UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 10-Q

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

| T | OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2009

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

| £ | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from | | to | |

Commission file number 1-10258

| Tredegar Corporation |

| (Exact Name of Registrant as Specified in Its Charter) |

| Virginia | | 54-1497771 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

1100 Boulders Parkway Richmond, Virginia | | 23225 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant's Telephone Number, Including Area Code: (804) 330-1000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | £ | Accelerated filer | T |

| Non-accelerated filer | £ | (Do not check if a smaller reporting company) | Smaller reporting company | £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No T

The number of shares of Common Stock, no par value, outstanding as of October 30, 2009: 33,883,938.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

Tredegar Corporation

Consolidated Balance Sheets

(In Thousands)

(Unaudited)

| | | September 30, | | | December 31, | |

| | | 2009 | | | 2008 | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 82,053 | | | $ | 45,975 | |

| Accounts and notes receivable, net of allowance for doubtful accounts and sales returns of $5,213 in 2009 and $3,949 in 2008 | | | 85,840 | | | | 91,400 | |

| Income taxes recoverable | | | 1,300 | | | | 12,549 | |

| Inventories | | | 30,663 | | | | 36,809 | |

| Deferred income taxes | | | 6,055 | | | | 7,654 | |

| Prepaid expenses and other | | | 3,933 | | | | 5,374 | |

| Total current assets | | | 209,844 | | | | 199,761 | |

| Property, plant and equipment, at cost | | | 667,489 | | | | 640,492 | |

| Less accumulated depreciation | | | 434,270 | | | | 403,622 | |

| Net property, plant and equipment | | | 233,219 | | | | 236,870 | |

| Other assets and deferred charges | | | 40,692 | | | | 38,926 | |

| Goodwill and other intangibles | | | 104,729 | | | | 135,075 | |

| Total assets | | $ | 588,484 | | | $ | 610,632 | |

| | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 57,737 | | | $ | 54,990 | |

| Accrued expenses | | | 35,129 | | | | 38,349 | |

| Current portion of long-term debt | | | 862 | | | | 529 | |

| Total current liabilities | | | 93,728 | | | | 93,868 | |

| Long-term debt | | | 746 | | | | 22,173 | |

| Deferred income taxes | | | 53,279 | | | | 45,152 | |

| Other noncurrent liabilities | | | 25,691 | | | | 29,023 | |

| Total liabilities | | | 173,444 | | | | 190,216 | |

| Shareholders' equity: | | | | | | | | |

| Common stock, no par value | | | 40,528 | | | | 40,719 | |

| Common stock held in trust for savings restoration plan | | | (1,320 | ) | | | (1,313 | ) |

| Foreign currency translation adjustment | | | 26,934 | | | | 23,443 | |

| Loss on derivative financial instruments | | | (463 | ) | | | (6,692 | ) |

| Pension and other postretirement benefit adjustments | | | (64,288 | ) | | | (64,788 | ) |

| Retained earnings | | | 413,649 | | | | 429,047 | |

| Total shareholders' equity | | | 415,040 | | | | 420,416 | |

| Total liabilities and shareholders' equity | | $ | 588,484 | | | $ | 610,632 | |

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statements of Income

(In Thousands, Except Per Share Data)

(Unaudited)

| | | Three Months | | | Nine Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Revenues and other items: | | | | | | | | | | | | |

| Sales | | $ | 175,662 | | | $ | 228,709 | | | $ | 486,843 | | | $ | 691,197 | |

| Other income (expense), net | | | 300 | | | | 7,709 | | | | 1,657 | | | | 8,929 | |

| | | | 175,962 | | | | 236,418 | | | | 488,500 | | | | 700,126 | |

| Costs and expenses: | | | | | | | | | | | | | | | | |

| Cost of goods sold | | | 135,779 | | | | 195,438 | | | | 386,652 | | | | 585,926 | |

| Freight | | | 4,692 | | | | 5,450 | | | | 11,791 | | | | 16,348 | |

| Selling, general and administrative | | | 16,152 | | | | 13,602 | | | | 45,191 | | | | 44,376 | |

| Research and development | | | 2,469 | | | | 3,027 | | | | 7,980 | | | | 8,361 | |

| Amortization of intangibles | | | 30 | | | | 30 | | | | 90 | | | | 93 | |

| Interest expense | | | 197 | | | | 483 | | | | 585 | | | | 1,921 | |

| Asset impairments and costs associated with exit and disposal activities | | | - | | | | - | | | | 1,482 | | | | 5,159 | |

| Goodwill impairment charge | | | - | | | | - | | | | 30,559 | | | | - | |

| Total | | | 159,319 | | | | 218,030 | | | | 484,330 | | | | 662,184 | |

| Income from continuing operations before income taxes | | | 16,643 | | | | 18,388 | | | | 4,170 | | | | 37,942 | |

| Income taxes | | | 5,647 | | | | 7,310 | | | | 15,504 | | | | 14,214 | |

| Income (loss) from continuing operations | | | 10,996 | | | | 11,078 | | | | (11,334 | ) | | | 23,728 | |

| Loss from discontinued operations | | | - | | | | - | | | | - | | | | (930 | ) |

| Net income (loss) | | $ | 10,996 | | | $ | 11,078 | | | $ | (11,334 | ) | | $ | 22,798 | |

| | | | | | | | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | .32 | | | $ | .33 | | | $ | (.33 | ) | | $ | .70 | |

| Discontinued operations | | | - | | | | - | | | | - | | | | (.03 | ) |

| Net income (loss) | | $ | .32 | | | $ | .33 | | | $ | (.33 | ) | | $ | .67 | |

| | | | | | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | .32 | | | $ | .33 | | | $ | (.33 | ) | | $ | .69 | |

| Discontinued operations | | | - | | | | - | | | | - | | | | (.03 | ) |

| Net income (loss) | | $ | .32 | | | $ | .33 | | | $ | (.33 | ) | | $ | .66 | |

| | | | | | | | | | | | | | | | | |

| Shares used to compute earnings (loss) per share: | | | | | | | | | | | | | | | | |

| Basic | | | 33,878 | | | | 33,672 | | | | 33,873 | | | | 34,042 | |

| Diluted | | | 33,922 | | | | 33,903 | | | | 33,873 | | | | 34,262 | |

| | | | | | | | | | | | | | | | | |

| Dividends per share | | $ | .04 | | | $ | .04 | | | $ | .12 | | | $ | .12 | |

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

| | | Nine Months | |

| | | Ended Sept. 30 | |

| | | 2009 | | | 2008 | |

| Cash flows from operating activities: | | | | | | |

| Net income (loss) | | $ | (11,334 | ) | | $ | 22,798 | |

| Adjustments for noncash items: | | | | | | | | |

| Depreciation | | | 29,607 | | | | 32,844 | |

| Amortization of intangibles | | | 90 | | | | 93 | |

| Goodwill impairment charge | | | 30,559 | | | | - | |

| Deferred income taxes | | | 3,647 | | | | 17,515 | |

| Accrued pension and postretirement benefits | | | (2,219 | ) | | | (3,354 | ) |

| Loss on asset impairments and divestitures | | | - | | | | 3,337 | |

| Gain on the write-up of an investment accounted for under the fair value method | | | - | | | | (5,000 | ) |

| Gain on sale of assets | | | (1,004 | ) | | | (2,500 | ) |

| Changes in assets and liabilities, net of effects of acquisitions and divestitures: | | | | | | | | |

| Accounts and notes receivable | | | 7,087 | | | | (22,101 | ) |

| Inventories | | | 7,088 | | | | 16,430 | |

| Income taxes recoverable | | | 11,249 | | | | (13,544 | ) |

| Prepaid expenses and other | | | 1,466 | | | | (1,600 | ) |

| Accounts payable and accrued expenses | | | 10,425 | | | | 12,120 | |

| Other, net | | | (1,154 | ) | | | 3,359 | |

| Net cash provided by operating activities | | | 85,507 | | | | 60,397 | |

| Cash flows from investing activities: | | | | | | | | |

| Capital expenditures (including settlement of related accounts payable of $1,709 in 2009) | | | (25,507 | ) | | | (13,849 | ) |

| Proceeds from the sale of the aluminum extrusions business in Canada (net of cash included in sale and transaction costs) | | | - | | | | 23,616 | |

| Proceeds from the sale of assets and property disposals | | | 1,118 | | | | 3,682 | |

| Investments | | | - | | | | (2,059 | ) |

| Net cash provided by (used in) investing activities | | | (24,389 | ) | | | 11,390 | |

| Cash flows from financing activities: | | | | | | | | |

| Dividends paid | | | (4,071 | ) | | | (4,090 | ) |

| Debt principal payments | | | (21,094 | ) | | | (75,657 | ) |

| Borrowings | | | - | | | | 22,000 | |

| Repurchases of Tredegar common stock (including settlement of payable of $3,368 in 2008) | | | (1,523 | ) | | | (19,792 | ) |

| Proceeds from exercise of stock options and other | | | 224 | | | | 4,069 | |

| Net cash used in financing activities | | | (26,464 | ) | | | (73,470 | ) |

| Effect of exchange rate changes on cash | | | 1,424 | | | | 90 | |

| Increase (decrease) in cash and cash equivalents | | | 36,078 | | | | (1,593 | ) |

| Cash and cash equivalents at beginning of period | | | 45,975 | | | | 48,217 | |

| Cash and cash equivalents at end of period | | $ | 82,053 | | | $ | 46,624 | |

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statement of Shareholders' Equity

