| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226486-10 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,202,148,724

(Approximate Initial Pool Balance)

BANK 2019-BNK22

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Bank of America, National Association

Wells Fargo Bank, National Association

Morgan Stanley Mortgage Capital Holdings LLC

National Cooperative Bank, N.A.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2019-BNK22

October 17, 2019

WELLS FARGO

SECURITIES | BofA MERRILL LYNCH | MORGAN STANLEY |

| | | |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

| | | |

Academy Securities, Inc. Co-Manager | | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, BofA Securities, Inc., Morgan Stanley & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| BANK 2019-BNK22 | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate Cut-off

Date Balance | Approx. % of

Initial Pool

Balance |

| Morgan Stanley Mortgage Capital Holdings LLC | 17 | 68 | $342,885,459 | 28.5% |

| Bank of America, National Association | 10 | 19 | 309,643,921 | 25.8 |

| Wells Fargo Bank, National Association | 11 | 24 | 262,610,467 | 21.8 |

| Wells Fargo Bank, National Association / Bank of America, National Association | 2 | 2 | 198,475,000 | 16.5 |

| National Cooperative Bank, N.A. | 18 | 18 | 88,533,878 | 7.4 |

Total | 58 | 131 | $1,202,148,724 | 100.0% |

Loan Pool:

| Initial Pool Balance: | $1,202,148,724 |

| Number of Mortgage Loans: | 58 |

| Average Cut-off Date Balance per Mortgage Loan: | $20,726,702 |

| Number of Mortgaged Properties: | 131 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $9,176,708 |

| Weighted Average Mortgage Interest Rate: | 3.483% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 60.7% |

| Weighted Average Original Term to Maturity or ARD (months): | 120 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 118 |

| Weighted Average Original Amortization Term (months)(2): | 361 |

| Weighted Average Remaining Amortization Term (months)(2): | 359 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 2.90x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 11.5% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 52.9% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 51.5% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 12.9% |

| % of Mortgage Loans with Single Tenants(3): | 23.0% |

(1) With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property are calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. (2) Fifteen (15) of the mortgage loans, each of which is secured by a residential cooperative property sold to the depositor by National Cooperative Bank, N.A., currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. (3) Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| BANK 2019-BNK22 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| Property Name | Mortgage Loan Seller in BANK 2019-BNK22 | Note(s)(1) | Original Balance | Holder of Note | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under

Lead Securitization

Servicing Agreement |

| Park Tower at Transbay | BANA | A-1 | $100,000,000 | BANK 2019-BNK20 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $100,000,000 | Bank of America, National Association | No |

| A-3 | $100,000,000 | BANK 2019-BNK21(2) | Yes |

| A-4 | $80,000,000 | BANK 2019-BNK22 | No |

| A-5 | $50,000,000 | Bank of America, National Association | No |

| A-6 | $50,000,000 | Bank of America, National Association | No |

| A-7 | $25,000,000 | BANK 2019-BNK22 | No |

| A-8 | $20,000,000 | BANK 2019-BNK20 | No |

| A-9 | $15,000,000 | BANK 2019-BNK21(2) | No |

| A-10 | $10,000,000 | BANK 2019-BNK22 | No |

| 230 Park Avenue South | WFB/BANA | A-1 | $55,000,000 | BANK 2019-BNK21(2) | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $30,000,000 | BANK 2019-BNK22 | No |

| A-3 | $25,000,000 | BANK 2019-BNK22 | No |

| A-4 | $55,000,000 | BANK 2019-BNK21(2) | No |

| A-5 | $30,000,000 | BANK 2019-BNK22 | No |

| A-6 | $25,000,000 | BANK 2019-BNK22 | No |

| A-7 | $30,000,000 | JPMorgan Chase Bank, N.A. | No |

| Midtown Center | WFB/BANA | A-1-1 | 135,950,000 | DCOT 2019-MTC | Yes | Wells Fargo Bank, National Association | CWCapital Asset Management LLC |

| A-1-2 | 52,525,000 | DCOT 2019-MTC | No |

| A-1-3 | 72,525,000 | DCOT 2019-MTC | No |

| A-2-1 | 12,068,966 | BANK 2019-BNK22 | No |

| A-2-2 | 13,881,034 | BANK 2019-BNK22 | No |

| A-2-3 | 10,000,000 | BANK 2019-BNK22 | No |

| A-2-4 | 37,931,034 | BANK 2019-BNK22 | No |

| A-2-5 | 14,593,966 | BANK 2019-BNK22 | No |

| A-2-6 | 6,262,500 | Goldman Sachs Bank USA | No |

| A-2-7 | 26,262,500 | Goldman Sachs Bank USA | No |

| B-1-1 | 64,350,000 | DCOT 2019-MTC | No |

| B-1-2 | 39,325,000 | DCOT 2019-MTC | No |

| B-1-3 | 39,325,000 | DCOT 2019-MTC | No |

| Storage Post Portfolio | MSMCH | A-1 | 85,000,000 | BANK 2019-BNK21(2) | Yes | | Rialto Capital Advisors, LLC |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| BANK 2019-BNK22 | Characteristics of the Mortgage Pool |

| | | A-2 | 45,000,000 | BANK 2019-BNK22 | No | Wells Fargo Bank, National Association | |

| A-3 | 20,000,000 | BANK 2019-BNK22 | No |

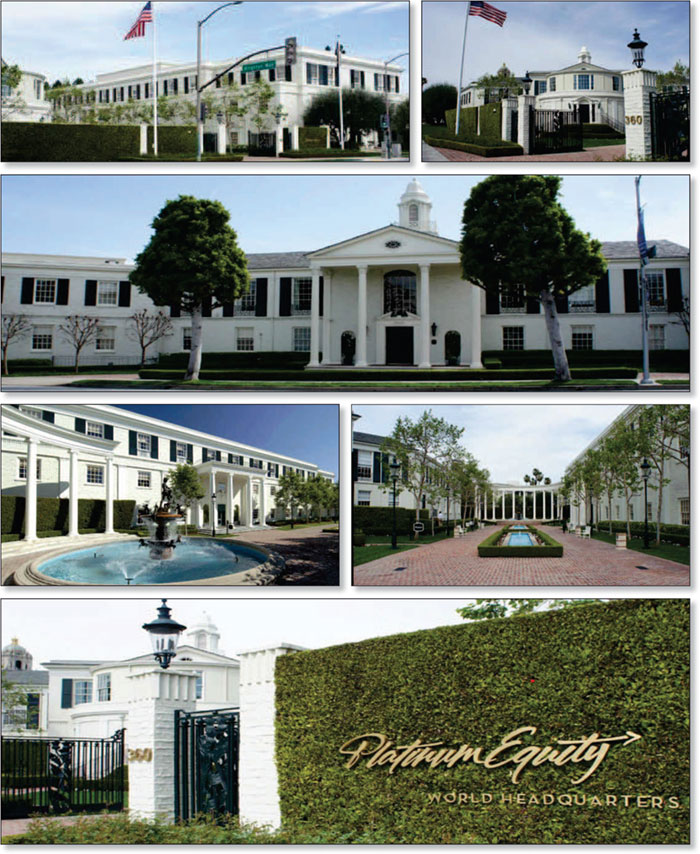

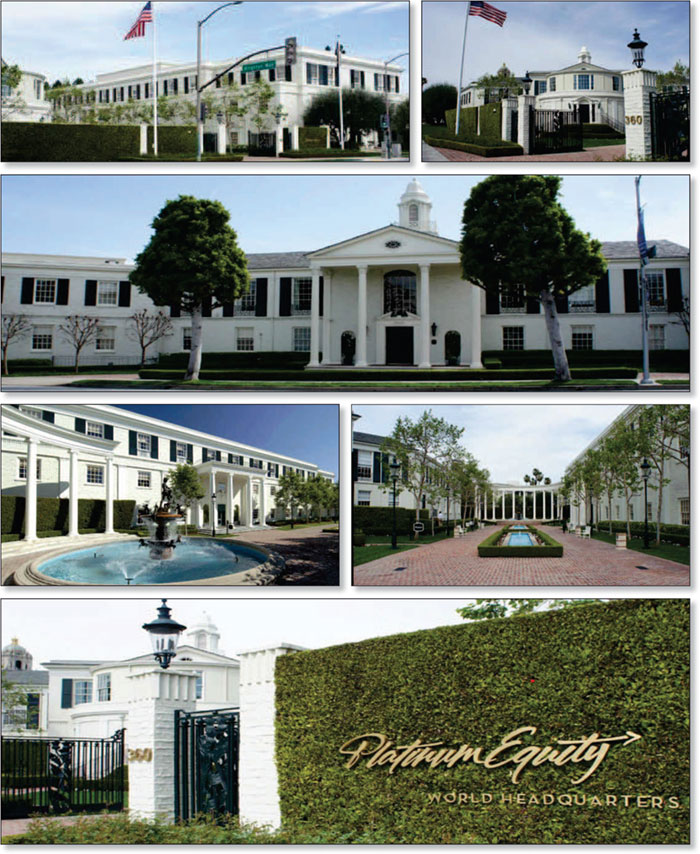

| 360 North Crescent Drive | WFB | A-1 | 73,600,000 | Wells Fargo Bank, National Association | Yes | Wells Fargo Bank, National Association(3) | KeyBank National Association(3) |

