The information in this Free Writing Prospectus is not complete and may be changed by delivery of information prior to the time of sale. This Free Writing Prospectus is not an offer to sell these securities nor is it soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THE INFORMATION IN THIS FREE WRITING PROSPECTUS MAY BE AMENDED OR COMPLETED PRIOR TO SALE DATED DECEMBER 4, 2006

PROSPECTUS SUPPLEMENT

(To accompany prospectus dated October 19, 2006)

$2,635,284,000 (Approximate)

(Offered Certificates)

Wachovia Bank Commercial Mortgage Trust

Commercial Mortgage Pass-Through Certificates

Series 2006-C29

(Issuing Entity)

Wachovia Commercial Mortgage Securities, Inc.

(Depositor)

Wachovia Bank, National Association

Artesia Mortgage Capital Corporation

(Sponsors)

| You should carefully consider the risk factors beginning on page S-51 of this prospectus supplement and on page 14 of the accompanying prospectus. |

| Neither the offered certificates nor the underlying mortgage loans are insured or guaranteed by any government agency or instrumentality. |

| The offered certificates will represent interests in the issuing entity only. They will not represent obligations of the sponsors, the depositor, any of their respective affiliates or any other party. The offered certificates will not be listed on any national securities exchange or any automated quotation system of any registered securities association. |

| This prospectus supplement may be used to offer and sell the offered certificates only if it is accompanied by the prospectus dated October 19, 2006. |

The trust fund:

| • | As of December 11, 2006, the mortgage loans included in the trust fund will have an aggregate principal balance of approximately $3,371,274,181. |

| • | The trust fund will consist of a pool of 142 fixed rate mortgage loans. |

| • | The mortgage loans are secured by first liens on commercial and multifamily properties. |

| • | All of the mortgage loans were originated by Wachovia Bank, National Association and Artesia Mortgage Capital Corporation. |

The certificates:

| • | The trust fund will issue 29 classes of certificates. |

| • | Only the 13 classes of offered certificates described in the following table are being offered by this prospectus supplement and the accompanying prospectus. Distributions on the certificates will occur on a monthly basis, commencing January 2007. |

| • | The only credit support for any class of offered certificates will consist of the subordination of the classes of certificates, if any, having a lower payment priority. |

| Class | Original Certificate Balance or Notional Amount(1) | Percentage of Cut-Off Date Pool Balance | Pass-Through Rate Description | Assumed Final Distribution Dates(2) | CUSIP No. | Expected S&P/Moody’s Rating(3) | |||||||||||||||

| Class A-1 | $ | 16,719,000 | 0.496% | Fixed | October 15, 2011 | AAA/Aaa | |||||||||||||||

| Class A-2 | $ | 291,337,000 | 8.642% | Fixed | December 15, 2011 | AAA/Aaa | |||||||||||||||

| Class A-3 | $ | 161,040,000 | 4.777% | Fixed | December 15, 2013 | AAA/Aaa | |||||||||||||||

| Class A-PB | $ | 49,253,000 | 1.461% | Fixed | June 15, 2016 | AAA/Aaa | |||||||||||||||

| Class A-4 | $ | 642,531,000 | 19.059% | Fixed | November 15, 2016 | AAA/Aaa | |||||||||||||||

| Class A-1A | $ | 699,011,000 | 20.734% | Fixed(5) | November 15, 2016 | AAA/Aaa | |||||||||||||||

| Class X-P | $ | 3,240,519,000 | N/A | Variable(4) | N/A | AAA/Aaa | |||||||||||||||

| Class A-M | $ | 337,128,000 | 10.000% | Fixed | December 15, 2016 | AAA/Aaa | |||||||||||||||

| Class A-J | $ | 303,415,000 | 9.000% | Fixed | December 15, 2016 | AAA/Aaa | |||||||||||||||

| Class B | $ | 25,284,000 | 0.750% | Fixed | December 15, 2016 | AA+/Aa1 | |||||||||||||||

| Class C | $ | 33,713,000 | 1.000% | Fixed(5) | December 15, 2016 | AA/Aa2 | |||||||||||||||

| Class D | $ | 29,498,000 | 0.875% | Fixed(5) | December 15, 2016 | AA–/Aa3 | |||||||||||||||

| Class E | $ | 46,355,000 | 1.375% | Fixed(5) | December 15, 2016 | A/A2 | |||||||||||||||

| (Footnotes explaining the table are on page S-3) |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-131262) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m.-5 p.m. EST).

Neither the SEC nor any state securities commission has approved or disapproved the offered certificates or has determined that this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is unlawful.

Wachovia Capital Markets, LLC is acting as sole lead manager for this offering. Wachovia Capital Markets, LLC is acting as sole bookrunner with respect to the offered certificates. Goldman, Sachs & Co. and Greenwich Capital Markets, Inc. are acting as co-managers for this offering. Wachovia Capital Markets, LLC, Goldman, Sachs & Co. and Greenwich Capital Markets, Inc. are required to purchase the offered certificates from us, subject to certain conditions. The underwriters will offer the offered certificates to the public from time to time in negotiated transactions or otherwise at varying prices to be determined at the time of sale. It is intended that Wachovia Securities International Limited will act as a member of the selling group on behalf of Wachovia Capital Markets, LLC and may sell offered certificates on behalf of Wachovia Capital Markets, LLC in certain jurisdictions. We expect to receive from this offering approximately % of the initial certificate balance of the offered certificates, plus accrued interest from December 1, 2006, before deducting expenses.

We expect that delivery of the offered certificates will be made in book-entry form on or about December 22, 2006.

WACHOVIA SECURITIES

| Goldman, Sachs & Co. | RBS Greenwich Capital |

December , 2006

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The certificates referred to in these materials, and the asset pools backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have confirmed the allocation of certificates to be made to you; any ‘‘indication of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligation for you or us.

As a result of the foregoing, you may commit to purchase offered certificates that have characteristics that may change, and you are advised that all or a portion of the offered certificates may not be issued that have the characteristics described in these materials. Our obligation to sell offered certificates to you is conditioned on the offered certificates and the underlying transaction that are actually issued having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the depositor nor any underwriter will have any obligation to you to deliver any portion of the certificates which you have committed to purchase, and there will be no liability between us as a consequence of the non delivery.

You have requested that the underwriters provide to you information in connection with your consideration of the purchase of certain offered certificates described in this prospectus supplement. This Free Writing Prospectus is being provided to you for informative purposes only in response to your specific request. The underwriters described in this Free Writing Prospectus may from time to time perform investment banking services for, or solicit investment banking business from, any company named in this prospectus supplement. The underwriters and/or their employees may from time to time have a long or short position in any contract or certificate discussed in this Free Writing Prospectus.

The information contained herein supersedes any previous such information delivered to you and may be superseded by information delivered to you prior to the time of sale. This Free Writing Prospectus is also referred to herein as the ‘‘prospectus supplement’’.

This Free Writing Prospectus does not contain all information that is required to be included in the prospectus and the prospectus supplement.

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS

PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

We provide information to you about the offered certificates in two separate documents that progressively provide more detail: (a) the accompanying prospectus, which provides general information, some of which may not apply to the offered certificates and (b) this prospectus supplement, which describes the specific terms of the offered certificates. You should read both this prospectus supplement and the prospectus before investing in any of the offered certificates.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information that is different. The information in this document may only be accurate as of the date of this document.

This prospectus supplement begins with several introductory sections describing the offered certificates and the trust fund in abbreviated form:

| • | SUMMARY OF PROSPECTUS SUPPLEMENT, commencing on page S-6 of this prospectus supplement, which gives a brief introduction of the key features of the offered certificates and a description of the mortgage loans included in the trust fund; and |

| • | RISK FACTORS, commencing on page S-51 of this prospectus supplement, which describes risks that apply to the offered certificates which are in addition to those described in the accompanying prospectus. |

This prospectus supplement and the accompanying prospectus include cross references to sections in these materials where you can find further related discussions. The Tables of Contents in this prospectus supplement and the accompanying prospectus identify the pages where these sections are located.

S-1

You can find a listing of the pages where capitalized terms used in this prospectus supplement are defined under the caption ‘‘INDEX OF DEFINED TERMS’’ beginning on page S-219 in this prospectus supplement.