(In Thousands, Except Per Share Data)

(Unaudited)

| | | | | | | | | | | | Accumulated Other | | | | |

| | | | | | | | | | | | Comprehensive Income (Loss) | | | | |

| | | Common Stock | | | Retained Earnings | | | Trust for Savings Restoration Plan | | | Foreign Currency Translation | | | Gain (Loss) on Derivative Financial Instruments | | | Pension & Other Post- retirement Benefit Adjust. | | | Total Shareholders' Equity | |

| Balance December 31, 2008 | | $ | 40,719 | | | $ | 429,047 | | | $ | (1,313 | ) | | $ | 23,443 | | | $ | (6,692 | ) | | $ | (64,788 | ) | | $ | 420,416 | |

| Comprehensive income (loss): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | | - | | | | (11,334 | ) | | | - | | | | - | | | | - | | | | - | | | | (11,334 | ) |

| Other comprehensive income (loss): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment (net of tax of $1,927) | | | - | | | | - | | | | - | | | | 3,491 | | | | - | | | | - | | | | 3,491 | |

| Derivative financial instruments adjustment (net of tax of $3,837) | | | - | | | | - | | | | - | | | | - | | | | 6,229 | | | | - | | | | 6,229 | |

| Amortization of prior service costs and net gains or losses (net of tax of $281) | | | - | | | | - | | | | - | | | | - | | | | - | | | | 500 | | | | 500 | |

| Comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | (1,114 | ) |

| Cash dividends declared ($.12 per share) | | | - | | | | (4,071 | ) | | | - | | | | - | | | | - | | | | - | | | | (4,071 | ) |

| Stock-based compensation expense & other | | | 1,950 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,950 | |

| Issued upon exercise of stock options (including related income tax expense of $65) & other | | | (618 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (618 | ) |

| Repurchases of Tredegar common stock | | | (1,523 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,523 | ) |

Tredegar common stock purchased by trust for savings restoration plan | | | - | | | | 7 | | | | (7 | ) | | | - | | | | - | | | | - | | | | - | |

| Balance September 30, 2009 | | $ | 40,528 | | | $ | 413,649 | | | $ | (1,320 | ) | | $ | 26,934 | | | $ | (463 | ) | | $ | (64,288 | ) | | $ | 415,040 | |

See accompanying notes to financial statements.

TREDEGAR CORPORATION

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

| 1. | In the opinion of management, the accompanying consolidated financial statements of Tredegar Corporation and Subsidiaries (“Tredegar,” “we,” “us” or “our”) contain all adjustments necessary to present fairly, in all material respects, Tredegar’s consolidated financial position as of September 30, 2009, the consolidated results of operations for the three and nine months ended September 30, 2009 and 2008, the consolidated cash flows for the nine months ended September 30, 2009 and 2008, and the consolidated changes in shareholders’ equity for the nine months ended September 30, 2009. All such adjustments are deemed to be of a normal, recurring nature. The preparation of these interim financial statements also includes an evaluation of subsequent events through November 2, 2009. These financial statements should be read in conjunction with the consolidated financial statements and related notes included in Tredegar’s Annual Report on Form 10-K for the year ended December 31, 2008. The results of operations for the nine months ended September 30, 2009, are not necessarily indicative of the results to be expected for the full year. |

| 2. | Plant shutdowns, asset impairments, restructurings and other charges in the third quarter of 2009 shown in the net sales and operating profit by segment table in Note 10 include: |

| | · | Pretax losses of $111,000 for timing differences between the recognition of realized losses on aluminum futures contracts and related revenues from the delayed fulfillment by customers of fixed-price forward purchase commitments (included in “Cost of goods sold” in the consolidated statements of income, see Note 8 on page 11 for additional detail). |

Plant shutdowns, asset impairments, restructurings and other charges in the first nine months of 2009 shown in the net sales and operating profit by segment table in Note 10 include:

| | · | Pretax charges of $1.6 million for severance and other employee-related costs in connection with restructurings in Film Products ($1.1 million), Aluminum Extrusions ($369,000) and corporate headquarters ($178,000, included in “Corporate expenses, net” in the net sales and operating profit by segment table in Note 10); |

| | · | Pretax losses of $1.5 million for timing differences between the recognition of realized losses on aluminum futures contracts and related revenues from the delayed fulfillment by customers of fixed-price forward purchase commitments (included in “Cost of goods sold” in the consolidated statements of income, see Note 8 on page 11 for additional detail); |

| | · | Pretax gain of $276,000 related to the reduction of future environmental costs expected to be incurred by Aluminum Extrusions (included in “Cost of goods sold” in the consolidated statements of income); |

| | · | Pretax gain of $275,000 on the sale of equipment (included in “Other income (expense), net” in the consolidated statements of income) from a previously shutdown films manufacturing facility in LaGrange, Georgia; |

| | · | Pretax gain of $175,000 on the sale of a previously shutdown aluminum extrusions manufacturing facility in El Campo, Texas (included in “Other income (expense), net” in the consolidated statements of income); and |

| | · | Pretax gain of $149,000 related to the reversal to income of certain inventory impairment accruals in Film Products. |

There were no plant shutdowns, asset impairments, restructurings, and other charges in the third quarter of 2008. Plant shutdowns, asset impairments, restructurings, and other charges in the first nine months of 2008 shown in the net sales and operating profit by segment table in Note 10 include:

| | · | Pretax charges of $2.7 million for severance and other employee-related costs in connection with restructurings in Film Products ($2.2 million) and Aluminum Extrusions ($510,000); |

| | · | Pretax charges of $2.5 million for asset impairments in Film Products; and |

| | · | Pretax charge of $105,000 related to expected future environmental costs at the aluminum extrusions facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statements of income). |

The reduction in workforce in Film Products in 2009 (approximately 40 people) is expected to save $1.1 million in 2009 and $2.1 million on an annualized basis. The reduction in workforce in Film Products in 2008 (approximately 90 people) is expected to save $4.2 million on an annualized basis.

Results for 2009 also include a pretax gain of $404,000 ($257,000 after tax) on the sale of corporate real estate in the first quarter. Results for the third quarter and first nine months of 2008 include a realized gain of $509,000 ($310,000 after tax) on the sale of equity securities and a realized gain of $492,000 ($316,000 after tax) on the sale of corporate real estate. Each of these gains is included in “Other income (expenses), net” in the consolidated statements of income.

Income taxes for the first nine months of 2009 include the recognition of a valuation allowance of $3.3 million (including a partial reversal of $476,000 recognized in the third quarter) related to the expected limitations on the utilization of assumed capital losses on certain investments. Income taxes for the first nine months of 2008 include the partial reversal of a valuation allowance recognized in the third quarter of 2007 of $1.1 million that originally related to expected limitations on the utilization of assumed capital losses on certain investments. The portion of the 2007 valuation allowance reversed in the third quarter of 2008 was $150,000.

On February 12, 2008, we sold our aluminum extrusions business in Canada for approximately $25 million to an affiliate of H.I.G. Capital. We recognized a charge of $1.1 million ($430,000 after taxes) in the first quarter of 2008 and $207,000 ($207,000 after taxes) in the second quarter of 2008, which was in addition to the asset impairment charges recognized in 2007, to adjust primarily for differences in the carrying value of assets and liabilities and related tax benefits associated with the business sold since December 31, 2007. The remaining after-tax loss for discontinued operations in 2008 of $293,000 relates to the loss from operations up through the date of sale. All historical results for this business have been reflected as discontinued operations in the accompanying financial statements and tables, except cash flows for discontinued operations have not been separately disclosed in the consolidated statements of cash flows.