| A-2 | 55,000,000 | BANK 2019-BNK22 | No |

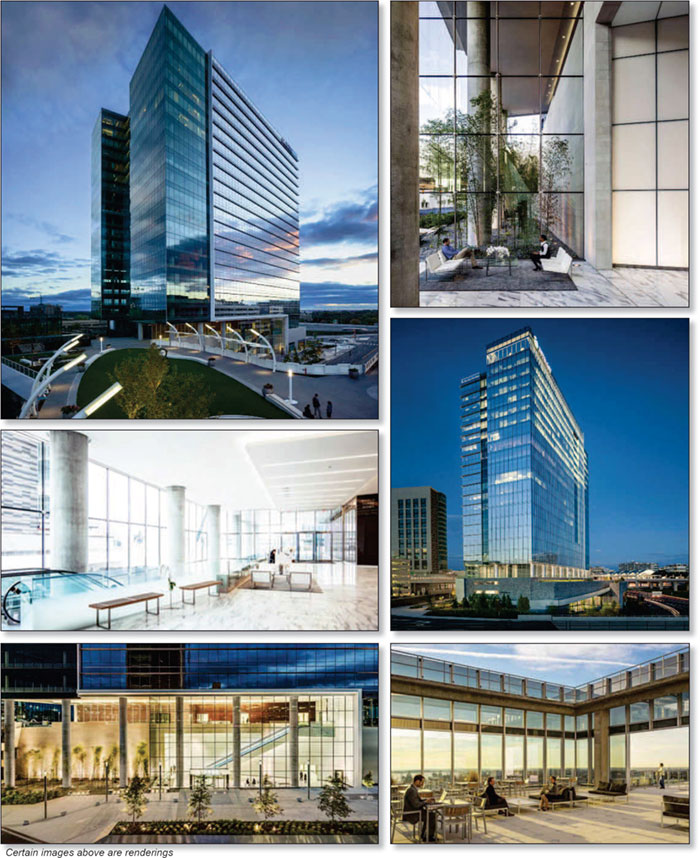

| Tysons Tower | WFB | A-1 | 50,000,000 | BANK 2019-BNK21(2) | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | 25,000,000 | BANK 2019-BNK22 | No |

| A-3 | 20,000,000 | BANK 2019-BNK22 | No |

| A-4 | 40,000,000 | JPMorgan Chase Bank, N.A. | No |

| A-5 | 10,000,000 | JPMorgan Chase Bank, N.A. | No |

| A-6 | 15,000,000 | JPMorgan Chase Bank, N.A. | No |

| A-7 | 30,000,000 | JPMorgan Chase Bank, N.A. | No |

| National Anchored Retail Portfolio | MSMCH | A-1 | 50,000,000 | BANK 2019-BNK21(2) | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | 37,000,000 | MSMCH | No |

| A-3 | 30,000,000 | BANK 2019-BNK22 | No |

| | | | | | | | | |

| (1) | No assurance can be provided that any unsecuritized note will not be split further. |

| (2) | The BANK 2019-BNK21 securitization is expected to close on or about October 23, 2019. |

| (3) | The related whole loan is expected to initially be serviced under the BANK 2019-BNK22 pooling and servicing agreement until the securitization of the related “lead”pari passunote (namely, the relatedpari passunote marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead”pari passunote. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the BANK 2019-BNK22 certificates after the closing of such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

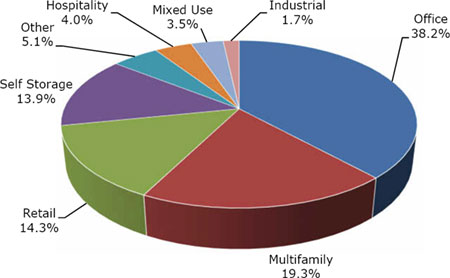

| BANK 2019-BNK22 | Characteristics of the Mortgage Pool |

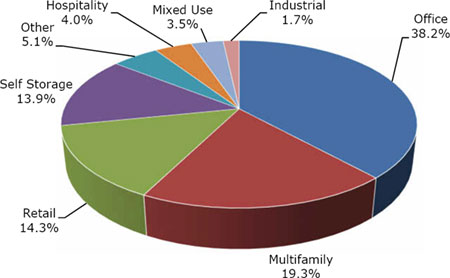

| C. | Property Type Distribution(1) |

| Property Type | | Number of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance ($) | | Approx. % of

Initial

Pool

Balance (%) | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | Weighted

Average

Balloon

LTV

Ratio (%) | | Weighted

Average

U/W NCF

DSCR (x) | | Weighted

Average

U/W NOI

Debt

Yield (%) | | Weighted

Average

U/W NCF

Debt

Yield (%) | | Weighted

Average

Mortgage

Rate (%) |

| Office | | 12 | | | $459,625,183 | | | 38.2 | % | | 49.0 | % | | 48.8 | % | | 2.95 | x | | 10.2 | % | | 10.0 | % | | 3.358 | % |

| CBD | | 3 | | | 313,475,000 | | | 26.1 | | | 47.1 | | | 47.1 | | | 3.12 | | | 10.4 | | | 10.3 | | | 3.284 | |

| Suburban | | 5 | | | 127,951,183 | | | 10.6 | | | 51.9 | | | 51.2 | | | 2.62 | | | 9.8 | | | 9.4 | | | 3.474 | |

| Medical | | 4 | | | 18,199,000 | | | 1.5 | | | 61.3 | | | 61.3 | | | 2.39 | | | 9.5 | | | 9.2 | | | 3.807 | |

| Multifamily | | 32 | | | 231,686,766 | | | 19.3 | | | 42.2 | | | 40.6 | | | 3.95 | | | 18.0 | | | 17.6 | | | 3.388 | |

| Cooperative | | 18 | | | 88,533,878 | | | 7.4 | | | 12.8 | | | 10.3 | | | 6.82 | | | 33.9 | | | 33.2 | | | 3.197 | |

| Garden | | 6 | | | 88,127,614 | | | 7.3 | | | 60.6 | | | 58.9 | | | 2.22 | | | 8.6 | | | 8.4 | | | 3.529 | |

| Mid Rise | | 8 | | | 55,025,275 | | | 4.6 | | | 59.9 | | | 59.9 | | | 2.09 | | | 7.5 | | | 7.3 | | | 3.468 | |

| Retail | | 45 | | | 171,705,107 | | | 14.3 | | | 62.0 | | | 60.9 | | | 2.49 | | | 9.8 | | | 9.5 | | | 3.673 | |

| Single Tenant | | 36 | | | 107,762,337 | | | 9.0 | | | 61.2 | | | 61.2 | | | 2.50 | | | 9.3 | | | 9.0 | | | 3.578 | |

| Anchored | | 6 | | | 41,467,770 | | | 3.4 | | | 63.7 | | | 59.9 | | | 2.64 | | | 11.4 | | | 10.8 | | | 3.747 | |

| Unanchored | | 2 | | | 17,975,000 | | | 1.5 | | | 63.3 | | | 61.3 | | | 1.94 | | | 9.1 | | | 8.6 | | | 4.104 | |

| Shadow Anchored | | 1 | | | 4,500,000 | | | 0.4 | | | 60.0 | | | 60.0 | | | 3.04 | | | 11.7 | | | 11.0 | | | 3.565 | |

| Self Storage | | 30 | | | 166,688,047 | | | 13.9 | | | 59.8 | | | 59.0 | | | 2.54 | | | 9.2 | | | 9.1 | | | 3.536 | |

| Self Storage | | 30 | | | 166,688,047 | | | 13.9 | | | 59.8 | | | 59.0 | | | 2.54 | | | 9.2 | | | 9.1 | | | 3.536 | |

| Other | | 1 | | | 61,000,000 | | | 5.1 | | | 64.9 | | | 64.9 | | | 1.71 | | | 6.7 | | | 6.7 | | | 3.840 | |

| Leased Fee | | 1 | | | 61,000,000 | | | 5.1 | | | 64.9 | | | 64.9 | | | 1.71 | | | 6.7 | | | 6.7 | | | 3.840 | |

| Hospitality | | 5 | | | 48,526,207 | | | 4.0 | | | 65.1 | | | 51.4 | | | 2.38 | | | 14.8 | | | 13.2 | | | 3.750 | |

| Limited Service | | 4 | | | 35,565,549 | | | 3.0 | | | 65.8 | | | 52.0 | | | 2.21 | | | 14.0 | | | 12.4 | | | 3.824 | |

| Select Service | | 1 | | | 12,960,658 | | | 1.1 | | | 63.3 | | | 49.6 | | | 2.84 | | | 17.0 | | | 15.4 | | | 3.550 | |

| Mixed Use | | 3 | | | 42,012,225 | | | 3.5 | | | 54.0 | | | 54.0 | | | 2.32 | | | 8.6 | | | 8.1 | | | 3.468 | |