In this prospectus supplement, the terms ‘‘depositor,’’ ‘‘we,’’ ‘‘us’’ and ‘‘our’’ refer to Wachovia Commercial Mortgage Securities, Inc.

We do not intend this prospectus supplement and the accompanying prospectus to be an offer or solicitation:

| • | if used in a jurisdiction in which such offer or solicitation is not authorized; |

| • | if the person making such offer or solicitation is not qualified to do so; or |

| • | if such offer or solicitation is made to anyone to whom it is unlawful to make such offer or solicitation. |

This prospectus supplement and the accompanying prospectus may be used by us, Wachovia Capital Markets, LLC, our affiliate, and any other of our affiliates when required under the federal securities laws in connection with offers and sales of offered certificates in furtherance of market-making activities in offered certificates. Wachovia Capital Markets, LLC or any such other affiliate may act as principal or agent in these transactions. Sales will be made at prices related to prevailing market prices at the time of sale or otherwise.

EUROPEAN ECONOMIC AREA

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (as defined below) (each, a ‘‘Relevant Member State’’), each underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the ‘‘Relevant Implementation Date’’) it has not made and will not make an offer of certificates to the public in that Relevant Member State prior to the publication of a prospectus in relation to the certificates which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it may, with effect from and including the Relevant Implementation Date, make an offer of certificates to the public in that Relevant Member State at any time:

(a) to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities;

(b) to any legal entity which has two or more of (1) an average of at least 250 employees during the last financial year; (2) a total balance sheet of more than €43,000,000 and (3) an annual net turnover of more than €50,000,000, as shown in its last annual or consolidated accounts; or

(c) in any other circumstances which do not require the publication by the issuer of a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression an ‘‘offer of certificates to the public’’ in relation to any certificates in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the certificates to be offered so as to enable an investor to decide to purchase or subscribe the certificates, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and the expression ‘‘Prospectus Directive’’ means Directive 2003/71/EC and includes any relevant implementing measure in each Relevant Member State.

S-2

UNITED KINGDOM

Each underwriter has represented and agreed that:

(a) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the ‘‘FSMA’’)) received by it in connection with the issue or sale of the certificates in circumstances in which Section 21(1) of the FSMA does not apply to the issuer; and

(b) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the certificates in, from or otherwise involving the United Kingdom.

NOTICE TO UNITED KINGDOM INVESTORS

The distribution of this prospectus if made by a person who is not an authorized person under the FSMA, is being made only to, or directed only at persons who (1) are outside the United Kingdom, or (2) have professional experience in matters relating to investments, or (3) are persons falling within Articles 49(2)(a) through (d) (‘‘high net worth companies, unincorporated associations, etc.’’) or 19 (Investment Professionals) of the Financial Services and Market Act 2000 (Financial Promotion) Order 2005 (all such persons together being referred to as the ‘‘Relevant Persons’’). This prospectus must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this prospectus relates, including the offered certificates, is available only to Relevant Persons and will be engaged in only with Relevant Persons.

Potential investors in the United Kingdom are advised that all, or most, of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the offered certificates and that compensation will not be available under the United Kingdom Financial Services Compensation Scheme.

(Footnotes to table on the front cover)

| (1) | Subject to a permitted variance of plus or minus 5.0%. |

| (2) | The ‘‘Assumed Final Distribution Date’’ has been determined on the basis of the assumptions set forth in ‘‘DESCRIPTION OF THE CERTIFICATES—Assumed Final Distribution Date; Rated Final Distribution Date’’ in this prospectus supplement and a 0% CPR (as defined in ‘‘YIELD AND MATURITY CONSIDERATIONS—Weighted Average Life’’ in this prospectus supplement). The ‘‘Rated Final Distribution Date’’ is the distribution date to occur in November 2048. See ‘‘DESCRIPTION OF THE CERTIFICATES—Assumed Final Distribution Date; Rated Final Distribution Date’’ and ‘‘RATINGS’’ in this prospectus supplement. |

| (3) | By each of Standard & Poor’s Ratings Services, a division of The McGraw-Hill Companies Inc. and Moody’s Investors Service, Inc. See ‘‘RATINGS’’ in this prospectus supplement. |

| (4) | The Class X-P certificates will not have a certificate balance and their holders will not receive distributions of principal, but these holders are entitled to receive payments of the aggregate interest accrued on the notional amount of the Class X-P certificates, as described in this prospectus supplement. The interest rate applicable to the Class X-P certificates for each distribution date will be as described in this prospectus supplement. See ‘‘DESCRIPTION OF THE CERTIFICATES —Pass-Through Rates’’ in this prospectus supplement. |

| (5) | The pass-through rate applicable to each of the Class A-1A, Class C, Class D and Class E certificates for any distribution date will be subject to a maximum rate equal to the applicable weighted average net mortgage rate calculated as described in this prospectus supplement for the related date. |

S-3

TABLE OF CONTENTS

S-4

S-5

SUMMARY OF PROSPECTUS SUPPLEMENT

| • | This summary highlights selected information from this prospectus supplement and does not contain all of the information that you need to consider in making your investment decision. To understand the terms of the offered certificates, you must carefully read this entire prospectus supplement and the accompanying prospectus. |

| • | This summary provides an overview of certain calculations, cash flows and other information to aid your understanding and is qualified by the full description of these calculations, cash flows and other information in this prospectus supplement and the accompanying prospectus. |

| • | We provide information in this prospectus supplement on the certificates that are not offered by this prospectus supplement only to enhance your understanding of the offered certificates. We are not offering the non-offered certificates pursuant to this prospectus supplement. |

| • | For purposes of making distributions to the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4, Class A-4FL and Class A-1A certificates, the pool of mortgage loans will be deemed to consist of 2 distinct loan groups, loan group 1 and loan group 2. |

| • | Unless otherwise stated, all percentages of the mortgage loans included in the trust fund, or of any specified group of mortgage loans included in the trust fund, referred to in this prospectus supplement are calculated using the aggregate principal balance of the mortgage loans included in the trust fund as of the cut-off date (which is December 11, 2006, with respect to 139 mortgage loans, December 9, 2006, with respect to 2 mortgage loans and December 1, 2006, with respect to 1 mortgage loan), after giving effect to payments due on or before such date whether or not received. The cut-off date balance of each mortgage loan included in the trust fund and each cut-off date certificate balance in this prospectus supplement assumes the timely receipt of principal scheduled to be paid (if any) on each mortgage loan and no defaults, delinquencies or prepayments on any mortgage loan on or before the related cut-off date. Percentages of mortgaged properties are references to the percentages of the aggregate principal balance of all the mortgage loans included in the trust fund, or of any specified group of mortgage loans included in the trust fund, as of the cut-off date represented by the aggregate principal balance of the related mortgage loans as of the cut-off date. |

| • | One (1) mortgage loan, the Newport Bluffs mortgage loan, is part of a split loan structure where the companion loan that is part of the split loan structure is pari passu in right of entitlement to payment with the mortgage loan. Certain other mortgage loans are each part of a split loan structure in which the related companion loan(s) is subordinate to the related mortgage loan. Amounts attributable to any companion loan will not be assets of the trust fund and will be beneficially owned by the holder of such companion loan. |

| • | All numerical or statistical information concerning the mortgage loans included in the trust fund is provided on an approximate basis and excludes information on the subordinate companion loans. |

S-6

OVERVIEW OF THE CERTIFICATES

The table below lists certain summary information concerning the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C29, which we are offering pursuant to the accompanying prospectus and this prospectus supplement. Each certificate represents an interest in the mortgage loans included in the trust fund and the other assets of the trust fund. The table also describes the certificates that are not offered by this prospectus supplement (other than the Class Z, Class R-I and Class R-II certificates) which have not been registered under the Securities Act of 1933, as amended, and which will be sold to investors in private transactions.