The components of the loss from discontinued operations are presented below:

| | | Three Months Ended | | | Nine Months Ended | |

| | | Sept. 30 | | | Sept. 30 | |

| (In Thousands) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Loss from operations before income taxes | | $ | - | | | $ | - | | | $ | - | | | $ | (391 | ) |

| Income tax cost (benefit) on operations | | | - | | | | - | | | | - | | | | (98 | ) |

| | | | - | | | | - | | | | - | | | | (293 | ) |

| Loss associated with asset impairments and disposal activities | | | - | | | | - | | | | - | | | | (1,337 | ) |

| Income tax cost (benefit) on asset impairments and costs associated with disposal activities | | | - | | | | - | | | | - | | | | (700 | ) |

| | | | - | | | | - | | | | - | | | | (637 | ) |

| Loss from discontinued operations | | $ | - | | | $ | - | | | $ | - | | | $ | (930 | ) |

A reconciliation of the beginning and ending balances of accrued expenses associated with asset impairments and exit and disposal activities for the nine months ended September 30, 2009 is as follows:

| (In Thousands) | | Severance | | | Other (a) | | | Total | |

| Balance at December 31, 2008 | | $ | 431 | | | $ | 4,491 | | | $ | 4,922 | |

| Changes in 2009: | | | | | | | | | | | | |

| Charges | | | 1,631 | | | | - | | | | 1,631 | |

| Cash spent | | | (1,435 | ) | | | (999 | ) | | | (2,434 | ) |

| Balance at September 30, 2009 | | $ | 627 | | | $ | 3,492 | | | $ | 4,119 | |

| (a) | Other primarily includes accrued losses on a sub-lease at a facility in Princeton, New Jersey. |

| 3. | We assess goodwill for impairment when events or circumstances indicate that the carrying value may not be recoverable, or, at a minimum, on an annual basis (December 1st of each year). Our reporting units include Film Products and Aluminum Extrusions, each of which may have separately identifiable operating net assets (operating assets including goodwill and intangible assets net of operating liabilities). We estimate the fair value of our reporting units using discounted cash flow analysis and comparative enterprise value-to-EBITDA multiples. Based on the severity of the economic downturn and its impact on the sales volumes of our aluminum extrusions business (a 36.8% decline in sales volume in the first quarter of 2009 compared with the first quarter of 2008), the resulting first quarter operating loss (see Note 10), possible future losses and the uncertainty in the amount and timing of an economic recovery, we determined that impairment indicators existed. Upon completing the impairment analysis as of March 31, 2009, a goodwill impairment charge of $30.6 million ($30.6 million after tax) was recognized in Aluminum Extrusions in the first quarter of 2009. This was the entire amount of goodwill associated with the Aluminum Extrusions reporting unit and an anomalous write-off under U.S. GAAP since the decline in the estimated fair value below the carrying value of the operating net assets of Aluminum Extrusions was far less than $30.6 million. The goodwill of Film Products will be tested for impairment at the annual testing date unless there is an indicator of impairment identified at an earlier date. |

| 4. | The components of other comprehensive income or loss are as follows: |

| | | Three Months | | | Nine Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| (In Thousands) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Net income (loss) | | $ | 10,996 | | | $ | 11,078 | | | $ | (11,334 | ) | | $ | 22,798 | |

| Other comprehensive income (loss), net of tax: | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment: | | | | | | | | | | | | | | | | |

| Unrealized foreign currency translation adjustment arising during period | | | 2,878 | | | | (6,656 | ) | | | 3,491 | | | | 508 | |

| Reclassification adjustment of foreign currency translation gain included in income (related to sale of aluminum extrusions business in Canada - see Note 2) | | | - | | | | - | | | | - | | | | (14,292 | ) |

| Foreign currency translation adjustment | | | 2,878 | | | | (6,656 | ) | | | 3,491 | | | | (13,784 | ) |

| Derivative financial instrument adjustment | | | 1,279 | | | | (3,655 | ) | | | 6,229 | | | | (1,068 | ) |

| Pension and other post-retirement benefit adjustment: | | | | | | | | | | | | | | | | |

| Amortization of prior service costs and net gains or losses | | | 109 | | | | 547 | | | | 500 | | | | 315 | |

| Reclassification of net actuarial losses and prior service costs (related to sale of aluminum extrusions business in Canada - see Note 2) | | | - | | | | - | | | | - | | | | 4,871 | |

Pension and other post-retirement benefit adjustment | | | 109 | | | | 547 | | | | 500 | | | | 5,186 | |

| Comprehensive income (loss) | | $ | 15,262 | | | $ | 1,314 | | | $ | (1,114 | ) | | $ | 13,132 | |

| 5. | The components of inventories are as follows: |

| | | Sept. 30 | | | Dec. 31 | |

| (In Thousands) | | 2009 | | | 2008 | |

| Finished goods | | $ | 5,578 | | | $ | 7,470 | |

| Work-in-process | | | 1,653 | | | | 2,210 | |

| Raw materials | | | 8,898 | | | | 14,264 | |

| Stores, supplies and other | | | 14,534 | | | | 12,865 | |

| Total | | $ | 30,663 | | | $ | 36,809 | |

| 6. | Basic earnings per share is computed by dividing net income by the weighted average number of shares of common stock outstanding. Diluted earnings per share is computed by dividing net income by the weighted average common and potentially dilutive common equivalent shares outstanding, determined as follows: |

| | | Three Months | | | Nine Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| (In Thousands) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Weighted average shares outstanding used to compute basic earnings (loss) per share | | | 33,878 | | | | 33,672 | | | | 33,873 | | | | 34,042 | |

Incremental dilutive shares attributable to stock options and restricted stock | | | 44 | | | | 231 | | | | - | | | | 220 | |

Shares used to compute diluted earnings (loss) per share | | | 33,922 | | | | 33,903 | | | | 33,873 | | | | 34,262 | |

Incremental shares attributable to stock options and restricted stock are computed using the average market price during the related period. During the three and nine months ended September 30, 2009 and three and nine months ended September 30, 2008, 709,433, 496,678, 336,850 and 519,246, respectively, of anti-dilutive options to purchase shares were excluded from the calculation of incremental shares attributable to stock options and restricted stock.

| 7. | Our investment in Harbinger Capital Partners Special Situations Fund, L.P. (“Harbinger Fund”) had a reported capital account value of $11.5 million at September 30, 2009, compared with $10.1 million at December 31, 2008. This investment has a carrying value in Tredegar’s balance sheet (included in “Other assets and deferred charges”) of $10.0 million, which represents the amount invested on April 2, 2007. |

During the third quarter of 2008, we sold our investments in Theken Spine and Therics, LLC for a gain of $1.5 million (included in “Other income (expense), net” in the consolidated statements of income). In 2009, we recognized a gain of $150,000 in the first quarter for a post-closing adjustment related to the sale (included in “Other income (expense), net” in the consolidated statements of income). AFBS, Inc. (formerly Therics, Inc.) received these investments in 2005, when substantially all of the assets of AFBS, Inc., a wholly owned subsidiary of Tredegar, were sold or assigned to a newly created limited liability company, Therics, LLC, controlled and managed by an individual not affiliated with Tredegar.

During the third quarter of 2007, we invested $6.5 million in a privately held drug delivery company. In the fourth quarter of 2008, we invested an additional $1.0 million as part of a new round of financing completed by the investee. The company is developing and commercializing state of the art drug delivery systems designed to improve patient compliance and outcomes, and our ownership interest on a fully diluted basis is approximately 21%. The investment is accounted for under the fair value method. We elected the fair value option over the equity method of accounting since our investment objectives are similar to those of venture capitalists, which typically do not have controlling financial interests. At September 30, 2009, the estimated fair value of our investment (also the carrying value included in “Other assets and deferred charges” in our balance sheet) was $13.1 million. The fair value of our investment, which exceeds the amount of cash invested by $5.6 million, was based on our estimate of the value of our ownership interest.

On the date of our most recent investment (December 15, 2008), we believe that the amount we paid for our ownership interest and liquidation preferences was based on Level 2 inputs, including investments by other investors. Subsequent to December 15, 2008, and until the next round of financing, we believe fair value estimates drop to Level 3 inputs since there is no secondary market for our ownership interest. In addition, the company currently has no product sales. Accordingly, after the latest financing and until the next round of financing or other significant financial transaction, value estimates primarily will be based on assumptions relating to meeting product development and commercialization milestones, cash flow projections (projections of sales, costs, expenses, capital expenditures and working capital investment) and discounting of these factors for the high degree of risk. As a result, an increase in our estimate of the fair value of our ownership interest is unlikely unless a significant new round of financing, merger, or initial public offering or significant favorable event versus plans indicates a higher value. However, if the company does not meet its development and commercialization milestones and there are indications that the amount or timing of its projected cash flows or related risks are unfavorable versus plans as of December 15, 2008, or a new round of financing or other significant financial transaction indicates a lower value, then our estimate of the fair value of our ownership interest in the company is likely to decline.