| Multifamily/Retail | | 1 | | | 21,274,725 | | | 1.8 | | | 48.4 | | | 48.4 | | | 2.40 | | | 8.1 | | | 7.8 | | | 3.210 | |

| Office/Retail | | 1 | | | 17,000,000 | | | 1.4 | | | 58.6 | | | 58.6 | | | 2.14 | | | 8.7 | | | 8.1 | | | 3.740 | |

| Industrial/Retail | | 1 | | | 3,737,500 | | | 0.3 | | | 64.4 | | | 64.4 | | | 2.68 | | | 11.2 | | | 10.0 | | | 3.700 | |

| Industrial | | 3 | | | 20,905,189 | | | 1.7 | | | 60.2 | | | 49.8 | | | 2.42 | | | 12.9 | | | 12.2 | | | 3.652 | |

| Flex | | 2 | | | 11,618,641 | | | 1.0 | | | 57.4 | | | 49.7 | | | 2.38 | | | 12.0 | | | 11.2 | | | 3.694 | |

| Warehouse | | 1 | | | 9,286,548 | | | 0.8 | | | 63.6 | | | 49.9 | | | 2.46 | | | 14.0 | | | 13.4 | | | 3.600 | |

| Total/Weighted Average: | | 131 | | | $1,202,148,724 | | | 100.0 | % | | 52.9 | % | | 51.5 | % | | 2.90 | x | | 11.5 | % | | 11.2 | % | | 3.483 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

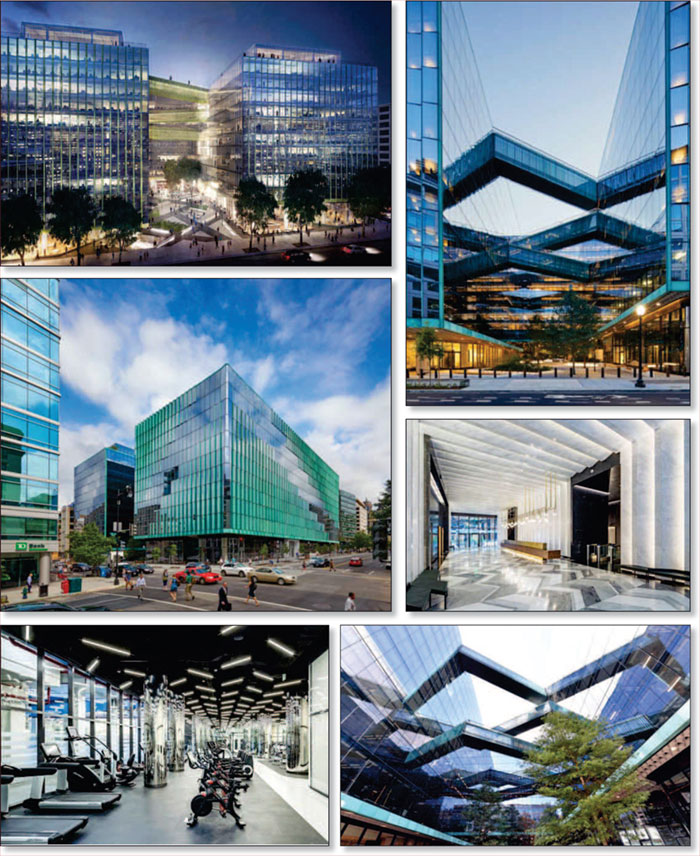

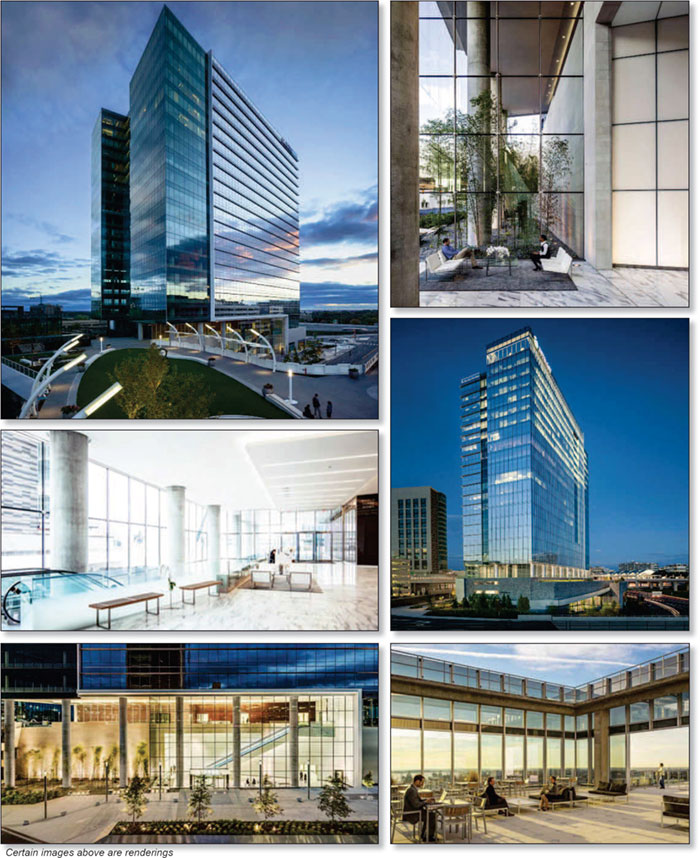

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| No. 1 – Park Tower at Transbay |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | Bank of America, National Association | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (DBRS/Fitch/S&P): | AAA/BBB-(sf)/NR | | Property Type – Subtype: | Office – CBD |

| Original Principal Balance(1): | $115,000,000 | | Location: | San Francisco, CA |

| Cut-off Date Balance(1): | $115,000,000 | | Size: | 764,659 SF |

| % of Initial Pool Balance: | 9.6% | | Cut-off Date Balance Per SF(1): | $719 |

| Loan Purpose: | Refinance | | Maturity Date/ARD Balance Per SF(1)(2): | $719 |

| Borrower Sponsor: | MetLife, Inc. | | Year Built/Renovated: | 2018-2019/NA |

| Guarantor: | Park Tower Owner LLC | | Title Vesting: | Fee |

| Mortgage Rate: | 3.4500% | | Property Manager: | MA West Management LLC (borrower-related) |

| Note Date: | July 23, 2019 | | Current Occupancy (As of)(4): | 98.9% (10/1/2019) |

| Seasoning: | 3 months | | YE 2018 Occupancy(5): | NAV |

| Anticipated Repayment Date(2): | August 1, 2029 | | YE 2017 Occupancy(5): | NAV |

| Maturity Date(2): | August 1, 2034 | | YE 2016 Occupancy(5): | NAV |

| IO Period: | 120 months | | YE 2015 Occupancy(5): | NAV |

| Loan Term (ARD)(2): | 120 months | | Appraised Value(6): | $1,120,000,000 |

| Amortization Term: | NAP | | Appraised Value Per SF(6): | $1,465 |

| Loan Amortization Type: | Interest-only, Balloon | | Appraisal Valuation Date(6): | October 1, 2019 |

| Call Protection: | L(23),YM(90),O(7) | | Underwriting and Financial Information |

| Lockbox Type: | Hard/Springing Cash Management | | TTM NOI(5): | NAV |

| Additional Debt(1): | Yes | | YE 2018 NOI(5): | NAV |

| Additional Debt Type (Balance)(1): | Pari Passu ($435,000,000) | | YE 2017 NOI(5): | NAV |

| | | | YE 2016 NOI(5): | NAV |

| | | | U/W Revenues: | $85,332,264 |

| | | | U/W Expenses: | $28,981,596 |

| Escrows and Reserves(3) | | U/W NOI: | $56,350,668 |

| | Initial | Monthly | Cap | | U/W NCF: | $56,277,672 |

| Taxes | $0 | Springing | N/A | | U/W DSCR based on NOI/NCF(1): | 2.93x / 2.93x |

| Insurance | $0 | Springing | N/A | | U/W Debt Yield based on NOI/NCF(1): | 10.2% / 10.2% |

| Deferred Maintenance | $4,412,926 | $0 | N/A | | U/W Debt Yield at Maturity/ARD based on NOI/NCF(1)(2): | 10.2% / 10.2% |

| TI/LC | $80,198,366 | $0 | N/A | | Cut-off Date LTV Ratio(1)(6): | 49.1% |

| Regulatory Fees Reserve | $5,528,653 | $0 | N/A | | LTV Ratio at Maturity/ARD(1)(2)(6): | 49.1% |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Whole Loan Amount(1) | $550,000,000 | | 100.0% | | Loan payoff | $294,460,472 | | 53.5 | % |

| | | | | | Upfront reserves(7) | 145,173,206 | | 26.4 | |

| | | | | | Return of equity | 108,543,869 | | 19.7 | |

| | | | | | Closing costs | 1,822,453 | | 0.3 | |

| Total Sources | $550,000,000 | | 100.0% | | Total Uses | $550,000,000 | | 100.0 | % |