| Class | Closing Date Certificate Balance or Notional Amount(1) | Percentage of Cut-Off Date Pool Balance | Credit Support | Pass-Through Rate Description | Initial Pass- Through Rate | Weighted Average Life(years)(2) | Cash Flow or Principal Window (Mon./Yr.)(2) | Expected S&P/ Moody’s Rating(3) | |||||||||||||||||||

| Class A-1 | $ | 16,719,000 | 0.496% | 30.000% | Fixed | % | 3.04 | 01/07 – 10/11 | AAA/Aaa | ||||||||||||||||||

| Class A-2 | $ | 291,337,000 | 8.642% | 30.000% | Fixed | % | 4.83 | 10/11 – 12/11 | AAA/Aaa | ||||||||||||||||||

| Class A-3 | $ | 161,040,000 | 4.777% | 30.000% | Fixed | % | 6.98 | 12/13 – 12/13 | AAA/Aaa | ||||||||||||||||||

| Class A-PB | $ | 49,253,000 | 1.461% | 30.000% | Fixed | % | 7.33 | 12/11 – 06/16 | AAA/Aaa | ||||||||||||||||||

| Class A-4 | $ | 642,531,000 | 19.059% | 30.000% | Fixed | % | 9.86 | 06/16 – 11/16 | AAA/Aaa | ||||||||||||||||||

| Class A-1A | $ | 699,011,000 | 20.734% | 30.000% | Fixed (5) | % | 8.81 | 01/07 – 11/16 | AAA/Aaa | ||||||||||||||||||

| Class X-P | $ | 3,240,519,000 | N/A | N/A | Variable (4) | % | N/A(4) | N/A(4) | AAA/Aaa | ||||||||||||||||||

| Class A-M | $ | 337,128,000 | 10.000% | 20.000% | Fixed | % | 9.95 | 11/16 – 12/16 | AAA/Aaa | ||||||||||||||||||

| Class A-J | $ | 303,415,000 | 9.000% | 11.000% | Fixed | % | 9.98 | 12/16 – 12/16 | AAA/Aaa | ||||||||||||||||||

| Class B | $ | 25,284,000 | 0.750% | 10.250% | Fixed | % | 9.98 | 12/16 – 12/16 | AA+/Aa1 | ||||||||||||||||||

| Class C | $ | 33,713,000 | 1.000% | 9.250% | Fixed (5) | % | 9.98 | 12/16 – 12/16 | AA/Aa2 | ||||||||||||||||||

| Class D | $ | 29,498,000 | 0.875% | 8.375% | Fixed (5) | % | 9.98 | 12/16 – 12/16 | AA–/Aa3 | ||||||||||||||||||

| Class E | $ | 46,355,000 | 1.375% | 7.000% | Fixed (5) | % | 9.98 | 12/16 – 12/16 | A/A2 | ||||||||||||||||||

| Class A-4FL | $ | 500,000,000 | (6) | 14.831% | 30.000% | Floating | % | (7) | (7) | AAA/Aaa(8) | |||||||||||||||||

| Class F | $ | 37,927,000 | 1.125% | 5.875% | Fixed (5) | % | (7) | (7) | A–/A3 | ||||||||||||||||||

| Class G | $ | 37,927,000 | 1.125% | 4.750% | Fixed (5) | % | (7) | (7) | BBB+/Baa1 | ||||||||||||||||||

| Class H | $ | 33,713,000 | 1.000% | 3.750% | WAC (9) | % | (7) | (7) | BBB/Baa2 | ||||||||||||||||||

| Class J | $ | 37,927,000 | 1.125% | 2.625% | WAC (10) | % | (7) | (7) | BBB–/Baa3 | ||||||||||||||||||

| Class K | $ | 12,642,000 | 0.375% | 2.250% | Fixed (5) | % | (7) | (7) | BB+/Ba1 | ||||||||||||||||||

| Class L | $ | 8,428,000 | 0.250% | 2.000% | Fixed (5) | % | (7) | (7) | BB/Ba2 | ||||||||||||||||||

| Class M | $ | 8,428,000 | 0.250% | 1.750% | Fixed (5) | % | (7) | (7) | BB–/Ba3 | ||||||||||||||||||

| Class N | $ | 4,214,000 | 0.125% | 1.625% | Fixed (5) | % | (7) | (7) | B+/B1 | ||||||||||||||||||

| Class O | $ | 8,429,000 | 0.250% | 1.375% | Fixed (5) | % | (7) | (7) | B/B2 | ||||||||||||||||||

| Class P | $ | 8,428,000 | 0.250% | 1.125% | Fixed (5) | % | (7) | (7) | B–/B3 | ||||||||||||||||||

| Class Q | $ | 37,927,181 | 1.125% | 0.000% | Fixed (5) | % | (7) | (7) | NR/NR | ||||||||||||||||||

| Class X-C | $ | 3,371,274,181 | N/A | N/A | WAC-IO (11) | % | (7) | (7) | AAA/Aaa | ||||||||||||||||||

| (1) | Subject to a permitted variance of plus or minus 5.0%. |

| (2) | Based on no prepayments and the other assumptions set forth under ‘‘YIELD AND MATURITY CONSIDERATIONS—Weighted Average Life’’ in this prospectus supplement. |

| (3) | By each of Standard & Poor’s Ratings Services, a division of The McGraw-Hill Companies, Inc. and Moody’s Investors Service, Inc. See ‘‘RATINGS’’ in this prospectus supplement. |

| (4) | The Class X-P certificates will not have a certificate balance and their holders will not receive distributions of principal, but these holders are entitled to receive payments of the aggregate interest accrued on the notional amount of the Class X-P certificates, as described in this prospectus supplement. The interest rate applicable to the Class X-P certificates for each distribution date will be as described in this prospectus supplement. See ‘‘DESCRIPTION OF THE CERTIFICATES—Pass-Through Rates’’ in this prospectus supplement. |

S-7

| (5) | The pass-through rate applicable to each of the Class A-1A, Class C, Class D, Class E, Class F, Class G, Class K, Class L, Class M, Class N, Class O, Class P and Class Q certificates for any distribution date will be subject to a maximum rate equal to the applicable weighted average net mortgage rate (calculated as described in this prospectus supplement) for the related date. |

| (6) | The certificate balance of the Class A-4FL certificates will be equal to the certificate balance of the Class A-4FL regular interest. |

| (7) | Not offered by this prospectus supplement. Any information we provide herein regarding the terms of these certificates is provided only to enhance your understanding of the offered certificates. |

| (8) | The ratings assigned to the Class A-4FL certificates only reflect the receipt of a fixed rate of interest at a rate of % per annum. See ‘‘RATINGS’’ in this prospectus supplement. |

| (9) | The pass-through rate applicable to the Class H certificates for any distribution date will be equal to the weighted average net mortgage rate (calculated as described in this prospectus supplement) minus % for the related date. |

| (10) | The pass-through rate applicable to each of the Class J certificates for any distribution date will be equal to the applicable weighted average net mortgage rate (calculated as described in this prospectus supplement) for the related date. |

| (11) | The Class X-C certificates are not offered by this prospectus supplement. Any information we provide in this prospectus supplement regarding the terms of these certificates is provided only to enhance your understanding of the offered certificates. The Class X-C certificates will not have a certificate balance and their holders will not receive distributions of principal, but these holders are entitled to receive payments of the aggregate interest accrued on the notional amount of the Class X-C certificates, as described in this prospectus supplement. The interest rate applicable to the Class X-C certificates for each distribution date will be as described in this prospectus supplement. See ‘‘DESCRIPTION OF THE CERTIFICATES—Pass-Through Rates’’ in this prospectus supplement. |