Had we not elected to account for our investment under the fair value method, we would have been required to use the equity method of accounting. For the three and nine months ended September 30, 2009, net losses recorded by the drug company, as reported to us by the investee, were $1.0 million and $4.4 million, respectively, compared to net losses of $2.0 million and $5.1 million for the three and nine months ended September 30, 2008, respectively. Total assets (which included cash and cash equivalents of $336,000 at September 30, 2009 and $5.5 million at December 31, 2008) were $3.2 million and $8.4 million at September 30, 2009 and December 31, 2008, respectively.

On December 31, 2008, the privately held drug company was converted from a limited liability company taxed as a pass-through entity (partnership) to a corporation. Substantially all shareholder rights from the limited liability company carried over in the conversion. Our allocation of losses for tax purposes as a pass-through entity in 2008 was approximately $4.8 million.

| 8. | We use derivative financial instruments for the purpose of hedging margin exposure from fixed-price forward sales contracts in Aluminum Extrusions and currency exchange rate exposures that exist as part of ongoing business operations primarily in Film Products. Our derivative financial instruments are designated as and qualify as cash flow hedges and are recognized in the consolidated balance sheet at fair value. A change in the fair value of derivatives that are highly effective as and that are designated and qualify as cash flow hedges is recorded in other comprehensive income (loss). Gains and losses accumulated in other comprehensive income (loss) are reclassified to earnings in the periods in which earnings are affected by the variability of cash flows of the hedged transaction. Such gains and losses are reported on the same line as the underlying hedged item. Any hedge ineffectiveness (which represents the amount by which the changes in the fair value of the derivative exceed the variability in the cash flows of the forecasted transaction) is recorded in current period earnings. The amount of gains and losses recognized for hedge ineffectiveness was not material to the three and nine month periods ended September 30, 2009 and 2008. |

The fair value of derivative instruments recorded on the consolidated balance sheets are based upon Level 2 inputs. If individual derivative instruments with the same counterparty can be settled on a net basis, we record the corresponding derivative fair values as a net asset or net liability.

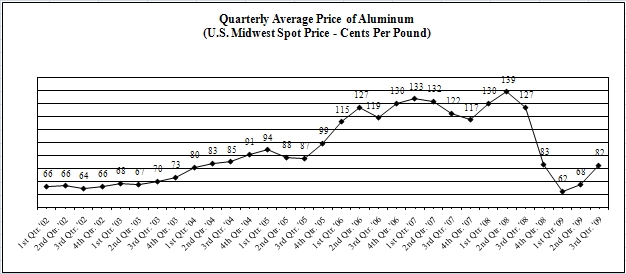

In the normal course of business, we enter into fixed-price forward sales contracts with certain customers for the future sale of fixed quantities of aluminum extrusions at scheduled intervals. In order to hedge our margin exposure created from the fixing of future sales prices relative to volatile raw material (aluminum) costs, we enter into a combination of forward purchase commitments and futures contracts to acquire or hedge aluminum, based on the scheduled purchases for the firm sales commitments. The fixed-price firm sales commitments and related hedging instruments generally have durations of not more than 12 months, and the notional amount of aluminum futures contracts that hedged future purchases of aluminum to meet fixed-price forward sales contract obligations was $8.6 million (9.6 million pounds of aluminum) at September 30, 2009 and $28.1 million (23.8 million pounds of aluminum) at December 31, 2008.

The table below summarizes the location and gross amounts of aluminum futures contract fair values in the consolidated balance sheets as of September 30, 2009 and December 31, 2008:

| (In Thousands) | | September 30, 2009 | | | December 31, 2008 | |

| | | Balance Sheet | | Fair | | | Balance Sheet | | Fair | |

| | | Account | | Value | | | Account | | Value | |

| | | | | | | | | | | |

| Derivatives Designated as Hedging Instruments | | | | | | | | | | |

| | | | | | | | | | | |

| Asset derivatives: | | | | | | | | | | |

| Aluminum futures contracts (before margin deposits) | | Accrued expenses | | $ | 506 | | | Accrued expenses | | $ | - | |

| | | | | | | | | | | | | |

| Liability derivatives: | | | | | | | | | | | | |

Aluminum futures contracts (before margin deposits) | | Accrued expenses | | $ | 1,069 | | | Accrued expenses | | $ | 11,042 | |

| | | | | | | | | | | | | |

| Derivatives Not Designated as Hedging Instruments | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Asset derivatives: | | | | | | | | | | | | |

| Aluminum futures contracts (before margin deposits) | | Accrued expenses | | $ | 231 | | | Accrued expenses | | $ | 973 | |

| | | | | | | | | | | | | |

| Liability derivatives: | | | | | | | | | | | | |

Aluminum futures contracts (before margin deposits) | | Accrued expenses | | $ | 231 | | | Accrued expenses | | $ | 973 | |

In the event that a counterparty to an aluminum fixed-price forward sales contract chooses not to take delivery of its aluminum extrusions, the customer is contractually obligated to compensate us for any losses on the related aluminum futures and/or forward purchase contracts through the date of cancellation. The offsetting asset and liability positions included in the table above are associated with the unwinding of aluminum futures contracts that relate to such cancellations.

Our aluminum futures brokers contractually require assets to be posted as collateral for unrealized losses in excess of a contractually defined credit limit. Due to significant reductions in aluminum prices on the London Metal Exchange (“LME”) in the second half of 2008 (see chart on page 31), we were required to post margin deposits of $4.0 million at December 31, 2008 on LME futures losses (no deposits required at September 30, 2009). These amounts are recorded as an offset to the fair value of unrealized aluminum futures contract losses included in “Accrued expenses” in the consolidated balance sheets.

Losses associated with the aluminum extrusions business of $111,000 ($68,000 after tax) and $1.5 million ($931,000 after tax) were recognized during the three and nine month periods ending September 30, 2009, respectively, for timing differences between the recognition of realized losses on aluminum futures contracts and related revenues from delayed fulfillment by customers of fixed-price forward purchase commitments. Such timing differences are included in “Plant shutdowns, assets impairments, restructurings and other” in the net sales and operating profit by segment table in Note 10. Timing differences prior to 2009 have not been significant.

We have future fixed Euro-denominated contractual payments for equipment being purchased as part of our expansion of the Carthage, Tennessee aluminum extrusion manufacturing facility. We have used a fixed rate Euro forward contract with various settlement dates to hedge exchange rate exposure on these obligations. The notional amount of this foreign currency forward was $1.5 million at September 30, 2009 and $4.2 million at December 31, 2008.

The table below summarizes the location and gross amounts of foreign currency forward contract fair values in the consolidated balance sheets as of September 30, 2009 and December 31, 2008:

| (In Thousands) | | September 30, 2009 | | | December 31, 2008 | |

| | | Balance Sheet | | Fair | | | Balance Sheet | | Fair | |

| | | Account | | Value | | | Account | | Value | |

| | | | | | | | | | | |

| Derivatives Designated as Hedging Instruments | | | | | | | | | | |

| | | | | | | | | | | | | |

| Asset derivatives: | | | | | | | | | | | | |

| Foreign currency forward contracts | | Prepaid expenses and other | | $ | 109 | | | Prepaid expenses and other | | $ | 56 | |

We receive Euro-based royalty payments relating to our operations in Europe. We use zero-cost collar currency options to hedge a portion of our exposure to changes in cash flows due to variability in U.S. Dollar and Euro exchange rates. The outstanding notional amount on these collars was $3.5 million at September 30, 2009, and the outstanding currency collar options will expire on December 31, 2009. There were no derivatives outstanding at December 31, 2008 related to the hedging of royalty payments with currency options. The table below summarizes our open currency option positions at September 30, 2009:

| | | | | | U.S. Dollar Equivalent Strike Prices of Options Bought and Sold on USD/EUR | |

| Period Covered by Contract | | Notional Amount (In Thousands) | | | Call Options Sold | | | Put Options Bought | |

| 4th Qtr 2009 | | $ | 3,500 | | | $ | 1.39 | | | $ | 1.28 | |

The table below summarizes the location and gross amounts of foreign currency option contract fair values in the consolidated balance sheets as of September 30, 2009 and December 31, 2008:

| (In Thousands) | | September 30, 2009 | | | December 31, 2008 | |

| | | Balance Sheet | | Fair | | | Balance Sheet | | | Fair | |

| | | Account | | Value | | | Account | | | Value | |

| | | | | | | | | | | | |

| Derivatives Designated as Hedging Instruments | | | | | | | | | | | |

| | | | | | | | | | | | |

| Asset derivatives: | | | | | | | | | | | |

| Foreign currency option contracts | | Accrued expenses | | $ | - | | | Not Applicable | |

| | | | | | | | | | | | | |

| Liability derivatives: | | | | | | | | | | | | |

| Foreign currency option contracts | | Accrued expenses | | $ | 178 | | | Not Applicable | |

Our derivative contracts involve elements of credit and market risk, including the risk of dealing with counterparties and their ability to meet the terms of the contracts. The counterparties to our forward purchase commitments are major aluminum brokers and suppliers, and the counterparties to our aluminum futures contracts are major financial institutions. Fixed-price forward sales contracts are only made available to our best and most credit-worthy customers. The counterparties to our foreign currency futures and zero-cost collar contracts are major financial institutions.