| (1) | The Park Tower at Transbay Mortgage Loan (as defined below) is a part of the Park Tower at Transbay Whole Loan (as defined below) with an original aggregate principal balance of $550,000,000. The Cut-off Date Balance Per SF, Maturity Date/ARD Balance Per SF, U/W DSCR based on NOI/NCF, U/W Debt Yield based on NOI/NCF, U/W Debt Yield at Maturity/ARD based on NOI/NCF, Cut-off Date LTV Ratio and LTV Ratio at Maturity/ARD numbers presented above are based on the Park Tower at Transbay Whole Loan. |

| (2) | The Park Tower at Transbay Whole Loan is structured with a 120-month loan term until the Anticipated Repayment Date (“ARD”) of August 1, 2029 and will be interest-only prior to the ARD. From and after the ARD, the Park Tower at Transbay Whole Loan will accrue additional interest at a fixed rate of 2.5000% which will be deferred and due and payable on the Maturity Date of August 1, 2034 (or earlier repayment in full of the Park Tower at Transbay Whole Loan.) The ARD automatically triggers a Cash Sweep Period (see “Lockbox and Cash Management”) whereby all excess cash flow is required to be used to pay down the principal balance of the Park Tower at Transbay Whole Loan and repay the additional accrued interest. |

| (3) | See “Escrows” below for further discussion of reserve requirements. |

| (4) | The sole office tenant, Facebook, Inc. (98.9% of NRA), is currently in the process of building out its space and, according to the borrower sponsor, is in occupancy of floors 2012 (Phase I) and is expected to move into the remaining September 2020. |

| (5) | Prior historical operating statements and occupancy are not applicable, as the Park Tower at Transbay Property (as defined below) was constructed in 2018-2019. |

| (6) | The Appraised Value shown reflects a “Prospective Market Value At Stabilization” value as of October 1, 2019, which assumes that Facebook, Inc. has commenced rent payments (which began in August 2019) and that all remaining construction project costs due by September 30, 2019 have been incurred (110% of the cost of which has been reserved by the lender). The “as-is” value as of May 30, 2019 of $959,000,000 results in both a Cut-off Date LTV Ratio and LTV Ratio at Maturity/ARD of 57.4% for the Park Tower at Transbay Whole Loan. The appraiser also provided an “as dark” value as of May 30, 2019 of $1,004,000,000, which results in both a Cut-off Date LTV Ratio and LTV Ratio at Maturity/ARD of 54.8% for the Park Tower at Transbay Whole Loan. The “as dark” value is greater than the “as-is” value due to the market rent being higher than the current contract rent at the Park Tower at Transbay Property. |

| (7) | Reserves include $55,033,261 paid by the Park Tower at Transbay Borrower (as defined below) at loan origination, which amount was subsequently disbursed to Facebook, Inc. by the escrow agent to buy out Facebook Inc.’s rent abatement period. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

The Mortgage Loan. The largest largest mortgage loan (the “Park Tower at Transbay Mortgage Loan”) is a part of a whole loan (the “Park Tower at Transbay Whole Loan”) evidenced by ten pari passu promissory notes in the aggregate original principal amount of $550,000,000. The Park Tower at Transbay Whole Loan is secured by a first priority fee mortgage on a 764,659 SF newly constructed, Class A office tower located in San Francisco, California (the “Park Tower at Transbay Property”).

The Park Tower at Transbay Mortgage Loan is evidenced by the non-controlling promissory Notes A-4, A-7 and A-10 in the original aggregate principal amount of $115,000,000. The controlling promissory Note A-3 and the non-controlling promissory Notes A-1, A-2, A-5, A-6, A-8 and A-9 are in the aggregate original principal amount of $435,000,000. Notes A-1 and A-8 have been contributed to the BANK 2019-BNK20 securitization trust. Notes A-3 and A-9 are expected to be contributed to the BANK 2019-BNK21 securitization trust. Notes A-2, A-5 and A-6 are currently held by Bank of America, N.A. and are expected to be contributed to future securitization trusts or may be otherwise transferred at any time. The Park Tower at Transbay Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BANK 2019-BNK21 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

Note Summary

| Notes | Original Principal Balance | Cut-off Date Balance | Note Holder | Controlling Interest |

| A-1 | $100,000,000 | $100,000,000 | BANK 2019-BNK20 | No |

| A-2 | $100,000,000 | $100,000,000 | Bank of America, N.A. | No |

| A-3 | $100,000,000 | $100,000,000 | BANK 2019-BNK21 | Yes |

| A-4 | $80,000,000 | $80,000,000 | BANK 2019-BNK22 | No |

| A-5 | $50,000,000 | $50,000,000 | Bank of America, N.A. | No |

| A-6 | $50,000,000 | $50,000,000 | Bank of America, N.A. | No |

| A-7 | $25,000,000 | $25,000,000 | BANK 2019-BNK22 | No |

| A-8 | $20,000,000 | $20,000,000 | BANK 2019-BNK20 | No |

| A-9 | $15,000,000 | $15,000,000 | BANK 2019-BNK21 | No |

| A-10 | $10,000,000 | $10,000,000 | BANK 2019-BNK22 | No |

| Total | $550,000,000 | $550,000,000 | | |

The Borrower and the Borrower Sponsor.The borrower is Park Tower Owner LLC, a Delaware limited liability company, structured to be bankruptcy-remote with at least two independent directors (the “Park Tower at Transbay Borrower”).

The borrower sponsor is MetLife, Inc. (NYSE: MET), a Fortune 500 financial services company, providing insurance, annuities, employee benefits and asset management. The borrower sponsor was the original developer of the Park Tower at Transbay Property. There is no non-recourse carveout guarantor and no separate environmental indemnitor for the Park Tower at Transbay Whole Loan.

The Property. The Park Tower at Transbay Property is comprised of a newly constructed, Class A, pre-certified LEED Gold, 43-story high-rise office building located on the northeast corner of Beale Street and Howard Street in the Transbay Transit District in the South Financial District of downtown San Francisco, California. The Park Tower at Transbay Property contains a total of 764,659 SF. All of the office space (755,914 SF) and the two-level subterranean parking are leased to Facebook, Inc. (“Facebook”). Facebook’s space includes a mix of open and private offices, various common areas, a cafeteria, fitness/wellness center and a child care center. There is 50,000 SF of outdoor space including fourteen sky decks: large rooftop terraces on floors 12 and 28, and outside terraces on every third floor starting on floor 13 and ending on the top floor, 43. 70% of the floors have San Francisco Bay views.

The Property. The Park Tower at Transbay Property is comprised of a newly constructed, Class A, pre-certified LEED Gold, 43-story high-rise office building located on the northeast corner of Beale Street and Howard Street in the Transbay Transit District in the South Financial District of downtown San Francisco, California. The Park Tower at Transbay Property contains a total of 764,659 SF. All of the office space (755,914 SF) and the two-level subterranean parking are leased to Facebook, Inc. (“Facebook”). Facebook’s space includes a mix of open and private offices, various common areas, a cafeteria, fitness/wellness center and a child care center. There is 50,000 SF of outdoor space including fourteen sky decks: large rooftop terraces on floors 12 and 28, and outside terraces on every third floor starting on floor 13 and ending on the top floor, 43. 70% of the floors have San Francisco Bay views.

The remaining rentable area is comprised of three retail spaces (8,745 SF) on the ground floor. One of the retail spaces was leased to Blue Bottle after loan origination and the other spaces are presently in lease negotiations with prospective tenants, according to the borrower sponsor. Building amenities include bike parking, an open plaza on the ground level, and two non-collateral adjacent public park spaces which are required to be maintained by the Park Tower at Transbay borrower sponsor.

The Park Tower at Transbay Property is located adjacent to the recently completed multi-billion-dollar Salesforce (f/k/a Transbay) Transit Center and City Park, providing immediate proximity to all forms of public transportation. The Park Tower at Transbay Property is within walking distance to the Ferry Building, waterfront AT&T Park, Moscone Center, Westfield Shopping Centre, SF MoMA, Union Square and South Park.

Major Tenant.Facebook leases all of the office space (755,914 SF) on a long term, triple-net lease which commenced on March 1, 2019. Facebook’s lease is divided into three phases: Phase I includes floors 2-12, Phase II includes floors 13-25 and Phase III includes floors 26-43. The initial rent for Phase I, Phase II and Phase III is $60.00 PSF, $66.00 PSF and $72.00 PSF, respectively, resulting in a current weighted average rent of $65.82 PSF. The Facebook office lease requires annual rental increases of 3.0%. Facebook also

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

leases the subterranean parking (110 spaces with capacity for 140 spaces with valet operations) based on an annual rent of $594,000 ($450/space per month), with increases to market rent every five years.

Facebook is currently in the process of building out its space and, according to the borrower sponsor, is in occupancy of Phase I and is expected to move into its remaining space by September 2019 and September 2020. The Park Tower at Transbay Borrower provided Facebook with a tenant improvement allowance of $110 PSF (of which $80,198,366 ($106 PSF) was outstanding as of the loan origination date and has been fully reserved by the lender) and estimates that Facebook will be spending an additional $300-$350 PSF on its build-out. Pursuant to its lease, Facebook was entitled to rent abatements, which have been bought out by the Park Tower at Transbay Borrower as of July 25, 2019. Facebook is now paying full unabated rent.

