming from the surgical products business, and continuing to grow our international presence which I think is underserved at this point in time.

We are in three different operating divisions. We have a diagnostics division which consists of the ThinPrep Pap test, the imaging system, the Adeza product which we acquired earlier this year, as well as our fast-growing surgical products division which consists of the MammoSite and the NovaSure endometrial ablation products. Both of those product lines are distributed internationally for a common international products division.

When you look at the surgical products — I’d like to hit those first. Two very exciting products, both NovaSure and MammoSite, are best in class products really serving unmet clinical needs for women. The NovaSure procedure — this is a product that is treating women who have abnormal menstrual flow during the monthly period, and is the way to ablate the tissue to prevent that excessive menstrual flow.

We have the best in class product. It’s a very short four minute outpatient procedure. There’s no pretreatment required whatsoever, done oftentimes in the office under conscious sedation. It has the highest success rates and it is reimbursed on a nationwide basis. So this is the product that I mentioned that went from $38 million to $225 million this year; a very successful acquisition.

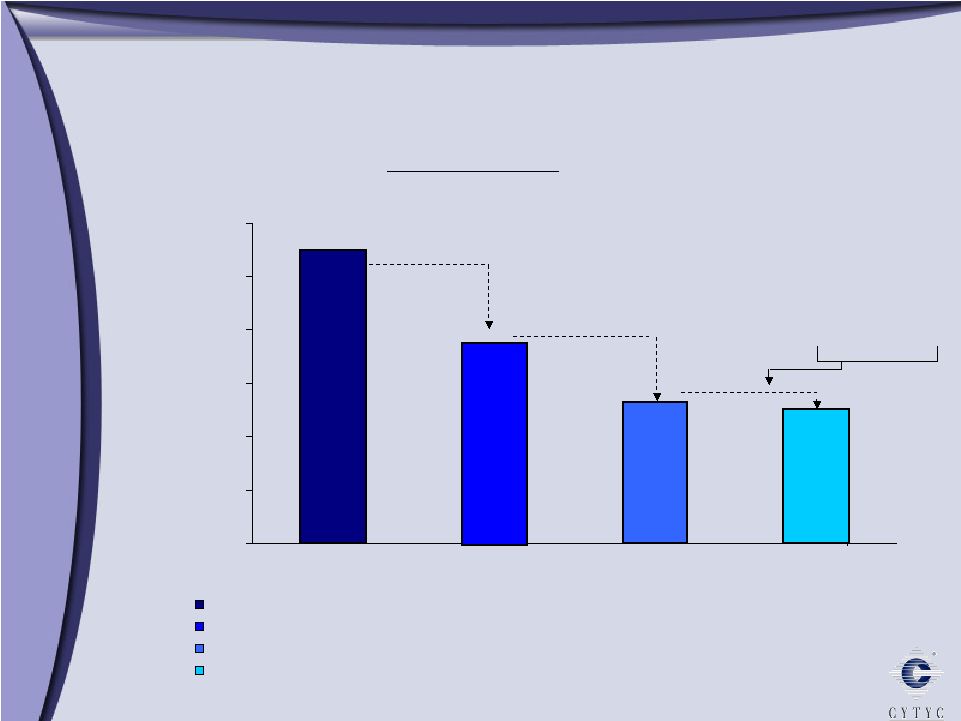

When you look at this market in particular, it is a very large market. On the left-hand side, total number of women that are suffering from this disorder is about 7 million women in just the United States. About 4.5 million of those women don’t do anything. They just suffer in silence thinking that their mother had the issue or that it’s just an issue that they can’t deal with. And so about 2.5 million women actually seek some sort of treatment. About 1.8 million of those women go on some sort of hormone therapy. Typically the doctor will provide a course or two of oral contraceptives to try to reduce the menstrual flow and that works maybe 50% of the time. It really is a coin toss as to whether or not oral contraceptives will help alleviate this disorder.