The pre-tax effect on net income (loss) and other comprehensive income (loss) of derivative instruments classified as cash flow hedges and described in the previous paragraphs

for the three and nine month periods ended September 30, 2009 and 2008 is summarized in the tables below:

| (In Thousands) | | Cash Flow Derivative Hedges | |

| | | Aluminum Futures Contracts | | | Foreign Currency Forwards and Options | |

| Three Months Ended September 30, | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

Amount of pre-tax gain (loss) recognized in other comprehensive income | | $ | 931 | | | $ | (5,489 | ) | | $ | (72 | ) | | $ | - | |

| Location of gain (loss) reclassified from accumulated other comprehensive income into net income (effective portion) | | Cost of sales | | | Cost of sales | | | Selling, general and admin. exp. | | | Not Applicable | |

| | | | | | | | | | | | | | | | | |

Amount of pre-tax gain (loss) reclassified from accumulated other comprehensive income to net income (effective portion) | | $ | (1,113 | ) | | $ | 717 | | | $ | (95 | ) | | $ | - | |

| (In Thousands) | | Cash Flow Derivative Hedges | |

| | | Aluminum Futures Contracts | | | Foreign Currency Forwards and Options | |

| Nine Months Ended September 30, | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Amount of pre-tax gain (loss) recognized in other comprehensive income | | $ | 289 | | | $ | (111 | ) | | $ | (321 | ) | | $ | - | |

| Location of gain (loss) reclassified from accumulated other comprehensive income into net income (effective portion) | | Cost of sales | | | Cost of sales | | | Selling, general and admin. exp. | | | Not Applicable | |

| | | | | | | | | | | | | | | | | |

Amount of pre-tax gain (loss) reclassified from accumulated other comprehensive income to net income (effective portion) | | $ | (9,974 | ) | | $ | 1,848 | | | $ | (95 | ) | | $ | - | |

Gains and losses on the ineffective portion of derivative instruments or derivative instruments that were not designated as hedging instruments were immaterial for the three and nine months ended September 30, 2009 and 2008. As of September 30, 2009, we expect $306,000 of unrealized after-tax losses on derivative instruments reported in accumulated other comprehensive income to be reclassified to earnings within the next twelve months. For the three and nine month periods ended September 30, 2009 and 2008, we had not realized any unrealized net gains or losses from hedges that had been discontinued.

| 9. | The components of net periodic benefit income (cost) for our pension and other post-retirement benefit programs reflected in consolidated results for continuing operations are shown below: |

| | | Pension | | | Other Post-Retirement | |

| | | Benefits for Three Months | | | Benefits for Three Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| (In Thousands) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Service cost | | $ | (741 | ) | | $ | (480 | ) | | $ | (17 | ) | | $ | (18 | ) |

| Interest cost | | | (3,277 | ) | | | (3,572 | ) | | | (114 | ) | | | (105 | ) |

| Expected return on plan assets | | | 5,223 | | | | 5,523 | | | | - | | | | - | |

Amortization of prior service costs, gains or losses and net transition asset | | | (171 | ) | | | (854 | ) | | | 49 | | | | 35 | |

| Net periodic benefit income (cost) | | $ | 1,034 | | | $ | 617 | | | $ | (82 | ) | | $ | (88 | ) |

| | | Pension | | | Other Post-Retirement | |

| | | Benefits for Nine Months | | | Benefits for Nine Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| (In Thousands) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Service cost | | $ | (2,307 | ) | | $ | (2,586 | ) | | $ | (53 | ) | | $ | (53 | ) |

| Interest cost | | | (9,965 | ) | | | (9,681 | ) | | | (371 | ) | | | (363 | ) |

| Expected return on plan assets | | | 15,601 | | | | 16,495 | | | | - | | | | - | |

Amortization of prior service costs, gains or losses and net transition asset | | | (781 | ) | | | (493 | ) | | | 95 | | | | 35 | |

| Net periodic benefit income (cost) | | $ | 2,548 | | | $ | 3,735 | | | $ | (329 | ) | | $ | (381 | ) |

We contributed approximately $122,000 to our pension plans for continuing operations in 2008. We expect to contribute a similar amount in 2009, which is less than the $2.3 million previously expected. We fund our other post-retirement benefits (life insurance and health benefits) on a claims-made basis, which were $243,000 for the year ended December 31, 2008.

| 10. | Information by business segment is reported below. There are no accounting transactions between segments and no allocations to segments. There have been no significant changes to identifiable assets by segment since December 31, 2008, except for the goodwill impairment charge relating to Aluminum Extrusions described in Note 3, and working capital fluctuations resulting from changes in business conditions or seasonal factors, changes caused by movement of foreign exchange rates and changes in property, plant and equipment due to capital expenditures, depreciation, asset impairments and other activity, which are described under Item 2 of Part I of this report. Net sales (sales less freight) and operating profit from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker for purposes of assessing performance. |

Tredegar Corporation

Net Sales and Operating Profit by Segment

(In Thousands)

(Unaudited)

| | | Three Months | | | Nine Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Net Sales | | | | | | | | | | | | |

| Film Products | | $ | 123,397 | | | $ | 131,187 | | | $ | 335,984 | | | $ | 399,030 | |

| Aluminum Extrusions | | | 47,573 | | | | 92,072 | | | | 139,068 | | | | 275,819 | |

| Total net sales | | | 170,970 | | | | 223,259 | | | | 475,052 | | | | 674,849 | |

| Add back freight | | | 4,692 | | | | 5,450 | | | | 11,791 | | | | 16,348 | |

| Sales as shown in the Consolidated Statements of Income | | $ | 175,662 | | | $ | 228,709 | | | $ | 486,843 | | | $ | 691,197 | |

| | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) | | | | | | | | | | | | | | | | |

| Film Products: | | | | | | | | | | | | | | | | |

| Ongoing operations | | $ | 21,750 | | | $ | 10,454 | | | $ | 48,978 | | | $ | 34,719 | |

| Plant shutdowns, asset impairments, restructurings and other | | | - | | | | - | | | | (660 | ) | | | (4,649 | ) |

| | | | | | | | | | | | | | | | | |

| Aluminum Extrusions: | | | | | | | | | | | | | | | | |

| Ongoing operations | | | (927 | ) | | | 3,861 | | | | (2,090 | ) | | | 7,809 | |

| Goodwill impairment charge | | | - | | | | - | | | | (30,559 | ) | | | - | |

| Plant shutdowns, asset impairments, restructurings and other | | | (111 | ) | | | - | | | | (1,417 | ) | | | (615 | ) |

| | | | | | | | | | | | | | | | | |

| AFBS: | | | | | | | | | | | | | | | | |

| Gain on sale of investments in Theken Spine and Therics, LLC | | | - | | | | 1,499 | | | | 150 | | | | 1,499 | |

| | | | | | | | | | | | | | | | | |

| Total | | | 20,712 | | | | 15,814 | | | | 14,402 | | | | 38,763 | |

| Interest income | | | 215 | | | | 209 | | | | 649 | | | | 655 | |

| Interest expense | | | 197 | | | | 483 | | | | 585 | | | | 1,921 | |

| Gain on sale of corporate assets | | | - | | | | 1,001 | | | | 404 | | | | 1,001 | |

| Gain on investment accounted for under the fair value method | | | - | | | | 5,000 | | | | - | | | | 5,000 | |

| Stock option-based compensation costs | | | 424 | | | | 178 | | | | 1,227 | | | | 516 | |

| Corporate expenses, net | | | 3,663 | | | | 2,975 | | | | 9,473 | | | | 5,040 | |

| Income from continuing operations before income taxes | | | 16,643 | | | | 18,388 | | | | 4,170 | | | | 37,942 | |

| Income taxes | | | 5,647 | | | | 7,310 | | | | 15,504 | | | | 14,214 | |

| Income (loss) from continuing operations | | | 10,996 | | | | 11,078 | | | | (11,334 | ) | | | 23,728 | |

| Loss from discontinued operations | | | - | | | | | | | | - | | | | (930 | ) |

| Net income (loss) | | $ | 10,996 | | | $ | 11,078 | | | $ | (11,334 | ) | | $ | 22,798 | |

| 11. | The effective tax rate for the third quarter of 2009 was 33.9% compared to 39.7% for the third quarter of 2008. The change in the effective tax rate for continuing operations for the third quarter reflects the impact to income taxes during the third quarter to adjust the effective tax rate for the first nine months of the year to the rate estimated for the entire year. |