S-8

THE PARTIES

| The Trust Fund | The trust fund will be created on or about the closing date pursuant to a pooling and servicing agreement, dated as of December 1, 2006, by and among the depositor, the master servicer, the special servicer and the trustee. | |

| The Depositor | Wachovia Commercial Mortgage Securities, Inc. We are a wholly-owned subsidiary of Wachovia Bank, National Association, which is one of the mortgage loan sellers, a sponsor, the master servicer, the swap counterparty and the master servicer under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28, under which the Newport Bluffs whole loan is serviced and an affiliate of one of the underwriters. Our principal executive office is located at 301 South College Street, Charlotte, North Carolina 28288-0166 and our telephone number is (704) 374-6161. Neither we nor any of our affiliates have insured or guaranteed the offered certificates. For more detailed information, see ‘‘THE DEPOSITOR’’ in the accompanying prospectus. | |

| On the closing date, we will sell the mortgage loans and related assets to be included in the trust fund to the trustee to create the trust fund. | ||

| The Issuing Entity | A common law trust, created under the laws of the State of New York, to be established on the closing date under the pooling and servicing agreement. The issuing entity is also sometimes referred to herein as the trust fund. For more detailed information, see ‘‘DESCRIPTION OF THE CERTIFICATES—The Issuing Entity’’ in this prospectus supplement and the accompanying prospectus. | |

| The Sponsors | Each of Wachovia Bank, National Association and Artesia Mortgage Capital Corporation is a sponsor for this transaction. For more information, see ‘‘DESCRIPTION OF THE MORTGAGE POOL—The Sponsors’’ in this prospectus supplement and ‘‘THE SPONSOR’’ in the accompanying prospectus. | |

| The Mortgage Loan Sellers | Each of the sponsors will be a mortgage loan seller for this transaction. For more information, see ‘‘DESCRIPTION OF THE MORTGAGE POOL—The Mortgage Loan Sellers’’ in this prospectus supplement. Wachovia Bank, National Association is the master servicer, a sponsor, the swap counterparty and the master servicer under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, | |

S-9

| Commercial Mortgage Pass-Through Certificates, Series 2006-C28, under which the Newport Bluffs whole loan is serviced and is an affiliate of the depositor and one of the underwriters. The mortgage loan sellers will sell and assign to us on the closing date the mortgage loans to be included in the trust fund. See ‘‘DESCRIPTION OF THE MORTGAGE POOL —Representations and Warranties; Repurchases and Substitutions’’ in this prospectus supplement. | ||

Mortgage Loans by Mortgage Loan Seller

| Mortgage Loan Seller | Number of Mortgage Loans | Aggregate Cut-Off Date Balance | Percentage of Cut-Off Date Pool Balance | Percentage of Cut-Off Date Group 1 Balance | Percentage of Cut-Off Date Group 2 Balance | |||||||||||||||||||||||||

| Wachovia Bank, National Association | 115 | $ | 3,036,387,201 | 90.1 | % | 93.1 | % | 78.4 | % | |||||||||||||||||||||

| Artesia Mortgage Capital Corporation | 27 | 334,886,980 | 9.9 | 6.9 | 21.6 | |||||||||||||||||||||||||

| Total | 142 | $ | 3,371,274,181 | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||

| The Master Servicer | Wachovia Bank, National Association. Wachovia Bank, National Association is one of the mortgage loan sellers, a sponsor, the swap counterparty and the master servicer under the 2006-C28 transaction and an affiliate of the depositor and one of the underwriters. The master servicer will be primarily responsible for collecting payments and gathering information with respect to the mortgage loans included in the trust fund and the companion loans which are not part of the trust fund; provided, however, the Newport Bluffs whole loan will be serviced under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28. The master servicer under the 2006-C28 pooling and servicing agreement is Wachovia Bank, National Association. | |

| See ‘‘SERVICING OF THE MORTGAGE LOANS—The Master Servicer’’ in this prospectus supplement. | ||

| The Special Servicer | Initially, LNR Partners, Inc. The special servicer will be responsible for performing certain servicing functions with respect to the mortgage loans included in the trust fund and the companion loans which are not part of the trust fund that, in general, are in default or as to which default is imminent; provided, however, the Newport Bluffs whole loan will be specially serviced (during those periods where special servicing is required) under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28. The special servicer under the 2006-C28 pooling and servicing agreement is CWCapital Asset Management LLC. | |

S-10

| Some holders of certificates (initially the holder of the Class Q certificates with respect to each mortgage loan other than the Galleria at Tyler mortgage loan, the Newport Bluffs mortgage loan and the Renaissance Tower Office Building mortgage loan) will have the right to replace the special servicer and to select a representative who may advise and direct the special servicer and whose approval is required for certain actions by the special servicer under certain circumstances. With respect to the Galleria at Tyler mortgage loan and the Renaissance Tower Office Building mortgage loan, except during the continuance of a control appraisal period under the related intercreditor agreement, the holder of the subordinate companion loan related to each of the Galleria at Tyler mortgage loan and the Renaissance Tower Office Building mortgage loan may appoint or remove the special servicer with respect to the related mortgage loan, subject to certain conditions set forth in the related intercreditor agreement. During the continuance of a control appraisal period with respect to either the Galleria at Tyler mortgage loan or the Renaissance Tower Office Building mortgage loan, the controlling class will have the right to replace the special servicer with respect to such mortgage loan. With respect to the Newport Bluffs mortgage loan, the special servicer may be removed at any time, with or without cause, but only with the consent of both the controlling class representative and the 2006-C28 controlling class representative, subject to certain conditions as set forth in the related intercreditor agreement. See ‘‘SERVICING OF THE MORTGAGE LOANS—The Special Servicer’’ and ‘‘—The Controlling Class Representative’’ in this prospectus supplement. | ||

| The Trustee | Wells Fargo Bank, N.A. The trustee will be responsible for (among other things) distributing payments to certificateholders and delivering to certificateholders certain reports on the mortgage loans included in the trust fund and the certificates. Wells Fargo Bank, N.A. is the trustee under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28. See ‘‘DESCRIPTION OF THE CERTIFICATES—The Trustee’’ in this prospectus supplement. | |

| The Underwriters | Wachovia Capital Markets, LLC, Goldman, Sachs & Co. and Greenwich Capital Markets, Inc. It is intended that Wachovia Securities International Limited will act as a member of the selling group on behalf of Wachovia Capital Markets, LLC and may sell offered certificates on behalf of Wachovia Capital Markets, LLC in certain jurisdictions. Wachovia Capital Markets, LLC is an affiliate of the depositor and of Wachovia Bank, National Association, which is the master servicer, a sponsor, one of the mortgage loan sellers, the swap | |

S-11

| counterparty and a sponsor of and the master servicer under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28, under which the Newport Bluffs whole loan is serviced. See ‘‘RISK FACTORS —The Offered Certificates—Potential Conflicts of Interest’’ in this prospectus supplement. Wachovia Capital Markets, LLC is acting as sole lead manager for this offering. Goldman, Sachs & Co. and Greenwich Capital Markets, Inc. are acting as co-managers for this offering. Wachovia Capital Markets, LLC is acting as sole bookrunner with respect to the offered certificates. | ||

| Certain Affiliations | Wachovia Bank, National Association and its affiliates are playing several roles in this transaction. Wachovia Bank, National Association is a mortgage loan seller, the master servicer, a sponsor and the swap counterparty. Wachovia Commercial Mortgage Securities, Inc. is the depositor and a wholly-owned subsidiary of Wachovia Bank, National Association. Wachovia Bank, National Association and Artesia Mortgage Capital Corporation originated the mortgage loans and will be selling them to the depositor. Wachovia Bank, National Association is also an affiliate of Wachovia Capital Markets, LLC, an underwriter for the offering of the certificates. In addition, Wachovia Bank, National Association is the master servicer under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28. Wells Fargo Bank, N.A., the trustee, is the trustee under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass Through Certificates, Series 2006-C28. Further, an affiliate of the special servicer is the anticipated initial holder of certain non-offered classes of certificates. These roles and other potential relationships may give rise to conflicts of interest as further described under ‘‘RISK FACTORS—The Offered Certificates—Potential Conflicts of Interest’’ in this prospectus supplement. | |