700,000 procedures that are done in the United States every year consist of global endometrial ablation which there’s about 300,000 procedures today, and the balance are — the other treatments are a hysterectomy as well as a dilation and curettage. And we see the market really growing from the existing procedures, the GEA procedures, overcoming hysterectomy and actually moving up into taking some of the growing market through replacement for the hormone therapy.

The second product that we have in surgical products is our MammoSite product. This is a very innovative product for treating women who have had a lumpectomy following breast cancer surgery. This is a product that provides radiation therapy for those

patients. In breast cancer treatment, once a woman has had a lumpectomy she typically will go on for a 30 day course of therapy to provide radiation to prevent the recurrence of cancer within the same breast at the same site.

And so what this product does is rather than using whole breast radiation, this is called partial breast radiation. And it’s delivered by inserting a catheter that’s shown here in the upper left-hand corner of this slide. It is literally put into the same spot where the tumor was removed and then a radiation source is threaded through this little catheter and it dwells in place for five days, twice a day, and provides the same therapeutic dose as you would receive with whole breast radiation and a 30 day course of therapy.

So the benefit to the patient is significant. Rather than going to the radiation clinic 30 days, she only has to go for five days, and the course of therapy is just as effective as — in terms of outcome — as whole breast radiation.

We acquired this company in 2005. To date we’ve done over 25,000 procedures using the MammoSite device and we have had zero recurrences in our five-year FDA clinical trial data. So this is a very exciting product. There are some other competitors coming onto the market that have products that do similar as the MammoSite device. However, the real market competition is replacing whole breast radiation and I think we are making great strides. We are about 10% of the overall market opportunity at this point in time.

When you look at this, it’s about a $300 million market opportunity in the United States. And you start off with 175,000 women who are diagnosed with breast cancer in the US, and then you exclude patients for whom MammoSite is really not appropriate. Those patients that would elect a mastectomy, that have small breasts or that have large tumors greater than 3 centimeters would be excluded from that market opportunity. And you end up with about 126,000 patients representing about a $300 million market opportunity in our breast cancer product.

The diagnostics products, the other side of our business, really the flagship side where the Company was actually founded, consists of the ThinPrep Pap test as well as the imaging system; two very exciting products. And we acquired a company called Adeza in early — in February/March of this year that provides us the fetal fibronectin test, a test that is determinate — to determine whether a woman is at risk for delivering early. And we have another product for our existing laboratory customers that we’re launching literally the second half of this year that provides us with an Automated Cell Block System that allows us to make additional samples from the ThinPrep file.