The significant differences between the U.S. federal statutory rate and the effective income rate for continuing operations for the nine month periods ended September 30, 2009 and 2008 are as follows:

| | | Percent of Income (Loss) Before Income Taxes for Continuing Operations | |

| Nine Months Ended September 30 | | 2009 | | | 2008 | |

| Income tax expense at federal statutory rate | | | 35.0 | | | | 35.0 | |

| Goodwill impairment charge | | | 256.5 | | | | - | |

| Valuation allowance for capital loss carry-forwards | | | 78.4 | | | | (2.8 | ) |

| Unremitted earnings from foreign operations | | | 32.4 | | | | 6.0 | |

| Remitted earnings from foreign operations | | | 11.5 | | | | - | |

| State taxes, net of federal income tax benefit | | | 6.6 | | | | 1.3 | |

| Non-deductible expenses | | | 1.0 | | | | 0.2 | |

| Valuation allowance for foreign operating loss carry-forwards | | | (3.3 | ) | | | 0.8 | |

| Research and development tax credit | | | (5.5 | ) | | | - | |

| Foreign rate differences | | | (39.6 | ) | | | (3.0 | ) |

| Other | | | (1.2 | ) | | | - | |

| Effective income tax rate | | | 371.8 | | | | 37.5 | |

A reconciliation of our unrecognized uncertain tax positions since December 31, 2008, is shown below:

| (In Thousands) | | Balance at January 1, 2009 | | | Increase (Decrease) Due to Tax Positions Taken in | | | Increase (Decrease) Due to Settlements with Taxing Authorities | | | Reductions Due to Lapse of Statute of Limitations | | | Balance at September 30, 2009 | |

| | | | | Current Period | | | Prior Period | | | | | | | |

| Gross unrecognized tax benefits on uncertain tax positions (reflected in current income tax and other noncurrent liability accounts in the balance sheet) | | $ | 2,553 | | | $ | 73 | | | $ | 201 | | | $ | (1,440 | ) | | $ | - | | | $ | 1,387 | |

Deferred income tax assets related to unrecognized tax benefits on uncertain tax positions for which ultimate deductibility is highly certain but for which the timing of the deduction is uncertain (reflected indeferred income tax accounts in the balance sheet) | | | (1,828 | ) | | | | | | | | | | | | | | | | | | | (514 | ) |

Net unrecognized tax benefits on uncertain tax positions, which would impact the effective tax rate if recognized | | | 725 | | | | | | | | | | | | | | | | | | | | 873 | |

| Interest and penalties accrued on deductions taken relating to uncertain tax positions with the balance shown in current income tax and other noncurrent liability accounts in the balance sheet | | | 1,303 | | | | | | | | | | | | | | | | | | | | 958 | |

Related deferred income tax assets recognized on interest and penalties | | | (476 | ) | | | | | | | | | | | | | | | | | | | (353 | ) |

Interest and penalties accrued on uncertain tax positions net of related deferred income tax benefits, which would impact the effective tax rate if recognized | | | 827 | | | | | | | | | | | | | | | | | | | | 605 | |

Total net unrecognized tax benefits on uncertain tax positions reflected in the balance sheet, which would impact the effective tax rate if recognized | | $ | 1,552 | | | | | | | | | | | | | | | | | | | $ | 1,478 | |

In the second quarter of 2009, we settled several disputed issues raised by the IRS during its examination of our U.S. income tax returns for 2001-2003, the most significant of which regarded the recognition of our captive insurance subsidiary as an insurance company for U.S. income tax purposes. The settlement with the IRS for the disputed issues cost us approximately $1.0 million, which is lower than the previous estimate of $1.3 million and was applied against the balance of unrecognized tax benefits.

Tredegar and its subsidiaries file income tax returns in U.S., state and foreign jurisdictions. Except for refund claims and amended returns, Tredegar is no longer subject to U.S. federal income tax examinations by tax authorities for years before 2006. With few

exceptions, Tredegar and its subsidiaries are no longer subject to state or non-U.S. income tax examinations by tax authorities for years before 2006. We believe that it is reasonably possible that approximately $190,000 of the balance for unrecognized tax positions may be recognized within the next twelve months as a result of the lapse of the statute of limitations.

| 12. | In December 2008, the Financial Accounting Standards Board (the “FASB”) issued new guidance that provided objectives for enhanced disclosure information about postretirement benefit plan assets, thereby addressing financial statement user concerns regarding the lack of transparency previously surrounding such disclosures. New disclosures are intended to provide users with an understanding of (1) how investment allocation decisions are made, including an understanding of investment policies and strategies, (2) major classes of plan assets, (3) the inputs and valuation techniques used to measure fair value of plan assets, (4) the effect of fair value measurements using significant unobservable inputs (Level 3) on changes in plan assets, and (5) significant concentrations of risk within plan assets. The enhanced disclosures for postretirement benefit plan assets are effective for annual periods ending after December 15, 2009. We do not believe that the adoption of these enhanced disclosure requirements will have a material impact on our financial statements and related disclosures. |

In June 2009, the FASB issued guidance that clarifies the information that an entity must provide in its financial statements surrounding a transfer of financial assets and the effect of the transfer on its financial position, financial performance, and cash flows. These new accounting rules are effective as of the beginning of the annual period beginning after November 15, 2009. We do not expect these FASB rules to have a material impact on our financial statements and disclosures.

The FASB also provided guidance in June 2009 that clarifies and improves financial reporting by entities involved with variable interest entities. The revised statement amends previous guidance to require an enterprise to perform a qualitative analysis to determine whether it has a controlling financial interest in a variable interest entity, to eliminate the quantitative approach previously required for determining the primary beneficiary of a variable interest entity, and to require enhanced disclosures that will provide users of financial statements with more transparent information about an enterprise’s involvement in a variable interest entity. This new accounting standard is effective for annual periods beginning after November 15, 2009. We are currently evaluating the impact of this updated standard on our financial statements.

In October 2009, the FASB Emerging Issues Task Force issued a consensus updating accounting standards for revenue recognition for multiple-deliverable arrangements. The stated objective of the accounting standards update was to address the accounting for multiple-deliverable arrangements to enable vendors to account for products or services (deliverables) separately rather than as a combined unit. The revision of current FASB guidance provides amended methodologies for separating consideration in multiple-deliverable arrangements and expands disclosure requirements. The accounting standards update will be effective prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010, with early adoption permitted. We do not expect these FASB rules to have a material impact on our financial statements and disclosures.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-looking and Cautionary Statements

Some of the information contained in this quarterly report on Form 10-Q may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. When we use the words “believe,” “estimate,” “anticipate,” “expect,” “project,” “likely,” “may” and similar expressions, we do so to identify forward-looking statements. Such statements are based on our then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. It is possible that our actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Factors that could cause actual results to differ from expectations include, without limitation: Film Products is highly dependent on sales to one customer — The Procter & Gamble Company; growth of Film Products depends on its ability to develop and deliver new products at competitive prices; sales volume and profitability of continuing operations in Aluminum Extrusions are cyclical and highly dependent on economic conditions of end-use markets in the U.S., particularly in the construction, distribution and transportation industries, and are also subject to seasonal slowdowns; our substantial international operations subject us to risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations; our future performance is influenced by costs incurred by our operating companies including, for example, the cost of energy and raw materials; and the factors discussed in the reports Tredegar files with or furnishes to the Securities and Exchange Commission (the “SEC”) from time-to-time, including the risks and important factors set forth in additional detail in “Risk Factors” in Part I, Item 1A of Tredegar’s 2008 Annual Report on Form 10-K (the “2008 Form 10-K”) filed with the SEC. Readers are urged to review and consider carefully the disclosures Tredegar makes in its 2008 Form 10-K. Tredegar does not undertake to update any forward-looking statement made in its interim filings with the SEC to reflect any change in management’s expectations or any change in conditions, assumptions or circumstances on which such statements are based.