Facebook’s lease expiration for Phase I is February 28, 2033 and for Phases II and III are February 28, 2034. Each phase has two eight-year renewal options at fair market rent. In order to exercise the renewal option for Phase II, Facebook must exercise its option for Phase I. In order to exercise the renewal option for Phase III, Facebook must exercise both options for Phase I and II.

Facebook has a right of first offer to purchase the Park Tower at Transbay Property, as discussed in “Right of First Offer” below.

Facebook (NYSE: FB) provides various products to connect and share “online”. The company’s products include Facebook, which enables people to connect, share and discover through mobile devices and personal computers; Instagram, a community for sharing photos, videos, and messages; and Messenger and WhatsApp, both messaging applications. Facebook also provides Oculus, a hardware, software and developer platform, which allows people to connect through its virtual reality products. As of December 31, 2018, Facebook had approximately 1.52 billion daily active users. The company was founded in 2004 and is headquartered in Menlo Park, California. Facebook also has large block leases at 181 Fremont and 215 Fremont, in downtown San Francisco, both within one block of the Park Tower at Transbay Property. For the fiscal year ending December 31, 2018, Facebook reported total revenue of $55.8 billion, up from $40.7 billion in the prior year and $27.6 billion in 2016. Facebook has a current market capitalization of $478 billion.

The following table presents certain information relating to the tenant at the Park Tower at Transbay Property:

Major Tenant

| Tenant Name | Credit Rating

(Fitch/Moody’s/

S&P)(1) | Tenant NRSF | % of

NRSF | Annual U/W Base Rent PSF | Annual

U/W Base Rent | % of Total Annual U/W Base Rent | Lease

Expiration

Date | Extension Options | Termination Option (Y/N) |

| Major Tenant | | | | | | | | |

| Facebook, Inc. – Phase I(1) | NR/NR/NR | 269,814 | 35.3% | $60.00 | $16,188,822 | 32.5% | 2/28/2033 | 2, 8-year | N |

| Facebook, Inc. – Phase II(1) | NR/NR/NR | 238,962 | 31.3% | $66.00 | $15,771,464 | 31.7% | 2/28/2034 | 2, 8-year | N |

| Facebook, Inc. – Phase III(1) | NR/NR/NR | 247,138 | 32.3% | $72.00 | $17,793,967 | 35.8% | 2/28/2034 | 2, 8-year | N |

| Office Totall/Wtd. Avg. | 755,914 | 98.9% | $65.82 | $49,754,253 | 100.0% | | | |

| | | | | | | | | | |

| Vacant Space (Retail) | 8,745 | 1.1% | | | | | | |

| | | | | | | | | |

| Collateral Total | 764,659 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Facebook is currently in the process of building out its space and expected to move Phase II and Phase III by September 2020. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

The following table presents certain information relating to the lease rollover schedule at the Park Tower at Transbay Property:

Lease Expiration Schedule

Year Ending

December 31, | No. of

Leases

Expiring | Expiring

NRSF | % of

Total

NRSF | Cumulative

Expiring NRSF | Cumulative

% of Total

NRSF | Annual

U/W

Base Rent | % of Total

Annual

U/W Base

Rent | Annual

U/W

Base Rent

PSF |

| 2019 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2020 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2021 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2022 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2023 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2024 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2026 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2027 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2028 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2029 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| Thereafter | 1 | 755,914 | 98.9% | 755,914 | 98.9% | $49,754,253 | 100.0% | $65.82 |

| Vacant | 0 | 8,745 | 1.1% | 764,659 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 1 | 764,659 | 100.0% | | | $49,754,253 | 100.0% | $65.82(1) |

| (1) | Wtd. Avg. UW Rent PSF Rolling excludes vacant space. |

The following table presents historical occupancy percentages at the Park Tower at Transbay Property:

Historical Occupancy(1)

2015 | 2016 | 2017 | 2018 | 10/1/2019(1) |

| NAV | NAV | NAV | NAV | 98.9% |

| (1) | Prior occupancy is not applicable, as the Park Tower at Transbay Property was constructed in 2018-2019. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

Underwritten Net Cash Flow. The following table presents certain information relating to the underwritten net cash flow at the Park Tower at Transbay Property:

Cash Flow Analysis(1)

| | U/W | %(2) | U/W $ per SF |

| Base Rent(3) | $50,322,681 | 57.0% | $65.81 |

| Straight Line Rent | $7,996,394 | 9.1% | $10.46 |

| Gross Potential Rent | $58,319,075 | 66.1% | $76.27 |

| Reimbursements | $29,328,101 | 33.2% | $38.35 |

| Parking Income | $594,000 | 0.7% | $0.78 |

| Net Rental Income | $88,241,176 | 100.0% | $115.40 |

| Vacancy(4) | ($2,908,912) | (5.0%) | ($3.80) |

| Effective Gross Income | $85,332,264 | 96.7% | $111.60 |

| | | | |

| Real Estate Taxes | $16,161,609 | 18.9% | $21.14 |

| Insurance | $1,561,863 | 1.8% | $2.04 |

| Other Operating Expenses | $11,258,124 | 13.2% | $14.72 |

| Total Operating Expenses | $28,981,596 | 34.0% | $37.90 |

| | | | |

| Net Operating Income | $56,350,668 | 66.0% | $73.69 |

| TI/LC | $0 | 0.0% | $0.00 |

| Capital Expenditures | $72,995 | 0.1% | $0.10 |

| Net Cash Flow | $56,277,673 | 66.0% | $73.60 |

| | | | |

| NOI DSCR(5) | 2.93x | | |

| NCF DSCR(5) | 2.93x | | |

| NOI Debt Yield(5) | 10.2% | | |

| NCF Debt Yield(5) | 10.2% | | |

| (1) | Prior historical operating statements are not applicable, as the Park Tower at Transbay Property was constructed in 2018-2019. |

| (2) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy, and (iii) percent of Effective Gross Income for all other fields. |

| (3) | UW Base Rent includes the ground floor retail space (8,745 SF) grossed up to an estimated NNN rent of $65.00 PSF. |

| (4) | The Park Tower at Transbay Property is 98.9% leased to Facebook. UW Vacancy is 2.5% for the office floors and 100.0% for the retail space. |

| (5) | The debt service coverage ratios and debt yields shown are based on the Park Tower at Transbay Whole Loan. |

Appraisal.The appraiser concluded to a “Prospective Market Value At Stabilization” value as of October 1, 2019, which assumes that Facebook, Inc. has commenced rent payments (which began in August 2019) and that all remaining construction project costs due by September 30, 2019 have been incurred (110% of the cost of which has been reserved by the lender). The appraiser concluded to an “as-is” value as of May 30, 2019 of $959,000,000 and also provided an “as dark” value as of May 30, 2019 of $1,004,000,000. The “as dark” value is greater than the “as-is” value due to the market rent being higher than the current contract rent at the Park Tower at Transbay Property.

Environmental Matters.According to the Phase I environmental site assessment dated June 10, 2019, no action was recommended other than to obtain documentation summarizing the implementation of the site management plan and to work toward regulatory closure due to identified contaminated soil from former industrial and gas station activities. The Phase I assessment expects that as a part of the construction of the Park Tower at Transbay Property, a large majority of any contaminated soil was removed to accommodate for the two-level basement and that the building site being covered with hard surfaces provides an engineering barrier.

Market Overview.The Park Tower at Transbay Property is located in the South Financial District of San Francisco, California, just north of the Rincon Hill/South Beach/SOMA District, which has seen a resurgence in leasing activity particularly with respect to the technology sector, and east of the Yerba Buena District, home to several major redevelopment projects including the Yerba Buena complex, Moscone convention center and Westfield Shopping Center.

A significant development in the San Francisco central business district is the redevelopment of the approximately 40-acre area surrounding the Transbay Terminal, the primary transit hub in the downtown area. Redevelopment plans include replacing the outdated Transbay Terminal (which was completed in August 2018), extending Caltrain 1.3 miles (which construction began in 2012) and developing the surrounding neighborhood by widening Folsom Street and promoting sidewalk cafes and markets, and developing approximately 2,600 new homes, 3 million SF of office and commercial space, and 100,000 SF of retail space. Recent developments of the office space include the 61-story Salesforce Tower.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

Salesforce has also leased approximately 325,000 SF at Transbay Parcel F (550 Howard) and approximately 335,000 SF at 350 Mission. Other technology firms leasing large blocks of space in the area include Facebook at 181 Fremont (432,000 SF) and at 215 Fremont (300,000 SF), Adobe at 100 Hooper (280,000 SF), Stripe at 510 Townsend (269,063 SF), Blend Labs at 500 Pine Street (72,000 SF), Twitch at 350 Bush Street (185,000 SF), LinkedIn at 222 Second Street (430,650 SF) and Pinterest at 88 Bluxome Street (490,000 SF). As of the first quarter of 2019, large block demand greater than 50,000 SF has climbed 41% year over year, outpacing supply. According to the appraisal, there are currently 20 tenant requirements of 100,000 SF or more but only five contiguous space options that can offer occupancy through 2023.