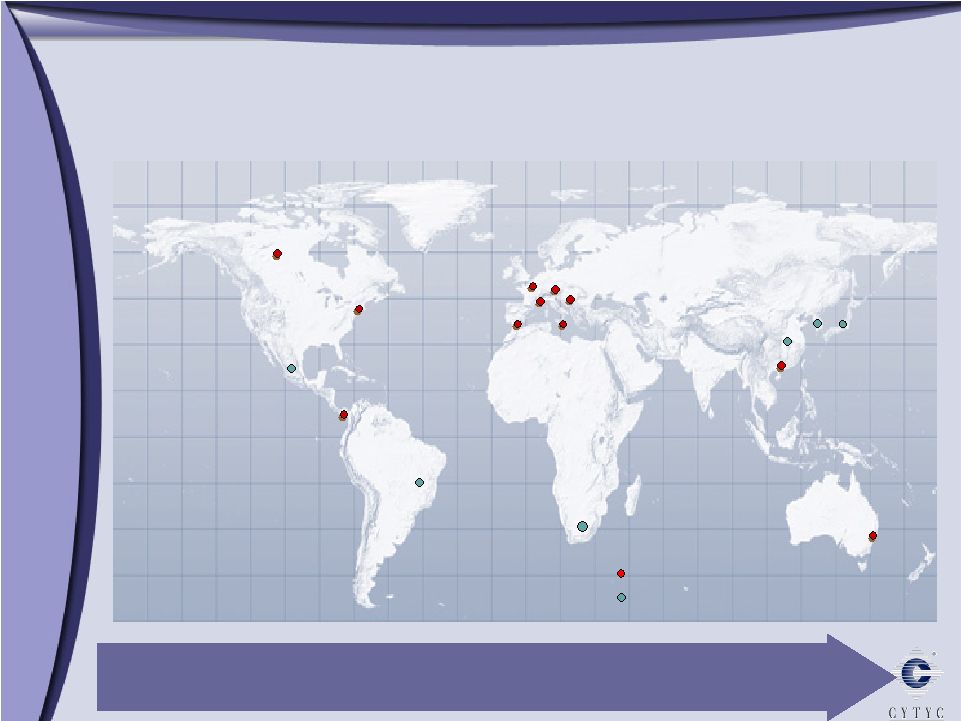

We are an international company in total, operating in over 20 countries. I think when you look at the Hologic merger with Cytyc that this is, I think, one of the major benefits that we bring a direct sales presence. Whereas Hologic uses distributors throughout the world, we have direct presence in all of Western Europe. Our headquarters are here in the UK. We have direct operations in Australia as well as Hong Kong where we operate our distributor, and then — which is a major benefit of having a direct presence.

International in total is about 12 percent of our business. It has grown from 40 million in 2004 to about 70 million last year, a 30% compounded annual growth rate. And we believe that this will continue. About — if you look at our overall business, mix of business internationally, of the $70 million last year about one-third came from Asia-Pacific and two-thirds came from the European business.

So the real challenge for us internationally is — the linchpin of our growth is the ThinPrep Pap test. There’s a tremendous market opportunity for us outside the United States. 100 million tests compared to the 50 million tests that are done within the United States. We are starting to launch our NovaSure business. We have a great presence both in the UK as well as the Benelux countries, Canada and Australia, are great products for our NovaSure products.

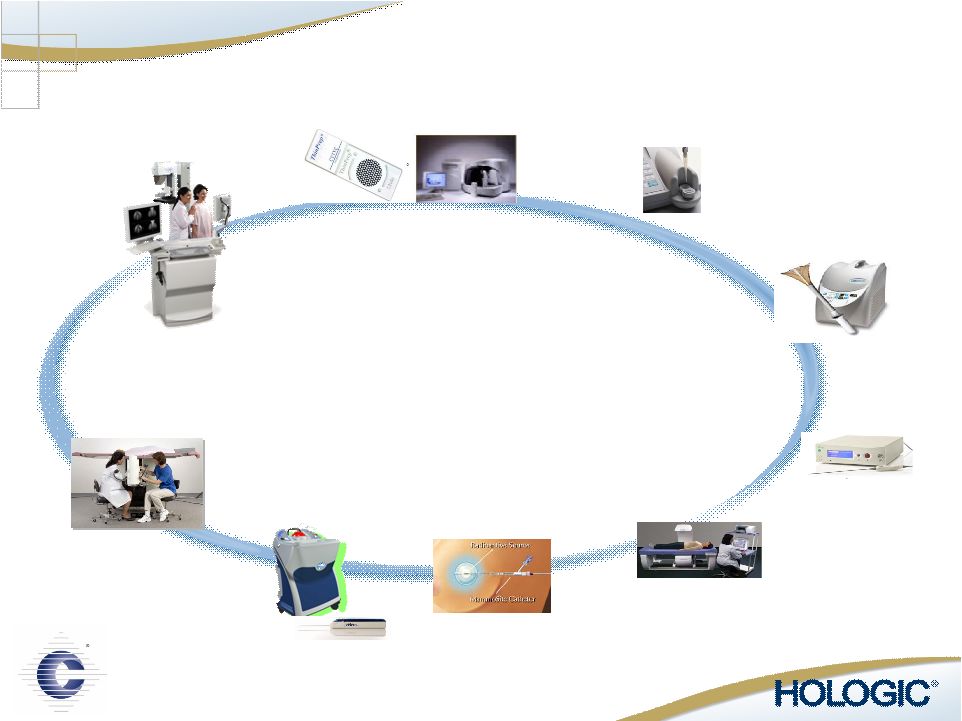

And now to talk about the Hologic merger with Cytyc. We are very excited about this opportunity. We believe we are creating a great women’s health care company, a pure play, as Thom mentioned, focused on women’s health care from — in all aspects from breast health care as well as gynecological health care. When you look at the strategic rationale, we really will have a very