S-12

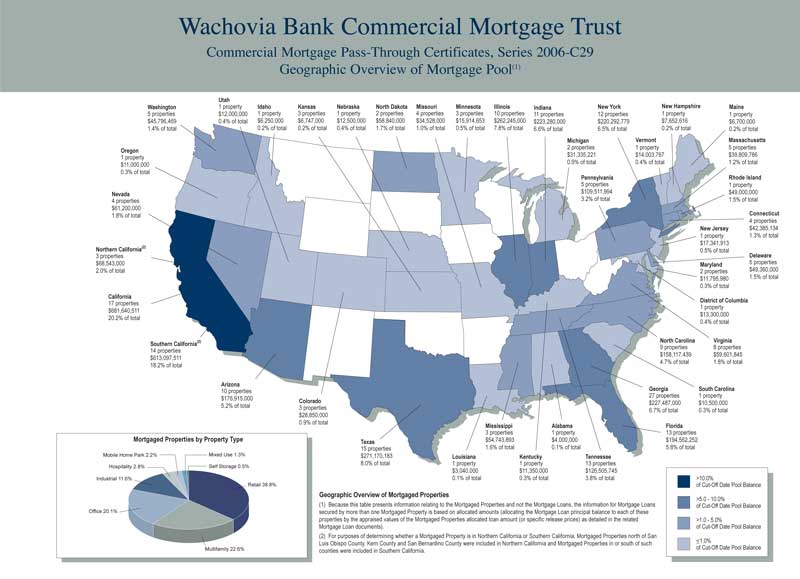

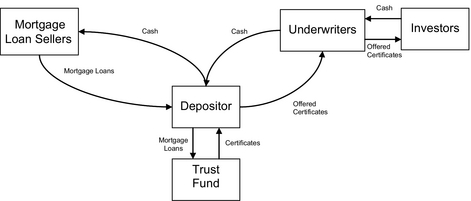

Transaction Overview

On the closing date, the mortgage loan sellers will sell the mortgage loans to the depositor, which will in turn deposit them into a common law trust created on the closing date. The trust fund, which will be the issuing entity, will be formed by a pooling and servicing agreement, to be dated as of December 1, 2006, among the depositor, the master servicer, the special servicer and the trustee. The master servicer will service the mortgage loans (other than the specially serviced mortgage loans and the Newport Bluffs whole loan (which will be serviced pursuant to the 2006-C28 pooling and servicing agreement)) in accordance with the pooling and servicing agreement and provide the information to the trustee necessary for the trustee to calculate distributions and other information regarding the certificates.

The transfers of the mortgage loans from the sponsors/mortgage loan sellers to the depositor and from the depositor to the issuing entity in exchange for the certificates are illustrated below:

S-13

IMPORTANT DATES AND PERIODS

| Closing Date | On or about December 22, 2006. | |

| Cut-Off Date | For 139 mortgage loans, representing 87.6% of the mortgage pool (99 mortgage loans in loan group 1 or 84.4% and all of the mortgage loans in loan group 2), December 11, 2006, for 2 mortgage loans, representing 11.7% of the mortgage pool (14.8% of loan group 1), December 9, 2006 and for 1 mortgage loan, representing 0.7% of the mortgage pool (0.8% of loan group 1), December 1, 2006. The cut-off date balance of each mortgage loan included in the trust fund and each cut-off date certificate balance in this prospectus supplement assumes the timely receipt of principal scheduled to be paid (if any) on each mortgage loan and no defaults, delinquencies or prepayments on any mortgage loan on or before the related cut-off date. | |

| Distribution Date | The fourth business day following the related determination date, commencing in January 2007. | |

| Determination Date | The 11th day of each month, or if such 11th day is not a business day, the next succeeding business day, commencing in January 2007. | |

| Collection Period | For any distribution date, the period beginning on the 12th day in the immediately preceding month (or the day after the applicable cut-off date in the case of the first collection period) through and including the 11th day of the month in which the distribution date occurs. Notwithstanding the foregoing, in the event that the last day of a collection period is not a business day, any payments with respect to the mortgage loans which relate to such collection period and are received on the business day immediately following such last day will be deemed to have been received during such collection period and not during any other collection period, and in the event that the payment date (after giving effect to any grace period) related to any distribution date occurs after the related collection period, any amounts received on that payment date (after giving effect to any grace period) will be deemed to have been received during the related collection period and not during any other collection period. | |

S-14

THE CERTIFICATES

| Offered Certificates | We are offering to you the following 13 classes of certificates of our Commercial Mortgage Pass-Through Certificates, Series 2006-C29 pursuant to this prospectus supplement: | |

| Class A-1 Class A-2 Class A-3 Class A-PB Class A-4 Class A-1A Class X-P Class A-M Class A-J Class B Class C Class D Class E | |||

| Priority of Distributions | On each distribution date, the owners of the certificates will be entitled to distributions of payments or other collections on the mortgage loans that the master servicer collected or that the master servicer and/or the trustee advanced during or with respect to the related collection period after deducting certain fees and expenses. For purposes of making certain distributions to the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A certificates and the Class A-4FL regular interest, the mortgage pool will be deemed to consist of 2 loan groups: | |

| • | Loan group 1 will consist of (i) all of the mortgage loans that are not secured by multifamily properties or mobile home park properties and (ii) 2 mortgage loans that are secured by multifamily properties; and | ||

| • | Loan group 2 will consist of (i) 38 mortgage loans that are secured by multifamily properties and (ii) 2 mortgage loans that are secured by mobile home park properties. | ||

| Annex A-1 to this prospectus supplement sets forth the loan group designation for each mortgage loan. | ||

| The trustee will distribute amounts to the extent that the money is available after the payment of fees and expenses of the master servicer, the special servicer, the trustee and the 2006-C28 master servicer, in the following order of priority: | ||

S-15

Interest, concurrently (i) pro rata, on the Class A-1, Class A-2, Class A-3, Class A-PB and Class A-4 certificates and the Class A-4FL regular interest from the portion of money available attributable to mortgage loans in loan group 1, (ii) on the Class A-1A certificates from the portion of money available attributable to mortgage loans in loan group 2, and (iii) pro rata, on the Class X-C and Class X-P certificates from any and all money attributable to the mortgage pool; provided, however, if on any distribution date, the money available on such distribution date is insufficient to pay in full the total amount of interest to be paid to any of the classes as described above, money available with respect to the entire mortgage pool will be allocated among all those classes pro rata.

Principal on the Class A-PB certificates, up to the principal distribution amount related to loan group 1, until the certificate balance of the Class A-PB certificates is reduced to the planned principal balance set forth in the table on Annex F to this prospectus supplement, and, after the Class A-1A certificate balance has been reduced to zero, the principal distribution amount relating to loan group 2 remaining after payments to the Class A-1A certificates have been made, until the certificate balance of the Class A-PB certificates is reduced to the planned principal balance set forth in the table on Annex F to this prospectus supplement.

After distributions of principal have been made from the principal distribution amount relating to loan group 1 to the Class A-PB certificates as set forth in the priority immediately preceding, principal on the Class A-1 certificates, up to the remaining principal distribution amount relating to loan group 1 and, after the Class A-1A certificate balance has been reduced to zero, the principal distribution amount relating to loan group 2 remaining after payments to the Class A-1A and Class A-PB certificates have been made, until their certificate balance is reduced to zero.

S-16

After distributions of principal have been made from the principal distribution amount relating to loan group 1 to the Class A-PB and Class A-1 certificates as set forth in the immediately preceding priorities, principal on the Class A-2 certificates, up to the remaining principal distribution amount relating to loan group 1 and, after the Class A-1A certificate balance has been reduced to zero, the principal distribution amount relating to loan group 2 remaining after payments to the Class A-1A, Class A-PB and Class A-1 certificates have been made, until their certificate balance is reduced to zero.

After distributions of principal have been made from the principal distribution amount relating to loan group 1 to the Class A-PB, Class A-1 and Class A-2 certificates as set forth in the immediately preceding priorities, principal on the Class A-3 certificates, up to the remaining principal distribution amount relating to loan group 1 and, after the Class A-1A certificate balance has been reduced to zero, the principal distribution amount relating to loan group 2 remaining after payments to the Class A-1A, Class A-PB, Class A-1 and Class A-2 certificates have been made, until their certificate balance is reduced to zero.

After distributions of principal have been made from the principal distribution amount relating to loan group 1 to the Class A-PB, Class A-1, Class A-2 and Class A-3 certificates as set forth in the immediately preceding priorities, principal on the Class A-PB certificates, up to the remaining principal distribution amount relating to loan group 1 and, after the Class A-1A certificate balance has been reduced to zero, the principal distribution amount relating to loan group 2 remaining after payments to the Class A-1A, Class A-PB, Class A-1, Class A-2 and Class A-3 certificates have been made, until their certificate balance is reduced to zero.