Third-quarter 2009 income from continuing operations was $11.0 million (32 cents per share) compared with $11.1 million (33 cents per share) in the third quarter of 2008. Losses from continuing operations for the first nine months of 2009 was $11.3 million (33 cents per share) compared with income from continuing operations of $23.7 million (69 cents per share) in the first nine months of 2008. Losses related to plant shutdowns, asset impairments, restructurings and other charges are described in Note 2 on page 6.

The following tables present Tredegar’s net sales and operating profit by segment for the third quarter and nine months ended September 30, 2009 and 2008:

Tredegar Corporation

Net Sales and Operating Profit by Segment

(In Thousands)

(Unaudited)

| | | Three Months | | | Nine Months | |

| | | Ended Sept. 30 | | | Ended Sept. 30 | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Net Sales | | | | | | | | | | | | |

| Film Products | | $ | 123,397 | | | $ | 131,187 | | | $ | 335,984 | | | $ | 399,030 | |

| Aluminum Extrusions | | | 47,573 | | | | 92,072 | | | | 139,068 | | | | 275,819 | |

| Total net sales | | | 170,970 | | | | 223,259 | | | | 475,052 | | | | 674,849 | |

| Add back freight | | | 4,692 | | | | 5,450 | | | | 11,791 | | | | 16,348 | |

| Sales as shown in the Consolidated Statements of Income | | $ | 175,662 | | | $ | 228,709 | | | $ | 486,843 | | | $ | 691,197 | |

| | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) | | | | | | | | | | | | | | | | |

| Film Products: | | | | | | | | | | | | | | | | |

| Ongoing operations | | $ | 21,750 | | | $ | 10,454 | | | $ | 48,978 | | | $ | 34,719 | |

| Plant shutdowns, asset impairments, restructurings and other | | | - | | | | - | | | | (660 | ) | | | (4,649 | ) |

| | | | | | | | | | | | | | | | | |

| Aluminum Extrusions: | | | | | | | | | | | | | | | | |

| Ongoing operations | | | (927 | ) | | | 3,861 | | | | (2,090 | ) | | | 7,809 | |

| Goodwill impairment charge | | | - | | | | - | | | | (30,559 | ) | | | - | |

| Plant shutdowns, asset impairments, restructurings and other | | | (111 | ) | | | - | | | | (1,417 | ) | | | (615 | ) |

| | | | | | | | | | | | | | | | | |

| AFBS: | | | | | | | | | | | | | | | | |

| Gain on sale of investments in Theken Spine and Therics, LLC | | | - | | | | 1,499 | | | | 150 | | | | 1,499 | |

| | | | | | | | | | | | | | | | | |

| Total | | | 20,712 | | | | 15,814 | | | | 14,402 | | | | 38,763 | |

| Interest income | | | 215 | | | | 209 | | | | 649 | | | | 655 | |

| Interest expense | | | 197 | | | | 483 | | | | 585 | | | | 1,921 | |

| Gain on sale of corporate assets | | | - | | | | 1,001 | | | | 404 | | | | 1,001 | |

| Gain on investment accounted for under the fair value method | | | - | | | | 5,000 | | | | - | | | | 5,000 | |

| Stock option-based compensation costs | | | 424 | | | | 178 | | | | 1,227 | | | | 516 | |

| Corporate expenses, net | | | 3,663 | | | | 2,975 | | | | 9,473 | | | | 5,040 | |

| Income from continuing operations before income taxes | | | 16,643 | | | | 18,388 | | | | 4,170 | | | | 37,942 | |

| Income taxes | | | 5,647 | | | | 7,310 | | | | 15,504 | | | | 14,214 | |

| Income (loss) from continuing operations | | | 10,996 | | | | 11,078 | | | | (11,334 | ) | | | 23,728 | |

| Loss from discontinued operations | | | - | | | | | | | | - | | | | (930 | ) |

| Net income (loss) | | $ | 10,996 | | | $ | 11,078 | | | $ | (11,334 | ) | | $ | 22,798 | |

Net sales (sales less freight) and operating profit from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker of each segment for purposes of assessing performance.

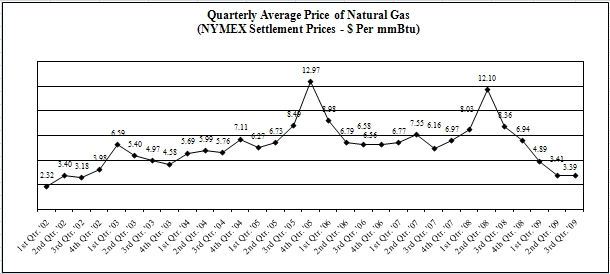

Film Products. Third-quarter net sales in Film Products were $123.4 million, down 5.9% from $131.2 million in the third quarter of 2008, while operating profit from ongoing operations increased to $21.8 million in the third quarter of 2009 from $10.5 million in 2008. Volume was 55.2 million pounds in the third quarter of 2009, down 1.5% from 56.1 million pounds in the third quarter of 2008. Net sales, operating profit and volume in the second quarter of 2009 were $107.8 million, $14.2 million and 49.6 million pounds, respectively.

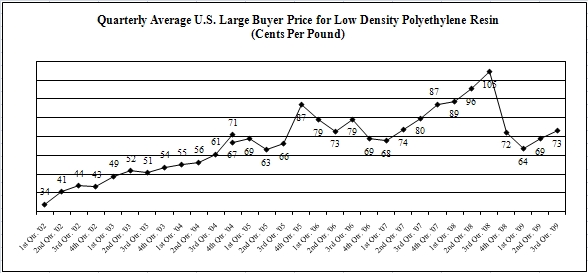

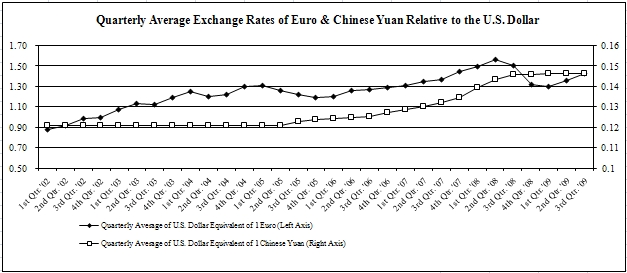

Net sales declined in the third quarter of 2009 compared with the third quarter of 2008 primarily due to the impact of lower selling prices from the pass-through of reduced resin prices and unfavorable changes in the U.S. dollar value of currencies for operations outside of the U.S., partially offset by the favorable effect of a change in product mix driven mostly by an increase in sales of high-value surface protection materials. Higher sales on a sequential quarter basis, most notably in surface protection and

personal care materials, are believed to include a rebuilding of inventory at the customer level. Operating profit from ongoing operations increased in the third quarter of 2009 versus the same period in 2008 due primarily to the positive impact of the change in product mix noted above, cost reduction efforts, productivity gains and the lag in the pass-through of substantially higher resin costs in 2008, partially offset by the unfavorable effect of currency changes.

Net sales in Film Products for the first nine months of 2009 were $336.0 million, a decrease of 15.8% from $399.0 million in the first nine months of 2008. Operating profit from ongoing operations was $49.0 million in the first nine months of 2009, an increase of 41.1% from $34.7 million in the first nine months of last year. Volume was 154.1 million pounds in the first nine months of 2009, down 9.8% from 170.8 million pounds in the first nine months of 2008.

Net sales in the first nine months of 2009 declined primarily due to lower volume in all market segments, most notably personal care materials and packaging films, and the factors noted above for the current quarter. Operating profit from ongoing operations increased in the first nine months of 2009 versus the same period in 2008 as cost reduction efforts, productivity gains and the lag in the pass-through of lower resin costs offset lower volumes and the unfavorable effect of currency changes.