expanded product portfolio, complete sales coverage with people calling on OB/GYN’s, radiation oncologists, breast surgeons as well as radiologists. We really think that there’s a tremendous opportunity to leverage the OB/GYN channel, and there will be great cross-selling opportunities between the two organizations with the various products that we both have together.

When you look at the two Companies, we really are very strong. There’s no weakness in either Company. We have a very strong management team. I’ve been at Cytyc for 16 years and will continue as Chairman of the Board. We believe that this will provide us a platform that provides significant cash flow generation that will allow us not only to become a large company — women’s health care company, but give us the opportunity to build upon that with an infrastructure that will allow us to do future acquisitions that complement the women’s health care strategy.

When you look at the products in the portfolio, the Hologic products principally focus on breast health. The Selenia system is a great product. It’s a digital mammography, just starting to get penetrated in the United States. Only about 19% of mammography today in the US is digital. You tie that together with their [stereotactic] biopsy, the Suros biopsy devices that they put together last year with our MammoSite device. You really have a suite of products that handles the issues of breast health from the diagnosis of breast cancer through the acquisition of sample and to the absolute treatment of breast cancer.

When you look at the overall products that Cytyc brings to the party — principally the gynecological health treating women for permanent sterilization — we acquired Adiana. That gives us a product to compete in the permanent sterilization space that we expect to have approved early next year. With the ThinPrep Pap test and the NovaSure product, we think we will have a suite of products that really is a full suite for a full product portfolio for a comprehensive women’s health care offering.

When you look at the products in the markets in which we will participate, whether it’s breast cancer, osteoporosis, permanent contraceptions, we will have the number one product in each and every category. So this is not — this is two very strong companies coming together to provide, we think, best in class products to meet all the needs of women’s health care.

The financial rationale is very strong. We will have multiple product platforms. You look at the EBITDA between the two companies — $436 million for the last quarter annualized, EPS of $0.10 — adjusted earnings per share of $0.10 and very accretive next year as well. The two companies are about the same size. A little over $700 million in revenue. Put them together, we will be a $1.4 billion Company with — taking operating margins from 46% in the case of Hologic combining with our 75% gross profit margin; a combined company with a 60% right out of the bat — right out of the shoot. But we think we will be moving that to about 65% in the very near term.

So we think that this is a tremendous opportunity to create really a best in class women’s health care product portfolio. We’ll expand our commercial capabilities across the board. We’ll have sales forces calling on breast surgeons, radiation oncologists, laboratories, OB/GYN and breast surgeons. So we will have a complete coverage of the women’s healthcare physicians that we think we can bring additional products in and really leverage this infrastructure.

When you look at the integrated solutions, we will have the best in class products for when a woman goes in for her annual gynecological visit, she will have access to the best cervical cancer screening products — the ThinPrep Pap test and the imaging system — and she will also have access to the best mammography system for breast cancer detection; all coming from the same company.

So with that, in closing I’d like to thank Thom for the opportunity to speak here today. It has been an interesting 10 or 11 year run with Cytyc. And I think we’re very excited about looking forward because we think that the future is very bright. And with the combined companies we’re going to make this even into a much bigger women’s healthcare diagnostic and therapeutic company. So thank you. And thank you, Thom.