S-17

After distributions of principal have been made from the principal distribution amount relating to loan group 1 to the Class A-PB, Class A-1, Class A-2 and Class A-3 certificates as set forth in the immediately preceding priorities, principal, pro rata on the Class A-4 certificates and the Class A-4FL regular interest, up to the remaining principal distribution amount relating to loan group 1 and, after the Class A-1A certificate balance has been reduced to zero, the principal distribution amount relating to loan group 2 remaining after payments to the Class A-1A, Class A-PB, Class A-1, Class A-2 and Class A-3 certificates have been made, until their certificate balance is reduced to zero.

Principal on the Class A-1A certificates, up to the principal distribution amount relating to loan group 2 and, after the certificate balances of the Class A-PB, Class A-1, Class A-2, Class A-3 and Class A-4 certificates and the Class A-4FL regular interest have been reduced to zero, the principal distribution amount relating to loan group 1 remaining after payments to the Class A-PB, Class A-1, Class A-2, Class A-3 and Class A-4 certificates and the Class A-4FL regular interest have been made, until their certificate balance is reduced to zero.

Reimbursement to the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A certificates and the Class A-4FL regular interest, pro rata, for any realized loss and trust fund expenses borne by such certificates or regular interest.

Interest on the Class A-M certificates.

Principal on the Class A-M certificates, up to the principal distribution amount, until their certificate balance is reduced to zero.

S-18

Reimbursement to the Class A-M certificates for any realized losses and trust fund expenses borne by such class.

Interest on the Class A-J certificates.

Principal on the Class A-J certificates, up to the principal distribution amount, until their certificate balance is reduced to zero.

Reimbursement to the Class A-J certificates for any realized losses and trust fund expenses borne by such class.

Interest on the Class B certificates.

Principal on the Class B certificates, up to the principal distribution amount, until their certificate balance is reduced to zero.

Reimbursement to the Class B certificates for any realized losses and trust fund expenses borne by such class.

Interest on the Class C certificates.

Principal on the Class C certificates, up to the principal distribution amount, until their certificate balance is reduced to zero.

Reimbursement to the Class C certificates for any realized losses and trust fund expenses borne by such class.

S-19

Interest on the Class D certificates.

Principal on the Class D certificates, up to the principal distribution amount, until their certificate balance is reduced to zero.

Reimbursement to the Class D certificates for any realized losses and trust fund expenses borne by such class.

Interest on the Class E certificates.

Principal on the Class E certificates, up to the principal distribution amount, until their certificate balance is reduced to zero.

Reimbursement to the Class E certificates for any realized losses and trust fund expenses borne by such class.

| If, on any distribution date, the certificate balances of the Class A-M through Class Q certificates have been reduced to zero, but any two or more of the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A certificates and the Class A-4FL regular interest remain outstanding, distributions of principal (other than distributions of principal otherwise allocable to reduce the certificate balance of the Class A-PB certificates to the planned principal amount set forth in the table on Annex F to this prospectus supplement) and interest will be made, pro rata, to the outstanding Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A certificates and the Class A-4FL regular interest. See ‘‘DESCRIPTION OF THE CERTIFICATES—Distributions’’ in this prospectus supplement. | ||

| No companion loan will be part of the trust fund, and amounts received with respect to any companion loan will not be available for distributions to holders of any certificates. | ||

S-20

| Interest | On each distribution date, each class of certificates (other than the Class Z, Class R-I and Class R-II certificates) and the Class A-4FL regular interest will be entitled to receive: | |

| • | for each class of these certificates and the Class A-4FL regular interest, one month’s interest at the applicable pass-through rate accrued during the applicable interest period, on the certificate balance or notional amount, as applicable, of each class of these certificates and the Class A-4FL regular interest immediately prior to that distribution date; | ||

| • | plus any interest that this class of certificates and the Class A-4FL regular interest was entitled to receive on all prior distribution dates to the extent not received; | ||

| • | minus (other than in the case of the Class X-C and Class X-P certificates) that class’ share of any shortfalls in interest collections due to prepayments on mortgage loans included in the trust fund that are not offset by certain payments made by the master servicer; and | ||

| • | minus (other than in the case of the Class X-C and Class X-P certificates) that class’ allocable share of any reduction in interest accrued on any mortgage loan as a result of a modification that reduces the related mortgage rate and allows the reduction in accrued interest to be added to the stated principal balance of the mortgage loan. | ||

| As reflected in the chart under ‘‘—Priority of Distributions’’ above, so long as funds are sufficient on any distribution date to make distributions of all interest on that distribution date to the Class A-1, Class A-2, Class A-3, Class A-PB and Class A-4 certificates and the Class A-4FL regular interest, interest distributions on the Class A-1, Class A-2, Class A-3, Class A-PB and Class A-4 certificates and the Class A-4FL regular interest will be based upon amounts available relating to mortgage loans in loan group 1 and interest distributions on the Class A-1A certificates will be based upon amounts available relating to mortgage loans in loan group 2. | ||

| See ‘‘DESCRIPTION OF THE CERTIFICATES— Certificate Balances and Notional Amounts’’ and ‘‘—Distributions’’ in this prospectus supplement. | ||

| The Class X-C and Class X-P certificates will be entitled to distributions of interest only on their respective notional amounts. The notional amounts of each of these classes of certificates are calculated as described under ‘‘DESCRIPTION OF THE CERTIFICATES—Certificate Balances and Notional Amounts’’ in this prospectus supplement. | ||

| Each of the Class X-C and Class X-P certificates will accrue interest at a rate as described under ‘‘DESCRIPTION OF | ||

S-21

| THE CERTIFICATES—Pass-Through Rates’’ in this prospectus supplement. | ||

| The certificates (other than the Class A-4FL, Class Z, Class R-I and Class R-II certificates) and the Class A-4FL regular interest will accrue interest on the basis of a 360-day year consisting of twelve 30-day months. The Class A-4FL certificates will accrue interest on the basis of a 360-day year and the actual number of days in the related interest accrual period; provided that if the pass through rate converts to a fixed rate as described in this prospectus supplement, the Class A-4FL certificates will accrue interest on the same basis as the Class A-4FL regular interest. | ||

| The interest accrual period with respect to any distribution date and any class of certificates (other than the Class Z, Class R-I and Class R-II certificates) and the Class A-4FL regular interest is the calendar month preceding the month in which such distribution date occurs. | ||

| As reflected in the chart under ‘‘—Priority of Distributions’’ beginning on page S-15 above, on each distribution date, the trustee will distribute interest to the holders of the offered certificates and the Class X-C certificates and the Class A-4FL regular interest: | ||

| • | first, pro rata, to the Class X-C, Class X-P, Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A certificates and the Class A-4FL regular interest as described above under ‘‘—Priority of Distributions’’, and then to each other class of offered certificates in order of priority of payment; and | ||

| • | only to the extent funds remain after the trustee makes all distributions of interest and principal required to be made on such date to each class of certificates or regular interest with a higher priority of distribution. | ||

| You may, in certain circumstances, also receive distributions of prepayment premiums and yield maintenance charges collected on the mortgage loans included in the trust fund. These distributions are in addition to the distributions of principal and interest described above. See ‘‘DESCRIPTION OF THE CERTIFICATES—Distributions’’ in this prospectus supplement. | ||

| Pass-Through Rates | The pass-through rate for each class of certificates (other than the Class X-C, Class X-P, Class Z, Class R-I and Class R-II certificates) on each distribution date is set forth above under ‘‘OVERVIEW OF THE CERTIFICATES’’ in this prospectus supplement. | |

| The pass-through rates applicable to the Class X-C certificates and the Class X-P certificates are described under ‘‘DESCRIPTION OF THE CERTIFICATES—Pass Through-Rates’’ in this prospectus supplement. | ||