According to a third party market report, the Park Tower at Transbay Property is located in the South Financial District office submarket of the San Francisco office market. For the first quarter of 2019, the submarket had total inventory of approximately 28.2 million SF with a vacancy rate of 6.7% and average asking rents of $83.02 PSF.

According to the appraisal, the estimated 2019 population within a one-half-, one- and three-mile radius of the Park Tower at Transbay Property was 16,122, 59,433 and 378,299, respectively. The 2019 median household income within the same radii was $204,917, $105,624 and $113,407, respectively.

The following table presents certain information relating to the appraiser’s market rent conclusion for the Park Tower at Transbay Property:

Market Rent Summary

| | Office – Low | Office – Mid | Office – High | Retail |

| Market Rent (PSF) | $75.00 | $80.00 | $85.00 | $65.00 |

| Lease Term (Years) | 12 | 12 | 12 | 10 |

| Rent Increase Projection | 3.0%per annum | 3.0%per annum | 3.0%per annum | 3.0%per annum |

The following table presents certain information from the appraisal relating to comparable properties to the Park Tower at Transbay Property:

Comparable Properties

| Property Name | Year

Built/

Renovated | Distance from Subject (miles) | Property Size (SF) | Tenant | Lease Area (SF) | Lease Date | Initial Rent PSF NNN | Lease Term (Yrs.) | TI PSF |

| Park Tower at Transbay(1) | 2018-2019 | N/A | 764,659 | Facebook | 755,914 | Mar-19 | $65.82 | 15 | $110 |

| Parcel F 546-550 Howard Street | 2023 (projected) | 0.2 | 1,100,000 | Salesforce | 325,000 | 4Q18 | $80.00 | 15 | $100 |

| 88 Bluxome Street | TBD | 1.4 | 1,000,000 | Pinterest | 490,000 | 1Q19 | $78.00 | 10-15 | N/A |

| 181 Fremont Street | 2018 | 0.1 | 432,000 | Facebook | 432,000 | Sep-17 | $65.00 | 10 | $100 |

| 45 Fremont | 1978 | 0.3 | 602,780 | Slack Technologies | 208,459 | Aug-19 | $69.00 | 11.3 | $100-$130 |

| One Tehama | 1929 | 0.2 | 98,566 | Social Finance | 98,566 | Sep-18 | $70.00 | 11 | $105 |

| (1) | Information obtained from the underwritten rent roll and Facebook lease. |

Escrows.

Taxes and Insurance Reserves -So long as (x) no Cash Sweep Period (as defined below) exists and (y) the Park Tower at Transbay Borrower provides evidence to the lender that all property taxes and insurance premiums have been paid in full, monthly escrows for taxes and insurance will be waived.

Deferred Maintenance -The Park Tower at Transbay Borrower deposited at loan origination $4,412,926, which is equal to 110% of the estimated cost for the completion of the outstanding project costs for the construction of the Park Tower at Transbay Property.

TI/LC Reserve -The Park Tower at Transbay Borrower deposited at loan origination $80,198,366 for outstanding tenant improvement allowances owed to Facebook.

Regulatory Fees Reserve -The Park Tower at Transbay Borrower deposited at loan origination $5,528,653 which is equal to 100% of the estimated cost for the regulatory fees in connection with the development of the Park Tower at Transbay Property as required pursuant to an owner participation/disposition and development agreement between the Successor Agency to the Redevelopment Agency of the City of San Francisco and the Park Tower at Transbay Borrower and as required for Municipal Transportation Agency additional street use fees.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Office – CBD | Loan #1 | Cut-off Date Balance: | | $115,000,000 |

| 250 Howard Street | Park Tower at Transbay | Cut-off Date LTV: | | 49.1% |

| San Francisco, CA 94105 | | UW NCF DSCR: | | 2.93x |

| | | UW NOI Debt Yield: | | 10.2% |

Lockbox and Cash Management. The Park Tower at Transbay Whole Loan documents require a hard lockbox with springing cash management upon the occurrence of a Cash Sweep Period. During the continuance of a Cash Sweep Period, all funds in the lockbox account are required to be swept each business day to a lender-controlled cash management account and disbursed in accordance with the Park Tower at Transbay Whole Loan documents. Additionally, during a Cash Sweep Period, all excess cash flow is required to be held as additional security for the Park Tower at Transbay Whole Loan until the discontinuance of the Cash Sweep Period.

A “Cash Sweep Period” will commence upon:

| (i) | an event of default under the Park Tower at Transbay Whole Loan documents beyond notice and cure periods (a “Default Trigger”), |

| (ii) | the Park Tower at Transbay Borrower seeking bankruptcy protection (a “Borrower Bankruptcy Trigger”), |

| (iii) | Facebook seeking bankruptcy protection (a “Facebook Bankruptcy Trigger”), |

| (iv) | Facebook (A) being in monetary or material non-monetary default beyond notice and cure periods or (B) terminating or giving notice to terminate its lease (each, a “Tenant Trigger”), |

| (v) | the Park Tower at Transbay Borrower failing to repay the Park Tower at Transbay Whole Loan in full on or before the ARD (an “ARD Trigger”), |

| (vi) | if a Facebook Bankruptcy Trigger or a Tenant Trigger previously occurred and was cured pursuant to clause (c) below and thereafter, the debt yield being less than 7.000% (not including any straight line rent) for two consecutive calendar quarters (a “Debt Yield Trigger”), or |

| (vii) | any replacement tenant (should the Facebook lease be terminated) subsequently going dark in more than 50% the office SF at the Park Tower at Transbay Property (a “Replacement Tenant Trigger”), unless the replacement tenant has a credit rating of at least “BBB-” by S&P or Fitch or “Baa3” by Moody’s. |

A Cash Sweep Period will end upon (provided no other Cash Sweep Period is continuing):

| (a) | if triggered by a Default Trigger, the cure of the event of default under the Park Tower at Transbay Whole Loan documents, |

| (b) | if triggered by a Facebook Bankruptcy Trigger, the replacement or assumption of the Facebook lease by the bankruptcy court and the dismissal of such bankruptcy proceedings, |

| (c) | if triggered by a Tenant Trigger or a Debt Yield Trigger, the debt yield being equal to or greater than 7.00% (not including any straight line rent) for the trailing two calendar quarters, and |

| (d) | if triggered by a Replacement Tenant Trigger (x) delivery of a replacement lease(s) for at least 50% of the office SF at the Park Tower at Transbay Property, or (y) the dark replacement tenant conducting business in at least 50% of the office SF at the Park Tower at Transbay Property. |

A Cash Sweep Period triggered by a Borrower Bankruptcy Trigger or an ARD Trigger may not be cured and will continue until the full repayment of the Park Tower at Transbay Whole Loan. All excess cash collected after an ARD Trigger will be applied to the reduction of principal, then to pay off additional accrued interest.

Release of Property. Not permitted.

Right of First Offer.Facebook has a right of first offer to purchase the Park Tower at Transbay Property at the same terms as any purchase offer received by the Park Tower at Transbay Borrower. If Facebook fails to exercise its right of first offer, the Park Tower at Transbay Borrower will be free to sell the Park Tower at Transbay Property to another party other than a Facebook competitor, namely Alphabet Inc., Amazon.com, Inc., Apple Inc., Microsoft Corporation, salesforce.com, inc., Snap Inc. and Samsung Electronics, which list of competitors is subject to change by Facebook in accordance with its lease.

Letter of Credit.None.

Terrorism Insurance.The Park Tower at Transbay Borrower is required to obtain and maintain property insurance that covers perils of terrorism and acts of terrorism in an amount equal to the full replacement cost of the Park Tower at Transbay Property and business interruption insurance for 36 months with a twelve month extended period of indemnity, provided, if the Terrorism Risk Insurance Act of 2002, as extended and modified by the Terrorism Risk Insurance Program Reauthorization Act of 2015 (as the same may be further modified, amended, or extended) is not in effect, the Park Tower at Transbay Borrower will not be required to pay annual premiums in excess of two times the premium then payable for the property and business interruption/loss of rents insurance in order to obtain the terrorism coverage. See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the Preliminary Prospectus.