A Leading Provider of Innovative Medical Technology Piper Jaffray London Healthcare Conference June 20, 2007 |

Disclaimer Regarding Forward-Looking Statements Forward-Looking Statements Regarding Cytyc Investors are cautioned that statements in this presentation which are not strictly historical statements, including, without limitation, Cytyc's future financial condition, operating results and economic performance, and management's expectations regarding key customer relationships, future growth opportunities, product acceptance and business strategy, constitute forward-looking statements. These statements are based on current expectations, forecasts and assumptions of Cytyc that are subject to risks and uncertainties, which could cause actual outcomes and results to differ materially from those statements. Risks and uncertainties include, among others, the successful integration of acquired businesses into Cytyc's business, dependence on key personnel and customers as well as reliance on proprietary technology, uncertainty of product development efforts and timelines, management of growth, product diversification, and organizational change, entry into new market segments domestically, such as pharmaceuticals, and new markets internationally, risks associated with litigation, competition and competitive pricing pressures, risks associated with the FDA regulatory approval processes and healthcare reimbursement policies in the United States and abroad, introduction of technologies that are disruptive to Cytyc's business and operations, the potential consequences of the restatement of Cytyc's |

Disclaimer Regarding Forward-Looking Statements (continued) financial statements for the period 1996 through 2002, relating to certain employee stock option exercises, including the impact of the expected any regulatory review or litigation relating to such matters, the impact of new accounting requirements and governmental rules and regulations, as well as other risks detailed in Cytyc's filings with the SEC, including those under the heading "Risk Factors" in Cytyc's 2006 Annual Report on Form 10-K/A and Adeza's 2006 Annual Report on Form 10-K, all as filed with the SEC. Cytyc cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they were made. Cytyc disclaims any obligation to publicly update or revise any such statements to reflect any change in its expectations or events, conditions, or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. |

Disclaimer Regarding Forward-Looking Statements (continued) Forward-Looking Statements Regarding the Proposed Hologic-Cytyc Transaction This presentation also includes forward-looking statements about the timing of the completion of the transaction, the anticipated benefits of the business combination transaction involving Hologic and Cytyc, including future financial and operating results, the expected permanent financing for the transaction, the combined company's plans, objectives, expectations and intentions and other statements that are not historical facts. Hologic and Cytyc caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. These include risks and uncertainties relating to: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the parties may be unable to complete the transaction because conditions to the closing of the transaction may not be satisfied; the risk that the businesses will not be integrated successfully; the transaction may involve unexpected costs or unexpected liabilities; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues; the need to develop new products and adapt to |

Disclaimer Regarding Forward-Looking Statements (continued) significant technological change; implementation of strategies for improving internal growth; use and protection of intellectual property; dependence on customers' capital spending policies and government funding policies, including third-party reimbursement; realization of potential future savings from new productivity initiatives; general worldwide economic conditions and related uncertainties; future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors; and the effect of exchange rate fluctuations on international operations. In addition, the transaction will require the combined company to obtain significant financing. While Hologic has obtained a commitment to obtain such financing, including a bridge to the permanent financing contemplated in the presentation, the combined company’s liquidity and results of operations could be materially adversely affected if such financing is not available on favorable terms. Moreover, the substantial leverage resulting from such financing will subject the combined company’s business to additional risks and uncertainties. The risks included above are not exhaustive. The annual reports on Form 10-K, the quarterly reports on Form 10-Q, current reports on Form 8-K and other documents Hologic and Cytyc have filed with the SEC contain additional factors that could impact the combined company’s businesses and financial performance. The parties expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in the parties’ expectations or any change in events, conditions or circumstances on which any such statement is based. |

Important Information for Investors and Stockholders Hologic and Cytyc will file a joint proxy statement/prospectus with the SEC in connection with the proposed merger. HOLOGIC AND CYTYC URGE INVESTORS AND STOCKHOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY EITHER PARTY WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders will be able to obtain the joint proxy statement/prospectus and other documents filed with the SEC free of charge at the website maintained by the SEC at www.sec.gov. In addition, documents filed with the SEC by Hologic will be available free of charge on the investor relations portion of the Hologic website at www.hologic.com. Documents filed with the SEC by Cytyc will be available free of charge on the investor relations portion of the Cytyc website at www.cytyc.com. |