S-22

| The weighted average net mortgage rate for each distribution date is the weighted average of the net mortgage rates for the mortgage loans included in the trust fund as of the beginning of the related collection period, weighted on the basis of their respective stated principal balances immediately following the preceding distribution date; provided that, for the purpose of determining the weighted average net mortgage rate only, if the mortgage rate for any mortgage loan included in the trust fund has been modified in connection with a bankruptcy or similar proceeding involving the related borrower or a modification, waiver or amendment granted or agreed to by the special servicer, the weighted average net mortgage rate for that mortgage loan will be calculated without regard to that event. The net mortgage rate for each mortgage loan included in the trust fund will generally equal: | ||

| • | the mortgage interest rate in effect for that mortgage loan as of the closing date; minus | ||

| • | the applicable administrative cost rate, as described in this prospectus supplement. | ||

| Any increase in the interest rate of a mortgage loan as a result of not repaying the outstanding principal amount of such mortgage loan by the related anticipated repayment date will be disregarded for purposes of calculating the net mortgage rate. | ||

| For the purpose of calculating the weighted average net mortgage rate, the mortgage rate of each mortgage loan will be deemed adjusted as described under ‘‘DESCRIPTION OF THE CERTIFICATES—Pass-Through Rates’’ in this prospectus supplement. | ||

| The stated principal balance of each mortgage loan included in the trust fund will generally equal the principal balance of that mortgage loan as of the cut-off date, reduced as of any date of determination (to not less than zero) by: | ||

| • | the portion of the principal distribution amount for the related distribution date that is attributable to that mortgage loan; and | ||

| • | the principal portion of any realized loss incurred in respect of that mortgage loan during the related collection period. | ||

| The stated principal balance of any mortgage loan as to which the mortgage rate is reduced through a modification may be increased in certain circumstances by the amount of the resulting interest reduction. See ‘‘DESCRIPTION OF THE CERTIFICATES—Pass-Through Rates’’ in this prospectus supplement. | ||

S-23

| Principal Distributions | On the closing date, each class of certificates (other than the Class X-C, Class X-P, Class Z, Class R-I and Class R-II certificates) will have the certificate balance set forth above under ‘‘OVERVIEW OF THE CERTIFICATES’’ and the Class A-4FL certificates will have a certificate balance equal to the certificate balance of the Class A-4FL regular interest. The certificate balance for each class of certificates and the Class A-4FL regular interest entitled to receive principal may be reduced by: | |

| • | distributions of principal; and | ||

| • | allocations of realized losses and trust fund expenses. | ||

| The certificate balance or notional amount of a class of certificates and the Class A-4FL regular interest may be increased in certain circumstances by the allocation of any increase in the stated principal balance of any mortgage loan resulting from the reduction of the related mortgage rate through modification. See ‘‘DESCRIPTION OF THE CERTIFICATES—Certificate Balances and Notional Amounts’’ in this prospectus supplement. | ||

| The Class X-C and Class X-P certificates do not have principal balances and will not receive distributions of principal. | ||

| As reflected in the chart under ‘‘—Priority of Distributions’’ above: | ||

| • | generally, the Class A-1, Class A-2, Class A-3, Class A-PB and Class A-4 certificates and the Class A-4FL regular interest will only be entitled to receive distributions of principal collected or advanced in respect of mortgage loans in loan group 1 until the certificate principal balance of the Class A-1A certificates has been reduced to zero, and the Class A-1A certificates will only be entitled to receive distributions of principal collected or advanced in respect of mortgage loans in loan group 2 until the certificate principal balances of the Class A-1, Class A-2, Class A-3, Class A-PB and Class A-4 certificates and the Class A-4FL regular interest have been reduced to zero; provided, however, the Class A-1, Class A-2, Class A-3 and Class A-4 certificates and the Class A-4FL regular interest will not be entitled to distributions of principal from either loan group 1 or loan group 2 until the certificate principal balance of the Class A-PB certificates is reduced to the planned principal balance set forth on Annex F to this prospectus supplement; | ||

| • | principal is distributed to each class of certificates and regular interest entitled to receive distributions of principal in the order described under ‘‘DESCRIPTION | ||

S-24

| OF THE CERTIFICATES—Distributions’’ in this prospectus supplement; | |||

| • | principal is only distributed on a related class of certificates and regular interest to the extent funds remain after the trustee makes all distributions of principal and interest on those classes of certificates and regular interest with a higher priority of distribution as described under ‘‘DESCRIPTION OF THE CERTIFICATE—Distributions’’ in this prospectus supplement; | ||

| • | generally, no class of certificates or regular interest is entitled to distributions of principal until the certificate balance of each class of certificates and regular interest with a higher priority of distribution as described under ‘‘DESCRIPTION OF THE CERTIFICATES— Distributions’’ in this prospectus supplement has been reduced to zero; | ||

| • | in no event will the holders of the Class A-M, Class A-J, Class B, Class C, Class D or Class E certificates or the classes of non-offered certificates (excluding the Class A-4FL certificates) be entitled to receive any payments of principal until the certificate balances of the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A certificates and the Class A-4FL regular interest have all been reduced to zero; and | ||

| • | on any distribution date, distributions in reduction of the certificate balance of the Class A-4FL certificates will be made in an amount equal to the amount of principal distributed in respect of the Class A-4FL regular interest. | ||

| The amount of principal to be distributed for each distribution date generally will be an amount equal to: | ||

| • | the scheduled principal payments (other than balloon payments) due on the mortgage loans included in the trust fund during the related collection period whether or not those scheduled payments are actually received; | ||

| • | balloon payments actually received with respect to mortgage loans included in the trust fund during the related collection period; | ||

| • | prepayments received with respect to the mortgage loans included in the trust fund during the related collection period; and | ||

| �� | all liquidation proceeds, insurance proceeds, condemnation awards and repurchase and substitution amounts received during the related collection period that are allocable to principal. | ||

| For purposes of making distributions to the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 and Class A-1A | ||

S-25

| certificates and the Class A-4FL regular interest, the principal distribution amount for each loan group on any distribution date will be equal to the sum of the collections specified above but only to the extent such amounts relate to the mortgage loans comprising the specified loan group. | ||

| However, if the master servicer or the trustee reimburses itself out of general collections on the mortgage pool for any advance that it or the special servicer has determined is not recoverable out of collections on the related mortgage loan and certain advances that are determined not to be reimbursed currently in connection with the work-out of a mortgage loan, then those advances (together with accrued interest thereon) will be deemed, to the fullest extent permitted pursuant to the terms of the pooling and servicing agreement, to be reimbursed first out of payments and other collections of principal otherwise distributable on the principal balance certificates, prior to, in the case of nonrecoverable advances only, being deemed reimbursed out of payments and other collections of interest otherwise distributable on the offered certificates. | ||

| Subordination; Allocation of Losses and Certain Expenses | Credit support for any class of certificates (other than the Class X-C, Class X-P, Class Z, Class R-I and Class R-II certificates) is provided by the subordination of payments and allocation of any losses to such classes of certificates which have a later priority of distribution. However, none of the Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4 or Class A-1A certificates or the Class A-4FL regular interest will be subordinate to any other class of Class A-1, Class A-2, Class A-3, Class A-PB, Class A-4, Class A-1A certificates or the Class A-4FL regular interest. The certificate balance of a class of certificates (other than the Class X-C, Class X-P, Class Z, Class R-I and Class R-II certificates) or regular interest will be reduced on each distribution date by any losses on the mortgage loans that have been realized and certain additional trust fund expenses actually allocated to that class of certificates or the Class A-4FL regular interest on that distribution date. In addition, while mortgage loan losses will not be directly allocated to the Class A-4FL certificates, mortgage loan losses may be allocated to the Class A-4FL regular interest in reduction of the certificate balance of the Class A-4FL regular interest and the amount of its interest entitlement. Any decrease in the certificate balance of the Class A-4FL regular interest will result in a corresponding decrease in the certificate balance of the Class A-4FL certificates, and any interest shortfalls suffered by the Class A-4FL regular interest will reduce the amount of interest distributed on the Class A-4FL certificates, to the extent described in this prospectus supplement. | |