Earthquake Insurance.The Park Tower at Transbay Whole Loan documents do not require earthquake insurance; the seismic report indicated a probable maximum loss of 12.0% for the Park Tower at Transbay Property.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

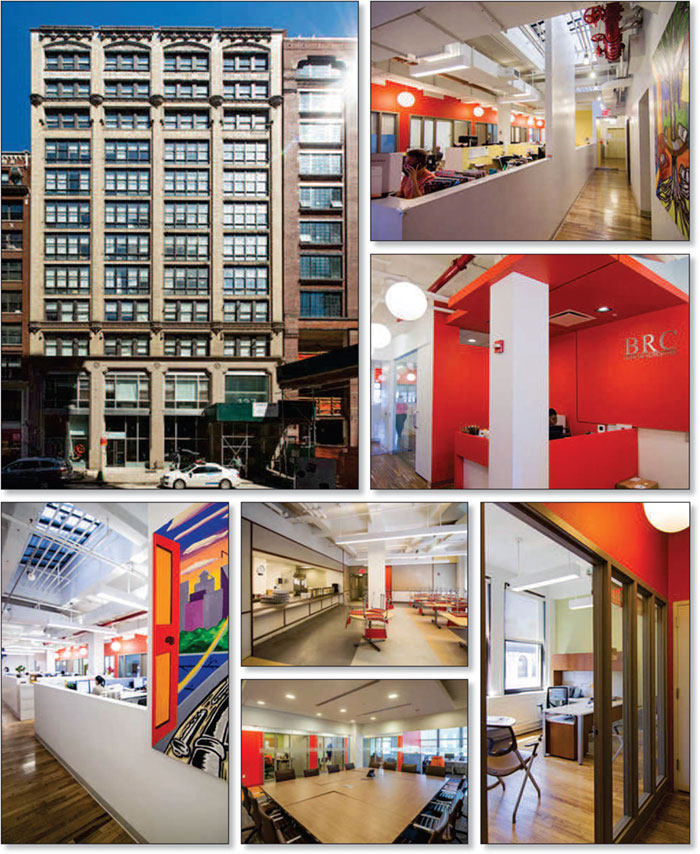

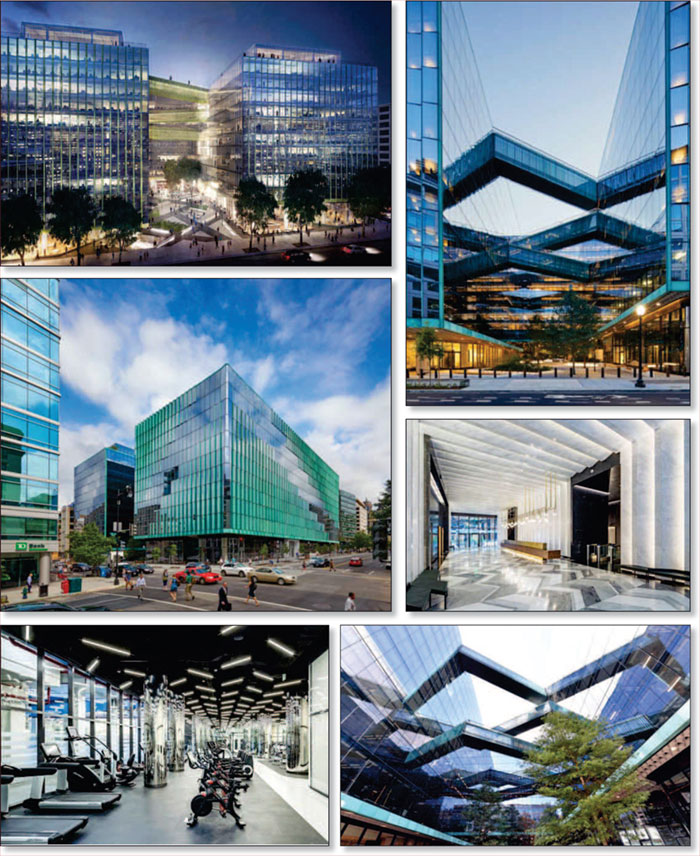

| Office – CBD | Loan #2 | Cut-off Date Balance: | | $110,000,000 |

| 230 Park Avenue South | 230 Park Avenue South | Cut-off Date LTV: | | 51.0% |

| New York, NY 10003 | | U/W NCF DSCR: | | 2.64x |

| | | U/W NOI Debt Yield: | | 8.9% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| No. 2 – 230 Park Avenue South |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association;

Bank of America, National Association | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (DBRS/Fitch/S&P): | BBB(low)/NR/NR | | Property Type – Subtype: | Office – CBD |

| Original Principal Balance(1): | $110,000,000 | | Location: | New York, NY |

| Cut-off Date Balance(1): | $110,000,000 | | Size: | 373,693 SF |

| % of Initial Pool Balance: | 9.2% | | Cut-off Date Balance Per SF(1): | $669.00 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per SF(1): | $669.00 |

| Borrower Sponsor: | TF Cornerstone Properties, LLC | | Year Built/Renovated: | 1895/2019 |

| Guarantor: | TF Cornerstone Properties, LLC | | Title Vesting: | Fee |

| Mortgage Rate: | 3.2700% | | Property Manager: | TF Cornerstone, Inc. (borrower-related) |

| Note Date: | September 11, 2019 | | Current Occupancy (As of): | 100.0% (9/1/2019) |

| Seasoning: | 2 months | | YE 2018 Occupancy: | 100.0% |

| Maturity Date: | September 11, 2029 | | YE 2017 Occupancy: | 100.0% |

| IO Period: | 120 months | | YE 2016 Occupancy: | 100.0% |

| Loan Term (Original): | 120 months | | YE 2015 Occupancy: | 100.0% |

| Amortization Term (Original): | NAP | | Appraised Value(4): | $490,000,000 |

| Loan Amortization Type: | Interest-only, Balloon | | Appraised Value Per SF(4): | $1,311.24 |

| Call Protection(2): | L(26),GRTR 1% or YM or D(87),O(7) | | Appraisal Valuation Date(4): | July 24, 2019 |

| Lockbox Type: | Hard/Springing Cash Management | | Underwriting and Financial Information |

| Additional Debt(1): | Yes | | TTM NOI(5): | NAV |

| Additional Debt Type (Balance)(1): | Pari Passu($140,000,000) | | YE 2018 NOI(5): | NAV |

| | | | YE 2017 NOI(5): | NAV |

| | | | YE 2016 NOI(5): | NAV |

| | | | U/W Revenues: | $33,596,638 |

| | | | U/W Expenses: | $11,449,082 |

| Escrows and Reserves(3) | | U/W NOI: | $22,147,556 |

| | Initial | Monthly | Cap | | U/W NCF: | $21,961,566 |

| Taxes | $0 | Springing | NAP | | U/W DSCR based on NOI/NCF(1): | 2.66x / 2.64x |

| Insurance | $0 | Springing | NAP | | U/W Debt Yield based on NOI/NCF(1): | 8.9% / 8.8% |

| Rent Concession Reserve | $24,763,070 | $0 | NAP | | U/W Debt Yield at Maturity based on NOI/NCF(1): | 8.9% / 8.8% |

| Existing Landlord Obligations Reserve | (3) | $0 | NAP | | Cut-off Date LTV Ratio(1)(4): | 51.0% |

| | | | | | LTV Ratio at Maturity(1)(4): | 51.0% |

| | | | | | | |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original whole loan amount(1) | $250,000,000 | | 100.0% | | Loan payoff | $146,203,186 | | 58.5 | % |

| | | | | | Upfront reserves | 59,026,648 | | 23.6 | |

| | | | | | Closing costs | 14,429,847 | | 5.8 | |

| | | | | | Return of equity | 30,340,319 | | 12.1 | |

| Total Sources | $250,000,000 | | 100.0% | | Total Uses | $250,000,000 | | 100.0 | % |

| (1) | The Cut-off Date Balance Per SF, Maturity Date Balance Per SF, U/W DSCR based on NOI/NCF, U/W Debt Yield based on NOI/NCF, U/W Debt Yield at Maturity based on NOI/NCF, Cut-off Date LTV Ratio and LTV Ratio at Maturity numbers presented above are based on the 230 Park Avenue South Whole Loan (as defined below). |

| (2) | Defeasance or prepayment of the 230 Park Avenue South Whole Loan is permitted at any time after the earlier to occur of (a) the end of the two-year period commencing on the closing date of the securitization of the last promissory note representing a portion of the 230 Park Avenue South Whole Loan to be securitized and (b) September 11, 2022 (“Defeasance Lockout Date”). No prepayment premium will apply on or after March 11, 2029. The assumed defeasance lockout period of 26 payments is based on the closing date of this transaction in November 2019. Partial defeasance or partial prepayment (with the applicable yield maintenance premium) of the 230 Park Avenue Whole Loan is permitted, after the Defeasance Lockout Date, solely to satisfy the debt yield threshold to prevent a Cash Trap Event Period (see the “Lockbox and Cash Management” below for further discussion). |

| (3) | See“Escrows and Reserves” below for further discussion of reserve requirements. |

| (4) | The Appraised Value shown reflects a “Hypothetical Market Value as Stabilized Today” which assumes that all free rent has burned off and all of the tenant improvements and landlord work have been completed. At loan closing, the 230 Park Avenue South Borrower escrowed $24,763,070 for all free rent and gap rent pertaining to the Discovery space and $34,263,578 representing 75% of the tenant allowances, tenant improvements and capital improvements pertaining to the Discovery lease and space (the remaining 25% was guaranteed by the Guarantor) (see “Escrows and Reserves” below for further information). The appraiser also concluded to an “As-Is” appraised value of $415,000,000 as of July 24, 2019, which results in a Cut-off Date LTV Ratio of 60.2% and LTV Ratio at Maturity of 60.2% for the 230 Park Avenue South Whole Loan. Additionally, the appraiser concluded to a hypothetical “Go Dark” value of $350,000,000 as of July 24, 2019. Further, the appraisal notes that, since the 230 Park Avenue South Property is the subject of and expected to be eligible for New York City’s Industrial and Commercial Abatement Program (ICAP), the 10-year benefit has been assumed in its analysis of both the “As-Is” appraised value and the “Hypothetical Market Value as Stabilized Today” (see “The Property” section below for further information about the ICAP). |