Participants in the Solicitation Hologic, and certain of its directors and executive officers, may be deemed participants in the solicitation of proxies from the stockholders of Hologic in connection with the merger. The names of Hologic’s directors and executive officers and a description of their interests in Hologic are set forth in the proxy statement for Hologic’s 2006 annual meeting of stockholders, which was filed with the SEC on January 25, 2007. Cytyc, and certain of its directors and executive officers, may be deemed to be participants in the solicitation of proxies from its stockholders in connection with the merger. The names of Cytyc’s directors and executive officers and a description of their interests in Cytyc is set forth in Cytyc’s Annual Report on Form 10-K/A for the fiscal year ended December 31, 2006, which was filed with the SEC on April 30, 2007. Investors and stockholders can obtain more detailed information regarding the direct and indirect interests of Hologic’s and Cytyc’s directors and executive officers in the merger by reading the definitive joint proxy statement/prospectus when it becomes available. |

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use the non-GAAP financial measures "adjusted EPS" and “EBITDA”. Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and tax provisions/benefits related thereto. EBITDA is defined as net earnings (loss) before interest, taxes, depreciation and amortization expense. Neither adjusted EPS nor EBITDA is a measure of operating performance under GAAP. We believe that the use of these non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts. When analyzing our operating performance, investors should not consider these non-GAAP measures as a substitute for net income prepared in accordance with GAAP. |

Growth Objectives and Strategy Deliver 20+% long-term earnings growth through: Global organic growth across divisions Internal research and development Strategic acquisitions and partnerships Grow existing businesses resulting in continued revenue growth and improved PBIT margins Enhance organizational bench strength by attracting, motivating, and retaining top talent to support business needs |

0 100 200 300 400 500 600 700 800 900 1 Billion Growth through Diversification 2003 2005 2006 Diagnostic International Surgical $303 Millions $ $508 $608 10% 90% 61% 29% 10% 11% 34% 55% 73% 16% 11% 2004 $394 |

Operating Divisions Domestic Surgical Products Division NovaSure ® Endometrial Ablation MammoSite ® Radiation Therapy Domestic Diagnostic Products Division ThinPrep ® Pap Test ThinPrep ® Imaging System Cellient ™ Automated Cell Block System Full Term ® : The Fetal Fibronectin Test International Division |

Domestic Surgical Products Changing medical practice with innovative medical technology NovaSure Endometrial Ablation • Treatment for excessive menstrual bleeding: $2.5 B market opportunity MammoSite Radiation Therapy • Treatment of early-stage breast cancer: $300 M opportunity |

NovaSure Procedure NovaSure Procedure 4-minute, outpatient procedure No pretreatment drugs required Conscious sedation Recovery = 1 hour Highest success rates Reimbursement established nationwide |

Endometrial Ablation: A Large and Underserved Market Estimates per Cytyc Corporation *All age groups Hysterectomy, D&C, GEA 0 1 2 3 4 5 6 7 8 Total Suffering Silent Sufferers Hormonal Therapy 7m 4.5m 1.8m 0.7m 1 in 5 women suffers from Abnormal Uterine Bleeding 2.5 million women seek treatment* In Millions 2.5 m |

MammoSite Radiation Therapy Creating new standard of care Deliver optimal dose of radiation to tissue at highest risk of cancer recurrence Minimize damage to healthy tissue Expanding data supports partial breast radiation and MammoSite Clinical trial (5-year data; 43 patients): 0 recurrences ASBS registry (2-year data; 1,400 patients) MammoSite RTS afterloader accessories MammoSite RTS applicator |

0 50,000 100,000 150,000 200,000 250,000 300,000 MammoSite Market Opportunity MammoSite Market Opportunity 275,221 189,490 131,695 126,002 MammoSite Primary U.S. Cases of Breast Cancer and DCIS (.4% Incidence, 40+) Patients Eligible for Breast Conserving Therapy (Excludes >3cm, Size A) Patients Receiving Breast Conserving Therapy (70%) Patients Eligible for Mammosite (Excludes women <45, Pathology) Market Opportunity Large tumors 70% elect BCT Surgical margins or lymph node involvement |