The company estimates that the impact on operating profit of the lag in the pass-through of changes in average resin costs was a negative $1.3 million and a negative $4.0 million in the third quarters of 2009 and 2008, respectively. The estimated impact of resin pass-through lag was a positive $1.7 million in the first nine months of 2009 and a negative $7.2 million in the first nine months of 2008. The company estimates that changes in the U.S. dollar value of currencies for operations outside of the U.S. had an unfavorable impact on operating profit of $857,000 in the third quarter of 2009 compared to the third quarter of 2008, and an unfavorable impact of approximately $2.4 million in the first nine months of 2009 compared with the first nine months of 2008.

We recognized severance and other employee-related costs of $1.1 million relating to a reduction in Film Products’ workforce in the first quarter of 2009 (approximately 40 people) that is expected to save $1.1 million in 2009 and $2.1 million on an annualized basis. During 2008, we recognized restructuring and asset impairment charges of $4.6 million, including charges relating to a reduction of the Film Products’ workforce (approximately 90 people) that is expected to save $4.2 million on an annualized basis.

Capital expenditures in Film Products were $9.1 million and $9.5 million in the first nine months of 2009 and 2008, respectively, and are projected to be approximately $15 million in 2009. Depreciation expense was $24.0 million in the first nine months of 2009 compared with $26.3 million in the first nine months of last year, and is projected to be approximately $33 million in 2009.

Aluminum Extrusions. Third-quarter net sales from continuing operations in Aluminum Extrusions were $47.6 million, down 48.3% from $92.1 million in the third quarter of 2008. Operating losses from ongoing U.S. operations were $927,000 for the third quarter of 2009, a change of $4.8 million from operating profits of $3.9 million for the third quarter of 2008. Volume from continuing operations decreased to 24.7 million pounds in the third quarter of 2009, down 30.0% from 35.3 million pounds in the third quarter of 2008.

Net sales in Aluminum Extrusions for the first nine months of 2009 declined 49.6% to $139.1 million from $275.8 million in the first nine months of 2008. Operating losses from ongoing operations were $2.1 million for the first nine months of 2009, a $9.9 million change from operating profits of $7.8 million for the same period in 2008. Volume was 72.4 million pounds in the first nine months of 2009, down 32.9% from 107.9 million pounds in the first nine months of 2008.

The net sales declines in the third quarter and first nine months of 2009 compared with the prior year were primarily due to lower sales volume and a decrease in average selling prices driven by lower average aluminum costs. Weak market conditions led to decreased shipments in most markets. Shipments for non-residential construction, which comprised approximately 72% of total volume in 2008, declined by approximately 32% during the first nine months of 2009 compared to the first nine months of 2008. Operating loss from ongoing operations in the third quarter and first nine months of the year were also primarily driven by lower sales volumes.

As described in Note 3 on page 8, we recognized a non-cash goodwill impairment charge of $30.6 million ($30.6 million after tax) in Aluminum Extrusions in the first quarter of 2009.

Capital expenditures for continuing operations in Aluminum Extrusions were $14.6 million in the first nine months of 2009 compared with $4.3 million in the first nine months of last year. Capital expenditures are projected to be approximately $21 million in 2009, of which $17 million relates to the 18-month project to expand the capacity at the Carthage, Tennessee manufacturing facility. This new capacity will be dedicated to serving customers in the non-residential construction sector. Depreciation expense was $5.6 million in the first nine months of 2009 compared with $6.0 million in the first nine months of last year, and is projected to be approximately $7.6 million in 2009.

Other Items. Net pension income from continuing operations was $1.0 million in the third quarter and $2.5 million in the first nine months of 2009, a favorable change of $417,000 and an unfavorable change of $1.2 million, respectively, from amounts recognized in the comparable periods of 2008. Most of the change in pension income is reflected in “Corporate expenses, net” in the Net Sales and Operating Profit by Segment table on page 20. We contributed approximately $122,000 to our pension plans in 2008, and we expect to contribute a similar amount in 2009. Corporate expenses, net in the third quarter and first nine months of 2009 increased in comparison to 2008 primarily due to adjustments made to accruals for certain performance-based compensation programs and the unfavorable change in pension income noted above.

Interest expense, which includes the amortization of debt issue costs, was $197,000 and $585,000 in the third quarter and first nine months of 2009, respectively, a decrease from $483,000 and $1.9 million in the third quarter and first nine months of last year, respectively, primarily due to lower average debt levels and lower average interest rates.

The effective tax rates used to compute income taxes from continuing operations was 33.9% for the third quarter of 2009 compared to 39.7% for the third quarter of 2008, and 371.8% in the first nine months of 2009 compared with 37.5% in the first nine months of 2008. The change in the effective tax rate for continuing operations for the third quarter reflects the impact to income taxes during the third quarter to adjust the effective tax rate for the first nine months of the year to the rate estimated for the entire year. The significant differences between the U.S. federal statutory rate and the effective tax rate for continuing operations for the first nine months is shown in the table provided in Note 11 on page 17.

Our investment in Harbinger Capital Partners Special Situations Fund, L.P. (“Harbinger Fund”) had a reported capital account value of $11.5 million at September 30, 2009, compared with $10.1 million at December 31, 2008. This investment has a carrying value in Tredegar’s balance sheet of $10.0 million (included in “Other assets and deferred charges”), which represents the amount invested on April 2, 2007.

Net capitalization and other credit measures are provided in the liquidity and capital resources section beginning on page 27.

Critical Accounting Policies

In the ordinary course of business, we make a number of estimates and assumptions relating to the reporting of results of operations and financial position in the preparation of financial statements in conformity with generally accepted accounting principles. We believe the estimates, assumptions and judgments described in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies” of our Annual Report on Form 10-K for the year ended December 31, 2008, have the greatest potential impact on our financial statements, so we consider these to be our critical accounting policies. These policies include our accounting for impairment of long-lived assets and goodwill, investment accounted for under the fair value method, pension benefits and income taxes. These policies require management to exercise judgments that are often difficult, subjective and complex due to the necessity of estimating the effect of matters that are inherently uncertain. Actual results could differ significantly from those estimates under different assumptions and conditions. We believe the consistent application of these policies enables us to provide readers of our financial statements with useful and reliable information about our operating results and financial condition. Since December 31, 2008, there have been no changes in these policies that have had a material impact on results of operations or financial position. See Note 2 on page 6 for losses related to plant shutdowns, asset impairments, restructurings and other occurring during 2009 and the comparable period in 2008.

Recently Issued Accounting Standards

In December 2008, the Financial Accounting Standards Board (the “FASB”) issued new guidance that provided objectives for enhanced disclosure information about postretirement benefit plan assets, thereby addressing financial statement user concerns regarding the lack of transparency previously surrounding such disclosures. New disclosures are intended to provide users with an understanding of (1) how investment allocation decisions are made, including an understanding of investment policies and strategies, (2) major classes of plan assets, (3) the inputs and valuation techniques used to measure fair value of plan assets, (4) the effect of fair value measurements using significant unobservable inputs (Level 3) on changes in plan assets, and (5) significant concentrations of risk within plan assets. The enhanced disclosures for postretirement benefit plan assets are effective for annual periods ending after December 15, 2009. We do not believe that the adoption of these enhanced disclosure requirements will have a material impact on our financial statements and related disclosures.

In June 2009, the FASB issued guidance that clarifies the information that an entity must provide in its financial statements surrounding a transfer of financial assets and the effect of the transfer on its financial position, financial performance, and cash flows. These new accounting rules are effective as of the beginning of the annual period beginning after November 15, 2009. We do not expect these FASB rules to have a material impact on our financial statements and disclosures.

The FASB also provided guidance in June 2009 that clarifies and improves financial reporting by entities involved with variable interest entities. The revised statement amends previous guidance to require an enterprise to perform a qualitative analysis to determine whether it has a controlling financial interest in a variable interest entity, to eliminate the quantitative approach previously required for determining the primary beneficiary of a variable interest entity, and to require enhanced disclosures that will provide users of financial statements with more transparent information about an enterprise’s involvement in a variable interest entity. This new accounting standard is effective for annual periods beginning after November 15, 2009. We are currently evaluating the impact of this updated standard on our financial statements.

In October 2009, the FASB Emerging Issues Task Force issued a consensus updating accounting standards for revenue recognition for multiple-deliverable arrangements. The stated objective of the accounting standards update was to address the accounting for multiple-deliverable arrangements to

enable vendors to account for products or services (deliverables) separately rather than as a combined unit. The revision of current FASB guidance provides amended methodologies for separating consideration in multiple-deliverable arrangements and expands disclosure requirements. The accounting standards update will be effective prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010, with early adoption permitted. We do not expect these FASB rules to have a material impact on our financial statements and disclosures.

Third Quarter 2009 Compared with Third Quarter 2008