| (5) | The 230 Park Avenue South Property (as defined below) has been approximately 100.0% leased since 2008, however, it is currently undergoing an extensive repositioning program to serve as Discovery, Inc.’s global corporate headquarters. Accordingly, operating history was not considered relevant to underwriting. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Office – CBD | Loan #2 | Cut-off Date Balance: | | $110,000,000 |

| 230 Park Avenue South | 230 Park Avenue South | Cut-off Date LTV: | | 51.0% |

| New York, NY 10003 | | U/W NCF DSCR: | | 2.64x |

| | | U/W NOI Debt Yield: | | 8.9% |

The Mortgage Loan. The mortgage loan (the “230 Park Avenue South Mortgage Loan”) is part of a whole loan (the “230 Park Avenue South Whole Loan”) that is evidenced by sevenpari passupromissory notes in the aggregate original principal amount of $250,000,000. The 230 Park Avenue South Whole Loan is secured by a first priority fee mortgage encumbering an office building located in New York, New York (the “230 Park Avenue South Property”). The 230 Park Avenue South Whole Loan was co-originated on September 11, 2019 by Wells Fargo Bank, National Association (“Wells Fargo”), Bank of America, N.A. (“Bank of America”) and JPMorgan Chase Bank, National Association (“JPMorgan”). The 230 Park Avenue South Mortgage Loan is evidenced by the non-controlling promissory notes A-2, A-3, A-5 and A-6 in the aggregate original principal amount of $110,000,000. The controlling promissory note A-1 in the original principal amount of $55,000,000 and the non-controlling promissory note A-4 in the original principal amount of $55,000,000 were contributed to the BANK 2019-BNK21 securitization trust and the non-controlling promissory note A-7 in the original principal amount of $30,000,000 is currently held by JPMorgan and is expected to be contributed to future securitization trusts or may be otherwise transferred at any time. The 230 Park Avenue South Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BANK 2019-BNK21 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement—Servicing of the Non-Serviced Mortgage Loans” in the Preliminary Prospectus.

Note Summary

| Notes | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| A-1 | $55,000,000 | $55,000,000 | BANK 2019-BNK21 | Yes |

| A-2 | $30,000,000 | $30,000,000 | BANK 2019-BNK22 | No |

| A-3 | $25,000,000 | $25,000,000 | BANK 2019-BNK22 | No |

| A-4 | $55,000,000 | $55,000,000 | BANK 2019-BNK21 | No |

| A-5 | $30,000,000 | $30,000,000 | BANK 2019-BNK22 | No |

| A-6 | $25,000,000 | $25,000,000 | BANK 2019-BNK22 | No |

| A-7 | $30,000,000 | $30,000,000 | JPMorgan | No |

| Total | $250,000,000 | $250,000,000 | | |

The Borrower and Borrower Sponsors.The borrower is 230 PAS SPE LLC (the “230 Park Avenue South Borrower”), a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to the 230 Park Avenue South Borrower delivered a non-consolidation opinion in connection with the origination of the 230 Park Avenue South Whole Loan.

The borrower sponsor and non-recourse carveout guarantor is TF Cornerstone Properties, LLC (the “Guarantor”), an affiliate of TF Cornerstone Inc., which, together with Guarantor and other affiliates (collectively, “TF Cornerstone”), comprise a family-owned real estate enterprise focused on acquisition, development, construction and management of residential and commercial properties. Founded in the 1970s and led by K. Thomas and Frederick Elghanayan, TF Cornerstone’s current portfolio includes approximately 12,625 apartment units in New York City and over 2.5 million square feet of commercial space in New York and Washington, D.C. (including 12 office properties). TF Cornerstone’s portfolio includes 387 Park Avenue South and Carnegie Hall Tower, approximately 0.4 and 2.1 miles northeast of the 230 Park Avenue South Property, respectively.

The Property.The 230 Park Avenue South Property is a 373,693 square foot, 14-story office building located within the Midtown South area of Manhattan in New York, New York. The 230 Park Avenue South Property was constructed in 1895 and is currently undergoing an extensive repositioning program that, per the appraisal, is expected to position the 230 Park Avenue South Property as a Class A building following completion. As part of a lease recently executed with Discovery for 96.7% of the NRA, the building is currently undergoing a $14.6 million modernization that includes the expansion and renovation of the entry and lobby areas (approximately $6.6 million), updated destination dispatch elevators and a newly-built service elevator that will operate on the cellar, ground and second floors (approximately $3.2 million). The 230 Park Avenue South Property will also undergo upgrades to the HVAC systems and cooling tower (approximately $2.0 million), improvements to the electrical service that will increase capacity to 8,000 Amps (approximately $2.0 million) and other miscellaneous renovations (approximately $0.8 million). Additionally, an indoor/outdoor studio is expected to be created in the newly-designed courtyard area; and the existing office spaces are expected to be renovated to consist of open, loft-style space with exposed ceilings.

According to the appraisal, as part of the proposed redevelopment, the 230 Park Avenue South Borrower is anticipated to benefit from a 10-year Industrial Commercial Abatement Program (“ICAP”) Tax Abatement. The ICAP provides abatements for property taxes for industrial or commercial properties that have been built, modernized, expanded or physically improved throughout Manhattan and the outer boroughs of New York. To qualify for the ICAP abatement, (a) properties must spend 30% of the taxable assessed value in capital expenses in four years from the date the building permit was issued, and (b) construction must be completed within five years of the issuance of a building permit, among other conditions. The borrower sponsor has filed for an ICAP tax abatement on the 230 Park Avenue South Property and is expected to be a candidate for approval of the ICAP tax abatement based on the repositioning of the existing improvements. As of the date of origination of the 230 Park Avenue South Whole Loan, the 230 Park Avenue South Property had not received the abatement; however, an ICAP application was filed in May 2018. The ICAP was not given credit in the lender’s underwriting; however, the ICAP was assumed in the appraiser’s analysis. The appraisal notes that the 230 Park Avenue South Property is expected to be eligible for the ICAP.

The 230 Park Avenue South Property was 100.0% leased to three tenants as of September 1, 2019; however, Discovery is not yet in occupancy or paying rent. Approximately 3.3% of the net rentable area and 5.9% of the underwritten base rent at the 230 Park Avenue South Property is attributed to two ground floor retail tenants (JPMorgan Chase and Earth Mail) with frontage along Park Avenue South and East 19th Street.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Office – CBD | Loan #2 | Cut-off Date Balance: | | $110,000,000 |

| 230 Park Avenue South | 230 Park Avenue South | Cut-off Date LTV: | | 51.0% |

| New York, NY 10003 | | U/W NCF DSCR: | | 2.64x |

| | | U/W NOI Debt Yield: | | 8.9% |

Major Tenant.

Discovery (361,214 square feet, 96.7% of NRA; 94.1% of underwritten base rent, January 31, 2037 expiration). Discovery Communications, LLC, a wholly owned subsidiary of Discovery, Inc. (“Discovery”; S&P: BBB-; NASDAQ: DISCA), is an American mass media company with numerous television networks including the Discovery Channel, Animal Planet, TLC, HGTV, Travel Channel, and the Food Network. As of September 6, 2019, Discovery had a market capitalization of approximately $15.9 billion. In March 2018, Discovery purchased Scripps Networks Interactive for approximately $14.6 billion, which was the owner of HGTV, Food Network, and the Travel Channel. Discovery is planning to move Scripps’ headquarters into the 230 Park Avenue South Property along with the rest of Discovery.

Discovery is expected to utilize its space at the 230 Park Avenue South Property as its corporate headquarters. Discovery is expected to occupy a portion of the ground floor, floors 2-13, the courtyard and the penthouse (floor 14), as well as eastern & western cellars. The company is expected to utilize all space from the fourth floor through the penthouse as space for general and executive offices, as well as certain ancillary purposes. The ground, second, and third floor are expected to be used by one of the channels in Discovery’s portfolio, the Food Network, as production kitchens and studio space.

Discovery has a signed lease but is not yet in occupancy or paying rent. Discovery has taken possession of the eastern & western cellars, its ground floor space and floors 2-11; floors 12-14 were recently delivered on September 1, 2019; and the courtyard space is expected to be delivered in February 2021. Discovery is expected to commence occupying the premises in January 2020 with a full occupancy date expected by December 2020. Discovery’s lease is guaranteed by Discovery, Inc., the rated parent company, and has either one, 10-year or two, five-year renewal options at the fair market rental rate following its lease expiration in January 2037.