Domestic Diagnostic Products ThinPrep ® Pap Test ThinPrep ® Imaging System FullTerm ® : The Fetal Fibrinectin Test Cellient ™ Automated Cell Block System |

Marlborough Cytyc International – Cytyc International – Driving Growth Worldwide Driving Growth Worldwide Legend Australia UK Spain France Italy Germany Switzerland Hong Kong Costa Rica China Mexico Brazil South Africa So. Korea Company presence Key distributors Japan Operating in over 20 countries Canada |

0 10000 20000 30000 40000 50000 60000 70000 80000 2004 2005 2006 ROW AsiaPac Europe Total CAGR 30% International Revenue 2004 – 2006 International Revenue 2004 – 2006 $40 m $52 m $68 m |

Cytyc International Cytyc International Pursue 3 key growth levers Capture and solidify diagnostic share Expand Gyn surgery share and market size Lay foundation for MammoSite growth Strengthen our infrastructure to better serve customers and capture market opportunities |

Creating a Global Leader in Women’s Healthcare Continuing a legacy of leading technology, innovation and rapid growth May 21, 2007 |

Expanded Product Portfolio Comprehensive Sales Coverage Ability to Leverage OB/GYN Channel Significant Cross-Selling Synergies Enhanced International Presence Creating a Global Leader in Women’s Healthcare Market Share Leader in Major Product Lines Proven Management Team Significant Cash Flow Generation Accretive to Adjusted EPS 1 Within the First Full Year After Close Strategic Rationale Combined Strengths 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

MultiCare Stereotactic Biopsy Discovery Osteoporosis Screening Selenia Breast Cancer Screening MammoSite Radiation Therapy ThinPrep Pap Test & Imaging System Cervical Cancer Screening NovaSure Endometrial Ablation Adiana Contraception FullTerm - Adeza Preterm Labor Best-in-Class Solutions in Women’s Healthcare Suros Biopsy Systems Comprehensive Women’s Healthcare Platform |

Solutions for Major Women’s Healthcare Issues Helica Unpenetrated 1 in 3 Gestiva International ThinPrep Imaging System International Tomosynthesis Suros Celero Additional Opportunities Adiana FullTerm Fetal Fibronectin Discovery Sahara NovaSure ThinPrep Pap Test Selenia MultiCare Suros ATEC MammoSite Combined Offering High Medium Low High Medium High Market Growth $100M $1B+ $400M $110M $2.5B+ $550M $1B U.S. Market Size 1 in 4 1 in 2 Pregnancies 1 in 2 1 in 5 1 in 138 1 in 8 U.S. Women Affected Endometriosis Permanent Contraception Preterm Labor Osteoporosis Menorrhagia Cervical Cancer Breast Cancer International NM NM #1 #1 #1 #1 #1 U.S. Market Position International International International International Source: Market research and company estimates. |

Multiple platforms to enhance top and bottom line growth Increased scale through diversification of revenue and strong margin profile Enhanced cash flow; LQA EBITDA of ~$436M Revenue and cost synergy opportunities Estimated more than $0.10 accretive to adjusted EPS 1 within the first full year after close, significantly more accretive thereafter Rapid debt repayment, incremental earnings growth Financial Rationale 1 Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and related tax effect. |

Combined Financial Strength 46% Gross Margin $161M EBITDA $724M Revenue LQA Hologic 75% Gross Margin $275M EBITDA $720M Revenue LQA Cytyc 60% Gross Margin $436M EBITDA $1.44B Revenue LQA Combined Company |

Creating a Global Leader in Women’s Healthcare Comprehensive Women’s Healthcare Product Portfolio – Complementary best-in-class technologies Expanded Commercial Capabilities – Expansive U.S. sales channel coverage – Enhanced presence in key international markets – Platform for entry into new markets Opportunity to offer Integrated Solutions – Screening – Diagnostics – Therapeutics |

A Leading Provider of Innovative Medical Technology |