S-26

| Losses on the mortgage loans that have been realized and additional trust fund expenses will be allocated without regard to loan group and will first be allocated to the certificates (other than the Class X-C, Class A-4FL, Class Z, Class R-I and Class R-II certificates) that are not offered by this prospectus supplement and then to the offered certificates (other than the Class X-P certificates) and the Class A-4FL regular interest (and, therefore, the Class A-4FL certificates) as indicated on the following table: | ||

| Class Designation | Original Certificate Balance | Percentage of Cut-Off Date Pool Balance | Order of Application of Losses and Expenses | ||||||||||||

| Class A-1 | $ | 16,719,000 | 0.496% | 8 | |||||||||||

| Class A-2 | $ | 291,337,000 | 8.642% | 8 | |||||||||||

| Class A-3 | $ | 161,040,000 | 4.777% | 8 | |||||||||||

| Class A-PB | $ | 49,253,000 | 1.461% | 8 | |||||||||||

| Class A-4 | $ | 642,531,000 | 19.059% | 8 | |||||||||||

| Class A-4FL(1) | $ | 500,000,000 | 14.831% | 8 | |||||||||||

| Class A-1A | $ | 699,011,000 | 20.734% | 8 | |||||||||||

| Class A-M | $ | 337,128,000 | 10.000% | 7 | |||||||||||

| Class A-J | $ | 303,415,000 | 9.000% | 6 | |||||||||||

| Class B | $ | 25,284,000 | 0.750% | 5 | |||||||||||

| Class C | $ | 33,713,000 | 1.000% | 4 | |||||||||||

| Class D | $ | 29,498,000 | 0.875% | 3 | |||||||||||

| Class E | $ | 46,355,000 | 1.375% | 2 | |||||||||||

| Non-offered certificates (excluding the Class A-4FL, Class R-I, Class R-II, Class X-C and Class Z certificates) | $ | 235,990,181 | 7.00% | 1 | |||||||||||

| (1) | The Class A-4FL certificates are not offered hereby. | ||

| Any losses realized on the mortgage loans included in the trust fund or additional trust fund expenses allocated in reduction of the certificate balance of any class of sequential pay certificates or regular interest will result in a corresponding reduction in the notional amount of the Class X-C certificates and, with respect to the Class A-2, Class A-3, Class A-PB, Class A-4, Class A-M, Class A-J, Class B, Class C, Class D and Class E certificates, the Class A-4FL regular interest and portions of the Class A-1 and Class A-1A certificates, a corresponding reduction in the notional amount of the Class X-P certificates. | ||

| Any losses and expenses that are associated with each co-lender loan will be allocated in accordance with the related intercreditor agreement. Specifically, with respect to the mortgage loans with one or more pari passu companion loans, any losses and expenses that are associated with the applicable whole loan will be allocated in accordance with the terms of the related intercreditor agreement, generally, pro rata between each related mortgage loan (and, therefore, to the certificates, other than the Class X-C, Class X-P, Class Z, Class R-I and Class R-II certificates) and the related pari passu companion loan(s). Further, with regard to the mortgage | ||

S-27

| loans with subordinate companion loans, any losses and expenses that are associated with the applicable whole loan will be allocated, in accordance with the terms of the related intercreditor agreement, generally, first, to the subordinate companion loan, and second, to the related mortgage loan (and the related pari passu companion loan, if applicable). The portions of those losses and expenses that are allocated to the mortgage loans that are included in the trust fund will be allocated among the Series 2006-C29 certificates in the manner described above. | ||

| See ‘‘DESCRIPTION OF THE CERTIFICATES— Subordination; Allocation of Losses and Certain Expenses’’ in this prospectus supplement. | ||

| Fees and Expenses | Certain fees and expenses are payable from amounts received on the mortgage loans in the trust fund and are generally distributed prior to any amounts being paid to the holders of the offered certificates. | |

| The master servicer is entitled to the master servicing fee which is payable monthly on a loan-by-loan basis from amounts received in respect of interest on each mortgage loan and each specially serviced mortgage loan (and from revenue with respect to each REO mortgage loan). The master servicing fee accrues at the related master servicing fee rate and is computed on the basis of the same principal amount respecting which any related interest payment due on the mortgage loan is computed. The weighted average master servicing fee rate will be approximately 0.02183% per annum as of the cut-off date. | ||

| The special servicer is entitled to the special servicing fee which is payable monthly on each mortgage loan that is a specially serviced mortgage loan and each REO mortgage loan from general collections on the mortgage loans. The special servicing fee accrues at a rate equal to 0.25% per annum and is computed on the basis of the same principal amount respecting which any related interest payment due on such specially serviced mortgage loan or REO mortgage loan, as the case may be, is paid. | ||

| The special servicer is also entitled to a liquidation fee with respect to each specially serviced mortgage loan that is generally an amount equal to 1.00% of any whole or partial cash payments of liquidation proceeds received in respect thereof; provided, however, in no event will the liquidation fee be payable to the extent a workout fee is payable concerning the related cash payments. | ||

| The special servicer also is entitled to a workout fee with respect to each mortgage loan that is no longer a specially serviced mortgage loan that is generally equal to 1.00% of all payments of interest and principal received on such mortgage loan for so long as it remains a corrected mortgage loan. | ||

S-28

| The trustee is entitled to a trustee fee for each mortgage loan and each REO mortgage loan for any distribution date equal to one-twelfth of the product of the trustee fee rate calculated on the outstanding principal amount of the pool of mortgage loans in the trust fund. The trustee fee accrues at a per annum rate equal to 0.00062% on the stated principal balance of such mortgage loan or REO mortgage loan, as the case may be, outstanding immediately following the prior distribution date. | ||

| The master servicer, special servicer and trustee are entitled to certain other additional fees and reimbursement of expenses. All fees and expenses will generally be payable prior to distribution on the certificates. | ||

| Further information with respect to the fees and expenses payable from distributions to certificateholders, including information regarding the general purpose of and the source of payment for the fees and expenses, is set forth under ‘‘SERVICING OF THE MORTGAGE LOANS— Compensation and Payment of Expenses’’ in this prospectus supplement. The master servicer and the special servicer under the pooling and servicing agreement entered into in connection with the issuance of the Wachovia Bank Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2006-C28 are each generally entitled to payment of similar fees and expenses described in this section. | ||

| Prepayment Premiums; Yield Maintenance Charges | On each distribution date, any prepayment premium or yield maintenance charge actually collected during the related collection period on a mortgage loan included in the trust fund will be distributed to the holders of each class of offered certificates, the Class A-4FL regular interest and the Class F, Class G, Class H and Class J certificates then entitled to distributions as follows: | |

| The holders of each class of offered certificates, the Class A-4FL regular interest and the Class F, Class G, Class H and Class J certificates then entitled to distributions of principal with respect to the related loan group on that distribution date will generally be entitled to a portion of prepayment premiums or yield maintenance charges equal to the product of: | ||

| • | the amount of those prepayment premiums or yield maintenance charges; | ||

| • | a fraction (in no event greater than one), the numerator of which is equal to the excess, if any, of the pass-through rate of that class of certificates over the relevant discount rate, and the denominator of which is equal to the excess, if any, of the mortgage interest rate of the prepaid mortgage loan over the relevant discount rate; and | ||

S-29

| • | a fraction, the numerator of which is equal to the amount of principal distributable on that class of certificates on that distribution date, and the denominator of which is the principal distribution amount for that distribution date. | ||

| If there is more than one class of certificates (or regular interest) entitled to distributions of principal with respect to the related loan group on any particular distribution date on which a prepayment premium or yield maintenance charge is distributable, the aggregate amount of that prepayment premium or yield maintenance charge will be allocated among all such classes up to, and on a pro rata basis in accordance with, the foregoing entitlements. | ||

| For so long as the swap contract is in effect and there is no continuing payment default under the swap contract, any prepayment premium or yield maintenance charge distributable in respect of the Class A-4FL regular interest will be payable to the swap counterparty pursuant to the terms of the swap contract. If the swap contract is no longer in effect or if there is a continuing payment default related to the swap contract, any prepayment premium and yield maintenance charges allocable to the Class A-4FL regular interest will be paid to the holders of the Class A-4FL certificates. | ||

| The portion, if any, of the prepayment premiums or yield maintenance charges remaining after any payments described above will be distributed as follows: (a) on or before the distribution date in December 2013, 49% to the holders of the Class X-P certificates and 51% to the holders of the Class X-C certificates and (b) thereafter, 100% to the holders of the Class X-C certificates. | ||